Why the Administrative Burden of Cross Compliance Matters

Pourquoi la charge administrative de la conditionnalité est-elle importante

Warum der Verwaltungsaufwand für die Cross-Compliance-Regelung wichtig ist

Summary

enThe administrative burden imposed by the direct payment system is a major concern highlighted in recent farmers’ protests. Based on a survey of 808 Swiss farmers, we analyse farmers’ perceptions of the administrative burden associated with the direct payment system and how this affects the costs and farmers’ views and reactions to the policy. Our results show that the perceived administrative burden varies among farmers and is not strongly related to the actual time spent on forms. Well-trained and informed farmers find administrative tasks less burdensome. The bureaucracy involved in agricultural policy matters not only because it increases farmers’ perceived administrative burden but also because it leads to dissatisfaction with the government. Overall, we estimate the private administrative costs of cross-compliance obligations for Switzerland to be about 5 per cent of the annual Swiss budget for direct payments. To reduce farmers’ perceived administrative burden, policymakers should prioritise reducing compliance costs, which will also reduce psychological costs. Digitalisation can help achieve this outcome, but its success depends on farmers’ knowledge of information and communication technologies. Knowledge, administrative efficiency and perceived legitimacy are crucial for reducing non-compliance with direct payment regulations. Addressing these factors will help improve the effectiveness of agricultural policies.

Abstract

frLa charge administrative imposée par le système de paiement direct est une préoccupation majeure mise en évidence lors des récentes protestations des agriculteurs. Sur la base d'une enquête menée auprès de 808 agriculteurs suisses, nous analysons la perception qu'ont les agriculteurs de la charge administrative associée au système de paiement direct et la manière dont cela affecte les coûts, ainsi que leurs opinions et leurs réactions à l'égard de la politique. Nos résultats montrent que la charge administrative ressentie varie selon les agriculteurs et n'est pas fortement liée au temps réel passé sur les formulaires. Les agriculteurs bien formés et informés trouvent les tâches administratives moins lourdes. La bureaucratie impliquée dans la politique agricole est importante non seulement parce qu'elle augmente le fardeau administratif ressenti par les agriculteurs, mais aussi parce qu'elle conduit au mécontentement à l’égard du gouvernement. Dans l'ensemble, nous estimons que les coûts administratifs privés liés aux obligations de conditionnalité pour la Suisse représentent environ 5 pour cent du budget annuel suisse destiné aux paiements directs. Pour réduire la charge administrative ressentie par les agriculteurs, les décideurs politiques devraient donner la priorité à la réduction des coûts de conformité, ce qui réduirait également les coûts psychologiques. La numérisation peut contribuer à atteindre ce résultat, mais son succès dépend de la connaissance qu'ont les agriculteurs des technologies de l'information et de la communication. Les connaissances, l'efficacité administrative et la légitimité ressentie sont essentielles pour réduire le non-respect des réglementations sur les paiements directs. La prise en compte de ces facteurs contribuera à améliorer l'efficacité des politiques agricoles.

Abstract

deDer mit dem Direktzahlungssystem verbundene Verwaltungsaufwand wird von vielen mit großer Besorgnis gesehen, was in den jüngsten Protesten der Landwirtschaft zum Ausdruck kam. Auf der Grundlage einer Umfrage unter 808 Schweizer Landwirtinnen und Landwirten analysieren wir, wie sie den Verwaltungsaufwand wahrnehmen, der mit den Direktzahlungen verbunden ist. Wir untersuchen auch wie sich die Kosten des Verwaltungsaufwands auf ihre Ansichten und Reaktionen auf die Politik auswirkt. Unsere Ergebnisse zeigen, dass der wahrgenommene Verwaltungsaufwand variiert und nicht in einem engen Zusammenhang mit dem tatsächlichen Zeitaufwand für das Ausfüllen der Formulare steht. Gut ausgebildete und informierte Landwirtinnen und Landwirte empfinden die Verwaltungsaufgaben als weniger belastend. Die mit der Agrarpolitik verbundene Bürokratie ist nicht nur deshalb von Bedeutung, weil sie den empfundenen Verwaltungsaufwand erhöht, sondern auch, weil sie zu Unzufriedenheit mit der Regierung führt. Insgesamt schätzen wir die privaten Verwaltungskosten der Cross-Compliance-Regelungen für die Schweiz auf etwa 5 Prozent des jährlichen Budgets der Direktzahlungen. Um die von den Landwirtinnen und Landwirten empfundene administrative Belastung zu verringern, sollte die Politik der Senkung der Compliance- bzw.- Erfüllungskosten Vorrang einräumen. Das würde auch die psychologischen Kosten senken. Die Digitalisierung kann dazu beitragen, aber ihr Erfolg hängt vom Wissen der Landwirtschaft Betreibenden über die Informations- und Kommunikationstechnologien ab. Wissen, Verwaltungseffizienz und wahrgenommene Legitimität sind für die Einhaltung von Direktzahlungsverordnungen entscheidend. Die Berücksichtigung dieser Faktoren wird dazu beitragen, die Wirksamkeit der Agrarpolitik zu verbessern.

