Accounting Research in Abacus, A&F, AAR, and AJM from 2008–2015: A Review and Research Agenda

Abstract

This paper uses bibliographic mapping techniques to map the research conversation in four Pacific Basin accounting journals listed on the Social Sciences Citation Index (Abacus, Accounting and Finance, Australian Accounting Review, and the Australian Journal of Management). We identify the main research streams in these journals as Accounting Standards, Environmental Accounting, Earnings Management, Disclosure, Conservatism, Auditing, Impairment, Cost of Capital, and Corporate Governance. We critically review each research stream, identify emerging research trends, and suggest an agenda for future research on accounting in the Pacific Basin.

This paper provides a systematic review of accounting research published in the four Pacific Basin accounting journals that have been listed on the Social Sciences Citation Index (SSCI) for more than five years. The Pacific Basin accounting journals meeting this criterion are (in alphabetical order) Abacus, Accounting and Finance (A&F), Australian Accounting Review (AAR) and Australian Journal of Management (AJM). 1 Data from the SSCI show that 661 papers on accounting were published in these journals between 2008 and 2015. We analyzed the data using the bibliographic mapping and visualization software HistCite™. 2 This software allows identification of the most-cited publications within any given citation dataset (i.e., papers attracting cross-citations), and visualizes the citation linkages between them. Analyzing the most highly cited publications in the local collection (i.e., the number of times a paper is cited by other papers in the four journals) reveals that there are nine major fields of research: Accounting Standards, Environmental Accounting, Earnings Management, Disclosure, Conservatism, Auditing, Impairment, Cost of Capital, and Corporate Governance.

We examine each of the nine research fields in detail and find that Accounting Standards, Environmental Accounting, Earnings Management, and Disclosure dominate the dataset in terms of their representation among the most highly cited papers. The Accounting Standards field focuses on the major issues and shortcomings associated with the introduction of International Financial Reporting Standards (IFRS). The Environmental Accounting field has a strong foothold in the accounting literature, and recent developments, such as the 2015 Paris Agreement, mean that there will be many opportunities for future research in this area. The Earnings Management field considers how earnings are managed in response to incentives. The Disclosure field is distinguished by the analytical nature of its models, many of which lead the way in the field of Information Economics. The Disclosure field will face many challenges in the future, as traditional sources of information and disclosure are subject to competition by new methods of disclosure, such as social media, blogs, chat rooms, and rumour boards.

In addition to mapping the research conversation in the four journals, we offer two additional analyses. The first additional analysis is to identify the articles that received the most citations globally (i.e., from all other papers within the Web of Science™, which is the platform hosting the SSCI). The second analysis is to identify future research streams by conducting a content analysis of papers published in Abacus, A&F, AAR, and AJM over the last five years (2011–2015). The content analysis here involves examining and synthesizing the research directions identified in these papers. In doing so, we identify six fields for future research: Accounting and Global Environmental Change, Future Research in International Accounting Standards, Future Research in Auditing, Accounting Education, The Impact of Moving to Fair Value Accounting, and Diversity. We review each of these emerging trends and set out an agenda for future research.

Methodology

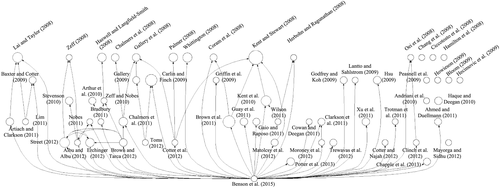

We use a methodology called ‘bibliographic mapping’ to map the research conversation in Abacus, A&F, AAR, and AJM and to reveal cross-citations between papers. Bibliographic mapping is an established technique for mapping a field of research and the influential publications within it. Unlike other methods of literature review, this technique allows us to objectively assess publications within a range of journals or a certain research field (Janssen, 2007, Janssen et al., 2006). A key outcome of this technique is a bibliographic map, which visualizes the structure of the literature over time. Specifically, it allows us to quickly identify the research conversation and to trace its historical development year by year (Garfield et al., 2003). To arrive at this map, we follow the methodological steps for data collection and analysis outlined by Janssen (2007) and Janssen et al. (2006). The first step is to compile a comprehensive database of published papers and their cited references. The data can then be analyzed and correlated using HistCite™. This program uses the citation details and cited references of the papers to map relationships between publications. The results are then visualized by the software in a bibliographic map, which highlights the most cited works (see also Figure 1). Each of these steps is detailed in the following sections.

