Codetermination on the audit committee: An analysis of potential effects on audit quality

Abstract

This paper empirically investigates the association between codetermination on the audit committee (AC) and audit quality. Using a sample of 655 firm-year observations related to German CDAX companies, our results indicate that the presence of employee representatives on the AC is negatively associated with audit quality. This negative association can also be observed for the percentage of employee representatives serving on the AC. However, our analyses show that the mentioned findings turn insignificant when employee representatives have accounting expertise. In addition, the type of employee representatives seems to influence audit quality differently: our findings turn insignificant for employee representatives who are classified as company outsiders and, thus, expected to be more independent. These findings highlight the importance of accounting expertise and independence for AC members' monitoring effectiveness. To the best of our knowledge, this study is the first that analyses the impact of codetermination on the AC on audit quality.

1 INTRODUCTION

In recent years, the influence of codetermination1 has gained considerable interest. In the 1970s, codetermination rules existed in only eight present member states2 of the European Economic Area (EEA) (Conchon, 2011). Nowadays, however, the majority of the 31 EEA member states have introduced a form of codetermination: in 2017, 14 countries had wide-ranging participation rights for employee representatives in both the public and private sector, five countries limited participation rights to state-owned or privatized companies, and 12 countries did not have any (or extremely limited) participation rights for employees (European Trade Union Institute, 2017).3 Thus, companies in 19 EEA member states are directly affected by codetermination. Furthermore, countries that have not enacted employee representation rights yet discuss the possibility of implementation. For instance, the former British Prime Minister, Theresa May, was considering an extension of workers' rights during her term of office (Weidenfeld, 2016).

Although employee representation is widespread in Europe, it gains in importance all over the world, particularly in the United States. For instance, this is reflected in the Reward Work Act, which was introduced but not enacted in 2018. The aim of that bill was to enable employees to elect one third of the board of directors (Reward Work Act, 2018). In the same vein, Elizabeth Warren, the US senator from Massachusetts and presidential candidate, considers employee representation in her campaign agenda (Warren, 2018). According to her agenda, employee representatives should directly elect at least 40% of the board of directors. Even though these legislative proposals have not been transposed into national law yet, they have initiated a debate on the integration of employees into the American corporate governance system. The discussion above outlines the importance of research in the field of codetermination.

The scientific discourse concerning the introduction of codetermination currently particularly revolves around potential effects of codetermination on corporate performance, while audit quality has so far not been considered—even though codetermination affects the supervisory body of a company and might, in turn, also affect audit quality. Our study addresses this issue by analysing the potential impact of codetermination on audit quality.

To empirically examine the potential influence of employee representatives serving on the audit committee (AC) on audit quality, we run multivariate analyses on 655 firm-year observations related to companies listed on the German General Standard and Prime Standard market segments (CDAX) of the Frankfurt Stock Exchange for the period 2013–2017. Germany is particularly well suited to analyse potential impacts of board-level employee representation, as it has one of the most advanced codetermination systems in Europe (Page, 2018).

When codetermination is present on the AC, the two main requirements for a high-quality audit—accounting expertise and independence—are likely to be violated. Therefore, audit quality might be lower when codetermination is present on the AC. Contrary, codetermination on the AC might increase audit quality as employee representatives bring valuable company information to the AC, enhance the working atmosphere, and are intrinsically motivated to monitor aggressive earnings management and fraudulent actions. However, our findings show that the presence of employee representatives on the AC is negatively associated with audit quality. This negative association can also be documented concerning the percentage of employee representatives serving on the AC. However, our analyses show that these findings only hold if the employee representatives do not have accounting expertise (as defined by prior studies, e.g., DeFond, Hann, & Hu, 2005).4 In addition, we can observe a negative association between codetermination and audit quality only if the employee representatives serving on the AC are company insiders and, thus, less independent than external employee representatives who are not regularly employed at the company. These findings indicate that the potentially positive effects of codetermination on the AC do not dominate. Therefore, our results outline the importance of accounting expertise and independence for AC members' monitoring effectiveness.

To the best of our knowledge, our paper is the first that examines the association between codetermination on the AC and audit quality. Our findings outline the impact of codetermination on audit quality and, thus, contribute to the ongoing debate on the role of employee representatives in supervisory bodies. In addition, our findings give insights into which requirements employee representatives should meet to mitigate potential negative impacts on audit quality. Overall, our results are of interest for regulators, investors, shareholders and researchers in countries that have implemented codetermination on the AC or plan to do so.

The paper proceeds as follows. The next section provides an overview of codetermination in Germany. Sections 3 and 4 present relevant previous literature and develop the paper's hypotheses. The research design as well as data and sample selection are described in Sections 5 and 6. In Section 7, we present our results. To further strengthen our results, we conduct several robustness checks, which are presented in Section 8. In Section 9, we conclude and elaborate on potential limitations.

2 CODETERMINATION IN GERMANY

The German corporate governance system is organized as a two-tier board system. Thus, German companies have an executive and a supervisory board. While the executive board is in charge of managing the company, the supervisory board's primary responsibility is to supervise the executive board (Schilling, 2001). The German codetermination system contains board-level employee representation. More precisely, employee representatives are present on the supervisory, but not on the executive board. The supervisory board can establish subcommittees, for example, an AC. Legally, the AC of the supervisory board is not affected by codetermination. However, most of the German companies also apply the regulations on codetermination for the supervisory board to its subcommittees and, thus, on the AC (Vitols, 2008).

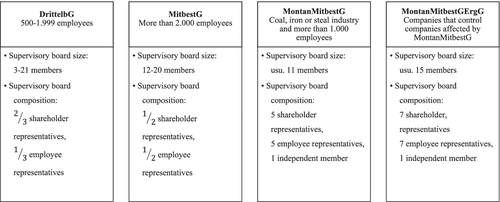

The proportion of employee representatives on the supervisory board depends on the size and industry of the company (as shown in Figure 1). When companies belong to the coal, iron or steel industries and they have at least 1,000 employees, they are subject to the Coal, Iron and Steel Codetermination Act (Montanmitbestimmungsgesetz [MontanMitbestG], 2015). In this case, the supervisory board regularly consists of 11 members. Five of them are shareholder representatives, five are employee representatives, and one is an independent member (Section 4, Paragraph 1 MontanMitbestG). Companies that are not subject to the Coal, Iron and Steel Codetermination Act but that control one or more companies affected by it must apply the Coal and Steel Codetermination Supplementary Act (Montanmitbestimmungsergänzungsgesetz [MontanMitbestGErgG], 2015, if these companies generate one fifth of the total turnover or employ one fifth of the group headcount. Then, the supervisory board consists of seven shareholder representatives, seven employee representatives, and one neutral member (Section 5, Paragraph 1 MontanMitbestGErgG).

For companies in other industries, codetermination depends on the size of the company. When listed companies have at least 500 employees, they are affected by codetermination. When companies' headcount is between 500 and 1,999, the One-Third Participation Act (Drittelbeteiligungsgesetz [DrittelbG], 2004) applies, and employee representatives hold at least one third of the voting rights on the supervisory board. If the companies' headcount exceeds the threshold of 2,000 employees, the Codetermination Act (Mitbestimmungsgesetz [MitbestG], 2015) applies, and employee and shareholder representatives share voting rights on the supervisory board equally. As decisions on the supervisory board require a majority, the chair's vote counts twice in the event of a tie (Section 29, Paragraph 1 MitbestG).

Employee representatives can be either external trade union representatives or internal employees of the company. The proportion of trade union representatives is determined by law and depends on the total number of employee representatives serving on the supervisory board. If a company is affected by the One-Third Participation Act, and this results in a maximum of two employee representatives being elected, these must be employees of the company and, thus, company insiders (Section 4, Paragraph 2 DrittelbetG). In accordance with the Codetermination Act, supervisory boards consist of at least six and no more than 10 employee representatives. Supervisory boards with six or eight employee representatives consist of four or six internal employees, respectively, and two trade union representatives (Section 7, Paragraph 1 MitbestG). If supervisory boards consist of 10 employee representatives, the proportion of union representatives increases to three (Section 7, Paragraph 1 MitbestG).

3 RELATED LITERATURE

The Codetermination Act (MitbestG) of 1976 obliged companies with more than 2,000 employees to share voting rights between employee representatives and shareholder representatives on the supervisory board equally for the first time. This law was enacted by a government of SPD and FDP (social democrats and liberals). Some believe that this law is a favour of the SPD to the traditionally closely linked trade unions, without bringing any economic benefit to the economy (FitzRoy & Kraft, 2005). However, other studies assume that codetermination on the supervisory board does have some advantages. One of these advantages might be that employee representatives are involved in the decision-making process of a company and, thus, increases the acceptance of the decision by the company's workforce (AKEIÜ, 2007; Benelli, Loderer, & Lys, 1987). From the employees' perspective, further advantages of codetermination are that these companies have greater job security and better working conditions (Gorton & Schmid, 2004). These factors can improve the working atmosphere, increase employee motivation, make the company a more attractive employer and reduce conflicts between management and employees (Lazear & Freeman, 1995; Lopatta, Böttcher, Lodhia, & Tideman, 2020).

