The New Tokenomics of Crowdfunding

Abstract

Whether proxied by the amount raised or the probability that this amount exceeds the soft cap, the factors driving the fundraising success of token offerings have changed considerably over the past 4 years. Possible factors include target market capitalization for the token, genuine signals of the venture's public credibility, price and momentum of ether, domicile of the venture and distribution of the token. There is a large previous literature on this topic, rooted in the entrepreneurial finance and crowdfunding literature, with numerous hypotheses based on signalling theory in its broadest sense. But due to substantial differences in samples, which end before 2020, the results are not only mixed but out of date. We have built the largest and most complete dataset on token offerings, spanning 2017 and 2022. The determinants of the amount raised were robust to different subsamples until the market virtually disappeared during the Covid pandemic. But it resumed in early 2021 and within 12 months had reached an all-time high in terms of number if not market capitalization of new offerings. During this period the market changed completely, with success now depending mostly on the type of token offering and the choice of launchpad platform.

Introduction

‘Tokenomics’ is a catch-all for the elements that add value to a token, including how it is issued and used within the native project. Token offerings are decentralized crowdfunding campaigns, typically conducted by a startup venture seeking to raise funds for a blockchain-related project during its early stages of development. A digital token is issued using a smart contract platform such as the Ethereum blockchain, or an exchange-based platform such as the Binance Launchpad.1 All aspects of the token itself and the token offering process are defined in smart contract code, which is usually written using common coding protocols such as the ERC-20 token standard for Ethereum. Ideally, the token serves an integral purpose in the venture's ecosystem, which is typically to grant access to a product or service related to the development of Web 3 and its metaverses, and if this is the case the token might be considered to be a utility token. More rarely, a token grants cash flows to the token holder which are similar to stock dividends or bond coupon payments, in which case it should be classified as a security token.2

A token offering consists of selling a certain number of tokens to investors who deposit assets to the venture's account in return for buying the token at a predefined rate of exchange. Most deposits are in bitcoin (BTC), ether (ETH) and/or stablecoins, but fiat currency may also be permitted. The token offering can include preferential exchange rates in the form of rebates for early investors – called a ‘bonus scheme’ – or rebates for advertising the token on social media – called a ‘bounty scheme’. The venture often sets minimum and maximum targets for the amount raised, but does not have to do so. The minimum fundraising target, called a ‘soft cap’, defines a lower boundary for the offering. That is, if it does not raise more than the soft cap, the entire token offering is usually cancelled and all the funds received so far should be returned to the early investors. The maximum fundraising target, called a ‘hard cap’, defines the upper funding boundary – if the amount raised exceeds the hard cap, the excess could be returned to later investors. The online Supplementary Appendix illustrates these features with a real token offering example.

A report by the OECD (2019) summarizes the differences and similarities between token offerings and more traditional funding channels, such as an initial public offering (IPO), reward-based or equity-based crowdfunding and venture capital. The primary difference between a token offering and an IPO is that a token does not usually afford its holders any ownership rights over a company. Also, IPOs are used by established companies with a revenue track record, whereas token offerings are often used by startup ventures that are not even incorporated. Token sales have much in common with traditional crowdfunding mechanisms but there are some important differences, such as the existence of a central counterparty in crowdfunding versus the decentralized structure of token sales (Block et al., 2021). However, this boundary has become less clear in recent years, with the emergence of token offering launchpad platforms on centralized and decentralized crypto-asset exchanges. Finally, venture capital funding is considered complementary to token offerings. Venture capital funds often participate in private token sales which precede the public token offering and provide ventures with valuable expertise, networking and strategic advice – see also Fisch, Meoli and Vismara (2022) for a comparative study of token offerings, venture capital and other alternative investments.

Our research hypotheses focus on the specific determinants of fundraising success for token offerings between January 2017 and September 2022. We proxy this success by the amount raised and by recording whether the minimum funding required (i.e. the soft cap) was exceeded. We examine a variety of specific factors derived from the characteristics of the venture itself and the management of the token offering processes, as well as common factors such as the average USD price level and momentum of ETH during the period of the token offering.

The incremental contributions of this paper are as follows. (1) Using the amount of funding raised and (where possible) the soft-cap exceedance as proxies for success, our determinants are selected from the characteristics of each token offering, the token's technical structure, the venture's online and social media presence and indicators relating to the overall token offering's ecosystem and crypto-asset market. (2) We re-examine several explanatory variables for which there is lack of consensus or an incomplete perspective in the extant literature and use novel transformations to quantify the size of the significant effects. (3) We introduce new explanatory variables such as the token's target market capitalization and the launchpad platform selected. (4) Our database spans 2017–2022, allowing both confirmation of previous results and an examination of the evolution of success determinants from the start of this market to date.

The remainder of this paper is structured as follows. The next section provides a very focused literature review and develops our hypotheses about the determinants of fundraising success. The third section describes our dataset, which is much larger, longer and more comprehensive than any dataset used in previous related studies. Then we specify our dependent, explanatory and control variables and define the regression models used for testing our hypotheses. The fourth section describes our empirical results on the changing role of different determinants over four consecutive subperiods. The fifth section concludes. Supporting results are provided in an online Supplementary Appendix and referenced in the main text.

Hypothesis development and related literature

We develop our hypotheses from primary research questions: ‘what are the determinants of token offering fundraising success’ and ‘how do these determinants change over time as the token offering space evolves’. Due to the lack of standardization and the rapid pace of innovation, even the terminology needs explaining. Some authors refer to token offerings as ICOs (initial coin offerings) but, given the emergence of several variants such as STOs (security token offerings), IEOs (initial exchange offerings) and more recently IDOs (initial decentralized exchange offerings), we prefer the more generic term ‘token offering’. A Scopus search yields 136 papers on determinants of success, 65% of which were published between 2020 and 2022.3

The theoretical frameworks underpinning token offering fundraising success are rooted in the entrepreneurial finance literature – see, for example, Cumming and Hornuf (2018) and Cumming and Johan (2020) for a detailed analysis and also the more extensive review in Alexander and Dakos (2022), an earlier ‘working paper’ version of the present paper. These success factors primarily concern the mitigation of asymmetric information for prospective investors.4 Several authors adapt and extend this framework to encompass token offerings. For instance, Blaseg (2018) and Bourveau et al. (2022) focus on the role of information disclosure, and Czaja and Röder (2022) examine the level of investor familiarity and attention. Venture quality signals in the context of signalling theory or other frameworks are examined by numerous authors, such as Aggarwal, Hanley and Zhao (2019), Chen (2019), Fisch (2019), Philippi, Schuhmacher and Bastian (2021), Yen, Wang and Chen (2021), Campino, Brochado and Rosa (2022) and Thies et al. (2022).5 Some papers also provide warnings on the misuse of venture quality signals: Momtaz (2021b) focuses on moral hazard in signalling; Boreiko and Vidusso (2019) examine the token offering ratings assigned by independent websites; and Ante and Fiedler (2020) examine ‘cheap talk’ signals. Additionally, several authors further examine venture and token offering characteristics that are not assigned to, or only loosely related to, the above frameworks.6

We also ask whether the quality of whitepapers continues to be an important determinant of token offering success. This has been examined previously, using machine learning techniques. For instance, Mansouri and Momtaz (2022) use the content of whitepapers to extract a score for each token offering to reflect the environment, society and governance relevance of the venture, and study its effect on fundraising success. Faust et al. (2022) quantify altruism based on the linguistic style of whitepapers and examine its effect on token offering success, while Meoli and Vismara (2022) extract information from the structure of each paper. Not all analysis of whitepapers uses machine learning techniques. In this strand of the literature, Thewissen et al. (2022) suggest that particular topics are associated with higher fundraising success, while Thewissen et al. (2023) analyse the negative impact of linguistic errors in whitepapers and Kasatkin (2022) focuses on their legal content – a topic which is similar to the ‘legal signalling’ examined by Schnyder et al. (2022) in the context of IPOs.

