Invoicing Currency in International Trade: An Empirical Investigation and Some Implications for the Renminbi

Abstract

To play the role of a unit of account, an international currency must be a currency widely used to invoice international trade. This paper investigates the determinants of the use of currencies in trade invoicing and evaluates the potential of the renminbi for the denomination of cross-border transactions in the Asia-Pacific region. In particular, we develop a simple model and establish the evidence showing that there is a convex relationship between the invoicing share of a currency and the economic size of its issuing country because of a coalescing effect and thick market externalities. We use the ratio of the foreign exchange (FX) turnover share of a currency to the global GDP share of its issuing country as a proxy for the size of thick market externalities, which we argue reflects capital account openness, financial development and exchange rate stability of the country. This ratio is very small for the renminbi compared with the ratios for established international currencies. Our quantitative analysis suggests that the renminbi can be a major invoicing currency in the region only if China sufficiently opens up its capital account and liberalises its financial sector. We also draw a parallel between the renminbi and the euro and forecast the invoicing share of the renminbi in the Asia-Pacific region if the renminbi market attained the same degree of thickness as the euro.

1 Introduction

What determines the use of a currency in the invoicing of international trade? This question is non-trivial for the management of exchange rate risk at the firm level, but also has important implications for the transmission of macroeconomic shocks across economies, especially in the form of exchange rate pass-through. There are by and large three major functions of an international currency: a unit of account (for trade invoicing, denomination of financial products and exchange rate pegging), a medium of exchange (for settlement of trade and financial transactions, and foreign exchange (FX) market interventions) and a store of value (for saving and reserve holding). Reflecting its role as a unit of account, an international currency must be widely used to invoice cross-border trade transactions. Understanding the potential of a currency to be an invoicing currency will help shed light on the extent to which it can be used as an investment currency or a reserve currency, as the three functions are all related. The acceptance for trade invoicing is an essential dimension of the international status of a currency.

This question has become more relevant in recent years as the renminbi has been increasingly used outside of China, especially in the Asia-Pacific region, an immediate neighbour and close trading partner of China. The internationalisation of the renminbi was put on the policy agenda by the Chinese authorities in the aftermath of the global financial crisis of 2007–2009 (Chen and Cheung, 2011; Eichengreen, 2011; Ito, 2011; McCauley, 2011; Frankel, 2012; He, 2012; Yu, 2012). Since then, the restrictions against the use of the renminbi in current account transactions have been removed, and the scope for the use of the renminbi in capital account transactions has been gradually expanded.

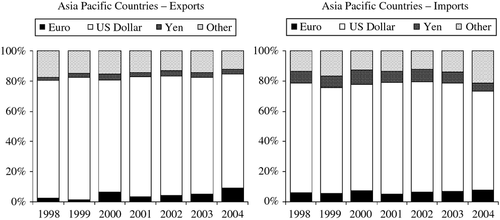

Figure 1 shows an obvious and steep upward trend in the share of China's cross-border trade settled in the renminbi, from almost zero in 2009 to 16.6 per cent in the first three quarters of 2013. Of all renminbi-settled trade, however, only about 56 per cent was invoiced in the renminbi in 2012 (Li, 2013). There is empirical evidence that, in general, the currency used in invoicing is also the one used in actual payment (Friberg and Wilander, 2008). Thus, this disparity between settlement and invoicing is largely unique for the renminbi, showing that the government policy works in promoting renminbi settlement, but the market is still hesitant to use the renminbi as an invoicing currency.1 To put the scale of renminbi invoicing in perspective, consider the following figures (latest, to the best of our knowledge): about 99.8 per cent of the US exports and 92.8 per cent of the imports were invoiced in the dollar in 2003 (Goldberg and Tille, 2008), while 62.5 per cent of exports and 49 per cent of imports were invoiced in the euro in extra-euro area goods transactions of euro area countries in 2012 (ECB, 2013). Therefore, the share of the Chinese currency in invoicing China trade is small compared with the corresponding shares of US$ and euro in invoicing American and Eurozone trade, respectively. Moreover, when China is not involved in the trade, the use of the renminbi as a vehicle currency for trade invoicing would be much less. In contrast, the dollar as the primary vehicle currency accounts for a dominating share in the Asia-Pacific region and even in the euro area, and other established currencies also play non-trivial roles (Figures 2 and 3).

- Data Source: People's Bank of China.

- Source: Kamps (2006).

- Source: Kamps (2006).

In short, the actual use of the renminbi as an invoicing currency remains very limited and seems to fall behind the overall progress in the internationalisation of the renminbi. It is therefore important to understand prospects for the renminbi as a major invoicing currency, at least in the Asia-Pacific region, and the factors that could impede the realisation of its potential.

Any research in this area is, however, constrained by the availability of data on invoicing behaviour. Because of the lack of historical data on renminbi invoicing, we cannot make predictions based on its past trend. The best we can do is to use the experience of some major currencies to benchmark the potential role of the renminbi under comparable economic and institutional conditions.2 Fortunately, we are able to construct two data sets that allow us to pursue this line of analysis.

We approach this problem from two angles. First, we focus on one country, namely Thailand, and investigate the determinants of the invoicing share of different currencies when it trades with various partner countries. Second, we focus on one currency, namely the euro, and investigate the determinants of its invoicing share in trade of various countries. We use empirical models estimated from these two types of regression analysis to gauge the extent to which the currency of interest, the renminbi, will be used to invoice international trade in the Asia-Pacific region, considering (i) the potential invoicing share of the renminbi in the trade of Thailand with China and ASEAN economies, and (ii) the projected use of the renminbi in invoicing the trade of Asia-Pacific countries such as Australia, the ASEAN countries and South Korea.

The above two methods address different aspects of the question of interest, but results are largely consistent with each other. The choice of Thailand is determined by the availability of the data as well as its relevance for the expansion of the cross-border use of the renminbi. As a typical Southeast Asian country, Thailand has close economic ties with China. China is now the largest trading partner of Thailand with a share of 12 per cent and 15 per cent in the total exports and imports, respectively, of Thailand in 2012. On the other hand, the choice of the euro is determined by the availability of the data as well as similarities with the renminbi as it emerged as a competitor with the dollar in Europe and its neighbouring regions. Interested in finding whether there is any historical experience of a currency that resembles the circumstances of the renminbi today, we think that the euro may be a good example. The euro was a new currency that emerged in the late 1990s, just like the renminbi is an emerging currency today. The circumstances in which the euro found itself then were somewhat like those for the renminbi today, that is, aspiring to be a regional currency that challenges the incumbent currency, the US dollar. While the euro challenged the dominance of the dollar in Europe, the renminbi may challenge the dollar in Asia.

We emphasise that we are estimating the potential of the renminbi conditional on it having comparable conditions as the reference currencies. In particular, we develop a simple theory for the determination of an invoicing currency, which implies a convex relationship between the invoicing share of a currency and the economic size of its issuing country. In our framework, it is the coalescing effect and thick market externalities that give rise to this convex relationship. We call this the ‘tipping phenomenon’ in invoicing currency and argue that thick market externalities can be attributed to the degree of capital account openness and financial market maturity of the issuing country. Our analysis of the Thai data finds some evidence of the tipping phenomenon and shows that the convexity between the invoicing share and the economic size is partly due to the size of thick market externalities, which is proxied by the ratio of FX turnover share of a currency to the GDP share of the issuing country (hereafter referred to as the FX-share-GDP-share ratio). This ratio is very small for the renminbi relative to the established currencies, such as the US dollar, euro, Japanese yen and pound sterling, reflecting the lack of capital account openness and immaturity of the financial sector in China. Our analysis of the euro data focuses only on one currency and hence cannot explicitly test the tipping phenomenon. Guided by our theory with the coalescing effect and thick market externalities, our empirical assessment of the renminbi's potential is conducted under the assumption of comparable capital mobility and well-functioning financial markets as in the euro area. To some extent, these estimates represent an upper bound of the renminbi's potential.

Taken together, our empirical estimates consistently suggest that the renminbi has the potential to become a major invoicing currency in the Asia-Pacific region. However, to arrive at the ‘tipping point’, China has to establish a market thickness for the renminbi comparable to that of established currencies. In other words, China needs to sufficiently open up its capital account and liberalise its financial sector to fully materialise the potential of the renminbi as an international invoicing currency.

2 Some Background Literature

There is a rich economic literature on the factors that determine the emergence of an international invoicing currency. Instead of carrying out a comprehensive survey, we provide a brief discussion on the two important forces behind our theoretical model in the context of the present paper.

Studying the currency denomination of international trade, Bacchetta and van Wincoop (2005) and Goldberg and Tille (2008) focus on the ‘unit of account’ function of money. In particular, Goldberg and Tille (2008) argue that exporting firms have the incentive to mimic the choice of invoicing currency of their competitors in the same market so as to minimise price volatility and maximise profits. They call this ‘coalescing effect’ and use it to explain why there is one single vehicle currency used in the world to invoice homogeneous commodities such as oil.3

Another reason why countries converge to using one single currency for trade invoicing is network externalities. Matsuyama et al. (1993) and Rey (2001) focus on the ‘medium of exchange’ function of money and conclude that ‘thick market externalities’ are very important in the making of a vehicle currency. As firms have an incentive to adopt the currency used by a majority of firms, once a currency becomes sufficiently widely used, its role as a vehicle currency is self-justifying. Following Kindleberger (1981), Krugman (1984) draws an analogy between money and language. He argues that what makes English the world's lingua franca is not its simplicity or internal beauty, but its wide use. As a language becomes more widely used, it is more attractive for outsiders to use it as well, as they can use it to communicate with more people in the world. Likewise, a firm is more willing to use a currency for invoicing if other firms are already using it.

