Bilateral responsive regulation and international tax competition: An agent-based simulation

Conflict of interest: The authors declare not to have any other potential conflicts of interest.

Abstract

Country-by-Country Reporting and Automatic Exchange of Information have recently been implemented in European Union (EU) countries. These international tax reforms increase tax compliance in the short term. In the long run, however, taxpayers will continue looking abroad to avoid taxation and, countries, looking for additional revenues, will provide opportunities. As a result, tax competition intensifies and the initial increase in compliance could reverse. To avoid international tax reforms being counteracted by tax competition, this paper suggests bilateral responsive regulation to maximize compliance. This implies that countries would use different tax policy instruments toward other countries, including tax and secrecy havens. Our agent-based simulation finds that a differentiated policy response could increase tax compliance by 6.54 percent, which translates into an annual increase of €105 billion in EU tax revenues on income, profits, and capital gains. Corporate income tax revenues in France, Spain, and the UK alone would already account for €35 billion.

1 Introduction

Tax policies are traditionally defined at the national level, predominantly serving the benefits of the country, irrespective of their spillover effect on other countries. Globalization has increased the transnational mobility of individuals, corporations, and the associated capital. Since the 1980s multinational enterprises and high-net-worth individuals have explored and exploited opportunities to minimize their tax burden by using legal loopholes caused by differences in tax regulation among countries. This led to increasing levels of tax avoidance and was incentivized even further through active public sector policies: tax policies were adjusted to attract capital from abroad, resulting in tax competition. To counter this dynamic, two international policy reforms have been implemented: Country-by-Country Reporting1 (CbCR) and Automatic Exchange of Information2 (AEoI). This paper focuses on the short and long-term effects of national tax policies and these international tax agreements on tax morale and tax compliance within the globally competitive tax environment. The short-term effects are defined as the behavioral changes that occur directly after implementing the tax agreements and the long-run effects relate to a gradual change that is observable over a 15-year period after the implementation.

The paper examines the short and long-run effectiveness of CbCR and AEoI and looks for ways to prevent hollowing out these reforms by tax competition. In the short run, implementing these tax reforms in all EU Member States increases their information about taxpayers and their power to collect taxes. To a certain extent, the increased power will be accepted or rejected by residents. When accepted, the power is considered legitimate, otherwise, it is coercive (Turner 2005). In countries where the tax regime is accepted and the government is trusted, the increased power will be accepted, and the perceived coerciveness remains small. In countries with less accepted tax regimes and government distrust, where tax money disappears in corrupt pockets, the increase is considered coercive. In such countries, the tax morale will deteriorate because the power lacks justification (Brehm & Brehm 1981; Braithwaite 2002a; Kirchler 2007).

Low tax morale invites people to look abroad for circumventing taxation. Countries, eager to receive more tax revenues, will offer new opportunities. High-net-worth individuals and corporations will compare their tax regime to the opportunities offered by others, having spillover effects on tax morale and tax compliance. This indicates that international reform can become ineffective, even if it was effective in the short run.

This paper shows these effects in an agent-based simulation model (ABM) and argues that tax compliance can be improved in the long run when countries – while implementing international tax reforms – adopt their national tax policy instruments (audit rates, tax rates, punishment, prescription times, and criminal thresholds) toward the countries they deal with.

The paper proceeds as follows. Section 2 discusses the literature on tax compliance, tax morale, and responsive regulation in a national context. Section 3 applies these concepts to an international setting. Section 4 explains the ABM that operationalizes our theoretical framework and allows us to test the potential effects of bilateral responsive regulation on tax morale and tax compliance. Section 5 shows the results of our simulation. Section 6 concludes.

2 Assessing and regulating tax compliance

Globalization significantly impacted the options to reduce the tax burden while remaining legally compliant through loopholes in tax laws and enforcement. Some options may consciously breach the legal limits of one or more countries in the hope that such activities will never be exposed. One example is reallocating assets to countries for which no information exchange is available, keeping them hidden from the home country's tax authorities. This is considered tax evasion and can be trialed when detected. Hiding assets becomes a legal construct again with the so-called “golden passports,” with which a person “purchases” a foreign nationality. The associated assets are then legally exempt from being reported by the “new home country” to the “original home country” (Ahrens et al. 2020).

Tax avoidance minimizes the tax burden of multinational enterprises using legal loopholes, while not breaching the legal restrictions of the jurisdictions involved. Therefore, it is not prosecutable. But there are grey zones. Aggressive tax planning schemes actively search for the boundaries of economic substance definitions and are, therefore, in the grey zone between tax avoidance and evasion. Artificially shifting profits, while possibly remaining within the limits of the law, is not within the spirit of the law. This paper considers both tax avoidance and tax evasion as forms of non-compliance, assuming that a tax policy intends to levy taxes based on real economic activity.

2.1 Important international tax agreements

Since the financial crisis of 2008, governments are confronted with severe budget constraints, preventing them from further lowering tax rates domestically. The need for more tax revenues pushes governments to cooperate with other jurisdictions and design multilateral policies that secure tax revenues (Genschel & Schwarz 2011). In 2016 and 2017, all European Member States have agreed with the AEoI3 and with implementing CbCR4, respectively.

CbCR requires corporations with consolidated revenue of €750 million or more to report key figures for each country in which they operate, and thus make it possible to control the economic substance (Borek et al. 2014) of the corporations' activity. Data on banking activity, which became available through CbCR, shows that banks in tax havens have a significantly larger turnover and that European banks prefer European tax havens (Bouvatier et al. 2017, Janský et al. 2021). Also, the tax expenses of banks that are affected by CbCR increased significantly compared to those that are not affected (Overesch & Wolff 2017). Therefore, CbCR is an effective tool to expose banks and increase their tax expenses and reduce tax avoidance, but whether this works for multinational corporations remains void, especially when corporate CbCR remains undisclosed to the public.

The agreement on AEoI, in which information on foreign-held assets are automatically provided to the country of origin of the asset holder, demonstrates substantial progress in international cooperation (Emmenegger 2017; Piciotto 2020). This allows the country of origin to collect taxes on previously hidden assets. Data from the Norwegian government shows that AEoI has significantly increased the taxes paid by individuals (Alstadsæter et al. 2018). According to some scholars, implementing AEoI treaties would end bank secrecy and might potentially end tax evasion fully (Johannesen & Zucman 2014). Unfortunately, this requires strong collaboration, which might be difficult to obtain. For example, a country like the US does not participate in AEoI while enforcing similar measures, that is the Foreign Account Tax Compliance Act. This makes the country both more attractive as a tax haven and less vulnerable to tax evasion (Hakelberg & Schaub 2018), which undermines eradicating tax evasion.

2.2 The “slippery slope” framework

Rational models of deterrence (Becker 1968; Allingham & Sandmo 1972; Yitzhaki 1974) claim that tax compliance depends solely on the coercive power of a country, such as auditing and punishment, underestimate tax compliance (Andreoni et al. 1998; Torgler 2008 and Alm et al. 2020). Auditing and penalizing are often not significant in econometric tests (Frey & Feld 2002). Thus, tax compliance cannot be rationally explained by such coercive powers only (Alm et al. 1992), and therefore introducing an additional factor, tax morale, is needed to further explain compliance.

