Impact of Green Credit and Heterogeneous Government Subsidies on New Energy Enterprises’ Bargaining Power in China’s Credit Market

Abstract

The development of the new energy industry is vital for achieving China’s “dual carbon” goals; however, financing constraints resulting from the significant disparity in bargaining power between banks and new energy enterprises (NEEs) remain a key obstacle. While existing research acknowledges that financial support policies can reduce financing costs, it has yet to adequately examine the complex interactions among different policy instruments, thereby limiting the development of effective policy portfolios. This study aims to address the issue of high financing costs faced by NEEs due to unequal bargaining power by quantitatively assessing the power imbalance between banks and NEEs and systematically evaluating both the individual and synergistic effects of green credit policies (GCPs) and government subsidies to inform optimized policy design. Using A-share listed NEEs in China as the sample, a two-tier stochastic frontier analysis (SFA) model is employed to measure the bargaining power and transaction surplus between NEEs and banks. Statistical and regression analyses are then conducted to investigate the individual and synergistic effects of GCPs and government subsidies, distinguishing between fiscal subsidies and research and development (R&D) subsidies to assess their respective impacts. The results reveal that NEEs possess substantially weaker bargaining power relative to banks; GCPs effectively weaken banks’ bargaining power with a stronger impact on banks holding greater initial power, thereby indirectly enhancing NEEs’ bargaining power. Fiscal subsidies do not significantly enhance NEEs’ bargaining power and show no synergy with GCPs. In contrast, R&D subsidies improve the bargaining power of NEEs, particularly for those with initially weaker positions, and exhibit a synergistic effect with GCPs. These findings provide practical insights for constructing a more effective policy framework to support the development of NEEs.

1. Introduction

Achieving the “peak carbon” and “carbon neutrality” goals is central to China’s strategy for transforming its energy structure, with the development of the new energy industry representing a critical pathway toward a clean and low-carbon economy [1–3]. Currently, new energy enterprises (NEEs) face multiple challenges including strong positive externalities, output uncertainties, extended investment return cycles, and elevated risk levels. These factors contribute to persistently high financing costs, which impede progress in low-carbon economic development [4]. Although China has made some progress in reducing financing costs for the new energy sector—for instance, since 2015, the average financing costs of photovoltaic, onshore wind, and offshore wind projects have decreased by 20%, 15%, and 33%, respectively, the current CoC (cost of capital) for renewable energy in China (3.9%, 3.0%, and 2.8%) remains higher than Germany’s lowest CoC benchmarks (1.4%, 1.1%, and 2.4%). This disparity indicates that policy support for China’s new energy sector remains insufficient, underscoring the urgency of optimizing policy portfolios to reduce financing costs amid an accelerated global energy transition and post-pandemic economic recovery [3, 5].

As an emerging economy, China’s capital market remains underdeveloped, with banks serving as the primary source of financing. Bank loans valued for their speed, flexibility, and interest deductibility are the preferred financing channel for NEEs [6, 7]. Within China’s bank-dominated financial system, corporate financing costs largely depend on firms’ bargaining power with banks [8]. However, research indicates that banks hold a dominant position in the credit market [9], a result of their franchise base monopoly over credit resources [10] and the inherently high-risk nature of NEEs. Enhancing the credit bargaining power of NEEs is therefore essential for reducing financing costs and promoting the green economic transition.

To address the financing difficulties and high costs faced by NEEs, the Chinese government has implemented a series of support policies from both financial and fiscal perspectives [11], primarily comprising green credit policies (GCPs) and government subsidies. Although prior studies have preliminarily examined the effects of these policies, several research gaps persist. First, limited attention has been given to analyzing how such policies influence the financing costs of NEEs through the lens of bargaining power, constraining the ability to identify underlying mechanisms and policy targets. Second, there has been no systematic comparison of the individual and synergistic effects of GCPs and government subsidies, which overlooks policy interactions and hindering the design of optimized policy combinations. Third, the heterogeneous effects of different types of government subsidies have not been comparatively analyzed, limiting the formulation of targeted strategies for enhancing subsidy mechanism.

This study uses data from Chinese A-share listed NEEs from 2008 to 2021 to examine the impact of GCPs and heterogeneous government subsidies on the credit bargaining power of NEEs. The contributions of this research are threefold. First, by investing the credit bargaining process, it reveals the mechanisms through which GCPs and government subsidies influence the bargaining power of NEEs and banks, addressing a gap in prior studies that focus solely on the final impact of policies on financing costs. This provides a more comprehensive analytical framework for understanding policy impacts. Second, by jointly analyzing the individual and synergistic effects of GCPs and government subsidies, the study uncovers the interactive relationships between policies and offers empirical support for their combined application and optimization. Third, by distinguishing between fiscal subsidies and research and developmeny (R&D) subsidies, it compares their respective synergistic effects with GCPs, offering valuable insights for refining the subsidy framework within the new energy sector. Accordingly, this research provides both constructive theoretical insights and practical guidance for addressing the challenge of insufficient credit bargaining power of NEEs, as identified in previous literature [9].

2. Literature Review and Theoretical Analysis

2.1. Literature Review

Existing studies have identified high financing costs as a key constraint on the high-quality development of NEEs in China. One primary reason for this is the disparity in bargaining power between NEEs and banks. Given that bank loans constitute the primary source of external financing [7], banks often dominate credit negotiations. Leveraging their monopoly over credit resources, banks can compel enterprises to accept higher loan rates, thereby generating excess profits and increasing financing costs for borrowers [12]. This imbalance is particularly acute in the case of NEEs, which are typically knowledge and technology intensive. As the relevant technologies remain in early stages, significant risks and uncertainties persist in their development [13]. Additionally, the initial fixed asset investments required for new energy projects are substantial, and their payback periods are relatively long [4]. Compared with traditional energy sources, China’s new energy sector still suffers cost disadvantages and lower market competitiveness. These characteristics result in higher risk coefficients for NEEs, often exposing them to pronounced credit discrimination during the financing process [14, 15]. As a result, bargaining power of NEEs is markedly weaker than that of banks, and new energy projects frequently incur elevated loan costs and risk premiums, with financing expenses exceeding fair market levels [16–18].

Previous research has also examined the role of government policy in reducing NEEs’ credit financing costs. The effectiveness of GCPs, in particular, has been preliminarily validated. Scholtens and Dam [19] found that GCPs in Australia encouraged companies to disclose green business information. Disclosure related to corporate social responsibility was found to enhance corporate performance and reduce financing costs. Lian [20] compared green enterprises with “two-high” enterprises and found that while GCPs raised financing costs for polluting enterprises, they did not reduce those of green enterprises. Li et al. [13] investigated the influence of GCPs on corporate green innovation and found that these policies improved financing conditions, thereby reducing financing costs and significantly enhancing innovation. Xu and Li [21] revealed that GCPs had asymmetric effects—raising financing costs for “two-high” enterprises but lowing them for green enterprises. However, Niu et al. [22] using panel data from 2001 to 2015, concluded that GCPs did not significantly reduce financing costs for green enterprises. Guo and Fang [23] found that including green credit assets as medium-term lending facility collateral increased credit availability and lowered financing costs for green credit enterprises. Zhou et al. [24] confirmed that GCPs enhanced credit access and reduced financing costs for green enterprises, leading to a Pareto improvement in resource allocation. Zhang and Zhong [25] demonstrated that GCPs promoted technological innovation, with mediation effects indicating that green credit substantially reduced interest expenses. Wang et al. [26] also found that green finance pilot policies eased financing constraints for NEEs.

