Generative AI for Finance: Applications, Case Studies and Challenges

Funding: The authors received no specific funding for this work.

ABSTRACT

Generative AI (GAI), which has become increasingly popular nowadays, can be considered a brilliant computational machine that can not only assist with simple searching and organising tasks but also possesses the capability to propose new ideas, make decisions on its own and derive better conclusions from complex inputs. Finance comprises various difficult and time-consuming tasks that require significant human effort and are highly prone to errors, such as creating and managing financial documents and reports. Hence, incorporating GAI to simplify processes and make them hassle-free will be consequential. Integrating GAI with finance can open new doors of possibility. With its capacity to enhance decision-making and provide more effective personalised insights, it has the power to optimise financial procedures. In this paper, we address the research gap of the lack of a detailed study exploring the possibilities and advancements of the integration of GAI with finance. We discuss applications that include providing financial consultations to customers, making predictions about the stock market, identifying and addressing fraudulent activities, evaluating risks, and organising unstructured data. We explore real-world examples of GAI, including Finance generative pre-trained transformer (GPT), Bloomberg GPT, and so forth. We look closer at how finance professionals work with AI-integrated systems and tools and how this affects the overall process. We address the challenges presented by comprehensibility, bias, resource demands, and security issues while at the same time emphasising solutions such as GPTs specialised in financial contexts. To the best of our knowledge, this is the first comprehensive paper dealing with GAI for finance.

1 Introduction

Generative artificial intelligence (GAI) is a form of artificial intelligence (AI) technology that can generate text, images, audio, and synthetic data, among other content types. The recent chatter around GAI has been driven by the simplicity of new user interfaces for creating high-quality text, graphics, and videos in seconds. It should be noted that the technology is familiar. Chatbots introduced GAI in the 1960s. But it was not until 2014, with the introduction of generative adversarial networks (GANs), a machine-learning algorithm, that GAI could create convincing images, video, and audio for users. Recent advances like Transformers and the language models they enabled have played a significant part in GAI's prominence. Transformers (Nuobu 2023) are machine-learning tools that allow researchers to train increasingly large models without labelling all the data beforehand. Thus, new models could be trained on many pages of text, resulting in more in-depth responses. In addition, transformers unlocked a new concept known as attention, which enabled models to monitor the connections between words across entire pages, chapters, and books instead of just individual sentences. Transformers could also use their ability to trace connections to analyse code, proteins, chemicals, DNA and words.

GAI models integrate various AI algorithms to present, process and modify content. Raw data inputs are transformed into various entities with the help of various natural language processing (NLP) techniques. After deciding how to represent the world, developers use a specific neural network to generate new content in response to a query or prompt. Techniques such as GANs and variational autoencoders (VAEs) are suitable for generating synthetic data for AI training. VAEs are neural network autoencoders consisting of two neural networks: an encoder and a decoder. The encoder network optimises for more efficient data representation, whereas the decoder network optimises for more efficient data regeneration. GANs generate content using a generator neural network that is compared to a discriminator neural network, which determines whether the content appears “real”. This feedback assists in the improvement of the generator network. The discriminator can also identify fraudulent content or content that does not belong to the domain. Both neural networks improve over time, and the feedback enables them to generate data as close to reality as feasible. GANs are typically employed when dealing with any kind of imagery or visual data. VAEs work better for signal processing use cases, such as anomaly detection for predictive maintenance or security analytics applications.

From the perspective of the finance industry, GAI will play a major role in boosting autonomous finance (Huang and Ren 2024; Luo et al. 2024). Autonomous finance refers to the automation of financial processes, decision-making and services through the use of AI and hyper-automation. The increasing adoption of autonomous finance in financial organisations and institutions is due to its potential to increase efficiency, decrease operational expenses and enhance consumer experiences. An autonomous finance function uses technologies that move beyond traditional automation to include capabilities, such as self-learning and self-correction, and can make decisions based on the data they collect. For instance, companies such as Morgan Stanley use Open AI-powered chatbots that assist customers and financial experts.1 These chatbots use internal collections of data sets and research as knowledge sources and can help users by providing them with specific information. Also, Bloomberg generative pre-trained transformer (GPT) (Wu et al. 2023) is a finance-specific generative model announced by Bloomberg that can assist with financial tasks.

The rest of the paper is organised as follows. Section 2 provides a brief overview of GAI, and Section 3 discusses the need for Generative in Finance. We discuss the applications of GAI in Finance in Section 4 and the real-world products of the same in Section 5. We also discuss several limitations and future research corresponding to GAI in Finance in Section 6. Finally, we conclude the paper in Section 7.

2 Overview of GAI

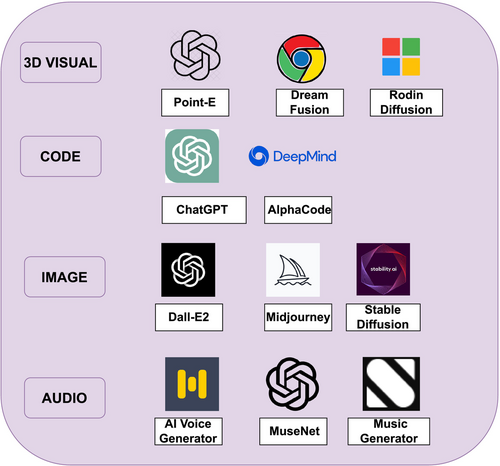

GAI helps users create new content in different formats by providing various inputs. This is different from traditional AI, which is trained on existing data to make classifications and predictions accordingly. Inputs and outputs to this model may include textual data like articles, essays or queries in the form of sound and images. New data instances are created that resemble patterns learned during training. Various examples of GAI models are given in Figure 1.

It uses various unsupervised or semi-supervised machine-learning algorithms to generate the outputs. This has helped organisations rapidly build foundation models from a vast quantity of unlabelled data. These foundation models can serve as the basis for AI systems that can be used for different implementations. These GAI models use neural networks like those mentioned above on existing data to generate patterns and new original content.

