Re-examining Strategic Flexibility: A Meta-Analysis of its Antecedents, Consequences and Contingencies

Abstract

Strategic flexibility (SF) is a concept that has evolved from strategy through other disciplines, including management, marketing, innovation, entrepreneurship and operations. However, despite attempts to consolidate the domain of SF, there remain theoretical and empirical tensions underlying its antecedents, the consequences and contingencies. Based on 106 independent samples reported in 98 different studies (n = 26,940 firms), we provide a meta-analytical examination of these tensions. We highlight and resolve several disagreements regarding the enablers, inhibitors and triggers of SF, and we reveal an adjusted mean performance effect of 0.24. We further find that the measurement of SF, as well as some, but not all, dimensions of the environment, moderate the performance effect. Finally, an explorative analysis reveals that innovation outcomes and market outcomes mediate the positive relationship between SF and financial outcomes, in addition to a negative direct effect. These insights provide a comprehensive and coherent understanding of the nomological network of SF and a stronger basis for further theorizing and conducting empirical research. Moreover, our findings help firms to refine their strategy by implementing the right enablers that drive SF and to understand how and when their investment in SF pays off.

Introduction

Over the last several decades, organizational adaptation has become a focal topic in management research because of increasing irregularity, complexity, uncertainty and dynamism in most markets and competitive environments (Posen and Levinthal, 2012; Stieglitz, Knudsen and Becker, 2016). Many strategists and management scholars alike assert that strategic flexibility (SF) is fundamental to organizational adaptation. SF is defined as a firm's ability to be proactive or respond quickly to changing conditions, with a wide variety of different internal and external options (Sanchez, 1995; Volberda, 1996).1 Consequently, researchers have a sustained and ongoing interest in the topic of SF (e.g. Brinckmann et al., 2019; Claussen, Essling and Peukert, 2018; Dai et al., 2018; see also Appendix 1 in the online Supporting Information). Recent literature reviews identify divergent theoretical perspectives and different conceptual underpinnings to SF, which pinpoint a series of unresolved tensions (Brozovic, 2018; Combe, 2012).

These tensions arise because the extant literature on SF is heavily fragmented. Research on this topic has developed concurrently in many academic fields, such as strategy, management, marketing, innovation, entrepreneurship and operations, with little theoretical and empirical integration (Combe, 2012). Consequently, several postulated enablers and inhibitors of SF have been subject to disagreement in the literature. For example, it has been argued that decentralization, defined as the degree to which decision-making is delegated within the firm, may either enable (Dai et al., 2018) or inhibit SF (Covin, Slevin and Schultz, 1997). Inhibitors of SF are a largely under-researched area, with several contradictory results reported. For example, some scholars claim younger firms to be more flexible (Nadkarni and Hermann, 2010), while others posit that the degree of flexibility is not dependent on the age of the firm (Brinckmann et al., 2019). Additionally, environmental variables are assumed to trigger SF (Brozovic, 2018), yet with limited empirical insights into whether this is truly the case.

Another major concern is the conflicting empirical evidence regarding the relationship between SF and performance. Evidently, proponents of SF highlight that there is a price to pay for being flexible, one that might outweigh its benefits. For example, Das and Elango (1995) point out that SF entails higher costs, increased stress among employees and a potential lack of focus. Consequently, a paradoxical challenge emerges for managers seeking to build SF, since this action may generate losses that outweigh potential gains. This possibility is mirrored by inconsistent empirical findings on the SF−performance relationship. Previous studies report positive effects (Nadkarni and Herrmann, 2010), mixed effects (Grewal and Tansuhaj, 2001), no effects (Brews and Hunt, 1999) or even negative effects on performance (e.g. adherence to plans pays off for firms; Covin, Slevin and Schultz, 1997).

These contradictory findings call for a thorough examination of the SF–performance relationship, in particular, because previous research has used different SF and performance measures in different types of studies and across a large variety of research contexts. For instance, contingency theory asserts that SF would be beneficial in dynamic environments, but not in stable environments – a theoretical postulate that is evident in empirical research (e.g. Claussen, Essling and Peukert, 2018). However, despite the multiplicity of different contingencies in previous studies, there is limited empirical evidence of the relative extent to which various distinct facets of the environment determine the performance effects of SF (Brozovic, 2018). Moreover, triggers and contingencies occasionally overlap, depending on the theoretical position (Combe, 2012), adding to their conceptual ambiguity.

Overall, despite ongoing academic interest and valuable contributions attempting to consolidate the domain of SF, the literature clearly exhibits unresolved theoretical tensions and disagreements, both across and within disciplines. We employ meta-analytic techniques for theory testing and extension to address these important gaps in the literature. Thus, the purpose of this paper is to bring more clarity to the domain of SF by empirically resolving several existing tensions in the relevant literature because meta-analysis is an indispensable research tool for integrating and expanding a domain's knowledge base (Hunter and Schmidt, 2004). To this end, we integrate the fragmented literature on SF using data obtained from 106 independent samples reported in 98 different studies (n = 26,940 firms). We then use a combination of theory, patterns in data (i.e. relationships from existing studies) and the interplay of theory and data (i.e. consistent and inconsistent findings) to develop a conceptual framework, which we then empirically test in the meta-analysis by employing a combination of bivariate correlation, meta-analytic structural equation modelling (MASEM), meta-analytic regression analysis (MARA) and a moderator analysis.

Our work advances the academic understanding of SF in several ways. First, we bring seemingly distinct but naturally related streams of research on various antecedents of SF into sharper focus through a quantitative meta-analytic synthesis. We resolve several tensions, consolidate the field and provide insights for further research. Second, we synthesize the existing empirical literature on the consequences of SF to derive the mean performance effect of SF. This effect is positive and supports theoretical perspectives that advocate for, rather than oppose, SF. Third, our analyses of contingencies provide guidance about methodological considerations, firm and sample characteristics, as well as conditions of the environment that mitigate or enhance the SF–performance relationship. Finally, our results suggest that the effect of SF on financial outcomes might be more nuanced than previously theorized.

