Interval Estimation of Stress-Strength Reliability Based on Lower Record Values from Inverse Rayleigh Distribution

Abstract

We consider the estimation of stress-strength reliability based on lower record values when X and Y are independently but not identically inverse Rayleigh distributed random variables. The maximum likelihood, Bayes, and empirical Bayes estimators of R are obtained and their properties are studied. Confidence intervals, exact and approximate, as well as the Bayesian credible sets for R are obtained. A real example is presented in order to illustrate the inferences discussed in the previous sections. A simulation study is conducted to investigate and compare the performance of the intervals presented in this paper and some bootstrap intervals.

1. Introduction

In many real life applications such as meteorology, hydrology, sports, life-tests and so on, we are dealing with record values. In industry and reliability studies, many products may fail under stress. For example, a wooden beam breaks when sufficient perpendicular force is applied to it, an electronic component ceases to function in an environment of too high temperature, and a battery dies under the stress of time. But the precise breaking stress or failure point varies even among identical items. Hence, in such experiments, measurements may be made sequentially and only values larger (or smaller) than all previous ones are recorded. Data of this type are called record data. Thus, the number of measurements made is considerably smaller than the complete sample size. This measurement saving can be important when the measurements of these experiments are costly if the entire sample was destroyed.

Let {Xi, i ≥ 1} be a sequence of independent and identically distributed (iid) random variables with an absolutely continuous cumulative distribution function (cdf) F(x) and probability density function (pdf) f(x). An observation Xj is called an upper record if its value exceeds all previous observations; that is, Xj is an upper record if Xj > Xi for every i < j. An analogous definition can be given for lower records. Records were first introduced and studied by Chandler [2]. Interested readers may refer to Arnold et al. [3], Ahmadi [4], and Gulati and Padgett [5] for more details and applications of record values.

The problem of estimating R = Pr(X > Y) arises in the context of mechanical reliability of a system with strength X and stress Y and R is chosen as a measure of system reliability. The system fails if and only if, at any time, the applied stress is greater than its strength. This type of reliability model is known as the stress-strength model. This problem also arises in situations where X and Y represent lifetimes of two devices and one wants to estimate the probability that one fails before the other. For example, in biometrical studies, the random variable X may represent the remaining lifetime of a patient treated with a certain drug while Y represent the remaining lifetime when treated by another drug. The estimation of stress-strength reliability is very common in the statistical literature. The reader is referred to Kotz et al. [6] for other applications and motivations for the study of the stress-strength reliability.

The problem of estimating the stress-strength reliability Pr(X > Y) in the inverse Rayleigh distribution was considered by Rao et al. [7] for ordinary samples. Soliman et al. [8] discussed different methods of estimation for the inverse Rayleigh distribution based on lower record values. Sindhu et al. [9] and Feroze and Aslam [10] considered the Bayesian estimation for the parameter of the inverse Rayleigh distribution under left censored data and under singly and doubly type II censored data, respectively. In this paper, we consider the problem of estimating the stress-strength reliability Pr(X > Y) in the inverse Rayleigh distribution based on lower record values.

The rest of the paper is organized as follows. In Section 2, we discussed likelihood inference for the stress-strength reliability, while in Section 3 we considered Bayesian inference. In Section 4, we presented a real example. A simulation study is described in Section 5. Finally conclusion of the paper is provided in Section 6.

