Can Africa compete with China in manufacturing? The role of relative unit labour costs

Abstract

This paper examines sub-Saharan Africa's (SSA) bilateral trade and cost competitiveness with China. We document an extraordinary imbalance in the structure of bilateral trade in that China overwhelmingly exports manufactured products to SSA and almost exclusively imports primary products in return. Our principal means of assessing the competitiveness of SSA's manufacturing sector vis-à-vis China are measures of relative unit labour costs (RULC). We find that African RULCs declined over the 2000s as China's wages rose faster than Chinese productivity while the reverse was true for the SSA countries in our sample. Nevertheless, RULCs vis-à-vis China remain very high for many SSA countries. High RULCs along with weaknesses in the business climate suggest that most SSA countries are unlikely to be competitive in labour-intensive manufacturing any time soon.

1 INTRODUCTION

Economic ties between China and Africa have intensified in recent years, with bilateral trade growing considerably faster than total trade for both parties. The effects of China's rising involvement in African economies are controversial (Asongu & Aminkeng, 2013; Brautigam, 2009; De Grauwe, Houssa, & Piccillo, 2012; Eisenman, 2012; Pigato & Tang, 2015; Tull, 2006). On the positive side, China's demand for African raw materials and its investments in African infrastructure contributed to Africa's improved economic growth in the 2000s. On the other hand, trade with China does little to promote and may even inhibit African structural transformation as booming exports of primary products exacerbate Africa's dependence on capital-intensive minerals and fuels while China's exports of labour-intensive manufactures create strong headwinds for Africa's meagre industrial base and formal employment. Still, manufacturing wages in China have been rising quickly in recent years, potentially creating new opportunities for low-cost producers. This paper examines whether African countries can develop labour-intensive manufacturing exports, taking advantage of rising wages in China.

Our principal means of assessing the competitiveness of sub-Saharan Africa's (SSA) manufacturing sector are measures of relative unit labour costs (RULC). We compare unit labour costs (ULCs) in SSA manufacturing to those in China. We also assess African competitiveness vis-à-vis India and other developing countries.

To our knowledge, our estimates are the first to evaluate SSA's manufacturing competitiveness with respect to China by comparing their ULCs. A number of previous contributions have examined manufacturing competitiveness in China and Africa, but few have made direct comparisons between Africa and China. Cox and Koo (2003) report comparative wage and productivity data for China vis-à-vis the United States and Mexico for 2001 but stop short of ULC comparisons. Szirmai, Ren, and Bai (2005) provide a careful analysis of relative Chinese labour productivity over time, but do not cover relative wages and ULCs. Banister (2004) is a detailed study of labour costs in Chinese manufacturing that includes a meticulously constructed estimate for 2002 but does not contain productivity or unit labour cost estimates.

Ceglowski and Golub (2007, 2012) analyse Chinese ULCs in detail, focusing on China's competitiveness relative to the United States, other developed countries and a few emerging economies. In an analysis covering 1980s through the early 2000s, Ceglowski and Golub (2007) showed that Chinese ULCs in manufacturing were very low in the early 2000s at about 25%–40% of the US level and even lower relative to the European Union. We found that China's cost competitiveness was due mainly to the large currency devaluations that preceded the establishment of a de facto peg around 1995, as well as rapid productivity gains that outpaced wage growth in the 1980s and early 1990s. From the mid-1990s to 2002, Chinese RULC stabilised at a low level, reflecting the combined effects of exchange-rate stability and roughly equal wage and productivity growth. Ceglowski and Golub (2012) returned to this issue, with updated evidence from the 2000s. Over 2003–08, China's competitiveness deteriorated considerably, with RULC rising between 20% and 70% against the United States, depending on the data used. This rise in China's RULC reflected very rapid growth in Chinese wages, exceeding Chinese productivity growth, and substantial real appreciation of the Chinese renminbi. Ceglowski and Golub (2012) also note that high wage growth in China continued in 2009–11, outpacing productivity growth and further moderating Chinese competitiveness.

There have been fewer studies of the international competitiveness of African manufacturing. Several studies find that while informal-sector wages are low in Africa, formal-sector wages are actually very high relative to per capita GDP. Gelb, Meyer, and Ramachandran (2013) use firm-level data from World Bank Enterprise Surveys to compare formal-sector wages in African manufacturing to those of other developing countries and conclude that Africa's labour costs are quite elevated and likely constitute a significant impediment to export diversification. Similar findings are reported in Golub and Hayat (2015) and Benjamin and Mbaye (2012). These studies do not provide time-series analyses of African competitiveness or measures of RULC. Mbaye and Golub (2003) and Edwards and Golub (2004) report findings of very high ULCs in Senegal and South Africa, respectively, over a considerable period of time.

The present paper updates and combines previous studies of both China and Africa, extending the previous studies on China (Ceglowski & Golub, 2007, 2012), Senegal (Mbaye & Golub, 2003) and South Africa (Edwards & Golub, 2004) and adds several other countries to the African comparators (Ethiopia, Kenya, Malawi, Mauritius and Tanzania). This choice of countries is dictated by availability of data on manufacturing labour costs and productivity.

