Nonlinear Dynamics in a Cournot Duopoly with Different Attitudes towards Strategic Uncertainty

Abstract

This paper analyses the dynamics of a duopoly with quantity-setting firms and different attitudes towards strategic uncertainty. By following the recent literature on decision making under uncertainty, where the Choquet expected utility theory is adopted to allow firms to plan their strategies, we investigate the effects of the interaction between pessimistic and optimistic firms on economic dynamics described by a two-dimensional map. In particular, the study of the local and global behaviour of the map is performed under three assumptions: (1) both firms have complete information on the market demand and adjust production over time depending on past behaviours (static expectations—“best reply” dynamics); (2) both firms have incomplete information and production is adjusted over time by following a mechanism based on marginal profits; and (3) one firm has incomplete information on the market demand and production decisions are based on the behaviour of marginal profits, and the rival has complete information on the market demand and static expectations. In cases 2 and 3 it is shown that complex dynamics and coexistence of attractors may arise. The analysis is carried forward through numerical simulations and the critical lines technique.

1. Introduction

In this paper, we analyse the dynamics of a Cournot duopoly under strategic uncertainty with pessimistic and optimistic firms within the framework of a nonlinear dynamic oligopoly as those developed by a recent burgeoning literature (see [1] and the papers cited therein).

The issue of decision making under uncertainty as distinct from risk has recently been revisited, amongst others, by [2–6]. In these papers, strategic uncertainty is represented by means of the Choquet expected utility (CEU) theory [7] where agents exhibit different attitudes towards uncertainty, that is, pessimism or optimism, overweighing less or more uncertain events. This theory has also been adopted by [8] to represent strategic behaviour à la Cournot with different firms’ attitude towards uncertainty (CEU theory has been applied to other economic contexts, where optimism and pessimism can explain the paradox of people buying insurance and gambling, the equity premium puzzle, and the small stock puzzle [6]).

In a strategic context such as a duopoly game, it is crucial to forecast the behaviour of the competitor in order to make a decision and to specify the information set available to each player. In the literature on nonlinear oligopolies, two distinct assumptions with regard to available information are usually made: players have a complete knowledge of the market demand and use some form of expectations about the rival’s strategic variable decision (e.g., naive, rational, or adaptive expectations or, alternatively, some weighted sum of previous rules) to set the price or the quantity in the future period (e.g., [9, 10]); players have limited information about the market demand and use some forms of estimation of their own current marginal profits (e.g., [11–14]) or other adjustment mechanisms such as the local monopolistic approximation to determine the price or quantity in the future period [15]. This is because, under the hypothesis of limited information, players are unable to solve the optimisation problem by accounting for expectations about the value of the strategic variable that the competitor will choose for the next period, but they are able to get either a correct estimate of the slope of their own profit function in the current period, that is, the partial derivative of the profit function computed at the current state of production, or use a linear approximation of the demand function by market experiments without any guess about the influence of the competitors (i.e., monopolistic approximation).

In this paper we study local and global dynamics of a Cournot duopoly model with strategic uncertainty as in [8] by considering different information sets of players. In particular, (1) both firms have complete information on the market demand and use the “best reply” adjustment mechanism (static expectations) to vary production period by period; (2) both firms have incomplete information on the market demand and adjust production by following a mechanism based on marginal profits; (3) one firm has incomplete information and production decisions are based on the behaviour of marginal profits, and the rival has complete information and static expectations. These assumptions make the topological structure of the map different and then comparing the local and global properties of the three dynamic systems is relevant. In particular, in cases 2 and 3 we find that complex dynamics as well as coexistence of attractors may occur. These phenomena depend on the relative value of the parameter that weights the strategic uncertainty of firms. The analysis is performed by applying the critical lines techniques as well as through numerical simulations.

The rest of the paper proceeds as follows. Section 2 develops the Cournot model with strategic uncertainty. Section 3 studies the dynamics of the model under complete information and static expectations of both firms. Section 4 introduces the adjustment mechanism of production based on marginal profits for both firms and performs the local and global dynamics. Section 5 analyses the mixed case. Section 6 outlines the conclusions.

2. The Model

By using CEU theory, it is assumed that each firm maximises its own CEU function which is given by a weighted average (with the parameter γ ∈ [0,1]) of its expected profits and the profits in the worst case (resp., best case) for the pessimistic (resp., optimistic) firm, where γ (assumed to be the same for both firms) represents the degree of confidence that each firm has about the Cournot behavioural assumption [5, 8]. An economic interpretation of γ is the following [8]: values of γ close to zero may represent a relatively new market characterised by a high level of strategic uncertainty (in which pessimistic firms are more likely to decide to do not produce because the level of uncertainty may be too high for them); values of γ close to one may represent mature markets characterised by a relatively stable environment, where firms are relatively confident about their conjecture.

