Research on the use of financial statement information for forecasting profitability

Abstract

Research on the use of financial statement information for forecasting profitability has two objectives: (i) to generate improved forecasts of profitability and accurate estimates of firm value; and (ii) to identify market inefficiencies with respect to financial statement information. For these areas of research, this article describes the evolution, provides examples and shares implications of the research. It also discusses opportunities for future research. The article highlights that financial statement analysis research has slowly evolved and has received limited attention from academics. The article argues that there are vast opportunities for impactful research on fundamental analysis and market inefficiencies.

1 Introduction

The purpose of this manuscript was to provide an overview of research on the use of financial statement information for forecasting profitability and, more broadly, research on financial statement analysis. My goal is to provide an overview of this stream of research and to convince you that this is an exciting area of research that has important implications for academics, teaching, and practice. It is also a stream of research in which relatively few academics have been involved and, therefore, an area with vast opportunities for future research.

Financial statement analysis research generally has two goals: (i) to improve fundamental analysis in order to generate improved forecasts of profitability and more accurate estimates of firm value; and (ii) to identify market inefficiencies with respect to financial statement information. For each of these areas of research, I will describe the evolution of the research, provide some examples of the research, share some important implications of the research, and discuss opportunities for future research.

2 Research on fundamental analysis

2.1 Evolution

The evolution of research on fundamental analysis has been influenced and, in my opinion, occasionally hampered by the consensus of beliefs regarding the appropriate model for firm valuation. Initially, most practitioners and academics used the dividend discount model as the framework for firm valuation. In this framework, the firm's equity value is the present value of expected future dividends. This model focuses on the cash distributed to shareholders and assumes that value is enhanced only when dividends are distributed. This valuation model leaves much of firm value to future periods and generally does not tie firm value directly to the current financial statements. Given that dividend policies are often ad hoc and do not necessarily reflect the profitability or growth of the firm, much of firm value is dependent on long-term projections. This arguably results in financial statement analysis research having little relevance for valuation except to the extent that it provides information about future dividends.

Over time, the consensus of beliefs changed to rely on the discounted free cash flow model for firm valuation. In this model, firm value is the present value of expected future free cash flows, where free cash flows reflect the operating cash flows less the cash invested in working capital and long-term assets that are necessary to sustain the business. The free cash flow model is incrementally useful relative to the dividend discount model because it does not require cash to be distributed to shareholders to create value. Instead, value is considered to be created when cash is generated by the firm which could be distributed to shareholders and/or debt holders regardless of whether it is actually distributed. This feature allows for less reliance on longer-term projections for firm valuation.

Similar to the dividend discount valuation model, the free cash flow model does not rely on financial statement information. Rather, this valuation model requires adjusting the financial statements to ‘undo’ the accounting accruals to calculate free cash flows. Therefore, the financial statements are again not very relevant when using this valuation model. Assuming this valuation perspective, fundamental analysis research has limited usefulness for valuation.

More recently, Ohlson (1995) highlights the residual income valuation model, which increases the relevance of financial statements for valuation. The residual income valuation model represents firm equity value as the firm's current book value plus the present value of expected future residual income, where residual income is net income less the cost of equity capital times the beginning book value. The residual income valuation model focuses on value created by the firm, regardless of whether it is distributed and consists of cash or other assets.

Figure 1 provides an illustration of how the residual income model values a firm. The residual income model values the firm's current book value (BV) because it represents the firm's net resources. The model also values future residual income. That is, for each future year, the model assumes that the firm earns a required rate (cost of equity capital) on its book value (labelled Required r⁎BV in Figure 1), given that it could earn a similar rate from investments with similar risk. However, if the firm earns income over and above the required rate times the firm's beginning book value (i.e. residual income), the firm's valuation includes the present value of this residual income (labelled PV(RI) in Figure 1). The firm's total income (i.e. residual income plus the required income for the year) is added to the firm's book value to result in the beginning book value for the following year (while also accounting for any dividends paid by the firm). Therefore, this valuation model estimates the residual income each year into the future and adds the present value of the expected residual income to calculate firm value.

