Energy Source Allocation Decision-Making in Textile Industry: A Novel Symmetric and Asymmetric Spherical Fuzzy Linear Optimization Approach

Abstract

In this study, the authors extended the concept of spherical fuzzy optimization models by considering different parameters of spherical fuzzy linear programming problem as symmetric and asymmetric spherical numbers. Eight spherical fuzzy linear programming models are discussed by converting decision variables, parameters, and coefficients of objective function and constraints into symmetric and asymmetric spherical fuzzy numbers. To verify the validity and efficiency of this study in contrast with a linear programming numerical and a physical energy optimization model for the textile industry is considered. The application of these symmetric and asymmetric spherical fuzzy optimization models is discussed along with the postoptimal analysis of the best optimization models that provide the feasible and most optimal solution.

1. Introduction

Growing urbanization is directly related to the increase in energy demands, usage, and cost. Energy optimization is globally targeted by every sector. Mostly, an industrial sector is the one who consumed most of the produced or natural energy. The key factor of rising production cost in the industrial sector is abrupt energy usage. Since industrial sectors cannot ignore this factor, getting help through mathematical modeling such as optimizing cost, profits, loss, and energy for such matters is sane act. A lot of work is performed for the optimal utilization of energy in different areas as Wang et al. presented their general guidelines regarding energy optimization in iron and steel industry by using mass-thermal network optimization [1]. Ullah et al. presented bio-inspired energy optimization techniques with the purpose of power scheduling in an office [2]. According to Ozturk et al., energy consumption could be decreased by using the waste-heat recovery systems for the industrial sector so they presented eighty-five techniques for the reduction of energy consumption in their study where thirteen of them were prioritized and applied as energy-efficient techniques [3]. Kimutai [4] proposed the physical energy optimization model for the textile industry and optimized the energy cost by using linear programming (LP). In the manufacturing sector, textile industries are considered major energy consumption units globally due to their several production stages. In the textile industry, mostly electricity and fuel, such as charcoal and petroleum, are used to create all the required kinds of energy. In Pakistan, this particular industrial sector is having a great share up to 8.5% towards GDP (gross domestic product) and considered Asia’s 8th largest textile exporter [5]. Pakistan is having a huge textile industrial sector and now facing many uncertainties due to the unpredicted policy shift 2020–25 and COVID. According to National Electric Power Regulatory Authority’s (NEPRA) report, one energy unit fluctuation cost causes almost 4 to 5 hours closure in the production of textile’s products [6]. To overcome this loss, it is best to optimize the usage and wastage of energy as much as possible. The most extensively adopted procedure for the optimal solution of modeled problem was linear programming (LP) due to its easy applicable nature that was first introduced by Kantorovich [7]. Advancement in this traditional LP generated several extensions such as bi-level LP, multilevel LP, and multiobjective. These LP extensions are highly applicable in real life such as it gave optimized solutions for transportation, supply chain, energy, profit, loss, and cost optimization problems.