A currency with strong network externalities usually possesses a few competitive advantages over other currencies, such as lower transaction costs, higher degree of convertibility, more open financial asset transaction and accessible financial services offered. The network externalities become self-enforcing as more firms use that currency for invoicing. In other words, as more firms use that currency for invoicing, its network externalities increase, which, in turn, enhances the attractiveness of the currency as an invoicing currency.

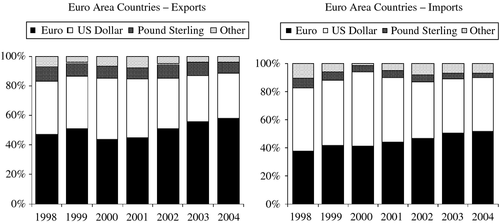

The self-reinforcing mechanism may also be applied to the adoption of a reserve currency. Chinn and Frankel (2007, p. 291) find that there is a statistically significant nonlinear relationship between the currency share in official reserves and the GDP share of issuing countries. They call this the ‘tipping phenomenon’: ‘if one currency were to draw even and surpass another, the derivative of reserve currency use with respect to its determining variables (e.g. GDP share) would be higher in that range than in the vicinity of zero or in the range when the leading currency is unchallenged’. This point is demonstrated in Figure 4, which is borrowed from Chen et al. (2009). In this figure, the panel data points of the reserve currency share are plotted against the GDP share of the issuing country, for the US dollar, euro, Japanese yen and pound sterling for the period of 1999–2008. There is clearly a convex relationship between the two variables.

- Source: Chen et al. (2009).

In this paper, we develop a simple model showing how the coalescing effect and thick market externalities work together to give rise to a convex relationship between the invoicing share of a currency and the economic size of the issuing country. Our empirical tests and evaluation of the renminbi's potential as a major invoicing currency in the Asia-Pacific region are carried out based on this theory.

3 A Simple Theory

3.1 Coalescing Effect with No Thick Market Externalities

To begin, let us denote a country by capital letter (e.g. J) and its currency by the lower case (e.g. j). Suppose there are many firms in each country, each selling a good to many different countries. Each firm chooses an invoicing currency in each market so as to maximise its profits. We assume that the unit of account is also the medium of exchange, so that the invoicing currency is also the settlement currency. A Nash equilibrium is then a set of invoicing strategies such that each firm has no incentive to change its invoicing currency in each market given the invoicing currencies chosen by its competitors in each market.

Due to the coalescing effect, a firm has an incentive to choose the same invoicing currency as its competitors to reduce output volatility and maximise profits. As a country grows larger relative to the rest of the world, firms have higher tendency to invoice in the country's currency so as to compete with local producers. As proved by Lai and Zhou (2012), the coalescing effect implies that the invoicing share of a currency increases at an increasing rate with the GDP share of the issuing country when the GDP share is sufficiently small.

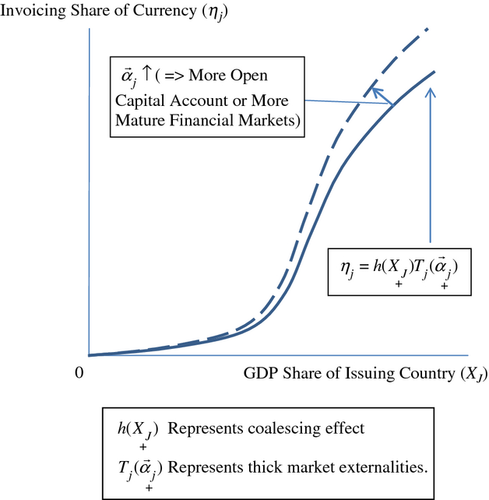

Let ηj denote the global invoicing share of currency j and let Xj denote the GDP share of country j. Use function ηj = h(Xj) to describe the relation between the two variables. Then, we have the following:

Proposition 1.In the presence of the coalescing effect in invoicing behaviour, h′(Xj) > 0 for any Xj ∈ [0, 1], and h′′(Xj) > 0 when Xj is sufficiently small.

The proof of Proposition 1 can be found in Lai and Zhou (2012). The proposition shows that the currency of a larger country has a higher global invoicing share; moreover, the global invoicing share of a currency increases at an increasing rate with the GDP share of the country when the latter is small. In other words, there is a convex relationship between the GDP share of the issuing country and the invoicing share of its currency for emerging economies.

3.2 Coalescing Effect with Thick Market Externalities

denote a vector that captures the degree of convertibility of j, the depth and breadth of the financial markets of country J and all other factors that enhance currency j's functioning as an international currency. When financial markets are allowed to operate more freely, all components of

denote a vector that captures the degree of convertibility of j, the depth and breadth of the financial markets of country J and all other factors that enhance currency j's functioning as an international currency. When financial markets are allowed to operate more freely, all components of  will be larger. For example, when there is relaxation of capital controls and financial market liberalisation, components of

will be larger. For example, when there is relaxation of capital controls and financial market liberalisation, components of  become larger. We summarise this effect by assuming that:

become larger. We summarise this effect by assuming that:

In the setting outlined above, the positive effect of the GDP share on the invoicing share is reinforced by a thicker market for the currency. We can further show the following result:

Proposition 2.In the presence of both the coalescing effect and thick market externalities in determining invoicing behaviour,

capturing the coalescing effect and thick market externalities, respectively. Then,

capturing the coalescing effect and thick market externalities, respectively. Then,  for any

for any  , and

, and  when XJ is small. Moreover, since

when XJ is small. Moreover, since  ,

,  .

.

The idea of Proposition 2 is illustrated in Figure 5. The solid curve shows the relationship between the invoicing share of an emerging currency j and the GDP share of its issuing country J when the vector  is given, that is, when the degree of financial development and capital account openness are given. The dotted curve shows how the solid curve shifts when both financial development and capital account openness increase.

is given, that is, when the degree of financial development and capital account openness are given. The dotted curve shows how the solid curve shifts when both financial development and capital account openness increase.

3.3 Tipping Phenomenon

Empirically, we proxy thick market externalities Tj by the ratio of the FX turnover share of j to the GDP share of J. As shown in Table 1, we find that there is a positive correlation between this FX-share-GDP-share ratio and the GDP share of J. Our interpretation is that financial development, capital account liberalisation and the degree of currency convertibility all increase in the GDP share, that is,  . Moreover, this is consistent with historical experience: that the financial development of the major economies of the world deepened as their global importance increased.

. Moreover, this is consistent with historical experience: that the financial development of the major economies of the world deepened as their global importance increased.

| 1998 | 2001 | 2004 | 2007 | 2010 | 2013 | |

|---|---|---|---|---|---|---|

| Correlation | 0.261 | 0.280 | 0.301 | 0.312 | 0.294 | 0.429 |

Notes

- The GDP data are not yet available for 2013 when we wrote this paper. Given that GDP share changes only slowly, we use 2012 GDP share as a proxy when computing the correlation in the last column.

- Data Source: BIS, World Bank.

An important implication of Proposition 2 is that the presence of thick market externalities, coupled with the fact that financial development is positively correlated with the relative size of an economy (i.e.  ), leads to a convex relationship between invoicing share ηj and GDP share Xj. That is, we can see that

), leads to a convex relationship between invoicing share ηj and GDP share Xj. That is, we can see that  even without controlling for

even without controlling for  .

.

Back to Figure 5,  implies that as country J’s GDP share increases,

implies that as country J’s GDP share increases,  also increases, and hence, its invoicing curve also shifts up. Suppose we start from the origin 0 of the diagram. Then, as Xj increases, ηj increases, not only because there is movement along the solid curve, but also because there is a shift of the curve. The first effect is the coalescing effect, while the second effect is the effect of thick market externalities.

also increases, and hence, its invoicing curve also shifts up. Suppose we start from the origin 0 of the diagram. Then, as Xj increases, ηj increases, not only because there is movement along the solid curve, but also because there is a shift of the curve. The first effect is the coalescing effect, while the second effect is the effect of thick market externalities.

The convexity of ηj in Xj is a manifestation of the tipping phenomenon. In Section 3a, we argued that  for small XJ when controlling for

for small XJ when controlling for  , because of the coalescing effect. When thick market externalities are also present, we expect the magnitude of

, because of the coalescing effect. When thick market externalities are also present, we expect the magnitude of  to become larger, as

to become larger, as  , and

, and  . Thus, the tipping phenomenon can be due to both the coalescing effect and thick market externalities. How strong these effects are is an empirical question. In the empirical analysis presented below, we will show that the lack of thick market externalities can lead to rather serious underuse of a currency as an invoicing currency.

. Thus, the tipping phenomenon can be due to both the coalescing effect and thick market externalities. How strong these effects are is an empirical question. In the empirical analysis presented below, we will show that the lack of thick market externalities can lead to rather serious underuse of a currency as an invoicing currency.

4 Empirical Evidence

In this section, we investigate the determinants of the use of invoicing currencies guided by the model outlined above. For an empirical study of invoicing behaviour, data limitation is a major constraint. We approach this problem from two perspectives: The first considers the determinants of the invoicing share of different currencies in a country's trade with its partners, while the second examines the determinants of the use of one currency in the trade of various countries. We use a data set from the Bank of Thailand for the first analysis and a data set on the euro for the second.