One benefit of the residual income valuation model relative to the dividend discount and free cash flow models is that the residual income model considers value to be the current book value and residual income when it is earned, regardless of whether it is received in cash. This premise allows value to be estimated earlier and places less reliance on longer term projections. Another benefit of the residual income model is that it directly expresses firm value as a function of financial statement summary measures, that is book value and net income. The residual income valuation model, therefore, ties firm value to the financial statements as prepared by accountants. The use of this model makes research on fundamental analysis especially relevant for valuation.

The residual income model also provides guidance for researchers by identifying the financial statement measures that are important for valuation. That is, residual income is defined as net income less the cost of equity capital times the beginning book value. If one rearranges this definition, it is clear that residual income can be defined as the firm's return on equity (ROE) less the cost of equity capital, multiplied by the firm's beginning book value. This specification suggests that firm value is a function of ROE and book values and, therefore, suggests research should focus on forecasting ROE and book value.

2.2 Examples of research

The residual income valuation model has greatly influenced fundamental analysis research because it provides researchers with an objective, as well as a framework, for how financial information relates to firm value (Richardson and Tinaikar, 2004). Specifically, the residual income valuation model has led fundamental analysis research to focus on identifying the analyses and disaggregations of financial statement information that improve forecasts of ROE.

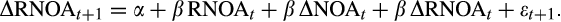

For example, Nissim and Penman (2001) provide insight into the fundamental behaviour of ROE over time. The basic finding in Nissim and Penman (2001) is reported in Figure 2. Specifically, Nissim and Penman (2001) place firms in deciles based on ROE and track the behaviour of ROE for the firms in each decile over the next five years. As evident in Figure 2, the authors document mean reversion in ROE, such that firms with relatively high ROE tend to experience decreases in ROE in the following years while firms with relatively low ROE tend to experience increases in ROE in the following five years.

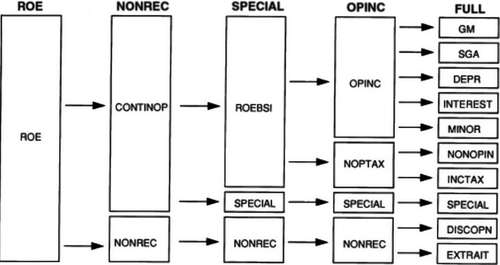

(1)

(1)The documentation of mean reversion in ROE provides an important benchmark for forecasting ROE for valuation.

The mean reversion phenomenon is also the basic benchmark for evaluating other analyses for forecasting ROE. That is, much of the subsequent research on fundamental analysis compares the usefulness of a base model that considers mean reversion in ROE to a model that disaggregates the financial statements or considers a more comprehensive set of ratios. This area of research examines whether more disaggregated models provide incremental information for future ROE over the base model.

An important aspect of this area of fundamental analysis research is out-of-sample forecasting. In many streams of research, documenting a significant coefficient on a variable (or documenting a significant difference in coefficients on variables) in a model is sufficient for concluding that the disaggregated model is informative. However, in fundamental analysis research, it is important that the researcher document that the more disaggregated model provides more accurate forecasts of ROE in out-of-sample analyses.

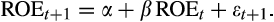

Figure 3 provides an illustration of the research design used in fundamental analysis research. Because of the importance of out-of-sample analyses, fundamental analysis research typically disaggregates the sample period into an estimation period (year t–k to year t) and a forecast period (year t + 1).

The researcher first uses the estimation period to generate the coefficients on the variables in the base model and the coefficients on the variables in the model(s) of interest (Step 1). He then applies the coefficient estimates from each model to the financial statement variables in year t to forecast ROE in year t + 1 (Step 2). He then calculates the forecast errors for ROE in t + 1 for each model (Step 3) and examines whether the model of interest yields significantly more accurate forecasts of ROE than the base model (Step 4). This out-of-sample analysis is key to fundamental analysis research.

Generating research ideas in fundamental analysis research is relatively natural, and many of the research ideas come directly from teaching. For example, when teaching the basic financial statements (or financial statement analysis), I often notice that key analyses that are suggested as necessary and important in textbooks have not been empirically shown to be useful. Therefore, when preparing for basic financial accounting classes, I often generate research ideas based on concerns that there is no empirical evidence to substantiate what I plan to tell the students to do in terms of fundamental analysis.

