The impact of air pollution on cost of debt: Evidence from corporate bond markets

Abstract

This study explores the influence of air pollution on the corporate bond market in China. An air pollution premium is documented, whereby bonds issued in more polluted areas are associated with higher offering yields at issue in the primary market and higher yield spreads in the secondary market. The statistically and economically significant air pollution premium is robust to a battery of sensitivity checks. The air pollution premium is associated with rising investor attention to climate risk in financial markets.

1 INTRODUCTION

Air pollution poses imminent threats to health, which accounts for more than 4.5 million premature deaths, 1.8 billion days of absence from work, 4 million cases of child asthma and 2 million premature births each year (Jerrett, 2015; Lelieveld et al., 2015; Li et al., 2019; Matus et al., 2012; Wood & Lawrence, 1980). Poor air quality affects health and leads to a wide range of diseases and cancers. Significant economic costs are incurred as a consequence of the adverse health impact of air pollution, amounting to $US2.9 trillion and accounting for 3.3% of GDP around the world (Centre for Research on Energy and Clean Air, 2019). China bears the heaviest financial burden of air pollution. The financial cost of air pollution is as high as $US900 billion per year, which amounts to 6.6% of its national GDP. This is closely followed by India, Russia, Germany and the US. China has been criticised for its severe pollution for decades (Christmann & Taylor, 2001).

In addition to the direct economic costs related to health, the influence of climate change on global financial markets has attracted immense attention. An emerging stream of literature investigates climate change risk in capital markets (Nordhaus, 1992; Stern, 2008), focusing primarily on equity markets. For instance, Bolton and Kacperczyk (2021) uncover that stocks with high carbon dioxide emissions generate higher returns to compensate investors for being exposed to carbon emission risk in the US equity markets. This important finding joins the debate on the price of carbon in global equity markets. In et al. (2019) reach an opposite finding in a different sample of US firms over a shorter sample period, and attribute it to market inefficiency. Chava (2014) supports the conjecture that investors incorporate climate change risk in determining cost of equity.

The role of air pollution in equity markets has been explored as well. Levy and Yagil (2011) find a negative association between equity returns and air pollution in the US, which is attributable to worsened investor mood with decline in air quality. Dong et al. (2021) uncover that the number of corporate visits by equity analysts declines, and analysts' pessimism increases with the presence of air pollution. This exerts a detrimental impact on the precision of profit forecasts in the Chinese equity market. Li et al. (2020) find that air pollution exerts a detrimental influence on workers' productivity, which translates to a reduction in the accuracy and timeliness of analyst forecasts in China. Biased decisions related to air pollution are further documented among investors in the share markets (Dong et al., 2021; Heyes et al., 2016; Li et al., 2021), and other types of participants in global financial markets (Chen, Chen, et al., 2022; Chen, Jin, & Chen, 2022; DeHaan et al., 2017; Zhou & Zhang, 2023).

While the extant investigation of climate change in capital markets is largely conducted in share markets, there is emerging interest in bond markets. In the American corporate bond market, Zhang and Zhu (2021) identify a positive relationship between firm-level exposure to weather change and financing costs. Painter (2020) shows that US municipal bonds attract higher yields in areas more vulnerable to sea-level rise, which is attributed to investor attention to climate change. Similar findings are documented in Goldsmith-Pinkham et al. (2023). Huynh and Xia (2021) find that corporate bonds with greater exposure to climate change news risk earn lower returns in the US. Baker et al. (2022) compare municipal bonds with corporate green bonds and document lower costs for issuing green bonds. Tang and Zhang (2020) find that shareholders' wealth increases following green bond issuance. Duan et al. (2021) show that bonds issued by carbon-intensive firms generate lower returns in the US, as a result of investor under-reaction to carbon risk. The bulk of the literature is heavily concentrated on the US bond markets. Sangiorgi and Schopohl (2023) administer a global survey among green bond issuers, whose main incentives to issue green bonds include enhanced reputation and mitigation and climate risk.

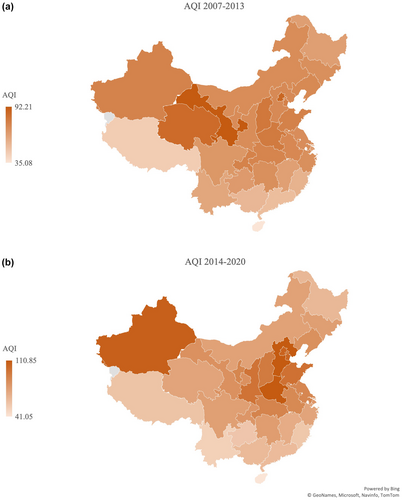

This study fills a critical gap by investigating the influence of air pollution on the corporate bond sector in China. We measure the extent of air pollution using the local Air Quality Index (AQI). Our study is undertaken in the Chinese bond market for the following reasons. First, as the world's third largest country by area, China is physically diverse, with significant spatial distance among major cities. As such, there is substantial variation in the severity of air pollution across different areas. This provides an ideal setting to explore the influence of air pollution on financial market outcomes. Next, the increasingly exacerbated quality of air in China has been in the spotlight both domestically and internationally in recent years.1 There is rising awareness of the severity of air pollution among Chinese citizens, evidenced by the 2016 protest in Chengdu and the 2017 protest in Daqing against worsened air quality. This indicates that air pollution has led to social and political instability, in addition to the health and economic costs. Since 2012, the Chinese government has made significant pledges to address climate change risk and mitigate air pollution. As such, air pollution is widely known and immensely experienced by investors in the Chinese financial markets.

Third, the Chinese bond market is growing at an exceptional speed. According to Standard & Poor's, the value of the bond market in China has exceeded the sum of all European bond markets, which is ranked second in the world.2 While most of the existing studies in this area focus on the US bond market, the Chinese market provides an interesting avenue to explore climate-related financial risks in an emerging market. Last but not least, climate risk is acutely relevant in the bond market. Different from equities, corporate bonds are associated with limited upside potential but significant exposure to downside risks (Allman, 2022; Duan et al., 2021). In pricing corporate bonds, investors incorporate their expectations on the future operations and outcomes of issuers. Given the increasing concerns about climate change, it is likely that bond issuers are subject to significant exposure to downside risks related to corporate bonds.

Our study encompasses a wide coverage at both the primary and secondary level in the corporate bond sector in China. The key findings of this study are summarised as follows. First, firms located in heavily polluted areas endure higher costs of debt. For each one standard deviation increase in AQI, yield spread as a proxy for cost of debt increases by Chinese yuan (CNY) 10.56 million (CNY 10.49 million) in the primary (secondary) corporate bond market, for an average size bond issue. The air pollution premium is statistically and economically significant, which survives a battery of sensitivity checks, including matched bond analysis, the exclusion of green bonds, alternative bond yield measures, differences between northern cities and southern cities, as well as macroeconomic and political factors.

We also explore factors that deepen our understanding of the air pollution premium. We first investigate the role of trading frictions in the air pollution premium. Air pollution is likely to cause investor pessimism and thus depress asset prices (Huang et al., 2020; Levy & Yagil, 2011). A decrease in investor sentiment is shown to be associated with declining trading volume (Gervais & Odean, 2001) and market liquidity (Baker & Stein, 2004). As such, investors may require higher yield spreads for compensation for bonds from highly polluted areas due to pessimism and illiquidity. Our analysis shows that there is no apparent relationship between trading volume in the bond market and air quality. This indicates that illiquidity and the associated trading frictions are unlikely to drive the air pollution premium in the bond market.

We also investigate the role of information environment. Air pollution exerts a detrimental impact on cognitive ability, which impairs judgement in corporate decision making. Air pollution also induces regulatory and financial uncertainty in the transition towards decarbonisation, which amplifies information asymmetry of firms from polluted areas and complicates the process for investors to assess and evaluate information. As such, investors may require higher costs of debt as compensation to hold bonds from polluted areas. Examining issuers with various levels of information asymmetry, the pollution premium is more prevalent in issuers with greater information frictions.

Next, Krueger et al. (2020) conduct a survey to explore institutional investors' understanding and attitude towards climate risks in investment decisions. The profound financial implication of climate risk is acknowledged by survey participants in the process of managing investment portfolios. In a similar manner, Alok et al. (2020) demonstrate that climate disasters induce professional money managers to adjust their portfolios. Choi et al. (2020) document inferior stock performance of carbon-intensive firms when the weather is abnormally warm. This is attributed to a heightened level of investor attention to climate risks. Investors are found to start to incorporate climate change in pricing municipal bonds after Nicholas Stern's ‘Economics of climate change review’ (Painter, 2020; Stern, 2008). As such, we postulate that investors are greatly concerned about climate-related financial risk and require compensation for investing in bonds from highly polluted areas.

Exploiting the Paris Climate Accord, the 18th National Congress of the Chinese Communist Party and the first time when the AQI exceeded 100 as exogenous shocks to investors' attention to climate change risk, we document a significantly stronger air pollution premium subsequent to these important milestones. We complement the analyses with the Baidu search index on air pollution to gauge investor attention to air pollution and their perceived air quality. Our results display a consistent pattern that the air pollution premium is more prevalent with rising investor awareness and attention to worsened air quality.