The administrative burden imposed on farmers by agricultural policy is widely discussed by both farmers and policymakers and has been one of the major concerns in recent farmers’ protests. The main reason for the increase in administrative burden is the shift from market support to direct payments and the introduction of a cross-compliance system. Accordingly, to become eligible for direct payments, farmers in the EU and other European countries have to fill in a number of forms and compile various documents to prove compliance with direct payment obligations. Although several attempts have been made by public authorities to reduce the administrative burden, many farmers still perceive the administrative requirements associated with the direct payment system as onerous. Reducing the administrative burden of farmers is crucial for successful agricultural policy reforms. Minimising this burden without compromising the purpose of the regulations can increase the efficiency of agricultural policy and the sector's competitiveness, making it a key interest for policymakers.

This article summarises the results of four studies conducted as part of a project on the perceived administrative burden of Swiss farmers. In the first study, we analysed farmers’ perceptions of the administrative burden with the direct payment system and its determinants (Ritzel et al., 2020). The second study encompassed an analysis of how the perceived burden affects farmers’ satisfaction with agricultural policy (Mack et al., 2021). In the third study, we analysed farmers’ non-compliance with direct payment regulations and the extent to which the perceived administrative burden plays a role (Mack et al., 2024b). The fourth study involved the quantification of the private costs of the administrative burden imposed by the direct payment system for the Swiss agricultural sector (El Benni et al., 2022).

Based on the results of the four studies, we provide policy recommendations on measures that help to reduce farmers’ perceived administrative burden and farmers’ non-compliance with regulations and thus increase the efficiency and effectiveness of agricultural policy. Although the studies were carried out in Switzerland, the results presented here are also relevant for the Common Agricultural Policy and agricultural policies of other European countries, as the policy goals and the related administrative procedures imposed on farmers in these regions are similar to those of Switzerland (Huber et al., 2024).

Assessing the administrative burden of farmers

Following Burden et al. (2014), administrative burden is defined as the individual's experience that a policy implementation is onerous and three types of costs can be distinguished: (a) learning costs (individuals have to find out about the programme, and whether they are eligible for it), (b) psychological costs (individuals experience a loss of autonomy or power, or an increase in stress), and (c) compliance costs (individuals have to fill in forms and provide documentation).

Data for the four studies were collected from a random sample of 2,000 Swiss farmers in 2019 using a postal questionnaire and an online survey. In the first part of the survey, data on farmers’ workload and perceived burden were collected for the following types of work: (1) total farm work; (2) administrative work related to the application of direct payments; and (3) other office work related to farm planning, bookkeeping, purchasing and sales (Mack et al., 2024a). Open-ended questions assessed the average weekly time spent on different types of work, while closed questions measured changes in workload compared to five years earlier. The participation rate was 40 per cent (N = 808). The sample's farm structure was representative of the Swiss farm population (for details, see Ritzel et al., 2020). This dataset was used to analyse farmers’ perceptions of administrative burden related to agricultural policy and reasons for non-compliance with direct payments obligations using different multivariate modelling techniques, such as latent class modelling, structural equation modelling, and hierarchical regression analysis.

To quantify the costs to farmers of the administrative burden at the national level the Standard Cost Model (SCM, n.d.) is used. Data were collected from farmers who completed the first part of the questionnaire. Those with farm types ‘dairy cows’, ‘arable farms’, or ‘combined dairy/crop farms’ were invited to participate in the second part of the survey. These farmers reported the amount of time they spent filling out various forms to comply with cross-compliance requirements. They indicated the frequency (i.e. 1 = daily, 2 = twice a week, 3 = once a week, 4 = monthly, 5 = annually) and time spent (i.e. 1 = 30 min to 6 = more than 150 min). They also rated the difficulty of providing the required documents (i.e. 1 = easy, 2 = medium, 3 = difficult). The participation rate was 16 per cent, with 100 out of 631 eligible farmers completing the survey. Annual administrative costs were calculated per type of farm, based on the sector level, and in relation to the direct payments received, with the hourly wage of farmers based on values from previous studies (see El Benni et al., 2022).