Our work also contributes to managers’ strategic decision processes and behaviours. In recent years, strategists have been increasingly subject to paradoxical challenges with environments that present ever increasing discontinuities. For example, previously unremarkable macro environments now represent some of the most formidable challenges, along with digital transformation and the new normal that summons strategists to question the status quo. Although it is organizationally tempting to embed flexibility as a panacea, strategists can become paralysed by the prospect of not knowing how to approach this SF agenda. A strategy playbook is therefore required in order to move organizations out of the current so-called ‘efficiency paradigm’ – whereby firms seek to service predictable demand behaviours, competing against direct and visible competitors with common resources that can produce repeatable activities, into the ‘exponential paradigm’ – whereby firms move with agility and speed to both shape and predict demand behaviours (Deloitte, 2016). Although this reality implores strategists to embody SF, this can paradoxically often make them inert because of the uncertainty surrounding how to approach this.

Conceptual development

Dimensionality of strategic flexibility

The concept of SF has been addressed by scholars across the strategy, management, marketing, innovation, entrepreneurship and operations disciplines. This diversity, combined with a proliferation in both the theoretical approaches and the empirical methods employed, has resulted in a ‘conceptual schizophrenia’ characterizing the SF literature (Bahrami and Evans, 2011: 37), as evident in the lack of cumulative theory development, multiple theoretical tensions and the need to pursue further attempts to consolidate the field. In reviewing the literature, we find that SF has been conceptualized in various ways, as displayed in Table 1. By summarizing the common ground among the definitions, one can attempt to extrapolate SF's dimensions and offer implications regarding the means by which it is performed. A firm can exhibit SF by being reactive (responding to change) and/or proactive (creating new opportunities) in terms of the variety of available strategic options and/or the speed (timely response) of pursuing a strategic option; it can also react internally through resource deployment and/or externally via competitive actions.

| Sanchez (1995) | Volberda (1996) | Hitt et al. (1998) | Young-Ybarra and Wiersema (1999) | Grewal and Tansuhaj (2001) | |

|---|---|---|---|---|---|

| Definition | Firm's ability to respond to various demands from dynamic competitive environments (p. 138) | The degree to which an organization has a variety of managerial capabilities and the speed at which they can be activated (p. 361) | The capability of the firm to proact or respond quickly to changing competitive conditions and thereby develop and/or maintain a competitive advantage (p. 27) | The ability to adapt to environmental changes, to change game plans, to precipitate intentional changes and to continuously respond to unanticipated changes (p. 440) | Organizational ability to manage economic and political risks by promptly responding in a proactive or reactive manner to market threats and opportunities (p. 72) |

| Context | Product competition | Organizational form | Competitive landscape | Strategic alliances | Economic crisis |

| Dimensions | |||||

| Reactivity | Responding to demands from the product market | The potential for a dynamic fit can be reactive | Responding to changing competitive conditions | Responding to changes in an alliance | Responding to market opportunities |

| Proactivity | – | The potential for a dynamic fit can be proactive | Proact to changing competitive conditions | Precipitate intentional changes in an alliance | Proact to market opportunities |

| Variety | Larger range of alternative products | Variety of managerial capabilities | Variety in product offerings | A wide variety of alliance options | Diverse portfolio of strategic options |

| Speed | Reducing the time required to switch between products | Speed at which managerial capabilities can be activated | Responding quickly to competitive conditions | Timely modification and exit of an alliance | Time to respond to market opportunities |

| Internally | Flexible use of resources for product creation | Ability to adapt capabilities to the demands of the environment | Building dynamic core competences | Internal structural adjustments in an alliance | Developing flexible capabilities |

| Externally | Coordinating resources in the product market | Ability to influence the environment | Exploiting global markets | Adapting to environmental changes | Adapting to market threats and opportunities |

| Google citations | 1,782 | 1,347 | 1,487 | 798 | 1,104 |

- Note: We consider the main conceptualizations of strategic flexibility based on their impact on the literature (i.e. measured with Google citations in January 2019).

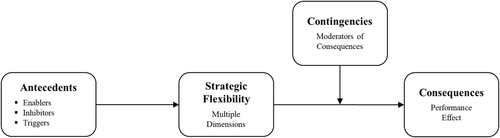

Taken together, and similar to more recent conceptual overviews (Brozovic, 2018; Combe, 2012), we thus consider SF a multidimensional construct.2 The dimensionality of SF has been emphasized previously (see e.g. Bahrami and Evans, 2011; Brozovic, 2018; Evans, 1991), together with its antecedents (i.e. enablers, inhibitors and triggers), as has its consequences and contingencies. We emphasize the inherent theoretical tensions present within every aspect when describing the theoretical background of our study.

Antecedents of strategic flexibility

The antecedents of SF encompass enablers, inhibitors and triggers of SF, as identified by Brozovic (2018). Previous studies stemming from different disciplines have identified a plethora of antecedents affecting SF and a number of tensions related to these antecedents. Based on existing empirical studies, Table 2 summarizes the tensions related to various antecedents and provides the main arguments for their expected influence on SF.3 These studies have distinguished between two categories of enablers: the strategic orientations of a firm and its organizational design. In terms of a firm's strategic orientation, the literature frequently relates entrepreneurial orientation (Nadkarni and Narayanan, 2007), market orientation (Johnson et al., 2003) and learning orientation (Santos-Vijande, Sanchez and Trespalacios, 2012) to SF. Moreover, in terms of organizational design, decentralization (Volberda, 1998), slack resources (Barker and Barr, 2002) and formal routines (Shimizu and Hitt, 2004) have been related to SF. However, there has been disagreement regarding these enablers of SF. For example, while formal routines have been posited to result in more rapid responses to environmental changes (Worren, Moore and Cardona, 2002), they have also been identified as a means for advancing efficiency rather than flexibility (Schreyögg and Sydow, 2010).