We also explore the influence of air pollution on the fundamental operations and default risks of firms. Firms located in highly polluted areas may face tighter financing constraints, given the regulatory risks, political uncertainty and physical costs to tackle environmental issues (Seltzer et al., 2022). Worsened air quality may also lead to inefficiency in the workforce, outflow of human capital to relocate to other areas and disruption in supply chains. As a consequence, firms in more polluted areas may suffer from unstable streams of revenue, cash flow and profitability, which increases credit risks. For instance, China has made enormous efforts in recent years to combat climate change, which is reflected in a series of new environmental regulations. The Chinese government has also imposed administrative orders that affect business operations of firms in polluted areas. A prominent example of disruption to business operations due to government orders is the Beijing Olympic Games in 2008. To improve the air quality significantly in a short period of time, the Beijing municipal government removed 60,000 taxis and buses and relocated 200 local factories by the end of 2007. Industrial production and thermal power plants in Beijing and surrounding cities were halted in July 2008. We explore the role of credit risk and fundamental operations of issuers in the interaction between air pollution and debt financing. Air pollution is not found to exasperate default risk, operating costs or operating cash flow of issuers, making a risk-based explanation unlikely.

In addition to bond investors, we also investigate credit rating agencies (CRAs) as another critical component in the ecosystem of the debt markets. We examine whether CRAs incorporate air pollution in their rating decisions, and find that CRAs continue to issue ratings based on the default risk and fundamental operations of issuers, whereby no significant difference is documented in credit ratings between matched bonds/firms, despite the higher cost of debt required by investors in bond markets.

Our study makes three significant and distinct contributions to the literature. To begin with, examining both the primary and secondary markets, our study is among the first to conduct a holistic analysis of the influence of climate-related financial risks on the Chinese bond markets. The most closely related studies of ours are Tan et al. (2022) and Wang et al. (2022). Both studies focus only on public companies in the corporate bond market in China. This market is dominated by private firms, which account for 80 percent of bond issuance. Our sample covers both public and private issuers in the primary and secondary markets, including more than 12,000 new bond issuance and more than 150,000 monthly secondary bond market data. Our research significantly advances the understanding of the financial implications of climate change in emerging markets. The primary bond market offers a relatively cleaner setting compared to the secondary bond market and equity market to explore investor preference on risk premia. Offering yield spreads in primary markets resemble expected risk premia to a larger extent, which are unobservable in secondary markets due to the influence of trading frictions (Chen et al., 2007; Halling et al., 2021). Offering yield spreads represent issuance costs that are intermediated by investment banks, for which credit risk rating is considered in determining fair spreads.

Second, this paper sheds light on the burgeoning issue of climate-related financial risk in capital markets, which primarily focuses on measuring and managing climate change risk, and the associated impact on the efficiency of the capital markets (Bolton & Kacperczyk, 2021; Brooks & Oikonomou, 2018; Chava, 2014; He et al., 2021; Hoepner et al., 2016; Huynh & Xia, 2021). Our study provides a timely contribution by providing evidence of an air pollution premium in debt financing costs. Equity markets are featured heavily in the extant research on climate finance. Our study joins the nascent field of work to shed light on how other asset classes navigate the uncertainty associated with climate change.

Third, our paper updates the literature on the determinants of yield spread of bonds. Bond yield spread has been shown to be influenced by default risk (Collin-Dufresne et al., 2001; Nieto & Rodriguez, 2015), expected bankruptcy costs (Leland, 1994), information frictions (Duffie & Lando, 2001; Ma et al., 2017), agency costs (Leland, 1998) and trading frictions (Bao et al., 2011). Our paper provides evidence that climate-related financial risk in the perspective of local air quality is another important determinant that should be considered in pricing corporate bonds.

The rest of this study progresses in the following manner. Section 2 illustrates the institutional settings of the corporate bond market in China. The sources of the requisite data and our research methods are introduced in Section 3. Sections 4 and 5 discuss our empirical findings. Section 6 concludes our paper.

2 INSTITUTIONAL BACKGROUND

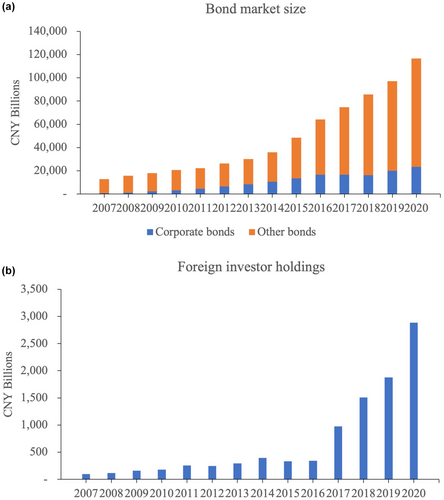

The corporate bond market in China has expanded substantially and rapidly over the recent decade. Since 2017, the Chinese corporate bond market has risen to become the world's second-largest. Figure 1 demonstrates the evolution of the domestic bond market from January 2007 to 2020 in China, whereby we use the total amount of debts outstanding in billions of CNY to measure market value. In 2007, the size of the non-governmental and non-financial bond segment was 20 trillion CNY ($US2.87 trillion) as shown in Panel A. As of the end of 2020, the total amount outstanding in this market grew to CNY 110 trillion ($US15.80 trillion). Panel B illustrates the value of the Chinese bond market as a proportion of its GDP. Despite a larger proportion accounted by government-related and financial bond issues in the amount outstanding, the non-governmental and non-financial bond segment has grown substantially from 4.24 percent to 50 percent as a proportion of GDP over the period 2007–2020. The exponential growth of this sector is associated with a hangover effect of a significant stimulus by the Chinese government in 2009. The 4-trillion stimulus deal is financed by the local governments in China using bank loans in 2009, followed by non-bank debt after 2012 as bank loans mature (Chen et al., 2020).

This paper explores the publicly issued debt instruments of non-financial firms. The non-governmental and non-financial debt securities comprise enterprise bonds, convertible corporate bonds, non-financial enterprise debt financing instruments (e.g., medium-term notes and short-term commercial papers), asset-backed securities and corporate bonds. This study investigates enterprise bonds (EBs), medium-term notes (MTNs) and corporate bonds (CBs). The interbank market and the exchange-based market are the trading venues of the aforementioned debt instruments. The major distinctions between these two markets are their respective regulatory authorities. Shanghai and Shenzhen Stock Exchanges as exchanged-based venues facilitate transactions of corporate bonds issued by public companies.3 The relevant governing body is the Chinese Securities Regulatory Commission (CSRC).

State-owned enterprises (SOEs) issue most of the enterprise bonds, which are overseen by the National Development and Reform Commission (NDRC) and traded in both the exchange-based and interbank markets. Public firms account for more than 20 percent of non-government and non-financial bond issuance, but less than 1 percent of enterprise bonds. Medium-term notes and short-term commercial papers are issued in the interbank market and regulated by the People's Bank of China (PBoC).4

Institutional investors represent the dominant group in the corporate bond market in China. In particular, commercial banks own the greatest proportion of bonds, followed by investment fund companies and insurance companies. There are two levels in each bond market, namely the primary and the secondary markets. Similar to equity markets, the primary market is the venue where bonds are issued for the first time. Subsequent to the initial issuance, bonds can be traded and exchanged among holders in the secondary market.

As a critical component in the debt markets, the Chinese credit rating industry has seen substantial growth since its establishment in the 1990s with the compulsory regulatory rating requirements imposed by the government. Different from the three leading credit rating agencies (Fitch, Moody's and Standard & Poor's) in the US, the China markets rely on nine dominant domestic issuer-pay credit rating agencies and one investor-pay credit rating agency during our sample period.5

3 DATA AND VARIABLE CONSTRUCTION

This section articulates the sources of the requisite data and explains the approaches to construct key variables. We first illustrate the datasets utilised in the study and the filtering criteria to process data in Section 3.1, followed by the estimation of important variables in Section 3.2. Summary statistics for our sample are presented in Section 3.3.

3.1 Data sources and filtering criteria

This study requires the data on air quality and financial data of bonds and issuers in China. Wind Information Co. Ltd (Wind) provides the requisite financial data for bonds and issuers, including basic issuer-level characteristics, such as tangible asset ratio, age of the issuer, leverage level, sales, profitability, revenue growth and cash holding. Wind also provides bond-level data, including issuance size, credit ratings, maturity, the outstanding debt amount, offering spread, transaction data and yield-to-maturity information.

Our sample of median and long-term corporate bonds spans a 13.5-year period from January 2007 to May 2020.6 These debt instruments include enterprise bonds, non-financial medium-term notes and corporate bonds, which results in 17,826 new issues of corporate bonds. Next, we remove bonds or issuers without information on identifiers or city-level air quality index, as well as those with more than one coupon payment per year (Livingston et al., 2018). Our sample coverage is extensive, whereby the primary bond market comprises 12,794 bonds from 3019 unique issuers. Merging the data in the primary bond market with bonds with valid data of trading information gives rise to a sample of the secondary market. In terms of trading information, we collect monthly closing and weighted average trading prices, as well as yield to maturity (YTM). We only retain a bond-month observation if its maturity is more than 1 month, the average daily trading price is between CNY 5 and CNY 130, and it has valid trading data and financial data to construct control variables. The above procedures give rise to a secondary bond market sample with 152,160 bond-month observations, which are associated with 10,411 bonds by 2787 issuers.

