The Impact of Water and Energy Performance on Waste Performance in South African JSE-Listed Companies

Abstract

This study examines whether enhanced environmental metrics—specifically, energy and water—lead to improved waste management. There is a limited body of existing literature on this topic, specifically within the context of African business contexts. Moreover, the available global studies present inconclusive findings regarding the association between these variables. The study utilises panel quantile regression methodology to examine the dataset, including South African companies listed on the Johannesburg Stock Exchange (JSE) from 2012 to 2021. In the independent single equations, it is apparent that the three regressions for market value (MFV), return on equity (ROE) and TOBIN’S Q (TBQ) illustrate that both water (WTPF) and energy performance (EPF) demonstrate a significantly positive relationship with waste performance (WSPF). Moreover, MFV, ROE and TBQ demonstrate significantly negative outcomes to WSPF in the three equations. When interaction terms are added, the three regressions for MFV, ROE and TBQ prove that the interaction term between EPF and WTPF to WSPF is significantly positive. In addition, the interaction term involving energy and MFV to WSPF is significantly positive. The interaction term between water and MFV to WSPF is significantly positive. The interaction term pertaining to water and ROE to WSPF is significantly negative. The interaction term between water and TBQ to WSPF is significantly positive. Policymakers should promote integrated resource management strategies that combine water and energy efficiency efforts to reduce waste. Incentives should be given to invest in technologies that improve performance simultaneously. Corporate transparency and targeted support may be needed to ensure resource efficiency does not negatively impact short-term profitability.

1. Introduction

Environmental performance can impact a company’s financial success, and managers are increasingly interested in sustainable practices [1]. Waste management is a crucial aspect of green practices, but there is a lack of research on its effects on individual corporations. Profit-oriented corporations aim to maximise wealth accumulation for owners, but it is crucial for organisations to show responsibility towards all stakeholders, not just shareholders [2]. ’Not just shareholders’ signifies that firms must take into account a broader constituency than merely stockholders. These ’stakeholders’ encompass all those impacted by the firm, including workers, customers, suppliers and the community. Although maximising profit for shareholders is a primary objective, competent organisations also consider the needs and interests of other stakeholders. This comprehensive perspective promotes enduring sustainability and ethical corporate conduct. With global corporate developments, demonstrating social accountability is essential, and a thorough study of waste performance (WSPF) is crucial.

South Africa’s citizens produce 54.2 million tons of general trash annually, including municipal, commercial and industrial waste [3]. With a population of 57 million, each person generates 2.5 kg of waste daily, resulting in an annual accumulation of around 98 million tonnes of rubbish. The country’s transformation into a global economy has led to enhanced monitoring and management of pollution and waste in all industries. The inclusion of waste accounting practices has significantly contributed to sustainable development in South Africa, despite the ongoing challenges posed by waste generation [4].

Sub-Saharan Africa (SSA) is facing a significant increase in waste-related difficulties due to population and economic expansion [5]. The annual waste volume in the region, including South Africa, is projected to rise from 174 million tonnes in 2016–516 million tonnes by 2050. Without proper waste reduction policies, waste disposal methods mainly involve landfill deposition or incineration, with 69% of total garbage directed towards landfill sites. South Africa’s recycling rate is only 10%, with an estimated 98 million tons of waste being disposed of in landfills annually [6]. The country’s poor recycling rate further complicates the situation.

Municipalities in South Africa are concerned about landfill overflows by 2025 due to unsustainable refuse output [7]. The country’s persistent poverty and inequality pose significant challenges, exacerbated by pollution from inadequate waste management [8]. This financial burden hinders the achievement of sustainable development goal 11, aiming to establish sustainable cities and communities. Ineffective waste management contributes to air pollution and climate change. The growing environmental pressures from organisational operations necessitate a thorough examination of waste management effectiveness. Despite significant resources, waste management is often indiscriminately discarded without considering its ecological impact.

Waste disposal in South Africa is causing significant environmental damage due to contamination of rivers and oceans, illegal dumping and unlicensed waste management operations. Informal and unplanned settlements exacerbate the country’s landfill space shortage [9]. The National Environmental Management Waste Act of 2008 aims to mitigate pollution and establish a sustainable ecosystem [10]. However, compliance is primarily seen in urban areas, affecting waste management practices across the nation. This issue extends beyond South Africa and has global implications.

A comprehensive review of the available literature is essential for contextualising our work within the wider academic dialogue. Although research exploring the individual relationships between water performance (WTPF), energy performance (EPF) or WSPF and financial performance is relatively abundant [11, 12], studies that specifically investigate the interconnections among these three components are less common, especially in emerging economies. Certain studies have examined the water–energy nexus [13], emphasising the interconnectedness of these resources, although frequently neglecting to explicitly include waste. Moreover, studies undertaken in analogous economic environments, such neighbouring African countries or developing economies in Asia and Latin America, may yield significant insights. Studies investigating resource efficiency in the industrial sectors of Brazil and India may provide analogous insights into the problems and possibilities encountered by enterprises working under similar developmental and environmental constraints [14]. Analysing these studies will provide a comparative assessment of legislative frameworks, resource availability and business sustainability practices, so reinforcing the rationale for concentrating on South Africa and augmenting the applicability of the results to other rising economies. This comprehensive literature evaluation will not only identify the research gap addressed by this study but also enhance the knowledge of the intricate link among WTPF, EPF and WSPF on a worldwide scale.

The necessity of this study stems from the difficulties to have the entire nation fully adopt and comply with environmental acts. Thus, this study aims to investigate the impact of WTPF and EPF on WSPF in South Africa’s corporate sector. The study highlights the need to address complacency in waste disposal and management, as it affects WTPF and EPF, which determine WSPF within organisations. The current waste management sector struggles to handle the increasing amount of waste, impacting revenue from waste management sales. Climate change issues have led to firms focusing on waste, energy and water levels as indices of sustainable performance. Organisations with high waste, energy and water usage are considered underperforming, while those with lower levels are considered great performers.

Hence, the objectives of this study are to evaluate how WTPF or EPF independently influences WSPF in South African companies by using financial performance and firm value indicators as moderating variables. Furthermore, the article investigates how the interactive impacts of water and energy and their relationship with the financial performance and firm value measures affect WSPF in South African JSE-listed companies. In this regard, the following are hypotheses for this study:

Hypothesis 1: Water and EPF positively affect WSPF in South African JSE-listed companies.

Hypothesis 2: Market value (MFV) positively impacts the nexus of WTPF, EPF and WSPF in South African JSE-listed companies.

Hypothesis 3: Firm financial performance (Tobin’s Q (TBQ) and Return on Equity (ROE)) positively impacts the nexus of WTPF, EPF and WSPF in South African JSE-listed companies.

Consequently, this study has pertinent practical consequences aligned with the specific hypothesis. This article advocates for integrated resource management strategies. Consequently, if Hypothesis 1 is validated, indicating a favourable correlation between water/energy and WSPF, organisations have to prioritise integrated resource management techniques. This signifies perceiving water, energy and waste as interrelated components within a comprehensive resource management framework rather than as independent concerns. Organisations may formulate comprehensive plans that maximise resource use across all three domains, resulting in synergistic advantages and improved overall sustainability performance. This may encompass activities such as closed-loop water systems that diminish both water use and wastewater production or energy-efficient technology that concurrently lower energy usage and waste outputs.

Secondly, this article examines MFV and sustainability performance. Consequently, if Hypothesis 2 is validated, demonstrating a favourable influence of MFV on the water–energy–waste nexus, it underscores the significance of integrating sustainability performance into business valuation and investor relations. Firms with elevated MFVs must be incentivised to sustain or augment their resource efficiency initiatives to retain their competitive edge. In contrast, firms with diminished MFVs may leverage enhanced sustainability performance to recruit investors and elevate their market position. This discovery highlights the increasing significance of Environmental, Social and Governance (ESG) concerns in investing choices.

Third, this research also considers financial performance and investments in resource efficiency. Consequently, if Hypothesis 3 is validated, indicating a favourable influence of financial performance (TBQ and ROE) on the nexus, it presents a compelling commercial rationale for investing in resource efficiency. Organisations exhibiting robust financial success are more adept at investing in novel technology and procedures that enhance water, energy and waste management. This discovery indicates that resource efficiency serves not only just as an environmental need but also as a catalyst for financial success, establishing a beneficial feedback loop in which prosperity facilitates more expenditures in sustainability.

Fourth, the findings can guide the development of more focused policy actions. If the study demonstrates differing effects across several quantiles, as anticipated with quantile regression, authorities can customise rules and incentives for certain groups of enterprises. Policies might prioritise assisting underperforming corporations in implementing fundamental resource efficiency strategies while motivating high-performing companies to strive for more ambitious sustainability objectives. This focused strategy can enhance the efficacy of policy interventions and encourage wider implementation of sustainable behaviours.

Fifth, the research can enable benchmarking and the exchange of best practices across South African JSE-listed firms. The research can uncover best practices in water, energy and waste management by analysing the performance of many firms across different quantiles. This material may be distributed via industry groups, conferences and other venues to promote broader adoption of best practices and enhance ongoing progress in company sustainability performance. This also generates opportunities for joint initiatives and information exchange within the corporate sector.