Data Collection

We obtained citation data for papers in Abacus, A&F, AAR, and AJM from the SSCI, which is an academic database containing bibliographic and citation information that can be accessed via the Thomson Reuters Web of Science™ platform. At the time of writing, the SSCI contained citation data for Abacus from 2005 onwards; for A&F from 2006 onwards; for AAR from 2008 onwards; and for AJM from 2007 onwards. We therefore focused our analysis on the common period during which the journals were listed on the SSCI (2008–2015). Data were retrieved in January 2016, thus including articles up to the end of 2015. We downloaded the citation data of all papers published in these four journals during this timeframe, and retrieved a total of 976 unique records (177 papers in Abacus, 359 papers in A&F, 259 papers in AAR, and 181 papers in AJM). The retrieved records were then imported into HistCite™ (version 12.03.17). For each paper, the following information was downloaded: name(s) of the author(s), title, name of the journal, citation details (volume, issue, and page numbers), abstract, and keywords. We also downloaded a full record of cited references (i.e., references cited by each paper in the data collection).

Data Cleaning

Next, we manually checked the citation records to only retain papers of interest to the analysis. Journals such as AJM and A&F do not just publish accounting papers—they publish in a range of disciplines, including management and finance. We filtered the citation records to ensure that our analysis only focuses on accounting research. To do so, four of the authors examined the title, abstract, keywords, and, where necessary, the published paper itself. Records not deemed suitable (e.g., papers focused solely on management or finance theory) were removed from the dataset. Out of the 976 unique records retrieved (see above), we retained 661 accounting papers (150 papers from Abacus, 207 papers from A&F, 253 papers from AAR, and 51 papers from AJM). Further checks were undertaken to detect errors or variations in cross-citations between journals. 3 The final dataset containing 661 records was then used to produce the maps and figures described in the next section.

Results

Below, we present a number of findings. First, we show a citation map for the four journals that identifies the most highly cited publications in the local collection (i.e., the number of times a paper is cited by other papers in the four journals) and visualizes the citation linkages between them to show the local research conversation. We classify each of the papers according to its main stream of research, and offer a review and summary of the different streams. Second, we identify the articles published in the four journals that received the most citations globally (i.e., from all other papers within the SSCI). Third, we identify fields for future research in Abacus, A&F, AAR, and AJM, by conducting a content analysis of future research needs identified in papers published over the last five years (2011–2015), irrespective of their citation counts.

Citation Map for the Four Pacific Basin Accounting Journals

The citation map generated with HistCite™ for the four Pacific Basin accounting journals (see Figure 1) illustrates the most highly cited publications within these journals along a timeline. Older publications are displayed at the top of the figure, while more recent publications appear at the bottom. We limited the review (and display of publications in Figure 1) to the top 60 cited publications with the highest Local Citation Score (LCS). The corresponding citation cut-off is at a LCS of 3. The LCS reflects the count of citations to each publication within the 661 records retained for analysis. There is no established rule as to where the cut-off should be set. We initially attempted to limit our analysis to the top 50 cited papers, but found a number of papers that received an equal number of citations (LCS of 3) until paper 61, which had a LCS of 2. We therefore decided to include the top 60 cited publications so that Figure 1 displays a sample of papers that are influential in the research conversation (as measured by their citation count), but is still readable.

The top 60 cited papers are displayed as nodes (or circles), and the citation connections between them are illustrated as arrows. The size of each node highlights the quantitative importance of the respective publication in the map, measured by the number of citations it has received from other publications within the dataset. Normally, in mapping exercises for other fields of research (e.g., Janssen, 2007; Janssen et al., 2006; Linnenluecke, 2015), the map does reveal concentrated research streams (i.e., clusters of papers) based on their cross-citations. The reason it does not here is that there is a distinct lack of cross-citations between the articles in the four journals.

Failing the visual identification of research streams, the authors read the papers in detail and assigned these papers to the following research streams (see Table 1): Accounting Standards, Environmental Accounting, Earnings Management, Disclosure, Conservatism, Auditing, Impairment, Cost of Capital, and Corporate Governance. Citation details corresponding to Figure 1 and citation counts for each node in Figure 1 can be found in Table 1. The fields are reviewed below based on the number of papers in each of these streams.

| # | Author | Journal | Field | LCS | GCS |

|---|---|---|---|---|---|

| 1 | Lai and Taylor (2008) | A&F | Conservatism | 8 | 11 |

| 2 | Zeff (2008) | AAR | Accounting Standards | 3 | 6 |

| 3 | Haswell and Langfield-Smith (2008) | AAR | Accounting Standards | 6 | 12 |

| 4 | Chalmers, Clinch, and Godfrey (2008) | AAR | Accounting Standards | 5 | 6 |

| 5 | Gallery, Cooper, and Sweeting (2008) | AAR | Accounting Standards | 5 | 8 |

| 6 | Palmer (2008) | A&F | Accounting Standards | 6 | 9 |

| 7 | Whittington (2008) | Abacus | Accounting Standards | 7 | 42 |

| 8 | Coram, Ferguson, and Moroney (2008) | A&F | Auditing | 4 | 25 |

| 9 | Kent and Stewart (2008) | A&F | Accounting Standards | 15 | 23 |

| 10 | Herbohn and Ragunathan (2008) | A&F | Earnings Management | 3 | 8 |

| 11 | Oei, Ramsay, and Mather (2008) | A&F | Earnings Management | 3 | 6 |

| 12 | Chang, D'Anna, Watson, and Wee (2008) | AJM | Disclosure | 3 | 7 |

| 13 | Ciccotosto, Nandan, and Smorfitt (2008) | AAR | Accounting Standards | 3 | 4 |

