Large audit firm premium and audit specialisation in the public sector

Abstract

The outsourcing of public-sector audits to the private sector is an important issue. This study examines the fee premium in the public sector by comparing audit fees between the government auditor and the Big5. The study (i) statistically adjusts for self-selection bias, (ii) allows the slope coefficients in the audit fee model to vary between the Big5 and the government audit and (iii) estimates the counterfactual audit fee premium. The Big5 premium is around 23 percent. However, the variation in premium depends on whether the Big5 auditor is an industry or city specialist.

1 Introduction

Since the 1980s, many countries have adopted ‘new public management models which have emphasised public accountability and best organisational practice (Hood, 1995). For many jurisdictions, the move to a more competitive public sector is a continuing process. Late adopters can benefit from the experience of jurisdictions that have used more competitive arrangements. For example, Chong et al. (2009) examine the outsourcing of public-sector audits for a sample of 178 public agencies in Western Australia. In their sample, the quality of an outsourced audit is similar to that of an in-house audit because the final audit report bears the signature of the government auditor, regardless of the supplier. Thus, contractors, including the BigN auditors, have limited incentives to deliver a level of audit quality above the required minimum acceptable.a Therefore, Chong et al. (2009) do not find a Big5 premium.

My study addresses the existence of an audit brand name premium in the public sector by comparing audit fees between the government auditor and BIG5 auditors in New Zealand over the period 1998–2000. I also test whether there is an audit fee premium or discount for industry and location (city) specialisation. The study contributes to the literature and complements Chong et al. (2009) in several ways.

First, the institutional setting is such that the audit fees are determined in a competitive market, that is evidence is provided from a market where public-sector entities have been subject to a tender process and have chosen a BIG5 auditor, rather than the government auditor. It differs from Chong et al. (2009) in that the private-sector auditors sign the audit report under their own name. Thus, BIG5 auditors can charge, and clients can purchase, a ‘brand name’ audit premium. The use of a BigN auditor and the associated audit premium is an important issue in public-sector audits (e.g. Rubin, 1988; Raman and Wilson, 1993; O'Keefe et al., 1994; Ward et al., 1994; Deis and Giroux, 1996; Jensen and Payne, 2005; Lownesohn et al., 2007).

Second, the data set comprises trading entities in the New Zealand public sector. Most prior audit fee research in the public sector has been conducted on municipalities in North America (e.g. recent studies include Bandyopadhyay and Kao, 2001; Thorne et al., 2001; Lownesohn et al., 2007), US school districts (Roberts et al., 1990; Deis and Giroux, 1992), national health services in England and Wales (Clatworthy et al., 2002; Basioudis and Ellwood, 2005) and public agencies in Australia (Chong et al., 2009).

As explained in Section 2.1, the reporting entities are largely removed from political interference. Hence, not only are the audit fees established in a competitive market they are also free from many of the confounding factors that exist in public-sector markets. The data are also free from survey nonresponse selection bias.

Third, the research design also implements two recent improvements in the audit fee literature. First, the two-stage Heckman procedure is used to adjust the self-selection bias in choosing a BigN auditor (e.g. Ireland and Lennox 2002; Chaney et al., 2004).2 Second, I allow the explanatory variable coefficients to vary between the government and BigN audit fee models and then estimate the counterfactual audit fee (Chaney et al., 2004; Carson et al., 2012). The actual audit fee is then compared to the estimated fee as if the alternative auditor choice was made.

Fourth, the existence of brand name premium is an important issue in the corporate audit fee literature (Moizer, 1997; Basioudis and Ellwood, 2005; Fung et al., 2012 provides literature summaries). The premium for large audit firms can arise through oligopolistic market power (US Department of the Treasury 2008) or a return on higher quality auditing (Simunic, 1980). Prior audit fee research has captured market competitiveness using small listed auditee markets (Simunic, 1980; Francis and Stokes, 1986; Raman and Wilson, 1993) and private (unlisted) auditee markets (e.g. Chaney et al., 2004). In the setting for this study, there is no threat of monopoly power by BigN audit firms and the tender process should ensure that audit fees are competitively determined. Another feature of the data set is that it comprises public-sector trading entities that are either for-profit entities or if they are not-for-profit they have comparable for-profit firms in the private sector. Hence, the results of this study will also be relevant for the general audit fee literature.

The results show that the audit fee premium using the traditional fixed-effect audit fee model is 15 percent. When the models are adjusted for self-section and model coefficients are allowed to vary between audit segments, the premium is estimated at 23 percent. However, if an industry specialist is engaged, there is a discount of 17 percent. There is no premium associated with being a private-sector national leader in public-sector audits. There is mixed evidence as to whether a city audit specialist can command a premium.

The next section describes the institutional background and develops the hypotheses. This is followed by sections that describe the model specification, the sample, descriptive statistics and results. The last section is a conclusion.

