Removing Distortions in the U.S. Ethanol Market: What Does It Imply for the United States and Brazil?

The authors wish to thank John C. Beghin, Chad Hart, Frank Fuller, Tun-Hsiang Yu, the editor Stephen K. Swallow, and three anonymous reviewers for their valuable comments and suggestions. Any remaining errors are the authors'.

Abstract

We analyze the impact of trade liberalization and removal of the federal tax credit in the United States on ethanol markets using a multimarket international ethanol model. We find that U.S. trade barriers have been effective in protecting the ethanol industry. Under current policy, there is separability of the U.S. ethanol market from world markets. With trade liberalization, the ethanol market deepens, making it less susceptible to price volatility. The effect of trade liberalization extends beyond ethanol markets, affecting agricultural markets. The results show that the impact of removal of the tax credit overrides the impact of the tariff removal.

In the past few years, interest in biofuels has greatly increased and this can be attributed to environmental, economic, and geopolitical factors. Harmful emissions, high crude oil prices, and the growing dependency on foreign oil supplies have provided incentives for pursuing alternative fuel sources such as ethanol and biodiesel. The rising importance of biofuels can also be attributed to the desire by countries to develop new markets for agricultural products. This push is currently policy driven, for example, in the United States through the U.S. Energy Bill of 2005 and in the European Union (EU) through the Renewable Fuels Directive of 2003. Brazil, an established producer and consumer of ethanol, promoted its ethanol industry through an ethanol program, the National Alcohol Programme (PROALCOOL), which was launched in the mid-1970s.

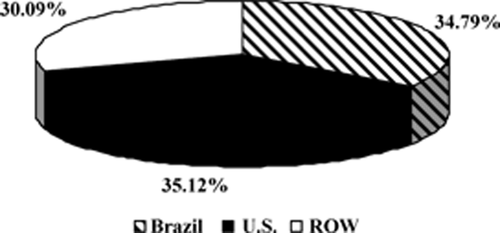

Ethanol is the most visible of the biofuels benefiting from this recent surge in interest. It can be produced from a variety of feedstocks such as cereals, sugarcane, and cellulosic material. The United States and Brazil are currently leading the way in the use of ethanol as an alternative fuel, making them the two largest producers in the world, accounting for about 70% of total world production in 2005 (figure 1).

Share in total ethanol production in 2005

With biofuels in general, and ethanol in particular, increasing in importance, a clear understanding of the fundamentals of the market and the impact of the biofuels expansion on agricultural markets is critical. Questions on how policy changes will affect this emerging market and spillover effects into other markets are currently being discussed. This article attempts to contribute to the debate by establishing a complete ethanol model linking energy to agricultural markets. This study is one of the first to model comprehensively the ethanol market not only in the United States but also in Brazil. Given the comprehensive modeling system, it is then feasible to examine the effect of the expanding biofuels sector both in the United States and worldwide and to analyze the impact of policy changes in the ethanol and agricultural sectors.

In addition to the 2005 Energy Bill, which introduced a renewable fuel standard (RFS), the recent rise in demand for ethanol in the United States is largely the result of several states banning the use of the gasoline additive MTBE (methyl tertiary butyl ether) and replacing it with ethanol. The recent boost has also been fueled by higher crude oil prices, which opened a new market for ethanol as a fuel extender (Eidman 2006).

The volatility of domestic ethanol prices and the occasional spikes in price caused by this recent hike in ethanol demand have led to discussions of eliminating the tariff on U.S. ethanol imports. In this context, this article has two objectives. The first is to set up an international ethanol model and create a baseline. The second is to analyze the impact of the removal of trade and domestic distortions in the United States on the world ethanol market.

There are a limited number of studies on ethanol markets, as the industry has experienced a boom only in recent years. Gallagher et al. (2006) look at the competitive position of Brazilian sugarcane-based ethanol vis-à-vis U.S. ethanol produced from corn under the assumption of no tariffs in the ethanol market. Koizumi and Yanagishima (2005) examine the implications of changes in the compulsory ethanol-gasoline blend ratio in Brazil on world ethanol and sugar markets. Gallagher, Otto, and Dikeman (2000) analyze the impact of introducing a minimum oxygen content for fuel in the Midwest.

This article offers a number of contributions to the literature on ethanol. Since a comprehensive ethanol model is linked to previously established U.S. and world agricultural models, we can endogenize the prices of crops used in ethanol production, specifically, sugarcane and corn, which previous studies have tended to hold constant (Koizumi and Yanagishima 2005; Gallagher et al. 2006). We also address the issue of ethanol acting as both a substitute and a complement to gasoline and how this affects the direction of the impact from policy change. Several sensitivity analyses were performed to test the robustness of the model. Data on ethanol are currently limited and sparse so this article contributes to the existing literature by utilizing and scrutinizing a multitude of data from different sources in order to provide the most cohesive data for analysis.