| 14 | Hamilton, Li, and Stokes (2008) | A&F | Auditing | 3 | 5 |

| 15 | Baxter and Cotter (2009) | A&F | Earnings Management | 4 | 12 |

| 16 | Gallery (2009) | AAR | Impairment | 4 | 4 |

| 17 | Carlin and Finch (2009) | AAR | Impairment | 10 | 11 |

| 18 | Griffin, Lont, and Sun (2009) | A&F | Accounting Standards | 3 | 6 |

| 19 | Godfrey and Koh (2009) | A&F | Impairment | 4 | 10 |

| 20 | Lantto and Sahlstrom (2009) | A&F | Accounting Standards | 3 | 14 |

| 21 | Hsu (2009) | A&F | Disclosure | 5 | 9 |

| 22 | Peasnell, Dean, and Gebhardt (2009) | Abacus | Accounting Standards | 3 | 3 |

| 23 | Howieson (2009) | A&F | Accounting Standards | 3 | 3 |

| 24 | Bloom (2009) | Abacus | Impairment | 3 | 3 |

| 25 | Hecimovic, Martinov-Bennie, and Roebuck (2009) | AAR | Auditing | 3 | 4 |

| 26 | Stevenson (2010) | AAR | Accounting Standards | 5 | 8 |

| 27 | Arthur, Cheng, and Czernkowski (2010) | A&F | Disclosure | 4 | 6 |

| 28 | Zeff and Nobes (2010) | AAR | Accounting Standards | 3 | 12 |

| 29 | Kent, Routledge, and Stewart (2010) | A&F | Earnings Management | 8 | 15 |

| 30 | Andriani, Kober, and Ng (2010) | AAR | Disclosure | 3 | 3 |

| 31 | Haque and Deegan (2010) | AAR | Environmental Accounting | 5 | 11 |

| 32 | Artiach and Clarkson (2011) | A&F | Disclosure | 5 | 7 |

| 33 | Lim (2011) | A&F | Conservatism | 3 | 8 |

| 34 | Nobes (2011) | Abacus | Accounting Standards | 3 | 16 |

| 35 | Bradbury (2011) | AAR | Disclosure | 3 | 4 |

| 36 | Chalmers, Clinch, and Godfrey (2011) | AJM | Accounting Standards | 6 | 10 |

| 37 | Brown, Beekes, and Verhoeven (2011) | A&F | Corporate Governance | 11 | 45 |

| 38 | Guay, Kothari, and Shu (2011) | AJM | Cost of Capital | 5 | 23 |

| 39 | Gaio and Raposo (2011) | A&F | Earnings Management | 4 | 6 |

| 40 | Wilson (2011) | AAR | Earnings Management | 3 | 3 |

| 41 | Cowan and Deegan (2011) | A&F | Environmental Accounting | 3 | 8 |

| 42 | Clarkson, Overell, and Chapple (2011) | Abacus | Environmental Accounting | 4 | 33 |

| 43 | Xu, Jiang, Fargher, and Carson (2011) | AAR | Auditing | 5 | 11 |

| 44 | Trotman, Tan, and Ang (2011) | A&F | Auditing | 3 | 9 |

| 45 | Ahmed and Duellman (2011) | A&F | Conservatism | 4 | 16 |

| 46 | Street (2012) | AAR | Accounting Standards | 8 | 12 |

| 47 | Albu and Albu (2012) | AAR | Accounting Standards | 3 | 9 |

| 48 | Erchinger (2012) | AAR | Accounting Standards | 6 | 6 |

| 49 | Brown and Tarca (2012) | AAR | Accounting Standards | 5 | 8 |

| 50 | Toms (2012) | AAR | Cost of Capital | 3 | 3 |

| 51 | Cotter, Tarca, and Wee (2012) | A&F | Accounting Standards | 3 | 8 |

| 52 | Matolcsy, Tyler, and Wells (2012) | AJM | Environmental Accounting | 4 | 4 |

| 53 | Moroney, Windsor, and Aw (2012) | A&F | Environmental Accounting | 3 | 11 |

| 54 | Trewavas, Redmayne, and Laswad (2012) | AAR | Accounting Standards | 4 | 4 |

| 55 | Cotter and Najah (2012) | AJM | Environmental Accounting | 3 | 9 |

| 56 | Clinch, Fuller, Govendir, and Wells (2012a) | A&F | Earnings Management | 3 | 6 |

| 57 | Mayorga and Sidhu (2012) | AAR | Accounting Standards | 3 | 3 |

| 58 | Potter, Ravlic, and Wright (2013) | AAR | Accounting Standards | 5 | 6 |

| 59 | Chapple, Clarkson, and Gold (2013) | Abacus | Environmental Accounting | 4 | 11 |

| 60 | Benson, Clarkson, Smith, and Tutticci (2015) | AJM | Review Article | 3 | 3 |

- Note: The LCS refers to the count of citations to each publication by other papers in the dataset. The Global Citation Score (GCS) refers to the count of citations to each publication within the Web of Science. The papers in Table 1 follow the order as they appear in the map, from left to right for each year, and then from top to bottom.

