How Management Accountants Purposefully Create Cash Flow Forecasts in Capital Budgeting: A Field Study of Product Development Decisions*

Accepted by Adam Presslee. We thank our colleagues for the many helpful suggestions provided in conferences, research seminars, and coffee meetings at MASOP 2019, Monforma 2020, AAA MAS Midyear Meeting 2021, University of Innsbruck, Monash University, UNSW, University of Queensland, ESSEC, and University of Amsterdam. We also thank the editor and reviewers for their guidance and constructive feedback.

ABSTRACT

enIn capital budgeting, management accountants may have their own agendas when they are creating cash flow forecasts and recommending particular capital investments. What are the mechanisms management accountants can use to influence cash flow forecasts in capital budgeting? This field study investigates how management accountants prepared cash flow forecasts for product development investment decisions at a car company. We describe in detail two instances of the technical design of new cars, the preparation of cash flow forecasts, and decisions on capital investment projects. When management accountants monetarily quantify various kinds of inputs, they not only make pragmatic choices as part of their normal work of dealing with complexity and uncertainty, but they also purposefully intervene in various ways to make their cash flow forecast support a particular capital investment. These interventions can be differentiated in terms of their nature (qualitative or quantitative) and timing (initiating or counteracting). This field study contributes a conceptualization and empirical evidence on accounting tactics in the context of capital budgeting.

RÉSUMÉ

frCOMMENT LES COMPTABLES DE GESTION EFFECTUENT À DESSEIN DES PRÉVISIONS DE TRÉSORERIE LORS DE L'ÉTABLISSEMENT DU BUDGET DES INVESTISSEMENTS : ÉTUDE SUR LE TERRAIN CONCERNANT LES DÉCISIONS RELATIVES AU DÉVELOPPEMENT DE PRODUITS

Dans le cadre de l'établissement du budget des investissements, il se peut que les comptables de gestion aient leurs propres objectifs lorsqu'ils effectuent des prévisions de trésorerie et recommandent des investissements particuliers. Quels sont les mécanismes qu'ils peuvent utiliser pour influencer les prévisions de trésorerie lors de l'établissement du budget des investissements? Cette étude sur le terrain se penche sur la façon dont les comptables de gestion ont réalisé des prévisions de trésorerie pour la prise de décisions concernant les investissements aux fins du développement des produits chez un fabricant automobile. Nous décrivons en détail deux occurrences de conception technique de nouvelles automobiles, la préparation des prévisions de trésorerie et les décisions relatives aux projets d'investissement. Lorsque les comptables de gestion quantifient monétairement différents types d'intrants, ils ne font pas uniquement des choix pragmatiques face à la complexité et à l'incertitude qui font partie de l'exercice normal de leurs fonctions, mais ils interviennent de diverses manières pour s'assurer que leurs prévisions de trésorerie appuient des investissements particuliers. Ces interventions peuvent être différentes selon leur nature (qualitative ou quantitative) ou la situation dans laquelle elles sont mises en œuvre (intervention initiale ou réactive). La présente étude sur le terrain offre une conceptualisation et des données empiriques relatives aux tactiques comptables dans le contexte de l'établissement du budget des investissements.

INTRODUCTION

Capital budgeting is an uncertain and political process that various actors try to influence (Haka, 2006; Jones & Dugdale, 1994) because they have different preferences regarding capital investments (Jones & Lee, 1998). They mobilize financial numbers because these are powerful in shaping rather than just describing investment activities (Haka, 2006; Northcott, 1991). Moreover, owing to uncertainty about the future, much of the input for capital budgeting is “soft” information (Kadous et al., 2005; Rowe et al., 2012), which can be shifted in one direction or another because it is difficult to formally verify the information objectively (Bertomeu & Marinovic, 2016). Prior research focused on managers and other actors biasing cash flow forecasts (Brüggen & Luft, 2011, 2016; Turner & Guilding, 2012). However, it is relevant to also investigate management accountants, because they have a central position in cash flow creation for capital budgeting and considerable scope to shape these forecasts through their professional judgment.

When management accountants create their cash flow forecasts and interact with various parties to obtain information (Haka, 2006), they may get an understanding of those parties' preferences regarding capital investments and may decide to respond to those preferences. For example, management accountants often depend on good relationships with local managers to be able to have a role as a relevant and trusted business partner and to obtain information needed for their reporting role (Fauré & Rouleau, 2011). To establish or strengthen those relationships, management accountants may choose to support the capital investment proposals of local managers (Jones et al., 1993). Management accountants also depend on good relationships with central finance managers and higher-level managers in other business areas. They are expected to be loyal to centrally set policies, to relay local information to central managers, and to push top management's agenda. Consequently, management accountants may choose to support the capital investment proposals that are preferred by powerful senior central managers.

Furthermore, management accountants' identity as business partners creates self-expectations (Wolf et al., 2020). Seeing themselves as analysts who need to understand the business from a financial perspective (Ahrens & Chapman, 2000), they may believe that particular investment decisions would benefit the organization and, therefore, consider it acceptable to bias their cash flow forecast to promote those investment decisions. Prior work has shown that pro-organizational motives can drive such kind of behavior (Mahlendorf et al., 2018): accountants and CFOs with stronger organizational identification were more willing to not disclose negative company information if they believed that nondisclosure would benefit their organization, and this behavior was not associated with career self-interest. Overall, management accountants may have their own agendas in capital budgeting decisions.

Thus, when management accountants monetize various inputs to create expected cash flows for capital budgeting decisions, their professional judgment comprises not only pragmatic assumptions and quantification choices, which are part of the normal work of dealing with complexity and uncertainty (for “getting on with the job” and “getting the forecast done”) but also purposeful assumptions and choices, intended to let the cash flow forecast support a particular capital investment proposal. Our study focuses on the second kind and enhances the understanding of the backstage information-producing activities of management accountants (Fauré & Rouleau, 2011; Goretzki et al., 2018). Complementing prior studies on frontstage information-centered interactions between management accountants and other actors who are testing, debating, reworking, and negotiating information (Denis et al., 2006; Rowe et al., 2012), our study describes detailed practices of management accountants producing information “behind the scenes” away from other actors. We observe management accountants who have an a priori preference regarding a particular capital budgeting decision—in that sense, they have their own agenda—but we do not necessarily characterize their behavior as being at odds with the organization's interests. This study is essentially describing how the management accountants achieved a desired outcome of their cash flow forecast. Our research question can be summarized as follows:

Research Question.How do management accountants prepare the cash flow information they provide to other parties in order to influence capital budgeting decisions?

To address this question, we draw upon data from a longitudinal field study of management accountants creating cash flow forecasts for investment decisions regarding the technical development of new products. This provides a relevant context, because investment decisions in product development are particularly uncertain (Chen, 2017; Cools et al., 2017; Davila & Ditillo, 2017; Grabner, 2014; Grabner et al., 2018; Janka & Guenther, 2018).

Similar to Hall (2010) and Bruns and McKinnon (1993), who looked at micro-practices of managers using information, we examine in detail the practices of management accountants in their production of information. By working closely with management accountants involved in product development and the creation of cash flow forecasts, we could observe their expression of what kind of outcome their cash flow forecast should support and how they prepared, shaped, and modified their cash flow forecasts. This paper provides a detailed understanding of a particular management accounting activity conducted in practice. We believe it is worthwhile to describe actual accounting practices we know little about. Several other papers also provide such kinds of insights (Boulianne & Fortin, 2020; Calderón & Stratopoulos, 2020; Chung & McCracken, 2014; Gaffney et al., 2007; Mangen et al., 2020). Specifically, this study contributes a further understanding of accounting tactics in the context of capital budgeting. Tactics concern deliberate choices regarding when, how, and what to report (Goretzki et al., 2018; Puyou, 2018). We focus on the last category, so changing information content. We provide a conceptualization and empirical evidence of specific and detailed tactics, thereby complementing prior research, which has mainly focused on tactics in the context of accrual-based ex post performance information (Fauré & Rouleau, 2011; Goretzki & Messner, 2019; Lambert & Sponem, 2005; Maas & Matějka, 2009).