The study finds that the removal of trade distortions in the first scenario induces a decrease in the U.S. domestic ethanol price, which results in a decline in U.S. ethanol production and an increase in consumption when compared to the baseline. Consequently, U.S. net ethanol imports increase significantly. The resulting higher world ethanol price leads to an increase in ethanol production and a decrease in total ethanol consumption in Brazil causing net exports to increase relative to the baseline. In the second scenario, the removal of trade distortions and the 51¢ per gallon tax credit to refiners blending ethanol with gasoline results in a lower increase in the world ethanol price relative to the first scenario. This study has a key role in providing answers to how the tariff and tax credit affect the welfare of the ethanol, corn, and sugarcane producers.

In the following paragraphs, we describe the U.S. and Brazilian ethanol markets.1 Then, we explain the structure of the international ethanol model used for the simulations as well as the country-specific models for the United States and Brazil. We also provide a concise description of the U.S. crops and world sugar models. After having introduced the policy reform scenarios, we present the key results of our simulations.

Overview of U.S. and Brazilian Ethanol Markets

In the United States, ethanol is produced primarily from corn using either a wet-milling or a dry-milling process. Wet mills produce ethanol and the by-products corn gluten meal, corn gluten feed, corn oil, and CO2. Dry mills, which are the predominant mill-type, produce ethanol with dried distillers grains (DDG) and solubles and CO2 as by-products (Coltrain 2001; Tiffany 2002).

There are numerous state and federal legislations that affect the U.S. ethanol market. The RFS requires U.S. fuel production to include a minimum amount of renewable fuel each year, starting at 4 billion gallons in 2006 and reaching 7.5 billion gallons in 2012. After 2012, renewable fuel production must grow by at least the same rate as gasoline production (Duffield and Collins 2006; Yacobucci 2006a).

The U.S. ethanol trade policy includes a 2.5% ad valorem tariff and a per unit tariff of 54¢ per gallon. Another trade policy is the Caribbean Basin Economic Recovery Act (CBERA). Under this agreement, if ethanol is produced from at least 50% agricultural feedstock grown in a CBERA country, it is admitted into the United States free of duty. Duty-free ethanol from non-CBERA feedstock is restricted to 60 million gallons or 7% of the U.S. consumption, whichever is greater. To comply with this requirement, hydrous ethanol is imported to a Caribbean Basin Initiative (CBI) country and is dehydrated before it can be exported to the United States. Dehydration plants are currently operating in CBI countries such as Jamaica, Costa Rica, and El Salvador, where hydrous ethanol produced in other countries, historically Brazil and Europe, can be dehydrated before it is exported to the United States (Yacobucci 2006b).

Brazil is the world's second largest producer of ethanol after the United States, deriving its supply from sugarcane. Brazil is one of the first countries to promote ethanol through its National Alcohol Program, launched in 1975 to reduce Brazil's dependence on foreign oil and to find alternative markets for Brazilian sugar (Bolling and Suarez 2001). The government promoted the production of ethanol through mandates and market incentives. The ethanol sector was further boosted by the 1979 introduction of ethanol vehicles that ran solely on hydrous ethanol. The Brazilian government currently provides support to ethanol production through a mandate of a blending ratio of anhydrous ethanol with gasoline of between 20% and 25% in transport fuel. There is also a lower excise tax for ethanol than for gasoline. Ethanol imports to Brazil are subject to a 20% tariff.

Recently, increased demand for ethanol in Brazil has been driven by the popularity of flex-fuel vehicles (FFVs) that can run on gasoline, ethanol, or a combination of the two. As with ethanol vehicles, FFVs enjoy some tax incentives not offered to gasohol cars that run only on gasoline blended with ethanol at the mandate set by legislation. These FFVs are expected to be the predominant vehicle type in Brazil within the next decade (F.O. Licht 2006b).

Structure of the Models

The international ethanol model is a nonspatial, multimarket world model consisting of a number of countries, including a Rest-of-World aggregate (ROW) to close the model. The model specifies ethanol production, use, and trade between countries. Country coverage consists of the United States, Brazil, EU-15, China, Japan, and ROW.

The general structure of the country model is made up of behavioral equations for production, consumption, ending stocks,2 and net trade. Complete country models are established for the United States, Brazil, and EU-15 while only net trade equations are set up for China, Japan, and ROW because of limited data. The model solves for a representative world ethanol price by equating excess supply and excess demand across countries.

We use the Brazilian anhydrous ethanol price as the world ethanol price, which is a standard assumption as Brazil is the major exporter of ethanol. Using price transmission equations, the domestic price of ethanol for each country is linked to the representative world price through exchange rates and other price policy wedges. All prices in the model are expressed in real terms. Through the U.S. crops and world sugar models, we endogenously solve for all the U.S. crops prices and its by-products, as well as the world sugar price. It is important to note that since this is a new area of investigation, the limited data availability dictates the modeling approach.