Similar to Dong et al. (2021), we collect the Air Quality Index (AQI) from the Ministry of Ecology and Environment of the People's Republic of China (MEEPC), which is summarised from the daily reports of air pollution by local environmental protection bureaus in every city.7 AQI is estimated as the combination of the values of six atmospheric pollutants, including nitrogen dioxide (NO2), sulfur dioxide (SO2), suspended particulates smaller than 2.5 μm in aerodynamic diameter (PM2.5), carbon monoxide (CO), suspended particulates smaller than 10 μm in aerodynamic diameter (PM10) and ozone (O3). Before 2014, AQI did not exist. The available alternative is the Air Pollution Index (API), which is based on PM10, NO2, and SO2.8 The API and AQI are strongly correlated (Zheng et al., 2014). For the period prior to 2014, we use the API to measure air quality.

We compute the natural logarithm of the mean of AQI/API for each city to measure the local air quality of each bond issuer on a monthly basis, denoted as Log_AQI. The MEEPC provides six categories of air quality: I, indicating ‘excellent’ (AQI ≤ 50); II, representing ‘good’ (50 < AQI ≤ 100); III, corresponding with ‘lightly polluted’ (100 < AQI ≤ 150); IV, indicating ‘moderately polluted’ (150 < AQI ≤ 200); V, suggesting ‘heavily polluted’ (200 < AQI ≤ 300); and VI, indicating ‘severely polluted’ (AQI > 300). These categories are employed consistently in the periods before and after 2014.

3.2 Variables

Bond yield spread at issue (Offering spread) is our key measure of cost of debt for the primary bond market, where a bond is issued for the first time. In terms of the secondary bond market, the yield-to-maturity spread (YTM spread) is employed. To estimate the YTM spread, we employ a comparable Treasury note based on maturity as the benchmark. All else equal, the credit risk of the underlying bond security is captured by the YTM spread.

We construct three alternative sets of spreads for sensitivity checks. The benchmarks in constructing Offering spread (CDB) and YTM spread (CDB) rely on similar bond instruments issued by the China Development Bank (CDB). Second, Offering spread (Synthetic) and YTM spread (Synthetic) are estimated with reference to a synthetic yield (Ang et al., 2023). First, the zero-coupon Treasury bond yield curve is calibrated based on the exponential functional form of Svensson (1994). Next, the implied price of the synthetic Treasury bond with identical coupon rate, frequency of coupon payment and maturity is estimated as the present value of each cash flow with the Treasury bond zero-coupon rates as the discount rates. Matched Treasury bond yield is computed based on its implied price. Subsequently, YTM spread (Avg) replaces the YTM spread, using the average trading volume-weighted price in the calculation.

We construct a raft of control variables to capture various features of bonds and issuers following Livingston et al. (2018). The important issue-level variables include the issue size/bond outstanding value measured by the par value of a bond in CNY 1 billion (ISize); credit rating represented by rating dummies, ranging from Below AA−, AA−, AA to AA+; the puttable, callable, or sinking fund feature; and years to maturity (Maturity). To account for the unique regulatory environments, dummy variables are assigned for both corporate and enterprise bonds (Corporate and Enterprise). The cross-listing dummy (Cross) identifies bonds traded in both the interbank and exchange-based markets. To control for firm-level variations, we compute a series of financial variables, including asset tangibility (Tangibility), cash holding to represent asset liquidity (cash and cash equivalents divided by current liability, Cash), earnings (operating income divided by average total assets, ROA), public companies (Public), state-owned enterprises (SOE), Leverage (total liability divided by total assets), the age of the issuer (Age), Sales (log of sales in billions of CNY) and Growth (annual growth rate in operating revenue) to proxy for firm profitability. The estimation approaches are articulated in Appendix 1.

3.3 Summary statistics

Table 1 provides a comprehensive overview of air quality across various cities and provinces in China. In Panel A, we present data on the 30 cities with both the highest and lowest Air Quality Index (AQI), along with their respective provinces, alongside the ranking of provinces based on their AQI during the sample period. Notably, the cities with the most severe air pollution are predominantly situated in Henan, Hebei and Shandong provinces, while provinces like Hainan, Yunnan, Guizhou and Sichuan exhibit comparatively better air quality. In general, the majority of provinces experience mediocre air quality, with AQI levels hovering around 90, although only one province consistently maintains excellent air quality, with an average AQI of 50 or less.

| Panel A: Average AQI across cities and provinces | |||||

|---|---|---|---|---|---|

| 30 cities with highest AQI | 30 cities with lowest AQI | Provinces | |||

| City (Province) | AQI | City (Province) | AQI | Province | AQI |

| Hetian (Xinjiang) | 205.058 | Sanya (Hainan) | 33.902 | Beijing | 96.777 |

| Kashi (Xinjiang) | 185.690 | Haikou (Hainan) | 41.184 | Henan | 94.017 |

| Akesu (Xinjiang) | 143.915 | Diqing (Yunnan) | 41.944 | Hebei | 92.110 |

| Xiangfan (Hubei) | 134.976 | Linzhi (Xizang) | 43.812 | Tianjin | 91.033 |

| Xingtai (Hebei) | 132.480 | Lijiang (Yunnan) | 43.928 | Xinjiang | 90.662 |

| Hengshui (Hebei) | 123.911 | Aba (Sichuan) | 44.452 | Gansu | 87.705 |

| Dezhou (Shandong) | 122.168 | Qianxinan (Guizhou) | 44.605 | Shandong | 86.978 |

| Kuerle (Xinjiang) | 122.149 | Ganzi (Sichuan) | 45.449 | Shanxi | 86.553 |

| Tulufan (Xinjiang) | 121.773 | Daxinganling (Heilongjiang) | 45.854 | Shaanxi | 83.678 |

| Liaocheng (Shandong) | 120.996 | Dali (Yunnan) | 46.015 | Hubei | 81.765 |

| Baoding (Hebei) | 119.319 | Chuxiong (Yunnan) | 46.109 | Ningxia | 79.818 |

| Heze (Shandong) | 119.158 | Heihe (Heilongjiang) | 46.121 | Jiangsu | 79.742 |

| Laiwu (Shandong) | 118.325 | Puer (Yunnan) | 46.903 | Anhui | 79.621 |

| Handan (Hebei) | 115.473 | Yichun (Heilongjiang) | 47.388 | Qinghai | 79.238 |

| Anyang (Henan) | 113.617 | Aletai (Xinjiang) | 47.929 | Chongqing | 78.040 |

| Xinxiang (Henan) | 113.586 | Nujiang (Yunnan) | 48.141 | Liaoning | 77.654 |

| Puyang (Henan) | 112.155 | Zhanjiang (Guangdong) | 48.825 | Hunan | 73.463 |

| Linyi (Shanxi) | 111.245 | Nanping (Fujian) | 49.221 | Jilin | 73.158 |

| Wujiaqu (Xinjiang) | 111.143 | Qiannan (Guizhou) | 49.408 | Neimenggu | 72.819 |

| Langfang (Hebei) | 109.578 | Longyan (Fujian) | 49.538 | Shanghai | 72.332 |

| Luohe (Henan) | 109.325 | Sanming (Fujian) | 49.811 | Zhejiang | 71.879 |

| Xuchang (Henan) | 108.339 | Qiandongnan (Guizhou) | 49.906 | Sichuan | 71.147 |

| Shijiazhuang (Hebei) | 108.335 | Lincang (Yunnan) | 49.908 | Jiangxi | 66.402 |

| Hebi (Henan) | 108.318 | Ali (Xizang) | 50.107 | Heilongjiang | 63.852 |

| Binzhou (Shandong) | 108.299 | Wenshan (Yunan) | 50.220 | Guizhou | 61.320 |

| Zhangqiu (Shandong) | 108.296 | Hulunbeier (Neimenggu) | 50.528 | Guangxi | 58.167 |

| Dongying (Shandong) | 108.271 | Fangchenggang (Guangxi) | 50.554 | Guangdong | 56.397 |

| Cangzhou (Hebei) | 107.799 | Beihai (Guangxi) | 51.107 | Yunnan | 56.356 |

| Yuncheng (Shanxi) | 106.534 | Zhuhai (Guangdong) | 51.915 | Fujian | 55.980 |

| Zhoukou (Henan) | 105.730 | Huangshan (Anhui) | 52.365 | Xizang | 51.560 |

| Hainan | 37.931 | ||||

| Panel B: Top 10 cities ranked by number of bond issues (top 10) | ||

|---|---|---|

| City (Province) | AQI | No. of bond issues |

| Beijing | 96.777 | 2628 |

| Shanghai | 72.332 | 804 |

| Shenzhen (Guangdong) | 52.984 | 566 |

| Guangzhou (Guangdong) | 66.726 | 509 |

| Chongqing | 78.040 | 462 |

| Tianjin | 91.033 | 426 |

| Nanjing (Jiangsu) | 84.259 | 421 |

| Hangzhou (Zhejiang) | 79.723 | 411 |

| Wuhan (Hubei) | 86.870 | 338 |

| Chengdu (Sichuan) | 88.321 | 337 |

- Note: This table illustrates the average AQI and number of bond issues across cities and provinces in China. Panel A presents the average monthly air quality index for the 30 most and least polluted cities, as well as 31 provinces between 2007 and May 2020. Province-level AQI is the average AQI of cities in the province. Panel B lists the top 10 cities with the highest frequency of issuing bonds from January 2007 to May 2020.