The effectiveness of government subsidies has also been validated, with a growing body of literature exploring the varying effects of heterogeneous subsidies. Wu et al. [27] found that, in inefficient credit markets, government intervention could reduce information asymmetry, lower financing costs, and improve credit resource allocation. However, rent-seeking behaviors might lead to over lending risks. Shen [28] argued that fiscal subsidies act as implicit guarantees, lowering banks’ risk assessments and reducing debt financing expenses for enterprises—although only when subsidies are large enough to shift firm profitability from negative to positive. Wang [29] studied the impact of R&D subsidies, finding that R&D subsidies facilitate technological and regulatory certification, which enhances investor confidence and lowers external financing costs. Zeng et al. [30] pointed out that subsidies offer implicit guarantees that reduce debt financing costs burdens. Liu and Du [31] identified a signaling effect, whereby subsidies alleviate information asymmetry between firms and external investors. Yao et al. [32] further showed that innovation related subsidies had stronger effects than noninnovation subsidies in stimulation investment in R&D.

More recently, scholars have begun to analyze the joint impacts of GCPs and government subsidies. Yang [33] compared direct subsidies and indirect tools (such as GCPs) on renewable energy generation enterprises, finding that mixed subsidies enhanced both renewable energy output and social welfare. Yang et al. [34] examined Chinese renewable energy enterprises and found that GCPs positively influenced performance under financing constraints, and that the combined use of GCPs and production subsidies generated stronger effects. Hong et al. [35] investigated how coordinated fiscal and financial policies improve corporate environmental governance and found that local green credit interest subsidy policies incentivized banks to expand provide green credit, thereby strengthening environmental governance.

In summary, the literature has extensively investigated the financing challenges faced by NEEs and largely attributes them to the substantial bargaining power imbalance between NEEs and banks. Prior research has established that GCPs can effectively reduce the debt financing costs by improving credit conditions and enhancing credit access. Government subsidies, through mechanisms such as implicit guarantees and certification effects, also help to mitigate information asymmetry and lower financing costs. Nonetheless, important gaps remain. First, most existing studies treat financing costs as the final outcome, lacking analysis from the perspective of bargaining power—thereby failing to illuminate how GCPs and subsidies affect the negotiation dynamics between NEEs and banks. This limits our understanding of the mechanisms underlying policy impacts on different stakeholders. Second, the synergistic effects of GCPs and government subsidies have received limited attention, and the interaction between these policy tools remain underexplored. Third, although some research has begun to investigate the differing effects of heterogeneous government subsidies, few studies have systematically compared how distinct subsidy types (e.g., fiscal versus R&D) interact with GCPs. This restricts the development of precision and effective policy framework. This study addresses these gaps by developing a systematic analytical framework grounded in bargaining power theory. Using empirical methods, it evaluates both the individual and combined effects of GCPs and government subsidies. Importantly, by distinguishing between fiscal and R&D subsidies, this research provides a detailed comparative analysis of their synergistic impacts when paired with GCPs. The findings contribute meaningful theoretical insights and offer practical guidance for optimizing the financial support policy system for NEEs.

2.2. Theoretical Analysis and Hypothesis

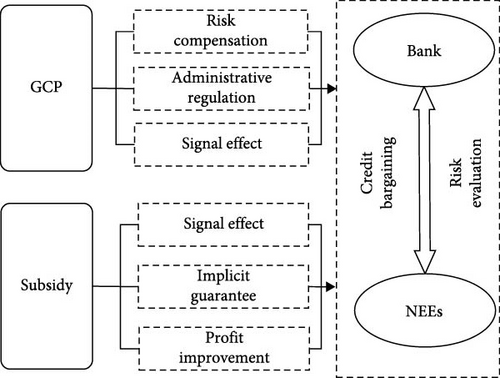

A comprehensive review of the literature reveal that GCPs did not initially enhance the bargaining power of green enterprises, and therefore failed to reduce their financing costs [20, 22]. However, after a period of policy development and refinement, GCPs began to improve bargaining power and ultimately reduced financing costs [23, 25]. This suggests that GCPs may exhibit a threshold effect in influencing the bargaining power of NEEs, indicating a nonlinear relationship. As GCPs mature, they can reduce the bargaining power of banks and, in turn, enhance that of NEEs. This effect operates through three primary mechanisms: risk compensation, administrative regulation, and signaling effects. Specifically, in terms of risk compensation, the GCPs provide interest subsidies and refinancing support to banks, helping to offset the additional risks associated with lending to NEEs. These mechanisms internalize externalities into profits, incentivizing banks to reduce the risk premiums on credit offered to NEEs. In terms of administrative regulation, the implementation of GCPs involves institutional mechanisms such as the “special statistical system for green loans”, which mandates the disclosure of green loan issuance and incorporates this data into performance assessments. These measures put pressure on banks and encourage their adherence to green credit standards. In terms of signaling effects, GCPs clarify long term expectations for the new energy sector, enhancing the confidence of financial institutions, including banks, in supporting NEEs. This, in turn, strengthens the bargaining power of NEEs. Based on this analysis, the following hypothesis is proposed.

H1: GCPs can indirectly enhance the bargaining power of NEEs by reducing the bargaining power of banks, and this effect is nonlinear.

Both fiscal subsidies and R&D subsidies can also improve the bargaining power of NEEs. These subsidies operate through three shared channels: signaling effects, implicit government guarantees, and improvements in business operations. In terms of signaling attributes, when enterprises receive government subsidies, it signals official endorsement of their growth potential and operational quality. This reduces information asymmetry, enabling banks to make more accurate risk assessments and consequently lowering financing costs [36]. Regarding implicit government guarantees, subsidies often imply a form of governmental backing, which alleviates creditor concerns about default risk and lowers the cost of debt [37]. In terms of operational improvements, subsidies provide enterprises with additional liquidity, enhancing cash flow, profitability, and financial stability. This reduces reliance on external financing and strengthens NEEs’ position in credit negotiations [38, 39].

However, R&D subsidies differ significantly from general fiscal subsidies in two respects. First, R&D subsidies involve a more selective allocation process that includes application, government review and final distribution. The review phase is particularly profitable enterprises typically qualify [40], resulting in stronger signaling effects. Second, R&D subsidies sever as a form of “certification” of enterprise quality from the perspective of external investors [41], thereby exerting a more pronounced influence on bargaining power compared to general fiscal subsidies. Accordingly, the second hypothesis is formulated.

H2: Both fiscal subsidies and R&D subsidies can directly enhance the bargaining power of NEEs, with R&D subsidies being more effective.

Although both the GCPs and government subsidies contribute to improving the bargaining power of NEEs, they target different entities. GCPs primarily affect banks, compelling them to make credit concessions, thereby indirectly benefiting NEEs. In contrast, government subsidies act directly on NEEs, improving their negotiation position. When implemented together, these policies jointly address risk compensation and information asymmetry, improve the credit negotiation environment, and facilitate redistribution of credit surplus in favor of NEEs. Given that R&D subsidies exhibit stronger selectivity and certification effects than fiscal subsidies, their synergy with GCPs is expected to be greater. Thus, the third hypothesis is proposed.