| Antecedent | Definition | Arguments for enabling SF | Arguments for inhibiting SF |

|---|---|---|---|

| Enablers of SF | |||

| Strategic orientation | |||

| Entrepreneurial orientation | Emphasizing risky projects and a proclivity to pioneer | Entrepreneurial intent may be central to improving strategic adaption and SF within a firm (Nadkarni and Narayanan, 2007) | Entrepreneurial orientation may result in an exploration trap, with an abundance of alternatives leading to inertia because of limited processing capacity (Levinthal and March, 1993) |

| Market orientation | Responding to customers’ needs and competitors’ actions | The generation, dissemination and use of market information may facilitate and accelerate SF (Johnson et al., 2003) | Excessive market orientation may constrain the SF of a firm (Grewal and Tansuhaj, 2001) |

| Learning orientation | Organization-wide activity to create and use knowledge | Learning may allow a more effective adjustment to changing conditions and thus promote SF (Santos-Vijande, Sanchez and Trespalacios, 2012) | Successful experiences are likely to reinforce themselves positively over time and may constrain SF (Nadkarni and Herrmann, 2010) |

| Organizational design | |||

| Decentralization | Degree to which decision-making is delegated within the firm | Sharing decision-making across an organization may promote SF (Volberda, 1998) | Decision-sharing throughout an organization may promote adherence to prevailing strategies (Covin, Slevin and Schultz, 1997) |

| Slack resources | Degree to which uncommitted resources are available | Organizations without uncommitted liquid resources are less likely to adapt to environmental changes (Barker and Barr, 2002) | Slack has a negative effective on firms’ response to environmental shifts and is therefore likely to reduce SF (Cheng and Kesner, 1997) |

| Formal routines | Degree to which formal rules govern decision-making | Standardized routines may generate more rapid responses to environmental changes and thus promote SF (Shimizu and Hitt, 2004) | Formal rules and routines are means for advancing efficiency and may thus constrain SF (Schreyögg and Sydow, 2010) |

| Inhibitors of SF | |||

| Firm size | Total number of employees | Larger firms may have more resources to devote to SF than smaller firms (Barker and Barr, 2002) | Smaller firms may be more dynamic than larger firms, which tend to have greater structural inertia (Nadkarni and Herrmann, 2010) |

| Firm age | Number of years since the firm was founded | Older firms may have more resources to devote to SF than younger firms (Barker and Barr, 2002) | Younger firms may shift their strategies more frequently than older firms, which focus on the status quo (Nadkarni and Herrmann, 2010) |

| Past success | A firm's prior success on the market | Past success may be positively associated with managers’ environmental awareness and may promote SF (Lant, Milliken and Batra, 1992) | Past success may reinforce the value of existing strategies and discourage SF (Nadkarni and Herrmann, 2010) |

| Triggers of SF | |||

| Environmental dynamism | Unpredictability and variation of change in the environment | Environmental changes may increase the likelihood of strategic reorientation and thus trigger SF (Lant, Milliken and Batra, 1992) | Organizations tend to maintain the status quo in high environmental uncertainty, thereby disapproving of SF (Shimizu and Hitt, 2004) |

| Demand uncertainty | Degree of uncertainty about customer demand | Markets with more variation in demand may favour more flexible firms (Claussen, Essling and Peukert, 2018) | High uncertainty may create resistance to change and discourages SF (Skordoulis, 2004) |

| Competitive intensity | Degree of competition | The strength and activity of competitors may trigger SF (Grewal and Tansuhaj, 2001) | Competitive pressure may reduce the resources available and limit SF (Barker and Barr, 2002) |

- Notes: We report potential antecedents of SF that have been investigated in three or more empirical studies. Due to space restrictions, the table contains only selected references in favour of the arguments.

Compared to the enablers, the inhibitors of SF are largely under-researched within the literature (Brozovic, 2018). We identify firm size, firm age and past success as potential inhibitors. However, in terms of firm size, some scholars ascribe SF as a characteristic of large firms because of the potential availability of slack resources (Pauwels and Matthyssens, 2004). In contrast, SF can be exhibited by smaller firms specifically because their resource adaptability is higher (Ebben and Johnson, 2005). Additionally, firm age (Barker and Barr, 2002) and past success (Lant, Milliken and Batra, 1992) have also been claimed to encourage SF.

Finally, the literature asserts that changes in the business environment may not only affect the SF–performance relationship, but also trigger SF. Environmental dynamism (Perez-Valls et al., 2016), demand uncertainty (Aaker and Mascarenhas, 1984) and competitive intensity (Das and Elango, 1995) may all act as external triggers of a firm's SF. Nevertheless, other scholars question whether the business environment has these triggering effects on SF. For example, Shimizu and Hitt (2004) caution that organizations tend to maintain the status quo in high environmental uncertainty, thereby disapproving of SF. Indeed, resistance to change as a reaction to pursuing SF in a firm is a practically implicit challenge that must be overcome to instil SF throughout the organizational hierarchy (Skordoulis, 2004).

To summarize, the extant literature offers a plethora of potential enablers, inhibitors and triggers of SF, but there are disagreements and controversies regarding how much (if at all) some of these factors actually affect SF. Another significant tension encompassing SF relates to the differential effects of SF, each of which are aligned with different theoretical paradigms.

Consequences of strategic flexibility

The theoretical tensions surrounding the consequences of SF are summarized in Table 3. When balancing the competing theoretical positions and considering the typical stance of the managerial literature, most researchers argue that SF is beneficial for firms (Brozovic, 2018). When theorizing on its positive performance effect, some scholars espouse SF as a dynamic capability because it emphasizes the flexible use of resources and the reconfiguration of processes (Johnson et al., 2003). Others consider SF to be a means of increasing control by maintaining a portfolio of strategic options (Dalziel, 2009). Adopting an organizational design perspective, other scholars have emphasized the benefits that arise from the degree to which an organization maintains a repertoire of managerial capabilities and the speed at which they can be activated (Wang, Senaratne and Rafiq, 2015).

| Theoretical perspectives advocating SF | Theoretical perspectives opposing SF |

|---|---|

| Dynamic capabilities | Resource-based view

|

Real options reasoning

|

Evolutionary theory |

| Organizational design | Population ecology |

| Industrial organization theory | Strategic planning school |

- Notes: Due to space restrictions, the table contains only selected statements that represent the views of both advocates and opponents of SF. These statements do not summarize the underlying theoretical streams, nor do they attempt to represent all aspects of the different theoretical streams.

However, in contrast to these viewpoints, other researchers argue that SF does not improve desired outcomes or may even reduce a firm's performance. For example, the flexibility–efficiency trade-off, which describes the distinction between efficient and flexible strategies (Ebben and Johnson, 2005), illustrates a long-standing dilemma in organization theory. Thompson (1967) calls this the ‘paradox of administration’ (p. 15), whereby managers need to reconcile, for example, the organization of routine tasks with tasks that are non-routine. Efficiencies in delivering strategy require the firm to maximize its output from existing resources, while flexibility requires it to reconfigure resources (Ghemawat and Ricart i Costa, 1993). Pursuing efficiency will therefore instil replicable routines that fundamentally oppose flexibility (Weigelt and Sarkar, 2009).

