A victim of regulatory arbitrage? Automatic exchange of information and the use of golden visas and corporate shells

Declaration of conflict of interest: There are no conflicts of interest to be reported.

Abstract

The multilateral adoption of the automatic exchange of information (AEI) on bank accounts held by nonresidents was a breakthrough in the fight against cross-border tax evasion, which led to a substantial reduction in the value of bank deposits and investment portfolios in traditional tax havens. However, there is suspicion that sophisticated tax evaders engage in regulatory arbitrage of AEI provisions. We examine whether two widely discussed secrecy schemes, namely golden visas and anonymous trusts and shell corporations, have been used to circumvent information reporting. Relying on a difference-in-difference design, we only find scattered evidence for use of the secrecy schemes. Overall, our results suggest that regulatory arbitrage is not yet widespread, but it seems to increase over time. We thus provide evidence for the current effectiveness of the AEI but also show that closing remaining loopholes is of utmost importance. We link our findings to debates about the (im)possibility of re-embedding neoliberal globalization.

1 Introduction

In October 2014, governments organized in the Group of 20 (G20) and the Organisation for Economic Co-operation and Development (OECD) claimed a historic breakthrough in the fight against tax evasion. Through the multilateral adoption of an automatic exchange of information (AEI) on bank accounts held by nonresidents, tax authorities should regularly obtain reliable and up-to-date information on taxpayers' foreign capital income. Most strikingly, all countries hitherto notorious for their financial secrecy accepted to participate in the AEI after the United States had forced them to abolish domestic banking secrecy provisions. After decades of successful resistance, even Liechtenstein and Switzerland eventually agreed to routinely report account data to the member states of the European Union (EU) (Steinlin & Trampusch 2012; Emmenegger 2017; Hakelberg & Schaub 2018). In some quarters, the multilateral adoption of the AEI raised hopes that governments could finally increase the effective progressivity of their income tax systems by realigning tax rates on capital and labor income. After all, policymakers' traditional justification for a preferential treatment of interest, dividends, and capital gains – the risk of capital flight to secretive tax havens – had just been abated at the international level (Ahrens et al. 2020; Hakelberg & Rixen 2020).

There is a small but rapidly expanding literature on the effects of AEI (for an overview, see O'Reilly et al. 2019 and Section 2). Virtually all studies agree that the adoption of the AEI reduced the value of cross-border investment in formerly secretive jurisdictions. These results raise the hopes of policymakers and academics alike. However, we can learn from previous attempts to curb cross-border tax evasion that one must remain skeptical. The finding that AEI reduced cross-border investments in secretive jurisdictions tells us little on whether the respective funds were legalized or merely transferred to new providers of financial secrecy. After all, research on previous types of information exchange shows that tax evaders routinely circumvented information exchange by exploiting loopholes (e.g. Johannesen & Zucman 2014; Menkhoff & Miethe 2019).

In this study, we ask to what extent the AEI is subject to regulatory arbitrage. Regulatory arbitrage is the ability of actors to circumvent or neutralize rules by restructuring or recharacterizing transactions and/or by relocating either the transactions or themselves (Marjosola 2019, p. 1).1 The term invokes a cat and mouse race, in which regulated actors are always one step ahead of regulators. The latter must constantly fill new loopholes that inventive regulatory targets find in regulations. While there are many accounts of individual cases of regulatory arbitrage (e.g. Blundell-Wignall & Atkinson 2009; Pistor 2019, pp. 73–76), systematic empirical assessments of the extent of regulatory arbitrage are less common (but see Milcheva 2013). One reason for the lack of empirical enquiry into regulatory arbitrage is that it is difficult to detect. Researchers need to show that an intended outcome of regulation has not been realized because of regulatory arbitrage. But the hypothesized counterfactual of full goal accomplishment is difficult to estimate. Like other attempts at measuring regulatory arbitrage, we therefore resort to the second-best strategy of identifying specific techniques of regulatory arbitrage (cf. Willesson 2017, p. 73).

The OECD's Common Reporting Standard (CRS) – the template for the multilateral adoption of the AEI – includes two important gaps (Menkhoff & Miethe 2019, p. 66; OECD 2018a).2 First, tax evaders may use one of the rapidly proliferating golden passport schemes, which allow them to acquire foreign passports. This would enable them to circumvent information reporting to appropriate tax authorities by feigning a false nationality. A Maltese bank, for instance, may no longer feel obliged to report the account of an Italian citizen if she can document tax residence in Malta despite not having her center of vital interests there (OECD 2018b). Second, the CRS requires banks to identify the beneficial instead of the immediate owner of an account to ensure that tax evaders cannot hide their identity behind interposed legal entities. But activists and scholars doubt that banks always live up to their customer due to diligence obligations, particularly when dealing with wealthy clients and in countries with lax beneficial ownership regulations (see the online appendix of Alstadsæter et al. 2019). So far, however, the impact of golden visas and lax beneficial ownership regulations on the AEI has not been investigated empirically.

We aim to close this gap with an empirical analysis of these AEI circumvention efforts. We use a difference-in-difference (DID) design that compares the development of cross-border bank deposits and portfolio investments from countries offering lax beneficial ownership regulations or golden passport schemes to deposits and portfolio investments from countries not making such offers. Our underlying assumption is that tax evaders merely use the former countries as conduits for investments in major financial markets (cf. Hanlon et al. 2015; Menkhoff & Miethe 2019). If golden passports or lax beneficial ownership regulations are an attractive workaround for tax evaders, adoption of the CRS should lead to an increase in investments from the countries offering these schemes.

Our results are mixed. We find that the two loopholes are used to hide portfolio investments in the Eurozone, but we find no corresponding evidence for portfolio investments in the Pound and Dollar markets and no evidence whatsoever for hidden deposits in any of the three markets. Overall, the data do not show widespread use of the secrecy schemes. However, the use of the secrecy schemes seems to increase over time, although this finding is associated with a degree of uncertainty. This suggests that even though regulatory arbitrage appears to be limited, policymakers must stay on their toes to shore up the regime in the future.

Assessing regulatory arbitrage of the AEI regime informs important political and scientific debates about the future of economic globalization and inequality. Can economic globalization be effectively regulated by states? Is it compatible with the pursuit of ecological, egalitarian, and redistributive public policies (e.g. Vogel 1995; Genschel 2004)? On the one hand, optimists argue that even in a globalized economy, hypermobile capital and financial assets can be subjected to state regulations and taxes, if all potential tax and regulatory havens participate. This was hard to achieve since the benefits of remaining a tax haven increase with the number of cooperating countries, as tax evaders shift their assets from newly transparent to staunchly secretive jurisdictions (Dehejia & Genschel 1999; Holzinger 2005). But recent research shows that the US government transcended this weakest link logic when exploiting its dominant position in international finance to force virtually all foreign countries at once to abandon banking secrecy through the Foreign Account Tax Compliance Act (FATCA) (Hakelberg & Schaub 2018; Hakelberg 2020).