2 Institutional background and hypothesis development

2.1 Institutional background

The Office of the Auditor-General of New Zealand (OAG) is responsible for the independent assurance services of all public entities, as defined in the Public Audit Act 2001. This definition includes all public-sector firms registered under the Companies Act 1993. To meet this commitment, a contestable process for appointing auditors was progressively introduced from 1990 to 2000. Under this process, the OAG invited almost all auditee firms to participate in the contestability arrangements (Glass, 2005).3 The audits are carried out by either Audit New Zealand (a business unit of the OAG) or private-sector auditing firms (OAG Annual Report 1999, p. 44). Tenders are sought for 3 years, but contracts are extended to 6 years provided the OAG and auditee are satisfied with the quality of audit service. A prominent independent accountant reports annually on whether the tendering process is ‘fair and appropriate’. Following an international independent review of the contestable audit process in 2001, the Auditor-General moved to a system of audit allocation.4

While the firms in my sample are defined as ‘public-sector entities’, they have many similarities to private-sector firms. They include ‘for-profit’ firms in the public-sector (such as utilities, ports, forests and research facilities). Other ‘not-for-profit’ entities in the sample have equivalent for-profit in the private sector. State-owned enterprises in New Zealand have a statutory obligation to be as profitable and efficient as comparable businesses that are not owned by the Crown. They have the ability to borrow and are subject to the same tax regime and solvency regime as private-sector firms. They are governed by private-sector style boards. Ownership varies from central government, local government, community trusts, or in some cases shares are listed.5

Public entity firms in New Zealand are also required to prepare financial statements using the same accounting standards as private-sector firms.6 The results should therefore be consistent with prior literature that uses New Zealand audit fee data (Firth, 1985; Johnson et al., 1995; Hay and Knechel, 2010; and Hay and Jeter, 2011).

2.2 Hypothesis development

Baber et al. (1987) argue there are fundamental economic differences between private and public entities that will lead to differences in the demand for and supply of audits. Thorne et al. (2001) identify two economic differences: the absence of a profit incentive and the political dimension. Both of these differences may put the BigN at a disadvantage relative to the other auditors. For example, local political relationships might outweigh expertise, as evidence shows that small municipalities tend to select local auditors (Thorne et al., 2001). Public entities might also be subject to additional compliance requirements that are unfamiliar to BigN auditors. For example, the Single Audit Act (1984) requires more extensive auditing than providing assurance on the fairness of financial statements (Raman and Wilson, 1993). The mixed results with regard to the BigN premium in the public sector (see Bandyopadhyay and Kao, 2001; Lownesohn et al., 2007) have arisen because BigN auditors find it difficult to compete with government and local auditors.

Hence, the existence of a BigN audit premium in the public sector is an empirical issue that reflects the institutional arrangements. For example, a BigN audit premium was not found to exist in the UK National Health Sector, where the supply of audit services and audit remuneration is regulated by the Audit Commission (Clatworthy et al., 2002). In Chong et al. (2009), the outsourcing or subcontracting arrangements of public-sector audits results in a situation where there are few incentives for Big5 auditors to provide a higher quality audit because the government auditor provides the audit report. Thus, the government auditor is likely to accept the best value-for-money audit and reject higher quality audits that are costlier. Hence, in this institutional setting, there is no BigN audit premium. In contrast, in this study, the BigN auditors sign the audit report under their own name and can therefore capture any brand name premium. Therefore, I hypothesise there will be a BigN premium.

Under the tendering regime of this study, the BigN firms complained that they acquired insufficient audits to achieve economies of scale. However, if economies of scale exist (through industry specialisation), then in a competitive market, these are likely to be shared with the client. Thus, I hypothesise there are audit fee discounts associated with industry audit specialists.

3 Model specification

3.1 Single-stage estimation of the large audit firm premium

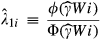

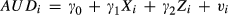

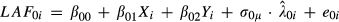

(1)

(1)Equation 1 is used to test the hypothesis that different-sized audit firms (AUDi) charge different audit fees. LAFi is the natural log of the audit fee for firm i. The Xi and Yi variables represent determinants of audit fees (other than auditor size). In a typical study, AUDi is captured using an indicator variable equal to 1 if the auditor is a BigN auditor and zero otherwise. Studies finding a positive statistically significant coefficient on AUDi (i.e.  > 0) conclude that there is a large audit firm fee premium, while a significant negative coefficient can arise from economies of scale in the provision of assurance services. BigN firms are considered to provide higher quality audits because they have less GAAS violations (O'Keefe et al., 1994). Private auditors are considered by analysts to be more independent than government auditors (Karns et al., 1983), which is assumed to increase the likelihood of reporting an error.7

> 0) conclude that there is a large audit firm fee premium, while a significant negative coefficient can arise from economies of scale in the provision of assurance services. BigN firms are considered to provide higher quality audits because they have less GAAS violations (O'Keefe et al., 1994). Private auditors are considered by analysts to be more independent than government auditors (Karns et al., 1983), which is assumed to increase the likelihood of reporting an error.7

If equation 1 is estimated on nonrandomly selected data, then the fitted coefficients will confound the parameters of interest with the parameters of the self-selection function. Thus, if clients choose whether to hire a private-sector (BIG5) auditor rather than a government auditor, then the coefficients on the independent variables will reflect both the audit fee function and the auditor choice function. I control for this self-selection bias by employing the Heckman (1979) a two-stage procedure.

3.2 Controlling for self-selection bias

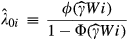

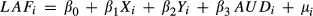

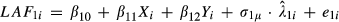

(2)

(2)In equations 1 and 2, the Xi variables affect both audit fees and auditor selection, whereas the Yi and Zi variables affect only the audit fee and the auditor selection, respectively.8

The functions ф and Ф are the standard normal probability density function and the cumulative distribution function, respectively.