Section 2 reviews trends in SSA–China trade, highlighting the imbalance in manufactured goods in China's favour. Section 3 develops the concept of RULC as a metric for assessing manufacturing competitiveness. RULC encompasses differences in real wage rates, labour productivity and exchange rates into a single measure of international competitiveness. Section 4 computes and analyses RULC for selected SSA countries vis-à-vis China. Section 5 discusses the implications of the competitiveness analysis for expanding SSA exports of labour-intensive goods.

2 CHINA–AFRICA TRADE IN MANUFACTURING

2.1 Overview

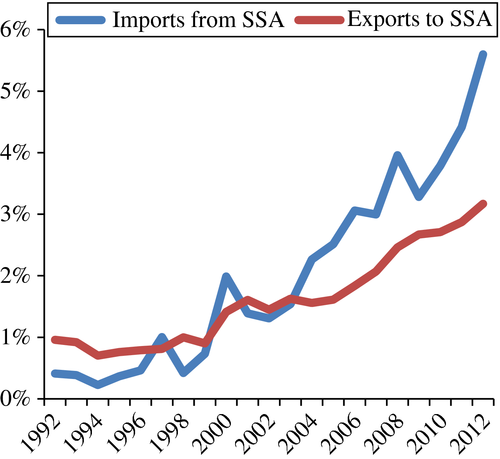

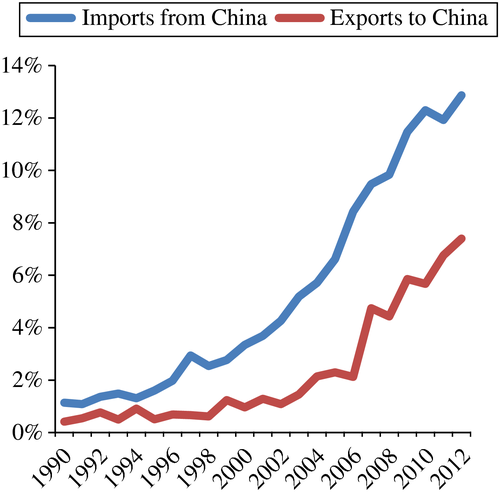

Trade and investment between China and SSA took off after the liberalisation era in China, accelerating in the 2000s (Ademola, Bankole, & Adewuyi, 2009; Broadman, 2007; Li, 2005; Lyons & Brown, 2010; Sautman & Hairong, 2007; Zafar, 2007). Figures 1 and 2 illustrate the rapid growth of this bilateral trade from China's and SSA's perspectives, respectively.1 Bilateral trade has grown faster for both China and SSA than their trade with the rest of the world, although it still remains quite small as a share of each economy's total trade. For China, trade with SSA has expanded from <1% of both exports and imports in the early 1990s to 3.2% of exports and 5.6% of imports in 2012. For SSA, trade with China grew even more strongly to 7.4% of its total exports and 12.9% of its total imports from about 1% each in the early 1990s. Thus, bilateral trade is more significant for SSA than China.

Source: Authors’ calculations using UN COMTRADE database.

[Colour figure can be viewed at wileyonlinelibrary.com]

Source: Authors’ calculations using UN COMTRADE database.

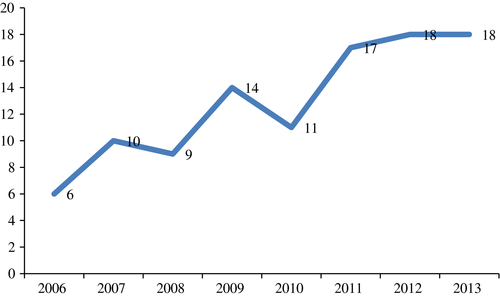

[Colour figure can be viewed at wileyonlinelibrary.com]Chinese foreign direct investment (FDI) in SSA has also increased rapidly. Data from the Heritage Foundation and American Enterprise Institute indicate it rose from $9 billion in 2006 to $29 billion in 2013. As Figure 3 shows, Chinese investment in SSA also became increasingly geographically diversified during this period.

Source: Authors’ calculations using data from the Heritage Foundation.

[Colour figure can be viewed at wileyonlinelibrary.com]2.2 Sectoral pattern of trade

Sub-Saharan Africa's bilateral trade is characterised by large compositional differences between its exports to and imports from China. The bulk of SSA's exports to China are primary products and China's reliance on Africa as a source of natural resources, particularly oil, increased in the 2000s (Alden & Alves, 2009; Kaplinsky, McCormick, & Morris, 2007). In contrast, Chinese exports to SSA mainly consist of light manufactures including clothing, footwear and plastic products, and heavy machinery, such as transport equipment (Haugen, 2011). These compositional differences have geographic implications. While a few countries account for a significant share of SSA's exports to China, reflecting the dominance of oil and minerals in China's bilateral import,2 Chinese exports to the region are less geographically concentrated.

To update and gain greater insight into the nature of this bilateral trade, this section presents trade flows between China and SSA using the International Trade Center's factor-intensity method (van Marrewijk & Hu, 2013; Maswana, 2011). Products are divided into five categories, primary products and four types of manufactured goods: natural resource-intensive products, unskilled labour-intensive products, human capital-intensive products and technology-intensive products. The individual products comprising each category are shown in the Appendix.

