International Public Sector Accounting Standards (IPSASs): A systematic literature review and future research agenda

Abstract

The development of International Public Sector Accounting Standards (IPSASs) aims at harmonizing public sector accounting at an international level. IPSASs are intended to generate more comparable financial information across national boundaries and minimize differences in countries’ generally accepted domestic accounting principles. Despite the various advantages of adopting IPSASs, the new accounting standards have been accompanied by critiques in terms of implementation costs, lack of pressure, and alignment with public sector specialties. In addition, many countries have refused to adapt their governmental accounting systems to IPSASs. In the last two decades, a plethora of studies has investigated the evolution of an internationally comparable accrual-based accounting system. This article provides a systematic review of this research. First, it identifies existing knowledge of research on IPSASs, resulting in a sample of 80 journal articles. Second, it structures research on IPSASs with an empirical focus in three main research areas: (a) antecedents of IPSAS adoption; (b) implementation of accrual accounting based on IPSASs; and (c) outcomes of IPSAS adoption. Third, it discusses the shortcomings and gaps in the existing research and develops an agenda for future research.

1 INTRODUCTION

In recent decades, the public sector accounting literature has been characterized by a focus on reforms to accounting practices (Lapsley & Miller, 2019) such as those with objectives of implementing accrual accounting and harmonizing accounting practices by minimizing the differences in financial reporting across countries (Brusca & Condor, 2002; Caperchione, Christiaens, & Lapsley, 2013; Christensen & Parker, 2010; Groot & Budding, 2008). Harmonizing public sector accounting at the international level is often realized today by applying the International Public Sector Accounting Standards (IPSASs) (Brusca & Martínez, 2016). IPSASs are intended to generate more comparable financial information across national boundaries and minimize differences in countries’ generally accepted domestic accounting principles (Aggestam-Pontoppidan & Andernack, 2016). Furthermore, the application of IPSASs aims to improve accountability and strengthen the transparency of financial transactions (Bergmann, 2009). Accordingly, IPSASs aim to improve decision-making by providing reliable information about assets, liabilities, and expenses.

Several countries have decided to (partly) adopt or align traditional cash-based accounting systems with accrual-based accounting systems, such as IPSASs (Bergmann, Fuchs, & Schuler, 2019; Brusca, Caperchione, Cohen, & Manes Rossi, 2018; Müller-Marqués Berger, 2018). The implementation of IPSASs, however, has greatly varied across the number of IPSASs applied, as well as countries and government levels (e.g., Cavanagh, Flynn, & Moretti, 2016; Christiaens, Vanhee, Manes Rossi, Aversano, & Van Cauwenberge, 2015; OECD/IFAC, 2017). Despite the various benefits associated with adapting governmental accounting (GA) systems to IPSASs, countries such as Finland or Germany are reluctant to change toward an IPSAS-based accounting system. For example, IPSASs have been criticized for the inadequate consideration of specific subsectors, business-style accounting in government, and a lack of pressure to implement standards (Bakre, Lauwo, & McCartney, 2017; Oulasvirta, 2014; Robb & Newberry, 2007).

-

Antecedents of the reform: Which factors have influenced the adoption of IPSASs?

-

The reform process: To what extent has accrual accounting based on IPSASs already been implemented?

-

Results of the reform: What are the outcomes of adopting IPSASs?

This study aims to contribute to the public financial management literature and answers these questions by conducting a systematic review of studies addressing IPSASs. First, it identifies literature contributing to research on IPSASs, resulting in a sample of 80 journal articles. Second, the study analyzes the emergence of the literature on IPSASs over time and focuses on research outlets and the research approaches of sample studies. Third, this article systematizes the existing knowledge in three main research fields: antecedents of IPSAS adoption, implementation of accrual accounting based on IPSASs, and outcomes of IPSAS adoption. The paper concludes with a discussion of the shortcomings and gaps of the existing research and develops an agenda for future research.

A systematic overview of the current research on IPSASs is relevant in many aspects: Public financial management as a research field is characterized by high publication activity (see Bergmann et al., 2019). Recently, research has focused on how to guarantee reliable financial information guiding public sector decision-making and supporting sustainable financial management. In this regard, scholars have intensively discussed replacing cash-based accounting systems with accrual-based systems and the harmonization of accounting systems across government levels and national boundaries, exerting pressure on national and international public sector organizations to reform and innovate accounting systems (Christiaens et al., 2015). This review aims to contribute to the recent discussion by summarizing and critically discussing current research findings on international public accounting harmonization. Although some government accounting systems have been adapted to or aligned with IPSASs (Brusca et al., 2018), the adoption of IPSASs and their application, however, have varied greatly across countries and governmental levels (e.g., Pina, Torres, & Yetano, 2009). A systematic review of empirical studies aims to provide answers to this heterogeneity. In addition, adopting IPSASs has been highly debated. Although the IPSAS Board has been pushing forward the development of IPSASs with the intention of improving public sector financial reporting, the effects of IPSASs in improving public sector accounting have been highly controversial (see, e.g., Christiaens, Reyniers, & Rollé, 2010; Grandis & Mattei, 2012; Harsányi et al., 2016). Although some favor the introduction of international accounting standards and harmonization at the global level, others doubt the usefulness of IPSASs for enhancing public sector accounting. Analyzing IPSASs adoption in light of newly developed sets of accounting standards (i.e., European Public Sector Accounting Standards [EPSASs]) might offer important findings for future research (Eulner & Waldbauer, 2018; Harsányi et al., 2016; Jones & Caruana, 2015; Müller-Marqués Berger, 2016). Finally, this review links research on IPSASs to public sector accounting research and accounting research in general. It adds to the discussion on whether the implementation of IPSASs resonates with the accounting objectives in general and could be an adequate alternative to national accounting (NA) systems or private accounting standards. This discussion further draws the line to public administration research and the organization and coordination of public sector organizations for the benefit of reliable and comparable financial information provision.

The remainder of this paper is structured as follows: First, the development and implementation of IPSASs is described. Second, we give an overview of the methodological approach of the study. Third, the findings of the systematic literature analysis are presented. Finally, the study concludes by providing directions for further research.

2 INTERNATIONAL PUBLIC SECTOR ACCOUNTING STANDARDS

Accounting practices in the private and public sectors are currently aimed at international harmonization and the minimization of differences in financial reporting across countries. This emergence of accounting harmonization at the international level is strongly driven by the need for financial transparency as a basis for better decision-making (Eulner & Waldbauer, 2018), intergenerational equity, and more efficiency and effectiveness regarding public expenditures (Heald & Hodges, 2015). Accordingly, harmonizing accounting standards is associated with advanced comparability of financial information across governments (Aggestam-Pontoppidan & Brusca, ; Brusca & Martínez, 2016; Christiaens et al., 2015).