Figure 2 further elucidates the trends in air quality by depicting the average AQI values across all provinces in China and specifically highlights the average AQI values of Beijing, the capital city of China, over time. The data indicate a concerning trend of deteriorating air quality over the observed period. In Panel b, we shift focus to the primary market for bond issuance, highlighting the 10 leading cities in this aspect. Cities such as Beijing, Shanghai, Shenzhen and Guangzhou emerge as prominent players in bond issuance, reflecting their economic significance and financial activity.

Table 2 illustrates the descriptive statistics of the key variables in our empirical analysis. The mean and median offering yields are approximately 200 bps above their maturity-matched Treasury yields in the primary market. Among the 12,794 bonds issued in the primary market, the offering yield spread has a mean (median) of 2.071% (1.830%). Bond offering yield differs from the yield on a comparable bond issued by the CDB based on maturity at 1.519% on average. The approach of Ang et al. (2023) gives rise to a 2.102% distinction between the offering yield and the yield on a synthetic government bond. This is consistent with prior work in China that the yields and spreads are lower than corporate bonds in the US market (Hu et al., 2020; Walker et al., 2021). The majority of the bonds are rated AA or above (99.1%), of which 50.1% are rated AAA, followed by 26.3% with AA+ and 22.7% rated as AA. The average maturity is 4.82 years, with an average issue size of CNY 1.424 billion ($US204.545 million). Issuers in the study have an average age of 18 years. Public issuers account for 18.9% of the bonds, whereas 85.1% are issued by SOEs. The average debt ratio is 61.2%.

| Panel A: Descriptive statistics for the primary corporate bond market | ||||||

|---|---|---|---|---|---|---|

| No. of observations | Mean | Median | SD | 25th | 75th | |

| Offering spread | 12,794 | 2.071 | 1.830 | 1.079 | 1.240 | 2.730 |

| Offering spread (CDB) | 12,794 | 1.519 | 1.254 | 1.038 | 0.735 | 2.060 |

| Offering spread (Synthetic) | 12,794 | 2.102 | 1.855 | 1.087 | 1.262 | 2.769 |

| Log_AQI | 12,794 | 4.363 | 4.370 | 0.311 | 4.168 | 4.561 |

| AAA | 12,794 | 0.501 | 1.000 | 0.500 | 0.000 | 1.000 |

| AA+ | 12,794 | 0.263 | 0.000 | 0.440 | 0.000 | 1.000 |

| AA | 12,794 | 0.227 | 0.000 | 0.419 | 0.000 | 0.000 |

| AA− | 12,794 | 0.008 | 0.000 | 0.091 | 0.000 | 0.000 |

| Below AA− | 12,794 | 0.000 | 0.000 | 0.009 | 0.000 | 0.000 |

| Maturity | 12,794 | 4.820 | 5.000 | 2.014 | 3.000 | 5.000 |

| Isize | 12,794 | 1.424 | 1.000 | 1.680 | 0.600 | 1.600 |

| Puttable | 12,794 | 0.259 | 0.000 | 0.438 | 0.000 | 1.000 |

| Callable | 12,794 | 0.110 | 0.000 | 0.312 | 0.000 | 0.000 |

| Sinking fund | 12,794 | 0.102 | 0.000 | 0.302 | 0.000 | 0.000 |

| Cross | 12,794 | 0.137 | 0.000 | 0.343 | 0.000 | 0.000 |

| MTN | 12,794 | 0.561 | 1.000 | 0.496 | 0.000 | 1.000 |

| Enterprise | 12,794 | 0.162 | 0.000 | 0.368 | 0.000 | 0.000 |

| Corporate | 12,794 | 0.277 | 0.000 | 0.448 | 0.000 | 1.000 |

| Public | 12,794 | 0.189 | 0.000 | 0.391 | 0.000 | 0.000 |

| SOE | 12,794 | 0.851 | 1.000 | 0.356 | 1.000 | 1.000 |

| Age | 12,794 | 18.048 | 17.000 | 8.685 | 12.000 | 24.000 |

| Leverage | 12,794 | 0.612 | 0.639 | 0.153 | 0.519 | 0.721 |

| Tangibility | 12,794 | 0.255 | 0.240 | 0.201 | 0.116 | 0.378 |

| Sales | 12,794 | 2.383 | 2.331 | 2.060 | 0.798 | 3.915 |

| Growth | 12,794 | 0.864 | 0.125 | 54.650 | 0.020 | 0.288 |

| ROA | 12,794 | 0.042 | 0.035 | 0.035 | 0.020 | 0.055 |

| Cash | 12,794 | 0.617 | 0.343 | 13.643 | 0.224 | 0.541 |

| Trading volume | 12,794 | 1.319 | 0.520 | 3.687 | 0.020 | 1.403 |

| Panel B: Descriptive statistics for the secondary corporate bond market | ||||||

|---|---|---|---|---|---|---|

| N | Mean | Median | SD | p25 | p75 | |

| YTM spread | 152,160 | 2.344 | 1.868 | 5.338 | 1.251 | 2.819 |

| YTM spread (CDB) | 152,160 | 2.249 | 1.932 | 2.761 | 1.303 | 2.765 |

| YTM spread (Synthetic) | 152,160 | 1.798 | 1.269 | 5.344 | 0.746 | 2.185 |

| YTM spread (Avg) | 152,160 | 2.089 | 1.608 | 5.346 | 1.022 | 2.487 |

| Log_AQI | 152,160 | 4.394 | 4.387 | 0.313 | 4.195 | 4.590 |

| AAA | 152,160 | 0.445 | 0.000 | 0.497 | 0.000 | 1.000 |

| AA+ | 152,160 | 0.282 | 0.000 | 0.450 | 0.000 | 1.000 |

| AA | 152,160 | 0.261 | 0.000 | 0.439 | 0.000 | 1.000 |

| AA− | 152,160 | 0.010 | 0.000 | 0.100 | 0.000 | 0.000 |

| Below AA− | 152,160 | 0.001 | 0.000 | 0.037 | 0.000 | 0.000 |

| Maturity | 152,160 | 3.324 | 2.951 | 2.051 | 1.825 | 4.605 |

| Isize | 152,160 | 1.954 | 1.200 | 2.510 | 0.800 | 2.000 |

| Puttable | 152,160 | 0.249 | 0.000 | 0.432 | 0.000 | 0.000 |

| Callable | 152,160 | 0.070 | 0.000 | 0.255 | 0.000 | 0.000 |

| Sinking fund | 152,160 | 0.144 | 0.000 | 0.351 | 0.000 | 0.000 |

| Cross | 152,160 | 0.187 | 0.000 | 0.390 | 0.000 | 0.000 |

| MTN | 152,160 | 0.571 | 1.000 | 0.495 | 0.000 | 1.000 |

| Enterprise | 152,160 | 0.236 | 0.000 | 0.425 | 0.000 | 0.000 |

| Corporate | 152,160 | 0.193 | 0.000 | 0.394 | 0.000 | 0.000 |

| Public | 152,160 | 0.218 | 0.000 | 0.413 | 0.000 | 0.000 |

| SOE | 152,160 | 0.841 | 1.000 | 0.366 | 1.000 | 1.000 |

| Age | 152,160 | 16.697 | 16.000 | 8.233 | 11.000 | 22.000 |

| Leverage | 152,160 | 0.613 | 0.638 | 0.147 | 0.519 | 0.719 |

| Tangibility | 152,160 | 0.255 | 0.247 | 0.197 | 0.119 | 0.385 |

| Sales | 152,160 | 2.465 | 2.359 | 2.098 | 0.836 | 3.991 |

| Growth | 152,160 | 0.271 | 0.104 | 4.488 | −0.003 | 0.267 |

| ROA | 152,160 | 0.038 | 0.032 | 0.041 | 0.017 | 0.052 |

| Cash | 152,160 | 0.491 | 0.354 | 0.775 | 0.230 | 0.554 |

| Trading volume | 152,160 | 0.646 | 0.145 | 2.93 | 0.049 | 0.408 |

- Note: This table displays descriptive statistics of a wide range of characteristics of issuers and bonds in the primary (secondary) bond market in Panel A (B) from January 2007 to May 2020, including the median, average, standard deviation (SD), and the 25th and 75th percentiles. Appendix 1 defines all variables.