Moreover, the rationale of this article is that this study examines South African JSE-listed firms from 2012– 2021, providing a significant backdrop for analysing the interaction between WTPF, EPF and WSPF, with consequences that transcend national boundaries. South Africa, a resource-abundant but water-scarce country, encounters distinct sustainability issues, positioning its corporate sector as a vital experimental arena for resource efficiency methods [15]. The nation’s historical socioeconomic disparities and its current shift towards a green economy underscore the necessity of comprehending the influence of resource management on company sustainability [16]. Additionally, South Africa’s comprehensive regulatory structure, which mandates sustainability reporting for publicly listed corporations, offers an extensive dataset for quantitative research [17, 18]. Analysing this link by quantile regression allows a detailed comprehension of these effects across varying performance tiers, providing insights pertinent to other developing countries facing analogous resource limitations and developmental obstacles [19]. This methodology is especially pertinent in situations characterised by increasing resource scarcity and regulatory demands, rendering the South African experience a significant case study for global sustainability initiatives. This research enhances the existing literature on the relationship between environmental performance measures and their influence on corporate sustainability, providing practical insights for firms and policymakers in comparable emerging economies.

By acknowledging the research deficiencies emphasised in the previous paragraphs, this investigation makes a scholarly contribution to the empirical body of knowledge. This study provides empirical evidence from South Africa on the impact of corporate water and EPF on environmental quality. It focuses on listed firms operating between 2012 and 2021, highlighting the importance of corporate sustainability in a developing economy. The study uses major environmental metrics, such as water, energy and waste, to examine their influence on sustainability proxies, financial performance and value indicators. Quantile regression is used to analyse the WSPF corporate model, the first of its kind in a developing economy. This technique helps understand disparities between organisations by calculating slope parameters at different quantiles of WSPF in South Africa.

The research study is divided into five sections: a comprehensive evaluation of current scholarly research, a detailed discussion of the research approach, findings, implications and a conclusion.

2. Literature Review and Hypothesis Development

This review analyses the literature on WTPF, EPF and WSPF across different economies to identify research gaps and establish hypotheses. Previous research has mainly focused on the relationship between environmental and financial performance, neglecting the interconnectedness of ecological indicators like water, energy and waste. There is a lack of research on the impact of water and energy efficiency on waste management outcomes within the corporate domain.

2.1. Influence of Water and Energy Performance on Corporate Waste Performance

The relationship between WTPF, EPF and WSPF is a topic of limited research, but studies have found a significant relationship. Luo and Tang [20] and Benjamin et al. [12] found a positive link between environmental disclosure and WSPF, particularly in terms of energy and water usage. Trung and Kumar [21] investigated the impact of resources on waste management in the Vietnamese hotel industry, revealing that energy and water management significantly contribute to the industry’s long-term sustainability. Rad and Lewis [22] examined energy consumption, water usage and waste water management in the dairy industry, highlighting the significant impact of water and energy on waste generation. However, the scarcity of data makes it difficult for businesses to evaluate their performance, and it is essential for companies to benchmark their performance with others to address environmental issues. The study by Braam et al. [23] suggests that the contribution of water consumption and greenhouse gas emissions to corporate environmental performance is incremental.

Hypothesis 1: WTPF and EPF positively affect WSPF in South African JSE-listed companies.

It is important to note that Luo and Tang [20] and Braam et al. [23] associate environmental performance with voluntary disclosure; nevertheless, it remains ambiguous if this pertains particularly to waste. Benjamin et al. [12] explicitly examine environmental disclosure and waste; yet, restrictions are present. Trung and Kumar [21] and Rad and Lewis [22] provide useful insights through industry-specific studies, although they lack generalisability. Moreover, all lack a South African context. This study examines the deficiencies by concentrating on water and energy efficiency that directly influences waste production in South African enterprises from 2012 to 2021. Employing quantile regression facilitates a more refined comprehension of this link across varying degrees of corporate performance, offering a more comprehensive perspective than prior research.

2.2. The Impact of Corporate MFV on Corporate Water, Energy and Waste (Environmental) Performance

A study by Kim et al. [24] found that improving corporate environmental performance can boost MFVs for businesses with a negative organisational structure but can only partially recover lost value by mitigating signalling conflicts, reinforcing the concept of corporate sustainability performance. Kumar and Shetty [25] found an inverse correlation between the pollution index and MFV but a positive correlation between voluntary environmental programmes and firm value. India can improve environmental performance by using capital market capacities for sustainable economic growth. Endo [26] found a positive correlation between environmental performance and firm value in Japanese manufacturing companies. Lourenço et al. [27] confirmed investors penalising North American corporations for inadequate corporate sustainability initiatives.

Hypothesis 2: MFV positively impacts the nexus of WTPF, EPF and WSPF in South African JSE-listed companies.

Current scholarship examines the relationship between environmental performance and commercial value but with contradictions. Kim et al. [24] emphasise the moderating influence of collective reputation, whereas Kumar and Shetty [25] identify a positive correlation in the Indian market. Endo [26] warns against the use of static regression models and the inherent biases in evaluating this connection. Lourenço et al. [27] investigate comprehensive sustainability performance and its assessment. These studies frequently concentrate on overall environmental performance rather than particularly addressing the interconnection of water, energy and waste. This study examines the influence of MFV on this particular relationship among South African JSE-listed companies from 2012 to 2021, employing quantile regression to identify potential variations across diverse MFV levels, thereby transcending the constraints of static models identified by Endo [26].

2.3. The Effect of Firm Financial Performance on Corporate Water, Energy and Waste (Environmental) Performance

Walls et al. [28] found a negative but statistically insignificant relationship between corporate governance and environmental performance by incorporating firm performance as a control variable. Li et al. [29] found a positive link between financial and environmental performance, with environmental performance enhancing financial performance through regulatory risk mitigation. Busch et al. [30] re-examined the relationship between corporate carbon and firm performance, finding that greater carbon emissions lead to superior long-term financial performance. Delmas et al. [31] found an inverse association between carbon performance and price-earnings ratio and a negative correlation between carbon performance and ROE. Manrique and Martí-Ballester [32] found a positive association between financial performance and corporate environmental activities in 2982 companies from 2008 to 2015.

Hypothesis 3: Firm financial performance (TBQ and ROE) positively impact the nexus of WTPF, EPF and WSPF in South African JSE-listed companies.

Studies investigating the relationship between financial and environmental performance yield inconclusive results. Walls et al. [28] examine the relationship between corporate governance and environmental performance, whereas Busch et al. [30] particularly re-evaluate the connection between carbon and financial success. Li et al. [29] and Manrique and Martí-Ballester [32] examine the influence of environmental performance on financial success in various scenarios. Delmas et al. [31] examine the interplay between greenhouse gas emissions and financial performance. Nonetheless, these studies frequently investigate overall environmental performance or particular elements like as carbon emissions, rather than the interconnected nexus of water, energy and waste. This study investigates the influence of company financial performance (TBQ and ROE) on this relationship among South African listed businesses from 2012 to 2021, providing a more concentrated examination than previous research.

3. Research Methodology

This section contains the data and the econometric estimating method applied in this study.

3.1. Data

This section outlines the data sources and sample selection of the article.

3.1.1. Sample Selection and Data Sources

The study analysed 69 JSE-listed companies from 2012 to 2021, focusing on their sustainability projects. It used the REFINITIV database as the primary source for financial and sustainability data. This research examines the 69 firms listed on the JSE, chosen for their extensive data availability on WTPF, EPF and WSPF measures from 2012 to 2021. The sample, while covering a significant segment of the JSE, is not completely random. Consequently, the selection of the 69 firms for this study required a definitive justification for sample representativeness. The inclusion criterion emphasised organisations with consistent data reporting across all three performance dimensions, among additional significant factors, to ensure a rigorous study. This method, although it introduces a certain level of selection bias, is essential for thorough quantile regression analysis, which necessitates entire data sets. Although data availability serves as a practical foundation, exclusive dependence on it may lead to prejudice [33]. A more rigorous method entailed establishing precise selection criteria pertinent to the study subject. Due to the emphasis on resource efficiency (water, energy and waste), enterprises in resource-intensive industries (e.g., mining, manufacturing, agricultural) should be prioritised to guarantee adequate variability in the variables of interest [34]. This tailored sample improved the study’s capacity to identify correlations among the variables. Moreover, evaluating market capitalisation or revenue size can guarantee the inclusion of enterprises with substantial environmental impacts, hence enhancing the study’s practical significance [35]. An analysis of the sector distribution and market capitalisation of the chosen businesses in relation to the total makeup of the JSE yields insights into the sample’s representativeness. Consequently, the chosen sample reflected the wider JSE in these dimensions, enhancing the generalisability of the findings to the South African JSE-listed firm context. The chosen companies encompassed a variety of sectors, such as mining, manufacturing, utilities, finance and services, offering a comprehensive view of the connections among resource efficiency, financial performance and waste management in the South African corporate environment. This methodology is consistent with prior research on corporate sustainability performance [12, 25, 29, 30, 32], acknowledging the compromise between sample size and data comprehensiveness in deriving significant insights into the intricate relationships being examined.

3.2. Variable Selection

This section discusses the dependent variable, explanatory variables and control variables of the article.

3.2.1. Dependent Variable

This article uses WSPF as a dependent parameter, calculating total waste consumption at year end and dividing it by total sales [36–38]. This formula is widely used in corporate sustainability studies [37, 39, 40] to standardise environmental metrics based on company size. As such, it enables efficient production procedures and aligns with previous environmental corporate research.

Thus, calculating WSPF as total waste consumption divided by total sales yields a comparative metric of waste-generating efficiency. This ratio standardises waste output relative to business size (assessed by sales), facilitating comparisons among enterprises of differing operational dimensions [41]. This method is frequently utilised in sustainability research since it illustrates the resource intensity of a company’s revenue creation, demonstrating how efficiently it reduces waste in relation to its economic output [42]. Utilising sales as a denominator mitigates variations in production volume, yielding a more consistent and comparable indicator than absolute waste statistics. This statistic corresponds with the principle of eco-efficiency, which prioritises the maximisation of economic value alongside the minimisation of environmental effect [43]. This ratio serves as an easily calculable and commonly recognised tool for assessing waste management success in a corporate environment, despite the existence of alternative indicators.