In addition, there are several studies dealing with the influence of codetermination on financial performance indicators. Existing studies show inconsistent results. On the one hand, some studies find a negative influence of codetermination on the productivity of a company and its firm value (e.g., FitzRoy & Kraft, 1993; Gorton & Schmid, 2004; Gurdon & Rai, 1990). This negative effect may be explained by the employee representatives' resistance to corporate restructuring (Gorton & Schmid, 2004). In the same vein, employee representatives may favour projects with negative net present values if they increase job security or employees' remuneration (Benelli et al., 1987). On the other hand, some studies document a positive association between codetermination and key financial indicators like profitability or efficiency (e.g., Fauver & Fuerst, 2006; Renaud, 2007). The positive effect of codetermination on performance indicators may be explained by employee representatives providing valuable insider information on internal operational procedures (Fauver & Fuerst, 2006; Lopatta, Böttcher, & Jaeschke, 2018). In addition, employee representatives may be able to increase employee acceptance of management decisions (Bermig & Frick, 2011) and, thus, reduce employee reluctance, which might have a positive impact on companies' productivity.

Furthermore, there are two studies investigating the influence of codetermination on earnings management (Claassen, 2016; Eulerich & Fligge, 2019). While the paper by Claassen (2016) approximates the effects of codetermination by comparing parity with one third of codetermination on the supervisory board, Eulerich and Fligge (2019) use the codetermination index by Scholz and Vitols (2019). Contrary to our results, both papers find that codetermination on the supervisory board is negatively associated with earnings management. In contrast to these studies, we focus on the direct impact of employee representatives serving on the AC, as we believe that particularly the composition of the AC affects audit quality. In addition, our study goes even beyond their findings, as we are the first to examine the impact of codetermination in relation to accounting expertise and independence of employee representatives serving on the AC.

The German AC plays a major role in ensuring audit quality. In this regard, different skills of AC members are required to ensure a high-quality monitoring process. Following DeAngelo (1981), audit quality is defined as “the market-assessed joint probability that a given auditor will both (a) discover a breach in the accounting system, and (b) report the breach”. This definition consists of two components: the auditor's ability to find an accounting mismatch and the auditor's willingness to report the mismatch. In order to ensure a high-quality monitoring process, these criteria must be met not only by the external auditor but also by the members of the AC (Redenius-Hövermann, 2017).

The AC has a major influence on the external audit and its quality (Baumann & Ratzinger-Sake, 2020). First, the AC itself performs supervisory tasks within the company, which in particular include the supervision of the financial reporting process, the evaluation of the effectiveness of internal controls and the monitoring of the external and internal auditor (Section 2.D3 Deutscher Corporate Governance Kodex [DCGK], 2019). Second, the AC can influence the level of audit assurance with three actions (Abbott, Parker, Peters, & Raghunandan, 2003): One, the AC can propose a more qualified auditor with a higher reputation (Section 2.D3 DCGK). Two, the AC can ask for an extension of the quantity of audit procedures (Section 2.D3 DCGK). Three, the AC can strengthen the position of the external auditor in situations of conflict between the auditor and the management, as the AC is the auditor's primary contact at the company (Carcello & Neal, 2000; Köhler, 2005). To perform these three tasks properly, the AC has to be able to understand and interpret key financial figures and financial reports. Accordingly, prior studies examine the association between the presence of accounting expertise on the AC and audit quality measures (Bédard, 2010). For instance, Abbott, Parker, and Peters (2004) analyse the association between the presence of accounting experts on the AC and the probability of financial restatements in an American setting. They find a significant negative association between these two aspects. In addition, DeZoort and Salterio (2001) analyse the support from the AC for the auditor in auditor–management disputes in an experimental setting. Their findings indicate that accounting expertise is positively linked to the likelihood of supportive actions by the AC. Consistent with this finding, additional studies show that high-quality supervision of the audit process requires adequate knowledge of the audit standards and procedures (Bull & Sharp, 1989; Kral, 2016). Only if AC members meet these criteria, they are able to independently evaluate the issues and enhance the value of the external audit (Bull & Sharp, 1989; Kral, 2016).

Prior studies have shown that dependencies between the AC and the management lead to lower audit quality. Therefore, to ensure an adequate supervision of the audit process, the AC needs to be independent from the management. In line with this notion, Carcello and Neal (2003) demonstrate that ACs that include independent members are more efficient in protecting external auditors from dismissal after they have issued qualified audit opinions. An investigation of Bronson, Carcello, Hollingwoth, and Neal (2009) goes even beyond: the authors recommend that the entire AC should be composed exclusively of independent members in order to obtain the supervision benefits of an independent AC.

From a theoretical point of view, accounting expertise and independence of the AC members are extremely important. According to the literature on cognitive or behavioural biases and heuristics, observers are frequently assumed to be rational actors even though findings suggest that individual judgment, decision making and behaviour do not depend solely on logical reasoning but also on cognitive biases and heuristics (Fama, 1980; Kahneman & Tversky, 1979; Marnet, 2005; Tversky & Kahneman, 1974). Although the presence of expertise does not hold observers off using cognitive heuristics, it does reduce the resulting bias (Koch & Wüstemann, 2010). For instance, expertise gained from professional experience reduces anchoring effects as the observers use more appropriate and internal anchor values (Butler, 1986). Turning to the independence of an observer, independence problems may occur from the so called ‘self-fulfilling prophecy effect’. The effect describes the fear that an announcement of a warning signal may precipitate company's failure due to its negative impact on external stakeholders (Louwers, Messina, & Richard, 2007). This negative self-fulfilling prophecy effect might hold dependent AC members off detecting fraudulent actions and accounting mistakes, as they could be afraid to lose their employment at the company.

4 HYPOTHESES DEVELOPMENT

If codetermination is applied with regard to the AC, the two main requirements to ensure high audit quality, that is, accounting expertise and independence, are likely to be violated. Although at least a certain proportion of the AC's shareholder representatives are legally required to be independent and to have accounting expertise, employee representatives serving as members of the AC must not fulfil these criteria. In addition, employee representatives are elected by other employees independently of their professional experiences, which further reduce their likelihood of having accounting expertise. In order to increase supervisory boards' control efficiency, Säcker (2004) recommends to exclude employee representatives from the supervisory board (and thus from the AC). His main argument for this exclusion is the lack of accounting experience of employee representatives.

Further supervisory shortcomings could arise from the dependency of employee representatives, even though some authors consider employee representatives as independent solely due to their position (e.g., Lopatta et al., 2018). However, caution has to be applied, as conflicts of interest may arise from their dual employment as work council or trade union members and members of the supervisory board. The main interest of employee representatives is—as the term reflects—to represent the interests of employees and thus ensure job security. Therefore, problems occur when effective monitoring could lead to redundancies. In the same vein, Staake (2016) argues that employee representatives have an interest to conduct a ‘selective’ supervision, that is, a supervision that entirely focuses on the interest of employees, even in the short term. Taking this into account, employee representatives cannot be considered independent. Furthermore, Rieble (2016) notes that the remuneration structure of employee representatives is seriously compromising their independence. This particularly applies, when the executive board is able to influence the AC's decisions by increasing work council remuneration (Rieble, 2016).

In contrast, some studies suggest that codetermination on the AC has a positive impact on audit quality. As mentioned before, codetermination can enhance the working atmosphere (Lazear & Freeman, 1995; Lopatta et al., 2020), which in turn has a positive effect on financial reporting quality (Ji, Rozenbaum, & Welch, 2017). In the same vein, codetermination on the AC might increase employee satisfaction as employees' interests are represented on the AC. According to Ji et al. (2017), companies with lower levels of job satisfaction are more likely to be subject to SEC fraud enforcement actions and securities class action lawsuits, which indicates lower audit quality. Furthermore, employee representatives might be better informed about internal company processes, strategies and interrelationships than external members of the AC (AKEIÜ, 2007; Fauver & Fuerst, 2006). The employee representatives' company information might increase the effectiveness of the supervision and, thus, enhance audit quality. According to Claassen (2016), employee representatives consider aggressive earnings management as a threat to the remuneration of the workforce and the firm's solvency, revolving in a higher incentive to monitor the financial reporting process of a company.

Overall, as the discussion above illustrates, there are both arguments for higher and arguments for lower audit quality if employee representatives are present on the AC. Thus, we state our first H1 as follows:

H1.There is an association between employee representation on the AC and audit quality.

Prior studies show that the influence of codetermination on companies' financial performance depends on the proportion of employee representatives on the supervisory board or AC (e.g., FitzRoy & Kraft, 2005; Gorton & Schmid, 2004). For instance, Gorton and Schmid (2004) demonstrate that companies with partial codetermination on the supervisory board trade their stocks at a market discount of 31% compared to companies with an employee representative proportion of one third. This dependence on the proportion of employee representatives could also apply to audit quality. Thus, we assume that a higher proportion of employee representatives serving on the AC results in lower or higher audit quality. Therefore, we state H2 as follows:

H2.A higher proportion of employee representatives serving on the AC are associated with lower or higher audit quality.

One explanation for a potential negative association between codetermination on the AC and audit quality might be the employee representatives' shortcomings in accounting expertise (Säcker, 2004). Particularly, the AC members need to have sufficient accounting expertise to understand and interpret the company's financial statements and, thus, be able to fulfil their supervisory tasks properly (Quick, Höller, & Koprivica, 2008). Therefore, we state our H3 as follows:

H3.The presence of employee representatives on the AC is only associated with lower audit quality if employee representatives do not have any accounting expertise.