Accounting Standards

Accounting Standards is by far the biggest research stream and is represented by 24 of the top 60 papers (40%). Papers in this area concentrate on the implementation and impact of IRFS. The impacts of IFRS are examined on many dimensions including value relevance (Chalmers et al., 2008, 2011); disclosure (Gallery et al., 2008; Kent and Stewart, 2008; Palmer, 2008); audit and non-audit fees (Griffin et al., 2009); key accounting ratios (Lantto and Sahlstrom, 2009); accounting system classification (Nobes, 2011); analysts’ forecasts (Cotter et al., 2012); and public sector financial statements (Trewavas et al., 2012) (see mainly the left side of Figure 1).

Several papers also focus on IFRS in the international context. The issue of whether countries have adopted IFRS or merely converged with local country standards is raised by Zeff and Nobes (2010). These authors compare several jurisdictions that have implemented IFRS and conclude that there are major differences in the extent to which they have been adopted. Stevenson (2010) discusses the domestic implications of IFRS and concludes that local standard setters still have an important role in setting global standards. Zeff (2008) examines the relevance of IFRS developments in countries such as the United States (Erchinger, 2012; Street, 2012) and Romania (Albu and Albu, 2012), in the Australian context. Researchers have also considered the application of these standards in small to medium-sized enterprises (Potter et al., 2013).

IFRS have been the subject of some controversy and criticism. Haswell and Langfield-Smith (2008) point out 57 serious defects in the Australian version of IFRS. Brown and Tarca (2012) examine whether the potential benefits and downsides of the standards have actually been realized, based on 10 years of practitioner experience. Finally, Mayorga and Sidhu (2012) investigate whether Australian firms comply with regulatory requirements to disclose key assumptions and major sources of estimation uncertainties. They argue that the volume and complexity of disclosure required by IFRS may have a potentially negative impact because they distract users from information relevant to their decision making. Companies with numerous accounting estimates may find disclosure of estimation uncertainties too complex and onerous and not sufficiently useful for their users or their management to warrant compliance.

Kent and Stewart (2008) has the highest local journal cites at 15, with 23 global cites. The paper is cited in top international journals such as Journal of Business Ethics and cross-disciplinary journals such as the Journal of Cleaner Production. It is one of the first studies to examine the link between the extent of IFRS compliance and the quality of corporate governance. Whittington (2008) has the most global cites with 42, and the paper is cited in leading international journals such as Accounting, Organizations and Society and Review of Accounting Studies. Whittington presents two sides of the fair value debate, one that assumes markets are relatively perfect and accounting provides valuations for passive investors, and the other that assumes markets have serious imperfections and accounting provides a valuable monitoring role. It is clear why this thoughtful piece of research has attracted so much global interest.

Environmental Accounting

The burgeoning area of Environmental Accounting is represented by seven of the top 60 papers (12%). Environmental databases such as the CDP (Carbon Disclosure Project) and the GRI (Global Reporting Initiative) provide researchers with global company data on carbon disclosures and sustainability reporting practices. Many reporting initiatives are voluntary, but there is some mandated disclosure (e.g., regulatory violations and environmental sanctions). The topic area examines a range of issues such as the environmental impacts of companies and, conversely, the effect of environmental change on company assets, profits, valuation, and human capital.

There are several studies of corporate environmental disclosure practices. For instance, Haque and Deegan (2010) examine climate change disclosure practices and find an increased trend to report over time. Cowan and Deegan (2011) study voluntary emissions reporting by Australian companies, particularly around the Natural Pollutant Inventory reporting initiative. Other studies consider the effect of assurance by professional advisors and private consultants (Moroney et al., 2012) and the effect of institutional investors on disclosure practices (Cotter and Najah, 2012). Other researchers investigate how disclosure relates to environmental performance (Clarkson et al., 2011) and how the anticipatory effects of introducing an emissions trading scheme affect company valuation (Chapple et al., 2013). Worldwide developments, such as the recent Paris carbon agreement, mean that there will be many opportunities for future research in this area (see the right side of Figure 1).

The Clarkson et al. (2011) paper has the most global cites in this area with 33. It is cited in top international journals such as Journal of Business Ethics and cross-disciplinary journals such as Journal of Cleaner Production. The paper shows how both the level and nature of voluntarily disclosed environmental information relates to environmental performance, and cautions that concerns about the reliability of voluntary disclosure of environmental information is warranted. The paper provides a major input into regulatory policy.