We propose that motivated reasoning theory may help to explain accountants' activities for preparing cash flow forecasts for capital budgeting decisions. Motivated reasoning theory (Boiney et al., 1997; Kunda, 1990) explains that people with directional preferences “search for, interpret, and process information in a biased manner and, consequently, are more likely to reach the preferred conclusion” (Kadous et al., 2003, p. 759). Prior accounting research has found extensive support for behavior in line with motivated reasoning theory (e.g., Anderson et al., 2017; Kadous et al., 2013). We offer that motivated reasoning also plays a role when accountants are creating cash flow forecasts for capital budgeting decisions. Their preferences would create a directional goal to prepare a cash flow forecast that supports their preferred alternative. We develop a framework for cash flow forecast interventions in capital budgeting. We conceptualize and empirically show how management accountants may intervene in various ways to influence cash flow forecasts, which can be differentiated in terms of their nature (qualitative or quantitative) and regarding their timing (initiating or counteracting).

RESEARCH METHOD

A Field Study of Cost Management in Product Development

The initial, broader focus of our research was cost management in product development. We wanted to know how technical approaches such as modular design and product platforms were employed for cost management purposes (Davila & Wouters, 2004), how accounting departments and accountants were involved, and how trade-offs were quantified. Although modularity is a much-researched topic (Campagnolo & Camuffo, 2009; Fixson, 2005, 2007; Jiao et al., 2007), little is known about its use for cost management in product development (Anderson & Dekker, 2009; Jørgensen & Messner, 2009, 2010; Labro, 2004).

The exploratory nature of the research motivated us to study a single case company. Field research through direct contact with the organizational participants (Merchant & Van der Stede, 2006) provides the opportunity to examine an accounting phenomenon in a broader context to understand why it exists, how it works, and what its effects are (Hopwood, 2007; Lillis, 2008; Malsch & Salterio, 2016). Surprising insights triggered a process of alternating between thinking about theoretically relevant questions and explanations and collecting further information in the field (Ahrens & Chapman, 2006).

We approached AutoCompany (anonymized), because of cost management's strategic importance during product development in the car industry (Anderson, 1995; Ansari et al., 2006; Berhausen & Thrane, 2018; Ibusuki & Kaminski, 2007) and because AutoCompany was known for a key project in the area of modularity and platforms for cost management. We conducted a field study where the researcher, instead of visiting for collecting data, was working on site in a management accounting department. This provided great access, because as natural part of his activities as a team member, the researcher talked with people, attended meetings, received documents, and accessed information systems. We considered this approach important owing to the need for an in-depth understanding of the complex product development processes and cost management methods that are used in car companies.1 We expected such an understanding to be very difficult to obtain by simply visiting the company.

Access and Data Collection

The junior researcher was basically fulltime onsite, working in a management accounting department of around 200 management accountants who focused solely on product development activities. The department's top manager reported directly to AutoCompany's CFO. The junior researcher's practical activities were very comparable to those of regular management accountants in the department. The senior researcher visited the company about every 6 months and met with this top manager and several other people in the management accounting department to discuss progress and the further direction of the research project, but remained basically offsite and coached the research process. The researchers' university received funding from AutoCompany to cover the costs of employing the junior researcher. Neither of the researchers received any personal financial compensation from the case company.

The field study lasted around 3 years. The first 10 months were for getting to know the organization and thinking about research ideas. Then, one part of the research became focused on further developing the organization's target-costing system (Stadtherr & Wouters, 2021). A few months later, the junior researcher got involved in the episodes described in this paper and started supporting senior management accountants at AutoCompany. After these episodes had taken place and data had been collected, the process of analyzing the data and writing started, while the junior researcher was still on site. More background information about this research project at AutoCompany is provided in Lukka and Wouters (2022).

The junior researcher was involved in the daily business of the management accounting department and worked with many different organizational members (see Table 1). This interaction provided numerous opportunities for data collection, such as by making notes on conversations and observations, asking specific questions, exchanging emails, receiving company presentations and other documents, discussing background information on presentations and other documents, and having access to information systems.2

| People or groups | Nature of the interaction | Kinds of data the researcher obtaineda |

|---|---|---|

| Close controlling colleagues (in the same team as the researcher, c. 10 people) | Participating in set departmental meetings Personal meetings, phone calls, and emailing in the process of working together with other management accountants |

Presentation slides and other kinds of company documents, background information (regarding specific data and analyses, or for a broader understanding), information in emails, notes on conversations, observations, and quotesb |

| Controlling colleagues (in other teams of the management accounting department, c. 50 people) | ||

| Senior management accountants of AutoCompany (two different people in both episodes) | ||

| Other controlling managers (management accountants at the same senior level as the focal senior management accountants, c. 10 people) | ||

| Top manager of the Management Accounting Department | Individual meetings on the research project and AutoCompany topics Emailing |

Company documents, information in emails, notes on conversations, observations, and quotes |

| Project Team Episode A, Segment 3c (representatives from various business areas at AutoCompany and other brands, 30–40 people) | Participation in weekly project team meetings for several months Personal meetings, phone calls, and emailing in the process of working together with separate team members |

Presentation slides, other kinds of company documents, cost estimates and other information for creating forecasts, information in emails, notes on conversations, observations, and impressions of what seemed to matter to team members (what they considered important or sensitive, wanted to achieve or avoid), quotes |

| Project Team Episode A, Segment 5 (same as team composition in Segment 3) | ||

| Project Team Episode Bd (representatives from various AutoCompany business areas, c. 20 people) | ||

| Management Committee (c. 20 people) | Participation in meetings (for example, by presenting cost estimates and cash flow forecasts) | Presentation slides and other kinds of company documents, minutes of meetings, oral information communicated with the presentation slides, notes on discussions and observations during the meeting, quotes |

| Top management committee (c. 10 people) | Attending meetings Getting formal and informal information about meetings from participants |

If the researcher attended the meeting, he could obtain the same kinds of data as mentioned above for the Management Committee. If he did not attend the meeting, he could obtain less data: presentation slides and other kinds of company documents, minutes of the meetings, notes of other participants' descriptions of the meeting |

| AutoCompany's executive board (c. 20 people) | Getting formal and informal information about the meeting from participants | Presentation slides and other kinds of company documents, minutes of the meetings, notes of other participants' descriptions of the meeting (The researcher could attend this meeting once and obtain the same kinds of data as mentioned above for the Management Committee.) |

- Notes: aThe researcher was also able to collect information by accessing information systems containing quantitative data and qualitative information, similarly to AutoCompany employees, such as on manufacturing costs, investments (technology development, product development, production assets), sales data and sales estimates, production plans, or strategic plans. bData collected by the researcher for research purposes is shown in italics, existing information for conducting AutoCompany tasks in regular font. cEpisode A of the field study describes the decision whether AutoCompany should adopt a common platform with VehicleFirm in Segment 3 and with CarEnterprise in Segment 5. Size segments is the European term for vehicle class. dEpisode B describes the decision whether AutoCompany should develop a single integrated architecture for conventional cars and BEVs, or each type of car should have its own dedicated architecture.