Table 1 summarizes the results from papers employing model specifications similar to those used here. Most use a linear regression model for (log) amount raised and for commonly used explanatory variables, we indicate a positive , negative or insignificant (o) effect. We also state each paper's sample period, sample size and (adjusted) model . All papers in Table 1 proxy token offering fundraising success by the amount raised during the offering, and almost all use a log transformation. Most of the samples span a period somewhere between 2013 and 2018, with only Philippi, Schuhmacher and Bastian (2021) and Campino, Brochado and Rosa (2022) extending their sample into 2020. None of the papers examine token offerings in 2021 or 2022, and Philippi, Schuhmacher and Bastian (2021) report only 70 offerings before 2017, while some papers in Table 1 have very small samples: Bourveau et al. (2022) use 200, Belitski and Boreiko (2022) use 166 and Ante and Fiedler (2020) use only 151. The most comprehensive study is by Lyandres, Palazzo and Rabetti (2022), who examine 980 token offerings between 2013 and 2018. They also review the data quality and availability from multiple online sources. The ‘Token Offerings Research Database’ (TORD) of Momtaz (2021d) also creates a ‘one-stop’ data source for token offerings, covering a variety of venture and offering characteristics for about 6000 offerings, at the time of writing.

| Authors | Bourveau et al. (2022) | Campino, Brochado and Rosa (2022) | Lyandres, Palazzo and Rabetti (2022) | Belitski and Boreiko (2022) | Boreiko and Risteski (2021) | Czaja and Röder (2022) | Philippi, Schuhmacher and Bastian (2021) | Thies et al. (2022) | Yen, Wang and Chen (2021) | Ante and Fiedler (2020) | Momtaz (2021b) | Momtaz (2020)* | Roosenboom, van der Kolk and de Jong (2020)** | Aggarwal, Hanley and Zhao (2019) | Albrecht, Lutz and Neumann (2020) | Boreiko and Vidusso (2019) | Chen (2019) | Fisch (2019) | Amsden and Schweizer (2018) | Blaseg (2018)* | Lee, Li and Shin (2022)* |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Data start | 4/14 | 5/16 | 1/13 | 1/13 | 1/13 | 7/14 | 1/14 | 11/16 | 1/17 | 4/17 | 8/15 | 8/15 | 8/15 | 1/15 | 1/17 | 1/13 | 1/15 | 3/16 | 1/15 | 1/14 | 1/16 |

| Data end | 2/18 | 5/20 | 11/18 | 12/17 | 10/17 | 1/18 | 10/20 | 3/19 | 1/18 | 10/18 | 7/18 | 4/18 | 12/17 | 9/18 | 3/18 | 9/17 | 3/18 | 3/18 | 3/18 | 12/17 | 5/18 |

| N | 200 | 428 | 980 | 166 | 272 | 664 | 357 | 1597 | 841 | 151 | 495 | 132 | 630 | 853 | 522 | 178 | 479 | 423 | 214 | 670 | 727 |

| Price | o | o | o | o | o | o | |||||||||||||||

| Supply | |||||||||||||||||||||

| Github | o | o | o | o | |||||||||||||||||

| Whitepaper | o | o | o | ||||||||||||||||||

| Pre-sale | o | o | − | − | − | o | o | − | |||||||||||||

| Rating | |||||||||||||||||||||

| Team size | o | o | |||||||||||||||||||

| # Advisors | o | o | o | ||||||||||||||||||

| ETH | o | o | o | ||||||||||||||||||

| Bonus | o | o | − | o | o | o | o | − | |||||||||||||

| Distribution | − | − | o | o | o | − | o | − | |||||||||||||

| Duration | − | o | − | − | − | o | − | − | − | o | |||||||||||

| R | 0.28 | 0.29 | 0.39 | 0.37 | 0.36 | 0.31 | 0.38 | 0.11 | 0.14 | 0.38 | 0.23 | 0.18 | 0.23 | 0.18 | 0.37 | 0.30 | 0.22 | 0.42 | 0.28 | 0.14 | 0.03 |

- * Note: Only results on linear regression models are included, with log amount raised as the dependent variable. The first row lists the relevant papers; papers denoted with * use the actual amount raised instead; ** denotes the use of . Note that several papers present results on multiple model specifications; whenever this is the case, we only include the most informative one. The data sample period and size (N) used in each paper are shown in rows 1–3; the final row shows the regression R, using the adjusted value when available. The remaining rows exhibit the results on relevant explanatory variables; a (−) sign denotes a positively (negatively) significant coefficient and an ‘o’ denotes an insignificant coefficient. No entry denotes that the explanatory variable was not included in the regression. The commonly used explanatory variables are derived using the characteristics of the venture, the token offering and the token itself, the venture's social media activity, venture ratings from dedicated rating and ranking websites and also market and sentiment factors. The ‘Rating’ variable includes results from any variant of the token offering rating variable (Experts Rating, Team Rating, Vision Rating, Project Rating) similar to Bourveau et al. (2022). We further combine the results for the average ETH/USD price, return and the returns’ (30-day) momentum into a single representative variable here, labelled ETH.

However, multiple and sometimes conflicting arguments are presented on the potential effect of token offering fundraising success factors. This is reflected in the variety of theoretical framework adaptions, and also in the contradictory empirical results of the tokenomics literature shown in Table 1. So, it is not only important to analyse the 2017–2019 sample to discern how success factors have changed over time. There remain several outstanding questions from earlier research where both theory and results have conflicted. For example, the distribution variable reflects the share of total token supply offered to investors, so a lower share implies higher equity retention by the venture, which in turn should reduce investor uncertainty as suggested by Ahlers et al. (2015). However, only half of the papers that examine this variable find a significant negative effect that would be consistent with the above argument. Some consensus is reached, such as the negative effect of longer offering duration on the amount raised, but even there at least one paper finds an insignificant or opposite effect; for instance, Blaseg (2018), Philippi, Schuhmacher and Bastian (2021), and Roosenboom, van der Kolk and de Jong (2020) find that duration has no significant effect on the amount raised. Notable exceptions are the rating variable where all papers find a significant positive effect, and also the supply variable which is used less extensively, possibly due to its high negative correlation with the token's initial price.

- H1: The fundraising success of token offerings increases with the target market capitalization.

- H2: The fundraising success of token offerings increases with signals of public credibility, but only if they are genuine.

- H3: The fundraising success of token offerings increases with investor belief in the appreciation of crypto-assets, as well as investor attention and hype.

- H4: The fundraising success of token offerings is higher for ventures domiciled in a tax haven or with an undisclosed domicile.