Another explanation for a potential negative association between codetermination and audit quality might be the employee representatives' shortcomings in independence. Independence of an employee representative is not directly observable. Therefore, we use the type of employee representatives as a surrogate for their independence. Similarly, to the literature on inside and outside directors, we distinguish between inside employee representatives who are regularly employed at the company and outside employee representatives who do not work for the company (DeZoort, Hermanson, Archambault, & Reed, 2002). One reason why we believe that outside employee representatives are more independent is that they do not have to supervise their own work. In addition, outside employee representatives cannot be directly influenced by an increase in the work council remuneration as only employees of the company can serve on the work council (Section 8 Betriebsverfassungsgesetz [BetrVG]). Thus, we state our H4 as follows:

H4.The presence of employee representatives on the AC is only associated with lower audit quality if employee representatives are company insiders.

5 RESEARCH DESIGN

For variable definitions, see Table 1.

| Variable | Empirical definition | Data | |

|---|---|---|---|

| Dependent variable and test variable | |||

| AQJ | Value of abnormal accruals based on the model by Jones (1991) | CG | |

| AQDSS | Value of abnormal accruals based on the model by Dechow et al. (1995) | CG | |

| AQKLWR | Value of abnormal accruals based on the model by Kothari et al. (2005) | CG | |

| Employee | 1 if the company has employee representatives on its AC; and 0 otherwise | FS | |

| %EmployeeAC | Number of employee representatives serving on the AC divided by the total number of AC members | FS | |

| %EmployeeExpert | Number of employee representatives with accounting expertise (as defined by prior studies, e.g., DeFond et al., 2005) serving on the AC divided by the total number of AC members | CV; PAS | |

| %EmployeeNoExpert | Number of employee representatives without accounting expertise (as defined by prior studies, e.g., DeFond et al., 2005) serving on the AC divided by the total number of AC members | CV; PAS | |

| %EmployeeIntern | Number of employee representatives employed within the company divided by the total number of AC members | FS; CV; PAS | |

| %EmployeeExtern | Number of external employee representatives serving on the AC divided by the total number of AC members | FS; CV; PAS | |

| Controls for AC characteristics | |||

| DirectorshipsChair | Number of additional directorships of AC's chairman | FS | |

| DirectorshipsMembers | Average number of additional directorships of AC members | FS | |

| ACChairExpert | 1 if the AC chairman has accounting expertise (as defined by prior studies, e.g., DeFond et al., 2005); and 0 otherwise | CV;PAS | |

| ACMemberExpert | Number of AC members with accounting expertise (as defined by prior studies, e.g., DeFond et al., 2005) divided by total number of AC members | CV; PAS | |

| ACOtherExpert | Number of AC shareholder representatives with accounting expertise (as defined by prior studies, e.g., DeFond et al., 2005) divided by total number of AC members | CV; PAS | |

| ACPayment | 1 if the AC members receive a fix compensation; and 0 otherwise | FS | |

| ACMeetings | Number of meetings held by the AC | FS | |

| ACSize | Number of members of the AC | FS | |

| FormerEB | 1 if a former executive board member is present on the AC; and 0 otherwise | FS; CV | |

| Controls for company characteristics | |||

| FirmSize | Natural logarithm of total assets | CG | |

| Losst−1 | 1 if the company has reported a loss in the year prior to the year of interest; and 0 otherwise | CG | |

| CFO | Operating cash flow divided by total assets | CG | |

| Leverage | Ratio of year-end total debt to total assets | CG | |

| SalesGrowth | Percentage of annual growth in total sales | CG | |

| PPEGrowth | Percentage of annual growth in property, plant, and equipment | CG | |

| BIG | 1 if the auditor is a Big4 audit firm; and 0 otherwise | AR | |

| Switch | 1 if the audit engagement is a first-year audit; and 0 otherwise | AR | |

| BTM | The ratio of book value of equity to market value of equity | CG | |

| Issuance | 1 if the company has issued equity; and 0 otherwise | CG | |

| Further variables used in robustness checks | |||

| %EmployeeACSize | Number of employee serving on the AC divided by the natural logarithm of total assets | FS; CG | |

| AQCS | 1 if a company's net income scaled by total assets is between 0% and 2%; and 0 otherwise | CG | |

| AQS | 1 if earnings exactly meet or beat the latest analysts' earnings forecast by one cent per share; and 0 otherwise | EI | |

| TotalEmployees | Natural logarithm of company's total employees | FS | |

| lnReportLag | Natural logarithm of number of calendar days between the date of the audit report and the company's year-end | FS | |

| EmployeeHigh | 1 if the proportion of employee representatives serving on the AC is above one third; and 0 otherwise | FS | |

| EmployeeLow | 1 if the proportion of employee representatives serving on the AC is below one third; and 0 otherwise | FS | |

| LNAF | Natural logarithm of audit fees | FS | |

| INVREC | Sum of inventory and receivables, divided by total assets | CG | |

| Segments | Natural logarithm of (business segments +1) | FS | |

| ROA | Net income before extraordinary items, divided by total assets | CG | |

| LQD | The ratio of current assets to current liabilities | CG | |

| NASAF | The ratio of nonaudit fees to total fees | FS | |

- Abbreviations: AC, audit committee; AR, audit reports; CG, Compustat Global Database; CV, AC member's curriculum vitae; EI, Thomson Reuters Eikon Database; FS, Companie's financial statements; PAS, other publicly available information.

We use three different measures of signed abnormal accruals in order to capture our dependent variable audit quality (AQ). First, we calculate the signed abnormal accruals based on the cross-sectional version of the Jones model (Jones, 1991) (AQJ). Second, we apply the modified Jones model (Dechow, Sloan, & Sweeney, 1995) (AQDSS), and third, we use the augmented Jones model including previous year's net income before extraordinary items, divided by total assets (ROA) as a determinant of accruals (Kothari, Leone, & Wasley, 2005) (AQKLWR).

To test our paper's H1, we include the test variable Employee in our model, which is a dummy variable that is equal to 1 if employee representatives are present on the AC and 0 otherwise. The test variable for H2 is %EmployeeAC, which reflects the proportion of employee representatives serving on the AC. To test our H3, we split the proportion of employee representatives serving on the AC into the proportion of employee representatives serving on the AC with (%EmployeeExpert) and without accounting expertise (%EmployeeNoExpert). In our last analysis, we test whether our H4 holds. Therefore, we split the proportion of employee representatives serving on the AC into internal employee (%EmployeeIntern) representatives and external employee (%EmployeeExtern) representatives. The variable %EmployeeIntern consists of work council members, some representatives of the senior management and some ordinary employees of the company, whereas the variable %EmployeeExtern mainly consists of union representatives and a few independent members. If our test variable is associated with lower (higher) audit quality, then the coefficient on our test variable is expected to be positive (negative).

5.1 AC characteristics

Prior literature has identified certain characteristics of the AC that are expected to have an impact on its effectiveness and its monitoring quality and, thus on audit quality (Bédard & Gendron, 2010). In particular, these characteristics include the meeting frequency, the number of members with accounting expertise and the size of the AC (Bédard & Gendron, 2010). While the meeting frequency and the number of members with accounting expertise should be positively associated with audit quality, empirical findings on the influence of AC size are mixed (Bédard, 2010). Furthermore, according to Sharma and Iselin (2012), the number of AC member's additional directorships is negatively associated with audit quality. In addition, studies focusing on AC compensation structure find that an incentive compensation of AC members is associated with lower AC independence and a higher probability of reporting failures, which indicates lower audit quality (Archambeault, DeZoort, & Hermanson, 2008). To control for the effects related to AC structure, we add seven independent variables to our model. In accordance with Tanyi and Smith (2015), we distinguish between AC members and AC chair expertise and directorships as these characteristics affect audit quality to a varying degree (DirectorshipsChair, DirectorshipsMembers, ACChairExpert, ACMemberExpert, ACPayment, ACMeetings, and ACSize).4 To test our H3, we replace the control variable ACMemberExpert with the variable ACOtherExpert, which is defined by the number of AC shareholder representatives with accounting expertise (as defined by prior studies, e.g., DeFond et al., 2005) divided by total number of AC members. We make this adjustment as our test variable %EmployeeExpert already reflects the proportion of employee representatives, which means we would count the proportion of employee representatives with accounting expertise twice, serving on the AC with accounting expertise.

In the German two-tier board system, further monitoring deficits can arise and, thus, reduce audit quality if former executive board members serve on the supervisory board and its committees (Behringer & Unruh, 2019). Therefore, we control for former executive board members on the AC by including the independent variable FormerEB in our model.

5.2 Company characteristics

We include a number of control variables that account for company characteristics and might affect audit quality. In accordance with Lesage et al. (2017), we control for company size (FirmSize), financial condition (Losst−1, CFO and Leverage), growth (SalesGrowth, PPEGrowth and BTM) and the issuance of equity (Issuance). Furthermore, as Big4 audit firms are expected to provide higher audit quality (e.g., Lin & Hwang, 2010), we control for whether the audit is performed by a Big4 audit firm or not (BIG). To account for a potential impact of auditor switches on audit quality, we add the dummy variable Switch that is equal to 1 if the client has changed the auditor and 0 otherwise (Tanyi, Raghunandan, & Barua, 2010).

6 SAMPLE SELECTION AND DESCRIPTIVE ANALYSIS

6.1 Sample selection

Our initial sample comprises all companies listed in the German CDAX index at the end of the years 2013–2017. The CDAX consists of all stocks of the Frankfurt Stock exchange listed in the General or Prime Standard segment. Therefore, it consists of large, middle, and small caps from a variety of industries. Due to varying company size and industry, our sample consists of companies with different proportions of employee representatives on the AC.