The findings are mainly based on observations and artifacts—that is, the cash flow forecasts. We consider this aspect to be a strength of the research method. With these artifacts, we can observe and analyze the tangible results of the management accountants' work and the choices they made. We achieved a detailed understanding of the technical background of the quantification process, such as the investment proposals that were on the table, the various kinds of data used for the quantification, the assumptions made and, perhaps most important, the potential for making other assumptions and quantification choices. Thus, we were able to collect a great deal of background information on how these artifacts were created. Furthermore, in working directly with the management accountants, the onsite researcher formed many impressions about what they considered important, what irritated them, and what they liked. These day-to-day interactions made very clear which outcomes the management accountants wanted to show with their cash flow forecasts, and which key quantification choices they deliberately made in that direction.

Data Analysis

Analyzing the information and guiding the research was a layered process. From the outset, each researcher kept his own research diary of reflections on what was happening in the organization, the research process, interesting topics, angles for the potential research contribution of the study, and emerging theoretical ideas. The onsite researcher's diary also served as a data collection medium for notes on events, conversations, meetings, and so on. He also made handwritten notes in hardcover notebooks during the workday.

Central in analyzing the data were the different perspectives of the two researchers. To mitigate the risk of researcher-induced bias, the offsite researcher had numerous discussions with the onsite researcher regarding the data and the analysis. In these conversations, which continued over a prolonged period after both episodes had occurred, the offsite researcher asked detailed questions about what happened in the case organization and requested more information, which triggered follow-up questions about the events. Besides analyzing what actually happened, the two researchers extensively discussed why things might have happened. Again, the offsite researcher's role was to critically probe and question the onsite researcher's explanations. The unit of analysis for these discussions comprised examples of the management accountants' specific choices for quantifying diverse inputs into cash flow forecasts. The researchers had regular discussions while the two episodes were happening. Afterwards, as the basis for further discussions, the onsite researcher wrote extensive chronological summaries of the two episodes, including hundreds of references to internal documents such as presentations, minutes of meetings, emails, and notes in the research diary and handwritten notebooks. The researchers' discussions formed the basis for writing the next versions of the summaries, and the researchers started writing, discussing, and rewriting several versions of a working paper. These efforts enabled discussions with other researchers, which also played an important role in the abductive process.3

THE FIELD STUDY

Company Background

AutoCompany was embarking on the development of a new modular architecture that would cover several vehicle types (sedans, station wagons, sports utility vehicles [SUVs]) in several size segments.4 A modular architecture comprised several platforms and modules. A platform entailed the lower part of the car body, where the engine, transmission, axles, and seats are connected, providing the common base of cars with similar dimensions. A module was a technical group of components that formed a functional and logical unit that was used by all cars within the same modular architecture, sometimes with adaptations. A key intended benefit of the modular strategy was to save on costs.

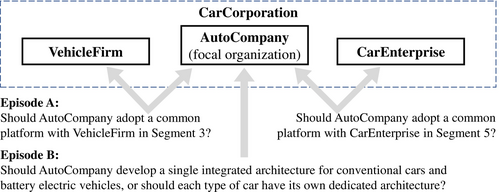

Developing the new modular architecture required many decisions on fundamental car design, which involved significant capital investments in product development and production assets. Management accountants produced forecasts on the cash flow consequences of decision alternatives. Other business areas, in particular engineering, production, procurement, and marketing and sales, provided inputs for the forecasts and offered qualitative arguments aside from the financial forecast. The forecasts were discussed at several hierarchical levels, sometimes more than once, and ultimately the formal decisions were made by the executive board. AutoCompany was part of a large corporation (CarCorporation) that included two other brands (VehicleFirm and CarEnterprise). Figure 1 and Table 2 provide an overview of the field study that comprises two episodes. These episodes concern two independent decisions on hand without including a comparison of Episodes A versus B.

| Episode A: Common platforms or each brand keeping its own separate platform? | Episode B: Integrated or split product architectures? | ||

|---|---|---|---|

| Segment 3 | Segment 5 | ||

| Decision focus | Should AutoCompany adopt a common platform with VehicleFirm in Segment 3? | Should AutoCompany adopt a common platform with CarEnterprise in Segment 5? | Should AutoCompany develop a single integrated architecture for conventional cars and BEVs, or should each type of car have its own dedicated architecture? |

| Accountant's preference | Pick your battles and don't try to migrate to a common platform in Segment 3 | Change to a common platform, which did not have to be AutoCompany's own platform | Ensure that the disadvantages of the integrated architecture and the advantages of the split architecture received much more attention |

| Other actors' preferences | AutoCompany and VehicleFirm representatives from other business areas did not want to forsake their own platform | AutoCompany and CarEnterprise representatives from other business areas did not want to forsake their own platform | Representatives from other business areas had a clear preference for an integrated architecture |

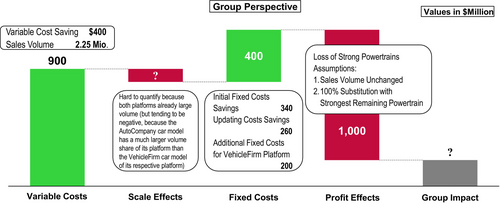

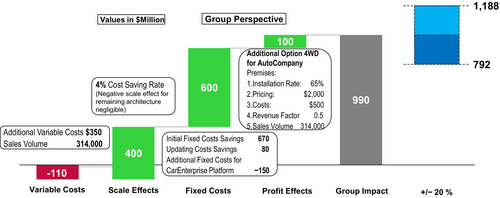

| Final forecast | Figure 2: cost savings and contribution margin effects for CarCorporation if AutoCompany were to cancel its own platform and adopt VehicleFirm's platform as the common platform | Figures 3 and 4: cost savings and contribution margin effects for CarCorporation if a brand were to cancel its own platform and adopt the other brand's platform as the common platform | Figure 5: comparison of four scenarios in terms of contribution margins, investments in product development and production facilities, and resulting net earnings |

| Formal decision | Maintain separate platforms in Segment 3 | Adopt a common platform in Segment 5, to be developed under the responsibility of CarEnterprise | Develop split architectures in all size segments |

- Notes: AutoCompany is the organization in which the field study took place. VehicleFirm and CarEnterprise are two other brands within the same CarCorporation. These are disguised names. Size segment is the European term for vehicle classes.

The strategic, product-related decisions for Episodes A and B belonged to particular areas within the large management accounting department, which the senior management accountants were leading, so they were charged with the assignments to make the cash flow forecasts. Representatives of the various business areas in the project teams contributed information and expressed their preferences regarding the capital investment decisions, but the management accountants would express the various arguments in Euro. That was seen as their job within AutoCompany and the management accountants' mandate from top management. Other business areas could not ignore the management accountants or create their own financial evaluation. For these strategic issues, the management accountants had many degrees of freedom for how to create the cash flow forecast. This was not the same as for routine questions that were analyzed very frequently and for which templates existed, such as for small product design changes. The senior management accountants' position was at quite a high level in the management hierarchy.

Episode A: Common Platforms?

Decision Focus and the Accountant's Preference

Within CarCorporation, brands offering car models in the same size segment sometimes shared a common platform. One brand would be responsible for developing a particular platform, have a large product development budget and many jobs in the product development department, and take the lead in product development decisions, although it would also have to consider the requirements of the other brands. Episode A, which lasted for about 4 months, was about potentially moving to common platforms. AutoCompany and VehicleFirm both offered car models in Segment 3, but they did not share a common platform. The decision was whether AutoCompany should adopt VehicleFirm's platform or both brands continue with their individual platforms.5 In fact, the possibility of a common platform for these two brands in Segment 3 had a history in CarCorporation and had already been investigated and rejected several times. During the first meeting with some cost experts at AutoCompany, one person said, “Okay, so we're doing it again. This discussion comes around every few years.” Similarly, AutoCompany and CarEnterprise both offered car models in Segment 5 without having a common platform. Should AutoCompany adopt CarEnterprise's platform, CarEnterprise adopt AutoCompany's platform, or both brands continue with their individual platforms?

