Integrating Household Risk Mitigation Behavior in Flood Risk Analysis: An Agent-Based Model Approach

Abstract

Recent studies showed that climate change and socioeconomic trends are expected to increase flood risks in many regions. However, in these studies, human behavior is commonly assumed to be constant, which neglects interaction and feedback loops between human and environmental systems. This neglect of human adaptation leads to a misrepresentation of flood risk. This article presents an agent-based model that incorporates human decision making in flood risk analysis. In particular, household investments in loss-reducing measures are examined under three economic decision models: (1) expected utility theory, which is the traditional economic model of rational agents; (2) prospect theory, which takes account of bounded rationality; and (3) a prospect theory model, which accounts for changing risk perceptions and social interactions through a process of Bayesian updating. We show that neglecting human behavior in flood risk assessment studies can result in a considerable misestimation of future flood risk, which is in our case study an overestimation of a factor two. Furthermore, we show how behavior models can support flood risk analysis under different behavioral assumptions, illustrating the need to include the dynamic adaptive human behavior of, for instance, households, insurers, and governments. The method presented here provides a solid basis for exploring human behavior and the resulting flood risk with respect to low-probability/high-impact risks.

1. INTRODUCTION

In the last 40 years (1970–2010), the global population living in the 1/100-year flood zone has almost doubled from approximately 500 million to a little less than 1 billion people.1 This number is expected to increase to 1.3 billion in 2050 due to population growth.1 The resulting urbanization in low-lying—flood-prone—cities further increases the exposed assets, such as buildings and infrastructure.2, 3 The value of these assets is expected to rise from 46 to 158 trillion USD from 2010 to 2050.1 Moreover, climate change and sea-level rise will further exacerbate flood risk, and extreme flood events are expected to increase in the future.4

An important objective of many flood risk assessments is to estimate current and future flood risk levels.5-7 Flood risk, expressed as expected annual damage (EAD), is often defined as a function of the flood hazard, the exposure of assets, and their vulnerability.8 Many studies have focused on the flood hazard,9-11 and more recently also on exposure.1, 3, 5, 7, 12, 13 However, a major challenge is to further explore the role of “the vulnerability of exposed assets,” which is directly related to adaptive human behavior, such as the implementation of loss-reducing measures by households.14 Flood risk projections commonly assume that the vulnerability remains constant,5-7 or they assume some external scenario for vulnerability.15, 16 Such a static approach leads to a possible misrepresentation of future flood risk because humans respond adaptively to flood events,17 flood risk communication,18, 19 incentives to reduce risk,20 and social interaction with neighbors and friends.21 An expanding literature has studied how individuals prepare for flood events using survey data, which provides important insights into factors of influence on flood preparedness decisions, such as risk perception; for a review, see Ref. 22. However, such survey data do not directly provide information on how individual behavior influences current flood risk or how individual adaptation decisions can limit flood damage when the frequency or severity of flooding increases over time due to climate change.

The main objective of this study is, therefore, to couple human behavior and flood risk assessment in order to analyze the effect of human behavior on estimates of current flood risk, as well as estimates of development of future flood risk under climate change. The coupling of behavior and flood risk assessments is complicated by the uncertainty of human decision making with respect to low-probability/high-impact risk. Moreover, individual decisions about flood preparedness can be influenced by external incentives, such as financial incentives provided by a flood insurance policy.23 Therefore, in order to couple human behavior and flood risk assessment, we need to address two subquestions (1): How do different assumptions about individual decisionmaking influence flood risk predictions? (2) How do external incentives influence flood risk predictions by steering individual decision-making processes?

The first subquestion will be examined by coupling a flood risk model with established economic models for decision making under risk, which are suitable for modeling how individual investments in loss-reducing measures depend on risk and financial incentives. Because there are limited data for calibrating a best descriptive model,24 we will explore different theoretically founded models and parameter settings, and discuss their implications for flood risk estimates. These decision models are rooted in expected utility theory and prospect theory. In standard expected utility theory, individuals maximize their expected utility by comparing the expected utility value (outcome × probability) of different strategies.25 This decision model assumes that households are fully informed, rational, self-interested agents.26-28 However, individual behavior with respect to low-probability/high-impact risk is often better described by bounded rationality, which is characterized by the limited information-processing capacities of the decisionmaker itself and limited information availability.26-29 Other decision-making models, like prospect theory,30, 31 try to account for bounded rationality in individual processing of probabilities. Moreover, a third decision model is applied that accounts for the dynamic process of how individuals form their perceptions of flood risk, which can have an important influence on flood preparedness decisions. This decision model applies a (Bayesian) process of individual flood risk perceptions that are updated on the basis of new information from: flood experience,17, 32, 33 social interactions,21, 34-37 and media coverage of floods.35, 37