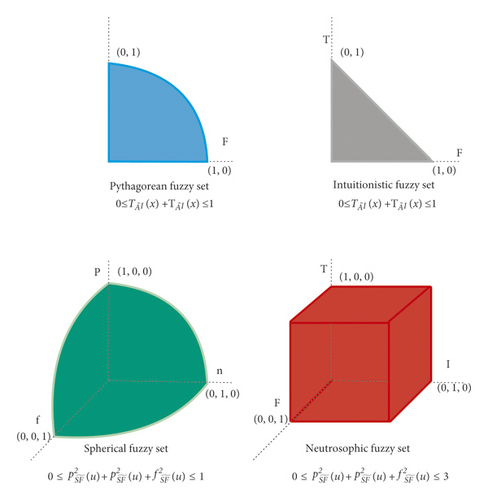

Huge modification happened in linear programming after the introduction of fuzzy sets by Zadeh [8]. Fuzzy linear programming was introduced by Zimmerman [9], who originated the technique to solve the multiobjective linear programming in a fuzzy environment. This method was defined according to the natural environmental uncertainties as all the optimization conditions can be considered in fuzzy. Improvements are continuously occurring till now; firstly, membership degree was considered well enough to understand decision-makers choices, but Atanssove [10] created an intuitionistic fuzzy set dealing with the degree of membership and nonmembership clearly, recognizing the choice of an element from the decision set. This definition of the intuitionistic fuzzy set became another reason for improvement in optimization techniques, and firstly, intuitionistic fuzzy (IF) optimization got revealed by Angelov [11]. A lot of work has been carried out in intuitionistic fuzzy linear programming (IFLP). Afterwards, Yager presented the concept of another generalization of fuzzy sets and named it Pythagorean fuzzy set by refining the condition that membership and nonmembership can be independent of each other and their sum of squares must be less than 1 [12]. In 1999, Smarandache [13] introduced a neutrosophic set, which covers the third predictable choice of decision-makers that might be neutral or indeterminacy. In the neutrosophic environment, many optimization models were considered and solved by Ahmad et al. [14, 15].

Recently, a spherical fuzzy set has been introduced by Gundogdu and Kahraman [16]. A spherical fuzzy set is defined with the compliance of positive, neutral, and negative membership functions under the condition that the sum of their squares must be less than 1 providing more general way to cope with uncertainty. It is considered that a spherical fuzzy set is a superset of fuzzy, Pythagorean fuzzy, and intuitionistic fuzzy sets. Ahmad and Adhami [17] presented their work on spherical fuzzy linear programming problem (SFLPP). They presented different types of optimization models under the spherical fuzzy (SF) environment. In this study, we are presenting symmetric and asymmetric energy optimization models inspired by the work of Ahmad and Adhami [17]. For this purpose, the LP model for the textile industry is considered in the spherical fuzzy environment as a numeric example to validate the working of generated energy optimization models in the SF environment. For the conversion of LP into SFLP, parameters were considered spherical fuzzy numbers (SFNs). By targeting each parameter one by one, different SF optimization models are constructed. Every model further contains two submodels in it on the basis of symmetric spherical fuzzy number (SSFN) and asymmetric spherical fuzzy numbers (ASFN) parameters. The deterministic version corresponding to SFNs is based on the spherical fuzzy set theory. Conclusions are based on the application of these spherical fuzzy models on the energy optimization model. The postoptimal analysis of the best feasible optimized SF model is also discussed.

2. Preliminaries

- (1)

- (2)

- (3)

3. Spherical Fuzzy Linear Programming Problem

Ideally for optimal solution of mathematically modeled problem, linear programming (LP) is considered the most convenient way [7]. Since this LP does not accommodate the fuzziness of nature, the best real-life modeled problem solution requires a method of fuzzy optimization. A lot of work is already carried out for fuzzy optimization modeling by utilizing different techniques such as intuitionistic fuzzy linear programming [11, 12] and neutrosophic LP [14–19]. Ahmad and Adhami presented different models for the solution of spherical fuzzy LP [17]. By continuing their idea for SF modeling, different spherical fuzzy models are constructed in this study. In the first model, only constraint coefficients were considered spherical fuzzy numbers, whereas all the other decision variables and parameters are real quantities. In the second model, two factors demand and constraint coefficients are taken as SFNs, while cost is taken as a real number. In the third model, other than decision variables, all the other factors are considered in the spherical fuzzy number, whereas in the fourth model, the cost and demand are in SF numbers. Table 1 is designed to illustrate all these cases.

| Model | Symmetric spherical fuzzy model (a) | Asymmetric spherical fuzzy model (b) |

|---|---|---|

| I | subjected to | subjected to |

| II | subjected to , ∀j = 1,2,3 … l | subjected to |

| III | subjected to | subjected to |

| IV | subjected to , ∀j = 1,2,3 … l | subjected to , ∀j = 1,2,3 … l |

In Table 1, , , and are symmetric spherical fuzzy, , , and asymmetric spherical fuzzy parameters, and s, d, c real-valued parameters.

4. Numerical Example

The SSF and ASF for the above LP are presented in Table 2.

| Model | Symmetric spherical fuzzy model (a) | Asymmetric spherical fuzzy model (b) |

|---|---|---|

| I | Max Z = 5x + 3y subjected to , | Max Z = 5x + 3y subjected to |

| II | Max Z = 5x + 3y subjected to , | Max Z = 5x + 3y subjected to |

| III | subjected to , | subjected to |

| IV | subjected to , | subjected to |

- In Table 2, , , , , , and , , , , . Since objective function is needed to be maximize, preference will be given to the model with a higher optimal value. By solving 0.3 in different fuzzy and crisp environment as in fuzzy, intuitionistic fuzzy, and spherical fuzzy, we obtain the results shown in Table 3).