- H5: The existence of a bonus scheme, the token's distribution and the duration of the offering have varying effects on the fundraising success of token offerings, depending on the time period examined.8

| Hypothesis | Variable | Definition |

|---|---|---|

| 1 | LogtCap | Log(Price Supply) |

| 2 | Rating | The average rating (between 1 and 5) assigned to each project in ICObench, which is a combination of two components: a rating assigned by ICObench based on project and token offering characteristics such as transparency and team quality, and a rating based on the team, vision and product of each project, assigned by independent experts registered on the ICObench website |

| Team | Number of members in the venture team | |

| Advisors | Number of members of venture advisory board | |

| Pre-Sale | Binary variable indicating whether a venture conducted a preliminary token sale prior to the main offering | |

| Github | Binary variable indicating whether the venture's Github profile was active at the beginning of the offering, a proxy for the venture's activity on Github | |

| Whitepaper | Binary variable indicating whether a venture's whitepaper is available on ICObench | |

| 3 | ETH Price | Average ETH/USD price level over the duration of each token offering |

| ETH Mom | Average of ether's momentum over the duration of each token offering | |

| Average value of Google search index relating to general token offering activities during duration of token offering | ||

| Binary variable indicating whether the venture was active on Twitter at the beginning of the offering | ||

| 4 | OFC | Offshore Financial Center is a binary variable that indicates if a venture is domiciled in a tax haven or has no registered domicile |

| 5 | Bonus | Binary variable showing whether an offering includes a bonus scheme rewarding early investors with rebates on the price paid for purchasing the token |

| Distribution | The percentage of the token's total supply offered for sale | |

| LogDuration | The log of the offering's duration in days |

- Note: 1. Token's initial offered price total number of token units created; 2. when ICObench unavailable, we obtained ratings from similar rating websites. No ratings available for 2021–2022; 3. Github profile URL obtained from ICObench or similar websites; 4. ETH price obtained from CryptoCompare; 5. momentum defined as 30-day moving average of daily returns; 6. daily values are average of the Google Web, Google News and YouTube search volume for any of the terms ‘Bitcoin’, ‘Ethereum’ and ‘Blockchain’. Obtained from Google Trends; 7. constructed by retrieving the date of creation for each venture's Twitter profile; 8. tax-havens include Anguilla, Bahamas, Belize, Bermuda, British Virgin Islands, Cayman Islands, Costa Rica, Curacao, Cyprus, Gibraltar, Guyana, Hong Kong, Isle of Man, Jersey, Liberia, Liechtenstein, Luxembourg, Malta, Marshall Islands, Mauritius, Monaco, Nauru, Panama, Saint Kitts and Nevis, Samoa, Seychelles, Singapore, St. Vincent & Grenadines, Taiwan; 9. more granular information in 2021–2022 sample (distributed via a token sale, retained by team, retained for liquidity provision, airdropped for promotion) combined into Distribution-H variable defined by Boydstun, Bevan and Thomas III (2014).

Data and models

Here we describe the data sources, define the dependent and independent variables used and specify the models.

Data sources

Our primary data sources were ICObench and Cryptorank. We created Python-based webscrapers to collect an initial sample of 7162 token offerings from these sites between 1 January 2015 and 1 September 2022. Some token offerings had missing data on important variables, which limited our sample to 3475 offerings, 2156 (62%) of which took place during the 2021–2022 period, which has not been examined before. Only 902 (26%) had data on soft-cap exceedance, and all those token offerings were during the pre-2021 period.9 Obtaining reliable data on offerings ending in 2020 was especially, difficult so we resorted to manual data collection from many different sources and launchpad websites such as Coinlist and also from the following ranking and rating websites: Bestcoinlist, Cryptototem, Coincurb, Coinpaprika and ICOmarks.10 From January 2021, the most reliable source of data appears to be Cryptorank but even this omitted data on ratings, team size, number of advisors, pre-sales events and the existence of a whitepaper. Manual searches on project websites garnered only partial information on these variables, so we were unable to investigate H2 using the same models as employed up to the end of 2020. Likewise, we could not test H4 due to lack of details about the domicile of the project. On the other hand, we now had information about the type of token offering, with most of the traditional ICO setups morphing into IDOs or IEOs. New data on the identity of the launch platforms might provide some insight to H2, but only if the platform selected is a signal of public credibility. It is now easier to find CEX/DEX ratings or lists of the best launch platforms than ratings of token offerings themselves. However, the exchange ratings are based on very broad criteria, and they can differ markedly according to the source. Also, apart from the Binance launchpad, which most lists agree upon, the best launchpads cited are quite different.11 So, data on platform ratings have too much uncertainty to use as a reliable indicator of quality.

Our dataset is much more extensive than those used in related studies. Lyandres, Palazzo and Rabetti (2022) review data availability and quality on token offerings, and Momtaz (2021d) provides TORD, including details of the amount raised for approximately 2100 offerings (excluding data on hard cap, total token supply and number of tokens for sale). The difficulty of obtaining complete data is apparent even when examining the ten largest offerings by funds raised: EOS, LEO, Telegram Open Network (TON), Dragon Coin, Huobi, Hdac, Filecoin, Tezos, Sirin Labs and Bancor. Only Dragon Coin and Filecoin have a complete dataset. We exclude TON and LEO from our sample: TON does not strictly qualify as a public token offering because it raised everything during the pre-sale; LEO provided no technical details until after the sale concluded amid numerous legal issues.

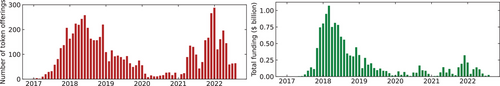

The left-hand panel of Figure 1 depicts the number of token offerings that end in each month. A decline began in June 2018 until the Covid pandemic, but by late 2021 the number reached new all-time highs, with almost 300 offerings in December 2021 and more than 800 between January 2022 and September 2022. The right-hand panel of Figure 1 depicts the total amount raised by token offerings in each month, omitting all but two of the ten largest offerings for the reasons given above. This amount reached an all-time high exceeding $1 billion in March 2018, but has dropped off markedly since, only beginning to rise again by the end of 2021. The results in Figure 1 motivate our selection of four subsamples for separate analysis: (i) the initial boom market from Q1-2017 to Q2-2018; (ii) the subsequent bear market from Q3-2018 to Q4-2019; (iii) the inactive Covid period during 2020; and (iv) the newly resurgent market from Q1-2021 to Q3-2022. In the next subsection we provide further motivation for the analysis of different subsamples, using a statistical analysis of how the variable's characteristics have changed over time.12 Given the larger than ever volume of token offerings in 2021 but much smaller amounts raised in each, the characteristics of token offerings changed considerably after the Covid period in 2020, confirming the need for entirely new models to explain the determinants of fundraising success.

Variables

The dependent variables are the log of the amount raised in USD (logRaised) and a binary variable indicating whether the amount raised exceeds the offering's soft cap (Raised Softcap). These two proxies for fundraising success are also complementary: using the log amount raised, requires exclusion of offerings with zero funding raised, but we can include such cases under the soft cap exceedance probit models, which capture a clear success–failure boundary. If an offering fails to reach its soft cap, the token sale is usually cancelled and all funds are returned to investors. Of more than 2000 token offerings in the 2021–2022 sample, not one included a soft cap. This is because ventures now aim for lower funding targets that are almost always achieved. As a result, in the 2021–2022 period, soft cap exceedance is no longer a meaningful measure of success. We do not use the hard cap as a similar variable because no adverse consequence is incurred if an offering does not achieve its hard cap.13

The explanatory variables are defined in Table 2 and the control variables are defined in Table 3. Endogeneity within the set of variables used might stem from the usual causes of omitted variables and measurement error. However, simultaneity is not likely to be an issue since all token offering characteristics – such as the sale price and venture domicile – are determined prior to the offering itself. Additionally, the examination of fundraising success for past token offerings can be considered as a quasi-experiment, as described by Gippel, Smith and Zhu (2015), that is, ‘a naturally occurring state (event) resulting from a social or political situation and thus not intentionally set up by the researcher’, and in that sense the explanatory variables can be considered as exogenous with respect to the fundraising success of an offering.