2. Likelihood Inference

3. Bayesian Inference

4. A Real Example

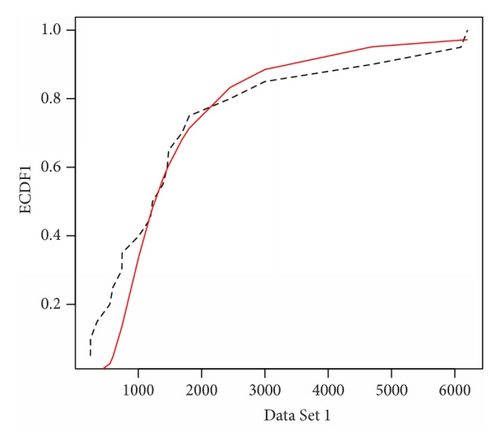

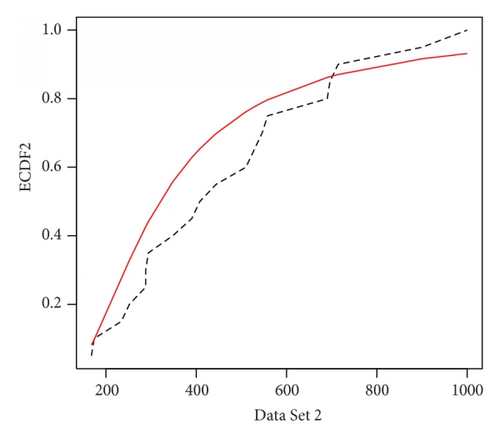

In order to illustrate the inferences discussed in the previous sections, in this section, we present a data analysis for two data sets reported by Stone [14]. He reports an experiment in which specimens of solid epoxy electrical-insulation were studied in an accelerated voltage life test. For each of two voltage levels 52.5 and 57.5 kV, 20 specimens were tested. Failure times, in minutes, for the insulation specimens are given as follows.

Data Set 1. It belongs to voltage level 52.5: 4690, 740, 1010, 1190, 2450, 1390, 350, 6095, 3000, 1458, 6200, 550, 1690, 745, 1225, 1480, 245, 600, 246, 1805.

Data Set 2. It belongs to voltage level 57.5: 510, 1000, 252, 408, 528, 690, 900, 714, 348, 546, 174, 696, 294, 234, 288, 444, 390, 168, 558, 288.

We fit the inverse Rayleigh distribution to the two data sets separately. We used the Kolmogorov-Smirnov (K-S) tests for each data set to fit the inverse Rayleigh model. It is observed that for data sets 1 and 2, the K-S distances are 0.2119 and 0.2280 with the corresponding P values 0.2878 and 0.2496, respectively. Therefore, it is clear that inverse Rayleigh model fits well to both the data sets. We plot the empirical distribution functions and the fitted distribution functions in Figures 1 and 2. These Figures show that the empirical and fitted models are very close for each data set.

-

: 4690,470,350,245,

-

: 510,252,174,168.

5. A Simulation Study

- (1)

Calculate , , and , the maximum likelihood estimators of λ1, λ2, and R based on rn and sm.

- (2)

Generate from the distribution given in (9) with λ1 replaced by and generate similarly.

- (3)

Calculate , , and using the and obtained in Step (2).

- (4)

Repeat Steps (2) and (3) B times to obtain .

Interested readers may refer to DiCiccio and Efron [16] and the references contained therein to observe more details.

- (1)

ML: the interval based on the MLE given in (15),

- (2)

Bayes: the interval based on the Bayes estimator given in (25),

- (3)

J.B: the interval based on the Bayes estimator given in (26),

- (4)

E.B: the interval based on the empirical Bayes estimator given in (32),

- (5)

Norm: the normal interval,

- (6)

Basic: the basic pivotal interval,

- (7)

Perc: the percentile interval.

The empirical coverage probability and expected lengths of intervals are obtained by using the 2000 replications. In the interval based on the Bayes estimators we used γ1 = 3, γ2 = 5, θ1 = 2, and θ2 = 4 wherever we need them. For bootstrap intervals we used 1000 bootstrap samples. The results of our simulations are given in Tables 1 and 2.

| n | m | R | ML | Bayes | J.B | E.B | Norm | Basic | Perc |

|---|---|---|---|---|---|---|---|---|---|

| 5 | 5 | 0.1 | 0.277 (0.942) | 0.406 (0.520) | 0.272 (0.944) | 0.190 (0.847) | 0.284 (0.933) | 0.276 (0.822) | 0.276 (0.940) |

| 5 | 5 | 0.25 | 0.451 (0.951) | 0.422 (0.791) | 0.453 (0.951) | 0.336 (0.862) | 0.461 (0.908) | 0.449 (0.812) | 0.449 (0.949) |

| 5 | 5 | 0.5 | 0.537 (0.947) | 0.434 (0.988) | 0.540 (0.956) | 0.414 (0.868) | 0.549 (0.886) | 0.536 (0.798) | 0.536 (0.941) |

| 5 | 10 | 0.1 | 0.220 (0.952) | 0.339 (0.645) | 0.217 (0.947) | 0.172 (0.883) | 0.257 (0.957) | 0.250 (0.857) | 0.250 (0.947) |

| 5 | 10 | 0.25 | 0.386 (0.948) | 0.377 (0.871) | 0.388 (0.949) | 0.314 (0.879) | 0.421 (0.929) | 0.413 (0.841) | 0.413 (0.942) |