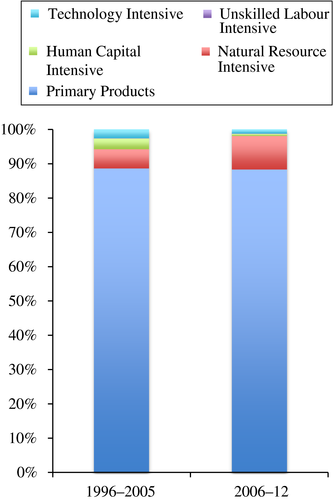

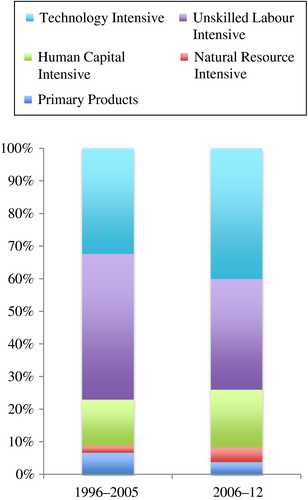

Figures 4 and 5 depict the composition of bilateral trade between China and SSA as a whole by factor intensity for 1996–2005 and 2006–12. SSA's bilateral exports consist overwhelmingly of primary products in both time periods (Figure 4). Moreover, the small share of manufactured exports has become increasingly concentrated in natural resource-intensive products, with the shares of technology-intensive and human capital-intensive products actually declining. Most significantly, SSA exports virtually no labour-intensive products to China. In contrast, SSA's imports from China are overwhelmingly manufactured goods, with a small and declining share of primary products (Figure 5). Reflecting China's rising sophistication in production, the shares of technology- and human capital-intensive products in China's exports to SSA have grown while those of unskilled labour-intensive products have declined.

Source: Authors’ calculations using UN COMTRADE database.

[Colour figure can be viewed at wileyonlinelibrary.com]

Source: Authors’ calculations using UN COMTRADE database.

[Colour figure can be viewed at wileyonlinelibrary.com]Table 1 shows bilateral Chinese trade with selected SSA countries and SSA as a whole, with and without South Africa, by product categories, as a share of each respective country or group's total bilateral trade with China. For all countries except South Africa, primary products account for the large majority of exports to China, with the share exceeding 90% in most cases and rising between 1999–2005 and 2006–12 (Table 1a). Kenya is a notable exception; its share of primary products fell to 71% from 89% over the two periods. Even Mauritius, the most successful exporter of manufactures in SSA, exports only primary products to China. Most SSA countries import little in the way of primary products from China.