Such decision processes are often steered by external incentives, which are aimed to stimulate risk-reducing activities. It is, therefore, important to examine how such incentives change behavior, and consequently reduce flood risk. It has been advocated that in the face of climate change, insurance companies in particular are well positioned to stimulate risk reduction by providing incentives.23, 38-41 Examples of insurance incentives are the discount received on health insurance if a person follows a healthy lifestyle, or the discount received on car insurance for years driven without damage. In case of flood risk, the insurance company can reward households that implement loss-reducing measures with a premium discount equal to the reduction in flood risk.20 Although the government can also provide for instance subsidies and tax discounts if loss-reducing measures are implemented, it is argued that market discipline is more efficient in stimulating damage reduction.41 We, therefore, examine subquestion 2 by incorporating an insurer in the model that offers a discount on the insurance premium if households implement loss-reducing measures.

To be able to model complex human behavior, we coupled the decision models and flood risk model within an agent-based model setup. An agent-based model is especially suitable for this study because it enables to simulate the interaction and behavior of human agents and their changing risk environment through prescribed rules.42 Agent-based models have been used in few previous studies related to flood risk and risk perceptions. Several studies focus, for instance, on flood risk and land or housing markets,43, 44 or, more specifically, how skewed perceptions of flood risk influence coastal land markets.45 Furthermore, Dawson et al.46 apply an agent-based model to investigate flood incident management (FIM), and Haer et al.47 show how flood risk communication can influence individuals' adaptive behavior. However, to our knowledge there is no agent-based modeling study that focuses on the assessment of flood risk itself, nor how flood risk will develop in the future, and there is still a knowledge gap in coupling adaptive behavior with flood risk assessment studies. In our study, the agent-based model will be used to analyze how flood risk evolves over a period of 100 years under a scenario of changing risk as a result of climate change. In the model, households can implement protective measures that lower flood risk,48 and purchase (or cancel) flood insurance, following the different decision models. Investments in protective measures are influenced by an insurance company, which can offer a discount on the premium if households indeed implement loss-reducing measures.39

The remainder of this article is organized as follows. Section 2. describes a case study and the setup of the agent-based model. Section 3. presents and discusses the results of the simulations. Section 4. provides conclusions and recommendations for further research.

2. METHODS

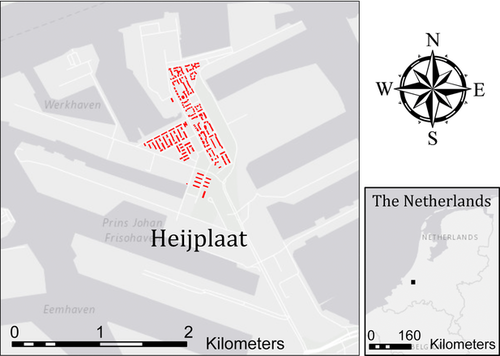

2.1. Case Study: Heijplaat in the Netherlands

To provide an illustrative flood risk analysis, the agent-based model will be applied to the Heijplaat neighborhood in Rotterdam, the Netherlands (Fig. 1). Being outside the embankments, Heijplaat falls outside the Dutch Water Embankment Act that requires high flood protection levels for the embanked areas throughout the Netherlands (Wet op de Waterkering, 1995). Although the Heijplaat is elevated, extreme floods can still inundate the area. Nevertheless, few loss-reducing measures are implemented in this area, which is attributed to the lack of knowledge among households about flood risk and loss-reducing measures, and the absence of legal enforcement and financial incentives to take such measures.48 Flood risk is expected to increase even further due to increased precipitation, increased river discharge, and sea-level rise.49 Although Rotterdam is protected from storm surges by the Maeslandt storm surge barrier, the necessity for more frequent closing of the barrier due to sea-level rise is expected to lead to more pile-up events of the extreme river discharges that cause flooding.49 Moreover, mean high-water levels are expected to rise due to higher sea levels, thus aggravating flood risks.50 Considering this increase in risk at Heijplaat, it serves as a good case study area for simulating household behavior and analysis of future flood risk.