4.1 Fixing Country and Varying Currencies: Determinants of Invoicing Share of Currencies Used in Thailand's Trade

4.1.1 Data

For comparison across multiple invoicing currencies, we use a data set from the Bank of Thailand that contains the distribution of settlement currencies for Thailand's export to and imports from major trading partners between 1993 and 2011. This is a rare, publicly available data set documenting the choice of market-determined settlement or invoicing currencies in a country over a reasonably long period of time. An obvious limitation of this data set is that it only covers the trade of Thailand, but this can also be an advantage. With one partner of the trade controlled for, we obtain a check on different acceptances of an international currency in different geographic areas.

As we suggested earlier, when the choice of settlement currency is market-determined, we can assume for practical purposes that the settlement currency is the invoicing currency as well. We will benchmark the potential of the renminbi as an invoicing currency based on the market-determined behaviour. We are interested in the role of the renminbi in the Asia-Pacific region, and so Thailand, as a typical Southeast Asian country, is very relevant for our purposes.

Invoicing currencies in our sample include major international currencies (US dollar, euro, Japanese yen and pound sterling), regional currencies (Canadian dollar, Thai baht, Singapore dollar and Malaysian ringgit) and historical currencies (German mark, French franc and Italian lira). The set of trading partners consists of 29 countries from the ASEAN, EU and NAFTA.

The main variable of interest is the invoicing share of a currency in Thailand's imports from or exports to a trading country. Explanatory variables include the characteristics of currencies (e.g. volatility of exchange rate), the characteristics of currency issuing countries (e.g. GDP share) and the characteristics of trading partners (e.g. amount of trade of the trading partner with issuing countries).

A more detailed description of currencies, partner countries and the definition and measurement of the variables, as well as the descriptive statistics of the data, can be found in Appendix A.

4.1.2 A Preliminary Look at the Data

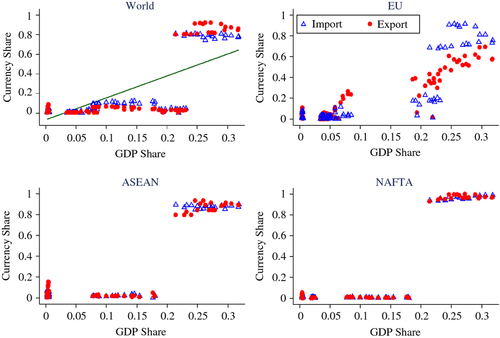

Our theoretical analysis implies a nonlinear relationship between the currency invoicing share and the issuing country's GDP share due to the coalescing effect and thick market externalities. Such tipping phenomenon seems to show up in Figure 6. In Thailand's trade with the rest of the world, the invoicing share of a currency jumps to a dominating level as the GDP share of the issuing country increases up to around 20 per cent. Below the threshold, an increase in the GDP share does not have a large effect. In Thailand's trade with the EU, the non-linearity seems to be quadratic, which partly motivates our specification with a squared term of the issuing country's GDP share in our regression analysis presented below. However, in trade with ASEAN and NAFTA countries, such a quadratic relation does not seem to be visible. Thus, we try an alternative specification using a logistic transformation of the invoicing share to capture nonlinearities.

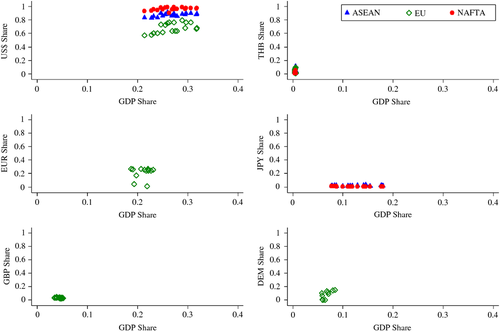

Figure 7 displays the invoicing share of major currencies. It is clear that the US dollar plays a dominant role in Thailand's trade with NAFTA, ASEAN and EU countries, in decreasing order of share. The local currency, the Thai baht, is used in trade with countries in different regions, which reflects the practice of producer currency pricing in exports and local currency pricing in imports. The euro is mainly used in trade with the EU, but at a non-trivial level. The Japanese yen actually plays a visible role not only in Thailand's trade with ASEAN countries but also in its trade with NAFTA countries, which reflects its international role as a vehicle currency. The pound sterling and German mark have non-trivial shares only in the Thailand-EU trade.

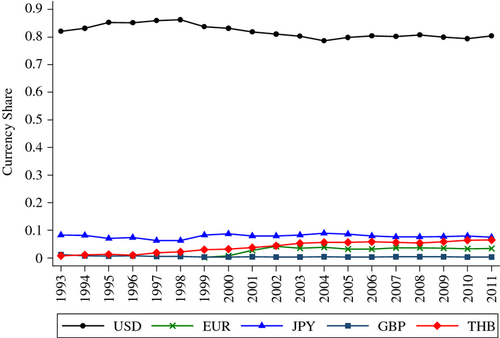

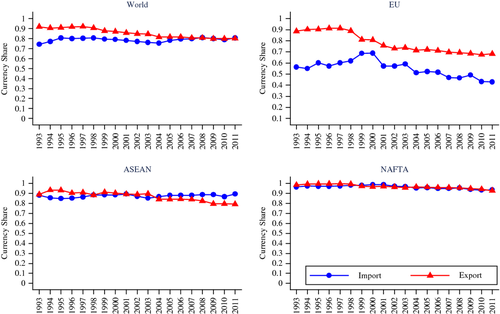

The US dollar plays a dominating role in invoicing Thailand's trade, regardless of whether the United States is the trading partner or not. As shown in Figure 8, this has not changed much in the past two decades. During the sample period, the invoicing share of the euro and Thai baht rose slowly. The share of the Japanese yen has been declining but remains as the second-most used currency for a typical ASEAN country such as Thailand. Figure 9 further shows the use of the US dollar in trade with countries from different regions. Except in trade with EU countries, where the euro plays an important role, the share of US dollar invoicing remains above 75 per cent. In trade with NAFTA countries, its share is consistently close to 1. The higher share of the US dollar in Thailand's exports to the EU relative to imports from the EU is consistent with the intuition behind Grassman's (1973) law that seller firms with more bargaining power will choose the home currency (the euro vs. Thai baht) to avoid exchange rate risk. In general, the data show that the pattern of trade invoicing is quite persistent over time.

4.1.3 Regression Analysis

In theory, the economic size of the issuing country will affect the international use of a currency in trade invoicing through multiple channels. For example, a larger economy usually trades more, and pricing in its currency is obviously convenient to foreign firms trading with that country. The bargaining power of domestic firms tends to increase as their home country becomes relatively larger economically, and hence, the trade of that country is more likely to be invoiced in the home currency, so that domestic firms can avoid exchange rate risks. The choice of the invoicing currency in bilateral trade certainly also depends on the trade patterns of the two trading partners. When the issuing country has a lot of trade with each of the trading partners, the currency tends to be used more because of the coalescing effect. Further, as argued in Engel (2006), the choice of an invoicing currency is essentially an indexing problem: firms that set prices in advance choose to index their prices to the current exchange rate in view of the uncertainty about exchange rate movements. The extent to which the exchange rate of a currency co-moves with the exchange rate of the Thai baht and that of the trading partner's currency is important in the management of exchange rate risk, in addition to transaction costs and exchange rate volatility.

Table 2 presents the baseline ordinary least squares (OLS) estimates of a simple linear model. In columns (1) and (2), we include only the GDP share of the issuing country and find evidence of its positive effects on the use of the currency in both Thailand's imports and exports. When we add the share of the issuing country in Thailand's and the partner's total trade to capture the pattern of trade, columns (3) and (4) show that the importance of the issuing country to the trading partners is positively associated with the use of the currency in the trade between two partners that are not the issuing country. This partly reflects the influences of vehicle currencies. Columns (5) and (6) introduce exchange rate variables. We find evidence for the positive role of exchange rate co-movement with the Thai baht, but not for the role of exchange rate co-movement with the trading partner's currency. Larger exchange rate volatility is associated with less use of the currency in trade invoicing. The coefficient on the bid-ask spread is not statistical significant, which may suggest that monetary transaction costs are not that important, compared with non-monetary transaction costs, such as the time it takes to buy and sell the currency in exchange for other currencies.

| Sample | Import (1) | Export (2) | Import (3) | Export (4) | Import (5) | Export (6) |

|---|---|---|---|---|---|---|

| Issuer's GDP share | 2.336*** | 2.444*** | 2.746*** | 3.045*** | 2.756*** | 2.980*** |

| (0.153) | (0.122) | (0.143) | (0.123) | (0.157) | (0.137) | |

| Issuer's share in Thailand total trade | 0.202*** | 0.231*** | 0.147*** | 0.185*** | ||

| (0.024) | (0.035) | (0.037) | (0.043) | |||

| Issuer's share in partner's total trade | 0.225*** | 0.134** | 0.222*** | 0.150** | ||

| (0.041) | (0.065) | (0.044) | (0.056) | |||

| EX co-movement with THB | 0.079*** | 0.128*** | ||||

| (0.015) | (0.010) | |||||

| EX co-movement with partner's currency | 0.009 | –0.023 | ||||

| (0.024) | (0.018) | |||||

| EX volatility | –0.134*** | –0.226*** | ||||

| (0.027) | (0.027) | |||||

| EX bid-ask spread | –0.680 | –0.785 | ||||

| (0.806) | (0.704) | |||||

| Constant | –0.019 | –0.022 | –0.154*** | –0.172*** | –0.110*** | –0.093*** |

| (0.015) | (0.015) | (0.015) | (0.029) | (0.032) | (0.032) | |

| R-square | 0.627 | 0.622 | 0.730 | 0.743 | 0.751 | 0.783 |

| No. of observations | 1,901 | 1,821 | 1,901 | 1,821 | 1,251 | 1,266 |

Notes

- (i) Standard errors, clustered within trading partners, are reported in parentheses.