On the other hand, pessimists argue that regulation is futile in the face of regulatory arbitrage. When nonparticipation in the AEI is no longer possible, tax havens might consider alternatives such as golden passports and opaque registries, thereby preserving secrecy and the weakest-link logic (Crasnic 2020). They are encouraged and supported in this by a well-functioning network of transnational elites, lawyers, and wealth managers. Going beyond the unitary state assumption, proponents of this view argue that the transnational capitalist class can access and assemble tailor-made regulations of formally sovereign, but often weak, states to create complex property protection and tax “optimization” structures across several jurisdictions. In effect, new transnational institutions are created that are impermeable to the regulatory ambitions of powerful states or civil society (Robinson 2001; Harrington 2016).

Fresh empirical evidence in this long-standing debate is crucial in finding sustainable alternatives to neoliberal globalization, which has brought inequality and a populist backlash (Rodrik 2018; Engler & Weisstanner 2020). Populist parties and governments in many countries promise to defend national sovereignty against global markets by implementing protectionist measures. Our findings contribute to this debate. If the AEI mainly led to mock compliance by tax havens and further arbitrage by tax evaders, this would potentially lend support to populist calls for a rollback of economic globalization in the name of democratic sovereignty and more socio-economic equality and security. If, however, the AEI turns out to be hard to circumvent, this would demonstrate that there is an alternative to protectionism – namely multilateral cooperation among states that secures the welfare benefits of open economies but regulates them effectively to avoid inequality. If effective, the AEI may indeed be a model for policies that re-embed globalization, thereby mitigating populist concerns. The regime is designed to restore national sovereignty in capital taxation where it had previously been lost to the competitive pressures of globalization (cf. Ahrens & Bothner 2020; Hakelberg & Rixen 2020). The fact that this is not just wishful thinking is evidenced by the explicit link some governments have established between the abolishment of flat taxes on capital income and the effective implementation of the AEI (CDU et al. 2018, p. 69). This makes research on regulatory arbitrage of the regime highly salient, as it may determine whether the preferential tax treatment of capital versus labor income persists or not. Our research may therefore have important consequences for the future progressivity of tax systems and income inequality.

We proceed as follows. In the next section, we describe different types of taxpayer information exchange and review the existing empirical evidence on their strengths and weaknesses. Based on this, we discuss how lax beneficial ownership regulations and golden passports may be used to undermine the AEI's effectiveness and present our strategy for causally identifying these loopholes (Section 3). In Section 4, we describe the data and methods used to empirically test the loopholes' relevance for the AEI regime. Section 5 presents our results, and Section 6 concludes.

2 Taxpayer information exchange and behavioral responses: State of the art

According to the principles of international taxation, passive income from cross-border investment, including dividends, interest, and capital gains, can be taxed where the investment is made and where the investor resides. To avoid double taxation, governments enter into bilateral tax treaties (BTTs) in which they agree on lower or zero withholding taxes applicable to investors from the partner country. Most OECD countries grant tax relief for taxes paid abroad but assert the right to tax households on their worldwide receipts of passive income. In terms of horizontal justice, this serves to ensure the equal treatment of the recipients of foreign income and the recipients of domestic income. In terms of vertical justice, it safeguards the ability to pay principle, according to which high-income earners should pay a larger share of their income in taxes than low-income earners (Arnold 2016, pp. 30–86).

Households are legally obliged to declare their worldwide capital income in their income tax statement, but tax authorities traditionally struggled to detect underreporting. Tax evaders could easily escape the taxman by investing in, or through, tax havens that offered financial secrecy, for instance by outlawing the dissemination of customer data from banks to tax authorities and refusing to exchange taxpayer information with residence countries. While the taxation of worldwide capital income at residence has been the de jure norm, its de facto implementation thus depends on the international exchange of taxpayer information. The available evidence suggests that the norm's implementation was weak before the adoption of the CRS. According to recent estimates, wealthy households held $9.5 billion, or about 10% of annual world gross domestic product (GDP), in tax havens in the early 2000s to mid-2000s, 80–90% of which was not declared to the households' countries of residence (Alstadsæter et al. 2018). Since the very rich account for the largest share of hidden wealth, the lack of effective information exchange does not only violate horizontal but also vertical equity considerations, thereby exacerbating income and wealth inequality (Alstadsæter et al. 2019).

While these numbers are suggestive of a lack of implementation and enforcement, a small but growing literature has attempted to go beyond aggregated numbers. These studies implicitly or explicitly rely on the theory of the economics of crime (Becker 1968) and its application to issues of tax enforcement (Allingham & Sandmo 1972). According to this theory, the deterrence effect of law enforcement depends on the severity of punishment and the probability of detection of unlawful behavior. Although personal attitudes, incentives, and social norms are also important for tax compliance (Brockmann et al. 2016; Alm 2019), the exchange of taxpayer information unfolds its effect on capital flight by making the identification of tax evaders more likely. The literature has investigated the effectiveness of different instruments of information exchange by testing whether taxpayers' behavioral responses accord to this model.3

First, traditional BTTs provided for information exchange upon request. The agreements conditioned the provision of account data on prior evidence for tax evasion and the domestic availability of requested information. In practice, a country could refuse to share data, if it did not collect it for domestic tax assessment purposes anyway, which was the case for all countries with banking secrecy legislation (Rixen 2008, pp. 75–76). We know of only one study providing empirical evidence on regulatory arbitrage of traditional BTTs. Huizinga and Nicodème (2004) found that while passive investments were sensitive to withholding tax rates in the source country, they were not sensitive to the signature between source and residence country of a BTT with information exchange provisions. While this may be interpreted as initial evidence for the proposition that information exchange on request is ineffective (Keen & Ligthart 2006, pp. 89–91; Sheppard 2009), this conclusion could not be drawn with certainty, as the study only included OECD countries, which omits a number of important tax havens.4

Second, the OECD toughened its upon request standard by scraping the principle of domestic availability and requesting the identification of beneficial owners in a 2002 reform of its Model Tax Convention (OECD 2002, 2017). It was only after the outbreak of the financial crisis and increased pressure from the G20 (2009), however, that a significant number of tax havens agreed to apply the new standard in BTTs or specific tax information exchange agreements (TIEAs) (Rixen 2013, pp. 443–44).5 Using data from the Bank of International Settlements (BIS) on cross-border deposits among 41 countries, including a number of tax havens, Johannesen and Zucman (2014) show that the value of deposits in tax havens, which signed TIEAs, declined. Using the same BIS data, but for more countries and over a longer time period, Menkhoff and Miethe (2019) confirm these results, estimating that TIEAs reduced bank deposits in tax havens by 27.5%. Focusing on portfolio investment rather than bank deposits, Hanlon et al. (2015) show that the conclusion of TIEAs led to a (modest) reduction in round-tripping by US investors, which refers to domestic investment that is routed through tax havens to increase returns. Extending the sample of countries, Heckemeyer and Hemmerich (2018) find reduced portfolio investment in OECD countries from tax havens that signed TIEAs. Kemme et al. (2017) present similar results, but with more modest effects.