Starting from 2,161 firm-year observations, we exclude 339 observations for which relevant accounting data in Compustat Global Database was missing. Furthermore, we exclude 264 observations of companies in the financial sector and another 59 observations of companies that did not prepare their financial statements in accordance with the International Financial Reporting Standards (IFRS). In addition, we eliminate 198 observations where we were not able to gather information that had to be hand collected. At last, we exclude 646 observations of companies that have not established an AC in the period under consideration. This sample selection procedure leads to a final sample of 655 firm-year observations as shown in Table 2.

| Total | |

|---|---|

| All firm-year observations of companies listed in the CDAX at the end of the years 2013–2017 | 2,161 |

| Less: Firm-year observations with missing data in Compustat Global Database | 339 |

| Less: Firm-year observations in financial sector (SIC 6000–6999) | 264 |

| Less: Firm-year observations of companies that do not prepare their financial statements in accordance with IFRS | 59 |

| Less: Firm-year observations for which data that had to be hand collected could not be obtained | 198 |

| Less: Firm-year observations related to companies without an AC in the respective year | 646 |

| Final sample | 655 |

- Abbreviations: AC, audit committee; IFRS, International Financial Reporting Standards.

The data regarding the AC's characteristics was hand collected from the company's annual reports. To identify whether a current member of the AC has accounting expertise, we mainly looked at the curriculum vitae (CVs) of the AC members as these have to be published on the company's website and have to be updated on an ongoing basis in accordance with the requirements of the German Corporate Governance Code (Section 3.C14 DCGK). If a company does not provide this information or if a member of the AC has already resigned and the company has removed the CV from the company website, we used other publicly accessible sources (e.g., online professional network services) to identify whether an AC member has accounting expertise or not. Company's annual reports, CVs and other public available information were also used to identify whether an employee representative serving on the AC is an internal or an external AC member. Furthermore, we used CVs and companies' annual reports to identify former executive board member serving on the AC. Audit data were hand collected from companies' annual reports and from auditors' reports, respectively. Data were required to calculate our audit quality measures and our controls for company characteristics were obtained from the Compustat Global Database.

6.2 Descriptive analysis

Table 3 provides descriptive statistics regarding our sample. The means of our audit quality measures, which were calculated using the abnormal accrual models by Jones (1991), Dechow et al. (1995) and Kothari et al. (2005), are −0.005, −0.006 and −0.001, respectively. These mean values are largely consistent with the findings of previous studies (e.g., Menon & Williams, 2004).

| Variables | Mean | Median | SD | Min | Max |

|---|---|---|---|---|---|

| AQJ | −0.005 | −0.001 | 0.054 | −0.458 | 0.239 |

| AQDSS | −0.006 | −0.004 | 0.055 | −0.465 | 0.242 |

| AQKLWR | −0.001 | −0.000 | 0.059 | −0.429 | 0.555 |

| Employee | 0.664 | 1 | 0.473 | 0 | 1 |

| %EmployeeAC | 0.294 | 0.333 | 0.223 | 0 | 0.667 |

| %EmployeeExpert | 0.022 | 0 | 0.074 | 0 | 0.50 |

| %EmployeeNoExpert | 0.277 | 0.333 | 0.219 | 0 | 0.667 |

| %EmployeeIntern | 0.221 | 0.250 | 0.178 | 0 | 0.667 |

| %EmployeeExtern | 0.073 | 0 | 0.106 | 0 | 0.400 |

| DirectorshipsChair | 2.376 | 2 | 2.800 | 0 | 26 |

| DirectorshipsMembers | 1.992 | 1.500 | 1.704 | 0 | 13.500 |

| ACChairExpert | 0.656 | 1 | 0.475 | 0 | 1 |

| ACMemberExpert | 0.174 | 0 | 0.214 | 0 | 1 |

| ACCOtherExpert | 0.152 | 0 | 0.212 | 0 | 1 |

| ACPayment | 0.664 | 1 | 0.492 | 0 | 1 |

| ACMeetings | 4.392 | 4 | 1.661 | 0 | 11 |

| ACSize | 4.212 | 4 | 1.407 | 2 | 10 |

| FormerEB | 0.127 | 0 | 0.333 | 0 | 1 |

| FirmSize (000000 €) | 15,455.030 | 1,785.500 | 45,057.880 | 9.498 | 422,193.000 |

| Losst−1 | 0.185 | 0 | 0.388 | 0 | 1 |

| CFO | 0.059 | 0.075 | 0.127 | −1.023 | 0.396 |

| Leverage | 0.576 | 0.586 | 0.188 | 0.067 | 1.609 |

| SalesGrowth | 1.062 | 1.040 | 0.237 | 0.270 | 4.358 |

| PPEGrowth | 1.059 | 1.044 | 0.244 | 0 | 4.510 |

| BIG | 0.899 | 1 | 0.301 | 0 | 1 |

| Switch | 0.042 | 0 | 0.202 | 0 | 1 |

| BTM | −1.170 | 1.938 | 95.099 | −2,429.996 | 46.313 |

| Issuance | 0.180 | 0 | 0.385 | 0 | 1 |

| Further variables used in robustness checks | |||||

| %EmployeeACSize | 0.093 | 0.105 | 0.078 | 0 | 0.338 |

| AQCS | 0.145 | 0 | 0.352 | 0 | 1 |

| lnReportLag | 4.162 | 4.143 | 0.287 | 3.332 | 6.073 |

| AQS* | 0.064 | 0 | 0.246 | 0 | 1 |

| EmployeeHigh* | 0.103 | 0 | 0.305 | 0 | 1 |

| EmployeeLow* | 0.752 | 1 | 0.433 | 0 | 1 |

- Note. For definitions of the variables, please see Table 1.

- a Values calculated on the basis of the individual reduced samples used in the robustness checks.

Turning to our codetermination variables, we find that codetermination on the AC is present in 66.4% of all firm-year observations. As there are only legal requirements regarding the composition of the supervisory board but not for the composition of the AC, the proportion of employee representatives serving on the AC can exceed partial codetermination (Quick et al., 2008). In our sample, the proportion of employee representatives serving on the AC is 29.4% on average and ranges between 0% and 66.7%. The average proportion of employee representatives serving on the AC can be divided into 7.3% of external employee representatives and 22.1% of internal employee representatives. If we only consider those companies that are affected by codetermination, the proportion of employee representatives serving on the AC is 44.3% on average and ranges between 14.3% and 66.7%.

If we look at the expertise of the AC members and the chair, we see that on average 65.6% of the AC chairs have accounting expertise. If we consider only the regular members of the AC, the proportion of persons with accounting expertise declines to 17.4% on average. More precisely, the average number of AC members with accounting expertise consists of 2.2% employee representatives and 15.2% shareholder representatives.

The correlations between the variables included in our regression model are reported in Table 4. The matrix shows that all accrual measures are significant positively associated with employee representation on the AC per se. In the same vein, the proportion of employee representatives on the AC is positively correlated with all abnormal accrual measures.

| Variables | (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | (9) | (10) | (11) | (12) | (13) | (13b) |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| (1) AQJ | 1 | |||||||||||||

| (2) AQDSS | 0.977*** | 1 | ||||||||||||

| (3) AQKLWR | 0.797*** | 0.781*** | 1 | |||||||||||

| (4) %EmployeeAC | 0.129*** | 0.132*** | 0.071* | 1 | ||||||||||

| (5) Employee | 0.152*** | 0.153*** | 0.087** | 0.940*** | 1 | |||||||||

| (6) %EmployeeNoExpert | 0.109*** | 0.113*** | 0.058 | 0.966*** | 0.901*** | 1 | ||||||||

| (7) %EmployeeExpert | 0.085** | 0.080** | 0.055 | 0.190*** | 0.210*** | −0.068* | 1 | |||||||

| (8) %EmployeeIntern | 0.145*** | 0.148*** | 0.096** | 0.883*** | 0.881*** | 0.852*** | 0.173*** | 1 | ||||||

| (9) %EmployeeExtern | 0.028 | 0.029 | −0.012 | 0.614*** | 0.492*** | 0.596*** | 0.108*** | 0.172*** | 1 | |||||

| (10) DirectorshipsChair | 0.032 | 0.032 | 0.003 | 0.067* | 0.039 | 0.026 | 0.151*** | 0.037 | 0.079** | 1 | ||||

| (11) DirectorshipsMembers | 0.074* | 0.050 | 0.081** | −0.127*** | −0.140*** | −0.152*** | 0.076* | −0.152*** | −0.011 | 0.220*** | 1 | |||

| (12) ACChairExpert | −0.071* | −0.077** | −0.037 | −0.031 | −0.065* | −0.014 | −0.059 | −0.037 | −0.003 | −0.003 | 0.001 | 1 | ||

| (13) ACMemberExpert | −0.026 | −0.026 | −0.036 | −0.083** | −0.067* | −0.138*** | 0.205*** | −0.074* | −0.049 | −0.002 | −0.035 | −0.007 | 1 | |

| (13b) ACOtherExpert | −0.056 | −0.054 | −0.055 | −0.151*** | −0.141*** | −0.115*** | 0.144*** | −0.0136*** | −0.087** | −0.055 | −0.062 | −0.014 | 0.949*** | 1 |