- (ii) ***p < 0.01 and **p < 0.05.

Following Chinn and Frankel (2007), we adopt a log-transformed specification as this transformation can partially capture the persistence of the international use of currencies in this setting.

Table 3 shows the estimates of the log-transformed version of the same set of regressions as presented in Table 2. The main message from Table 2 follows here. In columns (5) and (6), the exchange rate bid-ask spread has a negative coefficient, but is only significant at the 10 per cent and 5 per cent level, respectively. The other variables largely behave the same way as in the simple linear version.

| Sample | Import (1) | Export (2) | Import (3) | Export (4) | Import (5) | Export (6) |

|---|---|---|---|---|---|---|

| Issuer's GDP share | 20.337*** | 20.674*** | 25.424*** | 27.354*** | 24.130*** | 25.978*** |

| (1.269) | (1.017) | (1.055) | (1.145) | (1.339) | (1.519) | |

| Issuer's share in Thailand total trade | 3.213*** | 3.339*** | 2.148*** | 2.436*** | ||

| (0.243) | (0.343) | (0.332) | (0.437) | |||

| Issuer's share in partner's total trade | 3.635*** | 2.775*** | 3.627*** | 2.949*** | ||

| (0.262) | (0.463) | (0.321) | 0.405 | |||

| EX co-movement with THB | 0.629*** | 0.969*** | ||||

| (0.172) | (0.068) | |||||

| EX co-movement with partner's currency | –0.011 | –0.297 | ||||

| (0.235) | (0.176) | |||||

| EX volatility | –1.115*** | –1.995*** | ||||

| (0.288) | (0.316) | |||||

| EX bid-ask spread | –14.252* | –17.056** | ||||

| (7.508) | (7.725) | |||||

| Constant | –4.818*** | –4.800*** | –6.996*** | –7.128*** | –6.170*** | –5.991*** |

| (0.183) | (0.143) | (0.166) | (0.304) | (0.381) | (0.519) | |

| R-square | 0.546 | 0.546 | 0.716 | 0.694 | 0.726 | 0.736 |

| No. of observations | 1,893 | 1,820 | 1,722 | 1,649 | 1,247 | 1,265 |

Notes

- (i) Standard errors, clustered within trading partners, are reported in parentheses.

- (ii) ***p < 0.01 and **p < 0.05.

As shown in Figure 6, the relationship between the invoicing share and the GDP share does not seem to be linear. Our theory presented in Section 3 also predicts that the coalescing effect and thick market externalities can lead to the non-linearity between the two variables. One way to capture this feature is to introduce a squared term of the GDP share into our linear specifications. Non-linearity is of course embedded in the logistic specifications. In our empirical analysis, thick market externalities are proxied by the FX-share-GDP-share ratio. We argue that this variable is the driving force underlying the non-linearity, which we will test with the data. Further, domestic financial development is potentially another fundamental condition of the wide use of a currency in international trade invoicing.

Table 4 presents evidence on the nonlinearity and the role of thick market externalities and financial development. Columns (1) and (2) re-estimate the linear model without exchange rate co-movement with partner's currency and the exchange rate bid-ask spread, which appear insignificant in Table 2. The estimates are largely unchanged. Columns (3) and (4) document that, after adding the squared term of the GDP share, the invoicing share of a currency is convex in the GDP share of the issuing country, in both the import and export regressions. The coefficient on the squared GDP share is statistically and economically significant. The specification with the squared GDP share also fits the data better. When we include the FX-share-GDP-share ratio, as displayed in columns (5) and (6), the invoicing share becomes less convex in the GDP share, although the convexity remains. This is consistent with our theory. The coefficients on the FX-share-GDP-share ratio are positive and significant, which demonstrates the influence of thick market externalities. When we add the variable for financial development in columns (7) and (8), proxied by the capital market depth of the issuing country, the coefficients on the squared GDP share become statistically insignificant. Thus, financial openness and development largely give rise to the convexity between the invoicing share and the GDP share. When we drop the squared term in columns (9) and (10), the effect of market externalities becomes stronger. In columns (11) and (12), the removal of the squared term does not lead to much change over the results in columns (7) and (8). Columns (13) and (14) further test the effects of financial development, without controlling for thick market externalities.

| Sample | Import (1) | Export (2) | Import (3) | Export (4) | Import (5) | Export (6) | Import (7) | Export (8) | Import (9) | Export (10) | Import (11) | Export (12) | Import (13) | Export (14) |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Issuer's GDP share | 2.641*** | 2.918*** | 1.163*** | 0.620** | 1.424*** | 0.999** | 2.061*** | 2.162*** | 2.492*** | 2.625*** | 2.213*** | 2.206*** | 2.439*** | 2.615*** |

| (0.139) | (0.118) | (0.407) | (0.344) | (0.429) | (0.427) | (0.331) | (0.291) | (0.146) | (0.134) | (0.143) | (0.128) | (0.131) | (0.111) | |

| Issuer's GDP share squared | 4.880*** | 7.664*** | 3.484** | 5.358*** | 0.537 | 0.159 | ||||||||

| (1.506) | (1.183) | (1.493) | (1.291) | (1.102) | (0.851) | |||||||||

| Issuer's share in Thailand total trade | 0.167*** | 0.185*** | 0.115*** | 0.109*** | 0.351*** | 0.430*** | 0.426*** | 0.563*** | 0.399*** | 0.505*** | 0.434*** | 0.565*** | 0.207*** | 0.267*** |

| (0.023) | (0.031) | (0.030) | (0.036) | (0.060) | (0.081) | (0.061) | (0.057) | (0.060) | (0.086) | (0.057) | (0.054) | (0.022) | (0.032) | |

| Issuer's share in partner's total trade | 0.228*** | 0.140** | 0.222*** | 0.130** | 0.246*** | 0.230*** | 0.252*** | 0.250*** | 0.254*** | 0.245*** | 0.254*** | 0.250*** | 0.233*** | 0.155*** |

| (0.041) | (0.055) | (0.044) | (0.051) | (0.056) | (0.066) | (0.052) | (0.059) | (0.054) | (0.066) | (0.051) | (0.058) | (0.044) | (0.050) | |

| EX co-movement with THB | 0.066*** | 0.110*** | 0.061*** | 0.092*** | 0.009 | 0.014 | 0.019 | 0.037*** | 0.013 | 0.024 | 0.020 | 0.037*** | 0.076*** | 0.120*** |

| (0.012) | (0.010) | (0.009) | (0.007) | (0.012) | (0.013) | (0.014) | (0.012) | (0.014) | (0.016) | (0.014) | (0.013) | (0.013) | (0.009) | |

| EX volatility | –0.123*** | –0.203*** | –0.089*** | –0.136*** | –0.061*** | –0.111*** | –0.011 | –0.026 | –0.084*** | –0.157*** | –0.011 | –0.026 | –0.064*** | –0.097*** |

| (0.021) | (0.024) | (0.013) | (0.015) | (0.012) | (0.022) | (0.018) | (0.019) | (0.017) | (0.034) | (0.018) | (0.019) | (0.014) | (0.018) | |

| Ratio of FX turnover share to GDP share | 0.143*** | 0.189*** | 0.111*** | 0.130*** | 0.150*** | 0.203*** | 0.110*** | 0.130*** | ||||||

| (0.035) | (0.048) | (0.028) | (0.038) | (0.036) | (0.053) | (0.028) | (0.038) | |||||||

| Issuer's capital market depth | 0.111* | 0.194*** | 0.117*** | 0.196*** | 0.077*** | 0.132*** | ||||||||

| (0.040) | (0.021) | (0.041) | (0.022) | (0.027) | (0.018) | |||||||||

| Constant | –0.113*** | –0.117*** | –0.067*** | –0.048** | –0.289*** | –0.335*** | –0.470*** | –0.660*** | –0.335*** | –0.406*** | –0.484*** | –0.664*** | –0.248*** | –0.358*** |

| (0.015) | (0.026) | (0.020) | (0.023) | (0.060) | (0.097) | (0.095) | (0.069) | (0.061) | (0.105) | (0.090) | (0.065) | (0.048) | (0.038) | |

| R-square | 0.742 | 0.775 | 0.750 | 0.793 | 0.746 | 0.809 | 0.754 | 0.833 | 0.741 | 0.799 | 0.754 | 0.833 | 0.750 | 0.798 |

| No. of observations | 1,712 | 1,650 | 1,712 | 1,650 | 1,219 | 1,190 | 1,219 | 1,190 | 1,219 | 1,190 | 1,219 | 1,190 | 1,712 | 1,650 |

Notes

- (i) Standard errors, clustered within trading partners, are reported in parentheses.

- (ii) ***p < 0.01, **p < 0.05 and *p < 0.1.