2.2. Agent-Based Model

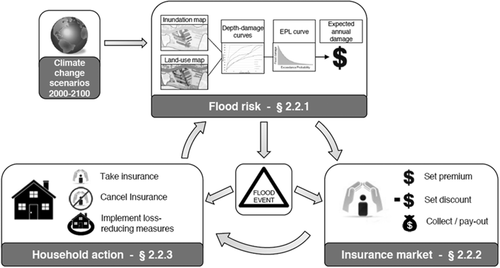

Fig. 2 shows the process flow of the agent-based model, which consists of three parts (1): flood risk assessment (2); the insurance market (3); and the decision making of households following three economic decision models. The agent-based model is implemented in NETLOGO v5.2.0,51 and is spatially explicit for household location, elevation, and flood depths based on the casestudy area. To further facilitate the reproducibility of the model, a full description of the ODD (overview, design concepts, and details) protocol for describing agent-based models is provided in the Supplementary Material (S1).52, 53 The simulations are run with monthly time-steps over a period of 100 years, a time span often used in climate assessment studies.4

2.2.1. Flood Risk

Flood risk is expressed as EAD (euro/year), and is calculated with a standard damage assessment approach as applied by, for example, Aerts et al.5 and Muis et al.7 For a detailed description, we refer to De Moel et al.48 or the ODD protocol provided in the Supplementary Material (Appendix S1). The flood risk calculation is fully integrated in the agent-based model. In short, the damage model consists of three components (1): a series of flood inundation maps each having different return periods (2); maps showing individual buildings to represent exposed assets (3); and a depth damage model, based on class-specific depth-damage curves that denote the fraction of total possible damage for a building type, given a certain water depth. As we focus on households in this study, we define flood risk for the Heijplaat as EAD estimates for direct damage to residential buildings. The flood depth associated with different return periods increases over time according to a climate change scenario. We here use a high-end sea-level rise scenario of 10.5 mm/year.49 Floods occur stochastically, meaning that, for instance, there is a 10% probability each year that a flood will occur with an associated return period of 10 years.

2.2.2. Insurance Market

The insurance market sets premiums and discounts each year based on the current simulated flood risk. The insurance premium for households is calculated each year by dividing the total EAD by the number of households.54 The premium is an actuarially fair premium, with a 10% deductible. Insurance companies can stimulate households to install loss-reducing measures by offering discounts on their premiums. The discount that can be offered is equal to the potential average risk reduction of the measure in the Heijplaat neighborhood per household (i.e., the average risk reduction if all households implement that measure).

2.2.3. Household Behavior

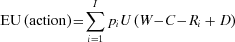

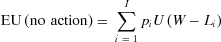

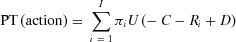

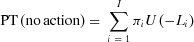

Based on the flood risk and insurance premiums, households can decide to take insurance, cancel insurance, or implement loss-reducing measures. The loss-reducing measures modeled here are “water barriers,” which will lower flood damage by 70%, but only if the inundation depth does not exceed 1 meter.14 If the inundation depth exceeds 1 meter, it is assumed that the water overtops the water barrier, and therefore normal damage is incurred.14 The costs of the loss-reducing measures are approximated for each individual household by multiplying the actual meter needing protection (http://www.kadaster.nl/BAG) by the cost of the measure per meter per year.14 Although loss-reduction measures are investments with a lifespan of roughly 20 years, insurance can be canceled every month. Households follow simple life-cycles, with age (representing the age of the decisionmaker of the household) ranging from 20 to 80 years, after which a new household moves in. Households are furthermore assumed to move out after seven years of residence at the Heijplaat. In both cases, new parameters are set as discussed below (and in the ODD protocol in Appendix S1). The agent-based model is run separately for three decision models: (1) expected utility theory; (2) prospect theory; and (3) prospect theory including the effects of social interaction, media influence, and experiencing a flood through Bayesian updating of risk perceptions. Note that in real life, different agents may follow different models, and each agent might switch between different decision models depending on different circumstances. However, to be able to explicitly show the effect of different behavioral assumptions, we kept the models separate. We here briefly explain the models in more detail:

, which is a function with constant relative risk aversion.55, 56 In line with common findings,55, 56 households are slightly risk averse, which is represented here with a β of 1, in which case

, which is a function with constant relative risk aversion.55, 56 In line with common findings,55, 56 households are slightly risk averse, which is represented here with a β of 1, in which case  .

.