3.2.2. Independent Variable

The research uses EPF and WTPF as explanatory variables. EPF is calculated by dividing total energy consumption at year end by total sales, while WTPF is calculated by considering aggregate water consumption at year-end and total sales. This formula follows recent research [37, 39, 40].

Thus, in this study, EPF and WTPF are operationalised as ratios of total resource consumption to total sales, reflecting resource intensity. This approach offers several advantages. Firstly, it standardises resource usage based on business size, as indicated by sales, facilitating comparisons among companies of different dimensions. Secondly, it offers an assessment of resource efficiency, demonstrating how well a firm earns money in relation to its resource utilisation. This is essential in business sustainability research since it connects environmental performance to economic success, illustrating the resource productivity viewpoint [44]. This ratio-based method is frequently utilised in environmental management accounting and sustainability reporting, as it enables benchmarking and trend analysis [45]. Although other metrics such as energy or water usage per unit of production are available, employing sales as a denominator provides a more comprehensive view of total firm resource efficiency, especially pertinent when examining several industries [41].

3.2.3. Moderator Variables

Financial performance is evaluated by both book value metrics (ROE) and MFV indicators (TBQ). ROE, obtained from Refinitiv, is a commonly utilised profitability measurement that assesses a company’s capacity to create returns from shareholder investments [46]. It demonstrates the company’s efficacy in employing shareholder capital. TBQ, defined as the ratio of MFV to total assets [37], reflects the market’s assessment of a company’s prospective profitability and growth potential [47]. It indicates the market’s valuation of the company’s assets relative to their replacement cost. MFV, sourced from Refinitiv, acts as a moderating variable, affecting the association between environmental performance and financial results. Companies with substantial market capitalisations may possess enhanced resources and motivations to engage in environmental sustainability efforts, which might result in improved financial outcomes [48]. This study uses these existing financial performance criteria to elucidate the relationship between environmental and financial results in the South African setting.

3.2.4. Control Variables

In corporate sustainability research, it is essential to account for firm-specific variables to discern the effect of WTPF and EPF on WSPF. Firm size (SIZE), quantified as the natural logarithm of total assets, serves as a conventional control variable, as larger enterprises frequently encounter heightened regulatory scrutiny and public pressure about environmental performance [49]. Firm growth (GRW), defined as the sales growth rate, can impact resource utilisation and waste production resulting from expansion efforts [50]. Advertisement intensity (ADV), defined as advertising expenditures divided by sales revenue, indicates a firm’s emphasis on brand image and stakeholder perceptions, potentially motivating environmental stewardship [51]. Leverage (LEV), defined as the ratio of total liabilities and net assets to shareholders’ equity, signifies financial risk and may limit expenditures in sustainability efforts [52]. Capital intensity (CIN), defined as sales revenue divided by stockholders’ equity, reflects the firm’s dependence on physical assets and manufacturing processes, which can directly influence resource utilisation and waste generation [53]. These variables are frequently employed as controls since they signify essential financial and operational dimensions of enterprises that might affect their environmental performance, facilitating a more precise evaluation of the association between water, EPF and WSPF. Controlling for these variables reduces the likelihood of misleading connections and strengthens the validity of the results. Recent research, such as those by Matsumura et al. [54] and Flammer [55], underscore the significance of these controls.

3.3. Econometric Estimation Approach

This study examines companies with skewed distributions in operational, administrative, financial and growth aspects. Quantile regression is the most effective method due to outliers and heavy-tailed classifications, as other econometric techniques, such as ordinary least square regression, may not yield strong results [56].

Quantile regression is a method that describes the entire conditional distribution of a dependent factor, unlike standard regression models, which focus on the mean [57]. It allows for independent recognition of research variables’ maximum and lowest values, allowing for a thorough examination of data [58]. This technique eliminates the restrictive assumption that error values are uniformly distributed at every point in the conditional distribution.

The study uses the quantile regression equation to examine the impact of independent and control elements on waste management performance levels, allowing it to recognise company variations and account for generated slope parameters at different quantiles of the conditional distribution.

Quantile regression offers advantages over traditional methods, such as allowing for gradient flexibility across the entire data distribution, providing more authentic and robust results even with heavy-tailed and outlier-filled data [62] and assessing the impact of independent parameters on parameters in different quantiles. This method lessens the difficulties presented by conventional regression techniques, which use the conditional expectation of response parameters and create equations by adding arbitrary reduced residual weights figures in the dependent factor’s inconsistent quantile [19].

4. Results and Discussion

This section presents the findings of the article. The first section presents Table 1 outlining a statistical overview of all the variables of this study. The study reveals that WTPF has the highest mean value at 2.1829, followed by EPF at 2.1740, advertising at 1.9658, MFV at 1.0937, WSPF at 1.0128 and TBQ at 0.9070. The lowest mean estimate is for companies’ growth rate at −2.3030. The remaining parameters are positively skewed, except for ROE, advertising, leverage, company size and growth rate. The data are typically not platykurtic since the majority of factor values are greater than three.

| Variable | Mean | Max. | Min. | Skewness | Kurtosis |

|---|---|---|---|---|---|

| WSPF | 1.0128 | 10.6925 | −3.2810 | 0.7624 | 3.6754 |

| WTPF | 2.1829 | 8.3402 | −1.0096 | 0.1773 | 2.8744 |

| EPF | 2.1740 | 7.9227 | −1.3886 | 0.0208 | 3.2082 |

| ROE | −0.5900 | 1.1802 | −2.7154 | −0.4578 | 5.2834 |

| MFV | 1.0937 | 5.2699 | −1.5501 | 0.4149 | 3.1405 |

| TBQ | 0.9070 | 4.5359 | −0.3335 | 0.9086 | 3.9038 |

| ADV | 1.9658 | 3.4874 | −1.0706 | −0.9396 | 3.3690 |

| LEV | −0.2271 | 0.3912 | −0.9057 | −0.5121 | 4.5026 |

| SIZE | 0.8009 | 1.0348 | −0.9097 | −4.0111 | 25.39 |

| CIN | 0.4809 | 2.4299 | −0.7282 | 0.6764 | 4.8800 |

| GRW | −2.3030 | 1 | −1133.8 | −25.51 | 661.96 |

- Note: [1] Source: Author computation.

- Abbreviations: ADV, advertisement intensity; CIN, capital intensity; EPF, energy performance; GRW, firm growth; LEV, leverage; MFV, market value; ROE, return on equity; SIZE, firm size; TBQ, Tobin’s Q; WSPF, waste performance; WTPF, water performance.

This article uses unit root tests to analyse the difficulties associated with non-stationary data in data distribution. As shown in Table 2, the Philips-Perron and Augmented Dickey-Fuller tests were used to determine the integration order of the time series data, revealing that all parameters are stationary at the first difference.

| Variable | At Level | At 1st Difference | ||

|---|---|---|---|---|

| ADF stat | PP Stat | ADF stat | PP Stat | |

| WSPF | 10.5339 ∗∗∗ | 10.5339 ∗∗∗ | 43.0060 ∗∗∗ | 43.0060 ∗∗∗ |

| WTPF | 8.1900 ∗∗∗ | 8.1900 ∗∗∗ | 37.0281 ∗∗∗ | 37.0281 ∗∗∗ |

| EPF | 7.0442 ∗∗∗ | 7.0442 ∗∗∗ | 42.1538 ∗∗∗ | 42.1538 ∗∗∗ |

| MFV | 4.0192 ∗∗∗ | 4.0192 ∗∗∗ | 30.5938 ∗∗∗ | 30.5938 ∗∗∗ |

| TBQ | 8.9149 ∗∗∗ | 8.9149 ∗∗∗ | 28.4118 ∗∗∗ | 28.4118 ∗∗∗ |

| ROE | 13.5747 ∗∗∗ | 13.5747 ∗∗∗ | 49.3103 ∗∗∗ | 49.3103 ∗∗∗ |

| ADV | 8.9962 ∗∗∗ | 8.9962 ∗∗∗ | 32.9426 ∗∗∗ | 32.9426 ∗∗∗ |

| LEV | 5.6224 ∗∗∗ | 5.6224 ∗∗∗ | 33.8814 ∗∗∗ | 33.8814 ∗∗∗ |

| SIZE | 9.5353 ∗∗∗ | 9.5353 ∗∗∗ | 30.3882 ∗∗∗ | 30.3882 ∗∗∗ |

| CIN | 6.6501 ∗∗∗ | 6.6501 ∗∗∗ | 37.9470 ∗∗∗ | 37.9470 ∗∗∗ |

| GRW | 14.0507 ∗∗∗ | 14.0507 ∗∗∗ | 38.7308 ∗∗∗ | 38.7308 ∗∗∗ |

- Abbreviations: ADV, advertisement intensity; CIN, capital intensity; EPF, energy performance; GRW, firm growth; LEV, leverage; MFV, market value; ROE, return on equity; SIZE, firm size; TBQ, Tobin’s Q; WSPF, waste performance; WTPF, water performance.

- ∗, ∗∗ and ∗∗∗significant at 10%, 5% and 1% levels of significance.

The study used Kao’s [63] panel cointegration approach to examine the cointegration of South African enterprises’ parameters and associations. The results validate the cointegration of variables, indicating a long-term link between the factors, as shown in Table 3.

| Equation: Reg. Var | Test statistic | t-statistics | p-Value |

|---|---|---|---|

| MFV | Augmented Dickey-Fuller (ADF) | −4.318279 | p ≤ 0.001 |

| ROE | Augmented Dickey-Fuller (ADF) | −4.264266 | p ≤ 0.001 |

| TBQ | Augmented Dickey-Fuller (ADF) | −4.822301 | p ≤ 0.001 |

- Note: [1] Source: Author computation.