Earnings Management

The Earnings Management field is represented by seven of the top 60 papers (12%). This field examines the incentives for managers to manipulate earnings and the manner in which they are able to do so. Wilson (2011) comprehensively reviews the earnings management literature as it relates to Australian companies. The papers in this area focus either on accounting-based measures or market-based measures. For accounting-based measures, Oei et al. (2008) study the effect of management ownership and accruals on earnings persistence; others examine corporate governance and earnings quality (Baxter and Cotter, 2009; Kent et al., 2010) as well as audit reports and earnings management (Herbohn and Ragunathan, 2008). Market-based approaches include investigating the existence of accrual anomaly in the Australian market (Clinch et al., 2012a) and international evidence of the effect of earnings quality on firm valuation (Gaio and Raposo, 2011).

Disclosure

The Disclosure research area is represented by six of the top 60 papers (10%). Artiach and Clarkson (2011) review the field, particularly as it relates to the cost of capital and conservatism. Hsu (2009) examines price-sensitive corporate disclosures under Australia's continuous disclosure regime. Chang et al. (2008) examine disclosure through investor relations programs and their effect on information asymmetry. Other studies consider the disclosure of cash flow components and the prediction of earnings (Arthur et al., 2010), the usefulness of cash versus accrual accounting information for public sector managers (Andriani et al., 2010), and direct versus indirect cash flow disclosures and their association with future earnings and stock prices (Bradbury, 2011).

Conservatism

Conservatism is represented by three of the top 60 papers (5%). Conservatism is the asymmetric verification requirement for good news and not bad news. Lai and Taylor (2008) develop a new measure of firm-specific conservatism. They find conservatism to be positively related to stock return volatility, investment cycle length, and prior period conservatism, and negatively related to firm age, size, and leverage. Lim (2011) examines the relation between corporate governance and conservatism, and Ahmed and Duellman (2011) examine the role of conservatism in monitoring managers’ investment decisions.

Auditing

Auditing is represented by five of the top 60 papers (8%). The auditing process requires astute judgement and strong decision-making skills. Trotman et al. (2011) provide an excellent review of 50 years of research in this area. Other papers have quantitatively examined the competitiveness of the audit services market (Hamilton et al., 2008), internal audit and fraud prevention (Coram et al., 2008), and audit reports and the global financial crisis (Xu et al., 2011). In addition, Hecimovic et al. (2009) offer a qualitative study on the impact of auditing standards on the auditing profession.

Coram et al. (2008) has the highest number of global cites in this area with 25. It is cited in leading international journals such as Journal of Accounting Research, Journal of Business Ethics, Accounting, Organizations and Society, the Accounting Review, and Contemporary Accounting Research. Their research on the effectiveness of internal audit functions in detecting and reporting fraud demonstrates the value add of internal audit functions and has sparked worldwide interest.

Impairment

The Impairment research area is represented by four of the top 60 papers (7%). Bloom (2009) discusses internally generated versus purchased goodwill, and considers whether accounting standards adequately account for goodwill. Carlin and Finch (2009) and Gallery (2009) examine concerns about the IFRS discount rates that managers use to test goodwill impairment and compare these rates to independently generated discount rates. Godfrey and Koh (2009) find that goodwill impairment is negatively related to a firm's investment opportunities.

Cost of Capital

The Cost of Capital research field is represented by only two of the top 60 papers (3%), but the cost of capital is an integral component of many other research areas. The two papers in this area consider alternative approaches to market-based beta estimates to calculate the cost of capital. Guay et al. (2011) examine the effectiveness of implied cost of capital estimates derived from analysts’ forecasts, while Toms (2012) proposes an accounting-based approach to calculate the cost of capital.

The Guay et al. (2011) paper has 23 global cites and is cited in leading international journals such as the Journal of Accounting and Economics, Review of Accounting Studies, Journal of Financial and Quantitative Analysis, Journal of Corporate Finance, and the Accounting Review. It is also cited in leading practitioner journals such as the Journal of Portfolio Management. Its examination of the properties of implied cost of capital estimates using analysts’ forecasts has attracted much interest in academic and practitioner circles alike.

Corporate Governance

Corporate Governance is represented by one of the top 60 papers—a comprehensive review paper by Brown et al. (2011). This paper has the most global cites of all papers in this review at 45. It is cited in top international journals such as the Journal of Business Ethics and in cross-disciplinary journals such as the Journal of Econometrics and Economic Modelling. Corporate governance is integral to many of the other research fields discussed above and the interested reader should refer to these areas to understand the extent of its reach. The final paper in the top 60 is a review article by Benson et al. (2015). This paper reviews the accounting literature along five dimensions: most frequently cited papers, topical coverage, impact on practice, research method, and noted authors. They conclude that accounting research in the Pacific Basin has made a significant contribution to research and practice, both within the region and internationally.

