Boreal First Nation: An Assurance and Financial Reporting Case on a Remote Indigenous Community*

Accepted by Darren Henderson. We would like to acknowledge the helpful comments provided by Darren Henderson (associate editor) and two anonymous referees, along with the research assistance provided by graduate students Anamika Jayendran, Kaija Maenpaa, and Mohammed Aldawsari, without whom this case would not have been written. We also benefited greatly from feedback provided by Indigenous and non-Indigenous colleagues with a keen interest in Indigenous accounting and education, including Nathaniel Anderson, Dave Covello, Paolo Lento, Jerri-Lynn Orr, Jo-Anne Ryan, and representatives of CPA Canada and CPA Ontario. We were supported by SSHRC Partnership Engage Grant 892-2020-3048 and earlier collaborations with Indigenous Works. Lastly, we thank the students from the Graduate Diploma and Master of Accounting classes at our institutions for their feedback on earlier versions of the case, which enriched the case and teaching notes.

ABSTRACT

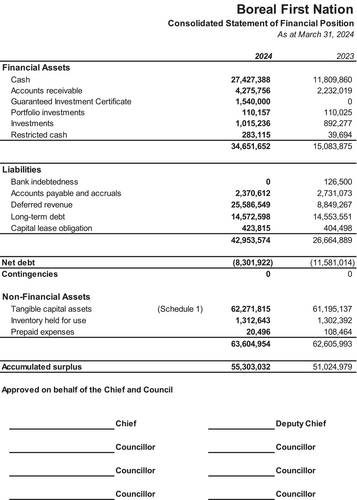

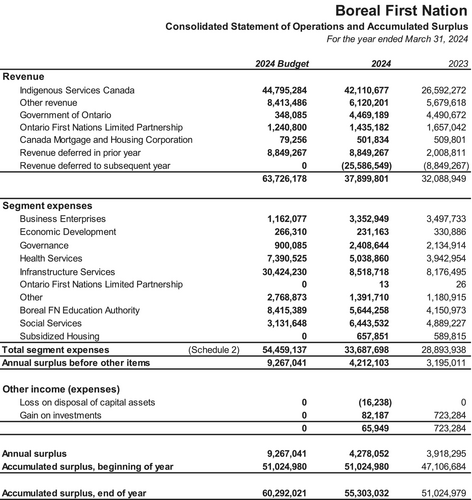

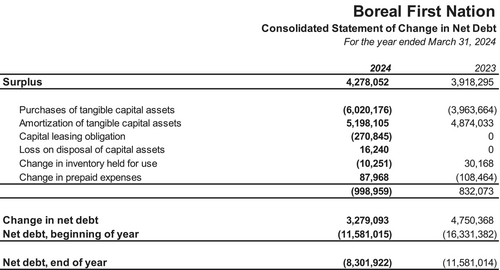

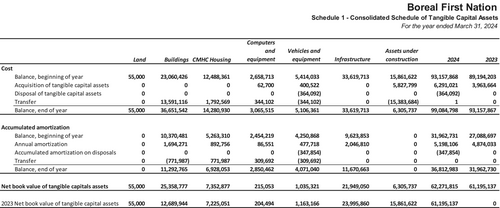

enFinancial accounting and accountability requirements for many Indigenous communities in Canada can be complex, yet very few accounting programs and students cover these issues. This case introduces financial reporting and assurance issues pertaining to a remote First Nations community in a realistic, yet fictional, setting. Students assume the role of a senior manager planning for the initial audit engagement with Boreal First Nation. A detailed appendix to the case provides background information on the complex historical, social, regulatory, and practical nature of Indigenous assurance engagements. The case includes detailed financial statements for Boreal First Nation prepared in accordance with Public Sector Accounting Standards in addition to special reporting requirements based on the First Nations Financial Transparency Act. The case fosters students' professional judgment and intercultural competence in relation to audit planning considerations (e.g., overall financial statement–level risks, materiality, and approach) along with special reporting and financial reporting (e.g., investments and tangible capital assets) issues unique to a remote First Nation.