| Variable | Definition |

|---|---|

| High | Artificial Intelligence, Banking, Big Data, Business services, DeFi, Electronics, Energy, Investment, Manufacturing |

| Medium | Art, Charity, Communication, Education, Fashion, Health, Infrastructure, Internet, Legal, Media, Real estate, Retail, Software, Tourism |

| Low | Casino and Gambling, Entertainment, Sports, Virtual Reality |

| Category | Categorical variable indicating the exact categorie(s) listed by the token offering |

| IEO | Binary variable indicating whether the token sale was conducted on centralized token launchpad(s) |

| IDO | Binary variable indicating whether the token sale was conducted on decentralized token launchpad(s) |

| ICO | Binary variable indicating whether the token sale was conducted privately on blockchains |

| Platform | Categorical variable indicating the actual platform(s) used for the token offering |

| Accepts BTC | |

| Accepts ETH | Binary variables indicating the accepted payment methods in each offering: |

| Accepts Other | bitcoin, ether, other crypto-assets and fiat money, respectively |

| Accepts Fiat | |

| Capped | Binary variable indicating whether the token offering includes a soft and/or a hard cap |

| LogSoftcap | Log of the soft-cap target |

| Ethereum | Binary variable indicating that the token is launched on the Ethereum platform following an ERC token standard such as ERC 20 |

| KYC | Binary variable indicating whether any investor know-your-customer compliance needs to be completed prior to participation in the offering |

| Whitelist | Binary variable indicating whether any investor pre-registration needs to be completed prior to participation in the offering |

| Offerings | The number of token offerings conducted by the same venture. This is only used in the 2021–2022 sample as it is becoming a common characteristic of token offerings |

- Note: We form three groups representing ventures more likely to be invested in by high-, medium- and/or low-income investors ventures’ categories as reported on ICObench. High-income investors are likely to be venture capital and angel investor funds, medium-income refers to retail investors and low-income refers to token purchases for casual uses such as betting, gaming etc. The overwhelming majority of ventures list multiple categories so the High, Medium and Low are not disjoint. Category, IDO and Platform are only available for the 2021–2022 sample. IEO data obtained from ICObench IEO list for the 2017–2020 sample and from Cryptorank.io for the 2021–2022 sample. Nearly all offerings accept ether since nearly all tokens are deployed as smart contracts on the Ethereum blockchain.

Tables 4 and 5 present the sample statistics for key variables, first for 2017–2020 and then for the subsample from 2021 onward. For brevity, we only include the analysis for the sample of both capped and uncapped token offerings used in the linear regression model configurations. The kurtosis of several variables (e.g. Raised) indicates the presence of outliers; outliers are also visible in the target Cap maximum value, as this variable can, in fact, be arbitrarily high.14 Moreover, scatterplots of Raised versus independent variables were non-linear, whereas logRaised versus independent variables plots were more linear, provided we also used a log transform for target Cap and Duration. Table 6 demonstrates that the means of almost all variables are significantly different across consecutive sample subperiods, further motivating the analysis of different subperiods.

| Mean | SD | Skewness | Kurtosis | Min | Max | |

|---|---|---|---|---|---|---|

| Raised | 10,757,121 | 37,466,999 | 17.99 | 416.98 | 189 | 1,000,000,000 |

| logRaised | 14.81 | 1.99 | −0.98 | 4.78 | 5.24 | 20.72 |

| tCap | 343,300,833,685 | 12,456,103,249,183 | 36.32 | 1319.00 | 1.91 | 452,381,568,335,207 |

| logtCap | 17.65 | 1.78 | −0.34 | 16.28 | 0.65 | 33.75 |

| Rating | 3.4 | 0.6 | −0.4 | 2.5 | 1.3 | 4.8 |

| Team | 9.54 | 6.54 | 1.92 | 9.14 | 1 | 54 |

| Advisors | 5.33 | 5.77 | 1.95 | 10.62 | 0 | 51 |

| ETH price | 420.82 | 244.01 | 0.73 | 2.85 | 10.1 | 1359.48 |

| ETH mom | 0.04 | 0.91 | 0.72 | 3.64 | −2.65 | 3.98 |

| Distribution | 0.51 | 0.23 | −0.36 | 2.61 | 0 | 1 |

| Duration | 59.66 | 68.74 | 3.85 | 26.57 | 1 | 877 |

| logDuration | 3.48 | 1.33 | −1.09 | 4.2 | 0 | 6.78 |

- Note: Based on a sample of 1319 offerings completed between January 2017 and December 2020. All variables are defined in Table 2. Amount raised, target cap and ether price are measured in USD. Logarithms are taken of variables with excessively high kurtosis. We did not use a log transform for variables such as Distribution, ETH price and ETH mom because their relationship with the dependent variable logRaised is fairly linear already.

| Mean | SD | Skewness | Kurtosis | Min | Max | |

|---|---|---|---|---|---|---|

| Raised | 747,356 | 4,159,912 | 14.53 | 286.03 | 3000 | 108,850,000 |

| logRaised | 12.01 | 1.19 | 1.66 | 7.68 | 8.01 | 18.51 |

| tCap | 6,754,166 | 54,495,934 | 33.65 | 1315.11 | 25 | 2,232,029,851 |

| logtCap | 14.13 | 1.53 | 0.15 | 6.29 | 3.23 | 21.53 |

| ETH price | 3140.12 | 925.45 | −0.23 | 2.21 | 822.32 | 4810.97 |

| ETH mom | 0.00 | 0.01 | 0.23 | 3.08 | −0.02 | 0.03 |

| 30.7 | 9.99 | 1.51 | 6.76 | 14.9 | 97.33 | |

| Offerings | 2.97 | 2.17 | 2.72 | 13.53 | 1 | 15 |

| Distribution-H | 0.40 | 0.43 | 0.19 | 1.09 | 0 | 0.99 |

| Duration | 1.69 | 2.92 | 10.53 | 176.53 | 1 | 70 |

| logDuration | 0.21 | 0.57 | 2.97 | 11.93 | 0 | 4.25 |

- Note: Based on a sample of 2156 offerings completed between January 2021 and September 2022. All variables are defined in Table 2. Amount raised, target cap and ether price are measured in USD. Logarithms are taken of variables with excessively high kurtosis.

| 01/2017–06/2018 | 07/2018–12/2019 | 01/2020–12/2020 | 01/2021–09/2022 | |

|---|---|---|---|---|

| Raised | 13,414,500 | 9,276,633*** | 4,618,561*** | 747,356*** |

| logRaised | 15.14 | 14.65*** | 13.87*** | 12.01*** |

| tCap | 768,320,034,306 | 400,412,681*** | 217,702,746*** | 6,754,166*** |

| logtCap | 17.84 | 17.51*** | 17.46*** | 14.13*** |

| Rating | 3.25 | 3.53*** | 3.50*** | |

| Team | 9.01 | 10.15*** | 8.92*** | |

| Advisors | 5.44 | 5.69*** | 2.61*** | |

| ETH price | 613.26 | 258.96*** | 305.39*** | 3,140.12*** |

| ETH mom | 0.29 | -0.28*** | 0.55*** | 0.00*** |

| Distribution | 0.56 | 0.52*** | 0.26*** | |

| Duration | 40.36 | 74.92*** | 77.16** | 1.69*** |

| logDuration | 3.37 | 3.76*** | 2.40*** | 0.21*** |

- Note: We use the standard t-test for differences in population means between the entries in two adjacent columns of the table. Here *, ** and *** indicate whether the difference of means for consecutive subperiods (current and preceding column) is significantly different from zero at the 1%, 5% and 10% levels, respectively. Since every element is significant at 1%, there is clear evidence that the values of the explanatory variables change, depending on the subperiod chosen. Data on some variables are not available during the last sample. As explained in the text, we believe that this is because they cease to be relevant for token offering success. And while data on Distribution are available, they are even more granular during the 2021–2022 subsample, so we use the Distribution-H instead as previously explained.

