A Positivity-Preserving Numerical Scheme for Nonlinear Option Pricing Models

Abstract

A positivity-preserving numerical method for nonlinear Black-Scholes models is developed in this paper. The numerical method is based on a nonstandard approximation of the second partial derivative. The scheme is not only unconditionally stable and positive, but also allows us to solve the discrete equation explicitly. Monotone properties are studied in order to avoid unwanted oscillations of the numerical solution. The numerical results for European put option and European butterfly spread are compared to the standard finite difference scheme. It turns out that the proposed scheme is efficient and reliable.

1. Introduction

It is widely recognized that the value of a European option can be obtained by solving the linear Black-Scholes equation under quite restrictive assumptions (such as liquid, frictionless, and complete markets) [1, 2]. However, these restrictive assumptions are never fulfiled in reality. In order to conform the actual situation, many modified Black-Scholes models have been proposed in recent years, such as transaction costs (Leland [3], Palmer [4], Hoggard et al. [5], Barles and Soner [6], and Jandačka and Ševčovič [7]), illiquid market (Frey and Patie [8], Sircar and Papanicolaou [9], Liu and Yong [10], etc.), and volatility uncertainty (Avellaneda et al. [11]). These models result in quasilinear or fully nonlinear Black-Scholes equations.

The existence and uniqueness of the solution of (1.1)–(1.3) have been shown by the theory of stochastic optimal control in [6]. However, analytical solutions cannot be found because of fully nonlinear properties of (1.1); thus, we need to compute the option values numerically.

There have been rich achievements for the numerical method of linear Black-Scholes equations (e.g., see [13–17]). As for the nonlinear situation, only a few results can be found. There is a stable numerical scheme developed in [7] (see also [18] for application to a general class of nonlinear Black-Scholes equations) for the so-called gamma equation (a quasilinear parabolic equation for the SVSS). Recently Kútik and Mikula [19] did some progress in showing its stability and accuracy for nonlinear Black-Scholes equation. Company et al. [20–22] construct explicit finite difference schemes for (1.1)–(1.3), and consistency and stability are studied. However, they have the disadvantage that strictly restrictive conditions on the discretization parameters are needed to guarantee stability and positivity. The implicit schemes do not have this disadvantage, but they are quite time-consuming. Yousuf et al. [23] develop a new second-order exponential time differencing (ETD) scheme to avoid unwanted oscillations near the non-smooth nodes for the Hoggard-Whalley-Wilmott (HWW) model [5] based on the Cox and Matthews approach [24] and partial fraction version of the matrix exponential, but the theoretical analysis of stability and convergence are not studied. Some authors (for instance, Düring et al. [25] for European options, Dremkova and Ehrhardt [26] for American options) construct high-order compact difference schemes with frozen values of the nonlinear coefficient of the nonlinear Black-Scholes equation to make the scheme linear and show that the resulted linearized problem is stable.

On the other hand, since the value of option is nonnegative, it is very important to make numerical schemes preserve the positivity of solution. Several authors have developed some schemes that guarantee the positivity of solutions for ordinary differential equations [27, 28] and parabolic equations [29]. In [30], Chen-Charpentier and Kojouharov propose an unconditionally positivity-preserving scheme for linear advection-diffusion reaction equations. They construct a nontraditional discretization of the advection and diffusion terms by the approximation of the spatial derivatives using values at different time levels. Motivated by this work, we will develop the method to a nonlinear Black-Scholes equation, and some properties (such as stability, monotonicity, and consistency,) of numerical scheme are studied in this paper. The new numerical method unconditionally preserves the positivity of the solutions, the stability, and monotonicity of the scheme. In addition, the designed numerical approximations allow us to solve the discrete equation explicitly, which reduces the time of calculation and increases the efficiency of the methods.

The rest of the paper is organized as follows. In the next section the original problem (1.1)–(1.3) is transformed into a nonlinear diffusion problem by an appropriate change of variables and some properties of the function Ψ(x) are given. In Section 3, the discretization method is constructed. In Section 4, we prove the boundedness of coefficients, positivity, and monotonicity of the numerical scheme. Stability and consistency are studied in Section 5. In Section 6, numerical experiments for European put option and a European butterfly spread are presented to support these theoretical results. Finally, some conclusions are drawn in Section 7.

2. The Transformed Problem

The following two lemmas give the properties of the function Ψ appearing in (1.2), which will play an important role in the numerical analysis and numerical calculation.