- Abbreviations: MFV, market value; ROE, return on equity; TBQ, Tobin’s Q.

As a moderator parameter, a company’s MFV influences the relationship between WTPF and EPF, with WSPF strongly influencing EPF and WTPF positively, as shown in Table 4. For most South African businesses, improving waste efficiency is directly linked to increased water and energy utilisation in production methods. Studies by Ardito and Dangelico [64] and Semenova and Hassel [65] support the idea that green initiatives positively impact waste production and environmental ratings of US firms.

| Quantiles | WTPF | EPF | MFV | ADV | LEV | SIZE | CIN | GRW |

|---|---|---|---|---|---|---|---|---|

| Q0.10 | 0.2548 ∗∗∗ | 0.3677 ∗∗∗ | −0.1286 ∗∗∗ | −0.1291 ∗∗∗ | −1.1535 ∗∗∗ | 0.3458 ∗∗∗ | 0.3353 ∗∗∗ | −0.0035 ∗∗∗ |

| Q0.20 | 0.3059 ∗∗∗ | 0.3395 ∗∗∗ | −0.3818 ∗∗∗ | −0.1305 ∗∗∗ | −0.0966 ∗ | −2.0643 ∗∗∗ | 0.1698 ∗∗∗ | −0.0032 ∗∗∗ |

| Q0.30 | 0.3142 ∗∗∗ | 0.3110 ∗∗∗ | −0.4146 ∗∗∗ | −0.0921 ∗∗∗ | −0.3918 ∗∗∗ | −2.2582 ∗∗∗ | 0.7118 ∗∗∗ | −0.0031 ∗∗∗ |

| Q0.40 | 0.3009 ∗∗∗ | 0.2305 ∗∗∗ | −0.3620 ∗∗∗ | −0.1237 ∗∗∗ | 0.1306 ∗∗ | −1.8934 ∗∗∗ | 0.4635 ∗∗∗ | −0.0029 ∗∗∗ |

| Q0.50 | 0.2799 ∗∗∗ | 0.1287 ∗ | −0.266 ∗ | −0.1815 ∗∗∗ | 0.2351 | −1.0938 | 0.2501 | −0.0021 ∗∗∗ |

| Q0.60 | 0.1593 ∗∗∗ | 0.2982 ∗∗∗ | −0.5894 ∗∗∗ | -0.05219 ∗∗∗ | −1.7321 ∗∗∗ | −2.7315 ∗∗∗ | 0.8913 ∗∗∗ | −0.0022 ∗∗∗ |

| Q0.70 | 0.2765 ∗∗∗ | 0.3234 ∗∗∗ | −0.6172 ∗∗∗ | 0.3837 ∗∗∗ | −4.3257 ∗∗ | −2.4784 ∗∗∗ | 1.5999 ∗∗∗ | −0.0014 ∗∗∗ |

| Q0.80 | 0.1408 ∗∗∗ | 0.3377 ∗∗∗ | −0.579 ∗∗∗ | 0.2136 ∗∗∗ | 0.9312 ∗∗ | −1.5421 ∗∗∗ | 0.3134 ∗∗ | 0.0000483 |

| Q0.90 | 0.4463 ∗∗∗ | 0.119 ∗∗∗ | −0.668 ∗∗∗ | 0.2581 ∗∗∗ | −1.8565 ∗∗∗ | −1.3035 ∗∗ | 1.6329 ∗∗∗ | 0.0001 ∗∗ |

- Abbreviations: ADV, advertisement intensity; CIN, capital intensity; EPF, energy performance; GRW, firm growth; LEV, leverage; MFV, market value; SIZE, firm size.

- ∗, ∗∗ and ∗∗∗significant at 10%, 5% and 1% levels of significance.

The MFV of companies has a negative and significant relationship with WSPF, indicating that a rise in MFV will decrease waste productivity in most organisations. Factors contributing to this situation include short-term-focused managers’ inability to foster green innovation and companies’ inability to adopt sustainable practices. Strict JSE SRI rules may not push businesses to adopt more sustainable practices, leading to more financing allocated to other projects. Firms often overlook green investments in the short term, as financial goals related to sustainability are typically achieved over time. Mohammadi et al. [66] found a strong correlation between corporate market valuation and sustainability, but Deswanto and Siregar’s [67] analysis found that environmental disclosures have no bearing on MFV or financial performance in conjunction with environmental performance.

The study shows a significantly negative association between advertising and WSPF across all quantiles. A 1% increase in advertising spending may decrease waste control. Companies listed on the JSE SRI may be perceived as environmentally conscious, but measures to address waste management receive less attention, lowering waste performance. Misleading statements in green advertising negatively impact consumer attitudes, and perceptions of greenwashing remain unchanged despite environmental competency [68]. However, a survey in China by Yang et al. [69] shows that green empowerment advertising enhances customers’ perceptions and intentions towards being green and businesses’ environmental responsibilities.

The research also shows that leverage significantly negatively impacts WSPF in most companies, with a 1% increase in leverage reducing waste performance. This is detrimental to businesses due to high interest rates and credit downgrades. To mitigate this, incentives for adopting environmentally friendly practices should be improved. However, Orazalin’s [70] study from 2009 to 2016 found that leverage does not affect a company’s environmental performance, contradicting the study’s findings.

The study reveals a significantly negative relationship between company size, growth rate and WSPF across most quantiles. When both factors increase by 1%, decreased waste performance is inevitable. This suggests that green issues, such as waste performance, may not be fully integrated into companies’ strategic goals and policies. However, a study by Wang et al. [71] found a positive correlation between firm size and environmental performance, suggesting external initiative support is crucial for sustainable practices. This study also found a strong positive relationship between CIN and WSPF. Secinaro et al. [72] also found a positive connection between corporate environmental performance and CIN in publicly traded European enterprises, suggesting high investment in green technologies.

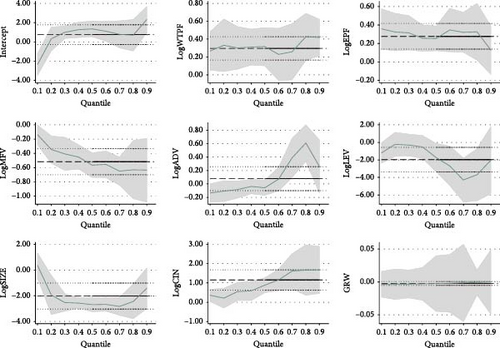

To substantiate the above analysis, Figure 1 illustrates the quantile regression results reveal heterogeneous effects of the explanatory variables on WSPF across the distribution. MFV shows a positive impact on WSPF, particularly at lower quantiles, diminishing towards the higher end. WTPF exhibits a generally positive relationship with WSPF, with a more pronounced effect around the median. EPF demonstrates a less consistent impact, fluctuating around zero across quantiles. Firm size (SIZE) negatively influences WSPF, especially at both lower and higher quantiles. Firm growth (GRW) shows a generally negative and statistically significant effect across most quantiles. ADV has a negative impact on WSPF, stronger at lower quantiles. Leverage (LEV) displays a fluctuating effect, with a notable negative impact around the median. CIN shows a positive relationship with WSPF, becoming stronger at higher quantiles. These findings suggest that the impact of WTPF and EPF, along with financial and control variables, on WSPF varies considerably across different segments of South African JSE-listed companies.

The study presents panel quantile regressions with ROE and TBQ as primary moderators (Tables 5 and 6), revealing that while MFV, ROE and TBQ are increasing, business WSPF typically falls. Conversely, an increase in water and EPF leads to better WSPF. The results suggest that achieving value for money requires balancing a company’s environmental and financial goals.

| Quantiles | WTPF | EPF | ROE | ADV | LEV | SIZE | CIN | GRW |

|---|---|---|---|---|---|---|---|---|

| Q0.10 | 0.2881 ∗∗∗ | 0.3917 ∗∗∗ | −0.2933 ∗∗∗ | −0.1211 ∗∗∗ | −1.8952 ∗∗∗ | 0.9843 ∗∗∗ | 0.7526 ∗∗∗ | −0.0036 ∗∗∗ |

| Q0.20 | 0.3628 ∗∗∗ | 0.3757 ∗∗∗ | −0.2876 ∗∗ | −0.1576 ∗∗∗ | −0.0073 | 0.161 ∗∗∗ | −0.1165 ∗∗∗ | −0.0034 ∗∗∗ |

| Q0.30 | 0.3889 ∗∗∗ | 0.3693 ∗∗∗ | −0.1083 ∗∗∗ | −0.0214 ∗∗∗ | 0.4211 ∗∗∗ | −1.2812 ∗∗∗ | −0.0752 ∗∗∗ | −0.0033 ∗∗∗ |

| Q0.40 | 0.3903 ∗∗∗ | 0.2894 ∗∗∗ | −0.1995 ∗∗∗ | −0.0032 | 0.6107 ∗∗∗ | −1.5241 ∗∗∗ | 0.0571 | −0.003 ∗∗∗ |

| Q0.50 | 0.4318 ∗∗∗ | 0.2581 ∗∗∗ | −0.0508 | 0.1215 ∗∗∗ | −0.2029 | −1.4863 ∗∗∗ | 0.2365 ∗∗∗ | −0.0028 ∗∗∗ |

| Q0.60 | −0.0000585 | 0.3668 ∗∗∗ | −0.4056 ∗∗∗ | 0.0376 | 1.0637 ∗∗ | 0.4827 | −0.1141 | −0.001561 ∗∗∗ |

| Q0.70 | −0.052 | 0.2506 ∗∗∗ | −0.5212 ∗∗∗ | 0.0915 ∗∗∗ | 1.0469 ∗∗∗ | −0.8753 ∗∗∗ | −0.2448 ∗∗∗ | −0.001149 ∗∗∗ |

| Q0.80 | 0.4188 ∗∗∗ | 0.2491 ∗∗∗ | −0.2116 | 0.1364 | 0.5986 | −0.2787 | 0.2178 | −0.0011 ∗∗∗ |

| Q0.90 | 0.4519 ∗∗∗ | 0.1111 ∗∗∗ | 0.5161 ∗∗∗ | 0.3109 ∗∗∗ | −0.5456 ∗∗∗ | −0.2718 ∗∗∗ | 0.5911 ∗∗∗ | 0.0002 ∗∗∗ |

- Abbreviations: ADV, advertisement intensity; CIN, capital intensity; EPF, energy performance; GRW, firm growth; LEV, leverage; ROE, return on equity; SIZE, firm size; WTPF, water performance.