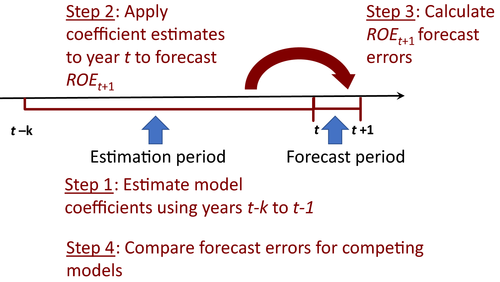

For example, when teaching basic financial accounting early in my career, I presented the students with the multi-step income statement under U.S. GAAP, such as the one shown in Figure 4.

This income statement presentation format presents each individual line item such as sales, cost of goods sold, selling expense, general and administrative expenses, depreciation expense, interest income, gains, interest expense, losses, income taxes and extraordinary items. The income statement also presents key subtotals such as income from operations, income from continuing operations before taxes, income from continuing operations and net income. The key question that arises when presenting the income statement using this format is which line items should be used for forecasting profitability. That is, one could focus on bottom-line net income because net income summarises the firm's profits for the year. Alternatively, one could use the income statement subtotals because regulators, standard setters and/or managers considered these to be important subcomponents of net income. Finally, one could consider each line item individually because each item is likely to have different implications for future profitability.

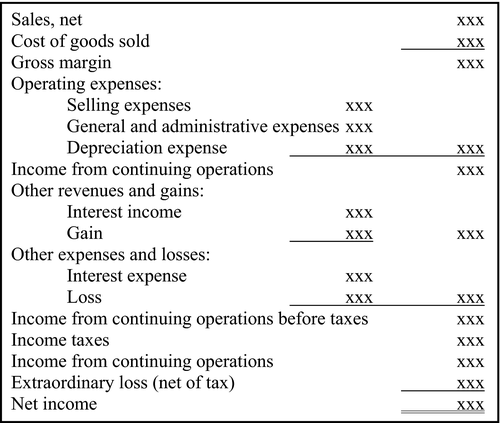

To provide insight into the optimal use of the disaggregated income statement, Fairfield et al. (1996) examine which earnings disaggregations improve forecasts of ROE by examining the improvement in forecast accuracy from each incrementally more disaggregated model compared with the relatively less disaggregated model. Figure 5, from Fairfield et al. (1996), illustrates the earnings disaggregations analysed.

The authors start with the ROE model as the benchmark model, which incorporates mean reversion in ROE. They then examine the NONREC model, which disaggregates ROE into two explanatory variables: income from continuing operations (CONTINOP) and the two non-recurring income components (NONREC), extraordinary items plus discontinued operations. The SPECIAL model retains NONREC as an explanatory variable and further disaggregates CONTINOP into special items, which are items that unusual or infrequent but not both, (SPECIAL) and ROE before special items (ROEBSI). The OPINC model retains NONREC and SPECIAL and further disaggregates ROEBSI into operating income (OPINC), and a variable that combines non-operating income and income taxes (NOPTAX). Finally, the FULL model disaggregates ROE into ten individual line items: gross margin (GM); selling, general and administrative expenses (SGA); depreciation and amortisation expense (DEPR); interest expense (INTEREST); minority income (MINOR); non-operating income (NONOPIN); income taxes (INCTAX); special items (SPECIAL): discontinued operations (DISCOPN); and extraordinary items EXTRAIT).

Fairfield et al. (1996) estimate each model in sample and then use the estimates to forecast year-ahead ROE. Fairfield et al. (1996) find that the NONREC model provides significantly more accurate forecasts than the aggregated ROE model, the SPECIAL model provides significant forecast improvement over the NONREC model, and the OPINC model yields significantly more accurate forecasts than the SPECIAL model. However, Fairfield et al. (1996) find that the FULL model provides significantly less accurate forecasts than the OPINC model.

These findings suggest that the individual line items in the FULL disaggregation do not exhibit sufficient differential persistence to make them useful for forecasting. They also suggest that the earnings disaggregation that yields the most accurate forecasts of year-ahead ROE is the OPINC model in which earnings are disaggregated into operating income, non-operating income and taxes, special items and nonrecurring items. These findings provide empirical evidence as to the optimal use of the disaggregated income statement for forecasting ROE.

