Managerial Ability and Debt Choice

The authors thank the editor, Stewart Jones, and an anonymous reviewer for helpful comments and suggestions on earlier drafts of this paper. They also acknowledge helpful comments and suggestions from Mark Clatworthy, Grantley Taylor, Prem Puwanenthiren, Haiyan Jiang, Carl Shen, Ileana Steccolini, Ahsan Habib, and Riaz Uddin. They are grateful to Peter Demerjian for making managerial ability data publicly available. Finally, thanks are due to Xianyang Xin for excellent research assistance. The usual disclaimer applies.

Abstract

Using a sample of 54,964 firm-year observations of US public firms during the period 2001 to 2020, we investigate how managerial ability affects corporate debt choice. We find evidence that managerial ability is negatively associated with the use of bank debt. This finding remains robust to a battery of robustness tests, including alternative measures of managerial ability and debt choice, various econometric specifications, and a range of endogeneity tests. Using the sudden death of the CEO as an exogenous shock to managerial ability, our difference-in-differences regression suggests a negative causal relationship between managerial ability and reliance on bank debt. Further, using advanced machine learning models, we identify that managerial ability is a highly influential variable in predicting firms’ debt choices. Our cross-sectional tests indicate that this relationship is more pronounced in the presence of higher information opacity, weaker corporate governance, and poor financial conditions. In additional tests, we show that firms with more able managers use more unsecured debt and public debt. Taken together, our findings suggest that managerial ability matters in shaping corporate debt choice.

In this study, we examine the relationship between managerial ability and debt choice. Debt has become a dominant source of financing in the US. For example, about $17 trillion in non-financial business debt was outstanding in the US at the end of 2021. Furthermore, the US capital market raised $2.3 trillion through debt issuance, while raising only $419 billion through equity issuance in 2021.1 A firm that chooses to procure funds through the issuance of debt has the option of borrowing from private sources (such as banks) or borrowing from public sources. Given the dominance of debt in the corporate capital structure, an emerging literature examines the factors that influence corporate choice between public and private debt (also known as the debt choice). For example, studies show that firm characteristics, product market competition, and corporate governance factors determine firms’ choices between public and bank debt (Ben-Nasr, 2019; Ben-Nasr et al., 2021; Boubaker et al., 2018; Boubakri and Saffar, 2019; Chen et al., 2020, 2021). While this body of literature provides valuable insights, it typically assumes that decisions regarding debt choice are made by managers possessing the full capability to process pertinent information and respond appropriately to their companies’ strategic needs. In reality, however, there is significant variation among managers in their abilities, influencing their access to external financing (Bertrand and Schoar, 2003; Bonsall et al., 2017; Demerjian et al., 2012; Shang, 2021). Therefore, in this study, we examine whether and how differences in managerial ability have any influence on corporate debt choices.

Consistent with Demerjian et al. (2012), we conceptualize managerial ability as the efficiency with which managers can convert corporate resources or inputs into revenue, profit, or firm value in comparison with industry peers. Prior studies provide considerable evidence that firms with more able managers are associated with higher operational, innovation, and financial performance (Cho et al., 2016; Demerjian et al., 2012). Studies also show that managerial ability improves informational transparency, as evidenced by lower earnings manipulation and more readable financial statements (Baik et al., 2020; Demerjian et al., 2013; Hasan, 2020). Therefore, managerial ability is viewed more favourably by credit rating agencies and lenders (Bonsall et al., 2017). We extend this literature by exploring how managerial ability affects a firm's debt choice between bank debt and public debt.

The corporate decision to raise funds through bank financing or public debt depends on the relevant costs and benefits. The extant literature proposes a number of theories to explain debt choice. These include the information asymmetry between managers and capital providers, the monitoring efficiency or agency theory, and the debt renegotiation theory (Bharath et al., 2008; Denis and Mihov, 2003; Diamond, 1984, 1991; Fama, 1985). Building on these theories, we propose three key arguments for the relationship between managerial ability and debt choice.

First, the information asymmetry thesis of debt choice proposes that private lenders’ ability to collect and process information is superior to that of public lenders. Therefore, firms with higher information asymmetry borrow privately to overcome the adverse selection costs arising from information asymmetry (Bharath et al., 2008). Nonetheless, the managerial ability literature shows that firms with more able managers demonstrate higher accounting and information quality, which reduces the information asymmetry and adverse selection costs of public debtholders (Baik et al., 2020; Demerjian et al., 2013; Hasan, 2020). Therefore, we argue that a higher level of accounting and information quality allows firms with more able managers to reduce their reliance on bank debt in financing their operations.

Second, the agency-based thesis of debt choice suggests that, owing to the concentrated ownership of debt claims, banks have greater ability and more incentives to monitor their borrowers closely, reducing their moral hazard problem. Consequently, firms with more agency problems borrow from banks rather than the public debt market (Denis and Mihov, 2003). Several studies suggest that agency problems are less salient in firms with higher managerial ability (Curi and Lozano-Vivas, 2020; Doukas and Zhang, 2021). To the extent that managerial ability reduces firms’ agency problems, it reduces their moral hazard problems, and thus their reliance on bank debt. However, some studies suggest that more able managers have incentives to maximize their private interests at the cost of other key stakeholders (Eisfeldt and Papanikolaou, 2013). This line of literature suggests that managerial ability increases the moral hazard problem and the need for close monitoring and thus the use of bank debt. Overall, the relationship between managerial ability and bank debt is unclear according to the agency-based view.

Finally, debt renegotiation theory suggests that private debt is more convenient to renegotiate because of the concentrated ownership of debt claims. Therefore, firms experiencing higher financial distress tend to borrow privately (Denis and Mihov, 2003). The literature shows that managers with better ability use their skills and experience to enhance their firm's productivity, profitability, and financial performance (Demerjian et al., 2012, 2013). Therefore, firms with more able managers are exposed to less financial distress (Bonsall et al., 2017). Based on this evidence, we expect firms with high-ability managers to rely less (more) on bank (public) debt.

To provide empirical evidence, we employ a large sample of US publicly listed firms from 2001 to 2020 (54,964 firm-year observations). We use the managerial ability measure of Demerjian et al. (2012). Following prior studies (e.g., Ben-Nasr et al., 2021; Chen et al., 2021), we measure a firm's debt choice as the ratio of its bank debt to its total debt (Bank/Total Debt). Our empirical analysis shows that managerial ability is significantly and negatively associated with bank loans, indicating that firms with more able managers rely less on bank debt. This finding is economically meaningful. For example, a one-standard-deviation increase in managerial ability reduces the reliance on bank debt by 9.07% relative to the mean bank debt.

We employ five identification strategies to address the endogeneity issues arising from omitted variable bias, selection bias, and reverse causality concerns. First, we include additional managerial traits and firm characteristics as controls and obtain consistent evidence. Second, we utilize Oster's (2019) bound estimate to alleviate the omitted variable bias. Our findings suggest that omitted confounding variables do not drive our results. Third, we exploit CEO sudden death as an exogenous shock to managerial ability. Our difference-in-differences (DiD) analysis alleviates concern about the reverse causality problem and indicates that the negative relationship between managerial ability and bank debt is causal. Fourth, we apply two-stage least squares (2SLS) using heteroscedasticity-based instruments. Our analysis confirms that the negative relationship between managerial ability and bank debt remains robust. Finally, we apply the entropy-balancing estimate, which ensures a covariate balance between treated and control firms, to mitigate the concern about selection bias. Again, we continue to find consistent evidence. Our baseline results remain robust when alternative regression models (including firm fixed effects and high-definition fixed effects) are used in the analysis. Moreover, our results persist when using alternative measures of managerial ability and bank debt.

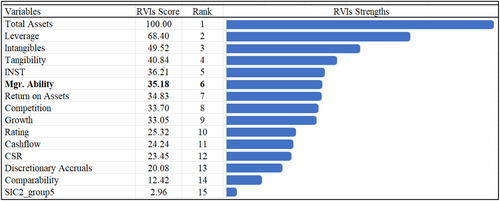

Next, we employ eXtreme Gradient Boosting (XGBoost) machine learning model to investigate the relative importance of managerial ability in predicting corporate debt choice. The relative variables importance (RVI) output from the XGBoost machine learning model suggests that managerial ability is the sixth most important variable among all of the independent variables in predicting the debt choice of firms, which strengthens the reliability of our key finding.

To provide further insights into our documented results, we conduct a range of cross-sectional analyses that investigate how the managerial ability–bank debt relationship varies depending on the information environment, financial conditions, and corporate governance mechanisms. Our results suggest that the negative relationship between managerial ability and bank debt is more pronounced for firms with greater information asymmetry, more financial constraints, and a poor governance structure. Our path analysis confirms that managerial ability has a direct effect on bank debt, while both the information environment and corporate governance channels mediate this relationship. In additional analyses, we find that firms with high managerial ability are negatively (positively) associated with unsecured (secured) debt. We also conclude that managerial ability is positively associated with public debt.

Our study contributes to the extant literature in three ways. First, to the best of our knowledge, this is the first study to investigate the impact of managerial ability on firm debt choice, specifically the choice between bank loans and public debt issuance. Previous studies identify product market competition (Boubaker et al., 2018), unemployment benefits (Ben-Nasr, 2019), board reforms (Ben-Nasr et al., 2021), board gender diversity (Datta et al., 2021), disclosure policy (Dhaliwal et al., 2011), ownership structure (Boubaker et al., 2017; Boubakri and Saffar, 2019; Liao, 2015; Lin et al., 2013), and social capital (Hasan et al., 2017) as affecting debt choice. We contribute to this literature by demonstrating that managerial ability plays an important role in shaping a firm's debt choice by reducing its reliance on bank debt.