H3: GCPs and government subsidies can jointly enhance the bargaining power of NEEs. And R&D subsidies demonstrating a stronger synergistic effect with GCPs than fiscal subsidies.

The specific impact mechanisms underlying these policy impacts are illustrated in Figure 1.

3. Research Design

3.1. Measurement of Bargaining Power and Analysis of Influencing Factors

3.1.1. Measurement of Bargaining Power

In this context, represents the lowest acceptable price for the banks, is the highest acceptable price for the NEEs, and η represents the banks’ bargaining power, where 0 ≤ η ≤ 1. represents the surplus that the banks can gain in reaching the equilibrium price.

Due to the one-sided nature of the effects of wi and ui in the above equation, it is assumed that both wi and ui follow independent and xidentical exponential distributions, that is, and . Furthermore, vi is assumed to follow a standard normal distribution, that is, . Simultaneously, it is assumed that wi, ui, and vi are mutually independent and unrelated to the characteristic variables xi influencing the credit financing price of the enterprise mentioned above. Under these assumptions, wi and ui both follow one-sided distributions, and in this case, ordinary least squares (OLS) estimates may lead to a biased composite disturbance term εi. Hence, to concurrently estimate the parameters and the transaction surplus, maximum likelihood estimation (MLE) should be employed for estimating Equation (3).

In Equation (5), ζ = {δ, σw, σu, σv} are the main parameters of concern. MLE is applied, that is, the corresponding parameters are obtained by maximizing the function value of the Equation (5). It is important to note that since σw and σu appear separately in the likelihood equation, σw appears in ai and bi, while σu appears in αi and βi. Thus, the identification of these three standard deviations is achieved.

Here, ,χ1i = Φ(bi) + exp(αi − ai) · Φ(βi), and χ2i = Φ(βi) + exp(ai − αi) · Φ(bi) = exp(ai − αi) · χ1i.

3.1.2. Analysis of Factors Influencing Bargaining Power

3.2. Sample, Variables, and Data

3.2.1. Sample Selection

Due to data availability constraints, this study uses China’s A-share listed NEEs as the research sample. The selection criteria are based on the methodology proposed by Xu et al. [43]. Annual reports were manually reviewed to identify the presence of new energy products and business activities for each firm in each year. Based on this process, a total of 2460 firm-year observations were selected, covering the period from 2008 to 2021.

3.2.2. Variable Selection

3.2.2.1. Variables for Measuring Bargaining Power

The selection of variables in this study is informed by a dual theoretical framework that integrates resource dependance theory and credit rationing theory. The financing costs variable follows the definitions used in Zhou et al. [24] and Guo and Fang [23]. Drawing on Guo and Fang [23] and Xu et al. [9], the following firm level characteristics are considered key determinants of financing costs: firm size, solvency, corporate governance structure, profitability, asset tangibility, asset liquidity, agency costs, and firm age. The names, symbols, and measurements of these variables are detailed in Table 1.

| Variable category | Variable name | Symbol | Measurement |

|---|---|---|---|

| Dependent variable | Financing costs | Cost | Financial expense/total liabilities |

| Characteristic variables | Enterprise size | Size | Natural logarithm of total assets |

| Debt repayment ability | Lev | Debt-to-equity ratio | |

| Dual position integration | Dual | Assigned 1, if chairman and general manager are the same person, else 0 | |

| Profitability | Roa | Asset profitability ratio | |

| Equity concentration | Top1 | Number of shares held by the largest shareholder divided by total number of shares | |

| Free cash flow | Inca | Free cash flow/total assets | |

| Asset liquidity | Liquid | Current assets/current liabilities | |

| Asset tangibility | Tangible | Net fixed assets/total assets | |

| Agency costs | Turnover | Operating expenses/operating revenue | |

| Firm age | Age | Natural logarithm of the time since establishment of the firm | |

3.2.2.2. Variables for Analyzing Policy Factors Influencing Bargaining Power

The policy factors variables include GCPs, fiscal subsidies and R&D subsidies. The proxy for GCPs was selected based on the methodologies proposed by Song et al. [44] and Lin and Pan [45]. Specifically, the implementation intensity of GCPs in each province is calculated using the formula: (1) Interest expenses of six major energy-intensive industries in each province/interest expenses of all industrial enterprises above a certain scale. Thus, each enterprise is then assigned the GCPs intensity value corresponding to its province. The measurement of fiscal subsidies follows the approach in existing literature, whereby subsidies are extracted from the nonoperating income section of firms’ financial reports [46]. The R&D subsidies variable is identified in accordance with Xu et al. [43], by extracting information related to R&D specific subsidies disclosed in the annual reports of listed firms. The bargaining power of NEEs is calculated using the two-tier SFA model, derived from the estimation and variance decomposition of Equation (3).

To analyze the individual impacts of policy factors, GCPs, fiscal subsidies and R&D subsidies are used as grouping variables, and the full research sample is divided into corresponding subsamples. GC_D is a binary variable representing the GCPs implementation phase [47], assigned GC_D a value of 0 for the period before 2012 and 1 for 2012 onwards. Sub_D equals 1 if fiscal subsidies exceed the sample median, and 0 otherwise. RD_D equals 1 if a firm receives R&D subsidies, and 0 if not.

In summary of the variable’s names, symbols, and measurements methods is provided in Table 2.

| Variable category | Variable name | Symbol | Measurement |

|---|---|---|---|

| Dependent variable | NEEs’ bargaining power | σu | Obtained from estimation and variance decomposition for Equation (3) |

| Core explanatory variables | GCPs Intensity | GC | 1–interest expenses of six major energy-intensive industries in each province/interest expenses of all industrial enterprises above a certain scale |

| Fiscal subsidies | Sub | Natural logarithm of total subsidies received by the NEEs | |

| R&D subsidies | RD | Natural logarithm of R&D subsidies disclosed in nonoperating income | |

| Grouping variables | GCPs | GC_D | Assigned 0, before 2012; otherwise 1 |

| Fiscal subsidies dummy | Sub_D | For values surpassing the median, set to 1; otherwise, set to 0. | |

| R&D subsidies dummy | RD_D | For R&D subsidies greater than 0, set to 1; otherwise, set to 0. | |

3.2.3. Data Sources

Data on credit financing costs and firm-level characteristics are obtained from the WIND and CSMAR databases, supplemented by manual collection from the annual reports of NEEs. Data on GCPs is sourced from the China Industrial Statistical Yearbook and Economic Census Data. Data on government subsidies are manually extracted from the annual reports of listed companies.