Tax morale captures the intrinsic motivation of tax-payers to comply (Kirchler 2007, p. 99) and is applied to both natural persons and legal persons (Alm & McClellan 2012). It is also influenced by social norms (Traxler 2010; Méder et al. 2012), by culture (Alm & Torgler 2006; Kountouris & Remoundou 2013), and by the performance of and trust in the state (Torgler et al. 2008; Horodnic 2018). As the mismatch between rationally expected levels of compliance and empirical observations demonstrate, besides tax compliance through enforcement, voluntary compliance must contribute too.

By combining the deterrence factors that force compliance (the coercive powers of the state) and the factors of legitimacy and trust which lead to voluntary compliance (the persuasive powers of the state), the expected level of tax compliance is observable within the “slippery slope framework” (Kirchler 2007; Kirchler et al. 2008). A mathematical version of this framework shows that increasing the coercive power could have an increasing but also decreasing effect on tax compliance based on the share of “evasion-minded” and “compliance-minded” taxpayers (Prinz et al. 2014). This distinction between the two types of taxpayers impacts the extent to which the powers of the state are considered. The slippery slope framework is consistent with empirical observations that use a standardized questionnaire (Kirchler & Wahl 2010), which is surveyed in many countries (Muehlbacher et al. 2011; Benk & Budak 2012; Kastlunger et al. 2013; Kogler et al. 2013, 2015; Batrancea et al. 2019).

A model that incorporates the coercive and persuasive powers of the state, social norms, and network effects, emphasizes the importance of the country's approach to regulating tax compliance. The interaction between the taxpayers and the authorities is central to compliance. When the tax authorities focus on coercing compliance through audits and penalties, the so-called “cops-and-robbers” perspective, the “net compliance” may decrease (Brehm & Brehm 1981). Also, trust and societal cooperation decrease, including the trust in the tax authorities (Braithwaite 2002a). Distrusting the authorities causes a negative spiral because it decreases the level of voluntary compliance of taxpayers, affecting the tax morale negatively, and as a consequence it increases the perception of the coerciveness of the country, deteriorating government trust even further (Kirchler 2007, p. 205).

2.3 Responsive regulation and tax compliance

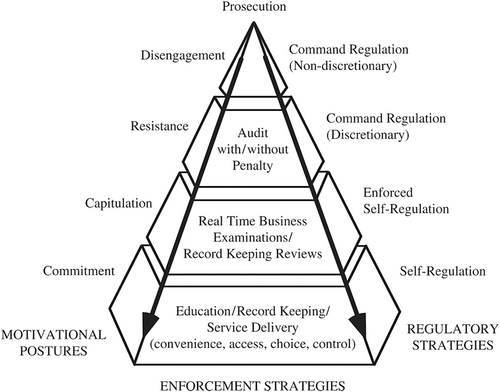

To counter this incremental fall of tax compliance, a more “service-customer” oriented paradigm is suggested. This paradigm is characterized by responsive regulation in which regulation should be context-dependent (Ayres & Braithwaite 1992; Braithwaite 2002b). Alignment of coercion and persuasion to stimulate compliance at the individual level lies at the core of responsive regulation theory and is frequently visualized using the so-called enforcement pyramid (see Fig. 1).

Source: Braithwaite (2007).

Responsive regulation acknowledges that non-compliance has different, possibly contradicting, motives, and when both the coercive and persuasive powers are activated properly, they support developing a more positive opinion about the regulator itself (Nielsen & Parker 2009). This will increase trust in the authorities and increases voluntary compliance (Kirchler et al. 2014). In the ABM, this feeds back into individual levels of tax morale. When authorities reward compliance, the personal attitude may increase tax compliance (Feld & Frey 2007).

Within the responsive regulation framework, taxpayers are categorized by motivational postures, that is the distance taxpayers place between them and the tax authorities, being: commitment, capitulation, resistance, and disengagement (Braithwaite 2002, Chapter 1). To help visualize the motivational postures and align them to the expected level of enforcement needed, the so-called “enforcement pyramid” is a frequently used theoretical tool. Figure 1 shows the enforcement pyramid as developed by the Australian Tax Office (ATO), which contains the motivational postures aforementioned (Braithwaite 2007). The pyramid shows the motivational posture of an individual, that is signals that indicate their liking for the authorities (Braithwaite 2014), on the left. The middle segment of the pyramid indicates how the regulation is enforced for individuals with a specific motivational posture. The right side of the pyramid typifies the implementation of such enforcement.

The slippery slope framework is considered an operational tool for the research strategies defined within the enforcement pyramid because the dimensions and their interaction in both frameworks are very similar (Kirchler et al. 2008).

While the responsive regulation framework has achieved success (Braithwaite 2003), Leviner (2008) is more critical about its implementation. Leviner (2008) warns about the required resources needed to further test and develop such a flexible approach, as well as the risk that the tax administrators may interpret the model inappropriately. The implementation of any set of rules is subject to interpretation and identifying the true intent of a perpetrator (i.e. the motivational posture) remains obscure regardless of the chosen approach. Our model simplifies the responsive regulation approach since the motivational posture becomes objectively measurable.

3 Theoretical analysis of international tax compliance

The slippery slope framework and responsive regulation focus on the domestic taxpayers' behavior, while the international aspect of compliance is increasing rapidly (Abbott & Snidal 2013). This paper combines the (national) insights on tax compliance, tax morale, the slippery slope framework, and responsive regulation and provides a theoretical analysis, operationalized in an ABM, for dealing with tax compliance internationally.

3.1 Domestic and relative power

All literature that relates to the slippery slope framework perceives a government's power from a national perspective only. We combine the coercive and persuasive powers of the state into one single dimension, the domestic power. Given the international mobility of people and corporations, governments must convince their residents to keep paying taxes in their jurisdiction. Residents should not get too tempted by international options, like golden visas, and lower tax rates in other countries. The ability of governments to convince residents to not use legal loopholes in the international tax system is represented by the relative power of the countries and is based on the differences in tax policy and economic wellbeing. The relative tax position (we call it relative power) of a country vis-à-vis another country, depends both on the actions of the country itself and on what the other country is doing.

Corporate tax havens and secrecy havens (considered target countries because they provide a target for financial assets allocation) provide tax benefits and secrecy to attract corporations through legal means to avoid taxation or evade taxes. It undermines tax morale in a residence country (considered the country of origin) and decreases its relative power. One way to deal with this so-called spillover effect is to increase the relative power of the country of origin by bridging the distance between the source and target tax policy.5 This could, for example, be achieved by the country of origin lowering its taxes or reporting requirements vis-à-vis the target country.6 When countries on the “losing end” of the relative power keep acting that way, this causes a race-to-the-bottom.

This paper focuses on the effects of implementing CbCR and AEoI. Both policies increase a country's domestic power. The increase in domestic power is created by providing transparency of financial assets which gives the authorities the ability to direct the choices of taxpayers without their consent – what Kirchler et al. (2008) call – an increase in the coercive power of the state.7 We assume that the increase of coercive power, whether through domestic or international regulation, affects taxpayers' behavior in the same way. If countries have a well-functioning tax regime, accepted and trusted by their residents, this will result in higher tax compliance. But when a country's tax regime is less well functioning, when tax collection is inefficient, when tax money gets into corrupt pockets, then the trust of its citizen is low. If the coercive power of the state is too large, when compared to the persuasive power, the international reforms signal that the state does not trust its citizens, which deteriorates the trust of its citizens (Kirchler et al. 2008), that is the state's persuasive power (Prinz et al. 2014). Alternatively, when the coercive power and persuasive power become more balanced, tax morale is expected to increase.