The estimates based on the log-transformed specification are reported in Table 5. Given the embedded non-linearity, we do not include the squared term. However, our empirical evidence continues to support the importance of thick market externalities and financial development for the choice of the invoicing currency. In addition to the fact that yit is bounded between 0 and 1, we observe that a large proportion of trade activities is invoiced in the US dollar. With this skewed distribution, the OLS coefficient estimates are unbiased but no longer efficient, and in small samples, the standard errors may be biased. Fortunately, we have a relatively large sample, which can partially alleviate the concern. Taking the log-transformation, the sample distribution becomes much less skewed. From this perspective, the logistic version is our preferred specification. Thus, we draw implications for the renminbi based on the results in Table 5.4

| Sample | Import (1) | Export (2) | Import (3) | Export (4) | Import (5) | Export (6) | Import (7) | Export (8) |

|---|---|---|---|---|---|---|---|---|

| Issuer's GDP share | 24.441*** | 26.088*** | 23.755*** | 23.356*** | 21.891*** | 21.066*** | 23.130*** | 24.323*** |

| (1.087) | (1.133) | (1.157) | (1.308) | (1.313) | (1.492) | (1.122) | (1.272) | |

| Issuer's share in Thailand total trade | 2.881*** | 2.975*** | 5.006*** | 6.022*** | 5.245*** | 6.351*** | 3.144*** | 3.454*** |

| (0.242) | (0.315) | (0.528) | (0.538) | (0.497) | (0.429) | (0.260) | (0.341) | |

| Issuer's share in partner's total trade | 3.668*** | 2.830*** | 3.783*** | 3.566*** | 3.779*** | 3.596*** | 3.698*** | 2.915*** |

| (0.252) | (0.386) | (0.321) | (0.432) | (0.314) | (0.427) | (0.263) | (0.356) | |

| EX co-movement with THB | 0.608*** | 0.858*** | 0.222 | 0.167 | 0.264* | 0.240** | 0.669*** | 0.918*** |

| (0.115) | (0.066) | (0.137) | (0.119) | (0.137) | (0.101) | (0.129) | (0.072) | |

| EX volatility | –1.129*** | –1.923*** | –0.930*** | –1.570*** | –0.443** | –0.852*** | –0.744*** | –1.307*** |

| (0.213) | (0.247) | (0.192) | (0.239) | (0.211) | (0.209) | (0.197) | (0.199) | |

| Ratio of FX turnover share to GDP share | 1.191*** | 1.826*** | 0.923*** | 1.425*** | ||||

| (0.291) | (0.356) | (0.225) | (0.270) | |||||

| Issuer's capital market depth | 0.784** | 1.069*** | 0.504** | 0.772*** | ||||

| (0.343) | (0.198) | (0.239) | (0.181) | |||||

| Constant | –6.615*** | –6.489*** | –8.47*** | –9.042*** | –9.472*** | –10.456*** | –7.495*** | –7.901*** |

| (0.224) | (0.318) | (0.507) | (0.533) | (0.741) | (0.463) | (0.486) | (0.354) | |

| R-square | 0.727 | 0.726 | 0.750 | 0.789 | 0.757 | 0.802 | 0.732 | 0.735 |

| No. of observations | 1,704 | 1,649 | 1,215 | 1,190 | 1,215 | 1,190 | 1,704 | 1,649 |

Notes

- (i) Standard errors, clustered within trading partners, are reported in parentheses.

- (ii) ***p < 0.01, **p < 0.05 and *p < 0.1.

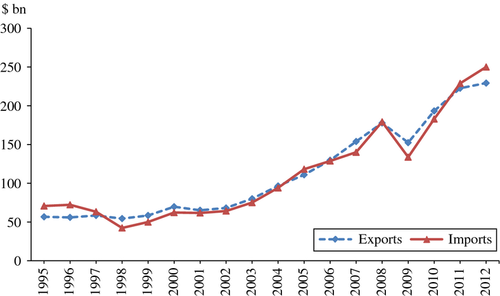

Finally, our sample period covers two major financial crises, the Asian financial crisis and the recent global financial crisis. Does this fact affect our regression results? Figure 10 exhibits the trend of imports and exports of Thailand over time. The trade was not interrupted by the Asian financial crisis, at least at the aggregate level, but was somewhat affected by the recent crisis. As shown in Figure 8, the pattern of invoicing behaviour has persisted through the financial crises. When we re-estimate the preferred logistic model using the subsample that excludes observations for 1997–99 and 2008–10, the regression results, presented in Table 6, are almost the same as before, in terms of both statistical significance and magnitude. In other words, our main empirical results are robust to the inclusion of years during economic crises. Since we are interested in the long-term potential of the renminbi that can withstand economic fluctuations and crises, we use the estimates based on the whole sample (without omitting the observations of crisis years), as the benchmark for counterfactual evaluation of the potential use of the renminbi for trade invoicing in a country similar to Thailand, such as other ASEAN countries.

| Sample | Import (1) | Export (2) | Import (3) | Export (4) | Import (5) | Export (6) | Import (7) | Export (8) |

|---|---|---|---|---|---|---|---|---|

| Issuer's GDP share | 24.114*** | 25.159*** | 23.579*** | 22.518*** | 21.670*** | 20.627*** | 23.289*** | 24.240*** |

| (1.131) | (1.220) | (1.187) | (1.409) | (1.323) | (1.562) | (1.163) | (1.259) | |

| Issuer's share in Thailand total trade | 2.767*** | 2.624*** | 5.045*** | 6.177*** | 5.154*** | 6.433*** | 3.074*** | 3.103*** |

| (0.268) | (0.354) | (0.647) | (0.638) | (0.544) | (0.478) | (0.263) | (0.377) | |

| Issuer's share in partner's total trade | 3.675*** | 2.776*** | 3.755*** | 3.557*** | 3.712*** | 3.575*** | 3.700*** | 2.837*** |

| (0.251) | (0.372) | (0.320) | (0.472) | (0.307) | (0.462) | (0.260) | (0.358) | |

| EX co-movement with THB | 0.693*** | 1.110*** | 0.054 | 0.026 | 0.267* | 0.240** | 0.793*** | 1.235*** |

| (0.145) | (0.095) | (0.129) | (0.113) | (0.146) | (0.107) | (0.165) | (0.124) | |

| EX volatility | –1.433** | –2.789*** | –1.335** | –1.908*** | –0.424 | –0.745*** | –0.673 | –1.696*** |

| (0.623) | (0.596) | (0.540) | (0.448) | (0.290) | (0.210) | (0.413) | (0.554) | |

| Ratio of FX turnover share to GDP share | 1.069*** | 1.898*** | 0.564** | 1.338*** | ||||

| (0.381) | (0.454) | (0.276) | (0.331) | |||||

| Issuer's capital market depth | 1.007*** | 1.163*** | 0.471** | 0.644*** | ||||

| (0.362) | (0.238) | (0.205) | (0.192) | |||||

| Constant | –6.607*** | –6.247*** | –8.171*** | –8.982*** | –9.500*** | –10.681*** | –7.698*** | –7.815*** |

| (0.372) | (0.482) | (0.721) | (0.785) | (0.775) | (0.591) | (0.417) | (0.566) | |

| R-square | 0.719 | 0.714 | 0.741 | 0.785 | 0.752 | 0.800 | 0.722 | 0.720 |

| No. of observations | 1,158 | 1,124 | 778 | 765 | 778 | 765 | 1,158 | 1,124 |

Notes

- (i) Observations for 1997–99 and 2008–10 are excluded.

- (ii) Standard errors, clustered within trading partners, are reported in parentheses.

- (iii) ***p < 0.01, **p < 0.05 and *p < 0.1.

- Data Source: Bank of Thailand.

4.2 Fixing Currency and Varying Countries: Determinants of Invoicing Share of the Euro across Countries

4.2.1 Data

To understand how the extent to which a currency is used for trade invoicing varies across countries, we focus on the experience of the euro. Our data are mainly from the report The International Role of the Euro (ECB, 2011), supplemented by reports from central banks of individual countries (e.g. United Kingdom, Australia and Thailand) and compiled by us. We have collected information on the annual use of the euro in trade invoicing at the country level. There are 35 countries covered in these data: nine euro area countries (Belgium, France, Germany, Greece, Italy, Luxembourg, the Netherlands, Portugal and Spain), 14 European Union accession countries (Bulgaria, Croatia, Cyprus, Czech Republic, Denmark, Estonia, Hungary, Latvia, Lithuania, Poland, Romania, Slovakia, Slovenia and United Kingdom),5 two European Union candidate countries (Former Yugoslav Republic of Macedonia and Turkey), one other European country (Ukraine) and nine countries outside Europe (Algeria, Australia, India, Indonesia, Pakistan, South Africa, Korea, Thailand and Tunisia). The period of coverage is 1999–2010. The earliest observations we use are from 1999 when the euro is introduced, and the latest observations are in 2010 (unbalanced panel). As far as we know, this is one of the most comprehensive data sets on euro invoicing across countries.6

In this part of our analysis, the dependent variable is the invoicing share of the euro in the annual imports or exports of a country at an aggregate level. We do not observe invoicing shares in bilateral trade as in the Thailand data. To explain variations in the use of the euro across country and over time, the independent variables mainly include the characteristics of relevant countries (e.g. EU membership and economic size) and the euro (e.g. bid-ask spread). Appendix B contains a more detailed description of our data.