4. Empirical Analysis

4.1. Descriptive Statistics of Variables

Descriptive statistics and correlation results for the variables listed in Tables 1 and 2 are presented in Table 3, excluding the NEEs’ bargaining power metric and dummy variables, which will be analyzed separately in a subsequent section. The results show that all variable values fall within reasonable and expected ranges, thereby validating their suitability for further empirical investigation.

| Variables | Mean | S.D. | (1) | (2) | (3) | (4) | (5) | (6) |

|---|---|---|---|---|---|---|---|---|

| (1) Cost | 0.018 | 0.023 | 1.00 | — | — | — | — | — |

| (2) GC | 0.583 | 0.123 | 0.11 ∗∗∗ | 1.00 | — | — | — | — |

| (3) Sub | 6.816 | 2.237 | − 0.03 | − 0.01 | 1.00 | — | — | — |

| (4) RD | 4.045 | 2.946 | − 0.07 ∗∗∗ | 0.06 ∗∗ | 0.17 ∗∗∗ | 1.00 | — | — |

| (5) Size | 22.86 | 1.454 | − 0.15 ∗∗∗ | − 0.10 ∗∗∗ | 0.38 ∗∗∗ | 0.02 | 1.00 | — |

| (6) Lev | 0.52 | 0.187 | − 0.00 | − 0.13 ∗∗∗ | 0.19 ∗∗∗ | − 0.04 ∗ | 0.51 ∗∗∗ | 1.00 |

| (7) Dual | 0.238 | 0.426 | − 0.02 | 0.17 ∗∗∗ | − 0.08 ∗∗∗ | 0.05 ∗∗ | − 0.21 ∗∗∗ | − 0.20 ∗∗∗ |

| (8) Roa | 0.047 | 0.06 | 0.07 ∗∗∗ | − 0.00 | 0.08 ∗∗∗ | 0.00 | 0.08 ∗∗∗ | − 0.26 ∗∗∗ |

| (9) Top1 | 0.348 | 0.156 | 0.10 ∗∗∗ | − 0.05 ∗∗ | 0.12 ∗∗∗ | − 0.04 ∗ | 0.30 ∗∗∗ | 0.06 ∗∗ |

| (10) Inca | 0.043 | 0.061 | 0.12 ∗∗∗ | 0.01 | 0.02 | − 0.08 ∗∗∗ | 0.18 ∗∗∗ | − 0.01 |

| (11) Liquid | 1.759 | 2.011 | − 0.08 ∗∗∗ | 0.02 | −0.09 ∗∗∗ | 0.02 | − 0.33 ∗∗∗ | − 0.61 ∗∗∗ |

| (12) Tangible | 0.306 | 0.201 | − 0.04 | − 0.18 ∗∗∗ | − 0.00 | − 0.16 ∗∗∗ | 0.28 ∗∗∗ | 0.21 ∗∗∗ |

| (13) Turnover | 0.470 | 0.311 | 0.04 | 0.10 ∗∗∗ | 0.04 ∗ | 0.06 ∗∗ | − 0.13 ∗∗∗ | − 0.03 |

| (14) Age | 2.872 | 0.395 | 0.15 ∗∗∗ | − 0.01 | − 0.11 ∗∗∗ | − 0.10 ∗∗∗ | 0.18 ∗∗∗ | 0.11 ∗∗∗ |

| (7) | (8) | (9) | (10) | (11) | (12) | (13) | (14) | |

| (7) Dual | 1.00 | — | — | — | — | — | — | — |

| (8) Roa | 0.06 ∗∗ | 1.00 | — | — | — | — | — | — |

| (9) Top1 | − 0.10 ∗∗∗ | 0.15 ∗∗∗ | 1.00 | — | — | — | — | — |

| (10) Inca | − 0.05 ∗ | 0.30 ∗∗∗ | 0.09 ∗∗∗ | 1.00 | — | — | — | — |

| (11) Liquid | 0.08 ∗∗∗ | 0.14 ∗∗∗ | − 0.05 ∗ | − 0.06 ∗∗ | 1.00 | — | — | — |

| (12) Tangible | − 0.12 ∗∗∗ | 0.01 | 0.09 ∗∗∗ | 0.32 ∗∗∗ | − 0.26 ∗∗∗ | 1.00 | — | — |

| (13) Turnover | − 0.01 | 0.09 ∗∗∗ | − 0.01 | 0.08 ∗∗∗ | 0.00 | − 0.17 ∗∗∗ | 1.00 | — |

| (14) Age | − 0.13 ∗∗∗ | − 0.01 | − 0.10 ∗∗∗ | 0.19 ∗∗∗ | − 0.18 ∗∗∗ | 0.17 ∗∗∗ | 0.00 | 1.00 |

- Note: N = 2460.

- ∗p < 10%.

- ∗∗p < 5%.

- ∗∗∗p < 1%.

4.2. Measurement Estimation Results: Bargaining Power of NEEs and Banks

4.2.1. Estimation Results of the Credit Bargaining Model

Table 4 presents the results derived from the estimation of Equation (3), where Models 1 and 2 present the results from the multivariate linear regression approach, while Models 3 and 4 report the outcomes obtained from the two-tier SFA method. The results show that the fitting effects of all models are quite good, with strong explanatory power for the majority of variables. Among them, Size, Tangible, and Inca have a significantly negative impact on the financing costs. However, Lev, Top1, and Turnover significantly increase the financing costs. These results are consistent with expectations and existing research [42]. The random disturbance terms for Models 3 and 4 indicate that random disruptive factors, NEEs’ bargaining power, and banks’ bargaining power are all significant, causing the final loan transaction price to deviate from the fair price. The results estimated from Model 4 are used as the foundation for subsequent variance decomposition, bargaining power, and surplus measurement.

| Variables | Dependent variable: Cost | |||

|---|---|---|---|---|

| Model 1 | Model 2 | Model 3 | Model 4 | |

| Size | − 0.045 ∗∗∗ (− 2.70) | − 0.039 ∗∗ (− 2.12) | − 0.050 ∗∗∗ (− 6.17) | − 0.037 ∗∗∗ (− 4.25) |

| Lev | 0.602 ∗∗∗ (5.12) | 0.528 ∗∗∗ (4.35) | 1.156 ∗∗∗ (15.78) | 1.057 ∗∗∗ (13.42) |

| Dual | − 0.022 (− 0.62) | 0.012 (0.34) | −0.000 (−0.02) | 0.023 (1.02) |

| Roa | − 1.279 ∗∗∗ (− 5.73) | − 1.159 ∗∗∗ (− 5.13) | − 0.011 ∗ (− 0.86) | − 0.012 ∗ (− 1.97) |

| Top1 | 0.034 (0.26) | −0.211 (−1.60) | − 0.049 (− 0.79) | − 0.138 ∗∗ (− 2.19) |

| Inca | − 0.917 ∗∗∗ (− 4.34) | − 0.986 ∗∗∗ (− 4.60) | − 0.424 ∗∗ (− 2.19) | − 0.658 ∗∗∗ (− 3.38) |

| Liquid | 0.138 ∗∗∗ (16.31) | 0.133 ∗∗∗ (15.88) | 0.091 ∗∗∗ (12.39) | 0.093 ∗∗∗ (12.99) |

| Tangible | 1.101 ∗∗∗ (11.35) | 0.794 ∗∗∗ (7.30) | 1.502 ∗∗∗ (26.75) | 1.148 ∗∗∗ (15.35) |

| Turnover | 0.064 (1.37) | 0.146 ∗∗∗ (2.84) | 0.178 ∗∗∗ (4.33) | 0.222 ∗∗∗ (5.36) |

| Age | − 0.285 ∗∗∗ (− 6.06) | − 0.150 ∗∗ (− 2.26) | −0.024 (−0.98) | −0.020 (−0.64) |

| Year and industry | — | Control | — | Control |

| Constant | 2.010 ∗∗∗ (5.85) | 2.497 ∗∗∗ (4.16) | 0.647 ∗∗∗ (3.51) | 0.394 (1.64) |

| sigma_v | — | — | −1.459 ∗∗∗ (− 13.52) | −1.960 ∗∗∗ (− 13.62) |

| sigma_u | — | — | −1.711 ∗∗∗ (− 12.85) | −1.576 ∗∗∗ (− 25.55) |

| sigma_w | — | — | − 0.854 ∗∗∗ (− 22.99) | − 0.832 ∗∗∗ (− 25.00) |

| N | 2460 | 2460 | 2460 | 2460 |

| Adj. R2 | 0.239 | 0.329 | — | — |

| ll | − 2304 | − 2120 | − 1985 | − 1815 |

- ∗p < 10%.