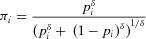

(1)

(1) (2)

(2) (3)

(3) (4)

(4) (5)

(5)The general utility function for the prospect theory model is given by  , which describes the tendency of people to weight a loss more than they weight a similar gain, as captured by the loss-aversion parameter λ.31, 57, 60, 61 To allow for different characteristics among households, the personal loss aversion is drawn from a normal distribution with a mean of 2.25,31 and a standard deviation of 1. This results in a population of which ∼90% of the individuals are more sensitive to losses than gains (λ > 1), which is consistent with the results found in different empirical studies.60-62 The parameter θ is a parameter of constant relative risk aversion.31 Because estimates of the constant relative risk aversion parameter θ also vary,31, 57, 61, 63 the personal θ is drawn from a normal distribution. We use the mean parameter value 0.88 found by Tversky and Khaneman,31 and set the standard deviation at 0.065, which is in line with Harrison and Rutström.63

, which describes the tendency of people to weight a loss more than they weight a similar gain, as captured by the loss-aversion parameter λ.31, 57, 60, 61 To allow for different characteristics among households, the personal loss aversion is drawn from a normal distribution with a mean of 2.25,31 and a standard deviation of 1. This results in a population of which ∼90% of the individuals are more sensitive to losses than gains (λ > 1), which is consistent with the results found in different empirical studies.60-62 The parameter θ is a parameter of constant relative risk aversion.31 Because estimates of the constant relative risk aversion parameter θ also vary,31, 57, 61, 63 the personal θ is drawn from a normal distribution. We use the mean parameter value 0.88 found by Tversky and Khaneman,31 and set the standard deviation at 0.065, which is in line with Harrison and Rutström.63

(6)

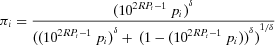

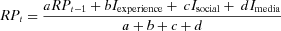

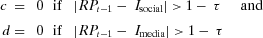

(6) . Risk perceptions, RPt, are updated over time, as shown in Equation 7, following a (quasi-) Bayesian learning approach similar to Viscusi.67, 68

. Risk perceptions, RPt, are updated over time, as shown in Equation 7, following a (quasi-) Bayesian learning approach similar to Viscusi.67, 68 (7)

(7)RPt−1 represents the prior risk perception of a household. Iexperience represents experiencing a flood. It is set to 0 if no flood occurs, and linearly increases with flood events up to half a meter to 11, representing increasing sensitivity to more severe floods.27 As there has not been a large flood on the Heijplaat for decades, Iexperience is initially set to zero. Isocial is the risk perception RPt of another household with which a person talks about flood risk and can thus range from 0 to 1. Imedia is a random value drawn from a normal distribution with mean 0.5, representing objective information, and a standard deviation of 0.05, which represents the difficulty of providing accurate objective risk information.

(8)

(8) (9)

(9) (10)

(10) (11)

(11) (12)

(12)Āt is the awareness level that describes how active a household is in seeking out new information at time-step t. Āt = 1 after new information is acquired from a source or experience, and diminishes by Āt = Āt−1 / 2 at each time-step t, representing the loss of interest if no new information is acquired.37 The parameters ωsocial and ωmedia represent an individual's tendency to discuss flood risk with his or her social network or search for information himself/herself. Both are initially set to 0.1. This results in a household population where clustering of risk perception is low and opposing risk perceptions coexist, even within social groups.37 The error parameter ε, representing the chance that individuals will interact on the topic of flood risk despite their lack of awareness, is set to 0.02 in accordance with Moussaïd.37

2.3. Experimental Design

To answer the first subquestion on the influence of behavioral assumptions on flood risk assessments, we run the model separately for each household decision model, and for a Business as Usual scenario where no adaptive measures are taken. To answer the second subquestion on the influence of external incentives, we furthermore run the model both including and excluding an external incentive in the form of an insurance premium discount that is offered if households take adaptive measures. Table I shows the experimental setup. All runs are repeated 100 times. Note that heterogeneous household parameters are set up up in a similar way for each repetition as discussed in Section 2.2. and summarized in the ODD protocol. The results are discussed in Sections 3.1. and 3.2..

| Influence of External Incentives | |||

|---|---|---|---|

| No External Incentives Offered to Reduce Risk | External Incentives Offered to Reduce Risk | ||

| Influence of behavioral assumptions | BAU (no adaptive behavior) | Exp.1a (x100) | Exp.1b (x100) |

| Expected utility theory model | Exp.2a (x100) | Exp.2b (x100) | |

| Prospect theory model | Exp.3a (x100) | Exp.3b (x100) | |

| Bayesian prospect theory model | Exp.4a (x100) | Exp.4b (x100) | |

In addition to these experiments, the complexity of the Bayesian prospect theory model allows us to test a range of assumptions on the level of social interaction (ωsocial), the level of information from the media (ωmedia), and the lingering effect of experiencing a flood (the weight b of experiencing a flood). We therefore do a parameter sweep for ωsocial (0.1–0.9) and ωmedia (0.1–0.9), and set the weight after experiencing a flood to 0.02, 0.04, and 0.06, which we discuss in Section 3.3..