U.S. Ethanol Demand

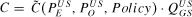

Total U.S. ethanol demand is divided into fuel-ethanol demand and a residual demand that consists of nonfuel alcohol use (industrial and beverage). Fuel-ethanol demand is a derived demand from the cost function for refiners blending gasoline with additives, including ethanol. Given that only aggregate data are available on U.S. motor gasoline consumption, we are constrained to model an aggregate composite gasoline production representing all types of gasoline available on the U.S. market. Let C denote the cost function for the refiners supplying all types of gasoline blended with additives, including gasoline blended with ethanol. We abstract from the time dimension when not necessary.

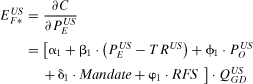

. The marginal cost (MCG) of gasoline is constant as long as input prices are constant. Gasoline output QUSGS is eventually determined by the intersection of gasoline demand and MCG at the equilibrium in the gasoline market. By Shephard's lemma, the intermediate demand for fuel ethanol, (∂C/∂PUSE), is derived as

. The marginal cost (MCG) of gasoline is constant as long as input prices are constant. Gasoline output QUSGS is eventually determined by the intersection of gasoline demand and MCG at the equilibrium in the gasoline market. By Shephard's lemma, the intermediate demand for fuel ethanol, (∂C/∂PUSE), is derived as

(1)

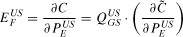

(1) is the derived demand for ethanol per unit of gasoline. Accounting for the specific policy interventions affecting refiners, we obtain the following equation:

is the derived demand for ethanol per unit of gasoline. Accounting for the specific policy interventions affecting refiners, we obtain the following equation:

(2)

(2) and β1 < 0.

and β1 < 0. (3)

(3) (4)

(4) can be interpreted as the share of fuel ethanol in total gasoline consumption (EUSF*/QUSGD).

can be interpreted as the share of fuel ethanol in total gasoline consumption (EUSF*/QUSGD).In U.S. gasoline production, fuel ethanol is mainly used as an additive to gasoline. Thus, ethanol acts as a complementary good to pure gasoline. However, in demand, ethanol is a substitute to gasoline, through E85 cars, which run on gasoline blended with up to 85% ethanol, as well as a fuel enhancer. In this analysis, through the parameterization of equation (4), it is assumed that the complementary relationship is more dominant than the substitute relationship because currently ethanol is blended mostly at 10% and is not available in all states. Furthermore, E85 cars represent a negligible portion of the U.S. vehicle fleet. Substitution effects are currently limited but may get larger in the future if E85 cars become popular. Due to complementarity, an increase in the price of gasoline translates into a net decrease in demand for ethanol EUSF*.

The magnitude of the complementary and substitute relationships also depends on the assumptions made about the composition of the U.S. vehicle fleet in the future. As long as the number of FFVs (E85) in the United States remains relatively small, there is only limited substitution for regular cars in terms of substituting gasoline for ethanol. Finally, to complete the specification of total ethanol demand, the residual ethanol demand is simply set up as a function of the U.S. domestic ethanol price.

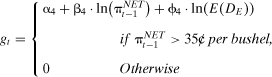

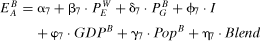

U.S. Ethanol Supply

(5)

(5) (6)

(6) (7)

(7)U.S. Ethanol Stocks

(8)

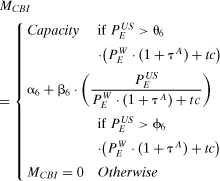

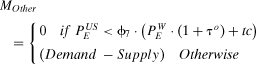

(8)U.S. Ethanol Trade

(9)

(9) (10)

(10)Through equations (9) and (10), we see that when the tariff is not prohibitive, import demand is positive making the domestic U.S. price dictated by the world ethanol price through a price transmission equation. However, since the United States is a large country importer, the world ethanol price is also affected by U.S. import demand. When the tariff is prohibitive and there are no imports from other countries, the domestic U.S. price is solved endogenously within the model, equating supply to demand. To account for this, we construct a price-switching regime. The domestic price of ethanol can be solved either endogenously (PEndogenousE) or it can be a price transmission from the world price of ethanol. If PEndogenousE >PWE · (1 + τo) + tc, the domestic ethanol price equals PWE · (1 + τo) + tc. If PEndogenousE < PWE · (1 + τo) + tc, the domestic ethanol price is PEndogenousE.

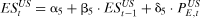

Brazilian Ethanol Demand

In Brazil, the ethanol demand is divided into anhydrous and hydrous ethanol demand, as they respond to different economic incentives depending on the three types of vehicles (alcohol, flex-fuel, and gasohol cars). The alcohol vehicles use only hydrous ethanol, the gasohol vehicles use only anhydrous ethanol (blended with gasoline), while the FFVs can use both hydrous ethanol and anhydrous ethanol (blended with gasoline). Therefore, we model anhydrous ethanol demand (EBA) and hydrous ethanol demand separately (EBH), where total ethanol demand in Brazil EBTotal equals (EBH + EBA).

