Margin trading and price efficiency: information content or price-adjustment speed?

Abstract

The literature offers contradictory views on the effect of margin-trading activities on price efficiency. Based on data from a Chinese margin-trading pilot programme in 2010, we separate price efficiency into information content and price-adjustment speed and investigate the effect of margin-trading activity on price efficiency. We find that after adding to the eligible list, pilot stocks experience a decrease in information content, but an increase in price-adjustment speed. Furthermore, increased margin-buying activities are associated with lower information content, but faster price adjustment. Our results reconcile the debate over the effect of margin trading on price efficiency.

1 Introduction

Discussions concerning the impact of margin trading have received the attention of academia since stock market crash of 1987. However, prior studies offer conflicting results on the effect of margin trading on price efficiency. Some literature documents that because allowing margin trading provides more funds, increases the demand for stocks, and may improve the liquidity of the stock market, margin trading may help increase price efficiency (Seguin, 1990; Seguin and Jarrell, 1993; Chordia et al., 2001; Alexander et al., 2004). In contrast, some studies argue that margin trading enhances the levering ability of ‘noise traders’ and increases the amount of ‘noninformational’ volatility (De Long et al., 1990; Hardouvelis, 1990; Hardouvelis and Peristiani, 1992; Chowdhry and Nanda, 1998; Rytchkov, 2014). In addition, forced sales due to margin calls in a falling stock market increase the supply of stocks and amplify the price decrease (Garbade, 1982; Thurner et al., 2012). Such literature suggests that margin trading may decrease market efficiency.

We argue that these conflicting findings are due to the variation in measures that prior studies use to represent divergent aspects of price efficiency. For example, measures such as deviations in stock prices from their fundamental values (Hardouvelis, 1990), variance ratio (Chang et al., 2014), cross-sectional dispersions of stock return volatilities (Rytchkov, 2014) and pricing error (Chen et al., 2016) represent the level of information incorporated into stock price, whereas cross-autocorrelation between stock returns and lagged market returns (Chang et al., 2014) and trading volume (Seguin, 1990; Seguin and Jarrell, 1993) are used to measure the speed of information incorporation.

According to Saffi and Sigurdsson (2011), price efficiency can be defined as ‘the degree to which prices reflect all available information in terms of speed and accuracy’. Therefore, price efficiency can be separated into two divergent aspects: information content, which measures the degree to which price reflects all available information with respect to accuracy, and price-adjustment speed, which represents the degree to which price reflects all available information with respect to speed. However, prior studies only focus on one aspect of it.1 In this paper, we take both information content and price-adjustment speed into consideration and investigate the effect of margin trading on these two distinct aspects of price efficiency. We use pricing error (Hasbrouck, 1993; Boehmer and Wu, 2013; Comerton-Forde et al., 2016), the absolute value of quote midpoint return autocorrelations (Chordia et al., 2005; Boehmer and Wu, 2013) and idiosyncratic volatility (Ang et al., 2009) as measures of information content. Meanwhile, we use price delay (Hou and Moskowitz, 2005; Boehmer and Wu, 2013) and cross-autocorrelation between current stock returns and lagged market returns (Bris et al., 2007; Chang et al., 2014) as proxies for price-adjustment speed.

Using a Chinese margin-trading pilot programme, we investigate the impact of margin-trading activity on divergent aspects of price efficiency. The China Securities Regulatory Commission (CSRC) lifted the ban on margin buying for the first time on 31 March 2010 and launched a pilot scheme allowing margin trading and short selling of stocks on a designated list. The list has since been revised four times, and more securities have been added to it.2

The pilot programme serves as an ideal setting for examining the effect of margin-trading activity on stock price efficiency for several reasons. First, it provides a channel for individual investors, who dominate the Chinese stock market and are at a disadvantage in terms of financing, to purchase stocks by margin. Therefore, we can use this event to verify the real effect of margin trading.3 Second, only a subset of stocks was allowed to be margin-bought. This feature enables us to investigate whether margin-buying constraints hinder price discovery by examining the changes in price efficiency after the ban is lifted. Third, China makes daily margin-trading amount data publicly available at the stock level, which can be used to examine the cross-sectional relationship between different aspects of price efficiency and margin-trading activity.

We begin by using a difference-in-differences (DID) approach to verify whether implementing the margin-trading programme affects price efficiency. We find that compared with nonpilot stocks, pilot stocks’ information content drops substantially, which decreases price efficiency, but price-adjustment speed increases rapidly, which increases price efficiency. These results indicate that the implementation of margin trading has opposite effects on information content and price-adjustment speed.

Moreover, as there is much variation in margin-trading activities among eligible stocks, we cross-sectionally investigate the effect of margin-trading activity on two aspects of price efficiency. We find that greater margin-trading activities are related to increased pricing errors but reduced idiosyncratic volatility, implying that greater margin-trading activities are associated with lower information content. In sharp contrast, margin-trading activities are negatively associated with price-delay measures and with the cross-autocorrelation between stock returns and lagged market returns, indicating that more margin-trading activities are associated with higher price-adjustment speed. Overall, margin trading lowers information content but speeds up price adjustment. This is consistent with the results of the DID analyses, which show that margin trading has opposite effects on information content and price-adjustment speed. Our results are robust after controlling for endogeneity, the effect of short selling and the interference of outliers.

We contribute to the literature in the following ways. First, we extend the literature on margin trading by demonstrating that this practice has a negative association with information content, but a positive association with price-adjustment speed. Previous studies offer different and sometimes contradictory conclusions about the effect of margin trading on price efficiency (e.g. Seguin, 1990; Alexander et al., 2004; Thurner et al., 2012; Chang et al., 2014). In contrast, we separate price efficiency into information content and price-adjustment speed. Using various measures of these two divergent aspects of price efficiency, we reconcile the debate regarding the effect that margin trading has on price efficiency, which relates to the different measures of price efficiency that prior literature uses.

Second, through this study, we complement the literature on price efficiency by showing that the observed effects of margin trading on price efficiency can be contradictory when different aspects of price efficiency are not separated (Bessembinder et al., 1996; Hou and Moskowitz, 2005; Bris et al., 2007; Ang et al., 2009; Boehmer and Wu, 2013; Chang et al., 2014). Thus, when investigating the impact on price efficiency, the decomposition of price efficiency is essential, and measures of the divergent aspects of price efficiency should be thoroughly considered. For example, in this study, margin trading lowers information content, but increases price-adjustment speed, which makes it difficult to determine whether margin trading has increased or decreased price efficiency.

Finally, this study has policy implications regarding margin trading in the Chinese stock market. As the stock market in mainland China is dominated by individual investors, the level of information content is much lower than it is in most other countries (Morck et al., 2000). However, the Chinese stock market is much more liquid than the stock markets in most other countries (Amihud et al., 2015).4 Thus, to promote stock market development, it is critical for the Chinese government to improve information content. As margin trading is unfavourable to information content in the Chinese stock market, margin trading should be restricted by higher margin requirements.

The remainder of this paper is structured as follows. Section 22 provides a brief overview of margin trading, the debate over the impact of margin trading in the literature and the background of the margin-trading programme in the Chinese stock market. Section 33 describes the data and methodology. Section 44 presents the empirical results of the effect of the implementation of margin-trading events on price efficiency. Section 55 discusses the effect of margin-trading activity on price efficiency. Section 66 concludes the paper.

2 Margin trading overview

2.1 A brief look at margin trading

Margin trading is permitted in most stock exchanges around the world. The Securities Exchange Act of 1934 allowed margin trading on exchange-listed securities; the Over-the-Counter Market Act of 1968 allowed margin trading on some over-the-counter (OTC) securities. In Asian countries, the Tokyo Stock Exchange launched margin transactions in 1951, the Taiwan Stock Exchange did so in 1974, and the Hong Kong Stock Exchange did so in January 1994. In March 2010, the CSRC lifted its ban on margin trading for the first time.

