Eco-Friendly Extraction of Sustainable and Valorized Value-Added Products From Ulva fasciata Macroalgae: A Holistic Technoeconomic Analysis

Abstract

The present work conducts a detailed technoeconomic analysis of an environmentally friendly zero-waste biorefinery process to valorize marine Ulva fasciata macroalgae into different sustainable value-added products. The proposed sequential fully integrated process yielded 34.89% mineral-rich water extract (MRWE), 2.61 ± 0.5% chlorophyll, 0.41 ± 0.05% carotenoids, 12.55 ± 1.6% starch, 3.27 ± 0.7% lipids, 22.24 ± 1.8% ulvan, 13.37 ± 1.5% proteins, and 10.66 ± 0.9% cellulose. The Aspen Plus software, utilizing the nonrandom two-liquid (NRTL) model, was applied for process design, simulation, and technoeconomic analysis. Key findings include a positive net present value (NPV) of $49,755,544.90, a high return on investment (ROI) of 485%, and an internal rate of return (IRR) of 17%. The anticipated payback period is 7 years, indicating a quick recovery of the initial investment. These findings confirm that Ulva fasciata is a promising resource in the biorefinery industry, providing a viable and eco-friendly alternative for the production of bio-based products and a new market for seaweed-based products.

1. Introduction

Environmental conservation and economic development increasingly recognize the global significance of sustainable bioresource utilization [1]. Marine macroalgal biomass, particularly species like Ulva fasciata, plays a crucial role in this paradigm. Ulva fasciata, a type of green seaweed, is abundant in the Mediterranean shoreline, fast-growing, and rich in valuable compounds [2]. The proliferation of such green macroalgae often results in eutrophication in enclosed coastal areas and adversely affects the marine ecosystem, aquaculture, touristic activities, and economy [3, 4]. Its application in green chemistry and biorefinery represents a sustainable approach to resource management and presents a viable strategy for ecosystem bioremediation, efficient use of marine macroalgal resources, and development of a green and low-carbon economy. Reliance on fossil fuels can be reduced and associated environmental impacts mitigated, by converting marine biomass into a range of value-added products, such as biofuels, pharmaceuticals, and biodegradable polymers [5]. Moreover, this approach aligns with circular and blue economy principles, promoting resource efficiency and waste reduction while fostering innovation in green technology [3].

Using the biorefinery approach on Ulva fasciata involves a unified process for valorizing this marine biomass into a wide range of sustainable and valuable products [3, 6]. This approach is grounded in the principles of sustainability, efficiency, and value maximization. It aims to extract maximum value from raw materials while minimizing waste. Consequently, all components of Ulva fasciata biomass are used to produce valuable products, including biofuels, pharmaceuticals, nutraceuticals, and biodegradable polymers [7]. The potential of this approach lies in its ability to enhance resource efficiency and diversify products, aligning with both environmental sustainability and economic viability [8]. By implementing integrated processes, every part of Ulva fasciata is valorized, supporting a more sustainable and circular bioeconomy.

Given the limited feasibility studies on macroalgae-based biorefinery processes [9, 10], a technoeconomic analysis (TEA) is essential to assess their feasibility and viability. TEA provides a comprehensive assessment of both technical aspects (such as yield, efficiency, and scalability) and economic factors (such as revenue potential and return on investment [ROI]) [11]. TEA is crucial for identifying economic barriers and technical obstacles in macroalgal biorefinery. This information can guide research and development toward more sustainable and practical solutions. Moreover, it aids in investment decision-making and policy development, ensuring the sustainable and profitable use of macroalgae as a bioresource [12].

The conversion of the problematic bloomed green macroalgae into various sustainable valued products and biopolymers has recently garnered significant interest due to its extensive applications in the food, animal feed, pharmaceutical, cosmetic, dye, organic fertilizer, biofuel, and biodegradable plastic industries [3, 4]. In earlier documented fully integrated routes, Indian Ulva fasciata biomass was converted into five valued products, including a mineral-rich liquid extract, lipids, ulvan, cellulose, and bioethanol [4]; Ulva lactuca was transformed into five valued products, including mineral-rich sap, lipids, ulvan, proteins, and cellulose [13]; and Ulva ohnoi was processed into six valued products, including salts, starch, lipids, ulvan, proteins, and cellulose [9]. As far as we know, there is no documented completely integrated zero-waste eco-friendly practice for the conversion of Ulva fasciata into eight valued products, including chlorophylla,b, carotenoids, mineral-rich water extract (MRWE), lipids, and proteins, in addition to the valuable biopolymers: starch, ulvan, and cellulose. Thus, in our previous work [3], we experimentally reported a fully integrated biorefinery process for the eco-friendly valorization of Ulva fasciata into various green and sustainable value-added products. The findings from that piece of paper prompted us to simulate the process to gain a deeper understanding of the process economy. Consequently, this work aims to present the pioneering complete TEA for valorizing Ulva fasciata into various valued products using the previously published zero-waste biorefinery approach [3]. This was performed by simulating the whole bioprocess using the Aspen Plus software and then figuring out the economy indicators, such as the payback period, positive net present value (NPV), ROI, and internal rate of return (IRR).