Some examples of GAI (Brynjolfsson et al. 2023) include Chat GPT (Aydın and Karaarslan 2023), DALL-E, Bard, Bloomberg GPT (Wu et al. 2023), and so forth. These can generate output in the form of texts or images depending on the prompts and dialogues given by the user. The rise in prominence of GAI is due to its wide-ranging applications and because of its potential to improve productivity and efficiency in different fields (Sai, Sai, et al. 2024). GAI can be used in various fields of work, whether for academic writing, composing, dubbing, image editing, architectural rendering, and so forth. (Mittal et al. 2024; Sai, Mittal, et al. 2024; Chamola et al. 2024; Sai, Yashvardhan, et al. 2024; Sai, Gaur, et al. 2024). The most compelling advantage of incorporating GAI in different fields is efficiency. GAI will enable businesses to automate specific tasks that are labour-intensive and focus their time and resources on more strategic objectives. It is capable of generating new ideas and content, drafting templates, bettering customer support through virtual assistants and chatbots, analysing data, writing and validating codes, and other types of information. However, it still seems to require human assistance and supervision to be used appropriately, and there are widespread concerns about GAI that bring up ethical, legal, social and economic issues.

2.1 GANs

GANs have enabled the generation of realistic data across various domains and have hence become a prominent tool in the field of AI (Eckerli and Osterrieder 2021). Making use of two neural networks, the generator and discriminator, it has a unique framework that makes it suitable for data generation (Saxena and Cao 2021). This model is trained by framing the problem as a supervised learning problem with two sub-models, with the generator generating synthetic data and the discriminator classifying content as either real (domain data) or generated. The two models are trained together in an adversarial zero-sum game until the discriminator is deceived for about half the time, indicating that the generator model generates plausible examples. The field of GANs is prominent and continuously changing to perform functionalities like image-to-image translations (Alqahtani et al. 2021). Table 1 shows various advantages and disadvantages of GAI in finance.

| Aspect | Advantages | Disadvantages |

|---|---|---|

| Data efficiency | Can generate synthetic financial data, reducing the need for large, real datasets. | Synthetic data may not fully capture the complexities of real-world financial data. |

| Model complexity | Capable of modelling complex financial systems and patterns. | Complexity makes the models hard to interpret, leading to a ‘black box’ issue. |

| Accuracy | High predictive accuracy for tasks like stock prediction, fraud detection, and so forth. | High-accuracy models may overfit the training data, leading to poor real-world performance. |

| Adaptability | Can adapt to new financial conditions or new types of fraud more quickly. | Adapting the model to new events may require re-training, which can be computationally very expensive. |

| Anomaly detection | Excellent at identifying anomalies, a key aspect in fraud detection and risk assessment. | May produce false positives or negatives in anomaly detection due to model complexity. |

| Real-time analysis | Capable of real-time analysis and decision-making. | Real-time analysis requires heavy computational resources, which leads to higher operational costs. |

| Operational costs | Can automate various financial tasks, potentially reducing operational costs. | Initial setup and on-going maintenance can be costly due to computational requirements. |

| Ethical concerns | Can be created with restrictions on fairness to decrease biased decision-making. | The ‘black box’ aspect could cause ethical issues, particularly when making important financial decisions. |

2.2 VAEs

A GAI algorithm called a VAE use deep learning to produce new material, identify irregularities and eliminate noise (Nguyen et al. 2024). VAEs are an excellent option for signal analysis to analyse IoT data streams, biological signals like EEG or financial data feeds (Xu et al. 2024). They are also well-suited for creating synthetic time series data that trains other AI algorithms. Like GANs, VAEs integrate two kinds of neural networks. They do, however, incorporate two separate types of neural networks that function in different ways. When it comes to VAEs, one network determines the best method to encode unprocessed data into a latent space, and the other network, known as the decoder, determines the best approach to turn these latent representations into new material.

3 Need of Generative AI in Finance

- Efficiency and Automation: GAI is capable of automating content generation. It can also be employed to do laborious tasks and previously manual processes that require more manual effort and human time (Sai, Sai, et al. 2024). It can assist users by providing them with templates for how they should represent content; this will help professionals focus more on decision-making and creativity on a strategic level. This will also reduce human error and substantially reduce expenses and time consumed.

- Creativity and originality: GAI can generate new and original content that is diverse and imaginative. The output can be of different forms. It can be textual data, AI-generated images, and so forth.

- Generation of content based on personalisation: GAI is capable of enhancing user experience by generating content based on the specifications and preferences of the user.

- More consistent and accurate: Provided the model is trained on appropriate valid data, it will output accurate and consistent results in real-time.

- Adaptability: Unlike humans, GAI models can be trained on humongous data sets related to different domains and can be generalised to create data constituting information from different domains and sectors based on constraints put forward by users who guide the generation process.