3. RESULTS

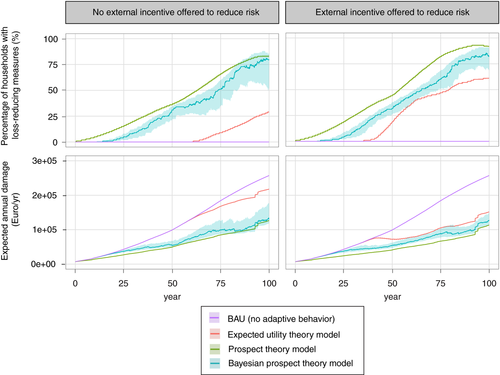

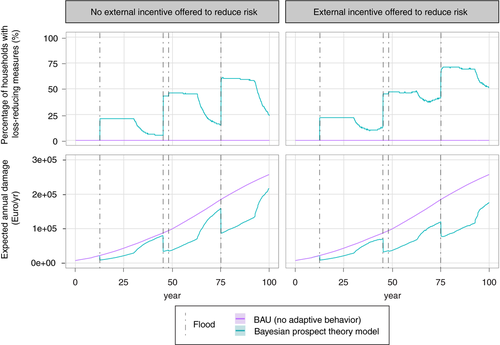

3.1. The Influence of Adaptive Behavior and External Incentives

Fig. 3 shows the results of household decision making over time, and the consequential change in the development of flood risk. It shows that for all three decision models, whether incentives are offered to reduce risk or not, implementation rates (top graphs) of loss-reducing measures increase with increasing risk. As the measures have a long life-span, they stay in place after the implementation decision is made, causing implementation rates to mostly increase over the simulation runs. Including adaptive behavior has significant impact on the flood risk assessment, as shown in the bottom graphs of Fig. 3. The estimated flood risk, expressed in EAD, is compared to a Business as Usual (BAU) scenario, where households are assumed not to implement any measures even if risk increases and floods become more frequent. This is a common assumption in many flood risk analysis studies.5-7 The graphs shows that including economic decision making by households in this case leads approximately to a factor 2 reduction in risk (−41% up to −56%) in the year 2100. This is true for all decision models and all scenarios, except for the scenario that follows the expected utility theory model when no incentives, in the form of a discount are offered, under which the implementation of loss-reducing measures is modest (−19% risk). As can be expected, implementation rates increase more when an incentive to reduce risk, in the form of an insurance premium discount, is offered. This is consistent with the findings of Botzen et al.,20 who showed that households in the Netherlands are indeed willing to take loss-reducing measures in exchange for a premium discount. Especially when applying the expected utility theory model, the results show that it is important for flood risk assessment studies to consider whether incentives for loss-reducing measures need to be taken into account, since the model predicts a one-third decrease in flood risk.

Note that the external incentive (insurance discount) is only received by households with insurance that implement measures. As such, differences in insurance penetration rates could mediate the results. In our model, the decision to insure and implement measures is autonomous, and therefore mediating effects are less relevant. However, because such effects might be relevant to address other questions, such as the consequences of mandatory insurance, we discuss the insurance penetration rates in the online supplementary material (Appendix S2).

3.2. Comparison of Behavioral Assumptions on Risk Estimates

Comparing the three different decision models, Fig. 3 shows that different assumptions about behavior significantly influence implementation of loss-reducing measures and, consequently, the assessment of flood risk. If households are modeled to be rational and risk averse (expected utility theory model), implementation rates of loss-reducing measures are lower than the assumption of bounded rationality (prospect theory model and Bayesian prospect theory model), which takes into account that individuals overweigh low-probability/high-impact events.30, 31 As a result, Fig. 3 shows that the commonly applied expected utility theory model leads to a higher estimation of flood risk. Furthermore, the Bayesian prospect theory model also results in higher flood risk than prospect theory, as the perception of risk declines after a period of no floods, and information from social interaction and the media does not correct for the low risk perceptions. This is in line with other studies.73, 74 To test for the statistical significance of these differences, we ran a Mann–Whitney U test, which is appropriate for the skewed data. The results show that the majority of the results of the three decision models are statistically significantly different (p < 0.001). However, when no external incentive is offered (left graphs) results for the prospect theory and Bayesian prospect theory models show higher p-values toward the end of the simulation (p < 0.05), and in the last few years they even cannot be considered significantly different. The reason that these results converge to each other in the end is that the high risk and more frequent flooding causes the Bayesian prospect theory model to behave more similar to the prospect theory model.