2. Material and Methods

2.1. Process Description

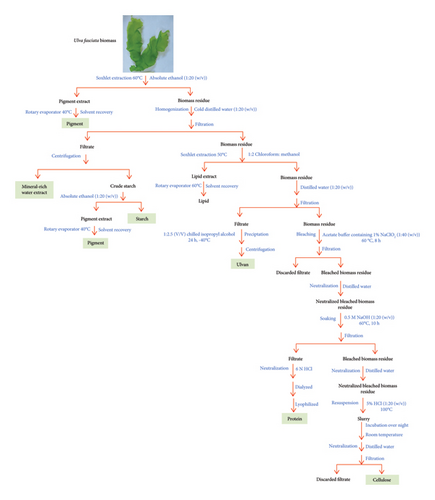

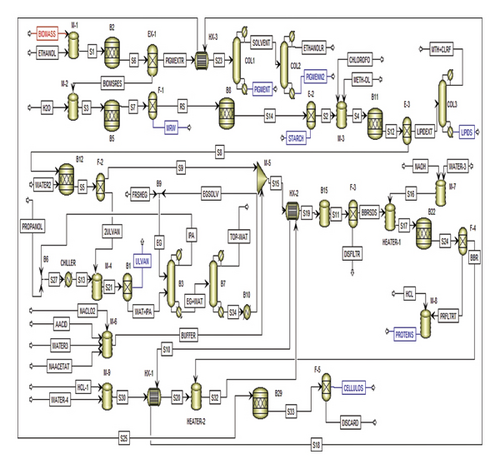

A fully integrated process for the extraction of value-added products from the collected Ulva fasciata was previously reported [3]. Figure 1 presents the schematic diagram for the previously published experimental work [3]. The Aspen Plus software (V.10, Aspen Tech Inc., Bedford, Massachusetts, USA) was employed to model the extraction of value-added products derived from Ulva fasciata macroalgae. The activity coefficient nonrandom two-liquid (NRTL) thermodynamic model, introduced by Renon and Prausnitz in 1968 [14], was used as the property method to simulate this process. This model is specifically recommended for processes involving valorizing seaweed biomass into proteins, lipids, carbohydrates, and similar substances. The composition of the biomass, detailed in Table 1 and obtained from a prior study [3], was adopted for the simulation. The Aspen Plus databases align most components, while the National Renewable Energy Laboratory (NREL) developed a physical property database to define any unavailable elements [15, 16].

| Proximate analysis | Weight % |

|---|---|

| Moisture content | 8.5 |

| Volatile content | 70.7 |

| Fixed carbon | 0.3 |

| Ash content | 20.5 |

| Calorific value MJ/kg | 15.19 |

| Cellulose, hemicellulose, and lignin contents | Weight % |

| Hemicellulose | 32.91 |

| Cellulose | 9.8 |

| Lignin | 1.5 |

| Chemical constituents | Weight % |

| Organic C | 24.59 |

| Organic matter | 42.30 |

| Moisture content | 8.5 |

| Total nitrogen | 2.1 |

| Mineral composition | mg/kg |

| P | 33 |

| K | 260 |

| Ca | 3700 |

| Mg | 82.47 |

| Fe | 180.14 |

| Zn | 66.32 |

| Mn | 15.29 |

| Cu | 3.23 |

| Ni | 0.0519 |

| Cd | 0.591 |

| Cr | 0.31 |

| Pb | 0.0001 |

| As | 0.002 |

| Hg | 0.001 |

| Co | 0.0278 |

The short-cut distillation model (DSTWU) was applied in the modeling process to forecast the production of pigments and lipids, while the Radfrac model facilitated the separation of isopropyl alcohol via azeotropic distillation. Given the significant difference in boiling points between water and ethylene glycol, a distillation column was applied to recover the solvent for future reuse. This approach was implemented across all distillation towers used throughout the process. To maintain the tank’s temperature, a mixer equipped with a heater was utilized. In addition, simulations involving membranes and filters were executed using RStoic and component separator tools, respectively, leveraging known conversion percentages. The heater performance metrics and properties across named units are illustrated in supporting information Table S1, while all data related to process heat exchangers are illustrated in supporting information Table S2. The DSTWU performance and key component recovery across designated units are illustrated in supporting information Table S3. The RStoic analysis across designated units is illustrated in supporting information Table S4. The operating conditions were taken from our previous work [3].