Our analysis extends to the secondary bond markets, where we observe comparable distributions to those in the primary market. Specifically, the average monthly YTM spread stands at 2.344%. A significant 89% of our observations boast ratings above AA, indicating a generally high level of creditworthiness within the market. The average maturity of bonds traded in the secondary market is approximately 3.324 years, accompanied by a substantial bond outstanding volume totalling CNY 1.954 billion (equivalent to $US280.675 million).

Interestingly, we find that the average air quality index (AQI) remains consistent across both primary and secondary market samples, hovering around 79.043. However, there exists a notable degree of variation within this metric, reflecting the diverse environmental conditions across different regions where bond trading occurs.

4 EMPIRICAL RESULTS

This section starts by showing the influence of air pollution on the pricing of Chinese bonds. It then progresses to a number of sensitivity checks to assess the robustness of our findings to methodological variations.

4.1 Baseline results

Table 3 demonstrates our baseline results. Columns (1)–(4) ((5)–(8)) represent the primary (secondary) bond market. captures how yield spreads relate to air pollution. The coefficient of Log_AQI is 0.214 (0.137) in column (1) ((5)), which is statistically distinguishable from zero. Replacing firm fixed effects with industry fixed effects in columns (2) and (6), the positive relation between air pollution and yield spreads remains intact.

| Primary market | Secondary market | |||||||

|---|---|---|---|---|---|---|---|---|

| Dependent variable = Offering spread | Dependent variable = YTM spread | |||||||

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | |

| Log_AQI | 0.214*** | 0.066** | 0.244*** | 0.137*** | 0.113*** | 0.146*** | ||

| (4.129) | (2.177) | (4.323) | (8.844) | (3.231) | (11.054) | |||

| AQI (dummy) | 0.074*** | 0.042*** | ||||||

| (3.256) | (5.797) | |||||||

| AA+ | 0.309*** | 0.605*** | 0.309*** | 0.357*** | 0.265*** | 0.508*** | 0.266*** | 0.266*** |

| (7.592) | (11.699) | (7.323) | (6.826) | (5.770) | (10.706) | (5.779) | (4.533) | |

| AA | 0.588*** | 1.098*** | 0.589*** | 0.670*** | 0.480*** | 0.905*** | 0.481*** | 0.491*** |

| (9.708) | (16.363) | (9.454) | (9.048) | (11.599) | (19.073) | (11.568) | (8.667) | |

| AA− | 1.182*** | 1.802*** | 1.184*** | 1.314*** | 1.540*** | 2.142*** | 1.543*** | 1.547*** |

| (6.903) | (16.598) | (6.976) | (6.778) | (10.274) | (18.816) | (10.308) | (7.614) | |

| Below AA− | – | 2.210*** | – | – | 3.592*** | 4.459*** | 3.590*** | 3.462*** |

| – | (24.230) | – | – | (12.603) | (21.082) | (12.560) | (8.697) | |

| Maturity | −0.004 | −0.023*** | −0.004 | −0.010 | 0.011 | 0.015 | 0.011 | 0.018* |

| (−0.909) | (−3.130) | (−0.934) | (−1.279) | (1.562) | (1.304) | (1.567) | (1.871) | |

| Isize | 0.002 | −0.030*** | 0.002 | −0.007 | 0.004 | −0.016 | 0.004 | 0.016 |

| (0.408) | (−2.981) | (0.449) | (−0.649) | (0.998) | (−1.587) | (1.009) | (0.687) | |

| Puttable | −0.233*** | −0.055* | −0.233*** | −0.199*** | −0.198*** | −0.105*** | −0.198*** | −0.147** |

| (−7.894) | (−1.737) | (−7.894) | (−5.319) | (−3.193) | (−2.665) | (−3.187) | (−2.322) | |

| Callable | 0.564*** | 0.542*** | 0.563*** | 0.642*** | 2.817*** | 2.584*** | 2.817*** | 2.864*** |

| (11.756) | (13.479) | (11.738) | (11.183) | (29.170) | (20.217) | (29.140) | (20.893) | |

| Sinking fund | 0.080 | 0.406*** | 0.076 | 0.069 | −0.086* | −0.020 | −0.088* | −0.057 |

| (1.039) | (7.354) | (1.001) | (0.812) | (−1.691) | (−0.369) | (−1.736) | (−0.991) | |

| Cross | −0.033 | −0.030 | −0.035 | −0.152 | −0.115** | −0.075 | −0.115** | −0.139** |

| (−0.214) | (−0.323) | (−0.221) | (−0.812) | (−2.255) | (−1.614) | (−2.241) | (−2.506) | |

| Enterprise | 0.193* | 0.269*** | 0.197* | 0.357** | 0.238*** | 0.282*** | 0.239*** | 0.230*** |

| (1.719) | (3.060) | (1.758) | (2.578) | (5.703) | (7.771) | (5.732) | (3.589) | |

| Corporate | 0.040 | 0.015 | 0.039 | 0.031 | −0.207*** | 0.032 | −0.208*** | −0.312*** |

| (1.340) | (0.494) | (1.334) | (0.851) | (−3.984) | (0.706) | (−4.010) | (−2.897) | |

| Public | – | −0.078* | – | – | – | −0.059 | – | – |

| – | (−1.763) | – | – | – | (−1.087) | – | – | |

| SOE | 0.431 | −0.919*** | 0.429 | 0.035 | 0.597 | −1.123*** | 0.597 | 0.059 |

| (1.030) | (−13.343) | (1.027) | (0.164) | (1.277) | (−13.609) | (1.272) | (0.266) | |

| Age | −0.159 | −0.004** | −0.153 | −0.355*** | −0.119*** | −0.005*** | −0.130*** | −0.116*** |

| (−1.351) | (−2.402) | (−1.314) | (−12.493) | (−11.532) | (−3.341) | (−12.126) | (−8.243) | |

| Leverage | 1.057*** | 0.318 | 1.070*** | 0.920** | 0.190 | 0.083 | 0.189 | 0.068 |

| (3.611) | (1.542) | (3.633) | (2.442) | (0.554) | (0.317) | (0.551) | (0.178) | |

| Tangibility | 0.129 | −0.280* | 0.120 | 0.058 | −0.372* | −0.561*** | −0.374* | −0.333 |

| (0.652) | (−1.780) | (0.619) | (0.239) | (−1.906) | (−3.109) | (−1.922) | (−1.620) | |

| Sales | −0.046* | −0.062*** | −0.050* | −0.051 | −0.051 | −0.075*** | −0.051 | −0.084 |

| (−1.683) | (−4.088) | (−1.782) | (−1.471) | (−1.484) | (−4.033) | (−1.502) | (−1.641) | |

| Growth | 0.045** | 0.033 | 0.047** | 0.066** | 0.028 | 0.031 | 0.028 | 0.065*** |

| (2.184) | (1.133) | (2.242) | (2.435) | (1.254) | (1.003) | (1.252) | (3.289) | |

| ROA | −2.798** | −2.462*** | −2.749** | −4.124** | −5.656*** | −4.551*** | −5.639*** | −7.351*** |

| (−2.565) | (−5.460) | (−2.537) | (−2.379) | (−5.508) | (−6.856) | (−5.482) | (−4.829) | |

| Cash | −0.022 | −0.036 | −0.021 | −0.018 | −0.070** | −0.041 | −0.071** | −0.060 |

| (−0.753) | (−1.177) | (−0.732) | (−0.478) | (−2.177) | (−0.973) | (−2.209) | (−1.545) | |

| Constant | 1.861* | 2.822*** | 2.689** | 7.828*** | 2.237*** | 2.831*** | 2.894*** | 2.998*** |

| (1.803) | (11.547) | (2.493) | (11.420) | (5.032) | (9.555) | (6.619) | (8.253) | |

| Observations | 12,794 | 12,794 | 12,794 | 8287 | 152,160 | 152,160 | 152,160 | 102,467 |

| Industry fixed effects | No | Yes | No | No | No | Yes | No | No |

| Firm fixed effects | Yes | No | Yes | Yes | Yes | No | Yes | Yes |

| Year fixed effects | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Adjusted R2 | 0.774 | 0.548 | 0.773 | 0.729 | 0.669 | 0.484 | 0.669 | 0.642 |

- Note: This table displays the panel regression output, where Offering spread and YTM spread are regressed on air quality index, as well as a raft of control variables. Offering spread is the difference between offering yield and the yield of a comparable Treasury bond based on maturity. YTM spread is the difference between month-end yield-to-maturity and the yield of a comparable Treasury bond based on maturity. Bonds of which issuers are located in Beijing, Shanghai, Shenzhen and Guangzhou are excluded in columns (4) and (8). Log_AQI is the natural logarithm of the local air quality index of the headquarters city of each observation in the previous month. Bond- and firm-level control variables are defined in Appendix 1. Different variations of fixed effects are also incorporated in the regressions. The robust t-statistics in parentheses are clustered at the industry level. AQI (dummy) in the regressions equals one if Log_AQI is equal to or higher than the sample median value and zero otherwise. Continuous variables are winsorised at the 1st and 99th percentiles. ***, ** and *Statistical significance at the 1%, 5% and 10% levels, respectively.