The suggestion here is not necessarily that efficiency is superior to flexibility, but that mixing both strategies can lead to underperformance (Ebben and Johnson, 2005). Firms may make a trade-off between flexibility and efficiency, but find that they achieve only mediocre performance as a result (Eisenhardt, Furr and Bingham, 2010). Moreover, firms may vacillate between strategic options, thereby wasting resources and risking failure (Shimizu and Hitt, 2004).

To conclude, the SF–performance relationship has been described as complex, and recent studies called for more research illuminating these tensions (Claussen, Essling and Peukert, 2018). Moreover, despite the multiplicity of different contingencies in previous studies, there is limited empirical evidence of the relative extent to which various distinct facets of the environment determine the performance effects of SF (Brozovic, 2018).

Contingencies of strategic flexibility

We have previously emphasized the tensions surrounding environmental dynamism, demand uncertainty and competitive intensity as triggers of SF. However, the extant literature has also regarded these three variables as contingencies in the SF–performance relationship, adding to the ambiguity surrounding these variables. Treating them as moderators of the strength of the relationship between SF and performance (Brozovic, 2018; Combe, 2012), the consolidating literature on SF has recommended even more research about them, despite some valuable insights (e.g. Grewal and Tansuhaj, 2001; Nadkarni and Narayanan, 2007).

Thus, SF is likely to become more important when an organization is faced with a high rate of change in the environment (Nadkarni and Narayanan, 2007). Similarly, high levels of environmental dynamism are suggested to favour flexibility (Johnson et al., 2003). As for demand uncertainty, Harrigan (1985) finds that SF is a means to manage demand volatilities. More specifically, demand uncertainty creates difficulty in devising strategic plans; SF should be more useful in these uncertain markets (Claussen, Essling and Peukert, 2018; Lee and Makhija, 2009). In other words, demand uncertainty moderates the relationship between SF and performance (Grewal and Tansuhaj, 2001). The same understanding is advanced for competitive intensity, whereby it is recommended to develop SF in order for firms to adapt to highly competitive environments (Hitt et al., 1998; Nadkarni and Narayanan, 2007). Indeed, the relationship between SF and firm performance is extensively moderated by competitive intensity (Guo and Cao, 2014). In addition, previous research has further indicated that firm size and firm age may determine the performance effects of SF, with smaller firms and younger firms benefitting more from SF (Segaro, Larimo and Jones, 2014). Consequently, we consider these contingencies in our analyses.

Our meta-analytical research framework is presented in Figure 1. While the framework itself is grounded in theory, the articulation of SF's expected antecedents, consequences and contingencies is driven by a combination of the portrayed theoretical tensions and patterns in existing empirical findings. Thus, the goal of this meta-analysis is to empirically determine the nomological network that encircles SF.

Data collection

We followed the suggestions and guidelines provided by Aguinis et al. (2011) and Bergh et al. (2016) for our meta-analysis. Our objective was to identify all articles that report empirical data on the outcomes and antecedents of SF. The key impetus for SF research was Aaker and Mascarenhas's (1984) article. Consequently, we adopt this as our census date and consider empirical research reported during the period from 1984 to April 2019. To identify relevant studies, we used five complementary search strategies. First, we explored electronic databases such as ABI/INFORM Global, EconLit, Google Scholar, JSTOR and SSRN, using the following search terms: strategic flexibility, strategic adaptability, strategic rigidity and strategic adherence. Second, we manually searched 19 scholarly journals, including the British Journal of Management, Academy of Management Journal, Journal of Management and Strategic Management Journal. Third, we explored the reference lists of all identified articles and traced all sources that cited them. Fourth, in an effort to identify relevant unpublished studies, we searched ProQuest Digital Dissertations and conference proceedings for the annual meetings of, among others, the Academy of Management and Strategic Management Society. Finally, requests were posted on the listservs of the Academy of Management and Strategic Management Society to elicit unpublished research.

Studies were selected for inclusion on the basis of three criteria. First, we included only empirical studies that reported an outcome statistic that allowed for the computation of a correlation coefficient (e.g. Hatum and Pettigrew, 2006 was excluded). Second, a study had to report on relationships involving one or more operationalizations of SF (or a related construct with a similar definition), as well as relevant antecedents and/or outcomes. Third, only studies that measured SF at the firm level were included. Accordingly, a number of studies could not be included, because they focused on flexibility at the individual or team level (Stewart and Barrick, 2000), or because the results were reported only in multivariate models.4

Using studies identified up to the end of 2018, these efforts yielded a final sample of n = 26,940 firms examined in 106 independent samples from 98 studies, consisting of 92 published studies and 6 unpublished studies. Appendices 2 and 3 in the online Supporting Information provide details on all studies, and Appendix 4 displays funnel plots for the performance effect; the plots suggest that neither publication bias nor other potential sources of plot asymmetry affect the obtained results.

To reduce coding error, we prepared a protocol that specified the information to be extracted from each study, and two coders extracted the data from each study. The level of agreement between the two coders was high (94%), and discussion between the coders helped clarify all disagreements. The coders further extracted data on effect sizes, measurement characteristics and measure reliability statistics, study sample sizes and other study characteristics. Following best-practice suggestions, we used a four-step approach to analyse the data: (1) bivariate associations, (2) MASEM of antecedents, (3) MARA of consequences and (4) moderation analysis of contingencies.

Analyses and results

Bivariate relationships

First, we estimate the bivariate relationships among all key constructs. As suggested by Aguinis et al. (2011), we use Hunter and Schmidt's (2004) random effects approach at the effect-size level, which allows for the correction of statistical artefacts and thus provides a relatively accurate estimate of the average strength and variance of a relationship in the population of interest. We use artefact-corrected effect sizes, transformed into Fisher's z coefficients and weighted by the estimated inverse of their variance. This correction gives more weight to more precise estimates before converting them back to correlation coefficients. For each bivariate relationship, we report a 95% confidence interval of the sample-weighted reliability-adjusted averaged correlation. We also calculate the ‘fail-safe N’, which indicates the number of non-significant and unavailable studies that would be needed to make the cumulative effect size non-significant to further evaluate a potential publication bias. We test the homogeneity of the distribution of effect size using the Q-statistic. Heterogeneity for all relationships was significant. However, the standard deviations are all below the common cut-off value for an acceptable standard deviation in a population (Cortina, 2003). Thus, analyses of the main effects are warranted. For each focal relationship, we apply the trim-and-fill method to assess publication bias and impute the missing values. None of the imputed relationships changed in direction or significance, and all bivariate relationships are reported in Table 3.