Models

Empirical results

We estimate models (1) and (2) for the 2017–2020 sample and model (3) for the 2021–2022 sample. We briefly comment on our results in light of the previous literature, but due to lack of space please refer to the Additional Results section of the online Supplementary Appendix for more detailed discussions and additional results.

2017–2020

Table 7 displays results for estimating Equation (1) using ordinary least squares with heteroscedasticity-robust standard errors estimated using the Huber–White sandwich estimator, while additional discussion on the probit model results is included in the online Supplementary Appendix.17

| Jan 2017 to Jun 2018 | Jul 2018 to Dec 2019 | Jan to Dec 2020 | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| (i) Basic | (ii) Full | (i) Basic | (ii) Full | (i) Basic | ||||||

| Constant | −0.931*** | (−3.83) | −0.937*** | (−3.38) | −0.224 | (−1.00) | 0.098 | (0.35) | −1.074* | (−1.81) |

| logtCap | 0.254*** | (4.59) | 0.264*** | (5.06) | 0.360*** | (8.70) | 0.348*** | (8.01) | 0.317** | (2.58) |

| Pre-sale | −0.036 | (−0.49) | −0.042 | (−0.57) | −0.021 | (−0.28) | −0.012 | (−0.15) | −0.249 | (−1.21) |

| Rating | 0.393*** | (6.11) | 0.354*** | (5.45) | 0.088 | (1.39) | 0.100 | (1.52) | 0.100 | (0.85) |

| Team | 0.022*** | (4.14) | 0.021*** | (3.87) | 0.017*** | (3.14) | 0.018*** | (3.10) | 0.024** | (2.26) |

| Advisors | 0.005 | (0.83) | 0.004 | (0.71) | 0.007 | (1.08) | 0.009 | (1.22) | −0.003 | (−0.11) |

| ETH price | 0.167*** | (3.83) | 0.165*** | (3.75) | 0.166*** | (2.84) | 0.162*** | (2.70) | −0.266* | (−1.77) |

| ETH mom | −0.010 | (−0.32) | 0.000 | (0.01) | −0.048 | (−0.86) | −0.027 | (−0.45) | 0.175 | (1.64) |

| OFC | 0.162** | (2.23) | 0.166** | (2.27) | 0.211*** | (2.97) | 0.193*** | (2.59) | 0.064 | (0.33) |

| Bonus | −0.131* | (−1.80) | −0.150** | (−2.03) | −0.108 | (−1.38) | −0.109 | (−1.35) | −0.296 | (−1.26) |

| Distribution | −0.081* | (−1.74) | −0.079 | (−1.61) | 0.113** | (2.54) | 0.092** | (2.03) | −0.009 | (−0.06) |

| logDuration | −0.149*** | (−4.65) | −0.165*** | (−4.95) | −0.071*** | (−2.62) | −0.085*** | (−2.84) | 0.019 | (0.32) |

| Accepts BTC | 0.149* | (1.79) | 0.157* | (1.95) | ||||||

| Accepts ETH | −0.018 | (−0.12) | −0.178 | (−1.02) | ||||||

| Accepts other | 0.002 | (0.02) | −0.022 | (−0.25) | ||||||

| Accepts fiat | 0.192* | (1.80) | −0.162 | (−1.57) | ||||||

| Capped | 0.171 | (1.35) | −0.210 | (−1.39) | ||||||

| Ethereum-based | 0.033 | (0.33) | 0.006 | (0.05) | ||||||

| IEO | 0.386 | (1.01) | −0.204* | (−1.69) | ||||||

| KYC | −0.027 | (−0.29) | 0.046 | (0.50) | ||||||

| Whitelist | 0.119 | (1.33) | −0.009 | (−0.13) | ||||||

| High | 0.006 | (0.07) | 0.092 | (1.22) | ||||||

| Medium | −0.156** | (−2.08) | −0.075 | (−1.05) | ||||||

| Low | 0.043 | (0.43) | −0.073 | (−0.64) | ||||||

| Observations | 589 | 589 | 626 | 626 | 104 | |||||

| R | 0.292 | 0.314 | 0.209 | 0.226 | 0.210 | |||||

| Adj. R | 0.278 | 0.286 | 0.195 | 0.197 | 0.116 | |||||

- Note: The sample period is divided into three subsamples: 1 January 2017 to 30 June 2018, 1 July 2018 to 31 December 2019 and 01 January 2020 to 31 December 2020. The model specifications are: (i) Basic which mostly includes the variables involved in our hypothesis; (ii) full which further includes additional variables. The first column in each model specification displays the regression betas and the second column displays the t-statistics in parentheses; *, ** and *** denote significance at 10%, 5% and 1%, levels respectively.

Consistent with H1 logtCap is significant and positive in all estimations. During the post-boom period, a 1% increase in target cap is associated with a 0.359% increase in amount raised.18 Using Rating, Pre-sale, Team and Advisors as genuine signals, there is only partial support for H2. The importance of Rating has dwindled over time, holding a pre-sale appears unimportant, and the number of team members has a significant and positive effect in all subsamples.19 There is overwhelming consensus about the positive significance of Team in the linear model.20 Like us, both Amsden and Schweizer (2018) and Ante and Fiedler (2020) find the effect of advisory team size to be insignificant, suggesting that investors consider certain cheap signals to be reliable and may not trust other signals, even if they are costly to produce. Regarding H3, until the pandemic subsample, the average ETH/USD price during the offering has a highly significant positive effect on the amount raised, indicating that it captures investor belief in crypto-asset appreciation.21 H4 is partially confirmed but only in the first subsample and likewise for H5, the significance of Bonus, Distribution and logDuration dwindles over time.22

2021–2022

Our largest sample of 2156 token offerings was completed during 2021–2022, a period not examined in the extant literature. We compare results with our previous findings from the 2017–2020 period by (i) estimating a basic configuration of model (3) which only includes the main variables of the 2017–2020 estimations, to the extent that they are available. Controls are added in the corresponding configurations for (ii) the type of token offering, (iii) the venture's category and (iv) the launchpad platform.23 All variables and controls are included in the full model (v). Table 8 includes the main results of the linear model and shows that they are consistent across all configurations, while the full results are included in the online Supplementary Appendix. The adjusted is much greater than in any previous results. During 2021–2022, the launchpad platform and the type of offering where the most significant determinants of token offering fundraising success.

| (i) Basic | (ii) Type | (iii) Category | (iv) Platform | (v) Full | ||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Constant | 0.147*** | (3.90) | 2.000*** | (10.01) | 0.280*** | (3.17) | 0.666*** | (6.70) | 1.920*** | (7.91) |

| logtCap | 0.377*** | (10.82) | 0.331*** | (9.58) | 0.365*** | (10.17) | 0.303*** | (10.01) | 0.254*** | (7.91) |

| ETH price | 0.093*** | (4.23) | 0.106*** | (5.04) | 0.130*** | (4.88) | 0.055*** | (2.78) | 0.130*** | (5.82) |

| ETH mom | −0.069*** | (−3.37) | −0.094*** | (−4.74) | −0.072*** | (−3.32) | −0.059*** | (−3.29) | −0.097*** | (−5.30) |

| −0.045** | (−2.32) | −0.045** | (−2.35) | −0.027 | (−1.29) | −0.042** | (−2.37) | −0.031* | (−1.73) | |

| Offerings | −0.073*** | (−8.12) | −0.077*** | (−9.21) | −0.080*** | (−8.74) | −0.050*** | (−5.94) | −0.047*** | (−5.48) |

| Distribution-H | 0.020 | (0.41) | 0.062 | (1.35) | −0.028 | (−0.53) | 0.023 | (0.56) | 0.004 | (0.10) |

| logDuration | 0.296*** | (6.93) | 0.251*** | (6.33) | 0.299*** | (6.95) | 0.124*** | (3.19) | 0.128*** | (3.37) |

| Type | Yes | Yes | ||||||||

| Category | Yes | Yes | ||||||||

| Platform | Yes | Yes | ||||||||

| Observations | 2156 | 2156 | 2156 | 2156 | 2156 | |||||

| R | 0.186 | 0.302 | 0.21 | 0.509 | 0.567 | |||||

| Adj. R | 0.183 | 0.299 | 0.193 | 0.486 | 0.538 | |||||

- Note: The sample period is 1 January 2021to 1 September 2022 containing 2156 token offerings. The model specifications are: (i) Basic, followed by additional specifications controlling for the token offering's type (ii), category (iii) and token offering platform (iv), and also a full specification (v) which contains all controls. Note that an extended table with full estimation results for all control variables (Type, Category, Platform) is included in the Supplementary Appendex. The first column in each model specification displays the regression betas and the second column displays the t-statistics in parentheses; *, ** and *** denote significance at 10%, 5% and 1%, levels respectively.