It must be noted that investments are not necessarily repatriated to residence countries. Instead, they are shifted to tax havens not covered by TIEAs. Johannesen and Zucman (2014) show, for the Swiss case, that new TIEAs with this country did not lead to better reporting by taxpayers in residence countries, because banks reacted by hiding their foreign clients behind shell companies registered in noncompliant tax havens. Menkhoff and Miethe (2019) find that tax evaders circumvented information requests by shifting formal account ownership to third countries or by letting another person stand in as account owner. They also show that the behavioral response of tax evaders to TIEAs becomes smaller over time. The reason may be that tax evaders learn to circumvent transparency measures. These findings are corroborated by Beer et al. (2019). Overall, the empirical evidence shows that while TIEAs have bite in the sense that they force tax evaders to act, they are subject to rampant regulatory arbitrage and thus remain largely ineffective.

A third set of instruments goes beyond bilateral and on-request information sharing, but also suffers from loopholes. The main example is the EU Savings Tax Directive (Directive 2005/60/EC) (STD), which established a multilateral, albeit geographically limited, agreement among EU members and neighboring tax havens in 2005. The directive introduced information exchange on a routine, automatic basis that is not subject to the limitations of the initial evidence requirement. In contrast to TIEAs, however, the STD only applied to interest payments and natural persons. Using data from the International Monetary Fund (IMF's) Coordinated Portfolio Investment Survey (CPIS), Rixen and Schwarz (2012) show that taxpayers stripped their portfolios off interest-bearing assets and shifted assets to third countries in response to the STD. Focusing on Switzerland, Johannesen (2014) confirms that the introduction of the STD leads to a relocation of assets to non-EU offshore centers. Omartian (2018) further corroborates this result, using data on shell company incorporation leaked as part of the Panama Papers. He finds that the number of offshore entity incorporations increased by 73% just prior to agreement on the STD, indicating that hiding beneficial ownership behind a corporate shell was indeed popular. Overall, while the STD was an early embodiment of the paradigmatic shift from on-request to automatic exchange, it was subject to significant regulatory arbitrage.

The fourth and latest class of instruments provides for comprehensive AEI on all types of capital income. The US government's FATCA requires foreign banks (and tax authorities) to automatically report information on American clients to the Internal Revenue Service (IRS). After the United States had passed this law, which required formerly secretive jurisdictions to abolish banking secrecy provisions, the G20 seized the opportunity, made AEI the new global standard, and tasked the OECD to develop guidelines for its implementation (Hakelberg 2020). The OECD's CRS – agreed upon in 2014 and currently adopted by 108 countries6 – provides for multilateral AEI. Like FATCA, it covers all income types and obliges banks in participating countries to disclose the beneficial owners of deposits and entities. The EU transposed the CRS into EU law with the Directive on Administrative Cooperation of 2014 (Directive 2014/107/EU2 - DAC2), replacing the loophole-ridden STD.

A number of studies have investigated taxpayers' behavioral responses to the AEI. Hakelberg and Schaub (2018) employ a difference-in-difference design and find that FATCA and the process toward multilateral AEI it triggered led to a substantial and significant decrease in the value of cross-border bank deposits in tax havens. While their study mostly predates the multilateral implementation of the CRS, Ahrens and Bothner (2020) extend the analysis accordingly.7 Their main finding is that the introduction of the AEI leads to a 67% decrease of cross-border deposits in tax havens relative to non-havens. Similarly, Menkhoff and Miethe (2019, p. 64) associate the activation of bilateral AEI relationships under the CRS8 with a 43% reduction in bank deposits in tax havens. O'Reilly et al. (2019) extend time and geographical coverage even further, so that the Multilateral Convention on Mutual Administrative Assistance on Tax Matters (MAC) is also included. In their main specification, deposits in tax havens are reduced by 22%. Similarly, Beer et al. (2019) find that deposits decreased by 35% (for the CRS) and 50% (for the revamped STD) after the AEI was agreed. de Simone et al. (2019) focus on the response of portfolio investment from tax havens in the United States and show that the FATCA reduced round-tripping for tax evasion purposes by 21.1%. Finally, Omartian (2018) finds that offshore entities, which had been created to circumvent the STD, are two to five times more likely to close than benchmark entities not subject to DAC 2.

3 Assessing regulatory arbitrage of the AEI

These contributions show that multilateral AEI raises the probability of detection more than bilateral exchange on request. While this is good news from a tax compliance perspective, the studies also raise concerns about remaining loopholes. Two of these are deemed particularly relevant in the literature (e.g. Meinzer 2019, p. 108; Menkhoff & Miethe, 2019, p. 66; OECD 2018a). First, while the CRS requires the identification of the ultimate beneficial owner of an account, there is concern that this requirement can still be circumvented. The CRS obliges financial institutions to collect information on beneficial owners only in case of passive non-financial entities (NFE), that is, entities whose income consists mainly of dividends, interests and other passive income. If the entity has mostly active business income, the CRS relies on the Financial Action Task Force's (FATF) definition of beneficial ownership (FATF 2016), which foresees a 25% ownership threshold. This allows tax evaders to conceal beneficial ownership by diluting the ownership structure (Beer et al. 2019). In many cases, banks could also fail to cross-check the information given by account holders because ownership registries for corporations and trusts do not exist, are hard to access, or contain irrelevant information in many countries (Knobel & Meinzer 2016). The United States, for instance, does not oblige banks to identify the beneficial owners of trusts for AEI purposes under FATCA.

To test whether tax evaders adopted more complex beneficial ownership structures in response to the AEI, Ahrens and Bothner (2020, pp. 11–12) compare the value of assets held through tax havens in other tax havens and non-havens. They find a marked reduction in the value of inter-haven deposits relative to deposits in non-havens after the adoption of the AEI. But their results do not consider comprehensively how tax evaders use trusts or shell companies to circumvent the CRS. If trust and account are located in the same jurisdiction, for instance, a transfer of formal account ownership to a trustee would not inflate the value of havens' deposits. Moreover, recent studies suggest that countries that have never been included in tax haven lists may also have lax beneficial ownership rules (see e.g. Casi et al. 2020). If formal ownership of an offshore account was transferred to a trustee in a country not considered a tax haven by Ahrens and Bothner, the value of inter-haven deposits would also remain unchanged. Hence, the relevance of trusts and shell companies for the circumvention of the CRS remains unclear.