(5)

(5) (6)

(6)If BigN clients are of higher-than-average quality, they will pay lower-than-average fees (Titman and Trueman, 1986; Thornton and Moore, 1993). Thus, Ireland and Lennox (2002) hypothesise that clients that choose a BigN audit firm will be of higher-than-average quality and therefore will pay lower audit fees compared to a random selection of firms.9 Hence, the coefficient on the inverse Mills ratio will be negative for large auditor clients (σ1μ < 0) and positive for small auditor clients (σ0μ > 0).

3.3 The explanatory variables (Xi, Yi and Zi)

The explanatory variables that used in the auditor choice and audit fee models (i.e. Xi, Yi and Zi) are defined in Table 1.

| Panel A: variables in both the audit fee models and auditor selection models (Xi) | |

| lnSIZE | Natural log of end of year total assets ($000) |

| lnSUB | Natural log of (the number of subsidiaries +1) |

| LEV | The ratio of debt to total assets |

| LISTED | = 1 if the firm is listed and 0 otherwise |

| INDUSTRY | A series of five industry indicator variables: agriculture, services, health, ports and research |

| Panel B: variables in the audit fee model only (Yi) | |

| BIG5 | = 1 if the firm employs a Big 5 auditor and 0 otherwise |

| INVREC | The ratio of inventories plus receivables to total assets |

| LOSS | = 1 if the firm incurred a loss in the current year and 0 otherwise |

| SMALL | = 1 if the firm is in the lowest decile by total assets |

| Panel C: Variables in the auditor selection model only (Zi) | |

| NAS | The ratio of nonaudit service fees to audit fees |

| ACOM | = 1 if the firm has an audit committee and 0 otherwise |

3.3.1 Audit fee model variables (Xi and Yi)

The variables in the audit fee model are the determinants of audit fees commonly used in prior research and require only a brief explanation. Potential economies of scale in the audit are captured by firm size. In keeping with prior research, the natural log of total assets (lnSIZE) is used. Complexity is captured by the natural log of the number of subsidiaries (lnSUB).10 Size and complexity are the most important determinants of audit fees. INVREC is the ratio of inventory plus receivables to total assets. It captures asset composition and is related to the inherent risk that might require specialised audit procedures. A positive relation between audit fees and INVREC is expected. Leverage (LEV) and profitability (LOSS) are employed to capture the financial and business risks of the client. Faced with higher risk, auditors are expected to increase audit fees. Ownership of the firm might also affect the auditors’ financial exposure, especially if the firm is listed. I therefore include an indicator variable (LISTED) if the firm is listed.11

Early research (e.g. Simunic, 1980) identified audit fees as being sensitive to client size. Francis and Stokes (1986) find audit fee premiums to BigN auditors for small firms. Hence, the audit fee premium is expected to be different depending on the market segment (based on client size) in which the auditor competes. Furthermore, even after logarithmic transformations, there is a nonlinear relation between fees and client size (Carson et al., 2004). I therefore include a size indicator variable (SMALL) which is set at 1 if the firm is in the lowest size decile as measured by total assets and zero otherwise.

Industry variables have been found to be associated with audit pricing in prior literature (e.g. Palmrose, 1989; Cairney and Young, 2006) and are used to control for the possibility of correlated omitted variables.12 Industry sectors are described in a later section. I choose the energy industry as the reference industry in the intercept, as this has largest number of observations.

3.3.2 Auditor selection model variables (Xi, Zi)

The choice of explanatory variables in model 2 is based on prior research on auditor choice in the public sector (e.g. Rubin, 1988). Size is expected to be related to auditor choice (Roberts et al., 1990). I also include the number of subsidiaries, as an additional dimension of size and complexity.

Credit analysts perceive audits performed by large firms as more objective than those performed by state auditors (Baskin, 1986). The evidence also suggests that lower debt costs are associated with private-sector auditors (Wallace, 1981; Wilson and Howard, 1984). Greater leverage (LEV) should relate to the use of private-sector auditor.

The motivation for including LISTED is that firms relying on capital markets are more likely to choose a private-sector auditor, as these are recognised as high-quality auditors in this sector. The ratio of nonaudit fees to audit fees (NAS) is included as firms are likely to select a BIG5 auditor to take advantage of specialist nonaudit services they offer. The audit committee indicator variable (ACOM) is included as firms with audit committees have been found to favour BigN auditors (Eichenseher and Shields, 1985).13

4 Sample and descriptive statistics

4.1 Sample

The audit fee data were provided by the OAG for all public-sector audits with more than 200 h, over the period 1998–2000. This is an appropriate period for this study because the audit tendering arrangements were no longer new and can be considered stable.14 In addition, the tender process is likely to result in a setting where audit fees reflect the various risks faced by the auditor. For example, in 2000, a total of 120 entities were invited to participate in tenders, of which 106 elected to renegotiate a 3-year term with their current audit service provider, rather than subject the audit to a tender process. The OAG considers this indicates ‘sufficiently high level of satisfaction’ with the service provided and with the ‘competitiveness of the fees proposed in the negotiations for renewal contracts’ (OAG Annual Report 2001, p. 56). The year 2000 is an appropriate ending date because the Auditor General moved from a tender process to an audit allocation process (see footnote 3).