| 5 | 10 | 0.5 | 0.482 (0.956) | 0.403 (0.976) | 0.482 (0.949) | 0.390 (0.883) | 0.489 (0.903) | 0.480 (0.833) | 0.480 (0.937) |

| 5 | 15 | 0.1 | 0.203 (0.946) | 0.300 (0.777) | 0.202 (0.943) | 0.164 (0.873) | 0.248 (0.964) | 0.241 (0.856) | 0.241 (0.927) |

| 5 | 15 | 0.25 | 0.367 (0.947) | 0.352 (0.902) | 0.365 (0.953) | 0.301 (0.887) | 0.410 (0.931) | 0.402 (0.866) | 0.402 (0.933) |

| 5 | 15 | 0.5 | 0.460 (0.956) | 0.386 (0.981) | 0.459 (0.947) | 0.375 (0.873) | 0.466 (0.907) | 0.458 (0.844) | 0.458 (0.936) |

| 10 | 5 | 0.1 | 0.235 (0.946) | 0.361 (0.502) | 0.236 (0.943) | 0.164 (0.856) | 0.209 (0.905) | 0.204 (0.825) | 0.204 (0.935) |

| 10 | 5 | 0.25 | 0.406 (0.961) | 0.377 (0.721) | 0.403 (0.935) | 0.299 (0.846) | 0.383 (0.911) | 0.375 (0.833) | 0.375 (0.945) |

| 10 | 5 | 0.5 | 0.482 (0.958) | 0.388 (0.982) | 0.480 (0.945) | 0.374 (0.855) | 0.489 (0.903) | 0.480 (0.829) | 0.480 (0.942) |

| 10 | 10 | 0.1 | 0.178 (0.947) | 0.292 (0.650) | 0.175 (0.950) | 0.144 (0.905) | 0.181 (0.939) | 0.178 (0.858) | 0.178 (0.950) |

| 10 | 10 | 0.25 | 0.326 (0.958) | 0.328 (0.828) | 0.327 (0.955) | 0.275 (0.913) | 0.330 (0.928) | 0.326 (0.872) | 0.326 (0.955) |

| 10 | 10 | 0.5 | 0.405 (0.943) | 0.352 (0.969) | 0.405 (0.949) | 0.346 (0.895) | 0.409 (0.900) | 0.404 (0.854) | 0.404 (0.940) |

| 10 | 15 | 0.1 | 0.157 (0.955) | 0.252 (0.735) | 0.156 (0.952) | 0.135 (0.913) | 0.167 (0.952) | 0.164 (0.875) | 0.164 (0.950) |

| 10 | 15 | 0.25 | 0.297 (0.951) | 0.300 (0.864) | 0.296 (0.949) | 0.258 (0.913) | 0.307 (0.938) | 0.304 (0.891) | 0.304 (0.947) |

| 10 | 15 | 0.5 | 0.374 (0.943) | 0.333 (0.968) | 0.374 (0.947) | 0.328 (0.913) | 0.377 (0.908) | 0.373 (0.868) | 0.373 (0.935) |

| 15 | 5 | 0.1 | 0.224 (0.946) | 0.339 (0.490) | 0.221 (0.935) | 0.151 (0.840) | 0.189 (0.898) | 0.185 (0.829) | 0.185 (0.934) |

| 15 | 5 | 0.25 | 0.386 (0.951) | 0.355 (0.706) | 0.386 (0.947) | 0.283 (0.871) | 0.353 (0.894) | 0.346 (0.835) | 0.346 (0.931) |

| 15 | 5 | 0.5 | 0.459 (0.946) | 0.367 (0.979) | 0.459 (0.943) | 0.354 (0.855) | 0.463 (0.888) | 0.455 (0.832) | 0.455 (0.919) |

| 15 | 10 | 0.1 | 0.160 (0.952) | 0.270 (0.614) | 0.162 (0.956) | 0.134 (0.911) | 0.154 (0.933) | 0.152 (0.865) | 0.152 (0.948) |

| 15 | 10 | 0.25 | 0.300 (0.943) | 0.304 (0.776) | 0.302 (0.950) | 0.256 (0.909) | 0.295 (0.911) | 0.291 (0.869) | 0.291 (0.937) |