Second, the CRS may be circumvented by acquiring a so-called golden passport or visa. Some countries or jurisdictions have residency-by-investment (RBI) or citizenship-by-investment (CBI) schemes that offer foreign individuals citizenship or residence rights in return for investment or a flat fee.9 The schemes on offer vary considerably with respect to their intended goal and attached conditions (such as minimum investment, residence requirements). Not all of them may easily be abused and “legitimate reasons” for acquiring dual citizenship exist (OECD 2018a, p. 2). Nevertheless, a number of schemes can be exploited. An Italian citizen could, for instance, acquire Maltese citizenship without moving her center of vital interests to the island. She can then use her new passport when opening a bank account. If the bank account is in Malta, the Maltese tax authority is likely to treat it as a domestic account instead of reporting it to its Italian counterpart. If the account is in Luxembourg, the Luxembourgian tax authority will report it to the Maltese instead of the Italian tax authority, thereby frustrating the purpose of the CRS. It should be noted that this strategy is illegal. Under the CRS, the Italian taxpayer is required to report all of her tax residences when opening an account or registering a corporation. But the intentional omission is hard to detect, making golden visas an attractive workaround for tax evaders.

The issue has already attracted attention from policymakers and activists (Knobel & Heitmüller 2018; OECD 2019; Trautvetter & Winkler 2019). The OECD has listed 24 potentially harmful CBI/RBI schemes in 16 countries,10 but concrete action against them is so far missing. In the academic debate, golden visas have also been recognized as a potential workaround to the AEI, but empirical evidence on its relevance is lacking. For example, Menkhoff and Miethe (2019, p. 65) argue that a similar pattern as we have seen with TIEAs is likely to emerge. They expect the effect of the AEI on assets in tax havens to decline over time as tax evaders learn to circumvent it. Given that the loophole in TIEAs they see as most relevant (see earlier) is closed under the AEI, they speculate that golden visas could be the new loophole, making the CRS ineffective. Yet, they do not test this proposition empirically.

Existing studies merely provide informed speculations as to whether tax evaders engage in regulatory arbitrage of the CRS. Most of the corresponding empirical investigations are rough and incomplete approximations. With our article, we aim to fill this gap. We directly investigate the empirical relevance of the two major loopholes supposedly undermining the effectiveness of the CRS. To this effect, we assess how the value of foreign deposits and portfolio investment from countries with lax beneficial ownership regulation or golden visa schemes developed in reaction to AEI adoption. As will be outlined in detail later, we employ an empirical approach with appropriate causal effect identification.

4 Data and methods

Our analysis relies on two data sets that cover dyadic cross-border investments in major financial markets (the United States, the United Kingdom, and the Eurozone). First, we use data from the Coordinated Portfolio Investment Survey (CPIS) (IMF 2019), covering portfolio investment liabilities of 19 debtor countries (the major financial markets) held by 71 creditor countries. Debtor countries are the countries in which an investment is made; creditor countries are the countries of formal residence of the investor. CPIS data are yearly and relate to the fourth quarter. They measure cross-nationally held equities, shares, and debt securities. Their value for Malta should increase when the Italian tax evader in our example above invests her wealth in, for example, the United States via a Maltese bank after acquiring the country's citizenship. In addition, we use the Locational Banking Statistics (LBS) by the Bank for International Settlements (BIS 2019), which quantify bank deposits and debentures held by nonbank entities. They cover quarterly liabilities of 12 debtor countries vis-à-vis 102 creditor countries.11 Their value for Malta should increase when our Italian tax evader decides to deposit her wealth with, for example, a Luxembourgian bank after acquiring Maltese citizenship. The observation period is restricted to years between 2009 and 2018 in both data sets, which is situated entirely in the postfinancial crisis era and represents a panel balanced around the adoption of the CRS in 2014.

In combination, the CPIS and LBS have a wide coverage of internationally held forms of capital, which allows us to conduct a comprehensive analysis of approaches to circumvent the CRS. The drawback of the data is that they do not only cover investments by households, which we are interested in because we assess tax evasion by households. The LBS data also cover investments by nonbank companies, and the CPIS data additionally cover banks' proprietary trading. This is not a major concern since companies, banks, and funds do not rely on RBIs/CBIs or anonymous trusts and corporations to minimize their taxes. Therefore, it is reasonable to assume that the development of nonhousehold entities is uncorrelated with our explanatory variables of interest, that is, RBI/CBI as well as trust and shell corporation schemes. However, the inclusion of nonbank entities adds considerable noise to the data and complicates the interpretation of estimated effects. It is necessary to know the share of investments held by households to ascertain the exact extent of CRS avoidance. Regarding the LBS, we rely on Zucman's (2013) estimate of a 50% household share, but there is no such estimate available for the CPIS data.

4.1 Identification strategy

We analyze whether countries that offer RBIs/CBIs or anonymous trusts and shell corporations benefitted after the CRS. If they did, we should observe an increase of their claims on foreign countries because both schemes function by falsely attributing asset ownership to persons or entities under their jurisdiction. We use a DID design for our assessment. It compares how investments made through a treatment group of jurisdictions that offer workarounds for the CRS developed relative to a control group of jurisdictions that do not offer them. It is assumed that, conditional on included covariates, the difference between the treatment and control groups would continue to be constant in the absence of potential workarounds (common trends assumption). If this assumption holds, the control group can be used to construct a counterfactual of how investments held by jurisdictions in the treatment group would have developed if they had not offered workarounds for the CRS. Causal effect estimates are given by the difference between observed values in the treatment group and this counterfactual (Lechner 2010).

The DID estimator is a variant of the fixed effect (FE) panel estimator. FE estimators remain unbiased by omitted time-invariant confounders, that is, stable characteristics that affect both the treatment status and the dependent variable. DID only requires that confounders that exert a different impact on the treatment and control groups (such as a financial crisis that only affects countries in the treatment group) are accounted for, which can be achieved by including such confounders as control variables. All additional variables that affect the treatment and control groups in the same way do not bias the effect estimate since they do not cause a violation of the common trends assumption, implying that such confounders need to be neither measured nor modeled (Brüderl & Ludwig 2015). The following two sections describe the data used for the analysis of RBI/CBI as well as the trust and shell corporation schemes.