2.2. Economic Analysis

The main goals of economic studies include identifying revenue sources, evaluating project management and implementation expenses, and assessing project feasibility through financial analysis. This ongoing technoeconomic research offers a thorough overview that can assist decision-making regarding value-added products derived from Ulva fasciata.

2.2.1. Synopsis of Overall Capital Investment

The OSBL cost covers off-site development for plant operations, typically falling between 10% and 100% [20]. However, this work applied a 30% OSBL ratio. The company’s research team possessed the necessary package, which excluded engineering fees. The project earmarked a 10% contingency to accommodate unforeseen expenses. 15% of the direct capital cost was designated as working capital [18, 21]. Start-up expenses accounted for 15% of the combined OSBL and ISBL costs. Table 2 details other economic assumptions utilized in this study.

| Economic assumptions | Parameters |

|---|---|

| Equity cost | 25% |

| Debt cost | 5% |

| Capital cost | 15% |

| Debt-to-equity ratio | 0.5 |

| Rate of discount | 11% |

| Taxation rate | 22.50% |

| Depreciation method | Falling balance |

| Depreciation period | 5 years |

| Depreciation rate | 10% |

| Project duration | 15 years |

2.2.2. Operating Costs

Operating costs include both fixed and variable production expenses. Irrespective of a project’s efficiency, fixed costs such as labor, overhead, maintenance, insurance, taxes, rent, and environmental fees are inherent [22]. Conversely, variable costs fluctuate with production rates and outputs. These include expenses for raw materials such as biomass, ethanol, methanol, chloroform, isopropyl alcohol, sodium hypochlorite, acetic acid, sodium acetate, HCl, NaOH, and ethylene glycol, as well as utilities such as energy, heating and cooling water, transportation, packaging, and waste disposal. Overall, effective resource utilization, such as reducing raw material losses and energy consumption, can help to reduce variable costs [18]. Raw materials, being notably costly, contribute significantly to the overall production expenses.

2.2.3. Economic Viability Indicators

3. Results and Discussion

3.1. The Yields of the Produced Value-Added Products

The proposed zero-waste biomass residue (BIOMSRES) technique yielded 34.89% MRWE, 2.61 ± 0.5% chlorophylla,b, 0.41 ± 0.05% carotenoids, 12.55 ± 1.6% starch, 3.27 ± 0.7% lipids, 22.24 ± 1.8% ulvan, 13.37 ± 1.5% proteins, and 10.66 ± 0.9% cellulose from the dry weight of Ulva fasciata [3]. The obtained results were better than those reported for Ulva ohnoi seaweed dry biomass, which yielded 45.42 ± 1.91%, 3.67 ± 1.38%, 3.81 ± 1.26%, 13.88 ± 0.40%, 14.83 ± 1.06%, and 8.70 ± 1.87% of salt-, starch-, lipid-, ulvan-, protein-, and cellulose-rich extracts, respectively, with a total recovery of approximately 90.31 ± 1.94% of Ulva ohnoi dry weight [9]. The current reported yields were also comparable to those reported for Indian Ulva fasciata seaweed dry biomass, which yielded approximately 26% MRWE, 3% lipids, 25% ulvan, and 11% cellulose [4].

3.2. Process Simulation for the Suggested Fully Integrated Process of Ulva fasciata Valorization Into Sustainable Value-Added Products

3.2.1. Production of Pigments and Antioxidants

Initially, 24 tons per day (t/d) of biomass were combined with absolute ethanol at 60°C for pigment extraction in a ratio of 1:20 (w/v). The pigment extraction stream analysis and properties across designated units are fully illustrated in supporting data Table S5. The resultant pigment extract (PIGMEXTR) stream was directed into COL1, aimed at isolating the primary product, “pigment and antioxidant,” from both the top and bottom products (Figure 2). The top product, identified as “solvent,” underwent recovery through a subsequent distillation column labeled COL2. COL2 separated and discharged ethanol from its top, while pigment and antioxidant residues emerged from its bottom (Figure 2). Table 3 provides specific details and specifications for COL1 and COL2.

| Model | COL1 | COL2 | COL3 | B3 | B7 | |

|---|---|---|---|---|---|---|

| Type | DSTWU | DSTWU | DSTWU | RadFrac | DSTWU | |

| Number of stages | 7 | 4 | 10 | 30 | 15 | |

| Reflux ratio | 0.1240405 | 0.263377 | 0.14508 | 1.2 | 0.13163 | |

| Feed stage | 5 | 3 | 6 | EG | WAT + IPA | 8 |

| 4 | 25 | |||||

3.2.2. Production of MRWE

Water (H2O) was introduced to the BIOMSRES, which exits from the bottom of EX-1, in a ratio of 1:20 (w/v) (BIOMSRES:H2O). The MRWE extraction stream analysis and properties across designated units are fully illustrated in supporting data Table S6. The separation processes then extracted MRWE from the bottom of the F-1 unit and directed the top product, known as residue (RS), into subsequent processes (Figure 2).