In finance, GAI (Chen et al. 2023) will result in improved finance operations by providing means to face challenges like the Complexity of financial data: simple narratives that are concise, understandable and capable of fitting the needed complex financial data, more effectively, will be of great assistance to a financial institution. Financial experts and analysts would have to spend a lot of time analysing this complex data that may be prone to human error. On the other hand, if tweaked accordingly, GAI can quickly analyse complex financial data that is accurate (Liu and Wang 2024). Cater to the needs of various stakeholders: different individuals may have different circumstances, and thus focus on different goals. Tailoring to all their needs will prove to be laborious and time-consuming. GAI can also provide critical insights to each individual, assisting them in decision-making that will help them in accomplishing their tasks in an effective manner. Contextualisation and Interpretation: with proper human assistance and GAI's capability to identify patterns, GAI might be able to provide insights and necessary contexts of statistical data rather than just numbers. Compliance and Punctuality: since financial organisations function on strict timelines, human error or delay in any of the build-up for a particular operation may hinder the functioning of the organisation. In certain areas, like report generation with human surveillance, GAI (Kumar et al. 2025) will be capable of generating accurate reports. GAI models facilitate collaborations and hybrid functioning of AI with the human workforce (Haase and Pokutta 2024), which includes professionals and experts. Knowledge workers, such as financial or legal analysts, product innovators, and consultative sales professionals, can become more efficient and effective with the assistance of GAI tools. GAI can shift the dynamics of work done by this part of the workforce by driving the focus from locating, aggregating and summarising key sections of text and images to verifying the accuracy and thoroughness of answers provided by GAI models. This applies to numerous job roles, such as financial advisors and analysts preparing investment recommendations, compliance analysts assessing the impact of new regulations, and so forth. In each of these instances, the human resources professional can retain editing rights and the final say while shifting their attention to other value-adding tasks. Fine-tuning and tweaking AI models according to the functionality and iterative training of AI can improve the performance of organisations and assist in adapting to specific constraints and changing preferences. This can improve decision support and analysis and ensure continuous improvement and learning of AI systems.

4 Applications

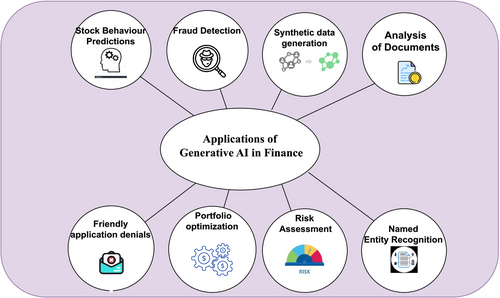

This section explores the various applications of GAI in finance. Figure 2 illustrates some prominent ones.

4.1 Conversational Finance

Conversational finance provides clients with enhanced customer service, customised financial guidance and payment reminders. Since they are trained to both simulate and understand human-like language patterns, GAI models can respond in a more precise and context-relevant way regarding finance. Therefore, GAI can considerably improve the performance of conversational finance systems by enhancing aspects like efficiency and user experience by providing more precise, engaging and nuanced responses in real time. Using NLP algorithms (Sabharwal et al. 2021), unstructured text is transformed into useful analytics. In recent years, NLP algorithms have become significantly more reliable and scalable, giving financial decision-makers a comprehensive understanding of the market. For example, depending on their level of sophistication, chatbots (Suta et al. 2020) can carry on whole conversations or just respond to certain terms, making it hard to distinguish them from people. By using machine learning (ML) and NLP, chatbots may learn from their interactions with people and get better over time. They can also understand the subtleties of the English language and ascertain the genuine meaning of a communication. The procedure used by chatbots is two-step. In order to answer the question, they first ascertain its meaning and collect any information from the user that could be required. They then answer the question accurately.

4.2 Stock Behaviour Predictions

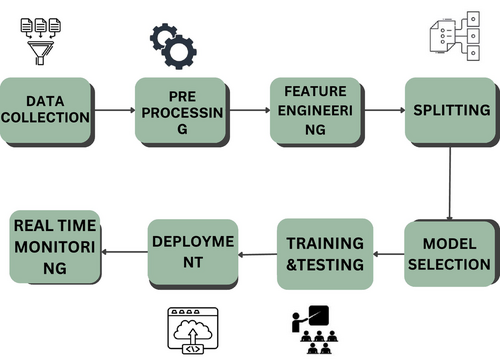

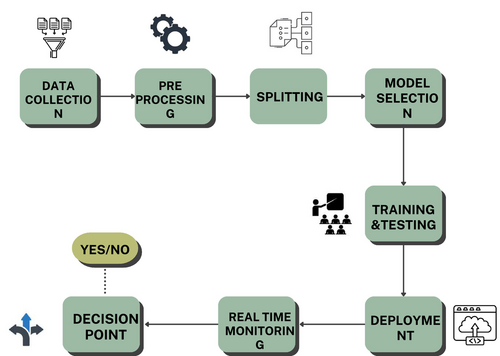

Predicting time series for financial analysis is a difficult process due to the fluctuating and irregular nature of the data, as well as the long-term and seasonal fluctuations that can result in enormous errors. In contrast, deep learning combined with NLP outperforms prior methods for working with financial time series by a wide margin. These two technologies can effectively manage massive amounts of data when combined. Several deep- learning algorithms have begun to outperform humans in a variety of tasks, including speech recognition and medical image analysis, over the past 5 years. Recurrent neural networks (RNNs) (Grossberg 2013) is a particularly effective technique for forecasting financial time series such as stock prices using RNNs. Because of their high level of accuracy, these strategies might be used as replacements to the current conventional stock index prediction techniques. When predicting patterns and volatility in stock prices, as well as when making trading decisions, NLP and deep- learning approaches are beneficial. RNNs can properly model any nonlinear function and can identify complex nonlinear relationships seen in financial time series data. A basic flow of activities that occur throughout the process of computing stock behaviour predictions is shown in Figure 3.

4.3 Fraud Detection

AI can be used to detect fraud and minimise risk by preventing fraudulent activities. By creating simulations of fraudulent and suspicious transactions through synthetic example generation, misconduct and ill-mannerisms can be detected in businesses and financial institutions (Raghavan and El Gayar 2019). These examples will further help augment and train machine-learning algorithms to recognise fraudulent patterns in financial data. Table 2 shows a comparison between GAIGAI and other methods in fraud detection. This capability to comprehend fraudulent patterns and transactions allows models to efficiently and accurately detect suspicious activities, leading to faster detection and, eventually, prevention of fraud. Using GAI in fraud detection systems, financial institutions can: Maintain consumer trust, Minimise losses due to fraud, enhance reliability and security as a whole. Fraud losses, primarily from wire transfers and credit/debit cards, cost banks, merchants and customers an estimated $16.9 billion USD. Companies train models with client data to detect and prevent fraud. Class imbalance is a known issue of fraud detection on real data sets: often, a data set represents a biased sample and often, a data set can represent a skewed sample of reality, which will inevitably result in flawed models (Ahmadi 2023). American Express Co.'s AI lab is searching for a remedy to this problem by generating synthetic data to enhance its fraud detection models.

