The impact of litigation risk on the association between audit quality and auditor size: Evidence from China

Abstract

We examine whether audit quality varies across different sizes of CPA firms under high or low auditor-specific litigation risk exposure. We measure audit quality by the issuance of modified audit opinions and the audit fees charged to clients, and we use the organizational form of CPA firms as the proxy for auditors’ litigation risk exposure, where a partnership (limited liability) CPA firm represents a high (low) litigation risk exposure. Built on Choi, Kim, Liu, and Simunic's (2008) theoretical framework, we hypothesize that the litigation risk exposure of CPA firm moderates the association between auditor size and audit quality. Our results show that when the auditor's liability is capped (i.e., registered as a limited liability form of CPA firm), larger size CPA firms are associated with higher audit quality when compared to smaller size CPA firms. However, this positive association between auditor size and audit quality disappears for audit firms that are subject to high litigation risk exposures (i.e., registered as a partnership form of CPA firm). Our research provides new insights on the impact of auditor-specific litigation risks on the relation between audit quality and auditor size. In particular, we show that only when auditor-specific litigation risk is limited, do large CPA firms appear to perform higher quality audits than small CPA firms.

1 INTRODUCTION

Prior research demonstrates that the risk associated with legal organizational form plays an important role in affecting audit quality in terms of auditors’ reporting behavior and audit pricing (e.g., Chan & Pae, 1998; Choi et al., 2008; Firth, Mo, & Wong, 2012; Muzatko, Johnstone, Mayhew, & Rittenberg, 2004; Simunic & Stein, 1996). These studies generally conclude that increasing an auditor's litigation risk exposure provides incentives for improving audit quality and reporting conservatism. Auditor size is another factor that may have a positive correlation with audit quality and audit pricing, and these associations have received support from previous theoretical and empirical research. While both streams of research show that audit quality is significantly affected by litigation risk and auditor size, there is a general lack of evidence about the interactive effect among litigation risk, auditor size, and audit quality.

Many studies find that audit quality increases with auditor size (e.g., Chen, Chen, & Su, 2001; Davidson & Neu, 1993; DeAngelo, 1981; DeFond, 1992; DeFond, Wong, & Li, 2000; Francis, 1984; Francis & Simon, 1987; Francis & Wilson, 1988; Johnson & Lys, 1990). However, some more recent studies arrive at an opposite conclusion and show that the audit quality of a small auditor is the same as or even higher than that of a large auditor (Boone, Khurana, & Raman, 2010; Geiger, Raghunandan, & Riccardi, 2014; Lawrence, Minutti-Meza, & Zhang, 2011; Lisowsky, Robinson, & Schmidt, 2011). One reason put forward to explain this finding is that small CPA firms are less well diversified, and thus, they cannot spread their risk exposure over many clients. Furthermore, small CPA firms find it more difficult to obtain insurance coverage. To counter this increased risk exposure, small CPA firms perform higher quality audits. We believe that these different findings on the association between auditor size and audit quality are caused, in part, by the different levels of litigation risk that the auditors face.

Two recent studies by Francis and Wang (2008) and Choi et al. (2008) suggest that the association between auditor size and audit quality changes according to a country's litigation risk. Francis and Wang (2008) find that the audit quality of large and small auditors is similar in countries with low litigation risk, where Choi et al. (2008) find that the audit fees of large auditors are higher than the audit fees of small auditors in countries with low litigation risk. These findings suggest either an insignificant or a positive association between auditor size and audit quality in countries with low litigation risk. Although these two studies are not directly comparable because they use different measures, they provide preliminary evidence that litigation risk across countries affects the association between auditor size and audit quality. Having said that, we argue that the litigation risk faced by auditors shall not be assumed uniform even within a country and that the impact of auditor-specific litigation risk has been underexamined in prior research. We thus investigate whether audit quality varies for different sizes of CPA firms when they are subject to different levels of litigation risk exposures based on their organizational form of partnership or limited liability. Because China allows different organizational forms of CPA firms and, with it, different exposures to legal liability, we base our study on Chinese data.

The unique institutional environment in China enables us to clearly classify two types of auditor-specific litigation risk based on CPA firms’ registered organizational forms. In China, CPA firms are allowed to register as partnership CPA firms where the partners are jointly and severally liable for any damages awarded against the CPA firms (MOF 1993) or as limited liability CPA firms where both the liabilities of the CPA firm and its partners are limited (MOF 1998). In other words, a partnership CPA firm and its partners are subject to unlimited liabilities, whereas a limited liability CPA firm and its partners are subject to limited liabilities.1 Particularly, professional indemnity insurance is less common in China than those in other developed countries (HKICPA 2010). Thus, a partner in a partnership CPA firm exposes his or her entire wealth to audit litigation risk. In contrast, a partner in a limited liability CPA firm exposes his or her existing capital in the firm to audit litigation risk, but their personal wealth is protected. We argue that this clearly distinguishable litigation risk exposure drives the audit quality of an individual CPA firm in China. Although prior evidence suggests that large auditors have higher audit quality, we expect that this association holds only for those firms that are subject to low auditor-specific litigation risk. If auditors are subject to high auditor-specific litigation risk exposure, small CPA firms having strong economic bonds with their clients face significantly higher economic costs and bankruptcy risk in the event of an audit failure. We thus expect that small CPA firms will increase their audit quality similar to those of large CPA firms in this situation.2

Based on 5,429 audits performed by the Chinese CPA firms over the period 2001–2006,3 we find that there is a positive association between auditor size and audit quality, but this positive association is reduced for firms with high litigation risk.4 Our results are robust no matter whether we use audit opinion or audit fees as the proxy for audit quality.5 This finding is consistent with the argument of Choi et al. (2008) who state that small auditors will increase their audit efforts (and thus charge higher audit fees) to reduce their expected legal liability costs. While Choi et al. (2008) use the strictness of legal regime across countries to measure the litigation risks and legal liability costs, our research provides additional and robust evidence that the litigation risk exposure of CPA firms within a country does matter in affecting CPA firms’ practices and that it provides significant moderating impacts on the association between auditor size and audit quality. Our findings also give support to the Lisowsky et al.'s (2011) argument that small auditors may supply high audit quality, especially to clients with a strong economic bond to the auditor. Small auditors face high audit failure costs if they are subject to unlimited legal liabilities as they have fewer clients and they can easily lose everything from an individual audit failure.6 Conversely, when the litigation risk exposure is low, a positive association between audit quality and auditor size will be manifest. In particular, the larger size limited liability CPA firms are associated with higher audit quality (in terms of more modified reports issued and higher audit fees charged to clients). The above findings hold (or are even stronger) when we control for endogeneity issues arising from a CPA firm's choice of a particular level of litigation risk and a client's choice of a particular type of CPA firm, when we partition the sample based on the litigation risk exposure of CPA firms, and when we restrict the sample to the audits of financially distressed clients. Overall, these results suggest that the association between auditor size and audit quality is conditioned on their litigation risk exposure.

Our research makes a significant contribution to the literature by examining the interactive impacts among auditor-specific litigation risk, auditor size, and audit quality. In particular, we use two well-established measures, namely an auditor's propensity to issue modified audit opinions and its audit pricing decision, as proxies for audit quality and use organizational form to capture the high and low litigation risk exposures of CPA firms. Prior research relies extensively on DeAngelo's (1981) argument about the positive association between auditor size and audit quality, but recently, there have been questions about whether there are real quality differentials between larger size CPA firms and smaller size CPA firms (Boone et al., 2010; Lawrence et al., 2011; Wong, Firth, & Lo, 2011). In particular, recent studies have expressed concerns about the potential discrimination against smaller size CPA firms when measuring the audit quality they supply (e.g., Wong et al., 2011). Our research provides new evidence that smaller size auditors do supply high audit quality just like large auditors (in terms of issuing more modified opinions and charging higher fees) under higher litigation risk exposure. The inconstant audit quality spread between large and small size CPA firms (under different litigation risk setting) should provide useful information for policy makers and regulators in devising appropriate regulatory oversight and/or facilitating a healthy and competitive environment to promote audit quality.

Furthermore, these results should provide a useful reference for future research when examining issues regarding the audit quality supplied by different size CPA firms. Our empirical findings demonstrate that apart from countrywide litigation risk, the association between auditor size and audit quality changes according to the individual CPA firm's litigation risk exposure. While prior research reveals the impacts of auditor's countrywide litigation risk exposure on audit quality, our research demonstrates that audit quality is also significantly affected by the auditor-specific litigation risk exposure within countries. We believe that this variation of auditor's litigation risk exposure within countries, which has been generally ignored in studies using cross-country data, should be considered when examining audit quality in future research. Particularly in China, CPA firms responsible for auditing listed companies are now in a new organizational form (i.e., the special partnership form).7 Future research could benefit from our findings to further examine the impact of this change of litigation risk on the association between auditor size and audit quality. Studying different levels of litigation risk faced by individual audit partners may also yield meaningful research that enhances our understanding of how audit quality is affected by the litigation risk differential within a country. Interpreting our results shall provide useful insights that can be used by the public and various stakeholders (e.g., investors, analysts, and regulators) to gain a better understanding of the reporting and pricing behavior of auditors and adds to the literature on the professionalization and organization of auditing.