4.2 Golden visa and passport schemes

We compiled an original data set on jurisdictions offering RBI/CBI schemes, including the corresponding implementation year. However, this information alone is of little use because tax evasion is not the only motivation behind acquiring a foreign passport. For example, those who can afford it may also be interested in the freedom to travel a foreign passport provides. Therefore, we also rely on the “tax risk” variable of the 2018 version of the Financial Secrecy Index (Tax Justice Network 2018). The variable indicates whether a country lacks a personal income tax or exempts foreign income or capital income from taxation. This is relevant because only low- or no-income taxation allows foreign investors to use RBI/CBI schemes for tax evasion purposes. The treatment group is given by all dyads in which the creditor country has tax risk and implemented an RBI/CBI scheme during our observation period. The corresponding control group consists of dyads where the creditor country has no tax risk and/or never implemented an RBI/CBI scheme.12 In total, 25 creditor countries covered in the CPIS data and 43 countries covered in the LBS data are part of the treatment group (see the online appendix).

4.3 Shell companies and trusts

To ascertain which countries facilitate a circumvention of the AEI using trusts and shell corporations, we rely on the second and third “Key Financial Secrecy Indicator” (KFSI 2 and 3) from the 2018 Financial Secrecy Index (Tax Justice Network 2018). KFSI 2 measures whether a jurisdiction has a central, accessible, and publicly available trusts and foundations register, including information on beneficial ownership. It is only possible to penetrate the financial secrecy offered by trusts and foundations when such information is available. When it is not, trusts and foundations can be used to hide illicit investments from information exchange. KFSI 3 measures whether companies must submit information on beneficial and legal ownership upon incorporation, and whether this information must be updated upon changes to the ownership structure. When this is not the case, shell corporations can be used to circumvent information reporting. Both KFSI 2 and KFSI 3 range between 1 and 0, with 1 indicating maximum financial secrecy.

The treatment group is given by countries with tax risk as well as maximum secrecy on either of KFSI 2 or KFSI 3. Such countries combine the possibility to easily set up an anonymous trust or shell corporation with a tax incentive to do so. The respective control group is made up of all other countries with non-missing values on tax risk, KFSI 2 and KFSI 3.13 In total, 27 creditor countries covered in the CPIS data and 44 countries covered in the LBS data are part of the treatment group (see the online appendix).

4.4 Model

All regressions use three control variables that are likely to cause different trends between the treatment and control groups. These variables all relate to the intended effect of the CRS, that is, the reduction of cross-border tax evasion. Research shows that the CRS affected investment relationships including traditional tax havens, which includes both inbound and outbound investments (Menkhoff & Miethe 2019). Furthermore, Ahrens and Bothner (2020) show (i) that the CRS affected all tax havens independent of their actual participation in the CRS Multilateral Competent Authority Agreement (MCAA) and (ii) that the reduction of cross-border investments followed the international endorsement of the CRS in the first quarter of 2014 (rather than actual treaty signature or bilateral activation of information flows). Therefore, we include three interaction terms as control variables. A dummy that identifies the post-2014 period is interacted with each of the following variables: a dummy indicating whether the creditor is a tax haven, a dummy indicating whether the debtor is a tax haven, and an interaction between these two dummies. This approach allows us to control for the diverging investment relationships between four types of dyads in the post-2014 period: investments of havens in non-havens, investments of havens in havens, investments of non-havens in non-havens, and investments of non-havens in havens. We rely on the list of 52 tax havens provided by Johannesen and Zucman (2014) but use the list compiled by Gravelle (2015) in a robustness check.

5 Analysis

This section reports evidence on regulatory arbitrage of the CRS by RBI/CBI as well as trust and shell corporation schemes. For each of the secrecy schemes, we first present graphical and regression-based evidence. The graphs, which only offer descriptive evidence, depict investments made by countries with and without such schemes over time. We plot the average percentage deviation from dyad-specific means to deal with systematically missing data points.15 Second, we present concluding evidence on the relative effect of the secrecy schemes. We will see that it is difficult to disentangle which of the analyzed secrecy schemes affects investment relationships because most countries that offer one of the schemes also offer the other. Third, we discuss the validity of our identification assumptions.

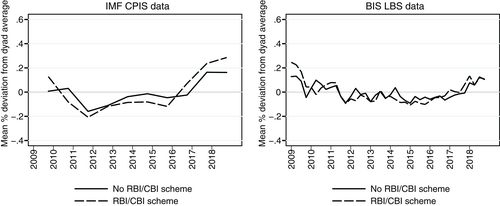

5.1 RBI/CBI schemes

We first turn to the analysis of RBI/CBI schemes. Figure 1 offers an initial graphical representation of their impact. The left panel depicts the development of portfolio investments and the right panel the development of deposits and debentures. In both panels, investments by creditor countries with and without RBI/CBI follow a mostly similar path until the end of 2015. Portfolio investments from RBI/CBI countries increase relative to countries with no such scheme thereafter, but no such difference can be spotted in the development of deposits and debentures. Therefore, the graphical evidence only points toward the use of RBI/CBI schemes to hide portfolio investments from reporting under the CRS. However, we refrain from making causal claims based on this graphical evidence. The following DID regressions will put the findings from Figure 1 under scrutiny.

Table 1 reports the results of eight DID regressions. The first four models focus on portfolio investments and the last four models on deposits and debentures. The four models for each investment type first assess investments in all three major markets combined (i.e. Dollar, Pound, and Euro) and then assess investments in these markets separately. Each model contains the full set of control variables that relate to the intended impact of the CRS. The results show that the estimates for the impact of RBI/CBI schemes are mostly null findings. There is some evidence that portfolio investments from RBI/CBI countries in the Eurozone increased by 16%,16 but the coefficient only reaches a significance threshold of P < 0.1. Furthermore, the analyses of all three major markets combined points toward a treatment effect of 13%, but the data are dominated by investments in the Eurozone because more countries are covered. The coefficients for the Pound and Dollar markets are either substantially small or even negative and/or wholly insignificant, which shows that there is only weak evidence for the use of RBI/CBI schemes to hide portfolio investments in the Eurozone.