| Optimization model | Objective function | x | y |

|---|---|---|---|

| LP | 12.3684 | 1.05263 | 2.36842 |

| FLP | 15.13159 | 1.44737 | 2.63158 |

| IFLP | 16.31579 | 1.052632 | 2.368421 |

| SSF Model-I | 22.1171 | 3.119093 | 2.173913 |

| ASF Model-I | 16.58654 | 1.442308 | 3.125 |

| SSF Model-II | 12.97593 | 1.100301 | 2.491472 |

| ASF Model-II | 12.71875 | 1.0625 | 2.46875 |

| SSF Model-III | 9.691474 | 1.100301 | 2.491472 |

| ASF Model-III | 8.957813 | 1.0625 | 2.46875 |

| SSF Model-IV | 6.808947 | 0.684211 | 1.8894744 |

| ASF Model-IV | 6.660789 | 0.768421 | 1.878947 |

5. Application

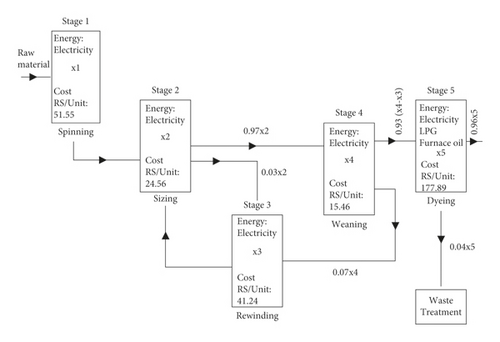

To elaborate the working efficiency of the above-defined SSF and ASF optimization models of our study, we construct an energy optimization model for the textile industry with five stages shown in Figure 1.

To conduct optimization in the spherical fuzzy environment, the uncertainty in demand, supply parameters, and energy cost per unit fluctuation is kept in mind and considered symmetric and asymmetric SFNs. The considered positive, neutral, and negative membership degree of acceptance is throughout (0.5, 0.3, 0.2).

6. Model-I(a)

subjected to , ∀j = 1,2, …, 5, where spherical fuzzy coefficients are considered symmetric with xi real decision variables where dj is real-valued demands. After the conversion of an inconsideration energy optimization model for the textile industry into the symmetric spherical fuzzy model-I(a), it is represented as follows:

7. Model-I(b)

Now in this model, the spherical fuzzy coefficients are considered asymmetric with xi real-valued decision variables with dj, ci, which are real demands and costs.

8. Model-II(a)

9. Model-II(b)

10. Model-III(a)

11. Model-III(b)

12. Model-IV(a)

13. Model-IV(b)

Table 4 shows the optimal output we obtained through different models.

14. Postoptimal Analysis

| Optimization model | Objective value | x1 | x2 | x3 | x4 | x5 |

|---|---|---|---|---|---|---|

| LP | 5987499 | 24195.38 | 23759.38 | 2326.043 | 23046.59 | 20833.33 |

| IFLP | 5927615.1 | 24159.4 | 23759.4 | 874.104 | 23046.6 | 20833.33 |

| Model-I(a) | 5702683 | 21744.58 | 21344.58 | 3639.78 | 21451.3 | 20100.50 |

| Model-I(b) | Infeasible solution | 0 | 0 | 0 | 0 | 0 |

| Model-II(a) | 5717777.8 | 21851.93 | 21416.93 | 3652.12 | 21524.02 | 20135.68 |

| Model-II(b) | Infeasible solution | 0 | 0 | 0 | 0 | 0 |

| Model-III(a) | 6027917.33 | 21851.93 | 21416.93 | 3652.12 | 21524.02 | 20135.68 |

| Model-III(b) | Infeasible solution | 0 | 0 | 0 | 0 | 0 |

| Model-IV(a) | 6333697.02 | 24273.59 | 23838.59 | 2333.8 | 23123.43 | 20869.79 |

| Model-IV(b) | 6448227.44 | 24280.77 | 23843.57 | 2334.28 | 23128.26 | 20872.08 |

Except one ASF model, all the other ASF (models-I, II, III) energy optimization models gave “Infeasible solution” in 0.5 and one ASF model-IV, which provided a solution that have the most highest optimal value (greater than LP) where objective function was needed to minimize, whereas in 0.3 where the objective function was needed to maximize the similar models, ASF (models-I, II, III) provided feasible solution, but other than SSF and AS (models- I, II), all the other remaining models provided outputs less than LP; that is, the outputs of these models are much lesser than LP’s outputs. Here, in the following tables, the sensitivity report and limits of all those SF models in 0.5 are discussed whose optimal solutions were not greater than the LP textile energy model.