Antecedents of strategic flexibility

The bivariate relationships between antecedents and SF in Table 3 are largely in line with our theoretical expectations. However, while primary studies investigating the antecedents of SF focus only on subsets of potential enablers, inhibitors and triggers of SF, the aggregated study effects can be used to assess simultaneously the effects of variables that prior research have not considered jointly (Bergh et al., 2016). Therefore, we use MASEM, a two-stage procedure, to estimate the unique contribution of each of the antecedents of SF (Cheung and Chan, 2005). During the first stage, we conduct several meta-analyses, relating all constructs of interest to each other, using data from the primary studies in our database. We thus calculate a complete correlation matrix, including the effect sizes of all relationships (see Appendix 5 in the online Supporting Information). In the second stage, we apply structural equation modelling on the correlation matrix.

Given the variability in sample sizes associated with each correlation coefficient in the meta-analytic correlation matrix, we base this analysis on the harmonic mean of the sample sizes comprising each entry in the meta-analytic correlation matrix (Viswesvaran and Ones, 1995). The fit indexes for the MASEM model in Table 5 suggest a good fit for the model (χ2/d.f. = 23.66/26; RMSEA = 0.00; AGFI = 0.99; SRMR = 0.02). All of the relationships hold when the statistically non-significant antecedents are removed. Moreover, using trim-and-fill-corrected effect sizes, the parameter estimates do not change.

Regarding enablers of SF, we find that, consistent with Schweiger et al. (2019), entrepreneurial orientation (β = 0.33, p < 0.01), market orientation (β = 0.22, p < 0.01) and learning orientation (β = 0.30, p < 0.01) all are positively associated with SF, indicating the importance of the strategic orientation of a firm. Turning to aspects of organizational design, we find that decentralization (β = 0.54, p < 0.01) and formal routines (β = 0.28, p < 0.01) are positively associated with SF, while slack resources (β = −0.22, p < 0.01) is negatively associated with SF. This is an unexpected finding, considering that previous studies have emphasized that firms need uncommitted, liquid resources to enable SF (Barker and Barr, 2002).

When considering the inhibitors of SF, we find that past success (β = −0.21, p < 0.01) is indeed negatively associated with SF, and there is no significant relationship between firm size and SF (β = −0.01, n.s.) and even a positive relationship between firm age and SF (β = 0.06, p < 0.01). These findings highlight that not all commonly acknowledged inhibitors of SF can be traced in existing empirical studies. Finally, the findings related to the triggers of SF reveal that competitive intensity is positively associated with SF (β = 0.38, p < 0.01). Contrary to our expectations derived from the literature, environmental dynamism (β = −0.24, p < 0.01) and demand uncertainty (β = −0.06, p < 0.01) are negatively associated with SF. Discovering that both environmental dynamism and demand uncertainty do not trigger SF highlights an important gap between theory and empirical findings in existing studies.

Consequences of strategic flexibility

The bivariate relationships in Table 4 support the claim that SF is positively related to performance consequences. The correlations between SF and firm performance range from −0.59 to 0.87, and the correlation frequency is normally distributed (Zskewness = −0.30, Zkurtosis = 0.92, pKolmogorov–Smirnov < 0.05). Most of the SF–performance correlations in the database are positive (85%), and the adjusted mean correlation of the focal performance relationship is 0.24 (95% CI = 0.23–0.27).

| ka | n | ps | pw | p | pʹ | SDp | 95% CIp | var% | Q | |

|---|---|---|---|---|---|---|---|---|---|---|

| Antecedents of SF | ||||||||||

| Enablers of SF | ||||||||||

| Strategic orientation | ||||||||||

| Entrepreneurial orientation | 11 | 2,424 | 0.32 | 0.44 | 0.51 | – | 0.24 | 0.45/0.57 | 5.47 | 207.00 |

| Market orientation | 27 | 7,952 | 0.27 | 0.32 | 0.40 | – | 0.12 | 0.36/0.44 | 15.10 | 233.34 |

| Learning orientation | 10 | 1,859 | 0.34 | 0.34 | 0.40 | – | 0.17 | 0.33/0.48 | 12.16 | 81.03 |

| Organizational design | ||||||||||

| Decentralization | 10 | 1,726 | 0.22 | 0.23 | 0.28 | – | 0.19 | 0.18/0.38 | 12.35 | 113.63 |

| Slack resources | 11 | 2,004 | 0.19 | 0.19 | 0.24 | – | 0.21 | 0.14/0.34 | 10.49 | 146.38 |

| Formal routines | 11 | 3,768 | 0.15 | 0.10 | 0.12 | 0.10 (2) | 0.17 | 0.02/0.22 | 8.65 | 160.63 |

| Inhibitors of SF | ||||||||||

| Firm size | 39 | 9,994 | 0.00 | 0.01 | 0.01 | – | 0.12 | −0.16/0.19 | 20.70 | 209.97 |

| Firm age | 31 | 6,914 | −0.01 | −0.02 | −0.03 | – | 0.09 | −0.18/0.12 | 34.53 | 103.63 |

| Past success | 15 | 1,842 | −0.13 | −0.04 | −0.04 | – | 0.16 | −0.26/0.17 | 23.39 | 66.38 |

| Triggers of SF | ||||||||||

| Environmental dynamism | 25 | 7,966 | 0.11 | 0.18 | 0.22 | – | 0.28 | 0.17/0.27 | 3.72 | 902.49 |

| Demand uncertainty | 14 | 4,489 | 0.06 | 0.01 | 0.00 | – | 0.27 | −0.33/0.33 | 4.18 | 440.73 |

| Competitive intensity | 16 | 3,729 | 0.22 | 0.25 | 0.30 | – | 0.21 | 0.24/0.37 | 7.65 | 268.20 |

| Consequences of SF | ||||||||||

| Performance effect | 181 | 47,604 | 0.25 | 0.21 | 0.24 | 0.24 (5) | 0.19 | 0.23/0.27 | 8.11 | 2,495.87 |

| Financial outcomes | 72 | 23,954 | 0.12 | 0.12 | 0.13 | – | 0.17 | 0.10/0.17 | 9.59 | 968.60 |

| Innovation outcomes | 50 | 10,916 | 0.33 | 0.32 | 0.38 | – | 0.17 | 0.34/0.41 | 9.85 | 438.01 |

| Market outcomes | 42 | 8,302 | 0.33 | 0.32 | 0.37 | 0.34 (2) | 0.14 | 0.33/0.41 | 15.65 | 240.77 |

| Other outcomes | 17 | 4,432 | 0.30 | 0.28 | 0.33 | – | 0.18 | 0.27/0.38 | 8.47 | 210.71 |