| Exports | Imports | |||

|---|---|---|---|---|

| 1999–2005 | 2006–12 | 1999–2005 | 2006–12 | |

| a. Primary products | ||||

| Angola | 99.8 | 99.0 | 6.4 | 2.7 |

| Benin | 99.8 | 92.3 | 0.9 | 2.3 |

| Cameroon | 97.9 | 93.9 | 2.6 | 5.2 |

| Ethiopia | 75.3 | 90.3 | 0.8 | 0.8 |

| Ghana | 99.5 | 98.6 | 6.7 | 5.9 |

| Kenya | 89.5 | 70.8 | 1.6 | 1.2 |

| Nigeria | 99.0 | 95.6 | 2.2 | 3.8 |

| Mauritius | 98.3 | 99.3 | 15.0 | 13.1 |

| Senegal | 99.4 | 96.8 | 27.6 | 34.8 |

| South Africa | 38.1 | 61.5 | 7.0 | 3.6 |

| Tanzania | 99.0 | 90.8 | 3.4 | 1.0 |

| Total SSA | 85.1 | 84.7 | 6.7 | 3.8 |

| Total SSA less South Africa | 97.1 | 91.3 | 6.2 | 3.9 |

| b. Unskilled labour-intensive products | ||||

| Angola | 0.0 | 0.0 | 31.0 | 19.7 |

| Benin | 0.0 | 0.3 | 62.4 | 66.5 |

| Cameroon | 0.0 | 0.0 | 47.4 | 28.1 |

| Ethiopia | 0.7 | 0.6 | 30.8 | 12.8 |

| Ghana | 0.0 | 0.0 | 43.8 | 34.3 |

| Kenya | 1.1 | 0.4 | 46.8 | 35.9 |

| Nigeria | 0.1 | 0.0 | 30.9 | 16.2 |

| Mauritius | 0.3 | 0.4 | 55.1 | 57.7 |

| Senegal | 0.5 | 0.0 | 47.9 | 24.5 |

| South Africa | 0.2 | 0.0 | 46.0 | 38.6 |

| Tanzania | 0.0 | 0.2 | 38.1 | 34.0 |

| Total SSA | 0.1 | 0.1 | 44.6 | 33.9 |

| Total SSA less South Africa | 0.1 | 0.1 | 44.3 | 32.1 |

| c. Technology intensive | ||||

| Angola | 0.0 | 0.0 | 41.5 | 44.0 |

| Benin | 0.2 | 0.0 | 23.1 | 17.2 |

| Cameroon | 0.0 | 4.1 | 25.7 | 37.7 |

| Ethiopia | 0.0 | 0.1 | 46.2 | 64.7 |

| Ghana | 0.0 | 0.1 | 30.4 | 35.1 |

| Kenya | 2.9 | 10.6 | 33.3 | 39.5 |

| Nigeria | 0.3 | 1.3 | 44.6 | 50.1 |

| Mauritius | 1.2 | 0.2 | 12.7 | 13.0 |

| Senegal | 0.1 | 0.2 | 13.8 | 24.2 |

| South Africa | 10.3 | 3.3 | 32.7 | 40.2 |

| Tanzania | 0.6 | 1.6 | 37.6 | 39.2 |

| Total SSA | 2.5 | 1.2 | 32.4 | 40.1 |

| Total SSA less South Africa | 0.4 | 0.6 | 32.6 | 40.1 |

| d. Human capital intensive | ||||

| Angola | 0.0 | 0.0 | 16.3 | 22.1 |

| Benin | 0.0 | 0.0 | 13.0 | 12.8 |

| Cameroon | 0.0 | 0.1 | 19.9 | 21.9 |

| Ethiopia | 0.0 | 0.0 | 20.9 | 19.0 |

| Ghana | 0.0 | 0.1 | 16.3 | 20.4 |

| Kenya | 2.4 | 0.1 | 16.7 | 19.7 |

| Nigeria | 0.0 | 0.0 | 19.5 | 21.7 |

| Mauritius | 0.1 | 0.1 | 12.6 | 12.1 |

| Senegal | 0.0 | 0.0 | 8.8 | 12.4 |

| South Africa | 14.5 | 2.4 | 11.7 | 14.4 |

| Tanzania | 0.0 | 0.0 | 19.3 | 21.3 |

| Total SSA | 3.0 | 0.5 | 14.1 | 17.6 |

| Total SSA less South Africa | 0.1 | 0.0 | 14.9 | 18.8 |

| e. Natural resource intensive | ||||

| Angola | 0.4 | 8.1 | 4.8 | 11.5 |

| Benin | 0.2 | 0.9 | 0.5 | 1.2 |

| Cameroon | 2.6 | 5.7 | 4.4 | 7.1 |

| Ethiopia | 0.6 | 2.0 | 1.3 | 2.6 |

| Ghana | 1.2 | 3.8 | 2.7 | 4.2 |

| Kenya | 0.9 | 2.4 | 1.6 | 3.6 |

| Nigeria | 1.6 | 6.1 | 2.8 | 8.3 |

| Mauritius | 0.0 | 0.0 | 4.6 | 4.1 |

| Senegal | 0.5 | 3.6 | 2.0 | 4.1 |

| South Africa | 2.2 | 3.4 | 2.7 | 3.2 |

| Tanzania | 1.5 | 3.0 | 1.7 | 4.4 |

| Total SSA | 1.2 | 3.6 | 2.2 | 4.6 |

| Total SSA less South Africa | 1.0 | 3.7 | 2.0 | 5.1 |

- Source: Authors’ calculations using UN Comtrade database.

Table 1b reveals the large imbalance in labour-intensive goods. The share of labour-intensive goods in exports to China is negligible for all countries and a mere 0.1% for SSA as a whole, with and without South Africa. In contrast, imports of unskilled labour-intensive products were large for all countries shown, accounting for about 45% of SSA's total imports from China in 1999–2005 and 32% in 2006–12.3 Table 1c, d show the rising proportion of SSA's bilateral imports in the technology- and human capital-intensive categories and the low and generally declining shares of SSA exports to China in the same categories. South Africa experienced particularly large declines in both categories. Natural resource-intensive products constitute the only improving sector for SSA exports of manufactured goods to China, but these remain small for most countries and the largest increases are for Angola and Nigeria, consisting of petroleum products (Table 1e).

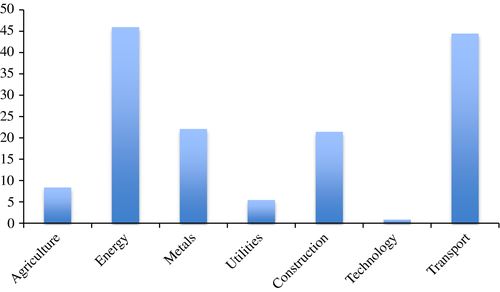

Chinese foreign investment is also heavily oriented towards primary products with energy and metals accounting for over half of the value of FDI inflows into SSA over 2006–14 (Figure 6). Infrastructure, particularly transport, is another important sector for Chinese FDI in the region. While there are some reports of increasing FDI in African manufacturing, these investments are small and oriented towards the domestic market (Shen, 2015), with the possible exception of Ethiopia (Dinh, Palmade, Chandra, & Cossar, 2012).

Source: Authors’ calculations using data from the Heritage Foundation.

[Colour figure can be viewed at wileyonlinelibrary.com]Some argue that China's trade is consistent with the Heckscher–Ohlin theory which predicts that bilateral trade depends on the relative factor abundance between trade partners. Proponents of this theory argue that the distinct composition of SSA–China bilateral trade reflects China's relatively scarce resource endowment and its comparative advantage in labour-intensive manufactures (Alden & Alves, 2009; Biggeri & Sanfilippo, 2009; van Marrewijk & Hu, 2013; Wang, 2007). Political and economic considerations can also coincide insofar as China's trade with Africa is seeking resource security (Alden & Alves, 2009).

