Auditing Estimates in Financial Statements: A Case Study of a Fish Farm's Biological Asset†

Abstract

enRecent decades have witnessed an increase in the overall uncertainty inherent in financial statements. It is now common for the financial statements of a public company to include estimates with measurement uncertainties that exceed materiality. As a result, auditing students are now required to have a more profound understanding of (i) the impact of accounting estimates on risk assessment and (ii) the development of audit procedures to deal with accounting estimates. This case allows students to explore CAS 540 – Accounting Estimates by assuming the role of Atlantic Canada Aquaculture's (ACA's) auditor. ACA operates in Eastern Canada and is prohibited by Canadian regulations to catch and release the fish in their farm to determine their biological asset value. As a result, ACA developed a statistical model to determine the number and weight of the fish in their farm. The model is based on various estimates, such as water temperature, survival rates, and food quality. Students are required to explore the impacts of the model's estimates on the inherent risks in the financial statements and assess the reasonability of the model from an external auditor's perspective. The case also allows students to explore CAS 620 – Using the work of an Auditor's Expert and CAS 701 – Communicating Key Audit Matters in the Independent Auditor's Report in the context of the audit of biological assets.

Abstract

frRésumé

Audit d'estimations contenues dans les états financiers : Étude de cas de l'actif biologique d'une ferme piscicole

Nous avons assisté, au cours des dernières décennies, à une hausse de l'incertitude globale inhérente aux états financiers. Il est désormais fréquent que les états financiers d'une société ouverte contiennent des estimations faisant appel à des mesures auxquelles sont associées des incertitudes excédant le seuil de signification. C'est pourquoi les étudiants en audit doivent maintenant avoir une compréhension plus approfondie i) de l'incidence des estimations comptables sur l’évaluation du risque et ii) de l’élaboration de procédures d'audit destinées à traiter les estimations comptables. Le cas proposé permet aux étudiants d’étudier la NCA 540, Audit des estimations comptables, en jouant le rôle de l'auditeur d'Atlantic Canada Aquaculture. La société en question exerce ses activités dans l'est du Canada, et il lui est interdit par la réglementation canadienne de prendre le poisson et de le remettre à l'eau dans sa ferme afin de déterminer la valeur de son actif biologique. Atlantic Canada Aquaculture a donc mis au point un modèle statistique pour déterminer le nombre et le poids des poissons de sa ferme. Le modèle est basé sur diverses estimations, comme celles de la température de l'eau, des taux de survie et de la qualité des aliments. Les étudiants sont appelés à explorer l'incidence des estimations du modèle sur les risques inhérents des états financiers et à évaluer le caractère raisonnable du modèle du point de vue d'un auditeur externe. Le cas permet également aux étudiants de se pencher sur la NCA 620, Utilisation par l'auditeur des travaux d'un expert de son choix, et la NCA 701, Communication des questions clés de l'audit dans le rapport de l'auditeur indépendant, dans le contexte de l'audit d'actifs biologiques.

Atlantic Canada Aquaculture (ACA) was founded in 1992 and is headquartered in Sydney, Nova Scotia, Canada. The company operates in the aquaculture industry, specializing in fish farming and developing sustainable fish farming practices and technologies. ACA's main source of revenues comes from farming Atlantic salmon, which are sold to various distributors in Canada and throughout the world. In 2003, the company's management began various expansion plans which focused on both organic growth and acquisitions of similar companies. By 2018, the company has grown to become one of Canada's largest aquaculture companies and is traded on the Toronto Stock Exchange.

Pesci & Pesci LLP (P&P), a large international public accounting firm, has been engaged as the new auditor of ACA for the December 31 year-end. ACA moved to P&P in the current year from a mid-tier regional firm in order to benefit from P&P's specialized knowledge of several International Financial Reporting Standards (IFRS) and National Instrument 52-109 – Certification of Disclosure in Issuers' Annual and Interim Filings.

You are an audit senior with P&P. The audit senior working on the ACA audit has taken a leave of absence, effective immediately. As a result, you have been assigned to the ACA audit, which is already in progress. You recently met with the audit manager who is trying to quickly get you up-to-date on the engagement, and more specifically, the issues surrounding ACA's biological assets.