Harmonizing public sector accounting at the international level is currently realized by applying IPSASs (Aggestam-Pontoppidan & Andernack, 2016; Bergmann, 2009). In more detail, IPSASs are a set of mainly accrual-based standards that provide a uniform basis for the preparation of annual financial statements in the public sector. The standards are developed, refined, and published by the IPSAS Board, an international standard-setting board that consists, for example, of representatives from ministries and government institutions, audit courts, public practitioners, and academia. In addition, the broad public is addressed in public consultations to participate in and influence the process of standard development by commenting on the published exposure drafts during the due process. Since the IPSASs are issued by IPSAS Board as an independent organ of International Federation of Accountants (IFAC), neither governments nor international organizations are obliged to apply IPSASs. However, several countries worldwide have decided to refer in their nation budget laws (voluntarily) to IPSASs.

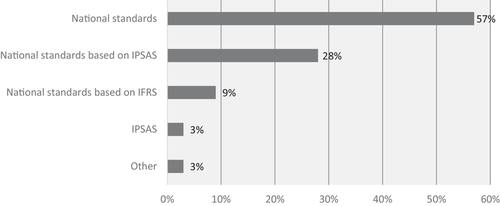

In general, a trend of switching from cash-based to accrual-based accounting standards can be observed in various nations (Cavanagh et al., 2016; OECD/IFAC, 2017). Table 1 and Figure 1 give an overview of the accounting basis for annual financial reports and types of standards used by Organisation for Economic Co-operation and Development (OECD) countries, respectively. Although the great majority of OECD countries have implemented accrual accounting, only 3% of countries have fully applied IPSASs. Approximately 30% of countries rely on their own national standards that are based on IPSASs. In general, IPSASs are fully or partially applied by approximately 80 countries, as well as international organizations such as the European Commission, the North Atlantic Treaty Organization, the OECD, and the United Nations (OECD/IFAC, 2017). In addition to great differences across countries in terms of accounting practices, government levels within countries vary in terms of accounting standards. For example, Austria has partially applied IPSASs at the central government level. However, Austrian municipalities are still currently using cash-based accounting standards. In summary, the implementation of IPSASs greatly varies across countries and government levels, and there are also differences in the number of IPSASs applied (e.g., Cavanagh et al., 2016; Christiaens et al., 2015; OECD/IFAC, 2017).

| Accrual | Cash | Cash to accrual | ||

|---|---|---|---|---|

| Australia | Finland | Poland | Germany | Greece |

| Austria | France | Slovakia | Ireland | Portugal |

| Belgium | Hungary | Spain | Italy | Slovenia |

| Canada | Iceland | Sweden | Luxembourg | |

| Chile | Israel | Switzerland | Netherlands | |

| Czech Republic | Japan | Turkey | Norway | |

| Denmark | Korea | UK | ||

| Estonia | Mexico | USA | ||

| New Zealand | ||||

- Source: OECD/IFAC (2017, p. 13), based on OECD Annual Survey (2016), answers from all OECD countries.

Types of standards, OECD countries

Source: OECD/IFAC (2017, p. 24) based on OECD Annual Survey (2016), answers from all OECD countries

3 METHODOLOGICAL APPROACH

To identify the current body of knowledge on IPSASs, the authors performed a systematic search of the literature. The literature review is based on the recommendations from the methodological and managerial literature to ensure that it is systematic, transparent, and thus replicable (Kroll, 2015; Meijer & Bolívar, 2016; Santis, Grossi, & Bisogno, 2018; Tranfield, Denyer, & Smart, 2003; Voorberg, Bekkers, & Tummers, 2015). The overall aim of our methodological approach is to identify international peer-reviewed journal articles contributing to the research on IPSASs. We included only journal articles in our analysis, as they are considered validated knowledge (Podsakoff et al., 2005), whereas books, chapters, and conference papers are excluded due to restrictions in availability and variations in peer review processes.

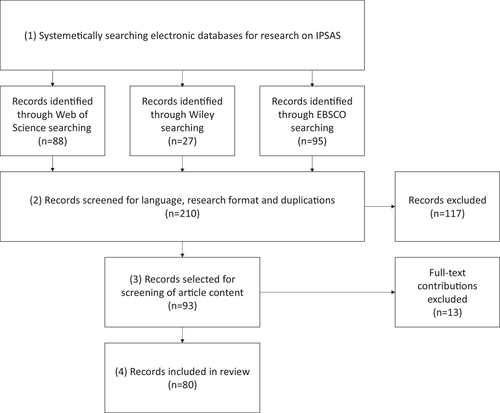

We started performing a systematic literature review by searching for articles dealing with IPSASs. Figure 2 summarizes the search process. To obtain relevant articles related to IPSASs, electronic databases were first searched using the terms “International Public Sector Accounting Standards,” “IPSAS,” and “IPSASs.” The search resulted in 210 hits using the “Web of Science” (88 hits), “Wiley” (27 hits), and “EBSCO” (95 hits) databases.

Second, we screened the records based on language and research format. The following inclusion criteria have been formulated by the author team: articles published up to and including 2017, English-language articles, and peer-reviewed journals as a research outlet. In terms of exclusion criteria, we excluded records written in languages other than English and with a publication type other than journal articles (e.g., conference papers, book chapters, debates, research notes, editorial material). In addition, we had to drop articles because of duplication, that is, the same records in two or more databases. This procedure resulted in 93 records.

Third, we conducted a qualitative content analysis of the 93 records. Every article was screened manually to analyze whether the article content was related to IPSASs. We excluded from the final sample articles that do not use the term “IPSAS” in the context of “International Public Sector Accounting Standards” and articles that do not provide an explicit or sufficient connection between IPSASs and public sector accounting, meaning that neither the research area, question(s) nor aim is related to IPSASs.1 Therefore, the screening of all 210 documents ultimately led to the inclusion of 80 peer-reviewed, English-language journal articles. This sample of articles is used for the literature analysis.

We analyzed the sample papers qualitatively to identify the research focus, research design, and key findings of papers. The main goal of the analysis was to map the current body of knowledge of research on IPSASs and to explore the extent to which certain issues, countries, or government levels attract more or less attention. To this end, we developed categories for these different dimensions inductively and applied these categories to the set of publications. A full text analysis was conducted to identify the antecedents of IPSASs adoption, the implementation of accrual accounting based on IPSASs, and the outcomes of IPSASs adoption and effectiveness of standards.

4 RESULTS OF THE SYSTEMATIC LITERATURE REVIEW

The results section is divided into three parts. First, we address the characteristics of the sample articles and analyze the temporal development of research on IPSASs, publication outlets, and research approach of sample papers. Second, we focus on the research design and methods used in empirical sample papers. Third, we summarize and discuss the results of empirical sample articles according to their research focuses and point to the theoretical approaches used by the studies.