(11)

(11) (12)

(12)The interaction term I is used to capture the higher demand responsiveness of FFVs to changes in the price of gasoline. As the number of FFVs increase in the projection period, demand for both anhydrous and hydrous ethanol becomes increasingly responsive to the change in the price of gasoline. In the case of anhydrous demand, as the price of gasoline rises, the demand for ethanol declines as FFVs substitute hydrous ethanol for gasoline blended with anhydrous ethanol. Conversely, for the demand for hydrous ethanol, if the price of gasoline increases, the demand increases as FFVs increase their use of hydrous ethanol relative to anhydrous ethanol blended with gasoline.

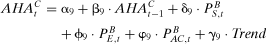

Brazilian Ethanol Supply

In modeling the supply of ethanol in Brazil, the link between sugar and ethanol markets is critical as both ethanol and sugar are produced from sugarcane in Brazil. Therefore, the derived demand for sugarcane that goes into ethanol production comes from the profit-maximization problem of sugarcane producers.

(13)

(13) (14)

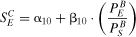

(14)Brazilian Ethanol Stocks

(15)

(15)Brazilian Ethanol Trade

Net exports are derived as a residual, that is, equal to production plus beginning stocks minus consumption minus ending stocks. Although there is an ethanol import tariff in Brazil, it is not incorporated into the model, as Brazil is a net exporter of ethanol.

U.S. Crops Model

The U.S. crops model is a partial-equilibrium econometric model, which includes behavioral equations that determine crop acreage planted, domestic feed, food and industrial uses, trade, and ending stocks. The model solves for the set of prices that brings supply and demand into balance in all crop markets.9 The U.S. crops model is divided into regions with equations for each crop grown within each region.10 For crops with by-products, behavioral equations for the by-products are also included.

Estimated regional net returns for modeled crops determine the area planted under each crop in each region. The submodels for all the crops and by-products in the U.S. crops model follow the same general framework. In the case of corn, the expected net return in a given region is determined by the expected corn price, the expected yield, variable production expenses, and the expected loan deficiency and counter-cyclical payments. Corn area planted is a function of the expected net returns for corn and competing crops, decoupled payments, and the area allocated to the Conservation Reserve Program. Corn production is given by corn area harvested multiplied by corn yield.

Total corn use is the sum of feed use, seed use, food use, high fructose corn syrup (HFCS) use, ethanol use, exports, and stocks. Feed use is based on feed use per grain-consuming animal unit and an estimate of grain-consuming animal unit for the U.S. livestock sector. Corn exports are estimated through a reduced form equation that reflects the response of international grains and oilseeds markets to changes in U.S. grain and oilseed prices.

International Sugar Model

The international sugar model is a nonspatial, partial-equilibrium econometric model including 29 countries and ROW. The model specifies sugar production, use, and trade between countries expressed in raw sugar equivalence. The general structure of the country submodel includes behavioral equations for area harvested, yield, production for sugar beet and sugarcane on the supply side, and per-capita consumption and ending stocks on the demand side. The world sugar price (Caribbean f.o.b.) is determined by equating excess supply and excess demand across countries. Through price transmission equations, the domestic sugar price of each country or region is linked to the world price through exchange rates and other price policy wedges.

The general framework for each country submodel includes an equation for area harvested in each country similar to equation (13). Area harvested is then multiplied by yield to obtain sugarcane or beet crop production. Total sugar production is obtained by converting beet production and raw cane production into raw sugar equivalent. On the demand side, sugar consumption in each country depends on the price of raw sugar and per-capita income. Ending stocks depend on beginning stock, consumption, and the price of raw sugar.

Model Calibration, Data Source, and Variables

All the models are calibrated on the most recent available data (2005) and generate a ten-year baseline to 2015. Given the fact that the ethanol market is emerging and going through structural change, the relevant data series is too short for reliable econometric estimation. Our final elasticity values for supply and demand in the ethanol model were reached using a process whereby we first reviewed the available literature, and then we performed sensitivity analyses to reach what we considered reasonable estimates. The elasticities in the U.S. and Brazilian ethanol models are presented in table 1.11 The response of ethanol consumption to price changes depends on the vehicle fleet composition. In Brazil, for example, ethanol and gasohol vehicles are less responsive to ethanol and gasoline price changes than FFVs since these vehicles can substitute between gasohol and ethanol.

| U.S. Ethanol Model | Brazilian Ethanol Model | U.S. Corn Model | International Sugar Model | |

|---|---|---|---|---|

| Price elasticity in supply | 0.65 | 0.20c | 0.13 to 0.40 | Beet: 0.04 to 0.50 |

| Cane: 0.04 to 0.20 | ||||

| Price elasticity in demand | −0.43a | Anhydrous ethanol: −0.10 | −0.10 to −0.20 | −0.01 to −0.27 |

| Hydrous ethanol: −0.30 | ||||

| Income elasticity in demand | 0.11b | 0.13 | 0.05 to 0.60 |

- a Response of share of ethanol in gasoline consumption.

- b Response of gasoline consumption.

- c Response of share of sugarcane in ethanol production.