Highly Cited Papers Globally

In addition to analyzing the most highly cited publications according to local citation count (i.e., the number of times a paper is cited by other papers in the four journals), we also look at the GCS, that is, the count of citations to each publication within the Web of Science. Table 2 shows the 10 most highly cited publications according to their GCS (11 papers are listed, because two have equal GCS). Here, we find significant overlap with the papers in Table 1—many papers with a high LCS also have a high GCS. However, several publications have attracted citations outside of Abacus, A&F, AAR, and AJM: Kavanagh and Drennan (2008) discuss the skills and attributes needed by accounting graduates, Ijiri and Sueyoshi (2010) review the accounting essays of Professor William W. Cooper, and Corrado (2011) reviews the methodologies for event studies.

| # | Author | Journal | Field | LCS | GCS |

|---|---|---|---|---|---|

| 1 | Brown, Beekes, and Verhoeven (2011) | AF | Corporate Governance | 11 | 45 |

| 2 | Whittington (2008) | Abacus | Accounting Standards | 7 | 42 |

| 3 | Clarkson, Overell, and Chapple (2011) | Abacus | Environmental Accounting | 4 | 33 |

| 4 | Kavanagh and Drennan (2008) | AF | Career Progression | 2 | 28 |

| 5 | Ijiri and Sueyoshi (2010) | Abacus | Review Article | 0 | 27 |

| 6 | Burritt, Schaltegger, and Zvezdov (2011) | AAR | Environmental Accounting | 1 | 27 |

| 7 | Coram, Ferguson, and Moroney (2008) | AF | Auditing | 4 | 25 |

| 8 | Artiach, Lee, Nelson, and Walker (2010) | AF | Environmental Accounting | 1 | 25 |

| 9 | Corrado (2011) | AF | Review Article | 2 | 24 |

| 10 | Kent and Stewart (2008) | AF | Accounting Standards | 15 | 23 |

| 11 | Guay, Kothari, and Shu (2011) | AJM | Cost of Capital | 5 | 23 |

Not surprisingly, we find many papers on Environmental Accounting in the highly cited papers list. This has become a very topical area of study, particularly in light of ongoing international and national policy debates about the impacts of global environmental change. Among the highly cited papers are Burritt et al. (2011), who provide a mixed-methods research approach to carbon accounting by leading German companies and ground these practices in a theoretical framework, and Artiach et al. (2010), who examine the determinants of corporate sustainability performance more broadly. The Environmental Accounting field has given rise to many future research opportunities in the area of Accounting and Global Environmental Change, which we outline in greater detail in the following section.

Future Research in Abacus, A&F, AAR, and AJM

Finally, we identify avenues for future research by conducting a content analysis of the future research needs identified by papers published in Abacus, A&F, AAR, and AJM over the last five years (2011–2015). This analysis was done by two of the authors, who independently examined the full text of articles published from 2011–2015 onwards. The content analysis here involves examining and synthesizing the research directions identified in these papers. Several promising avenues for future research emerge: Accounting and Global Environmental Change, Future Research in International Accounting Standards, Future Research in Auditing, Accounting Education, The Impact of Moving to Fair Value Accounting, and Diversity.

Accounting and Global Environmental Change

The Accounting and Global Environmental Change field is an evolution and continuation of the Environmental Accounting field (see Linnenluecke et al., 2015). The 2015 Paris Climate Treaty to limit temperature change to below 2°C will lead to renewed efforts for mitigation and adaptation to climate change and present many opportunities for natural experiments. Researchers can build on existing papers on Environmental Accounting, and on emerging research in the Global Environmental Change field, by studying topics such as those relating to the disclosure of environmental impacts and performance (Bachoo et al., 2013; Cotter and Najah, 2012; de Villiers and van Staden, 2011; Griffin and Sun, 2013; Ji and Deegan, 2011; Kamal and Deegan, 2013; Loh et al., 2015; Mock et al., 2013); capital market effects (Bird et al., 2013; Chapple et al., 2013; Clarkson et al., 2011; Herbohn et al., 2014); and the role of accounting in supporting environmental change strategies (Hartmann et al., 2013; Linnenluecke et al., 2015; Tang and Luo, 2014).

Future Research in International Accounting Standards

There have already been many studies conducted in the European Union and the Asia-Pacific region that investigate the implementation of international accounting standards. But there are still many opportunities for future research arising from ongoing developments related to the international adoption of IFRS. International accounting standards were first introduced in 2005 to ‘bring transparency, accountability and efficiency to financial markets around the world’ (IFRS, 2016). The standards were supposed to bring many benefits, for example, reducing the cost of capital, decreasing information asymmetry, and increasing comparability and understandability. 3 However, they have been found to also have drawbacks; for instance, the cost of implementation (Lai et al., 2013); unintended consequences relating to fair value accounting (Goncharov and van Triest, 2014); the process of convergence with existing regulatory regimes (Devi and Samujh, 2015; Mala and Chand, 2012; Nguyen and Gong, 2014) and limited suitability to the public sector (Laswad and Redmayne, 2015); and small to medium-sized businesses (Chand et al., 2015; Devi and Samujh, 2015).