Countries with high relative power can attract taxable funds from countries with low relative power. These high relative power countries are typically the tax and secrecy havens.8 When tax morale decreases in countries that are more susceptible to tax havens, the tax haven becomes even more attractive, making the slippery slope even more slippery. Even though tax compliance might initially increase because of implementing CbCR and AEoI, tax morale can deteriorate, which intensifies the fierceness of tax competition.

This paper argues that bilateral responsive regulation, that is differentiated policy responses when dealing with different countries, especially for tax and secrecy havens, could curb these problems and increase tax compliance when implemented correctly. The underlying ABM is used to find the “correct implementation” and tests its impact for nine country-pairs that represent relations with tax havens, secrecy havens, and non-havens.

3.2 Responsive regulation when dealing with other countries

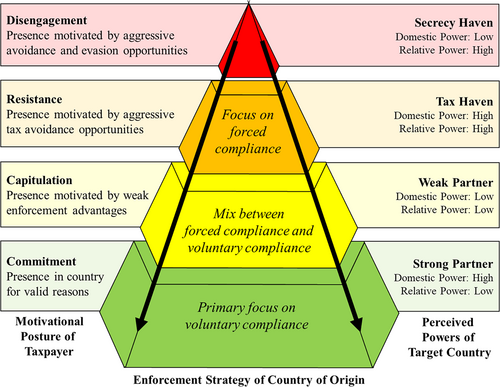

Our international version of the slippery slope framework is shaped according to the domestic and relative powers, instead of the coercive and persuasive powers, which are the drivers in the original, domestically oriented, version (see Kirchler 2007; Kirchler et al. 2008). Given the strong parallels between the enforcement pyramid and the slippery slope framework, our enforcement pyramid also becomes an international one, by making it a bilateral enforcement pyramid. Instead of applying motivational posturing from the perspective in which the taxpayer distances himself from the (tax)authorities and shows associated behavior (Braithwaite 1995), the international enforcement pyramid shows how the target country distances itself from international regulation. This distance between that country's “self” and the overarching international regulation, demonstrates whether the country undermines international regulations by providing tax benefits to foreign entities or strongly complies with international regulation instead.

A country is committed to countering non-compliance when it strongly enforces tax compliance (it has high domestic power) and strongly implements international agreements for tax compliance (it has low relative power). Multinational corporations that have strong economic ties to such committed target countries can thus be classified as “committed” too, to the country of origin. Audit rates and penalty levels toward these multinational corporations can be relatively low. When countries with a low relative power also have low domestic power, that is they are not very internationally attractive (for tax reasons) but also do not put much effort into domestic compliance, evasion is somewhat higher. Such countries merely capitulate to international regulation; thus, enforcement levels should be slightly stronger.

Contrary to these “partner” target countries, tax and secrecy havens have stronger relative positions over many other countries. A resistant target country, a tax haven, puts sufficient effort into enforcing compliance domestically (it has a well-functioning tax system and well-trusted government, hence it has a high domestic power) and actively attracts foreign corporations with fiscal policies (it has high relative power). Therefore, corporations with stronger financial positions in such target countries need to be audited more frequently and penalties should be higher in the country of origin to achieve tax compliance. When countries care less about any form of tax compliance and have low administrative and reporting requirements, they can be perceived as secrecy havens. Since countries with low domestic power and high relative power do not tax corporations nor strongly enforce forms of administrative reporting, they are perceived as fully disengaged from participating in any international tax agreements. In line with the four categories of responsive regulation at the domestic level (Braithwaite 2002, Chapter 2), Table 1 shows the categories mapped onto the international framework. The table includes a description of the country profile and expected enforcement requirements to corporations and high-net-worth individuals with a substantial presence in such countries. We assume that high-net-worth individuals tend to hold companies to have larger flexibility of moving capital globally.

| Relative power | |||

|---|---|---|---|

| Low | High | ||

| Domestic power | Low | Capitulation: These countries accept the international fight against tax evasion and avoidance and do not provide special benefits to corporations. They also do not actively try to restrict tax flight domestically. To better align enforcement, corporations with significant activity in such countries should be penalized when illicit transactions are detected but due to the reduced likelihood auditing can be relatively low. |

Disengagement: Countries with little domestic power that provide strong competitive advantages (disengaged from any form of taxation) aim for attracting foreign capital or business through providing services, while not enforcing tax compliance significantly. To better align enforcement, corporations operating extensively in these countries may evade and avoid taxes. They should be audited more frequently and penalties should be highest. |

| High | Commitment: Countries in this category actively develop tax compliance in their jurisdiction and contribute to fighting international tax avoidance and evasion schemes. To better align enforcement, corporations operating extensively in such countries have little incentive to avoid and evade taxes, thus can be audited less and penalized less in case of non-compliance. |

Resistance: These countries ensure that taxes are paid domestically while providing tax loopholes for foreign corporations (thus resist international tax compliance legislation). To better align enforcement, corporations that are highly represented in such countries potentially avoiding taxes abroad, need to be penalized strongly whenever laws are broken. In addition, withholding taxes may be increased to discourage tax flight. |

|

In line with the enforcement pyramid of the Australian Tax Office (Braithwaite 2002, fig. 1.1, see Fig. 1 in this paper) Table 1 can be represented by the bilateral enforcement pyramid as shown in Figure 2. The pyramid shows the perceived domestic and relative powers of a target country (right). The domestic and relative power of the target country Luxembourg will be perceived differently by Spanish, French, and UK taxpayers since they compare Luxembourg's tax policy with their own country. Based on these powers, one of the four motivational postures (left) a taxpayer is expected to have is defined by the predominant presence of that taxpayer in the associated target country. In the middle of the pyramid, the suggested enforcement strategies are provided (which are implemented using five tax policy instruments, which are eventually represented by the average suggested optimal policy values in Table 3). The bilateral enforcement pyramid should be applied to all corporations registered in the enforcing (source) country. Depending on in which target country they are active, they should be treated differently, since the chance of not paying taxes to the country of origin is different. The enforcement strategies vary between voluntary compliance (very low audit rates, low punishment, low prescription times, high crime threshold) and forced compliance (high audit rates, low crime thresholds, high punishment, high prescription times, a high withholding tax).

Source: Authors.

This paper argues that applying the theory of responsive regulation at the international level and adjusting the domestic power through enforcement policies specifically targeted at other countries, increases tax morale while it retains or even improves the effectiveness of international regulations like CbCR and AEoI. The question is how a country of origin should adjust its enforcement policies to deal with taxpayers linked to target countries with different motivational postures regarding international agreements. We test this with an ABM.