Two project teams (one for each segment) comprised representatives from several business areas of the brands involved: accounting, development, production, marketing and sales, purchasing, and quality management. The project team leader reported to a top manager directly under AutoCompany's CEO. The senior management accountant was a member of both project teams and directed the cash flow forecast process; the researcher supported him by conducting analyses, providing ideas, and participating in most of the project team meetings. The results were presented and discussed in several rounds and at several management levels, including AutoCompany's executive board.

Later, when resistance from several other project team members mounted, he said to colleagues in management accounting: “If we succeed in putting both cars on one platform, we'll have achieved something really good for the company.”We have to somehow achieve that we get all these … vehicles on one platform, irrespective of whether it's then going to be developed by [AutoCompany] or [CarEnterprise]. It makes absolutely no sense to develop two platforms for this segment. There's simply too much savings potential here. We simply cannot ignore it anymore.

[The senior management accountant and other finance] colleagues agreed (almost with annoyance) at how one-sided the other departments always argue.

Such resistance to migrate to CarEnterprise's platform was nicely illustrated by a manager stating, “If we go on that platform, then we are just sheet metal benders like [two other brands within CarCorporation].”[The senior management accountant] is extremely annoyed that the business areas are putting forward arguments that are not valid—from our point of view, of course—in order to avoid having to give up any competencies.

The senior management accountant also knew about the concerns expressed by CarCorporation's CEO regarding development costs and lack of synergies in CarCorporation. The onsite researcher made notes about an event that was broadly discussed by the senior management accountant and other senior people in the management accounting area:“The relative development costs are significantly above those of the competition. [Competitor] for example, makes 30–40 percent more revenues than [AutoCompany], whereby the absolute R&D costs are about the same.”

The onsite researcher's notes describe how this same event was also brought up by the project leader during a management committee meeting on the same day:Last Friday, there was a managers' meeting in [headquarters location] that [CarCorporation's CEO] had personally opened. His talk focused on the modular architectures … and the sharing of these in [CarCorporation]. [The CEO] pointed out how sharply the development expenses for the modular architectures had increased over time.

More broadly, the senior management accountant was not only mindful of the rise of development costs, but he also believed it was his role to provide a professional opinion about which capital budgeting decisions should be made from a financial perspective. He should be the one to consider costs, profitability, return on investment and such financial criteria. Representatives from other business areas put more weight on nonfinancial criteria for capital budgeting decisions, such as an exciting technology, cool design, job preservation in engineering and manufacturing, sales volume, or brand image, but his self-image was being the one who should consider the financial implications and trade-offs (Ahrens & Chapman, 2000; Lambert & Pezet, 2011; Wolf et al., 2020). This self-image was probably also fueled by some frustration that the importance of finance was not self-evident at AutoCompany—therefore at least he and the finance colleagues should care about it. For example, senior people in the management accounting department told the onsite researcher about a meeting for a large number of managers from all business areas during which the company's CFO had brought up problems with AutoCompany's financial results. Absolute profits had been quite stable for several years, but last year's profit was much more reliant on favorable exchange rate influences and decreases in provisions. Also, sales had constantly grown, so relative profit had deteriorated. Nevertheless, the CEO then downplayed the CFO's message. The onsite researcher's notes read:The [CEO's] appeal must have been very passionate that everyone should finally take off their “brand hats” and put on the “corporate hat.” In other words: pull together. [The project team leader] once again repeated the clear task of reducing development costs and investments. This should also be achieved by consolidating and reducing the complexity of the modular world.

Note, though, that the explanation for his preference regarding this particular capital investment decision (namely, moving to a common platform for the two brands in Segment 5) requires more than only a focus on finance. In principle, the senior management accountant could still conduct a rigorous cash flow forecast without any a priori preferences and argue on the basis of just that. As described by Lambert & Pezet (2011, p. 20), “Whenever computation shows that an investment decision would delay or jeopardize the fulfillment of their (cash) objectives, the management accountants are not slow to wield their veto.” It was not only his conviction about the importance of finance for capital budgeting decisions, but we suggest there was also an economic intuition that made him believe that particular actions were financially more sensible than others. Given the enormous development costs and low sales volumes in Segment 5, he believed it was financially sensible to combine several car models in the Segment 5 on one platform. He drew on various kinds of information collected for the decision at hand, information for other more or less similar decisions, general contextual information, and his broader professional and personal experience. It became relevant to create cash flow forecasts that played an influencing role in the decision-making process, instead of just reporting projected numbers (Ahrens & Chapman, 2000).The problem is that [the CEO's] positive portrayal—along the lines of “We've done a great job again, and now we're continuing to go full throttle”—means that this message is not getting through to other business areas outside finance. The engineers are probably thinking to themselves, “Another [X] billion profit—everything's just fine.”

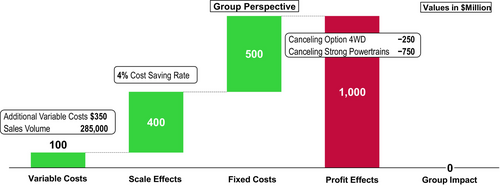

Final Forecast and Formal Decision for Segment 3

Management accountants determined that by migrating to the platform of VehicleFirm from its current unique platform, AutoCompany would save $400 variable cost per unit. This translates to a total savings of $900 million based on production volume forecast of 2.25 million units. Combined with additional savings in fixed costs of $400 million, a total cost savings of $1,300 million was forecasted.7 However, these were offset by a loss of $1,000 million in contribution margin that would be foregone if AutoCompany would offer its cars in Segment 3 on a common platform with VehicleFirm. Figure 2 shows these forecasted cash flow numbers.8

Notes: This figure shows the forecasted cash flow consequences for the entire corporation if AutoCompany would cancel its own platform and adopt VehicleFirm's as the common platform in Segment 3. These consequences comprise lower variable costs, unquantified scale effects, lower investments (called Fixed Costs) and loss of contribution margin (called Profit Effects). In total, the Group Impact is presented with a question mark: not clear, but possibly slightly positive.

Figure 2 provides some explanations. The loss in contribution margin (called Profit Effects) was caused by a lower contribution margin of vehicles that would be sold with a substituted, less powerful engine on VehicleFirm's platform. This effect is separate from the $400 savings in material cost per unit, which was mentioned above and will be discussed in more detail later in the paper. Figure 2 mentions several components of the savings in fixed cost. If AutoCompany would not require its own platform, large initial investments for product development and production assets ($340 million) and for a product upgrade ($260 million) could be avoided. Yet higher investments were needed for VehicleFirm's platform if it should also support AutoCompany's vehicle models ($200 million), resulting in the above-mentioned $400 million savings in fixed costs. Figure 2 also provides more information on scale effects: AutoCompany would produce and purchase smaller volumes of particular parts after migrating to VehicleFirm's platform, which could lead to cost increases; volumes would increase somewhat at VehicleFirm, which could lead to cost savings. The scale effects in Figure 2 are indicated with a question mark, suggesting a small, negative combined impact that was not quantified. The total effect (called Group Impact) is near nil and Figure 2 includes a question mark for this, suggesting that it might be slightly positive, but altogether not clear and perhaps not worthwhile.

The senior management accountant who presented the calculation to the top management committee had the impression that people were relieved that the cash flow forecast suggested no change to the status quo, which was also what the other members of the project team had recommended. As the project leader stated, “Finally, there is a reason why we do things the way we do them.” CarCorporation's executive board formally decided to maintain separate platforms in Segment 3.