3.2.3. Production of Starch

For starch extraction, the RS stream was directed toward the hydrolysis reactor (RStoic), as shown in Figure 2. The starch extraction stream analysis and properties across designated units are fully illustrated in supporting data Table S7. The RStoic (B8) was set to operate at a temperature of 40°C, a pressure of 1 atm, and a conversion reaction rate of 20.2% from the initial “RS” input.

3.2.4. Production of Lipids

The BIOMSRES stream (S2) underwent mixing with chloroform and methanol at a ratio of 1:2, as illustrated in Figure 2. The lipid extraction stream analysis and properties across designated units are fully illustrated in supporting data Table S8. The resultant mixed stream (S4) was introduced into the hydrolysis reactor (B11) to facilitate the production of lipid extract. The specifications for reactor B11 involved operating at a temperature of 50°C and a pressure of 1 atm, with reaction conversions specified according to Table 4. To obtain the lipids and recover the chloroform–methanol mixture, a distillation column labeled COL3 was utilized. Table 3 details the conditions for COL3, which governed the separation process.

| Fatty acid | Content (%) | Total amount in the biomass (kg) | Conversion (%) |

|---|---|---|---|

| Caprylic acid | 1.17 | 0.38259 | 0.077 |

| Capric acid | 0.84 | 0.27468 | 0.055 |

| Myristic acid | 4.45 | 1.45515 | 0.294 |

| Palmitic acid | 38.93 | 12.73011 | 2.570 |

| Margaric acid | 1.63 | 0.53301 | 0.108 |

| Stearic acid | 3.72 | 1.21644 | 0.246 |

| Arachidic acid | 0.39 | 0.12753 | 0.026 |

| Behenic acid | 2.64 | 0.86328 | 0.174 |

| Lignoceric acid | 0.92 | 0.30084 | 0.061 |

| Palmitoleic acid (n − 9) | 3.08 | 1.00716 | 0.203 |

| Heptadecenoic acid | 1.84 | 0.60168 | 0.121 |

| Oleic acid (n − 9) | 1.16 | 0.37932 | 0.077 |

| Linoleic acid (n − 6) | 1.42 | 0.46434 | 0.094 |

| α-Linolenic acid (n − 3) | 15.68 | 5.12736 | 1.035 |

| γ-Linolenic acid (n − 6) | 2.95 | 0.96465 | 0.195 |

| Stearidonic acid (n − 3) | 16.15 | 5.28105 | 1.066 |

| Gondoic acid (n − 9) | 1.16 | 0.37932 | 0.077 |

| Eicosapentaenoic acid (n − 3) | 1.87 | 0.61149 | 0.123 |

| Total | 100.00 | 32.7 | 6.601 |

3.2.5. Production of Ulvan

The BIOMSRES stream (S8) was mixed with distilled water with a ratio of 1:20 (w/v), as shown in Figure 2. The ulvan extraction stream analysis and properties across designated units are fully illustrated in supporting data Table S9. The filtration process received this mixture (S5) and sent the upper product (S9) to other processes. Then, the filtrate (2ULVAN) was mixed with chilled isopropyl alcohol at −40°C, and the mixing ratio was 1:2.5 (v/v). Following Ulvan’s separation, the Radfrac distillation tower (B3) recovered the isopropyl alcohol. However, there is an azeotrope between water and isopropyl alcohol, and the separation of pure isopropanol is very difficult under normal conditions. So, using ethylene glycol as a solvent is an effective solution to the azeotrope problem. The column (B3) recycles the isopropanol as it exits. To recover the ethylene glycol solvent, another distillation column (B7) was used. The recovered ethylene glycol (EGSOLV) was sent back to mixer B9 in order to mix it with fresh ethylene glycol (FRSHEG), and then, the mixture (EG) was fed to the column (B3). Table 3 displays the specifications for columns B3 and B7.

