Unresolved conflict in workers' compensation: The impact of legal representation on workers' compensation benefits

Abstract

We estimate the causal effect of attorney involvement on the indemnity benefits workers receive after their injuries. To address the fundamental challenge that claims and injuries may differ on unmeasured dimensions that affect both attorney involvement and benefits received, we propose and use two instruments. The first is the baseline local area attorney involvement rate derived from a subset of claims for fractures, lacerations, and contusions without permanent partial disability and/or lump-sum payments. The second instrument is a delay in the first indemnity payment. Our outcome is the total indemnity benefits that workers receive after their injuries, which captures payments to workers for time lost from work and other adverse effects of an injury. Our analysis of more than 950,000 claims with more than 7 days of lost time indicates that attorney involvement substantially increases total indemnity benefits paid to workers.

1 INTRODUCTION

The workers' compensation system started as a social insurance system designed to replace costly litigation that pitted workers against employers with a system that provides predictable coverage of medical care and replacement of lost wages for workers recovering after work-related injuries (Burton, 1972; Fishback & Kantor, 1998). However, more than 100 years after its origination, disputes that entail attorney involvement remain common. This raises important questions regarding the impact of legal representation on the indemnity benefits that workers receive after their injuries.

The impact of attorney involvement on the payments that workers receive is subject to policy debate.1 Worker advocates often claim that attorneys help injured workers obtain the benefits that they are entitled to and increase the chance of a favorable outcome (Rosanes, 2023).2 They argue that employers and insurance companies may not have incentives to pay what a worker is entitled to if the worker is not represented by an attorney. Furthermore, advocates for injured workers argue that attorneys help workers navigate a complex system of workers' compensation rules that can help them get the benefits to which they are entitled.3 On the other hand, advocates for employers and insurance companies claim that the workers' compensation system does a reasonable job compensating most cases without the need for counsel (Okamoto, 2013). They claim that attorneys are involved in the system too frequently, add unnecessary transaction costs, and take benefits away from workers since workers pay attorneys from their workers' compensation awards (Whiteley, 2009, 2010; Sams, 2006; Bernick, 2023).4

These debates and considerations prompt the question we consider in this study: what is the impact of legal representation on the workers' compensation payouts workers receive.5 To date, there has been virtually no evidence on the actual—or causal—effect of legal representation of workers on workers' compensation benefits. Our study provides such evidence. There are studies on the frequency of disputes, litigation, and attorney involvement in the workers' compensation system (Borba & Appel, 1987; Roberts, 1992; Thomason, 1991; Falaris et al., 1995; Card & McCall, 2009; Victor & Savych, 2010). There are studies that consider the relationship between legal representation and indemnity benefits, as well as duration of disability. Workers represented by an attorney have claims with higher medical and indemnity costs and longer duration of disability, and tend to have slower recovery or worse outcomes after surgeries than workers without an attorney.6

This descriptive evidence does not imply that worker legal representation causes higher costs, longer duration, slower recovery, or worse outcomes. Economic reasoning suggests that workers will hire attorneys if the expected increase in indemnity benefits outweighs the cost, and attorneys will be more likely to choose to represent cases with higher expected payments, higher expected settlements, and, therefore, higher attorney fees. These indemnity benefits are likely to be higher when recovery is slower, surgical outcomes are worse, and so forth. Thus, when we compare claims with and without an attorney, we should find a positive association between indemnity benefits, longer duration, and so forth, and hiring an attorney, but such positive associations need not reflect the true causal effects of worker legal representation. Rather, the positive associations between indemnity benefits and worker legal representation may reflect selection on which cases end up with attorneys, rather than the causal effect of attorney involvement for otherwise similar cases. The studies mentioned above control for claim characteristics, but the data may fail to capture all relevant characteristics of a claim and injury that can impact benefits and other outcomes.7

In this study, we use an instrumental variables (IV) approach designed to estimate the causal effect of attorney involvement on the indemnity benefits workers receive after their injuries. Our IVs isolate the variation in attorney involvement that is driven by either local attorney involvement rates or initial delays in payments, rather than by individual characteristics (including, most importantly, characteristics of the injury that can affect indemnity benefits), workers' preferences, or decisions of workers that pertain to the nature of care or the speed of return to work. If our IVs are valid, then we can credibly account for the unobservable factors associated with attorney involvement that can also affect indemnity benefits and thus arrive at a valid comparison between similar claims that differ only in whether the worker was represented by an attorney—a causal estimate.

Our first IV is the baseline local area attorney involvement rate derived from a subset of claims for fractures, lacerations, and contusions without permanent partial disability and/or lump-sum payments. The second IV is a delay in the first indemnity payment. To explore the validity of these IVs, we conducted informal interviews with workers' compensation attorneys and adjudicators practicing in several states. These interviews revealed that our assumptions for the instruments are plausible. For example, interviewees suggested that delays in payment, while increasing the likelihood that workers seek an attorney, should not have an effect on the amount of indemnity benefits among compensable workers’ compensation claims. We also present indirect evidence and a number of auxiliary analyses that bolster the assumptions underlying our IVs.

Our main outcome of interest reflects the total indemnity benefits that workers receive after their injuries. This measure captures payments to workers for time lost from work and other adverse effects of an injury. It includes various types of income replacement benefits that workers receive, including payments for temporary disability benefits, lost wages, loss of earning capacity, and permanent partial disability (PPD) benefits and/or lump-sum (LS) settlements. The latter types of payments are critical to include, as attorneys are often involved in helping workers obtain PPD/LS payments.

Our analysis of more than 950,000 claims with more than 7 days of lost time indicates that attorney involvement substantially increases total indemnity benefits paid to workers. These results are robust to different statistical approaches. In linear regression models, attorneys increase payments by $7700 to $12,400 (a smaller effect than suggested by estimates that only reflect associations between payments and attorney involvement, which could also reflect other confounding factors associated with both—like injury severity). In log regression models, attorneys also increase payments, implying roughly four- to fivefold increases in income benefits.

We find significant effects of attorney involvement across different injury types, such as fractures, lacerations, contusions, low back pain cases, inflammations, and non-back sprains and strains. We also find that attorneys increase payments for low and high values of indemnity benefits. And we document that our estimates are robust to multiple sensitivity analyses and modifications of the empirical approach.

Questions regarding the effects of attorneys on outcomes in disputes or litigation are important in many spheres beyond the workers' compensation system, where similar issues arise over whether attorneys generate value for clients or create unnecessary costs. Examples include Social Security Disability Insurance (SSDI) applications (Hoynes et al., 2022); automobile accident liability (Browne & Puelz, 1996; Browne & Schmit, 2008); divorce (Halla, 2007); and tax court litigation (Lederman & Hrung, 2006). For example, Hoynes et al. (2022) found that attorney involvement increases the likelihood that SSDI applications are approved on the first attempt, although they do not have a substantial effect on the overall likelihood of an award; this is valuable to workers because the benefits come earlier in time and because processing time is faster. Lederman and Hrung (2006) estimated that attorney representation lowers amounts owed to the Internal Revenue Service (IRS) in tax-related disputes when the cases are resolved in a trial but has little effect if the cases are resolved with a settlement.8

The workers' compensation setting provides a number of potential advantages for addressing the general question of the effects of attorney involvement. Unlike other areas of the law, the workers' compensation system makes available data on the universe of claims9 and therefore reflects the full spectrum of experiences, including disputes that may arise. Lederman and Hrung (2006) noted that this is also true for tax disputes. However, in many other settings, we generally know little about cases that do not end up in litigation.10

2 ATTORNEYS IN THE WORKERS' COMPENSATION SYSTEM: POLICY CONTEXT AND DESCRIPTIVE INFORMATION

2.1 Policy context

The workers' compensation program aims to deliver necessary medical care and replace lost earnings when workers are injured on the job, without the uncertainty, delay, and expense of litigation. A typical workers' compensation claim begins when a worker is injured on the job and notifies his or her employer or insurer about the injury. The insurer then investigates the claim and, if the claim is accepted, pays for medical care and indemnity benefits for lost income while workers are recovering from their injuries and are unable to work.11 Often, workers fully recover from their injuries and return to work. In some cases, workers may have permanently disabling injuries, in which case insurers provide PPD or, in a small share of cases, permanent total disability (PTD) payments.