Final Forecast and Formal Decision for Segment 5

Alternatively, CarEnterprise could migrate to AutoCompany's platform. This impact was estimated to be neither negative nor particularly attractive. Savings in variable costs ($100 million), scale effects ($400 million), and investments ($500 million) would all be wiped out by a significant loss of contribution margin amounting to $1,000 million. See Figure 4.If somebody's going to grumble about one small element of our evaluation, we can prevent any distraction from the whole picture by saying we know our assumptions are rough, but even if we're 20 percent off there's still considerable money to be saved.

Notes: This figure shows the forecasted cash flow consequences for the entire corporation if AutoCompany would cancel its own platform and adopt CarEnterprise's as the common platform in Segment 5. These consequences comprise somewhat higher variable costs, favorable scale effects, lower investments (Fixed Costs) and additional contribution margin (Profit Effects). In total, the Group Impact is presented as very positive and robust because changing the financial benefits by 20% would not affect the conclusion.

Notes: This figure shows the forecasted cash flow consequences for the entire corporation if CarEnterprise were to cancel its own platform and adopt AutoCompany's as the common platform in Segment 5. These consequences comprise somewhat lower variable costs, favorable scale effects, lower investments (Fixed Costs) but extremely large loss of contribution margin (Profit Effects). In total, the Group Impact is presented as zero.

CarEnterprise's senior management accountant was frustrated with this outcome: “From my perspective, this is a clear failure of our assignment.”[The senior management accountant] remained steadfast, which, in the end, results in the other business areas attaching a green check mark to many scenarios, but then a red cross appears in the finance column. On the other hand, the scenarios where we put a green check often come with a red cross from the other business areas.

After the project team results were presented, neither the management committee nor the top management committee made a formal decision. In the months that followed, the CEO of AutoCompany mentioned that he recognized the necessity of a common platform in Segment 5, and later the CEO of CarCorporation stated in a meeting that future Segment 5 vehicles should be based on a common platform. Subsequently it was officially decided that the common platform would be developed as the responsibility of CarEnterprise.

Episode B: An Integrated or Split Architecture for Battery Electric Vehicles?

Decision Focus and the Accountant's Preference

This episode concerned a decision whether to develop a single integrated architecture for future battery electric vehicles (BEVs) and conventional cars with an internal combustion engine (ICE), or to develop a dedicated architecture for each type of car. This episode lasted for around 13 months. The project team composition and how this reported to management was comparable to the first episode, but a different senior management accountant of AutoCompany was involved. Again, the researcher supported the senior management accountant and was informally part of the project team.

The project team leader and representatives from engineering, marketing, and production expressed a clear preference for an integrated architecture. Their main reason was flexibility: AutoCompany would be able to manufacture both conventional cars and BEVs on the same production lines and could react easily to changes in the sales mix of conventional cars and BEVs. The team members claimed that two separate, split architectures would mean separate production facilities for each type of car, requiring much larger investments, and that product development investments to develop separate architectures would also be much higher. However, the team members acknowledged that the integrated architecture would result in some disadvantages for conventional cars, such as a higher weight. None of these qualitative arguments was quantified, but the top management committee's decision at that time was that “the option of the separate architectures was not expedient.”

The management accountants started to quantify some of the arguments, especially the difference in investments for product development and production facilities, which was supposed to be an advantage of the integrated architecture, and the difference in variable costs, which they expected to be the main financial disadvantage of this architecture.[several senior people in the management accounting department], to mention just a few names, are taking a very different position here. The pro-arguments make perfect sense to us. However, it is still not clear what the technical implementation of such a multi-traction approach will be and what disadvantages and additional costs for the vehicles will ultimately be the result.

Similar circumstances as in Episode A drove the preference of the senior management accountant. He was mindful of the concern about the starkly rising development costs, he saw it as his role to focus on financial implications and trade-offs, and he had an economic intuition that preceded the detailed calculation of the cash flow forecast. Important for his intuition in Episode B was that he had lost some of his trust in the engineers. Given delays and cost overruns in many other development projects, he was not sure how they would fare with the extra complicated development of an integrated architecture. Also, he was aware that CarEnterprise had already decided to not develop an integrated architecture and he considered that to be an important signal, because they usually made smart decisions. His intuition was that the integrated design was not only going to be expensive regarding material costs, which he wanted to be quantified, but also costly and likely delayed during development. Too ambitious, too much engineering-driven—as another management accountant said during Episode B: “They want to show that they are the best engineers in the world, so they can also invent such an all-in-one solution that is suitable for every purpose.”9

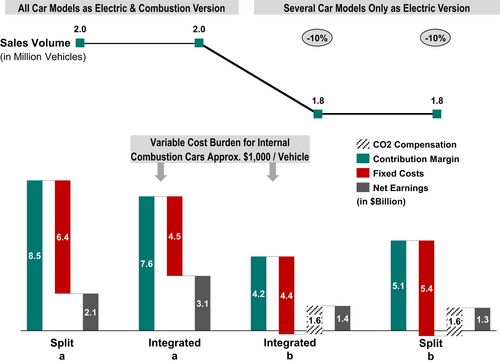

Final Forecast and Formal Decision

After some 7 months, a cash flow forecast was presented to the top management committee and the executive board, concerning cars in one particular size segment. The cash flow forecast compared two options (Figure 5): AutoCompany would develop a single integrated architecture for conventional cars and BEVs, or AutoCompany would develop a dedicated architecture for each type of car (called a “split” architecture). This comparison was made for two scenarios: (a) all models would be offered as conventional cars and BEVs; (b) not all models would be offered both ways, resulting in a different product portfolio, a different sales mix and a smaller total sales volume (1.8 vs. 2.0 million vehicles).

Notes: This figure pertains to Episode B and compares two options: a single architecture for conventional cars with an internal combustion engine (ICE) and battery electric vehicles (BEVs) (“Integrated”), or separate dedicated architectures for each type of car (“Split”). This comparison is made for two scenarios: (a) all models would be offered as ICE cars and BEVs and (b) not all models would be offered both ways, resulting in a different sales mix and a lower total sales volume. It is mentioned that the integrated architecture causes higher variable costs of ICE cars of around $1,000 per vehicle.

The forecast included higher fixed costs for the split architecture (red bars, $6.4 vs. $4.5 billion and $5.4 vs. $ 4.4 billion) because more development efforts and larger investments in production facilities would be needed. The forecast also included fees that car companies would pay based on fleet emissions (CO2 compensation), which were favorable for scenario (b) (shaded bars, $1.6 billion vs. $0) because it included a lower number of conventional cars.

In the months that followed, similar analyses for related size segments were conducted, whereby the result of approximately $1,000 additional variable costs per unit remained quite stable. At the end, AutoCompany's executive board decided on separate architectures for BEVs and conventional cars in all segments.there is a total burden of [$1,000] per unit for [conventional cars] in the [integrated] approach. This is evaluated as very critical by the executive board, especially against the background of the tense profit situation in the … segment. Against this background, the examination of various alternative split-scenarios that are using existing/planned platforms … is demanded.

ANALYSIS AND DISCUSSION

A Framework for Cash Flow Forecast Interventions in Capital Budgeting

We use the lens of motivated reasoning theory to analyze how preferences may lead to biasing cash flow forecasts. People's reasoning is sometimes driven not by accuracy goals but motivational goals. Motivated reasoning concerns the individual's cognitive processes for intentionally pursuing the goal of reaching a desired conclusion (Boiney et al., 1997; Kunda, 1990). If the individual favors a particular conclusion from the outset, that directional preference biases the judgment process. People selectively retrieve information in their own memory and creatively combine knowledge. They are more skeptical of the quality of information provided to them when it is inconsistent with their preferences. They process and present information to reach the preferred conclusion. Prior accounting research has found extensive support for behavior in line with motivated reasoning theory, including on the part of auditors and tax professionals (Anderson et al., 2017; Blay, 2005; Bradshaw et al., 2016; Kadous et al., 2003, 2008, 2013; Kang et al., 2020; Kaplan et al., 2018; Koch & Salterio, 2017; Luft et al., 2016).