The audit manager explains that ACA's biological assets have a high degree of estimation uncertainty as their fair value is determined with a regression model that is currently considered to be a level three fair value measurement under IFRS 13 – Fair Value Measurements. As a result, the audit program directs considerable effort to obtaining adequate and persuasive evidence for the biological assets' balance-related assertions and ensuring that standards in CAS 540 – Auditing Accounting Estimates are applied properly. Due to the complexity of the fair value model developed by ACA, the audit manager also mentioned that the audit team had preliminary discussions regarding the possibility of using an audit expert and early adopting CAS 701 – Communicating Key Audit Matters to issue an audit report with additional information for users. Preliminary discussions have been held between ACA's management and the audit partner regarding the benefits to key stakeholders of early adopting CAS 701.

- a draft copy of the Statement of Financial Position (Exhibit 1);

- background information on the aquaculture industry and ACA's operations (Exhibit 2);

- a summary of IAS 41 – Agriculture as applied to ACA's biological assets (Exhibit 3);

- a summary of ASA's biological asset fair value model (Exhibit 4) extracted from the prior year's working paper file;

- current year information related to ASA's biological assets taken from the draft current year working papers (Exhibit 5).

Exhibit 1—ACA's draft statement of financial position

| As at December 31—all figures in (000s) | Draft 2018 | Actual 2017 |

|---|---|---|

| ASSETS | ||

| Current assets | ||

| Cash | 9,333 | 7,970 |

| Other current assets | 8,016 | 6,846 |

| Trade and other receivables | 22,651 | 19,342 |

| Inventory | 8,393 | 7,167 |

| Biological assets | 44,274 | 37,807 |

| 92,667 | 79,132 | |

| Noncurrent assets | ||

| Biological assets | 55,980 | 47,803 |

| Deferred income taxes | 789 | 674 |

| Investment property | 2,597 | 2,218 |

| Intangible asset | 8,584 | 7,330 |

| Property, plant, and equipment | 47,433 | 40,504 |

| 115,383 | 98,529 | |

| Total assets | 208,050 | 177,661 |

| LIABILITIES AND EQUITY | ||

| Current Liabilities | ||

| Trade and other payables | 23,586 | 20,140 |

| Short-term borrowings | 3,203 | 2,735 |

| Current portion of long-term debt | 12,130 | 10,358 |

| Other current liabilities | 4,330 | 3,698 |

| 43,249 | 36,931 | |

| Noncurrent liabilities | ||

| Long-term debt | 73,766 | 62,992 |

| Deferred income tax liability | 5,484 | 4,683 |

| Net defined benefit obligation | 1,807 | 1,543 |

| Government grant | 3,936 | 3,361 |

| Other current liabilities | 849 | 725 |

| Provision | 342 | 292 |

| 86,184 | 73,596 | |

| Equity | ||

| Share capital | 57,532 | 49,129 |

| Retained earnings | 21,085 | 18,005 |

| 78,617 | 67,134 | |

| Total liabilities and equity | 208,050 | 177,661 |

Exhibit II—Industry and company background

The Aquaculture Industry

Aquaculture's share of global seafood consumption has grown significantly over the past half century. According to the United Nations Food and Agriculture Organization, aquaculture accounts for more than 50 percent of the share of global seafood consumption in 2010, an increase from only 3 percent in 1950. Assuming current seafood consumption rates continue into the future, there is a projected shortfall of 50–80 million tonnes of food fish by 2030, which would result in the aquaculture industry doubling its output over the next 25 years.

“Aquaculture is the farming of aquatic organisms such as fish, shellfish and aquatic plants – it's essentially agriculture, but in the water” (Canadian Aquaculture Industry Alliance). Aquaculture takes place all across Canada (e.g., freshwater trout) although most operations are found in the west and east coasts. The Atlantic Canada aquaculture industry is the most prominent, accounting for approximately 50 percent of Canada's aquaculture output and employing over 4,000 people. Exports for the Atlantic Canada aquaculture industry increased from about $40 million in 1994 to over $150 million in 2009,1 and focus on salmon, mussels, trout, oysters, and clams farms.

The aquaculture industry is heavily regulated in Canada. The Fisheries Act was established to regulate the aquaculture industry with the intent of protecting the fish and fish habitat. The Act establishes regulations for fisheries licensing, management, protection, and pollution prevention. In addition, a Code of Containment was developed by Atlantic fish farmers in order to outline the guidelines for the prevention of escapee farm fish. The Code of Containment is based upon the International Guidelines for Containment as established by the International Salmon Farmers Association and the North Atlantic Salmon Conservation Organization.