Margin-trading activities make up a large proportion of total trading amount. For example, NYSE customers borrowed US$377 billion to purchase securities in May 2013 (accounting for approximately 2.25 percent of the total market capitalisation of listed companies) and this number increased to US$461 billion in December 2015 (accounting for approximately 2.51 percent of the total market capitalisation).5 The margin-buying debt in China was RMB213 billion in May 2013 (accounting for approximately 0.87 percent of the total market capitalisation) and sharply increased to RMB1,174 billion at the end of December 2015 (accounting for approximately 2.81 percent of the total market capitalisation).6

2.2 Debate on the effect of margin trading on price efficiency

Many studies document a positive relationship between margin trading and stock liquidity (Seguin, 1990; Seguin and Jarrell, 1993; Chang et al., 2014). However, margin traders are often considered as potentially informative speculators and are blamed for increasing excess volatility of stock prices. In practice, margin requirements are officially changed frequently, especially when the market is unstable.7 For example, the Tokyo Stock Exchange changed margin requirements 63 times between 1970 and 1990. Likewise, margin requirements changed 23 times in the United States between 1934 and 1974 (Hardouvelis, 1990). The U.S. government claimed, ‘It has long been recognised that margin requirements, through leverage, affect the volume of speculative activity’ after the crash of October 1987 (U.S. Presidential Task Force on Market Mechanisms, U.S., 1988). Furthermore, regulatory bodies have tended to propose higher margin requirements to discourage speculators. Similarly, many professionals and researchers attribute the rapid changes in the 2015 Chinese stock market to margin-trading activities.

These arguments suggest that margin trading affects many aspects of the stock market, such as liquidity, stability and price efficiency. Numerous studies examine the effect of margin trading on price efficiency, but do not reach consensus. Some studies support the view that margin trading and lower margin requirements increase price efficiency. Seguin (1990) examined the effect of adding OTC issues to the list of marginable securities and suggested that margin eligibility adds value by increasing the flow of information and enhancing its depth. Alexander et al. (2004) documented that the information content of trades increases after the level of margin requirements decreases, suggesting that margin trading improves market quality. Chen et al. (2016) also suggested that prices become significantly more informative when stocks are allowed to be traded on margin in China.

In contrast, some researchers argue that margin trading may destabilise the market and decrease market efficiency (Chowdhry and Nanda, 1998; Rytchkov, 2014). Hardouvelis (1990), Hardouvelis and Peristiani (1992), and Hardouvelis and Theodossiou (2002) documented that higher or increasing margin requirements are associated with lower stock-price volatility, lower excess volatility and smaller deviations in stock prices from their fundamental values. Thurner et al. (2012) argued that when funds are allowed to leverage, a margin call resulting from a downward price fluctuation causes them to sell into an already falling market, amplifying the downward price movement.

2.3 Background of margin trading in China

Both margin trading and short selling were strictly prohibited in China at the opening of the Chinese securities market. The constraint was lifted as of 31 March 2010, when the CRSC launched a long-awaited pilot programme allowing 90 stocks on a designed list to be purchased on margin and/or sold short ‘to enlarge the supply and demand of funds and securities and to increase the trading volume to some extent, thus leading to active liquidity on the securities market’ (CSRC, 2010).8 Later, four major additional revisions of the pilot list occurred on 5 December 2011, 31 January 2013, 16 September 2013 and 22 September 2014.9 Table 1 illustrates the timeline of these reforms. The underlying security list was finally expanded to cover 900 stocks and 15 exchange-traded funds (ETFs) in September 2014, covering more than one-third of the total listed stocks in China.

| Effective date | Announcement date | No. of stocks added | No. of stocks deleted | No. of stocks listed |

|---|---|---|---|---|

| 03/31/2010 | 02/12/2010 | 90 | 0 | 90 |

| From 04/01/2010 to 12/04/2011 | 6 | 6 | 90 | |

| 12/05/2011 | 11/25/2011 | 189 | 1 | 278 |

| 01/31/2013 | 01/25/2013 | 222 | 0 | 500 |

| From 02/01/2013 to 09/15/2013 | 0 | 6 | 494 | |

| 09/16/2013 | 09/06/2013 | 206 | 0 | 700 |

| From 09/17/2013 to 09/21/2014 | 0 | 5 | 695 | |

| 09/22/2014 | 09/12/2014 | 205 | 0 | 900 |

| From 09/23/2014 to 12/31/2015 | 0 | 9 | 891 | |

- This table summarises the changes in the pilot list, including the initial implementation of the pilot programme (12 February 2010) and other major revisions in China. ‘Effective date’ refers to the date on which a designated stock can begin to perform margin trading and/or short selling. ‘Announcement date’ refers to the date on which the China Securities Regulatory Commission announces a change in the list of qualified stocks. We do not count exchange-traded funds in this table.

According to the administrative rules promulgated by the CSRC, only ‘qualified’ investors can purchase stocks on margin or sell stocks short. Such investors must meet certain requirements. For example, in most securities companies, qualified investors must (i) possess assets of at least RMB500,000 and (ii) have a trading history of longer than 1.5 years. As in Japan and Taiwan, the margin-trading and short-selling business in mainland China seems to cater to individual investors rather than to institutions. However, the cost of margin trading is quite high in China. At the beginning of the pilot programme, the interest rate for margin trading, approximately 8.6 percent per year, is much higher than the yield of 1-year treasury bonds (ranging from 2.60 to 2.85 percent), making margin trading costly for investors. In contrast, D'avolio (2002) reports that the value-weighted loan fee is only 0.25 percent in the United States, and only 9 percent of stocks have a loan fee higher than 1 percent. Although margin trading is high cost and imposes strict requirements relative to investors’ qualifications, margin-buying debt is growing quickly, reaching RMB1,174 billion by the end of 2015, as shown in Figure 1.

China's margin-trading and short-selling programme has several significant features. First, only stocks on the designated list can be purchased on margin and/or sold short. This restriction provides an excellent opportunity to examine the effect of this pilot programme and the impact of margin-trading activities on price efficiency. Additionally, as Chinese investors are new to the short-selling mechanism, unsophisticated investors may choose to steer clear of short selling. Thus, margin trading is much more active than short selling (Li et al., 2016), even though stocks on the list are eligible for both. Figure 2 illustrates the monthly margin-trading and short-selling activities from April 2010 through December 2015. It reveals that margin trading has become increasingly popular over the years. For example, the cross-sectional average of the monthly margin-trading amount scaled by trading amount was 1.73 percent in December 2010 and increased sharply to 20.50 percent in December 2015. Figure 2 also shows that there is far less short-selling activity than margin-buying activity. The cross-sectional average of monthly short-selling volume scaled by trading volume was < 2.3 percent from April 2010 to December 2015.

3 Data and methodology

3.1 Data

We retrieve information on the designated or revised stock list from the Shanghai Stock Exchange and Shenzhen Stock Exchange, and margin-trading amounts are available from March 2010 through December 2015.10 We match daily margin-trading amount data with the China Stock Market Trading Research database to obtain each stock's closing price, trading amount, market capitalisation, turnover, institutional ownership, and high-frequency trade and quote data. We include only domestic stocks in our analysis, but exclude eligible ETFs from the list.

3.2 Measures of price efficiency

The literature uses various price-efficiency measures (Seguin and Jarrell, 1993; Morck et al., 2000; Chordia et al., 2005; Boehmer and Wu, 2013; Chang et al., 2014; Chen et al., 2016). Some measures (e.g. pricing error, absolute value of quote midpoint return autocorrelations, idiosyncratic volatility and R2) reflect the information content of stock price, whereas other proxies (e.g. cross-autocorrelation between stock return and lagged market returns, price delay and trading volume) represent the speed of price adjustment to public news. However, there is very little evidence on which measure can fully capture information content or price-adjustment speed. Thus, we include most of these measures in this study to investigate the impact of margin trading on divergent aspects of price efficiency as thoroughly as possible.