Offering premium discounts, which stimulates the implementation of loss-reducing measures, also stimulates risk reduction. This effect is strongest when household decision making is consistent with expected utility theory. For both the prospect theory model and the Bayesian prospect theory model, whether or not a risk reduction incentive is included has a less profound influence because implementation rates of loss-reducing measures are already high without such incentives. Nevertheless, results for these runs are still statistically significantly different with p < 0.001. As Fig. 3 clearly demonstrates, not including behavior leads to a strong misrepresentation of flood risk, even if only including a simple example of a flood-proofing measure. We do note that our example focuses on adaptive responses, and that nonadaptive behavior is also possible, such as increased exposure after levee construction.75

3.3. Detailed Results for the Bayesian Prospect Theory Model

The uncertainty intervals around the curve of the Bayesian prospect theory model show that these results are significantly influenced by stochastically introduced flood events and opinion dynamics. Although the other two models do include heterogeneous households (different CRRA and loss-aversion parameters), the emergent behavior is not influenced by interactions, resulting in small uncertainty intervals. To analyze the stochastic behavior of the Bayesian prospect theory decision process, we disentangle the behavior results further by showing a single-run example in Fig. 4. By introducing only a limited number of floods, Fig. 4 also shows the implications for household behavior if only infrequent floods are experienced.

The results for the Bayesian prospect theory model in Fig. 4 show how the pattern of adoption of flood risk mitigation measures is in agreement with patterns found in the real world.23, 34, 73, 76 In particular, Fig. 4 shows that investments in risk mitigation (top graphs) are low prior to flood events, which is in line with the observation of Kunreuther,23 Thieken et al., 73 and Bubeck et al.76 that homeowners are not inclined to take protective measures before floods. Consequently, this leads to a relatively high flood risk, but not as high as the BAU scenario, which does not account for adaptive behavior. Furthermore, the graphs show how a flood event triggers a spike in investments in loss-reducing measures, which is in agreement with research by Thieken et al.,73 and more recently by Bubeck et al.76 Bubeck et al.76 analyzed household investments in flood risk mitigation measures between 1980 and 2011 in three regions in Germany affected by flooding. They observed that prior to a flood event, few households invested in flood-loss-reducing measures, but that major events triggered the acceleration of such investments. Their study also found that two consecutive floods only caused a small increase in flood preparedness after the second flood, since the preparedness was already high after the first flood event. This effect is also observed in the results here, as shown in the top graphs of Fig. 4 at years 45 and 47. The effect of offering an incentive to reduce risk is also shown. Interestingly, the difference between offering an incentive or not is rather small in the period around the first flood, and the effect increases with increasing risk. Furthermore, if no incentives are offered, households seem to be triggered mostly by flood events, as can be concluded from the declining implementation rates in the years without a flood. If incentives in the form of a discount are offered, households also proactively take measures, as can be seen in the ∼5 years leading up to a flood event (top-right graph). Similar to Fig. 3, Fig. 4 shows the relevance of coupling both adaptive behavior, and possible steering mechanisms with flood risk assessments.

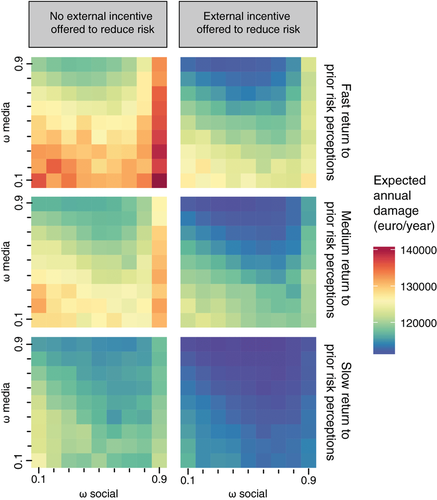

Furthermore, the Bayesian prospect theory model can be applied to investigate flood risk under a range of different assumptions on the effect of flood risk experience, the effect of media coverage, or the effect of social interaction. Fig. 5 shows the median EAD when varying the social interaction parameter, ωsocial, the media coverage parameter, ωmedia, and the flood risk experience, which is a combination of Iexperience and the weight b assigned to Iexperience.