| 15 | 10 | 0.5 | 0.374 (0.948) | 0.327 (0.967) | 0.375 (0.950) | 0.323 (0.911) | 0.378 (0.919) | 0.374 (0.873) | 0.374 (0.947) |

| 15 | 15 | 0.1 | 0.138 (0.946) | 0.229 (0.658) | 0.139 (0.947) | 0.122 (0.919) | 0.140 (0.936) | 0.138 (0.881) | 0.138 (0.948) |

| 15 | 15 | 0.25 | 0.266 (0.953) | 0.274 (0.847) | 0.267 (0.951) | 0.236 (0.920) | 0.268 (0.929) | 0.266 (0.884) | 0.266 (0.950) |

| 15 | 15 | 0.5 | 0.339 (0.952) | 0.305 (0.965) | 0.339 (0.948) | 0.303 (0.915) | 0.342 (0.931) | 0.339 (0.899) | 0.339 (0.952) |

| n | m | R | ML | Bayes | J.B | E.B | Norm | Basic | Perc |

|---|---|---|---|---|---|---|---|---|---|

| 5 | 5 | 0.1 | 0.223 (0.890) | 0.343 (0.504) | 0.224 (0.895) | 0.159 (0.766) | 0.235 (0.900) | 0.223 (0.782) | 0.223 (0.890) |

| 5 | 5 | 0.25 | 0.378 (0.908) | 0.359 (0.632) | 0.383 (0.892) | 0.284 (0.775) | 0.385 (0.868) | 0.378 (0.768) | 0.378 (0.908) |

| 5 | 5 | 0.5 | 0.460 (0.897) | 0.369 (0.961) | 0.462 (0.912) | 0.351 (0.784) | 0.461 (0.832) | 0.460 (0.746) | 0.460 (0.895) |

| 5 | 10 | 0.1 | 0.180 (0.899) | 0.288 (0.650) | 0.183 (0.890) | 0.145 (0.804) | 0.213 (0.931) | 0.200 (0.819) | 0.200 (0.892) |

| 5 | 10 | 0.25 | 0.331 (0.910) | 0.320 (0.744) | 0.329 (0.901) | 0.265 (0.802) | 0.356 (0.894) | 0.350 (0.808) | 0.350 (0.892) |

| 5 | 10 | 0.5 | 0.411 (0.897) | 0.342 (0.951) | 0.411 (0.904) | 0.330 (0.799) | 0.410 (0.846) | 0.409 (0.778) | 0.409 (0.893) |

| 5 | 15 | 0.1 | 0.171 (0.895) | 0.255 (0.733) | 0.171 (0.895) | 0.139 (0.803) | 0.209 (0.936) | 0.197 (0.834) | 0.197 (0.879) |

| 5 | 15 | 0.25 | 0.309 (0.894) | 0.299 (0.797) | 0.310 (0.910) | 0.255 (0.837) | 0.341 (0.881) | 0.334 (0.819) | 0.334 (0.879) |

| 5 | 15 | 0.5 | 0.392 (0.900) | 0.328 (0.938) | 0.391 (0.902) | 0.318 (0.812) | 0.389 (0.845) | 0.389 (0.793) | 0.389 (0.883) |

| 10 | 5 | 0.1 | 0.190 (0.890) | 0.305 (0.492) | 0.191 (0.907) | 0.135 (0.805) | 0.175 (0.869) | 0.169 (0.785) | 0.169 (0.889) |

| 10 | 5 | 0.25 | 0.341 (0.895) | 0.319 (0.588) | 0.340 (0.900) | 0.253 (0.795) | 0.323 (0.848) | 0.320 (0.796) | 0.320 (0.886) |

| 10 | 5 | 0.5 | 0.411 (0.900) | 0.330 (0.950) | 0.410 (0.899) | 0.317 (0.792) | 0.410 (0.852) | 0.410 (0.786) | 0.410 (0.892) |

| 10 | 10 | 0.1 | 0.145 (0.901) | 0.246 (0.611) | 0.145 (0.898) | 0.120 (0.834) | 0.150 (0.907) | 0.145 (0.832) | 0.145 (0.895) |

| 10 | 10 | 0.25 | 0.276 (0.897) | 0.277 (0.705) | 0.274 (0.905) | 0.231 (0.848) | 0.278 (0.885) | 0.276 (0.834) | 0.276 (0.898) |