Our paper is organized as follows. Section 2 provides a literature review and develops our hypotheses. Section 3 describes the research methodology, while Section 4 presents the empirical findings. We present conclusions in Section 5.

2 LITERATURE REVIEW AND HYPOTHESIS DEVELOPMENT

2.1 Litigation risk and audit quality

Prior studies generally show that increased liability exposures are associated with higher audit quality. In their analytical study, Chan and Pae (1998) show that an increase in liability protection for auditors may decrease auditor effort and audit quality. They argue that the proportionate liability rule, as promulgated by the Private Securities Litigation Reform Act of 1995 in the USA, discourages third parties from suing and thus results in lower auditor effort. Melumad and Thoman (1990) find that under the threat of litigation, auditors may report truthfully their findings to reduce the probability of paying damages and thus supply a higher quality audit.

Further support for this proposition is shown in several empirical studies (e.g., Dopuch, King, & Schatzberg, 1994; Gramling, Schatzberg, Bailey, & Zhang, 1998), which conclude that a decrease in litigation risks leads to lower auditor effort (and thus lower audit quality). Auditors are also found to have a lower propensity to issue going-concern modified audit reports (which is a proxy for a lower quality audit) with a decreased litigation risk (Geiger & Raghunandan, 2001; Geiger, Raghunandan, & Rama, 2006). Similarly, Muzatko et al. (2004) show that a decreased litigation risk exposure for auditors (as captured by a change in a CPA firm's organizational form from a general partnership to a limited liability partnership) is associated with a perceived reduced audit quality and thus a greater uncertainty for investors and greater IPO underpricing.8 Venkataraman, Weber, and Willenborg (2008) find that auditors are more conservative, in terms of restricting clients from using positive discretionary accruals, when auditing the financial statements in an IPO prospectus as the litigation risk exposure is higher than that for a post-IPO audit. Based on an analysis of the Chinese market, Firth et al. (2012) find that auditors in partnership CPA firms are subject to higher litigation risk exposures and are more likely to issue modified audit reports than auditors in limited liability CPA firms. In addition, they find that the incorporated CPA firms are less likely to issue modified reports (to their continuing clients) than they did before the incorporation. Their results imply that an unlimited liability regime provides a strong motivation for auditors to report conservatively in an emerging market.

Litigation risk also plays an important role in audit pricing (Gendron, 2002; Power, 2003). Laux and Newman (2010) show that an increase in the probability of being sued and suffering damage awards (i.e., an increased litigation risk) is associated with an increase in both audit quality and the equilibrium audit fee. Choi et al. (2008) argue that audit fees increase with the strength of a country's legal liability regime. Overall, these previous studies conclude that increasing an auditor's liability exposure should motivate a CPA firm to supply a higher audit quality by reporting more conservatively and doing more work (as reflected in higher audit fees).

2.2 Auditor size and audit quality

Auditor size is widely used as a proxy of audit quality. DeAngelo (1981) argues that larger size auditors (measured by the number of clients) have more client-specific quasi-rents, which serve as a collateral against loss from discovery of a lower quality audit than was promised. This collateral motivates the larger size auditors to behave less opportunistically and thus to supply a higher perceived quality of audit and a higher level of independence than do smaller size auditors. Since then, many researchers use auditor size as a measure of audit quality (Chen et al., 2001; DeFond, 1992; DeFond, Wong, et al., 2000; Francis, 1984; Francis & Wilson, 1988; Geiger & Rama, 2006; Johnson & Lys, 1990). Francis and Wilson (1988), Johnson and Lys (1990), and DeFond (1992) use the sales of the clients to proxy for audit quality because client sales revenues should be highly correlated with client-specific quasi-rents, and greater client sales signify larger auditor size. Another indicator of auditor size is the Big N versus non-Big N CPA firms (e.g., Baber, Brooks, & Ricks, 1987; Francis, 1984). In the Chinese context, DeFond, Wong, et al. (2000), Chen et al. (2001), and Lin, Liu, and Wang (2009) use clients’ total assets as a surrogate of quasi-rents and use a dummy variable, TOP10, to indicate whether the auditor is one of the ten largest auditors in China.

Auditor size also affects the pricing decision of auditors. Based on the DeAngelo's (1981) quality differentiation argument, auditors will voluntarily specialize in different quality levels for the purpose of capturing higher fees (product differentiation). Larger size auditors generally charge an audit fee premium, which may reflect higher audit quality (Davidson & Neu, 1993; Francis, 1984; Francis & Simon, 1987; Simon & Francis, 1988), and this price premium exists even in the small client segment of the US audit market for publicly traded companies (Francis & Simon, 1987). Other research studies report similar findings that Big N (i.e., larger size) auditors charge higher premiums, which imply the existence of a Big N product differentiation in the market for audit services (DeFond & Zhang, 2014).

2.3 Impact of litigation risk on the relation between auditor size and audit quality

While there is impressive support for a positive relation between auditor size and audit quality in the USA, there are dissenting views (Boone et al., 2010; Lawrence et al., 2011). For example, whether the positive relation between audit quality and auditor size remains unchanged under different litigation environments is questioned by prior studies. Chung, Firth, and Kim (2003) and Francis and Wang (2008) find that the Big N firms are not quality-differentiated auditors in countries with lower investor protection. Choi et al. (2008) also argue that legal liability should not be neglected when investigating audit quality and audit pricing. They find that although large auditors provide high-quality audit services in general, the audit fee premium charged by large auditors to their clients is significantly lower in countries with high litigation risk than is the case for their clients in countries with low litigation risk (i.e., weak legal regime). The above findings suggest that country-level litigation risks (using the strength of investor protection or the strictness of legal regimes as proxies) have significant impacts on the association between auditor size and audit quality.

Applying the above findings to a single country, we argue that the litigation risk faced by auditors can be varied within a country and that the association between auditor size and audit quality can rather be affected by auditor-specific litigation risk.9 This is particularly manifest under China's institutional environment because CPA firms in China are subject to clearly distinguishable litigation risk exposures (due to their different registered organizational forms), and the trade-offs between audit costs and the benefits of reducing the risk of audit failure are different for firms that are subject to different levels of litigation risk. Small CPA firms have fewer listed clients, and therefore, the economic bond they form with those clients is stronger than is the case with large CPA firms. Such economic bonding can impair independence and hence reduce audit quality. Therefore, in general, small CPA firms are expected to have lower audit quality than large CPA firms. This is especially the case when CPA firms are subject to low litigation risk exposures (under a limited liability regime), where they are less motivated to increase their audit efforts because the increased audit costs outweigh the limited benefits of reducing the risk of audit failure. However, when CPA firms are subject to high litigation risk exposures (under an unlimited liability regime), we expect that small CPA firms are more motivated to increase their audit efforts to reduce the risk of audit failure. The strong economic bond also makes small auditors suffer from significantly higher economic costs and bankruptcy risk in the event of an audit failure concerning that client, especially if they are under an unlimited liability regime (Lisowsky et al., 2011). As such, small auditors are likely to perform high-quality audits when they are subject to a high litigation risk.

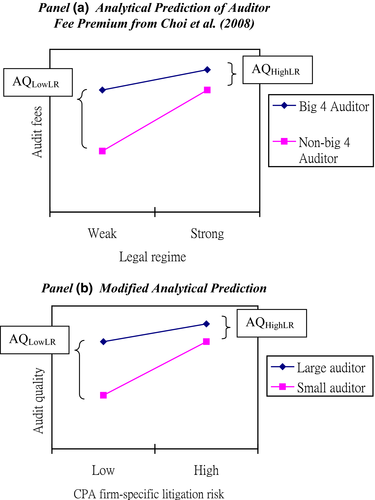

As discussed earlier, some recent research (Boone et al., 2010; Lawrence et al., 2011) has questioned the long-held view that the large CPA firms provide higher quality audits. Prior studies using cross-country samples have shown that the national level of litigation risk has a significant impact on the association between auditor size and audit quality. Figure 1, Panel A, presents the analytical predictions provided by Choi et al. (2008), where the x-axis represents the strictness of the legal regime and the y-axis represents the audit fees charged by CPA firms. They argue that CPA firms are profit-maximizing entities and the legal liability cost for a large auditor is generally greater than that for a small auditor. However, the audit fee spread between Big 4 and non-Big 4 auditors is smaller under a strong legal regime than it is under a weak legal regime. In other words, the difference in the audit effort (and thus the difference in audit quality) between Big 4 and non-Big 4 auditors is decreasing as the legal regime becomes stronger. We extend their research by examining the different levels of litigation risk faced by a CPA firm within a single country and examine how it affects the relation between auditor size and audit quality. Our theoretical prediction is presented in Figure 1, Panel B. Here, we distinguish between the high and low litigation risk exposures of CPA firms based on the CPA firm's organizational form (the x-axis) and investigate whether the spread of audit quality (the y-axis) between different sizes of auditors persists under each type of litigation risk setting.