3.2.1 Measures of information content

Two types of indicators are used to capture the relative information content of stock prices. The first information-content proxy is made of two high-frequency information measures: pricing error and the absolute value of quote midpoint return autocorrelations. Both are estimated using quote data.

The pricing error is used to capture temporary deviations from a random walk. According to Hasbrouck (1993), a stock's transaction price can be separated into an efficient price component following a random walk process, and a residual component, referred to as pricing error. The efficient price component reflects new public information and the information content of order flow (Boehmer and Kelley, 2009). Thus, the pricing error describes how closely transaction prices follow the efficient price over time and can therefore be interpreted as an (inverse) measure of information content. By estimating a vector autoregression model based on Boehmer and Wu (2013), we separate changes in the pricing error from changes in the transaction price and further divide the standard deviation of pricing error by the standard deviation of transaction price to get our first high-frequency information-content measure. We refer to this measure as PriceErr. A higher PriceErr implies that the transaction price deviates more from the efficient price, indicating lower information content.

The absolute value of quote midpoint return autocorrelations is another high-frequency measure of relative information content. According to efficient market theory, an efficient price fully reflecting all available information should follow a random walk and exhibit no autocorrelation. If the quote midpoint price incorporates more available information and is close to the market's best estimate of stock's efficient price, the autocorrelation of quote midpoints, in either direction, should be smaller (Boehmer and Wu, 2013). Therefore, a smaller absolute value of quote midpoint return autocorrelations indicates less deviation from a random walk and thus greater stock-price information content. Following Chordia et al. (2005), we use a 15-min interval to calculate this indicator (denoted as |AR15|).11

We use idiosyncratic volatility as a second type of information-content proxy, computed based on low-frequency data. Following Ang et al. (2009), we estimate the Fama and French (1993) three-factor model for each stock and compute the standard deviation of the residuals as idiosyncratic volatility. Thus, idiosyncratic volatility measures the firm-specific component of stock returns and can be used as a proxy for information content (Ang et al., 2009; Brockman and Yan, 2009).12 We use IVOL to denote this proxy. Different from PriceErr and |AR15|, a smaller IVOL means less firm-specific information incorporated into the stock price and thus a lower level of information content.

3.2.2 Measures of price-adjustment speed

We use two different types of proxies to measure price-adjustment speed: price delay (Hou and Moskowitz, 2005) and the cross-autocorrelation between stock returns and lagged market returns (Bris et al., 2007). These two proxies capture the speed with which marketwide information is impounded into stock prices.

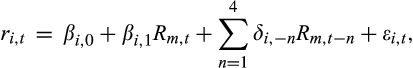

(1)

(1) (2)

(2)Both of these two price-delay measures capture the portion of individual stock return variation that is explained by lagged market returns. A larger price delay implies that more price variation is captured by lagged returns, and it takes more time to incorporate marketwide information.

Bris et al. (2007) use daily cross-autocorrelation between current stock returns and lagged market returns as an alternative proxy for price-adjustment speed. The cross-autocorrelations are equivalent to estimating the regression coefficients of individual stock returns on lagged market returns, as in Hou and Moskowitz (2005). Thus, the cross-autocorrelation coefficient is an alternative way of standardising the measure of price delay and can be used to measure the speed of individual stock price adjustment to common factor information. We adopt their approach and use |CR| to denote this proxy. If the stock price adjusted quickly to marketwide information, there would be a small |CR|. Overall, a higher |CR| indicates a lower price-adjustment speed.

3.3 Regression models

3.3.1 Testing the effect of implementing margin trading on price efficiency

China launched the pilot programme to lift the ban on margin trading in March 2010 and, as mentioned earlier, revised the list on 5 December 2011, 31 January 2013, 16 September 2013 and 22 September 2014. These changes provide a quasinatural experiment, allowing us to use a DID approach to verify the effect of the implementation of margin trading on price efficiency. The based event dates are the dates on which margin trading is initiated or changed, including the date of programme initiation and the dates of the four major revisions of the eligible list.

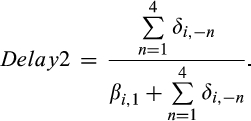

(3)

(3)Following prior studies (Bris et al., 2007; Boehmer and Kelley, 2009; Boehmer and Wu, 2013; Chang et al., 2014), we also consider several control variables (Controlsi,t) that may be associated with price efficiency. We include measures of share price, market capitalisation, turnover and institutional ownership as control variables in our model. Specifically, we use the natural logarithm of volume-weighted closing price (denoted as LnPrice) to control for stock-price variation that may affect price efficiency. As it is easier and more precise to value bigger and more active stocks, we also include both the market value of the stock (LnCap), calculated as the natural logarithm of individual stock's market value divided by 1 billion, and turnover (Turnover), measured by trading volume scaled by shares outstanding. Moreover, Boehmer and Kelley (2009) find that institutional ownership may be related to price efficiency. Therefore, we control for this effect using the fraction of shares owned by institutional investors at the end of the previous quarter (denoted as Insti).

3.3.2 Testing the effect of margin-trading activity on price efficiency

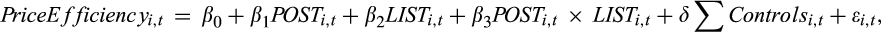

(4)

(4)4 Effect of implementing margin trading on price efficiency

After the initiation of margin trading in March 2010, the CSRC revised the eligible list on four separate occasions. These events allow us to use the DID approach to verify the overall effect of implementing margin-trading pilot programme on price efficiency. For each event, stocks newly added to the list are considered to be the treatment group, and the control group is generated using the PSM method with scores computed by turnover, market capitalisation and stock price. With this design, we estimate Model (3) and discuss the real impact of margin trading on price efficiency.

4.1 Descriptive statistics

We estimate high-frequency measures of price efficiency using quota data for each stock and compute low-frequency measures using daily data over a single calendar month. For brevity, we average all of the variables for each stock over pre- or postevent windows, yielding a sample with 3,360 observations.16 Panel A of Table 2 reports the summary statistics. Both our information-content measures (i.e. PriceErr, |AR15| and IVOL) and price-adjustment speed proxies (i.e. Delay1, Delay2 and |CR|) exhibit a positive mean value and substantial cross-sectional variation.