Based on the model estimation in columns (1) and (5), when AQI increases by 100, bond yields increase by 99 and 63 bp in the primary and secondary markets, respectively.9 This represents an additional cost of CNY 12.34–14.10 million ($US1.77–2.02 million) per year to issue an average-sized bond. We further employ a dummy variable denoted as AQI (dummy), which equals one if Log_AQI is above the sample median and zero otherwise. Bonds issued by firms from severely polluted areas are subject to an additional yield spread of 7.4 (4.2) bps in comparison with their counterparts from the less polluted areas in the primary (secondary) bond market (columns (3) and (7)).

Furthermore, as indicated in Panel B of Table 1, firms from Beijing, Shanghai, Shenzhen and Guangzhou dominate corporate bond market issuance (35% of the issuance frequency). As such, we exclude these firms in estimating the regression in columns (4) and (8), to alleviate a potential concern that issuers from the above areas drive our findings. The positive relation between AQI and bond yields continues to hold. Further, the relation between other variables and bond yield spreads are largely in line with the extant literature. To illustrate, yield spreads decrease with bond credit ratings (Livingston et al., 2018). We also document lower yield spreads among publicly listed companies, SOEs, mature firms, larger and more profitable issuers.

4.2 Endogeneity and robustness checks

Our results indicate an air pollution premium in the corporate bond sector in China, whereby bonds issued in areas with poor air quality are associated with higher costs, which are both economically and statistically significant. A raft of robustness checks are implemented to address issues arising from the fundamental differences in cities, endogeneity, unobservable factors, macroeconomic conditions of Chinese cities, differences across industries and alternative measures of bond yields.

4.2.1 Matched bond analysis

Air pollution is not randomly assigned to cities. Deterioration of air quality is associated with local economic development (Zhao et al., 2018). Air pollution is potentially endogenously determined with credit spreads, as variations in economic conditions may affect both credit spreads and air pollution. We undertake a range of analyses to address this potential concern. First, companies located in highly polluted cities may differ from those in cities with better air quality fundamentally due to the relation between air quality and local economic development. To address this possibility, the propensity score matching (PSM) method is employed to identify the nearest matched issue in cities with good air quality for bonds issued in heavily polluted cities. Specifically, a city is defined as a heavily polluted one if its monthly AQI is above 100. Next, we employ the PSM approach to match bonds from cities with poor air quality with comparable bonds in cities with good air quality based on an extensive set of observable issue and firm characteristics described in Section 3 and Appendix 1, including bond credit rating dummies, bond value at issue (ISize), Puttable, Sinking fund, Cross, time to maturity (Maturity), MTN, Enterprise, Callable, Corporate, Non-SOE, Local SOE, financial leverage (Leverage), company listing status (Public), Central SOE (State-owned enterprises), Sales, sales growth (Growth), firm age (Age), asset tangibility (Tangibility), return-on-assets ratio (ROA), and cash holdings (Cash).

The propensity scores are allowed to fall within a calliper level of 0.1 standard deviation of the distinctions between the bonds associated with poor versus good air quality. Having identified comparable bonds, we obtain 1-to-1 matched bonds in the less polluted group. In the spirit of Roberts and Whited (2013), we implement the PSM with replacements, so that a control observation can be included in more than one matched set.

This method mitigates biases and sensitivity of the matching process.10 We identify 2744 (35,875) bond issues from cities with better air quality that can be closely matched to bonds issued in highly polluted cities in the primary (secondary) market. In Appendix 2, we conduct the mean and median difference tests on key issue and issuer variables between high and low AQI bonds at issuance, and we find that the treatment and control bonds are largely similar. Panel A of Appendix 4 presents the outcomes of this exercise by repeating Equation (1) in the PSM sample. A positively significant coefficient on Heavily polluted is observed. Given that each bond from heavily polluted cities is matched with an almost identical counterpart from cities with better air quality, it indicates that the air pollution premium is unlikely to be driven by the fundamental differences in bonds and issuers.

4.2.2 The impact of green bonds

Second, it is possible that our findings may be impacted by the presence of green bonds, which have emerged as a prominent fixture in the global financial landscape over the past decade. Green bonds, characterised by their focus on financing environmentally sustainable projects, have gained considerable traction, with the Chinese green bond market experiencing remarkable growth since its formal establishment in 2015. In particular, China's green bond segment commands a substantial share of the global market at 36% (Climate Bonds Initiative, 2020), indicating its significance in shaping market dynamics. To address the potential influence of green bonds on our results, we have excluded 203 green bond issuances from the primary market and 648 bond-month observations for green bonds from the secondary market in Panel B of Appendix 4. This deliberate exclusion allows us to isolate the effects of conventional bonds more effectively and ascertain the robustness of our findings.

Importantly, our thorough analysis reveals that even after excluding green bonds from the sample, our conclusions remain consistent with the baseline results. This suggests that the inclusion or exclusion of green bonds does not significantly alter the substantive outcomes of our study. Consequently, while acknowledging the growing importance of green bonds in the financial landscape, our findings underscore the resilience and stability of the observed relationships within the realm of conventional bond markets.

4.2.3 Northern vs. southern cities

Next, given that local economic development is directly associated with air pollution, our results may be confounded by unobserved city-level characteristics. In order to control for the fundamental differences such as economic conditions among cities, we use the Qinling-Huaihe line as a natural cut-off to divide cities in our sample to northern and southern cities. In China, northern cities provide residents with centralised heating in the winter, which potentially leads to poorer air quality. For each northern city in each year, we employ the PSM method to identify its closest matched city from the southern areas based on city-level GDP growth, the contribution of secondary industry to the local GDP, population, population growth rate, population density as well as average salary. We successfully match 156 southern cities for the 156 northern cities in our sample, which display similar characteristics in terms of economics conditions and population.

We demonstrate the mean and median difference tests between northern cities and their paired southern cities in Appendix 3. Except for the average AQI, the northern and southern cities identified in this process are largely comparable. When regressing yield spread on North in Panel C of Appendix 4, the air pollution remains intact. As such, it is unlikely that our key finding is driven by the differences in city-level fundamental conditions other than local air quality.

It is also possible that areas with varying levels of air quality are associated with other unobserved characteristics that affect yield spreads. For instance, provinces may face differences in the supply of managerial talent or labour as well as labour costs, given the variations in air quality. Additionally, provinces with high/low air quality may also attract firms that differ in firm-level innovations. Further, a wide range of political variables vary at the province level, which may affect air quality as well as the political risk of firms. Firms that innovatively reduce emissions may also obtain lower yields and cluster in a city where air quality is lower. To mitigate this concern, province-level control variables such as local GDP growth, the weighting of primary and secondary industry, population, death rate, population growth rate and average salary are incorporated in the baseline analysis and presented in Panel D of Appendix 4. The key finding is qualitatively unchanged.

4.2.4 Alternative model specifications

We replace the Treasury note yield with the yields of comparable CDB bonds as the benchmarks in columns (1) and (5) of Appendix 5. The air pollution premium is insensitive to the choice of our benchmark. We also replace the benchmark interest rate with a synthetic yield in columns (2) and (6) of Appendix 5. Our key findings are supported, whereby yield spread increases with the severity of air pollution. Our examination reveals that the air pollution premium remains consistent regardless of the chosen benchmark, indicating the resilience of our observed effects.

In addition to these adjustments, we introduce an alternative measure for YTM spread. It is replaced by an alternative measure, namely YTM spread (Avg) as described in Section 2. Column (7) in Appendix 5 shows that our main finding of an air pollution premium continues to hold, reinforcing the consistency of our results. Moreover, to account for potential confounding factors and enhance the validity of our conclusions, we incorporate bond as well as year-month fixed effects in columns (8) and (9) in Appendix 5. The air pollution premium endures even after controlling for these fixed effects, underscoring the robustness of our findings. We also employ clustering standard errors in various permutations in columns (3), (4), (10) and (11), yet the substantial air pollution premium remains unchanged. This robustness across different error clustering methods further bolsters the credibility of our results.

4.2.5 Differences across industries

The variability among industries may influence the observed air pollution premium, a factor we aim to address through the inclusion of industry fixed effects in our baseline results, as outlined in Table 3. However, to deepen our understanding of industry-specific dynamics, we conduct a comparative analysis between heavily polluting and cleaner industries. To delineate between these sectors, we reference the Ministry of Environmental Protection of China's classification, which identifies 16 industries deemed as heavy polluters. These cover fermentation, brewing, building materials, chemicals, coal, electrolytic aluminium, tanning, cement, thermal power, metallurgy, petrochemicals, papermaking, pharmaceuticals, steel, textiles and mining. Bonds issued by firms operating within these sectors are categorised as polluter bonds, while those from other industries are classified as non-polluters.