4.1 Characteristics of sample articles

4.1.1 The emergence of research on IPSASs

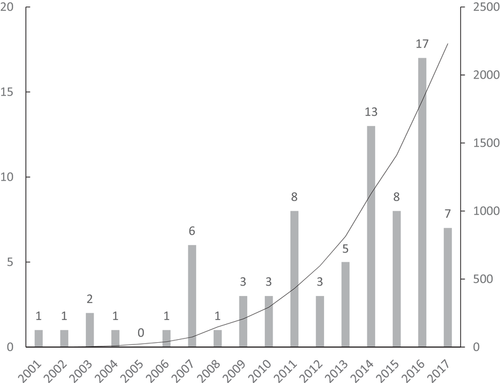

Figure 3 illustrates the temporal development of research on IPSASs by referring to the number of publications per year. Additionally, the citation growth trend indicates the increased significance of IPSASs in the research, as the total number of citations has steadily grown during recent years. First, international articles on IPSASs have been published since 2001. In 2007, research on IPSASs reached its peak of the first decade because six articles were published during this year. In 2016, 20% of the sample articles were published. In total, research on IPSASs was cited more than 2230 times by the end of 2017. These results indicate that there may be a growing scientific interest in the development of IPSASs and harmonization of public sector accounting standards. The most frequently cited articles are displayed in Table 2.

Number of publications and cumulative citations on IPSASs by year

Note. N = 80, citations drawn from Google Scholar 8/11/2018

| # | Article | # of citations |

|---|---|---|

| 1 | Chan (2003), Public Money & Management: Government accounting: An assessment of theory, purposes and standards | 363 |

| 2 | Pina and Torres (2003), Canadian Journal of Administrative Sciences: Reshaping public sector accounting: An international comparative view | 200 |

| 3 | Pina et al. (2009), European Accounting Review: Accrual Accounting in EU Local Governments: One Method, Several Approaches | 198 |

| 4 | Benito et al. (2007), International Review of Administrative Sciences: The harmonization of government financial information systems: the role of the IPSASs | 181 |

| 5 | Christiaens, Reyniers, and Rolle (2010), International Review of Administrative Sciences: Impact of IPSAS on reforming governmental financial information systems: a comparative study | 149 |

| 6 | Torres (2004), Public Administration and Development: Accounting and accountability: Recent developments in government financial information systems | 109 |

| 7 | Grossi and Soverchia (2011), Abacus: European Commission Adoption of IPSAS to Reform Financial Reporting | 96 |

| 8 | Oulasvirta (2014), Critical Perspectives on Accounting: The reluctance of a developed country to choose International Public Sector Accounting Standards of the IFAC. A critical case study | 79 |

| 9 | Martí (2006), Public Budgeting & Finance: Accrual Budgeting: Accounting Treatment of Key Public Sector Items and Implications for Fiscal Policy | 78 |

| 10 | Christiaens et al. (2015), International Review of Administrative Sciences: The effect of IPSAS on reforming governmental financial reporting: an international comparison | 72 |

- Note. Citations drawn from Google Scholar 08/11/2018.

4.1.2 Publication outlets

This literature review focuses on peer-reviewed journal articles on IPSASs. Table 3 lists the top 10 journals having published sample articles. In total, 40 different journals were identified. Twenty-two of 80 articles were published in one of two journals: Public Money & Management and International Review of Administrative Sciences. A number of journals have published four articles on IPSASs. These findings show that research on IPSASs is published in a great variety of journals. The overview on publication outlets indicates, however, that just two journals publish more than one quarter of all IPSASs studies. Furthermore, research on IPSASs is published predominately in journals with a focus on public (financial) management, whereas general accounting journals have published comparatively fewer articles on IPSASs.

| Journal quality | |||||

|---|---|---|---|---|---|

| # | Journal name | # of IPSAS papers | VHB | ABS | IF |

| 1 | Public Money & Management | 12 | C | 2 | .881 |

| 2 | International Review of Administrative Sciences | 10 | C | 3 | 1.988 |

| 3 | International Journal of Public Administration | 5 | C | 2 | n.a. |

| 4 | Accounting, Economics, and Law: A Convivium | 4 | B/C | n.a. | n.a. |

| 4 | Financial Accountability & Management | 4 | C | 3 | n.a. |

| 4 | Journal of Government Financial Management | 4 | n.a. | n.a. | n.a. |

| 4 | Public Administration and Development | 4 | n.a. | 2 | 1.25 |

| 8 | Transylvanian Review of Administrative Sciences | 3 | n.a. | n.a. | .617 |

| 9 | Abacus - A Journal of Accounting Finance and Business Studies | 2 | B | 3 | .609 |

| 9 | Global Policy | 2 | n.a. | n.a. | 1.22 |

- Notes. Journal quality is measured by the journal ranking VHB-JOURQUAL 3, ABS 2015, and the journal impact factor.

- Abbreviation: n.a. = not available.

4.1.3 Research approach

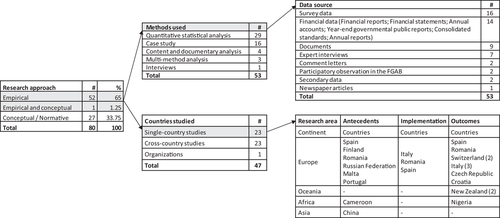

Figure 4 provides an overview of the research approach of the sample articles. Of the total sample, 66% of the articles have empirically analyzed IPSASs, its antecedents, or outcomes. Thirty-four percent of sample papers are normative or conceptual papers, and one article uses both normative and empirical analysis. Although there is a growing interest in normative research on accounting methods, empirical research still outweighs normative research. Online Appendix 1 summarizes conceptual or normative contributions on IPSASs.

4.2 Empirical research on IPSASs

In this section, we focus on empirical research on IPSAS papers in greater detail. Empirical papers are categorized according to their research focuses. Three main research areas are identified and provide the structure for the presentation of results: antecedents of IPSAS adoption; implementation of accrual accounting based on IPSASs; and outcomes of IPSAS adoption. In the following sections, these empirical papers are analyzed according to their research design (Section 4.2) and in terms of their research findings (Section 4.3).

4.2.1 Methods used

Figure 4 outlines the research methods used in the sample papers. Authors investigating the implementation of IPSASs have mainly used descriptive statistical analysis to examine accounting systems in a cross-comparative setting. Few papers have conducted content or documentary analysis and case studies to analyze the status of IPSAS implementation. Most articles focusing on the antecedents of IPSAS adoption have conducted case studies. Two papers have used multivariate statistics to examine the factors influencing IPSAS adoption. The effects of IPSAS adoption are investigated by applying multiple research methods. Most papers have conducted a quantitative statistical analysis. However, there are several papers with a focus on qualitative research methods such as content and documentary analysis, the use of case studies, or conducting interviews. In total, the majority of the sample papers have conducted a quantitative statistical analysis. In addition, a great share of the sample has used a qualitative case study methodology.

4.2.2 Data source

In addition, Figure 4 summarizes the data sources of the empirical sample articles. Sixteen out of 29 quantitative statistical papers used survey data to conduct an empirical analysis. In addition, data from financial reports or statements, as well as secondary data, form the basis for the statistical analysis. Qualitative research draws mainly on documents, expert interviews, comment letters, or participatory observation.

