On the Agricultural Commodities Supply Chain Resilience to Disruption: Insights from Financial Analysis

Abstract

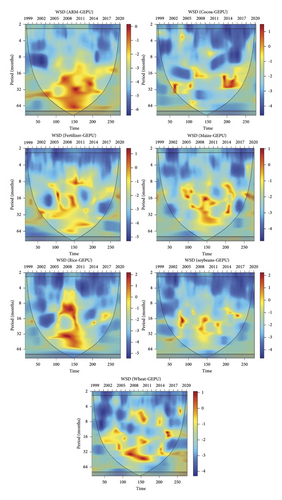

The study proffers the need to strengthen supply chain resilience toward the minimization of disruptions. We investigate the financial performance of agricultural commodities' supply chain amid external uncertainty shocks in both time and frequency dimensions. The wavelet techniques are employed for the analysis. Specifically, both the Windowed Scalogram Difference (WSD) and Wavelet Multiple techniques are utilized. First, the study finds from the WSD that disruption which we proxy with global economic policy uncertainty (GEPU) hurts all the agricultural commodities in the medium and long terms. For instance, we find high comovements between agricultural raw material (ARM) and GEPU. This is similar to the comovements between rice and GEPU. Additionally, high potential comovements between 2005 and 2016 in the medium and long term for fertilizer, maize, and possibly wheat with the GEPU are found. Generally, there seem to be fewer comovements between soybeans and the GEPU which is indicative of a resistance to shocks. Second, we find from the Wavelet Multiple approaches that most of the agricultural commodities are highly integrated, except rice. Findings from the study imply minimization of diversification, hedge, or safe haven benefits with regard to market conditions among the commodities. The findings have important inferences for policymakers, supply chain actors of agricultural commodities, and investors to extensively examine the heterogeneous and adaptive dynamics of the commodity markets. We advocate that supply chains of agricultural commodities must be borne with dynamic capacities to manage vulnerabilities in an uncertain environment, necessitating resilience capabilities to thrive in the long run. Also, investors should hedge against the portfolio risk present in these agricultural commodities. This study is the first to provide insights into the supply chain of agricultural commodities from a financial perspective through time and/or frequency analysis.

1. Introduction

Agricultural commodities (such as wheat, cocoa, soybean, and maize) can be purchased as inputs for a company’s goods or as components of purchased items from a company’s suppliers and/or as part of a company’s operations and overhead costs [1]. This makes agricultural commodities a significant input for food companies. When a large amount of a company’s overall purchasing is made up of price-volatile commodities, however, a major issue is that commodity prices will fluctuate dramatically, jeopardizing the company’s economic survival [1]. Commodity price fluctuation, if not adequately controlled, can seriously jeopardize a company’s capacity to meet customer needs, posing problems for product pricing decisions, budgeting, and so on.

Supply chains are frequently subjected to various interruptions as global commerce becomes more complex [2, 3]. This is due to a variety of factors. Catastrophic procedures have seriously interrupted numerous supply systems. Globalization has expanded the length and complexity of supply networks, as well as their openness to disruption. If the impacts of such adverse events accumulate and are not addressed promptly, they can be quite severe [2]; for instance, when disruptions are revealed in the media, the implications are significantly greater, resulting in quickly falling prices.

A supply chain disruption is a break in the usual flow of the supply chain that has a negative consequence [4]. A supply chain disruption may originally target or incapacitate just one or a few firms. However, disruptions may spread further down the supply chain via material flow, information flow, and finance flow, thereby disrupting supply chain operations. As a result, any firm’s failure could result in the entire supply chain failing catastrophically [5, 6].

The occurrence of several disruptive events has sparked interest in supply chain resilience, as standard risk management methods are inadequate in today’s extremely uncertain and dynamic corporate environments [2, 7]. Organizations must create a resilient approach to fight the problems posed by uncertain and dynamic settings [5, 8]. Managers and academics have demonstrated a strong interest in resilience as a way to guard supply chains against disruptions and recover from them [5].