I have audit fee data for 327 firm-year observations. Missing financial statement data resulted in a loss of 52 firm-year observations. Twelve firm-year observations are eliminated because firms are involved in reorganisations or are influential outliers in diagnostic tests.15 This results in a final sample of 263 firm-year observations, comprising 153 audited by the government auditor (GOVA) and 110 by large (BIG5) audit firms.

4.2 Descriptive statistics

A description of the data by year and industry analysed by auditor choice (i.e. GOVA or BIG5) is provided in Table 2. The observations are evenly spread across each year. Pooling audit fee data over 3 years is a trade-off between increasing the sample size and the problem of nonindependent observations. This problem is addressed by adjusting the standard errors of coefficients by ‘clustering’ on each firm (Rogers, 1993).16 Panel B of Table 2 reports auditor choice by industry. In four of the six industries, the government auditor has the dominant share of audits, that is only for the agriculture and ports industries do the BIG5 audit more firms than the GOVA.

| Auditora | Total | ||

|---|---|---|---|

| GOVA | BIG5 | ||

| Panel A: firm-year observations by year | |||

| 1998 | 50 | 36 | 86 |

| 1999 | 56 | 36 | 92 |

| 2000 | 47 | 38 | 85 |

| Total | 153 | 110 | 263 |

| Panel B: firm-year observations by industry | |||

| Agriculture | 4 | 6 | 10 |

| Energy | 50 | 38 | 88 |

| Health | 47 | 12 | 59 |

| Ports | 16 | 28 | 44 |

| Research | 16 | 14 | 30 |

| Services | 20 | 12 | 32 |

| Total | 153 | 110 | 263 |

- a Auditors are GOVA = government auditor and BIG5 = Big 5 audit firms.

Table 3 provides descriptive statistics for the dependent and explanatory variables for government audited firms (Panel A) and for BIG5 audited firms (Panel B). Panel C reports parametric and nonparametric statistics for differences between panel A and panel B. Audit fees (AFi) range from $10,000 to $333,000 with a mean value for GOVA of $41,000 and for BIG5 of $73,000. The clients of BIG5 audit are larger with mean total assets (SIZE) of $465.7 million, compared to a mean $101.9 million for GOVA clients. This difference is significant at the 0.01 level.

| AF ($000) | X i | Y i | Z i | |||||||

|---|---|---|---|---|---|---|---|---|---|---|

| SIZE ($000) | NSUBS | LEV | LISTED | INVREC | LOSS | SMALL | NAS | ACOM | ||

| Panel A: GOVA sample (n = 153) | ||||||||||

| Mean | 41 | 101,972 | 1 | 0.402 | 0.01 | 0.142 | 0.20 | 0.14 | 0.154 | 0.55 |

| SD | 22 | 157,281 | 2 | 0.237 | 0.119 | 0.364 | ||||

| Min | 10 | 2,340 | 0 | 0.011 | 0.007 | 0.000 | ||||

| p25 | 27 | 22,552 | 0 | 0.186 | 0.047 | 0.000 | ||||

| p50 | 37 | 57,933 | 1 | 0.403 | 0.128 | 0.000 | ||||

| p75 | 49 | 105,402 | 2 | 0.614 | 0.186 | 0.154 | ||||

| Max | 177 | 100,7201 | 15 | 0.976 | 0.656 | 3.275 | ||||

| Panel B: BIG5 sample (n = 110) | ||||||||||

| Mean | 73 | 465,708 | 3 | 0.345 | 0.11 | 0.099 | 0.15 | 0.04 | 0.693 | 0.49 |

| SD | 65 | 965,930 | 4 | 0.184 | 0.074 | 1.042 | ||||

| Min | 17 | 9,634 | 0 | 0.018 | 0.004 | 0.000 | ||||

| p25 | 34 | 52,214 | 1 | 0.234 | 0.041 | 0.036 | ||||

| p50 | 48 | 75,570 | 2 | 0.300 | 0.071 | 0.316 | ||||

| p75 | 88 | 343,713 | 4 | 0.512 | 0.146 | 0.970 | ||||

| Max | 333 | 515,2000 | 18 | 0.779 | 0.318 | 6.076 | ||||

| Panel C: statistical tests | ||||||||||

| t-test | −5.663 | −4.578 | −4.899 | 2.094 | 3.343 | −5.920 | ||||

| p-value | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | ||||

| MWU | −4.921 | −4.171 | −5.127 | 1.902 | 2.766 | −6.781 | ||||

| p-value | 0.000 | 0.000 | 0.000 | 0.057 | 0.006 | 0.000 | ||||

| χ2 | 14.324 | 1.425 | 8.259 | 1.061 | ||||||

| p-value | 0.000 | 0.233 | 0.004 | 0.303 | ||||||

BIG5 audit firm clients have more subsidiaries (NSUBS), lower leverage, are more likely to be listed, have lower INVREC, lower proportion of small clients (SMALL), and purchase more nonaudit services (NAS), relative to the clients of GOVA. For these variables, the differences between the BIG5 audit clients and GOVA clients are significant at the 0.01 level. There are differences between BIG5 and GOVA auditors in the number of LOSS making clients. The proportion of clients with audit committees is not significant (at conventional levels). The difference in industry sectors between BIG5 and GOVA (not tabulated) is not statistically significant.

The statistical differences in Table 3 suggest that firms might choose auditors because of asset mix (e.g. SIZE, NSUBS, INVREC and SMALL) and because of client risk (LEV) and access to capital markets (LISTED). This provides a prima facie case for allowing the coefficients on audit fee determinants to vary between BIG5 and GOVA auditors and adjusting for self-selection bias.