Elasticities in the U.S. crops and sugar models are comparable to those found in the literature. For example, sugar supply is price-inelastic particularly in the short run.12 In demand, own-price elasticities are inelastic especially in developing countries where sugar is a diet staple fulfilling basic caloric requirements (Hafi, Connell, and Sturgiss 1993; Devadoss and Kropf 1996; Wohlgenant 1999). Table 1 shows the elasticity ranges for supply and demand found in the U.S. crops and international sugar models.13

In general, data for ethanol supply and utilization were obtained from the F.O. Licht (2006) Online Database, the Food and Agricultural Organization (FAO) of the United Nations (FAOSTAT (2006) Online), the Production, Supply and Distribution View (PS&D) of the U.S. Department of Agriculture (USDA), and the European Commission Directorate General for Energy and Transport (2006). Macroeconomic data were gathered from various sources, including the International Monetary Fund and Global Insight.

U.S. ethanol import data are divided into imports from different countries according to the U.S. International Trade Council (2006) data set. The U.S. production capacity was obtained from the Renewable Fuels Association's Annual Industry Outlook publications. Both the U.S. ethanol and unleaded gasoline prices are the f.o.b. average rack prices for Omaha, Nebraska, provided by the Nebraska Ethanol Board (2006). The crude oil price is the refiners' acquisition cost of imported crude oil and the U.S. gasoline consumption is the finished motor gasoline demand both obtained from Energy Information Administration (EIA 2006) Short-Term Energy Outlook May 2006 and Annual Energy Outlook 2006 publications. The corn price is the farm price from the USDA National Agricultural Statistics Service (2006) online database. The natural gas utility price index was from Global Insight. The DDG price, gluten meal price, and gluten feed price were from the USDA Economic Research Service Feed Situation and Outlook Yearbook (2006).

Most of the data for Brazil, including ethanol supply and utilization data as well as ethanol and sugar prices, sugarcane data, and Brazilian gasoline consumption, were obtained from the Attaché Reports of USDA's Foreign Agriculture Service (2006). Ethanol prices are for anhydrous ethanol provided on a monthly basis for the State of São Paulo, Brazil. Anhydrous ethanol consumption data were computed using the formula  , where QBG is gasoline consumption for Brazil in million gallons. Flex-fuel and other vehicle data were obtained from the Brazilian Automotive Industry Yearbook (ANFAVEA 2005) and vehicle projections were obtained from UNICA 2006. In the Brazilian ethanol model, the gasoline price is the U.S. gasoline price converted to local currency per gallon.14

, where QBG is gasoline consumption for Brazil in million gallons. Flex-fuel and other vehicle data were obtained from the Brazilian Automotive Industry Yearbook (ANFAVEA 2005) and vehicle projections were obtained from UNICA 2006. In the Brazilian ethanol model, the gasoline price is the U.S. gasoline price converted to local currency per gallon.14

Reform Scenarios and Results

We consider two scenarios as deviations from the baseline. The first scenario is the removal of the trade distortions in the United States. The out-of-quota tariffs of 2.5% and 54¢ per gallon are removed for all U.S. ethanol imports. For CBI countries, the TRQ is also eliminated. The second scenario removes the trade barriers and the federal tax credit for refiners that blend ethanol with gasoline. In each scenario, the policy reforms are fully implemented in 2006 and their impact is measured in deviations for the years 2006 to 2015. We report the average of these annual changes as a summary indicator of the impacts. Table 2 summarizes the impact on the world, U.S., and Brazilian markets for the first scenario; table 3 presents the impacts for the second scenario.15

| (US$/gallon) | (US$/cwt) Raw Sugar Price | (US$/bushel) Corn Price | (US$/ton) DDG Price | (US$/ton) Gluten Feed Price | ||

|---|---|---|---|---|---|---|

| Average 2006–2015 World | Ethanol Price | Crude Oil Price | ||||

| Baseline | 1.27 | 1.39 | 14.34 | 2.38 | 78.47 | 58.80 |

| Scenario 1 | 1.57 | 1.39 | 14.59 | 2.34 | 79.00 | 58.50 |

| % chg from baseline | 23.89% | 0.00% | 1.77% | −1.53% | 0.68% | −0.50% |

| (Million Gallons) | Share of Fuel Ethanol in Gasoline Consumption | (US$/gallon) Domestic Ethanol Price | ||||

|---|---|---|---|---|---|---|

| United States | Production | Consumption | Net Imports | Gasoline Consumption | ||

| Baseline | 7,063.80 | 7,458.87 | 396.04 | 152,796.54 | 0.046 | 1.95 |

| Scenario 1 | 6,563.66 | 7,730.73 | 1,169.05 | 152,962.58 | 0.048 | 1.68 |

| % chg from baseline | −7.23% | 3.75% | 199.04% | 0.11% | 3.74% | −13.57% |

| (Million Gallons) | ||||||

|---|---|---|---|---|---|---|

| Brazil | Production | Anhydrous Consumption | Hydrous Consumption | Total Consumption | Net Exports | Share of Sugarcane in Ethanol Production |