- ∗, ∗∗ and ∗∗∗significant at 10%, 5% and 1% levels of significance.

| Quantiles | WTPF | EPF | TBQ | ADV | LEV | SIZE | CIN | GRW |

|---|---|---|---|---|---|---|---|---|

| Q0.10 | 0.2848 ∗∗∗ | 0.3249 ∗∗∗ | −0.061 ∗∗∗ | −0.0802 ∗∗∗ | −0.292 ∗∗ | 0.4216 ∗∗∗ | −0.1456 ∗∗∗ | −0.0035 ∗∗∗ |

| Q0.20 | 0.2973 ∗∗∗ | 0.2327 ∗∗∗ | −0.6087 ∗∗∗ | −0.0621 ∗∗∗ | −0.2742 ∗∗∗ | −2.9043 ∗∗ | 0.1701 ∗∗∗ | −0.0031 ∗∗∗ |

| Q0.30 | 0.3357 ∗∗∗ | 0.2029 ∗∗∗ | −0.6395 ∗∗∗ | −0.1883 ∗∗∗ | −0.1530 ∗∗∗ | −2.6784 ∗∗∗ | 0.2685 ∗∗∗ | −0.0029 ∗∗∗ |

| Q0.40 | 0.2197 ∗∗∗ | 0.2858 ∗∗∗ | −0.5832 ∗∗∗ | −0.1381 ∗∗∗ | 0.5304 ∗∗∗ | −2.5808 ∗∗∗ | −0.01732 | −0.0026 ∗∗∗ |

| Q0.50 | 0.1155 | 0.3138 ∗∗∗ | −0.8709 ∗∗∗ | −0.3106 ∗∗ | 0.1514 | −2.0697 ∗∗∗ | 0.0299 | −0.0015 ∗∗∗ |

| Q0.60 | 0.0533 ∗∗∗ | 0.3951 ∗∗∗ | −0.9902 ∗∗∗ | −0.2507 ∗∗∗ | −0.5705 ∗∗ | −2.2711 ∗∗∗ | 0.2299 ∗∗ | −0.0015 ∗∗∗ |

| Q0.70 | 0.27241 ∗∗∗ | 0.3251 ∗∗∗ | −0.9374 ∗∗∗ | 0.2704 ∗∗∗ | −2.5186 ∗∗∗ | −3.1879 ∗∗∗ | 0.7602 ∗∗∗ | −0.0012 ∗∗∗ |

| Q0.80 | 0.2535 ∗∗∗ | 0.3712 ∗∗∗ | −0.8738 ∗∗∗ | 0.3058 ∗∗∗ | −1.9311 ∗∗ | −2.6132 ∗∗∗ | 0.8318 ∗∗∗ | −0.00042 ∗∗ |

| Q0.90 | 0.3920 ∗∗∗ | 0.1056 ∗∗∗ | −0.7536 ∗∗∗ | 0.2075 ∗∗ | −0.3588 ∗∗∗ | −1.7121 ∗∗∗ | 0.7313 ∗∗∗ | 0.0001933 ∗∗∗ |

- Abbreviations: ADV, advertisement intensity; CIN, capital intensity; EPF, energy performance; GRW, firm growth; LEV, leverage; SIZE, firm size; WTPF, water performance.

- ∗, ∗∗ and ∗∗∗significant at 10%, 5% and 1% levels of significance.

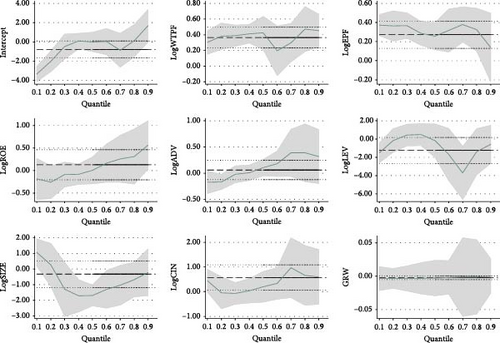

To validate the results shown in Table 5, Figure 2 proves that the quantile regression analysis reveals varying impacts of explanatory variables on WSPF across different quantiles. ROE shows a negative association with WSPF, particularly at lower quantiles, that flare up at higher quantiles. WTPF generally exhibits a positive relationship with WSPF, with a more pronounced effect around the median. EPF shows a more consistent positive impact, fluctuating around zero. Firm size (SIZE) negatively affects WSPF, especially at lower and higher quantiles, except the middle quantile. Firm growth (GRW) has a relatively stable, statistically significant negative effect across quantiles. ADV has a negative influence on WSPF, more pronounced at lower quantiles, but the higher quantiles are positively influencing WSPF. Leverage (LEV) displays a fluctuating negative and positive impact, on WSPF across the quantiles. CIN is unevenly positively and negatively associated with WSPF, with the impact is positively strengthening at higher quantiles. These results suggest that the relationships between water and EPF, financial performance and control variables with WSPF differ across the distribution of South African JSE-listed companies

A negative association between ROE and WSPF, particularly at lower quantiles, flaring up at higher quantiles, suggests complex dynamics. At lower quantiles (less wasteful firms), prioritising ROE might lead to marginal increases in waste due to cost-cutting measures or increased production intensity without commensurate waste management investments [61]. However, at higher quantiles (more wasteful firms), the relationship becomes more pronounced, indicating that aggressive pursuit of ROE in already inefficient firms may exacerbate waste generation. This could be attributed to a focus on short-term profits over long-term sustainability, neglecting waste reduction strategies [73]. Additionally, firms with high ROE might have access to capital for cleaner technologies but choose not to invest, prioritising shareholder returns [74]. This non-linear relationship highlights the varying impact of financial performance on waste management across different levels of wastefulness, emphasising the need for targeted interventions.

Utilising quantile regression, the article also uncovers a nuanced dynamic where WTPF generally exhibits a positive correlation with WSPF, particularly around the median. This suggests that companies effectively managing water resources tend to demonstrate stronger waste management practices. This finding aligns with the broader sustainability discourse, emphasising the interconnectedness of resource efficiency [75]. Several factors may explain this positive relationship. Improved water management practices can lead to reduced water consumption, consequently decreasing wastewater generation and associated waste streams [76]. Additionally, companies prioritising water efficiency often adopt holistic environmental management systems, fostering a culture of resource optimisation that extends to waste reduction [77]. Furthermore, efficient water use can translate into cost savings, freeing up resources for investment in waste management technologies and infrastructure [78].

However, the impact of WTPF on WSPF is not uniform across all quantiles. The observed stronger effect around the median suggests that companies with average levels of WTPF stand to gain the most in terms of waste reduction by improving their water management practices. This could be attributed to the presence of diminishing returns, where companies with already high WTPF may experience smaller marginal improvements in WSPF. These findings highlight the importance of integrated resource management for South African companies. By recognising the synergies between WTPF and WSPF, businesses can unlock opportunities for enhanced environmental and financial sustainability.

EPF demonstrating a more consistent positive impact on WSPF suggests that companies prioritising energy efficiency also tend to manage waste more effectively. This could be due to several interconnected factors. Firstly, efficient energy use often implies optimised production processes, which inherently generate less waste [79]. Secondly, a focus on resource efficiency, driven by energy management, may foster a broader organisational culture of sustainability, leading to improved waste management practices [80]. Additionally, investments in energy-efficient technologies can often have co-benefits in waste reduction, such as closed-loop systems or reduced material usage. Finally, regulatory pressures and stakeholder expectations regarding environmental performance may incentivize companies to address both energy and waste issues concurrently [81]. These factors collectively suggest a synergistic relationship between energy and waste management, explaining the consistent positive impact of EPF on WSPF.

The results of this research also demonstrate Firm size (SIZE) negatively affects WSPF, especially at lower and higher quantiles, except the middle quantile. The reasons could be that some firms can achieve economies of scale in waste management. They can invest in advanced technologies, specialised personnel and efficient processes to minimise waste generation and improve resource utilisation [82]. This is especially true for firms at lower quantiles of WSPF, who may initially have significant room for improvement. Moreover, some larger firms face greater scrutiny from stakeholders, including investors, customers and regulatory bodies, regarding their environmental performance [60]. This pressure can drive them to adopt more sustainable practices and reduce waste generation, particularly for firms at higher quantiles who are already performing relatively well. Additionally, larger firms often have greater financial and managerial resources, allowing them to invest in waste reduction initiatives and absorb the associated costs [83]. This resource slack can be particularly beneficial for firms in the middle quantile, enabling them to implement waste management strategies without significantly impacting their financial performance.

However, the negative relationship may not hold for all quantiles. For instance, firms in the middle quantile exhibit a weaker or non-significant relationship between size and WSPF. This could be because these firms have already implemented basic waste management practices but lack the resources or motivation to invest in more advanced solutions [84].