| Aspect | Existing methods | Generative AI (GAI) |

|---|---|---|

| Data requirement | Typically requires large, well-labelled data sets for training. | Can generate synthetic data for training, reducing the need for large datasets. |

| Model complexity | May use simpler models that might not capture all complexities. | Complex models capable of understanding complicated patterns in the data. |

| Training time | Because the models are simpler, training is usually faster. | May require longer training time due to complexity. |

| Accuracy | Accuracy can vary; it may not be as high as GAI in some cases. | High degree of accuracy for recognising fraudulent activity due to better information and more complicated models. |

| Adaptability | May require manual feature engineering to adapt to new fraud types. | Can adapt to new types of fraud by retraining the generative model. |

| Anomaly detection | Additional algorithms can be necessary, particularly for anomaly detection. | Excellent at identifying abnormalities in data, which is a key feature of fraud detection. |

| Real-time analysis | Real-time capabilities may vary; some methods may not be suitable for real-time analysis. | Capable of real-time fraud detection due to advanced algorithms. |

| Computational requirements | Usually lower computational requirements. | Generally higher due to the complexity of the models. |

| Regulatory and ethical issues | Mostly easier to interpret, which can be beneficial in meeting legal prerequisites. | May raise concerns due to the ‘black box’ nature of some generative models. |

DALL-E can generate visual representations of anomalies and fraudulent patterns in financial transactions, and it can generate images that emphasise potential fraud indicators by describing suspicious transaction patterns, thereby aiding in fraud detection and risk mitigation. Figure 4 reflects the flow of events during the process of fraud detection.

4.4 Synthetic Data Generation

- Privacy and compliance regulations can severely restrict the availability and application of data.

- In product testing environments, evaluators frequently require data that is limited or unavailable.

- ML necessitates vast quantities of training data, which can be costly and scarce.

The expansion of data-driven processes and the new opportunities afforded by this type of analytics and modelling have increased the need for data and data scientists in the finance industry. Financial data sets are mostly highly regulated, which restricts their application in the creation of new products and procedures. According to JPMorgan's AI Research (Tulsi et al. 2024), anonymisation is unreliable, and encryption can impair data applications. The majority of these limitations can be overcome with synthetic financial data, and the production of large volumes of synthetic test data significantly improves scalability and collaborative work with typically sensitive or limited datasets. Amex researchers proposed GANs to generate synthetic datasets (Efimov et al. 2020). AI models like ChatGPT can be used to create synthetic data for stress testing or validating different models.

4.5 Analysis of Financial Documents

GAI can be used to process, derive useful information and summarise information from large amounts of financial documents, such as financial statements, annual reports and earnings calls, enabling more efficient analysis that leads to better decision-making. Using AI technology, users can integrate their document finance solution into existing workflows without disrupting existing processes. Massive quantities of financial documentation can be automatically read and interpreted by NLP use cases that are implemented by finance professionals (Mou 2019). Businesses can train NLP models using their existing documentation resources. The most useful and instructive information is then extracted and condensed from hundreds of papers by the financial statement analyser, which is driven by NLP. NLP is also necessary for creating a search engine for financial markets. Numerous documents can be found in financial institutions' databases. To gather useful investment data, the NLP-powered search engine extracts the ideas, concepts and components of these publications. Financial decision-makers now have a comprehensive grasp of the market thanks to recent advancements in NLP algorithms' accuracy, scalability, consistency and dependability. it is also being utilised to automate accounting and audits, minimise laborious tasks, expedite negotiations, analyse risks, understand financial emotions and construct portfolios. By going through historical financial information, GAI models can capture complex relationships and patterns in the data, enabling them to make predictive analytics about asset prices, economic indicators and future trends (Luk 2023; Park et al. 2023). GAI models can produce different scenarios by replicating variables like market conditions, macroeconomic factors, and so forth, bringing awareness to potential risks and opportunities, provided it is tweaked properly (Finkenstadt et al. 2024; Flaig and Junike 2022). For example, DALL-E can create visual representations or graphical structures of concepts and schemes like investment-related schemes by describing market trends, portfolio allocations or simulated scenarios. For instance, DALL-E can produce images that help analyse investment opportunities and communicate insights to stakeholders. For instance, Deloitte's Audit Command Language has evolved into a more effective NLP application. It has used NLP techniques to analyse contract documents and long-term procurement agreements, especially those involving government data.

4.6 Financial Query Resolution

GAI (Golda et al. 2024; Bansal et al. 2024) can provide more accurate and comprehensive solutions to user queries than other alternatives because of its ability to understand human language patterns and NLP capabilities. This results in contextually relevant and in-depth explanations and responses. By training these models on large data sets of financial data, they can respond with appropriate information to financial questions, which touch upon topics such as Stock analysis, Financial ratios, Principles of accounting, Regulatory compliance (Chen et al. 2021; Yang et al. 2024). NLP capabilities added to live agent transactions can comprehend caller sentiment to a satisfactory extent. It can also file urgency if needed and then respond by routing a call to the needed department more quickly and with accuracy. Or provide e-translation to solve issues like language barriers between an agent and caller. By sifting through massive data sets, NLP can conduct sentiment analysis to identify complaints, reviews and mentions across multiple touchpoints, identify and comprehend patterns in customer behaviour that are undetectable to humans, and even learn and adapt to site visitors by storing their preferences or providing them with custom-tailored content. Bloomberg GPT is more apt to answer finance-related queries than other GAI products.