Factor endowment-based explanations of SSA–China trade, however, are inconsistent with the fact that a significant number of sub-Saharan African countries have few natural resources and most countries have a large reservoir of underemployed workers with very low earnings (Golub & Hayat, 2015). From this perspective, imports of labour-intensive goods from China inhibit the growth of manufacturing in SSA (Giovannetti & Sanfilippo, 2009; Jenkins & Edwards, 2006). Thus, while Chinese demand for raw materials has benefited some SSA countries (Jacobs, 2012), the question remains why SSA is unable to compete with China in manufacturing despite rising wages in China and plenty of underemployed labour in SSA. To address this issue, we propose a framework based on RULC.

3 ASSESSING COMPETITIVENESS: RELATIVE UNIT LABOUR COSTS

3.1 Method

A country's international competitiveness in manufacturing depends on its costs of production relative to competitors. Relative unit labour costs are a useful metric of these relative production costs in manufacturing. The use of RULC as a measure of cost competitiveness focuses solely on labour costs and labour productivity. While other factors such as capital costs, energy costs, human capital, infrastructure, and institutional quality also matter, the RULC approach is less limiting than it may first appear. In a world where capital and intermediate inputs are mobile and production is footloose between countries, the relative costs of non-tradable inputs matter more for export competitiveness than the costs of tradable inputs such as capital and energy, which tend to be equalised internationally. Thus, low non-tradable input costs will be important factors in attracting footloose inputs, notably FDI and technology transfer (Golub, Jones, & Kierzkowski, 2007) and global buyers will tend to source from locations with low non-tradable costs. Because labour is the most important non-tradable input, particularly for labour-intensive goods, RULC provides a useful measure of competitiveness. By accounting for labour productivity, it is superior to international wage comparisons that commonly appear in policy and popular discussions of competitiveness. Infrastructure (electricity, transport and telecommunications) is also an important non-tradable input not explicitly considered in RULC calculations, but the quality and cost of infrastructure may be reflected partially in RULC measures through their impact on labour productivity. In part for these reasons, Turner and Van't Dack's (1993) and Turner and Golub's (1997) surveys of the literature conclude that RULC in manufacturing are the best single indicator of competitiveness. Hinkle and Nsengiyumba (1999) also endorse the use of ULCs, for analysis of both levels and rates of change of competitiveness.

In addition to its clear intuitive appeal, RULC is the key relative price in a Ricardian model of trade (Golub & Hsieh, 2000). Ferguson (1978) showed that in the presence of mobile capital, the Heckscher–Ohlin model takes on a Ricardian character, with comparative advantage depending only on ULC. Jones (2016) provides empirical support for the argument that capital stocks play a rather small part in explaining international differences in total factor productivity. In particular, his estimates show that labour productivity and total factor productivity are much higher in China than Malawi and Kenya but that the capital–output ratio of these two African countries is very close to China's.4

Notwithstanding these several advantages, it should be kept in mind that RULC do not capture all aspects of international cost competitiveness. In particular, as discussed in the concluding section, the overall business climate is also very important.

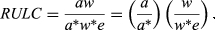

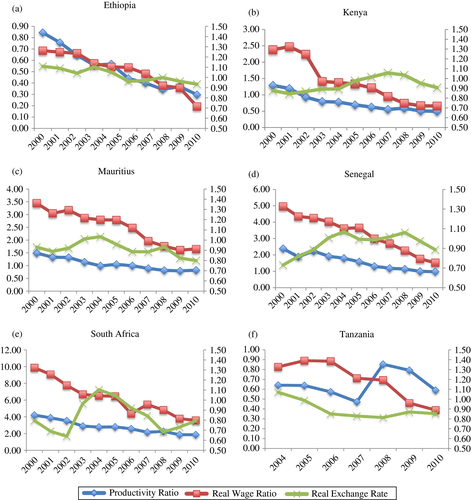

(1)

(1) (2)

(2)The last expression in Equation 2 shows that RULC can be decomposed into relative productivity and relative wages measured in a common currency. The home country will have a competitive advantage in manufacturing when RULC < 1, that is, its ULCs are below those of its trading partners.

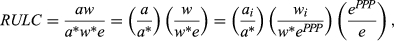

(3)

(3) (4)

(4)A country's competitiveness vis-à-vis other countries depends on the three terms in Equation 4: (i) labour productivity in the home country relative to other countries; (ii) real labour compensation in the home country relative to those of other countries;5 and (iii) the level of the bilateral exchange rate relative to its PPP level or, equivalently, the real bilateral exchange rate. Gains or losses in a country's competitive position over time can originate with changes in any of these ratios.

3.2 Data

Our measures of SSA–China RULC are constructed in two steps. We first construct RULCs for individual SSA countries and China relative to the United States. We then compare the RULCs for individual SSA countries to the RULC for China to assess their competitiveness in manufacturing relative to China. These calculations require data for manufacturing productivity and wages, as well as exchange rates. Productivity is calculated as manufacturing value added per employee, deflated by a manufacturing value-added deflator and converted to US dollars at an equilibrium or purchasing power parity exchange (PPP) rate. Wages are defined as total labour compensation per employee, converted to dollars at the market exchange rate. As is accepted in the literature on international labour productivity and unit labour cost comparisons, PPP exchange rates are used for international productivity comparisons to eliminate the effects of exchange-rate volatility on measures of real output, which should be invariant to such exchange-rate fluctuations. But deviations of exchange rates from PPP do affect relative labour costs, so it is appropriate to use the market exchange rate in converting wages. Currency depreciation consequently tends to improve international competitiveness by reducing labour costs relative to labour productivity.