A consistent negative relationship between firm growth (GRW) and WSPF across quantiles suggests that rapidly growing firms tend to exhibit poorer waste management. This could be attributed to several factors. During periods of rapid expansion, firms may prioritise increasing production and market share over implementing robust waste management practices [85]. This focus on growth can lead to inefficiencies in resource utilisation and increased waste generation. Furthermore, rapid growth often involves increased operational complexity and challenges in maintaining consistent environmental standards across expanding operations [86]. This is especially true for firms at all performance levels (quantiles), as the pressures of growth impact waste management regardless of existing practices. This can result in a consistent negative impact across all quantiles.

The varying impact of ADV on WSPF across quantiles suggests a nuanced relationship. At lower quantiles (poor waste performers), higher ADV may signal a focus on marketing and sales at the expense of operational efficiency, including waste management. Firms prioritising aggressive marketing campaigns may allocate fewer resources to waste reduction initiatives, leading to a negative relationship. Conversely, at higher quantiles (good waste performers), advertising could be used to promote the firm’s environmental stewardship and sustainable practices, enhancing brand image and attracting environmentally conscious consumers [51]. This ’green marketing’ strategy can positively influence WSPF by reinforcing the firm’s commitment to sustainability and potentially driving further improvements.

The fluctuating impact of leverage (LEV) on WSPF across quantiles suggests a complex relationship influenced by financial constraints and strategic priorities. At lower quantiles (poor waste performers), higher leverage may exacerbate financial constraints, limiting investments in waste reduction technologies and practices, leading to a negative impact [87]. These firms may prioritise debt repayment over environmental improvements. Conversely, at middle quantiles, a moderate level of leverage might incentivize efficiency improvements, including waste reduction, to enhance profitability and meet debt obligations. This could explain a positive impact. However, at higher quantiles (good waste performers), excessive leverage could again divert resources from further waste management enhancements, as firms prioritise financial stability. This could lead to another negative impact.

The uneven impact of CIN on WSPF, with a strengthening positive effect at higher quantiles, suggests that investment in physical assets has a complex relationship with waste management. At lower quantiles (poor waste performers), high CIN might reflect outdated or inefficient technologies that generate more waste, leading to a negative or weak positive association. However, at higher quantiles (good waste performers), greater CIN likely signifies investment in modern, cleaner production technologies and waste treatment facilities, directly improving WSPF. This is because firms with higher CIN are more likely to invest in advanced equipment and processes that minimise waste generation and maximise resource efficiency, especially as they already have better WSPF practices.

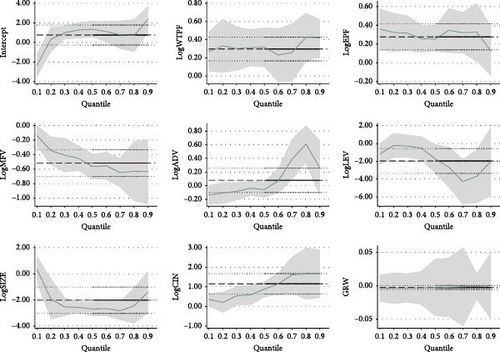

The quantile regression analysis reveals heterogeneous effects of the independent variables on WSPF across the distribution as shown in both Table 6 and also graphically in Figure 3. TBQ demonstrates a significantly negative relationship with WSPF, particularly pronounced at both higher and lower quantiles. WTPF exhibits a generally positive and significant association with WSPF, with a stronger effect around the median. EPF shows a non-fluctuating and generally positive and significant impact across all quantiles. Firm size (SIZE) negatively influences WSPF, especially at all quantiles. Firm growth (GRW) shows a relatively stable, statistically negative and significant effect on WSPF in most quantiles. ADV has a negative impact on WSPF, more pronounced at lower quantiles, but turns significantly positive in higher quantiles. Leverage (LEV) displays a fluctuating effect, with a noticeable negative impact in the lower and higher quantiles, although the middle quantiles are positively associated to WSPF. CIN demonstrates a predominantly significantly positive relationship with WSPF, strengthening at higher quantiles. These findings suggest that the impacts of WTPF and EPF, financial performance and control variables on WSPF vary considerably across different segments of South African JSE-listed companies.

Table 7 of this study adds interaction variables and MFV as a principal moderator to the regression equation. It shows that a percentage increase in WTPF and EPF significantly reduces WSPF. Promethium Carbon [88] and the Water Research Commission [89] emphasise the need for efficiency in water and energy resources in South Africa to combat poverty, corruption and inequality. Also, in Table 7, the interaction term of WTPF × EPF generates a positively significant link with WSPF, suggesting that a combined nexus of water and energy performance can improve waste performance in firms.

| Quantiles | WTPF | EPF | WTPF ∗EPF | MFV | WTPF ∗MFV | EPF ∗MFV | ADV | LEV | SIZE | CIN | GRW |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Q0.10 | −0.1067 ∗∗∗ | −0.3788 ∗∗∗ | 0.2077 ∗∗∗ | −0.623 ∗∗∗ | 0.1252 ∗∗∗ | 0.066 ∗∗∗ | −0.0497 | −0.433 ∗∗∗ | −0.647 ∗∗∗ | 0.216 ∗∗∗ | −0.0029 ∗∗∗ |

| Q0.20 | −0.1802 ∗∗∗ | −0.3910 ∗∗∗ | 0.215 ∗∗∗ | −0.713 ∗∗ | 0.0930 ∗∗∗ | 0.138 ∗∗∗ | 0.0251 ∗∗∗ | −0.409 ∗∗∗ | −1.259 ∗∗∗ | 0.176 ∗∗∗ | −0.0026 ∗∗∗ |

| Q0.30 | −0.1951 ∗∗∗ | −0.2024 ∗∗∗ | 0.1802 ∗∗∗ | −0.793 ∗∗∗ | 0.1226 ∗∗∗ | 0.096 ∗∗∗ | 0.0746 ∗∗∗ | −0.33 ∗∗∗ | −2.533 ∗∗∗ | 0.15 ∗∗∗ | −0.0024 ∗∗∗ |

| Q0.40 | −0.278 ∗∗∗ | −0.2179 ∗∗∗ | 0.1855 ∗∗∗ | −0.767 ∗∗∗ | 0.1179 ∗∗∗ | 0.071 ∗∗∗ | 0.0223 ∗∗∗ | −0.079 ∗∗∗ | −2.479 ∗∗∗ | 0.278 ∗∗∗ | −0.0020 ∗∗∗ |

| Q0.50 | −0.3904 ∗∗∗ | −0.0450 ∗∗ | 0.1614 ∗∗∗ | −0.618 ∗∗∗ | 0.1231 ∗∗∗ | 0.024 ∗∗∗ | −0.0687 ∗∗∗ | −0.634 ∗∗∗ | −2.047 ∗∗∗ | 0.351 ∗∗∗ | −0.0018 ∗∗∗ |

| Q0.60 | −0.4184 ∗∗∗ | −0.1782 ∗∗∗ | 0.1819 ∗∗∗ | −0.898 ∗∗∗ | 0.2858 ∗∗∗ | −0.029 ∗∗∗ | 0.0683 ∗∗∗ | −1.833 ∗∗∗ | −2.138 ∗∗∗ | 0.831 ∗∗∗ | −0.0014 ∗∗∗ |

| Q0.70 | −0.4706 ∗∗∗ | −0.1308 ∗∗∗ | 0.19259 ∗∗∗ | −1.2531 ∗∗ | 0.2616 ∗∗∗ | 0.059 ∗∗∗ | 0.3097 ∗∗∗ | −3.905 ∗∗∗ | −2.342 ∗∗∗ | 1.579 ∗∗∗ | −0.0007 ∗∗∗ |

| Q0.80 | −0.1342 ∗∗∗ | −0.3020 ∗∗∗ | 0.2091 ∗∗∗ | −1.441 ∗∗∗ | 0.1010 ∗∗∗ | 0.159 ∗∗∗ | 0.6176 ∗∗∗ | −2.458 ∗∗∗ | −3.369 ∗∗∗ | 1.487 ∗∗∗ | −0.0003 ∗∗∗ |

| Q0.90 | −0.0503 ∗∗∗ | 0.0288 ∗∗ | 0.1059 ∗∗∗ | −1.097 ∗∗∗ | 0.1798 ∗∗∗ | 0.038 ∗∗∗ | 0.3041 ∗∗∗ | −1.765 ∗∗∗ | −2.090 ∗∗∗ | 1.627 ∗∗∗ | −0.00004 ∗∗∗ |

- Abbreviations: ADV, advertisement intensity; EPF, energy performance; LEV, leverage; MFV, market value; SIZE, firm size; WTPF, water performance.

- ∗, ∗∗ and ∗∗∗significant at 10%, 5% and 1% levels of significance.

The study also reveals that a firm’s MFV has a negative association with WSPF across all quartiles, but a positive link exists between its MFV and EPF and WTPF. This suggests that a firm’s MFV alone cannot achieve high waste management performance unless managers combine their financial decisions with WTPF and EPF objectives. The Department of National Treasury of South Africa [90] emphasises the need for green and socially focused financial resources for balanced growth. The International Finance Corporation states that South Africa needs R8.9 trillion in climate investment from 2015 to 2030 [91]. Ernst and Young [92] recommends South African companies integrate sustainability into their vision, finance ESG projects, ensure investor-grade ESG data and involve stakeholders in emerging issues. This also shows that control variables such as advertising and CIN strongly positively influence WSPF, while leverage, company size and growth rate significantly negatively affect it.