Assumption 1 (γ ∈ (0,1]). In addition, from (8) the condition to guarantee that the quantities are positive is as follows:

Assumption 2 (a > alow). We note that the values of price and profits corresponding to Nash equilibrium (8) are given by

3. Dynamics under Complete Information (“Best Reply” Dynamics)

Proof. First of all, we focus on

(1) If , then and , and the property for M0 follows from the property stated for L.

(2) If ,, then

(3) If , then

(4) If , then

Then, we can conclude that fixed point (8) is the global attractor for M0 on cl (D) . From the inequality for any (q1, q2) ∈ D, we have the result.

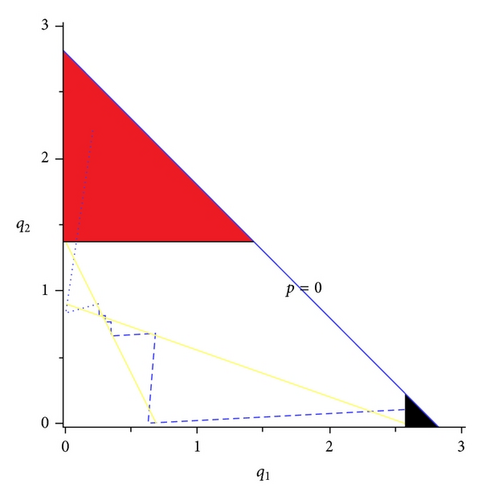

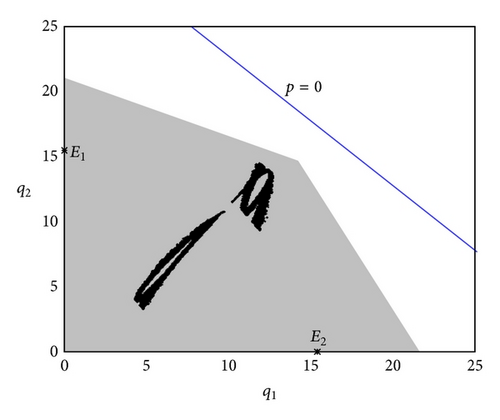

In addition, we note that in contrast with the standard Cournot game (γ = 1), under strategic uncertainty (γ < 1) it is more likely that the pessimistic (resp., optimistic) firm decides not to produce (resp., to produce) a positive quantity at a certain date (as shown in Figure 1).

4. Dynamics under Limited Information

4.1. Local Analysis

Proposition 4. The fixed points E0, E1, and E2 are unstable.

Proof. We have

The eigenvalues associated with (24) are λ1 = 1 + α(γa − c) > 1 and λ2 = 1 + α(a − c) > 1. Then, E0 is a source:

Proposition 5. The fixed point E* is locally stable if and only if , where Dis (a) is defined in proof. For α = αf, E* undergoes a supercritical flip bifurcation. No other local bifurcations may arise around E*.

Proof. The Jacobian matrix of map (20) evaluated at E* is the following:

Now, since a > alow, Dis(alow) = (c(γ−1)(4−γ)/γ)2 > 0 and Dis′(alow) = c(γ − 2) 2(γ − 1)(4 − γ)/γ > 0, then Dis(a) > 0 for any feasible value of a.

To sum up, V3 > 0 for any α such that α < α1∨α > α2, where 0 < α1 < α2 and their explicit expressions are given by

With regard to the first condition in (30), we note that the sign of V1 is given by the sign of