The likelihood of a supply chain resuming normal operations after an unanticipated disruption is known as supply chain resilience [9]. Supply chain resilience, according to Al-Talib et al. [10], is the supply chain’s adaptive ability to prepare for unexpected events, respond to disruptions, and recover from them by maintaining operations at the desired level of connectedness and control over structure and function. The features of supply chain resilience were examined by Soni and Jain [11] in terms of flexibility, control, collaboration, and visibility. In today’s business climate, which is marked by complexity, constant change, and uncertainty, supply chain flexibility is critical [12]. Flexibility ensures that disruptions can be handled without causing harm to the supply chain. Incorporating the Internet of things (IoT) into supply chain management can reduce the requirement for humans to physically monitor supply chain processes. The ability to share information in real time is essential for effective supply chain collaboration. Supply chain collaboration necessitates the sharing of information among all parties involved. Because supply chain resilience is network-wide, it is critical to ensure reduced ambiguity and event readiness [10]. Supply chain visibility entails timely information sharing and transparency. As a result, IoT provides visibility into the supply chain, allowing it to track products, delivery, and services, reducing interruptions through effective reactions.

By knowing every associated practice, an effective coordinating agricultural system ensures varied practices to successfully manage the entire system. As a result, the lack of a coordination system will lead to erroneous information exchange [13]. This results in higher agricultural product processing costs, inventory maintenance costs, stockout times, distribution costs, product promotion costs, and consumer unhappiness, all of which contribute to fluctuations in agricultural commodity prices [4].

Following a disruption, a resilient supply chain can rapidly revert to its previous state or transition to a new and more appealing state [14]. The resilience of the supply chain is measured by its ability to respond and adapt quickly to the production process, demand and supply failures, irregularities and uncertainties in the mix of products and quantities demanded, and quality problems of delivered products [15]. Making the supply chain more robust can help to minimize susceptibility to uncertainties and improve risk management [5]. Agribusiness supply chains require greater resilience than traditional manufacturing supply chains because they have additional sources of volatility [14], even though agricultural products are subject to inherent risks in their biological manufacturing processes [14]. Variable weather conditions, illnesses, and pests can all have an impact on the timing, production, and quality of a harvest, which can affect the supply chain’s financial performance, particularly agricultural commodity pricing.

According to the Resource-Based View Theory (RBV), supply chain disruption in agricultural commodities hurts both physical and capital resources [4, 16]. The RBV emphasizes the need of developing capabilities to overcome challenges and acquire a competitive edge. When dynamic changes occur in uncertain contexts, however, the standard RBV lacks sufficient capability delineation. As a result of the disruption, supply chain integration capabilities have been weakened, potentially reducing traceability and flexibility during logistical activities inside the agricultural commodities supply chain over time.

The dynamic capability theory (DCV) can be used to examine the need for resilience capability requirements in the aftermath of disruptive occurrences [17]. DCV assists in the allocation of resources and capabilities to respond to situational changes [2]. The DCV’s primary concept is that a company’s ability to integrate, build, and reconfigure organizational resources utilizing its processes to respond to environmental changes and uncertainties and design new value-creating strategies is based on its processes. In terms of their regularly fluctuating demands, the agricultural commodities supply chain system may not be able to match the needs of customers [4].

In a similar spirit, we suggest that agricultural commodity supply chains must acquire dynamic capacities to manage vulnerabilities in an uncertain environment, necessitating resilience capabilities to thrive in the long run. The supply chain resilience of the agricultural commodities in this study is examined from the standpoint of fluctuations in prices over time which influences the supply chain’s financial flow. That is, resilience in agricultural commodities’ supply chain can be better understood when managers and other partners keep abreast of variations in prices. This would enable the resuscitation of price disruption by putting some mitigation strategies in place for the minimization of severe uncertainty shocks.