- ∗∗p < 5%.

- ∗∗∗p < 1%.

Table 5 presents the results of the variance decomposition based on Model 4, reflecting the impact of the bargaining power of various parties on loan prices in the credit market. The results reveal that the difference in bargaining power between banks and NEEs is positive, E(w − u) = σw − σu = 0.2281, indicating that banks hold a strong position in negotiations. Bargaining factors account for 92.12% of the total variance, with the proportion of banks’ bargaining power accounting for 81.56%. The proportion of NEEs’ bargaining power accounts for only 18.44% of the variance, further illustrating the absolute dominance of banks in the process of credit market price formation. This perspective supports the findings by Wei and Zeng [12] and Kochiyama and Nakamura [48].

| Variable category | Variable meaning | Symbol | Estimation result |

|---|---|---|---|

| Disturbance term | Random error term | σv | 0.1408 |

| Bargaining power of NEEs | σu | 0.2069 | |

| Bargaining power of banks | σω | 0.4350 | |

| Variance decomposition | Total variance of the error term | 0.2518 | |

| Proportion of bargaining factors in the total variance | 92.12% | ||

| Proportion of NEEs’ bargaining power | 18.44% | ||

| Proportion of banks’ Bargaining Power | 81.56% | ||

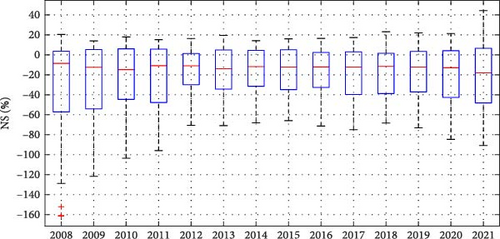

Table 6 provides a quantile statistical analysis of surplus, highlighting the unilateral gains of each party. On average, the surplus obtained by NEEs reduces the loan price by 17.1%, whereas the surplus obtained by banks increases the price by 30.1%, leading to an average 13% loan premium borne by NEEs. At the 25th percentile, loan prices exceed the fair price by 28.5%, while at the median, they exceed it by 10%. At the 75th percentile, NEEs surpasses banks in bargaining power, achieving a positive surplus equivalent to 3.4% of the fair price though this remains a small portion of the sample. These results are consistent with those of Xu et al. [9] and Wei [10].

| Variable | Mean % | P25 (%) | P50 (%) | P75 (%) |

|---|---|---|---|---|

| Firms | 17.10 | 12.30 | 13 | 17.90 |

| Banks | 30.10 | 14.60 | 23 | 40.80 |

| NS | − 13 | − 28.50 | − 10 | 3.40 |

4.2.2. Analysis of Temporal Trends in Bargaining Power and Surplus

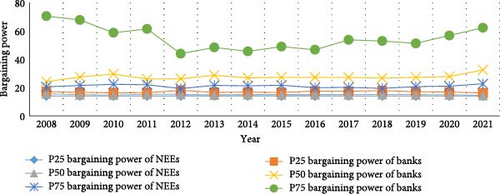

Figure 2 illustrates the temporal evolution of bargaining power quantiles for both NEEs and banks. Between 2008 and 2021, banks at the 75th percentile show the largest decrease in bargaining power from 70% in 2008 to 52% in 2021, reflecting a substantial 18% decline. In contrast, bargaining power for banks at the median and 25th percentiles exhibits relatively minor changes. NEEs show no significant time trends across percentiles, suggesting that reductions in banks dominance have not been matched by uniform improvements in NEEs’ bargaining power. These findings indicate that the bargaining power of stronger banks has weakened more significantly over time.

Figure 3 presents the annual distribution of NS obtained by NEEs, with a 1% trimmed mean applied to exclude outliers. It shows that from 2008 to 2021, the trends in changes across quantile samples are not entirely consistent, exhibiting significant heterogeneity. At the 25th percentile, the surplus shows a significant fluctuation during each year from 2008 to 2021, presenting an inverted U-shape and ultimately showing some growth. The lowest point, in 2008, is approximately −57%, while the highest point, in 2012, is around −30%, exhibiting an increase of 27%. And comparing 2021–2008, there is an increase of about 10%. This indicates that weak enterprises experience a substantial increase in the available surplus in the credit market. At the median, the NS value stays below 0 and exhibits no significant trends in any direction over time. Similarly, at the 75th percentile, the NS value stays above 0 and exhibits no significant trends over time. The results indicate that, over time, the increase in NS for NEEs is primarily reflected in NEEs that are initially weaker, such as private enterprises and small enterprises, and this change is associated with the weakening bargaining power of dominant banks.

4.3. Analysis of the Impact of Policy Factors on Bargaining Power and Surplus

4.3.1. Individual Impact of Policies

Following the methodology of Xie [42], the full sample was divided into subgroups based on the policy related dummy variables defined in Table 2, and Equation (3) was reestimated for each subgroup.

4.3.1.1. Individual Impact of GCPs

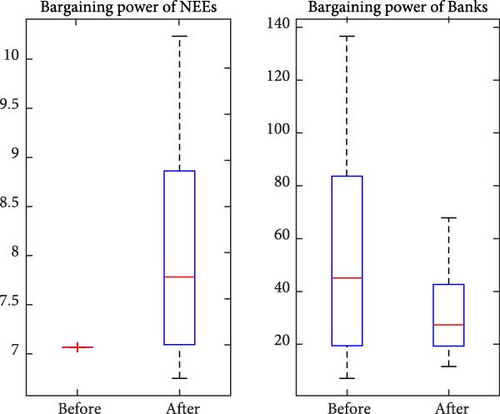

Equation (3) was reestimated using subsamples grouped by GC_D, and the bargaining power, surplus for each party, and NS are calculated. Figure 4 presents the distribution of bargaining power for NEEs and banks before and after the implementation of the GCPs. Prior to implementation, NEEs’ bargaining power of NEEs was around 7%, indicating a clear disadvantage relative to banks. Following GCPs implementation, the bargaining power of NEEs increased markedly. Concurrently banks at the 75th and 50th percentiles experienced a substantial reduction in bargaining power, while the 25th percentile showed little change.

Figure 5 displays the distribution of surplus before and after the implementation of GCPs. Before the policies, surplus of NEEs was below 5%, and banks at the 75th percentile captured over 80% of the total surplus. Additionally, over 25% of firms had an NS below −80%, and more than 50% had NS below −40%. Post GCPs, the median surplus of NEEs exceeded 15%, reflecting a significant increase. Banks’ surplus decreased overall, especially among banks in the upper quantiles (i.e., the 75th and above), suggesting that those with stronger initial bargaining power made greater concessions. Moreover, more than 25% of the sample achieved positive NS, and the 25th percentile increases substantially, highlighting the greater benefits that accrued to NEEs with initially weaker bargaining position.