In Table 5 the flexibility regarding allowable change in optimal and feasible conditions is mentioned. Since solution is effected by both and impacts the efficiency of model, how much cost and demand fluctuation can be handled by these models in 0.5 is discussed, whereas in Tables 6, 7 and 8 the feasibility range of the decision variable is discussed along with the optimal solution between that range. In Table 9 the validity range of all the parameters and decision variables of the best optimal model for 0.5 is mentioned. According to the above postoptimal analysis, we obtain the following information about the range of each factor of the energy optimization model in a spherical environment. SSF model-I(a) is providing a minimal optimal value of the objective function for a longer range of coefficients that insure the feasibility for a huge change in 0.5. In both situations, where objective function is needed to maximize 0.3 or to minimize 0.5, SSF model-I(a) provided the best results.

| Variables | Final value | Reduced cost | Objective coefficient | Allowable increase | Allowable decrease |

|---|---|---|---|---|---|

| x1 | 21744.57 | 0 | 51.55 | 1E+30 | 51.55 |

| x2 | 21344.57 | 0 | 24.56 | 1E+30 | 98.68 |

| x3 | 3639.78 | 0 | 41.24 | 1E+30 | 578.68 |

| x4 | 21451.3 | 0 | 15.46 | 1E+30 | 98.19 |

| x5 | 20100.50 | 0 | 177.89 | 1E+30 | 279.64 |

| Constraint | Final value | Shadow price | RHS | Allowable increase | Allowable decrease |

| 1 | 400 | 51.55 | 400 | 21923.36 | 21744.57 |

| 2 | 4.55E–13 | –41.24 | 0 | 3639.78 | 1E+30 |

| 3 | 0 | 78.4 | 0 | 1E+30 | 21451.3 |

| 4 | 600 | 101.75 | 600 | 13462.94 | 20700.50 |

| 5 | 20000 | 281.05 | 20000 | 9685.38 | 20000 |

| 6 | 489.80 | 0 | 720 | 1E+30 | 230.19 |

| Variable | Values | Lower limit | Objective result | Upper limit | Objective result |

|---|---|---|---|---|---|

| x1 | 21744.57 | 21744.57 | 5702683.001 | 43667.94 | 6832832.271 |

| x2 | 21344.57 | 21344.57 | 5702683.001 | 21344.57 | 5702683.001 |

| x3 | 3639.78 | 3639.78 | 5702683.001 | 3639.78 | 5702683.001 |

| x4 | 21451.3 | 21451.3 | 5702683.001 | 21451.30 | 5702683.001 |

| x5 | 20100.50 | 20100.50 | 5702683.001 | 20100.50 | 5702683.001 |

| Variables | Final value | Reduced cost | Objective coefficient | Allowable increase | Allowable decrease |

|---|---|---|---|---|---|

| x1 | 21851.93 | 0 | 51.55 | 1E+30 | 51.55 |

| x2 | 21416.93 | 0 | 24.56 | 1E+30 | 98.68 |

| x3 | 3652.12 | 0 | 41.24 | 1E+30 | 578.68 |

| x4 | 21524.02 | 0 | 15.46 | 1E+30 | 98.19 |

| x5 | 20135.68 | 0 | 177.89 | 1E+30 | 279.64 |

| Constraint | Final value | Shadow price | RHS | Allowable increase | Allowable decrease |

| 1 | 435 | 51.55 | 435 | 25085.47 | 21851.9 |

| 2 | 4.55E−13 | −41.24 | 0 | 3652.12 | 1E+30 |

| 3 | 0 | 78.4 | 0 | 1E+30 | 21524.02 |

| 4 | 635 | 101.75 | 635 | 15404.76 | 20770.68 |

| 5 | 20035 | 281.045 | 20035 | 11082.36 | 20035 |

| 6 | 491.60 | 0 | 755 | 1E+30 | 263.4 |

| Variable | Values | Lower limit | Objective result | Upper limit | Objective result |