4.7 Report Generation

GAI is capable of generating informative, well-structured and reasonable financial reports based on available data. These reports may include cash flow statements, income statements and balance sheets (Shukla et al. 2023). Since it is done automatically, it reduces manual effort in the reporting process, which is often labour-intensive, and it also speeds up and streamlines the procedure, resulting in accurate, consistent delivery of reports. Additionally, it provides room for the customisation of financial reports, which will help generate visualisations depending on the user's needs, making them valuable for financial professionals and organisations. Using NLP, financial professionals can promptly detect, focus on and visualise irregularities in daily transactions. With the proper technology, identifying transaction anomalies and their causes requires less time and effort. In the banking business, NLP is being used to automate audits and accounting (Fisher et al. 2016; Oyewole et al. 2024). In natural language generation tasks, transformer models, such as the GPT series, have demonstrated outstanding performance. These models utilise attention mechanisms for text comprehension and generation. On financial data sets, pre-trained models such as GPT-2 or GPT-3 can be fine-tuned and used to generate reports with high-quality written content.

4.8 Generating Applicant-Friendly Application Denials

AI plays an essential position in the banking industry, especially in loan decision-making procedures. It aids banks and financial institutions by evaluating consumers' creditworthiness and determining appropriate credit limits, thus establishing risk-based loan pricing. However, both loan applicants and decision-makers require full disclosure of AI-based decisions, such as application denial reasons, to cultivate trust and increase customer awareness for future loan applications. GANs have been used to generate user-friendly denial explanations (Srinivasan et al. 2019). By organising denial reasons hierarchically based on complexity, two-level conditioning is used to generate explanations that are more understandable to applicants. GAI can also be used to enhance customers with good support systems and can be implemented for tasks like generating applicant-friendly denial applications. By providing AI with input that contains important details regarding the applicant, it can analyse the circumstances of each applicant through attributes like income, credit history, records and other information and provide a clear, concise and valid reason for denial. It can be more effective due to the accurate and qualitative answers it can generate over time. It is also continuously fine-tuned, and its ability to respond in a simple manner without complexity and technical jargon makes it more accessible to customers. Therefore, this can result in increased satisfaction and confidence in the organisation and is of great use in a financial institution. Microsoft Language Understanding Intelligent Service (LUIS) can be used to generate applicant-friendly denials because of its capability to train custom language models and utilise them for different uses (Williams et al. 2015).

4.9 Portfolio Optimisation

GAI models trained on financial texts can help users in wealth and asset management by providing room for personalisation and taking into consideration factors like risk tolerance, expected returns, and so forth. GAI can create synthetic data and go through vast quantities of data. If it is trained on data like historical financial records, news articles and so forth, it can generate multiple investment scenarios and simulate different market conditions, economic environments and sentiments; it can assist investors and other financial experts in making data-driven decisions, refining investment strategies, minimising risk, gain a deeper context and in turn enhance portfolio performance and result in better financial outcomes. The past information can be used to forecast the beginning of a trading session and a portfolio. Using this information, investors can allocate their current capital amongst the various assets. NLP can be utilised for semi-log-optimal portfolio optimisation. Semi-log-optimal portfolio selection is a computational alternative to log-optimal portfolio selection. When environmental parameters are ambiguous, this aids in attaining the highest growth rate possible. Data envelopment analysis may be used to select a portfolio by eliminating attractive and unattractive stocks. GANs can be utilised to generate synthetic financial data, such as synthetic asset returns or portfolio compositions, which can be used for various portfolio management tasks.

4.10 Risk Assessment

Banks can estimate the likelihood of loan repayment based on a credit risk assessment. Typically, payment capacity is evaluated based on past purchasing patterns and loan repayment history. However, this information is often unavailable, particularly amongst the impoverished. According to estimates, approximately half of the world's population does not utilise financial services due to destitution. This is a problem that NLP can assist with. NLP methods utilise various data elements to assess credit risk. For instance, NLP can be used to evaluate attitude and entrepreneurial mind-set in company financing. Similarly, it may flag data that does not make sense and submit it for further investigation. Throughout the loan process, NLP may also be used to incorporate subtle variables such as the emotions of the lender and borrower. Typically, businesses extract a vast quantity of information from personal loan documents and input it into credit risk models for further analysis. Inaccuracies in data extraction can result in erroneous credit risk assessments despite the fact that the gathered information assists in the evaluation of credit risk. In such situations, named entity recognition (NER), an NLP technique, is advantageous. NER facilitates the extraction of pertinent entities from the loan agreement, including the date, location and party information.

4.11 Named Entity Recognition

Named entity recognition (NER) is a potent NLP method that the banking sector is using more and more to enhance customer satisfaction, automate procedures and extract insightful information from unstructured data. Named entity recognition entails tasks like recognising and categorising entities included in text data (Saju and Shaja 2017), such as people, institutions, organisations, and so forth. This is of great importance in finance, and GAI can be utilised in finance for this since it has the ability to generate, comprehend, analyse texts and observe trends in training data. Once a GAI model is trained on financial data, it is capable of recognising named entities in new financial texts. Models like transformers can learn patterns and trends between words, entities and phrases used in financial texts on which they are trained and appropriately respond to newer data and inquiries. This helps them to comprehend the context of the data and understand the semantics and logic that could be implemented while analysing future data. The model can analyse documents, generate forecasts and predict, and identify and classify entities and terms. GPTs have risen in prominence due to their ability to perform NLP tasks effectively. These models have attained state-of-the-art performance in various NLP tasks, including NER, using self-attention mechanisms to capture global dependencies between words. On financial text data, pre-trained transformer models can be fine-tuned to perform NER specific to the finance domain. Bloomberg GPT is a domain-specific model developed by Bloomberg for the financial industry. It is likely tailored to handle financial terminology and context, making it a potential choice for NER in finance. Also, GPTs like GPT-3 can also be used for NER. GAI for NER in finance offers significant benefits, including enhanced efficiency, accuracy and scalability in handling vast amounts of financial information. It empowers financial professionals with the ability to extract critical named entities, facilitating improved analysis, risk assessment, and decision-making in the dynamic and complex world of finance.