RÉSUMÉ

frPREMIÈRE NATION BORÉALE : ÉTUDE DE CAS SUR LA CERTIFICATION ET LA COMMUNICATION D'INFORMATION FINANCIÈRE DANS UNE COMMUNAUTÉ AUTOCHTONE ÉLOIGNÉE

Pour bon nombre de communautés autochtones au Canada, les exigences en matière de comptabilité financière et de reddition de comptes peuvent être complexes, mais très peu de programmes de comptabilité et d'étudiants abordent ces questions. Cette étude de cas présente des enjeux liés à la communication de l'information financière et à la certification dans le cadre d'une communauté des Premières Nations éloignée dans un contexte réaliste, mais fictionnel. Les étudiants jouent le rôle d'un gestionnaire principal qui planifie la toute première mission d'audit auprès de la Première Nation Boréale. Une annexe détaillée fournit de l'information sur la nature complexe, historique, sociale, réglementaire et pratique des missions de certification auprès des Autochtones. L'étude de cas inclut les états financiers détaillés de la Première Nation Boréale préparés conformément aux Normes comptables pour le secteur public, ainsi que les exigences particulières de communication d'information inscrites dans la Loi sur la transparence financière des Premières Nations. L'étude de cas fait appel au jugement professionnel et à la compétence interculturelle des étudiants à l'égard des considérations relatives à la planification de l'audit (p. ex., risques associés à l'ensemble des états financiers, importance relative, et approche d'audit), en plus d'aborder des enjeux en matière de production de rapports spéciaux et de communication d'information financière (p. ex., investissements et immobilisations corporelles) propres à une Première Nation éloignée.

THE CASE

ABC Public Accountants LLP (“ABC PA”) is a midsized regional assurance firm with offices across Northwestern Ontario. ABC PA provides assurance services to clients in a wide variety of industries, including small and medium-sized private businesses and government entities, such as municipalities, universities and colleges, school boards, and hospitals.

For over 20 years, ABC PA has been offering assurance and accounting, consulting, tax, and bookkeeping services for Indigenous nations, businesses, and individuals across Canada through its Indigenous Service Line. The firm has invested significant time and resources in developing and providing practical services to meet the unique needs of its Indigenous clients. ABC PA has recently been increasing its strategic focus on developing and delivering service offerings tailored to First Nations, Métis, and Inuit clients. Most recently, the firm has developed tailored services related to health consulting, duty to consult, and training solutions.

You are a senior manager with ABC PA, but you have been specializing primarily in providing assurance, tax, and consulting services to non-Indigenous medium-sized private businesses. As a result, you are well versed in Accounting Standards for Private Enterprises (ASPE) reporting. Recently, the senior manager overseeing the Indigenous Service Line has announced her departure. The partner of this service line has requested your help with an audit that is fast approaching. Eager to learn more and expand your skill set, you agree. The following dialogue takes place during your meeting with the partner.

Partner: As you know, the senior manager leading the Indigenous Services Line is leaving the firm shortly. I am hoping that you can help lead the Boreal First Nation audit engagement. We were recently informed that the chief and council were pleased with our proposal during the audit tender process, and we have been appointed as Boreal First Nation's external auditors for the next three years. Since this is your first assurance engagement with a First Nation client, I am providing you with some general background information on the principles our Indigenous Service Line has developed over the years. This is general information that applies to all engagements that our Indigenous Service Line undertakes (see the Appendix).

You: Thanks. I look forward to reviewing the materials. I will read this as a first step before considering any of the audit or reporting issues.