Motivated reasoning requires normative ambiguity (Kadous et al., 2003, 2008): lacking clear guidance, for example from objective benchmarks, hard evidence, or strict rules, it becomes unclear which conclusions should or should not be reached. Furthermore, people want to appear rational and try to construct a plausible justification for the desired conclusion (Kunda, 1990). Biasing in motivated reasoning is limited by “reasonableness constraints,” and “while motivated decision makers will bias their judgments to favor the desired outcome, they will try to avoid biasing them more than necessary” (Boiney et al., 1997, p. 5).

Uncertainty around the future impact of capital investments creates normative ambiguity. Yet, we propose that the management accountant's directional preferences and the normative ambiguity surrounding the capital budgeting process are not sufficient for motivated reasoning to occur. Accountants need to intervene and make use of the flexibility that this offers to purposefully influence the cash flow forecast toward their directional preferences. We propose that for motivated reasoning to actually occur, the management accountant undertakes specific interventions to construct cash flow forecasts that are directed toward preferred conclusions.

It is intriguing how such interventions would “work” in the context of creating cash flow forecasts for capital budgeting. On the one hand, management accountants may have extensive opportunities to purposefully influence and justify their cash flow forecasts, not only due to uncertainty, but also because they have substantial flexibility in how to construct internal, undisclosed, cash flow forecasts that are not bound by financial reporting standards (Goretzki et al., 2018). Moreover, forecast biasing is more likely if it is more difficult to detect (Armstrong et al., 2007). Since these cash flow forecasts concern a separate decision, instead of entity-wide results, it is difficult to later isolate the actual impact of the specific decision, verify the forecast, and pinpoint any biases. Additionally, product development decisions likely impact the results with a long delay. On the other hand, management accountants need to rely on significant input from others in capital budgeting (Rowe et al., 2012), which reduces their control and limits opportunities for influencing the cash flow forecast. Also, managers may be able to critically review the forecasts that support the management accountants' recommendations (Rowe et al., 2012), which reduces opportunities for forecast biasing that goes unnoticed. Furthermore, management accountants need to maintain the image of a competent and truthful professional (Goretzki et al., 2018).

We propose a conceptual framework of particular kinds of interventions as the links between normative ambiguity and the concrete occurrence of motivated reasoning in the context of capital budgeting. Specifically, we propose that management accountant's interventions can be distinguished along two dimensions: the timing and nature of these interventions. Regarding timing, the management accountant could either take the initiative to make choices that influence the cash flow forecast in a preferred direction, or the management accountant could react to the actions other people are taking in the construction of the cash flow forecast. Regarding nature, the management accountant's actions or reactions could be of a quantitative or qualitative sort. These different kinds of interventions are shown in Table 3.

| Nature of the intervention (how) | |||

|---|---|---|---|

| Quantitative | Qualitative | ||

| Timing of the intervention (when) | Management accountant initiating | Assumptions about sales substitution effects (engines) (Example 1) Assumptions about feature sales (four-wheel drive) (Example 2) Quantification (or not) of scale effects (Example 3) |

Classification of axles (Example 4) Classification of transmissions (Example 5) Quantifying the cost impact of technical differences (Example 6) |

| Management accountant counteracting | Rejecting investment estimates (Example 7) |

Changing the comparison of sales estimates (Example 8) | |

- Notes: Examples 1–5 concern Episode A. The assumptions in Examples 1 through 5 consistently favorably presented not introducing a common platform in Segment 3, but to adopt the platform of CarEnterprise as the common platform in Segment 5. Examples 6–8 concern Episode B. The assumptions in Examples 6 through 8 consistently made the split architecture look less unfavorable relative to the integrated architecture.

Crucially, this framework concerns purposeful interventions by management accountants. Inherent to the uncertain nature of capital investments, many assumptions and quantification choices simply have to be made in pragmatic ways, because “you have to assume something” and “this is what accountants do” to “get on with the job” when things are complex and uncertain. For example, the management accountants made the analyses in Episode A on the basis of current car models, simulating the cost impact if these were to be based on common platforms. The framework addresses intentional choices management accountants make on the basis of how these affect the outcome of the cash flow forecast. Such intentional choices utilize a gray zone of uncertainty—a bandwidth of reasonable ways to construct a forecast for an unknown future. In this gray zone, ambiguity prevails, and one way of constructing the forecast is as believable—and uncertain—as another. Management accountants make use of this opacity by making deliberate choices to create a cash flow forecast that supports a particular capital investment proposal.

We deductively developed this framework on the basis of the field study. Our case analysis focuses on eight examples of quantification choices the management accountants made, which are also shown in Table 3. For each example, the analysis essentially rests on three arguments: that the specific quantification choice the senior management accountant made influenced the cash flow forecast in the direction that supported what he wanted; that the quantification choice could easily have been made differently; and that this influence of a quantification choice on the cash flow forecast was no coincidence but was purposely created. Regarding this third argument, we cannot provide quotes that explicitly state the management accountant's intention, but infer this from impressions and subtle clues in the process of working together. We present not just one example, but a set of examples with a consistent pattern.

Initiating a Quantitative Intervention

Initiating a quantitative intervention refers here to the situation that the accountant claims particular quantitative choices for the construction of the cash flow forecast, such as taking the lead in stating particular numerical values as inputs to the forecast calculation. These number inputs do not change the calculation steps (the mathematical operations) but impact the result of these steps. The accountant takes the initiative and claims numerical values in order to make the results more closely support their preference.

We analyze three examples of the management accountant initiating quantitative interventions in the field study, which concern claiming particular numerical assumptions for the quantification of substitution effects (Example 1), feature sales (Example 2), and scale effects (Example 3). These examples concern Episode A, in which the senior management accountant was willing to accept the status quo of AutoCompany's own platform in Segment 3, but strongly preferred switching to a common platform in Segment 5. Anticipating that CarEnterprise's senior management accountant definitely would not accept giving up their platform, he was willing to accept that a common platform would be CarEnterprise's platform. The cash flow forecasts should support these preferences—how was this achieved? Of course, these examples cover only a small part of the management accountants' overall effort. Throughout the analysis, they made many quantification choices that were pragmatic ways for modeling a complex and uncertain situation.

Example 1: Assumptions About Sales Substitution Effects

The cash flow forecasts in Figures 2 and 4 include contribution margin losses that were based on subtly different, strangely inconsistent, but deliberately made assumptions for both segments, which significantly influenced the outcomes. In Segment 3, AutoCompany offered a strong, large powertrain that it could no longer sell if VehicleFirm's platform were to become the common platform. The powertrain would face geometric limitations fundamental to the modular architecture, and even significant additional development investments would not deliver a solution. Although how important that powertrain would be in the future was unclear, AutoCompany's senior management accountant decided to evaluate the issue. He gathered pricing, cost, and installation rate data on the various powertrains for the current product generations, assumed that all customers who had purchased the strongest powertrain would buy the next strongest (less profitable) instead (so a 100% substitution rate) and estimated the lost contribution margin to be $1,000 million (Figure 2).