| Panel A: Descriptive statistics | ||||||

|---|---|---|---|---|---|---|

| N | Mean | p50 | SD | Min | Max | |

| PriceErr | 3,360 | 0.0581 | 0.0504 | 0.0289 | 0.0132 | 0.2398 |

| |AR15| | 3,360 | 0.1942 | 0.1937 | 0.0117 | 0.1452 | 0.2363 |

| IVOL | 3,360 | 0.0171 | 0.0164 | 0.0059 | 0.0000 | 0.0541 |

| Delay1 | 3,360 | 0.3682 | 0.3602 | 0.1407 | 0.0649 | 0.9168 |

| Delay2 | 3,360 | 0.5856 | 0.5872 | 0.0907 | 0.3213 | 0.9197 |

| |CR| | 3,360 | 0.1822 | 0.1762 | 0.0475 | 0.0545 | 0.4116 |

| LnCap | 3,360 | 2.0390 | 1.9411 | 0.8408 | −0.6835 | 6.9988 |

| LnPrice | 3,360 | 2.5320 | 2.5399 | 0.7050 | 0.5032 | 5.1426 |

| Turnover | 3,360 | 0.0198 | 0.0146 | 0.0176 | 0.0003 | 0.2257 |

| Insti | 3,360 | 0.0862 | 0.0521 | 0.1192 | 0.0000 | 0.8812 |

| Panel B: Change in price-efficiency measures and firm characteristics | ||||||

|---|---|---|---|---|---|---|

| Pilot stocks | Nonpilot stocks | |||||

| Pre-event | Postevent | T-values | Pre-event | Postevent | T-values | |

| PriceErr | 0.0537 | 0.0475 | 6.05*** | 0.0714 | 0.0599 | 7.49*** |

| |AR15| | 0.1947 | 0.1927 | 3.60*** | 0.1965 | 0.1929 | 6.53*** |

| IVOL | 0.0171 | 0.0180 | −2.95*** | 0.0153 | 0.0179 | −10.21*** |

| Delay1 | 0.3745 | 0.3600 | 2.18** | 0.3583 | 0.3798 | −3.25*** |

| Delay2 | 0.5887 | 0.5815 | 1.69* | 0.5776 | 0.5944 | −3.90*** |

| |CR| | 0.1741 | 0.1936 | −8.96*** | 0.1705 | 0.1903 | −9.02*** |

| LnCap | 1.9905 | 2.2762 | −6.65*** | 1.7769 | 1.9667 | −5.39*** |

| LnPrice | 2.5355 | 2.5561 | −0.62 | 2.4686 | 2.4428 | 0.78 |

| Turnover | 0.0224 | 0.0242 | 0.36 | 0.0136 | 0.0167 | −5.31*** |

| Insti | 0.0875 | 0.0790 | 1.65* | 0.0932 | 0.0890 | 0.69 |

| Panel C: Pearson correlation coefficients between measures of efficiency | |||||

|---|---|---|---|---|---|

| PriceErr | |AR15| | IVOL | Delay1 | Delay2 | |

| |AR15| | 0.361*** | ||||

| IVOL | −0.408*** | −0.402*** | |||

| Delay1 | −0.077*** | −0.249*** | 0.572*** | ||

| Delay2 | −0.100*** | −0.275*** | 0.582*** | 0.965*** | |

| |CR| | −0.196*** | −0.166*** | 0.358*** | 0.267*** | 0.284*** |

- Panel A of this table reports the descriptive statistics of the price-efficiency measures and other control variables used in the difference-in-differences regression. Panel B reflects the change in price-efficiency measures and firm characteristics. Panel C reflects the Pearson correlation coefficients between the measures of efficiency. The sample covers five events in China, including the initial implementation of the pilot programme (31 March 2010) and the four major revisions on 5 December 2011, 31 January 2013, 16 September 2013 and 22 September 2014. Stocks newly added to the list are considered to be the treatment group, and the control group is generated by the propensity scores matching method, in which scores are computed by turnover, market capitalisation and price. PriceErr is pricing error as used by Boehmer and Wu (2013). |AR15| is the absolute value of the 15-min quote midpoint return autocorrelation. IVOL, introduced by Ang et al. (2009), is idiosyncratic volatility, the standard variation of the residuals of the Fama and French (1993) three-factor model, which is used to directly capture the incorporation of firm-specific information. Delay1 and Delay2 are price-delay proxies based on Hou and Moskowitz (2005). |CR| is the cross-autocorrelation coefficient between stock return and lagged market return. LnCap is the natural logarithm of the market value of equity scaled by 1 billion. LnPrice is the natural logarithm of the volume-weighted daily closing price. Turnover is the stock's trading volume scaled by shares outstanding. Insti is the fraction of shares owned by institutional investors at the end of each quarter. ⁎⁎⁎, ⁎⁎ and ⁎ indicate significance at the 1, 5 and 10 percent levels using two-tailed tests.

We then perform paired t-tests to examine the changes in price-efficiency measures and firm characteristics around these event dates. Panel B of Table 2 shows the comparison results. We find that after the bans are lifted, PriceErr and |AR15| for both the pilot and nonpilot stocks decrease significantly, whereas IVOL increases significantly. This indicates that, overall, stock prices deviate less from their fundamental values and incorporate more firm-specific information after the pilot programme. In contrast, the price delay (Delay1 and Delay2) decreases significantly for the pilot stocks, but increases significantly for the nonpilot stocks, suggesting that the price adjusts quicker for eligible stocks after the pilot programme. |CR| increases significantly for both the pilot and nonpilot stocks after this pilot programme.

We also present Pearson correlation coefficients between different efficiency measures in Panel C of Table 2. PriceErr is positively correlated with |AR15|, and the Pearson correlation coefficients between IVOL and the first type of information-content measures (PriceErr and |AR15|) are significantly negative, implying that these measures share a common component of information content. Moreover, the Pearson correlation coefficients between the different proxies of price-adjustment speed, ranging from 0.267 (between Delay1 and |CR|) to 0.965 (between Delay1 and Delay2), are significantly positive, indicating that these measures also have a common component of price-adjustment speed. Information content and price-adjustment speed seem to be negatively correlated in general. These findings emphasise the need to decompose price efficiency.

4.2 Regression results

To reduce the interference of outliers, we winsorise all of the variables in our estimation at the 1st and 99th percentiles.17 We use event dummies to control for time-fixed effects and use the robust ordinary least squares approach to estimate Model (3). Table 3 presents these estimation results. Columns 1 to 3 report the regression results for measures of information content (PriceErr, |AR15| and IVOL, respectively), whereas columns 4 to 6 present the regression results for the price-adjustment speed proxies (Delay1, Delay2 and |CR|, respectively).

| (1) | (2) | (3) | (4) | (5) | (6) | |

|---|---|---|---|---|---|---|

| PriceErr | |AR15| | IVOL | Delay1 | Delay2 | |CR| | |

| POST | −0.0056*** | −0.0028*** | 0.0018*** | 0.0223*** | 0.0165*** | 0.0153*** |

| (−5.00) | (−5.46) | (11.11) | (4.07) | (4.65) | (7.74) | |

| LIST | −0.0081*** | −0.0002 | 0.0002 | 0.0121** | 0.0072** | −0.0033* |

| (−7.75) | (−0.38) | (1.38) | (2.20) | (2.06) | (−1.70) | |

| POST × LIST | 0.0045*** | 0.0015** | −0.0014*** | −0.0359*** | −0.0238*** | −0.0000 |

| (3.42) | (2.13) | (−5.69) | (−4.76) | (−4.99) | (−0.01) | |

| LnPrice | −0.0155*** | −0.0053*** | 0.0025*** | 0.0793*** | 0.0522*** | 0.0051*** |

| (−22.73) | (−18.36) | (25.23) | (25.49) | (27.44) | (4.72) | |

| LnCap | −0.0106*** | −0.0010*** | 0.0001 | −0.0133*** | −0.0064*** | 0.0111*** |

| (−17.14) | (−3.16) | (0.74) | (−4.17) | (−3.13) | (9.63) | |

| Turnover | −0.6728*** | −0.1118*** | 0.1557*** | 0.0756 | 0.1243 | 0.4235*** |

| (−17.38) | (−8.31) | (24.93) | (0.54) | (1.42) | (6.85) | |

| Insti | 0.0079* | 0.0006 | −0.0010** | −0.0347** | −0.0171 | 0.0045 |

| (1.81) | (0.42) | (−2.19) | (−2.21) | (−1.62) | (0.80) | |

| TimeEffect | Control | Control | Control | Control | Control | Control |

| N | 3,360 | 3,360 | 3,360 | 3,360 | 3,360 | 3,360 |

| Adj. R2 | 0.527 | 0.205 | 0.609 | 0.350 | 0.372 | 0.237 |

- This table reports the ordinary least squares regression results on the differences in price efficiency between the treatment and control groups after implementation of the pilot programme. The event dates include the initiation date and the four revision dates, and the window is 1 year before and after the event date. The final sample includes 3,360 observations, after deleting samples with missing data. A firm is classified as a treatment stock when it is added to the eligible list on the event date and the control group is generated using the propensity scores matching method by turnover, market value and price. PriceErr is pricing error as used by Boehmer and Wu (2013). |AR15| is the absolute value of the 15-min quote midpoint return autocorrelation. IVOL, introduced by Ang et al. (2009), is idiosyncratic volatility, the standard variation of the residuals of the Fama and French (1993) three-factor model, which is used to directly capture the incorporation of firm-specific information. Delay1 and Delay2 are price-delay proxies based on Hou and Moskowitz (2005). |CR| is the cross-autocorrelation coefficient between stock return and lagged market return. LnCap is the natural logarithm of the market value of equity scaled by 1 billion. LnPrice is the natural logarithm of the volume-weighted daily closing price. Turnover is the stock's trading volume scaled by shares outstanding. Insti is the fraction of shares owned by institutional investors at the end of the previous quarter. Time-fixed effect is also considered in our model by including dummies for each event. Standard errors clustered by time and stock are displayed in parentheses. For brevity, the coefficients of intercepts and the coefficients estimated on time-fixed effects are not reported. ⁎⁎⁎, ⁎⁎ and ⁎ indicate significance at the 1, 5 and 10 percent levels using two-tailed tests.