The primary data source for manufacturing productivity and wages is the UNIDO Industrial Statistics database (INSTAT). INSTAT reports nominal value-added, labour compensation and employment to 2010 for various countries, including China and a limited number of African countries. The INSTAT data were supplemented with national data for the United States and Senegal. The series for nominal value added in manufacturing were converted to real terms by deflating them by manufacturing value-added deflators derived from measures of nominal and real manufacturing value added reported in the World Bank's World Development Indicators.6 Two sources are used for PPP exchange rates: the International Comparison Project (ICP) PPPs for traded goods, and the University of Groningen manufacturing PPPs. While manufacturing-specific PPPs are ideal and are available for China, they are not available for most SSA countries, with the exception of South Africa.

4 AFRICAN RELATIVE UNIT LABOUR COSTS VIS-À-VIS CHINA

This section compares manufacturing productivity, wages and unit labour costs in selected SSA countries to China.7 Some initial insights into SSA's competitiveness in manufacturing emerge from a comparison of manufacturing wages to per capita GDP. Per capita GDP can be taken as an indicator of a country's overall productivity level. In comparison with a number of other countries, manufacturing wages are very high in SSA relative to per capita GDP (Table 2). In 2010, most Asian countries, including China, had ratios of manufacturing wages to per capita GDP at or below 1.0. That is, average annual manufacturing wages are roughly equal to per capita income in most Asian countries. The same is true in Eastern Europe and Latin America. In SSA, however, wages are typically several times per capita GDP. The only exception is Mauritius and to a lesser extent South Africa. The ratio of wages to per capita GDP fell in SSA since 2000 but remained very high as of 2010.

| 2000 | 2010 | |||

|---|---|---|---|---|

| Level in US$ | Relative to per capita GDP | Level in US$ | Relative to per capita GDP | |

| Sub-Saharan Africa | ||||

| Burundi | NA | NA | 3,261 | 14.9 |

| Cameroon | 3,088 | 5.3 | NA | NA |

| Ethiopia | 771 | 6.3 | 807 | 2.4 |

| Ghana | 1,832 | 4.9 | NA | NA |

| Kenya | 2,118 | 5.2 | 2,854 | 3.6 |

| Malawi | 436 | 2.8 | 2,045 | 5.7 |

| Mauritius | 3,254 | 0.8 | 6,285 | 0.8 |

| Senegal | 3,680 | 7.8 | 6,450 | 6.5 |

| South Africa | 7,981 | 2.6 | 12,331 | 1.7 |

| Tanzania | 2,296 | 7.5 | 1,581 | 3.0 |

| North Africa | ||||

| Egypt | 2,028 | 1.3 | 3,453 | 1.2 |

| Morocco | 4,123 | 3.2 | 6,654 | 2.4 |

| Tunisia | 4,066 | 1.8 | 5,455 | 1.3 |

| Latin America | ||||

| Brazil | 5,822 | 1.6 | 10,918 | 1.0 |

| Colombia | 4,096 | 1.6 | 4,680 | 0.8 |

| Mexico | 8,048 | 1.2 | 7,310 | 0.8 |

| Asia | ||||

| Bangladesh | NA | NA | 680 | 1.6 |

| China | 1,016 | 1.1 | 4,770 | 1.1 |

| India | 1,356 | 3.0 | 2,619 | 1.8 |

| Indonesia | 929 | 1.2 | 1,897 | 0.6 |

| Malaysia | 4,405 | 1.1 | 6,548 | 0.7 |

| Vietnam | NA | NA | 1,727 | 1.3 |

| Eastern Europe | ||||

| Czech Rep. | 3,964 | 0.7 | 12,673 | 0.7 |

| Latvia | 3,689 | 1.1 | 9,191 | 0.8 |

| Poland | 5,829 | 1.1 | 10,162 | 0.8 |

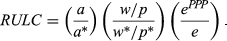

Table 3 and Figure 7 compare the ULCs in manufacturing of individual SSA countries to Chinese ULCs. Two sets of RULC measures are shown based on the two alternative estimates of PPP exchange rates.8 The first set, labelled ICP-based, is based on tradable-goods PPPs (exports and imports) from the ICP. The second set of estimates, labelled ICOP-based, uses manufacturing PPP values derived from the University of Groningen International Comparison of Output and Productivity (ICOP) project for those countries for which such data are available (China and South Africa), and the ICP traded goods values for other countries. The higher values in the second set of estimates are mainly due to the fact that the China–US PPP exchange rate in ICOP is considerably lower than that of ICP.

| ICP-based measures | ICOP-based measures | |

|---|---|---|

| Ethiopia | 0.61 | 1.01 |

| Kenya | 1.21 | 2.01 |

| Malawi | 1.75 | 2.92 |

| Mauritius | 1.61 | 2.68 |

| Senegal | 1.38 | 2.30 |

| South Africa | 1.52 | 3.01 |

| Tanzania | 0.56 | 0.94 |

Note

- RULC > 1.0 means African countries have higher unit labour costs than China.