4.2. Critical Curves

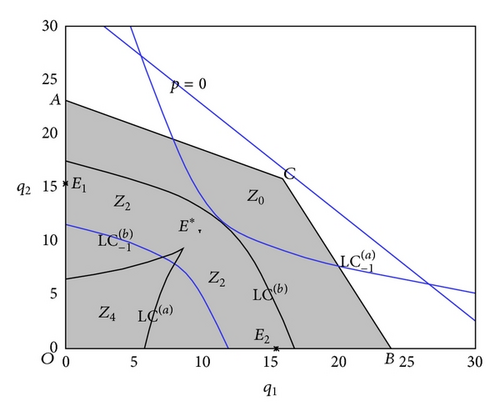

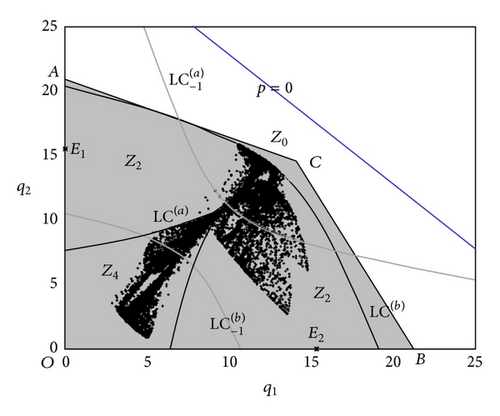

An important feature of map (20) is that it is a noninvertible endomorphism. In fact, for a given the rank-1 preimage (that is the backward iterate defined as ) may not exist or may be multivalued. In the specific case, if we want to compute (q1, q2) in terms of in (20) we have to solve a fourth-degree algebraic system that may have four, two, or no solutions. In a natural way, we are led to subdivide the plane in regions Z0, Z2, and Z4 according to the number of such preimages (where the subscripts in Z indicate this number). A direct consequence of this fact is that if we let vary in the plane R2, M1, the number of the rank-1 preimages changes as the point crosses the boundary that separates these regions. Such boundaries are generally characterised by the existence of two coincident preimages. In this regard, by following [20] we introduce the definition of the critical curves. The critical curve of rank 1, denoted by LC is defined as the locus of points that have two (or more) coincident rank-1 preimages located on a set called LC−1. It is quite intuitive to interpret the set LC as the two-dimensional generalisation of the notion of critical value, local minimum or maximum, of a one-dimensional map, and LC−1 as the generalization of the notion of critical point (local extremum point). Arcs of LC separate the regions of the plane characterised by a different number of real preimages.

4.3. Basins of Attraction

It follows that the dynamics on axes q1 = 0 and q2 = 0 can be obtained from the well-known behaviour of the standard logistic map by a homeomorphism (see [21]). In particular, (a) if 0 < α(a − c) < 3 (resp., 0 < α(aγ − c) < 3), then we can deduce that bounded trajectories along q1 = 0 (resp., q2 = 0) are generated if the initial conditions are taken inside the segment line ω1 = [0, (1 + α(a − c))/2αb] (resp., ω2 = [0, (1 + α(aγ − c))/2αbγ]; (b) from the computation of the eigenvalues of the cycles belonging to one of axes, we have that the direction transverse to the coordinate axes is always repelling; (c) initial conditions with or generate a divergent trajectory. From (a), (b), and (c) it follows that ω1 and ω2 and their preimages belong to the boundary of B(∞). In addition, under the conditions in (a), when the preimages belong to Z0, we can show that B(∞) is given by the region outside the quadrilateral OABC with A(0, (1 + αa − αc)/2αb), B((1 + αaγ − αc)/2αbγ, 0), and where and so that the quadrilateral represents the region of trajectories that converge to a finite distance attractor that does not lie on the axes. Finally, from an economic point of view we note that, in order to preserve a positive value of the price inside the quadrilateral OABC, we have to impose the condition ; that is, a > 2(1 − αc)/αγ.

4.4. Global Analysis and Numerical Simulations

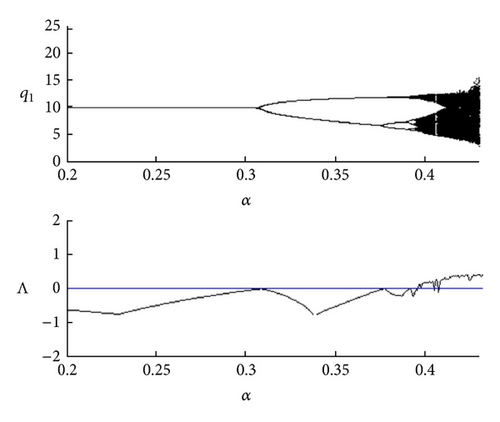

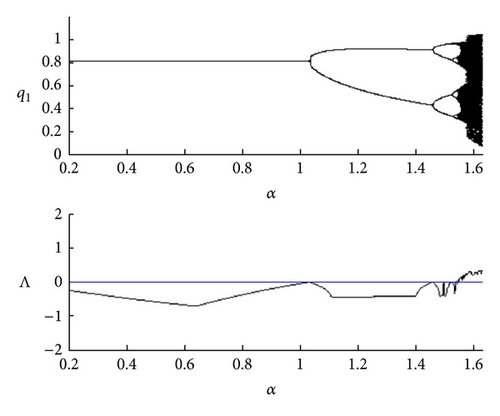

In this section we study the dynamic system M1 for the following parameter values: a = 7.2, b = 0.22, c = 0.4, and γ = 0.9 and let α vary. Figures 3(a) and 3(b) show the existence of a period doubling cascade that (starting from the flip bifurcation value α = αf≅0.3081) generates cyclic attractors of higher period until a global attractor is born.