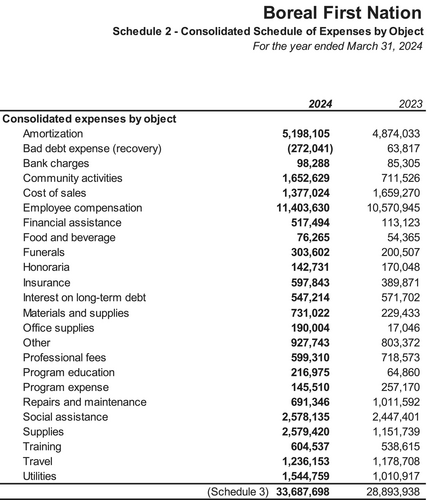

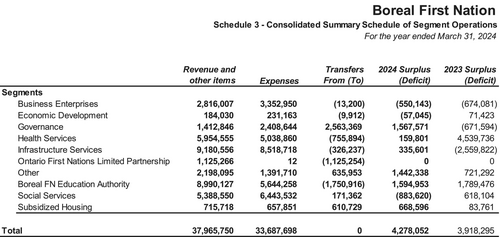

Partner: Regarding the year-end audit engagement, please prepare a preliminary audit planning memo that outlines your assessment of overall financial statement–level risks, materiality, and the audit approach. I have some background information on the client (Exhibit 1) and the draft financial statements (Exhibit 2) to get you started. I know you specialize in ASPE and have less experience with the Public Sector Accounting Standards (PSAS) issued by the Public Sector Accounting Board (PSAB). However, to take on this engagement, you will need to get up to speed on the PSAS standards. We have many team members specialized in PSAS who can provide support, but I would like you to start by preparing a preliminary assessment of why PSAS is the appropriate framework for Boreal First Nation, based on the Introduction section within PSAS. Don't worry about a full assessment of risks and procedures at the account and assertion levels at this point; we can always do that later as you become more familiar with PSAS. However, it would be great if you could identify any potential risks at the assertion level with the tangible capital asset continuity in Schedule 1 in the Financial Statements and draft some audit procedures to address those risks.

You: Sounds great. I am looking forward to expanding my knowledge of PSAS and preparing a preliminary memo.

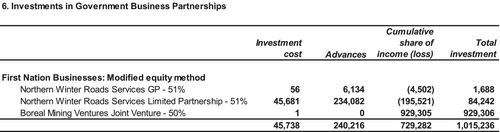

Partner: Based on discussions with the predecessor auditors, I know that a significant challenge in this engagement is a recent investment made by Boreal First Nation in Northern Winter Roads Service LP. I will share with you some information we received from the predecessor auditor regarding the investment (Exhibit 3). Can you include in your memo a discussion of the assurance and reporting implications of this investment? And one last thing: In addition to the audit of the historical financial statements, our proposal included the completion of a special reporting engagement for Boreal First Nation addressing their compliance with the First Nations Financial Transparency Act in regard to their Statement of Remuneration and Expenses. As part of our proposal, we did not specify the exact special reporting option that we would adopt for the Schedule. Therefore, I would like you to consider some appropriate special reporting options, discuss their pros and cons in this situation, and make a recommendation we can share with the chief and council. I would also like you to propose an audit procedure for each of the main criteria. I will send you an email with more details on the special reporting engagement (Exhibit 4).

You: I am very much looking forward to this opportunity to become more involved with the Indigenous Service Line.

You head back to your desk and start to think more deeply about the upcoming engagement.

EXHIBIT 1. Boreal First Nation: Audit planning considerations

Background

Boreal First Nation (Boreal) is a remote community located 700 km from the city of Thunder Bay in Northwestern Ontario. Boreal, with a population of over 800 people, is a tight-knit community deeply rooted in its cultural heritage and traditions. More than 75% of the community's members have lived at the same address for over 5 years.

Boreal's governance is structured around a chief and eight councillors, who are responsible for making decisions on behalf of the First Nation and its members. An election of the chief and councillors is held every 2 years in accordance with the process outlined in the Indian Act. Voters have the opportunity to nominate candidates for the positions of the chief and councillors. Decision-making processes prioritize consensus-building and respect for traditional values, ensuring that the voices of all members are heard and respected.