In both sets of estimates, RULCs with respect to China were very high in key SSA countries in the early 2000s (Figure 7). They have dropped for all countries since then but nevertheless remained high for most countries in 2010. Most countries’ RULC were above 1.0 in 2010, indicating their ULCs in manufacturing exceeded those in China. Ethiopia and Tanzania are exceptions. As of 2010, ULCs for Ethiopia and Tanzania were at rough parity with China according to the ICOP-based measures and were substantially below China's according to the ICP-based measures (Table 3).

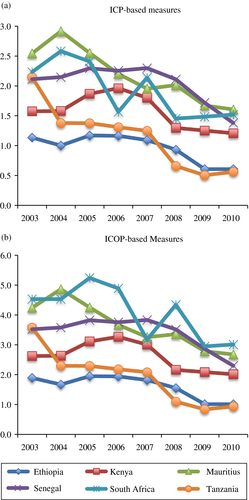

Table 4 breaks down the improvement in RULCs for SSA into Chinese and SSA real wage and productivity growth and real exchange-rate movements over 2000–10. Chinese productivity and wages both grew strongly, with wage growth outpacing productivity and pushing up Chinese ULCs. Manufacturing productivity growth in the SSA economies was slower than China's, substantially so in most cases. However, real wage growth in the SSA economies was even slower, pushing down ULCs. In a nutshell, the improvement in SSA's manufacturing competitiveness reflects both rising Chinese ULCs and productivity growth in SSA countries that outpaced wages. Figures 8a–f plot the factors underpinning the bilateral RULC levels vis-à-vis China over 2000–10: relative productivity, real wages and the real bilateral exchange rate of our sample of SSA countries relative to China. These figures show that relative real wages and relative productivity in the SSA countries are both high and generally declining, with relative real wages exceeding relative productivity in most cases. There is no clear trend for the real bilateral exchanges rate between the SSA countries and China over 2000–10. However, exchange-rate changes contributed to falling RULCs for Ethiopia, Mauritius, and Tanzania; these countries all experienced real appreciations that were smaller than the real appreciation of China's currency, effectively resulting in a real depreciation against the renminbi (Table 4). Overall, wage moderation in domestic currency—rather than productivity growth or real exchange-rate depreciation—is the main reason for improving competitiveness of the six African countries. Sustained improvements in African competitiveness accompanied by rising living standards will depend on boosting productivity growth, as China has done.

| Productivity growth | Real wage growth | Real appreciation vis-à-vis US dollar | Relative unit labour cost vis-à-vis USA | Relative unit labour cost vis-à-vis China | |

|---|---|---|---|---|---|

| China | 11.7 | 12.9 | 4.7 | 7.8 | NA |

| Ethiopia | 0.2 | −1.3 | 2.5 | 2.2 | −5.6 |

| Kenya | 1.5 | −0.7 | 5.0 | 4.7 | −3.1 |

| Mauritius | 5.2 | 4.8 | 3.1 | 4.7 | −3.1 |

| Senegal | 2.2 | 0.3 | 6.7 | 6.8 | −1.0 |

| South Africa | 3.0 | 2.0 | 4.6 | 5.6 | −2.2 |

| Tanzania | 8.4 | 0.6 | 1.8 | −4.2 | −12.0 |

- Source: Authors’ calculations using UNIDO INSTAT database.

Several key findings emerge from this analysis. First, manufacturing wages in SSA are very high relative to per capita GDP. Second, until recently, real wages and productivity in SSA manufacturing have both been well above China's levels, with the real wage differential exceeding the productivity differential. Consequently, ULCs in our sample of SSA economies have been significantly higher than in China. These high labour costs have harmed African competitiveness and explain in part Africa's failure to develop labour-intensive manufacturing. Third, the growth of real wages and productivity in SSA manufacturing has lagged the growth in their Chinese counterparts in recent years. Fourth, relative real wages dropped more rapidly than relative productivity for our sample of SSA countries, boosting their competitiveness vis-à-vis China. Unit labour costs in some countries (Ethiopia and Tanzania) fell to or even below China's levels in 2010. For other SSA countries, however, RULC remained high.

While the focus of this paper is on China–Africa bilateral competitiveness, we also examined Africa's competitiveness vis-à-vis other emerging economies. Table 5 shows wages, productivity and ULCs in 2010 for the African countries in the sample, China, some other Asian developing countries (Bangladesh, India and Indonesia) and two important Latin American emerging countries (Brazil and Mexico). All of these figures are relative to the United States, for ease of comparison across multiple countries. The other Asian countries have RULC that are quite similar to China's. In fact, India and Indonesia had lower relative unit costs than China in 2010. In the case of Latin America, Mexico has low RULC, well below those of most African countries, whereas Brazil has high RULC similar in magnitude to those of most of the African countries. Thus, the finding that most African ULCs are relatively high holds for other comparator countries in Table 5, especially India. The exception, Brazil, is not known as an exporter of labour-intensive manufactured goods.