Table 8 shows the results of adding interaction variables and using ROE as the moderating parameter in the framework. Thus, Table 8 shows a significant negative relationship between WTPF and WSPF, while the reverse is true for EPF. South African companies need to integrate smart waste management technologies with water efficiency measures. DRA Global [93] emphasises the need for policies enhancing water technologies and digitisation to promote productivity and innovation. CSIR [94] highlights the critical condition of 56% of municipal wastewater treatment works, highlighting the need for effective water and waste control strategies.

| Quantiles | WTPF | EPF | WTPF ∗EPF | ROE | WTPF ∗ROE | EPF ∗ROE | ADV | LEV | SIZE | CIN | GRW |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Q0.10 | −0.4179 ∗∗∗ | 0.5714 ∗∗∗ | 0.1380 ∗∗∗ | −0.3216 ∗∗∗ | −0.7285 ∗∗∗ | 0.8417 ∗∗∗ | −0.0543 ∗∗∗ | −0.3948 ∗∗∗ | 0.1959 ∗∗∗ | 0.2272 ∗∗∗ | −0.0032 ∗∗∗ |

| Q0.20 | −0.3403 ∗∗∗ | 0.3915 ∗∗∗ | 0.1335 ∗∗∗ | −0.1850 ∗∗∗ | −0.741 ∗∗∗ | 0.7498 ∗∗∗ | −0.0148 ∗∗∗ | 0.7320 ∗∗∗ | −0.1163 ∗∗∗ | −0.1845 ∗∗∗ | −0.003 ∗∗∗ |

| Q0.30 | −0.3109 ∗∗∗ | 0.1576 ∗∗∗ | 0.1722 ∗∗∗ | −0.6302 ∗∗∗ | −0.4803 ∗∗∗ | 0.5899 ∗∗∗ | 0.0789 ∗∗∗ | 1.0673 ∗∗∗ | −1.6369 ∗∗∗ | −0.0800 ∗∗∗ | −0.0025 ∗∗∗ |

| Q0.40 | −0.2786 ∗∗∗ | −0.0908 ∗∗∗ | 0.1881 ∗∗∗ | −0.1363 ∗∗∗ | −0.3381 ∗∗∗ | 0.2788 ∗∗∗ | 0.03074 ∗∗∗ | 0.2784 ∗∗∗ | −1.8483 ∗∗∗ | 0.1073 ∗∗∗ | −0.0022 ∗∗∗ |

| Q0.50 | −0.1306 ∗∗ | −0.0947 ∗∗∗ | 0.1617 ∗∗∗ | −0.4406 ∗∗∗ | −0.1601 ∗∗∗ | 0.1671 ∗∗∗ | 0.0227 ∗∗∗ | 0.4195 ∗∗∗ | −1.6198 ∗∗∗ | 0.1122 ∗∗∗ | −0.0021 ∗∗∗ |

| Q0.60 | −0.1230 ∗∗∗ | −0.0178 | 0.142 ∗∗∗ | −0.1155 ∗∗∗ | −0.334 ∗∗∗ | 0.2342 ∗∗∗ | 0.1082 ∗∗∗ | −0.9436 ∗∗∗ | −1.5226 ∗∗∗ | 0.3874 ∗∗∗ | −0.0019 ∗∗∗ |

| Q0.70 | 0.0316 ∗∗∗ | 0.5504 ∗∗∗ | 0.0794 ∗∗∗ | −0.415 ∗∗∗ | −0.3548 ∗∗∗ | 0.5868 ∗∗∗ | 0.5771 ∗∗∗ | −3.0942 ∗∗∗ | −1.1662 ∗∗∗ | 0.9009 ∗∗∗ | −0.0015 ∗∗∗ |

| Q0.80 | −0.3435 ∗∗∗ | 0.8407 ∗∗∗ | 0.0602 ∗∗∗ | 0.3290 ∗∗∗ | −0.9861 ∗∗∗ | 0.9632 ∗∗∗ | 0.4952 ∗∗∗ | −2.0189 ∗∗∗ | −0.898 ∗∗∗ | 0.8718 ∗∗∗ | −0.0009 ∗∗∗ |

| Q0.90 | −0.3935 ∗∗∗ | 0.4381 ∗∗∗ | 0.1531 ∗∗∗ | 0.3242 ∗ | −0.5683 ∗∗∗ | 0.4519 ∗∗∗ | 0.0077 | 0.0174 | 0.6329 ∗∗∗ | 0.5953 ∗∗∗ | −0.0000234 |

- Abbreviations: ADV, advertisement intensity; EPF, energy performance; LEV, leverage; ROE, return on equity; SIZE, firm size; WTPF, water performance.

- ∗, ∗∗ and ∗∗∗significant at 10%, 5% and 1% levels of significance.

The interaction factor between WTPF and EPF is positively and significantly connected to WSPF across all quantiles. According to the WorldWide Fund for Nature South Africa (2014)[95], South Africa’s energy and water management are crucial for sustainable economic development. The country plans to invest R700 billion in the water value chain over the next decade to ensure proper governance of water and energy resources, water reuse and sustainable off-setting infrastructure [96].

Table 8 also illustrates a significantly negative link between ROE and WSPF, suggesting that shareholders’ returns on investment are reducing WSPF. However, the interaction term ROE × EPF is significantly positively related to WSPF. ADV, leverage and CIN also show a strong positive association with waste performance, while opposite findings are found for company size and growth rate. Improving resource utilisation is crucial for mitigating environmental risks.

Table 9 indicates a significant negative association between WTPF and EPF and WSPF in South Africa if TBQ is a moderator of the regression. This is due to the country’s arid climate, economic development pressures and population growth, which lead to water scarcity and increased energy demand [97]. The study also shows a strong positive relationship between the interaction variable, WTPF × EPF and WSPF. Byala [98] contributes that Coca-Cola’s efforts to improve water, energy and waste nexus in Africa include photovoltaic practices at individual plants, environmentally compatible co-generation projects and recycling through packaging recovery. However, measures to align sustainability initiatives have been limited, leading to increased pollution and ecosystem degradation.

| Quantiles | WTPF | EPF | WTPF ∗EPF | TBQ | WTPF ∗TBQ | EPF ∗TBQ | ADV | LEV | SIZE | CIN | GRW |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Q0.10 | −0.1704 ∗∗∗ | −0.3975 ∗∗∗ | 0.217 ∗∗∗ | −0.8693 ∗∗∗ | 0.1036 ∗∗∗ | 0.0434 ∗∗∗ | −0.0246 ∗∗∗ | −0.2735 ∗∗∗ | −1.440375 ∗∗∗ | 0.0890 ∗∗∗ | −0.0027 ∗∗∗ |

| Q0.20 | −0.1194 ∗∗∗ | −0.3842 ∗∗∗ | 0.1958 ∗∗∗ | −0.771 ∗∗∗ | −0.0643 ∗∗∗ | 0.0910 ∗∗∗ | 0.0768 ∗∗∗ | 0.1264 ∗∗∗ | −2.249853 ∗∗∗ | −0.1295 ∗∗∗ | −0.0024 ∗∗∗ |

| Q0.30 | −0.191 ∗∗∗ | −0.253 ∗∗∗ | 0.1797 ∗∗∗ | −0.9723 ∗∗∗ | 0.0715 ∗∗∗ | 0.0555 ∗∗∗ | 0.0214 ∗∗∗ | −0.1836 ∗∗∗ | −2.854734 ∗∗∗ | −0.0316 | −0.0022 ∗∗∗ |

| Q0.40 | −0.2399 ∗∗∗ | −0.1632 ∗∗∗ | 0.1623 ∗∗∗ | −0.8225 ∗∗∗ | −0.061 ∗∗∗ | 0.0833 ∗∗∗ | 0.0384 ∗∗∗ | −0.0285 | −2.827802 ∗∗∗ | −0.0713 ∗∗∗ | −0.0019 ∗∗∗ |

| Q0.50 | −0.3152 ∗∗ | −0.2159 ∗∗∗ | 0.1783 ∗∗∗ | −0.9256 ∗∗∗ | 0.0564 ∗∗∗ | 0.0688 ∗∗∗ | 0.007 ∗∗∗ | −0.0603 ∗∗∗ | −2.655736 ∗∗∗ | 0.0705 ∗∗∗ | −0.0018 ∗∗∗ |

| Q0.60 | −0.4731 ∗∗∗ | −0.4009 ∗∗∗ | 0.1962 ∗∗∗ | −1.3976 ∗∗∗ | 0.0780 ∗∗∗ | 0.1228 ∗∗∗ | 0.0773 ∗∗∗ | −0.7117 ∗∗∗ | −2.895098 ∗∗∗ | 0.3068 ∗∗∗ | −0.0010 ∗∗∗ |

| Q0.70 | −0.0339 ∗∗∗ | −0.363 ∗∗∗ | 0.0914 ∗∗∗ | −1.8262 ∗∗∗ | −0.0727 ∗∗∗ | 0.1677 ∗∗∗ | 0.2607 ∗∗∗ | −2.4814 ∗∗∗ | −4.067594 ∗∗∗ | 1.0582 ∗∗∗ | −0.0008 ∗∗∗ |

| Q0.80 | 0.02834 ∗∗∗ | −0.2718 ∗∗∗ | 0.141 ∗∗∗ | −1.6783 ∗∗∗ | −0.0691 ∗∗∗ | 0.1063 ∗∗∗ | 0.4962 ∗∗∗ | −1.8174 ∗∗∗ | −3.934131 ∗∗∗ | 1.0198 ∗∗∗ | −0.0004 ∗∗∗ |

| Q0.90 | −0.0289 ∗∗∗ | 0.05175 ∗∗∗ | 0.0996 ∗∗∗ | −1.2443 ∗∗∗ | 0.0876 ∗∗∗ | 0.0735 ∗∗∗ | 0.057 ∗∗∗ | −0.2024 ∗∗∗ | −0.2029397 ∗∗∗ | 0.8147 ∗∗∗ | 0.0000805 ∗∗∗ |

- Abbreviations: ADV, advertisement intensity; EPF, energy performance; LEV, leverage; TBQ, Tobin’s Q; WTPF, water performance.