| (14) ACPayment | 0.002 | −0.005 | −0.019 | −0.003 | −0.013 | −0.032 | 0.108*** | −0.046 | 0.072* | −0.054 | 0.033 | 0.037 | 0.043 | 0.056 |

| (15) ACMeetings | −0.055 | −0.054 | −0.020 | 0.271*** | 0.258*** | 0.256*** | 0.067* | 0.226*** | 0.188*** | 0.074* | 0.036 | 0.127*** | 0.000 | −0.023 |

| (16) ACSize | 0.099** | 0.100** | 0.060 | −0.629*** | 0.581*** | 0.585*** | 0.187*** | 0.513*** | 0.457*** | 0.267*** | 0.098** | −0.026 | −0.101** | −0.167*** |

| (17) FormerEB | 0.019 | 0.020 | 0.015 | −0.056 | −0.011 | −0.031 | −0.100** | −0.066* | −0.008 | 0.067* | −1.233*** | 0.034 | −0.065* | −0.031 |

| (18) FirmSize | 0.054 | 0.047 | 0.006 | 0.616*** | 0.551*** | 0.593*** | 0.124*** | 0.519*** | 0.421*** | 0.230*** | 0.015 | −0.028 | −0.051 | −0.095** |

| (19) Losst−1 | −0.048 | −0.037 | −0.033 | −0.218*** | −0.245*** | −0.193*** | −0.111*** | −0.225*** | −0.079** | −0.029 | 0.039 | 0.038 | 0.070* | 0.011*** |

| (20) CFO | −0.294*** | −0.299*** | −0.345*** | 0.180*** | 0.179*** | 0.181*** | 0.007 | 0.162*** | 0.101*** | 0.015 | −0.050 | 0.034 | 0.006 | 0.004 |

| (21) Leverage | −0.104*** | −0.102*** | −0.145*** | 0.345*** | 0.298*** | 0.339*** | 0.053 | 0.285*** | 0.244*** | 0.017 | −0.071* | −0.098** | −0.059 | −0.078** |

| (22) SalesGrowth | 0.023 | 0.031 | 0.065* | −0.212*** | −0.216*** | −0.216*** | 0.004 | −0.185*** | −0.133*** | −0.023 | 0.111*** | 0.020 | 0.162*** | 0.163*** |

| (23) PPEGrowth | −0.004 | −0.015 | 0.012 | −0.084** | −0.071* | −0.114*** | 0.130*** | −0.071* | −0.056 | 0.027 | 0.123*** | 0.034 | 0.136*** | 0.092** |

| (24) BIG | −0.050 | −0.067* | −0.057 | 0.295*** | 0.267*** | 0.306*** | −0.038 | 0.248*** | 0.201*** | 0.119*** | 0.153*** | 0.089** | 0.041 | 0.054 |

| (25) Switch | −0.025 | −0.016 | −0.043 | −0.028 | −0.010 | −0.025 | −0.014 | −0.022 | −0.022 | −0.015 | −0.007 | −0.061 | −0.043 | −0.038 |

| (26) BTM | 0.047 | 0.044 | 0.040 | 0.045 | 0.048 | 0.043 | 0.010 | 0.043 | 0.023 | 0.029 | 0.046 | 0.056 | −0.058 | −0.062 |

| (27) Issuance | −0.059 | −0.040 | −0.064 | −0.192*** | −0.213*** | −0.180*** | −0.060 | −0.163*** | −0.128*** | −0.003 | 0.018 | 0.038 | 0.036 | 0.057 |

| Variables | (14) | (15) | (16) | (17) | (18) | (19) | (20) | (21) | (22) | (23) | (24) | (15) | (16) | (27) |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| (14) ACPayment | 1 | |||||||||||||

| (15) ACMeetings | 0.042 | 1 | ||||||||||||

| (16) ACSize | 0.001 | 0.245*** | 1 | |||||||||||

| (17) FormerEB | −0.094** | −0.090** | −0.009 | 1 | ||||||||||

| (18) FirmSize | −0.112*** | 0.339*** | 0.550*** | −0.036 | 1 | |||||||||

| (19) Losst−1 | 0.051 | −0.041 | −0.184*** | −0.087** | −0.289*** | 1 | ||||||||

| (20) CFO | −0.100** | 0.055 | 0.134*** | 0.062 | 0.298*** | −0.469*** | 1 | |||||||

| (21) Leverage | 0.011 | 0.032 | 0.254*** | −0.042 | 0.381*** | −0.065* | 0.027 | 1 | ||||||

| (22) SalesGrowth | −0.013 | −0.114*** | −0.151*** | −0.042 | −0.160*** | 0.138*** | −0.081** | −0.150*** | 1 | |||||

| (23) PPEGrowth | 0.013 | −0.139*** | −0.088** | −0.035 | −0.098** | 0.021 | 0.023 | −0.095** | 0.377*** | 1 | ||||

| (24) BIG | −0.048 | 0.321*** | 0.242*** | 0.082** | 0.314*** | −0.167*** | 0.298*** | −0.007 | −0.070* | −0.026 | 1 | |||

| (25) Switch | −0.007 | 0.027 | −0.048 | 0.033 | −0.053 | −0.042 | 0.046 | 0.009 | −0.013 | 0.014 | 0.021 | 1 | ||

| (26) BTM | −0.026 | 0.080** | 0.029 | 0.011 | 0.083** | −0.081** | 0.194*** | −0.094** | 0.017 | 0.012 | 0.116*** | 0.008 | 1 | |

| (27) Issuance | 0.035 | −0.101*** | −0.147*** | −0.047 | −0.125*** | 0.278*** | −0.279*** | 0.002 | 0.231*** | 0.128*** | −0.147*** | −0.021 | −0.081** | 1 |

The correlation matrix shows that for the vast majority of our control variables, the correlations are below 0.3. However, as most of our codetermination variables are highly correlated with firm size (correlation between %EmployeeAC and FirmSize: 0.616; correlation between Employee and FirmSize: 0.551; correlation between %EmployeeNoExpert and FirmSize: 0.593; correlation between %EmployeeExpert and FirmSize: 0.124; correlation between %EmployeeIntern and FirmSize: 0.519; and correlation between %EmployeeExtern and FirmSize: 0.421), we calculate variance inflation factors (VIFs) to rule out multicollinearity concerns. In doing so, we find all VIFs are well below the threshold VIF of 10 (Gujarati & Porter, 2009). Therefore, we assume that multicollinearity is not likely to bias our results.

7 RESULTS

The results of our regressions testing for a potential association between codetermination on the AC and audit quality are presented in Table 5. Panel A of Table 5 shows that codetermination per se is significantly and positively associated with all three abnormal accrual measures (0.023 for AQJ [p = 0.007], 0.024 for AQDSS [p = 0.005], 0.016 for AQKLWR [p = 0.054]). Hence, we find a negative association between employee representation on the AC and audit quality. This result supports our H1.

| Panel A: Audit quality model—The influence of employee representation | ||||||

|---|---|---|---|---|---|---|

| Variables | AQJ | AQDSS | AQKLWR | |||

| β | t statistic | β | t statistic | β | t statistic | |

| Constant | −0.008 | −0.03 | −0.002 | −0.07 | −0.016 | −0.60 |

| Employee | 0.023*** | 2.73 | 0.024*** | 2.83 | 0.016* | 1.94 |

| DirectorshipsChair | −0.000 | −0.25 | −0.000 | −0.15 | −0.001 | −1.07 |

| DirectorshipsMembers | 0.002 | 1.20 | 0.001 | 0.94 | 0.002 | 0.95 |

| ACChairExpert | −0.005 | −1.05 | −0.005 | −1.20 | −0.002 | −0.41 |

| ACMemberExpert | 0.001 | 0.08 | 0.001 | 0.07 | −0.006 | −0.42 |

| ACPayment | 0.000 | 0.00 | −0.001 | −0.28 | −0.005 | −1.02 |

| ACMeetings | −0.004*** | −2.63 | −0.004** | −2.43 | −0.003* | −1.67 |

| ACSize | −0.000 | −0.03 | 0.001 | 0.24 | 0.000 | 0.23 |

| FormerEB | 0.007 | 1.06 | 0.008 | 1.06 | 0.008 | 1.12 |

| FirmSize | 0.004** | 2.52 | 0.004** | 2.26 | 0.005*** | 2.83 |

| Losst−1 | −0.025*** | −2.90 | −0.024*** | −2.76 | −0.031*** | −3.55 |

| CFO | −0.214*** | −4.60 | −0.212*** | −4.44 | −0.268*** | −4.83 |

| Leverage | −0.065*** | −3.22 | −0.067*** | −3.16 | −0.075*** | −3.55 |

| SalesGrowth | 0.009 | 1.05 | 0.012 | 1.37 | 0.017 | 1.08 |

| PPEGrowth | −0.001 | −0.09 | −0.004 | −0.68 | 0.002 | 0.12 |

| BIG | −0.006 | −0.53 | −0.009 | −0.91 | −0.004 | −0.31 |

| Switch | 0.001 | 0.13 | 0.004 | 0.44 | −0.004 | −0.52 |

| BTM | 0.000*** | 3.57 | 0.000*** | 3.39 | 0.000*** | 3.06 |

| Issuance | −0.014** | −2.09 | −0.011*** | −1.63 | −0.020** | −2.31 |

| Year | Controlled | Controlled | Controlled | |||

| Industry | Controlled | Controlled | Controlled | |||

| Observations | 655 | 655 | 65 | |||

| Adj. R2 | 21.10% | 20.40% | 24.30% | |||

| Panel B: Audit quality model—The influence of employee representation: Proportion of employee representation | ||||||