Hypothesis 1: The audit quality spread between large and small CPA firms becomes smaller when the CPA firms are subject to a high litigation risk.

3 RESEARCH METHODOLOGY

3.1 Data collection

Our sample includes companies that are listed on the Chinese A-share market during the period 2001–2006. Companies that are listed on the B-share and H-share markets and companies that are in the utilities and finance sectors are excluded, because these companies have different reporting regulations. We also exclude companies with missing data about audit opinions and audit fees, companies that have incomplete financial information, companies that are in the first year of audit (initial public offering firms), and companies whose auditors were engaged in merger exercises in the year of audit. The final sample consists of 5,429 audits of listed companies.10

In distinguishing between the high or low litigation risk exposures of CPA firms, we follow Firth et al.'s (2012) identification of the organizational form of a CPA firm by examining its full name as stated in the listed company's annual report. We classify a CPA firm as a limited liability CPA firm if the name of a CPA firm contains the word “limited”; otherwise, we classify it as a partnership. We ensure the accuracy of our classification by checking the organizational form of an audit firm with a database kept by the Chinese Institute of Certified Public Accountants (CICPA). Then, we partition the full sample into the High Litigation Risk Group (where the audits are performed by the partnership CPA firms) and the Low Litigation Risk Group (where the audits are performed by the limited liability CPA firms) and investigate whether auditor size matters in explaining audit quality within each risk group. This sample partitioning procedure gives rise to 678 observations in the High Litigation Risk Group and 4,751 observations in the Low Litigation Risk Group.

3.2 Regression models

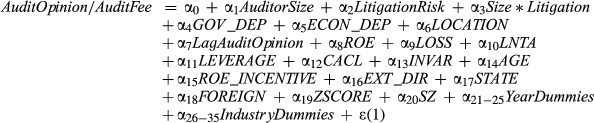

(1)

(1)The dependent variable refers to our two main proxies for audit quality, namely the issuance of a modified audit opinion (AuditOpinion) and the audit fees charged to clients (AuditFee). AuditOpinion takes the value 1 if the CPA firm issues a modified audit opinion and 0 otherwise. Following previous research on audit reporting (e.g., Chan, Lin, & Mo, 2006; Chen, Zhang, & Zhou, 2017; Chen et al., 2001; DeFond, Wong, et al., 2000; Lennox, 2005), we classify opinions that are unqualified with an explanatory paragraph, qualified, disclaimer, and adverse as modified audit opinions. AuditFee measures the natural logarithm of the audit fees charged to clients by the CPA firm within the specific year (Chaney, Jeter, & Shivakumar, 2004; Choi et al., 2008; Fan & Wong, 2005). AuditOpinion and AuditFee capture the audit quality of CPA firms in the forms of the reporting conservatism of auditors and the audit pricing behavior of auditors, respectively. High-quality auditors are expected to report more conservatively by issuing more modified audit opinions and to charge higher audit fees.

We use the variable, AuditorSize, to capture the effect of the size of a CPA firm. AuditorSize is the natural logarithm of the total assets of all of a CPA firm's listed clients. We expect AuditorSize to be positively associated with AuditOpinion and AuditFee (based on DeAngelo's (1981) argument). LitigationRisk equals 1 if the client is audited by a CPA firm with high litigation risk exposure (i.e., a partnership CPA firm) and equals 0 if the client is audited by a CPA firm with low litigation risk exposure (i.e., a limited liability CPA firm). We expect LitigationRisk to be positively associated with AuditOpinion and AuditFee (which is consistent with the findings of Chan and Pae (1998) and Firth et al. (2012)).

The main variable of interest in the model is the interaction term, Size*Litigation, that captures the interaction effect between auditor size and an auditor's litigation risk exposure. “Size” is AuditorSize, and “Litigation” is LitigationRisk. We are particularly interested in the significance and the sign of the coefficient on Size*Litigation in our model. An insignificant coefficient on Size*Litigation implies that litigation risk has no moderating impact on the association between auditor size and audit quality. Conversely, a significant coefficient on Size*Litigation represents the difference in audit quality spread between large and small size CPA firms in the high versus low litigation risk setting (i.e., [AQHighLR – AQLowLR] in Figure 1). Consistent with our expectation in Hypothesis 1, we expect the coefficient on Size*Litigation to be negative, regardless of whether we use modified audit opinions or audit fees as a proxy for audit quality.

We include several auditor and client characteristics in the model to control for the possible impacts caused by the variations in an auditor's clientele. GOV_DEP represents the economic and political influence from local government on a CPA firm's practicing behavior and equals 1 if the listed company is audited by a local auditor and 0 otherwise. Following Chan et al. (2006), we classify a CPA firm to be a local firm when the firm is located in the same jurisdiction (province or equivalent in China) as the client, and more than 50% of its clients’ total assets come from the same jurisdiction. As government's economic and political influence on CPA firms and client management was quite common during the economic development phase in China (Aharony, Lee, & Wong, 2000; Chan et al., 2006; Chen & Yuan, 2004), we control for this important auditor characteristic in our regression. Reynolds and Francis (2001) argue that large clients may pressure auditors to compromise their independence and affect their audit quality. We thus include ECON_DEP to control for the effects of economic dependence on an individual client (Khurana & Raman, 2006; Li, 2009; Reynolds & Francis, 2001). ECON_DEP is calculated as a client's total assets divided by the total assets of all of the CPA firm's listed clients.

We include the variable LOCATION to control for the impact of regional economic development on a CPA firm's practicing behavior (Firth et al., 2012). LOCATION represents a composite index (at the provincial level) consisting of a government decentralization index, legal environment index, market intermediary index, foreign investment index, credit market index, and indexes showing the relative number of lawyers and CPAs that practice in the province. In general, the higher the index, the more developed the province where the CPA firm is located. The raw indexes are developed by the China's National Economic Research Institute (Fan & Wang, 2004), and these market development indexes are widely used as control variables in other research (e.g., Chen, Firth, Gao, & Rui, 2006; Firth et al., 2012; Wang, Wong, & Xia, 2008).11

As prior research suggests that audit opinion type could be sticky (Dopuch, Holthausen, & Leftwich, 1987; Lennox, 2000), we include LagAuditOpinion, which is a dummy variable that equals 1 if the CPA firm issued a modified audit opinion for the client in the lag year (and 0 otherwise), to control for the effect of persistent audit qualifications on audit clients. ROE represents a client's return on equity. LOSS is an indicator variable that equals 1 if the client experiences losses in the current year and 0 otherwise. LNTA measures client size and it is defined as the natural logarithm of the total assets of the client.12 LEVERAGE represents financial leverage and is computed as the total long-term liabilities over the total assets of the client. CACL is the current ratio and is computed as the total current assets over total current liabilities. INVAR captures the complexity of a client firm's operations. It is measured by the sum of year-end inventory and accounts receivable of the client companies (scaled by the total assets of the clients). We also include AGE to control for the impact of the client's listing age.

In China, listed companies need to meet a prescribed profitability level to raise additional capital and to avoid being delisted. These regulatory requirements induce companies to manipulate earnings to meet the various thresholds of ROE for rights issuance and avoidance of delisting (Chan et al., 2006; Chen et al., 2001; Firth et al., 2012; Lo & Wong, 2011). These earnings management incentives may have impacts on the propensity to issue modified audit reports and on audit effort and hence the audit fees charged to the clients. To control for these earnings management incentives caused by the regulatory requirements, we include a dummy variable, ROE_INCENTIVE, in our model. ROE_INCENTIVE equals 1 if the client experienced losses in the previous two consecutive years (i.e., indicating a high chance of being delisted if loss is sustained in the current year), its current ROE lies just above the delisting earnings threshold (i.e., between 0.00 and 0.01), or its current ROE lies just above the earnings threshold for issuing new shares (i.e., between 0.06 and 0.075, or between 0.10 and 0.11), and it is 0 otherwise.