Second, our study extends the literature on managerial ability that investigates how high-ability management influences corporate decisions and firm financial policies. For example, the extant literature shows that managerial ability significantly affects earnings quality (Demerjian et al., 2013), corporate innovation (Cho et al., 2016), corporate tax avoidance (Koester et al., 2017), corporate investment (Andreou et al., 2017; Lee et al., 2018), income smoothing (Baik et al., 2020), the information environment (Baik et al., 2018), and mergers and acquisitions (Doukas and Zhang, 2021). There are a few studies that also focus on the implications of managerial ability for the capital market, including credit risk management (Bonsall et al., 2017; Cornaggia et al., 2017), bank loan pricing (De Franco et al., 2017), and bank loan contracts (Bui et al., 2018). Our study significantly differs from these as we attempt to broaden our understanding regarding the impact of managerial ability on debt structure choices, which is largely overlooked in the existing literature.

Finally, our study supplements the literature that investigates the determinants of secured versus unsecured loans. For example, Barclay and Smith (1995), Benmelech and Bergman (2009), Di Filippo et al. (2022), and Ioannidou et al. (2022) document that growth opportunities, loan size, creditworthiness, and information asymmetry significantly affect firms’ access to secured and unsecured loans. We add to this stream of literature by providing evidence that firms with more able managers have greater access to unsecured loans. Taken together, our findings contribute to a growing literature documenting the role of managerial ability in financing policies.

LITERATURE REVIEW AND HYPOTHESIS DEVELOPMENT

The idea of managerial ability dates back to the work of Lang and Stulz (1994), which argues that managers’ actions can enhance or damage the firm value depending on their ability. In their seminal study, Bertrand and Schoar (2003) show that managerial idiosyncratic differences explain corporate policies and financial performance. In a more recent study, Demerjian et al. (2012) utilize data envelopment analysis (DEA) to estimate managers’ efficiency in transforming corporate resources into revenues relative to their firms’ industry peers. Subsequent studies exploit the managerial ability data of Demerjian et al. (2012) and document that managerial ability has a considerable influence on corporate outcomes (e.g., Bonsall et al., 2017; Cho et al., 2016; Demerjian et al., 2013; Koester et al., 2017). We expand this literature by investigating the role of managerial ability in influencing corporate debt choice. We propose three plausible theoretical arguments to establish a link between managerial ability and corporate debt choice.

Managerial Ability, Information Quality and Bank Debt

The extant literature suggests that higher-ability managers have a better understanding of their firms’ business and use this information to communicate with investors more efficiently (Baik et al., 2011; Demerjian et al., 2012, 2013; Francis et al., 2008; Malmendier and Tate, 2009). Baik et al. (2018) and Demerjian et al. (2013) document that firms with more able managers have superior information quality. Furthermore, Baik et al. (2020) find that firms with more able managers demonstrate higher income smoothing, improving earnings’ informativeness. In a related study, Hasan (2020) shows that managerial ability leads to superior financial performance, which motivates firms to produce more readable financial statements to communicate their superior quality to the market. In addition, Baik et al. (2011) report that managerial ability is positively correlated with the regularity and precision of management earnings forecasts, as well as the market reaction to these forecasts, which further implies that managerial ability improves firms’ information environment and information quality.

The information asymmetry-based argument of debt choice contends that banks have better access to a borrower firm's private information relative to public bondholders (Fama, 1985; Liao, 2015). Moreover, banks’ ability to gather and process information is superior to that of public bondholders (Diamond, 1991). Therefore, firms with a poor information environment find it expedient to obtain finance from banks to lower the adverse selection costs (Bharath et al., 2008; Dhaliwal et al., 2011). According to Li et al. (2019), higher information asymmetry prompts firms to shift from public to bank debt.

To the extent that managerial ability reduces information asymmetry and adverse selection costs, firms with higher managerial ability are likely to reduce the information disadvantage of public debt holders, which in turn reduces the cost of issuance of public debt. Therefore, building on the information environment-based argument, we predict that higher managerial ability reduces firms’ reliance on bank debt.

Managerial Ability, Agency Problems and Bank Debt

Existing studies provide mixed evidence concerning the effect of managerial ability on agency problems. Several studies document that more able managers reduce the agency problem by promoting the corporate social culture (Doukas and Zhang, 2021) and informational transparency (Baik et al., 2011, 2020; Hasan, 2020). For example, Curi and Lozano-Vivas (2020) contend that more able managers suffer less from inefficiencies, which lowers agency costs. Demerjian et al. (2013) provide evidence that firms with more able managers are less prone to alter financial statements opportunistically. Bui et al. (2018) also find that managerial ability reduces borrowers’ agency problems, leading to a lower loan spread.

In contrast, other studies suggest that managerial ability escalates the agency problems between a firm and its outside shareholders. This line of literature contends that highly able managers have more incentives and the ability to maximize their interests, which is not aligned with shareholders’ interests. For example, Eisfeldt and Papanikolaou (2013) show that managers with more outside options (i.e., more able managers) have a disproportionate share of firms’ cash flow, which increases shareholders’ risk. Koester et al. (2017) find that firms with more able managers avoid corporate tax. Moreover, studies indicate that managerial ability is positively associated with over-investment behaviour (Eisfeldt and Papanikolaou, 2013).

The prior literature proposes that agency problems play an important role in shaping corporate debt choice. In particular, on the one hand, because of concentrated debt ownership, bank debt involves fewer free-rider problems and banks have a greater ability and more incentives to monitor borrowers, reducing managerial opportunistic behaviour (Ben-Nasr et al., 2021; Denis and Mihov, 2003). On the other hand, public debt holders are exposed to the diffuse-ownership problem, which reduces their motivation and ability to monitor borrowers. Consequently, firms with high (low) agency problems tend to borrow privately (publicly).

In the context of our study, we argue that, because high-ability managers are associated with fewer agency problems, monitoring high-ability managers is less important. Therefore, public debtholders will be willing to extend debt to firms with more able managers. This argument suggests that firms with more able managers are negatively associated with the use of bank debt. However, given the evidence that highly able managers may exhibit more opportunistic behaviour, public debt holders may be less inclined to lend to firms with more able managers because of their monitoring disadvantage when compared with private lenders. Therefore, firms with more able managers may borrow more from banks. To this end, the relationship between managerial ability and bank debt is unclear ex-ante.

Managerial Ability, Financial Conditions and Bank Debt

Finally, we use the financial conditions of the firm as a plausible channel through which managerial ability may affect corporate debt choice. The extant literature suggests that managerial ability is a source of a resource base (Holcomb et al., 2009) and that more capable managers are better able to predict product demand, invest in higher-value projects, comprehend technology and industry trends, and manage their teams more effectively than their less capable counterparts (Demerjian et al., 2012). Studies also show that managerial ability is positively associated with innovation output (Cho et al., 2016) and corporate investment during the crisis period (Andreou et al., 2017). Cornaggia et al. (2017) contribute to this literature by demonstrating that managerial ability leads to a more favourable credit rating. Bonsall et al. (2017) expand this literature by revealing that managerial ability results in lower credit spreads. The prior literature also shows that managerial ability is negatively associated with both audit fees and the probability of obtaining a going-concern opinion.

Building on the debt renegotiation-based argument, we contend that superior financial conditions stemming from more able managers may affect corporate debt choice. According to debt renegotiation theory, because of the concentrated ownership of debt claims, bank debt is more flexible and easier to renegotiate than public debt. Therefore, it is optimal for borrowers in a weaker financial condition or a higher ex-ante probability of distress to borrow privately. Correspondingly, Denis and Mihov (2003) hypothesize that firms with high and low credit ratings use public debt while firms with intermediate ratings use bank loans. Given that more able managers are associated with superior operating, innovation and financial performance, and that firms with high managerial ability are not exposed to financial distress and debt covenant violation, firms with high managerial ability are not concerned with the renegotiation of debt. To the extent that managerial ability improves operational efficiency, financial performance, credit quality, and debt management capacity, we expect firms with more able managers to rely less (more) on bank (public) debt.

Thus, the above arguments lead us to hypothesize that firms with higher managerial ability rely less on bank debt, ceteris paribus.

H1.All else being equal, managerial ability reduces firms’ reliance on bank debt.

DATA AND RESEARCH METHOD

Data and Sample

We obtain debt structure data from Standard & Poor's Capital IQ database, which provides data on commercial papers, senior bonds and notes, subordinated bonds and notes, term loans, and revolving credit. We start our sample in 2001 since debt structure data are mostly unavailable before this period. We use the managerial ability data of Demerjian et al. (2012).2 The financial data used in this study are acquired from Compustat. Following prior studies (Ben-Nasr et al., 2021; Chen et al., 2020), we exclude observations from financial (Standard Industrial Classification (SIC) 6000–6999) and utility (SIC 4900–4999) firms. We also exclude observations with missing and zero total debt, missing managerial ability, and control variables. This sampling process yields a final sample of 54,964 firm-year observations pertaining to 7,651 unique firms for the period 2001–2020.