However, disputes can arise, and when these are perceived by workers as challenging their claim or benefits, workers may seek help from an attorney. For example, Victor and Savych (2010) found that workers who reported that their claim was initially denied (even though it was later paid) were more likely to seek help from an attorney, as were workers who reported that their supervisor did not think the injury was legitimate. Moreover, even in the absence of disputes, workers may seek help from an attorney to advocate on their behalf, navigate the complexities of workers' compensation cases, and inform them about the benefits to which workers may be entitled.

2.2 Descriptive information

The preceding discussion helps explain why simple associations between indemnity benefits and attorney involvement can be misleading as to the causal effect of hiring an attorney, because attorneys get involved in different types of cases having to do with the extent of disputes, complexity, or other features of the injury or claim. Descriptive evidence indicates that, in fact, attorney involvement on behalf of workers varies across different types of workers' compensation claims.12

As shown in Table 1, 34 percent of workers who had more than 7 days of lost time after a work-related injury had an attorney represent them during the claim process (within 36 months of maturity).13 Attorney involvement rates differed widely across different types of claims. In the majority of cases, where workers received only temporary disability benefits and did not have any PPD/LS payments, 14 percent of workers were represented by an attorney.14 In contrast, 64 percent of claims that ended up with payments for PPD benefits and/or LS settlements were represented by an attorney. This is expected since claims with PPD/LS payments are open longer and are more likely to develop disagreements about different aspects of the claim. Lump-sum settlements are used to close out future liability on workers' compensation claims and are often applied for claims that have permanent disability.15 Unadjusted summary statistics make clear that claims with attorney involvement have higher indemnity benefits (Table 2). Median payments are lower than average payments, reflecting a long right tail of the distribution. The average indemnity benefit on claims that we examine was around $19,000, although the amount varied across different types of claims—with higher total indemnity benefits for claims with PPD/LS payments.

| Claim type | Percentage of sample | Percentage of workers with an attorney | Indemnity benefits | |

|---|---|---|---|---|

| Average | Median | |||

| All claims with more than 7 days of lost time | 100% | 34% | $19,305 | $5548 |

| Type of indemnity benefits | ||||

| Claims with TD payments only | 61% | 14% | $6890 | $2198 |

| Claims with PPD/LS payments | 39% | 64% | $39,150 | $22,653 |

| Type of PPD/LS payments | ||||

| PPD only | 13% | 38% | $22,292 | $11,839 |

| PPD and LS | 5% | 79% | $55,001 | $38,449 |

| LS only | 21% | 76% | $45,583 | $25,456 |

- Notes: The sample includes claims with more than 7 days of lost time due to work-related injuries. The data cover claims for injuries that occurred between October 1, 2012, and September 30, 2019, across 31 states and reported to insurers within 14 days of an injury. Measures capture experience at an average of 36 months after an injury. Not adjusted for differences in mix of claims.

| Measure | Did worker have an attorney? | |

|---|---|---|

| No | Yes | |

| Average indemnity benefit per claim | $7957 | $41,148 |

| Median indemnity benefit per claim | $2584 | $24,181 |

- Notes: The sample includes claims with more than 7 days of lost time due to work-related injuries. The data cover claims for injuries that occurred between October 1, 2012, and September 30, 2019, across 31 states and reported to insurers within 14 days of an injury. Measures capture experience at an average of 36 months after an injury. Not adjusted for differences in mix of claims.

2.3 Injury characteristics associated with attorney involvement

Table 3 highlights characteristics of injuries and workers related to attorney involvement that are potentially predictive of both the likelihood of disputes and the resulting indemnity benefits. Attorneys are more likely to be involved in claims with neurologic spine pain and in claims with inpatient stays. Attorney involvement typically decreases with workers' tenure at the employer, and it varies across industries, with the highest rates of attorney involvement among workers in construction. Our analyses control for measures describing injury and worker characteristics that we capture in the data. However, we are not able to capture all relevant worker and injury characteristics (including the behavior of insurance companies). This is the main challenge that we address with our IV approach.

| Sample | Percentage of sample | Percentage of workers with an attorney | Indemnity benefits | Percentage with PPD/LS payments | |

|---|---|---|---|---|---|

| Average | Median | ||||

| Injury group | |||||

| Fractures | 10% | 25% | $16,601 | $5815 | 41% |

| Lacerations and contusions | 10% | 22% | $7818 | $1788 | 26% |

| Neurologic spine pain | 9% | 61% | $40,670 | $21,434 | 55% |

| Spine (back and neck) sprains, strains and nonspecific pain | 15% | 36% | $15,199 | $3638 | 34% |

| Inflammations | 9% | 43% | $29,913 | $14,899 | 52% |

| Other sprains and strains | 26% | 31% | $16,909 | $5130 | 36% |

| Carpal tunnel | 1% | 40% | $21,204 | $10,279 | 49% |

| Other | 19% | 32% | $18,504 | $5022 | 37% |

| Worker received inpatient care | |||||

| No | 94% | 33% | $17,226 | $5051 | 38% |

| Yes | 6% | 55% | $54,456 | $29,315 | 53% |

| Workers’ tenure | |||||

| Less than 6 months | 19% | 39% | $17,324 | $4500 | 39% |

| 6 to 12 months | 10% | 37% | $17,153 | $4459 | 38% |

| 1 to 2 years | 12% | 35% | $17,375 | $4626 | 38% |

| 2 to 5 years | 16% | 34% | $18,564 | $5168 | 37% |

| 5 to 10 years | 13% | 33% | $19,900 | $6055 | 39% |

| Over 10 years | 23% | 32% | $24,434 | $8246 | 41% |

| Missing | 7% | 27% | $14,766 | $4403 | 35% |

| Industry group | |||||

| Manufacturing | 15% | 35% | $19,904 | $6499 | 43% |

| Construction | 6% | 38% | $32,659 | $10,107 | 45% |

| Clerical and professional | 7% | 32% | $16,856 | $5220 | 40% |

| Trade | 21% | 34% | $16,261 | $4444 | 36% |

| High-risk services | 28% | 35% | $18,808 | $5132 | 37% |

| Low-risk services | 12% | 35% | $19,724 | $5822 | 39% |

| Other | 10% | 30% | $18,567 | $5564 | 37% |

| Missing | 1% | 29% | $18,540 | $4455 | 27% |

- Notes: The sample includes claims with more than 7 days of lost time due to work-related injuries. The data cover claims for injuries that occurred between October 1, 2012, and September 30, 2019, across 31 states and reported to insurers within 14 days of an injury. Measures capture experience at an average of 36 months after an injury. Not adjusted for other differences in mix of claims.

3 DATA

The WCRI Detailed Benchmark/Evaluation (DBE) database provides details about indemnity benefits and the use of attorneys in workers' compensation claims. The DBE database collects information about workers' compensation claims from national and regional insurers (including residual market carriers), state funds, and self-insured employers (from their third-party administrators). The analysis sample includes information for workers injured between October 1, 2012, and September 30, 2019, in the 31 states covered by the DBE database and evaluated through March 2022.16 These states represent over 80 percent of the benefits paid nationwide in 2017 (Weiss et al., 2019).

The analysis uses information from the DBE at an average of 36 months of maturity. Using this window explains why the last injuries we study are from 2019.17 The study sample includes claims with indemnity benefits and more than 7 days of lost time. We define the sample to exclude other claims because we focus on indemnity benefits as the outcome of interest. We also exclude from the analysis claims that had more than 14 days between the time of injury and the time when the claim was reported to an insurer. We do so to ensure that the sample includes claims where insurers were promptly made aware of the injury and to avoid concerns that some of these claims were filed with the help of an attorney, perhaps because workers consulted with an attorney before reporting the claim.18 We want to understand the consequences of variation in attorney involvement for a broad set of claims both with and without attorney involvement.

3.1 Attorney involvement

Our treatment of interest is whether workers were represented by an attorney at any time during the claim process. This measure is collected when the insurer receives a notice of representation or notice of appearance informing the insurer that the claimant is represented by an attorney.