4 Finding optimal policy responses with an agent-based model

This paper views the economy as a biological ecosystem. In such a system, competition, specialization, and cooperation among the interacting agents and the interaction with the environment are key phenomena (Rothschild 1990, p. xi). A tax ecosystem is an environment that creates and sustains different types of agents, all of which have their values and beliefs. This environment supports interactions among these agents and allows for heterogeneous responses of agents caused by the perceived powers of the state (domestic and relative) and the extent to which agents can influence each other over time.

In traditional approaches such a model is based upon deterministic mathematical equations and statistics, populations are generalized into a single or a few types of “representative agents” and so are the interactions among them. ABMs differ from this by using heterogeneous intelligent agents of which several key characteristics are: autonomy, social ability, reactivity, and pro-activeness (Wooldridge & Jennings 1995). This allows agents to have different perceptions of their environment and to interact with neighbors instead of a generic total population. Intelligent agents can learn from their experience, try and predict the future, and alter their choices accordingly. As a consequence, ABMs incorporate randomness and enable the emergence of patterns instead of defining such patterns deterministically (Wilensky & Rand 2015).

- First, taxpayers observe their (inter)national environment, and their perceived domestic and relative power of the country of origin is calculated. Based upon this, taxpayers set their behavioral intent to comply with this country, adjusted to their local neighborhood and their intrinsic tax morale.

- Knowing each taxpayer's intention to comply, all taxpayers calculate an adjusted utility for evading taxes using an updated weighted deterrence model and a weighted utility for tax avoidance.

- Then, the taxpayers choose between compliance, evasion, or avoidance and determine how much of their financial assets to report. Taxpayers move within their local environment slightly causing them to lose existing and create new connections.

- Next, tax enforcing agents audit several taxpayers in their local neighborhood and are guaranteed to expose evasion when it occurred. They will then penalize the evading taxpayers. Tax avoidance is not illegal (given it is defined as such) and thus cannot be penalized.

- Taxpayers gain auditing experience and share this with their neighborhood and use this to adjust their tax morale, after which a new iteration (year) of the simulation begins at step 1.

Inspired by the mathematical formalization of the slippery slope framework (Prinz et al. 2014), the interaction between the domestic and relative power as well as the social interaction of the agents (steps 1 and 5), influence the tax morale of agents and their individual compliance decisions. For example, if the domestic power of a country is very high, thus when the people trust their government and the country has a strong ability to enforce tax compliance, the undermining effect of a tax haven influences the tax morale less strongly than when the domestic power was already low (because the people do not trust the government, or the country cannot validate and enforce compliance). The social interaction among agents also affects an agent's tax morale, for example when many neighbors evade and avoid taxes this will lower the tax morale of the agent more than when there are only a few evading agents in the vicinity. Appendix details the operationalization of domestic and relative power for our ABM.

4.1 Country selection and data used for simulation

To find the best tax enforcement policies a country can implement to improve both tax morale and tax compliance when dealing with tax havens, secrecy havens, and non-havens, the ABM is executed many times under different policy scenarios. Using a “hill-climbing” algorithm (Miller 1998) that alters the possible policy instruments slightly before each simulation, the average tax morale of the simulated population and their tax compliance is optimized. If the algorithm would optimize the average tax morale only, setting the tax rate to 0 percent would do the job. If tax compliance is the sole point of optimization, then a near 100 percent audit rate would result in the highest, but fully forced compliance. Clearly, besides other explanations, this level of auditing is unrealistic due to the limited resources of the tax authorities. To avoid such corner solutions, the optimization algorithm multiplies the average tax morale of all agents (a value between 0 and 1) with the fraction of the total amount of paid taxes relative to the total tax revenues if all agents would pay their taxes fully (also resulting in a value between 0 and 1). Full compliance and high morale are preferred, but when enforcement, while positively affecting compliance, negatively affects tax morale (Cialdini 2007), the optimal outcome becomes less predictable. Given that the number and granularity of combining different policy choices are infinitely diverse, restricting the number of options available to the optimization algorithm makes this computing-intensive approach feasible.

The number of countries and the tax policy instruments included in this algorithm are restricted. Table 2 shows the variables that the algorithm alters during the optimization process. The first two columns name and describe the variable. The next column shows the range, or the minimum and maximum possible values, that the variable can be given. The granularity, the minimum amount of change that can be applied, is added in the last column (a lower granularity requires more computation to cover the same distance).

| Variable | Description | Range | Granularity |

|---|---|---|---|

| Audit rate | Defines the percentage of taxpayers that are audited each year (with potential operations in the target country). | 0–10% | 0.01 p.p. |

| Penalty rate | Defines how much must be paid to the country when tax evasion is detected, relative to the evaded amount. A rate of 1 indicates no penalty and requires returning the amount that was evaded. | 1–15 | 0.10 |

| Withholding tax rate | This parameter defines a tax rate withheld by the payer in the country of origin on interest, royalty, and dividend payments to foreign entities. | 0–50% | 0.05 p.p. |

| Crime threshold | When the amount of tax evaded exceeds the threshold amount, the offense will be prosecuted according to criminal law instead of civil law. The punishment under criminal law usually contains jail-time and probation, while civil law usually involves financial arrangements. | €0–1 M | €10 k |

| Prescription time | Defines the number of years after the initial offense for which prosecution remains possible. For example, an offense in 2005 with a prescription of 5 years can be prosecuted when detected between 2005 and 2010. | 1–25 years | 1 year |

The tax policy instruments audit rate, penalty rate, crime threshold, and prescription times, have been selected, because they cannot stimulate tax competition, since they only influence the country of origin's ability to enforce tax compliance. The only exception is the withholding tax rate, which affects the vulnerability to tax flight from the country of origin but does not affect any target country. So, all five tax policy instruments can be combined by the country of origin, in order to influence tax morale and tax compliance of its taxpayers without engaging in tax competition with another country.

This paper illustrates the analysis by finding the policy options for France, Spain, and the UK. These three (source) countries are selected because an earlier version of this ABM showed that they are most affected by tax evasion and tax avoidance through CbCR and AEoI (Gerbrands & Unger 2021). The corporate tax haven index (CTHI) is used to select a target country that represents tax havens (Tax Justice Network 2019). The financial secrecy index (FSI) is used to select a representative for secrecy havens (Tax Justice Network 2018). For both indicators, the highest-ranking European country is selected which shows up in only one of the top five lists for both indicators. This results in making Luxembourg the representative example for tax havens and Liechtenstein for secrecy havens (as target countries). Another European country must be selected that is not considered an outlier, which will represent the control group. This country represents non-havens for which Poland is selected as the target country as an example.11

4.2 Methodology for finding the appropriate response

To find the results the BehaviorSearch application (Stonedahl & Wilensky 2010) is used. Five independent searches are performed for each of the selected nine country-combinations. Each configuration that has evolved within these searches ran 10 times after which the mean outcome of the overall tax morale is calculated. This makes the outcome less affected by random chance given the stochastic nature of ABMs. Only if the mean outcome is better than the best earlier outcome, the system will run the same configuration another five times to ensure the outcome is an improvement and if so, a new best solution is found. This process repeats for 250 iterations in which the best set of parameters evolves. The steps in the developed ABM are executed at least 450,000 times, and the three additional runs are executed each time a better solution is found to validate its consistency.