4.3.1.2. Individual Impact of Subsidies

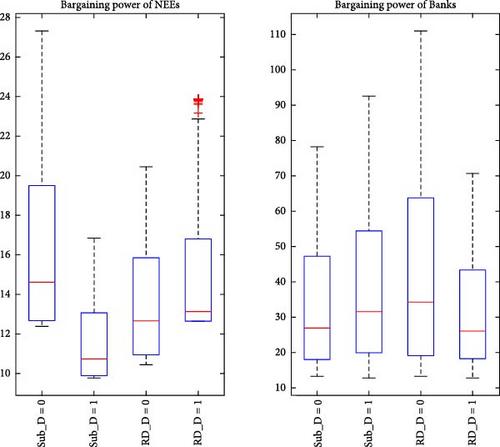

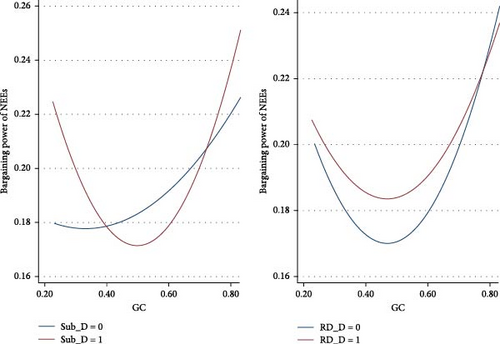

Equation (3) was reestimated for subsamples grouped bySub_D and RD_D, respectively. The bargaining power, surplus, and NS were computed accordingly. Figure 6 illustrates the impact of fiscal and R&D subsidies on the bargaining power of NEEs and banks. Firms receiving higher fiscal subsidies (Sub_D = 1) experienced a decline in bargaining power. In contrast, R&D subsidies (RD_D = 1) significantly enhanced the bargaining power of NEEs. For banks, the opposite effects were observed: excessive fiscal subsidies increased banks’ bargaining power, while R&D subsidies reduced it. These findings suggest that while GCPs improve NEEs’ bargaining power and NS especially among weaker firms, fiscal subsidies may unintentionally strengthen banks’ positions, whereas R&D subsidies directly empower NEEs.

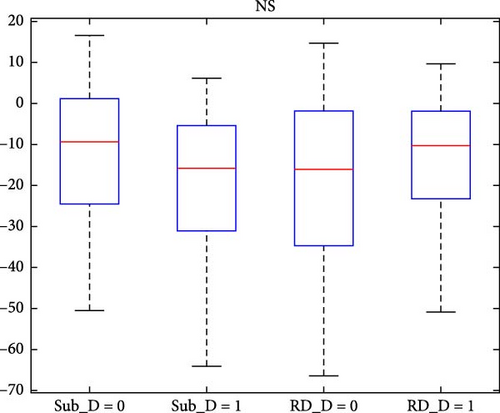

Figure 7 shows the impact of subsidy factors on NS. The results indicate that, when NEEs receive a higher fiscal subsidy (Sub_D = 1), it actually reduces the NS obtained by the NEEs. However, receiving R&D subsidies (RD_D = 1) increases the NS for NEEs, which is particularly evident in the improvement of NS for NEEs at the 25th and 50th percentiles. These findings reveal that excessive fiscal subsidies tend to reduce bargaining power of NEEs and NS, possibly due to issues such as budget constraints and rent-seeking encouraged by the fiscal subsidies, and R&D subsidies can enhance NEEs’ bargaining power and NS.

4.3.2. Synergistic Impact of Policies

First, to investigate the synergistic effects of GCPs and government subsidies, Equations (11)–(14) were estimated, and the results are reported in Models 5 to 8 of Table 7.

| Variables | Dependent: σu | |||

|---|---|---|---|---|

| Model 5 | Model 6 | Model 7 | Model 8 | |

| GC | − 0.360 (− 1.64) | − 5.859 ∗∗∗ (− 3.56) | − 5.797 ∗∗∗ (− 3.38) | − 6.579 ∗∗∗ (− 3.87) |

| GC2 | — | 5.796 ∗∗∗ (3.80) | 5.962 ∗∗∗ (3.88) | 5.924 ∗∗∗ (3.85) |

| Sub | — | — | − 0.043 (− 0.73) | — |

| GC × Sub | — | — | 0.036 (0.36) | — |

| RD | — | — | — | 0.076 ∗ (1.70) |

| GC × RD | — | — | — | 0.148 ∗∗ (2.00) |

| Constant | − 4.366 ∗∗∗ (− 33.32) | − 5.937 ∗∗∗ (− 13.76) | − 5.692 ∗∗∗ (− 10.29) | − 6.271 ∗∗∗ (− 13.12) |

| N | 2460 | 2460 | 2460 | 2460 |

- ∗p < 10%.

- ∗∗p < 5%.

- ∗∗∗p < 1%.

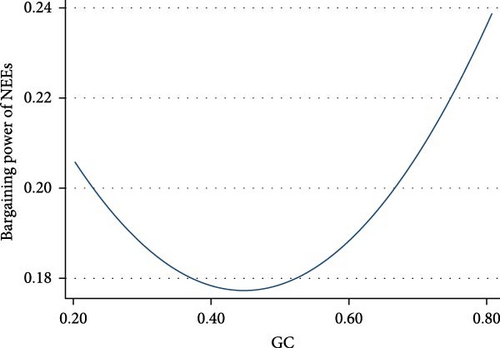

The results in Table 7 show that, in Model 5, the effect of GC is not statistically significant. This might be attributable to that GCPs follow a nonlinear influence pattern on NEEs’ bargaining power according to the theoretical analysis. However, in Model 6, GC has a significantly negative impact, whereas GC2 has a significantly positive impact, this suggests a U-shaped relationship between GCPs and NEEs’ bargaining power. In Model 7, the impact of GC and GC2 remains consistent with that in Model 6, but Sub and the interaction term GC × Sub are not significant. This indicates that the impact of fiscal subsidies on the bargaining power of NEEs is not significant, and there is no substantial synergistic effect with GCPs. In Model 8, the impact of GC is significantly negative, while those of GC2, RD, and GC × RD are all significantly positive. This implies that R&D subsidies can significantly enhance the bargaining power of NEEs and that there is a positive synergistic effect with GCPs. Based on the empirical results, hypothesis H1 is verified, while hypothesis H2 and hypothesis H3 are partially verified.

Second, to further validate the nonlinear impact mechanism of GCPs on the bargaining power of NEEs, this study employs fitted curve analysis to visually illustrate the relationship between key variables (Figure 8). The results confirmed a significant U-shaped relationship, supporting and reinforcing empirical findings. Notably, Figure 9 reveals a clear synergistic effect between heterogeneous government subsidies and GCPs, with R&D subsidies exhibiting particularly strong complementarity with GCPs in enhancing the bargaining power of NEEs.