4.2.3 Countries studied

Finally, Figure 4 gives an overview of the research unit of empirical papers. Most of the empirical sample papers have analyzed countries or organizations. Approximately 49% of these papers investigated one country. For example, Bolívar and Galera (2007) analyzed the usefulness of IPSASs for financial information users by surveying Spanish municipal finance officers. Approximately 49% of the papers examined IPSASs in a multicountry setting. For example, Christiaens et al. (2010) conducted a comparative study of accrual accounting adoption across 17 European countries. Although the great majority of papers have investigated the accounting practices of local or national governments, Bergmann and Fuchs (2017) analyzed the implementation of IPSASs in the UN System Organizations. As illustrated, the great majority of single-country studies are conducted in the context of Europe. Spain, Romania, and Italy are among the most frequently studied countries.

4.2.4 Accounting theory

Numerous authors have drawn on different theories to explain the antecedents and outcomes of IPSAS adoption and the accounting system's development toward IPSAS-like accrual accounting. The factors influencing IPSAS adoption have mainly been explained by institutional theory or the contingency model (e.g., by Lüder, 1992, 1994, 2002). When studying the implementation of accrual accounting based on IPSASs, many authors have drawn on the New Public Management (NPM) paradigm to argue that the reform is modernizing the state and improving decision-making and accountability (Lüder, 2002). Furthermore, public choice theory (Buchanan, 1972, 1978; Niskanen, 1971, 1973) and institutional theory were used by Pina et al. (2009), while Bunget, Blidisel, Feleaga, and Popa (2014) referred to legitimacy theory and stakeholder theory. Consolidation theory has also been used (Bergmann, Grossi, Rauskala, & Fuchs, 2016; Bisogno, Santis, & Tommasetti, 2015). To explain the outcomes of IPSAS adoption, studies have relied on NPM (e.g., Bolívar & Galera, 2016), the garbage can model (see Robb & Newberry, 2007; Oulasvirta & Bailey, 2016), economic theory (see Bergmann, 2012), or decision-making under uncertainty (see Fuchs, Bergmann, & Brusca, 2017). Finally, a great number of articles describe accounting practices without explicitly referring to a theory. Online Appendices 2–4 provide a more detailed mapping of theories referred to in our analyzed set of IPSAS studies.

4.3 Empirical findings of research on IPSASs

4.3.1 Antecedents of IPSAS adoption

The first group of sample papers addresses the antecedents of IPSAS adoption (full list of articles in online Appendix 2). Several papers have used a case study approach to analyze the process of implementing IPSASs and identify factors influencing IPSAS adoption. Antipova and Bourmistrov (2013) investigated the accounting reform in the Russian Federation and found that, despite 8 years of reform, modernization of accounting practices is still under development. This ongoing development is attributed to the continued local use of traditional cash-oriented accounting practices and thus path dependency. Similarly, the reasons for Finland's refusal to adopt IPSASs include path dependency in the accounting tradition. Furthermore, Oulasvirta (2014) referred to a lack of pressure to change and no regional competition.

In focusing on the Portuguese accounting reform, Gomes, Fernandes, and Carvalho (2015) characterized accounting as a social and institutional practice because cohesion among stakeholders seems to be a driver of success. Similarly, Brusca, Gómez-Villegas, and Montesinos (2016) explained the implementation of IPSASs in Colombia and Peru by referring to institutional theory and found that both countries aimed at the modernization of accounting systems. According to Brusca, Montesinos, and Chow (2013), the Spanish government's decision to adopt IPSASs was influenced by political goals in terms of public sector accountability and promotional efforts by the IPSAS Board. Jones and Caruana (2016) describe the decision of the central government of Malta to fully adopt IPSAS as being a result of pursuing credibility. Chan (2016) found that the Chinese government's decision to adopt accrual accounting can be attributed to a desire to counteract local government debt and reduce fiscal risk. Nistor and Deaconu (2016) associated the Romanian adoption of accrual accounting with international managerial public reform and internal factors.

In addition to the case study approach, various scholars have used survey data to identify the antecedents of IPSAS adoption. Christiaens et al. (2015) surveyed accounting experts from 59 countries and found that comparability of financial information and facilitation of the consolidation of financial statements are the main reasons for using IPSASs, whereas fear of losing standard-setting authority deters countries from IPSAS adoption. Findings from Brusca and Martínez (2016) indicated a need for harmonizing public sector accounting, particularly in American countries. Drivers for IPSAS adoption include international comparability and the improvement of quality of financial reporting systems, whereas the reduction in sovereignty and costs of adoption hinder countries from adopting accrual-based standards. In addition to these cross-country comparison surveys, Tanjeh (2016) conducted a survey among accounting experts in Cameroon and identified knowledge and awareness, costs, and political support as factors facilitating the organizational adoption of IPSASs.

Table 4 provides a summary of the parameters of reform. Factors promoting the adoption of IPSASs include political desire and support as well as the need to harmonize public sector accounting. The latter is the desire to compare financial information, facilitate consolidation of financial statements, and improve credibility. In addition, the modernization of accounting systems and internationalization are found to be antecedents of IPSASs adoption. In contrast, factors preventing countries or organizations from adopting IPSASs include path dependency, fear of losing standard-setting authority, and the costs of adoption. Furthermore, conflicting interests and a lack of pressure to change prevent countries or organizations from modernizing accounting systems.

| Reform drivers |

|---|

|

| Reform barriers |

|---|

|

- Note. The total is higher than the sum of the sample papers, as some studies described multiple factors.

Summarizing the results of the antecedents of IPSASs adoption considering the analyzed papers, we see a broad scope of drivers and reform paths resulting from completely different origins and having different reasons. We recognize neither that switching to IPSASs in several nations worldwide is one solution to one specific problem nor that one single specific political or even entrepreneurial (e.g., audit companies) influence is the driver of this reform paradigm. We see that introducing ISPASs is most often organized as a specific reform project in financial ministries, which goes along with proposed benefits in the context of sustainable financial management, internationalization, accountability, and general modernism. Whether these mimetic beliefs to follow worldwide innovative paths really lead to specific advantages concerning the management of public budgets and improved clarity of accounting remains most often unclear or was not within the scope of these analyzed papers.

4.3.2 Implementation of accrual accounting based on IPSASs

The second group outlines empirical articles on the implementation of IPSASs (full list in online Appendix 3). As the first implementation study, Pina and Torres (2002) analyze the development of Spanish local government accounting and the compliance of annual accounts with IPSAS 1. Thereafter, the compliance of the governmental financial statements of 18 OECD countries with the legal requirements of IPSAS 1 was tested by Pina and Torres (2003). The descriptive results indicate a great diversity among GA systems with respect to financial statement presentation. Torres (2004) provided similar results in comparing the information disclosure with the legal requirements of IPSAS 1 for annual accounts of 22 countries. Similar to Pina and Torres (2003), the level of disclosure was measured by Cooke's index. Analyzing the level of financial information from Latin American countries, Caba-Pérez and López-Hernández (2007) concluded that there is great focus on traditional budgetary information. In a similar vein, Caba-Pérez and López-Hernández (2009) found that the annual financial reports of MERCOSUR countries have not fully considered the public financial reporting practices recommended by IFAC. Based on this method, Abushamsieh, López-Hernández, and Ortiz-Rodríguez (2014) emphasized the level of public financial information disclosed in Arab countries in the Middle East where aid-receiving countries are doing well in implementing IPSASs, whereas countries with oil revenues have lower efforts to implement IPSASs. Manes Rossi, Aversano, and Christiaens (2014) assessed the application of the IPSAS-Board's Conceptual Framework in European countries by using documentary analysis. They concluded that external harmonization of accounting standards is challenging because of a lack of vertical harmonization within levels of government, an insufficient alignment with user needs and country characteristics, and a preference for national standards. Grossi and Pepe (2009) and Bergmann et al. (2016) highlighted consolidation efforts in a cross-country comparison setting. Grossi and Soverchia (2011) examined the development of the European Union (EU) consolidation process. Although the majority of papers analyzed a country's efforts to implement IPSASs, Bergmann and Fuchs (2017) concentrated on the UN System Organizations and concluded that implementing IPSASs is a complex management reform rather than a technical issue.