A major regulation that impacts the ACA audit is the prohibition of physical inventory counts. Fish farms in Canada are prohibited from catching and releasing all of their fish at any given point in time due to various concerns regarding the well-being of the fish. Catching and releasing the fish has been determined to be unnecessarily stressful for the fish. As a result, it is not possible for ACA to physically count their inventory at year-end.

Company Background

ACA was founded by Dillion Lampoon in 1992 in Sydney, Nova Scotia. Dillion is still activity involved with the company, and acts as the CEO. For the first 5–10 years of operations, the company's sales were relatively modest, with 2002 revenues of approximately $10 million. In 2003, the company's management began various expansion activities which focused around both organic growth and acquisitions of similar companies and hatcheries. By 2018, the company had become one of Canada's largest publicly traded aquaculture companies.

ACA has a strong Board of Directors that has provided valuable oversight activities for the company's organic growth, acquisitions, and initial public offering. The Board continues to oversee ACA's strategic direction while further strengthening their broad governance role. Currently, ACA's Board has adopted various measures of corporate social responsibility, and has a vision of being a leader in sustainable and clean fish farming while strengthening their stakeholder communities.

The company specializes in fish farming and ACA's main source of revenues comes from farming Atlantic salmon, which is sold to various distributors in Canada and throughout the world. Approximately 35 percent of the salmon is sold within Canada, with the primary export market being the United States. Other export destinations include Japan, China, Hong Kong, and Singapore.

ACA has recently been undertaking various R&D projects related to sustainable fish farming practices and technologies. The outcome of the R&D efforts has yet to yield any material revenues. However, ACA management believes these efforts are important for the future of the company in order to diversify revenue streams and to fulfill their corporate social responsibilities. For example, a major project currently in process is exploring new fish net materials that will significantly reduce escapee fish. Not only would this project reduce legal claims resulting from violations of the Code of Containment, but it would also significantly reduce the devastating impacts of escapee fish on surrounding ecosystems. The company is also trying to tackle challenges related to habitat degradation, pollution, and aquatic invasive species.

ACA's Fish Farming Process

Salmon can take upward of 3 years to grow from an egg to a mature, harvestable adult salmon. Salmon progresses through two main stages of growth: (i) egg to smolt (approx. 100 g), which generally takes 15–18 months and (ii) smolt to mature fish, which takes 15–18 months. There are some situations whereby live smolts are sold, but, in general, most farmed salmon is grown to be harvested at maturity.

Farmed salmon are fed a diet of dry pellets composed of animal, fish and plant proteins as approved by the Canada Food Inspection Agency. The dry pellets are rich in nutrients, essential vitamins, and minerals which are consistent with the natural diet of salmon. In general, a salmon farm has several round net pen systems. Each net pen system can hold between 15,000 and 30,000 smolts and is approximately 70–150 m in circumference and 8–10 m in depth. Approximately 95 percent of the net pen system is unoccupied by the salmon in order to provide the fish with a large, natural environment to replicate instinctual schooling patterns.

Fish biological assets represent a significant portion of an aquaculture company's working capital, and overall assets. For example, fish biological assets can represent between 15 and 30 percent of an aquaculture company's total assets, and 20–50 percent of net worth. Furthermore, changes in fish biological asset valuations generally result in significant impacts on various key ratios, such as the debt-to-assets and current ratio.

Exhibit III—IAS 41 and ACA'S biological assets

ACA's fish farming operations are considered to be agricultural activities as per the definition in IAS 41 – Agriculture. Agricultural activity is the management by an entity of the biological transformation of biological assets for sale, into agricultural produce or into additional biological assets (IAS 41.5). As a result, ACA's fish is considered to be a biological asset (a biological animal or plant).

IAS 41 requires biological assets to be measured at their fair value less cost to sell for both initial recognition and at each balance sheet date (IAS 41.12). In limited circumstances, there are some exceptions to the fair value measurement. IAS 41 defines fair value as the amount for which the asset could be exchanged between knowledgeable, willing parties in an arm's length transaction (IAS 41.30). More detailed guidance on the determination of fair value is available in IFRS 13 – Fair Value Measurement.

In accordance with IAS 41, ACA recognizes a gain or loss for the period in which it arises on initial recognition of a biological asset at fair value less costs to sell and from a change in fair value less costs to sell of a biological asset (IAS 41.26). A gain on initial recognition may also occur at the birth of new living organism/fish (IAS 41.28).