|---|---|---|---|---|---|---|

| Variables | AQJ | AQDSS | AQKLWR | |||

| β | t statistic | β | t statistic | β | t statistic | |

| Constant | 0.000 | 0.01 | 0.007 | 0.24 | −0.007 | −0.25 |

| %EmployeeAC | 0.050** | 2.56 | 0.053*** | 2.71 | 0.038* | 1.97 |

| DirectorshipsChair | −0.000 | −0.30 | −0.000 | −0.19 | −0.001 | −1.06 |

| DirectorshipsMembers | 0.002 | 1.14 | 0.001 | 0.89 | 0.002 | 0.96 |

| ACChairExpert | −0.006 | −1.24 | −0.006 | −1.39 | −0.003 | −0.53 |

| ACMemberExpert | 0.002 | 0.15 | 0.002 | 0.14 | −0.005 | −0.36 |

| ACPayment | −0.000 | −0.09 | −0.002 | −0.38 | −0.005 | −1.09 |

| ACMeetings | −0.004** | −2.52 | −0.004** | −2.32 | −0.002 | −1.61 |

| ACSize | −0.000 | −0.15 | 0.000 | 0.08 | −0.000 | −0.01 |

| FormerEB | 0.009 | 1.29 | 0.009 | 1.30 | 0.010 | 1.29 |

| FirmSize | 0.004** | 2.33 | 0.004** | 2.04 | 0.004** | 2.59 |

| Losst−1 | −0.026*** | −3.01 | −0.025*** | −2.87 | −0.032*** | −3.61 |

| CFO | −0.215*** | −4.60 | −0.213*** | −4.44 | −0.269*** | −4.85 |

| Leverage | −0.067*** | −3.24 | −0.069*** | −3.19 | −0.077*** | −3.59 |

| SalesGrowth | 0.008 | 0.94 | 0.011 | 1.25 | 0.017 | 1.06 |

| PPEGrowth | 0.000 | 0.00 | −0.004 | −0.57 | 0.002 | 0.14 |

| BIG | −0.006 | −0.57 | −0.010 | −0.96 | −0.004 | −0.36 |

| Switch | 0.002 | 0.21 | 0.005 | 0.50 | −0.003 | −0.46 |

| BTM | 0.000*** | 3.59 | 0.000*** | 3.42 | 0.000*** | 3.07 |

| Issuance | −0.014** | −2.14 | −0.012* | −1.68 | −0.021** | −2.33 |

| Year | Controlled | Controlled | Controlled | |||

| Industry | Controlled | Controlled | Controlled | |||

| Observations | 655 | 655 | 655 | |||

| Adj. R2 | 20.80% | 20.10% | 24.40% | |||

- Note. For definitions of the variables, please see Table 1.

- * p < 0.10.

- ** p < 0.05.

- *** p < 0.01.

In the same vein, Panel B of Table 5 shows that the proportion of employee representatives on the AC is also positively associated with our three abnormal accrual measures (0.050 for AQJ [p = 0.011], 0.053 for AQDSS [p = 0.008], 0.038 for AQKLWR [p = 0.050]). This indicates that a higher proportion of employee representatives on the AC are negatively associated with audit quality, which supports H2. Overall, both findings indicate that codetermination on the AC is likely to reduce audit quality.

We have assumed that the negative association between codetermination and audit quality arises from the shortcomings in accounting expertise of employee representatives. To test this assumption, we rerun our main regression analysis and split our test variable %EmployeeAC into the proportion of employee representatives serving on the AC with (%EmployeeExpert) and without (%EmployeeNoExpert) accounting expertise. In doing so, we find that only %EmployeeNoExpert is significantly and negatively associated with audit quality ( 0.049 for AQJ [p = 0.013], 0.052 for AQDSS, [p = 0.009], and 0.038 for AQKLWR [p = 0.055]). In contrast, we find %EmployeeExpert to be insignificant for all audit quality proxies (0.051 for AQJ, [p = 0.144], 0.053 for AQDSS [p = 0.125], and 0.026 for AQKLWR [p = 0.367]). This result indicates that employee representatives' shortcoming in lack of accounting expertise may be one reason for the negative association between codetermination on the AC and audit quality. This finding supports our H3. The results of this analysis are provided in Table 6.

| Audit quality model—Employee representatives expertise | ||||||

|---|---|---|---|---|---|---|

| Variables | AQJ | AQDSS | AQKLWR | |||

| β | t statistic | β | t statistic | β | t statistic | |

| Constant | 0.001 | 0.04 | 0.008 | 0.26 | −0.007 | −0.24 |

| %EmployeeNoExpert | 0.049** | 2.52 | 0.052*** | 2.66 | 0.038* | 1.93 |

| %EmployeeExpert | 0.051 | 1.47 | 0.053 | 1.54 | 0.026 | 0.90 |

| DirectorshipsChair | −0.000 | −0.33 | −0.000 | −0.22 | −0.001 | −1.03 |

| DirectorshipsMembers | 0.002 | 1.15 | 0.001 | 0.90 | 0.002 | 0.96 |

| ACOtherExpert | 0.001 | 0.08 | 0.001 | 0.07 | −0.005 | −0.34 |

| ACChairExpert | −0.006 | −1.22 | −0.006 | −1.38 | −0.003 | −0.54 |

| ACPayment | −0.001 | −0.12 | −0.002 | −0.41 | −0.005 | −1.10 |

| ACMeetings | −0.004*** | −2.59 | −0.004** | −2.39 | −0.002 | −1.61 |

| ACSize | −0.000 | −0.14 | 0.000 | 0.09 | −0.000 | −0.00 |

| FormerEB | 0.009 | 1.30 | 0.009 | 1.31 | 0.010 | 1.30 |

| FirmSize | 0.004** | 2.32 | 0.004** | 2.04 | 0.004*** | 2.58 |

| Losst−1 | −0.026*** | −2.94 | −0.025*** | −2.80 | −0.031*** | −3.52 |

| CFO | −0.215*** | −4.58 | −0.213*** | −4.42 | −0.269*** | −4.84 |

| Leverage | −0.067*** | −3.25 | −0.069*** | −3.20 | −0.077*** | −3.59 |

| SalesGrowth | 0.008 | 0.96 | 0.011 | 1.28 | 0.017 | 1.06 |

| PPEGrowth | −0.001 | −0.09 | −0.004 | −0.64 | 0.002 | 0.12 |

| BIG | −0.006 | −0.52 | −0.010 | −0.91 | −0.004 | −0.35 |

| Switch | 0.002 | 0.20 | 0.005 | 0.49 | −0.003 | −0.46 |

| BTM | 0.000*** | 3.56 | 0.000*** | 3.39 | 0.000*** | 3.06 |

| Issuance | −0.014** | −2.12 | −0.012* | −1.66 | −0.021** | −2.33 |

| Year | Controlled | Controlled | Controlled | |||

| Industry | Controlled | Controlled | Controlled | |||

| Observations | 655 | 655 | 655 | |||

| Adj. R2 | 20.70% | 20.00% | 24.30% | |||

- Note. For definitions of the variables, please see Table 1.

- * p < 0.10.

- ** p < 0.05.

- *** p < 0.01.

Furthermore, we have assumed that another explanation for the negative association between codetermination and audit quality is shortcomings in independence of employee representatives. As the independence of the employee representatives is not directly observable, we use the type of employee representatives as a surrogate for their independence. We assume that internal employee representatives are less independent than external employee representatives. Thus, we expect only the internal employee representatives to be significantly and positively associated with discretionary accruals (and, thus, negatively associated with audit quality). To test our H4, we split our test variable %EmployeeAC into the proportion of internal (%EmployeeIntern) and external (%EmployeeExtern) employee representatives serving on the AC. In line with our expectation, we find that only our test variable %EmployeeIntern is significantly and negatively associated with audit quality (0.056 for AQJ [p = 0.006], 0.060 for AQDSS [p = 0.004], and 0.046 for AQKLWR [p = 0.025]). We find insignificant result for our test variable %EmployeeExtern (0.024 for AQJ [p = 0.369], 0.028 for AQDSS [p = 0.302], and 0.011 for AQKLWR [p = 0.661]). This finding supports our H4. The results of this analysis are shown in Table 7.