- Notes: k = number of effect sizes; n = total sample size; ps = simple mean in population; pw = sampling-error-corrected mean in population; p = bias-corrected mean in population; pʹ = trim-and-fill-corrected mean in population and number of missing studies (if applicable); SDp = estimated standard deviation of corrected correlations in population; 95% CIp = 95% confidence interval for p; var% = percentage of observed variance accounted for by statistical artefacts; Q = Q-test for homogeneity in the true correlation across studies.

We next investigate the specific conditions under which the performance effect of SF might be larger or smaller. We consider measurement of constructs, as well as methodological and sample characteristics, as potential influencers of the SF–performance relationship (e.g. Karna, Richter and Riesenkampff, 2016). Regarding the measurement of SF, we code all operationalizations according to the six dimensions displayed in Table 1. In line with other meta-analyses (e.g. Rubera and Kirca, 2012), we group the various operationalizations of firm performance into innovation outcomes, market outcomes and financial outcomes (see Appendix 6 in the online Supporting Information). We further code the year of data collection, whether the study is published, the ISI impact factor and secondary data versus survey data collection, as well as the geographic region of the sample and whether the sample consists of large firms or SMEs.

(1)

(1)The positive SF–performance relationship is stronger when SF is measured in terms of proactively creating new opportunities (γ = 0.05, p < 0.01), internal resource deployment (γ = 0.05, p < 0.05) and external competitive actions (γ = 0.04, p < 0.01), compared to when it is not. Measuring SF in terms of reactivity (responding to change), variety (increasing options) and speed (timely response) does not affect the SF–performance relationship. We further find that the performance effect of SF is stronger when performance is measured in terms of innovation outcomes (γ = 0.05, p < 0.01) or market outcomes (γ = 0.07, p < 0.01) rather than financial outcomes. Finally, the SF–performance relationship is stronger both in newer studies (γ = 0.06, p < 0.01) and in published studies (γ = 0.03, p < 0.05).

Contingencies of strategic flexibility

The lack of available correlations involving interaction terms precludes moderation analyses of the theoretically relevant contingencies with MARA. Therefore, consistent with other meta-analyses (e.g. Blut et al., 2015), we report the partial correlation between the moderator and the effect size while controlling for all significant effects from the MARA analysis. Table 7 shows that only environmental dynamism significantly and positively moderates the SF–performance relationship (rcorrected = 0.46, p < 0.01). While we find directional support for the moderating effects of demand uncertainty and competitive intensity, these effects are not statistically significant (the significance tests in all analyses take the sample size k into account). Moreover, neither firm size nor firm age moderate the SF–performance relationship.

Post-hoc analysis: from strategic flexibility to financial outcomes

Both the bivariate results in Table 4 and the MARA results in Table 6 reveal that SF has a higher performance effect when firm performance is measured as innovation or market outcomes rather than as financial outcomes. In line with other meta-analyses (e.g. Rubera and Kirca, 2012), we thus explore the potential chain of effects, from strategic flexibility to financial outcomes, via innovation and market outcomes. On the one hand, SF enables firms to anticipate market demands and to develop innovative products and services (Neill and Rose, 2007), thereby increasing performance in terms of innovation outcomes (Kortmann et al., 2014). On the other hand, SF enables firms to respond and adapt to changing market demands (Johnson et al., 2003), thereby increasing performance in terms of market outcomes (Segaro, Larimo and Jones, 2014). Finally, improvements in both innovation and market outcomes should subsequently increase financial outcomes (Rubera and Kirca, 2012).

Considering the direct effect of SF on financial outcomes, SF may enable firms to possess a variety of different plans, decisions and strategies unrelated to innovation or the firm's market position (e.g. Evans 1991). This variety, however, introduces costs and potential benefits needed to exceed the necessary investments, as highlighted by the opponents of SF in Table 3. For example, when assets are committed for the purpose of SF, the firm forgoes its short-term earning potential, introducing the additional burden of opportunity costs (Shimizu and Hitt, 2004). Thus, one may expect no direct effect from SF on financial outcomes; rather, one may expect that the innovation and market outcomes will mediate the financial effects of SF.

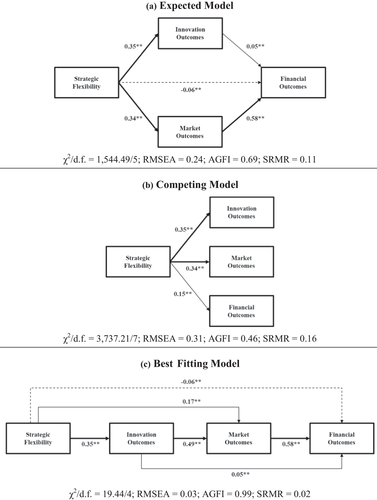

We use MASEM to gain insights into the chain of effects between SF and financial performance (Bergh et al., 2016). As Figure 2a summarizes, an analysis of the expected mediation model did not result in an adequate model fit. Given this, and consistent with the modification indices, we revise the model, as shown in Figure 2c. This model fits the data well (χ2/d.f. = 19.44/44; RMSEA = 0.03; AGFI = 0.99; SRMR = 0.02) and demonstrates that SF has a direct positive effect on innovation outcomes (β = 0.35, p < 0.01), a small direct positive effect on market outcomes (β = 0.17, p < 0.01) and a small direct negative effect on financial outcomes (β = −0.06, p < 0.01). We use a bootstrapping procedure with 1,000 samples to test for indirect effects. The results show a positive effect of SF on market outcomes through innovation outcomes (β = 0.17, p < 0.01; 95% CI = 0.16–0.19) and a positive effect of SF on financial outcomes through innovation outcomes and market outcomes (β = 0.21, p < 0.01; 95% CI = 0.19–0.23). The overall effect of SF on financial outcomes, which combines both the direct and indirect effects, is positive (β = 0.15, p < 0.01; 95% CI = 0.13–0.18). These results suggest that SF is indeed an important part of a firm's competitive armoury, but its effect on financial outcomes might be more nuanced than previously theorized.