A similar powertrain issue was in play in Segment 5. CarEnterprise would no longer be able to offer a strong powertrain if it were to adopt AutoCompany's platform. This time, however, it was assumed that substitution would be significantly less than 100%, meaning that many CarEnterprise customers would not purchase a vehicle at all if this powertrain was not available. CarEnterprise's senior management accountant had inserted the bar carrying a contribution margin loss of $750 million into the PowerPoint slide (Canceling strong powertrains, Figure 4) and simply mentioned in an accompanying email to AutoCompany's senior management accountant that “without offering this [powertrain], we expect a significant loss of sales volume.” No further explanation was provided. AutoCompany's senior management accountant readily agreed to this adjustment of the forecast, writing, “Thank you for the input, we will include the information accordingly. It goes rather exactly to (almost) zero.” When he later presented Figure 4 to the management committee, he mentioned only briefly the different assumptions on substitution.

While both forecasts might separately seem reasonable, the combination is significant. The senior management accountant included much stronger assumptions about sales losses in Segment 5, namely loss of sales volume. As a result, although the absolute number of contribution margin loss was lower than in Segment 3, it was much more relative to the total contribution margin, because sales in Segment 5 were significantly lower than in Segment 3. However, despite the significant impact of this assumption, the lack of detail and support, and the inconsistency with Segment 3, details were neither provided by CarEnterprise's senior management accountant nor required by AutoCompany's senior management accountant. Moreover, this large contribution margin loss would be avoidable. The senior management accountant of AutoCompany could reasonably have assumed the development of a platform in Segment 5 that would technically still enable including the large powertrain. The significant extra product development investments would still be much lower than the very large contribution margin loss. Similar assumptions had been made about other technical features, but not this time, as the assumption about substitution effects favored the outcome of CarEnterprise not adopting AutoCompany's platform.

Example 2: Assumptions About Feature Sales (Four-Wheel Drive)

Within Segment 5, the profit effects shown in Figures 3 and 4 also rested on subtly different assumptions regarding future sales of the four-wheel drive feature in this segment. Currently, the platform of CarEnterprise enabled offering this feature as an option, which the vast majority of customers ordered and generated huge additional contribution margins, but AutoCompany's platform included this as a standard feature. If CarEnterprise provided the common platform, the senior management accountant of AutoCompany saw the chance for AutoCompany to offer this feature as a paid option. The senior management accountant estimated a positive impact of $100 million, as shown in Figure 3, on the basis of current prices, costs, and adoption rates from CarEnterprise. If AutoCompany provided the common platform, CarEnterprise would include the feature as standard on all cars and would assume a contribution margin loss of $250 million, shown in Figure 4, but no further explanation or details were provided. These assumptions again supported the conclusion that it would be favorable if AutoCompany adopted CarEnterprise's platform and unfavorable the other way around.

While the business case for AutoCompany and the estimation of revenue losses for CarEnterprise might be plausible on their own, the combination is remarkable. A reasonable assumption could have been that a technical solution could be developed that enabled CarEnterprise to continue offering the feature in the same way as a paid option, even with AutoCompany's platform as the common platform. However, this alternative assumption would have made the outcomes less favorable to the senior management accountant's preferences.

Example 3: Quantification (Or Not) of Scale Effects

A quantitative intervention can also be initiated by claiming that particular numerical inputs are too uncertain and should be ignored, thereby implicitly assuming particular numbers to be zero. In this approach, instead of not considering an effect (because it would be too uncertain), a numerical input (of zero) is put forward, which affects the outcome in a particular direction—as demonstrated next. Figure 2 (for Segment 3) indicates that scale effects have a small negative impact, which was not quantified and depicted with a question mark. In contrast, Figures 3 and 4 (for Segment 5) show an explicit financial impact of scale effects of $400 million. The crux of this example is this difference in quantification choices for both segments. The $400 million was a significant part of the total impact in Figure 3, which favored the conclusion that AutoCompany should adopt CarEnterprise's platform in Segment 5. Quantification of scale effects was needed here. The senior management accountant based this number on a 1-year-old analysis that was performed for another purpose but also quantified scale effects. It showed a cost impact of between 3% and 12% on material costs, estimates that had previously been accepted by CarCorporation's top management. The senior management accountant applied the percentages to the platforms' current material costs, resulting in a scale effect of $400 million in Figure 3. In Figure 4, this undesirably favored the conclusion that CarEnterprise should adopt AutoCompany's platform, which was not what CarEnterprise's senior management accountant wanted, but this effect could be sufficiently countered in total.

Even though attempts could have been made to also quantify scale effects in Segment 3—and an explicit negative number would have influenced the result toward the desired conclusion—these were not undertaken. The senior management accountant anticipated that such a quantification attempt might not be accepted by representatives from other business areas and might create too much discussion. Quantification would be more difficult for Segment 3 and, since representatives from other business areas would see scale effects as quite a tangible and “hard” effect, the senior management accountant would have to provide solid evidence. Complicating matters further, they would also have needed much additional information from VehicleFirm, which was difficult to obtain. So, an explicit number on scale effects in Segment 3 would be difficult to construct and justify and, importantly, the senior management accountant did not require such an explicit number. There were better ways to counter, as Examples 1 and 2 showed.

Initiating a Qualitative Intervention

Initiating a qualitative intervention refers here to the situation that the accountant states specific, detailed methodological choices on how the forecast is constructed. Using an overall approach for constructing a cash flow forecast, which is known and accepted in an organization, the accountant takes the initiative to make specific choices on how to implement the approach. Such choices may concern qualitative, technical details for putting the forecast together, or pertain to the scope of the cash flow forecast (what it includes and excludes). These choices increase the likelihood of a result that supports the management accountant's preferred conclusion. We discuss three examples in more detail: Continuing with Episode A, Example 4 concerns the classification of the costs of axles, as either a relevant (in Segment 3) or irrelevant (in Segment 5) cost difference, and Example 5 concerns the classification of the transmission in Segment 5, initially as a relevant but subsequently as an irrelevant cost difference. Switching to Episode B, Example 6 involves the inclusion of the cost impact of particular technical differences between the integrated and split architecture.

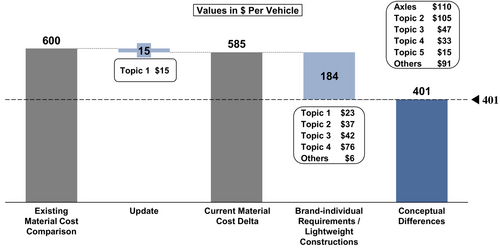

Example 4: Classification of Axles

To describe this example, we first need to take a step back and clarify where the numbers of $400 and $350 variable cost per unit (basically material costs) in Figures 2-4 came from. This is shown in Figures 6 and 7. Because the considerable uncertainty about future cars precluded a meaningful cost comparison, the senior management accountant adopted a pragmatic approach and estimated the material cost impact as if the current car models had been based on one platform instead of two, even though the decision at hand concerned future car models. The analysis started with already available material cost comparisons, which were made regularly at CarCorporation for other purposes and did not include any effects of having a common platform. This indicated that VehicleFirm's material costs were approximately $600 per vehicle lower than AutoCompany's costs (the first bar in Figure 6). The senior management accountant checked and updated this cost comparison, which required only a small adjustment to $585 per vehicle (second and third bar). Crucially, AutoCompany would not entirely save these material costs when migrating to VehicleFirm's platform, because AutoCompany would sometimes fit different, more expensive parts than VehicleFirm if the platform technically allowed such brand-specific choices (e.g., better seats). This reduced the relevant material cost difference to $401 per vehicle (fifth bar), so the cost saved after accounting for the material costs that remain unchanged irrespective of whether a common platform is adopted or not (fourth bar).

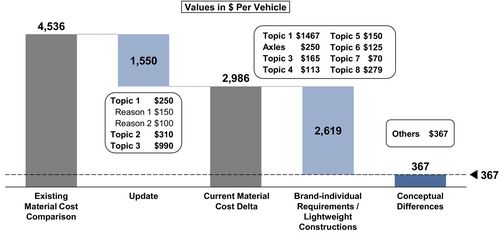

Notes: The per-unit material cost difference (Current Material Cost Delta) is split into two parts: some costs are considered irrelevant for the decision (Brand-Individual Requirements) and only the final bar is considered a relevant cost difference (Conceptual Differences). A rounded cost difference of $400 per unit is used in Figure 2.