Key Variables

Dependent variable: Debt choice

Following extant studies (Ben-Nasr et al., 2021; Boubaker et al., 2018; Chen et al., 2021; Lin et al., 2013), we measure corporate debt choice as the ratio of bank debt to total debt (Bank/Total Debt). Bank debt is specified as the sum of term loans and revolving credit, and total debt is measured as the sum of bank debt and public debt (i.e., the sum of commercial papers, senior bonds and notes, and subordinate bonds and notes).3 In the sensitivity analysis, we also specify debt choice as bank debt over total liabilities, the natural logarithm of bank debt and bank debt over total assets.

Main independent variable: Managerial ability

Our main variable of interest is managerial ability (Mgr. Ability). We exploit the managerial ability score of Demerjian et al. (2012). The authors use two-stage procedures to estimate managerial efficiency in the use of corporate resources. In the first stage, they estimate the total firm efficiency, which gauges how efficiently a firm generates revenue from a certain set of inputs, using data envelopment analysis (DEA – a form of nonparametric frontier analysis). In particular, to estimate a firm's total efficiency in comparison with its industry peers, the authors solve an optimization problem that models the output (sales) as a function of seven inputs (cost of goods sold (COGS), selling and administrative expenses (SGA), property, plant and equipment (PP&E), operating leases, R&D, goodwill and other intangibles).

The residuals from the above regression model capture the managerial ability of the firm. The authors show that this measure of managerial ability captures the desirable attributes and that it is superior to other measures of managerial ability used in the prior literature (e.g., past stock returns, past ROA, managers’ compensation, tenure, media citations, etc.). Consistent with prior studies (e.g., Bonsall et al., 2017; Cornaggia et al., 2017; Demerjian et al., 2013; Hasan, 2020), our empirical analysis uses both continuous and industry-year-level decile rank scores of managerial ability.

Regression Model

In the sensitivity analysis, we estimate equation (2) using the firm fixed effect (FFE), Tobit, Newey–West, weighted least squares (WLS), and Fama–MacBeth (FM) regression models.

Descriptive Statistics

Table 1 reports the descriptive statistics of the variables used in our study. The mean (median) bank debt as a proportion of the total debt (Bank/Total Debt) is 0.412 (0.274), which is largely consistent with the prior studies (e.g., Boubaker et al., 2018). Moreover, the mean (median) value of managerial ability (Mgr. Ability) is –0.01 (–0.033), with a standard deviation of 0.128. These values are consistent with the prior studies (Bonsall et al., 2017). The average firm in our study has a log of total assets of 5.616, a market-to-book ratio (Growth) of 2.791, financial leverage of 0.385, and returns on assets of –0.035. We also find that term loans and revolving credit capture 22.3% and 18.1% of the total debt, whereas senior bonds and notes represent 35.3% of the total debt.

| N | Mean | Std. Dev. | p25 | Median | p75 | |

|---|---|---|---|---|---|---|

| Bank/Total Debt | 54,964 | 0.412 | 0.414 | 0.000 | 0.274 | 0.905 |

| Mgr. Ability | 54,964 | –0.010 | 0.128 | –0.085 | –0.033 | 0.030 |

| Total Assets | 54,964 | 5.616 | 2.598 | 3.877 | 5.867 | 7.471 |

| Growth | 54,964 | 2.791 | 4.621 | 1.151 | 1.578 | 2.484 |

| Leverage | 54,964 | 0.385 | 0.664 | 0.102 | 0.245 | 0.422 |

| Return on Assets | 54,964 | –0.035 | 0.506 | –.009 | 0.096 | 0.156 |

| Tangibility | 54,964 | 0.256 | 0.234 | 0.075 | 0.176 | 0.371 |

| Distress | 54,964 | 0.610 | 0.488 | 0.000 | 1.000 | 1.000 |

| Rating | 54,964 | 0.298 | 0.457 | 0.000 | 0.000 | 1.000 |

| Competition | 54,964 | 0.068 | 0.065 | 0.032 | 0.043 | 0.077 |

| Mgr. Ability Rank | 54,964 | 0.538 | 0.279 | 0.300 | 0.500 | 0.800 |

| Bank/Total Liabilities | 54,964 | 0.187 | 0.225 | 0.000 | 0.087 | 0.328 |

| LN(Bank) | 54,964 | 2.436 | 2.439 | 0.000 | 1.900 | 4.511 |

| Bank/Total Assets | 54,964 | 0.129 | 0.201 | 0.000 | 0.045 | 0.187 |

| No Dividends | 54,964 | 0.275 | 0.447 | 0.000 | 0.000 | 1.000 |

| RE/TE | 47,680 | –1.417 | 4.071 | –1.167 | 0.144 | 0.671 |

| Bog Index | 49,815 | 84.961 | 7.368 | 80.000 | 85.000 | 90.000 |

| REM | 47,024 | 0.006 | 0.620 | –0.163 | 0.064 | 0.304 |

| AUDIT_SPEC | 46,437 | 0.443 | 0.497 | 0.000 | 0.000 | 1.000 |

| INST | 35,130 | 0.190 | 0.258 | 0.043 | 0.070 | 0.201 |

| E-Index | 24,437 | 3.305 | 1.417 | 2.000 | 4.000 | 4.000 |

| DIND | 14,562 | 0.763 | 0.137 | 0.692 | 0.800 | 0.875 |

| Secured Debt/Total Debt | 54,964 | 0.509 | 0.436 | 0.002 | 0.526 | 0.998 |

| Unsecured Debt/Total Debt | 54,964 | 0.453 | 0.435 | 0.000 | 0.359 | 0.979 |

| Com. Paper/Total Debt | 54,964 | 0.003 | 0.022 | 0.000 | 0.000 | 0.000 |

| Sr. Bonds & Notes/Total Debt | 54,964 | 0.353 | 0.413 | 0.000 | 0.063 | 0.779 |

| Sub. Bonds & Notes/Total Debt | 54,964 | 0.054 | 0.187 | 0.000 | 0.000 | 0.000 |

| Term Loans/Total Debt | 54,964 | 0.223 | 0.344 | 0.000 | 0.000 | 0.381 |

| Revolving Credit/Total Debt | 54,964 | 0.181 | 0.315 | 0.000 | 0.000 | 0.223 |

- This table presents summary statistics of the variables. The Appendix A provides variable definitions.

Correlation

We present the correlations between the variables in Panel A of Table 2. We observe that managerial ability is significantly negatively correlated with bank debt (p < 0.01), which provides initial support for our hypothesis. We also note that bank debt is negatively correlated with total assets, growth, leverage, distress, and rating, while it is positively correlated with return on assets and competition (all significant at p < 0.01). Finally, the variance inflation factor (VIF) values included in the panel are relatively low, providing evidence that multicollinearity is not a major issue for our analysis.

| Panel A: Pairwise correlations | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Variables | VIF | (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | (9) | (10) |

| (1) Bank/Total Debt | 1.00 | ||||||||||

| (2) Mgr. Ability | 1.08 | –0.10* | 1.00 | ||||||||

| (3) Total Assets | 2.51 | –0.10* | –0.01* | 1.00 | |||||||

| (4) Growth | 2.63 | –0.10* | 0.15* | –0.42* | 1.00 | ||||||

| (5) Leverage | 1.93 | –0.08* | 0.05* | –0.32* | 0.63* | 1.00 | |||||

| (6) Return on Assets | 2.55 | 0.09* | 0.03* | 0.53* | –0.69* | –0.55* | 1.00 | ||||

| (7) Tangibility | 1.12 | –0.01 | –0.13* | 0.16* | –0.11* | 0.03* | 0.12* | 1.00 | |||

| (8) Distress | 1.36 | 0.04* | 0.10* | 0.32* | –0.14* | –0.32* | 0.36* | –0.10* | 1.00 | ||

| (9) Rating | 1.84 | –0.22* | –0.01 | 0.64* | –0.15* | –0.01* | 0.21* | 0.16* | 0.08* | 1.00 | |

| (10) Competition | 1.06 | 0.02* | –0.04* | 0.11* | –0.07* | –0.01* | 0.09* | 0.18* | 0.11* | 0.08* | 1.00 |

| Panel B: Univariate tests of difference | |||

|---|---|---|---|

| Variables | (1) | (2) | (3) |

| Mgr. Ability>Median | Mgr. Ability<Median | Diff. | |

| Bank/Total Debt | 0.389 | 0.434 | –0.045* |

| Bank/Total Liabilities | 0.163 | 0.209 | –0.046* |

| LN(Bank) | 1.956 | 2.884 | –0.928* |

| Bank/Total Assets | 0.120 | 0.138 | –0.018* |

- Panel A of this table presents the correlation matrix of the variables. Panel B reports the univariate mean difference test.

- * indicates significance at the 1% level (two-tailed). The Appendix A provides variable definitions.

Univariate Analysis

Panel B of Table 2 reports the univariate mean difference test of the use of bank debt between the subsample of high and the subsample of low managerial ability. We divide the sample using the median managerial ability score. Firm-year observations with higher (lower) than the sample median managerial ability scores are treated as a high- (low-) ability subsample. As shown in Panel B of Table 2, the mean value of bank debt is significantly lower for the high-ability subsample than for its low-ability counterpart (p < 0.01), and this result remains robust irrespective of the measure of bank debt used in the analysis. Overall, the finding from this analysis provides preliminary support for our main hypothesis that firms with a higher level of managerial ability rely less on bank debt.

