Comparative Risk Aversion under Background Risk Revisited

Abstract

This paper determines a new sufficient condition of the (von Neumann-Morgenstern) utility function that preserves comparative risk aversion under background risk. It is the single crossing condition of risk aversion. Because this condition requires monotonicity in the local sense, it may satisfy the U-shaped risk aversion observed in the recent empirical literature.

1. Introduction

Pratt [1] and Arrow [2] introduced the notion of risk aversion and its associated order in the expected utility framework. These are represented by concavity and the degree of concavity of the (von Neumann-Morgenstern) utility function. Comparative risk aversion, which is the order of risk aversion, has intuitive and reasonable properties in many decision-making problems that have appeared in economics and finance. For example, in typical portfolio problems, more risk averse investors hold less risky and more risk-free assets. In this example, investors face single risk. However, it is natural that investors face other risk which cannot traded in asset markets, for example, human capital risk cannot be traded in asset markets. In other situations, we face risk which investors cannot control and trade. This risk is called background risk. Optimal decision problems are rather complex by the presence of background risk. Over the past three decades, many researchers have examined how background risk influences optimal decisions in economics and finance. (Gollier [3] provided an excellent survey of this topic.) Since comparative risk aversion may be different with and without background risk, comparative risk aversion too weal to compare optimal decisions in the presence of background risk. This leads to the following question on this topic: “what conditions guarantee that comparative risk aversion is preserved in the presence of background risk?" This paper provides a new answer to this question.

Important contributions to this question are from Kihlstrom et al. [4], Nachman [5], and Pratt [6]. The first two studies obtained a sufficient condition for the preservation of comparative risk aversion in the presence of background risk. As in the case of additive and multiplicative background risk, these sufficient conditions are decreasing absolute risk aversion (DARA) and decreasing relative risk aversion (DRRA), respectively. Pratt [6] established a necessary and sufficient condition for the preservation of comparative risk aversion in the presence of background risk. This paper proposes a new sufficient condition, which is the single crossing condition of risk aversion. The motivation for our analysis has arisen from recent developments. From an empirical viewpoint, Jackwerth [7] and Aït-Sahalia and Lo [8] observed U-shaped absolute and relative risk aversion using options data. Since the U-shaped risk aversion is decreasing in low wealth and increasing in high wealth, DARA and DRRA determined by Kihlstrom et al. [4] and Nachman [5] are inconsistent with this type of risk aversion Because it is difficult to imagine the shapes of risk aversion to satisfy conditions determined by Pratt [6], we cannot determine whether Pratt′s conditions satisfy this empirical finding or not. The condition proposed in this paper may be consistent with this observation, because our condition requires monotonicity of risk aversion in the local sense. From a theoretical viewpoint, Jewitt [9] and Athey [10] proposed a new comparative static technique using the concept of log-supermodularity. We derive a new sufficient condition by applying this technique.

The organization of the paper is as follows. In Section 2, we provide some preliminary discussion for the analysis. In Section 3, we determine the condition on utility function that preserves (reserves) comparative risk aversion under background risk and compare our result with the previous studies. In Section 4, we provide the condition in the case that the payoff function has additive and multiplicative forms and discuss the implications of our result for recent empirical findings. In the last section, we make concluding remarks. Some technical issues are presented in the appendices.

2. Preliminaries

Because our setting is basically identical to that of Nachman [5], we borrow his notation. Let us consider utility function u : ℝ → ℝ of a decision maker (DM). The utility function u is strictly increasing, and the higher order derivatives required in the analysis are assumed to exist. We note that the DM is not necessarily risk averse, that is, concavity of the utility function is not required for the analysis. Let us consider payoff function g : X × Y → ℝ, X, Y⊆ℝ. The payoff function g is strictly increasing function of x. x ∈ X is a realization of a decision variable and y ∈ Y is a realization of an exogenous variable. The exogenous risk , called background risk, is a random variable with probability density function (PDF) m defined over support Y. The capital letter M stands for cumulative distribution function (CDF) associated with PDF m. For example, let us consider a financial market with one risk-free asset and one risky asset. In this economy, endogenous risk is the market portfolio, and exogenous risk is nontraded labor income risk (Weil, [11]).

3. Main Result

Pratt [1] and Arrow [2] introduced the notion of comparative risk aversion defined as follows: u1 is more risk averse than u2 if . We denote this as u1≥A u2. The aim of the paper is to determine a new sufficient condition that guarantees the preservation of comparative risk aversion under background risk, u1≥A u2⇒v1≥A v2.

3.1. Theorem

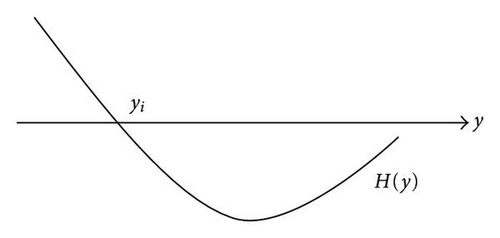

Before providing the theorem, we define the notion of the single crossing condition: H : Y → ℝ satisfies the single crossing condition at yi from above (below), ∃yi, for all y, (y − yi) H(y) ≤ 0((y − yi) H(y) ≥ 0). Figure 1 describes an example of function satisfying the single crossing condition from above. We also define y1, y2 ∈ Y as follows: there exists yi ∈ Y such that hi(x, yi) = for i = 1,2. The following theorem is our main result.

Theorem 1. Suppose that g(x, y) is an increasing function of y for all y ∈ Y. Suppose also that either of H1(y) : = h1(x, y) − h1(x, y1) or H2(y) : = h2(x, y) − h2(x, y2) satisfies the single crossing condition from above (below) ∃ y1, for all y, (y − y1) H1(y) ≤ 0 or ∃y2, for all y, (y − y2) H2(y) ≤ 0 (∃y1, for all y, (y − y1) H1(y) ≥ 0 or ∃y2, for all y, (y − y2) H2(y) ≥ 0). If u1≥A u2, then v1≥A(≤A)v2.