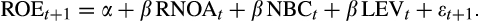

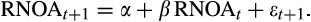

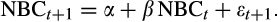

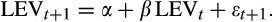

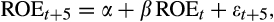

Another disaggregation that is often proposed in textbooks is the disaggregation of ROE into operating activities and financing activities. That is, disaggregating ROE into return on net operating assets (RNOA), net borrowing costs (NBC) and leverage (LEV) such that ROE equals RNOA plus the product of the spread between RNOA and NBC and LEV. While textbooks often suggest that operating and financing activities have different implications for future profitability, there was no empirical evidence that this disaggregation is useful for forecasting.

(2)

(2) (3)

(3) (4)

(4) (5)

(5)Esplin et al. (2014) find that the OPFIN model yields significantly less accurate forecasts than the aggregate ROE model but that the COMPONENT OPFIN model provides significantly more accurate forecasts than the aggregate ROE model. These findings provide guidance for fundamental analysis and suggest that the operating and financing disaggregation of profitability is only useful for forecasting when each component is forecasted separately and then combined to forecast ROE.

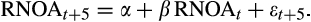

Another disaggregation that is often discussed in textbooks is the disaggregation of RNOA into asset turnover (ATO) and profit margin (PM). Textbooks generally suggest that examining the mix of ATO and PM is useful for understanding a firm's strategy. That is, a firm with a low PM and high ATO is likely to use a strategy of offering discount prices while a firm with a high PM and low ATO is likely to use a strategy of offering high prices but superior service. The question for fundamental analysis is whether considering the mix of ATO and PM is useful for forecasting.

(6)

(6) (7)

(7)The study documents that the disaggregation of RNOA into ATO and PM leads to significantly worse forecasts than the aggregate model. This finding suggests that, while knowing a firm's mix of ATO and PM provides insight into a firm's strategy, knowing the mix is not useful for forecasting profitability.

(8)

(8)The study documents a significant improvement in forecasts of operating profitability resulting from this disaggregation. In addition, Fairfield and Yohn (2001) note that the in-sample coefficient estimates suggest that the information content of the disaggregation is driven by ∆ATO and not ∆PM. The authors note that the lack of information in ∆PM for forecasting could be attributable to the fact that PM is based only on income statement measures and could, therefore, reflect changes in efficiency or changes in accounting conservatism. In contrast, ∆ATO reflects changes in the firm's ability to generate revenues from its assets and should be informative about future profitability. These insights provide specific guidance on how ATO and PM can be used for forecasting.

In each of these analyses, the forecasting models are estimated across firms in the economy. However, textbooks often suggest that financial analyses should be performed within an industry. In addition, analysts generally focus on specific industries and benchmark the firms they analyse on other firms in the industry rather than on all firms in the economy. This focus leads to the question as to whether financial analysis should be performed by comparing firms to all firms in the economy or to firms in each specific industry.

In other words, applying the mean reversion framework, does firm profitability revert to the economy-wide mean or to individual industry means? This question is important for forecasting because a firm could report current ROE (RNOA) that is higher than the economy-wide mean, which would suggest that ROE (RNOA) should decrease in the future if there is mean reversion to the economy-wide mean. At the same time, however, the firm's current ROE (RNOA) could be lower than the mean ROE (RNOA) for the industry, which would suggest that ROE (RNOA) should increase in the future if there is mean reversion to the industry specific mean. When forecasting the firm's ROE (RNOA), it would arguably be useful to know whether profitability tends to revert to the economy or the industry mean.

(9)

(9) (10)

(10)The authors examine two types of forecasting analyses: (i) an economy-wide analysis in which all firms in the economy are pooled into one regression; and (ii) an industry-specific analysis in which separate regressions are run for each industry. The authors examine whether the industry-specific analysis yields significantly more accurate forecasts of future ROE (RNOA) than the economy-wide analysis. In doing so, Fairfield et al. (2009) document that industry specific analysis yields significantly worse forecasts of five year-ahead ROE and insignificantly different forecasts of five year-ahead RNOA than the economy-wide analysis. The results suggest that industry-level analysis does not improve forecasts of future profitability.

2.3 Implications

The studies discussed above are just a few examples of research on fundamental analysis. However, they reflect research on basic and fundamental questions that arise when attempting to use current financial statements to forecast a firm's profitability. The results of fundamental analysis research obviously have important implications for teaching. In my experience, preparing for teaching, and the uneasiness that stems from the lack of empirical evidence to support many of the financial analyses suggested in textbooks, provides an impetus for much of the research in this area. In my opinion, few areas of research provide greater synergies between research and teaching than fundamental analysis, that is many research ideas derive from teaching and teaching materials naturally result from fundamental analysis research.