3.2 Indemnity benefits

Our outcome of interest is the total indemnity benefits that workers receive within 36 months after an injury. These include payments for temporary disability benefits (either temporary total or temporary partial disability payments), permanent disability benefits (either PPD or PTD payments), and settlements that workers may have received.19 By focusing on total indemnity benefits, we avoid concerns that the definition and determination of different components of indemnity benefits vary across states.20

3.3 Other controls

We control for a rich set of covariates that could affect the indemnity benefits that workers receive after their injuries. For example, indemnity benefits increase with age (Savych & Ruser, 2019) and differ across occupations and industries, which vary regarding workers' ability to go back to work (Galizzi & Boden, 1996). We control for the following worker characteristics in our regressions: age, gender, marital status, tenure at the time of injury, and preinjury weekly wages. We also control for the following workplace characteristics: firms' payroll size and indicator variables for industry/occupation.21

Since indemnity costs vary across injuries (Table 3), we include dummy variables for injury type, as follows: fractures; lacerations and contusions; neurologic spine pain (e.g., discs, peripheral neuropathy); spine (back and neck) sprains, strains, and nonspecific pain; inflammations; other (non-back) sprains and strains; upper extremity neurologic pain (carpal tunnel); and a residual category of other injuries.22 We also control for whether the worker had an inpatient stay during the recovery period.

Local labor market characteristics may contribute to differences in the indemnity benefits. We control for the county unemployment rate and whether workers lived in a rural area. We also control for three other population characteristics: the county-level percentage of residents who were disabled, the percentage of working age adults without health insurance, and the state-industry specific share of workers who were members of a union.23 These variables may capture important characteristics of local areas and other factors that are correlated with workers' ability to go back to work and, therefore, with indemnity benefits.

Since determinants of indemnity benefits vary across states, we also include fixed state effects. These account for differences across states in time-invariant workers' compensation policies and other factors that are constant over time. For example, across most states, the policies that determine the generosity of various components of indemnity benefits did not change over the sample period; these include approaches for determining PPD benefits, as well as limits on the duration of temporary disability and PPD benefits.24 With state fixed effects included, we compare indemnity benefits within each state—that is, for cases where the same rules and procedures for determining indemnity benefits and resolving disputes apply. We also include fixed year effects to capture factors that are changing across all states at the same time, such as federal rules and regulations.

4 EMPIRICAL APPROACH

4.1 Baseline specification

Yijst is indemnity benefit payments for worker i, in area j (explained below) of state s, in year t. ATTORNEYijst is the indicator variable capturing whether a worker was represented by an attorney. Xijst is a vector of the control variables discussed above. YRt is a vector of year fixed effects, and STs is a vector of state fixed effects. εijst is an error term.25

As we discussed above, ordinary least squares (OLS) estimation of Equation (1) does not account for the endogenous or selective nature of attorney involvement. It is true that we control for some factors that can affect both indemnity benefits and whether a worker has legal representation, which can help isolate the association of attorney involvement with indemnity benefits for cases that are similar with regard to the characteristics we can measure in our data. However, these associations may not reflect the causal impact of attorney involvement because they may also reflect unobserved factors related to both attorney involvement and indemnity benefits.

Several kinds of unmeasured characteristics of workers/injuries that may not be captured in our controls could lead to biased estimates of Equation (1). Our controls do not capture severity variation, but injury severity may directly affect indemnity benefits and also prompt a worker to get legal representation. In this example, we would expect the OLS estimate of β in Equation (1) to be biased upward. Workers may also hire attorneys when they feel that they are getting inadequate medical care, are being forced back to work too quickly, or are unsatisfied with settlement offers. In such cases, the bias could go in either direction. On the one hand, such cases are likely to be associated with more severe injuries entailing higher indemnity benefits, leading to upward bias. On the other hand, if the indemnity benefits still end up being lower in these cases—because attorneys do not fully offset, for example, workers having to return to work more quickly—the bias could be negative.

Workers may also engage attorneys to avoid the burden of the workers' compensation system. We do not know how this unmeasured variation in worker preferences to hire an attorney is related to indemnity benefits, so it is hard to know the direction of the bias. If, for example, workers who are less confident about dealing directly with the workers' compensation system (and therefore hire an attorney) tend to have lower earnings potential (and therefore lower indemnity benefits), then the OLS estimate can understate the effect of attorney involvement on the amount of indemnity benefits. Alternatively, high-income workers who are confident about dealing with the system may still hire an attorney, in which case the bias would be in the other direction—overstating the effect of an attorney on indemnity benefits (because indemnity benefits are related to preinjury income).

4.2 Instrumental variables approach

The variables ATTYLOCALijst and DELAYijst are the two IVs that we use. This regression includes the same controls as in Equation (1), represented by Xijst. The absence of direct effects of the IVs on indemnity benefits is the key assumption underlying this strategy. We present the justification for this assumption, for each of the IVs, below.

4.2.1 Local area variation in attorney involvement

Excluding individual i avoids creating a mechanical correlation between the instrument and attorney involvement in an individual case—variation that would not be purged of unmeasured injury severity or expected indemnity payments.

We use non-PPD/LS claims for fractures, lacerations, and contusions for several reasons. First, attorney involvement for these claims is more likely to be driven by the supply of attorneys and workers' preferences toward hiring attorneys in certain locales, rather than by state system features that lead to high rates of attorney involvement, but also influence benefits. It would not be informative to derive this measure from a subset of claims that always attract attorneys; for example, Boden and Victor (1994) showed that nearly all of the low back claims with PPD/LS payments had an attorney in some states. Second, focusing on a subset of injuries avoids concerns about variation in local attorney involvement rates that are driven by injury composition. Third, these injuries are common across all workers' compensation jurisdictions, reducing concerns about the impact of industry and occupation mix in determining local area attorney rates.

We define local areas using commuting zones (CZs).27 CZs aggregate counties to better define local economies. The boundaries of these areas are drawn to minimize commuting flows across CZs and maximize them within CZs (Tolbert & Sizer, 1996). For CZs that span multiple states, we treat each part of the CZ located in a different state as a separate area. In creating our instrument, we only use observations that are in areas with at least 15 observations within each CZ-and-year combination to increase precision of the local pattern estimate.

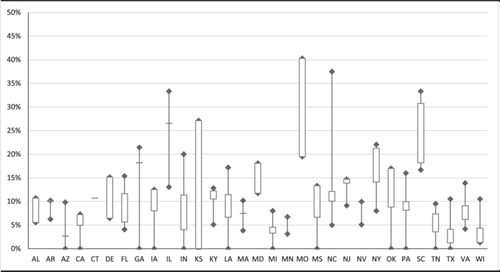

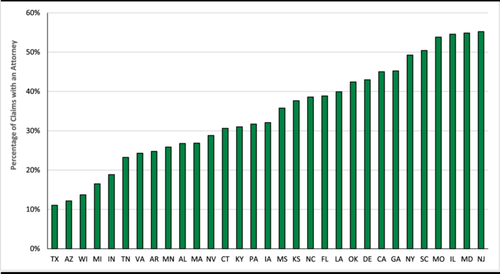

Attorney involvement rates at the CZ level vary within states. Figure 1 provides information on the distribution of the attorney involvement rates (among fractures, lacerations, and contusions without PPD/LS) for our analysis sample. The figure shows the minimum, 25th percentile, 75th percentile, and maximum across CZs for each state in our sample. We observe variation in the rates of attorney involvement both across and within states; given that we include state fixed effects in our model, the within-state variation is critical to our analysis.28

4.2.2 Delay in the first indemnity payment

Our second IV is a novel instrument, unique to the context we are studying—delay in the payment of the first indemnity benefit. This IV (DELAY) is a dummy variable indicating whether the time between the start of disability and the first indemnity payment was more than 30 days.29 We observe this information for every claim in our analysis. As we show in Table 4, 25 percent of workers in our sample had more than 30 days between the start of disability and the first indemnity payment.

| Sample | Percentage of sample | Percentage of workers with an attorney | Average indemnity benefits | Percentage with PPD/LS payments |

|---|---|---|---|---|

| Area type | ||||

| Metropolitan area | 93% | 35% | $19,338 | 39% |

| Micropolitan area | 4% | 29% | $19,480 | 38% |

| Small town or rural area | 3% | 26% | $17,897 | 36% |

| Time to first indemnity payment was over 30 days | ||||

| No | 75% | 29% | $18,888 | 33% |

| Yes | 25% | 50% | $20,538 | 56% |

- Note: The sample includes claims with more than 7 days of lost time due to work-related injuries. The data cover claims for injuries that occurred between October 1, 2012, and September 30, 2019, across 31 states and reported to insurers within 14 days of an injury. Measures capture experience at an average of 36 months after an injury. Not adjusted for differences in mix of claims.