By 2015, more than 120 countries had adopted IFRS and many others permit the use of IFRS in some circumstances. Adopting countries in the Asia-Pacific region include Australia, Bangladesh, Hong Kong, New Zealand, Singapore, South Korea, and Taiwan. China, India, Japan, and Thailand are yet to fully adopt IFRS, offering research opportunities related to the future of IFRS in these jurisdictions. Future research can contribute to the ongoing monitoring of the effects of international accounting standards, including studies on important fundamentals of accounting. Researchers interested in this field can build on existing studies of value relevance (Chalmers et al., 2011; Clacher et al., 2013; Martinez et al., 2014); disclosure (Stent et al., 2013; Wee et al., 2014); earnings management (Navarro-Garcia and Madrid-Guijarro, 2014); private equity valuation (Palea and Maino, 2013); conservatism (Barker and McGeachin, 2015); firm financing behaviour (Tarca et al., 2013); and earnings forecasts (Chalmers et al., 2012; Cotter et al., 2012). There have also been studies investigating specific standards (e.g., IAS 19 Defined Benefits (Cho et al., 2014) and IFRS 8 Segment Reporting (Kang and Gray, 2013)). This work could be further extended in the international context.

There is also considerable research and discussion on the Conceptual Framework underlying IFRS. Decision usefulness to capital providers is the main emphasis, with the more conservative stewardship approach a secondary consideration and prudence not a real factor at all. As Gebhardt et al. (2014) point out, this is particularly relevant to debt contracting where conservatism is valuable through monitoring, facilitating access to debt funds, risk sharing, and dividend conflict between owners and debt holders. Gebhardt et al. (2014) make a convincing argument for reintroducing prudence back into the Conceptual Framework.

Changes to international accounting standards will continue to provide important research topics for academics, particularly when it comes to providing feedback to standard-setting bodies about post-implementation issues (Ewert and Wagenhofer, 2012). There will also be opportunities to conduct natural experiments on the effects of these changes. The current work program for the International Accounting Standards Board (IASB) includes topics such as revenue recognition, financial instruments, insurance contracts, and development of a Conceptual Framework. There are also assessment-stage projects regarding discount rates, goodwill and impairment, income taxes, pollutant pricing mechanisms, post-employment benefits, primary financial statements, provisions, contingent liabilities and contingent assets, and share-based payments. The IASB also has several projects in development, including business combinations, disclosure, equity methods of accounting, financial instruments with characteristics of equity, and financial instruments which account for dynamic risk management. Finally, the IASB also has an inactive project—Extractive activities/intangible assets R&D—which could be back on the research agenda in the not too distant future.

Future Research in Auditing

None of the four Pacific Basin accounting journals included in this review focuses exclusively on auditing. Nonetheless, the area has attracted a lot of attention in recent publications and is starting to emerge as one of the healthiest and most fruitful research streams. There are many emerging areas in audit research, including competition and pricing (Carson, 2013; Carson et al., 2014; Ciconte et al., 2015; Dutillieux et al., 2013; Kend et al., 2014; van der Laan and Christodoulou, 2012); the effects of regulatory change (Carey et al., 2014; Houghton et al., 2013; Lee et al., 2013); trust (Howieson, 2013); reputation (Bigus, 2015); and audit judgement and decision making (Trotman et al., 2011).

Other emerging research is being undertaken in a variety of areas, including internal versus external auditors (Rose et al., 2013; Sarens et al., 2013); corporate governance and auditing (Aldamen et al., 2012; Bliss, 2011; Bolton, 2014; Chan et al., 2013; Contessotto and Moroney, 2014; Purcell et al., 2014; Seamer, 2014; Wu et al., 2014); the effects of international accounting standards (Samsonova-Taddei, 2013); financial crises and auditing (Carey et al., 2012; Xu et al., 2013); non-audit fees (Habib, 2012); and the effect of audit quality on information asymmetry (Clinch et al., 2012b). The variety and depth of auditing research is extremely impressive and the field looks likely to grow even stronger in the future. Opportunities exist here for expanding on emerging research and also for developing integrative and overarching frameworks which draw together the various research streams.

Accounting Education

Research into accounting education is particularly important because accounting provides the information and the workforce that are fundamental to the efficient functioning of capital markets. Accounting education research is diverse. Research on undergraduate-level education covers topics such as approaches to learning and the impact of prior learning (Cameron et al., 2015; Crawford and Wang, 2014). Research on masters-level education considers the benefits of case-based teaching pedagogy (Thaker, 2015) and research on doctoral-level education investigates the impact of higher education policy changes (Heaney et al., 2013). Emerging topics of interest include the performance of domestic versus international students (Phang et al., 2014), the implications of IFRS for accounting education (Jackling et al., 2012) and the effect of educational reforms (Carrera and Carmona, 2013; Heaney et al., 2013).