Following prior studies (e.g., Chen et al., 2006; Firth et al., 2012), we also include several variables that capture the governance and ownership structure of client firms in the model. EXT_DIR measures the percentage of external directors on the board, and STATE and FOREIGN represent the percentage of shares owned by the state and foreign owners, respectively. Additionally, we include ZSCORE, which represents the Altman (1983) Z-score calculated for each company for each year, to capture a client's financial distress, with a higher value indicating a lower probability of financial distress. We also include a dummy variable to indicate whether the client is listed on the Shenzhen Stock Exchange (i.e., SZ = 1) or the Shanghai Stock Exchange (i.e., SZ = 0). Finally, we include year dummies and industry dummies to control for possible year and industry effects on an auditor's propensity to issue modified audit opinions and audit fees in the regression model. A summary of the variable descriptions is provided in Table 1.

| Variable name | Definition |

|---|---|

| AuditorSize | Size of the CPA firm measured as the natural logarithm of its clients’ total assets |

| LitigationRisk | Indicator variable that equals 1 if the client is audited by a CPA firm with high litigation risk exposure (i.e., a partnership CPA firm) and 0 if the client is audited by a CPA firm with low litigation risk exposure (i.e., a limited liability CPA firm) |

| Size*Litigation | Interaction term that captures the interaction effect between auditor size and auditor litigation risk exposure. “Size” is AuditorSize, and “Litigation” is LitigationRisk |

| AuditOpinion | Indicator variable that equals 1 if the CPA firm issued a modified audit opinion for the client and 0 if a clean opinion is issued |

| AuditFee | Natural logarithm of the total audit fee received by the CPA firm within a specific year |

| GOV_DEP | Indicator variable that equals 1 if both the CPA firm and its client are located in the same provincial location and more than 50% of the CPA firm's clients’ total assets come from the same jurisdiction and 0 otherwise |

| ECON_DEP | The CPA firm's economic dependence on an individual client. It is calculated by dividing the assets of a client by the combined assets of all the listed clients of the CPA firm |

| LOCATION | Composite index of regional market development from a set of indexes (government decentralization index, legal environment index, market intermediary index, foreign investment index, credit market index, and indexes showing the relative number of lawyers and CPAs that practice in the province) developed by the China's National Economic Research Institute (Fan & Wang, 2004). The higher the index, the more developed the province where the CPA firm is located. Details of the index are discussed in footnote #11. |

| LagAuditOpinion | Indicator variable that equals 1 if the CPA firm issued a modified audit opinion for the client in the lag year and 0 if a clean opinion is issued |

| ROE | Return on equity of the client company |

| LOSS | Indicator variable that equals 1 if the client experiences losses in the current year and 0 otherwise |

| LNTA | Natural logarithm of the total assets of the client company |

| LEVERAGE | Financial leverage of the client, measured by the ratio of long-term liabilities to total assets of the client company |

| CACL | Client's current assets over current liabilities |

| INVAR | Client's inventory and accounts receivable level scaled by total assets |

| AGE | Number of years the client has been listed |

| ROE_INCENTIVE | Indicator variable that equals 1 if the client experiences losses in each of the previous two years or its current ROE lies between 0.00 and 0.01, 0.06 and 0.075, or 0.10 and 0.11 and 0 otherwise |

| EXT_DIR | Percentage of external directors on the board of the client company |

| STATE | Percentage of state ownership of the client company |

| FOREIGN | Percentage of foreign ownership of the client company |

| ZSCORE | Altman (1983) Z-score |

| SZ | Indicator variable that equals 1 if the client is listed on the Shenzhen Stock Exchange and 0 if the client is listed on the Shanghai Stock Exchange |

3.3 Endogeneity issues

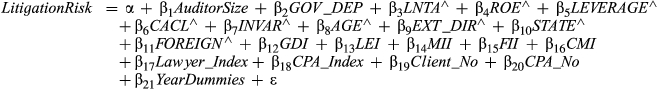

We note that endogeneity issues may be present in our research design and CPA firms with particular levels of audit quality may self-select an organizational form (with its respective litigation risk) that influences their reporting and pricing behaviors. Moreover, client firms may also self-select a particular type of CPA firm that affects the audit opinion type and audit fees. With reference to Tucker (2010) and Firth et al. (2012), we use two approaches, namely the inverse Mills ratio (IMR) and the propensity score matching (PSM), to resolve the concerns arising from possible self-selection biases.13

As for the IMR approach, we follow the Firth et al.'s (2012) methodology to first estimate two probit models (which serve as the first-stage estimation of the inverse Mills ratios): one to predict a CPA firm's choice of a particular level of litigation risk (i.e., organizational form) and another to predict a client firm's choice of the type of CPA firm. Details of the models and results are presented in Appendix A.14 The results show that CPA firms with fewer governmental influence, better legal development, healthier client portfolio, and larger client base are likely to register in an organizational form with higher litigation risk exposures (i.e., a partnership form).15 These results are consistent with the view that better legal environment and stronger client base facilitate CPA firms’ choice of an organizational form that offers better legal protection to the public (despite its increased litigation risk exposures for CPA firms). Based on the regression results, we obtain the selectivity correction variable, that is, the inverse Mills ratio (λa), for each CPA firm from the probit regression, and then include the auditor-specific λa in the main regression (i.e., second-stage probit) model to correct for the potential self-selection problem arising from a CPA firm's choice of organizational form and therefore its choice of a particular level of litigation risk.

For the client firm's choice of a particular type of CPA firm, we regress the litigation risk of CPA firms on various client characteristics (including client's size, profitability, complexity, and governance and ownership structure). We also control for the modified audit opinions received in the lag year and the litigation risk of the CPA firm in the lag year as additional controls (Li, 2009; Weber & Willenborg, 2003). The regression results, as reported in Panel B of Appendix A, show that clients with higher leverage, smaller incentive to manage earnings, and shorter listing age are likely to choose CPA firms with high litigation risk exposures. Similarly, we obtain another selectivity correction variable, the inverse Mills ratio (λc), for each client firm from the probit regression and include this client-specific λc in the main regression model (i.e., Model (1)) to account for the self-selection bias arising from a client's choice of CPA firm.

As for the PSM approach, we match each client of a CPA firm with high litigation risk (i.e., LitigationRisk = 1; the treatment group) with a client of a CPA firm with low litigation risk (i.e., LitigationRisk = 0; the control group) based on the closest propensity scores. These propensity scores refer to the predicted values of the model capturing the client choice of particular type of CPA firms as discussed previously (i.e., Appendix A, Panel B). Then, we pool the treatment group and the control group together and run the main regression Model (1) based on the matched sample.16

4 EMPIRICAL FINDINGS

4.1 Descriptive statistics

Table 2 provides the descriptive statistics for the regression variables in our model. It shows that about 11% of our sample firms receive modified audit opinions (AuditOpinion) from their auditors. The mean audit fee charged by the auditors (AuditFee; unlog) over our sample period is RMB 0.563 million. Table 2 also reports that 12.5% of client firms are audited by CPA firms with high litigation risk exposures (i.e., audited by partnership CPA firms).

| Variable | n | Mean | Median | SD | Minimum | Maximum |

|---|---|---|---|---|---|---|

| AuditOpinion | 5,429 | 0.110 | 0.000 | 0.308 | 0.000 | 1.000 |

| AuditFee | 5,429 | 13.031 | 12.948 | 0.592 | 9.390 | 16.560 |

| AuditFee (unlog; in RMB millions) | 5,429 | 0.563 | 0.420 | 0.549 | 0.012 | 15.510 |

| LitigationRisk | 5,429 | 0.125 | 0.000 | 0.331 | 0.000 | 1.000 |

| AuditorSize | 5,429 | 24.672 | 24.588 | 1.318 | 2.980 | 29.750 |

| AuditorSize (unlog; in RMB billions) | 5,429 | 124.499 | 47.679 | 524.147 | 0.001 | 8334.200 |

| GOV_DEP | 5,429 | 0.620 | 1.000 | 0.484 | 0.000 | 1.000 |

| ECON_DEP | 5,429 | 0.054 | 0.029 | 0.089 | 0.000 | 1.000 |

| LOCATION | 5,429 | 27.978 | 29.550 | 7.727 | 10.190 | 36.690 |

| LagAuditOpinion | 5,429 | 0.110 | 0.000 | 0.313 | 0.000 | 1.000 |

| ROE | 5,429 | 0.023 | 0.056 | 2.293 | −81.410 | 75.970 |

| LOSS | 5,429 | 0.130 | 0.000 | 0.339 | 0.000 | 1.000 |

| LNTA | 5,429 | 21.112 | 21.049 | 0.950 | 12.310 | 26.600 |

| LNTA (unlog; in RMB billions) | 5,429 | 2.510 | 1.385 | 6.921 | 0.001 | 356.128 |

| LEVERAGE | 5,429 | 0.066 | 0.026 | 0.141 | 0.000 | 6.830 |

| CACL | 5,429 | 1.548 | 1.223 | 1.681 | 0.000 | 55.740 |

| INVAR | 5,429 | 0.269 | 0.236 | 0.516 | 0.000 | 35.930 |

| AGE | 5,429 | 6.825 | 6.597 | 3.171 | 0.000 | 20.290 |

| ROE_INCENTIVE | 5,429 | 0.210 | 0.000 | 0.410 | 0.000 | 1.000 |

| EXT_DIR | 5,429 | 0.334 | 0.333 | 0.235 | 0.000 | 1.000 |

| STATE | 5,429 | 0.317 | 0.339 | 0.260 | 0.000 | 0.890 |

| FOREIGN | 5,429 | 0.016 | 0.000 | 0.068 | 0.000 | 0.650 |

| ZSCORE | 5,429 | 0.631 | 0.518 | 1.196 | −78.140 | 10.010 |

| SZ | 5,429 | 0.450 | 0.000 | 0.498 | 0.000 | 1.000 |

- See Table 1 for variable definitions.