| Baseline | 6,164.54 | 1,443.50 | 3,574.47 | 5,017.97 | 1,146.92 | 0.534 |

| Scenario 1 | 6,730.05 | 1,410.04 | 3,444.13 | 4,854.18 | 1,877.14 | 0.560 |

| % chg from baseline | 9.10% | −2.32% | −3.74% | −3.32% | 63.96% | 4.87% |

| (US$/Gallon) | (US$/cwt) Raw Sugar Price | (US$/Bushel) Corn Price | (US$/ton) DDG Price | (US$/ton) Gluten Feed Price | ||

|---|---|---|---|---|---|---|

| Average 2006–2015 World | Ethanol Price | Crude Oil Price | ||||

| Baseline | 1.27 | 1.39 | 14.34 | 2.38 | 78.47 | 58.80 |

| Scenario 2 | 1.48 | 1.39 | 14.51 | 2.33 | 79.20 | 58.39 |

| % chg from baseline | 16.51% | 0.00% | 1.22% | −2.10% | 0.94% | −0.69% |

| (Million Gallons) | Share of Fuel Ethanol in Gasoline Consumption | (US$/gallon) Domestic Ethanol Price | ||||

|---|---|---|---|---|---|---|

| United States | Production | Consumption | Net Imports | Gasoline Consumption | ||

| Baseline | 7,063.80 | 7,458.87 | 396.04 | 152,796.54 | 0.046 | 1.95 |

| Scenario 2 | 6,384.51 | 7,310.96 | 928.74 | 152,699.71 | 0.045 | 1.59 |

| % chg from baseline | −9.92% | −2.12% | 136.97% | −0.06% | −2.26% | −18.38% |

| (Million Gallons) | Share of Sugarcane in Ethanol Production | |||||

|---|---|---|---|---|---|---|

| Brazil | Production | Anhydrous Consumption | Hydrous Consumption | Total Consumption | Net Exports | |

| Baseline | 6,164.54 | 1,443.50 | 3,574.47 | 5,017.97 | 1,146.92 | 0.534 |

| Scenario 2 | 6,553.90 | 1,420.39 | 3,484.43 | 4,904.82 | 1,650.07 | 0.552 |

| % chg from baseline | 6.26% | −1.61% | −2.58% | −2.29% | 44.01% | 3.39% |

Scenario 1: Impact of Trade Liberalization

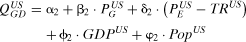

With the removal of the tariffs, the U.S. domestic ethanol price decreases by 13.6%, which results in a 7.2% decline in ethanol production and a 3.8% increase in consumption. The lower domestic price leads to a rise in the share of fuel ethanol in gasoline consumption by 3.7%. Given the lower domestic ethanol price, consumers are substituting gasoline blended with ethanol for gasoline blended with other additives. The removal of trade distortions in the United States and the corresponding higher U.S. ethanol demand increases the world ethanol price by 23.9% on average over the simulation period (table 1). With the open border, the world ethanol price is $1.57 per gallon and the U.S. domestic ethanol price is $1.68 per gallon. Thus, the U.S. domestic ethanol market now sees the world ethanol price plus the transportation cost. Because of their significantly smaller domestic ethanol markets, the impact of demand by countries such as Japan and the EU-15 on the world ethanol price is marginal relative to the United States and Brazil.

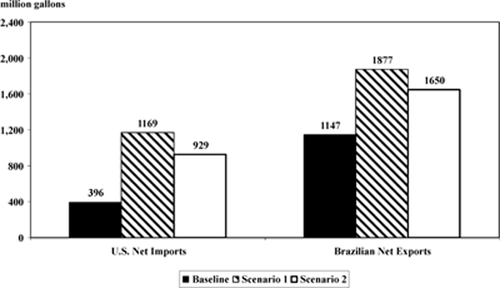

U.S. net imports of ethanol increase by 199% (figure 2). Given that net imports make up only 5.3% of domestic consumption in the baseline, the large increase in net imports in the first scenario translates to a 15.1% share of imports in total U.S. domestic consumption. Since the tariffs are removed, Brazil can now export ethanol to the United States directly without having to go through the CBI countries to avoid the tariff as is the case under the closed border. Therefore, trade diversion occurs, and we assume that ethanol imports from CBI countries decline to zero and that Brazil makes up for the decline with higher exports to the United States. However, it is possible that some ethanol imports may continue to come from CBI countries. If ethanol prices are competitive, CBI countries may use domestic feedstock to produce ethanol for exporting to the United States.

Net trade impacts

The lower domestic production of ethanol translates into a reduced demand for corn in the United States. Thus, the corn price declines by 1.5% on average relative to the baseline. Given the decline in corn used in ethanol production, the production of by-products decreases, by 7.1% for DDG, and by 1.7% each for gluten feed, gluten meal, and corn oil. The reduction in the production of DDG increases the price of DDG by 0.7%. The price of gluten meal increases by 0.9% because of its production decline. However, the prices of gluten feed and corn oil fall by 0.5% and 0.2%, respectively, as the impact from the lower corn price, which decreases the cost of production, exceeds the impact from lower production.