As shown in Table 3, the coefficients of POST are statistically significantly negative in columns 1 and 2, but statistically significantly positive in Column 3, suggesting that the overall information content in the Chinese stock market increases after the pilot programme. The coefficients of POST are statistically significantly positive in columns 4 to 6, indicating a marketwide decrease in price-adjustment speed after the pilot programme.

Additionally, the coefficient of LIST in Column 1 is statistically significantly negative, implying that eligible stocks deviate less from the random walks and thus incorporate more information. The coefficients of LIST are statistically significantly positive in columns 4 and 5, suggesting that the eligible stocks may incorporate information more slowly.

The interaction term between POST and LIST has statistically significant coefficients in most of these specifications. The coefficient of the interaction term is statistically significantly positive in columns 1 and 2, and is statistically significantly negative in Column 3. These results indicate that implementing margin-trading pilot programme is associated with higher pricing error, greater absolute value of intraday return autocorrelations, and lower idiosyncratic volatility, after controlling for other potential determinants of information content. Overall, the implementation of the pilot programme lowers the information content of eligible stocks at both high- and low-frequency levels.

In contrast, the coefficient of the interaction term between POST and LIST is statistically significantly negative in columns 4 and 5 and is negative in Column 6, indicating that the implementation of the pilot programme in China is associated with smaller price delay and smaller cross-autocorrelation. This association suggests that the implementation of the pilot programme accelerates the speed of information incorporation.

As we divide price efficiency into information content and price-adjustment speed, it is clearer to separately identify the effect of the implementation of margin trading on the divergent aspects of price efficiency. We find that this implementation reduces information content, which is disadvantageous in price efficiency. However, it speeds up price adjustment, which is favourable for price efficiency. These findings provide a more integrated view of the impact of the pilot programme on price efficiency in China compared with findings in the literature.18

5 Effect of margin-trading activities on price efficiency

Since initiating the pilot programme, China has made daily margin-trading amount data publicly available. As there is much variation in margin-trading activity among eligible stocks, we further perform more powerful cross-sectional assessments of the impact of margin-trading activity on two aspects of price efficiency. Following Saffi and Sigurdsson (2011), we estimate monthly price-efficiency proxies at the stock level based on daily returns or intraday quote data. We also obtain the monthly average of daily margin-trading activities for each stock, where daily margin-trading activities are defined as the daily margin-buying amount divided by the daily total trading amount (Boehmer and Wu, 2013). Utilising these panel data, we regress the divergent aspects of price-efficiency measures on margin-trading activities to further investigate the impact of margin trading on price efficiency.

5.1 Summary statistics

Panel A of Table 4 reports the summary statistics of price efficiency and other control variables based on monthly panel data. The mean value of the monthly margin-trading activity proxy (i.e. Margin) is 16.48 percent, indicating that the relative margin-buying amount accounts for 16.48 percent of the total trading amount during our sample period. In addition, both our information-content measures and price-adjustment speed proxies exhibit positive mean values and substantial cross-sectional variation.

| Panel A: Descriptive statistics | ||||||

|---|---|---|---|---|---|---|

| Stats | N | Mean | p50 | SD | Min | Max |

| PriceErr | 29,061 | 0.0454 | 0.0397 | 0.0235 | 0.0079 | 0.2578 |

| |AR15| | 29,061 | 0.1940 | 0.1931 | 0.0339 | 0.0692 | 0.3819 |

| IVOL | 29,061 | 0.0171 | 0.0150 | 0.0094 | 0.0000 | 0.0870 |

| Delay1 | 29,061 | 0.3374 | 0.2617 | 0.2599 | 0.0013 | 1.0000 |

| Delay2 | 29,061 | 0.5675 | 0.5560 | 0.1743 | 0.0675 | 0.9999 |

| |CR| | 29,061 | 0.1917 | 0.1658 | 0.1385 | 0.0000 | 0.8686 |

| LnCap | 29,061 | 2.7543 | 2.6312 | 1.1036 | 0.1190 | 7.7599 |

| LnPrice | 29,061 | 2.5211 | 2.4993 | 0.7451 | 0.4256 | 5.5522 |

| Turnover | 29,061 | 0.4615 | 0.3058 | 0.4628 | 0.0013 | 6.0947 |

| Insti | 29,061 | 0.0810 | 0.0469 | 0.1147 | 0.0000 | 0.8627 |

| Margin | 29,061 | 0.1648 | 0.1736 | 0.0732 | 0.0000 | 0.4293 |

| Panel B: Correlation between measures of efficiency | |||||

|---|---|---|---|---|---|

| PriceErr | |AR15| | IVOL | Delay1 | Delay2 | |

| |AR15| | 0.15*** | ||||

| IVOL | −0.36*** | −0.17*** | |||

| Delay1 | −0.11*** | −0.06*** | 0.28*** | ||

| Delay2 | −0.14*** | −0.06*** | 0.28*** | 0.90*** | |

| |CR| | −0.06*** | −0.03*** | 0.12*** | 0.18*** | 0.19*** |

- Panel A of this table reports the descriptive statistics of the price-efficiency measures and other control variables based on the panel data. Panel B reports the Pearson correlation coefficients between the measures of efficiency. The sample includes stocks eligible for margin trading and covers the period from the date of implementing pilot programme in China (31 March 2010) to 31 December 2015. Margin is calculated as the daily ratio of the amount margin-bought to the trading amount. PriceErr is pricing error as used by Boehmer and Wu (2013). |AR15| is the absolute value of the 15-min quote midpoint return autocorrelation. IVOL, introduced by Ang et al. (2009), is idiosyncratic volatility, the standard variation of the residuals of the Fama and French (1993) three-factor model, which is used to directly capture the incorporation of firm-specific information. Delay1 and Delay2 are price-delay proxies based on Hou and Moskowitz (2005). |CR| is the cross-autocorrelation coefficient between stock return and lagged market return. LnCap is the natural logarithm of the market value of equity scaled by 1 billion. LnPrice is the natural logarithm of the volume-weighted daily closing price. Turnover is the stock's trading volume scaled by shares outstanding. Insti is the fraction of shares owned by institutional investors at the end of the previous quarter. All of the variables are averaged to obtain the monthly measures. ⁎⁎⁎, ⁎⁎ and ⁎ indicate significance at the 1, 5 and 10 percent levels using two-tailed tests.

In Panel B of Table 4, we report cross-sectional Pearson correlation coefficients between different price-efficiency measures. The Pearson correlation coefficients between IVOL and the other two information-content measures (PriceErr and |AR15|) are statistically significantly negative, indicating that these three measures share a common component of information content. In addition, the Pearson correlation coefficients between different measures of price-adjustment speed are statistically significantly positive, implying that these measures also have a common component of price-adjustment speed. These results are in line with those in Table 2.