5 Results

To facilitate comparison with prior research, I describe the analysis in four parts: (i) fixed-effect estimation of the audit fee premium (using a BIG5 indictor variable), (ii) two-stage estimation of the audit fee model controlling for self-selection, (iii) an analysis of alternative (counterfactual) fees and (iv) the inclusion of city and industry specialists in the audit fee analysis.

5.1 Fixed-effect audit premium model

Table 4 reports the results of single-stage ordinary least square regressions to examine if there is a BigN premium. Model 1 in Table 4 is a commonly employed in prior research to estimate the BigN audit premium. The model F test indicates the model is significant. The adjusted R2 is 0.743.17 The coefficients on lnSIZE, lnSUBS, LEV are significant at 0.01. The coefficient on SMALL is positive and significant at 0.05. The coefficients on INVREC, LISTED and LOSS are not significant at conventional levels. The industry indicators for Ports and Research are significant at 0.05. Overall, the results for model 1 are broadly consistent with prior research. The coefficient on BIG5 of 0.143 is significant at 0.05, indicating that a BIG5 commands a fee premium of approximately 15 percent.18

| All (n = 263) | GOVA (n = 153) | BIG5 (n = 110) | Test for differences in coefficients | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Model 1 | Model 2 | Model 3 | Models 2 and 3 | ||||||

| Coefficient | p value | Coefficient | p value | Coefficient | p value | χ2 | p value | ||

| BIG5 | + | 0.143 | 0.014 | ||||||

| lnSIZE | + | 0.255 | 0.000 | 0.276 | 0.000 | 0.267 | 0.000 | 0.020 | 0.883 |

| lnSUBS | + | 0.301 | 0.000 | 0.210 | 0.000 | 0.285 | 0.000 | 0.850 | 0.357 |

| INVREC | + | −0.285 | 0.267 | −1.281 | 0.001 | 1.691 | 0.005 | 10.150 | 0.001 |

| LEV | + | 0.587 | 0.002 | 0.424 | 0.007 | 0.801 | 0.002 | 0.910 | 0.340 |

| LISTED | + | 0.169 | 0.196 | 0.060 | 0.422 | −0.017 | 0.445 | 0.130 | 0.723 |

| LOSS | + | 0.034 | 0.301 | 0.130 | 0.027 | −0.130 | 0.092 | 4.060 | 0.044 |

| SMALL | + | 0.244 | 0.039 | 0.545 | 0.000 | −0.072 | 0.354 | 10.260 | 0.001 |

| Agriculture | ? | 0.179 | 0.342 | −0.269 | 0.092 | 0.527 | 0.000 | 4.540 | 0.033 |

| Health | ? | 0.164 | 0.127 | 0.318 | 0.000 | −0.154 | 0.229 | 8.450 | 0.004 |

| Ports | ? | −0.279 | 0.016 | −0.454 | 0.000 | −0.085 | 0.440 | 3.790 | 0.052 |

| Research | ? | 0.184 | 0.045 | 0.422 | 0.000 | −0.002 | 0.986 | 5.430 | 0.020 |

| Services | ? | −0.078 | 0.491 | −0.066 | 0.655 | 0.140 | 0.243 | 0.550 | 0.459 |

| Intercept | ? | 0.362 | 0.319 | 0.295 | 0.394 | 0.145 | 0.715 | 0.050 | 0.818 |

| F-test | 29.070 | 0.000 | 26.030 | 0.000 | 38.330 | 0.000 | 59.600 | 0.000 | |

| Adjusted R2 | 0.743 | 0.664 | 0.804 | ||||||

| AIC | 161.948 | 60.061 | 62.742 | ||||||

| BIC | 211.958 | 99.456 | 97.849 | ||||||

The use of a fixed effect BIG5 indicator variable in model 1 does not allow the coefficients on the audit fee determinants differ between the two groups of auditors. If BIG5 auditors and the GOVA have different training, technology and experience, then there is a possibility that they will place different weights on audit risk, client business risk and auditor business risk. Furthermore, the government auditor might price audits on a portfolio basis. A portfolio setting can result in different risk assessment, which can affect audit effort (e.g. Bradbury and Rouse, 2002). Models 2 and 3 in Table 4 employ the same variables as model 1 (except for the BIG5 variable) and are estimated on separate GOVA and BIG5 samples.

The coefficients on size (lnSIZE), complexity (lnSUBS) and leverage (LEV) are significant and in the expected direction in both models 2 and 3. The sign, size and significance of the coefficients of the remaining variables vary. INVREC is negative and significant in GOVA model and positive and significant level in the BIG5 model. LISTED is not significant in either model. LOSS is positive and significant (at the 0.05 level) in the GOVA model but negative and weakly significant (at the 0.10 level) in the BIG5 model. Industry indicators (Health, Ports and Research) are significant in the GOVA model, while only Agriculture is significant in the BIG5 model.

Wald test statistics (Judge et al., 1985; 20-28) for differences in coefficients across models 2 and 3 are reported in the last columns in Table 3. The joint test for differences across all coefficients (except for the intercept) is significant. Six of the 12 explanatory variables differ significantly (at the 0.05 level) between the two auditor models.