As shown in the table, the mean values of the clients’ return on equity (ROE), total assets (LNTA; unlog), financial leverage (LEVERAGE), and current ratios (CACL) are 0.023, RMB 2.510 billion, 0.066, and 1.548, respectively. Around 13% of clients experience losses in the current year (LOSS), and 21% of clients had ROEs that just exceeded the ROE earnings targets (ROE_INCENTIVE). On average, around one-third of directors on the board are represented by external directors (EXT_DIR), and the state ownership (STATE) and the foreign ownership (FOREIGN) are 31.7% and 1.6%, respectively. About 45% of clients are listed on the Shenzhen Stock Exchange (SZ).

4.2 Comparison between large and small CPA firms

We first examine whether there are any systematic differences in (1) an auditor's propensity to issue modified audit opinions and (2) audit fees between audits performed by large and small CPA firms. Table 3 reports the univariate test results. Large CPA firms refer to those with AuditorSize equal to or above the median value (n = 2,712), whereas small CPA firms are those below the median value (n = 2,717). As shown in the table, large CPA firms are associated with higher audit fees (AuditFee). These univariate results are consistent with the findings of Francis and Wang (2008) and Choi et al. (2008) who find that in a weak legal regime,17 large auditors charge higher audit fees than small auditors.18 However, we find that there is no discernible difference in the issuance of modified audit opinions (AuditOpinion) between large and small CPA firms. We believe that these inconsistent univariate relations between auditor size and the audit quality proxies (i.e., AuditOpinion and AuditFee) may be attributable to the auditor-specific litigation risks. We thus further investigate these issues in a multivariate setting (as presented in the next section) where the auditor's litigation risk and various auditor and client characteristics are controlled for.

| Large CPA firm | Small CPA firm | ||

|---|---|---|---|

| (AuditorSize ≥ Median; n = 2,712) | (AuditorSize < Median; n = 2,717) | ||

| Variable | Mean | Mean | t–statistic/(χ2) |

| AuditOpinion | 0.100 | 0.113 | (2.304) |

| AuditFee | 13.178 | 12.884 | 18.899*** |

| AuditFee (unlog; in RMB millions) | 0.674 | 0.453 | 15.147*** |

| LitigationRisk | 0.175 | 0.075 | (123.435***) |

| GOV_DEP | 0.617 | 0.632 | (1.444) |

| ECON_DEP | 0.031 | 0.078 | −20.450*** |

| LOCATION | 31.132 | 24.830 | 32.902*** |

| LagAuditOpinion | 0.106 | 0.114 | (0.946) |

| ROE | −0.014 | 0.060 | −1.186 |

| LOSS | 0.114 | 0.151 | (16.790***) |

| LNTA | 21.305 | 20.920 | 15.242*** |

| LNTA (unlog; in RMB billions) | 3.302 | 1.721 | 8.471*** |

| LEVERAGE | 0.065 | 0.066 | −0.145 |

| CACL | 1.539 | 1.558 | −0.410 |

| INVAR | 0.284 | 0.253 | 2.226** |

| AGE | 7.506 | 6.145 | 16.188*** |

| ROE_INCENTIVE | 0.225 | 0.202 | (4.089**) |

| EXT_DIR | 0.342 | 0.326 | 2.592*** |

| STATE | 0.316 | 0.317 | −0.234 |

| FOREIGN | 0.022 | 0.009 | 7.232*** |

| ZSCORE | 0.670 | 0.592 | 2.403** |

| SZ | 0.396 | 0.508 | (68.617***) |

- *** and ** indicate significance at the 1% and 5% levels, respectively (two–tailed test). See Table 1 for variable definitions.

Table 3 also shows that large CPA firms are more likely to register as a partnership with its attendant higher litigation risk exposure (LitigationRisk).19 Large CPA firms are more likely to be located in a more developed region (LOCATION), and they are less likely to be economically dependent on clients (ECON_DEP). There are also a few differences in the client portfolios of the large and small CPA firms. For example, the clients of large CPA firms are generally larger-sized (LNTA), older (AGE), with a higher proportion of external directors (EXT_DIR) and foreign ownership (FOREIGN), financially healthier (as captured by a smaller proportion of LOSS and a larger ZSCORE), and less likely to be listed on the Shenzhen Stock Exchange (SZ) than the clients of small CPA firms.

4.3 Impact of CPA firm-specific litigation risk

4.3.1 Auditor's propensity to issue modified audit opinions

Table 4 presents the regression results for our research hypothesis. Column (1) represents the regression results for Model (1) where the dependent variable is modified audit opinions (AuditOpinion). As shown in the table, both AuditorSize and LitigationRisk are positive and significant in the model. These results imply that an increase in auditor size and auditor-specific litigation risk can help to improve audit quality (using auditors’ higher propensities to issue modified audit reports as a proxy of audit quality). Most importantly, we find a negative coefficient on Size*Litigation and this coefficient is statistically significant at the 5% level. This finding suggests that the positive association between auditor size and the issuance of modified audit reports is offset when the auditor has high litigation risk (i.e., is organized as a partnership). Consistent with our main hypothesis, we find that the audit quality spread between large and small auditors decreases when the CPA firm's litigation risk exposure increases. In other words, auditor size does not have a significant influence on the audit quality of CPA firms with high litigation risk even though they are in a country with an overall weak legal regime.

| Column (1) DV = AuditOpinion | Column (2) DV = AuditFee | |||

|---|---|---|---|---|

| Variable | Coefficient | z–statistic | Coefficient | t–statistic |

| AuditorSize | 0.081 | 1.890** | 0.134 | 14.290*** |

| LitigationRisk | 2.261 | 2.280** | 2.471 | 9.960*** |

| Size*Litigation | −0.085 | −2.120** | −0.101 | −10.090*** |

| GOV_DEP | −0.039 | −0.630 | 0.003 | 0.200 |

| ECON_DEP | 0.631 | 1.430 | 0.660 | 6.140*** |

| LOCATION | −0.001 | −0.250 | 0.005 | 5.500*** |

| LagAuditOpinion | 1.627 | 22.910*** | 0.107 | 5.210*** |

| ROE | 0.015 | 1.410 | 0.002 | 0.760 |

| LOSS | 1.086 | 15.390*** | 0.034 | 1.760* |

| LNTA | −0.117 | −3.110*** | 0.313 | 35.020*** |

| LEVERAGE | −0.117 | −0.650 | −0.114 | −2.580*** |

| CACL | −0.036 | −0.740 | −0.021 | −5.600*** |

| INVAR | −0.048 | −1.910* | 0.024 | 2.030** |

| AGE | 0.019 | 1.630* | 0.009 | 3.880*** |

| ROE_INCENTIVE | −0.050 | −0.670 | 0.012 | 0.810 |

| EXT_DIR | −0.093 | −0.730 | −0.108 | −3.940*** |

| STATE | −0.136 | −1.180 | −0.075 | −3.080*** |

| FOREIGN | 0.145 | 0.370 | 1.193 | 12.910*** |

| ZSCORE | −0.224 | −2.460** | −0.012 | −2.250** |

| SZ | 0.055 | 0.930 | −0.039 | −3.100*** |

| Year Dummies | Included | Included | ||

| Industry Dummies | Included | Included | ||

| Constant | −1.354 | −1.320 | 2.796 | 12.730*** |

| Chi–square/Model F | 1383.845*** | 122.813*** | ||

| Pseudo R2/R2 | .376 | .436 | ||

- ***, **, and * indicate significance at the 1%, 5%, and 10% levels, respectively. Significances are based on a one- (two-) tailed test when the coefficient sign is predicted (not predicted). See Table 1 for other variable definitions.

Taken together, our research findings suggest that the positive relation between auditor size and audit quality, in terms of an auditor's propensity to issue modified audit opinions, exists only in the group with low auditor litigation risk exposure (i.e., CPA firms that are registered in a limited liability form or LitigationRisk = 0). In the group with high litigation risk exposure (i.e., CPA firms that are registered in a partnership form or LitigationRisk = 1), auditor size has a less significant effect on an auditor's propensity to issue modified audit opinions.20 Here, CPA firm-specific litigation risks play an important role in influencing the auditor's reporting behavior. With increased litigation risk exposures, smaller size partnership CPA firms report more conservatively. To avoid high economic costs and bankruptcy risk in the event of an audit failure, smaller size CPA firms will increase their audit efforts (and thus audit quality) to reduce the expected legal liability costs under high litigation risk exposure.