The DCV emphasizes that market winners must quickly reorganize their resources and skills to regain competencies during tumultuous periods. To ensure long-term success of the supply chain resilience in agricultural commodities during uncertainties, time-frequency analysis with the quest of assessing various market conditions needs to be enhanced, to provide implications for supply chain managers, investors, and policymakers. As provided in the heterogeneous market hypothesis (HMH), market participants behave in diverse time horizons [18]. The study also accentuates the adaptive market hypothesis (AMH) by Lo [19]. The AMH advocates that market efficiency fluctuates in degree at different times. We respond to market fluctuations in dealing with dynamic changes that ensue in uncertain financial markets. So long as these hypotheses have a direct relation with portfolio analysis through markets, there may be a delayed effect on the supply chain performance through the supply chain finance flow. We, therefore, examine the extent of the delayed effect of uncertainties in prices on the supply chain’s agricultural commodities. This analysis may be extended to other commodities or assets whose dynamics have a potential effect on ensuring supply chain resilience.

It is not daunting to examine resilience in agricultural commodities prices because, in supply chain risk management, effective management of price-volatile agricultural commodities and associated risks is regarded as a significant, emerging task [5, 20]. Though studies in supply chain risk management have been rising in the area of disruptions [7, 21], studies on agricultural commodity price volatility are still limited. The supply chain management literature equally labels strategies that businesses adopt to alleviate agricultural commodity price risk. Yet, the description of mitigation strategies is not clear in the literature as a result of limited empirical findings through time-frequencies that provide some level of coherency with supply chain management.

Commodity price trends have demonstrated sudden shifts with substantial fluctuations: in the twentieth century, average commodity prices declined by around half a percent per year; after 2000, they more than doubled and then plunged 34% in 2014, leaving prices at 2009 levels [22]. In addition, over the last ten years, commodity price volatility has been nearly three times that of the 1990s, posing substantial challenges to industrial enterprises. Because it connects to directly sourced inputs (raw materials) globally, as well as upstream supply chains, the risk of such exposure grows as the supply chain becomes more complex [23].

Recent changes in global commodity prices may have a substantial impact on the dynamics of ongoing agricultural commodity pricing talks [24], necessitating rapid study. Several agricultural commodities prices have been steadily declining since their 2011 peak throughout the last ten years. Domestic pressures on policymakers throughout the world are likely to shift when these prices reach their lowest levels since 2006, altering the prospects for international cooperation.

Commodity price volatility is a subcategory of supply chain disruption connected to operational or resource risk, according to the literature on supply chain management [22]. A considerable increase in commodity prices might result in operational risks, such as a supply chain interruption if the business lacks the financial resources to purchase the product [25]. Furthermore, severe drops in commodity prices might put a supplier’s profit in jeopardy and, in the worst-case scenario, throw the supplier out of business [22].

Food and agriculture markets have been notably turbulent in recent years, with several large peaks and troughs in price patterns for agricultural commodities tracked by the UN’s Food and Agriculture Organization (FAO). After a long period of generally declining real food costs, prices spiked substantially upwards in 2006/07 and again in 2010/11 [24]. Agricultural commodity prices, on the other hand, plummeted during the financial crisis of 2008/09, as output in numerous major economies stalled. Prices have experienced a downward spike from 2011, until very recently. Even though these aggregate food price trends hide varied patterns among individual product groupings, prices have dropped dramatically across the board. Farm inputs, production, storage, and transportation, as well as the shortening of global supply chains and the growing significance of digital trading, can all be blamed for the price drop.

Recent trade policy surveys have found a return of protectionist measures in tandem with the decrease in commodity prices [24]. As countries expand their markets, they become more subject to foreign price fluctuations, posing substantial dangers to emerging or established agricultural production. The current trends of financialization in commodities, which has heightened comovements and volatility spillover within markets in addition to other traditional asset classes, limit the diversification potentials of commodities [26–30]. This has induced the interest of researchers around the globe to ascertain the spillover effects and predictors of commodity prices to investigate stability in prices to support the world’s poorest individuals as averred by Frimpong et al. [30].