The F-tests for models 2 and 3 are significant, and the adjusted R2 are 66.4 and 80.4 for the GOVA and BIG5 models, respectively. I also report two information criteria to facilitate comparison across models in Table 3: Akaike's information criterion (AIC) (Akaike, 1974) and Bayesian information criterion (BIC) (Schwarz, 1978). For both criteria, a smaller value indicates a better-fitting model. Both the GOVA model and BIG5 model have a lower AIC and BIC than the combined model. This provides further support for employing separate audit fee models between COVA and BIG5 auditors.

The results in Table 4 suggest there are underlying differences in audit technologies or risk assessments between BIG5 auditors and the GOVA. Thus, it is unreasonable to employ a model that imposes the restriction that the coefficients on the Xi and Yi variables are the same (i.e. model 1). Table 4, however, does not take into account the self-selection of a BIG5 auditor.

5.2 Audit fee model adjusted for self-selection

In Table 4, auditor choice is likely to be endogenous in the audit fee regressions (Copley et al., 1995; Ireland and Lennox, 2002; Chaney et al., 2004), that is client firms are not randomly assigned to audit firms rather auditor choice is based on jointly related characteristics of the firm and auditor. To address this issue, the Heckman's (1979) two-stage procedure is employed. In the first stage, a probit model is used to estimate the demand for a BIG5 auditor.

Table 5 reports the results of the probit regression described in equation 2. Firms that choose a BIG5 auditor are significantly larger, are listed and purchase a larger proportion of nonaudit services. The coefficients on the number of subsidiaries, leverage and the existence of an audit committee are not significant at conventional levels. The model correctly classifies 74.5 percent of the sample compared to a naive classification accuracy of 58.2 percent.19

| Coefficient | p-Value | ||

|---|---|---|---|

| Intercept | −3.333 | 0.018 | |

| lnSIZE | + | 0.236 | 0.033 |

| lnSUBS | + | 0.268 | 0.116 |

| LEV | + | −0.262 | 0.353 |

| LISTED | + | 1.037 | 0.039 |

| NAS | + | 0.706 | 0.025 |

| ACOM | + | −0.246 | 0.207 |

| Agriculture | 0.684 | 0.340 | |

| Health | −0.212 | 0.634 | |

| Ports | 0.566 | 0.201 | |

| Research | 0.621 | 0.195 | |

| Services | 1.021 | 0.032 | |

| Wald χ2 | 25.540 | 0.008 | |

| Classified correctly | 74.5% |

Estimates from this model are used to compute the inverse Mills ratios ( 0i and

0i and  1i), which are used as an additional explanatory variable in the audit fee model. These results are reported in models 4–6 in Table 6. The coefficients in Table 6 are similar to Table 4, with the exception that the indicator variables for LISTED and health industry are not significant in the GOVA model.

1i), which are used as an additional explanatory variable in the audit fee model. These results are reported in models 4–6 in Table 6. The coefficients in Table 6 are similar to Table 4, with the exception that the indicator variables for LISTED and health industry are not significant in the GOVA model.

| All (n = 263) | GOVA (n = 153) | BIG5 (n = 110) | Test for differences in coefficients | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Model 4 | Model 5 | Model 6 | Models 5 and 6 | ||||||

| Coefficient | p value | Coefficient | p value | Coefficient | p value | χ2 | p value | ||

| BIG5 | + | 0.190 | 0.002 | ||||||

| lnSIZE | + | 0.252 | 0.000 | 0.329 | 0.000 | 0.249 | 0.000 | 1.570 | 0.210 |

| lnSUBS | + | 0.272 | 0.000 | 0.253 | 0.000 | 0.223 | 0.000 | 0.090 | 0.760 |

| INVREC | + | 0.027 | 0.475 | −1.372 | 0.000 | 1.870 | 0.003 | 11.560 | 0.001 |

| LEV | + | 0.573 | 0.002 | 0.492 | 0.002 | 0.744 | 0.004 | 0.430 | 0.511 |

| LISTED | + | 0.014 | 0.472 | 0.201 | 0.251 | −0.167 | 0.132 | 2.100 | 0.147 |

| LOSS | + | 0.031 | 0.313 | 0.124 | 0.031 | −0.136 | 0.081 | 4.550 | 0.033 |

| SMALL | + | 0.190 | 0.002 | 0.562 | 0.000 | −0.128 | 0.253 | 12.690 | 0.000 |

| Agriculture | ? | 0.158 | 0.375 | −0.188 | 0.236 | 0.441 | 0.004 | 2.760 | 0.097 |

| Health | ? | 0.084 | 0.351 | 0.241 | 0.009 | −0.078 | 0.561 | 4.670 | 0.031 |

| Ports | ? | −0.249 | 0.029 | −0.395 | 0.000 | −0.117 | 0.287 | 2.310 | 0.128 |

| Research | ? | 0.218 | 0.014 | 0.501 | 0.000 | −0.030 | 0.801 | 8.620 | 0.003 |

| Services | ? | −0.090 | 0.460 | 0.089 | 0.569 | 0.043 | 0.740 | 0.030 | 0.874 |

i

i

|

−0.241 | 0.000 | |||||||

0i

0i

|

−0.307 | 0.007 | |||||||

1i

1i

|

−0.272 | 0.083 | |||||||

| Intercept | ? | 0.554 | 0.119 | −0.164 | 0.663 | 0.643 | 0.188 | 1.450 | 0.228 |

| F-test | 27.860 | 0.000 | 25.720 | 0.000 | 36.380 | 0.000 | 59.670 | 0.000 | |

| Adjusted R2 | 0.754 | 0.679 | 0.808 | ||||||

| AIC | 149.501 | 54.029 | 61.283 | ||||||

| BIC | 211.958 | 96.456 | 99.089 | ||||||

The coefficients on the inverse Mills ratios in all the GOVA and BIG5 model are negative and significant at the 0.01 and 0.10 level, respectively. This suggests that auditees pay lower fees than they would pay to a random auditor in the same market segment, that is auditees appear to optimise their choice of auditor. It is also worth noting that that the models in Table 6 have higher adjusted R2 and lower information criteria (AIC, BIC) than the corresponding regressions in Table 4.