Fundamental analysis research also has important implications for financial analysis in practice. Many investment companies and analysts are interested in the findings of this research in order to improve their forecasting capabilities and to generate more accurate firm valuations. By considering this stream of research, analysts can arguably determine the optimal use of financial statement information for forecasting and firm valuation. This obviously leads to great interest in this area by practitioners.

Further, standard setters are also interested and influenced by the findings of this research. By understanding the optimal use of information for forecasting and valuation, standard setters can gain insight into the disaggregations and analyses that are likely to be most useful for financial statement users. For example, Biddle and Choi (2006) examine whether comprehensive income improves the predictive ability of income. This stream of research is therefore very important for standard setters in developing standards, especially related to the presentation of financial statements.

2.4 Opportunities

Given that research on fundamental analysis is influenced by the valuation models generally in vogue, and given that the residual income valuation model was not widely accepted by accounting academics until the mid-1990s, the evolution of this stream of research has been slow and the academic involvement in this research has been limited. The limited history of research in this area results in great opportunities for the future. In my opinion, there are basic questions regarding fundamental analysis that remain unexplored. A faculty member needs only think deeply about the analyses covered in a basic financial accounting class and consider whether the analyses suggested have been empirically tested. In many cases, the suggested fundamental analyses are based on conjecture and have not been empirically examined. For this reason, teaching is likely to lead to a great many research questions in this area of research.

In addition, as one attempts to provide specific instructions on how to use the current financial statements to forecast profitability for valuation, it is clear that there is often a lack of empirical evidence guiding this endeavour. In general, I think that there are many basic questions to be answered regarding how to best use financial statement information to forecast profitability and estimate firm value. Therefore, the slow evolution of research on fundamental analysis has led to great opportunities for future research in this area.

3 Research on identifying market inefficiencies

3.1 Evolution

As noted in the previous section, financial statement analysis research generally begins with fundamental analysis, which attempts to identify the optimal use of financial statement information for forecasting profitability and estimating firm value. Another important goal of financial statement analysis research is to identify market inefficiencies with respect to the use of financial statement information. That is, after identifying the optimal use of financial statement information, one can then examine whether the market efficiently uses this information.

As with fundamental analysis research, the research aimed at identifying market inefficiencies has been heavily influenced by the consensus of beliefs regarding market efficiency. Until relatively recently, the consensus of beliefs was that the market is semi-strong efficient, that is, a firm's stock price equals the firm's fundamental value based on public information.

The presumption of semi-strong market efficiency suggests that financial statement analysis research has little relevance to the market because the market efficiently uses all publicly available information. As a result, it was believed that financial analysis research could provide few insights that would be useful to the market.

Over time, however, the assumption of semi-strong market efficiency has been challenged. Market anomalies such as the glamour/value anomaly (Lakonishok et al., 1994; Gaunt, 2004), the momentum anomaly (Jegadeesh and Titman, 1993; Hurn and Pavlov, 2003), the post earnings announcement drift anomaly (Bernard and Thomas, 1990), and the closed end mutual fund puzzle (Lee et al., 1990) have raised questions about the validity of the semi-strong market efficiency assumption. This uncertainty regarding market efficiency allows for the potential for financial statement analysis research to be useful in terms of understanding the differences between a firm's stock price and its fundamental value.

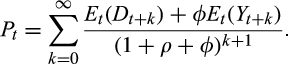

(11)

(11)The first component of price is fundamental value, or the value that is derived from the optimal use of public information to estimate firm value. This component of price is driven by information traders who optimally use the public information to estimate firm value and compare the value to price. The second component of price is investor sentiment. Investor sentiment is driven by noise traders who have time varying demands and whose valuations are not based on the optimal use of public information. The noise traders have systematic and correlated investing biases that affect the market price for the stock.

The influence of fundamental value versus investor sentiment on the firm's stock price is determined by the cost of arbitrage, ф. Information traders drive price to fundamental value; however, the cost of arbitrage affects their ability and willingness to do so. Therefore, if the cost of arbitrage is high, then investor sentiment will have a greater influence on the firm's stock price, while if the cost of arbitrage is low, then price will be closer to fundamental value.