A significant positive effect for logtCap confirms H1. The size of this effect is much larger than previously found. The number of token offerings launched by the same venture is negatively associated with the amount raised, since the total funding required for the venture is achieved from multiple offerings. In line with H3 ETH price again has a positive effect, but contrary to H3, ETH momentum now has a significant negative effect, perhaps because the sample spans a prolonged period of negative momentum in ETH/USD returns while token offerings continue to be successful. Regarding the ‘hype’ aspect of H3, the combined volume of Google and YouTube searches on ‘Bitcoin’, ‘Ethereum’ and ‘Blockchain’ keywords is negatively correlated with the amount raised. Investors in token offerings, therefore, appear to be more informed about Web 3 developments than the general public, who were reducing their attention to the crypto-asset space during this period. Regarding H5, the effect of distributing the token's supply shares more equally is relatively small and insignificant, and the duration of the offering now has a significant positive effect, contrary to our findings for 2017–2020. This is not surprising because the average duration fell from approximately 40 days in 2017–2020 to less than 2 days in 2021–2022. Regarding H2, recall that the last subsample only has one potentially genuine signal of public credibility (i.e. the choice of platform), and given that the launchpad platform choice now appears to play a central role in token offering success, the domicile effect of H4 is no longer relevant, as discussed previously.

Table 9 summarizes the parameters of the basic model configurations of Tables 7 and 8, now marking statistically significant parameter differences between consecutive sample subperiods. Most parameters vary significantly across subperiods, confirming that token offering success determinants exhibit significantly different behaviour across time.

| 01/2017–06/2018 | 07/2018–12/2019 | 01/2020–12/2020 | 01/2021–09/2022 | |

|---|---|---|---|---|

| Constant | −0.931 | −0.224*** | −1.074*** | 0.147*** |

| logtCap | 0.254 | 0.360** | 0.317 | 0.377*** |

| Pre-sale | −0.036 | −0.021 | −0.249*** | |

| Rating | 0.393 | 0.088*** | 0.100 | |

| Team | 0.022 | 0.017 | 0.024 | |

| Advisors | 0.005 | 0.007 | −0.003 | |

| ETH price | 0.167 | 0.166 | −0.266*** | 0.093*** |

| ETH mom | −0.010 | −0.048 | 0.175** | −0.069*** |

| OFC | 0.162 | 0.211* | 0.064*** | |

| Bonus | −0.131 | −0.108 | −0.296*** | |

| Distribution | −0.081 | 0.113*** | −0.009** | |

| logDuration | −0.149 | −0.071 | 0.019 | 0.296 |

- Note: We use the basic specification (i) for each subperiod, and parameter differences are tested for in consecutive subperiods. Here *, ** and *** indicate whether the difference of parameters for consecutive subperiods (current and preceding column) is significantly different from zero at the 10%, 5% and 1% levels, respectively. Note that the 2021–2022 subperiod model does not include variables such as Pre-sale, Rating etc. as they were unavailable.

Token offering type, category and platform

These are included as control variables in models (ii), (iii) and (iv) of Table 8, respectively.24 Each estimated coefficient is added to the overall constant coefficient to find the net effect on log amount raised. We compare the effect of different control variables on fundraising success in standard deviation units of the amount raised.25 There are 62 ICOs, 297 IEOs and 1797 IDOs in the sample. In specification (ii) of Table 8, the constant is 2.00 and we set ICO type as base, so its coefficient is zero, while the IDO and IEO coefficients are −1.846 and −2.252, respectively. The resulting offering ‘Type ’ for the log amount raised, in standard deviation units, is therefore 2.00 for an ICO, 0.154 for an IDO and −0.252 for an IEO. Therefore, even though the traditional ICO is no longer very common, these offerings tend to raise more funds. IDOs are now much more prevalent than ICOs, and it is also possible to raise above-average funding via IDOs. But for IEOs overall, the net effect on logRaised is significantly negative. ICOs have a higher average tCap compared to IEOs and IDOs and, consistent with H1, ICOs are found to have the highest alpha; interestingly, this is not the case for IEOs and IDOs (i.e. IEOs have a significantly higher average tCap compared to IDOs, but exhibit a much lower–even negative–alpha). Perhaps IEOs are considered more as a means of marketing by on-boarding the token directly to a CEX? The negative IEO alpha may also be explained by the fact that most large CEXs require a minimum issuance amount for IEOs, hence it is possible that in order to launch their IEOs, issuers are required to raise larger amounts than initially intended, which are usually pre-allocated and validated with key investors just as in traditional IPOs, and this practice may be deterring prospective investors.

Next we examine the effect of category. Categories represent the economic sector that a project is aiming to improve and/or is based in within the crypto space; they comprise projects with similar products, applications or other common properties such as business model, degree of decentralization and nature of blockchain interaction, and provide information about the key technical properties of a project, which can be useful during initial analysis. It is important to note that each aggregation website is inventing its own ad hoc project category taxonomy, given that no standardized framework exists, such as an extension of the CryptoCompare framework to token offerings; while such a standardization is greatly needed in this space, its lack is to some extent reasonable given how quickly the token offerings market changes.

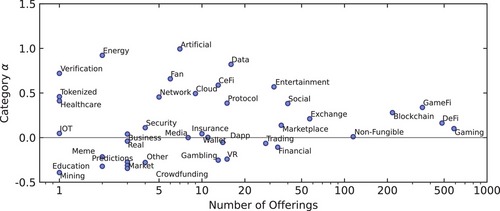

We rank-order categories by their corresponding ‘Category ’, this being the sum of the constant in (iii) plus the coefficient estimate for each category. Figure 2 depicts the scatterplot of category versus the number of token offerings per category. The largest alphas are observed for categories such as Energy, Artificial Intelligence (AI) and Data, although together these categories only include 25 token offerings in total. The correlation between category and number of offerings is significantly negative. Thus, less competition from other ventures in the same category allows the issuers to capture more of the available funding in that space. Nevertheless, the very popular categories like Gaming, DeFi, GameFi, Blockchain and Non-Fungible ventures have a positive alpha, indicating that considerable funding is still available in these areas of Web 3 project development. It is considered reasonable that such categories attract significant investor interest in 2021–2022 in terms of both the number of offerings as well as the higher-than-average funding raised, given that IDOs themselves are a product of the decentralized finance (DeFi) surge in late 2020; similarly, interest in non-fungible token (NFT) ventures has increased significantly in 2021–2022, while GameFi is defined as the intersection of gaming and finance in an environment driven by use of blockchain, NFTs and smart contracts. Moreover, a near-zero and even negative category is observed for several token offering categories at both ends of the popularity spectrum, such as Education and Internet-of-Things ventures with only a single offering each, as well as more popular categories such as Virtual Reality, Gambling and Trading. This indicates that certain token offering categories do not attract higher-than-average funding, whether by design or inability, regardless of the level of intra-category competition or lack thereof. In the context of H3, the alphas observed for different categories are also a reflection of prospective investors’ level of conviction relative to the appreciation of tokens launched by ventures in each category, while also reflecting the overall level of public credibility attributed to specific offering categories in the context of H2.