Lemma 2.1 (see [20].)The solution Ψ of ordinary differential equation (1.4) exists and is unique, and it satisfies,

- (i)

Ψ is an increasing function mapping the real line onto the interval (−1, +∞).

- (ii)

Ψ = Ψ(A) is implicitly defined by

() - (iii)

if A > 0, then the function Ψ(A) is bounded and satisfies

()

3. The Unconditionally Positivity-Preserving Scheme

Since the value of an option is nonnegative, it is important that numerical scheme is positivity preserving.

Remark 3.1. From property (i) of Lemma 2.1, Ψ takes values in the interval (−1, +∞), so the coefficients are nonnegative, that is, for any i, n.

Obviously, numerical scheme (3.3) is unconditionally positive for a nonnegative payoff . However, we cannot obtain the numerical solution explicitly since the nonlinear term involves the value u at the time level n + 1, which makes it quite difficult to prove the stability of the scheme presented previously. In fact, the numerical scheme (3.3) can only be solved by a nonlinear iteration in each time step which is quite time-consuming.

In order to obtain an efficient scheme, we correct the approximation of the nonlinear coefficients in (2.2) by using the standard second-order central difference. Thus the corrected numerical scheme is as follows:

Since the calculation of (3.5) for i = 0 and i = N requires us to know the fictitious values and , we obtain them using the linear extrapolation as follows:

Thus the values of boundary points turn out

The left boundary condition is not needed and in fact must not be prescribed in the case of a parabolic equation with degenerating diffusion term at x = 0. This is known in the literature as the Fichera condition [31] (see [18] for application in Black-Scholes equations, Chapter 8, (8.25)). The Fichera condition is just a comparison of the speed of degeneration versus. speed of advection at the boundary x = 0. Fortunately, the left boundary condition in (3.8) is a consequence of (3.5) with . The only boundary condition that can be prescribed is the right boundary condition at x = B. For the convenience in the numerical calculation, let us denote the vectors , then numerical scheme (3.5), (3.8) can be written in matrix form

In order to study the related properties of numerical scheme (such as monotonicity and stability), we need to know the behaviour of appearing in the nonlinear team .

Lemma 3.2. With the previous notation, appearing in the nonlinear team satisfies the scheme

Proof. From (3.6) and (3.7) we can know for i = 0 and i = N that

Putting (3.5) into the expression (3.6) of , and after a simple calculation we can obtain (3.12).

On the other hand, the most common option price sensitivities are the first and second derivatives with respect to the price of the underlying asset, that is, “delta” and “gamma”, respectively. These are important features in risk management and are challenging to compute numerically. From the transformation (2.1) we can obtain the approximations of Greeks of the option as follows:

4. Properties of the Numerical Scheme

4.1. Boundedness of the Coefficients

For the sake of convenience, we introduce the following definition.

Definition 4.1 (see [32].)If x = [x1, x2, …, xN] is a vector in ℝN, then its 1-norm is denoted by , and maximum-norm is denoted by ∥x∥∞ = max1≤i≤N | xi|.

The following theorem shows that the nonlinear team appearing in (3.5) is bounded.

Theorem 4.2. Let , then the following properties hold true.

- (i)

∥Δn∥1 is nonincreasing.

- (ii)

The nonlinear team appearing in (3.5) satisfies

()

Proof. Property (i) is proved using the induction principle over index n.

For n = 0, from Lemma 3.2 and by Remark 4.7, it follows that

Now, let us assume that property (i) holds true up n, that is,

On the other hand, from (3.6) and the monotonic increasing property of Ψ (see Lemma 2.1), it follows that

Since xi ∈ [0, B] and from the property (iii) and property (i) of Lemma 2.2, we have

4.2. Positivity

Since the value of option is nonnegative, a nice property of the numerical scheme for the pricing equation is positivity-preserving.

Clearly, all the coefficients of the numerical scheme (3.5) are nonnegative (see Theorem 4.2). Hence, for a nonnegative payoff , the following result has been established.

Remark 4.4. is also unconditionally positive, that is, if for 0 ≤ i ≤ N, then for 0 ≤ i ≤ N, 0 ≤ n ≤ L.

4.3. Monotonicity

For the sake of convenience in the presentation, we introduce the following definition of a monotonicity preserving numerical scheme.

Definition 4.5 (see [31].)In numerical scheme , we say that it is monotonicity-preserving. If each time that or for all i, then it occurs that or for all i.