This framework for stock price leads to the question of what determines investor sentiment. A stream of research in finance, labelled behavioural finance, attempts to understand investor sentiment by marrying psychology and finance to examine the cognitive errors and biases that systematically affect investment choices. The behavioural finance literature has identified systematic behavioural biases that affect investment decisions and the investor sentiment component of price.

Some biases identified in behavioural finance are limited attention, representativeness, loss aversion and herding. The limited attention bias suggests that investors tend to fixate on specific signals and disregard other signals. This fixation systematically leads to investment biases. The representativeness bias suggests that the brain uses short cuts to reduce the complexity of analysing information which also leads to systematic investment biases. The loss aversion bias suggests that investors analyse ‘gains’ and ‘losses’ differently such that the value of a loss is larger than that of a gain. The herding bias suggests that investors are influenced by each other, and there is a social pressure to conform. These systematic biases affect investor sentiment; therefore, behavioural finance provides insight into investor sentiment by directly examining the biases made by investors when analysing information and making investment decisions.

Financial statement analysis research can also provide insights into investor sentiment, but in a different manner. Specifically, the research relies on the results from fundamental analysis research to determine fundamental value and then compares the estimated fundamental value to the stock price. The difference between the stock price and fundamental value reflects the influence of investor sentiment. Alternatively, the research relies on the results from fundamental analysis research to determine the optimal use of accounting information for forecasting and valuation and then compares the forecasting implications of the accounting information to the market's valuation of the information.

3.2 Examples of research

As the consensus of beliefs moved away from semi-strong market efficiency and allowed for the potential for market inefficiencies, financial statement analysis research became more relevant and useful for understanding the market's use of information. The research generally examines the optimal use of financial statement information and then examines whether the market appears to use the information in this optimal manner.

(12)

(12)Consistent with his prediction, Sloan (1996) finds that accrued earnings are significantly less persistent than operating cash flows. This finding suggests that the optimal use of accounting information is to disaggregate earnings into its accrual and operating cash flow components and consider their differential persistence when forecasting year-ahead profitability.

Sloan (1996) also examines the market's valuation of the accrual and operating cash flow components of earnings. He finds that the valuation coefficient on accruals is significantly larger than the forecasting coefficient on accruals. In contrast, he finds that the valuation coefficient on operating cash flows is significantly smaller than the forecasting coefficient. Sloan (1996) concludes that the market overvalues (undervalues) accruals (operating cash flows) relative to their actual persistence. This finding has been examined in non-US countries (Clinch et al., 2012) and is consistent with the limited attention bias in behavioural finance in which investors fixate on bottom-line earnings.

Fairfield et al. (2003) extend the findings in Sloan (1996) by examining whether the lower persistence of accruals relative to operating cash flows is part of a more general growth anomaly. Fairfield et al. (2003) note that accruals are not only a component of profitability but also a component of growth in the balance sheet. That is, ACC is growth in working capital less depreciation. Therefore, just as ROA can be disaggregated into ACC and CFO, growth in net operating assets on the balance sheet (GrNOA) can be disaggregated into ACC and growth in long-term net operating assets (GrLTNOA). These observations raise the question as to whether ACC are less persistent than CFO because of their role as a component of profitability or because of their role as a component of GrNOA.

(13)

(13)The authors find that both GrLTNOA and ACC are less persistent than CFO for year-ahead ROA. Importantly, they also find that GrLTNOA and ACC have equivalent persistence for year-ahead ROA, suggesting that they have similar implications for future profitability. Fairfield et al. (2003) also compare the forecasting coefficients and the valuation coefficient for these financial statement measures. They find that the valuation coefficients for both ACC and GrLTNOA are significantly larger than their forecasting coefficients. The authors also find that the difference between valuation and forecasting coefficients for ACC is equivalent to the difference in the valuation and forecasting coefficients for GrLTNOA. These findings suggest that the market generally misprices growth in net operating assets and provide additional insight into the source of the market's inefficiencies in using accounting information for forecasting and valuation.