Brazil responds to the higher world ethanol price by increasing its production by 9.1% on average relative to the baseline. Total ethanol consumption decreases by 3.3% and net exports increase by 64%. The higher ethanol price leads to an increase in the share of sugarcane used in ethanol production by 4.9%. This results in less sugarcane used in sugar production, which decreases sugar production in Brazil. The lower supply of Brazilian sugar leads to an increase in the world raw sugar price by 1.8% on average.

Since trade barriers are usually set in place to protect the domestic industry and keep competing foreign products out, the results show that the import tariff in the United States is achieving the desired goal by keeping Brazilian ethanol out of the U.S. domestic market. However, trade barriers contribute to price volatility in the U.S. ethanol market, which can be dampened by opening the borders. The world ethanol market deepens with the removal of the tariff. With the increase in imports in the U.S., this provides less volatility in ethanol prices in the domestic ethanol market. Hence, trade is a way to mitigate price surges from shocks within the United States from ethanol expansion.

Scenario 2: Impact of Trade Liberalization and Tax Credit Removal

In this scenario, in addition to the removal of the tariffs in the United States, the 51¢-per-gallon federal tax credit is removed. The simulation results are presented in table 3. U.S. ethanol consumption decreases by 2.1% as the tax credit for refiners is removed. The U.S. domestic ethanol price decreases by 18.4%, which is a larger drop compared to the first scenario, since U.S. ethanol consumption is lower as consumers now see a higher effective price. In response to the lower domestic price, production decreases by 9.9% compared to the 7.2% decline in the first scenario. The world ethanol price increases by 16.5% on average compared to the baseline, which is also lower than in scenario 1. The impact on the corn by-products market is similar to that in the first scenario, particularly in direction.

Welfare Analysis Results

To calculate welfare changes, each scenario is evaluated relative to the baseline using change in producer surplus, consumer surplus, and tariff revenue. The welfare impacts are computed for the U.S. and Brazilian ethanol industries, the U.S. corn market, and the Brazilian sugarcane market.

Table 4 shows the welfare impacts of U.S. trade liberalization on U.S. and Brazilian consumers and producers. With trade liberalization, U.S. ethanol and corn producers lose because of the decline in the U.S. domestic ethanol and corn prices. Alternatively, U.S. ethanol consumers experience a gain in consumer surplus. The loss of tariff revenue totals $74.6 million. Brazilian ethanol producers benefit from the increase in the world ethanol price while Brazilian consumers lose a part of their consumer surplus. The higher demand for ethanol increases the sugarcane price in Brazil, which in turn translates into an increase in the producer surplus of sugarcane producers.

| (1995 Million U.S. Dollars) | ||||

|---|---|---|---|---|

| Average 2006–2015 Category | Change in Producer Surplus | Change in Consumer Surplus | Tariff Revenue | Net Welfare Change |

| U.S. ethanol market | −1,188.89 | 1,430.15 | −74.58 | 166.68 |

| U.S. corn market | −307.24 | −307.24 | ||

| Brazil ethanol market | 567.91 | −386.47 | 181.44 | |

| Brazil sugarcane market | 42.92 | 42.92 | ||

Table 5 shows the welfare impacts of the removal of the tariff and tax credit. In this scenario, the decrease in U.S. domestic ethanol price results in a decline in the producer surplus of U.S. ethanol producers. The producer surplus for corn producers also declines as the U.S. corn price falls. The change in U.S. consumer surplus is affected by the decline in the U.S. domestic ethanol price and the increase in the effective ethanol price (domestic price minus tax credit) that the ethanol consumers see. The second effect comes from the removal of the tax credit, which is no longer passed on to the consumers. When computing the change in consumer surplus, both effects are taken into consideration. Thus, ethanol consumers see a net decline in their consumer surplus. Given the higher world ethanol price, Brazilian ethanol and sugarcane producers see a net gain while ethanol consumers experience a loss in consumer surplus.

| (1995 Million U.S. Dollars) | ||||

|---|---|---|---|---|

| Average 2006–2015 Category | Change in Producer Surplus | Change in Consumer Surplus | Tariff Revenue | Net Welfare Change |

| U.S. ethanol market | −1,541.64 | −750.02 | −101.00 | −2,392.66 |

| U.S. corn market | −419.89 | −419.89 | ||

| Brazil ethanol market | 377.72 | −271.36 | 106.36 | |

| Brazil sugarcane market | 29.31 | 29.31 | ||

Sensitivity Analysis

We conduct sensitivity analysis and rerun the two scenarios in a series of alternative assumptions on prices responses of supply and demand.16 We first double the original price response elasticities in supply, demand, and inventory equations for all countries in the ethanol model. We then decrease them by half with respect to their original values.