4.3.2 Audit pricing

Table 4, Column (2), presents the regression results for Model (1) where the dependent variable is audit fees (AuditFee). As shown in the table, both the auditor size proxy (i.e., AuditorSize) and LitigationRisk are positive and significant, while Size*Litigation is negative and significant at the 1% level.21 Overall, our results are consistent with those reported in Column (1) and demonstrate that the positive relation between audit quality and auditor size exists only when the auditors’ litigation risk exposure is low (i.e., LitigationRisk = 0). Conversely, the higher litigation risks incurred by the smaller size partnership CPA firms (i.e., LitigationRisk = 1) motivate them to charge higher audit fees (and issue more modified reports) to their clients.22

4.3.3 Correction for endogeneity issues

As discussed previously, we control for the possible endogeneity arising from the self-selection choice of a particular level of litigation risk by CPA firms and the client's choice of a particular type of CPA firm via the application of the IMR (inverse Mills ratios obtained from the first-stage regressions) and the PSM (propensity score matching) methods. Table 5 reports the regression findings of Model (1) where the dependent variable is AuditOpinion (i.e., Column (1) and Column (2)) and where the dependent variable is AuditFee (i.e., Column (3) and Column (4)) using these two approaches. As reported in Columns (1) and (2) of Table 5, we find that the auditor size variable (AuditorSize) and the auditor-specific litigation risk variable (LitigationRisk) are positive and significant at the 5% level. Most importantly, we find consistent results that Size*Litigation (our main variable of interest) is negative and statistically significant no matter which method (i.e., IMR or PSM) we use to control for the self-selection biases.

Columns (3) and (4) of Table 5 show that both the size (AuditorSize) and the litigation risk (LitigationRisk) of an auditor are positively and significantly associated with audit fees charged to clients (AuditFee), regardless of which selectivity correction method is adopted. We also find that the coefficients on Size*Litigation are negative and statistically significant across all models presented in the columns. Other results are qualitatively similar to the main results reported in Table 4. Overall, these additional tests show that our prior results are robust and demonstrate that audit quality is positively associated with auditor size only when the auditors’ litigation risk exposure is low (i.e., LitigationRisk = 0). When CPA firms are subject to high litigation risks (i.e., LitigationRisk = 1), the association between auditor size and audit quality diminishes, and the smaller size partnership CPA firms are motivated to issue more modified audit reports and charge higher audit fees to their clients.

| DV = AuditOpinion | DV = AuditFee | |||||||

|---|---|---|---|---|---|---|---|---|

| Column (1) IMR (n = 5,429) | Column (2) PSM (n = 1,356) | Column (3) IMR (n = 5,429) | Column (4) PSM (n = 1,356) | |||||

| Variable | Coefficient | z–statistic | Coefficient | z–statistic | Coefficient | t–statistic | Coefficient | t–statistic |

| AuditorSize | 0.086 | 2.010** | 0.143 | 1.620** | 0.135 | 12.880*** | 0.108 | 4.990*** |

| LitigationRisk | 2.234 | 2.290** | 4.061 | 2.070** | 2.478 | 8.970*** | 2.237 | 4.610*** |

| Size*Litigation | −0.088 | −2.210** | −0.158 | −2.000** | −0.101 | −8.880*** | −0.089 | −4.570*** |

| GOV_DEP | −0.039 | −0.600 | −0.218 | −1.710* | 0.002 | 0.014 | 0.004 | 0.130 |

| ECON_DEP | 0.683 | 1.540 | 0.920 | 0.980 | 0.675 | 5.070*** | 0.418 | 1.920* |

| LOCATION | −0.001 | −0.280 | −0.013 | −1.440 | 0.005 | 5.520*** | 0.010 | 4.420*** |

| LagAuditOpinion | 1.629 | 22.850*** | 1.369 | 10.720*** | 0.106 | 4.850*** | 0.141 | 3.360*** |

| ROE | 0.015 | 1.390 | −0.044 | −0.880 | 0.002 | 0.560 | 0.001 | 0.230 |

| LOSS | 1.088 | 15.400*** | 0.737 | 5.300*** | 0.033 | 1.830* | 0.021 | 0.510 |

| LNTA | −0.119 | −3.140*** | −0.173 | −2.550** | 0.312 | 31.730*** | 0.345 | 19.340*** |

| LEVERAGE | −0.101 | −0.056 | −0.042 | −0.230 | −0.113 | −1.380 | −0.016 | −0.280 |

| CACL | −0.035 | −0.072 | 0.006 | 0.360 | −0.021 | −4.680*** | −0.017 | −3.130*** |

| INVAR | −0.046 | −1.820* | −0.074 | −0.540 | 0.025 | 3.400*** | 0.031 | 2.210** |

| AGE | 0.019 | 1.630* | 0.025 | 1.070 | 0.009 | 3.990*** | 0.007 | 1.200 |

| ROE_INCENTIVE | −0.053 | −0.700 | −0.259 | −1.590 | 0.012 | 0.790 | 0.042 | 1.130 |

| EXT_DIR | −0.094 | −0.740 | −0.095 | −0.420 | −0.108 | −3.760*** | −0.133 | −2.290** |

| STATE | −0.141 | −1.220 | 0.127 | 0.560 | −0.073 | −2.920*** | −0.017 | −0.310 |

| FOREIGN | 0.144 | 0.360 | 0.798 | 1.330 | 1.194 | 11.680*** | 1.074 | 6.870*** |

| ZSCORE | −0.226 | −2.490** | −0.658 | −3.320*** | −0.012 | −0.830 | 0.042 | 1.310 |

| SZ | 0.060 | 0.990 | 0.281 | 2.320** | −0.039 | −3.020*** | −0.047 | −1.580 |

| λa | 0.109 | 1.210 | 0.042 | 1.780* | ||||

| λc | −0.004 | −0.030 | −0.031 | −1.410 | ||||

| Year Dummies | Included | Included | Included | Included | ||||

| Industry Dummies | Included | Included | Included | Included | ||||

| Constant | −1.458 | −1.410 | −1.203 | −0.550 | 2.817 | 11.190*** | 2.569 | 5.010*** |

| Chi–square/Model F | 1385.681*** | 364.259*** | 116.300*** | 39.110*** | ||||

| R2 | .377 | .352 | .437 | .502 | ||||

- ***, **, and * indicate significance at the 1%, 5%, and 10% levels, respectively. Significances are based on a one- (two-) tailed test when the coefficient sign is predicted (not predicted). λa = inverse Mills ratio obtained from the first–stage probit auditor–choice model. λc = inverse Mills ratio obtained from the first–stage probit client–choice model. See Table 1 for other variable definitions.

| DV = AuditOpinion | DV = AuditFee | |||||||

|---|---|---|---|---|---|---|---|---|

| Column (1) LitigationRisk = 1 (n = 678) | Column (2) LitigationRisk = 0 (n = 4,751) | Column (3) LitigationRisk = 1 (n = 678) | Column (4) LitigationRisk = 0 (n = 4,751) | |||||

| Variable | Coefficient | z–statistic | Coefficient | z–statistic | Coefficient | t–statistic | Coefficient | t–statistic |

| AuditorSize | −1.974 | −0.940 | 0.070 | 1.470* | −0.066 | −1.210 | 0.141 | 14.550*** |

| GOV_DEP | −0.269 | −1.210 | −0.010 | −0.150 | −0.129 | −0.240 | 0.001 | 0.030 |

| ECON_DEP | 1.074 | 1.780* | 0.552 | 0.930 | 0.270 | 1.470 | 0.628 | 5.670*** |

| LOCATION | −0.010 | −0.660 | −0.050 | −0.630 | 0.014 | 3.640*** | 0.004 | 4.200*** |

| LagAuditOpinion | 1.345 | 6.960*** | 1.633 | 21.420*** | 0.180 | 2.840*** | 0.099 | 4.560*** |

| ROE | −0.037 | −0.570 | 0.026 | 2.400** | 0.002 | 0.410 | 0.002 | 0.730 |

| LOSS | 0.668 | 3.370*** | 1.112 | 14.860*** | 0.051 | 0.840 | 0.030 | 1.490 |

| LNTA | −0.172 | −1.990** | −0.091 | −2.010** | 0.358 | 16.460*** | 0.312 | 32.220*** |

| LEVERAGE | 0.050 | 0.230 | −0.442 | −1.280 | −0.009 | −0.150 | −0.331 | −4.400*** |

| CACL | 0.041 | 1.500 | −0.261 | −5.480*** | −0.017 | −1.880* | −0.023 | −5.580*** |

| INVAR | −0.303 | −0.610 | 0.246 | 1.230 | 0.034 | 2.430** | −0.016 | −0.390 |

| AGE | 0.012 | 0.340 | 0.018 | 1.350 | 0.013 | 1.640 | 0.008 | 3.250*** |

| ROE_INCENTIVE | −0.378 | −1.660* | −0.018 | −0.210 | 0.050 | 0.960 | 0.005 | 0.350 |

| EXT_DIR | 0.351 | 1.060 | −0.165 | −1.160 | −0.112 | −1.320 | −0.104 | −3.610*** |

| STATE | 0.339 | 1.020 | −0.214 | −1.590 | 0.106 | 1.340 | −0.085 | −3.300*** |

| FOREIGN | 0.418 | 0.420 | 0.177 | 0.390 | 1.205 | 4.140*** | 1.180 | 12.100*** |

| ZSCORE | −0.737 | −2.740*** | −0.186 | −2.460** | −0.005 | −0.110 | −0.013 | −2.420** |

| SZ | 0.323 | 1.770* | 0.022 | 0.340 | −0.079 | −1.790* | −0.031 | −2.340** |

| λa | 0.188 | 1.570 | 0.061 | 0.510 | −0.045 | −1.310 | 0.095 | 3.710*** |

| λc | 0.029 | 0.180 | −0.158 | −0.950 | −0.079 | −2.050** | 0.004 | 0.110 |

| Year Dummies | Included | Included | Included | Included | ||||

| Industry Dummies | Included | Included | Included | Included | ||||

| Constant | 2.212 | 1.100 | −1.434 | −1.240 | 5.036 | 10.110*** | 2.764 | 12.020*** |

| Chi–square/Model F | 188.965*** | 1272.888*** | 17.984*** | 107.460*** | ||||

| R2 | .353 | .406 | .487 | .437 | ||||

- ***, **, and * indicate significance at the 1%, 5%, and 10% levels, respectively. Significances are based on a one- (two-) tailed test when the coefficient sign is predicted (not predicted). λa = inverse Mills ratio obtained from the first–stage probit auditor–choice model. λc = inverse Mills ratio obtained from the first–stage probit client–choice model. See Table 1 for other variable definitions.