| Productivity | Wages | Unit labour cost | |

|---|---|---|---|

| Africa | |||

| Ethiopia | 0.03 | 0.02 | 0.53 |

| Kenya | 0.05 | 0.06 | 1.23 |

| Malawi | 0.03 | 0.05 | 1.79 |

| Mauritius | 0.09 | 0.14 | 1.64 |

| Senegal | 0.10 | 0.15 | 1.41 |

| South Africa | 0.18 | 0.28 | 1.56 |

| Tanzania | 0.06 | 0.04 | 0.57 |

| Asia | |||

| Bangladesh | 0.02 | 0.02 | 0.70 |

| China | 0.18 | 0.11 | 0.61 |

| India | 0.12 | 0.06 | 0.50 |

| Indonesia | 0.08 | 0.04 | 0.55 |

| Latin America | |||

| Brazil | 0.13 | 0.25 | 1.92 |

| Mexico | 0.19 | 0.17 | 0.88 |

- Source: Authors’ calculations using UNIDO INSTAT database.

High ULCs are not the only reason for Africa's lack of competitiveness in manufacturing. The general business environment also matters. African countries tend to perform poorly in comparisons of the quality of infrastructure, corruption and institutional quality more generally (Eifert, Gelb, & Ramachandran, 2008; Golub, O'Connell, & Du, 2008). In Ethiopia and Tanzania, the two countries with favourable ULCs, power outages are frequent, roads are of poor quality, and ports are slow to process containers (Golub & Hayat, 2015).

5 CONCLUSIONS AND POLICY IMPLICATIONS

Economic growth in SSA has improved but has been substantially based on capital-intensive sectors such as minerals and telecommunications, with consequent limited growth of formal-sector employment. This contrasts with Asia's reliance on labour-intensive manufacturing exports, which have boosted employment and contributed dramatically to poverty reduction. China in particular has become a dominant exporter of manufactured goods, and the composition of its bilateral trade with SSA is highly skewed towards exports of manufactures and imports of minerals. In recent years, however, Chinese wages have been rising rapidly and outpacing productivity growth, reducing China's competitive advantage in manufacturing and opening the door to inroads by lower-income countries, including those in SSA.

We show that SSA's international competitiveness has improved but remains largely unfavourable relative to China, as measured by RULC. Real wages in sub-Saharan African formal manufacturing are very high relative to per capita income. High real wages in formal manufacturing reduce competitiveness in labour-intensive manufacturing. Poor infrastructure and weak institutions also adversely affect the business environment for foreign investment. Low-income Asian countries have so far shown a greater ability to enter into the global market for labour-intensive manufactures than sub-Saharan countries. Given new Asian competitors and China's continued dominant presence, the possibilities for Africa to compete in low-skill manufacturing are not encouraging, despite some progress in a few countries such as Ethiopia (Dinh et al., 2012).

Instead, African countries may have greater potential to boost labour-intensive exports in other sectors, especially agriculture, including traditional primary products, horticulture and fishing (Golub et al., 2008). Agricultural exports share many of the features of manufacturing, both in terms of their potential to spur growth and employment, and the institutional constraints they face in achieving this potential. Several critical aspects of manufacturing exports that promote development and poverty reduction apply to traditional and non-traditional agriculture. These include high labour intensity, possibilities for technological upgrading and consequently raising producer incomes, and access to state-of-the-art foreign technology through FDI and outsourcing. But they also include the necessity of attaining international competitiveness and thus the critical roles of low-cost labour and a favourable climate for investment. For agriculture, especially, sanitary and phyto-sanitary norms in developed-country, markets are a major hurdle for successful exporting (Golub & McManus, 2009; Mbaye & Gueye, 2014), analogous to the demanding specifications of global buyers of manufactures. SSA's success in exporting labour-intensive products, in agriculture as in manufacturing, hinges on improving the business climate and boosting competitiveness through increased labour productivity and wage moderation.

ACKNOWLEDGEMENT

The authors thank Haroon Bhorat and the University of Cape Town's Development Policy Research Unit (DPRU) for inviting and funding this contribution and participants in the conference on China in Africa in November 2014 sponsored by DPRU for comments.

NOTES

APPENDIX A

DEFINITION OF PRODUCT GROUPS

| Group | Constituents | SITC codes |

|---|---|---|

| Primary products | Food, beverages, minerals, crude oil, animal and vegetable oils | 0, 1, 2, 32, 333, 34, 35, 4 |

| Natural resource intensive | Leather manufactures, lime, cement, clay, mineral manufactures, precious stones, pig iron, non-ferrous metals | 61, 63, 661, 662, 663, 667, 671, 68 |

| Human capital intensive | Dyeing materials, essential oils, rubber manufactures, steel ingots, telecommunications equipment, photographic apparatus, watches | 53, 55, 62, 672, 673, 674, 675, 676.677, 678, 679, 69, 761, 762, 73, 885, 894, 895, 896, 897, 898, 899 |

| Unskilled labour intensive | Textile yarn, glass, prefabricated buildings, plumbing, heating, furniture, travel goods, apparel, footwear | 65, 664, 665, 666, 81, 82, 83, 84, 85, 894, 895 |

| Technology intensive | Organic and inorganic chemicals, fertilisers, plastics | 51, 52, 54, 56, 57, 58, 59, 71, 72, 73, 7475, 764, 77, 792, 87, 881, 882, 883, 884, 892, 893 |