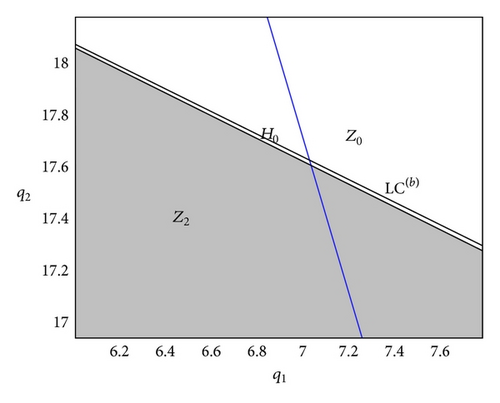

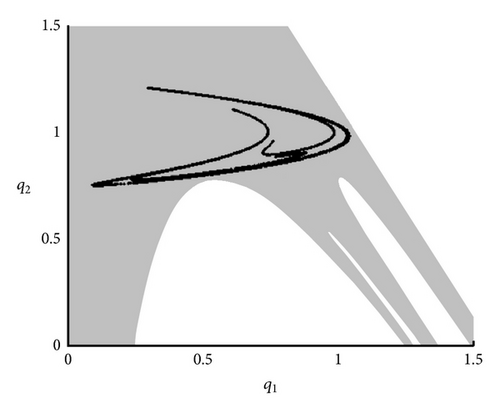

By increasing the value of α, we have an important topological change in the structure of the basins of attraction. In particular, when α≅0.4265 we have a tangency between LC(b) and the upper side of the quadrilateral (the grey region in the figures). For higher values of α portions of the basin of attraction of the attractors on the axes enter Z2 region (at least one of the firms exit the market). After the bifurcation (tangency), one main lake lies inside Z2. Hence, the lake has further preimages which form smaller lakes within the grey region. These ones lie inside the quadrilateral in the region complement to Z0. When α increases further, LC continues to move upwards, the portion H0 grows up and then the holes become larger (see Figures 4(a) and 4(b)). At this stage it is really difficult to predict the long-term dynamics of the economic model, because slight changes in the initial conditions may lead to very different long-term outcomes (it is possible that only one firm produces or both firms produce but with erratic patterns). We note that the attractors located on the axes are not locally attracting. However, they attract a set of initial conditions with positive Lebesgue measure; that is, they are attractors à la Milnor (we recall that a closed invariant set A is a Milnor attractor if its stable set B(A) has positive Lebesgue measure (see [11] for details)). Finally, for α sufficiently large a contact bifurcation destroys the interior attractor.

5. Dynamics under Both Limited and Complete Information

Map (40) admits two fixed points: defined by (8) and . To guarantee that the unique Nash equilibrium of the game has economic meaning, we assume that the inequality a > c(2 − γ)/γ continues to be fulfilled. This condition also implies that the equilibrium values of profits and price are positive.

5.1. Local Analysis

The following propositions hold.

Proposition 6. The fixed point is unstable.

Proof. The Jacobian matrix of map (40) evaluated at is as follows

Proposition 7. The fixed point E* is locally stable if and only if . For , E* undergoes a supercritical flip bifurcation. No other local bifurcations may arise around E*.