Research in this very important field is sure to flourish, especially with changes in technology, making alternative and complementary delivery methods available for accounting education. This technology includes using laptops in classrooms and web-based lecturing systems, such as Lectopia or Echo 360. Today's accounting graduates require additional technical skills, such as familiarity with the XBRL Taxonomy and the ability to keep up-to-date with the latest accounting software (e.g., MYOB or Quickbooks). Research could conduct pre- and post-testing of students to determine if they have the necessary skills to enter the graduate workforce.

The Impact of Moving to Fair Value Accounting

Whittington (2015) provides a comprehensive review of measurement in financial reporting covering 50 years of research and practice. Whittington points out that although historical cost is still the predominant measurement technique in practice, progress has been made in implementing fair value accounting, but much needs to be done in choosing between alternative values (entry versus exit values) and this will continue to be a focus for academics and standard setters. The fair value theory of measurement owes its genesis to Chambers and his theory of continuously contemporary accounting (CoCoA). 4

Diversity

Diversity in any discipline is an important topic, but particularly in accounting, where women are under-represented in both academia and practice. Researchers can build on emerging studies on female representation in accounting. Cullen and Christopher (2012) examine the career progression of women accountants in the state public service of Western Australia and New South Wales and find that work-related barriers are significantly negatively related to career progression. Gago and Macias (2014) ask whether the lack of female professors in accounting can be attributed to female academics specializing in non-mainstream fields. They examine the research interests of over 1,000 male and female academics and find no significant gender difference in the choice of research field and conclude that the lack of promotion of women cannot be put down to their choice regarding non-mainstream fields. Whiting et al. (2015) examine the prospects for female partnerships in professional accounting firms in Australia, New Zealand, and the United Kingdom. Their study concludes that women's perceived preferences and organizational structural boundaries contribute strongly to the lack of women partners. The authors also find traditional stereotypical discrimination against women in smaller accounting firms.

Future diversity research can also focus on minority groups, which are extremely under-represented in the accounting field. A promising avenue for future research is to expand upon the study by Lombardi and Cooper (2015), which investigates the under-representation of Aboriginal and Torres Straight Islanders in the accounting profession to further understand their experiences, obstacles, and future career opportunities. There is a strong push for diversity in the board room and in the accounting, auditing, and academic fields; if voluntary codes do not achieve the desired outcomes, then mandatory changes may be enforced. Some overseas jurisdictions have now mandated quotas for gender diversity, for instance, Belgium, Quebec, Denmark, Finland, France, Iceland, India, Israel, Italy, Kenya, and the Netherlands. The implementation of such quotas creates exogenous shocks 5 which are fruitful avenues for future diversity research.

Other promising research avenues

Our content analysis has focused on the main research directions revealed by papers published in Abacus, A&F, AAR, and AJM over the last five years (2011–2015). We appreciate the importance of streams including accounting for intangibles (such as R&D), revaluations, direct versus indirect cash flows disclosure methods, insurance accounting, and mining company disclosures. These are all fields in which there is much research in progress.

Conclusion

This paper uses bibliographic mapping techniques to map the research conversation in four Pacific Basin accounting journals listed on the Social Sciences Citation Index (Abacus, Accounting and Finance, Australian Accounting Review, and the Australian Journal of Management). We identify the main research streams in these journals as Accounting Standards, Environmental Accounting, Earnings Management, Disclosure, Conservatism, Auditing, Impairment, Cost of Capital, and Corporate Governance. We critically review each research stream, identify emerging research trends and an agenda for future research on accounting in the Pacific Basin.

The research streams identified above are cited widely across all academic fields and accounting is known as a rigorous and scientifically sophisticated field. We identify fields for future research using the last five years of publications in the four Pacific Basin accounting journals. These are Accounting and Global Environmental Change, Future Research in International Accounting Standards, Future Research in Auditing, Accounting Education, The Impact of Moving to Fair Value Accounting, and Diversity.

References

- 1 We only included journals that were listed on the SSCI Index because our methodology requires citation statistics from the SSCI, which are not available for unlisted journals. We did not include internationally oriented journals, such as Accounting, Auditing & Accountability.

- 2 The journals have only been listed on the SSCI in recent years because they are regional journals (see the Methodology section for details).

- 3 At times, the references retrieved from the Web of Science™ platform contained citation errors (e.g., missing page numbers, missing issue numbers, or missing authors). We checked for such errors to ensure that the retrieved citation data were correct.

- 3 For a detailed discussion, see Schipper (2005) and Pownall and Schipper (1999).

- 4 See, for example, Clarke (1996).

- 5 See Gippel et al. (2015) for a discussion of natural experiments in the context of exogenous shocks.