Benito, Brusca, and Montesinos (2007) conducted the first survey-based research to analyze the adoption of IPSASs in OECD countries. An analysis of survey data from government accounting professionals and academics indicates a lack of homogeneity among different accounting systems. Additionally, based on survey data, Christiaens et al. (2010) focused on European countries and demonstrated that accrual accounting has been strongly adopted in Europe.

Although former studies have concentrated on IPSASs implementation at the national level, Pina et al. (2009) focused on the level of information de facto disclosure by analyzing the annual accounts of 51 local governments. They interpreted the introduction of accrual accounting at the local level as a widespread trend in the EU and identified the UK and Sweden as leaders in IPSASs implementation. Adam, Mussari, and Jones (2011) also investigated accounting practices at the local level by focusing on infrastructure as well as art and heritage assets. Bunget et al. (2014) compared the annual reports of Romanian municipalities with the requirements of IPSAS 31 and found a size effect in terms of disclosure, meaning that the disclosure is greater in larger municipalities. Bisogno et al. (2015) described the use of performance management tools that are limited to decision-making or accounting purposes in Italian local governments.

Two papers analyzed the comments letters submitted to the IPSAS-Board. Nistor (2013) investigated the Exposure Draft, “Key Characteristics of the Public Sector with Potential Implications for Financial Reporting,” and Bisogno et al. (2015) examined Exposure Draft No. 49 on the replacement of IPSAS 6. Dabbicco (2013) proposed changes to the Excessive Deficit Procedure Table 2.

Papers in this research area focus on implementing accrual accounting based on IPSASs. Therefore, “implementing IPSAS-like standards” is an important aspect of the investigation. Table 5 summarizes how studies have measured the extent to which IPSASs have been implemented. Four papers have drawn on expert evaluation, for example, by surveying professionals, academics, and consultants from jurisdictions (e.g., Christiaens et al., 2010).

| Degree of IPSAS implementation is measured by … |

|---|

| Case study evaluation (5) |

| Expert evaluation (4) |

| Cooke's index (1989) (3) |

| Methodology developed by Caba Pérez and López-Hernández (2009) (2) |

| Exposure drafts (2) |

| Index of compliance with IPSAS (1) |

| Methodology used by Torres and Pina (2003) (1) |

| Self-developed disclosure levels (1) |

Concluding the results of our analysis of the implementation efforts in the different countries, we see a clear bottom line: switching to IPSASs is a challenge; it takes time and is costly. Furthermore, we found that every national transition to IPSASs is different and that IPSASs, which were adopted in the reform, are greatly different, meaning that we see dozens of IPSAS implementations. This fact often goes along with some IPSASs only being cherry-picked—ignored and not implemented. These different IPSAS proximities are surprising since one core argument of all IPSAS reforms is better comparability between states—a promise not yet reached.

4.3.3 Outcomes of IPSAS adoption

The third category of sample articles adopted qualitative and quantitative research techniques to study the outcomes of IPSASs adoption and effectiveness of standards (full list of articles in online Appendix 4). Numerous papers have focused on the impact of IPSASs on financial information use. Bolívar and Galera (2007) conducted a survey among Spanish municipal finance officers to learn about the perceived usefulness of fair value accounting (FVA) for financial information users. Analysis showed that FVA implementation provides useful information for deciding about resource allocation and selecting the best management model for public sector services. In a cross-country setting, Galera and Bolívar (2007) found that accounting reforms could contribute to implementing NPM postulates. Accordingly, developing countries benefit more from accounting reforms than developed countries. In addition, Galera and Bolívar (2011) analyzed the relevance and reliability of financial government reports cross-nationally and found that FVA enhances efficiency measurement and comparability of government financial statements. In 2012, Bolívar and Galera evaluated the capability of FVA based on survey data from 26 official NASS in the most representative Anglo-Saxon, Nordic, and continental European countries and concluded that FVA enhances transparency, but understandability and comparability could be improved. Bolívar, Galera, and Muñoz (2015) examined the usefulness of IPSASs for users of governmental financial statements in 29 countries and concluded that FVA improves governmental financial statements due to better understandability, transparency, and accountability. However, the adoption of FVA involves higher costs for financial audits. Bolívar and Galera (2016) focused on the usefulness of governmental financial statements for citizens and based on survey data from 29 NASS in continental European, Anglo-American, and Scandinavian countries, concluded that FVA can increase the usefulness of government financial statements for information users.

In addition, research on IPSASs has concentrated on the impact of IPSASs on decision-making. Bergmann (2012) examined the influence of accounting basis on decision-making by analyzing Swiss newspaper articles and found that accrual accounting information is used for decision-making. In particular, the ratio of self-financed investments is frequently used by Swiss state and local governments. Aversano and Christiaens (2014) conducted a survey in 130 Italian municipalities to test the effect of IPSAS 17 on the satisfaction of users’ needs in terms of governmental financial reporting and heritage assets. A descriptive analysis showed that IPSAS 17 insufficiently responded to user needs such that an extension of the standard was recommended. Fuchs et al. (2017) concentrated on the effect of accrual accounting reforms on financial reporting and decision-making processes in Switzerland. Based on interviews with chief accounting advisors or treasury officials, the findings highlight that the implementation of accrual financial reporting is a significant step toward achieving resilient government finances. Accounting reforms stimulate the strategic use of newly provided financial data, and the more developed the financial reporting, the more involved it is in decision-making processes.

Jorge, Jorge de Jesus, and Laureano (2014) and Jorge, Jesus, and Laureano (2016) focused on the impact of IPSAS-based accounting systems on the diversity and materiality of GA-NA reconsolidation. In 2014, the authors analyzed 27 EU member states from 2007 to 2010 and concluded that technical accounting variables, not economic policy variables, explain diversity and materiality. Their 2016 paper found that IPSASs do not make a difference regarding GA-NA adjustments, indicating that IPSAS-based EPSASs also might not contribute to approaching GA-NA reconsolidation.

Martí (2006) analyzed the relationship between the accrual basis and fiscal policy. The findings indicate that accrual-based accounting reports higher deficits than the cash-based accounting because of its conservative nature. However, analyzing financial reports from local Croatian government units and utility firms, Primorac (2011) found that IPSAS-based regulations have the benefit of determining the overall direct and indirect exposures of local governments arising from the financial operations of their units.