3.2.6. Production of Proteins

The BIOMSRES stream (S9) underwent a bleaching process utilizing an acetate buffer containing 1% NaClO2 at a ratio of 1:40 (w/v) and conducted at a temperature of 60°C. The protein extraction stream analysis and properties across designated units are fully illustrated in supporting data Table S10. The preparation of the buffer solution involved mixing components—acetic acid, sodium acetate, water, and NaClO2—using a mixer (M-6). The F-3 unit then filtered the resulting mixture stream (S11), directing the bleached biomass residue (BBR) toward the subsequent neutralization and soaking processes depicted in Figure 2. Following this, the resulting mixture underwent filtration, neutralization, and hydrolysis stages. The hydrolysis, aimed at producing proteins from the biomass, was executed within the B22 unit at a temperature of 60°C and a pressure of 1 atm.

3.2.7. Production of Cellulose

The BBR stream was combined with 5% HCl at a ratio of 1:20 (w/v), as depicted in Figure 2. The cellulose extraction stream analysis and properties across designated units are fully illustrated in supporting data Table S11. The mixture was heated using the heater (HEATER-2) to reach a temperature of 100°C. Subsequently, this heated mixture was directed into the hydrolysis reactor (B29), which was maintained at a temperature of 25°C and a pressure of 1 atm to facilitate the production of cellulose.

3.3. Process Heat Integration and Energy Analysis

Three heat exchangers were employed to conserve energy and cut costs. In the process, the S32 product stream, exiting the heater at 100°C with a mass flow rate of 150 tons per day, was utilized to elevate the temperature of stream S15 from 25°C to 60°C in HX-2. Concurrently, stream S10 was employed to increase the temperature of stream S30 from 27°C to 90°C in HX-1. This resulted in a decreased heat duty requirement for HEATER-2. Similarly, stream S18 was utilized in HX-3 to raise the temperature of stream PIGMEXTR from 60°C to 78°C, following the same approach.

The estimation of total energy consumption across various units involved in this simulation is detailed in Table 5. It enumerates the types of heat exchangers and their corresponding units and provides a comprehensive overview of the diverse heat exchange mechanisms and their corresponding types employed throughout the simulation. These units encompass a range of functions, including coolers, heaters, process exchangers, and reboilers. Each unit plays a distinct role in the overall process, contributing to the exchange or regulation of heat within the system.

| Heat exchanger | Type | Base duty (kW) |

|---|---|---|

| B10 | Cooler | 1129 |

| B11_heat_Exchanger | Heater | 391.8 |

| B12_heat_Exchanger | Heater | 107.6 |

| B2_heat_Exchanger | Heater | 582.5 |

| B22_heat_Exchanger | Heater | 474.1 |

| B29_heat_Exchanger | Cooler | 222.5 |

| B5_heat_Exchanger | Cooler | 311 |

| B8_heat_Exchanger | Heater | 493.9 |

| CHILLER | Cooler | 46.86 |

| Condenser@B3 | Cooler | 189.8 |

| Condenser@B7 | Cooler | 2.08E + 04 |

| Condenser@COL1 | Cooler | 4211 |

| Condenser@COL2 | Cooler | 4963 |

| Condenser@COL3 | Cooler | 40.22 |

| HEATER-1 | Heater | 38.14 |

| HEATER-2 | Heater | 4317 |

| Reboiler@B3 | Heater | 3209 |

| Reboiler@B7 | Heater | 2.15E + 04 |

| Reboiler@COL1 | Heater | 1669 |

| Reboiler@COL2 | Heater | 4963 |

| Reboiler@COL3 | Heater | 739.2 |

| Total | kW | 70448.62 |

3.4. Economic Evaluation

The investment decisions of manufacturers heavily rely on the overall capital expenditure, particularly the cost associated with the ISBL plant, which stands as a primary consideration. In this context, utilizing Bridgewater’s approach, the estimated ISBL cost for the process presented here amounts to $19,488,430.20, as evident in Table 6. Understanding the total production cost, in addition to the ISBL cost, proves critical in determining process feasibility. Table 7 delineates the costs associated with raw materials and extracted products from Ulva fasciata. Table 8 highlights the overall cost per ton of products at $3107.22. Thus, Tables 6, 7, and 8 collectively emphasize the pivotal role played by both the ISBL cost as an initial metric and the comprehensive production expenditure in evaluating the feasibility of manufacturing processes. This dual perspective provides critical insights into the financial aspects necessary for assessing the viability of such processes.