In Appendix 6, we present the results of our analysis conducted on these two distinct samples, encompassing both primary and secondary markets. We observe a consistent air pollution premium for both polluter and non-polluter bonds. While polluter bonds exhibit slightly elevated debt financing costs during periods of worsened air quality, this disparity is not statistically significant compared to their non-polluting counterparts. In summary, our findings demonstrate the presence of a statistically and economically significant air pollution premium across various industries, a trend that remains robust across a spectrum of sensitivity checks. Despite the marginally higher financing costs experienced by polluting industries during episodes of poor air quality, the overall difference in premiums between polluter and non-polluter bonds is not deemed statistically significant. This underscores the persistent influence of environmental factors on financial markets and reinforces the validity of our documented air pollution premium.

5 FACTORS CONTRIBUTING TO THE AIR POLLUTION PREMIUM

Our results thus far provide strong empirical support that bonds issued in provinces with worse air quality are more costly. This section explores potential factors that may contribute to our understanding of the air pollution premium in the Chinese corporate bond markets.

5.1 Trading frictions

Previous studies finds that investors become pessimistic with worsened air quality, thus depressing asset value (Ding et al., 2021; Levy & Yagil, 2011), reducing trading intensity (Gervais & Odean, 2001) and market liquidity (Baker & Stein, 2004). Even though the majority of the bond investors are institutions, fund managers are also found to exhibit certain mood-driven behavioural biases (e.g., Itzkowitz & Itzkowitz, 2017; Shiller, 2000). This implies that air pollution may reduce trading intensity in the market, thus increasing illiquidity. As such, investors may command higher yield spreads as compensation for holding bonds from highly polluted areas. To explore this factor empirically, we regress trading volume on Log_AQI, along with control variables at both the primary and secondary levels.

Specifically, Trading volume is the first-month bond transaction volume in billions of CNY for the primary bond market, and the monthly transaction volume in CNY billion for the secondary bond market, respectively. Table 4 presents the relationship between bond trading volume and local air quality. If the air pollution premium is attributable to investor mood swing and the associated reduction in trading intensity, AQI and trading volume are expected to be negatively related. However, the slope coefficients on trading volume are statistically indistinguishable from zero. The evidence suggests that the air pollution premium is not associated with trading frictions in the Chinese bond market.

| Primary market | Secondary market | |

|---|---|---|

| (1) | (2) | |

| Log_AQI | 0.163 | 0.031 |

| (1.638) | (0.928) | |

| Observations | 12,794 | 152,160 |

| Bond- and firm-level controls | Yes | Yes |

| Firm and year fixed effects | Yes | Yes |

| Adjusted R2 | 0.451 | 0.268 |

- Note: This table regresses Trading volume on Log_AQI. Trading volume is the first-month trading volume in CNY billion for the primary market in column (1), and the monthly trading volume in CNY billion for the secondary market in column (2). Log_AQI is the natural logarithm of the local air quality index for the headquarters city in the previous month. Bond- and firm-level control variables are introduced in Appendix 1. Continuous variables are winsorised at the 1st and 99th percentiles. The robust t-statistics in parentheses are clustered at the industry level.

5.2 Information asymmetry

We further explore the role of information asymmetry of the issuers. Information asymmetry is more prevalent in firms with weaker governance (Masulis & Reza, 2015). Issuers with weaker governance and disclosure regimes may concern investors, who demand a higher cost of debt. It is documented that air pollution affects the mental health and cognitive ability of financial market participants. For instance, air pollution is likely to induce mental breakdowns, immoral activities and increase the likelihood of suicides (Bakian et al., 2015; Lim et al., 2012). The detrimental impact of air pollution on mental health potentially gives rise to errors in making corporate decision and dampens the ability to analyse information (Ackert et al., 2003). Air pollution may exert detrimental influence on the information environment of firms in various ways. First, air pollution directly affects local labour. Wu et al. (2022) find that air pollution is associated with a greater degree of accounting conservatism. Xue et al. (2021) document significant loss of skilled labour driven by air pollution. The adverse impact of air pollution on local employees induces investors' concerns over the accuracy and reliability of firms' disclosures, thus exacerbating information asymmetry. Second, heavily polluted areas are potentially subject to heightened regulatory enforcement risks (Seltzer et al., 2022), which elevates business uncertainty and increases the complexity for investors to analyse firms from polluted areas. Poor air quality potentially has a negative influence on the local information environment, which induces investors to require higher yields to invest in bonds from polluted areas.

The listing status of firms and firm size are employed as proxies for their level of information asymmetry, which are available for both public and private issuers. Idiosyncratic volatility (IVOL) is adopted as the third proxy for information asymmetry, which requires stock return data and is only available for public issuers. If the air pollution premium is associated with worsened information environment, it should be more pronounced in companies that are susceptible to information asymmetry. First, we partition our sample into public versus private firms based on their listing status. We next analyse the role of firm size measured by its sales level, as a widely used proxy for information asymmetry (Freeman, 1987). Publicly listed firms and large firms tend to have more readily available information compared to private firms and small firms. Idiosyncratic volatility is a popular measure of asymmetric information, which captures significant fluctuations in stock price movements due to trading by informed traders based on private information (Moeller et al., 2007). We calculate IVOL for public firms by employing the market model using daily return over a rolling 252-day period and taking the standard deviation of the residuals in the regressions.

In Panel A of Table 5, columns (1) and (5) ((2) and (6)) display the regression output for public (private) companies. Columns (3) and (7) ((4) and (8)) illustrate the results for large (small) companies, of which Sales are higher (lower) than the sample median. Bonds issued by firms with lower information asymmetry (public and large firms) are associated with a lower loading on the air pollution premium. Nonetheless, we observe positive coefficients for all identifications, which is in line with our baseline results.

| Panel A: Groups based on issuer status and size | ||||||||

|---|---|---|---|---|---|---|---|---|

| Primary market | Secondary market | |||||||

| Dependent variable = Offering spread | Dependent variable = YTM spread | |||||||

| Public | Private | Large | Small | Public | Private | Large | Small | |

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | |

| Log_AQI | 0.053 | 0.243*** | 0.165*** | 0.217*** | 0.132*** | 0.145*** | 0.072*** | 0.153*** |

| (0.717) | (3.733) | (3.932) | (3.037) | (2.938) | (9.033) | (2.922) | (8.925) | |

| Coefficient Diff | 0.190** | 0.052** | 0.023 | 0.081** | ||||

| χ2 = 5.80 | χ2 = 6.32 | χ2 = 0.69 | χ2 = 6.51 | |||||

| Observations | 2415 | 10,379 | 6397 | 6397 | 33,121 | 119,039 | 76,088 | 76,072 |

| Bond- and firm-level controls | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Firm and year fixed effects | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Adjusted R2 | 0.802 | 0.769 | 0.776 | 0.764 | 0.638 | 0.685 | 0.697 | 0.657 |

| Panel B: IVOL groups | ||||

|---|---|---|---|---|

| Primary market | Secondary market | |||

| Dependent variable = Offering spread | Dependent variable = YTM spread | |||

| Low IVOL | High IVOL | Low IVOL | High IVOL | |

| (1) | (2) | (3) | (4) | |

| Log_AQI | 0.000 | −0.020 | 0.060 | 0.236*** |

| (0.004) | (−0.150) | (1.047) | (3.964) | |

| Coefficient Diff | −0.020 | 0.176*** | ||

| χ2 = 0.04 | χ2 = 8.59 | |||

| Observations | 999 | 999 | 13,931 | 13,937 |

| Bond- and firm-level controls | Yes | Yes | Yes | Yes |

| Firm and year fixed effects | Yes | Yes | Yes | Yes |

| Adjusted R2 | 0.867 | 0.794 | 0.658 | 0.665 |

- Note: This table presents results of the air pollution premium in groups of varying levels of information environment. Offering spread is the difference between offering yield and the yield on a comparable Treasury bond based on maturity. YTM spread is the difference between yield to maturity at month-end and yield on a comparable Treasury bond based on maturity. Columns (1) and (5) ((2) and (6)) represent bonds issued by public (private) companies in Panel A. Columns (3) and (7) relate to bonds issued by large companies whose sales are higher than the sample median and columns (4) and (8) represent bonds issued by small companies whose sales are lower than the sample median in Panel A. Panel B displays results for public companies in groups of different levels of IVOL, using the sample media as breakpoints. Log_AQI is the natural logarithm of the local air quality index for the headquarters city in the previous month. Bond- and firm-level control variables are defined in Appendix 1. Continuous variables are winsorised at the 1st and 99th percentiles. The robust t-statistics in parentheses are clustered at the industry level. ***, ** and *Statistical significance at the 1%, 5% and 10% levels, respectively. Coefficient Diff is the difference in the coefficients between the two groups.

Taking the primary market as an example, the coefficient of public companies is 0.053, while the number is 0.243 for private firms. Economically, this result indicates that yield spread will increase by CNY 3.476 million for public listed firms and CNY 15.935 million for private firms per year for an average size bond issue, when the air quality index increases by 100. The CNY 12.459 million cost difference is statistically and economically significant. The air pollution premium is more prevalent in small firms. The analysis in Panel B is restricted to public issuers, as the calculation of IVOL requires stock return data. Results are overall in tandem with Panel A, whereby the air pollution premium attenuates among public issuers subject to poor information environment in the secondary market. As such, information asymmetry is likely a relevant factor in understanding the air pollution premium. These results also indicate that more transparent corporate disclosure potentially mitigates the detrimental influence of local air pollution on debt financing costs.