- Key: PPD/LS, permanent partial disability or lump sum.

4.2.3 Validity of the instruments

The first condition for the validity of IVs, which can be tested, is that they strongly predict whether workers had an attorney. With regard to the local pattern of attorney involvement, nonstructured interviews with lawyers and workers' compensation judges that we conducted for this project indicated that attorney involvement rates often differ in different parts of states.30 Interviewees indicated that these differences may reflect the supply of attorneys (fewer attorneys in rural areas), as well as different attitudes that workers have toward litigation in different parts of states. For example, interviewees mentioned that rural areas tend to have a higher level of distrust toward attorneys, a stronger feeling of community ties, and a greater concern that by involving an attorney they are suing their employer. Consistent with this, Table 4 indicates that attorney involvement varied between rural and urban areas. Among workers who reside in metropolitan areas (the overwhelming majority of our sample), 35 percent had an attorney involved in their claim. In contrast, in rural areas, 26 percent had an attorney involved in a claim. Interviewees also mentioned that many of their new clients come as referrals from workers' friends, coworkers, union representatives, and medical providers. These referrals would perpetuate prevailing regional patterns of attorney involvement—workers who used an attorney in the past will advise other workers to also use attorneys.

The second panel in Table 4 shows that attorneys are more likely to be involved in claims for which the start of indemnity benefit payments was delayed. Among workers who had more than 30 days from the start of disability to the first indemnity payments, 50 percent had an attorney involved in a claim. Among those who received their first indemnity payments within 30 days, 29 percent had an attorney. This reflects a common refrain that delays in payments of indemnity benefits lead workers to seek help from an attorney.31 These delays may happen when claims are initially denied or when insurance companies take extra time to investigate claims. Workers may interpret a delay as a denial and may seek an attorney. This is also consistent with prior evidence from surveys of injured workers that showed that workers who thought that their claim was initially denied were more likely to seek help with their claim from an attorney (Victor & Savych, 2010).

The second condition for the validity of the instruments—the exclusion restriction—is that they are not correlated with claim or claimant characteristics that are unobserved by researchers but that affect indemnity benefits, conditional on controlling for other observable factors. We discuss this assumption (which cannot be tested directly) for each of the instruments separately. Our first IV (ATTYLOCAL) reflects attorney involvement patterns based on all other workers within the same CZ with fractures, lacerations, and contusions (and without PPD/LS), which should be driven by the prevailing attorney involvement rates within an area for other claimants. Our construction of the IV (Equation (3)) avoids a mechanical effect of individual-level attorney involvement on the local average. Moreover, it seems unlikely that attorney involvement patterns for other workers in the same local area would be correlated with an individual worker's indemnity benefits, conditional on their own attorney involvement.

For the second IV (DELAY), the exclusion restriction requires that unobserved worker and injury characteristics that affect indemnity benefits are not correlated with whether the payments of indemnity benefits were initially delayed. There are good reasons to expect this to hold. The delay of the initial payment often indicates that an insurance company spent more time investigating details of the injury to decide whether it is indeed a compensable claim or requesting additional documentation about the injury. It may also indicate an initial denial of the claim before it was ultimately accepted, and the payments on the claim were made. Once the compensability of a claim is established, subsequent benefit payments should not directly depend on an initial payment delay but reflect the underlying severity of an injury or remaining permanent disability after the worker has recovered. We obtained evidence consistent with this view from our nonstructured interviews of workers' compensation lawyers and judges. They suggested that delays in payment, while increasing the likelihood that workers seek an attorney, should not have an effect on the amount of indemnity benefits among compensable workers' compensation claims.32

Nonetheless, there are possible reasons the exclusion restriction for either IV could be violated. For the first IV (the local attorney involvement pattern), the potential concern is that workers are sorted across parts of the state in a way that generates a correlation between unobserved injury severity or a propensity for higher indemnity benefits, on the one hand, and attorney involvement patterns, on the other. However, this seems unlikely given our extensive controls. For instance, some areas may have higher-wage workers, and wages could influence both attorney involvement patterns and indemnity benefits. We address this by controlling for workers' preinjury wages. Similarly, some areas could have an overrepresentation of specific industries or occupations and, hence, injuries that are correlated with both attorney involvement and indemnity benefits (e.g., because return to work is more challenging in some industries). But our models control for workers' industry and injury types. Likewise, some areas may have an older workforce, and age could influence both attorney involvement patterns and indemnity benefits, but we control for workers' ages. Another dimension of sorting is variation in labor market conditions across parts of the state. For example, weak labor markets could create a slower return to work (and, hence, higher indemnity benefits) and perhaps also be associated with more attorney involvement (as workers lean on attorneys to protect their benefits). We address this concern by including controls for county-level unemployment rates. There could also be regional variation in comorbidities that affect indemnity benefits (through differences in return to work) and are correlated with attorney involvement. But we account for this by controlling for county-level variation in the percentage of disabled workers. Thus, none of these possibilities should result in local attorney involvement rates affecting indemnity benefits once we condition on these controls and include the effect of the individual worker's attorney involvement.

For the delay in payments IV, the potential concern is that delays in payments reflect unobserved injury or worker characteristics that are related to both the likelihood of attorney involvement and expected indemnity benefits. One possible problematic unobserved factor is the presence of a pre-existing condition or a prior injury that contributed to the current condition. These cases may take longer to investigate to ensure that the injury is indeed compensable. Furthermore, several states allow for a decrease in the amount of permanent disability payments when there is a pre-existing condition (through a process called apportionment). As a result, a delay in payment that is driven by concerns about compensability may also be associated with lower indemnity benefits for a small share of claims. However, we show in the appendix that our results are not driven by particular states that commonly allow the use of apportionment.

As additional evidence, Table 5 shows differences in payment delays by injury characteristics. Some of the differences are consistent with our expectations. Overall, a typical worker received the first indemnity payment within 2 weeks from the start of disability, and 75 percent of workers received the first indemnity payment within 30 days of disability. Workers with neurologic spine pain and carpal tunnel, when compared with workers with fractures, had a longer average time to the first payment and were more likely to have more than 30 days until the first indemnity payment (although the median time to the first payment did not vary substantially across different claim groups). We also observe faster first indemnity payments among workers who needed inpatient care. These injury-related differences also translate into differences in delays of payments across industry groups. The percentage of workers with more than 30 days to the first payment varies from 23 percent among those in construction to 30 percent among workers in clerical and professional occupations. At the same time, we find small differences in the time to first indemnity payment for other worker characteristics. For example, delays in payment vary little by workers' age, tenure with preinjury employer, or whether the worker lives in a metropolitan area. This evidence reinforces our arguments that delays in indemnity payments likely reflect the speed with which different types of claims are processed rather than the differences in characteristics of workers who filed the claims.