REGRESSION RESULTS

Baseline Regression

In Table 3, we present the baseline regression results that examine whether managerial ability influences firms’ debt choice. We predict that managerial ability reduces firms’ reliance on bank debt. In Column (1), we regress debt choice (i.e., Bank/Total Debt) on managerial ability (Mgr. Ability) along with industry and year effects. The estimated coefficient for Mgr. Ability is negative and highly significant (coefficient = –0.312; p < 0.01), supporting our hypothesis. In Column (2), we re-estimate the full baseline regression model after including a set of control variables (e.g., Ben-Nasr, 2019; Chen et al., 2022). We find a consistent negative and statistically significant coefficient for Mgr. Ability (coefficient = –0.292; p < 0.01), which further bolsters our empirical finding. In Column (3), we re-run the baseline regression using a high-dimensional fixed effect, in which we replace year and industry effects with year × industry effects. Prior studies suggest that this regression specification controls for time-variant industry-level heterogeneity, which may affect a firm's debt choice (Chen et al., 2020). Our estimates in Column (3) continue to show that managerial ability is negatively associated with bank debt. We note that the coefficients of our controls are largely consistent with our expectations and the earlier literature (Boubaker et al., 2018; Chen et al., 2021; Lin et al., 2013).

| (1) | (2) | (3) | |

|---|---|---|---|

| OLS | OLS | HDFE | |

| VARIABLES | Bank/Total Debt | Bank/Total Debt | Bank/Total Debt |

| Mgr. Ability | –0.312*** | –0.292*** | –0.294*** |

| [0.026] | [0.023] | [0.023] | |

| Total Assets | –0.022*** | –0.021*** | |

| [0.002] | [0.002] | ||

| Growth | –0.006*** | –0.007*** | |

| [0.001] | [0.001] | ||

| Leverage | 0.007 | 0.007 | |

| [0.006] | [0.006] | ||

| Return on Assets | 0.111*** | 0.108*** | |

| [0.008] | [0.008] | ||

| Tangibility | 0.041* | 0.049** | |

| [0.022] | [0.022] | ||

| Distress | 0.041*** | 0.041*** | |

| [0.007] | [0.007] | ||

| Rating | –0.182*** | –0.184*** | |

| [0.011] | [0.011] | ||

| Competition | 0.167 | – | |

| [0.115] | |||

| Constant | 0.409*** | 0.457*** | 0.567*** |

| [0.004] | [0.084] | [0.013] | |

| Observations | 54,964 | 54,964 | 54,964 |

| Year effects | Yes | Yes | No |

| Industry effects | Yes | Yes | No |

| Year*Industry effects | No | No | Yes |

| Adj. R2 | 0.01 | 0.14 | 0.14 |

- This table presents baseline regression results of the impact of managerial ability on debt choice. We present robust standard errors clustered at the firm level in parentheses. *, **, and *** indicate significance at the 10%, 5%, and 1% levels, respectively (two-tailed). The Appendix provides variable definitions.

The economic significance of our estimates is non-trivial. For example, our baseline estimates in Column (2) suggest that a one-standard-deviation increase in managerial ability (= 0.128) is associated with a 9.07% (13.64%) decrease in bank debt relative to its mean (median) level. This economic significance remains qualitatively similar when interpreted using the estimates from the high-dimensional fixed-effect regression in Column (3). We also note that the economic significance of our study is in line with that of prior related studies (e.g., Boubaker et al., 2018; Chen et al., 2021).4

Taken together, our baseline regression results, reported in Table 3, provide strong support for our hypothesis that managerial ability reduces firms’ reliance on bank debt as a form of financing.

Endogeneity Tests

One may contend that our above main finding is susceptible to endogeneity problems. In particular, it is possible that our regression model omits some variables that are correlated with bank debt and included controls. In addition, firms with lower bank debt may hire more able managers, which raises a concern about the reverse causality problem. In this section, we undertake several strategies to address the possible endogeneity problems.

Omitted variable bias: Additional control variables

As a straightforward way to address omitted variable bias, we introduce additional control variables. In this section, we include two sets of control variables. First, we investigate whether the negative influence of managerial ability on bank debt persists after controlling for CEO-level attributes.

The prior literature shows that CEOs’ personal and organizational factors have significant effects on firm financial decisions and debt financing. For example, Serfling (2014) argues that young CEOs utilize more debt, even with stringent covenants, than their older counterparts, suggesting that younger CEOs prefer risky financial strategies. In addition, Graham et al. (2013) report that female CEOs are less likely to utilize debt with rigid terms and conditions than male CEOs. Likewise, studies show that CEOs’ risk-taking incentives (i.e., delta and vega) strongly influence firms’ credit ratings as well as debt policies (Chen et al., 2021; Kuang and Qin, 2013). Therefore, considering the role of CEO attributes in a firm's debt financing, in Panel A of Table 4, we control for the CEO general ability index of Custódio et al. (2013) (Column 1), the natural logarithm of CEO age (Column 2), CEO–chair duality (Column 3), CEO gender (Column 4), CEO overconfidence (Column 5), CEO delta (Column 6), and CEO vega (Column 7). We include these additional controls separately (Columns 1–7) and collectively (Column 8). In both cases, we find that the negative effect of managerial ability on bank debt remains significant (p < 0.01) after controlling for the CEO-level controls, alleviating the concern that our managerial ability score is simply capturing the characteristics of top management.

| Panel A: Control for managerial attributes | ||||||||

|---|---|---|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | |

| VARIABLES | Bank/Total Debt | Bank/Total Debt | Bank/Total Debt | Bank/Total Debt | Bank/Total Debt | Bank/Total Debt | Bank/Total Debt | Bank/Total Debt |

| Mgr. Ability | –0.140*** | –0.164*** | –0.151*** | –0.176*** | –0.162*** | –0.138*** | –0.135*** | –0.117*** |

| [0.037] | [0.033] | [0.036] | [0.032] | [0.034] | [0.034] | [0.034] | [0.043] | |

| Total Assets | –0.066*** | –0.070*** | –0.076*** | –0.071*** | –0.072*** | –0.067*** | –0.061*** | –0.059*** |

| [0.005] | [0.005] | [0.006] | [0.005] | [0.005] | [0.006] | [0.005] | [0.008] | |

| Growth | –0.023** | –0.027*** | –0.042*** | –0.027*** | –0.026*** | –0.023** | –0.022** | –0.031*** |

| [0.010] | [0.007] | [0.005] | [0.007] | [0.007] | [0.009] | [0.009] | [0.008] | |

| Leverage | 0.038 | 0.043 | 0.031 | 0.042 | 0.045 | 0.047 | 0.048 | –0.012 |

| [0.049] | [0.040] | [0.037] | [0.040] | [0.043] | [0.049] | [0.049] | [0.046] | |

| Return on Assets | 0.302*** | 0.334*** | 0.474*** | 0.341*** | 0.292*** | 0.344*** | 0.333*** | 0.438*** |

| [0.110] | [0.082] | [0.066] | [0.079] | [0.085] | [0.094] | [0.098] | [0.088] | |

| Tangibility | 0.022 | –0.010 | –0.053 | –0.007 | 0.024 | –0.003 | –0.008 | –0.027 |

| [0.042] | [0.038] | [0.041] | [0.038] | [0.040] | [0.040] | [0.040] | [0.049] | |

| Distress | –0.020 | –0.019 | –0.033** | –0.021 | –0.023 | –0.020 | –0.016 | –0.035** |

| [0.016] | [0.014] | [0.014] | [0.014] | [0.015] | [0.015] | [0.015] | [0.017] | |

| Rating | –0.147*** | –0.147*** | –0.149*** | –0.143*** | –0.133*** | –0.150*** | –0.150*** | –0.146*** |

| [0.017] | [0.016] | [0.018] | [0.016] | [0.017] | [0.017] | [0.017] | [0.021] | |

| Competition | 0.200 | 0.208 | 0.166 | 0.235 | 0.105 | 0.192 | 0.182 | –0.038 |

| [0.201] | [0.179] | [0.187] | [0.176] | [0.188] | [0.182] | [0.183] | [0.256] | |

| General Ability | 0.002 | 0.003 | ||||||

| [0.006] | [0.008] | |||||||

| CEO Age | 0.028 | 0.098 | ||||||

| [0.041] | [0.063] | |||||||

| Duality | –0.018 | –0.025* | ||||||

| [0.011] | [0.014] | |||||||

| Female CEO | 0.001 | 0.039 | ||||||

| [0.027] | [0.046] | |||||||

| Overconfidence | 0.062*** | –0.003 | ||||||

| [0.020] | [0.031] | |||||||

| LN(Delta) | –0.004 | 0.002 | ||||||

| [0.004] | [0.009] | |||||||

| LN(Vega) | –0.012*** | –0.021*** | ||||||

| [0.003] | [0.006] | |||||||

| Constant | 0.650*** | 0.565*** | 0.711*** | 0.695*** | 0.699*** | 0.697*** | 0.683*** | 0.310 |

| [0.123] | [0.189] | [0.118] | [0.107] | [0.115] | [0.112] | [0.109] | [0.271] | |

| Observations | 15,026 | 18,564 | 14,562 | 20,147 | 16,588 | 16,697 | 16,758 | 8,688 |