Deaconu and Nistor (2011) investigated the effects of accrual accounting on financial management in the Romanian public sector and found that IPSAS-like accrual accounting reflects revenues and costs better than cash accounting. Agasisti, Catalano, Di Carlo, and Erbacci (2015) analyzed the impact of full accrual accounting on Italian public universities and, based on a multiple case study, found that IPSASs do not provide specific guidelines that support universities in overcoming the recognition and valuation problems typical of the public sector. Bakre, Lauwo, and McCartney (2017) examined the effect of IPSASs adoption in Nigeria. The case study results indicate that IPSAS 17 was not used for increasing transparency in accounting or reducing corruption, which was attributed to an ineffective governmental institution and a weak regulatory framework. Dvorák and Poutník (2017) focused on Czech accounting standards (CAS) and analyzed whether the transition of financial reporting from CAS to IPSASs has influenced the financial situations of public sector entities in the context of intangible fixed assets. The findings indicate that IPSAS 31 and CAS do not correspond or have only partial correspondence.

The preparers of public sector reports were surveyed by Laswad and Redmayne (2015). According to their perceptions, managers are the primary users of public sector financial reports; they use the information for internal decision-making and particularly focus on income statements as the most important financial statement.

Grossi and Steccolini (2015) focused on the adoption of business-like practices where the public and private sectors interact. Analyzing four Italian local governments over time, the authors found that the adoption of IPSAS does not lead to the expected increase in disclosure. Accordingly, accountability is restricted by a lack of relevant public service providers in the reporting entities.

Finally, four papers took a critical perspective on IPSASs and addressed the accounting reform in general and alternatives to IPSASs more specifically. Robb and Newberry (2007) criticized the application of business-style accounting to governments, a trend having begun in Australia and New Zealand and thereafter applied to governments worldwide. This approach is illustrated, for example, by the necessity of cash expenditure controls for governments and transfer of power from the Parliament to the executive government. Although IPSASs are superior to IFRS, the public sector characteristics must be considered in implementing accrual accounting. More than the accrual accounting maturity, the form of accrual accounting and the information of users have to be taken into account. Aggestam-Pontoppidan (2016) focused on the harmonization of public sector accounting in the EU and concluded that IPSASs are rarely applied in EU member states. Instead of a global convergence of standards, the development of EPSASs is favored due to the emergence of regional governance. Oulasvirta and Bailey (2016) also favored EPSASs instead of IPSASs. However, the development of EPSASs is associated with high costs. Finally, Harsányi et al. (2016) reviewed the current status of European public sector accounting. According to the EU, IPSASs are not easy to apply by the member states, which means that an EU public sector accounting framework should be developed.

Table 6 summarizes the results of sample papers on the outcomes of IPSASs adoption. As illustrated, there is substantial evidence that IPSASs adoption is related to an enhanced level of financial information quality. Accordingly, studies found positive effects of IPSASs adoption on transparency, comparability, and completeness of financial information (e.g., Bolívar et al., 2015). Furthermore, IPSAS-based information is used for internal decision-making (e.g., Laswad & Redmayne, 2015) and strategic use (Fuchs et al., 2017). Galera and Bolívar (2007) found that IPSASs correspond with the NPM postulates, in general. In addition to these intended purposes, studies also shed light on the dark sides of IPSASs adoption. First, IPSASs are related to higher costs for financial audits and higher deficits due to the conservative method used. In addition, IPSASs application is criticized for the inadequate consideration of specific subsectors, limited responses to user needs (especially IPSAS 17), and a lack of relevant public service providers in the reporting entities. Furthermore, Bakre et al. (2017) provided evidence for deviant behavior related to IPSASs adoption by showing that patronage and corruption are legitimized by applying IPSASs. Finally, several studies observed a countermovement in the direction of accounting regionalism. For example, instead of IPSASs, EU member states discuss the development of EPSASs (e.g., Harsányi et al., 2016; Oulasvirta & Bailey, 2016; Pontoppidan & Brusca, 2016).

| Positive outcomes |

|---|

| Enhancing informational quality (transparency, comparability, completeness, understandability) (9) |

| Internal decision-making (3) |

| Regionalism as a countermovement (EPSAS) (3) |

| Decrease in GA-NA adjustment diversity (2) |

| Strategic use of financial data (1) |

| NPM postulates (1) |

| More benefits for developing countries than for developed (1) |

| Negative outcomes |

|---|

| Higher costs for financial audits (1) |

| Legitimization of patronage and corruption (1) |

| Higher deficits due conservative method (1) |

| Limited responses of IPSAS 17 to user needs (1) |

| Critique of business-style financial reporting (1) |

| Inadequate consideration of specific subsectors (1) |

| Lack of relevant public service providers in the reporting entities (1) |

Again, summarizing the outcomes and negative effects of IPSAS conversion in the available paper-based literature depicts a very heterogeneous view of pros and cons. On the one hand, we see that improved stewardship of assets and liabilities goes along with more comprehensive and relevant information. Therefore, we assume that the theoretical and normative/prescriptive literature showing that accrual accounting offers a richer information basis than cash accounting is obviously confirmed. On the other hand, the pros concerning transparency and accountability seem to be suppressed at a low level of consistency and comparability due to very specific and nationalistic endorsements of the available IPSAS sets into domestic accounting rules.

5 DISCUSSION AND FUTURE RESEARCH

5.1 Key insights

Numerous scholars and practitioners of public financial management consider the adoption of IPSASs as a necessary condition for harmonizing public sector accounting systems and meeting the needs of transparency, comparability, and comprehensiveness of financial information. In particular, several financial crises and high levels of public debt are seen as red flags for changing the current accounting systems of countries and international organizations. Consequently, addressing effective accounting systems seems to be at the top of the agenda in both public financial management research and daily governmental administrative practice. However, what do we know about harmonizing public sector accounting by applying an accrual accounting system? To increase our empirical and conceptual understanding of the existing regimes of IPSASs, we conducted a systematic review of the current knowledge about IPSASs.

The first research aim of this article was to systematically analyze the emergence of literature on IPSASs over time and to investigate the characteristics of the sample articles. From 2001 to 2017, the IPSAS literature grew substantially, resulting in a sample of 80 articles from international peer-reviewed journals. The peak number of sample articles reached 17 in 2016. In addition to the number of articles, the number of citations has grown exponentially so that research on IPSASs was cited more than 2,200 times over the previous 17 years. Articles with the most scholarly attention have included the seminal work by Chan (2003) on government accounting, the international comparative study on public sector accounting by Pina and Torres (2003), and the article on accrual accounting in EU local governments by Pina et al. (2009). IPSASs authors have been published most often in Public Money & Management and International Review of Administrative Sciences. The majority of IPSASs articles feature empirical research with a focus on single-country or cross-country studies. By depicting this rapid growth in public sector accounting research addressing IPSASs, we have given evidence of the booming consideration of this research field in the public management research area.