5 Real World Scenarios/Products

In this section, we explore various GAI-related technologies and products that have already hit the market or are soon to be released. These products showcase the utility and transformative potential of GAI in the real world.

5.1 Finance GPT

Finance GPT (Lee et al. 2025), also known as GPT-F, is a language model trained and optimised for finance-related tasks and applications. GPT-F is trained on a large data set of financial data, and thus, it has better knowledge of finance-specific content and terminology than other standard GPT models, even though their fundamental architecture is similar. It is trained by exposure to financial papers, news articles, documents, market analysis data, and so forth. GPT-F is capable of constructing context-specific and convincing resolutions and putting forward insightful responses on finance-related topics. This is because they are able to perceive the domain-specific language, patterns, relationships and trends that could be seen in the data it is trained on. In the financial industry, GPT-F's ability to comprehend natural language (NLP) has a wide range of applications that make the system more productive and efficient. It simplifies data entry, extracts important information from financial records and summarises reports. GPT-F accelerates and simplifies various financial processes through the use of AI and language processing. Some applications of GPT-F are given below.

5.1.1 Financial Research and Analysis

GPT-F can be used to identify patterns, understand the context and gather content from different financial documents. It is capable of complex language processing and, therefore, can handle different documents like financial news articles and find patterns in sentiment and market trends, enabling them to extract info from multiple sources. This helps analysts and other users to make informed and user-based choices that may be profitable down the line. Thus, GPT-F can be used for financial research, generating reports and analysing given data.

5.1.2 Wealth Management and Planning

GPT-F is a useful tool for making financial plans and wealth management. People can make personalised financial plans that take into account investment strategies, tax minimisation and diversifying their portfolios. Analysing their financial traits and goals aids people to make informed choices about their financial futures.

5.1.3 Personalised Recommendation

GPT-F can also be used by users depending on the individual's goals and profile and depending on their risk tolerance while making particular decisions. By providing tailored recommendations for investments and asset management, GPT-F provides room for personalisation and preferences. These recommendations are put forward based on the financial data it trained on, which includes records, market trends and individual attributes like risk tolerance and user profile.

5.1.4 Investor Sentiment Analysis

GPT-F can be used to estimate how investors view the market and certain assets by going through sources with financial contexts like news articles, blogs and social media posts. They are capable of comprehending the linguistic nuances and emotions present in the data given. Thus, it can be used to make more accurate predictions and market sentiment analysis, which is important for investors as it helps in decision-making. Customer care or resolving user queries; GPT-F is capable of providing information on customer inquiries and finance. It can be used for providing account information and has the capability to assist transactions and recommend financial goods and services to users.

5.1.5 Data Generation and Natural Language Processing

GPT-F help organisations provide customers with appropriate care by providing their inquiries with proper responses through chatbots and other support systems.

5.1.6 Risk Evaluation and Fraud Detection

GPT-F is trained on historical data and is capable of analysing transaction data. By doing this, it is able to find certain trends and patterns that can assist organisations in differentiating between genuine and fraudulent activities. This makes it easier to detect fraudulent transactions and peculiar behaviour. Using GPT-F, organisations can mitigate risk, safeguard the institution and prevent unwanted financial losses by detecting fraudulent activities and evaluating risk. GPT-F plays a vital role in risk assessment and management, which will help them make data-driven decisions. GPT-F, therefore, can be used to detect fraud and evaluate risk in financial institutions and businesses. Regulation compliance businesses face a formidable challenge when it comes to navigating complex regulatory frameworks. GPT-F offers assistance that simplifies the situation. Compliance with financial regulations remains a top priority for businesses around the world. The GPT-F tool proves instrumental in providing much-needed support via a carefully designed package. The instrument ensures adherence to ethical standards within the confines of the law by providing guidance on compliance requirements, interpreting regulations and assisting with the implementation of appropriate measures. GPT-F is also capable of risk modelling, scenario analysis, computer commerce and quantitative analysis. GPT-F can mimic financial scenarios, evaluate their potential outcomes, and aid organisations in determining risks and how to counter them.

5.2 Bloomberg GPT

Bloomberg is a global media and financial information company that offers services and tools to people who work in the financial business. Bloomberg offers a wide range of goods and services that are useful in many different ways. One of its best-known products is the Bloomberg Terminal, which is a software system that provides real-time financial information, market news and the ability to trade. The Bloomberg Terminal is used by experts and analysts and also for personalised use by traders and portfolio managers in the financial industry to monitor markets, access and analyse data, and make deals. Table 3 gives a detailed analysis of Bloomberg GPT. Bloomberg GPT (Wu et al. 2023) was launched partially due to the prevalence of specialised terminology and complexity in the financial industry. Bloomberg GPT is optimised to produce and understand financial text because it is trained on a large quantity of financial data that includes news articles and reports and is capable of analysing this to forecast market trends. The Financial Industry is complex on its own because of the presence of concepts, terminology and jargon related to finance. Recent advances based on large language models (LLMs) are widely used in various domains. The complexities of finance facilitate the need for a domain-specific model, and Bloomberg GPT is a significant step in its development and execution. Bloomberg GPT makes tasks related to existing NLP jobs easier. Bloomberg can thus conduct duties like named entity recognition, sentiment analysis and query resolution by using AI skills that have been developed and trained on financial data. This model can potentially develop and complement Bloomberg's database and procedures. Bloomberg Terminal houses a vast quantity of financial data such as company filings, financial records, indicators, news articles, regulatory documents, and so forth.