| Year effects | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Industry effects | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Adj. R2 | 0.21 | 0.22 | 0.25 | 0.23 | 0.22 | 0.22 | 0.22 | 0.24 |

| Panel B: Additional firm-level controls | |||||||

|---|---|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | |

| VARIABLES | Bank/Total Debt | Bank/Total Debt | Bank/Total Debt | Bank/Total Debt | Bank/Total Debt | Bank/Total Debt | Bank/Total Debt |

| Mgr. Ability | –0.167*** | –0.281*** | –0.281*** | –0.235*** | –0.242*** | –0.292*** | –0.096** |

| [0.033] | [0.025] | [0.028] | [0.032] | [0.023] | [0.023] | [0.041] | |

| Total Assets | –0.075*** | –0.023*** | –0.038*** | –0.061*** | –0.026*** | –0.022*** | –0.082*** |

| [0.005] | [0.003] | [0.004] | [0.004] | [0.002] | [0.002] | [0.006] | |

| Growth | –0.026*** | –0.007*** | –0.013*** | –0.023*** | –0.006*** | –0.006*** | –0.016** |

| [0.005] | [0.001] | [0.002] | [0.004] | [0.001] | [0.001] | [0.006] | |

| Leverage | 0.012 | 0.007 | 0.026** | 0.059** | 0.001 | 0.008 | –0.093*** |

| [0.037] | [0.007] | [0.012] | [0.028] | [0.006] | [0.006] | [0.033] | |

| Return on Assets | 0.342*** | 0.124*** | 0.171*** | 0.304*** | 0.104*** | 0.107*** | 0.577*** |

| [0.049] | [0.009] | [0.015] | [0.031] | [0.008] | [0.009] | [0.076] | |

| Tangibility | –0.028 | 0.050** | 0.056* | 0.042 | 0.133*** | 0.042* | 0.305*** |

| [0.038] | [0.023] | [0.029] | [0.033] | [0.024] | [0.022] | [0.054] | |

| Distress | –0.031** | 0.044*** | 0.031*** | 0.023* | 0.049*** | 0.041*** | –0.010 |

| [0.014] | [0.008] | [0.009] | [0.012] | [0.007] | [0.007] | [0.017] | |

| Rating | –0.124*** | –0.200*** | –0.181*** | –0.167*** | –0.192*** | –0.182*** | –0.136*** |

| [0.016] | [0.011] | [0.013] | [0.016] | [0.011] | [0.011] | [0.020] | |

| Competition | 0.263 | 0.106 | 0.177 | 0.504** | 0.206* | 0.165 | 0.448 |

| [0.191] | [0.131] | [0.142] | [0.216] | [0.116] | [0.115] | [0.299] | |

| CSR | –0.208*** | –0.196*** | |||||

| [0.030] | [0.039] | ||||||

| Discretionary Accruals | –0.100*** | 0.404*** | |||||

| [0.023] | [0.090] | ||||||

| INST | –0.014 | –0.083** | |||||

| [0.018] | [0.034] | ||||||

| Comparability | 0.061*** | 0.030 | |||||

| [0.018] | [0.026] | ||||||

| Intangibles | 0.206*** | 0.450*** | |||||

| [0.020] | [0.045] | ||||||

| Cashflow | 0.008 | –0.348*** | |||||

| [0.010] | [0.085] | ||||||

| Constant | 0.892*** | 0.467*** | 0.519*** | 1.044*** | 0.422*** | 0.457*** | 1.210*** |

| [0.139] | [0.082] | [0.089] | [0.061] | [0.082] | [0.084] | [0.099] | |

| Observations | 19,109 | 48,661 | 35,096 | 24,310 | 53,869 | 54,941 | 11,447 |

| Year effects | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Industry effects | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Adj. R2 | 0.22 | 0.14 | 0.17 | 0.21 | 0.14 | 0.14 | 0.27 |

- Panel A of this table presents baseline regression after including CEO-level additional controls. Panel B presents the main results after including additional firm-level variables. We present robust standard errors clustered at the firm level in parentheses. *, **, and *** indicate significance at the 10%, 5%, and 1% levels, respectively (two-tailed). The Appendix provides variable definitions.

Second, while we control for a range of standard firm characteristics in our baseline regression, we now control for some additional firm and governance aspects. Following the extant literature (Bharath et al., 2008; Cline et al., 2020; Tan et al., 2020), we include a firm's corporate social responsibility (Column 1), the absolute value of discretionary accruals (Column 2), institutional share ownership (Column 3), financial statement comparability (Column 4), intangibles scaled by total assets (Column 5), and operating cash flow over total assets (Column 6). In Panel B of Table 4, we observe that our main findings remain qualitatively similar when we include these additional controls separately (Columns 1–6) and collectively (Column 7). Overall, we present reasonable evidence that our main results are not prone to omitted variable bias problems.

Omitted variable bias: Oster's (2019) bound estimate

While we have included additional firm- and CEO-level control variables in the previous sections to deal with omitted variable concerns, the observed controls may not always represent the actual omitted factors (Ghouma and Ouni, 2022). Therefore, to alleviate the concern about omitted variable bias further and ensure the validity of our findings, we employ Oster's (2019) bound estimate method. This novel estimation method assesses the strength of coefficients from regressions, including and excluding control variables in conjunction with R-squared values to generate a new identifiable set. Oster (2019) suggests that the null hypothesis, that is, omitted variable bias, can be rejected if the identifiable set does not include a value of zero. Contemporary studies use this estimation technique to mitigate endogeneity concerns (e.g., Ferracuti, 2022; Hasan and Uddin, 2022; Jacob and Vossebürger, 2022).

Table 5 reports the results. Following past studies (e.g., Gao and Huang, 2020; Oster, 2019), we set δ = 1 and Rmax = min (1.3R̃, 1). Our findings suggest that the estimated identified set for managerial ability does not contain zero, indicating that the omitted variable is unlikely to influence our baseline result that managerial ability has a negative impact on the use of bank debt. The findings from our analysis remain unaffected if we use Rmax = min (1.5R̃, 1) or Rmax = min (2.2R̃, 1) (untabulated).

| (1) Controlled | (2) Uncontrolled | (3) Parameters: δ =1; RMAX = min(1.3R̃,1) | |||

|---|---|---|---|---|---|

| Variable of Interest | Beta | R2 | Beta | R2 | Identified Set |

| Mgr. Ability | –0.292 | 0.140 | –0.312 | 0.01 | –0.286, –0.292 |

- This table reports the omitted variable bias test results suggested by Oster (2019). Columns (1) and (2) report beta and R2 from controlled and uncontrolled OLS regressions, respectively. Column (3) includes the identified set using the parameters. Following prior studies (e.g., Gao and Huang, 2020; Oster, 2019) we set δ = 1 and Rmax = min(1.3R̃,1). The Appendix provides variable definitions.

Quasi-natural experiment

Our second approach to address endogeneity is a quasi-natural experiment that exploits the exogenous turnover of CEOs because of sudden death. Considering that the CEO is the key decision-maker and the major contributor to the overall managerial ability of a firm (Chang et al., 2010; Custódio et al., 2019), a CEO's exogenous departure because of sudden death is likely to cause a negative shock to a firm's overall managerial ability. We argue that a CEO's sudden death is a purely exogenous incident as such a departure is neither pre-planned nor driven by poor managerial performance. This allows us to investigate how the variation in managerial ability after a CEO's sudden death in a given year affects a firm's debt choice. Given that the sudden death of a CEO causes a decline in a firm's managerial ability in the following year, we expect such shocks in managerial ability to increase firms’ reliance on bank debt.

We obtain CEO turnover data from Gentry et al. (2021). In our dataset, we identify 17 incidents of sudden deaths. Following Gao et al. (2021), we employ a PSM-DiD methodology. We treat each CEO's death year as a cohort, and we retain three years before and three years after the CEO's demise. In each cohort, the firms that experienced a CEO death in the cohort period are defined as the treatment group, while the firms without such a shock are defined as the control group. We use the PSM approach to select the control firms for each treatment firm. First, we perform logistic regression one year before the CEO's death to estimate the propensity score that a firm appears in the treatment group. We use all the control variables in the baseline regression to conduct the matching. Second, we match each treatment firm with four control firms within the same industry (two-digit SIC) using the nearest propensity score.5 In particular, we use caliper matching with replacement and require the control firms to have a propensity score within 0.01 of the treatment firms.6 Third, we stack the matched control–treatment firms from all the cohorts to form a sample for DiD analysis.

| Panel A: PSM matching quality | |||||

|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | |

| Treatment | Control | Differences | t-stat | p-value | |

| Total Assets | 8.037 | 7.690 | 0.347 | 0.690 | 0.497 |

| Growth | 1.723 | 1.828 | -0.105 | -0.280 | 0.781 |

| Leverage | 0.243 | 0.230 | 0.013 | 0.240 | 0.808 |

| Return on Assets | 0.132 | 0.106 | 0.026 | 0.580 | 0.569 |

| Tangibility | 0.296 | 0.271 | 0.025 | 0.310 | 0.761 |

| Distress | 0.882 | 0.838 | 0.044 | 0.360 | 0.721 |

| Rating | 0.588 | 0.574 | 0.014 | 0.0800 | 0.933 |

| Competition | 0.0422 | 0.0617 | -0.020 | -0.970 | 0.339 |

| Panel B: Standard and dynamic DiD estimation results | ||

|---|---|---|

| Dep. Var. | Bank/Total Debt | Bank/Total Debt |

| (1) | (2) | |

| Treatment*Post | 0.121*** | |

| (0.043) | ||

| Treatment*Post−2 | 0.063 | |

| (0.060) | ||

| Treatment*Post−1 | 0.052 | |

| (0.071) | ||

| Treatment*Post0 | 0.050 | |

| (0.079) | ||

| Treatment*Post+1 | 0.134* | |

| (0.076) | ||

| Treatment*Post+2 | 0.148* | |

| (0.084) | ||

| Treatment*Post+3 | 0.210** | |

| (0.087) | ||

| Constant | 0.281 | 0.318 |

| (0.471) | (0.465) | |

| Other controls | Yes | Yes |

| Firm*Cohort FE | Yes | Yes |

| Year*Cohort FE | Yes | Yes |

| Observations | 796 | 796 |

| Adj. R2 | 0.798 | 0.798 |

- Panel A of this table presents the comparison of the mean value of the variables between treatment and control groups. Panel B presents the standard and dynamic DiD estimation results. We present robust standard errors clustered at the firm level in parentheses. *, **, and *** indicate significance at the 10%, 5%, and 1% levels, respectively (two-tailed). The Appendix provides variable definitions.