This necessitates a careful investigation of the nexus between global economic policy uncertainties (GEPU) and agricultural commodities (see, [30]). The GEPU is important in this study because there is a growing set of uncertainty-generating policies that affect economic policy and financial decisions as a result of the current conflicts and pervasive global uncertainty [31]. The GEPU index covers a wide range of issues, including those that arise internationally, such as regulatory conflicts, disputes over income inequality, and price changes [32].

A study by Frimpong et al. [30] sheds light on the tendency for GEPU to distort comovements in agricultural commodities using biwavelet and partial wavelet giving implications on finance and economic decisions. The current study departs from Frimpong et al. [30] and other recent studies on agricultural commodities by employing the Wavelet Multiple (WM) and the Windowed Scalogram Difference (WSD) techniques for supply chain, finance, and economic implications. The WSD allows for a more detailed depiction of the correlation dynamics between variables (see, [33]), whereas the WM is applied to assess the leading/lagging variable relative to the scales through linear combinations for more than two variables to provide the full picture of the nexus.

The wavelet techniques are necessary for this study because prior studies that come close to examining the relationship in the context of commodities assess this phenomenon with limited attention on time-frequency analysis [22, 34–37]. Thus, due to the convoluting dynamics of time series analysis, the time-frequency domain has grown, making wavelet analysis a popular tool for evaluating limited fluctuations in power within a time series. We can account for the dominant modes of fluctuations and how the modes alter in time [38–43].

We provide two main contributions to the empirical literature. First, we assess the comovements among agricultural commodities in the frequency domain to provide some idea on the degree of resilience required with cognizance from the supply chain finance flow. Hence, we employ the wavelet multiple correlations and cross-correlations(see, [40, 44]).

Second, we investigate the nexus between global economic policy uncertainty and agricultural commodities in a time-frequency domain to contribute to the discussion of supply chain disruption through the WSD. The WSD utilized in this study can decipher hidden structures in the nexus between each of agricultural commodities returns and GEPU for effective comparison across time and frequency unlike the wavelet squared coherence. Therefore, this is the first study, to the best of our knowledge, that employs both the Wavelet Multiple and WSD approaches to offer insights into agricultural commodity prices and GEPU nexus while providing implications for supply chain resilience and disruptions in addition to enhancing finance and economic decisions.

We reveal that external uncertainty shock hurts all the agricultural commodities in the medium and long term. Also, most of the agricultural commodities are highly integrated among themselves, except rice. This may minimize diversification benefits with regard to market conditions among the commodities. The findings have important inferences for supply chain actors of agricultural commodities, policymakers, and investors alike.

The subsequent sections deal with methodology, and Section 3 deals with the study’s findings and discussion. Section 4 contains the study’s conclusion, which includes the findings’ implications and suggestions.

2. Methodology

2.1. Wavelet Multiple Correlation (WMC)

To calculate WMCC and WMC let X = {X1, X2, …, XT} be the recognition of the multivariate stochastic process Xt for t = 1,2, …, T. MODWT of order J is linked to individual univariate time series {X1i,. ., X1T}, for i = 1,2, …, n; the Jlength − T vectors of coefficients of MODWT , are obtained.

2.2. Windowed Scalogram Difference (WSD)

The concept of WSD by Bolós et al. [46] compares the behavior of two time series using their respective scalograms for various time and scale windows. It, therefore, allows one to identify the scales and time intervals in which both time series exhibit a similar pattern, compare their scalograms, and verify the extent of the same weight application to the various scales.

The WSD is used to determine and measure the degree to which two time series follow a comparable pattern across time. In this case, the most dominating scales in the time series, which is limited in both time and scale, are identified. Hence, the WSD is capable of detecting hidden structures as in the case of wavelet squared coherence.