Farmers’ perceptions of the administrative burden and its determinants

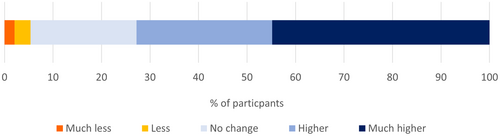

On average, in 2019, Swiss farmers spent 4.5 per cent of their total farm work time on administrative tasks. Assuming an average working week of 60 hours, this means that farmers spend 2.7 hours per week on administrative work, that is, administrative work related to the application of direct payments, and 4.1 hours per week on other office work, such as farm planning, bookkeeping, purchasing and sales. Farmers rated the perceived burden of administrative work as higher than the burden of total farm work or other office work. They also noted that the time spent on administrative work and the associated perceived administrative burden has increased compared to 5 years ago (Figure 1). On average, this increase was rated higher for administrative work than for total farm work or for other office work. In addition, digitisation through the introduction of electronic forms has so far had limited success in reducing the administrative burden perceived by farmers (Mack et al., 2024a).

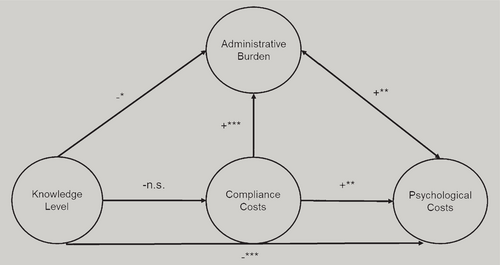

Using the concept of administrative burden, Ritzel et al. (2020) showed how learning costs, psychological costs, and compliance costs associated with direct payments contribute to the perceived administrative burden (Figure 2). The authors showed that both compliance and psychological costs significantly increase the perceived administrative burden and that the perceived administrative burden is positively correlated with psychological costs (i.e. both factors reinforce each other). Ritzel et al. (2020) also found that well-trained and well-informed farmers find administrative tasks less burdensome. However, the direct effect of farmers’ knowledge on the perceived burden is lower (i.e. less significant) than its indirect effect via reduced psychological costs. Furthermore, higher education and knowledge levels do not reduce perceived compliance costs.

Determinants of farmers’ perceived administrative burden with the direct payment system

Notes: n.s. denotes statistically non-significant effect; statistically significant effects are denoted as *** (p ≤ 1%), ** (p ≤ 5%), * (p ≤ 10%-significance level). Reading examples: The higher the compliance and psychological costs of farmers, the higher their perceived administrative burden. The higher the knowledge level of farmers, the lower their perceived administrative burden.

Farmers’ perceived administrative burden influences their perception of agricultural policy

- ‘Grumpy farmers’ (20 per cent) strongly agreed with negative statements about the direct payment system and felt that their entrepreneurial freedom was restricted. This group perceived the highest administrative burden and showed the highest administrative learning and compliance costs.

- ‘Supporting farmers’ (27 per cent) agreed with the most positive statements about the direct payment system and did not feel restricted in their entrepreneurial freedom. They showed the lowest administrative burden and the lowest administrative learning and compliance costs.

- ‘Indifferent farmers’ (53 per cent) neither agreed nor disagreed with most statements about the direct payment policy but felt restricted in their entrepreneurial freedom. They perceived a higher administrative burden than ‘supporting farmers’ but a lower burden than ‘grumpy farmers’.

The higher the administrative workload, the higher the non-compliance with agricultural policy regulation

Mack et al. (2024b) analysed farmers’ non-compliance with regulations and the reasons for non-compliance, in order to provide policy recommendations on which measures can be used to reduce non-compliance and thus improve the efficiency and effectiveness of agricultural policy. In total, 28 per cent of respondents reported receiving penalties for non-compliance with direct payment requirements. Factors contributing to non-compliance with direct payment requirements among farmers were knowledge of inspection measures, acceptance of regulations, and level of education. By contrast, the greater the administrative workload to prepare documents for on-farm inspections, the greater the likelihood of non-compliance. Neither farm size nor type significantly affected the likelihood of receiving a penalty, and hardly any differences in penalty likelihood were observed across agricultural production zones.

Farmers’ administrative costs of cross-compliance obligations make up 5 per cent of the direct payment budget

Following the standard cost model (SCM, n.d.), El Benni et al. (2022) calculated administrative costs to Swiss farms of complying with cross-compliance requirements, assuming all administrative tasks are solely to meet direct payment obligations, excluding the time required for inspection controls.