| Cost item | Cost ($) |

|---|---|

| ISBL | 19,488,430.20 |

| OSBL | 5,846,529.06 |

| Direct cap. investment (ISBL + OSBL) | 25,334,959.26 |

| Contingency cost | 2,533,495.93 |

| Engineering cost | 3,800,243.89 |

| Fixed capital cost | 31,668,699.07 |

| Working capital | 3,800,243.89 |

| Startup expenses | 3,800,243.89 |

| Total capital investment | 49,086,483.56 |

| Raw materials | Products | ||||||

|---|---|---|---|---|---|---|---|

| Parameter | ton/day | $/ton | Total | Parameter | ton/day | $/ton | Total |

| Biomass | 24 | 1440 | 34,560 | Carotene | 0.09547 | 130,000 | 12,411.68 |

| Ethanol | 0.004134 | 850 | 3.5142 | Chlorophyll | 0.62906 | 12,000 | 7548.69 |

| Chloroform | 3.87819E − 06 | 600 | 0.0023269 | MRWE | 8.373671 | 1000 | 8373.67 |

| Methanol | 2.4E − 05 | 480 | 0.01152 | Cellulose | 2.56015 | 2500 | 6400.37 |

| Isopropanol | 0.1056 | 1290 | 136.224 | Lipids | 0.78483 | 2100 | 1648.14 |

| NaClO2 | 2.30688 | 1200 | 2768.256 | Proteins | 3.211071 | 5000 | 16,055.35 |

| Acetic acid | 0.0816 | 600 | 48.96 | Starch | 3.011624 | 3000 | 9034.87 |

| Water | 249.215 | 0.10 | 24.92151 | Ulvan | 5.338134 | 15,000 | 80,072.01 |

| Sodium acetate | 1.781 | 240 | 427.49568 | ||||

| HCl | 0.408 | 5000 | 2040 | ||||

| NaOH | 0.4608 | 345 | 158.976 | ||||

| Fresh ethylene glycol | 0.024 | 600 | 14.4 | ||||

| Total cost $ for (t/d) | 40,182.76 | 141,544.79 | |||||

| Cost parameter | Assumption | Value ($) |

|---|---|---|

| Raw materials | 40,182.76 | |

| Energy | $0.16/m3 | 25,427.72 |

| Heat losses | 5% | 1271.39 |

| Variable production cost/d | 66,881.87 | |

| Product formulation into beads and packing | 1% | 668.82 |

| Maintenance | 10% | 6688.19 |

| Waste steam disposal | 0.5% | 334.41 |

| Cost/day | 74,573.28 | |

| Cost/ton | 3107.22 | |

| Cost/y | 24,609,183.52 | |

| Income ($/d) | 141,544.79 | |

| Income ($/y) | 46,709,779.25 | |

| Profit/d | 66,971.50 | |

| Profit/y | 22,100,595.73 | |

| Profit % | 89.8 |

The NPV represents the disparity between the present values of cash inflows and outflows within a specific timeframe (15 years in this project). When the NPV is positive, a project is considered economically viable. Table 9 offers an overview of the NPV for this process. Cash flow initiation, known as the design phase, begins in Year 1 of the project. During the construction and installation stages in Year 2, the project allocates the entire fixed capital investment within this phase. Depreciation costs are deducted from the profit starting in Year 3, when the operation reaches full capacity.

| Project life | Investment (%) | Capacity (%) | Dep. | Investment | Ope. expenses | Revenues | Profit | Dep ex | Taxable income | Tax paid | Cash flow | Dis. cash flow | Pre tax | Column 1 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1 | 0 | 0 | 0 | 0 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | |

| 2 | 100 | 0 | 0 | $49,086,483.56 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | -$49,086,483.56 | -$44,222,057.26 | $49,086,483.56 | |

| 3 | 0 | 100 | 0.2 | $28,409,427.41 | $46,709,779.25 | $18,300,351.84 | $3,660,070.37 | $14,640,281.47 | $3,294,063.33 | $15,006,288.51 | $12,179,440.39 | $11,712,225.18 | ||

| 4 | 0 | 100 | 0.32 | $28,409,427.41 | $46,709,779.25 | $18,300,351.84 | $5,856,112.59 | $12,444,239.25 | $2,799,953.83 | $15,500,398.01 | $10,972,468.82 | $12,700,444.18 | ||

| 5 | 0 | 100 | 0.192 | $28,409,427.41 | $46,709,779.25 | $18,300,351.84 | $3,513,667.55 | $14,786,684.29 | $3,327,003.96 | $14,973,347.88 | $9,885,107.05 | $11,646,343.91 | ||

| 6 | 0 | 100 | 0.1152 | $28,409,427.41 | $46,709,779.25 | $18,300,351.84 | $2,108,200.53 | $16,192,151.31 | $3,643,234.04 | $14,657,117.80 | $8,905,501.85 | $11,013,883.75 | ||

| 7 | 0 | 100 | 0.1152 | $28,409,427.41 | $46,709,779.25 | $18,300,351.84 | $2,108,200.53 | $16,192,151.31 | $3,643,234.04 | $14,657,117.80 | $8,022,974.64 | $11,013,883.75 | ||