The WSD calculates the difference between the windowed scalograms of two time series using (7). It allows us to compare two time series for distinct finite time and scale intervals and quantify the degree of similarity between them. Similarly, the WS can identify the relative relevance of various scales when windowed around a certain time point. When the wavelet is discretely sampled (i.e., class of dyadic wavelet), time variable u = 2kj and s = 2k is given by the dyadic version (see, [33]).

2.3. Data Description and Sources

The study utilizes monthly data from agricultural commodity prices of agricultural raw materials (ARM: timber, cotton, wool, rubber, and hides), cocoa, fertilizer, maize, rice, soybeans, and wheat. In addition, we employ the global economic policy uncertainty (GEPU) to ascertain the extent of disruptions in agricultural commodities. The data spans January 1997 to May 2021, yielding a total of 293 observations. We chose this period due to steady data availability. The data on agricultural commodity prices and GEPU were gleaned from IMF Primary Commodity Prices Database and the website https://www.policyuncertainty.com/index.html as developed by Baker, Bloom, and Davis [31] respectively. The study is grounded on monthly returns – rt = ln(Pt/Pt−1), where rt is the continuous returns, Pt is current index, and Pt−1 is previous index.

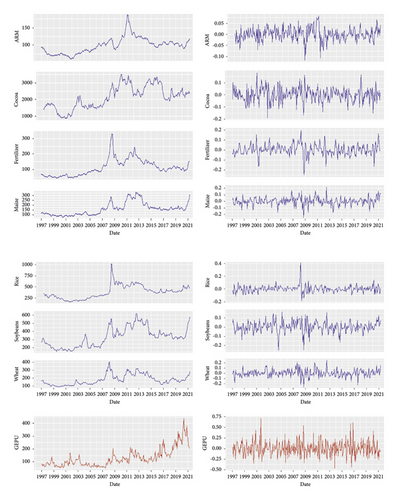

Figure 1 depicts the prices and log-returns of agricultural commodities over time. Following a downward spike between 2015 and 2019, the price series for agricultural commodities trend upward in the early part of 2020, according to the price series. The variations in the agricultural commodities are similar across time. The rise in commodity prices from 2006 to 2013 can be traced to the period of the 2008 global financial crisis and the Eurozone crisis. This period can be specifically attributed to exogenous factors such as the food riot in 2007 to 2008 and the Arab Spring which induced the need for expansionary fiscal and monetary policy as well as speculative activities which led to an erupted price spike in agricultural commodities. The GEPU illustrates an upward trend which suggests an increase in uncertainty in the global economy. This, therefore, indicates the extent to which agricultural commodities are more likely to be susceptible to shocks from the GEPU. Moreover, Figure 1 shows how the log-returns series supports the stylized facts of asset returns, demonstrating volatility clustering.

In Table 1, we show the descriptive statistics for the study. The skewness values observed depict closer to symmetry except for rice. The returns of the commodities are associated with more drawdowns as shown by the negative skewness values except for rice. This may be due to the increase in demand for rice over the years across the globe, compared to the other agricultural commodities. Except for agricultural raw materials, cocoa, and GEPU, the kurtosis values, on the other hand, further indicate leptokurtic behavior. The Kwiatkowski-Phillips-Schmidt-Shin (KPSS) test is used to determine stationarity. All of the returns series are stationary, according to the KPSS observations.

| Statistic | ARM | Cocoa | Fertilizer | Maize | Rice | Soybeans | Wheat | GEPU |

|---|---|---|---|---|---|---|---|---|

| Mean | 0.0008 | 0.0018 | 0.0026 | 0.0032 | 0.0010 | 0.0026 | 0.0017 | 0.0031 |

| Std. dev. | 0.0298 | 0.0577 | 0.0572 | 0.0593 | 0.0560 | 0.0587 | 0.0693 | 0.1752 |

| Skewness | −0.2500 | −0.1227 | −0.3745 | −0.5703 | 2.0090 | −0.4505 | 0.0916 | 0.5193 |

| Kurtosis | 1.0086 | 0.5030 | 2.4905 | 1.8947 | 13.5769 | 2.0146 | 1.5959 | 1.0895 |