| Data | IMF CPIS | BIS LBS | ||||||

|---|---|---|---|---|---|---|---|---|

| Currency zone | All | Dollar | Pound | Euro | All | Dollar | Pound | Euro |

| Model | (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) |

| Post-2014 × Treatment | 0.12* (0.07) | −0.05 (0.14) | −0.02 (0.19) | 0.15* (0.08) | 0.06 (0.06) | −0.00 (0.08) | −0.07 (0.12) | 0.10 (0.08) |

| Post-2014 × THdebtor | 0.03 (0.09) | — | — | 0.02 (0.09) | −0.16** (0.07) | — | — | −0.07 (0.09) |

| Post-2014 × THcreditor | −0.25*** (0.08) | −0.15 (0.13) | −0.03 (0.19) | −0.28*** (0.10) | −0.36*** (0.10) | 0.08 (0.10) | −0.48*** (0.14) | −0.45*** (0.15) |

| Post-2014 × THcreditor × THdebtor | 0.01 (0.19) | — | — | 0.03 (0.20) | 0.20 (0.14) | — | — | 0.28 (0.18) |

| Constant | 5.99*** (0.11) | 9.04*** (0.32) | 8.13*** (0.36) | 5.63*** (0.12) | 4.71*** (0.10) | 6.51*** (0.26) | 6.56*** (0.30) | 4.24*** (0.10) |

| Observations | 9,961 | 616 | 614 | 8,731 | 31,873 | 3,019 | 3,601 | 25,253 |

| Number of dyads | 1,134 | 65 | 65 | 1,004 | 998 | 85 | 92 | 821 |

| Dyad fixed effects | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Time fixed effects | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

- *P < 0.1. **P < 0.05. ***P < 0.01. Note: Some variables could not be included in certain models because there is no empirical variation in the data. Block-bootstrapped standard errors clustered by dyads in parentheses. BIS, Bank of International Settlements; CPIS, Coordinated Portfolio Investment Survey; IMF, International Monetary Fund; LBS, Locational Banking Statistics; RBI/CBI, residency-by-investment/citizenship-by-investment; TH, tax haven.

The robustness of these results is assessed with a set of alternative specifications. The full results are available in the online appendix. First, we re-estimate all models with a more stringent approach to the potential bias from the intended effect of AEI. We then include a dummy that switches to one as soon as two countries in a dyad signed the CRS MCAA or, in cases where the United States is the creditor country in a dyad, a FATCA intergovernmental agreement (IGA). Just like in the main specifications, this dummy is additionally interacted with our two tax haven dummies as well as their interaction. Our motivation is that, despite the findings of Ahrens and Bothner (2020), actual treaty signature may have a further effect on investments. Second, we re-estimate our main specifications using an alternative tax haven list compiled by Gravelle (2015). Third, we include an additional set of control variables to our main specifications: two dummies capturing whether the creditor and the debtor country offer a voluntary disclosure program that allows resident tax evaders to repatriate illicit funds with impunity or even tax amnesties, as well as log GDP per capita.17 Fourth, we add an interaction between the post-2014 and tax risk dummies to our main specifications. Recall that tax risk is used in the definition of what countries are part of the treatment group. The rationale is that countries may have changed their foreign claims in the post-2014 period because of being a tax risk jurisdiction (rather than a combination of tax risk and the secrecy schemes). All four robustness models replicate the results of our main specifications.

Finally, we check whether the (weak) result that RBI/CBI jurisdictions increased their cross-country investment in the Eurozone depends on the inclusion of certain creditors in the sample. We re-estimate Model 4 (see Table 1) 25 times and drop one of the creditor countries with an RBI/CBI scheme each time. The resulting coefficients (0.1–0.18) and P values (0.01–0.2) vary considerably between the estimates and either turn significant or wholly insignificant in several cases. Excluding South Korea and South Africa from the sample decreases the coefficient most and makes it least significant while the opposite holds for excluding Costa Rica and Portugal. Therefore, the results suggest that the development of cross-border portfolio investments is quite varied between the countries in the treatment group. Overall, there is inconsistent evidence for a positive effect of RBI/CBI schemes that is limited to portfolio investments in the Eurozone.

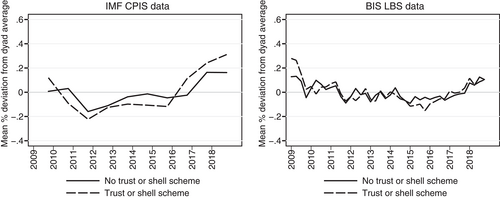

5.2 Trusts and corporate identities

We now turn to the analysis of trusts and shell corporations. Figure 2 presents graphical evidence. The left panel compares portfolio investments and the right panel deposits and debentures of creditor countries with and without such schemes. Just as in the analysis of RBI/CBI schemes, the results point toward the use of trust and shell schemes to hide illicit portfolio investments from the CRS with no corresponding evidence regarding deposits and debentures. These results are hardly surprising given that most countries have both schemes on offer. Again, we refrain from making causal claims based on Figure 2 and turn to regression-based evidence for our main inferences.

Table 2 presents the results of several DID regressions. Just as mentioned earlier, the first four models focus on portfolio investments and the last four models on deposits and debentures, each split up further by the currency zone of the market that is invested in (all, Dollar, Pound, and Euro). The estimates mostly result in null findings. Most treatment effects are insignificant, and in the case of deposits and debentures, they are substantially small or even negative. However, there is significant evidence suggesting that creditor countries with trust and shell schemes increased their cross-border investments in the Eurozone by 22%. Furthermore, the treatment effects regarding investments in the Dollar (9% increase) and Pound (14% increase) markets are substantially large considering the sheer size of these markets. These coefficients are, however, insignificant and therefore associated with insufficient certainty. Just as mentioned earlier, the coefficient for all three markets combined is also significant, but recall that the data are dominated by investments in the Eurozone.

| Data | IMF CPIS | BIS LBS | ||||||

|---|---|---|---|---|---|---|---|---|

| Currency zone | All | Dollar | Pound | Euro | All | Dollar | Pound | Euro |

| Model | (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) |

| Post-2014 × Treatment | 0.19** (0.08) | 0.09 (0.17) | 0.13 (0.22) | 0.20** (0.09) | 0.01 (0.07) | −0.01 (0.10) | −0.10 (0.14) | 0.04 (0.09) |

| Post-2014 × THdebtor | 0.00 (0.09) | — | — | −0.01 (0.09) | −0.11 (0.07) | — | — | 0.00 (0.09) |

| Post-2014 × THcreditor | −0.32*** (0.08) | −0.20 (0.16) | −0.11 (0.21) | −0.36*** (0.10) | −0.30*** (0.10) | 0.17* (0.10) | −0.44*** (0.13) | −0.38** (0.16) |

| Post-2014 × THcreditor × THdebtor | 0.03 (0.19) | — | — | 0.06 (0.19) | 0.19 (0.14) | — | — | 0.27 (0.18) |

| Constant | 5.80*** (0.11) | 8.89*** (0.32) | 7.99*** (0.35) | 5.42*** (0.12) | 4.62*** (0.10) | 6.44*** (0.25) | 6.54*** (0.28) | 4.13*** (0.10) |

| Observations | 9,964 | 630 | 628 | 8,706 | 32,144 | 3,032 | 3,665 | 25,447 |

| Number of dyads | 1,158 | 67 | 67 | 1,024 | 1,008 | 86 | 93 | 829 |

| Dyad fixed effects | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Time fixed effects | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

- *P < 0.1. **P < 0.05. ***P < 0.01. Note: Some variables could not be included in certain models because there is no empirical variation in the data. Block-bootstrapped standard errors clustered by dyads in parentheses. BIS, Bank of International Settlements; CPIS, Coordinated Portfolio Investment Survey; IMF, International Monetary Fund; LBS, Locational Banking Statistics; RBI/CBI, residency-by-investment/citizenship-by-investment; TH, tax haven.