| Sample | Percentage of sample | Days from start of disability to the first indemnity payment | ||

|---|---|---|---|---|

| Average | Median | Percentage with more than 30 days | ||

| Overall | 56% | 62 | 13 | 25% |

| Injury group | ||||

| Fractures | 10% | 42 | 13 | 16% |

| Lacerations and contusions | 10% | 58 | 13 | 22% |

| Neurologic spine pain | 9% | 76 | 15 | 31% |

| Spine (back and neck) sprains, strains, and nonspecific pain | 15% | 71 | 14 | 27% |

| Inflammations | 9% | 69 | 14 | 30% |

| Other sprains and strains | 26% | 62 | 14 | 25% |

| Carpal tunnel | 1% | 78 | 13 | 31% |

| Other | 19% | 57 | 13 | 25% |

| Worker received inpatient care | ||||

| No | 94% | 63 | 14 | 26% |

| Yes | 6% | 40 | 13 | 17% |

| Workers’ tenure | ||||

| Less than 6 months | 19% | 61 | 14 | 26% |

| 6 to 12 months | 10% | 61 | 14 | 26% |

| 1 to 2 years | 12% | 61 | 14 | 25% |

| 2 to 5 years | 16% | 62 | 14 | 25% |

| 5 to 10 years | 13% | 65 | 14 | 26% |

| Over 10 years | 23% | 65 | 13 | 25% |

| Missing | 7% | 55 | 13 | 22% |

| Age groups | ||||

| 15–25 years | 9% | 47 | 13 | 21% |

| 25–35 years | 20% | 55 | 13 | 23% |

| 35–45 years | 21% | 64 | 14 | 26% |

| 45–55 years | 26% | 68 | 14 | 27% |

| 55–65 years | 20% | 67 | 13 | 26% |

| 65+ years | 4% | 61 | 13 | 24% |

| Industry group | ||||

| Manufacturing | 15% | 70 | 13 | 28% |

| Construction | 6% | 56 | 13 | 23% |

| Clerical and professional | 7% | 80 | 15 | 30% |

| Trade | 21% | 58 | 13 | 25% |

| High-risk services | 28% | 58 | 13 | 24% |

| Low-risk services | 12% | 64 | 13 | 25% |

| Other | 10% | 59 | 14 | 24% |

| Missing | 1% | 51 | 13 | 20% |

| Area type | ||||

| Metropolitan area | 93% | 62 | 13 | 25% |

| Micropolitan area | 4% | 59 | 13 | 24% |

| Small town or rural area | 3% | 55 | 13 | 23% |

- Note: The sample includes claims with more than 7 days of lost time due to work-related injuries. The data cover claims for injuries that occurred between October 1, 2012, and September 30, 2019, across 31 states and reported to insurers within 14 days of an injury. Measures capture experience at an average of 36 months after an injury. Not adjusted for differences in mix of claims.

Despite these arguments in favor of the validity of our IVs, it is important to emphasize that whether our IV approach uncovers the causal effects of attorney involvement ultimately rests on the assumption that the second condition for the validity of the IVs—that they can be excluded from the equation for indemnity benefits—is valid. We have provided a priori arguments and some indirect evidence for why we think the condition may hold (and we provide more such evidence in the appendix), and why our rich controls make this even more likely. Furthermore, as we discuss in Section 5, with the two potential IVs instead of only one, we can provide further suggestive statistical evidence on the validity of our IVs, as long as we believe that one of the IVs is valid (without having to specify which one). This evidence, too, bolsters the validity of our approach.

5 THE EFFECTS OF ATTORNEY INVOLVEMENT

In this section, we turn to our statistical analysis of the relationship between worker legal representation and indemnity benefits.

5.1 OLS estimates

First, we review OLS estimates (Table 6). These estimates reveal the association between attorney involvement and indemnity benefits while adjusting for injury, worker, workplace, and location characteristics. We show estimates using as the dependent variable either the level or the log of benefits. In the first case, we find that claims with an attorney have $30,500 more in payments than claims without an attorney (similar to the unadjusted difference of $33,000 shown in Table 2). In the second case, the estimated impact of 197.4 in logs similarly implies a large increase in indemnity benefits paid when workers are represented by an attorney; the log reduces the impact of very large values of the outcome.33

| Indemnity benefits | Logged indemnity benefits | |||

|---|---|---|---|---|

| Coefficient | S.E. | Coefficient | S.E. | |

| Attorney is involved | $30,586*** | (636) | 197.4*** | (1.6) |

| Observations | 959,611 | 959,611 | ||

- Note: The sample includes claims with more than 7 days of lost time due to work-related injuries. The data cover claims for injuries that occurred between October 1, 2012, and September 30, 2019, across 31 states and reported to insurers within 14 days of an injury. Measures capture experience at an average of 36 months after an injury. Specifications include controls for state and year dummies, as well as controls for worker and workplace characteristics (age, gender, marital status, preinjury wage and tenure, and firms' payroll and industry), controls for injury characteristics (injury group dummies and whether workers had hospitalizations), and controls for location characteristics (county unemployment rate, whether a zip code reflects a rural area, percentage of county population without health insurance, percentage of county population who were disabled, and percentage of workers within each state and industry who were members of a union). The full set of estimates in this and subsequent tables is available upon request.

- *** Statistically significant at the 1 percent level, **statistically significant at the 5 percent level, *statistically significant at the 10 percent level. Standard errors clustered at CZ level.

Using either the level or log specification, the estimates in Table 6 point to a strong positive relationship between attorney involvement and indemnity benefits. However, to obtain estimates of the causal effect of attorney involvement, we turn to our IV approach.

5.2 First-stage estimates

We first present estimates of our first-stage regressions (Equation (2)) showing relationships between whether an individual worker was represented by an attorney, on the one hand, and local attorney involvement patterns and delays in payments (our IVs), on the other, in Table 7. The results indicate that each IV separately and both IVs together have high predictive power for attorney involvement, meeting the first requirement for IVs to be valid. The first model, using only the local pattern to predict attorney involvement, implies that a 10 percentage point increase in the baseline local area attorney involvement rates is associated with a 3.2 percentage point higher likelihood that injured workers have an attorney. The F-statistic on the first-stage estimate is very large (69). The second estimate is for the delay in payments IV. The estimate implies that the likelihood of being represented by an attorney is 18 percentage points higher for claims that had more than 30 days from the time of disability to the first indemnity payment. The F-statistic on the first-stage regression is even larger (1289). Finally, the estimates at the bottom of the table include both IVs; each one of them continues to have a large impact in predicting variation in attorney involvement, and the joint F-statistic is very high (643).

| Observations | Coefficient | S.E. | |

|---|---|---|---|

| Local attorney involvement patterns instrument | |||

| Percentage with attorneys among claims for fractures, lacerations, and contusions without PPD/LS at CZ-year level | 959,611 | 0.3171*** | (0.0385) |

| F-statistic | 69 | ||

| R-squared | 0.14 | ||

| Delay in payments instrument | |||

| Claim had more than 30 days from time of disability to the first indemnity payment | 959,611 | 0.1754*** | (0.0049) |

| F-statistic | 1289 | ||

| R-squared | 0.16 | ||

| Two instruments | |||

| Percentage with attorneys among claims for fractures, lacerations, and contusions without PPD/LS at CZ-year level | 959,611 | 0.2781*** | (0.0371) |

| Claim had more than 30 days from time of disability to the first indemnity payment | 0.1750*** | (0.0049) | |

| F-statistic | 643 | ||

| R-squared | 0.16 | ||

- Note: The sample includes claims with more than seven days of lost time due to work-related injuries. The data cover claims for injuries that occurred between October 1, 2012, and September 30, 2019, across 31 states and reported to insurers within 14 days of an injury. Measures capture experience at an average of 36 months after an injury. Specifications include controls for state and year dummies, as well as controls for worker and workplace characteristics (age, gender, marital status, preinjury wage and tenure, and firms' payroll and industry), controls for injury characteristics (injury group dummies and whether workers had hospitalizations), and controls for location characteristics (county unemployment rate, whether a zip code reflects a rural area, percentage of county population without health insurance, percentage of county population who were disabled, and percentage of workers within each state and industry who were members of a union).

- *** Statistically significant at the 1 percent level, **statistically significant at the 5 percent level, *statistically significant at the 10 percent level. Standard errors clustered at CZ level.