| 10 | 10 | 0.5 | 0.344 (0.897) | 0.298 (0.934) | 0.344 (0.904) | 0.293 (0.835) | 0.344 (0.862) | 0.344 (0.825) | 0.344 (0.898) |

| 10 | 15 | 0.1 | 0.129 (0.899) | 0.212 (0.655) | 0.130 (0.900) | 0.112 (0.844) | 0.139 (0.913) | 0.134 (0.839) | 0.134 (0.900) |

| 10 | 15 | 0.25 | 0.248 (0.895) | 0.254 (0.750) | 0.250 (0.892) | 0.182 (0.853) | 0.256 (0.882) | 0.253 (0.834) | 0.253 (0.896) |

| 10 | 15 | 0.5 | 0.318 (0.903) | 0.282 (0.915) | 0.318 (0.896) | 0.278 (0.850) | 0.318 (0.876) | 0.318 (0.847) | 0.318 (0.904) |

| 15 | 5 | 0.1 | 0.182 (0.913) | 0.286 (0.407) | 0.179 (0.898) | 0.125 (0.785) | 0.159 (0.878) | 0.155 (0.814) | 0.155 (0.897) |

| 15 | 5 | 0.25 | 0.321 (0.903) | 0.300 (0.530) | 0.323 (0.889) | 0.238 (0.763) | 0.295 (0.850) | 0.293 (0.800) | 0.293 (0.884) |

| 15 | 5 | 0.5 | 0.391 (0.893) | 0.311 (0.951) | 0.390 (0.884) | 0.299 (0.773) | 0.390 (0.841) | 0.389 (0.789) | 0.389 (0.878) |

| 15 | 10 | 0.1 | 0.133 (0.899) | 0.227 (0.501) | 0.134 (0.894) | 0.111 (0.836) | 0.131 (0.897) | 0.128 (0.844) | 0.128 (0.896) |

| 15 | 10 | 0.25 | 0.251 (0.881) | 0.255 (0.674) | 0.250 (0.891) | 0.212 (0.831) | 0.247 (0.865) | 0.245 (0.827) | 0.245 (0.888) |

| 15 | 10 | 0.5 | 0.317 (0.896) | 0.277 (0.935) | 0.318 (0.907) | 0.273 (0.852) | 0.317 (0.862) | 0.317 (0.820) | 0.317 (0.897) |

| 15 | 15 | 0.1 | 0.115 (0.899) | 0.193 (0.620) | 0.116 (0.904) | 0.102 (0.858) | 0.118 (0.913) | 0.115 (0.859) | 0.115 (0.898) |

| 15 | 15 | 0.25 | 0.225 (0.906) | 0.231 (0.738) | 0.224 (0.900) | 0.199 (0.852) | 0.226 (0.890) | 0.225 (0.858) | 0.225 (0.905) |

| 15 | 15 | 0.5 | 0.287 (0.901) | 0.258 (0.927) | 0.287 (0.905) | 0.256 (0.871) | 0.286 (0.872) | 0.287 (0.840) | 0.287 (0.898) |

6. Conclusion and Discussion

Based on simulation results in Tables 1 and 2, we observe that the length of the intervals is maximized when R = 0.5 and gets shorter and shorter as we move away to the extremes. Increasing the sample size on either variable also results in shorter intervals. The performance of both basic pivotal interval and percentile interval is similar in terms of expected length but in terms of coverage rate percentile interval has the better performance. The percentile interval appears to be the best among bootstrap intervals. The interval based on the MLE and the interval based on the Bayes estimator given in (26) appear to perform almost as well as the percentile interval. The interval based on the Bayes estimator given in (25) has best coverage rate and the short expected length between the other intervals when R = 0.5, but it has the low coverage rate and the long expected length for small values of R since it is dependent on choice of θ1 and θ2 values. Furthermore, the interval based on the empirical Bayes estimator has the shortest expected length between the other intervals but it has the low coverage rate.

Based on the above discussion, we can conclude that, between the intervals obtained in this paper, the intervals based on the MLE, and the Bayes estimator given in (26) and between the bootstrap intervals, percentile interval simultaneously has the short expected length and very good coverage rate in comparison with the other intervals. Hence, we recommend using this confidence interval in all.

Conflict of Interests

The authors declare that there is no conflict of interests regarding the publication of this paper.

Acknowledgments

The authors express their sincere thanks to the editor and the referees for their constructive criticisms and excellent suggestions which led to a considerable improvement in the presentation of the paper.