3.2. Two Lemmas

For the preparation of the proof, we provide the following two lemmas. A similar result to the first lemma was obtained by Osaki [12], Ohnishi and Osaki [13], and others in various contexts. We note that Pratt [6] obtained a similar result and gave a different proof for the result of Kihlstrom et al. [4], using the property of stochastic dominance. Before providing the first lemma, we define monotone likelihood ratio dominance (MLRD). For the sake of simplicity, we assume that two random variables and with CDF M(1) and M(2) have the same support Y.

Definition 1. M(2) dominates M(1) in the sense of MLRD if m(y; 2)/m(y; 1) is increasing in y ∈ Y. We denote this as M(1)≤MLRD M(2).

Lemma 1. u1≥A u2 if and only if M(u1)≤MLRD M(u2).

The proof of Lemma 1 is presented in Appendix B.

Lemma 2 is known as the variation diminishing property. Hence, we give the following lemma without a proof. It was presented by Karlin and Novikoff [14] and Karlin [15]. Jewitt [9] and Athey [10] discussed some economic applications. Before providing the lemma, we define log-supermodularity as follows: m : Y × Θ → ℝ is log-supermodular with respect to y and i if for all yL ≤ yH, m(yL, 2)m(yH, 1) ≤ m(yL, 1)m(yH, 2). (Log-supermodularity is also called TP2 property.) If we let M(i) to denote CDF, log-supermodularity is equivalent to M(1)≤MLRD M(2). (See, e.g., Gollier [3].)

Lemma 2. Let us assume that H : ℝ → ℝ satisfies the single crossing condition at yi from above (below): ∃yi, for all y, (y − yi) H(y) ≤ 0((y − yi) H(y) ≥ 0). If a function m(y; i) : Y × I → ℝ is log-supermodular for y and i, then ∫YH(s)m(s; 1)dt = 0 implies ∫YH(s)m(s; 2)dt ≤ (≥)0.

3.3. Proof

In this subsection, we provide a proof of Theorem 1. Because the logic is similar, we only provide the proof for the following statement.

Suppose that H1(y) = h1(x, y) − h1(x, y1) satisfies the single crossing condition at y1 from above: ∃y1, for all y, (y − y1) H1(y) ≤ 0. If u1≥A u2, then v1≥A v2.

3.4. Remarks

- (i)

M(2) dominates M(1) in the sense of FSD;

- (ii)

for every increasing function g;

(see, e.g., Gollier [3] and Müller and Stoyan [17]). Using this property, we obtain that if u1≥A u2 and either of h1(x, y) or h2(x, y) is a decreasing function of y, then v1≥A v2.

Because monotone functions imply functions that satisfy the single crossing condition, the condition determined in this paper is weaker than that determined by Nachman [5]. The reason why our condition is weaker than Nachman′s condition is that our analysis uses a stronger stochastic dominance than his analysis, that is, MLRD is a stronger stochastic dominance than FSD.

4. Specific Forms

In this section, we consider two specific forms of background risk: additive and multiplicative. We specify additive background risk which has the additive payoff function g(x, y) = x + y and multiplicative background risk which has the multiplicative payoff function g(x, y) = xy. In the multiplicative case, we restrict x and y to be positive, x, y ≥ 0. Applying our main result, we can easily determine a condition that guarantees the preservation of comparative risk aversion in the presence of additive and multiplicative background risk. We also discuss some implications for the U-shaped absolute and relative risk aversion observed in recent empirical literature.

4.1. Additive Background Risk

We define y1, y2 ∈ Y such that for i = 1,2. We obtain the following corollary by applying Theorem 1.

Corollary 1. Suppose that g(x, y) has an additive form, g(x, y) = x + y. Suppose also that either of 𝒜(x + y; u1) − 𝒜(x + y1; u1) or 𝒜(x + y; u2) − 𝒜(x + y2; u2) satisfies the single crossing condition from above (below). If u1≥A u2, then v1≥A(≤A)v2.

4.2. Multiplicative Background Risk

Corollary 2. Suppose that g(x, y) has a multiplicative form, g(x, y) = xy. Suppose also that either of functions ℛ(xy; u1) − ℛ(xy1; u1) or ℛ(xy; u2) − ℛ(xy2; u2) satisfies the single crossing condition from above (below). If u1≥A u2, then v1≥A(≤A)v2.

4.3. Implications

- (i)

they preserve comparative risk aversion under additive (multiplicative) background risk;

- (ii)

they are consistent with recent empirical findings, for example, absolute (relative) risk aversion is decreasing in low wealth and increasing in high wealth.

5. Concluding Remarks

In this paper, we determined a new sufficient condition for utility functions that preserve comparative risk aversion under background risk. The condition determined by Kihlstrom et al. [4], and Nachman [5] requires the monotonicity in the global sense. Our condition, on the other hand, requires it only in the local sense. This generalization does not only have theoretical but also has empirical importance because recent empirical literature has observed the U-shaped risk aversion using options data.

Acknowledgments

The authors would like to thank Mark Bremer, Chiaki Hara, John Quiggin Katsushige Sawaki, and especially an anonymous referee for their useful comments and constructive suggestions. This research was partly supported by Grants-in-Aid for JSPS Fellows (no. 02205), Grants-in-Aid for Research Activity Start-up (no. 21830146), the Japan Securities Scholarship Foundation, and Nihon Housei Gakkai Foundation. Of course, all remaining errors are the authors.