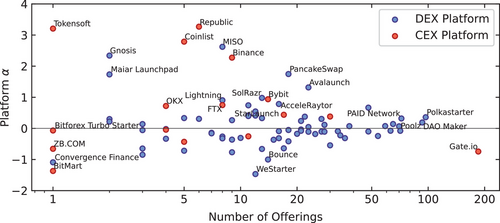

Finally, we discuss the coefficients from model (iv) which we call the ‘Platform ’. These vary considerably, from over 3 to less than −1. For example, a token offering on the Republic platform has a coefficient of 2.603 which we add to the constant of 0.666 to obtain a platform of 3.269. So, ceteris paribus, launching a token offering on the Republic launchpad platform increases the log amount raised by more than three standard deviations. By contrast, launching on the WeStarter platform would decrease the log amount raised by more than one standard deviation. Again, we set these platform α's in context, by recording the number of token offerings per platform.26 To this end, Figure 3 presents a scatter plot of platform versus number of offerings, where we colour each point according to the platform type: blue for decentralized exchanges (DEX) and red for centralized exchanges (CEX). The correlation between number of offerings and IDO is significant and negative, but there is no significant correlation with IEO . The greatest s are achieved by less popular platforms such as Republic, Tokensoft, Coinlist, MISO and Gnosis. However, PancakeSwap and Avalaunch have a slightly lower alpha but are somewhat more popular, hence providing more liquidity at the trading stage, so token issuers may still prefer to list there. Binance has one of the highest alphas of all CEX platforms, and Gate.io has one of the most negative. Although it is the most popular platform, there are several critical reviews of Gate.io's service.27 These platform s may provide a more objective means of rating launchpad platforms than the ad-hoc lists currently available. Additionally, in the context of our hypothesis–and specifically H2–the alpha values observed for different platforms are again a reflection of the public credibility attributed to offerings launched in the corresponding launchpad platforms. Similarly, and in the context of H4, the significant increase in the regression observed in specification (iii), which adds the platform control variable, as shown in Table 8, could indicate that investors may now be less interested in the venture's domicile (which is unknown for all offerings in the 2021–2022 sample) and perhaps they are now more interested in the domicile and regulatory standing of launchpad platforms, given their newfound central role in the token offerings space.

Summary and conclusions

Our data allow one to track how the fundraising success of token offerings has changed over time, and resolves the conflicts in previous research based on much smaller, and different, samples. Most previous empirical research on this topic uses samples that end in 2018, but the number of token offerings in 2021 and 2022 is much higher than previously, whereas the average amount raised per offering is very much smaller than it was before. Many structural changes in the token-offering market have changed the determinants of fundraising success, and now a whole new set of variables explains why some token offerings are more successful than others.

Only a handful of the earlier findings are robust to changes in the sample period, specifically, a higher target market capitalization still has a positive and significant effect (1% increase in target cap increases amount raised by roughly 0.3%), a higher soft cap still has a negative effect (1% increase in soft cap decreases the probability of exceeding it by around 14%) and a higher dollar price for ether always increases the amount of USD funding raised. However, some data are now difficult to source, including the number of team members and being located in a tax-haven or undisclosed venture domicile. Both of these variables used to have a positive and significant influence on the amount raised.

Some of our results are particular to token offerings, since they build on specific features that are not present in other forms of fundraising. Other results confirm previous findings in the entrepreneurial finance literature. Specifically, that crowdfunding success improves with certain genuine signals of credibility, the attention and beliefs of investors and the hype surrounding particular types of project; but a tax haven domicile has no significant effect on crowdfunding success. Analysis of the most recent period also shows a very highly significant, positive and robust effect of both target cap and duration on the amount of funds raised. These topics have been investigated previously in the entrepreneurial literature, but results from different studies sometimes differ considerably.

We focus on the actual size of the effect, not only on its significance. An expert's rating of the project used to be one of the most influential variables, with a rise of 1 on a Likert scale increasing the amount raised by almost 50% and the probability of exceeding the soft cap by about 25%. But in 2021–2022, subjective reviews of the platform used, rather than ratings of the project itself, are more influential indicators of fundraising success. Our platform provides a more objective means of rating launchpad platforms. It also focuses on offering success, and not the numerous other qualities of a CEX or DEX that are commonly used in exchange ratings. In terms of project characteristics, the category seems very important too. Gaming, DeFi, NFTs and Blockchains are able to raise more than average, but Energy and AI are the most successful. The type of offering and launchpad platform used are also much more important now. The size and significance of all these determinants of fundraising success overshadows any previously documented effect in the literature. We conclude that token offerings are becoming more accepted as valid forms of crowdfunding.

Biographies

Carol Alexander is Professor of Finance at the University of Sussex and an expert in crypto markets, risk analysis, pricing and hedging options, volatility analysis, investment strategies and portfolio management. Throughout her corporate and academic careers, Carol has designed models and solutions for a wide range of asset management and investment banking clients and several of the largest global exchanges. She also acts as an expert witness.

Michael Dakos was Carol's PhD student at Sussex when working on this paper. As well as this work on tokenomics, his thesis also focused on risk modelling and manipulation of crypto asset markets, providing some of the earliest data analysis in these fields, with an additional two papers published in Quantitative Finance. He is now a business consultant at Ernst & Young, Athens specializing in financial risk modelling, engaging in quantitative model development and validation.

References

- 1 Except for some native tokens to new layer 1 blockchain projects, most tokens are minted on a non-native blockchain.

- 2 In certain jurisdictions, security token offerings have been regulated more strictly than other types of token offering. See OECD (2019) and also relevant research by Ante and Fiedler (2020), Bongini et al. (2022) and Lambert, Liebau and Roosenboom (2022). In fact, the increase in regulatory oversight for security tokens has driven the majority of ventures to classify their token as utility. However, at the time of writing, the Securities and Exchange Commission is actively pressing for all tokens to be classified as securities, along with the blockchains on which they reside.

- 3 The full Scopus query used is: TITLE-ABS-KEY((‘initial coin offering’ OR ‘ICO’ OR ‘token offering’ OR ‘initial exchange offering’ OR ‘IEO’ OR ‘security token offering’ OR ‘STO') AND (‘success’ or ‘fundraising’ or ‘funding’ or ‘crowdfunding’ OR ‘performance')) AND (LIMIT-TO(SUBJAREA, ‘BUSI') OR LIMIT-TO (SUBJAREA, ‘ECON')) AND (LIMIT-TO(DOCTYPE, ‘ar') OR LIMIT-TO(DOCTYPE, ‘cp')).

- 4 For instance, Thies et al. (2022) suggest that the components of a token offering exhibit the typical characteristics of crowdfunding and IPOs. Ahlers et al. (2015) examine funding success on equity crowdfunding platforms and develop a framework in which the key factors of a venture's funding success are: (i) observable characteristics of venture quality and (ii) reduced investor uncertainty. Ahlers et al. (2015) suggest that venture quality is demonstrated to prospective investors via signals of human, social and intellectual capital, while Baum and Silverman (2004) present a similar argument for startups that receive venture capital funding. Connelly et al. (2011) argue that an observable signal of venture quality also needs to be costly to produce.