The community's population is comparatively young, with children and young adolescents making up 37% of the population. Almost all (96%) of the population speaks English. Because of inadequate funding, the distance from educational opportunities, and a lack of culturally inclusive education programs, the level of education attainment within the community has been impacted. More than 54% of the population above the age of 20 do not have a degree, certificate, or diploma. A larger section of the remaining population is engaged in trades/apprenticeship learning, with approximately 1.5% of the population having earned a university degree.

The community has a labor force participation rate of 52%, with health and education being the primary employment sectors. This is followed by employment in wholesale and retail services along with manufacturing and construction. The average total income of a community member is approximately $30,000 annually. The community is located in a Zone 4 geographic area, meaning that it has no year-round road access to a service center and, as a result, experiences a higher cost of transportation. Boreal is accessible by air year-round and via a winter road in the coldest months, although community members are increasingly concerned that climate change will limit the functioning of the winter road in the future.

Accounting Staff and Procedures

Heather Judge is Boreal's only accountant. Heather works primarily as the community's chief administrative officer, but she took on additional responsibilities for the accounting function 6 months ago when the previous part-time accountant left the community. Heather has no formal training in accounting. It is not unusual for there to be no professionally designated accountants (Chartered Professional Accountants [CPAs]) in Canada's Indigenous communities as there are very few Indigenous CPAs in Canada.a Heather fulfills all accounting and control functions herself. Although the community as a whole is very interested in the First Nation's ability to invest in necessary programs and infrastructure projects, the chief and council trust Heather and rarely ask questions about the community's accounting.

Notes from Discussion with Predecessor Auditor

Boreal's predecessor auditor indicated to you that they routinely recommended what they described as “an inordinate number” of adjusting journal entries during the course of their audits. They also indicated that they needed to check at the beginning of each audit to ensure these adjustments had been posted correctly; at times they needed to post the adustments themselves before beginning the next year's audit. In addition, Heather's predecessor regularly contacted the predecessor auditor for advice on how to account for unfamiliar transactions.

Additional challenges the predecessor auditor encountered included difficulties in obtaining timely information on some of Boreal's investments with other partners (see details in Exhibit 3), several of which have different year-ends compared to Boreal's March 31 year-end.

The predecessor auditor also advised you that gaining access to Boreal and its accounting records could be challenging. The external auditors usually undertook their audit field work in April, which meant that the only means of accessing the community was by air in a small aircraft. Finally, the predecessor indicated that they were typically invited to return to the community to present, explain, and discuss the audited financial statements at a community meeting.

- aRecent estimates by CPA British Columbia (2023) indicate that Canada has “very low numbers of Indigenous CPAs,” with Indigenous CPAs being underrepresented relative to their population by 10 times.

EXHIBIT 3. Boreal First Nation's investments

-

A brief summary of investments is as follows:

- Northern Winter Roads Service is the general partner (GP) of Northern Winter Roads Service Limited Partnership (LP).

- Northern Winter Roads Service LP is an investment created to research and develop winter roads for remote First Nations in Northern Ontario. The LP is investigating alternative materials, routes, and vehicles for use on winter roads in consideration of the changing climate in Northern Ontario.

- Boreal Mining Ventures Joint Venture is an agreement with a junior mining company to explore a precious metal deposit on Boreal First Nation's traditional lands. The joint venture intends to provide economic benefits for the community while sustainably developing the land.

Under PSAS 3070.35, these investments are accounted for using the modified-equity method. The modified-equity method is the same as the equity method of accounting, except that government business enterprises' accounting principles are not adjusted to conform to the accounting principles of the government.