5 Simulation results

The ABM determines the appropriate policy response for each individual country-pair and calculates the effect of implementing these recommendations on the expected tax morale and compliance. First, the appropriate responses are analyzed within the context of the relative and domestic powers of the countries which form the pair. Countries have five tools they can combine selectively to find the optimal tax policy response toward non-tax havens, tax havens, and secrecy havens without affecting the target country. As shown in Table 2, the simulation allows countries to vary some of their tax policy instruments to influence the expected perception of domestic and relative power (see Appendix for the underlying logic of the ABM).

Alternatively, countries become less vulnerable to non-compliance if for example inequality levels decrease or the average per capita income level increases, but this requires a proper functioning tax system. Next, the overall effects on the tax morale and associated compliance levels are compared to the scenario in which the policies are not adjusted as proposed (in Sections 5.2 and 5.3 respectively).

5.1 Estimating optimal enforcement policies

The hill-climber algorithm estimates the best possible policy response for each tested country pair. Table 3 shows the optimized policy responses per country pair, both the suggested value and the relative change for the current country of origin's level. The last column shows the average level of enforcement per target country.

| Target country | Policy measure | France | Spain | United Kingdom | Average | |||

|---|---|---|---|---|---|---|---|---|

| Value | Diff % | Value | Diff % | Value | Diff % | Value | ||

| Strategies toward tax havens | ||||||||

| Luxembourg | Audit rate | 4.08 | 2.16 | 3.71 | 1.94 | 8.13 | 0.68 | 5.31 |

| Crime threshold | 562 k | 14.13 | 488 k | −0.26 | 506 k | 34.95 | 519 k | |

| Penalty rate | 5.34 | 1.05 | 5.56 | −0.81 | 8.22 | 3.11 | 6.37 | |

| Prescription time | 13.20 | 1.20 | 10.00 | 0.00 | 13.40 | 0.23 | 12.20 | |

| Withholding tax | 43.83 | 0.55 | 43.18 | 1.43 | 46.16 | 3.13 | 44.39 | |

| Strategies toward secrecy havens | ||||||||

| Liechtenstein | Audit rate | 6.38 | 3.94 | 6.82 | 4.40 | 5.86 | 0.21 | 6.35 |

| Crime threshold | 290 k | 6.81 | 396 k | −0.40 | 286 k | 19.32 | 324 k | |

| Penalty rate | 5.34 | 1.05 | 9.42 | −0.67 | 11.24 | 4.62 | 8.67 | |

| Prescription time | 17.20 | 1.87 | 19.60 | 0.96 | 19.60 | 0.80 | 18.80 | |

| Withholding tax | 44.12 | 0.56 | 46.44 | 1.62 | 43.52 | 2.90 | 44.69 | |

| Strategies toward non-havens | ||||||||

| Poland | Audit rate | 7.08 | 4.49 | 5.18 | 3.10 | 4.96 | 0.03 | 5.74 |

| Crime threshold | 862 k | 22.21 | 428 k | −0.35 | 362 k | 24.72 | 551 k | |

| Penalty rate | 4.88 | 0.88 | 6.96 | −0.76 | 6.36 | 2.18 | 6.07 | |

| Prescription time | 17.20 | 1.87 | 14.00 | 0.40 | 9.20 | −0.16 | 13.47 | |

| Withholding tax | 47.21 | 0.67 | 40.08 | 1.26 | 42.36 | 2.79 | 43.22 | |

The median of the appropriate results, which are purely linked to the optimal hill-climber algorithm, is shown in the column “Value” of including the change relative to the current country of origin settings (column “Change”). For example, for taxpayers in France that have strong connections to Luxembourg, the French authorities must increase their audit rate (from 1.29 percent) to 4.08 percent, a change of 2.16 p.p. to accommodate this specific taxpayer group and increase the penalty rate to 5.34 times the evaded taxes. The expected logic behind this decision is that such a combination does not affect the tax morale of the other taxpayers more than the extra revenues for increasing the enforcement policy will provide. The withholding tax rate should be increased to 43.83 percent to curb avoidance. Finally, the prescription time needs to expand from 6 to 13 years but the threshold amount after which the case becomes a criminal offense increases to €562,000. Spain, on the other hand, needs to increase its audit rate and decrease its penalty rate for Luxembourg, to 3.71 percent and 5.56 respectively.

These are the results of optimizing the simulation model and clear explanations other than many trial-and-errors remain void. The reason behind these policies is always related to the effect that the domestic and relative powers of the two countries and the susceptibility for evasion or avoidance practices, the tax morale. For example, France's higher tax rates, between 15 percent and 33 percent relative to Spain's 25 percent flat rate might create a stronger “need to avoid or to evade” while a higher average withholding tax in France (currently 28.3 percent) relative to Spain (currently 17.7 percent) makes tax evasion more attractive for the French than for the Spanish taxpayers. Auditing typically counters tax evasion but also makes the population more distrustful. Therefore, the high domestic power of France requires a decrease in the audit rate to support tax morale, while Spain, with its lower domestic power, needs to increase it to force compliance.

The tradeoff between reducing tax evasion and avoidance through enforcement and managing the difference between the domestic and relative powers to optimize tax morale and tax compliance is the core objective of the appropriate policy simulations. Each country of origin adjusts its tax policy instruments toward another country to minimize tax evasion and to maximize tax compliance. When companies of the source countries are active in a tax haven, the country of origin should for example increase the audit rate for these companies, while it should audit companies active in other countries less. Depending on whether the country of origin has a high or low trust of its residents, an increase in the audit rate will affect domestic power differently. If the trust of the residents is high, an increase in the audit rate will be more accepted by residents than if the country has low trust. Also, the attractiveness of the target country compared to the country of origin affects what countries could do best to reduce tax evasion and avoidance and to increase tax compliance.

Since the cross-border implementation of responsive regulation in this paper is based on the domestic and relative power that each country pair results in, the recommended policies are related to these powers and country pairs. Therefore the results per country pair are complex, and also the results in Tables 4 and 5 cannot be explained through basic causality, but require complex causality assumptions (Morçöl 2012, Chapter 9). Psychological aspects play an important role in defining tax compliance and complicate the causality assumptions even further. For example, the perception of “self” and the situational context in which this “self” is perceived may change when new reforms happen or new neighbors with different tax morale move in. This becomes especially important when this perception of self is related to the level of similarity of the tax morale of the taxpayer with its direct neighborhood (Braithwaite et al. 2017). Heterogeneity among the initialization parameters of the agents in the simulation model (in this case the influence factor) correct for such behavior. The associated policy recommendations are aiming to maximize both tax compliance and tax morale.

| Country of origin | Target country | Tax morale not responsive | Tax morale responsive | Absolute difference | Relative difference (%) | P-value |

|---|---|---|---|---|---|---|

| France | No haven | 0.574 | 0.616 | 0.042 | 7.29 | 0.106* |

| France | Secrecy haven | 0.460 | 0.475 | 0.015 | 3.35 | 0.999 |

| France | Tax haven | 0.482 | 0.511 | 0.029 | 6.00 | 0.705 |

| Spain | No haven | 0.512 | 0.621 | 0.109 | 21.22 | 0.000*** |

| Spain | Secrecy haven | 0.398 | 0.506 | 0.108 | 27.19 | 0.000*** |

| Spain | Tax haven | 0.418 | 0.517 | 0.099 | 23.61 | 0.000*** |

| UK | No haven | 0.668 | 0.712 | 0.043 | 6.51 | 0.075* |

| UK | Secrecy haven | 0.521 | 0.562 | 0.040 | 7.71 | 0.149 |

| UK | Tax haven | 0.558 | 0.618 | 0.060 | 10.70 | 0.001*** |

- *p < 0.1; **p < 0.05; ***p < 0.01.