| Normtest.W | 0.9866 | 0.9935 | 0.9592 | 0.9702 | 0.8547 | 0.9718 | 0.9766 | 0.9814 |

| Unit root test | ||||||||

| KPSS | 0.0893 | 0.0664 | 0.0824 | 0.0899 | 0.1003 | 0.0803 | 0.0810 | 0.0262 |

- Note. Normtest.W indicates a significant difference from a normal distribution at all conventional levels of significance. [∗], [∗∗], and [∗∗∗] indicate significance at 10%, 5%, and 1% levels, respectively.

3. Results

3.1. Frequency-Dependent

The frequency-dependent wavelet analysis is presented in this section for seven variables: agricultural raw materials (ARM), fertilizer, cocoa, soybeans, wheat, maize, and rice. We use a monthly data and set, lj, j = 1 … 5, of the wavelet factors, which are connected to times of, respectively, “2–4 months (short term), 4–8 months (medium term), 8–16 months (medium term), 16–32 months (medium term), and above 32 months (long term)” for Figures 4 and 5, following Li et al. [47].

3.1.1. Wavelet Bivariate Correlations Matrix (WBCM)

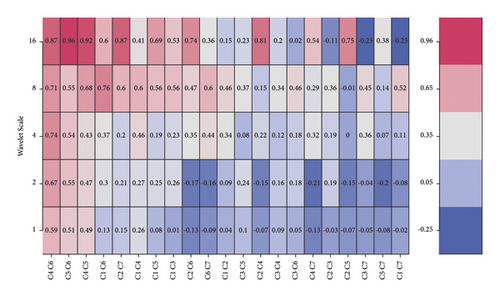

We display the bivariate contemporary correlations at 4 wavelet scales in Figure 2. The supplied codes include agricultural raw materials (C1), fertilizer (C2), cocoa (C3), soybeans (C4), wheat (C5), maize (C6), and rice (C7). The horizontal axis indicates the potential choices for generating wavelet correlation coefficients. The similarities between the pairs (C1–C7) get weaker as we move from left to right. The wavelet scales on the vertical axis represent periods. The bivariate contemporaneous correlation matrix examines the relationship between the realizations of two possible time series combinations during the same era [32, 48, 49].

The pairwise interactions from Figure 2 have a combination of positive and negative nexus. Soybeans and maize had the highest levels of comovement, with coefficients ranging from 0.59 to 0.87 over a range of time scales averaging 0.72. Wheat and maize are next, followed by soybeans and wheat. This implies that the commodities are interdependent in some way. Most of agricultural commodities record a negative relationship with rice. This indicates that the demand for rice is inversely related to the demand for commodities such as agricultural raw materials, wheat, maize, cocoa, and soybeans, but fertilizer. This suggests that rice acts as a substitute for the remaining agricultural commodities. The inverse relationships between some of the agricultural commodities may provide potential investors in these markets some diversification, hedge, or safe haven benefits depending on the market conditions. Also, to achieve a long-term resilient supply chain towards the improvement of its financial performance, actors are enjoined to either scale up their commodities that show less interconnectedness or divest segments that indicate high associations. Efficient financial risk management techniques, coupled with resilience in the supply chain, would boost financial performance and maximize the wealth of supply chain investors.

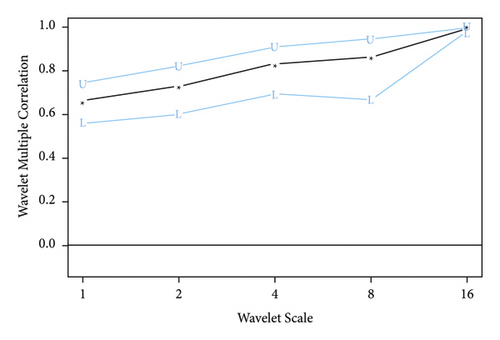

3.1.2. Wavelet Multiple Correlations (WMC)

Continuously, Figure 3 and Table 2 establish the degree of integration among commodities based on short-, medium-, and long-term dynamics. For the monthly return series, the degree of integration is relatively high, reaching around 99.6% for the wavelet multiple correlations, 98 percent for the lower panel, and 99.9% for the upper panel. Multiple correlations are continuously increasing throughout periods. The remaining factors can explain the monthly returns of one variable to a degree of roughly 98 from monthly, resulting in scale 16 months’ integration. This illustrates very high integration among the agricultural commodities from short, medium, and long term.