5.3 Awareness and attention to climate change

We also explore the possibility that the higher borrowing costs in Chinese bond markets are associated with growing investor awareness and attention to climate change risk. Krueger et al. (2020) administer a survey to explore the climate risk management strategies among active investment managers. Survey results indicate that investors are aware of the threats brought by climate-related financial risks. As such, they also believe that climate risks should become important determining factors in investment decision making and portfolio management. The evidence echoes Alok et al. (2020), who show that portfolio adjustments are made by fund managers in times of climate disasters.

Three salient events have potentially considerably shifted investors' perception of environmental risk and elevated their awareness in recent years. The first event is the Paris Agreement on 22 April 2016, whereby 196 countries agreed to limit global warming to below 2°C.11 The Paris Agreement represents a significant milestone in the multilateral management of the climate crisis. It is the first time that all nations are united by a binding agreement for a common cause to combat climate change and the associated impact. We anticipate a notable change in investors' perception of climate risk after the Paris Agreement. As such, a more profound positive relationship between local air quality and yield spread is likely to prevail.

Parallel with the Paris Agreement, the second salient event is the 18th National Congress of the Chinese Communist Party (CCP) in November 2012. A key outcome of this event was that the construction of ecological civilisation as a major goal of the party was written into the party constitution. This is a significant extension of the preceding constitution, which included cultural, economic, social and political realms. This purportedly increases the attention and resources dedicated by the CCP to mitigate climate change risk. As such, we expect a more pronounced air pollution premium following the National Congress.

Our third significant shock to investor attention to air pollution is when the average monthly AQI across all cities exceeded 100 for the first time. This occurred in January 2013 and is widely regarded as the milestone when China's struggle with air quality became mainstream in both China and around the world.12

To explore the effect of these exogenous shocks on investors' perception of climate-related financial risk, Equation (1) is augmented with a Post Paris dummy variable for the Paris Agreement, a Post 18th dummy variable to reflect the National Congress and a Post 2013 dummy variable for the period after the first time when extremely severe air pollution was recorded.

Specifically, the dummy variables equal one if the observations are after May 2016, December 2012 or January 2013, respectively. Interaction terms between Log_AQI and the three event dummies are incorporated to ascertain the influence of investors' attention to climate change on the air pollution premium. We use a 2-year window before and after each event.13 The interactions between Log_AQI and Post 18th are positively significant, implying reduction in investor tolerance on climate risk after the reform. A similar pattern is documented in the interaction terms between Log_AQI and Post 2013 in both markets, in columns (3) and (6) of Table 6.

| Primary market | Secondary market | |||||

|---|---|---|---|---|---|---|

| Dependent variable = Offering spread | Dependent variable = YTM spread | |||||

| (1) | (2) | (3) | (4) | (5) | (6) | |

| Log_AQI × Post Paris | 0.210*** | 0.193** | ||||

| (3.026) | (2.516) | |||||

| Log_AQI × Post 18th | 0.253** | 0.328*** | ||||

| (2.606) | (5.415) | |||||

| Log_AQI × Post 2013 | 0.148* | 0.238*** | ||||

| (1.677) | (4.472) | |||||

| Log_AQI | 0.045 | −0.074 | 0.010 | 0.084*** | −0.009 | 0.182*** |

| (0.775) | (−0.921) | (0.141) | (2.850) | (−0.181) | (4.620) | |

| Post Paris | −0.839*** | −1.027*** | ||||

| (−2.833) | (−2.778) | |||||

| Post 18th | −1.387*** | −1.677*** | ||||

| (−3.198) | (−6.139) | |||||

| Post 2013 | −0.920** | −1.348*** | ||||

| (−2.292) | (−5.648) | |||||

| Observations | 5424 | 2287 | 2322 | 73,959 | 31,577 | 33,421 |

| Bond- and firm-level controls | Yes | Yes | Yes | Yes | Yes | Yes |

| Firm fixed effects | Yes | Yes | Yes | Yes | Yes | Yes |

| Adjusted R2 | 0.471 | 0.624 | 0.627 | 0.703 | 0.676 | 0.679 |

- Note: This table demonstrates the impact of three salient environmental events on the air pollution premium over the event window 2 years before and after each event. Offering spread in columns (1)–(3) represents the difference between offering yield and the yield on a comparable Treasury bond based on maturity. YTM spread in columns (4)–(6) captures the difference between yield to maturity at month-end and yield on a comparable Treasury bond based on maturity. Log_AQI is the natural logarithm of the local air quality index for the headquarters city in the previous month. Bond- and firm-level control variables are defined in Appendix 1. Post Paris is a dummy variable taking the value of one if the observation is after May 2016 and zero otherwise. Post 18th is a dummy variable taking the value of one if the observation is after December 2012 and zero otherwise. Post 2013 is a dummy variable taking the value of one if the observation is after January 2013 and zero otherwise. Continuous variables are winsorised at the 1st and 99th percentiles. The robust t-statistics in parentheses are clustered at the industry level. ***, ** and *Statistical significance at the 1%, 5% and 10% levels, respectively.

To further explore investors' attention to and perception of air pollution, we collect the daily Baidu search index data on the key word ‘air pollution’ (空气污染) at the city level and the national level.14 Next, we aggregate the daily Baidu indexes within a month, which gives rise to a series of monthly investor attention and sentiment measures concerning air pollution in China. We define Baidu Trend (City) and Baidu Trend (Country) as the total value of the Baidu search index on ‘air pollution’ every month at the city level and country level, respectively. While AQI reflects the severity of air pollution, the Baidu search index on ‘air pollution’ is likely to complement the actual air quality by capturing the perceived air pollution and concerns over air quality. If the air pollution premium is associated with rising investor attention and awareness to air pollution, bond yields are expected to increase with the Baidu Trend measure of air pollution. We regress measures of yield spreads in both markets on both Baidu Trend (City) and Baidu Trend (Country) and present the regression output in Appendix 7. In line with our conjecture, yield spreads load positively on the investor attention measure using the Baidu search index. For instance, the slope coefficient is 0.012 and significant at the 5% level. This indicates that bonds are more costly when investors pay a greater amount of attention to worsened air quality. The results are insensitive to the use of the city level of the national Baidu research index on ‘air pollution’.

5.4 Default risk and air pollution

We further investigate whether local air pollution affects the fundamental operations and default risks of companies headquartered in polluted cities, thus leading to differences in bond pricing. Air quality may exert adverse influence on firm operations in various ways. For instance, worsened air quality presents a hazard for local employees' physical and mental health, which leads to departure of local talent. As a consequence, firm performance and productivity drop significantly (Xue et al., 2021). Alternatively, firms may resort to increase employee compensation to retain human capital. As another example, air pollution may compel local governments to shut down coal-fired thermal power plants, resulting in industrial electricity shortages or increase in electricity prices that directly impact the operating capacity and costs of companies. Taken together, it is likely that air pollution may increase operating costs, reduce operating cash flows and thus increase default risk of companies located in polluted areas.

Table 7 illustrates the regression results where we regress the aforementioned proxies for firm operations on the level of AQI and a dummy variable for AQI when it is higher than the sample median. Across various model identifications, there is no evidence that air pollution worsens the fundamental operations for issuers, including credit risks, operating costs and operating cash flow. As such, the air pollution premium is unlikely to be associated with the explanation associated with default risk.

| Dependent variable | PD | Z China | Operating cost | Net operating cash flow | ||||

|---|---|---|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | |

| Log_AQI | −0.521 | −0.334 | −0.021 | 0.004 | ||||

| (−1.191) | (−1.537) | (−1.630) | (1.398) | |||||

| AQI (dummy) | −0.079 | −0.059 | −0.006 | −0.001 | ||||

| (−0.394) | (−0.962) | (−1.602) | (−0.534) | |||||

| Observations | 17,679 | 17,679 | 17,679 | 17,679 | 17,679 | 17,679 | 17,679 | 17,679 |

| Firm controls | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Firm fixed effects | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Year fixed effects | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Adjusted R2 | 0.464 | 0.464 | 0.927 | 0.927 | 0.943 | 0.943 | 0.439 | 0.439 |

- Note: This table reports the relationship between firm risk and local air quality. We regress PD, ZChina on Log_AQI, operating costs and net operating cash flow on air quality and bond and issuer characteristic controls. The dependent variable is PD for columns (1) and (2), which measures the probability of default based on Altman et al. (2021). The dependent variable in columns (3) and (4) is ZChina, which is derived from Zhang et al. (2010). Operating cost is the dependent variable in columns (5) and (6). Net operating cash flow is the dependent variable in columns (7) and (8). Log_AQI is the natural logarithm of the local air quality index for the headquarters city in the previous month. AQI (dummy) in the regressions equals one if Log_AQI is equal to or higher than the sample median value and zero otherwise. Control variables are defined in Appendix 1. Continuous variables are winsorised at the 1st and 99th percentiles. The robust t-statistics (reported in parentheses) are clustered at the firm level.

5.5 CRAs and air pollution