| Country of origin | Target country | Tax compliance not responsive | Tax compliance responsive | Absolute difference | Relative difference (%) | P-value |

|---|---|---|---|---|---|---|

| France | No haven | 0.934 | 0.940 | 0.006 | 0.68 | 1.000 |

| France | Secrecy haven | 0.864 | 0.879 | 0.014 | 1.65 | 0.948 |

| France | Tax haven | 0.879 | 0.887 | 0.009 | 0.98 | 1.000 |

| Spain | No haven | 0.911 | 0.921 | 0.010 | 1.08 | 0.999 |

| Spain | Secrecy haven | 0.819 | 0.861 | 0.042 | 5.08 | 0.000*** |

| Spain | Tax haven | 0.582 | 0.840 | 0.258 | 44.44 | 0.000*** |

| UK | No haven | 0.964 | 0.971 | 0.007 | 0.75 | 1.000 |

| UK | Secrecy haven | 0.919 | 0.951 | 0.031 | 3.42 | 0.016** |

| UK | Tax haven | 0.831 | 0.956 | 0.125 | 15.06 | 0.000*** |

- *p < 0.1; **p < 0.05; ***p < 0.01.

From a legal perspective, some changes are commonplace, like changing audit rates per target country, and are considered profiling. It may seem like a far stretch to have different criminal threshold amounts or prescription times for corporations that operate in different countries, even if they evade the same amount of taxes. But doing so will change either the domestic power of the country of origin or the relative power that the target country captures. If the criminal threshold amount for evading in a secrecy haven is lower than elsewhere, it affects those agents (corporations) that operate in the selected country more than those who are not. A legal discussion on the feasibility of adjusting criminal or civil law based on the decisions that corporations and high-net-worth individuals make concerning their head office or investment portfolios is out of scope for this paper. Still, implementing the exact measures as defined in Table 3, results in significant improvements in tax compliance and tax morale as the next section shows. A discussion of further appropriate alternative tools that could still be developed might be legally easier to implement and might have positive effects on tax morale and tax compliance, is left to future research.

Now that the best policies are identified, the next step is to implement the recommended policy changes and to run the simulations several times (in this analysis each country pair has been simulated 10 times). By comparing the results concerning tax morale and tax compliance to the scenario in which no policy recommendations are implemented, the impact of the policy recommendations can be assessed.

5.2 Effect on tax morale

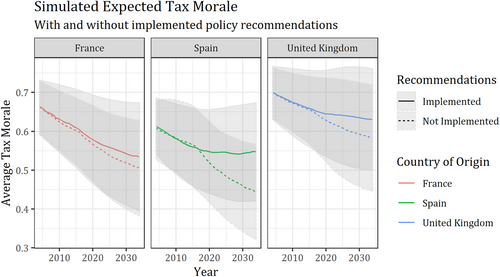

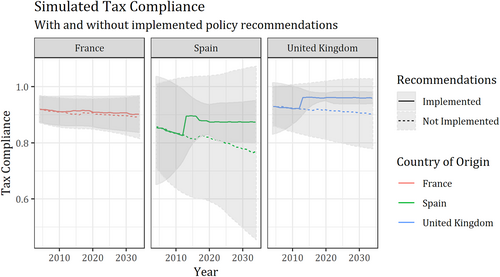

Running the simulation multiple times allows for calculating the expected effect of two scenarios, one with and one without the policy recommendations implemented. As can be seen in Figure 3, in which the light grey area indicates the 95 percent confidence interval (CI), the graphs of the selected source countries show a large overlap of the CI (which then becomes dark grey) for the scenarios in which the recommendations were implemented versus those in which they were not implemented. The three charts show the average tax morale of the taxpayers in their respective home countries (source) under the conditions of having the policy recommendations implemented (solid line) or not implemented (dotted line). The figure indicates that implementing the recommended policy changes has a positive effect on the average tax morale. Unfortunately, the effect for France seems rather small. The positive effect of implementing CbCR and AEoI is visible since the tax morale in all “not implemented” scenarios suddenly drops.

To analyze this difference statistically, a one-way ANOVA test is performed12 which compares the effect of the country of origin, the type of target country, and implementing the recommended policy changes on the tax morale of the country of origin. It shows that the country of origin is significant for determining the tax morale (F = 251.968, DF = 2, P-value = 0.000), which makes sense given that it determined the starting point for the tax morale. Whether the country is a tax haven, secrecy haven, or non-haven is significant too (F = 342.638, DF = 2, P-value = 0.000), which is part of the theoretical assumption made in this paper. Finally, implementing the recommended policy changes also has a significant effect on tax morale (F = 202.818, DF = 1, P-value = 0.000), showing that implementing the optimal enforcement strategy matters.

Table 4 shows the numerical simulation results for the expected tax morale in 2034. Columns 3 and 4 show the expected tax morale when the recommendations are not implemented and when they are implemented respectively. Column 5 shows the difference in tax morale between the two scenarios. A positive number indicates that the average morale after implementing the policy recommendations is higher than when not implemented (tax morale has increased) which, in column 6, is also expressed as a percentage of expected tax morale in the case the recommendations are not implemented.13 The significance of the change is reported in column 7 using Tukey's range test (Tukey 1949), with a P-value (in which P-value <0.05** is considered significant).

Table 4 shows that in all scenarios, implementing the recommended policies increased the average tax morale (the absolute difference is always positive). In Spain, the relative difference is the highest, on average 24.01 percent. In the UK tax morale increases by 8.30 percent and a slightly smaller increase of 5.54 percent is achieved by France. On average, the tax morale in 2034 for the top three countries most affected by tax evasion and avoidance (Gerbrands & Unger 2021), increases from 51.0 percent when no recommendations are implemented to 57.1 percent after implementation, a change of 11.87 percent or 6.1 percentage points.

5.3 Effect on tax compliance

The tax morale has improved by following the suggested policy recommendations, as the previous section demonstrates. But does this result in higher tax compliance and thus the associated tax revenue? To answer this, the same procedure as in the previous section is followed. To operationalize the level of tax compliance, the total amount of taxes paid by all agents is calculated and divided by the total amount of taxes expected due to the individual income levels of all taxpayers.

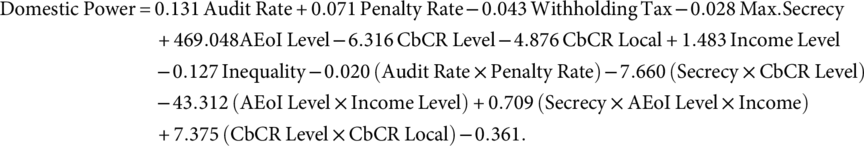

Figure 4 shows the development of tax compliance over time for the three countries of interest. The solid line indicates tax compliance after implementing the policy recommendations; the dotted line shows the scenario in which the recommendations were not followed. The grey areas around the lines represent the 95 percent confidence interval. In all cases, even if very little like in France, implementing the policy recommendations result in a higher compliance level. The implementation of CbCR and AEoI is hardly visible, merely a little dent is visible in the dotted lines (the “not implemented” scenario), thus their implementation has increased tax compliance only slightly for a short period since the dotted lines all have a downwards slope.