The same set of robustness models is estimated as earlier, the results of which are available in the online appendix. These alternative specifications expand the approach to remove the bias from the intended effect of AEI, use an alternative tax haven list, include an additional set of control variables, and assess whether our results are merely driven by the tax risk variable. Again, the results from the main specifications replicate. Furthermore, we check whether the result that trust and shell corporation jurisdictions increased their cross-country investment in the Eurozone depends on the inclusion of specific creditors in the sample. Once more, the results show that the development of portfolio investments in the Eurozone is diverse. The resulting estimates vary, with coefficients between 0.15 and 0.25 and P values between 0.006 and 0.1. Again, the coefficients drop most with the exclusion of South Africa and South Korea and increase most with the exclusion of Costa Rica and Portugal. Overall, the evidence suggests a positive effect of trust and shell schemes that is limited to portfolio investments in the Eurozone.

5.3 Which scheme drives the estimates?

The previous sections showed that there is some evidence that both RBI/CBI and trust/shell schemes were used to circumvent the CRS. However, these results primarily pertain to portfolio investments in the Eurozone, with investments in the Pound and Dollar markets as well as deposits and debentures in general seemingly being unaffected. This section puts these results under scrutiny and tries to disentangle, which scheme drives the positive findings. The problem is that there are 35 jurisdictions which are part of both the RBI/CBI and trust/shell treatment groups, nine countries that are only part of the trust/shell treatment group, and only one country that only belongs to the RBI/CBI treatment group (i.e. Andorra). We therefore do not know which of the two secrecy schemes may be behind the (limited) effects identified in the presented graphs and regressions.

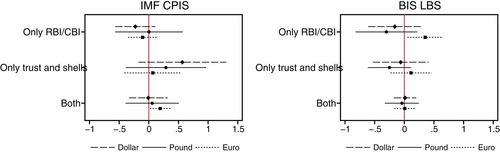

It is not feasible to add both our treatments as variables in the same model to assess their relative explanatory power due to their collinearity. We opt for the following approach instead. Figure 3 presents estimated treatment effects from 18 DID regressions. The left panel shows estimated effects on portfolio investments and the right panel on deposits and debentures. The treatment groups are split up into the three distinct groups. In each panel, the top three estimates are based on treatment groups with the one country that only has an RBI/CBI scheme (with separate coefficients for each of the three major markets). The three estimates in the middle use treatment groups consisting of the nine countries with only a trust/shell scheme. And the bottom three estimates are based on treatment groups consisting of the 35 countries that offer both secrecy schemes.

Relative effect size of the two secrecy schemes. BIS, Bank of International Settlements; CPIS, Coordinated Portfolio Investment Survey; IMF, International Monetary Fund; LBS, Locational Banking Statistics; RBI/CBI, residency-by-investment/citizenship-by-investment Note: The horizontal bars represent 95% confidence intervals. The full results are available in the online appendix.

The results show that it is not possible to disentangle the effect of RBI/CBI and trust/shell schemes with sufficient certainty. There is weak evidence suggesting that trust and shell schemes drive the effects on portfolio investments found in the main specifications. Substantially large and positive treatment effects (which are only partly significant) are only observed when creditor countries with trust/shell schemes are part of the treatment group (i.e. countries with only a trust/shell scheme or both schemes). However, this trend is ambiguous because countries with only trust/shell schemes did not increase their investments in the Eurozone, where we find our most consistent effects. Only countries with both schemes increased their investments in the Eurozone.

We also find that the one country with only an RBI/CBI scheme significantly increased their deposits and debentures in the Eurozone, but this result is only based on a single country in the treatment group and we refrain from drawing any inferences from this isolated finding. Overall, we can only conclude that countries with either RBI/CBI or corporate shell schemes increased their foreign investments with some weak evidence, suggesting that trust and shell schemes may be paramount.

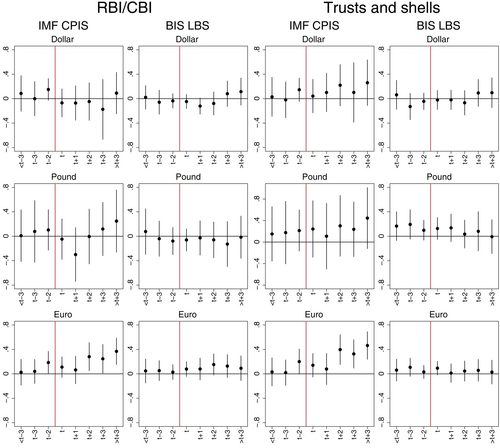

5.4 Temporal effect heterogeneity and validity of identification assumptions

This section assesses whether our treatment has heterogeneous effects over time and whether the main identification assumption of common trends is valid. The assessment is based on several event studies depicted in Figure 4. Each event study shows the difference between investments made by the treatment and control group in years before and after treatment relative to their difference observed in the last year before treatment (t−1). The 12 panels are separated by treatment type (RBI/CBI schemes in the left columns and trust/shell schemes in the right columns), investment type (portfolio investments in the first and third columns and deposits and debentures in the second and fourth columns), and investment market (Dollar in the top row, Pound in the middle row, and Euro in the bottom row).

Event studies. BIS, Bank of International Settlements; CPIS, Coordinated Portfolio Investment Survey; IMF, International Monetary Fund; LBS, Locational Banking Statistics; RBI/CBI, residency-by-investment/citizenship-by-investment Note: The vertical bars represent 95% confidence intervals. The full results are available in the online appendix.

First, Figure 4 confirms the results from the previous sections. There is only reliable evidence for a use of RBI/CBI and/or trust and shell schemes to circumvent the CRS regarding (i) portfolio investments and (ii) investments in the Eurozone, where the treatment group increases their investment in the post-CRS period. A number of other event studies have broadly similar results (particularly deposits and debentures of RBI/CBI countries in the Eurozone as well as portfolio investments by trust/shell countries in the United States), but the coefficients do not reach conventional levels of statistical significance (even though they are substantially large). Second, estimated treatment effects do seem to vary over time. Where we do find an effect, the coefficients increase over time and only become significant in the later years of the posttreatment period. By the fifth treatment year and beyond, investments by RBI/CBI and trust/shell countries in the Eurozone are estimated to have increased by 45% and 58%, respectively, which is a sizable increase. But it must be noted that to truly show that treatment effects increase over time, the coefficients for different years after treatment would have to be significantly different from one another, which is not the case.