5.3 IV estimates

Table 8 presents the IV estimates of the effect of attorney involvement. We show estimated effects from three specifications: using only local variation in attorney involvement as an IV, using delay in payments as an IV, and using both IVs. The key result is that all the estimates indicate a positive and statistically significant effect of attorney involvement on indemnity benefits. Comparisons with Table 6 indicate that the IV estimates are smaller than the OLS estimates, which is consistent with positive bias in the OLS estimates. A positive bias means that attorney involvement is positively related to unmeasured factors that are associated with higher indemnity benefits.

| Indemnity benefits | Logged indemnity benefits | |||

|---|---|---|---|---|

| Coefficient | S.E. | Coefficient | S.E. | |

| Specification with local attorney involvement patterns instrument | ||||

| Attorney involvement | $12,382** | (4737) | 168.8*** | (22.3) |

| Specification with delay in payments instrument | ||||

| Attorney involvement | $7653*** | (914) | 179.7*** | (3.8) |

| Specification with two instruments | ||||

| Attorney involvement | $7736*** | (916) | 179.5*** | (3.8) |

| Observations | 959,611 | 959,611 | ||

- Note: The sample includes claims with more than 7 days of lost time due to work-related injuries. The data cover claims for injuries that occurred between October 1, 2012, and September 30, 2019, across 31 states and reported to insurers within 14 days of an injury. Measures capture experience at an average of 36 months after an injury. Specifications include controls for state and year dummies, as well as controls for worker and workplace characteristics (age, gender, marital status, preinjury wage and tenure, and firms' payroll and industry), controls for injury characteristics (injury group dummies and whether workers had hospitalizations), and controls for location characteristics (county unemployment rate, whether a zip code reflects a rural area, percentage of county population without health insurance, percentage of county population who were disabled, and percentage of workers within each state and industry who were members of a union).

- *** Statistically significant at the 1 percent level, **statistically significant at the 5 percent level, *statistically significant at the 10 percent level. Standard errors clustered at the CZ level.

The magnitude of these estimates in levels, depending on the IVs used, ranges from $7700 to $12,400. Estimates using only the local area variation in attorney involvement suggest that attorneys increase indemnity benefits by $12,400. We view the smaller estimates associated with using the delay IV as likely to be more reliable, in part because the IV is a stronger predictor of attorney involvement, as reflected in the much more precise estimates when using this IV (i.e., the much smaller standard errors)—whether or not combined with the local patterns IV.34 The estimates for log indemnity benefits also suggest that attorney involvement increases indemnity benefits. The estimated coefficient is 169–180, depending on the specification. Again, these are smaller than the OLS estimate. The IV log estimates imply that attorney involvement boosts indemnity benefits four- to fivefold. While large, these estimates are not broadly out of line with levels estimates of a $7700 effect; the median of indemnity benefits is $5500 (Table 1), so a $7700 increase represents more than double the indemnity benefits. The log specification puts more weight on smaller claims, indicating higher percentage gains in benefits among smaller claims.

Regardless, when we compare workers with and without an attorney using only the variation in attorney involvement that is predicted by different local patterns across parts of the state and/or by initial delays in payments, we find considerably smaller effects of an attorney on the amount of benefits than what is implied by an OLS regression. Nonetheless, the IV estimates imply large positive effects of total indemnity benefits from legal representation of workers. Moreover, the log specification is easier to interpret when asking whether the estimates imply that workers who hire an attorney are better off once we account for fees paid to the attorney. Our understanding is that attorneys are usually paid a given percentage of the indemnity benefits received—typically 20 to 33 percent.35 Our estimates of effects of well over 200 percent suggest that workers benefit substantially from hiring an attorney.36

Next, we report IV estimates for four separate groups of injuries (using both IVs): (1) fractures, lacerations, and contusions; (2) low back pain cases; (3) inflammations and non-back sprains and strains; and (4) other injuries, not included in the other groups. We do this to check that our results are not affected by potential issues with the delay in payments IV associated with it being correlated with compensability. In particular, similar results for fractures, lacerations, and contusions, where compensability is not at issue, would bolster our findings. The IV estimates in Table 9 indicate that attorneys have a strong effect on indemnity benefits across all groups of injuries. Attorneys increase indemnity benefits by $4900 among workers with fractures, lacerations, and contusions. The estimated effect is larger among workers with other injuries—a $7800 increase for low back pain cases, and an $8300 increase for inflammations and non-back sprains and strains—but average indemnity benefits are larger for these injuries (Table 1). The estimated coefficients for log indemnity benefits range from 147 to 210 across different injury groups, implying three- to sevenfold increases in indemnity payments due to attorney involvement.

| Injury group | Sample size | OLS | IV | ||

|---|---|---|---|---|---|

| Coefficient | S.E. | Coefficient | S.E. | ||

| Impact of attorney on indemnity benefits | |||||

| Fractures, lacerations, and contusions | 195,044 | $24,545*** | (662) | $4850*** | (1040) |

| Low back pain cases | 233,922 | $32,021*** | (655) | $7848*** | (1268) |

| Inflammations and non-back sprains and strains | 345,393 | $30,414*** | (642) | $8291*** | (1216) |

| Other injuries | 185,252 | $33,466*** | (790) | $11,141*** | (1429) |

| Impact of attorney on logged indemnity benefits | |||||

| Fractures, lacerations, and contusions | 195,044 | 188.7*** | (2.2) | 146.8*** | (6.2) |

| Low back pain cases | 233,922 | 207.2*** | (1.7) | 210.1*** | (4.3) |

| Inflammations and non-back sprains and strains | 345,393 | 189.6*** | (1.6) | 164.5*** | (4.8) |

| Other injuries | 185,252 | 202.9*** | (2.0) | 180.2*** | (5.1) |

- Note: The sample includes claims with more than seven days of lost time due to work-related injuries. The data cover claims for injuries that occurred between October 1, 2012, and September 30, 2019, across 31 states and reported to insurers within 14 days of an injury. Measures capture experience at an average of 36 months after an injury. Specifications include controls for state and year dummies, as well as controls for worker and workplace characteristics (age, gender, marital status, preinjury wage and tenure, and firms' payroll and industry), controls for injury characteristics (injury group dummies and whether workers had hospitalizations), and controls for location characteristics (county unemployment rate, whether a zip code reflects a rural area, percentage of county population without health insurance, percentage of county population who were disabled, and percentage of workers within each state and industry who were members of a union).

- *** Statistically significant at the 1 percent level, **statistically significant at the 5 percent level, *statistically significant at the 10 percent level. Standard errors clustered at CZ level.

5.4 Threats to identification

One possible concern about the IV based on local area variation in attorney involvement is that differences across areas may reflect other important within-state factors that affect both attorney involvement and benefits. For instance, areas with high attorney involvement may be dominated by one or two large employers or workers' compensation insurance companies that may be particularly aggressive in challenging claims. This would create a greater demand for attorneys, causing them to locate in the area and making it easy for workers to find an attorney. At the same time, more aggressive challenging of claims would mean longer time to resolve the claims, which could lead to either higher or lower indemnity benefits depending on changes in claim composition and approaches for resolving claims. In this case, the omitted employer behavior would violate the exclusion restriction for valid IV estimation. We address this concern in two ways. First, we estimate the local area variation in attorney involvement while leaving out the worker's employer in the year when the worker has a workers' compensation claim. Second, we estimate local area variation in attorney involvement ignoring claims in that year from the insurer who is handling a specific claim. These are two related ways of ensuring that the local area variation in attorney involvement does not reflect the demand for attorneys driven by employer and insurer practices but rather reflects the supply of attorneys across different areas.