| Audit quality model—Type of employee representatives | ||||||

|---|---|---|---|---|---|---|

| Variables | AQJ | AQDSS | AQKLWR | |||

| β | t statistic | β | t statistic | β | t statistic | |

| Constant | −0.006 | −0.21 | 0.001 | 0.04 | −0.014 | −0.49 |

| %EmployeeExtern | 0.024 | 0.90 | 0.028 | 1.03 | 0.011 | 0.44 |

| %EmployeeIntern | 0.056*** | 2.79 | 0.060*** | 2.92 | 0.046** | 2.26 |

| DirectorshipsChair | −0.000 | −0.31 | −0.000 | −0.20 | −0.001 | −1.08 |

| DirectorshipsMembers | 0.002 | 1.24 | 0.001 | 1.00 | 0.002 | 1.06 |

| ACMemberExpert | 0.002 | 0.15 | -(0.002 | 0.14 | −0.005 | −0.37 |

| ACChairExpert | −0.005 | −1.21 | −0.006 | −1.37 | −0.003 | −0.50 |

| ACPayment | 0.000 | 0.06 | −0.001 | −0.23 | −0.004 | −0.92 |

| ACMeetings | −0.004*** | −2.55 | −0.004** | −2.35 | −0.002 | −1.62 |

| ACSize | 0.000 | 0.05 | 0.001 | 0.26 | 0.000 | 0.19 |

| FormerEB | 0.009 | 1.33 | 0.009 | 1.34 | 0.010 | 1.33 |

| FirmSize | 0.004** | 2.40 | 0.004** | 2.10 | 0.004*** | 2.68 |

| Losst−1 | −0.025*** | −2.89 | −0.025*** | −2.76 | −0.031*** | −3.48 |

| CFO | −0.214*** | −4.58 | −0.212*** | −4.42 | −0.268*** | −4.82 |

| Leverage | −0.066*** | −3.19 | −0.068*** | −3.14 | −0.075*** | −3.53 |

| SalesGrowth | 0.008 | 0.97 | 0.011 | 1.28 | 0.017 | 1.06 |

| PPEGrowth | 0.000 | 0.00 | −0.004 | −0.57 | 0.002 | 0.14 |

| BIG | −0.006 | −0.59 | −0.010 | −0.98 | −0.005 | −0.39 |

| Switch | 0.002 | 0.23 | 0.005 | 0.52 | −0.003 | −0.44 |

| BTM | 0.000*** | 3.58 | 0.000*** | 3.41 | 0.000*** | 3.07 |

| Issuance | −0.015** | −2.19 | −0.012* | −1.72 | −0.021** | −2.38 |

| Year | Controlled | Controlled | Controlled | |||

| Industry | Controlled | Controlled | Controlled | |||

| Observations | 655 | 655 | 655 | |||

| Adj. R2 | 20.90% | 20.20% | 24.50% | |||

- Note. For definitions of the variables, please see Table 1.

- * p < 0.10.

- ** p < 0.05.

- *** p < 0.01.

8 ROBUSTNESS CHECKS

We perform a variety of robustness checks to test the reliability of our results and to provide detailed insight on how codetermination on the AC affects audit quality.

Our first robustness check addresses potential size effects. In Germany, the number of employee representatives serving on the supervisory board is determined by law and depends on the size of the company and the company's industry. In addition, the number of supervisory board members is legally specified and increases with the number of employee representatives. Therefore, companies affected by codetermination tend to be larger and to have larger supervisory board committees. Given that companies affected by codetermination differ in these characteristics from companies without codetermination, we were not able to perform a matching in which treatment and nontreatment group do not differ concerning company and AC size. Since regression analyses based on low-quality matching techniques are expected to have lower explanatory power than ordinary regression analysis (Dichev & Tang, 2008), we do not perform a propensity score matching or other matching techniques. However, to rule out concerns regarding potential size effects, we rerun our regression with a modified test variable %EmployeeACSize that is given by the number of employees serving on the AC divided by FirmSize. As our results remain largely unchanged (0.179 for AQJ [p = 0.014], 0.192 for AQDSS [p = 0.010], 0.150 for AQKLWR [p = 0.055]), potential size effects do not seem to drive our results.

Second, we replace our dependent variable capturing audit quality using abnormal accrual measures with a binary variable (AQCS) that captures the tendency to report small profits (earnings benchmark test), calculated in accordance with Carey and Simnett (2006). In doing so, a company is classified as reporting a small profit if its net income deflated by lagged total assets is between 0% and 2%. Our results remain robust, as our test variables Employee, %EmployeeAC, %EmployeeNoExpert, and %EmployeeIntern remain significant and positively associated with the dependent variable AQCS and thus negatively associated with audit quality, while we find insignificant effect for our test variables %EmployeeExpert and %EmployeeExtern (1.089 for Employee [p = 0.032], 2.170 for %EmployeeAC [p = 0.048], 2.202 for %EmployeeNoExpert [p = 0.042], 0.880 for %EmployeeExpert [p = 0.616], 2.165 for %EmployeeIntern [p = 0.061], and 2.187 for %EmployeeExtern [p = 0.175]). In fact, this analysis shows that companies with codetermination on the AC are 13.5% less likely to report a small profit.5

Third, we replace our dependent variable capturing audit quality with a binary variable that measures the tendency to meet or beat an earnings target (AQS). Similar to prior literature, we use the last mean analyst forecast of the earnings per share before the annual earnings announcement as a benchmark (e.g., Rajgopal, Srinivasan, & Zheng, 2020; Reichelt & Dechun, 2010). We exclude 111 observations from our sample, as analyst forecasts in Thomson Reuters Eikon Database on earnings per share were not available for these observations. Our dependent variable is coded one if the firm's annual earnings per share meet analysts' consensus or beat it by exactly one cent per share. In doing so, we find that companies with codetermination on the AC are 9.1% more likely to meet or beat an earnings target (1.512 for Employee [p = 0.002] and 2.979 for %EmployeeAC [p = 0.006]).6 Following DeFond and Zhang (2014), meeting or beating an earnings target indicates lower independence of the auditor and, thus, lower audit quality. In line with our prior audit quality analyses, our results turn insignificant if employee representatives have sufficient accounting expertise (3.030 for %EmployeeNoExpert [p = 0.005], 1.094 for %EmployeeExpert, [p = 0.753]) or are classified as company outsiders (3.167 for %EmployeeIntern [p = 0.005] and 1.890 for %EmployeeExtern [p = 0.391]).

Fourth, we replace our audit quality proxies using abnormal accrual measures with a variable (lnReportLag) capturing audit effort (audit report lag) (Knechel & Sharma, 2012). The audit report lag is defined as the number of calendar days between the date of the audit report and the company's year-end. In the context of codetermination, we find that both codetermination per se and higher proportions of employee representatives on the AC are negatively associated with the length of the audit report lag (−0.123 for Employee [p = 0.007], −0.297 for %EmployeeAC [p = 0.004]). This finding suggests that companies with codetermination on the AC are associated with lower audit effort. One explanation for these findings could be that auditors assume that the company's audit risk is lower when employee representatives are present on the AC and, thus, lower their extent of audit procedures. In the same vein, auditors might believe that employee representatives are interested in reducing aggressive earnings management and fraudulent actions as they are a threat to the remuneration of the workforce and company's solvency (Claassen, 2016). In addition, auditors might believe that employee representatives are interested in the long-term success of the company, to ensure job security and, thus, assume that codetermination on the AC revolves in an extension of supervisory tasks of the AC (Gorton & Schmid, 2004). Problems may occur if effective monitoring leads to job losses or if the employee representatives are not able to identify the need for an extension of supervisory tasks of the AC (Staake, 2016). Another explanation might be that ACs affected by codetermination generally ask for lower extent of audit procedure from the auditor. The lack of accounting expertise of the employee representatives on the AC may result in companies affected by codetermination being less likely to recognize the need for an extension of the audit procedures by the auditor (Quick et al., 2008; Säcker, 2004). Thus, these companies require fewer audit procedures than other companies. The fact that our finding is only documented for employee representatives serving on the AC without accounting expertise supports this assumption (−0.310 for %EmployeeNoExpert [p = 0.003] and −0.111 for %EmployeeExpert [p = 0.651]). If we differentiate between external and internal employee representatives, our finding holds for both types of employee representatives serving on the AC (−0.289 for %EmployeeIntern [p = 0.007] and −0.328 for %EmployeeExtern [p = 0.053]). Thus, differences in audit effort cannot be explained by the independence of the employee representatives serving on the AC.

Fifth, we analyse whether codetermination on the AC affects the level of audit fees. Taken our main analysis into account, we assume audit fees to be lower if codetermination is present on the AC as audit fees are considered as an input-based proxy for audit quality (DeFond & Zhang, 2014). In addition, prior literature finds a positive association between AC expertise or independence and the level of audit fees (e.g., Abbott et al., 2003). Due to the employee representatives' shortcomings in accounting expertise and independence, we expect audit fees to be lower. Furthermore, audit fees might be lower as audit fees reflect the auditors' business risk assessment, which might be lower due to the potential positive effects of codetermination (Huang, Masli, Meschke, & Guthrie, 2017). To test these assumptions, we adapt the audit fee model from Lesage et al. (2017).7 However, we do not find the presence of employee representatives on the AC to be significantly associated with the level of audit fees (Employee: −0.096 and p = 0.312; %EmployeeAC: −0.041 and p = 0.860). This finding indicates that codetermination on the AC does not significantly influence the audit fee negotiation process.

Sixth, we attempt to reveal more clearly whether differences in the proportion of employee representatives significantly drive the effects on audit quality. Most of the German companies apply the DrittelbG or MitbestG, and thus, employee representatives hold one third or half of the voting rights on the AC. Therefore, it is of particular interest whether codetermination in accordance with the DrittelbG instead of MitbestG would improve audit quality. To address this issue, we have to exclude all observations without codetermination from our sample. In addition, we generate two new test variables—EmployeeHigh and EmployeeLow. Both are dummy variables that are coded one if the proportion of employee representatives serving on the AC is above (EmployeeHigh)/below (EmployeeLow) one third. In doing so, we find that audit quality significantly increases if the proportion of employee representatives serving on the AC are below one third and, thus, below the threshold of the DrittelbG (EmployeeLow: −0.023 for AQJ [p = 0.014], −0.028 for AQDSS [p = 0.006], −0.0198 for AQKLWR [p = 0.022]). In contrast, we fail to find that companies with more than one third of employee representatives on the AC provide significantly lower audit quality than companies with exactly one third of employee representatives on the AC (EmployeeHigh: −0.009 for AQJ [p = 0.241], −0.011 for AQDSS [p = 0.152], −0.005 for AQKLWR [p = 0.385], −0.005 for EmployeeHigh [p = 0.385]). This finding indicates that a reduction in the proportion of employee representatives serving on the AC can increase audit quality. However, in order to improve audit quality, the proportion of employee representatives serving on the AC should be reduced below one third and, thus, below the threshold of the DrittelbG.