- 5 Fisch (2019) introduces several proxy factors for technological capability. Chen (2019) highlights the importance of highly credible and easily interpretable signals. Philippi, Schuhmacher and Bastian (2021) examine technological, venture and campaign characteristics as signals of the venture's technological capabilities. Campino, Brochado and Rosa (2022) view token offering projects operating in an ‘open systems model’ in relationship to prospective investors. Thies et al. (2022) distinguish between endogenous and exogenous signals and suggest that both can influence token offering success. In the same vein, Aggarwal, Hanley and Zhao (2019) and Yen, Wang and Chen (2021) examine external quality ratings, while Belitski and Boreiko (2022) interpret additional venture characteristics as quality signals.

- 6 For instance, Faust et al. (2022) and Mansouri and Momtaz (2022) examine whitepapers using machine learning models, while Samieifar and Baur (2021), Florysiak and Schandlbauer (2022), Kasatkin (2022) and Thewissen et al. (2022, 2023) also focus on whitepaper characteristics; Roosenboom, van der Kolk and de Jong (2020) examine bonus schemes and offering duration; Amsden and Schweizer (2018) consider the ETH/USD traded price and volatility; Albrecht, Lutz and Neumann (2020) focus on the initial offering price and online search trends; Blaseg (2018), Momtaz (2020), Campino, Brochado and Rosa (2021), Guzman, Pinto-Gutierrez and Trujillo (2021) Huang, Vismara and Wei (2021), and Xu et al. (2021) focus on venture team characteristics; venture CEO characteristics are examined by Momtaz (2021a, 2021c) and Colombo et al. (2022); Fisch, Meoli and Vismara (2022) examine the choice of token offerings versus traditional financing alternatives; topics such as venture capital investor participation, venture domicile and fraudulent behaviour are examined by Giudici and Adhami (2019), An et al. (2021), Hackober and Bock (2021) (similar to the topics examined for traditional venture capital finance by Capizzi, Croce and Tenca, 2022 and Levasseur, Johan and Eckhardt, 2022), Shrestha et al. (2021), Hornuf, Kück and Schwienbacher (2022), Swartz (2022), and Ahmad, Kowalewski and Pisany (2023).

- 7 The size of the venture's team and advisory board could be interpreted as cheap signals, as they give no indication of quality. But a high-quality individual's reputation is put at risk when joining a venture team or advisory board of low quality, so we consider the voluntary participation of an individual in a venture as a genuine signal of credibility.

- 8 Given the lack of consensus in the formulation of hypothesis about bonus, distribution or duration in the extant literature, it is difficult to argue consistently for either positive or negative alternative hypothesis relating to these variables.

- 9 The gaps remained despite considerable efforts to fill in missing/unknown values from other ranking/rating websites, such as ICOdata, TokenData, ICOdrops, ICOrating and Neironix.

- 10 We sporadically use the following sources as well: ICOholder, Cryptocompare, Smith and Crown, ICOmarketdata, ICOstats, Coincodex and Cryptodiffer.

- 11 See Zipmex Launchpad Ranking or Bitcourier Launchpad Ranking for examples.

- 12 By ending sample (i) in June 2018, we can also compare our regression results with previous empirical findings in the tokenomics literature, where most samples end in the second or third quarter of 2018 (see Table 1).

- 13 Some authors use exchange listing and first-day return as success proxies. However, since almost all the crowdfunding campaigns in 2021–2022 occur on an exchange, listing is automatic. It is rather the quality of the platform that now becomes a new measure of success. We also hesitate to use first-day returns because these can be seriously distorted by pump-and-dump attacks (Hornuf, Kück and Schwienbacher, 2022).

- 14 Given that tCap can be set by the issuers via the starting price and token supply for sale, tCap can be theoretically arbitrarily high. However, in practice, this is not the case for the overwhelming majority of the sample. For example, for the 2017–2020 sample, the high tCap mean (343 billion USD) and maximum (452 trillion USD) values are driven by a very small number of outliers, as shown by the much more reasonable median (49.5 million USD) and 1% and 99% quantiles (300,000 and 4.5 billion USD, respectively), For example, 99% of the 2017–2020 sample of offerings have a target cap below 4.5 billion, while no such issues are observed in the 2021–2022 sample, where issuers appear to set much more reasonable target cap values (max. 2.2 billion USD). Moreover, even in the extreme outlier cases of issuers that tend to ‘abuse’ the arbitrary nature of the target cap, it appears that they tend to massively underperform the obviously unreasonable target, for example, the Prover token offering which set a tCap of 452 trillion USD only raised 7.2 million USD, while out of the 14 token offerings in the 2017–2020 sample which set a target cap higher than the 99th percentile value of the entire population, none were able to achieve even 1% of that target. On a final note, the empirical results of the paper are only based on the logtCap variable, that is, tCap is not used as is, which sidesteps such outlier issues.

- 15 We avoid standardizing binary variables and also variables with units that are already difficult to handle, for example: Rating, which is measured in a Likert-type scale; Team and Advisors, which are measured in ‘number of people’; and logDuration, which is measured in log(Days).

- 16 Blaseg (2018), Albrecht, Lutz and Neumann (2020), Lee, Li and Shin (2022) and Lyandres, Palazzo and Rabetti (2022) provide brief coefficient interpretations but do not explain the impact of standardization or the application of a log.

- 17 Results are robust to the inclusion of controls and previously established token offering fundraising success variables decline in significance over time.

- 18 The online Supplementary Appendix explains our interpretations of the size and marginal effects of coefficient estimates.

- 19 Rating is significant in Aggarwal, Hanley and Zhao (2019), Boreiko and Vidusso (2019), Fisch (2019) and Roosenboom, van der Kolk and de Jong (2020), but not in Momtaz (2021b). Fisch (2019) agrees that Pre-sale is unimportant, but Roosenboom, van der Kolk and de Jong (2020) do not.

- 20 This is confirmed by Amsden and Schweizer (2018), Aggarwal, Hanley and Zhao (2019),Chen (2019), Ante and Fiedler (2020), Roosenboom, van der Kolk and de Jong (2020), Bourveau et al. (2022), and Lyandres, Palazzo and Rabetti (2022).

- 21 Note that we exclude the Twitter, Github and Whitepaper variables from both the linear and probit models because they produce inconsistent results.

- 22 Previous results are mixed: Roosenboom, van der Kolk and de Jong (2020) find (positive) significance for Bonus, but Amsden and Schweizer (2018) do not. Amsden and Schweizer (2018) and Lyandres, Palazzo and Rabetti (2022) find Distribution to be significant, but Fisch (2019) finds the opposite. Roosenboom, van der Kolk and de Jong (2020) also find that , that is, insider token retention, is insignificant. The consensus on the negative significance of offering duration is quite strong across other papers, see , for example, Chen (2019), Fisch (2019), Roosenboom, van der Kolk and de Jong (2020), and Momtaz (2021b).

- 23 This includes both centralized (CEX) and decentralized (DEX) exchanges. All offerings on CEX platforms are IEOs and all offerings on DEX platforms are IDOs.

- 24 Refer to the extended table of 2021–2022 results in the online Supplementary Appendix for the full estimation of type, platform and category parameters.

- 25 Note that the estimated coefficients for certain categories and platforms that only include a small number of offerings may be prone to outlier effects; however, even in these cases the estimated coefficients reflect the average effect observed on the dependent variable from offerings belonging to the corresponding categories or launched on the corresponding platforms.

- 26 Note that there are offerings in our sample for which the launchpad platform is unknown. We denote these with an ‘other’ value and include them in the estimation of Equation (3), also setting the ‘other’ platform value as base so that its estimated coefficient is zero. We do not include the ‘other’ category in Figure 3 since its coefficient does not provide information on a specific launchpad platform.

- 27 See, for instance, the review by Cryptonews.