5.3 Counterfactual fees BIG5 analysis

While the purpose of Table 6 is to statistically adjust for the possibility of self-selection bias, it is important to estimate the mean value of the dependent variable for the alternative choice (Maddala, 1983). Following Ireland and Lennox (2002), Chaney et al. (2004) and Carson et al. (2012), I undertake a counterfactual analysis by estimating the audit fee that would have been paid using the alternative audit fee model. The predicted value for the BIG5 sample using parameters from the GOVA model represents the counterfactual or alternative fee. The counterfactual audit fee premium for each firm is estimated as (predicted values from BIG5 model – predicted values from GOVA model)/predicted values from BIG5 model.20 On average, clients choosing a BIG5 auditor results a 16.4 percent premium (median 20.7 percent) than if the client had used the government auditor.21 The range of premium is from a discount of 76 percent to a premium of 62 percent.

In summary, the estimated audit premium for a BIG5 auditor (using a fixed effect model) is 15.4 percent. Adjusting for self-selection and estimating the counterfactual audit fee, the BIG5 premium is higher at 16.4 percent. The next section examines the source of this premium.

5.4 Industry and city specialisation premiums

Client industry has been found to affect audit fees and audit hours (O'Keefe et al., 1994; Stein et al., 1994; Ward et al., 1994). Industry specialisation can arise because of the types of transactions, types of assets-in-place, business and financial risk, and the level of regulatory compliance. Specialisation has also been found at the local office level (Ferguson et al., 2003, 2006). O'Keefe et al. (1994) find that local office specialisation of school districts audits is associated with lower levels of GAAS reporting violations. Lownesohn et al. (2007) find that several measures of auditor specialisation, including industry and office-level specialisation, are positively associated with perceived audit quality.

I use three indicator variables to measure auditor specialism. The industry specialist (ISPEC) is a BIG5 audit firm that has a market share of >33 percent of the number of firms in an industry audited and has a minimum of three audits.22 The national specialist (NSPEC) is the BIG5 firm that has the largest number of audits. The city specialist (CSPEC) is the BIG5 firm that has a market share in each city that is >33 percent of the number of audits and has a minimum of three audits.23 Specialist variables are estimated each year. ISPEC can be thought of as capturing knowledge and reputation effects for specific industries. NSPEC and CSPEC are not based on industry characteristics and therefore reflect national (and perhaps international) reputation and local (city) reputations, respectively.

The relation between auditor specialisation and audit fees is not clear. A positive relation might reflect audit quality (Copley, 1991; Gramling and Stone, 2001; Neal and Riley, 2004) or reputation effects (e.g. Copley et al., 1995). A negative relation can arise through economies of scale (e.g. Mayhew and Wilkins, 2003). The evidence for public-sector audits is mixed. Jensen and Payne (2005) suggest that specialised auditors provide higher quality audits at lower fee levels. Ward et al. (1994) find the regional audit firm with the largest number of municipal clients received significantly higher fees. Lownesohn et al. (2007) find that specialisation is positively associated with audit quality but not with audit fees. Because of the mixed results, no predications are made for the specialist coefficients.

Table 7 presents the results of the audit specialist analysis. Model 7 uses the full sample and includes indicator variables for BIG5 and audit specialist (ISPEC, NSPEC and CSPEC). The coefficient on BIG5 is weakly significant (at the 0.10 level) suggesting that a BIG5 premium remains after specialist premiums have been considered. ISPEC is negative and significant, which suggests that industry specialisation is related to economies of scale of audit production and the benefits are shared with the client. National specialism (NSPEC) is not rewarded, whereas a local reputation or city specialism (CSPEC) is positive and significant at the 0.01. This is consistent with specialist premiums in the New Zealand private-sector market (Hay and Jeter, 2011). The sign, size and significance on other variables are similar to the corresponding model in Table 6.