| Aspect | Description |

|---|---|

| Purpose | Designed to analyse financial news and reports. |

| Data sources | Financial news, stock market data and other Bloomberg services. |

| Primary users | Financial analysts, traders, portfolio managers and journalists. |

| Key features | Real-time news summarization, predictive analytics for varying market trends. |

| Natural language capabilities | High-level natural language understanding and generation for complex financial topics. |

| Integration | Effortlessly integrates with Bloomberg terminal and its other services. |

| Customization | Allows users to tailor news feeds and alerts based on individual preferences and portfolios. |

| Security and compliance | Follows the privacy and data security laws put in by the financial industry. |

| Accessibility | Accessible via Bloomberg terminal, web interface and mobile applications. |

| Cost | Mostly a premium service given the specialised financial focus. |

One of the major advantages of Bloomberg GPT is its access to the Bloomberg terminal and its data. This can help the model provide accurate and useful responses to user inquiries. Bloomberg GPT, like any other language model, requires preprocessing, extensive data collection, and fine-tuning on specific financial datasets in order to understand the intricate details of the financial domain. In order to make it more reliable and precise, the model's performance is constantly assessed and enhanced. In the finance industry, the use of GAI with Bloomberg GPT is an exciting advancement. It could improve the knowledge of professionals, create new data-driven decision-making opportunities, and thus alter the way financial work is performed.

5.3 SmartSummaries (AlphaSense)

AlphaSense2 is a market intelligence financial search engine and analytics platform used by financial institutions and professionals for its capabilities in the finance domain. Specialising in AI-based technologies, AlphaSense assists businesses and financial institutions in making informed decisions by delivering insights from financial content constituting company filings, news, trade journals, and so forth. One of its notable features is its GAI tool called SmartSummaries3 which is able to utilise all the past structure and organisation of data, and goes a step further by not only classifying content but also aiding users by generating responses based on its bulk of data. AlphaSense has been developing LLMs by leveraging open-source models and fine-tuning them on financial content. Therefore, like the above GAI tools, SmartSummaries is internally ML and NLP algorithms structured into a model capable of giving concise summaries and overviews of relevant information. It is also trained in financial data and hence can comprehend the data in a financial context and understand the industrial jargon and terminology. When a user searches specific topics or keywords on AlphaSense, algorithms detect relevant data from content like company filings, research reports, and so forth. These are combined and optimised to generate a response or SmartSummary that is a basic overview of relevant data. Its capability to detect patterns and hence understand market sentiment, assess risk and relate different textual data provides a better contextual understanding of the user. SmartSummaries enables customers to track a large number of companies for their needs. Hedge fund analysts and market analysts will have comprehensive data available based on companies.

5.4 Index GPT (JPMorgan)

JPMorgan Chase is developing a software service similar to ChatGPT that uses a disruptive form of AI to select investments for customers. JPMorgan may be the first financial firm planning to release a GPT-like product to its clients directly. JPMorgan has applied for a trademark of a product named IndexGPT4 and is, therefore, aiming to release the product within 3 years of approval to secure it. IndexGPT employs the same flavour of AI as ChatGPT; the bank intends to use AI-fueled ‘GPT’. This means that, similar to ChatGPT, normal users would be able to get responses regarding investments and other financial queries if they have access to the internet and a computer. The product is likely to be launched in late 2025s to early 2026. According to the financial firm, IndexGPT will facilitate ‘financial investment in the field of securities; investment in funds; financial and monetary affairs, specifically financial information and analysis services for securities investing.’ Customers will be able to readily learn about the various investment products on the market, reason and select options based on their current financial health when using IndexGPT. The AI software will then advise clients on how to invest in these securities. Although JPMorgan's IndexGPT promises to be an exciting venture in the AI scene related to finance, it also has some obstacles it has to tackle. Anxieties regarding whether it will save private data or use it in ways that will invade a user's privacy are common. Also, there have been questions regarding how it would change the workforce dynamics, potentially threatening financial analysis and advisory roles. Figure 5 contains the major real-world products that are developed for implementing GAI in finance.

6 Limitations and Future Works

This section discusses current shortcomings, risks and issues related to the usage of GAI in the financial domain. The unknown potential of GAI seems to be the primary cause for concern. Recent reports indicate that JPMorgan, Citigroup and Deutsche Bank have prohibited their employees from using ChatGPT, primarily due to the undetermined nature of the technology.

6.1 Lack of Real-World Complexity

Financial markets are like a big, complicated puzzle. They are affected by many things happening all around the world. This includes changes in the economy, what people are feeling about the stock market, big global events like elections or conflicts, and even natural disasters like hurricanes or earthquakes. Now, imagine teaching a computer program to understand this puzzle. You can only teach it what we know. So, if we don't know about all the pieces of the puzzle, neither will the computer program. This is what happens with GAI models. They create fake or “synthetic” financial data based on what they've been taught. But if they have yet to be taught about all the complicated things that can affect financial markets, then the fake data they create won't include those things either.

6.2 Market Risks

Financial markets can sometimes be affected greatly due to surprising events that nobody saw coming, like a sudden and unavoidable market crash (Krause 2023). These are called “black swan” events. GAI models, the computer programs that try to predict what will happen in the markets, can get confused by these unexpected events and may end up giving incorrect results. That is because these programs learn from what has happened in the past, and they are not great at guessing surprises that have never happened before Wach et al. 2023. So, if people or companies rely too much on these AI models to make financial decisions, they could end up in trouble when something unexpected happens (Fritz-Morgenthal et al. 2022).

6.3 Interpretability and Explainability

GAI models, particularly complex deep-learning models, need more interpretability and explainability. Understanding the model's decision-making process or how it produces its results might be challenging. This drawback may prevent GAI from being widely used in the finance industry, where interpretability and transparency are essential for risk assessment, regulatory compliance and decision-making.

6.4 Limited Long-Term Predictive Ability

Imagine we are trying to predict the weather. It is easier to say what will happen tomorrow than to accurately predict the weather a month from now. GAI models have a similar issue when it comes to finance. They are pretty good at making short-term predictions, like what a stock price might do in the next few days. But when it comes to long-term predictions, like what the stock market will look like a year from now, they are not as reliable. This is because financial markets are influenced by a ton of things—like new laws being passed, real-world events or even sudden changes in what people are interested in buying. These are things that the AI model might not have data on or cannot' foresee because they are too far in the future.