- ∗, ∗∗ and ∗∗∗significant at 10%, 5% and 1% levels of significance.

The article shows a significantly negative relationship between TBQ and WSPF across all quantiles, but their interaction factors, TBQ × EPF and TBQ × WTPF to WSPF, show a strong positive link. Hence, South Africa’s market understands green issues and is supporting sustainability practices in business operations. The majority of investors now demand sustainability performance data and consider environmental and social issues more critical than before the COVID-19 pandemic [99]. The amendment of the JSE Listings Requirements broadens the existing green category of the JSE Interest Rate Market, improving accountability, reporting and regulatory implementation of sustainability mandates [100]. Table 9 also proves that ADV and CIN significantly positively impact WSPF in sample countries, while company size, growth rate and leverage have a superior negative relationship.

5. Implications of the Study and Conclusion

The positive link between water and energy efficiency, as well as waste management, indicates that South African organisations prioritising effective resource utilisation across several domains attain synergistic advantages. This indicates that enterprises ought to implement integrated resource management methods instead of addressing water, energy and waste as separate concerns. Through the adoption of comprehensive strategies, including closed-loop systems, waste-to-energy projects and water recycling efforts, organisations may concurrently diminish their environmental impact and boost resource efficiency, resulting in cost reductions and improved sustainability.

In addition, the study’s results present a persuasive rationale for investing in water and energy-saving initiatives. The evident beneficial effect on WSPF indicates that these measures not only save direct resource usage and expenses but also yield indirect advantages by reducing waste production. This data may inform investment prioritisation inside organisations, promoting the allocation of resources to initiatives that have numerous environmental and economic benefits. This may also impact investor choices, drawing capital to firms with robust environmental performance.

Furthermore, the notable connections shown in the study underscore the necessity of integrating WTPF, EPF and WSPF indicators into corporate sustainability reporting systems. By openly revealing performance metrics in these domains, firms may show their dedication to resource efficiency and responsibility to stakeholders. This increased openness can also enable benchmarking and peer comparison, promoting further advancements in environmental performance across sectors.

The study’s results can guide the formulation of more efficacious environmental laws and regulations. By illustrating the interdependence of water, energy and waste management, policymakers may develop cohesive regulatory frameworks that promote comprehensive resource efficiency enhancements. This may encompass policies that advocate for joint water and energy audits, streamlined permitting procedures and incentives for enterprises using cutting-edge resource management technology.

It is also apparent that this research highlights the significance of stakeholder involvement in enhancing environmental performance. By conveying the beneficial relationship among water, energy and waste management to stakeholders such as investors, consumers and communities, organisations may foster trust and improve their reputation. Moreover, cultivating collaboration throughout the value chain, including with suppliers and consumers, may enhance the implementation of best practices and advance overall sustainability enhancements.

It has been evident that the study’s findings on the impact of MFV, ROE and TBQ on WSPF, especially the interaction effects, underscore the connection between financial success and sustainability outcomes. This indicates that firms exhibiting robust financial success are more adept at investing in and reaping the advantages of enhanced resource management strategies. This knowledge may prompt corporations to include sustainability into their fundamental business strategy, acknowledging that environmental performance may enhance long-term financial success.

In this case, policy makers and practitioners must consider this study to achieve sustainability goals. As a result, South Africa requires a greater allocation of funds for environmentally sustainable research and development. Within this framework, green funding should provide timely and pertinent funding to support investments in eco-friendly research and technologies that support activities like resource and area conservation, recycling, energy efficiency, water efficiency and ecosystem and territory preservation, among other things. A programme of this kind will promote and assist the complete incorporation of ecologically friendly practices into business operations. Legislators should also design green legislation that specifically facilitate the increased use of energy-efficient resources and technologies. Here, it is believed that using green energy and energy efficiency will lessen environmental degradation. The government can also encourage businesses to recycle and reprocess garbage by designating incentives specifically for these kinds of eco-friendly operations.

In this instance, it is critical that businesses implement recycling practices rather than delegating this obligation to local government authorities. In a similar spirit, recycling promotes energy efficiency, which in turn leads to increased business economic value through improved environmental performance in the areas of water and energy conservation. This study shows that the company’s voluntary environmental participation initiatives do, in fact, impact and guide its sustainability policies. It is important to remember that other factors, such as economics, financial market interests and political pressure, can have a significant impact. As a result, businesses need to exercise caution when considering environmental concerns originating from outside sources.

Furthermore, market-wide implementation of ecological benchmarking tools is possible. By obtaining information related to important environmental indicators, this kind of technology will enable businesses to identify best practices and procedures and assist them in being modified and put into action. Additionally, there is an improvement in the efficient use of resources and a reduction in waste output. Enhancing green performance also requires the creation of green departments and corporate policies that compensate senior managers based on their performance on environmental criteria.

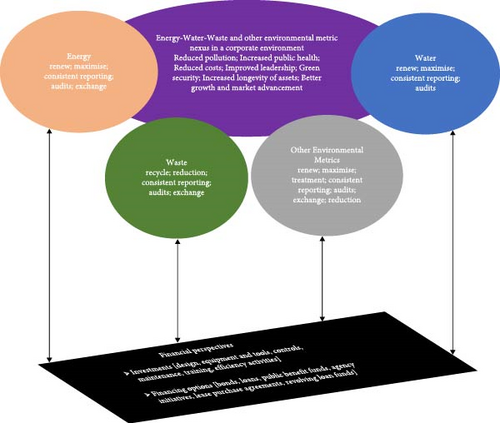

The framework of attaining sustainable energy, water and waste consumption, which harmonises with corporate financial objectives

The following diagram, that is, Figure 4 illustrates the expansion of a framework that supports the organisation’s financial goals while promoting sustainable energy, water and waste management. When it comes to the use of energy in the business sector, the development of strategies should be based on guidelines that allow resources to be shared, swapped, refreshed and used efficiently. It is clear that business transportation and electricity supplies account for the majority of energy use. If so, it would be appropriate to reinforce business policy in these areas in order to sustain efficiencies and close energy deficits. Waste can ideally be converted into energy, and durable, environmentally friendly assets should take the place of productive ones. According to Ouda et al. [101], for example, waste-to-energy technologies have the potential to significantly increase the production of green energy while lowering the cost of landfilling in relation to its environmental effects. Furthermore, it is necessary to include opportunities that allow staff members to utilise virtual spaces outside of their offices in an effort to reduce energy use. This will also mean that creating green structures and switching to electric cars is essential because these infrastructures are inherently eco-friendly and reduce carbon emissions. Similarly, regular reporting of energy and related metrics is critical to enhancing responsibility within the organisation, presenting timely, verifiable information and proving the accuracy, dependability and comparability of business operations.

In relation to water usage within the corporate sector, the implementation of water recycling practices is of utmost importance. Utilising water resources as efficiently as possible for distribution and recycling is also essential. For instance, Alkaya and Demirer [102] attest to the observation of water recycling and reuse activities in the cooling systems of a Turkish soft drink/beverage company, resulting in an annual water savings of 503,893 m3. Company policy should incorporate management activities that support enhancing value addition, reducing water pollution and raising awareness of environmentally friendly practices in water generation and transmission systems. Utilising green technology that improve waste treatment can help manage waste. When the waste is broken down, treatment is highly efficient, and the leftover material can be utilised as a component in other manufacturing procedures. Accordingly, the use of appropriate, innovative, environmentally friendly instruments and equipment can help to boost processes like reproduction, maximum consumption and waste exchange. Regeneration, ongoing disclosure, audits and, in certain situations, reduction are also required for other environmental indicators including land use and climate risk, among others.

The corporation benefits from the implied mutual harmonisation of these systems as a result of the interaction involving its waste, water, energy and other environmental metric consumption structures (since their efficiency has improved). As a result, since non-renewable energy sources are no longer used to produce electricity, emissions are reduced. Reduced emissions benefit public health since they also contribute to the production of acid rain, smog and other harmful compounds that have an impact on people’s health, especially respiratory issues. Moreover, cost savings are a result of more effective waste, water and energy treatment. Along with creating jobs for locals through installation, maintenance and distribution, the integration of renewable energy technology, energy efficiency systems and waste treatment also promotes market expansion. In this sense, these kinds of projects show responsible business leadership that other sectors of the economy, including the government, might emulate. Moreover, reduced energy demand (which lessens load shedding), reduced water scarcity and reduced waste generation are all examples of how energy, water and waste efficiency contribute to green security. In a same spirit, the machinery, equipment and infrastructure that are in place can withstand a lot of use.

In the financial perspective section, the expenses and financing prospects for energy, water and waste facilities and programmes are detailed. In order to develop a green firm that appreciates the demands of the natural environment in the short- and long-term and is not just profit-oriented, it is preferable to create a scenario that balances costs, benefits and corporate operations. Therefore, creating ecologically friendly waste, energy and water infrastructure necessitates upfront financial outlays. These expenditures could take the shape of buying eco-friendly machinery and technology or changing the present designs to more environmentally friendly ones. The business can also assist with green training, green education and installing and updating green remodelling and control systems.

On the other hand, there are various instruments the company can incorporate to finance its water, energy and waste infrastructure. As such, financing vehicles may be lease purchase agreements (particularly for capital investment projects), bonds (since they permit the amortisation of costs of a number of years of repayment agreements), and loans (they are important in instances where the company is required to upgrade and renovate). Moreover, the firm can take advantage of state revolving loans (capital funds which create loans, gather payments and re-lend such payments to support new schemes) and public benefits funds (normally offered by local governments to fund programmes which benefit the community).