MASEM results: from strategic flexibility to financial outcomes

Notes: We control for firm size and firm age in all models. Dominant effects are in bold. MASEM results display standardized path coefficients, which equal effect sizes. We use the harmonic mean (n = 5,575) for estimation purposes. For clarity of presentation, these figures do not include correlations or endogenous error terms.

Discussion and conclusions

Given the importance of SF in the contemporary economic reality and its more recent manifestations in the form of agility, it is important to take stock of the research in this area and provide guidance for its development in the future. We address this gap and employ a meta-analytic approach to develop and test a model of the antecedents, consequences and contingencies of SF rooted in theory and existing studies. In doing this, we contribute to the further consolidation of the field of SF by connecting the seemingly distinct but naturally related research streams of strategy, management, marketing, innovation, entrepreneurship and operations, and we resolve several disagreements and theoretical deficits identified in the literature. More specifically, our results offer guidance for scholars and managers alike by providing an overview of SF's multidimensionality (Table 1), highlighting theoretical tension in the literature (Tables 2 and 3), summarizing empirical generalizations regarding key relationships (Table 4), testing an overall model of the antecedents of SF (Table 5), examining the consequences of a more nuanced SF (Table 6 and Figure 2) and identifying contingencies for the performance effect (Table 7). While our results resolve some theoretical tensions, we also highlight gaps between theoretical developments and related empirical findings in existing studies.

| β | SE | 95% CI | t-Ratio | p-Value | |

|---|---|---|---|---|---|

| Enablers of SF | |||||

| Strategic orientation | |||||

| Entrepreneurial orientation | 0.33 | 0.02 | 0.28, 0.37 | 13.66 | >0.001 |

| Market orientation | 0.22 | 0.02 | 0.18, 0.27 | 9.46 | >0.001 |

| Learning orientation | 0.30 | 0.03 | 0.23, 0.36 | 10.01 | >0.001 |

| Organizational design | |||||

| Decentralization | 0.54 | 0.04 | 0.46, 0.61 | 14.72 | >0.001 |

| Slack resources | −0.22 | −0.02 | −0.27, −0.18 | −9.10 | >0.001 |

| Formal routines | 0.28 | 0.04 | 0.19, 0.37 | 6.66 | >0.001 |

| Inhibitors of SF | |||||

| Firm size | −0.01 | 0.02 | −0.06, 0.03 | −0.57 | 0.566 |

| Firm age | 0.06 | 0.02 | 0.02, 0.09 | 2.82 | 0.005 |

| Past success | −0.21 | 0.02 | −0.25, −0.16 | −10.10 | >0.001 |

| Triggers of SF | |||||

| Environmental dynamism | −0.24 | 0.03 | −0.31, −0.18 | −7.79 | >0.001 |

| Demand uncertainty | −0.06 | 0.02 | −0.11, −0.03 | −3.21 | 0.001 |

| Competitive intensity | 0.38 | 0.03 | 0.31, 0.45 | 12.19 | >0.001 |

| Harmonic mean | 1,317 | ||||

| χ2/d.f. | 23.66/26 | ||||

| RMSEA | 0.00 | ||||

| AGFI | 0.99 | ||||

| SRMR | 0.01 | ||||

| R2 | 0.42 | ||||

- Notes: Results are based on a meta-analytic correlation matrix. The standardized path coefficients equal effect sizes. Error variances for each construct indicator were fixed at zero. SE = standard error; CI = bias-corrected confidence interval.

| Sample | γ | SE | t-Ratio | p-Value | |

|---|---|---|---|---|---|

| Intercept | 0.27 | 0.02 | 15.02 | <0.001 | |

| Measurement of SF | |||||

| Reactivity | 88% of studies | −0.02 | 0.02 | −1.00 | 0.320 |

| Proactivity | 50% of studies | 0.05 | 0.02 | 2.68 | 0.009 |

| Variety | 89% of studies | −0.01 | 0.02 | −0.38 | 0.708 |

| Speed | 40% of studies | 0.01 | 0.02 | 0.32 | 0.754 |

| Internal | 81% of studies | 0.05 | 0.02 | 2.50 | 0.015 |

| External | 71% of studies | 0.04 | 0.02 | 2.81 | 0.006 |

| Measurement of performance | |||||

| Lagged measurement | 14% of studies | −0.06 | 0.03 | −1.82 | 0.073 |

| Innovation outcomes | 28% of studies | 0.05 | 0.02 | 3.38 | 0.001 |

| Market outcomes | 23% of studies | 0.07 | 0.02 | 3.93 | <0.001 |

| Other outcomes | 9% of studies | 0.02 | 0.02 | 1.08 | 0.285 |

| Methodological controls | |||||

| Year of data collection | Mean: 2005.94 | 0.06 | 0.02 | 3.02 | 0.003 |

| Published study | 88% of studies | 0.03 | 0.02 | 2.06 | 0.043 |

| ISI impact factor | Mean: 2.36 | −0.02 | 0.02 | −1.50 | 0.139 |

| Secondary data (vs. survey data) | 17% of studies | −0.02 | 0.03 | −0.81 | 0.418 |

| Sample controls | |||||

| European sample | 27% of studies | 0.00 | 0.02 | 0.03 | 0.977 |

| Asian sample | 19% of studies | −0.04 | 0.03 | −1.73 | 0.088 |

| Mixed sample | 8% of studies | 0.01 | 0.01 | 0.88 | 0.380 |

| Large firms (vs. SME) | 47% of studies | 0.03 | 0.02 | 1.15 | 0.254 |

| Between-study R2 | 0.39 | ||||

| Within-study R2 | 0.59 | ||||

| Number of studies (Level 3) | 88 | ||||

| Number of effects (Level 2) | 181 | ||||

- Notes: We use US samples (35% of studies) and financial outcomes (40% of studies) as base categories. Standardized results with robust standard errors are reported, and all slope coefficients were treated as fixed. SE = standard error.

| Correlation with performance effect | Partial correlation with performance effect | ||||

|---|---|---|---|---|---|

| k | rsimple | rcorrected | rsimple | rcorrected | |

| Environment | |||||

| Environmental dynamism | 45 | 0.31* | 0.34* | 0.43** | 0.46** |

| Demand uncertainty | 18 | 0.02 | 0.10 | 0.39 | 0.41 |

| Competitive intensity | 32 | 0.23 | 0.30 | 0.12 | 0.20 |

| Firm characteristics | |||||

| Firm size | 24 | 0.25 | 0.28 | −0.09 | −0.09 |

| Firm age | 43 | −0.08 | −0.09 | 0.29 | 0.25 |

- Notes: *p < 0.05 (two-tailed). Please note that the significance tests take the sample size k into account. Partial correlations control for all significant effects from the MARA analysis (year of data collection, published study, measurement in terms of proactivity, internal and external attribution, as well as innovation and market outcomes).