| Column (1) DV = GC | Column (2) DV = AuditFee | |||

|---|---|---|---|---|

| Variable | Coefficient | z–statistic | Coefficient | t–statistic |

| AuditorSize | 0.164 | 2.170** | 0.121 | 8.410*** |

| LitigationRisk | 6.897 | 3.680*** | 2.261 | 5.210*** |

| Size*Litigation | −0.273 | −3.580*** | −0.095 | −5.440*** |

| GOV_DEP | 0.024 | 0.210 | 0.013 | 0.590 |

| ECON_DEP | 1.076 | 1.700* | 0.657 | 4.190*** |

| LOCATION | 0.001 | 0.080 | 0.007 | 4.440*** |

| LagAuditOpinion | 1.357 | 12.670*** | 0.104 | 3.750*** |

| ROE | 0.005 | 0.490 | 0.001 | 0.390 |

| LOSS | 0.775 | 7.360*** | 0.010 | 0.440 |

| LNTA | −0.304 | −4.860*** | 0.296 | 22.250*** |

| LEVERAGE | 0.109 | 0.670 | −0.052 | −1.030 |

| CACL | −0.873 | −5.470*** | −0.009 | −0.580 |

| INVAR | −0.031 | −1.320 | 0.032 | 2.600*** |

| AGE | 0.007 | 0.360 | 0.008 | 2.070** |

| ROE_INCENTIVE | −0.076 | −0.530 | −0.004 | −0.150 |

| EXT_DIR | −0.097 | −0.420 | −0.067 | −1.440 |

| STATE | −0.347 | −1.660* | −0.043 | −1.020 |

| FOREIGN | 0.072 | 0.120 | 1.352 | 10.180*** |

| ZSCORE | −0.394 | −2.390** | −0.022 | −3.850*** |

| SZ | −0.264 | −2.610*** | −0.055 | −2.680*** |

| λa | 0.168 | 1.260 | 0.125 | 3.950*** |

| λc | 0.003 | 0.020 | −0.031 | −0.810 |

| Year Dummies | Included | Included | ||

| Industry Dummies | Included | Included | ||

| Constant | 0.976 | 0.550 | 3.473 | 9.920*** |

| Chi–square/Model F | 637.767*** | 49.990*** | ||

| Pseudo R2/R2 | .436 | .468 | ||

- ***, **, and * indicate significance at the 1%, 5%, and 10% levels, respectively. Significances are based on a one– (two–) tailed test when the coefficient sign is predicted (not predicted). GC = 1 if the CPA firm issued a going–concern opinion for the client; 0 if a clean opinion is issued. LagAuditOpinion = 1 if the CPA firm issued a going–concern opinion for the client in the lag year; 0 if a clean opinion is issued. λa = inverse Mills ratio obtained from the first–stage probit auditor–choice model. λc = inverse Mills ratio obtained from the first–stage probit client–choice model. See Table 1 for other variable definitions.

4.3.4 Partitioned sample

As alternative tests, we partition our sample into clients that are audited by CPA firms with high litigation risks (i.e., LitigationRisk = 1; n = 678) and clients that are audited by CPA firms with low litigation risks (i.e., LitigationRisk = 0; n = 4,751) and then regress audit quality on the auditor size proxy (i.e., AuditorSize) and other control variables specified in the main regression Model (1). Performing these additional tests serves as a direct contrast between the groups of high versus low litigation risk exposures and provides further evidence as if the positive association between auditor size and audit quality persists for CPA firms that are subject to high and low litigation risk exposures. Table 6 reports the findings.

As shown in the table, we find that the auditor size proxy (AuditorSize) is only positive and significant in the groups where firms are audited by CPA firms with low litigation risk (i.e., LitigationRisk = 0; Columns (2) and (4)). In the groups where firms are audited by CPA firms with high litigation risk (i.e., LitigationRisk = 1; Columns (1) and (3)), the coefficients on AuditorSize are negative and insignificant.23 Overall, these additional tests show qualitatively similar results as the main findings reported in Table 4 and provide further support to our argument that the positive association between audit quality and auditor size is only presented in the low litigation risk setting. When the litigation risk is high, the association diminishes.

4.3.5 Financially distressed subsample

Although modified audit opinions are widely used as a proxy for audit quality, auditors issuing modified audit opinions to financially healthy clients may be viewed as reporting overconservatively, which results in a lower audit quality. Therefore, we perform sensitivity tests by rerunning our regression models with a reduced sample that includes only those audited clients under financial distress.24 Following previous studies (e.g., Carcello et al., 2009; Geiger & Rama, 2006; Geiger et al., 2014), we replace the dependent variable of AuditOpinion by the going-concern opinions issued by the auditors (GC). Table 7 presents the regression results.

As shown in the table, both AuditorSize and LitigationRisk are positively and significantly associated with GC (going-concern opinions) and AuditFee, which are proxies for audit quality. The findings are broadly consistent with the previous literature and show that both the size and the litigation risk exposure of an auditor play important roles in influencing audit quality. Of particular note are the negative and significant coefficients on Size*Litigation in both regressions.

Overall, the results from the financially distressed firm sample provide further support to our main findings that the association between auditor size and audit quality is conditioned on the litigation risk exposure of the auditors. If an auditor's liability is capped (i.e., LitigationRisk = 0), the larger the auditor size, the higher the audit quality. However, if an auditor is exposed to a higher litigation risk setting (i.e., LitigationRisk = 1), the positive effect of auditor size on audit quality disappears.

4.3.6 Alternative proxy of the size of CPA firms

As a sensitivity test, we use another proxy of auditor size (TOP14) to check for the robustness of our results. TOP14 represents the fourteen largest CPA firms in China's market, and it equals 1 if the client is audited by one of the Big 4-affiliated CPA firms or by one of the ten largest local CPA firms and 0 otherwise. According to a survey by the Chinese Institute of Certified Public Accountants (CICPA), the ten largest local CPA firms experienced a revenue growth of 38% in 2011, whereas the revenue growth of the Big 4-affiliated CPA firms in 2011 was about 6% (A-Plus 2012). We believe that the ten largest local CPA firms play an increasingly important role compared with the Big 4-affiliated CPA firms during our sample period. These fourteen largest CPA firms collectively dominate the listed company audits in China's market. Accordingly, we replace the AuditorSize variable by the TOP14 variable and rerun our main regression model. Although we do not tabulate the results for brevity's sake, we find that TOP14 is positive and significant at the 1% level, no matter whether the dependent variable is AuditOpinion or AuditFee. Consistent with our main findings, the variable of Size*Litigation (where “Size” represents TOP14) is negative and significant at the 5% level when AuditOpinion is the dependent variable and at the 1% level when AuditFee is the dependent variable.25 Overall, these results buttress our main findings and imply that when CPA firms are subject to high litigation risk (i.e., LitigationRisk = 1), small CPA firms are motivated to increase their audit quality.

5 CONCLUSIONS

Both litigation risks and auditor size have been found to be associated with audit quality. However, there is scarce empirical research examining the interactive relationship among these three important factors. We are specifically interested in answering the research question—“Does audit quality vary for different sizes of CPA firms under both high and low auditor-specific litigation risk exposure?” We examine this empirical issue using data from China because its institutional setting enables us to clearly distinguish between the litigation risks of CPA firms through their organizational forms. This allows us to investigate whether CPA firm-specific litigation risk has an impact on the association between auditor size and audit quality in terms of an auditor's propensity to report conservatively and its audit pricing decision. Modeled on Choi et al.'s (2008) theoretical framework and based on 5,429 audits of Chinese listed companies during the period 2001–2006, our empirical findings suggest that auditor size and audit quality are positively correlated but only in the low auditor-specific litigation risk setting. In contrast, when CPA firms are subject to high auditor-specific litigation risk exposure (e.g., when they are registered in a partnership form), the audit quality spread between large and small CPA firms is smaller, and the positive effect of auditor size on audit quality diminishes. Our research suggests that high litigation risks motivate smaller size CPA firms to report more conservatively and receive higher audit fee premiums from clients.