Seventh, as the company's total number of employees determines whether a company is affected by codetermination, the company's number of employees might bias our results. To address this issue, we generate a new control variable TotalEmployees that is defined as the natural logarithm of the company's total number of employees. Given that our control variable FirmSize and our new control variable TotalEmployees both reflect company size, we have to replace our variable FirmSize with the new variable TotalEmployees to avoid multicollinearity.8 Afterwards, we rerun our initial regressions. In doing so, our results stay largely unchanged (Employee: 0.022 for AQJ [p = 0.007], 0.024 for AQDSS [p = 0.005], 0.016 for AQKLWR [p = 0.052]; %EmployeeAC: 0.048 for AQJ [p = 0.011], 0.053 for AQDSS [p = 0.006], 0.038 for AQKLWR [p = 0.043]; %EmployeeNoExpert: 0.047 for AQJ [p = 0.012], 0.052 for AQDSS [p = 0.007], 0.038 for AQKLWR [p = 0.045]; %EmployeeExpert: 0.052 for AQJ [p = 0.148], 0.054 for AQDSS [p = 0.115], 0.028 for AQKLWR [p = 0.361]; %EmployeeIntern: 0.055 for AQJ [p = 0.006], 0.060 for AQDSS [p = 0.003], 0.045 for AQKLWR [p = 0.022]; %EmployeeExtern: 0.026 for AQJ [p = 0.327], 0.031 for AQDSS [p = 0.251], 0.014 for AQKLWR [p = 0.579]), which indicates that our results are not driven by the company's total number of employees.

Eighth, to ensure that our results are not driven by differences in reporting and disclosure requirements of the General and Prime Standard market segment, we drop all observations from the General Standard market segment of the Frankfurt Stock exchange from our sample. Afterwards, we rerun our main analysis on our new sample that consists now exclusively of companies from the Prime Standard market segment of the Frankfurt Stock exchange. In doing so, our results remain largely unchanged (Employee: 0.023 for AQJ [p = 0.014], 0.023 for AQDSS [p = 0.017], 0.017 for AQKLWR [p = 0.067]; %EmployeeAC: 0.053 for AQJ [p = 0.011], 0.054 for AQDSS [p = 0.010], 0.044 for AQKLWR [p = 0.044]; %EmployeeNoExpert: 0.053 for AQJ [p = 0.011], 0.054 for AQDSS [p = 0.011], 0.045 for AQKLWR [p = 0.043]; %EmployeeExpert: 0.037 for AQJ [p = 0.322], 0.041 for AQDSS [p = 0.265], 0.011 for AQKLWR [p = 0.730]; %EmployeeIntern: 0.061 for AQJ [p = 0.004], 0.062 for AQDSS [p = 0.005], 0.052 for AQKLWR [p = 0.021]; %EmployeeExtern: 0.027 for AQJ [p = 0.331], 0.031 for AQDSS [p = 0.273], 0.017 for AQKLWR [p = 0.522]).

Ninth, to assure that our results are not biased by outliers, we winsorized our audit quality measures as well as continuous control variables at the 1% level prior to regression. Our test variable %EmployeeAC is not winsorized as the extreme values of our test variables occur very frequently and therefore do not represent outliers. In doing so we find, that our results remain robust (Employee: 0.019 for AQJ [p = 0.012], 0.020 for AQDSS [p = 0.009], 0.014 for AQKLWR [p = 0.052]; %EmployeeAC: 0.040 for AQJ [p = 0.020], 0.043 for AQDSS [p = 0.012], 0.031 for AQKLWR [p = 0.076]; %EmployeeNoExpert: 0.039 for AQJ [p = 0.025], 0.042 for AQDSS [p = 0.015], 0.031 for AQKLWR [p = 0.084]; %EmployeeExpert: 0.045 for AQJ [p = 0.206], 0.045 for AQDSS [p = 0.193], 0.027 for AQKLWR [p = 0.347]; %EmployeeIntern: 0.048 for AQJ [p = 0.009], 0.051 for AQDSS [p = 0.006], 0.040 for AQKLWR [p = 0.028]; %EmployeeExtern: 0.015 for AQJ [p = 0.547], 0.019 for AQDSS [p = 0.445], −0.001 for AQKLWR [p = 0.963]). Thus, we are confident that our results are not seriously biased by outliers.

Tenth, in accordance with Frank (2000), we calculate the impact threshold for a confounding variable (ITCV) to test whether our results are affected by correlated omitted variable bias. Larcker and Rusticus (2010) define the ITCV as “the lowest product of the partial correlation between y and the confounding variable and the partial correlation between x and the confounding variable that makes the coefficient statistically insignificant”. For our first test variable Employee, we calculate ITCVs of 0.046 (for regression with the dependent variable AQJ), 0.050 (for regression with the dependent variable AQDSS) and 0.013 (for regression with the dependent variable AQKLWR). Therefore, the coefficient of our test variable Employee will turn statistically insignificant if a correlated omitted variable has a correlation of at least |0.114|(

) with our test variable and the audit quality proxies. For our second test variable %EmployeeAC, we have estimated ITCV of 0.039 (for regression with the dependent variable AQJ), 0.045 (for regression with the dependent variable AQDSS) and 0.014 (for regression with the dependent variable AQKLWR). Hence, our test variable %EmployeeAC will turn statistically insignificant if a correlated omitted variable has a correlation higher than |0.118| (

) with our test variable and the audit quality proxies. For our second test variable %EmployeeAC, we have estimated ITCV of 0.039 (for regression with the dependent variable AQJ), 0.045 (for regression with the dependent variable AQDSS) and 0.014 (for regression with the dependent variable AQKLWR). Hence, our test variable %EmployeeAC will turn statistically insignificant if a correlated omitted variable has a correlation higher than |0.118| (

) with our test variable and the audit quality proxies. For the majority of our control variables, the product of the partial correlation between our test variables and the audit quality proxies does not exceed this threshold. Therefore, it is unlikely that our results are seriously affected by correlated omitted variables.

) with our test variable and the audit quality proxies. For the majority of our control variables, the product of the partial correlation between our test variables and the audit quality proxies does not exceed this threshold. Therefore, it is unlikely that our results are seriously affected by correlated omitted variables.

Eleventh, because of the fragmented distribution of our test variable %EmployeeAC, the assumptions of an ordinary least squares regression may be violated. To address this issue, we use the nonparametric bootstrapping algorithm introduced by Efron (1979). The nonparametric bootstrapping algorithm is also robust if the sample size is small. For our analysis, we use the bootstrapping algorithm with 10,000 repetitions to generate our new sample and rerun our regressions for all audit quality proxies. As our results remain nearly unchanged (Employee: 0.023 for AQJ [p = 0.009], 0.024 for AQDSS [p = 0.007], 0.016 for AQKLWR [p = 0.076]; %EmployeeAC: 0.050 for AQJ [p = 0.016], 0.053 for AQDSS [p = 0.011], 0.038 for AQKLWR [p = 0.071]; %EmployeeNoExpert: 0.049 for AQJ [p = 0.018], 0.052 for AQDSS [p = 0.012], 0.038 for AQKLWR [p = 0.081]; %EmpoyeeExpert: 0.051 for AQJ [p = 0.180], 0.053 for AQDSS [p = 0.168], 0.026 for AQKLWR [p = 0.429]; %EmployeeIntern: 0.056 for AQJ [p = 0.008], 0.060 for AQDSS [p = 0.006], 0.046 for AQKLWR [p = 0.035]; %EmployeeExtern: 0.024 for AQJ [p = 0.407], 0.028 for AQDSS [p = 0.341], 0.011 for AQKLWR [p = 0.684]), we are confident that our initial results are not biased by small sample size or a violation of distribution assumptions.

9 CONCLUSION AND LIMITATIONS

In this paper, we empirically examine the impact of codetermination on the AC on audit quality. As such, our study offers important insights on the ongoing debate in Europe and the United States concerning the introduction or expansion of codetermination. In addition, we contribute to audit quality research by identifying requirements employee representatives serving on the AC should meet to mitigate potential negative impacts on audit quality.

Analysing 655 firm-year observations of companies included in the German CDAX between 2013 and 2017, we find that codetermination per se and the proportion of employee representatives serving on the AC are negatively associated with audit quality. However, we cannot observe this negative association if the employee representatives have accounting expertise or if they are external employee representatives and can therefore be classified as independent. These findings demonstrate the importance of accounting expertise and independence for AC members.

This study is subject to some limitations. First, the presence of codetermination on the AC might not be exogenous but rather due to specific company characteristics. Second, we have to rely on publicly available information, including the CVs of the AC members, to be correct and complete in order to classify an AC member as an accounting expert. At last, due to legal determination of the number of supervisory board members, which does not change much over time, adequate matching techniques or change analysis could not be performed. However, we attempted to address these issues within our robustness checks, and our results remain robust.