In the first scenario, when the elasticities are doubled and U.S. trade distortions are removed, the model becomes more price responsive. The trade policy reforms induce larger marginal changes in supply, demand, trade, and the world ethanol price. The increase in ethanol demand in the United States is larger. This results in a larger increase in net imports of ethanol and a larger increase in the world ethanol price compared to the original scenario. In response, Brazil expands its ethanol production beyond the levels in the original scenario, with a larger decline in Brazilian total ethanol consumption. Consequently, Brazilian net exports of ethanol increase by a more significant amount. We find that the same holds true for the second scenario when elasticities are doubled.

With the halving of elasticities the tendencies are reversed with the responses being smaller than they were in the original scenarios. As in the doubling of the elasticities, the qualitative results of the original analysis are maintained. The direction of changes is unaffected by changes in elasticities with the exception of the world sugar price when elasticities are halved. The world sugar price declines instead of increasing as it did in the original scenarios. In the first scenario, the removal of the trade barriers induces a smaller increase in the world ethanol price and, with elasticities halved, the increase in Brazilian ethanol production is smaller than in the original scenario. Brazilian ethanol production increases by 5.5% instead of 9.1% so that the increase in the share of sugarcane in ethanol production is 2.4% instead of almost 5% in the original scenario 1. Since the elasticities are unchanged in sugarcane production, sugarcane production responds to the higher ethanol price and more sugarcane goes into sugar production. The higher supply in Brazilian sugar induces the reduction in the world sugar price. In the original scenario with higher elasticities, the increase in ethanol production is larger, therefore more sugarcane went into the production of ethanol than sugar such that the supply of sugar fell and the world sugar price increased.

Conclusions

The study finds that trade barriers in the United States have been effective in protecting the ethanol industry and keeping domestic prices strong. Under current policy, there is a separability of the U.S. ethanol market from world ethanol markets. When the tariff is removed, the United States sees the world price (plus transportation costs). However, the world ethanol price is also impacted by U.S. trade since the United States is not a small country importer. Under free trade, the world ethanol price increases as U.S. ethanol imports increase. Brazil, with its comparative advantage in ethanol production, would benefit from the tariff removal. With trade liberalization, the ethanol market deepens making it less susceptible to price volatility arising from demand and supply shocks.

The effect of the removal of trade distortions extends beyond the ethanol market, affecting corn and other crop markets and their by-products. We can extend the model to examine the food versus fuel debate, which has intensified as crop and food prices in the United States and the world increased with the expansion of the U.S. ethanol industry. The U.S. corn price is impacted by the change in the demand for corn used in ethanol production. The prices of other crops are also affected, as well as the area allocation among them. There are also implications on the food and livestock sectors. For example, the demand for corn resulting from ethanol expansion leads to an increase in the corn price and an increase in corn area harvested. Since land allocation depends on relative net returns, the increased corn area comes at the expense of other crops such as soybeans and wheat. This implies higher crop prices that ultimately affect the U.S. livestock sector through higher feed prices such as corn and soymeal. With open borders, the impact of ethanol expansion on crop, feed, and food prices would be mitigated by increased trade.

Trade liberalization also has consequences on world crop and feed markets beyond the United States as other countries respond to higher prices by increasing their supply of agricultural commodities and of ethanol. Thus, land allocation both in the United States and the world would change under free versus restricted trade when there is an ethanol expansion.

The second scenario adds the removal of the federal tax credit for refiners blending ethanol to the removal of the trade barriers in the United States. The marginal impact of the tax credit removal is a reduction in the refiners' and final consumers' demand for ethanol. The scenario results show that the tax credit acts as consumption subsidy for ethanol consumers. This is based on the assumption that the tax credit is passed on completely from the blenders to the final consumers. The results show that the impact of removal of the tax credit, that is a reduction in ethanol demand, overrides the impact of the tariff removal, which leads to an increase in ethanol demand.

It is important to note that given the emerging nature of the ethanol markets, our analysis of the two scenarios comes with some caveats. Data availability and consistency are limited, and the time series for ethanol data is very short making econometric estimations difficult. Although we remove the tax credit at the federal level, there are various state-level regulations targeting ethanol that are not incorporated into the aggregate U.S. model. It is also important to note that the increasing popularity of FFVs in Brazil, and to a lesser extent in the United States, may change the dynamics of how ethanol markets respond to a price change. As the number of FFVs increase, the complementary relationship between gasoline and ethanol becomes less pronounced while the substitution effect becomes stronger. This in turn changes the demand response, which may change the results of our policy scenarios.

For the two scenarios, we also conduct welfare analysis, which show that U.S. ethanol and corn producers benefit from the tariff and the tax credit. This implies that there is wealth creation through trade distortions as U.S. policy is transferring income to ethanol and corn producers from other sectors such as livestock. With the tariff removal, the pressure on domestic corn demand is reduced, which frees up corn for domestic food and feed use.

There are also environmental implications resulting from trade liberalization. Corn-based ethanol provides 20–25% savings on carbon emissions relative to fossil energy while sugarcane-based ethanol provides about 80% savings on carbon emissions. With open borders, U.S. ethanol demand would be partly met by sugarcane-based ethanol. As part of future research, this issue could be addressed using an extension of this modeling framework.