Finally, the event studies raise concerns about the validity of the common trends assumption. There should be no difference between the treatment and control groups in each period before treatment. This is the case in most event studies, and where there is a significant difference it is only significant on a P < 0.1 level. However, the estimated coefficients do point toward differences between the treatment and control groups in some event studies. Furthermore, the treatment effects we do find are possibly inflated because investments by RBI/CBI and trust/shell countries in the Eurozone already slightly increased relative to the control group in the year before treatment.

Unfortunately, our data are noisy because investments by nonhousehold entities are included, which is more problematic in the IMF CPIS data since they also cover banks. Furthermore, the time series do have some missing values, which implies that the composition of the treatment and control groups is not fixed over time. We believe that these issues contribute to the fluctuations observed in the pretreatment period and that these may also be present in the posttreatment period. We concede that our estimates are not free from bias due to noisy data.18

It must be noted that common trends in the pretreatment period are a necessary but not a sufficient condition for the validity of the common trends assumption since we also assume that trends would continue to be common in the hypothetical absence of treatment (which is an inherently untestable assumption). However, we believe that, by and large, the common trends assumption is reasonable. There is no reason to expect that the analyzed secrecy schemes are relevant for nonhousehold entities, which are unfortunately also covered in both our data sources. There was also no policy or international development that subjected the treatment and control groups to different causal influences (which applies to both household and nonhousehold investments). The adoption of AEI obviously affected investments, but our results hold using several different model specifications to correct for possible bias. Furthermore, the AEI may not even have affected our treatment and control groups differently since our treatment and control groups are both populated by jurisdictions who were affected by the AEI, that is, traditional tax havens. Overall, we conclude that our inferences are somewhat imprecise but credible.

6 Discussion and conclusion

In sum, our results offer limited evidence for the use of RBI/CBI schemes and lax beneficial ownership registration as instruments of regulatory arbitrage of the AEI. Jurisdictions offering such schemes increased their portfolio investments in the Eurozone, but no corresponding evidence is found for portfolio investments in other major markets or for deposits and debentures in general. This suggests that tax evaders have so far made some but not intensive use of the available workarounds to the CRS. Since virtually all research on the impact of the FATCA and CRS points toward a reduction in hidden wealth in traditional tax havens (see Section 2), we have reason to believe that the value of hidden assets declined in response to the multilateral adoption of the AEI. However, this conclusion is preliminary since there is also some indication that the limited use of secrecy schemes increased over time. This suggests that regulatory arbitrage may become more prevalent in the future.

Menkhoff and Miethe (2019) have emphasized that all previous efforts at strengthening information exchange have been subject to regulatory arbitrage, but that the adjustment of tax evaders to new regulations has been characterized by inertia. They speculate that the same dynamic will apply to the new AEI regime. Contrary to this skepticism, one may argue that the CRS is a paradigmatic change in that it provides for automatic and routine exchange of taxpayer information. The weakness of previous regimes can largely be attributed to the on-request nature of exchange. There is thus a strong a priori argument that the CRS increases the costs of regulatory arbitrage significantly more than previous regulations. While it is too early to settle the issue definitely, we bring fresh empirical evidence to this question. In our main results, we find little evidence for regulatory arbitrage. Regulatory innovation in tax havens has so far only caused limited shifts in assets from countries that have recently become more transparent. On the other hand, we do find some indications that there is a slight increase of the (overall still limited) use of secrecy schemes over time. Overall, the CRS is neither subject to rampant regulatory arbitrage nor is arbitrage completely absent and it tends to increase over time.

In the debate on the possibility of regulating economic globalization, our findings lend some support for the optimists' view. For now, the proponents of the AEI seem to have transcended the weakest-link logic. We thus have reason to believe that national governments and international organizations are able to overcome the structural constraint of capital mobility and establish effective forms of cooperation against tax evasion. Nevertheless, the pessimists may rightly point out that, for the time being, regulatory arbitrage is still possible – albeit at a much higher cost. While secrecy schemes may not be available to a wide range of taxpayers anymore, the offshore industry increasingly caters to the small minority of the super-rich (Alstadsæter et al. 2019). So far, these ever more sophisticated secrecy schemes are indeed impermeable to the regulations of powerful nation states. Moreover, as much as it is welcome that tax evasion is less widespread, this reorientation of the market for tax evasion further amplifies the process of increased wealth concentration and the widening gap between the super-rich and the rest of society.

Although this may be seen to lend some plausibility to the notion of a dominant position of a transnational capitalist class (Robinson 2001), we maintain that it is too early to judge. Whether or not the AEI can be shored up and the weakest-link logic remains suspended depends on the ability of policymakers to regularly adjust the CRS to regulatory innovations created to undermine it. In any case, the AEI's current success must not lull policymakers into a false sense of security. They should intensify ongoing efforts (OECD 2018a) to close loopholes and work toward the establishment of a global norm for transparent trust and company registries (ICRICT 2019). Ideally, compliance with this norm would be assessed by a multilateral body that includes civil society organizations and relies on verifiable and regularly evolving criteria.

Speeding up the regulatory process is key to preserving the AEI's positive impact on the tax policy leeway of national governments under conditions of economic globalization. Recent research has shown that the level of financial transparency in a country's investment network determines whether governments respond to domestic demand for higher taxes on capital income (Ahrens et al. 2020). Hence, the AEI enables governments to set taxes in response to domestic democratic preferences instead of pressures from international tax competition (Hakelberg & Rixen 2020). If governments defend its effectiveness in the long-term, the AEI may help them to address one of the most pressing political problems of our time, which has important consequences for the future of democracy and its ability to withstand populist and authoritarian challenges: the increase in income and wealth inequality (cf. Saez & Zucman 2019). If governments fail to make regulatory innovation as dynamic as innovation in the market for tax evasion, however, we risk losing a prime example for international cooperation aimed at re-embedding globalization.

Acknowledgments

Funding by the European Commission for the Horizon 2020-Project “Combatting Fiscal Fraud and Empowering Regulators (COFFERS)” is gratefully acknowledged. We had helpful discussions with Andres Knobel, Markus Meinzer and Jakob Miethe about these and related issues and we learned a lot from the thoughtful comments of the anonymous reviewers. Svenja Schrader, Felicia Riethmüller, and Lea Maurer provided research assistance and helped with data collection. We thank all of them! Open access funding enabled and organized by Projekt DEAL.