For all countries, but especially for Spain and the UK, implementing the responsive policy recommendations caused a sudden increase in tax compliance, resulting in a higher and stable level of tax compliance in the long term (the solid lines in Fig. 4 all end higher than their dotted counterparts). Given the large overlap of the confidence intervals, the significance of the policy changes seems visually inconclusive and must be tested numerically.

To numerically assess the effect of implementing the policy changes on tax compliance, as with the analysis of tax morale, an ANOVA test was planned. Unfortunately, the required assumptions for normality and heteroskedasticity could not be met14 and thus the non-parametric Kruskal–Wallis test (Kruskal & Wallis 1952) is conducted instead. The country of origin significantly affects the level of tax compliance (χ2 = 62.667, DF = 2, P-value = 0.0000) which could be explained by, for example the different initial levels of tax morale measured by the European Value Study.15 Similar to the effect of tax morale, the type of target country also significantly influences tax compliance (χ2 = 66.185, DF = 2, P-value = 0.0000). Finally, theoretically argued in this paper, also implementing the recommended policies significantly impacts tax compliance (χ2 = 13.918, DF = 1, P-value = 0.0002). To identify the significance of the change in compliance by country of origin, target country, and policy implementation level, Tukey's range test (Tukey 1949) is applied, for which the results are listed in column 7 of Table 5 (a P-value <0.05** is considered significant).

Table 5 shows, for the countries selected as examples for source countries (column 1), the median values (columns 3 and 4) of the expected level of tax compliance for the target countries (column 2). Positive differences between these levels (column 5) indicate that after implementing the policy recommendations, tax compliance has increased. The relative change is calculated as a percentage of the median compliance of the scenario in which the recommendations were not implemented and reported in column 6.

For example, when France would implement all suggested policy responses as shown in Table 3, tax compliance increases by 0.68 percent when its taxpayers compare France to other non-haven countries (from 0.934 to 0.940). These results are not significant. Possible explanations for this are: the improvement of implementing the policy recommendations is so small that the stochastic characteristic of the ABM causes larger differences or there is no specific target country that generates exceptionally large losses for France. Implementing the policy changes has a significant effect on tax compliance in Spain and the UK, in the case of encountering tax and secrecy havens. When the Spanish taxpayers compare their country to secrecy havens, implementing the policy recommendations increases tax compliance by 5.08 percent (from 0.819 to 0.861). The biggest gain of implementing the recommended policy measures is when Spanish taxpayers compare the options in their own country to the ones in tax havens. Here, setting the right tax tools in Spain can improve the compliance level by 44.44 percent (from 0.582 to 0.840).

Overall, the analysis shows that changes in the policy instruments, in line with the recommendations generated by the optimizations algorithm as presented in Table 3, are associated with a significant but sometimes small increase in tax compliance. On average this approach results in a 12.12 percent total increase in tax compliance. Comparing the average effect per country of origin shows that the smallest total effect is achieved in France, which could increase, its tax compliance from 0.892 by 1.09 percent to 0.902. This is closely followed by the UK with an increase of 6.04 percent (from 0.905 to 0.959). Spain will benefit most from internationally responsive policies, increasing the average tax compliance from 0.771 to 0.874 with 13.40 percent. The effect of implementing the recommended policies on tax compliance specifically for tax havens and secrecy havens is significant, while non-havens remain stable, hence no negative effect of the new policies is observed. Averaging all 9 country pairs results in a compliance level of 85.6 percent before implementing the policy recommendations and 91.2 percent shortly after, this corresponds to a reduction of evasion and avoidance levels of 6.54 percent.

6 Conclusions

While tax policies are traditionally national, international tax challenges make this policy field more and more international. However, most literature on tax compliance still analyses the national setting only and ignores the interaction between individual taxpayers and multiple countries. This paper focuses on the effects of two specific international tax regulations: CbCR and AEoI. While these regulations might be able to increase tax revenues in the short run, too much coercion without trust could deteriorate tax morale and thus compliance in the long run.

Responsive regulation can increase the trust in authorities and the associated voluntary compliance by properly activating both the coercive and persuasive powers of the government. This paper proposes to use this framework in a bilateral setting where countries adjust their policies depending on the country they are dealing with. We show that tax compliance can increase in the long term, while still implementing important internationally agreed policies like CbCR and AEoI, by aligning national tax policy instruments to the potential tax spillover caused by another country.

We test the potential effectiveness of such a bilateral approach with an ABM that simulates the actions of agents, based on the policies in place but also other relevant factors, like the actions of agents in their vicinity. The policy instruments that countries in our model can intensify or abate to increase tax compliance are the audit rate, the penalty rate, the withholding tax rate, the crime threshold, and the prescription time.

As an illustration, the simulation is used to find the best policy response for France, Spain, and the UK toward three other European countries: Liechtenstein, Luxembourg, and Poland. These can be seen as examples of how specific countries can deal best with tax havens, secrecy havens, and non-tax havens. We simulate with different values at least 450,000 times to find the optimal bilateral responsive regulation. The simulation shows that the same policy has different effects in different countries. Adjusting domestic power by changing enforcement policies based on the threat posed by other countries can be an effective way to increase tax compliance.

We use our ABM to identify an appropriate policy mix for France, Spain, and the UK that maximizes tax compliance in the long run. More specifically, we show that adjusting the enforcement policies in relation to the target country in which the taxpayers are predominantly represented – the responsive approach – has a significant impact, especially when targeting tax havens. One explanation for this effect lies in the willingness of taxpayers to accept the enforcement pressure when they know their business is located in a known tax haven. Analogous to the proverb “who plays with fire might get burned,” placing it in the context of this paper: “who conducts business in a tax haven might get audited and penalized more strictly,” taxpayers are expected to have a higher level of accepting the increased enforcement when playing with fire (i.e. their tax morale is less damaged by the new policies). A similar effect occurs for those who do not play with fire and expect not to be forced into compliance, thus will not accept the state's coerciveness. Adjusting the policies responsively, therefore, results in higher tax morale and consequently in a higher level of compliance. The results indicate that there are many opportunities in which primarily tax havens, but also secrecy havens, can be effectively dealt with. Our simulation finds that a differentiated policy response of these three countries toward non-tax havens, tax havens, and secrecy havens could increase tax compliance per country by, on average, 6.54 percent in the next 15 years. For taxes on income, profits, and capital gains within all EU Member States, this would amount to €105 billion extra revenues per year.16 Focusing on corporate income taxes in France, the UK, and Spain in 2018, the extra revenues would be around €35 billion. More importantly, the approach does not result in further tax competition. By adjusting enforcement policies responsively, the negative side-effect of two major European directives (CbCR and AEoI) on the tax morale is decreased, increasing the average tax morale by more than 11 percent for the selected countries in the long run (in 2034).