- Juvenile salmon: ACA groups together salmon eggs, alevin, and fry into the juvenile category. The juvenile category is measured at fair value less cost to sell. Fair value is estimated based on future cash flow calculations, as defined by Level 3 of the fair value hierarchy presented in IFRS 13, which rely upon various estimates (e.g., the expected rate of maturation, market prices of mature salmon, etc.).

- Smolt and adult salmon: Smolt and adult salmon are measured at fair value less cost to sell. The estimated fair value of the fish population at each reporting date is based on various factors, such as observable market prices for the harvested salmon, the expected timing of harvesting, and the estimated biomass2 available for harvest.

- Broodstock salmon: ACA groups together mature fish that are used for breeding purposes into the broodstock category. The broodstock category is measured at less cost any impairment losses.

Exhibit IV—Extract from prior year's working paper files: ACA's biological asset fair value model

Market Value of Salmon Biomass

Estimating the market value of ACA's salmon biomass generally does not pose many problems. The market value is readily available from weekly publications issued by industry organizations. The industry reports summarize the trade values of superior quality salmon as specified by different weight classes (e.g., 1–2 kg, 2–3 kg, etc.). ACA's management is able to determine the market value of their salmon biomass with little measurement uncertainty.

Estimated Salmon Biomass

Estimating the total salmon biomass poses a much greater challenge and is subject to much more measurement uncertainty. In general, auditors can obtain evidence for the existence and completeness inventory assertions by conducting a physical count. However, aside from issues surrounding practicality, various regulations prohibit the “catch, weight, and release” of farmed fish in order to measure their biomass at year-end.

Researchers are continuing to develop more sophisticated models for estimating salmon biomass (e.g., Beverton-Holt models); however, ACA continues to use the regression model outlined in equation (2).

Exhibit V—Draft extract from current year working papers: information related to biological assets

Materiality

Key users for the ACA's financial statements are its shareholders and creditors. While shareholders are generally most interested in net income, ACA's creditors have a general security agreement that lists inventory, biological assets, and capital assets as security for ACA's long-term debt. As a result, the creditors have a particular interest in ACA's assets. Thus, we have selected total assets as the most appropriate benchmark for determining materiality. Planning materiality for the financial statements as a whole has been set to 1% of total assets. Given the importance of biological assets for ACA, it is likely a material misstatement in biological assets could reasonably be expected to influence users' decisions. Thus, it is important to determine specific performance materiality for biological assets as an account balance, distinct from overall planning materiality. Performance materiality is used to assess the risk of material misstatements and to determine the nature, extent, and timing of audit procedures. Based upon our firm policies, specific performance materiality is determined based upon a range, such that the higher the risk of the account balance, the lower the percentage used for determining performance materiality. P&P's guidance for materiality recommends specific performance materiality should range from 75 percent of planning materiality for low risk accounts or classes of transactions to 50 percent of planning materiality for high risk accounts or classes of transactions. Specific performance materiality for biological assets is set at 50 percent of planning materiality for ACA, given the comparative riskiness of the account balance.

Estimated Versus Actual Data

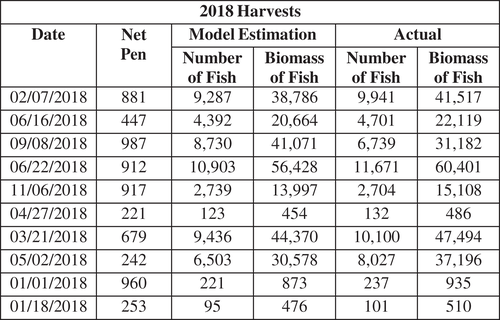

During year, ACA harvested 606 net pens. ACA's management has provided P&P with a large spreadsheet that outlines their model's estimated parameters relative to the actual counts for all 606 harvested net pens (see Figure 1 for the first 10 rows from the spreadsheet).

Biomass Estimation Model Assessment

Computer-assisted audit techniques will be used to analyze the spreadsheet in order to assess the forecasting accuracy of ACA's biomass estimation model.

Teaching Notes

Teaching notes for instructional cases are not published in the journal but are made available to full CAAA member subscribers via the CAAA website. If you are a full member of the CAAA and wish to obtain a copy of the Teaching Notes, please go to http://www.caaa.ca/journals-and-research/accounting-perspectives-ap/ and click on “Teaching Notes.” You will then be directed to your member login and you can access and download the notes.