In Segment 5, a 2-year-old comparison of the material cost per unit was updated, reducing the cost difference by around one-third, from $4,536 to $2,986 per unit (Figure 7, first, second, and third bars). This update was only done to account for the major technical changes since the original cost analysis had been conducted, such as a change of the engine in one of the cars, changes in manufacturing tasks conducted in-house versus by suppliers, and smaller changes of parts and parts costs. This standard cost comparison did not include any effects of having a common platform. Therefore, the next step was to identify variable costs that would change by migrating to a common platform. This was limited, because it was basically assumed that a common platform would still offer much flexibility to the brands for using different parts. If AutoCompany migrated to CarEnterprise's more expensive platform, it could still fit many of its own parts that were less expensive. If CarEnterprise migrated to AutoCompany's platform, it would still fit many of its own higher-performance, more expensive parts. The relevant material cost difference was forecasted at $367 per vehicle (fifth bar), rounded to $350 per vehicle.

Now we can analyze the purposeful classification of axles in the two segments. Figure 6 includes axles as a relevant cost difference in Segment 3. AutoCompany used more expensive axles than VehicleFirm in Segment 3. The cost experts in the management accounting department classified the axles as a technical difference inherent to the platform, making the cost difference relevant to the decision (part of the “Conceptual Differences” in Figure 6). When adopting VehicleFirm's platform, AutoCompany would have to use other axles and thereby save material costs. The senior management accountant did not question this classification. He suggested it was not within his competence, nor was it his job, to define which kind of axle AutoCompany would need: “Who am I that I could answer all these questions today? As controllers, we cannot.” In Segment 5, however, the senior management accountant took a very different position and pushed back in similar discussions. He argued that he found the classification unconvincing and he could not see why axles would be fundamental to the current platforms: “I wouldn't know why [CarEnterprise] couldn't use our axles tomorrow.” He assumed that the choice of axles was not restricted by the platform, which made axles an irrelevant cost difference. So, this time, Figure 7 shows axles as irrelevant cost differences that did not affect the cost comparison (part of the “Brand-individual Requirements”). As a result, the relevant cost difference became smaller in Segment 5, favoring the adoption of a common platform.

Example 5: Classification of Transmissions

In the weeks that followed, the senior management accountant looked into technical issues and cost differences in more detail. CarEnterprise's expensive transmission was one reason for the initially large cost differences. Further discussions led to the assumption that the future platform would be able to flexibly accommodate several kinds of transmission, and AutoCompany would not be forced to adopt the expensive transmission if it were to have a common platform with CarEnterprise. Conversely, CarEnterprise would not achieve cost savings due to a common platform with AutoCompany. As a result, the cost difference for the transmissions became categorized as irrelevant, thereby significantly reducing the relevant difference in material cost per unit. For several other parts, these assumptions were also changed and ultimately, the senior management accountant reduced the relevant cost difference to $367 (as shown in Figure 7). AutoCompany's adoption of CarEnterprise's platform became a more attractive option, and CarEnterprise's adoption of AutoCompany's platform became a less attractive option.“I disagree with the diagram ‘Material cost delta from [AutoCompany's platform] to [CarEnterprise's platform].’ I cannot confirm the platform-determined [material cost] delta like this. … Please adjust the diagram accordingly. Thank you.”

The assumptions in Examples 1 through 5 helped deliver the outcomes shown in Figures 2-4 and led to two “inevitable” conclusions: in Segment 3, AutoCompany's adoption of a common platform with VehicleFirm would have no financial benefit, and in Segment 5, AutoCompany should dispense with its own platform and adopt CarEnterprise's architecture.

Example 6: Quantifying the Cost Impact of Technical Differences

This example comes from Episode B. The senior management accountant's preference was to give more weight to the disadvantages of the integrated design and to the advantages of the split design. The cash flow forecasts should support this—how was this achieved? As a qualitative intervention, the management accountants influenced the scope of the cash flow forecast. Specifically, this example concerns the management accountants' initiative to include the technical differences as explicit cost differences in the calculation. Without this intervention, those technical differences would not have been part of the quantification activity.

Figure 5 includes a specific remark about a “Variable Cost Burden for Internal Combustion Cars Approx. $1,000/vehicle.” How did this information get there? The senior management accountant insisted on quantifying the higher unit cost implications of technical characteristics of the integrated design. As noted earlier, the integrated architecture required the cars to be a little higher and heavier, which increased production costs and CO2 emissions and required wheels with a larger diameter. The senior management accountant had collected data on these technical differences and insisted the cost impact should be estimated. When presenting the data on technical differences in the project team meeting, the project leader expressed his doubts: “That's too much for me—surely, only around 15 kilograms will remain.” The senior management accountant protested, refused to change the numbers the engineers had provided and insisted on their acceptance, arguing that speculation was unnecessary.

In the weeks that followed, the senior management accountant worked with the cost experts to quantify the technical differences, presenting and discussing them with the project team several times. They relied on cost information from the current car models, which indicated a material cost of around $4 per kg of car body weight, which they multiplied by the additional weight per car (40 kg). They valued CO2 emissions at $95 per gram, equal to the fine imposed on car companies from 2021 in the EU if they fail to meet the emission goals. They considered the additional complexity costs by multiplying material costs by 3%, which was a reasonable but quite arbitrary assumption of higher material costs due to greater complexity stemming from the integrated architecture. As a concept engineer said, “Somehow, [these additional costs] will be there. I just can't tell you in detail today which parts will be affected.” In total, the additional material costs for conventional cars owing to the integrated design were estimated at some $800–$1,000 per car. Not everyone was convinced, and after the meeting with the executive board the sales manager in the project team stated, “[That] $1,000, I still don't believe it to this day.”

Counteracting with a Quantitative Intervention

The accountant may either accept or contest information that is provided by other stakeholders in the process of constructing the cash flow forecast. The earlier Example 1 illustrates how the senior management accountant readily accepted the information regarding contribution margin losses that was provided by his colleague from CarEnterprise. Counteracting information providers, however, refers to the accountants' having an averting response to information provided by other stakeholders if that information does not support an outcome in line with their preferences for particular capital investments. These counteracting responses may involve quantitative interventions in the sense of accepting or changing numerical values, as the next example illustrates.

Example 7: Rejecting Investment Estimates

Figure 5 includes numbers on “Fixed Costs” which were included only after significant intervention by the senior management accountant. Three business areas provided the project team with their first estimates of the required investments for both architecture concepts, which indicated significantly higher investments for the split architecture compared to the integrated architecture. Production simply stated it would need everything doubled to be able to build both kinds of car, and estimated twice the investment expenditure for the split architecture. Development and purchasing also estimated an almost twofold investment. When the project leader asked the senior management accountant in the project team for a presentation slide to show the investment differences to top management, he refused: “We want to provide decision alternatives to the executive board. At the moment, we have two scenarios, but one of them is definitely not an alternative.”

The senior management accountant provided only a qualitative diagram, because he refused to accept the investment estimates from the production, development, and purchasing business areas, arguing that they were too large and too uncertain. In the weeks that followed, the three business areas significantly reduced their numbers on investment requirements, which the senior management accountant then accepted and incorporated into Figure 5.

Counteracting with a Qualitative Intervention

Counteracting with a qualitative intervention refers to the management accountant methodologically changing the way in which the cash flow forecast is constructed in order to neutralize information that is provided by other stakeholders.

Example 8: Changing the Comparison of Sales Estimates