5.2 Regression results

We run a panel regression with month- and stock-fixed effects to estimate Model (4).19 Table 5 reports the regression results. Columns 1 to 3 present the regression results for measures of information content (PriceErr, |AR15| and IVOL, respectively), and columns 4–6 present the results of the price-adjustment speed proxies (Delay1, Delay2 and |CR|, respectively).

| (1) | (2) | (3) | (4) | (5) | (6) | |

|---|---|---|---|---|---|---|

| PriceErr | |AR15| | IVOL | Delay1 | Delay2 | |CR| | |

| Margin | 0.0257*** | 0.0155** | −0.0275*** | −0.3653*** | −0.2714*** | −0.0818*** |

| (4.96) | (2.20) | (−16.65) | (−6.55) | (−7.69) | (−3.16) | |

| LnPrice | −0.0187*** | −0.0065*** | 0.0061*** | 0.1101*** | 0.0746*** | 0.0012 |

| (−20.08) | (−7.18) | (21.58) | (14.07) | (14.84) | (0.33) | |

| LnCap | −0.0026*** | 0.0015* | −0.0043*** | −0.0569*** | −0.0405*** | 0.0111*** |

| (−3.53) | (1.74) | (−16.32) | (−7.22) | (−8.24) | (3.20) | |

| Turnover | −0.0130*** | −0.0067*** | 0.0112*** | 0.1392*** | 0.0859*** | −0.0066** |

| (−19.27) | (−8.50) | (38.84) | (19.64) | (20.15) | (−1.97) | |

| Insti | 0.0041 | 0.0036 | 0.0091*** | 0.2708*** | 0.1725*** | 0.0164 |

| (0.71) | (0.55) | (4.51) | (4.89) | (4.74) | (0.61) | |

| Month Effect | Control | Control | Control | Control | Control | Control |

| Stock Effect | Control | Control | Control | Control | Control | Control |

| N | 29,061 | 29,061 | 29,061 | 29,061 | 29,061 | 29,061 |

| Adj. R2 | 0.493 | 0.087 | 0.513 | 0.239 | 0.248 | 0.104 |

- This table reports panel regression results on price efficiency for the eligible stocks from 31 March 2010 to 31 December 2015. The sample includes firms that have data available to calculate firm characteristics and price efficiency over the sample period. Margin is calculated as the monthly average of the daily ratio of the amount margin-bought to the trading amount. PriceErr is pricing error as used by Boehmer and Wu (2013). |AR15| is the absolute value of the 15-min quote midpoint return autocorrelation. IVOL, introduced by Ang et al. (2009), is idiosyncratic volatility, the standard variation of the residuals of the Fama and French (1993) three-factor model, which is used to directly capture the incorporation of firm-specific information. Delay1 and Delay2 are price-delay proxies based on Hou and Moskowitz (2005). |CR| is the cross-autocorrelation coefficient between stock return and lagged market return. LnCap is the natural logarithm of the market value of equity scaled by 1 billion. LnPrice is the natural logarithm of the volume-weighted daily closing price. Turnover is the stock's trading volume scaled by shares outstanding. Insti is the fraction of shares owned by institutional investors at the end of the previous quarter. Both the month- and stock-fixed effects are also considered. Standard errors clustered by stock and month are displayed in parentheses. For brevity, the coefficients of intercepts, the coefficients of lagged explained variables, and the coefficients estimated on month- and stock-fixed effects are not reported. ⁎⁎⁎, ⁎⁎ and ⁎ indicate significance at the 1, 5 and 10 percent levels using two-tailed tests.

As shown in Table 5, the coefficients of Margin in columns 1 and 2 are statistically significantly positive, which indicates that increased margin-trading activities are associated with higher pricing error (PriceErr) and higher absolute value of intraday return autocorrelations (|AR15|). In addition, the coefficient of Margin in Column 3 is statistically significantly negative, implying that greater margin-trading activities are associated with lower idiosyncratic volatility (IVOL). These findings suggest that stock prices deviate more from their efficient prices and incorporate less firm-specific information when there are more margin-trading activities. Overall, more margin-trading activities are associated with less information content, so margin trading is not conducive to information content.

In sharp contrast, the coefficients of Margin in columns 4–6 are statistically significantly negative, which implies that increased margin-trading activities are associated with smaller price delay (both Delay1 and Delay2) and smaller cross-autocorrelation between stock return and lagged market return (|CR|). These findings suggest that pilot stocks with greater margin-trading activities incorporate marketwide information more quickly into prices than do those with fewer margin-trading activities. Hence, more margin-trading activities are associated with faster price adjustment, implying that margin trading is beneficial to price-adjustment speed.

Our findings based on margin-trading activities in this section highlight the divergent impacts of margin trading on different aspects of price efficiency. We find that more margin-trading activities are associated with less information content, which is also supported by Hardouvelis (1990) and Rytchkov (2014). In sharp contrast, we show that more margin-trading activities are associated with faster price-adjustment speed, which is in line with Seguin (1990) and Chang et al. (2014). These findings indicate that the debate on the effect of margin trading on price efficiency may be related to the different measures of price efficiency used in the literature. The cross-sectional result in this section is more persuasive than that in the previous section.

5.3 Alternative tests

5.3.1 Endogeneity concerns

As margin traders may prefer stocks with lower information content or higher price-adjustment speed, our findings may result from endogeneity. To test this possibility, we lag the proxy for margin-trading activity by one period in Model (4) and present the estimation results in Table 6. The sign and significance of Margin in each column are consistent with those in the corresponding column in Table 5. This reveals that increased margin-trading activities are associated with higher PriceErr, greater |AR15| and smaller IVOL. In sharp contrast, greater margin-trading activities are associated with smaller price delays (Delay1 and Delay2) and smaller cross-autocorrelations between stock returns and lagged market returns (|CR|). These results strongly suggest that increased margin-trading activities are associated with less information content, but faster price-adjustment speed, even after controlling for endogeneity.

| (1) | (2) | (3) | (4) | (5) | (6) | |

|---|---|---|---|---|---|---|

| PriceErr | |AR15| | IVOL | Delay1 | Delay2 | |CR| | |

| Margin | 0.0338*** | 0.0134** | −0.0081*** | −0.1568*** | −0.1600*** | −0.0776*** |

| (6.90) | (2.00) | (−5.29) | (−3.07) | (−4.74) | (−2.91) | |

| LnPrice | −0.0192*** | −0.0065*** | 0.0062*** | 0.1142*** | 0.0777*** | 0.0008 |

| (−20.17) | (−6.97) | (20.97) | (14.28) | (15.03) | (0.22) | |

| LnCap | −0.0023*** | 0.0017* | −0.0042*** | −0.0591*** | −0.0427*** | 0.0121*** |

| (−3.00) | (1.92) | (−14.99) | (−7.47) | (−8.48) | (3.35) | |

| Turnover | −0.0132*** | −0.0068*** | 0.0113*** | 0.1389*** | 0.0860*** | −0.0077** |