4.2.2 A Preliminary Look at the Data

The use of the euro for trade invoicing is shown in Table 7, along with US dollar invoicing. The first (third) column shows the euro share in the invoicing of exports (imports), averaged across the available observations in the sample period for each country. Similarly, the second (fourth) column shows the dollar share in export (import) invoicing, for which we have constructed a comparable data set for the role of the US dollar. For countries in the Eurozone, the euro is their local currency and typically amounts to a share over 50 per cent. For other European countries (except Ukraine), EU member or not, the euro also plays a significant role, which is at least comparable to the role of the US dollar. However, the US dollar overwhelmingly dominates both export and import invoicing in all non-European countries with observations in our sample. The different pictures are partly captured by the EU dummy that is included in the regression analysis presented below. Overall, the US dollar is the prominent invoicing currency globally.

| Export | Import | |||

|---|---|---|---|---|

| Euro Share (%) | US$ Share (%) | Euro Share (%) | US$ Share (%) | |

| European countries | ||||

| Belgium | 53.630 | 30.967 | 53.730 | 34.200 |

| Bulgaria | 53.200 | 50.186 | 58.369 | 42.886 |

| Croatia | 69.192 | 31.057 | 73.917 | 22.214 |

| Cyprus | 18.550 | 9.950 | ||

| Czech Republic | 71.642 | 13.633 | 68.208 | 19.217 |

| Denmark | 32.883 | 21.950 | 33.900 | 20.450 |

| Estonia | 60.925 | 9.200 | 58.388 | 21.950 |

| France | 50.325 | 37.940 | 43.142 | 48.680 |

| Germany | 61.717 | 26.600 | 54.833 | 34.767 |

| Greece | 37.930 | 54.350 | 35.960 | 57.150 |

| Hungary | 78.643 | 16.400 | 69.857 | 21.343 |

| Italy | 61.609 | 24.800 | 45.664 | 34.300 |

| Latvia | 50.709 | 39.600 | 56.536 | 35.660 |

| Lithuania | 46.342 | 50.029 | 49.092 | 47.700 |

| Luxembourg | 52.691 | 29.000 | 43.664 | 40.233 |

| Macedonia, FYR | 68.167 | 35.800 | 67.242 | 33.714 |

| Netherlands | 49.560 | 35.940 | 41.900 | 47.000 |

| Poland | 62.942 | 31.829 | 58.250 | 30.571 |

| Portugal | 54.118 | 31.725 | 53.609 | 34.725 |

| Romania | 63.425 | 36.357 | 67.167 | 30.914 |

| Slovakia | 74.663 | 25.400 | 78.800 | |

| Slovenia | 83.230 | 9.580 | 74.870 | 14.860 |

| Spain | 57.869 | 35.614 | 54.223 | 41.714 |

| Turkey | 47.767 | 43.467 | 36.522 | 55.600 |

| United Kingdom | 21.000 | 27.750 | 22.000 | 34.750 |

| Ukraine | 6.086 | 76.275 | 16.417 | 74.767 |

| Non-European countries | ||||

| Algeria | 0.530 | 99.000 | 49.400 | |

| Australia | 0.942 | 71.167 | 8.467 | 51.117 |

| India | 7.100 | 8.100 | ||

| Indonesia | 1.667 | 92.586 | 4.858 | 80.429 |

| Pakistan | 4.000 | 91.433 | 6.500 | 83.867 |

| South Africa | 17.000 | 52.000 | ||

| South Korea | 4.925 | 85.900 | 4.350 | 80.375 |

| Thailand | 2.242 | 86.667 | 3.925 | 78.333 |

| Tunisia | 50.775 | |||

- Data Source: ECB, authors’ compilation.

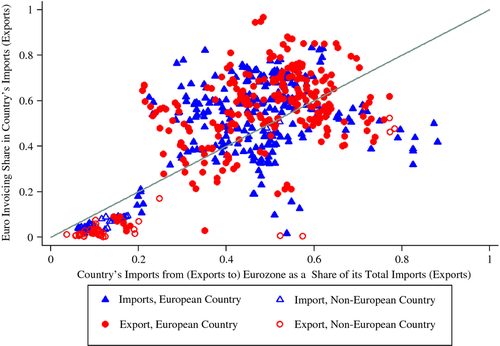

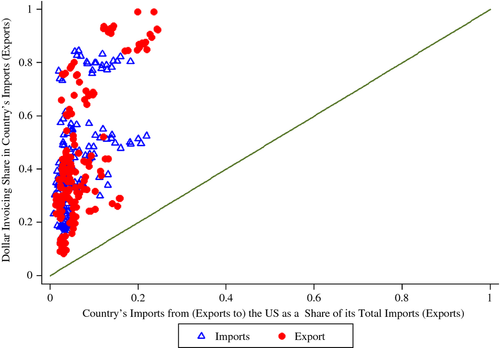

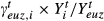

The role of the euro is further illustrated in Figure 11, which displays the euro invoicing share in a country's imports (exports) against the country's imports from (exports to) the Eurozone as a share of its total imports (exports). Following Goldberg and Tille (2008), all sample points would lie along the 45-degree line under the extreme case of complete euro invoicing of trade with the Eurozone and no vehicle currency role for the euro. For European countries, observations lie close to this reference line, with more than half of them lying above. In contrast, the use of the euro for trade invoicing in non-European countries is much smaller than what would be expected purely based on the direct trade flows with the Eurozone. For comparison, the role of the US dollar in trade invoicing across countries is shown in Figure 12. The use of the dollar is far more than the trade with the United States for all sampled countries. Taken together, Figures 11 and 12 imply the tipping phenomenon in the sense that the currency invoicing share is convex in the underlying conditions of the issuing country, such as economic size and trade share.

- Data Source: ECB, authors’ compilation.

- Data Source: authors’ compilation.

4.2.3 Regression Analysis

We focus on one specific currency, the euro, to understand its use for trade invoicing in different countries. Without variation across currencies, we cannot identify the tipping phenomenon or test the convex relationship between the invoicing share of a currency and the GDP share of its issuing country, and neither is there such a need. In this context, our empirical analysis does not directly account for thick market externalities and underlying institutional factors. In fact, we are dealing with a new question, and therefore, our model specification is different to the one used in Section 4a.

The dependent variable  is the share of euro invoicing in the exports or imports of country i in year t. The variable

is the share of euro invoicing in the exports or imports of country i in year t. The variable  is the share of the Eurozone in the total trade (exports and imports) of country i,

is the share of the Eurozone in the total trade (exports and imports) of country i,  is the economic size of country i relative to the Eurozone, EU is an indicator variable for the EU membership of country i, yeareur is the number of years after the introduction of the euro, taking 1999 as the base year, and pipeur–$ is the difference in bid-ask spread between the euro and the US dollar in year t.

is the economic size of country i relative to the Eurozone, EU is an indicator variable for the EU membership of country i, yeareur is the number of years after the introduction of the euro, taking 1999 as the base year, and pipeur–$ is the difference in bid-ask spread between the euro and the US dollar in year t.  is the currency preference for cost hedging as defined in Goldberg and Tille (2008): for country i, it equals 1 when the euro is the preferred hedging currency for transactions, 0 when the euro and the US dollar are equally preferred for hedging and −1 when the US dollar is the preferred hedging currency. Finally,

is the currency preference for cost hedging as defined in Goldberg and Tille (2008): for country i, it equals 1 when the euro is the preferred hedging currency for transactions, 0 when the euro and the US dollar are equally preferred for hedging and −1 when the US dollar is the preferred hedging currency. Finally,  is an i.i.d. error term.

is an i.i.d. error term.

There are a number of points to note about this specification. First, as shown in Lai and Zhou (2012), countries that trade more with the Eurozone are more willing to use the emerging euro. This is an implication of the coalescing effect and captured by the coefficient δ1 on  . The interaction term

. The interaction term  is intended to reflect the potential effect that a smaller country tends to be more reliant on trading with the Eurozone and more affected by the trade share with the Eurozone

is intended to reflect the potential effect that a smaller country tends to be more reliant on trading with the Eurozone and more affected by the trade share with the Eurozone  . The weak influence of its own currency, home or abroad, would give way to the euro. Therefore, we may expect the sign of the coefficient δ2 to be negative. Second, the time trend variable yeareur is included because the growth in relative economic size of the issuing country leads to the emergence of its currency as a major invoicing currency. In the case of the euro, the economic size of the Eurozone jumped immediately when the euro was introduced and increased as more and more European countries adopted the euro as their official currency. In addition, this time variable also captures the inertia in adopting the euro for invoicing purposes. By an argument similar to the above, the interaction term

. The weak influence of its own currency, home or abroad, would give way to the euro. Therefore, we may expect the sign of the coefficient δ2 to be negative. Second, the time trend variable yeareur is included because the growth in relative economic size of the issuing country leads to the emergence of its currency as a major invoicing currency. In the case of the euro, the economic size of the Eurozone jumped immediately when the euro was introduced and increased as more and more European countries adopted the euro as their official currency. In addition, this time variable also captures the inertia in adopting the euro for invoicing purposes. By an argument similar to the above, the interaction term  allows for the potential effect that a smaller country tends to adopt the euro faster, and hence, the sign of its coefficient δ6 is expected to be negative. Finally, term pipeur–$ captures the effect of the differential in transaction costs, which are calculated in a way that is standard in literature – the median difference between the bid-ask spreads (pips) of the euro and the dollar on the local currency each year.

allows for the potential effect that a smaller country tends to adopt the euro faster, and hence, the sign of its coefficient δ6 is expected to be negative. Finally, term pipeur–$ captures the effect of the differential in transaction costs, which are calculated in a way that is standard in literature – the median difference between the bid-ask spreads (pips) of the euro and the dollar on the local currency each year.