Overall, our research provides useful information for examining research issues regarding audit quality and its determinants. Auditor size has been considered to be one of the key determinants of audit quality. However, our empirical findings show that such an assumption does not necessarily hold when CPA firms are subject to high auditor-specific litigation risk exposure. One possible interpretation of this result is that due to the higher economic bonding to clients and greater bankruptcy risk for audit failure, smaller size CPA firms are more motivated to increase their audit efforts such that the expected legal liability costs associated with the high litigation risk exposures could be reduced. We contribute to the existing literature by demonstrating the significant impact of auditor-specific litigation risk exposures on the association between auditor size and audit quality in a within-country setting. Extrapolating our results suggests that auditor litigation risk (and other possible auditor attributes) should be taken into consideration when conducting research on the relation between audit quality and auditor size. Policy makers and regulators could also make reference to our findings in devising feasible and sound policies in promoting competitive environment of the accounting profession.

Our research using a sample period of 2001–2006 benefits us to distinguish the difference in litigation risk exposure arisen from two distinct organizational forms. However, as the partnership form and limited liability form of CPA firms are gradually disappeared in the post-sample period (as previously discussed), it is arguable that our results may not be readily generalizable to the institutional setting in the absence of such organizational form(s). Besides, we use the Chinese data in this paper. The audit market in China is not dominated by the Big 4 auditors, and this lack of market dominance provides an opportunity and a need to re-examine the association between audit quality and auditor size under different levels of litigation risk. One limitation of this setting is that our findings would be less relevant in those developed countries where the majority of listed companies are audited by Big 4 auditors.26

ACKNOWLEDGEMENTS

We are especially grateful to the editor (Sidney Gray) and the two anonymous referees for their insightful and constructive suggestions. We dedicate this work to the deceased Professor Michael A. Firth and are indebted to his innovative and logical thoughts in guiding us throughout the research process. We also thank seminar participants at the 25th Asian-Pacific Conference on International Accounting Issues at Bali, Indonesia, for their helpful comments, discussions, and suggestions on earlier drafts of the paper. This research has benefited from financial support from the Lingnan University, Hong Kong. Raymond Wong (corresponding author) acknowledges the financial support of a grant from the Research Grants Council of the Hong Kong Special Administrative Region, China (Project No. CityU 152012). All remaining errors and omissions are our own.

ENDNOTES

- 1 The Ministry of Finance promulgated a new regulation in the year 2010 that requires all large- and medium-sized domestic CPA firms to change their organizational forms to that of a special partnership by the end of year 2011 (MOF 2010). If a CPA firm is registered in a special partnership form, the liabilities of the firm and its non-negligent partners are limited; only the liability of the negligent partner is unlimited. Although the transformation took a longer time than anticipated, there is gradually less variation in the types of organizational form of CPA firms that are responsible for listed company audits after the issuance of this regulation. Having said that, litigation risk is still a major concern affecting CPA firm's practice in China in the post-regulation period. For example, Wang and Dou (2015) find that the transformation of Chinese CPA firms from the form of limited liability company (i.e., lower litigation risk exposure) to the form of special partnership (i.e., higher litigation risk exposure) significantly lowers the clients’ discretionary accruals (in absolute term and in signed positive form). Interpreting their results suggests that CPA firms taking the new special partnership form view litigation risk as a major concern and thus improve their audit quality in response to the increased legal exposure (as compared with that of limited liability company form). Therefore, investigating whether auditor-specific litigation risk affects the association between audit quality and auditor size helps regulators better understand the influence of organization forms on audit quality.

- 2 This prediction is based on Choi et al.'s (2008) theoretical argument, which we discuss later in Section 2.

- 3 We use data up to the year 2006 because the number of CPA firms (licensed to audit listed firms) that are registered in a partnership form significantly dropped after 2006. There are five partnerships in 2006, but only two partnerships in 2007 and one partnership in 2008. Most of the partnerships changed to limited liability corporations in response to the increased litigation risks (Firth et al., 2012).

- 4 We capture the size of a CPA firm by a CPA firm's clients’ total assets. As a sensitivity test, we also use an indicator variable of Big-4 affiliated CPA firms and the ten largest local CPA firms to serve as an alternative proxy for the size of a CPA firm. More discussions are provided in Section 3 and Section 4.

- 5 We acknowledge that there is no available proxy that could perfectly capture the audit quality, which is generally considered unobservable. Nevertheless, the main audit quality proxies that we adopt in this paper, namely modified audit opinions (or going-concern opinions for distressed firms) and audit fees, are conventionally and widely adopted by previous literature (DeFond & Zhang, 2014) in which employing them in our research is contributory to our understanding of factors influencing audit quality and increases the comparability of our research.

- 6 In an untabulated test, we find that small CPA firms do have a lower propensity to lose their clients. In particular, over the sample period, more than 23% of small CPA firms experience no client loss, while <9% of large CPA firms experience no client loss (t-statistic = 4.045; p-value < .001). We further find that such no-client-loss percentage is highest for small CPA firms that are subject to high litigation risk (i.e., registered in partnership form); 25% of them experience no client loss. These analyses give some support to the argument that there is a stronger economic bond between small CPA firms and their clients, and small CPA firms are more likely to retain their clients. We, however, could not completely rule out the possibility that small CPA firms’ lower propensity to lose their clients is also because of their familial or social connections. We thank the reviewer for raising this issue.

- 7 A detailed discussion of the regulatory change is provided earlier in footnote #1.

- 8 In contrast, using UK data, Lennox and Li (2012) find no evidence that CPA firms switching from an unlimited liability general partnership to a limited liability partnership result in lower audit quality.

- 9 Similar to the US studies, prior studies in China find that large CPA firms provide higher audit quality and charge higher audit fees than do small CPA firms (e.g., DeFond, Francis, & Wong, 2000; DeFond, Wong, et al., 2000).

- 10 There are 1,254 clients and 76 auditors over the sample period. On average, there are about 60–70 auditors responsible for around 800–900 listed company audits in each year.

- 11 Fan and Wang (2004) develop a set of indexes to capture the economic and market development across major provinces in China. We incorporate some of these indexes, which are likely affect the development of the accountancy profession and the securities market, in constructing the LOCATION variable. These indexes include (1) the extent of central government involvement in the province (i.e., government decentralization index), where a higher government decentralization index represents a lower central government involvement in the province, (2) the development of the provincial legal environment (i.e., legal environment index), where a higher legal environment index represents a more developed legal environment in the province, (3) the development of provincial market intermediaries (i.e., market intermediary index), where a higher market intermediary index represents a more developed system of market intermediaries in the province, (4) the extent of foreign investment in the province (i.e., foreign investment index), where a higher foreign investment index represents a greater extent of foreign investment in the province, (5) the development of the provincial credit market (i.e., credit market index), where a higher credit market index represents a more developed credit market in the province, and (6) the relative index of the number of lawyers and CPAs that practice in the province. Prior studies use similar indexes in capturing economic development across Chinese provinces, and we argue that this economic development also has significant impacts on the development of accountancy profession and thus audit quality in China.

- 12 Although clients of larger size are likely to be more complex and have higher litigation risk than the clients of smaller size (which result in greater audit efforts spent and higher audit quality), larger clients are also likely to be more important to auditors and may exert fee pressures on auditors that compromise their independence and result in lower audit quality (Ettredge, Fuerherm, & Li, 2014).

- 13 Tucker (2010) discusses the abilities of the IMR approach and the PSM approach to resolve the endogeneity problems in accounting and finance research. We adopt both approaches to increase the robustness of the findings.

- 14 The sample size for the model of CPA firm's choice of litigation risk (i.e., Panel A) is 418 auditor-year observations, whereas the sample size for the model of a client firm's choice of the type of CPA firm (i.e., Panel B) is 5,429 firm-year observations.

- 15 Variables in the regression models of auditor choice and client choice are presented in the notes to Appendix A.

- 16 Appendix B presents the univariate tests for the client characteristics between the treatment group (i.e., LitigationRisk = 1) and the control group (i.e., LitigationRisk = 0). We also report the univariate tests for the client characteristics of our original sample (without applying the PSM approach). As reported in the appendix, there are some significant differences in client characteristics in our original full sample. For instance, the clients of CPA firms with high litigation risks (i.e., LitigationRisk = 1) have higher financial leverage (LEVERAGE), higher levels of inventory and accounts receivable (INVAR), and lower incentives for earnings management (ROE_INCENTIVE) and are younger (AGE) than the clients of CPA firms with low litigation risks. These differences become mostly insignificant after applying the PSM approach.

- 17 Although neither study uses data from China, we believe that their findings relating to a weak legal regime can be generalized and applied to China.