We further test the parallel trend assumption of DiD estimation. For this test, we replace Treatmenti,c*Postt,c with a set of indicators (i.e., Treatmenti,c*Postt,c [–2,+3]). Column (2) of Panel B (Table 6) reports the parallel-trend analysis results. We find that the treatment impact is only evident after the event year, as supported by the positive and statistically significant coefficient estimates for Treatment*Post+1, Treatment*Post+2, Treatment*Post+3. Thus, our findings satisfy the parallel-trend assumption of the DiD approach. Overall, the quasi-natural experiment confirms the causality between managerial ability and bank debt.

Instrumental variable approach

Our third approach to mitigate the endogeneity concern is the instrumental variable (IV) approach, utilizing a method developed by Lewbel (2012). While the traditional instrumental variable approach relies on an external instrument, Lewbel's (2012) model generates an internal instrument based on heteroscedastic errors in the models, in which error correlations are caused by unobserved common factors (Mavis et al., 2020). Given that finding an appropriate exogenous instrument is a difficult undertaking (Jiang, 2017), this method is used in the contemporary finance literature to address endogeneity problems (e.g., Chen et al., 2021; Hasan et al., 2021; Mavis et al., 2020).

We report the results from this analysis in Panel A of Table 7. We observe that the internal instruments generated by Lewbel (2012) are appropriate for estimating the second-stage regressions as they do not have any under-identification, weak identification, or over-identification problems. The second-stage regression from the IV approach shows that the coefficient for instrumented managerial ability remains negative and significant (p < 0.01), indicating that our main result of a negative relationship between managerial ability and bank debt is not an artefact of endogeneity problems.

| Panel A: Endogeneity – 2SLS | ||

|---|---|---|

| (1) | (2) | |

| VARIABLES | Bank/Total Debt | Bank/Total Debt |

| Mgr. Ability | –0.250*** | –0.257*** |

| [0.042] | [0.043] | |

| Total Assets | –0.021*** | –0.021*** |

| [0.002] | [0.002] | |

| Growth | –0.008*** | –0.008*** |

| [0.001] | [0.001] | |

| Leverage | 0.004 | 0.003 |

| [0.006] | [0.006] | |

| Return on Assets | 0.110*** | 0.108*** |

| [0.008] | [0.009] | |

| Tangibility | 0.044** | 0.051** |

| [0.022] | [0.022] | |

| Distress | 0.041*** | 0.041*** |

| [0.007] | [0.008] | |

| Rating | –0.183*** | –0.185*** |

| [0.011] | [0.011] | |

| Competition | 0.163 | 0.000 |

| [0.115] | [0.000] | |

| Constant | 0.235** | 0.493*** |

| [0.113] | [0.017] | |

| Observations | 54,964 | 54,964 |

| Year effects | Yes | No |

| Industry effects | Yes | No |

| Year*Industry effects | No | Yes |

| Adj. R2 | 0.12 | 0.07 |

| Underidentification test | ||

| Kleibergen-Paap rk LM statistic | 265.631 | 263.001 |

| p-value | (0.00) | (0.00) |

| Hansen J statistic | 4.516 | 5.163 |

| p-value | 0.341 | 0.271 |

| Weak instrument robust tests and confidence sets | Conf. Set | Conf. Set |

| LC_2sls | [–0.331, –0.168] | [–0.340, –0.173] |

| Panel B: Entropy balancing estimates | ||

|---|---|---|

| (1) | (2) | |

| VARIABLES | Bank/Total Debt | Bank/Total Debt |

| Mgr. Ability | –0.205*** | –0.218*** |

| [0.028] | [0.028] | |

| Total Assets | –0.012*** | –0.014*** |

| [0.003] | [0.003] | |

| Growth | –0.010*** | –0.009*** |

| [0.002] | [0.001] | |

| Leverage | 0.012 | 0.009 |

| [0.008] | [0.007] | |

| Return on Assets | 0.073*** | 0.078*** |

| [0.013] | [0.011] | |

| Tangibility | 0.088*** | 0.084*** |

| [0.030] | [0.029] | |

| Distress | 0.071*** | 0.070*** |

| [0.010] | [0.010] | |

| Rating | –0.234*** | –0.232*** |

| [0.014] | [0.013] | |

| Competition | 0.111 | – |

| [0.142] | ||

| Constant | 0.235** | 0.493*** |

| [0.113] | [0.017] | |

| Observations | 54,964 | 54,964 |

| Year effects | Yes | No |

| Industry effects | Yes | No |

| Year*Industry effects | No | Yes |

| Adj. R2 | 0.15 | 0.16 |

- Panel A of this table presents 2SLS regression results of the impact of managerial ability on debt choice using the heteroscedasticity -based instrument (Lewbel, 2012). Panel B reports results using entropy balancing estimates. We present robust standard errors clustered at the firm level in parentheses. *, **, and *** indicate significance at the 10%, 5%, and 1% levels, respectively (two-tailed). The Appendix provides variable definitions.

Entropy-balancing approach

In this sub-section, following the extant literature (e.g., Chen et al., 2022; Hasan and Uddin, 2022), we apply the entropy-balancing approach to disentangle potential endogeneity issues further. Unlike propensity score matching, entropy balance conserves the original full sample and ensures a balance of covariates between the treatment and the control group by reweighting the observations to confirm that the two groups are indistinguishable in terms of their firm characteristics (Hainmueller, 2012).

To execute the entropy-balancing estimate, we divide the sample into subsamples of high managerial ability (treatment—if Mgr. Ability > sample median) and low managerial ability (control—if Mgr. Ability < sample median). We then implement a reweighting scheme to ensure that the mean, variance, and skewness of all the covariates are balanced across the high-managerial-ability (the treatment group) and low-managerial-ability (the control groups) subsamples. Indeed, the results in Table A.1 (online appendix) show that our estimation approach achieves a desirable balance as there is no difference between the treatment and the control group with respect to the first, second, and third moments of the covariates. Panel B of Table 7 presents the regression results with the entropy-balanced sample. The results corroborate our baseline findings as we conclude that managerial ability has a significant negative association with bank debt at the 1% significance level.

Evidence from Machine Learning Model

The extant literature typically relies on parametric statistical models (e.g., OLS) to draw inference, which has received criticism recently because of concerns about “p-hacking” (Dyckman and Zeff, 2015; Harvey, 2017; Ohlson, 2015, 2022; Kim et al., 2018; Johnstone, 2022). Therefore, following recent studies (Jones, 2017; Chen et al. 2022; Bertomeu et al. 2021), we use advanced machine learning model, specifically XGBoost, to further examine the importance of managerial ability in predicting debt choice. Importantly, unlike traditional statistical models, XGBoost does not rely on p-values, instead functioning as ensemble learning, where it combines the predictive strength of numerous learners. The predictive ability of an XGBoost model is assessed through relative variable importance (RVI) scores and corresponding ranks assigned to each variable. RVI scores range from 0 to 100, with 100 indicating the highest possible importance in the model's predictions. Conversely, a score of 0 denotes no contribution to the model's predictions (Hastie et al., 2009; Jones, 2017). The rank, in this context, signifies the order in which variables are positioned based on their RVI scores.

Figure 1 displays the RVI scores and ranks generated by the XGBoost machine learning model.7 Our analysis reveals that the RVI score for managerial ability is 35.183, well above zero, indicating significant predictive power in the machine-learning model (Jones et al., 2023). The rank of six suggests that managerial ability variable is the sixth most important variable among all the independent variables employed in the model for predicting corporate debt choice. This finding further supports our primary conclusion regarding the importance of managerial ability in debt choice.

CROSS-SECTIONAL ANALYSES

The Role of the Information Environment

Now we explore whether the relationship between managerial ability and bank debt varies depending on the information environment of the firm. Prior studies suggest that private lenders are less sensitive to information asymmetry problems since they have a superior ability to acquire and process private information (Fama, 1985; Houston and James, 1996; Li et al., 2019). Therefore, firms with more information asymmetry obtain more debt from banks than from public sources (Bharath et al., 2008). Thus, if the documented negative effect of managerial ability on bank debt is explained by the information asymmetry-based argument, one would expect this relationship to be amplified in an environment of high information asymmetry.