The estimates in Table 10 show that our conclusions about the effects of an attorney on indemnity benefits do not change when we use these two alternative approaches for measuring local area variation in attorney involvement, although the estimates that use only the local attorney pattern IV are somewhat higher when we measure local area variation excluding either the worker's employer or the insurer, but much less so when using the two alternative approaches for measuring the local attorney involvement IV and also using the delay IV. The estimates in logs display similar patterns.

| Specification from Table 8 (leave out worker instrument) | Leave out employer instrument | Leave out insurer instrument | ||||

|---|---|---|---|---|---|---|

| Coefficient | S.E. | Coefficient | S.E. | Coefficient | S.E. | |

| A. Indemnity benefits | ||||||

| OLS | ||||||

| Attorney involvement | $30,586*** | (636) | $30,593*** | (637) | $30,605*** | (651) |

| IV specification with local attorney involvement patterns instrument | ||||||

| Attorney involvement | $12,382*** | (4737) | $18,214*** | (3468) | $21,381*** | (5078) |

| IV specification with two instruments | ||||||

| Attorney involvement | $7736*** | (916) | $7990*** | (910) | $8284*** | (926) |

| B. Logged indemnity benefits | ||||||

| OLS | ||||||

| Attorney involvement | 197.4*** | (1.6) | 197.4*** | (1.6) | 197.7*** | (1.7) |

| IV specification with local attorney involvement patterns instrument | ||||||

| Attorney involvement | 168.8*** | (22.3) | 180.5*** | (16.9) | 189.9*** | (24.1) |

| IV specification with two instruments | ||||||

| Attorney involvement | 179.5*** | (3.8) | 179.7*** | (3.8) | 180.5*** | (3.8) |

| Observations | 959,611 | 957,476 | 933,291 | |||

- Note: The sample includes claims with more than seven days of lost time due to work-related injuries. The data cover claims for injuries that occurred between October 1, 2012, and September 30, 2019, across 31 states and reported to insurers within 14 days of an injury. Measures capture experience at an average of 36 months after an injury. Specifications include controls for state and year dummies, as well as controls for worker and workplace characteristics (age, gender, marital status, preinjury wage and tenure, and firms' payroll and industry), controls for injury characteristics (injury group dummies and whether workers had hospitalizations), and controls for location characteristics (county unemployment rate, whether a zip code reflects a rural area, percentage of county population without health insurance, percentage of county population who were disabled, and percentage of workers within each state and industry who were members of a union).

- *** Statistically significant at the 1 percent level, **statistically significant at the 5 percent level, *statistically significant at the 10 percent level. Standard errors clustered at the CZ level.

Another concern about the local attorney involvement rate is that insurers may change their claim-handling behavior in areas where attorney involvement is higher, because that higher involvement acts as an implicit threat of legal conflict. Thus, to try to preclude costly legal battles, insurers may offer a more generous initial settlement for all claims when they perceive a higher threat of attorney involvement in an area. This may create a direct relationship between local attorney involvement rates in an area and workers' indemnity payments, violating the exclusion restriction. In the appendix, we provide evidence against this concern based on overidentification tests and the robustness of the results to using only the delay IV and not excluding the local attorney involvement measure from the second-stage regression (Equation (1)).

A potential concern about the delay in payments IV is that it may reflect employer or insurer approaches toward different types of claims, which may, in turn, be related to indemnity benefits (again, leading to violation of the exclusion restriction). We address this concern by estimating specifications that control for insurer and employer fixed effects.37 The estimates in Table 11 show that the estimates are not sensitive to including insurer or employer fixed effects, whether using levels or logs. These specification checks highlight the robustness of our results to multiple potential concerns about the IVs.

| Specification from Table 8 | With state-insurer fixed effects | With employer fixed effects | ||||

|---|---|---|---|---|---|---|

| Coefficient | S.E. | Coefficient | S.E. | Coefficient | S.E. | |

| A. Indemnity benefits | ||||||

| OLS | ||||||

| Attorney involvement | $30,586*** | (636) | $30,613*** | (634) | $30,238*** | (653) |

| IV specification with local attorney involvement patterns instrument | ||||||

| Attorney involvement | $12,382*** | (4737) | $9602* | (4974) | $13,064 | (8012) |

| IV specification with delay in payments instrument | ||||||

| Attorney involvement | $7653*** | (914) | $8194*** | (816) | $6895*** | (698) |

| IV specification with two instruments | ||||||

| Attorney involvement | $7736*** | (916) | $8216*** | (819) | $6935*** | (696) |

| B. Logged Indemnity Benefits | ||||||

| OLS | ||||||

| Attorney involvement | 197.4*** | (1.6) | 197.9*** | (1.6) | 195.4*** | (1.8) |

| IV specification with local attorney involvement patterns instrument | ||||||

| Attorney involvement | 168.8*** | (22.3) | 156.6*** | (22.9) | 168.6*** | (28.1) |

| IV specification with delay in payments instrument | ||||||

| Attorney involvement | 179.7*** | (3.8) | 176.3*** | (3.9) | 180.7*** | (2.4) |

| IV specification with two instruments | ||||||

| Attorney involvement | 179.5*** | (3.8) | 176.0*** | (3.9) | 180.6*** | (2.4) |

| Observations | 959,611 | 959,611 | 780,137 | |||

| Controls for: | ||||||

| Worker, employer, and injury characteristics | x | x | x | |||

| Fixed effects for: | ||||||

| State | x | x | ||||

| Year | x | x | x | |||

| State-insurer | x | |||||

| Employer fixed effects | x | |||||

- Note: The sample includes claims with more than 7 days of lost time due to work-related injuries. The data cover claims for injuries that occurred between October 1, 2012, and September 30, 2019, across 31 states and reported to insurers within 14 days of an injury. Measures capture experience at an average of 36 months after an injury. Specifications include controls for state and year dummies, as well as controls for worker and workplace characteristics (age, gender, marital status, preinjury wage and tenure, and firms' payroll and industry), controls for injury characteristics (injury group dummies and whether workers had hospitalizations), and controls for location characteristics (county unemployment rate, whether a zip code reflects a rural area, percentage of county population without health insurance, percentage of county population who were disabled, and percentage of workers within each state and industry who were members of a union).

- *** Statistically significant at the 1 percent level, **statistically significant at the 5 percent level, *statistically significant at the 10 percent level. Standard errors clustered at the CZ level.

5.5 Attorney effects on the distribution of indemnity benefits

Next, we examine how attorney involvement shifts the distribution of indemnity benefits conditional on claim characteristics. Table 12 shows estimates from quantile regressions and IV quantile regressions for the effects of attorney involvement across deciles of indemnity benefits. In every single case in Table 12, the estimates from the IV quantile regressions are smaller than estimates from the quantile regressions, which is consistent with positive bias because attorney involvement is positively related to unmeasured factors that shift the distribution of indemnity payments—exactly paralleling the earlier results.

| Percentiles of payments | Quantile regression | Instrumental variables quantile regression | Indemnity benefits (percentile) | ||

|---|---|---|---|---|---|

| Coefficient | S.E. | Coefficient | S.E. | ||

| Total indemnity benefits | |||||

| 10th percentile | $3514*** | (21) | $2887*** | (28) | $498 |

| 20th percentile | $6640*** | (27) | $4468*** | (37) | $1098 |

| 30th percentile | $10,021*** | (37) | $5947*** | (47) | $1976 |

| 40th percentile | $14,172*** | (49) | $7533*** | (69) | $3360 |

| 50th percentile | $19,036*** | (60) | $9516*** | (116) | $5548 |

| 60th percentile | $24,760*** | (74) | $12,267*** | (133) | $9210 |

| 70th percentile | $32,285*** | (99) | $15,150*** | (158) | $15,522 |

| 80th percentile | $42,710*** | (133) | $18,580*** | (234) | $27,291 |

| 90th percentile | $59,329*** | (201) | $17,211*** | (1617) | $52,941 |

| Log of total indemnity benefits | |||||

| 10th percentile | 216.2*** | (0.6) | 203.4*** | (2.5) | $498 |

| 20th percentile | 221.8*** | (0.4) | 187.0*** | (2.5) | $1098 |

| 30th percentile | 219.4*** | (0.4) | 173.7*** | (2.2) | $1976 |

| 40th percentile | 215.2*** | (0.4) | 161.3*** | (2.6) | $3360 |

| 50th percentile | 209.0*** | (0.3) | 152.3*** | (3.0) | $5548 |

| 60th percentile | 202.1*** | (0.3) | 145.8*** | (2.3) | $9210 |

| 70th percentile | 192.3*** | (0.3) | 138.5*** | (1.9) | $15,522 |

| 80th percentile | 179.0*** | (0.3) | 121.9*** | (1.8) | $27,291 |

| 90th percentile | 157.7*** | (0.4) | 93.4*** | (5.4) | $52,941 |

- Note: The sample includes claims with more than 7 days of lost time due to work-related injuries. The data cover claims for injuries that occurred between October 1, 2012, and September 30, 2019, across 31 states and reported to insurers within 14 days of an injury. Measures capture experience at an average of 36 months after an injury. Specifications include controls for state and year dummies, as well as controls for worker and workplace characteristics (age, gender, marital status, preinjury wage and tenure, and firms' payroll and industry), controls for injury characteristics (injury group dummies and whether workers had hospitalizations), and controls for location characteristics (county unemployment rate, whether a zip code reflects a rural area, percentage of county population without health insurance, percentage of county population who were disabled, and percentage of workers within each state and industry who were members of a union).