| 8 | 0 | 100 | 0.0576 | $28,409,427.41 | $46,709,779.25 | $18,300,351.84 | $1,054,100.27 | $17,246,251.58 | $3,880,406.60 | $14,419,945.24 | $7,227,905.08 | $10,539,538.63 | ||

| 9 | 0 | 100 | 0 | $28,409,427.41 | $46,709,779.25 | $18,300,351.84 | $0.00 | $18,300,351.84 | $4,117,579.16 | $14,182,772.68 | $6,511,626.20 | $10,065,193.51 | ||

| 10 | 0 | 100 | 0 | $28,409,427.41 | $46,709,779.25 | $18,300,351.84 | $0.00 | $18,300,351.84 | $4,117,579.16 | $14,182,772.68 | $5,866,329.91 | $10,065,193.51 | ||

| 11 | 0 | 100 | 0 | $28,409,427.41 | $46,709,779.25 | $18,300,351.84 | $0.00 | $18,300,351.84 | $4,117,579.16 | $14,182,772.68 | $5,284,981.90 | $10,065,193.51 | ||

| 12 | 0 | 100 | 0 | $28,409,427.41 | $46,709,779.25 | $18,300,351.84 | $0.00 | $18,300,351.84 | $4,117,579.16 | $14,182,772.68 | $4,761,244.95 | $10,065,193.51 | ||

| 13 | 0 | 100 | 0 | $28,409,427.41 | $46,709,779.25 | $18,300,351.84 | $0.00 | $18,300,351.84 | $4,117,579.16 | $14,182,772.68 | $4,289,409.87 | $10,065,193.51 | ||

| 14 | 0 | 100 | 0 | $28,409,427.41 | $46,709,779.25 | $18,300,351.84 | $0.00 | $18,300,351.84 | $4,117,579.16 | $14,182,772.68 | $3,864,333.21 | $10,065,193.51 | ||

| 15 | 0 | 100 | 0 | $28,409,427.41 | $46,709,779.25 | $18,300,351.84 | $0.00 | $18,300,351.84 | $4,117,579.16 | $14,182,772.68 | $3,481,381.27 | $10,065,193.51 | Discount rate | |

| 11% | ||||||||||||||

| $237,904,5 | NPV | $47,030,647.87 | $49,755,544.90 | |||||||||||

| ROI | 484.66% | |||||||||||||

| IRR | 17% | Average annual cash flow | $7,019,438.86 | |||||||||||

| Payback | 6.992935556 | Years |

The proposed approach, as shown in Table 9, demonstrates promising indicators with an NPV of $49,755,544.90 and an impressive ROI of 485%. In addition, the IRR, calculated at a significant 17%, signals a strong potential for profitability. Moreover, the anticipated payback period of 7 years indicates a swift recovery of the initial capital investment. These findings highlight the financial feasibility and attractiveness of this process initiative. The robust IRR and rapid payback period underscore the project’s potential for substantial returns and swift capital recovery, establishing it as an appealing and promising investment opportunity.

4. Ulva fasciata Value-Added Products and Their Proposed Potential Uses

The present research presents an environmentally friendly, sequential, and zero-waste method to generate various valuable products from Ulva fasciata, including 34.89%, 2.61%, 0.41%, 12.55%, 3.27%, 22.24%, 13.37%, and 10.66% of MRWE, chlorophylla,b, carotenoids, starch, lipids, ulvan, proteins, and cellulose, respectively. The produced MRWE can be used as liquid organic fertilizer. The produced chlorophyll and carotenoids have different uses as natural pigments and antioxidants. The production of biodegradable plastics, as well as the biofuels, food, and pharmaceutical industries, can utilize Ulva-derived starch and cellulose. Ulvan, with its biocidal activities, can be applied in food packaging, water disinfection, wound healing, and other biomedical applications. The food and animal feed industries can apply Ulva-derived lipids and proteins [3, 4, 9].