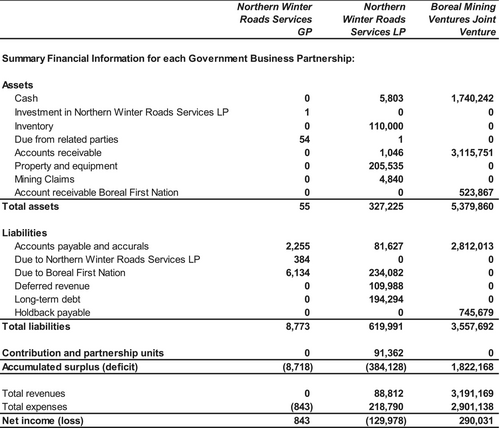

- Northern Winter Roads Service LP and GP have a December 31 year-end, and a different firm is conducting a review of their financial statements. In the past, it has been very challenging to obtain their financial statements prior to the completion of Boreal First Nation's audit. In this regard, we need to consider the requirements under PSAS 3070.47, which states,

When the fiscal periods of the Government reporting entity and a government business enterprise are not the same, events relating to, or transactions of, the government business enterprise that have occurred during the intervening period and significantly affect the consolidated financial position or results of operations of the government reporting entity should be recorded in Government consolidated financial statements.

-

In addition, PSAS 3070.60 outlines the disclosure requirements:

As such, the previous financial statements included the following disclosures:Government consolidated financial statements should disclose, in notes or schedules, condensed supplementary financial information relative to government business enterprises.

EXHIBIT 4. Email with information on the special reporting engagement

To: Senior Manager, CPA

From: Partner

Date: April 15, 2024

Subject: Special reporting engagement for Boreal First Nation

Hi Senior Manager,

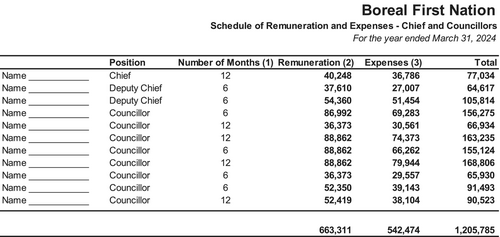

In addition to the financial statement audit, we are required to provide assurance on the Schedule of Remuneration and Expense—Chief and Councillors (“Schedule”). The Schedule summarizes the remuneration and expenses paid to Boreal First Nation's chief and councillors. It is important to note that Boreal First Nation's management must prepare the Schedule as per the requirements in the First Nations Financial Transparency Act. Our job is to provide some assurance on the Schedule.

- The number of months during the fiscal year that the individual was a chief or councillor.

- Remuneration includes any salaries, wages, commissions, bonuses, fees, honoraria, and dividends, as well as any other monetary benefits—other than the reimbursement of expenses—and nonmonetary benefits.

- Expenses include costs such as transportation, accommodation, meals, hospitality, and incidental expenses.

Partner

Indigenous Service Line Leader

REQUIREMENTS

- Prepare a preliminary assessment of why PSAS is the appropriate financial reporting framework for Boreal First Nation.

- Prepare a preliminary audit planning memo for the year-end audit that outlines your assessment of overall financial statement–level risks, materiality, and the audit approach.

- Identify any potential risks at the assertion level with the tangible capital asset continuity schedule in Schedule 1 in the Financial Statements and draft audit procedures to address those risks.

- Discuss the assurance and reporting implications of the investment in Northern Winter Roads Service Limited Partnership (LP).

- Consider special reporting options for the Statement of Remuneration and Expenses, discuss their pros and cons in this situation, and make a recommendation to be shared with the chief and council. Also, propose an audit procedure for each of the main criteria.

TEACHING NOTES

Teaching notes for instructional cases are not published in the journal but are made available to full CAAA member subscribers via the CAAA website. If you are a full member of the CAAA and wish to obtain a copy of the Teaching Notes, log in to http://www.caaa.ca to access and download the notes.

APPENDIX: INDIGENOUS SERVICE LINE BACKGROUND AND PRINCIPLES

Memorandum

Subject: Assurance Services Audit for [Business Name]

As we embark on the assurance services audit for [Business Name] in accordance with Public Sector Accounting Standards (PSAS), it is imperative for us, as a team, to recognize and address the unique factors inherent in conducting audits within Indigenous communities. Our commitment to understanding and respecting the cultural, social, and legal contexts is paramount to the success and integrity of this engagement.