Table 8 presents the results for euro invoicing in exports, with the explanatory variables added one by one. The share of the Eurozone in a country's total trade  has strongly positive effect on the use of the euro in export invoicing by a country, and it contributes to explaining more than 60 per cent of the cross-country and intertemporal variation in the euro's share in export invoicing (adjusted R2 is equal to 0.601 in column (1)). This supports distinguishing countries according to their trade relationship with the Eurozone. The negative and significant coefficient on

has strongly positive effect on the use of the euro in export invoicing by a country, and it contributes to explaining more than 60 per cent of the cross-country and intertemporal variation in the euro's share in export invoicing (adjusted R2 is equal to 0.601 in column (1)). This supports distinguishing countries according to their trade relationship with the Eurozone. The negative and significant coefficient on  shows that the euro is used less in exports by countries that are relatively large, when the share of trade with the Eurozone is controlled for. EU members use the euro more widely, as suggested by column (3). The hedging motive seems not as important in magnitude, but is statistically significant, according to column (4). The time trend yeareur enters with a significant and positive coefficient (column (5)). In general, the use of the euro increases over time, owing mainly to an increasing contribution of smaller countries, as signified by strongly negative coefficient on the interaction term

shows that the euro is used less in exports by countries that are relatively large, when the share of trade with the Eurozone is controlled for. EU members use the euro more widely, as suggested by column (3). The hedging motive seems not as important in magnitude, but is statistically significant, according to column (4). The time trend yeareur enters with a significant and positive coefficient (column (5)). In general, the use of the euro increases over time, owing mainly to an increasing contribution of smaller countries, as signified by strongly negative coefficient on the interaction term  (column (6)). In particular, when this is introduced, the magnitude of the coefficient on the first interaction term

(column (6)). In particular, when this is introduced, the magnitude of the coefficient on the first interaction term  drops by nearly half, because these two terms are partially correlated. Consistent with Goldberg and Tille (2008), column (7) shows that pipeur–$ is insignificant in explaining invoicing currency choice. Since missing observations in the data for transaction costs limit the number of observations that we can use, we report the results without these for import invoicing and in the counterfactual analysis for the renminbi.7

drops by nearly half, because these two terms are partially correlated. Consistent with Goldberg and Tille (2008), column (7) shows that pipeur–$ is insignificant in explaining invoicing currency choice. Since missing observations in the data for transaction costs limit the number of observations that we can use, we report the results without these for import invoicing and in the counterfactual analysis for the renminbi.7

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | |

|---|---|---|---|---|---|---|---|

| Eurozone's share in exporter's total trade | 1.273*** | 1.319*** | 1.144*** | 1.223*** | 1.184*** | 1.215*** | 1.298*** |

| (0.072) | (0.069) | (0.078) | (0.072) | (0.074) | (0.075) | (0.076) | |

| Eurozone’ share in exporter's total trade × ratio of exporter's size to Eurozone | –3.675*** | –3.889*** | –3.356*** | –1.980** | –1.371 | –1.712** | |

| (0.759) | (0.732) | (0.670) | (0.932) | (0.979) | (0.749) | ||

| EU dummy (exporter = EU member) | 0.117*** | 0.084*** | 0.069*** | 0.063** | 0.082*** | ||

| (0.028) | (0.026) | (0.026) | (0.026) | (0.028) | |||

| No. of years after introduction of euro | 0.021*** | 0.0249*** | 0.025*** | 0.031*** | |||

| (0.003) | (0.004) | (0.004) | (0.003) | ||||

| No. of years after introduction of euro × ratio of exporter's size to Eurozone | –0.212** | –0.208** | –0.247*** | ||||

| (0.101) | (0.100) | (0.077) | |||||

| Preferred hedging currency | –0.062* | –0.040 | |||||

| (0.032) | (0.032) | ||||||

| Diff. in bid–ask spread btw euro and USD | –0.564 | ||||||

| (1.722) | |||||||

| Constant | –0.0348 | –0.0287 | –0.0271 | –0.163*** | –0.149*** | –0.171*** | –0.224*** |

| (0.030) | (0.029) | (0.028) | (0.032) | (0.033) | (0.035) | (0.033) | |

| Adjusted R-square | 0.601 | 0.639 | 0.666 | 0.725 | 0.729 | 0.733 | 0.877 |

| No. of observations | 210 | 210 | 210 | 210 | 210 | 210 | 144 |

Notes

- (i) Standard errors are reported in parentheses.

- (ii) ***p < 0.01, **p < 0.05 and *p < 0.1.

| (1) | (2) | (3) | (4) | (5) | (6) | |

|---|---|---|---|---|---|---|

| Eurozone's share in importer's total trade | 1.238*** | 1.301*** | 1.219*** | 1.248*** | 1.202*** | 1.202*** |

| (0.063) | (0.058) | (0.071) | (0.068) | (0.070) | (0.071) | |

| Eurozone’ share in importer's total trade × ratio of importer's size to Eurozone | –4.190*** | –4.248*** | –3.918*** | –2.393*** | –2.394*** | |

| (0.607) | (0.603) | (0.585) | (0.812) | (0.862) | ||

| EU dummy (importer = EU member) | 0.048* | 0.0328 | 0.0169 | 0.017 | ||

| (0.025) | (0.024) | (0.024) | (0.025) | |||

| No. of years after introduction of euro | 0.0116*** | 0.0158*** | 0.016*** | |||

| (0.003) | (0.003) | (0.003) | ||||

| No. of years after introduction of euro × ratio of exporter's size to Eurozone | –0.233*** | –0.233*** | ||||

| (0.087) | (0.087) | |||||

| Preferred hedging currency | 0.000 | |||||

| (0.028) | ||||||

| Constant | –0.00664 | –0.00218 | 0.00102 | –0.0717** | –0.056* | –0.056* |

| (0.026) | (0.023) | (0.023) | (0.028) | (0.029) | (0.031) | |

| Adjusted R-square | 0.659 | 0.725 | 0.729 | 0.749 | 0.757 | 0.756 |

| No. of observations | 199 | 199 | 199 | 199 | 199 | 199 |

Notes

- (i) Standard errors are reported in parentheses.

- (ii) ***p < 0.01, **p < 0.05 and *p < 0.1.

Table 9 reports the results for euro invoicing for imports, which share similar patterns with those for euro invoicing for exports. This is an extension of Goldberg and Tille (2008), who only examine export invoicing. Overall, both sets of our estimates are close to their findings, both qualitatively and quantitatively.

5 The Potential of the Renminbi as an Invoicing Currency

In this section, we evaluate the potential of the renminbi for trade invoicing in the Asia-Pacific region, based on the two sets of empirical evidence in Section 3.1. We continue to offer two different angles for the assessment: the extent of renminbi invoicing in the bilateral trade between Thailand and other countries and the extent of renminbi invoicing in the total trade of countries in the Asia-Pacific region.

5.1 The Implications of the Cross-currency Experience

To capture the effects of thick market externalities, our empirical analysis evaluates the impact of the normalised global FX turnover of a currency on the extent to which the currency is used as an invoicing currency in various countries of the world. In 2013, the renminbi was the 9th-most traded currency (BIS, 2013), but as shown in Table 10, its market share remained very limited, accounting for only about 1 per cent of global turnover. Relative to China's GDP share, its turnover share is even smaller (no larger than, for example, Thai baht). On the other hand, this means that the renminbi has a lot of potential in the development of its market thickness, which in turn can promote its use as an invoicing currency.

| 1998 | 2001 | 2004 | 2007 | 2010 | 2013 | |

|---|---|---|---|---|---|---|

| Global FX turnover share (%) | ||||||

| US$ | 43.401 | 44.932 | 44.004 | 42.798 | 42.430 | 43.523 |

| EUR | – | 18.956 | 18.705 | 18.518 | 19.526 | 16.706 |

| GBP | 5.508 | 6.523 | 8.249 | 7.433 | 6.440 | 5.905 |

| JPY | 10.862 | 11.767 | 10.415 | 8.625 | 9.496 | 11.519 |

| CAD | 1.763 | 2.244 | 2.100 | 2.145 | 2.642 | 2.284 |

| SGD | 0.553 | 0.527 | 0.453 | 0.584 | 0.709 | 0.698 |

| THB | 0.071 | 0.076 | 0.100 | 0.098 | 0.096 | 0.160 |

| RMB | 0.007 | 0.004 | 0.048 | 0.226 | 0.431 | 1.119 |

| Ratio of FX turnover share to GDP share | ||||||

| US$ | 1.500 | 1.411 | 1.577 | 1.711 | 1.869 | 1.996 |

| EUR | – | 0.960 | 0.809 | 0.836 | 1.027 | 0.985 |

| GBP | 1.138 | 1.428 | 1.588 | 1.469 | 1.813 | 1.744 |

| JPY | 0.838 | 0.909 | 0.946 | 1.105 | 1.097 | 1.390 |

| CAD | 0.863 | 1.008 | 0.895 | 0.841 | 1.064 | 0.902 |

| SGD | 1.744 | 1.859 | 1.751 | 1.935 | 2.073 | 1.827 |

| THB | 0.193 | 0.210 | 0.262 | 0.221 | 0.192 | 0.314 |

| RMB | 0.002 | 0.001 | 0.011 | 0.036 | 0.046 | 0.096 |

Notes

- The GDP data are not yet available for 2013 when we wrote this paper. We use 2012 GDP share as a proxy when computing the ratio of foreign exchange turnover share to GDP share in the last column of the lower panel.

- Data Source: BIS, World Bank.

To make predictions about the potential of the renminbi, we rely on the empirical models reported in columns (3) and (4) of Table 5 for imports and exports, respectively. The estimates are based on our preferred logistic specification, which is robust across different regressor configurations. In particular, we consider two cases: (i) China is the trading partner of Thailand and (ii) an average ASEAN country is the trading partner of Thailand.