Disentangling the different parameters, the results shown in Fig. 5 indicate that moving from a society with low media input on flood risk (ωmedia = 0.1) toward a society where individuals are constantly confronted with objective information on flood risk (ωmedia = 0.9), there is a significant reduction in EAD. This reduction follows from an increased implementation rate of loss-reducing measures. The results are in line with the conclusions drawn by Botzen and van den Bergh,77 and Poussin et al.,65 who respectively showed that offering comprehensible objective risk information has a significant impact on the willingness to pay for insurance and the uptake of loss-reducing measures.

All parameter settings show the positive effect of offering discounts on the uptake of insurance and the implementation rates of loss-reducing measures. The results related to the social interaction parameter, ωsocial, are more complex, as EAD decreases first and then increases again, when moving from a society with low social interaction (ωsocial = 0.1) on the topic of flood risk towards a society with high social interaction (ωsocial = 0.9). The upward correction of risk perceptions, which is the basis for the reduced risk, can be explained by the diffusion of objective information through increasing social interaction. However, the increased social interaction also leads to a faster diffusion of declining risk perceptions after an event. If social interaction is high enough, then this second process counterbalances the input of objective risk information. Such processes are nicely illustrated by the experimental study by Lorenz et al.,78 who showed that social influences cause opinions to converge, but opinions do not necessarily improve in accuracy. Furthermore, the effect of social interaction found here is relatively consistent with that of the study of Poussin et al.,65 who found correlations with the social network and the implementation of loss-reducing measures, like water barriers. As households tend to forget or ignore past events, increased social interaction only strengthens the underestimation of the risk if no relatively objective information is provided or searched for. Offering relatively objective information can only partly correct for this behavior.

Finally, for flood experience, the initial assumption was made that after a flood, risk perceptions return to their prior level after 4–6 years. This assumption was made based on empirical evidence reported by Kunreuther23 and Bin and Landry.69 However, the actual return to prior risk perceptions can of course differ, depending on local circumstances and personal characteristics. To analyze how differences in diminishing sensitivity to risk after a flood event affects household decision making, we varied the parameters such that risk perceptions return to normal twice as fast, or twice as slow, than our first parameter setting. As can be expected, Fig. 5 shows how EAD increases if households more quickly return to their prior low risk perceptions. This is especially clear for a society with low objective media input. High media input corrects the low risk perceptions, and stimulates the uptake of flood insurance and loss-reducing measures. Although it is realistic to assume that media input is high after a flood event, much effort is needed to maintain this level of objective information and household awareness if no further floods occur.

The results shown in Figs. 3-5 show that not only different economic decision models, but also the displayed real-world behavior that is fed into the model influences the resulting flood risk considerably. This emphasizes the importance of integrating human behavior and flood risk analyses. Although there are still challenges to capture household behavior in a model, the agent-based modeling approach allows for an in-depth analysis of flood risk, incorporating much more realism than standard economic decision models or flood risk analysis models alone.

4. DISCUSSION AND CONCLUSION

4.1. Advancing Flood Risk Assessments

There is a large literature of flood risk assessment studies that aim to predict current and future flood losses.5-7 However, limited attention has been paid to the adaptive behavior of humans, and how this influences flood risk estimates. Although this gap in knowledge has been widely acknowledged,79 the role of changing vulnerability due to household flood preparedness has up to now not been addressed in flood risk assessments. Other studies have investigated dynamic behavior toward flood risk in an agent-based model,45, 46 but they did not specifically focus on flood risk assessments. In this study, we developed a novel agent-based model approach to integrate human behavior in flood risk analysis, which resulted in a more holistic flood risk assessment approach. Our results show how accounting for dynamic adaptation of households to changing flood risk over time can reduce estimated flood risk by 19% to 56%. Although this factor of difference will vary depending on the included behavior, and our results are bound to the case study area, the results show that there is a need to update flood risk analysis with an approach that does include the dynamic adaptive behavior of households.

Our study contributes to ongoing debates about implementing integrated flood risk management in which, in addition to the public sector, households and other private actors play a role in limiting flood risk. With floods being the most costly natural hazard in Europe,80 it has been advocated that responsibility for flood protection should, or will, shift partially from the government toward individuals.76, 81-83 As households implement loss-reducing measures, and segregate risk through flood insurance, resulting damage from flood events can be mitigated and government postdisaster recovery costs can be reduced. By explicitly modeling adaptive behavior, our study offers a methodology to investigate how such a shift of responsibility leads to changes in overall flood risk.