Soliman (2008) further examines whether the market efficiently incorporates the information in the disaggregated ratios into stock prices. That is, Soliman (2008) extends the finding in Fairfield and Yohn (2001) that ∆ATO but not ∆PM is useful for forecasting profitability. Soliman (2008) examines whether the information in ∆ATO is informative about future abnormal stock returns. If the market efficiently incorporates the information in ∆ATO, then ∆ATO should not be associated with future stock returns. Soliman (2008) finds a significant positive relation between ∆ATO and year-ahead abnormal stock returns and finds no significant relation between ∆PM and year-ahead abnormal stock returns. These findings suggest that the market misprices the implications of ∆ATO for future profitability and firm value.

3.3 Implications

Financial statement analysis research on identifying market inefficiencies has important implications for teaching, practice and standard setting. With respect to teaching, research in this area has led to the development of a new course. Charles Lee developed a course entitled ‘Alphanomics’ at Stanford and I have introduced a very similar course at Indiana University.

The course first covers fundamental analysis in terms of ratio analysis, earnings disaggregations, forecasting and valuation. Research that provides insight into these analyses is covered in this section of the course and students learn how to forecast profitability and value firms based on the state-of-the-art research. The course then covers market inefficiencies. The section of the course introduces the students to academic research on market inefficiencies, especially with respect to accounting information. The last section of the course introduces the students to quantitative stock selection in which the students use advanced tools to build stock screens and back-test trading strategies. The students develop trading strategies based on their review of fundamental analysis and market inefficiency research.

This course has been extremely popular and well received. The synergies between research and teaching become obvious in the development and teaching of the course. Arguably such a course is direct evidence of the impact that this stream of research has on teaching and vice versa.

Financial analysis research for identifying market inefficiencies also has important implications for practice. Hedge funds are extremely interested in the academic research in this area and have hired accounting academics that perform research in this area in order to inform the funds about potential trading strategies. This stream of research has therefore directly impacted practice by aiding in the development of hedge fund trading strategies.

From arguably a more altruistic perspective, research on market inefficiencies has aided in understanding the areas in which the market inefficiently uses accounting information for forecasting and valuation. These insights have the potential to inform analysts, investors and students about how to better use accounting information for valuation. These insights, therefore, also have the potential to increase the efficiency of the stock market.

Finally, financial statement analysis research on market inefficiencies has important implications for standard setters. By gaining insight into what accounting information the market efficiently and inefficiently incorporates, standard setters can make better decisions regarding financial statement presentation that could increase the efficient use of the information. This is important for improving market efficiency.

3.4 Opportunities

Given that the notion of market inefficiency is relatively new, there are great opportunities for research in this area. Future research could combine financial statement analysis research and behavioural finance research to provide greater insights into the behavioural biases with respect to the use of accounting information for investing. Future research could also examine whether and how financial statement presentation and accounting standards changes could improve market efficiency. Therefore, integration of financial statement analysis research with behavioural finance research and with experimental research on how financial statement presentation affects investor decisions appears to be fruitful areas for future research.

4 Conclusion

Financial statement analysis research aims (i) to identify the optimal use of accounting information for forecasting profitability and valuation; and (ii) to identify potential inefficiencies in the market's use of accounting information for valuation. Both areas of research have limited histories and have received limited attention until recently. The slow evolution of these streams of research is largely attributable to the use of valuation models that are not directly associated with financial statement information and to the assumption of semi-strong market efficiency.

The popular acceptance of the residual income valuation model which expresses firm value as a function of book value and ROE and the gradual change in the consensus of beliefs regarding market efficiency has led to more financial statement analysis research. The research in this area has important implications for teaching and provides incredible synergies between teaching and research. Financial statement analysis research also has important implications for practice, such that analysts, investors, hedge fund managers and standard setters can yield important insights for the use of financial statement information for forecasting and valuation.

The slow evolution and fundamental importance of financial statement analysis research suggests that there are great opportunities for research in this area. Very basic financial analysis questions remain unanswered and unexplored. In addition, students, analysts, investors, regulators and standard setters have a lot to learn from the findings of this research. The importance of these findings to teaching, academics and practice and the vast opportunities in terms of future research suggest that financial statement analysis research is an area of research that should be of great interest to young and emerging scholars. In addition, financial statement analysis research is fundamental to accounting and to finance, suggesting that perhaps we as academics should be spending more time exploring this area of research.