Thus, the green Ulva fasciata biomass can be considered a good candidate for a sustainable blue economy. Moreover, Ulva biomass has been reported for carbon dioxide sequestration, and it has the ability to capture about 3.85 million tons of CO2 equivalent [25]. For its importance, according to statistics, the worldwide production of cultivated Ulva reached 2155 metric tons in 2019, with an estimated value of approximately 750,000 USD [26]. Ulva is reported to have wide applications in the existing food, animal feed, and pharmaceutical industrial sectors, in addition to biofuel production and agricultural sector [27, 28]. In addition, incorporating Ulva cultivation into integrated multitrophic aquaculture (IMTA) systems has proven its viability for large-scale operations and contributes significantly to environmental sustainability [29–31]. For capitalizing on their potential applications in food production, animal feed, biofuel, and bioremediation, Ulva have been cultivated globally using pilot commercial systems [32]. Initial commercial trials took place in America, as a biomass feedstock for biomethane production. In Denmark, research was conducted on outdoor tank cultivation to be used as a feedstock for bioenergy production. In South Africa, Ulva are harvested for animal feed production. In addition, in Saudi Arabia, Ulva is strategically grown as a biofilter within IMTA systems, while in Australia, land-based cultivation of Ulva is undertaken for nutraceuticals and cosmeceuticals industries [32]. In several developing countries, such as the Pacific Islands, Indonesia, Tanzania, and the Philippines, promoting seaweed cultivation has been recommended as a strategy to reduce fishing pressure, alleviate poverty, create new job opportunities, and empower women by providing an alternative income source [33].

5. Conclusion

The study concludes that extracting value-added products from Ulva fasciata is economically viable and sustainable, as it has several industrial applications. Moreover, key financial indicators—an NPV of $49,755,544.90, an ROI of 485%, and an IRR of 17%—coupled with a 7-year payback period, demonstrate the process’s profitability and quick investment recovery.

This proposed study can be utilized for the preliminary design and to build a functional biorefinery for sustainable products derived from marine algal biomass. Further work is planned now to incorporate pilot-scale validations, thereby creating a new market for the bio-based blue economy, which would consider other possible scaling challenges including maintaining product quality, solvent recovery efficiency, and equipment optimization, to align the simulated and real-world results. This approach is both strategic and promising, requiring only three fundamental inputs: carbon dioxide, sunlight, and seawater. It is essential to emphasize that the exact pricing of Ulva fasciata–derived bioproducts intended for widespread usage remains undetermined, as they have not yet entered the market and their unique attributes are still unknown. However, this suggested zero-waste BIOMSRES process can improve resource sustainability by converting biomass in the best way possible, lower the growth of invasive algal biomass along the Mediterranean coast, and make the process more useful in low-carbon sectors. It can also lessen the negative impacts of harmful algal blooms on tourism, the environment, and the economy. Further work is being undertaken now to assess the life cycle assessment (LCA), water footprint, and carbon footprint of the suggested bioprocess to assure its economic and environmental viability.

Nomenclature

-

- CCOP

-

- Cash cost of production

-

- COL

-

- Distillation column

-

- DSTWU

-

- Distillation unit

-

- EX-1

-

- Extractor (component separator)

-

- HX

-

- Heat exchanger

-

- IRR

-

- Internal rate of return

-

- ISBLs

-

- Inside battery limits

-

- MRWE

-

- Mineral-rich water extract

-

- NPV

-

- Net present value

-

- NREL

-

- National Renewable Energy Laboratory

-

- NRTL

-

- Nonrandom two-liquid

-

- OSBLs

-

- Outside battery limits

-

- ROI

-

- Return on investment

-

- TEA

-

- Technoeconomic analysis

Ethics Statement

We have followed the ethical norms established by our respective institutions.

Conflicts of Interest

The authors declare no conflicts of interest.

Author Contributions

N.S.E.-G., the corresponding author, put forth the idea of scientific research, conceived and designed research, supervised experimental work, validated the results, interpreted and discussed the results, and wrote the manuscript; H.N.N. performed collection and sampling of macroalgae and helped in the extraction of the value-added products; M.S.S. and A.M. together have performed the process design, simulation, and technoeconomic analysis and also helped in the interpretation of data and writing of the manuscript. All authors have read and agreed to the published version of the manuscript.

Funding

This work was funded by the Science, Technology & Innovation Funding Authority (STDF) under the grant number 45614.

Acknowledgments

The authors express their gratitude to the Science, Technology & Innovation Funding Authority (STDF) for funding this work under grant number 45614.

Supporting Information

Table S1 illustrates the heater performance metrics and properties across named units.

Table S2 illustrates all data related to process heat exchangers.

Table S3 illustrates the DSTWU performance and the key component recovery across designated units.

Table S4 illustrates the RStoic analysis across the designated units.

Table S5 illustrates the pigment extraction stream analysis and properties across designated units.

Table S6 illustrates the MRWE extraction stream analysis and properties across designated units.

Table S7 illustrates the starch extraction stream analysis and properties across designated units.

Table S8 illustrates the lipid extraction stream analysis and properties across designated units.

Table S9 illustrates the ulvan extraction stream analysis and properties across designated units.

Table S10 illustrates the protein extraction stream analysis and properties across designated units.

Table S11 illustrates the cellulose extraction stream analysis and properties across designated units.

Open Research

Data Availability Statement

Data are available from the corresponding author upon request.