We use the 2010 data on China's share in Thailand's total trade, China's share in the partner's trade, exchange rate co-movement between the renminbi and Thai baht and renminbi exchange rate volatility. With these variables fixed at their values in 2010, we compute the required GDP share for the share of renminbi invoicing to reach certain level under different assumptions about market depth. In particular, we show how the required GDP share varies with the imposed ratio of FX turnover share to GDP share. Table 11 shows the Chinese data on the main explanatory variables in 2010, along with the US data for the same year. China is not comparable with the United States in either economic size, thickness of its currency market or capital market depth.

| Main Variables | China (RMB) | United States (US$) |

|---|---|---|

| Dependent variables | ||

| Currency share in Thailand import from issuer | – | 0.935 |

| Currency share in Thailand export to issuer | – | 0.945 |

| Currency share in Thailand import from ASEAN | – | 0.869 |

| Currency share in Thailand export to ASEAN | – | 0.796 |

| Independent variables | ||

| Issuer's GDP share | 0.094 | 0.227 |

| Issuer's share in Thailand total trade | 0.121 | 0.079 |

| Issuer's share in ASEAN's total trade | 0.173 | 0.107 |

| Exchange rate co-movement with Baht | 0.782 | 0.735 |

| Exchange rate volatility | 0.358 | 0.313 |

| Ratio of FX turnover share to issuer's GDP share | 0.046 | 1.869 |

| Issuer's capital market depth | 1.052 | 1.947 |

- Data Source: Bank of Thailand, BIS, World Bank.

Table 12 presents the results for renminbi invoicing in the trade between Thailand and China. It shows that, at the current level of the renminbi's FX market thickness and China's GDP share, the renminbi could reach an invoicing share around 10 per cent in Thailand's trade with China. Although there is no direct evidence on renminbi invoicing in the Thailand–China trade, the fact that China was the second-largest trading partner of Thailand, accounting for 17 per cent of Thailand's total trade in 2010, and that the renminbi was not visible in the currency distribution Thailand's total trade (the minimum observation is less than 0.5 per cent) imply that the renminbi is still far from reaching its projected invoicing share in the bilateral trade.

| Ratio of FX Turnover Share to GDP Share | ||||

|---|---|---|---|---|

| 0.046 (as of 2010) | 0.5 | 1.00 | 1.50 | |

| RMB invoicing share in Thailand's imports (%) | ||||

| 10 | 8.371 | 6.095 | 3.588 | 1.081 |

| 20 | 11.785 | 9.509 | 7.002 | 4.495 |

| 25 | 12.996 | 10.720 | 8.213 | 5.706 |

| 30 | 14.054 | 11.778 | 9.271 | 6.764 |

| 40 | 15.914 | 13.637 | 11.131 | 8.624 |

| 50 | 17.620 | 15.344 | 12.838 | 10.331 |

| RMB invoicing share in Thailand's exports (%) | ||||

| 10 | 12.405 | 8.856 | 8.856 | 1.038 |

| 20 | 15.877 | 12.328 | 12.328 | 4.510 |

| 25 | 17.109 | 13.560 | 13.560 | 5.742 |

| 30 | 18.185 | 14.636 | 14.636 | 6.818 |

| 40 | 20.077 | 16.528 | 16.528 | 8.710 |

| 50 | 21.813 | 18.264 | 18.264 | 10.446 |

Notes

- (i) Calculations are based on the empirical models with logistic transformation, as reported in columns (3) and (4) of Table 5.

- (ii) It is assumed that all independent variables other than GDP share and FX turnover share will remain at their current level.

Why is the renminbi so much underused in the invoicing of trade? One possible reason is inertia in the adoption of an emerging currency. Although changes in fundamental conditions imply changes in the composition of invoicing currencies, there may be a substantial time lag in adjustment. As argued by Krugman (1984, p. 268), ‘the choice of a vehicle currency reflects both history and hysteresis’. A similar argument applies for invoicing currencies and might explain why the renminbi has not realised its potential yet. Another possible explanation is that the implied potential reflects only the average experience of different currencies, but idiosyncratic factors may contribute to the disparity between actual use and average potential.8

Moreover, it clear from Table 12 that when the renminbi's market thickness increases, the required GDP share for the emergence of the renminbi as a major invoicing currency becomes significantly smaller. This shows the importance of improving capital account openness and financial development.

Table 13 reports the predictions for the potential of the renminbi as a vehicle currency in invoicing trade between Thailand and ASEAN countries. When China is not involved in the trade, it requires a much higher GDP share of China for the renminbi to play an important role than the share required when China is the trading partner. However, if the FX-share-GDP-share ratio of the renminbi reaches a level comparable to that of more established currencies (e.g. 1 or 1.5), the renminbi could have an invoicing share of around 10 per cent when China's GDP share reaches 13 to 18 per cent, which is likely to be achieved in the near future. The renminbi could even play a leading role (around 40 to 60 per cent invoicing share) in the ASEAN region as a vehicle currency was China's GDP share to reach a level around 25 per cent, which is roughly the GDP share of the United States in 2012, under the assumption of high capital account openness and financial development, and hence a thick market for the renminbi.

| Ratio of FX Turnover Share to GDP Share | ||||

|---|---|---|---|---|

| 0.046 (as of 2010) | 0.5 | 1.00 | 1.50 | |

| RMB invoicing share in Thailand's imports (%) | ||||

| 10 | 21.541 | 19.265 | 16.758 | 14.251 |

| 20 | 24.955 | 22.678 | 20.172 | 17.665 |

| 25 | 26.166 | 23.890 | 21.383 | 18.876 |

| 30 | 27.223 | 24.947 | 22.441 | 19.934 |

| 40 | 29.083 | 26.807 | 24.301 | 21.794 |

| 50 | 30.790 | 28.514 | 26.007 | 23.501 |

| RMB invoicing share in Thailand's exports (%) | ||||

| 10 | 25.032 | 21.483 | 17.574 | 13.665 |

| 20 | 28.504 | 24.955 | 21.046 | 17.137 |

| 25 | 29.736 | 26.186 | 22.277 | 18.368 |

| 30 | 30.812 | 27.262 | 23.353 | 19.444 |

| 40 | 32.703 | 29.154 | 25.245 | 21.336 |

| 50 | 34.439 | 30.890 | 26.981 | 23.072 |

Notes

- (i) Calculations are based on the empirical models with logistic transformation, as reported in columns (3) and (4) of Table 5.

- (ii) It is assumed that all independent variables other than GDP share and FX turnover share will remain at their current level.

5.2 The Implications of the Euro's Experience

The euro was introduced in 1999 as a new currency and offers a comparison for the path of the renminbi as an emerging currency today. The circumstances in which the euro found itself then were a bit like those in which the renminbi finds itself today, namely aspiring to be a regional currency that challenges the incumbent currency, the US dollar. We use the estimation results for the euro presented in Section 4b to predict the potential path of the renminbi in trade invoicing.

We are using the euro's experience to estimate the potential use of the renminbi for trade invoicing. By potential, we mean the invoicing share of the renminbi conditional on China reaching the same degree of capital account openness and financial development as the Eurozone, so that the renminbi has a market as thick as the euro. In carrying out the estimation, we make a couple of assumptions. First, we assume that the empirical model estimated for the euro is applicable to the renminbi. The variables included in the model should behave in the same way. For example, the share of China in the total trade of a country should have the same marginal effect on the use of the renminbi as that of the Eurozone on euro invoicing measured by the estimate of coefficient δ1. Second, there are aspects for which we cannot draw parallels between the euro and the renminbi. For example, before the launch of the euro, the German mark had been used as an invoicing currency in continental Europe to a large extent. Once the euro was introduced, those who used the German mark likely switched to the euro immediately. Thus, the share of euro invoicing in some European countries was already non-trivial at the birth of the currency (Portes and Rey, 1998). This is certainly not true for the renminbi. From this perspective, it may be useful to consider our out-of-sample predictions based on the euro regressions as an upper bound for the potential use of the renminbi in trade invoicing.

Specifically, our predictions are based on the estimates contained in column (3) of Tables 8 and 9 for export and import invoicing, respectively. This is because of there is no China-equivalent for yeareur, years after the introduction of the euro. It is still hard to assess the international use of the renminbi for cost hedging. There is thus no China-equivalent for  either, the indicator for the euro as preferred hedging currency over the US dollar. Columns (3) account for the effect of EU membership. The equivalent ‘China-dummy’ should be set to zero for all countries that we are considering. The actual Chinese data on all other variables are used to pin down the implied invoicing shares of the renminbi.

either, the indicator for the euro as preferred hedging currency over the US dollar. Columns (3) account for the effect of EU membership. The equivalent ‘China-dummy’ should be set to zero for all countries that we are considering. The actual Chinese data on all other variables are used to pin down the implied invoicing shares of the renminbi.

The results for both export invoicing and import invoicing are listed in Table 14. For example, based on the data of 2010, potential renminbi invoicing in Australia, Indonesia, South Korea, Malaysia, Philippines and Singapore is in the range of between 8 and 12 per cent of the country's total imports or exports, assuming the same level of capital account openness and financial development as the Eurozone. The implied potential use of the renminbi increases from 2008 to 2010, reflecting the growth in relative economic size of China in the global economy.

| Export | Import | |||

|---|---|---|---|---|

| 2008 Data | 2010 Data | 2008 Data | 2010 Data | |

| Australia | 3.8 | 8.3 | 3.6 | 8.5 |

| Indonesia | 7.1 | 8.2 | 7.4 | 8.6 |

| Korea | 6.7 | 10.2 | 6.7 | 10.5 |

| Malaysia | 10.3 | 12.6 | 10.9 | 13.4 |

| Philippines | 9.2 | 9.9 | 9.8 | 10.6 |

| Singapore | 9.8 | 10.7 | 10.4 | 11.3 |

| Thailand | 9.1 | 11.1 | 9.6 | 11.7 |