| Scale | WMC “lower” | Correlation | WMC “upper” |

|---|---|---|---|

| 1 | 0.562724825 | 0.664434745 | 0.746327286 |

| 2 | 0.604144546 | 0.732411148 | 0.823684436 |

| 3 | 0.696629028 | 0.834235375 | 0.912638642 |

| 4 | 0.670192631 | 0.866074239 | 0.949157882 |

| 5 | 0.982270024 | 0.996395966 | 0.999271531 |

The high integration among the agricultural commodities returns may heighten their vulnerability to adverse shocks which may influence the financial performance of the supply chain. In an uncertain environment, dynamic capabilities are required to mitigate vulnerabilities, and resilience capabilities are required to survive in the long run. Although the high integration provides clear indications that these agricultural commodities are not inversely related or are entirely substitutes, it is required that more collaborative, flexible, and control measures are instituted throughout the supply chain to minimize future disruptions that may arise. This would aid in the accomplishment of the supply chain financial performance within agricultural commodities.

3.1.3. Wavelet Multiple Cross-Correlations (WMCC)

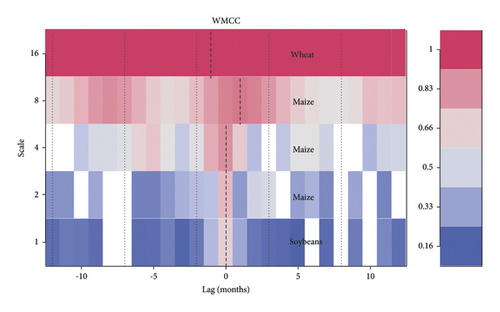

The WMCC coefficients for four distinct wavelet scales are shown in Table 3. Figure 4’s y-axis scales have the same meanings as those described before in the Wavelet Multiple analysis discussion. According to Asafo-Adjei, Adam, and Darkwa [43]; Asafo-Adjei, Boateng, Isshaq, Idun, Owusu Junior, and Adam [48]; and Boateng et al. [49], the x-axis represents the series’ lag length. The positive and negative lags are ten months apart in this instance. Positive lag represents a lagging variable on the related scales, while negative lag denotes a leading variable. There is no lead or lag at the zero-lag of localization. The maximum values in the linear combination of all variables at the wavelet scales, which are illustrated by dashed lines within the dotted lines, are referred to as localization (at all lags). When a variable is placed on a scale, it can outperform or underperform all other variables. It denotes that it has the highest value in the linear combination of all the variables at the relevant scales at that scale. The wavelet multiple cross-correlations (WMCC) have an economic impact since it finds the most influential variable at a specific wavelet scale and displays the degree of dependency between the variables [44, 48]. As a result, it can function as a leading (first to respond to shocks) or lagging (last to respond to shocks after other factors) variable.