6.5 Overfitting

In the absence of appropriate validation and training, GAI models are susceptible to overfitting (Gavrilov et al. 2018). Overfitting occurs when a model works well on the training data rather than on new or unseen data. GAI models must be validated and tested to ensure that they can perform well in real-world scenarios. Regularisation techniques in ML are for preventing overfitting by including a penalty term in the objective function of the model. It can prevent the model from memorising the training data and assist it in finding more general trends; hence, regularisation techniques can be used to reduce the chances of overfitting in GAI models (Dietterich 1995).

6.6 Resource-Heavy

Training and deploying large-scale GAI models in the financial domain can be challenging due to the significant computational resources, memory and processing capacity they demand. Scaling these models to handle larger data sets or real-time applications can present additional difficulties, requiring a robust infrastructure to accommodate the increased workload. Moreover, the cost associated with maintaining and expanding such infrastructure should be carefully evaluated to ensure a sustainable and efficient implementation that aligns with the financial industry's specific needs and limitations (Sai, Prasad, et al. 2024).

6.7 Costly to Maintain

Think of GAI models like a fancy smartphone that needs constant updates. Just like we must keep updating our phone's software to get new features or fix bugs, these AI models also need regular updates to stay accurate and useful. But updating these models is not as simple as tapping a button. It takes experts to do it, and their time costs money. Plus, we might need more powerful computers as the model gets more complex, and that is another expense. So, while these AI models can do some complex stuff, like helping to predict stock prices or catch people committing fraud, they can also be like a money-eating machine that constantly needs to be fed to keep doing its job well.

6.8 Bias

It is possible that biases present in earlier financial data were introduced into the data used to train GAI models. These biases can be continued and reflected in the generated outputs, potentially leading to biased recommendations or predictions if they are not carefully addressed.

6.9 Comprehending Terminology

GAI models excel at generating genuine text based on patterns in the training data, but they may need help comprehending the financial domain's context and nuances. Financial terminology, jargon and complex financial concepts require an in-depth comprehension that may be difficult for GAI models to comprehend accurately. With the emergence of GPTs such as the Bloomberg GPT, which has been trained on vast quantities of financial data, this problem can be readily resolved.

6.10 Privacy

Another concern associated with GAI is the danger associated with data. OpenAI's Frequently Asked Questions indicate that OpenAI employees and third-party contractors can access user-posted information and questions for review. In a disturbing development, three instances of sensitive data leakage via ChatGPT (Gupta et al. 2023) were reported in less than a month. Italy had prohibited ChatGPT due to concerns about GDPR compliance before restoring its access in late April 2023. Financial services organisations hold enormous amounts of consumer and employee data; if a single employee were to enter this information into ChatGPT, there could be widespread data exposure (Wach et al. 2023).

6.11 NVIDIA Avatars

The development of AI-powered virtual assistants, also known as avatars (Chamola et al. 2023), has had a rise in prominence (Liu et al. 2019). These agents are self-learning and interactive and equipped with animated features, allowing them to provide appropriate and user-friendly interactions across a variety of platforms, including virtual environments, computers and the mob. They aim to retain customers through personalisation and providing recommendations. The new generation of cloud-based avatars could revolutionise customer service. Using advanced technologies such as NLP, ML and LLMs, these avatars are able to handle large data sets and a wide variety of tasks and queries, avoiding the need for prewritten scripts and thus resolving all limitations that come with it. Their capabilities continue to grow as they learn and adapt to user preferences and needs. The ability of these avatars to utilise non-verbal signals, such as facial expressions and eye contact, to enhance communication and better comprehend user requests and intent is a notable characteristic. Empathy for customers is vital as it strengthens relationships and improves overall customer satisfaction (Mittal 2019). Since it is capable of conveying emotions like empathy, urgency, and so forth, through nonverbal signals, these avatars can be used to empathise with and understand consumers. These avatars make consumer interactions more productive, enjoyable and personalised (Chamola et al. 2024). They are able to provide updates, payment confirmations and information without delay and respond to inquiries in real-time with AI models and technologies like NLP, ML and LLMs. This is capable of transforming customer assistance as avatars will be able to adapt and learn from past interactions, hence improving their utility and providing accurate and appropriate assistance.

6.12 Personalised Financial Product Generation

By customising products to specific consumer profiles, GAI in banking can revolutionise existing product offers. Instead of using standardised financial products, banks can utilise cutting-edge algorithms to create unique credit, investment and insurance options that perfectly match a user's spending patterns, financial objectives and risk tolerance. Tailoring financial solutions to each customer's needs increases customer happiness and fosters more trust. Such personalisation, which provides a blend of data-driven insights and individual-centric solutions, will become increasingly important to the financial industry as AI develops. Figure 6 shows limitations and future work for using GAI in finance.

7 Conclusion

It is important to note that GAI offers many benefits, substantial opportunities and potential for the financial sector and the broader economy to grow. Despite GAI's rapidly advancing nature, governments, experts and regulatory agencies continue to study and investigate GAI. Eventually, it may serve as the foundation for multiple functions, including data analysis, sophisticated search, risk management and translation. Powered by developments in machine-learning algorithms, GAI has the potential to emerge as a game-changing technology in the finance industry. Its applications in fraud detection, synthetic data generation, document analysis, financial question answering, report generation, portfolio management, risk assessment and overall autonomous finance have proved extremely valuable. By utilising GAI, financial institutions can optimise their processes and implement them accurately, while at the same time, enhancing their customers' experiences. Significant potential exists for GAI and, if incorporated appropriately, can be applied in the above-mentioned ways. GAI is poised to revolutionise decision-making and financial services to the ultimate benefit of both industry professionals and consumers.

Endnotes

Open Research

Data Availability Statement

Data sharing not applicable to this article as no datasets were generated or analysed during the current study.