The next result shows the monotonicity of the numerical scheme.

Theorem 4.6. The numerical scheme (3.5), (3.8) is unconditionally monotonicity-preserving with 0 ≤ i ≤ N, 0 ≤ n ≤ L.

Proof. Let us write

The monotonicity of the scheme in the internal mesh points has been proved.

In an analogous way, we can verify that

Similarly, we can prove that if , then for 0 ≤ i ≤ N − 1, 0 ≤ n ≤ L − 1.

Thus the proof of theorem is complete.

Remark 4.7. If the payoff f(x) is nondecreasing with f(0) = 0 (e.g., f(x) = max{x − K, 0}), then for a fixed n with 0 ≤ n ≤ L.

5. Stability and Consistency

5.1. Stability

5.2. Consistency

The proposed new difference scheme (3.5) is explicit, unconditionally positive, and unconditionally stable; however, it is not unconditionally consistent. There are extra truncation error terms since the approximations to second derivatives with respect to x are at different time levels.

The following theorem gives the consistency condition of the difference scheme (3.5).

Theorem 5.2. With the previous notation, suppose that the exact solution u of (1.1)–(1.3) satisfies . Then the local truncation error is given by

Proof. Let us write the scheme (3.5) in the form

From Theorem 5.2, we can see that the meshes should satisfy k/h2 → 0 as k and h go to zero in order to ensure the consistency. Therefore, the key to the convergence of the scheme is the consistency rather than the stability. In actual calculation, we can choose the time step depending on the spatial size so that inconsistent terms go to zero.

6. Numerical Experiments

6.1. European Put Option

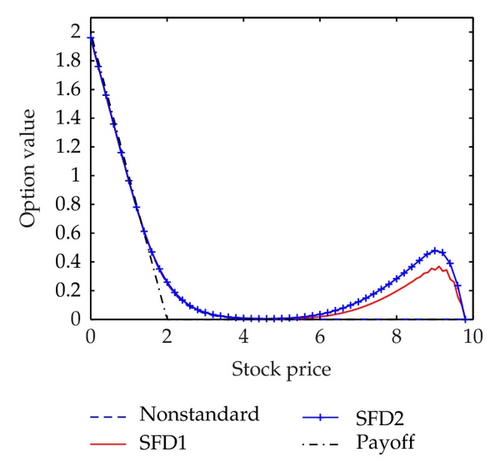

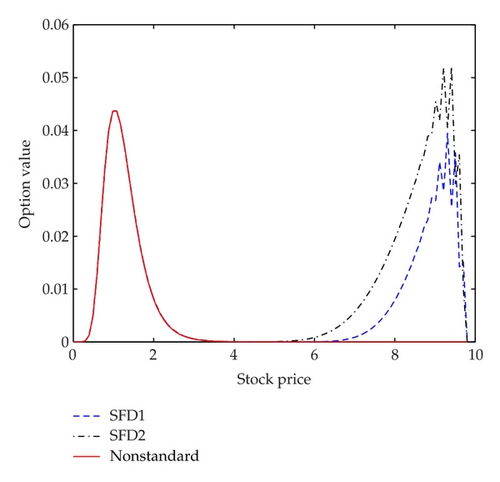

Equations (1.1)–(1.3) give analytical solution for only a = 0 (see [6]). Figure 1 (the left one: a = 0, the right one: a = 0.02) gives the option value using scheme (3.5) and schemes (SFD1 and SFD2) in [20, 21], which shows that our scheme stable, monotonous, and is able to produce solution that is close to the exact solution, but numerical solution of scheme (6.1) appears as spurious oscillation for k = 0.0005 and h = 0.1.