We use three proxies to measure information asymmetry: (1) the Bog index (BOG); (2) real earnings management (REM); and (3) audit specialization (AUDIT_SPEC). These measures are widely used in the literature (Abad et al., 2018; Bonsall and Miller, 2017; Chen et al., 2021). We treat firm-year observations that are higher (lower) than the median BOG and REM as groups with high (low) information asymmetry. In addition, firms audited by non-specialist auditors are associated with more information asymmetry.

The results, presented in Panel A of Table 8, suggest that the negative association between managerial ability and bank debt is significantly more prominent for the sub-sample of firms with a higher BOG (i.e., when BOG > median) and higher REM (i.e., when REM > median). Moreover, although the coefficient for managerial ability is higher for non-specialist auditors than for specialist auditors, the difference between the coefficients is not statistically significant. Overall, our evidence is consistent with the expectation that information asymmetry moderates the association between managerial ability and bank debt.

| Panel A: The role of information environment | ||||||

|---|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | (6) | |

| VARIABLES | Bank/Total Debt | Bank/Total Debt | Bank/Total Debt | Bank/Total Debt | Bank/Total Debt | Bank/Total Debt |

| BOG>Median | BOG<Median | REM < Median | REM > Median | AUDIT_SPEC = Yes | AUDIT_SPEC = No | |

| Mgr. Ability | –0.310*** | –0.201*** | –0.185*** | –0.357*** | –0.209*** | –0.235*** |

| [0.029] | [0.035] | [0.033] | [0.037] | [0.032] | [0.035] | |

| Constant | 0.348** | 0.438*** | 0.360*** | 0.693*** | 0.604*** | 0.384*** |

| [0.144] | [0.077] | [0.092] | [0.092] | [0.112] | [0.089] | |

| χ2 (p–value) | 14.17*** (0.00) | 31.27*** (0.00) | 0.76 (0.38) | |||

| Observations | 22,855 | 26,960 | 23,489 | 23,535 | 20,554 | 25,883 |

| Other controls | Yes | Yes | Yes | Yes | Yes | Yes |

| Year effects | Yes | Yes | Yes | Yes | Yes | Yes |

| Industry effects | Yes | Yes | Yes | Yes | Yes | Yes |

| Adj. R2 | 0.15 | 0.15 | 0.14 | 0.16 | 0.19 | 0.14 |

| Panel B: The role of corporate governance | ||||||

|---|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | (6) | |

| VARIABLES | Bank/Total Debt | Bank/Total Debt | Bank/Total Debt | Bank/Total Debt | Bank/Total Debt | Bank/Total Debt |

| INST>Median | INST<Median | E-Index<Median | E-Index>Median | DIND>Median | DIND<Median | |

| Mgr. Ability | –0.133*** | –0.197*** | –0.128*** | –0.249*** | –0.080*** | –0.250*** |

| [0.049] | [0.033] | [0.042] | [0.037] | [0.038] | [0.069] | |

| Constant | 0.373*** | 0.755*** | 0.841*** | 0.608*** | 0.935*** | 0.399*** |

| [0.081] | [0.111] | [0.148] | [0.166] | [0.106] | [0.099] | |

| χ2 (p–value) | 2.59* (0.10) | 13.07*** (0.00) | 12.99*** (0.00) | |||

| Observations | 17,328 | 17,802 | 11,795 | 12,642 | 8,589 | 5,973 |

| Other controls | Yes | Yes | Yes | Yes | Yes | Yes |

| Year effects | Yes | Yes | Yes | Yes | Yes | Yes |

| Industry effects | Yes | Yes | Yes | Yes | Yes | Yes |

| Adj. R2 | 0.13 | 0.22 | 0.20 | 0.24 | 0.30 | 0.20 |

| Panel C: The role of financial conditions | ||||||

|---|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | (6) | |

| VARIABLES | Bank/Total Debt | Bank/Total Debt | Bank/Total Debt | Bank/Total Debt | Bank/Total Debt | Bank/Total Debt |

| Rating = NO | Rating = YES | DIV=NO | DIV=YES | RE/TE > Median | RE/TE < Median | |

| Mgr. Ability | –0.212*** | –0.115*** | –0.235*** | –0.164*** | –0.180*** | –0.259*** |

| [0.033] | [0.030] | [0.028] | [0.039] | [0.035] | [0.033] | |

| Constant | 0.426*** | 0.793*** | 0.386*** | 0.817*** | 0.723*** | 0.300*** |

| [0.086] | [0.082] | [0.085] | [0.110] | [0.109] | [0.088] | |

| χ2 (p–value) | 13.78*** (0.00) | 6.80*** (0.01) | 7.26*** (0.01) | |||

| Observations | 38,584 | 16,380 | 39,846 | 15,118 | 23,844 | 23,836 |

| Other controls | Yes | Yes | Yes | Yes | Yes | Yes |

| Year effects | Yes | Yes | Yes | Yes | Yes | Yes |

| Industry effects | Yes | Yes | Yes | Yes | Yes | Yes |

| Adj. R2 | 0.11 | 0.21 | 0.11 | 0.31 | 0.27 | 0.11 |

- Panels A, B, and C of this table examines how information environment, formal and informal governance mechanisms, and financial conditions moderate the relationship between managerial ability and debt choice. We present robust standard errors clustered at the firm level in parentheses. *, **, and *** indicate significance at the 10%, 5%, and 1% levels, respectively (two-tailed). The Appendix provides variable definitions.

The Role of Corporate Governance

Next, we explore the moderating role of corporate governance in the link between managerial ability and bank debt. The prior literature suggests that, because of debt concentration, private lenders, such as banks, have superior ability and incentives to scrutinize and monitor borrowers closely (Ben-Nasr et al., 2021; Berlin and Loeys, 1988). Therefore, firms with more monitoring needs (i.e., with a weak governance structure) tend to use more bank debt. In the context of our study, we argue that, if the disciplinary mechanism arguments explain our documented negative link between managerial ability and bank debt, we should observe this relationship to be stronger for firms with a weak corporate governance practice.

Following the prior literature (Aggarwal et al., 2015; Bebchuk et al., 2009; Liu et al., 2015), we use three measures of corporate governance: (1) institutional shareholder concentration (INST); (2) the entrenchment index (E-Index); and (3) director independence (DIND). We define firm-year observations with lower (higher) than median INST and DIND as groups with high (low) agency problems. Moreover, firm-year observations with higher (lower) than the median E-Index are treated as groups with high (low) agency problems.

We present the results for this cross-sectional test in Panel B of Table 8. We observe that the negative impact of managerial ability on bank debt is significantly more salient for the sub-sample of firms with a lower INST (i.e., when INST < median), lower DIND (i.e., when DIND < median) and higher E-Index (i.e., when E-Index > median). Thus, our evidence is consistent with the prediction that firms with high-ability managers rely less on bank debt in the presence of weak corporate governance.

The Role of Financial Conditions

In our final cross-sectional test, we examine the role of financial constraints in the association between managerial ability and bank debt. Several studies show that financial constraints have a significant role in determining the choice of debt (Denis and Mihov, 2003; Lin et al., 2013). For example, Denis and Mihov (2003) argue that firms with a higher probability of distress are more likely to choose a bank for finance because private debt (e.g., banks) allows for easier renegotiation in the event of debt covenant violation. Therefore, we argue that the role of managerial ability in affecting bank debt is likely to be stronger in the presence of weaker financial conditions.

We use three proxies to capture firms’ financial conditions: (1) credit ratings (Rating); (2) dividend payments (DIV); and (3) firm maturity, measured as the ratio of retained earnings to total equity (RE/TE). Prior studies suggest that firms with a credit rating (i.e., Rating = yes), firms with a dividend payment (i.e., DIV = yes), and firms in the mature stage of the life cycle (RE/TE > median) have better financial conditions and access to external financing (Dickinson, 2011; Farre-Mensa and Ljungqvist, 2016; Kisgen, 2006).

In Panel C of Table 8, we find that the role of managerial ability in reducing the reliance on bank debt is significantly stronger for firms without credit ratings (i.e., Rating = no) and without dividend payments (DIV = no). Moreover, the effect is more pronounced for early and growth firms (when Re/TE < median).

Overall, our cross-sectional results provide reasonable evidence that the constraining role of managerial ability on bank debt is stronger in the presence of an opaque information environment, weak corporate governance, and poor financial conditions.

PATH ANALYSIS: THE MEDIATING ROLE OF INFORMATION ASYMMETRY, CORPORATE GOVERNANCE, AND FINANCIAL CONDITIONS

Equation (4.1) illustrates the impact of information asymmetry (REM), corporate governance (INST), and financial condition (Rating) on bank debt. The inclusion of Mgr. Ability in this equation captures the possibility of managerial ability having a direct impact on bank debt. Equations (4.2) to (4.4) capture the indirect effect as they explain how Mgr. Ability affects REM, INST, and Rating, respectively. Thus, the coefficient ψ1 in equation 4.1 measures the direct influence of Mgr. Ability on bank debt, while the coefficients of ψ2*λ1, ψ3*𝛾1, and ψ4*𝜑1 represent the mediation effects of REM, INST, and Rating, respectively. All equations include control variables used in our baseline specifications.