| (−18.97) | (−8.43) | (38.68) | (19.25) | (19.59) | (−2.24) | |

| Insti | 0.0052 | −0.0009 | 0.0100*** | 0.2684*** | 0.1723*** | −0.0019 |

| (0.83) | (−0.14) | (4.83) | (4.85) | (4.79) | (−0.07) | |

| Month Effect | Control | Control | Control | Control | Control | Control |

| Stock Effect | Control | Control | Control | Control | Control | Control |

| N | 27,621 | 27,621 | 27,621 | 27,621 | 27,621 | 27,621 |

| Adj. R2 | 0.481 | 0.087 | 0.358 | 0.213 | 0.222 | 0.074 |

- This table reports the panel regression results of price efficiency for eligible stocks from 31 March 2010 to 31 December 2015. The sample contains firms that have data available to calculate firm characteristics and price efficiency over the sample period. Margin is calculated as the monthly average of the daily ratio of the amount margin-bought to the trading amount. PriceErr is pricing error as used by Boehmer and Wu (2013). |AR15| is the absolute value of the 15-min quote midpoint return autocorrelation. IVOL, introduced by Ang et al. (2009), is idiosyncratic volatility, the standard variation of the residuals of the Fama and French (1993) three-factor model, which is used to directly capture the incorporation of firm-specific information. Delay1 and Delay2 are price-delay proxies based on Hou and Moskowitz (2005). |CR| is the cross-autocorrelation coefficient between stock return and lagged market return. LnCap is the natural logarithm of the market value of equity scaled by 1 billion. LnPrice is the natural logarithm of the volume-weighted daily closing price. Turnover is the stock's trading volume scaled by shares outstanding. Insti is the fraction of shares owned by institutional investors at the end of the previous quarter. We lag Margin by one period to control for endogeneity. Month- and stock-fixed effects are also considered. Standard errors clustered by stock and month are displayed in parentheses. For brevity, the coefficients of intercepts, the coefficients of lagged explained variables and the coefficients estimated on month- and stock-fixed effects are not reported. ⁎⁎⁎, ⁎⁎ and ⁎ indicate significance at the 1, 5 and 10 percent levels using two-tailed tests.

5.3.2 Controlling short-selling activities

As margin trading and short selling are simultaneously allowed in China and stocks on the list are eligible for both, one may argue that the impact on price efficiency may be caused by short-selling activity instead of margin-buying activity. To address this argument, we introduce a proxy for short-selling activity, computed by short-selling volume scaled by trading volume (Boehmer et al., 2008), as another control variable into Model (4). The estimation results are presented in Table 7. Even after controlling for the effect of short selling, the impact of margin-trading activities is consistent with the findings in Table 5 and remains statistically significant. Increased margin-trading activities are associated with greater pricing error, greater absolute value of intraday return autocorrelations, and lower idiosyncratic volatility, indicating that lower information content results from more margin-trading activities. However, greater margin-trading activities are associated with smaller price delays and smaller cross-autocorrelations, which implies that margin-buying activities are positively associated with price-adjustment speed. These findings support our previous results by showing that the impact of margin trading on price efficiency still holds after considering the impact of short-selling activity.

| (1) | (2) | (3) | (4) | (5) | (6) | |

|---|---|---|---|---|---|---|

| PriceErr | |AR15| | IVOL | Delay1 | Delay2 | |CR| | |

| Margin | 0.0250*** | 0.0143** | −0.0279*** | −0.3893*** | −0.2880*** | −0.0877*** |

| (4.83) | (2.05) | (−16.80) | (−7.03) | (−8.19) | (−3.39) | |

| Shorting | −0.0394** | −0.0683** | −0.0221*** | −1.4175*** | −0.9824*** | −0.3484*** |

| (−2.24) | (−2.25) | (−3.72) | (−7.22) | (−7.91) | (−3.64) | |

| LnPrice | −0.0187*** | −0.0065*** | 0.0061*** | 0.1102*** | 0.0747*** | 0.0013 |

| (−20.05) | (−7.17) | (21.56) | (14.17) | (14.93) | (0.34) | |

| LnCap | −0.0024*** | 0.0019** | −0.0042*** | −0.0502*** | −0.0358*** | 0.0127*** |

| (−3.24) | (2.11) | (−15.90) | (−6.44) | (−7.40) | (3.65) | |

| Turnover | −0.0130*** | −0.0067*** | 0.0112*** | 0.1386*** | 0.0855*** | −0.0067** |

| (−19.26) | (−8.55) | (38.76) | (19.59) | (20.12) | (−2.01) | |

| Insti | 0.0039 | 0.0032 | 0.0090*** | 0.2616*** | 0.1662*** | 0.0141 |

| (0.65) | (0.49) | (4.37) | (4.68) | (4.61) | (0.53) | |

| MonthEffect | Control | Control | Control | Control | Control | Control |

| StockEffect | Control | Control | Control | Control | Control | Control |

| N | 29,061 | 29,061 | 29,061 | 29,061 | 29,061 | 29,061 |

| Adj. R2 | 0.493 | 0.087 | 0.513 | 0.241 | 0.250 | 0.104 |

- This table reports the panel regression results of price efficiency for the eligible stocks from 31 March 2010 to 31 December 2015. The sample contains firms that have data available to calculate firm characteristics and price efficiency over the sample period. Margin is calculated as the monthly average of the daily ratio of the amount margin-bought to the trading amount, whereas Shorting is computed as the monthly average of the daily ratio of the volume shorted scaled by trading volume. PriceErr is pricing error as used by Boehmer and Wu (2013). |AR15| is the absolute value of the 15-min quote midpoint return autocorrelation. IVOL, introduced by Ang et al. (2009), is idiosyncratic volatility, the standard variation of the residuals of the Fama and French (1993) three-factor model, which is used to directly capture the incorporation of firm-specific information. Delay1 and Delay2 are price-delay proxies based on Hou and Moskowitz (2005). |CR| is the cross-autocorrelation coefficient between stock return and lagged market return. LnCap is the natural logarithm of the market value of equity scaled by 1 billion. LnPrice is the natural logarithm of the volume-weighted daily closing price. Turnover is the stock's trading volume scaled by shares outstanding. Insti is the fraction of shares owned by institutional investors at the end of the previous quarter. Month- and stock-fixed effects are also considered. Standard errors clustered by stock and month are displayed in parentheses. For brevity, the coefficients of intercepts, the coefficients of lagged explained variables, and the coefficients estimated on month- and stock-fixed effects are not reported. ⁎⁎⁎, ⁎⁎ and ⁎ indicate significance at the 1, 5 and 10 percent levels using two-tailed tests. All of the variables are defined and calculated in the same manner here as in earlier tables.

5.3.3 Excluding outliers

The Chinese stock market experienced rapid changes and substantial volatility in 2015. In the same year, the Chinese government carried out various policies to stabilise the market. As these policies may affect the price efficiency of stocks and cannot be easily controlled, a subperiod during 2015 may be considered to be an outlier. Hence, we remove this subperiod and conduct our test in another sample that includes only the period from March 2010 to December 2014. The estimation results are shown in Table 8. The sign and significance of each coefficient of Margin are the same as those in Table 5, suggesting that greater margin-trading activities are associated with lower information content but higher price-adjustment speed. These results imply that the effect of margin-trading activities on price efficiency is consistent.

| (1) | (2) | (3) | (4) | (5) | (6) | |

|---|---|---|---|---|---|---|

| PriceErr | |AR15| | IVOL | Delay1 | Delay2 | |CR| | |

| Margin | 0.0380*** | 0.0080 | −0.0208*** | −0.3032*** | −0.2291*** | −0.0313 |

| (6.69) | (0.80) | (−12.24) | (−3.92) | (−4.46) | (−0.87) | |

| LnPrice | −0.0222*** | −0.0056*** | 0.0039*** | 0.0751*** | 0.0594*** | −0.0041 |

| (−17.31) | (−3.97) | (11.30) | (5.77) | (7.08) | (−0.76) | |

| LnCap | −0.0072*** | 0.0011 | −0.0032*** | −0.0581*** | −0.0459*** | 0.0124** |

| (−7.10) | (0.88) | (−10.20) | (−4.90) | (−6.09) | (2.22) | |

| Turnover | −0.0231*** | −0.0089*** | 0.0163*** | 0.2857*** | 0.1709*** | 0.0165*** |