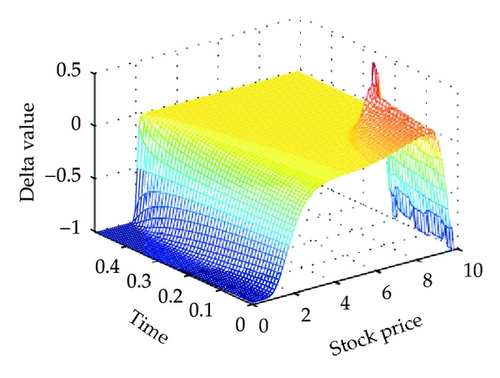

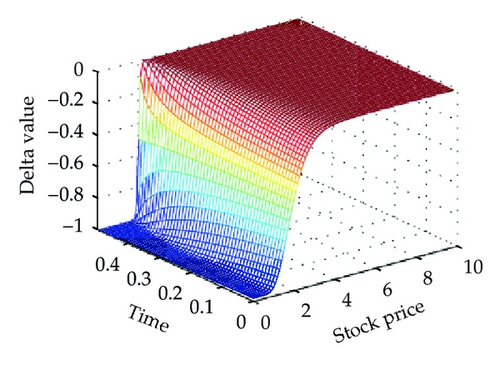

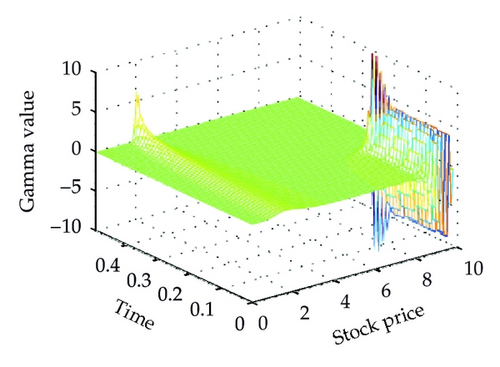

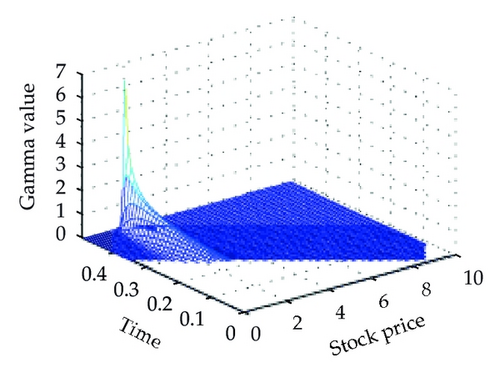

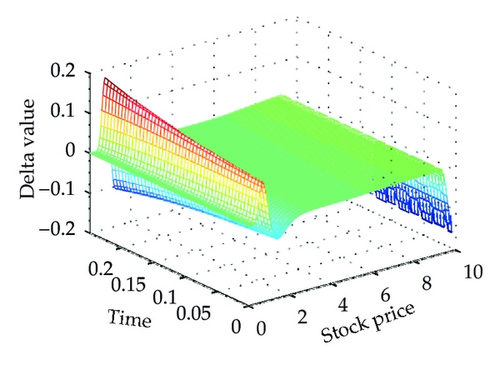

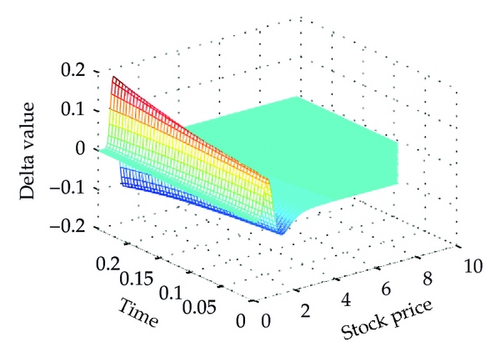

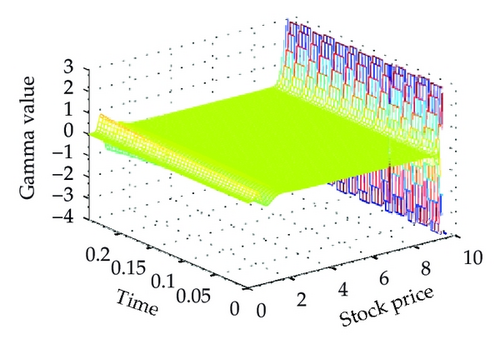

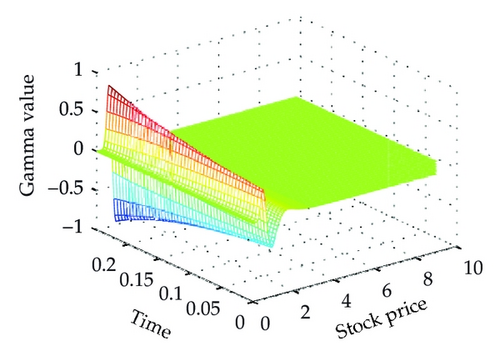

Moreover, Figure 2 presents the related hedging parameters of European put option using the two schemes. We can see that our proposed scheme produces smoother solutions than standard scheme for the delta and gamma. In addition, the gamma is positivity preserving and is maximal as it closes the strike price K = 2.