- Cultural Sensitivity

Understanding Indigenous Culture:

- Familiarize yourselves with the history, traditions, and values of the First Nations Peoples in Canada.

First Nations, Inuit, and Métis Peoples, as the original peoples of this country and as self-determining peoples, have treaty, constitutional, and human rights that must be recognized and respected (Public Health Agency of Canada, 2023).

- Consider engaging with local Elders or community leaders to gain insights into the cultural context of the community that you are working within.

- Be mindful of the historical context and impact of colonialism on Indigenous communities.

Assurance teams undertaking an audit of an Indigenous business organization must recognize the complexity of such audits and their differences from more conventional audits as well as the burden of colonial history that accompanies these audit processes (Morantz, 2018). Members of the team are expected to exercise sensitivity in all interactions and communications.

Recognizing the potential challenges in establishing a rapport with the community, the audit team may need to invest considerable effort in cultivating a relationship grounded in trust and understanding. Historical experiences may have contributed to a certain level of aversion to outsiders, necessitating a delicate and thoughtful approach in our interactions.

- Acknowledge and respect Indigenous customs and traditions throughout the audit process. Recognize that cultural practices and traditions are essential to the health and well-being of First Nations, Inuit, and Métis (Public Health Agency of Canada, 2023).

- Recognize and adhere to any specific protocols established by the community for engaging with external parties, including auditors. Seek permission before entering community spaces and respect any restrictions on access.

- Engagement

- Acknowledge the significance of relationships and trust-building within the community. As new assurance providers to a First Nations business organization, the team must first focus on building a relationship of trust, accountability, and respect with the members of the organization. The same applies subsequently to any new members of the audit team.

- Recognize the importance of reciprocity and trust and commit to work with partners in a circle of shared responsibility, accountability, and stewardship (Public Health Agency of Canada, 2023).

- Familiarize yourselves with the governance structures, decision-making processes, and community dynamics of the Indigenous First Nations Business. Recognize the significance of Elders, traditional leaders and community members in the decision-making and consultative processes for [Business Name].

- Use appropriate, clear, and straightforward language and maintain respect in all communications. Communicate transparently and avoid the use of technical jargon and acronyms in conversations with the community (Indigenous Corporate Training, 2019).

- Prioritize building open and transparent lines of communication with the leadership, management, and stakeholders of the Indigenous First Nations business.

- Seek advice and be open to receiving feedback from community members and representatives to ensure their perspectives are considered throughout the audit process.

- Technical Training

- Understand the legal and regulatory frameworks applicable to Indigenous governance and business operations, including the Indian Act, self-governance agreements, and treaties.

- Be aware of any specific reporting requirements or exemptions under PSAS that may apply to Indigenous entities.

- Be attentive to any unique accounting practices or financial reporting requirements specified by the Indigenous community or prescribed by PSAS.

- Exercise care in the reporting of audit findings to ensure that cultural nuances are considered.

- Logistics and Planning

- Depending on resource allocations within the community, [Business Name] may not always be able to assist with accommodations for the team during the site visit. To that end, the audit team is encouraged to commence discussions with the local contact person to determine appropriate accommodations, considering factors such as proximity to the audit site, logistical convenience, and cultural appropriateness.

- The team must commit to work in a way that produces timely results, while respecting [Business Name] internal governance structure and timelines (Public Health Agency of Canada, 2023). Auditors must respect the community's differences of perspectives on work, priorities and subsequent timelines and prepare accordingly.

- Our aim is to ensure that our stay is both respectful and conducive to the successful execution of our audit objectives.

In conclusion, the success of our audit engagement with [Business Name] relies on our ability to conduct the audit with cultural sensitivity and respect for the unique context of the First Nations community. By embracing these considerations, we can strengthen our relationships, build trust, and contribute to the overall success of our assurance services.