| Model 7 | |||

|---|---|---|---|

| Coefficient | p-Value | ||

| BIG5 | + | 0.109 | 0.096 |

| ISPEC | ? | −0.283 | 0.001 |

| NSPEC | ? | 0.099 | 0.169 |

| CSPEC | ? | 0.285 | 0.000 |

| lnSIZE | + | 0.266 | 0.000 |

| lnSUBS | + | 0.283 | 0.000 |

| INVREC | + | −0.351 | 0.269 |

| LEV | + | 0.495 | 0.001 |

| LISTED | + | 0.111 | 0.302 |

| LOSS | + | 0.020 | 0.734 |

| SMALL | + | 0.255 | 0.010 |

| Industry indicators | |||

| Agriculture | ? | 0.117 | 0.297 |

| Health | ? | 0.156 | 0.033 |

| Ports | ? | −0.367 | 0.000 |

| Research | ? | 0.166 | 0.018 |

| Services | ? | −0.067 | 0.464 |

1i

1i

|

|||

| Intercept | ? | 0.323 | 0.162 |

| F-test | 50.330 | 0.000 | |

| Adjusted R2 | 0.751 | ||

| AIC | 142.742 | ||

| BIC | 203.469 | ||

Panel A of Table 8 analyses the counterfactual audit premium by specialist. The average premiums for industry, national and city specialists are 6.6, 10.5 and 12.9 percent. Note, these premiums are not additive. For example, there is no audit firm that is solely an industry specialist. Panel C reports a regression of auditor specialism on the counterfactual audit fee premiums. The intercept is positive and significant (at the 0.01 level), indicating that there is BIG5 premium. The coefficient on industry specialist is negative and significant (at the 0.01 level). The coefficients on national specialist and city specialist are not significant at conventional levels. Except for the nonsignificance of city specialists, these results are consistent with those in Table 7. It is possible in Table 7 that city specialist premium is picking up a BIG5 premium effect.

| Mean | Min | p25 | p50 | p75 | Max | SD | |

|---|---|---|---|---|---|---|---|

| Panel A: analysis by specialist | |||||||

| ISPEC | 6.6 | −76.0 | −6.6 | 2.4 | 20.7 | 62.3 | 23.4 |

| NSPEC | 10.5 | −76.0 | −5.4 | 20.6 | 41.2 | 62.2 | 37.8 |

| CSPEC | 12.9 | −76.0 | −5.5 | 10.0 | 35.9 | 62.3 | 28.4 |

| Coefficient | p-Value | |

|---|---|---|

| Panel B: regression of audit specialism on counterfactual audit premium | ||

| ISPEC | −17.433 | 0.004 |

| NSPEC | −0.608 | 0.918 |

| CSPEC | 2.927 | 0.588 |

| Intercept | 23.101 | 0.000 |

| F-test | 3.880 | 0.011 |

| Adjusted R2 | 0.0734 | |

5.5 Additional tests

The ratio of nonaudit fees to audit fees is a significant explanatory variable in the auditor choice model. Its inclusion in the audit fee model is not significant. Only one listed firm is audited by the GOVA. I, therefore, re-ran all tests by dropping the listed firms from our analysis. Although the auditor selection and audit fee models improve, the interpretation of the sign and size of the coefficients in the audit fee models does not change.

6 Conclusion

A recent study by Chong et al. (2009) shows that there is no audit premium in an outsourcing arrangement where the BigN cannot associate their ‘brand name’ with the audit report. I extend this line of research by examining a setting where almost all public-sector entities were invited to place their audit for tender. Hence, I exploit a natural experiment where audit BigN auditors report under their own name and can therefore capture any brand name premium.

I also examine whether audit specialisation results a premium (for brand name) or discount (for efficiencies created by economies of scale). The existence of premiums or discounts is important because outsourcing of public-sector audits to private-sector auditors is a major concern in many jurisdictions. This study also (i) controls for self-selection bias and (ii) allows the coefficients in the audit fee model to vary across audit segments.

There are limitations of the study that need to be considered when interpreting the results. First, the sample is small which lowers the statistical power. Multiple years’ data are used to increase the sample size, and the standard errors are adjusted to account for clustering. The analysis employs a parsimonious audit fee model and uses industry indicator variables to control for omitted variables. While the data are somewhat old, the external validity is dependent upon the institutional setting in which the audit fees are determined. In this case, there is a robust tendering process in which auditors sign the audit report under their own name. The sample includes New Zealand public-sector trading entities across a wide range of industries.

The results show that the coefficients for audit fee determinants differ between the government auditor and the BIG5 auditors (e.g. inventories and receivables, client losses, and smaller client audits). This indicates that there are differences in the audit between BIG5 and the government auditor, which are likely to be related to differences in technology and risk assessment. Therefore, separate regressions for the BIG5 and government auditor segments provide a better estimate of the audit fee premium.

The traditional fixed effect model yields a BIG5 premium of 15.4 percent. After allowing slope coefficients to vary and after adjusting for self-selection bias, the results show that the BIG5 premium is, on average, 16.4 percent. However, the variation in premium varies considerably across clients. Further analysis shows that BIG5 premium is around 23 percent and that there is a discount of 17.4 percent for engaging the industry specialists, who presumably are sharing the efficiency savings (due to economies of scale) with the client. There is no premium for being a national leader in public-sector audits. It is unclear whether an audit premium exists for being city specialist.

For policy makers, the results indicate that audit client characteristics differ between a BIG5 or government auditor. One difference is that firms self-select by choosing whether to be audited by AuditNZ or a BIG5 auditor. After adjusting for self-selection, audit fees for both AuditNZ and BIG5 are lower than if the auditor was randomly chosen. Thus, auditees appear to optimise auditor choice. This indicates that the government auditor customises the audit to the client and is able to pass a discount on to the client. Whether the customisation by the government auditor is due to the introduction of a more competitive audit market is beyond the scope the data set in his study. The analysis shows that auditees are willing to pay a BIG5 audit fee premium, which may reflect either a brand name (reputation) or a higher quality audit. The existence of an industry specialist discount suggests any audit allocation process should consider the potential for economies of scale.

0i and

0i and  1i):

1i):