The second research aim of this article was the topical synthesis of the IPSAS literature. We structured our findings into three main research areas and separated the process of implementing IPSASs from the outcomes of applying IPSASs. First, we analyzed research findings on the antecedents of IPSAS adoption. We distinguished between factors stimulating the adoption of standards and factors hampering the reform process. In general, previous research found various factors influencing accounting reform. The most frequently mentioned parameters of reform are political desire, the need to harmonize public sector accounting and the internationalization and modernization of accounting. Barriers to reform include the path dependency of accounting practices, fear of losing standard-setting authority, and the costs of adoption. Consequently, we see worldwide progress in the assimilation of public sector accounting practices toward applying mercantile and accrual-based regimes. Reviewing the sample articles, it remains unclear from a broader perspective whether this reform relies on the judgment of certain decision makers or promotors in the public domain that IPSASs come with clear advantages or whether the reform is merely a reflex of mimetic isomorphism, of a (pseudo-)innovative following of the general reform path.

Second, we analyzed studies with a focus on implementing IPSASs. Most of these studies conducted comparative studies across different countries. The presentation of year-end governmental public financial reports and consolidation standards are among the most frequently analyzed topics. Previous research has indicated several challenges for IPSAS adoption, such as a lack of information considered essential for greater informative transparency (Caba-Pérez & López-Hernández, 2007), a lack of consideration of public sector entity characteristics (Bisogno et al., 2015), and a lack of consensus about whether information should be stated in the main section of the report or in the notes (Caba-Pérez & López-Hernández, 2009). Most studies have measured the successful implementation of IPSASs by experts, case studies or Cooke's index (1989). Reviewing the available papers, we can conclude that there is no standardized way of implementing IPSASs to be found worldwide. The scope of IPSAS implementation varies tremendously, and even a minimal standard extent of an IPSAS implementation is difficult to find. In the sense of critical innovation management analysis, it remains unclear how the specific benefits of IPSAS introduction could be captured. Consequently, the evidence for successful reform is presented in a heterogeneous and versatile way and is often accompanied by descriptions of soft benefits, such as better overall transparency.

Consequently, in our study, we analyzed a third group of studies that focused on the precise outcomes of IPSASs. Most of these studies agreed that IPSASs are related to better informational quality and that internal decision-making is improved, but numerous papers also discussed the weaknesses of IPSASs. It often remains unclear whether the reform toward IPSASs ends up as a mere ceremonial presentation of balance sheets and fiscal numbers or whether the new accounting practices stimulate useful effects, such as better budgeting or an intensified discussion in the political domain. In addition to these general questions, we realized the European way of questioning the sufficiency of IPSASs and the reluctance of EU member states to fully adopt IPSASs. This emergent regionalism, which leads to the development of a European version of IPSASs (the EPSASs) (see, e.g., Oulasvirta & Bailey, 2016) is often accompanied by a general perception that the pure IPSASs are too unspecific and too volatile to offer a sound basis for a comparable European public sector accounting regime for the different member states.

Before concluding, however, important limitations of this review article have to be acknowledged: A main selection criterion was that only journal articles have been included in the review. Of course, there are several books and guidelines about IPSASs. Although these literature outlets offer valuable knowledge, we did not include them in the review because of issues of accessibility, a lack of comparability, and a limited possibility to screen the whole body of knowledge. Nevertheless, it might be an ambitious goal of future literature reviews to draw on an even larger number of sample articles and analyze them with text mining and topic modeling.

5.2 Implications for scholars and researchers

The main contribution of this study for researchers is twofold. For the first time, major research areas of IPSASs were quantitatively determined. This study guides newcomers, as well as experienced scholars, to these research fields and supports identifying seminal and path-breaking publications (which are, in the case of ISPASs, not very many). Second, the analysis reveals contextual factors for the general establishment of recent research on IPSAS papers, which shall enhance future researchers’ capability to identify research gaps and to be aware of cutting edge research when building upon existing methodological and contextual (e.g., national adoption) knowledge.

Our bibliographic analysis reveals that we could only find 80 articles in total in qualified journals addressing public sector accounting issues in the field of IPSASs. This number stands in comparison to the mere budgetary size of the worldwide public sector and especially in comparison to research on private sector accounting standards, showing extremely low publication activity. In private sector accounting research endeavors, we can find thousands of research articles in qualified journals over the same analyzed time span, addressing, for example, IFRS issues. To address and close that tremendous imbalance of research activity, we propose to bridge private and public sector accounting research. As IPSASs are intensively derived from IFRSs for example, we see de facto no research on the effects, of the appropriateness, and the local use of specific IPSASs for the evaluation and measurement of certain categories of assets and debts.

Revisiting the empirical methods performed in the analyzed papers, we see a great amount of descriptive statistical analyses examining accounting systems, especially in a cross-comparative setting. With regard to state-of-the art research methods, for example, in finance and economics, we see a clear lack of a sound analyses of, for example, archival data (e.g., intertemporal analyses of IPSAS-based balance sheets) and greater research on the outcomes of IPSASs, for example, by analyzing the budgetary, political, or fiscal consequences of the use and adoption of (new) accrual accounting regimes. In the sense of experimental economics, we see highly attractive fields or research before us, in which one could perform real-time examinations of the effects of changing, redefining, and switching accounting regimes more or less in real time.

Addressing the theoretical baseline of the analyzed articles, again, we see research gaps to link research on IPSASs with broader and more general theoretical grounding, especially heading toward a broader (normative) accounting theory. The core question of why, how, and to whom a public body can take account of the execution of its budget is still far from being answered appropriately. The mere transposition from IFRS rule to IPSASs might be an expensive and fruitful technocratic achievement, but the answer of whether this reform makes sense still has not been appropriately investigated, especially in light of the 80 papers analyzed.

This concern about the adoption of IPSASs as a starting point for red tape only, with low or even negative effects for sustained public financial management, leads us to the next point: from a behavioral science point of view, diverse questions remain unanswered today, addressing the benefits, the usage, and the appropriateness of the new accounting information, especially in decision-making arenas (e.g., legislatures and budget offices). Theoretical lenses, currently adopted in private sector research, such as institutional theory approaches on, for example, explaining information-driven budget negations or core psychological issues in the reception and perception of accounting information for management issues, remain unexplored in the public sector with regard to IPSASs.

This intensive adoption of IPSASs (as the only existing public sector accounting regime on an accrual basis), which is reflected in the existing literature that we analyzed, verifies the ongoing capture of commercial accounting practices in the public sector over the last decade. The serious discussion of cash accounting versus accrual accounting and its appropriateness for the public domain seems to belong to the past now. Given the broad manifestations of IPSASs today, however, the question arises of whether the benefits that were foreseen and proclaimed with accrual accounting (on an IPSAS basis) were achieved. Reviewing our collection of research on IPSASs, we could be concerned: The variety of IPSAS implementations in different public bodies public bodies seems to be highly diverse, and the observed papers presented all types, from strong to low proximity and orientation toward the IPSASs (which are themselves dynamic and are refurbished continuously by the IPSAS Board). Therefore, from a critical academic point of view, academic research must consider whether the intergovernmental comparability of fiscal budgets are now based on a better benchmark level. Only very small steps in this direction have been undertaken. This heterogeneous realization and the implementation status of IPSASs directly call for research explaining and characterizing these dissatisfying observations.