This paper contributes to the academic field of tax compliance by providing an alternative to the individual approach mostly used. The model presented in this paper incorporates the relationship between taxpayers and the tax authorities as well as between taxpayers. These interactions are embedded by enabling taxpayers with higher and lower propensities to pay taxes, to meet other taxpayers and tax authorities in their neighborhood which affects their behavior. These taxpayers also look for loopholes in the international tax system and do business abroad if they judge the foreign country as more attractive than their own.

6.1 Limitations and discussion

The simulation model presented in this paper can help policymakers. Using the model, regulators can design and test policies before implementation. A more detailed temporal analysis can be performed to further improve the ABM that underlies this analysis when more data and more precise data become available.

The bilateral responsive regulatory approach depends on legal possibilities. For example, for the source (or residence) country, applying different penalties for tax evasion based on the country that is used to funnel the funds (the target country) might be subject to criticism. A legal analysis of such possibilities is needed.

The risks associated with the target countries will only translate into the motivational postures of some taxpayers, not all. A possible extension of this model is to separate the country's risk profile from the responsive regulation framework. A hybrid form of risk-based regulation, which would determine the resource allocation of tax auditing and control, could then be aligned with the responsive regulation approach in which the enforcement type and level would be adjusted on a taxpayer's representation in selected countries.

Large multinational corporations use their power to negotiate for special fiscal treatment in different tax jurisdictions, as the LuxLeaks17 show for example. Even though part of this negotiation power lies in the alternatives that competing jurisdictions provide, the model does not include the effects of lobbying and the resulting tax-rulings that arise from such activities. One could argue that the resulting outcomes are fairly conservative and that increasing transparency might increase the effect of the suggested policy recommendations. A possible extension of the ABM is to treat some taxpayers differently.

Exposures like the LuxLeaks,18 the Panama Papers,19 and the Paradise Papers20 influence the public perception of specific countries through the media. Media attention related to these topics21 is likely to influence the public's decisionmaking process. Whether this results in a reduced or increased interest in specific jurisdictions needs more investigation.

Acknowledgments

This article has been prepared in the Combating Fiscal Fraud and Empowering Regulators (COFFERS) project. This project has received funding from the European Union's Horizon 2020 research and innovation program under grant agreement No. 727145. The authors declare that the received funding has not influenced the work reported, neither directly nor indirectly.

Endnotes

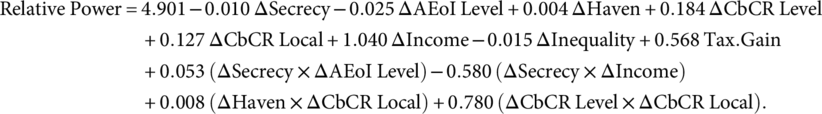

Appendix

Operationalization of domestic and relative power

In the agent-based model, the coefficients vary per individual agent, in line with the variance observed. Several enforcement instruments are included, that is the audit and penalty rates, withholding taxes, and the extent to which AEoI is implemented. Also, in how far opportunities for tax avoidance and evasion can be created, like secrecy levels (Tax Justice Network 2019), and the implementation of CbCR are included. Finally, indicators for national wellbeing in terms of income levels and inequality also influence the perceived domestic power of a country. The variables are domestic and do not include any policy configurations abroad.

The variable “tax gain” indicates the difference between the income tax rate of the country of origin and the adjusted income tax rates for foreign entities in the target country. Below is an example that uses the formulae for domestic and relative power.

| Country | Denmark | Bulgaria | Ireland |

|---|---|---|---|

| Corporate income tax rate | 22% | 10% | 12.5% |

| Average income | €39,020 | €14,015 | €30,406 |

| Inequality index | 28.2 | 37.4 | 31.8 |

| Audit rate | 4.520% | 5.837% | 3.075% |

| Penalty rate | 2.079 | 1.421 | 4.355 |

| Criminal threshold | €50,698 | €12,446 | €529,626 |

| Domestic power | 4.79 | 4.17 | 4.50 |

| Relative power toward Denmark | n/a | 4.46 | 4.65 |

| Relative power toward Bulgaria | 5.38 | n/a | 5.26 |

| Relative power toward Ireland | 4.61 | 3.80 | n/a |

- Note: The domestic and relative powers are calculated using the aforementioned equations, but due to the stochastic properties of any agent-based simulation model, the reported results are the average of running each simulation scenario 10 times.

- n/a, not applicable. Sources: CIT rates are retrieved from PwC's worldwide tax summaries (https://www.pwc.com/gx/en/services/tax/worldwide-tax-summaries.html), the average income is retrieved from UNDP's GNI per capita (http://hdr.undp.org/en/content/gni-capita-ppp-terms-constant-2011-ppp) and converted to Euro, the inequality index is retrieved from the World Bank estimated GINI indices (https://data.worldbank.org/indicator/SI.POV.GINI), audit rates are estimated using OECD reports on Tax Administration 2015 and 2019, penalty rates and criminal thresholds are defined using Utrecht Codebook on Fiscal Fraud to Empower Regulators (Rossel et al. 2019).

For example, as shown in Table A1, the corporate income tax rate in Denmark is 22 percent. The average annual income is estimated to be €39,020 and inequality as measured by the GINI index is 28.2. We have calculated that Denmark audits 4.52 percent of the taxpayers and that criminal prosecution follows after €50,698 is of taxes is evaded, which will be penalized with a factor of 2.079 of the evaded amount. The calculated domestic power of Denmark is therefore around 4.79.

Bulgaria has a tax rate of 10.0 percent and evasion is criminalized when exceeding almost €12.446 which is then penalized by 1.421 times the evaded amount. The average income level is slightly lower, with €15,015 per year, and inequality is higher, given a GINI index of 37.4. These numbers lead to a domestic power of Bulgaria as perceived by the Danish taxpayers to range around 4.17. The differences between these countries are quite large with the average income in Denmark doubling Bulgarian income. Also, Bulgaria considers tax evasion a criminal activity even before the annual average income is reached, while Denmark adds more leeway. The chance of getting audited in Denmark is slightly lesser than in Bulgaria. Altogether, compared to Bulgaria, Denmark provides a better environment for evasion and avoidance purposes, even when the penalties in Denmark are slightly higher. Thus, Bulgaria is despite its lower tax rate not considered to be an attractive tax haven. This results in Denmark having a high relative power over Bulgaria (around 5.38) which leads to a high tax compliance level in Denmark (almost 93% of the Danish population would not evade or avoid through Bulgarian channels).

But comparing Denmark with Ireland instead changes this relative power of Denmark over Ireland to 4.61. Ireland has an estimated audit rate of 3.08 percent and provides a very high criminal threshold of €529,626, considering an income level of €30,406 and an inequality of 31.8. The undermining effect of Ireland as a tax haven for Denmark, causes the expected compliance level to drop to 81 percent of the population.

So, when the Danish choose between Bulgaria and Ireland as a target country to evade or avoid taxes, they prefer Ireland even though it has a slightly higher corporate tax rate than Bulgaria, due to the difference in relative power.

Open Research

Data availability statement

The data that support the findings of this study are available from the corresponding author upon reasonable request.