4.4. Robustness Test

To ensure the robustness of the research findings, this study replaces explanatory variables and estimation method, respectively. First, the explanatory variable GC is replaced with the green finance development index (GFD) of each province [49], and Equations (11)–(14) were reestimated, as shown in Table 8. The results show that GFD2, RD, and GFD × RD are significantly positively correlated with σu, meaning that the main conclusions shown in Table 7 are further verified.

| Variables | Dependent: σu | |||

|---|---|---|---|---|

| Model 9 | Model 10 | Model 11 | Model 12 | |

| GFD | − 0.806 ∗∗ (− 2.01) | − 0.732 ∗ (− 1.82) | − 0.892 ∗∗ (− 2.18) | 0.055 (0.09) |

| GFD2 | — | 0.375 ∗ (1.84) | 0.360 ∗ (1.75) | 0.357 ∗ (1.75) |

| Sub | — | — | − 0.033 ∗∗ (− 2.52) | — |

| GFD × Sub | — | — | 0.039 (0.40) | — |

| RD | — | — | — | 0.148 ∗ (1.72) |

| GFD × RD | — | — | — | 0.211 ∗ (1.90) |

| Constant | − 3.976 ∗∗∗ (− 13.02) | − 3.901 ∗∗∗ (− 12.65) | − 5.692 ∗∗∗ (− 10.29) | − 4.463 ∗∗∗ (− 13.12) |

| N | 2460 | 2460 | 2460 | 2460 |

- ∗p < 10%.

- ∗∗p < 5%.

- ∗∗∗p < 1%.

Here, Cost is the dependent variable; GC, GC2, Sub, and RD, along with the corresponding interaction terms—GC × Sub and GC × RD are selected as explanatory variables denoted by Policy; Controls consists of Table 1, ∑Year denotes the fixed effects for years; and ∑Ind represents the industry fixed effects. The model is then estimated, and the results are presented in Table 9.

| Variables | Dependent Variable: Cost | |||

|---|---|---|---|---|

| Model 13 | Model 14 | Model 15 | Model 16 | |

| GC | 0.656 ∗∗∗ (4.29) | 5.355 ∗∗∗ (5.58) | 5.388 ∗∗∗ (5.41) | 5.530 ∗∗∗ (5.75) |

| GC2 | — | − 4.139 ∗∗∗ (− 4.96) | − 4.016 ∗∗∗ (− 4.79) | − 4.062 ∗∗∗ (− 4.88) |

| Sub | — | — | 0.021 (1.12) | — |

| GC × Sub | — | — | − 0.023 (− 0.74) | — |

| RD | — | — | — | 0.053 ∗∗∗ (3.34) |

| GC × RD | — | — | — | − 0.076 ∗∗∗ (− 2.91) |

| Controls | Yes | Yes | Yes | Yes |

| Year and industry | Control | Control | Control | Control |

| Constant | 1.643 ∗∗∗ (3.88) | 0.402 (0.82) | 0.317 (0.62) | 0.350 (0.71) |

| N | 2460 | 2460 | 2460 | 2460 |

| Adj. R2 | 0.382 | 0.379 | 0.380 | 0.395 |

- ∗p < 10%.

- ∗∗p < 5%.

- ∗∗∗p < 1%.

The results in Table 9 indicate that, the impact of GCPs on Cost exhibits an inverted U-shaped relationship. The interaction term GC × Sub does not have a significant impact on Cost, but the interaction term GC × RD shows a significant negative effect on Cost. Therefore, R&D subsidies play a synergistic role with GCP in reducing the credit financing costs for NEEs. In summary, the main research conclusions remain robust.

4.5. Endogeneity Treatment

The Sub and RD variables may have endogeneity due to potential two-way causality. On one hand, NEEs may apply for subsidies based on their operational status and development prospects [50], on the other hand, governments assess these same enterprise characteristics during the subsidy review process—factors that banks also consider when setting loan terms. To address this issue, this study adopts a two-stage instrumental variable approach, following the methodology of Guo [50] and Xu et al. [51].

Instrumental variables must be strictly exogenous and highly correlated with the endogenous explanatory variables. First, reasonable instrumental variables are selected for government subsidies. As local governments in China depend on “land finance”, an increase in government fiscal revenue leads to a corresponding increase in the fiscal subsidies available to enterprises. Therefore, following Xu et al. [51], the natural logarithm of the land transfer fees in the enterprise’s city (lnland) is used as the first instrumental variable. In addition, referencing Feng and Zhu [52], the first-order lag term of fiscal subsidies (lSub) is used as the second instrumental variable. Second, reasonable instrumental variables are selected for R&D subsidies. Referring to Guo [50], the mean of industry R&D subsidies (mRD) and the lagged R&D subsidies (lRD) are chosen as the corresponding instrumental variables. Third, Models 7 and 8 in Table 7 are separately reestimated by two-stage regression. Finally, weak instrumental variables and overidentification tests are performed. The results are shown in Table 10.

| Variables | Endogenous treatment of sub | Endogenous treatment of RD | ||

|---|---|---|---|---|

| First-stage | Second-stage | First-stage | Second-stage | |

| Sub | σu | RD | σu | |

| lnland | 0.085 ∗∗∗ (3.59) | — | — | — |

| LSub | 0.496 ∗∗∗ (26.96) | — | — | — |

| Sub | — | 0.001 (0.15) | — | — |

| GC × Sub | — | − 0.518 (− 0.10) | — | — |

| GC | — | − 0.028 ∗∗∗ (− 3.44) | — | − 0.045 ∗ (− 1.70) |

| GC2 | — | 0.032 ∗∗∗ (4.07) | — | 0.049 ∗∗ (1.99) |

| mRD | — | — | 0.768 ∗∗∗ (25.44) | — |

| lRD | — | — | 0.424 ∗∗∗ (27.18) | — |

| RD | — | — | — | 0.001 ∗ (1.92) |

| GC × RD | — | — | — | 0.029 ∗∗∗ (2.89) |

| Controls | Yes | Yes | Yes | Yes |

| Year and industry | Yes | Yes | Yes | Yes |

| Constant | − 6.616 ∗∗∗ (−7.98) | 0.467 (0.12) | − 6.584 ∗∗∗ (− 6.83) | 0.045 ∗∗∗ (4.21) |

| N | 2460 | 2460 | 2460 | 2460 |

|

— |

|

— |

|

| K–P LM | — |

|

— |

|

| K–P Wald F | — | 80.037 | — | 109.8 |

| Hansen J | — |

|

— |

|

- ∗p < 10%.

- ∗∗p < 5%.

- ∗∗∗p < 1%.

As reported in Table 10, standard diagnostic checks, including weak instrument tests and over identification tests, are conducted to validate instrument relevance and exogeneity, all instrumental variables meet statistical requirements, confirming their suitability. The reestimated results demonstrate that, after addressing endogeneity concerns, R&D subsidies significantly enhance the bargaining power of NEEs and show a synergistic interaction with GCPs. These findings further reinforce the robustness of the study’s benchmark regression outcomes.

5. Discussion

This study introduces a novel bilateral bargaining framework to analyze the dynamics of credit bargaining power between NEEs and banks, with a focus on the influence of GCPS and heterogeneous government subsidies. Moving beyond prior studies that emphasize only financing cost outcomes [20, 24], while overlooking policy influences on credit negotiation processes [9], or separately examined GCPs and subsidy mechanisms [13, 28]. This research directly examines the bargaining process, filling a critical gap in the literature on how policy instruments affect negotiation dynamics. The empirical results demonstrate that the measured bargaining power distribution substantiates established theories of institutional dominance [12, 48], while the observed surplus allocation patterns validate previous findings on asymmetric market power structures [9, 12].