5.2. Global Dynamics

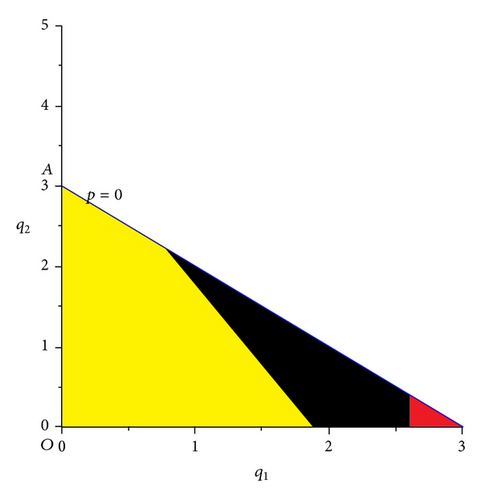

This section develops the global analysis of map (40). First of all, we note that if we relax the nonnegative constraints on variables q1 and q2, map (40) results to be invertible (i.e., given there exists one and only one (q1, q2)). However, map (40) is noninvertible with nonnegative constraints on q1 and q2. This can be ascertained by looking at Figure 5. From a global perspective, it is possible to identify regions on set D corresponding to which at least one of the best replies of the two firms is zero (Figure 5). It is important to note that the introduction of heterogeneity in the mechanism of adjustment between the two firms leads to different behaviours of the map along the Cartesian axes with respect to the model developed in Section 4. In particular, the axis q1 = 0 is a trapping subset. In fact, when q1 = 0 the subsequent iteration results to be (0, (a − c)/2b). In contrast, the axis q2 = 0 does not have this property: the points that start on axis q2 = 0 can lead to different fates (Figure 6(b)). Figure 5 shows that in the black region the subsequent iteration leads to a point (0, q2), with q2 > 0, while in the yellow region the subsequent iterate leads to a point (q1, q2) with q1 > 0 and q2 > 0. In the red region the subsequent iteration leads to (0,0) and finally the successive iterates will be located on the segment line OA.

We note, however, that by starting from points that lie in the yellow region it is possible that the subsequent iteration continues to lie in the yellow region or, alternatively, it leads to either the red region or black region and the dynamics will definitely end up on the point (0, (a − c)/2b). In this case the side equilibrium is not locally attracting. However, it attracts a set of initial conditions with positive Lebesgue measure. From a mathematical point of view, these portions of the phase plane can be identified through the union of the preimages of any rank of the points in black and red regions.

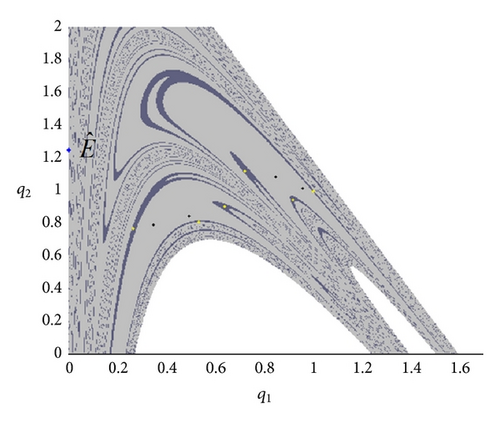

Analogously with map M1, complex dynamics can be observed also for map M2. Figures 6(a) and 6(b) show the bifurcation diagram and the corresponding Lyapunov exponent (Λ) for α by using the following parameter values: a = 3, b = 1, c = 0.5, and γ = 0.963. When α < 1.032, the interior fixed point is stable. Starting from , there exists a cascade of period-doubling bifurcations until the occurrence of a chaotic attractor, which is shown in Figure 6(b) that depicts the basin of attraction and the corresponding chaotic attractor for α = 1.61.

In addition, in the model with heterogeneous adjustment mechanisms we note that coexistence of interior attractors can occur by slightly reducing the value of α (this result is not usual in the nonlinear oligopoly literature with heterogeneous adjustment mechanisms [9, 10]). With this regard, Figure 7 shows that a cycle of period four (black points in the light-grey region) coexists with a cycle of period six (yellow points in the dark-grey region) when α = 1.498.

6. Conclusions

This paper developed a nonlinear Cournot duopoly to study the role of strategic uncertainty on the dynamics of the model economy. We characterised the local and global properties of a discrete two-dimensional map by considering that (1) both firms have complete information on the market demand and adjust production over time depending on past behaviours (static expectations, “best reply” dynamics); (2) both firms have incomplete information and production is adjusted over time by following a mechanism based on marginal profits; and (3) one firm has incomplete information and production decisions depend on marginal profits, and the rival has complete information with static expectations (mixed case). In cases 2 and 3 we showed the existence of complex phenomena such as chaotic attractors and coexistence of attractors. The different behaviour of the model depending on whether the adjustment mechanisms are homogeneous or heterogeneous is interesting from an economic point of view, because of the different long-term dynamics that can be observed. In particular, in the cases in which (a) both firms have incomplete information and the adjustment mechanism of production is homogeneous and (b) the information set available to firms and the adjustment mechanisms of production are mixed, there exists the possibility that at least one firm decides to exit from the market (i.e., to do not produce). This result does not hold when both firms have complete information on the market demand and production is based on the behaviour of the previous period.

Acknowledgments

The authors gratefully acknowledge that this work has been performed within the activity of the PRIN-2009 project “Local interactions and global dynamics in economics and finance: models and tools,” MIUR (Ministry of Education), Italy, and PRIN-2009 project “Structural change and growth,” MIUR, Italy. Numerical simulations have benefited from algorithms that can be found in http://dysess.wikispaces.com/. The authors also thank an anonymous reviewer for valuable comments. The usual disclaimer applies.