5.3 Research agenda

Based on the recent considerations and the findings of the systematic review of the current body of knowledge on IPSASs, we develop an agenda for future research. In the following, we define six research gaps that should direct future research to improve our understanding of IPSASs.

Research Gap 1 : Investigating single IPSASs for development and modification.

Although previous studies have focused on evaluating the implementation of IPSASs by analyzing the levels of better and broader disclosure by financial information, only a few papers have discussed the single standards so far. Given the volatility of IPSASs (the right to select specific concepts of the assessment of, e.g., assets and liabilities), the continuous modification and the current development of new standards, the question of how effective and how stable the single standards are constantly arising. Specific research questions would be as follows. Are IPSASs functional, objective, valid, and sufficiently reliable for public sector use? Are IPSASs adopted accurately in a specific environment? How are IPSASs applied, and how (why) are they modified in a national endorsement process? Are there differences among single IPSASs in terms of acceptance and adoption? Future scholars might also learn from research on IFRS standards that are typically embedded in a national endorsement process.

Research Gap 2 : Examining the adoption of IPSAS cross-nationally.

Although the development of IPSASs is relevant at the international level and many countries and international organizations are concerned with international public accounting, there are only a few cross-national studies. International research on IPSASs with a focus on comparative analysis is, however, significant because countries with similar governance and political systems might learn from each other and gain support in adopting standards. Although the Comparative International Governmental Accounting Research Network (CIGAR-Network, 2019) stimulates exchange among the international research community, comparative GA with a special focus on IPSASs would be a promising area of further research (Humphrey & Miller, 2012).

Research Gap 3 : Cui bono IPSAS?

IPSASs are supposed to have various positive effects on transparency, decision-making, and intergenerational equity. However, research has to match these assumptions to evidence, and the outcomes of accounting practices have to be investigated (Broadbent & Guthrie, 1992; Broadbent & Guthrie, 2008). Consequently, future research might ask to what extent adopting IPSASs affects the decision-making behaviors of politicians (e.g., concerning budgets or debts), capital market actors, investment bankers, or audit boards. Does IPSAS adoption in a country improve the understanding, acceptance, and compliance of financial information of public financial managers?

Research Gap 4 : Advancing normative research on IPSASs.

Existing knowledge on IPSASs is mainly based on empirical research. However, normative research might contribute to current knowledge by examining whether accrual accounting based on IPSASs improves transparency, trust in the political–administrative system, and trust in government institutions, for example, from a taxpayer perspective. Analyzing the relationship among parliaments, decision makers, public financial managers, and the broad public and focusing on the level of trust by drawing on principal–agent theory might be an interesting field of future research.

Research Gap 5 : Advancing theoretical foundations of research on IPSASs.

This systematic literature review analyzes a great number of empirical papers, and the findings indicate that only a few articles build their analyses on a theoretical approach and that various studies do not explicitly refer to a theory (see also Anessi-Pessina, Barbera, Sicilia, & Steccolini, 2016; Jacobs, 2012). Furthermore, it is evident that different theories from various scientific disciplines (see Bergmann et al., 2019, p. 563) are applied. For example, many studies refer to NPM as their theoretical basis (also compare Anessi-Pessina et al., 2016; Jacobs, 2012, 2016); however, it has also been criticized due to the lack of stringency in its use as a theoretical basis for public sector accounting research (Gruening, 2001). In summary, previous research has charged that theories such as neoinstitutional theory are applied to but not developed for public sector accounting research; therefore, the objectives of public sector accrual accounting such as IPSASs are not considered (Bergmann et al., 2019; Steccolini, 2019). Accordingly, theory testing does not provide the intended results. Referring to the objectives of public sector accounting and understanding why public sector accounting influences transparency, trust, or efficacy are thus an important area of future research, which should include developing an own theoretical basis for accrual accounting research and going beyond disciplinary boundaries (see Jacobs & Cuganesan, 2014). Furthermore, future research is recommended to investigate the purposes of public sector accounting concerning the assessment and evaluation of assets and debt and the measurement of profit and losses. Conceptual research might advance our understanding of whether good governance means a balance of the annual budget, accrual accounting is an appropriate tool for performance management, and a European set of accounting standards (i.e., EPSASs) is appropriate and necessary.

Research Gap 6 : Applying more advanced statistical techniques to link causes to effects.

The majority of studies have applied case study techniques or descriptive statistics to describe the implementation process of IPSASs, antecedents of IPSASs adoption, or outcomes of applying IPSASs. To relate antecedents to varying levels of IPSAS adoption or assess the effect of different levels of information on outcomes, it is necessary to apply more advanced statistical methods. For example, an experimental research design can be applied to study the differential effect of a country applying IPSASs versus a “control group” in a natural experiment. Furthermore, the consequences of IPSAS adoption can be analyzed by linking various data sources, such as government data, budget information, and survey data, and by conducting longitudinal studies.

Research Gap 7 : Embedding research on IPSASs in accounting research.

Bearing the findings of this review in mind, it becomes evident that research on IPSASs is more insular than embedded in general accounting research. For example, most IPSAS articles are published in public management journals rather than outlets of general management. On the one hand, this is not surprising, as the IPSASs are developed for public sector entities and public and private accounting systems differ greatly. Simultaneously, studies have investigated public sector reforms by taking the implementation of accrual accounting or new accounting standards as an example. On the other hand, relating research on IPSASs to topics of general accounting, such as IFRS, standard setting, and accrual accounting, might benefit the refinement of IPSASs and reflections on standards implementation alike. Instead of concentrating exclusively on public sector accounting, using public sector accounting cases as examples to contribute to the general accounting literature might also provide an opportunity for theory development and for improving the relevance of studies for the accounting and management research communities (see also Anessi-Pessina et al., 2016). One must bear in mind that accounting developments in the public sector influence other areas and that issues in private sector accounting also have an effect on public sector accounting; thus, accounting research will benefit from disclosing contextual accounting research and from promoting collaborative and interdisciplinary research (Broadbent & Guthrie, 1992; Humphrey & Miller, 2012).

6 CONCLUSION

Given the recent practical and political emphasis placed on the harmonization of public sector accounting worldwide, the aim of this article was to critically review the current academic discussion of IPSASs based on a broad paper analysis. We aimed to identify key themes and future research fields. Due to high levels of public debt worldwide and the current discussion of implementing new accounting standards in parts of the hemisphere (e.g., the EPSASs project in Europe), this review is timely in helping to advance our understanding of the research landscape of public sector accounting within and beyond national boundaries. On the basis of this systematic literature review, we propose a research agenda that will help both theoretical and practical conceptualizations of a range of issues facing accounting harmonization in the public sector.

CONFLICT OF INTEREST

The authors declare that they have no conflict of interest.

NOTES

Open Research

DATA AVAILABILITY STATEMENT

Data sharing is not applicable to this article as no new data were created or analyzed in this study.