| Scale | Localizations | Time lag (months) | Leading/lagging variable |

|---|---|---|---|

| 1 | 0.664434745 | 0 | Soybeans |

| 2 | 0.732411148 | 0 | Maize |

| 3 | 0.834235375 | 0 | Maize |

| 4 | 0.886030196 | 1 | Maize |

| 5 | 0.998611268 | −1 | Wheat |

From Figure 4, soybeans have the likelihood to lead or lag for months 2–4, representing the short-term perspective. Also, maize has the likelihood to lead or lag from 4–16 months but eventually lags at 16–32 months in the medium-term perspective. At scale of 16–32 months, maize is considered to be the last variable to respond to shocks which suggests a possible supply chain resilience. Finally, we find that wheat maximizes the WMCC from a linear combination of the remaining agricultural commodities beyond 32 months representing a long-run comovement as shown in Table 3 as well as Figure 4. At this point, wheat is the first agricultural commodity to respond to shocks (at time −1), which may be less likely to offer diversification benefits. Supply chain actors are therefore advised to ensure flexibility, control, collaboration, and visibility [11] in the supply chain of wheat. This is necessary to respond and adapt quickly to the production process, demand and supply failures, irregularities and uncertainties in the mix of products and quantities demanded, and quality problems of delivered products [15] in times where the financial performance of supply chain, specifically price, is likely to experience disruptions. Ensuring resilience in the supply chain reduces vulnerability and makes risk management more efficient [5].

3.2. Time-Frequency Analysis

Figure 5 depicts the Windowed Scalogram Difference (WSD) between agricultural commodities and GEPU. The surface color and color palette indicate the interdependence between the matched series. The higher the similarity between time series, the brighter the color. The red (warm) color denotes portions with strong interactions of statistical significance at the 5% level (high similarity), whereas the blue (cool) color denotes a lower series of correlations (low similarity) as determined by Monte Carlo simulations [30, 38]. Outside of the cone of influence (COI), the outcomes are insignificant (see, [48]). The stronger the comovements, the more susceptible the agricultural commodities to the GEPU.

From Figure 5, it can be seen that there are very high comovements between agricultural raw material (ARM) and GEPU in the medium and long term from 2005 to 2016. This is similar to the comovements between rice and GEPU. There are high potential comovements between 2005 and 2016 in the medium and long term for fertilizer, maize, and possibly wheat with the GEPU, as indicated by declining warm color. Generally, there seem to be fewer comovements between soybeans and the GEPU which indicates resistance to shocks from the adverse impact of the GEPU. Comovements between cocoa and GEPU heighten at 16–32 months (medium term) from 2013 to 2016 and possibly at scale of 32 months for 2002. The high comovements between 2007 and 2017 could be attributed to the global financial crisis, Eurozone crises, and the US-China trade tension with interment events such as the 2007–2008 food riot and the Arab Spring.

4. Conclusion

The study employs two main wavelet techniques, Wavelet Multiple (thus, WBCM, WMC, and WMCC) and Windowed Scalogram Difference (WSD), to execute the purpose of the study. The Wavelet Multiple made it possible to examine the interdependencies among the agricultural commodities in the short, medium, and long term. On the other hand, the WSD was utilized to investigate the interconnectedness between each of the agricultural commodities and the global economic policy uncertainty in time-frequency domain to divulge the extent of similarities between the variables. Specifically, we draw insights from these financial and econometric techniques to support the need for a more collaborative, flexible, visible, and controlled supply chain towards resilience and fewer disruptions for a reliable supply chain financial performance. The outcome of this study is also pertinent to all kinds of investors, policymakers, and risk managers at large.

We found that external uncertainty shock has an adverse impact on all the agricultural commodities in the medium and long term. Also, most of the agricultural commodities are highly integrated among themselves, except rice, which may not offer efficient diversification, hedge, or safe haven benefits based on market conditions.

It is recommended that the supply chain of agricultural commodities must be incorporated with dynamic capacities to manage vulnerabilities in an uncertain environment, necessitating resilience capabilities to thrive in the long run. Also, investors should hedge against the portfolio risk present in these agricultural commodities.

Further studies may be conducted on the efficiency, effectiveness, and economy of the agricultural commodities supply chain. This is necessary to ascertain the extent of supply chain resilience and risk minimization strategies instituted by supply chain actors in agricultural commodities.

Conflicts of Interest

The authors declare that they have no conflicts of interest.

Open Research

Data Availability

The data used to support the findings of the study can be obtained from th corresponding author upon reasonable request.