Our illustrative case study can be readily expanded to address related questions about agent responses to flood risk. For instance, future research can focus on how flood risk estimations change if not only individuals adapt, but if whole communities take action,83 and also how these estimations change if governments implement flood risk management policies. Furthermore, depending on the research questions at hand, processes like migration in response to flood disasters,84 housing market adjustments to changing flood risk,45 socioeconomic change,85 anticipation of increasing flood risk due to climate change,86 and political change87 can be included to capture responses to flood risk. For this purpose, the agent-based model presented in this study can serve as a starting point. In such further research, the question can also be raised if, considering the complexity of human behavior, estimations over long time-frames, such as the 100-year period that is often used in climate change studies, can provide realistic scenarios of future flood risk.

4.2. Uncertainties of Adaptive Behavior

A challenge faced in this study is the uncertainty of individual behavior and, in particular, of flood preparedness decisions. Several studies have examined flood preparedness decisions using survey data,22 and a large literature exists on experimental studies of behavior under risk,57 which provide useful insights for the assumptions made in our agent based model and for the parameterization of our decision models. Nevertheless it is challenging to firmly establish which kind of adaptive behavior most realistically describes risk-reduction efforts in face of changing risk in a specific case study area. Obtaining these data for model calibration is especially difficult due to the low-probabilistic nature of floods in most specific areas. To address this uncertainty, we applied three different decision models, which are rooted in behavioral economic theories of decision making under risk. Our results show how different assumptions can cause significant changes in flood risk estimates, and that care needs to be taken when selecting a preferred decision model. For instance, assuming that individuals act fully rational leads to ∼40% to ∼90% higher estimates of flood risk compared to different assumptions of bounded rationality in which individuals in general overweigh low probabilities. Furthermore, assuming different levels of social interaction, media information about flood risk, and the impact of flood events on individual risk perceptions shows that these could also strongly influence individual flood preparedness decisions and related effects on flood risk estimates. For instance, our findings show that the diffusion of objective information through social interaction could lead to reduced risk, but that this same process can lead to a declining risk perception if no floods are experienced over a certain time period. Although such assumptions may capture realistic patterns of behavior,17 without empirically proven decision models that capture these processes in the face of changing flood risk, it cannot be readily decided which model describes reality best. Furthermore, in real life, different decision models may be used by different agents, or even by the same agent for different situations. Moreover, agents may follow, partly, or in whole, more psychological-oriented decision models, for example, protection motivation theory,88 or the social amplification of risk theory,89 which can be considered in future research. Nevertheless, our approach that examines the influence of three main behavioral economic models of decisions making under risk serves as a solid basis for exploring the influence of human behavior on flood risk. Future research can focus on developing and validating decision models that capture complex real-life behavior in the face of changing flood risk, such as the Bayesian prospect theory model presented here.

4.3. Steering Risk Reduction with External Financial Incentives

Individual decisions are often steered by external financial incentives, which can, for example, reward those who reduce risk. In our study, we show an example of how an insurance premium discount provided to those who reduce flood risk can correct for nonadaptive behavior. We find that especially when assuming that households act fully rational, offering an incentive to reduce risk strongly influences risk estimations (−29% in the year 2100). Other decision models also show a reduction of risk, although less strong, because these models overall imply an overweighting of low-probability flood risk. These results directly contribute to the current debate on how to stimulate private investments in flood risk reduction. Flood insurance has been advocated because of its ability to segregate risk and stimulate risk reduction.20, 41, 90 Our agent-based methodology offers a tool to investigate how policies that provide such external financial incentives could result in risk reduction, but also how, for instance, the implementation of loss-reducing measures influences the outcomes of the policy itself (see Appendix S2 for a discussion about flood insurance penetration rates). It is clear from our results that human adaptation to changing flood risk is not a completely autonomous process, but can be steered in the right direction by providing adequate financial incentives.

Future research could focus on analyzing the effectiveness of other policies for stimulating adaptive behavior. For instance, there is a range of other market-based instruments that could be applied to stimulate natural disaster risk reduction, such as tax rebates, subsidies, and marketable permits and caps, for instance, for building development.91 Although such instruments could have similar aims, they may change behavior in different ways, which consequently can lead to different outcomes of estimated risk. An agent-based model framework may be especially suitable for examining rich behavioral mechanisms in response to these policy instruments for encouraging disaster risk reduction.

ACKNOWLEDGMENTS

The authors thank Michael Siegrist and two anonymous reviewers for their valuable comments and suggestions. Furthermore, the authors thank Scott Heckbert for his comments, which helped to improve the quality of this article. This research was funded by the European Commission through the ENHANCE project (grant agreement No. 308438), and by NWO VIDI (grant agreement No. 45214005), and VICI (grant agreement No. 016140067) grants.