The results showed that cross-compliance obligations generated private administrative costs of about CHF 136 million per year for the Swiss agricultural sector, representing roughly 5 per cent of the direct payment budget. Specialised dairy farms, which constituted 33 per cent of Swiss farms, bore 36.5 per cent of the total administrative costs and spent 5.5 per cent of their direct payments on these costs. Specialised crop farms, making up 5.9 per cent of Swiss farms, contributed about 2 per cent to the sector's total administrative costs and spent 5.8 per cent of their direct payments on administrative costs. Combined dairy/crop farms, which represented 5.5 per cent of all farms, accounted for about 6 per cent of the sector's total administrative costs and spent 5.2 per cent of their direct payment budget on administrative tasks.

Discussion and conclusion

The Swiss agricultural policy is comparable to the Common Agricultural Policy of the European Union (Huber et al., 2024). As the administrative procedures related to the direct payment system and cross-compliance obligations have not changed significantly in recent years, the results presented here provide valuable insights into how to reduce the perceived administrative burden of agricultural policy on farmers, which is a concern often mentioned in current farmer protests.

Our results show that the perceived administrative burden of farmers matters not only because it increases private and public administrative costs but also because it can lead to dissatisfaction with the government. To reduce the perceived administrative burden, policymakers should focus on lowering compliance costs, which will also reduce psychological costs. Digitalisation offers various options, such as automating records, providing updated forms via apps, and linking new and existing tools. However, the effectiveness of e-government services depends on farmers’ attitudes towards ICT and their ICT expertise, infrastructure, work organisation, and use of external support (Reissig et al., 2022). The latter is especially important, as farmers who perceive a high administrative burden often outsource administrative work. Therefore, close cooperation between government bodies and extension services is necessary.

Investment should also be made in training and educating professional farmers. Well-trained and informed farmers experience fewer psychological costs, indirectly reducing the perceived administrative burden. Training in handling electronic forms can also lower psychological costs. Practical exercises should be included, as the perceived user-friendliness of digital technologies is crucial for their adoption (Ammann et al., 2022). Furthermore, training should aim to improve farmers’ understanding of and identification with agricultural policy, particularly the direct payment system, as better understanding can reduce the perceived administrative workload. Peer learning could also be strengthened, for example through online platforms, so that farmers can learn from colleagues who perceive less administrative burden.

To reduce farmers’ non-compliance with direct payment regulations, different measures can be taken. First, as improving farmers’ knowledge of inspection measures can reduce non-compliance, targeted training programmes that educate farmers about inspection processes and common pitfalls that lead to penalties should be offered. Providing administrative training, particularly for less educated farmers, can help reduce the likelihood of non-compliance by ensuring that farmers are well-informed about documentation. Providing support services, such as hotlines and advisory services, can also help farmers navigate complex administrative requirements and reduce errors that lead to penalties. Second, reducing the administrative workload by streamlining administrative processes and reducing the burden of paperwork can lower the likelihood of non-compliance. The implementation of user-friendly digital tools and support systems can aid in this effort. Although higher workloads from e-government services were not linked to increased penalties, ensuring that these services are accessible and easy to use is crucial for compliance. Third, increasing the perceived legitimacy of regulatory authorities can also improve compliance with policy regulations. This might involve transparent communication about the reasons for regulations and penalties and involving farmers in the policymaking process. Considering an increase in the intensity of penalties for non-compliance might be necessary to deter non-compliance more effectively. Fourth, investing in education programmes that provide farmers with comprehensive knowledge about agricultural policies, compliance requirements, and the benefits of adhering to regulations can enhance compliance.

Further Reading

To reduce the perceived administrative burden, policymakers should focus on lowering compliance costs, which also reduce psychological costs.

Pour réduire la charge administrative ressentie, les décideurs de l'action publique devraient se concentrer sur la réduction des coûts de conformité, ce qui réduirait également les coûts psychologiques.

Um den wahrgenommenen Verwaltungsaufwand zu verringern, sollten sich die Politik darauf konzentrieren, die Compliance- bzw. Erfüllungskosten zu senken. Das würde auch die psychologischen Kosten verringern.

Complying with cross-compliance obligations is mandatory to receive direct payments © 123rf.com.

Policymakers should focus on reducing compliance costs to reduce psychological costs and perceived administrative burden © 123rf.com.

The provision of support services can help farmers to navigate through complex administrative requirements and reduce errors that can lead to penalties © 123rf.com.