Table 9 reports the regression results of the path analysis. In Column (1), we observe that the coefficient for Mgr. Ability is negative and statistically significant (coeff. = –0.241, p < 0.01). We also observe that the coefficients of INST (coeff. = –0.112, p < 0.01) and Rating (coeff. = –0.181, p < 0.01) are negative and significant, whereas the coefficient of REM (coeff. = 0.032, p < 0.01) is positive and significant. These results confirm that managerial ability, corporate governance, and financial conditions independently reduce bank debt while information asymmetry increases bank debt. In Column (2), we find that the association between Mgr. Ability and REM is negative and significant (coeff. = –1.032, p < 0.01), implying that managerial ability improves a firm's information environment. In Column (3), we report a positive relationship between Mgr. Ability and INST (coeff. = 0.157, p < 0.01), signifying that managerial ability improves corporate governance. Nevertheless, in Column (4), we fail to find any significant association between Mgr. Ability and Rating.

| (1) | (2) | (3) | (4) | |

|---|---|---|---|---|

| VARIABLES | Bank/Total Debt | REM | INST | Rating |

| REM | 0.032*** | |||

| [0.005] | ||||

| INST | –0.112*** | |||

| [0.012] | ||||

| Rating | –0.181*** | –0.008 | 0.065*** | |

| [0.006] | [0.007] | [0.003] | ||

| Mgr. Ability | –0.241*** | –1.032*** | 0.157*** | –0.003 |

| [0.019] | [0.022] | [0.009] | [0.016] | |

| Total Assets | –0.050*** | 0.039*** | –0.085*** | 0.152*** |

| [0.002] | [0.002] | [0.001] | [0.001] | |

| Growth | –0.013*** | –0.058*** | –0.009*** | –0.001 |

| [0.001] | [0.001] | [0.001] | [0.001] | |

| Leverage | 0.048*** | 0.168*** | 0.074*** | 0.181*** |

| [0.007] | [0.008] | [0.003] | [0.006] | |

| Return on Assets | 0.173*** | 0.292*** | –0.038*** | –0.053*** |

| [0.010] | [0.012] | [0.005] | [0.009] | |

| Tangibility | 0.058*** | 0.244*** | –0.000 | –0.022* |

| [0.014] | [0.017] | [0.007] | [0.013] | |

| Distress | 0.021*** | 0.094*** | –0.064*** | –0.088*** |

| [0.006] | [0.007] | [0.003] | [0.005] | |

| Competition | 0.157 | –0.215* | –0.066 | 0.117 |

| [0.101] | [0.121] | [0.047] | [0.090] | |

| Constant | 0.626*** | –0.491*** | 0.815*** | –0.573*** |

| [0.048] | [0.057] | [0.022] | [0.042] | |

| Year effects | Yes | Yes | Yes | Yes |

| Industry effects | Yes | Yes | Yes | Yes |

| Observations | 32,582 | 32,582 | 32,582 | 32,582 |

| R-squared | 0.185 | 0.256 | 0.513 | 0.491 |

| Direct effect | ||||

| Mgr. Ability | –0.241*** | |||

| [0.019] | ||||

| Mediation effects | ||||

| REM | –0.033*** | |||

| [0.005] | ||||

| INST | –0.018*** | |||

| [0.002] | ||||

| Rating | 0.001 | |||

| [0.003] | ||||

| Total effect | –0.291*** | |||

| [0.019] |

- This table examines how the information environment (REM), corporate governance (INST) and financial conditions (RATING) mediate the influence of managerial ability on bank debt. Standard errors clustered at the firm level are presented in parentheses. *, **, and *** signify significance at the 10%, 5%, and 1% levels. The Appendix provides variable definitions.

We also explicitly estimate the direct and mediating effects of Mgr. Ability on bank debt. We find that the direct impact of Mgr. Ability (coeff. = –0.241, p < 0.01) and the mediation impact of Mgr. Ability on bank debt through its effect on REM (coeff. = –0.033, p < 0.01) and INST (coeff. = –0.018, p < 0.01) is statistically significant. However, the mediating effect of Rating is positive but insignificant. Importantly, the total effect (i.e., the combined direct and mediation effects) of Mgr. Ability on bank debt is significantly negative (coeff. = –0.291; p < 0.01). Overall, our path analysis confirms that managerial ability has a direct effect on bank debt, while both information environment and corporate governance channels mediate this relationship.

SENSITIVITY ANALYSIS

Alternative Regression Models

To bolster our findings from the main regression, we use five alternative regression specifications and report the results in Panel A of Table 10. First, we re-estimate the baseline regression with the firm fixed-effect model, which mitigates concern about firm-specific time-invariant unobserved heterogeneity. The results in Column (1) show that the coefficient for managerial ability is negative and significant (coeff. = –0.040, p < 0.05). Next, we re-estimate the main regression using the Tobit model, which addresses the concern about our censored bank debt data (truncated between 0 and 1). The results presented in Column (2) show that the coefficient for managerial ability is still negative and significant (coeff. = –0.532, p < .01). We then use the Newey–West and weighted least squares (WLS) models to alleviate the concerns about serial correlation and heterogeneity in different industries, respectively. The results reported in Column (3) and Column (4) confirm that our baseline results are robust as the coefficient for managerial ability remains negative and significant (p < 0.01). We finally re-estimate the main regression using the Fama–MacBeth (FM) model. The negative and highly significant coefficient for managerial ability (coeff. = –0.271, p < .01) in Column (5) again confirms our earlier findings. Overall, the results from these five alternative regression estimates corroborate the main finding that firms with more able managers rely less on bank debt.

| Panel A: Alternative regression specifications | |||||

|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | |

| FFE | Tobit | Newey–West | WLS | FM | |

| VARIABLES | Bank/Total Debt | Bank/Total Debt | Bank/Total Debt | Bank/Total Debt | Bank/Total Debt |

| Mgr. Ability | –0.040** | –0.532*** | –0.292*** | –0.322*** | –0.271*** |

| [0.020] | [0.045] | [0.013] | [0.026] | [0.035] | |

| Constant | 0.285*** | 0.251** | 0.457*** | 0.465*** | 0.745*** |

| [0.030] | [0.120] | [0.036] | [0.089] | [0.040] | |

| Observations | 54,964 | 54,964 | 54,964 | 54,964 | 54,964 |

| Other controls | Yes | Yes | Yes | Yes | Yes |

| Year effects | Yes | Yes | Yes | Yes | No |

| Industry effects | Yes | Yes | Yes | Yes | Yes |

| Firm effects | Yes | No | No | No | No |

| Adj. R2/Pseudo R2 | 0.53 | 0.07 | – | 0.14 | 0.15 |

| Panel B: Alternative measures of managerial ability and bank debt | ||||

|---|---|---|---|---|

| (1) | (2) | (3) | (4) | |

| VARIABLES | Bank/Total Debt | Bank/Total Liabilities | LN(Bank) | Bank/Total Assets |

| Mgr. Ability Rank | –0.117*** | |||

| [0.010] | ||||

| Mgr. Ability | –0.188*** | –1.989*** | –0.094*** | |

| [0.013] | [0.163] | [0.010] | ||

| Constant | 0.560*** | 0.278*** | –0.925*** | 0.135*** |

| [0.084] | [0.056] | [0.336] | [0.030] | |

| Observations | 54,964 | 54,964 | 54,964 | 54,964 |

| Other controls | Yes | Yes | Yes | Yes |

| Year effects | Yes | Yes | Yes | Yes |

| Industry effects | Yes | Yes | Yes | Yes |

| Adj. R2 | 0.13 | 0.13 | 0.35 | 0.22 |

- This table presents baseline regression results of the impact of managerial ability on debt choice using alternative regression models (Panel A) and different measures of managerial ability and bank debt (Panel B). We present robust standard errors clustered at the firm level in parentheses. *, **, and *** indicate significance at the 10%, 5%, and 1% levels, respectively (two-tailed). The Appendix provides variable definitions.

Alternative Measures of Managerial Ability and Bank Debt

As a robustness test, we use an alternative measure of managerial ability. In particular, following prior studies (Demerjian et al., 2013; Hasan, 2020), we use a decile rank value of managerial ability (Mgr. Ability Rank) as our main independent variable. The results obtained using this alternative specification are presented in Column (1) of Table 10 (Panel B). We find that the results from this estimation are highly consistent with our primary results, showing a negative and significant coefficient (coeff. = –0.117, p < 0.01).

We then use three other specifications of bank debt: (1) bank debt as a proportion of total liabilities (Bank/Total Liabilities); (2) the natural log of bank debt (LN(Bank)); and (3) bank debt as a proportion of total liabilities (Bank/Total Assets). The results are presented in Table 10, Panel B (Columns (2) to (4)). We find that the coefficient for managerial ability remains negative (coeff. ranging from –0.094 to –1.989) and statistically significant (p < 0.01) for alternative specifications of bank debt. Overall, the findings from these alternative measures of variables of interest suggest the robustness of our finding that firms with more able managers rely less on bank debt.

Lagged Regression Model

The possibility that managerial ability affects the corporate future debt choice may be a concern. Therefore, to examine the sensitivity of our findings, we regress the bank debt of year t + 1 on the one-year-lagged managerial ability and controls. Our results in Table A.2 show that the coefficient for lagged managerial ability remains negative and significant (p < 0.01), suggesting the robustness of our main finding.

Holdout Samples