|---|---|---|---|---|---|

| x1 | 21851.93 | 21851.93 | 5717777.832 | 46937.41 | 7010934.09 |

| x2 | 21416.93 | 21416.93 | 5717777.832 | 21416.93 | 5717777.832 |

| x3 | 3652.12 | 3652.12 | 5717777.832 | 3652.12 | 5717777.832 |

| x4 | 21524.02 | 21524.02 | 5717777.832 | 21524.02 | 5717777.832 |

| x5 | 20135.68 | 20135.68 | 5717777.832 | 20135.69 | 5717777.832 |

| Factors | SSF model-I(a) | Range |

|---|---|---|

| x1 | 21744.56 units | 21923.38 unit |

| x2 | 21344.56 units | 0 |

| x3 | 3539.73 units | 0 |

| x4 | 21451.3 units | 0 unit |

| x5 | 20100 units | 0 unit |

| c1 | 51.55 Rs./unit | 51.55 Rs/unit |

| c2 | 24.56 Rs./units | 98.68 Rs/unit |

| c3 | 41.24 Rs./units | 578.71 Rs/unit |

| c4 | 15.46 Rs./units | 98.2 Rs/unit |

| c5 | 177.89 Rs./units | 279.64 Rs/unit |

| d1 | 400 kg/month | 43667 kg/month |

| d2 | 0 | 3639.78 kg/month |

| d3 | 0 | 21451.3 kg/month |

| d4 | 20000 kg/month | 29685.39 kg/month |

| d5 | 600 kg/month | 43163.44 kg/month |

| d6 | 720 working hours/month | 489.81 hours/month |

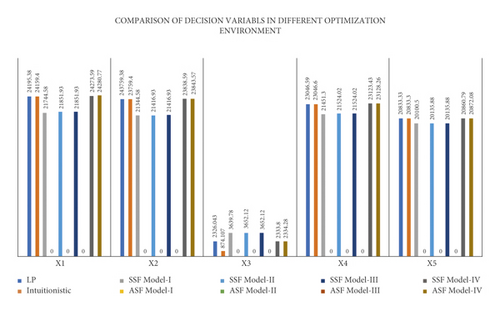

From Figure 2 it is clearly seen that all the decision variables in SSF model-I for 0.5 is having least value as compared to other models except x3. This x3 is providing its minimal value in the intuitionistic fuzzy environment.

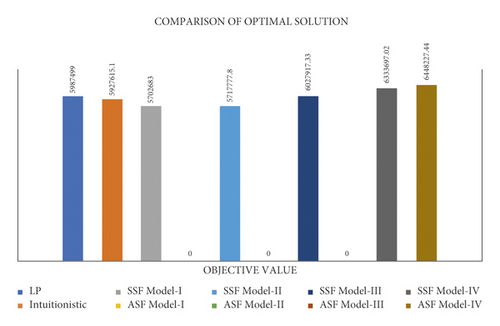

In Figure 3 an objective value of 0.5 in different fuzzy and LP environments is graphically presented. Three bars in the right-hand side denote ASF models and are clearly higher than even LP’s bar. Therefore, they are not considered the best models for 0.5. SSF model-I is providing the best results as compared to others.

15. Conclusion

- (1)

Due to the spherical region, parameters are highly flexible and can provide optimal solution between a long range

- (2)

Spherical fuzzy set is a super set of the intuitionistic and Pythagorean fuzzy set, so it will cover more area graphically (see Figure 4) and can easily target those points for solution that are far away to those points, which are obtained through LP or IF technique

- (3)

No need to construct or change a model for a huge change due to long-range flexibility of parameters

The method can be used in any decision-making problem simply by identifying the objectives, parameters, and the constraints imposed to maximize or minimize the objective. In recent years, the fuzzy set and its generalizations are used widely in decision-making related to real-life problems [22, 23]. Any advancement in basic fuzzy set theocratic concepts will ultimately improve the accuracy of its implementation by incorporating the imprecision and vagueness in the data. Spherical fuzzy optimization techniques can be used to find the suitable weights for the best criteria over others in the decision-making process. [24–26].

Conflicts of Interest

The authors declare that there are no conflicts of interest regarding the publication of this article.

Authors’ Contributions

All authors contributed equally to the preparation of this manuscript.

Acknowledgments

The fifth author (YUG) would like to acknowledge that this publication was made possible by a grant from the Carnegie Corporation of New York.

Open Research

Data Availability

No data were used to support this study.