| (−18.25) | (−6.71) | (28.96) | (18.78) | (18.82) | (2.94) | |

| Insti | 0.0165** | 0.0006 | 0.0060** | 0.2347** | 0.1210* | 0.0068 |

| (2.22) | (0.05) | (2.33) | (2.08) | (1.81) | (0.14) | |

| Month Effect | Control | Control | Control | Control | Control | Control |

| Stock Effect | Control | Control | Control | Control | Control | Control |

| N | 16,921 | 16,921 | 16,921 | 16,921 | 16,921 | 16,921 |

| Adj. R2 | 0.458 | 0.048 | 0.426 | 0.154 | 0.168 | 0.052 |

- This table reports the panel regression results of price efficiency for the eligible stocks from 31 March 2010 to 31 December 2014. The sample contains firms that have data available to calculate firm characteristics and price efficiency over the sample period. Margin is calculated as the monthly average of the daily ratio of the amount margin-bought to the trading amount. PriceErr is pricing error as used by Boehmer and Wu (2013). |AR15| is the absolute value of the 15-min quote midpoint return autocorrelation. IVOL, introduced by Ang et al. (2009), is idiosyncratic volatility, the standard variation of the residuals of the Fama and French (1993) three-factor model, which is used to directly capture the incorporation of firm-specific information. Delay1 and Delay2 are price-delay proxies based on Hou and Moskowitz (2005). |CR| is the cross-autocorrelation coefficient between stock return and lagged market return. LnCap is the natural logarithm of the market value of equity scaled by 1 billion. LnPrice is the natural logarithm of the volume-weighted daily closing price. Turnover is the stock's trading volume scaled by shares outstanding. Insti is the fraction of shares owned by institutional investors at the end of the previous quarter. Month- and stock-fixed effects are also considered. Standard errors clustered by stock and month are displayed in parentheses. For brevity, the coefficients of intercepts, the coefficients of lagged explained variables and the coefficients estimated on month- and stock-fixed effects are not reported. ⁎⁎⁎, ⁎⁎ and ⁎ indicate significance at the 1, 5 and 10 percent levels using two-tailed tests. All of the variables are defined and calculated in the same manner here as in earlier tables.

5.3.4 How margin trading affects the probability of informed trading and liquidity

Next, we discuss how margin trading affects the probability of informed trading (PIN) and liquidity. Uninformed individual investors dominate the Chinese stock market (Wang and Sun, 2015). They are accustomed to profiting from buying and selling, but it is difficult for them to obtain financing. Thus, they may be the primary group engaging in margin trading, which may reduce PIN. Following Easley et al. (1996), we compute PIN using both 1- and 5-min interval returns, denoted by PIN_1 min and PIN_5 min.

In addition, transactions by margin trading provide more funds, increase the demand for stocks and may improve the stock market's liquidity. To verify this possibility, we use Amihud illiquidity and the bid-ask spread as two liquidity proxies. Following Amihud (2002), we compute the Amihud illiquidity measure as the absolute value of stock returns scaled by daily trading amount and multiply the measure by 1 million (denoted as Illiquidity). Following McInish and Wood (1992), we also calculate time-weighted bid-ask spread by intraday quota data. We refer to this measure as ‘IntraSprd’ for brevity.

Table 9 reports the estimation results. Columns 1 and 2 present the regression results for the measures of PIN (PIN_1 min and PIN_5 min, respectively), and columns 3 and 4 present the estimation results for measures of liquidity (Illiquidity and IntraSprd, respectively). As shown in Table 9, the coefficients of Margin in columns 1 and 2 are statistically significantly negative, which suggests that greater margin-trading activities are associated with smaller PIN_1 min and smaller PIN_5 min.20 The coefficients of Margin are statistically significantly negative in columns 3 and 4, suggesting that greater margin-trading activities are associated with smaller Illiquidity and IntraSprd.21 These results suggest that increased margin-trading activities are associated with lower PIN, which may be due to the engagement of uninformed individual investors in margin buying, but greater margin-trading activities are associated with higher liquidity, which may be related to the additional funding brought by margin buying.

| (1) | (2) | (3) | (4) | |

|---|---|---|---|---|

| PIN_1 min | PIN_5 min | Illiquidity | IntraSprd | |

| Margin | −0.1751*** | −0.1497*** | −0.0005*** | −0.0505*** |

| (−12.87) | (−12.93) | (−11.76) | (−8.28) | |

| LnPrice | −0.0086*** | −0.0049*** | −0.0001*** | 0.0025*** |

| (−4.45) | (−3.07) | (−10.32) | (3.03) | |

| LnCap | −0.0041*** | −0.0029** | −0.0001*** | 0.0047*** |

| (−2.76) | (−2.23) | (−8.85) | (5.50) | |

| TurnOver | 0.0097*** | 0.0145*** | −0.0001*** | 0.0090*** |

| (6.18) | (10.67) | (−16.04) | (11.31) | |

| Insti | 0.0468*** | 0.0338** | −0.0000 | 0.0061 |

| (2.67) | (2.21) | (−0.03) | (0.95) | |

| MonthEffect | Control | Control | Control | Control |

| StockEffect | Control | Control | Control | Control |

| N | 29,061 | 29,061 | 29,061 | 29,061 |

| Adj. R2 | 0.264 | 0.213 | 0.385 | 0.620 |

- This table reports the panel regression results of liquidity and the probability of informed trading (PIN) for the eligible stocks from 31 March 2010 to 31 December 2015. The sample contains firms that have data available to calculate firm characteristics, liquidity and PIN over the sample period. Margin is calculated as the monthly average of the daily ratio of the amount margin-bought to the trading amount. PIN_1 min and PIN_5 min are the measures of PIN in intraday 1- and 5-min intervals, based on Easley et al. (1996). Illiquidity is the Amihud (2002) illiquidity measure multiplied by 1 million. IntraSprd is the spread computed from quota data and weighted by time, following McInish and Wood (1992). LnCap is the natural logarithm of the market value of equity scaled by 1 billion. LnPrice is the natural logarithm of the volume-weighted daily closing price. Turnover is the stock's trading volume scaled by shares outstanding. Insti is the fraction of shares owned by institutional investors at the end of the previous quarter. Month- and stock-fixed effects are also considered. Standard errors clustered by stock and month are displayed in parentheses. For brevity, the coefficients of intercepts, the coefficients of lagged explained variables and the coefficients estimated on month- and stock-fixed effects are not reported. ⁎⁎⁎, ⁎⁎ and ⁎ indicate significance at the 1, 5 and 10 percent levels using two-tailed tests. All of the variables are defined and calculated in the same manner here as in earlier tables.

6 Conclusions

Margin trading is popular in most stock markets and represents a substantial fraction of total trading volume. It has critical effects on many aspects of the stock market, such as liquidity, volatility and price efficiency. However, prior literature offers contradictory views on its impact on price efficiency. We argue that such contradictions arise because different studies use different measures to represent divergent aspects of price efficiency.

Using the Chinese margin-trading pilot programme in 2010, we separate price efficiency into information content and price-adjustment speed, and investigate the effect of margin trading on these two distinct aspects of price efficiency. We first use the DID method to address the impact of the implementation of this margin-trading programme. We find that pilot stocks experience a decrease in information content, but an increase in price-adjustment speed when added to the eligible list.

Moreover, as there is much variation in margin-trading activity among eligible stocks, we cross-sectionally investigate the impact of margin-trading activity on two aspects of price efficiency. More margin-trading activities are associated with lower information content, which is disadvantageous in price efficiency, and faster price adjustment, which is favourable for price efficiency. These results indicate that the debate regarding the effect of margin trading on price efficiency may be related to the different measures of price efficiency that prior literature used. Our results are robust after controlling for various factors, such as endogeneity, the effect of short selling, and the interference of outliers.

We extend the literature on margin trading by demonstrating that this practice is negatively associated with information content, but positively associated with price-adjustment speed. In addition, this study complements the literature on price efficiency by showing that the effect of relevant issues on different aspects of price efficiency can be divergent. Finally, our results have important policy implications. As margin trading is unfavourable for information content in the Chinese stock market, it should be restricted by imposing higher margin requirements.