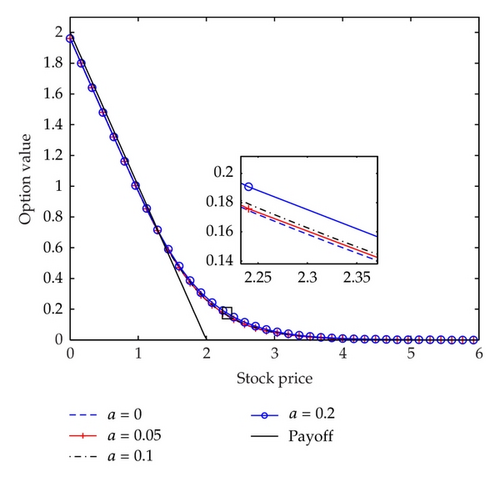

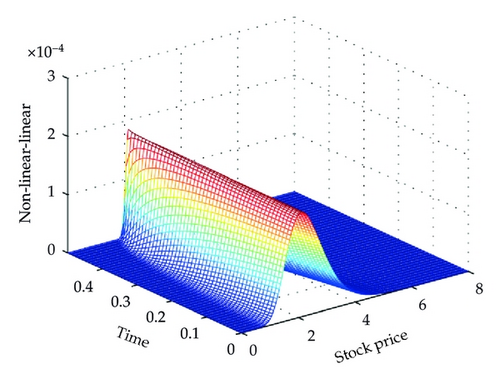

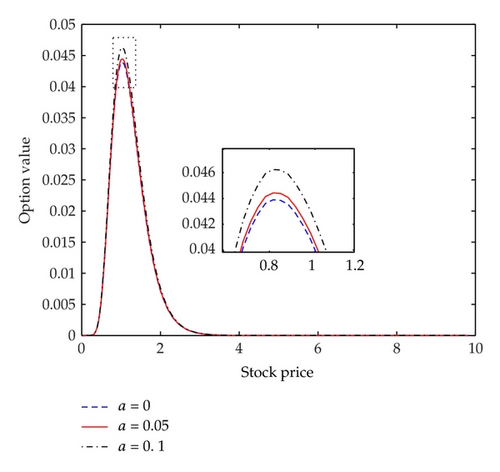

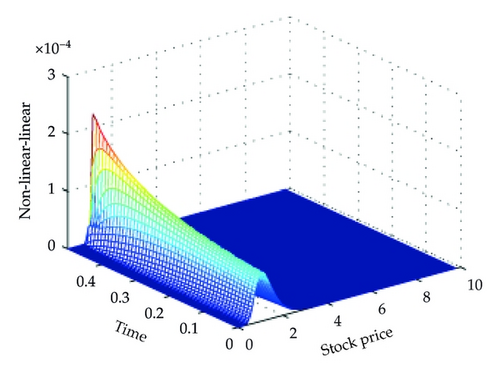

Next we consider the influence of transaction costs (parameter a) on the value of European put option (Figure 3). The left one shows the change of the option value with the parameter a, and the right one presents an evolution profile of the difference Vnonlinear(S, t) − Vlinear(S, t) between our proposed scheme with transaction costs and without transaction costs. We can see that the difference is not symmetric, but decreases towards the expiry date, and is maximal close to the strike price K = 2, where the nonlinear value is significantly higher than the linear value.

6.2. European Butterfly Spread

Figure 4 shows the different solutions of two schemes at t = 0 for a = 0.02. We can see that our proposed scheme is smooth and stable at the same step sizes. Moreover, Figure 5 shows the Greeks of the numerical solution calculated with scheme (3.14), which is different from the vanilla option. The standard scheme (the left one) is unstable and produces unwanted oscillations which are not present while using our proposed scheme (the right one).

The last two figures show the value of European butterfly spread with different transaction costs (parameter a). It is evident from Figure 6 that butterfly spread becomes more expensive in the presence of transaction cost and the difference is maximal as it closes the strike price K2 = 1, which is similar with the vanilla option.

7. Discussions and Conclusions

Acknowledgments

The authors would like to thank the anonymous referees for several suggestions for the improvement of this paper. This work is supported by the Fundamental Research Funds for the Central Universities of China (Grant no. JGK101677).