Specifically, through theoretical and empirical analysis, several conclusions can be made. First, NEEs generally have weaker bargaining power, while banks exhibit stronger bargaining power. Most NEEs have a negative NS, indicating that NEEs often engage in credit financing at costs that are higher than the fair price. Second, the GCPs can influence banks, reducing their bargaining power and thereby improving the bargaining power of NEEs. This results in a decrease in the surplus obtained by banks, with more dominant banks experiencing a greater impact than less dominant ones. The impact of the GCPs on the bargaining power of NEEs follows a U-shaped distribution, indicating that the positive effects of the GCPs are realized only when the policy reaches a certain level of implementation; thus, hypothesis H1 is verified. Thirdly, the fiscal subsidies are ineffective in improving the bargaining power for NEEs, while R&D subsidies can enhance the bargaining power of NEEs. However, R&D subsidies also increase the surplus obtained by enterprises, with a more pronounced impact exerted on weaker enterprises. This suggests that different policies not only have distinct effects on different entities, but also that they vary in their degree of impact. Therefore, hypothesis H2 is partially verified. Finally, fiscal subsidies do not show a synergistic effect with the GCPs, though. R&D subsidies do positively influence the bargaining power of NEEs. Thus, hypothesis H3 is partially verified.

5.1. Theoretical Contributions

This study makes three significant theoretical contributions: First, it constructs a novel analytical framework for assessing the credit bargaining power of NEEs, thereby moving beyond the traditional one-dimensional focus on financing costs. By empirically verifying the asymmetric bargaining relationship between banks and NEEs, this study reveals the theoretical mechanism underpinning structural imbalances in the credit market and deepens the application of resource dependance theory in the context of green finance. Second, it proposes a theory of differential policy effects, demonstrating that fiscal and R&D subsidies have fundamentally distinct impacts on bargaining power. While fiscal subsidies fail to enhance NEEs’ bargaining positions, R&D subsidies significantly improve surplus acquisition, particularly for disadvantaged firms. This finding supports the targeting principle in policy tool theory and empirically validates the central role of knowledge capital accumulation in strengthening credit negotiation power, thus enriching the theoretical foundations of innovation subsidy theory. Third, the study identifies the conditions and boundaries under which policy synergies occur. It confirms that GCPs and R&D subsidies exhibit significant synergistic effects, while no such synergy exists with fiscal subsidies. This insight contributes critical empirical support to the development of policy mix theory in the context of credit markets.

5.2. Practical Implications

The findings of this study have several important implications for the refinement of GCPs and government subsidy policies. First, it is recommended to establish a policy evaluation mechanism that systematically monitors and assesses the long-term effectiveness of GCPs. Dynamic policy adjustments should be evidence based. A dedicated regulatory agency should be established to guide and supervise financial institutions to ensure effective and consistent policy implementation. Second, in light of the increasing fiscal burden and widening subsidy gap, it is essential to optimize subsidy structures. This includes setting reasonable subsidy levels to prevent resource misallocation due to indiscriminate disbursements. Given the evolving development stage of the new energy industry, production-oriented subsidies may be gradually phased out. A phased approach could involve reducing subsidies for production activities while temporarily retaining R&D subsidies to support innovation. Finally, the development of a new, integrated financing support system for NEEs is crucial. This system should prioritize green credit as the primary financing tool, supplemented by targeted government subsidies to identify and support high-quality NEEs. Such a combined approach would form a more efficient and effective policy framework, balancing fiscal sustainability with industrial development goals.

5.3. Limitations and Future Research Directions

Despite its theoretical and practical contributions, this study has several limitations: First, the research sample consists solely of A-share listed NEEs, excluding nonlisted firms. Due to their more standardized financial structures and higher levels of information disclosure, listed firms may systematically differ from nonlisted NEEs in terms of financings to the broader NEEs population. Second, data limitations constrain the precision of policy variable measurement. Specifically, due to the lack of microlevel data on GCPs, this study employs provincial-level GCPs intensity as a proxy variable. While this approach enables empirical estimation, it may not fully capture the actual level of green credit support experienced by individual firms. The considerable regional variation in policy enforcement introduces potential measurement error, which could lead to biased estimates. Third, the findings are context-dependent. China’s unique bank-dominated financial system, its centralized industrial policy framework, and the current stage of development of its new energy sector may jointly limit the external validity of the conclusions. The extent to which these findings apply to other countries or financial systems thus require further investigation.

These limitations also point to valuable directions for future research. First, the development of a comprehensive financing database for NEEs using digital technologies could significantly improve data quality and availability. In this context, blockchain can ensure data transparency and integrity, while artificial intelligence can facilitate dynamic data cleaning and analysis, thereby enhancing the robustness of empirical research [53, 54]. Second, adopting mixed-methods approaches that integrate both quantitative and qualitative analyses could help address current methodological constraints and provide deeper insights into policy mechanisms. Finally, future studies could incorporate policy text analysis and other advanced techniques to more accurately capture the implementation intensity of GCPs, allowing for the more precise measurement and evaluation of policy effects at the firm level.

6. Conclusions

Grounded in resource dependance theory, this study investigates how the effects of GCPs and heterogeneous government subsidies on the credit bargaining power of NEEs and explores the synergistic relationships between these policy instruments. The findings indicate that GCPs indirectly strengthen NEEs’ bargaining power by weakening banks’ bargaining power, with the effect exhibiting a U-shaped pattern. While fiscal subsidies do not significantly enhance NEEs’ bargaining power, R&D subsidies demonstrate a substantial positive impact. Furthermore, a synergistic effect exists between GCPs and R&D subsidies, whereas no significant interaction is observed between GCPs and fiscal subsidies. This study provides empirical support for policy designs aimed at alleviating financing constraints in the new energy sector and contribute to the broader objective of achieving carbon peaking and carbon neutrality goals.

Nomenclature

-

- NEEs:

-

- New energy enterprises

-

- GCPs:

-

- Green credit policies

-

- CoC:

-

- Cost of capital

-

- R&D:

-

- Research and development

-

- Two-tier SFA:

-

- Two-tier stochastic frontier

-

- PDF:

-

- Probability density function

-

- CDF:

-

- Cumulative distribution function

-

- NS:

-

- Net surplus

-

- MLE:

-

- Maximum likelihood estimation

-

- GFD:

-

- Green finance development index.

Conflicts of Interest

The authors declare no conflicts of interest.

Author Contributions

Lu Meng is responsible for data curation, methodology, software, visualization, writing – original draft, writing – review and editing. Chunyan Li is response for conceptualization, investigation, supervision, article review and editing. Zhe Xu is responsible for fund acquisition, article framework construction, article review and editing.

Funding

The authors are grateful for the financial support provided by the National Natural Science Foundation of China (Grant 72103142).

Acknowledgments

The authors are grateful for the financial support provided by the National Natural Science Foundation of China (Grant 72103142).

Open Research

Data Availability Statement

The data will be made available by the corresponding authors upon reasonable request.