- The quantile instrumental variables regression is estimated using the "sivqr" module in Stata 16 based on Kaplan and Sun (2017).

- *** Statistically significant at the 1 percent level, **statistically significant at the 5 percent level, *statistically significant at the 10 percent level.

These quantile regression estimates provide information on whether attorney involvement has different effects in different parts of the distribution of indemnity benefits. For instance, perhaps attorney involvement does not matter much for smaller cases but has a larger impact at the upper tails of the distribution, where the claims are more expensive (and attorney payments larger). These potentially contrasting effects are apparent from the quantile regressions estimated for higher and lower percentiles of the distribution. Estimates from regressions in levels indicate an increasing effect of an attorney on the amount of benefits a worker receives. These vary from an increase of less than $6000 for the bottom three deciles of the distribution of indemnity benefits to increases of $15,000–$18,000 for the top three deciles of the distribution of benefits. It is natural that the level effects are larger higher up in the distribution. Estimates from log specifications make the findings clearer, showing that the percentage effects are larger for cases with smaller payments. Note that this finding is consistent with what we found in the earlier standard regression IV estimates in levels and logs. The log specification puts more weight on the effect of attorney involvement in cases involving lower benefit levels, so the larger estimates from the log specification reported above reflect larger impacts in cases involving relatively lower indemnity benefits.

5.6 Variation in effects of attorney involvement across states

States differ in terms of the percentage of claims with attorney involvement as well as the percentage of claims with PPD/LS payments (for which attorney involvement is more common).38 The nature of disputes and how disputes are resolved also vary across states. In some states, attorneys are involved in nearly every claim that receives PPD/LS payments; in other states, they are only involved in a subset of these claims. States also differ in terms of rules that determine whether lump-sum settlements are used—a common occurrence in some states but not in others. The states also differ in terms of how attorney fees are determined and whether attorney fees are capped, which may contribute to the different incentives for attorneys to choose to represent workers' compensation clients. Given these differences across states, there is a potential concern that the results are driven by particular states, possibly because of workers' compensation system features in those states.

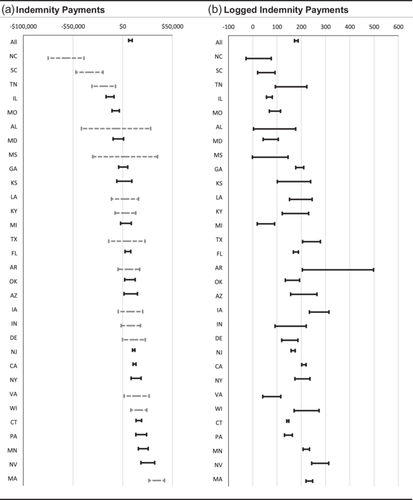

To address this issue, we explore estimates computed separately for each state in our data. These estimates are plotted in Figure 2. For the models in levels, the IV estimates by state vary a lot. In some cases, we find small and statistically insignificant estimates or even a few negative and significant estimates. However, the estimates from log specifications are more stable and always positive. Moreover, in every state but one (North Carolina), the estimate is statistically significant and sufficiently large relative to the percentage paid to attorneys that the estimate implies that workers gain from hiring an attorney.

When state-specific models of the relationship between attorney involvement and indemnity benefits are estimated, the estimates can become imprecise, both because of fewer observations and because (within states) the IVs may not predict attorney involvement very strongly. Indeed, in most states, the first-stage estimates indicate only a weak relationship between local area attorney involvement rates and individual-level attorney rates, although we still find a strong relationship between an initial delay in indemnity benefits and the individual attorney involvement rates. Hence, we need to be mindful of whether a given state-specific estimate is reliable enough to provide useful information. We emphasize the concern about precision of state-specific estimates point by including in Figure 2 (at the top) the overall estimate and confidence interval; this confidence interval is markedly smaller than for most states.

To provide information on what the state-level evidence says for the subset of states for which the data are sufficiently informative, we selected those states for which the estimates are precise enough to be able to identify our aggregated estimates from Table 8 as statistically significant. For the model in levels, we found that (with both IVs) attorneys increase indemnity benefits by $7700, so the standard error needs to be less than 3928 for the estimate to remain statistically significant at the 5 percent level. For the regressions in logs, the standard error needs to be less than 91 for the estimates to remain statistically significant. We apply those thresholds about how informative the state estimates are in Figure 2. In particular, we shade in black the estimates corresponding to states with estimates that meet the precision criterion just specified, and the other less precise estimates are shaded in gray (which, by construction, have larger confidence intervals). For estimates in levels (Panel a), of the 16 states for which the estimates are informative, the estimated effects are positive and statistically significant for 10 states. For estimates in logs (Panel b), all states had standard errors below our threshold of 91 (and hence none are shaded gray), although there were a number of states with fairly large estimated standard errors. This suggests that estimates from the log specifications provide a more reliable view of the relationship between attorney involvement and indemnity benefits at the state level. This could reflect the impact of outliers that become more influential in smaller samples but are less important when we use logs.39 Moreover, nearly all of the estimates for log benefits are positive and statistically significant.

6 CONCLUSIONS AND DISCUSSION

In this study, we examine the specific question of the effect of legal representation for workers on the amount of indemnity benefits that workers receive after their work-related injuries. Our estimates from different specifications indicate that workers receive substantially higher indemnity benefits when attorneys are involved, even after accounting for the fees that workers pay to attorneys.

This evidence opens up an important question for future research. In particular, our evidence could be interpreted as implying that workers often do not get the benefits to which they are entitled without hiring an attorney. However, our evidence does not necessarily imply this interpretation. It is also possible that attorney involvement leads to excessive payouts to workers (from which attorneys representing workers also gain). Establishing whether the latter is true or not is not possible with the data available for this study. Researchers would need to examine not only the indemnity benefits that workers receive but also the earnings losses that workers sustain after injuries. Comparing these measures would allow examining the adequacy of workers' compensation benefits (see, e.g., Savych & Hunt, 2017). With these measures in hand, one could, in principle, estimate the effect of attorney involvement on the adequacy of benefits rather than the level of benefits.

To see why this is important, suppose one believes that the payments that workers receive without an attorney are the “right” amount of benefits. Then the implication from our study is that attorneys create unnecessary costs to the system, and policymakers should focus on reducing the need for an attorney. However, if attorneys help obtain adequate benefits, then policy should focus on ensuring access to representation—and perhaps also focus on addressing system features that necessitate attorney involvement to obtain adequate benefits. A workers' compensation system that provides adequate benefits without attorney involvement would be a more efficient system.

Further work is needed to understand the sources of friction in the administrative process that makes hiring an attorney beneficial. It would likely be useful to examine how the intricacies of the administrative process, differences in dispute resolution approaches, and policy choices for determining payments for permanent partial disability benefits contribute to incentives for workers to seek attorney representation. Future studies could also examine administrative tools that workers' compensation agencies might implement to help reduce unnecessary litigation, including simplifying claim processing and alternative dispute resolution strategies.

Future research should also try to study how employers and insurers respond to litigation. While our study focuses on indemnity benefit payments, attorney involvement in a claim can change the dynamics of the claim process, including the nature of communications between employers/insurers and injured workers, and insurers' decisions about how to handle claims and disputes that may arise. In particular, settlement strategies may differ based on whether workers are represented and the quality of representation. A deeper exploration of how attorney involvement affects the broader claims process, including whether it leads to more contentious disputes or faster settlements, and whether it leads to appropriate benefit amounts or benefits in excess of what would be deemed adequate in light of lost earnings capacity, would provide a more complete understanding of attorneys' role in the system.

ACKNOWLEDGMENTS