- **p < 0.01.

Research implications

Table 8 summarizes our core findings, theoretical and managerial implications and future research directions. Several potential antecedents of SF have proved to be controversial in the literature (see Table 2). We address these tensions and offer insights into the key enablers, inhibitors and triggers of SF. Our multivariate results reveal that both the strategic orientation and the organizational design of a firm enable SF. Interestingly, decentralization has a higher impact on SF than any other enabler (χ2diff = 8.75, p < 0.01). Thus, shared decision-making across an organization appears to be crucial to promote SF. We further find that slack resources negatively affect SF. While this finding contradicts the common claim that organizations without uncommitted, liquid resources are less likely to adapt to environmental changes (Barker and Barr, 2002), it is in line with Sanchez (1995), who caution that resources should be flexible rather than slack. Following his logic, resource surplus implies they are not utilized optimally and efficiently, while resource flexibility implies that resources can swiftly be re-utilized to underpin new strategic options.

| Issue | Core findings | Theoretical implications | Managerial implications | Future research directions |

|---|---|---|---|---|

| Antecedents |

|

|

|

|

| Consequences |

|

|

|

|

| Contingencies |

|

|

|

|

The analyses also reveal that past success inhibits SF, while firm size and firm age do not inhibit SF. These insights extend the knowledge on the inhibitors of SF, previously an under-researched area, and provide resolution to tensions on whether firm size and firm age inhibit SF. Finally, competitive intensity triggers SF, while environmental dynamism and demand uncertainty exhibit a negative relationship with SF. Discovering that neither environmental dynamism nor demand uncertainty trigger SF challenges the existing literature and raises some potential controversies, especially in suggesting that SF is achieved more easily in highly competitive environments. However, taking into consideration the multidimensionality of the environment and the results of the contingency analyses, the whole picture is complex. Evidently, more research on the triggers and contingencies of SF, especially on environmental dynamism and competitive intensity, is needed.

Our findings also address the conflicting empirical evidence regarding the relationship between SF and performance (see Table 3). We find a general moderately positive effect size of 0.24 for the SF–performance relationship, thereby resolving the ongoing debate over whether SF has performance-enhancing benefits for firms or whether it can even harm firms. Our findings support the arguments submitted by proponents of SF, namely that, in today's competitive landscape, firms’ success depends on their ability to address changing conditions and to constantly adapt their strategies accordingly.

From a contingency point of view, our results also indicate that neither the aspects of the environment nor the firm characteristics affect the SF–performance relationship in the way we might expect based on previous studies conducted in particular settings (e.g. Grewal and Tansuhaj, 2001). While environmental dynamism positively moderates the SF–performance relationship, no significant effects were found for either demand uncertainty or competitive intensity. These findings suggest a more nuanced view on the nature of environmental contingencies affecting the consequences of SF than previously considered.

Moreover, we demonstrate that conflicting findings in the literature can be at least partly attributed to the conceptualizations of SF employed in earlier studies. In order to appreciate the wider contribution of SF, it must be acknowledged that it is a multidimensional concept, something that many earlier studies failed to recognize sufficiently. We find that the performance effect is larger when SF is measured in terms of proactively creating new opportunities, internal resource deployment and external competitive actions. It is surprising to find that neither variety nor speed (timely response) affect the SF–performance relationship. Our analyses suggest that for many firms, the cost of developing and maintaining strategic options may outweigh the benefits.

We also identified the avenues through which SF influences firm performance. We find that SF has a negative direct effect on financial performance, therefore providing prima facie support for the opponents of SF when the ‘bottom-line’ performance of firms is considered. However, when the indirect positive effect of SF through innovation outcomes and market outcomes is considered, SF's overall impact on financial outcomes is positive, with an effect size of 0.15. This overall positive effect suggests that, all else being equal, the innovation- and market-related outcomes of SF (positive indirect effect) outweigh the costs associated with SF (negative direct effect), leading to a positive SF effect on financial performance. However, it should be stated that the small-to-moderate effect size of the SF–performance relationship does not justify the overly enthusiastic appraisal of SF in the normative literature. Thus, while our findings attest to the overall importance of SF, we caution against regarding SF as a panacea for all kinds of competitive threats.

Although we were able to study only firm-level effects, there is a dearth of literature devoted to the micro foundations and micro-level variables in the study of SF. Individual-level phenomena with regard to C-suite executives (such as leadership variables) should be examined in order to identify the individual- and also group/team-level dynamics that enable SF to flourish (such as motivations and engagement). Moreover, future studies in SF should adopt multi-level approaches in which micro-, meso- and macro-level phenomena can be examined simultaneously, along with their interactions and interdependencies. Equally, studies should consider the extent to which SF can be differentially geared within organizations. By this we mean that SF can be treated in an ambidextrous manner whereby parts of the organization are exposed to the demands of SF whereas other parts are not. From this form of intra-organizational research, modest forms of flexibility can be considered exploitative whereas substantive forms can be described as exploratory. This is apparent in the ambidexterity literature but not explicitly from a SF perspective.

Managerial implications

In 1964 the average tenure of firms on the S&P 500 index was 33 years. By 2016 this reduced to 24 years and is projected to be a mere 12 years by 2027 (Anthony et al., 2018). This equates to half of these large US$6bn or more firms disappearing by 2027. Various reasons account for this attrition, not least of which is firms’ lack of strategic flexibility in aligning their offerings to the market. Our results provide important insights for managers faced with questions regarding SF to remain competitively vital, in order to strategically flourish over time.

Table 8 provides a series of actionable managerial practices that are available for strategists to engage in seeking to realize SF. Our results from the multivariate analysis of antecedents of SF demonstrate the importance of entrepreneurial orientation, market orientation, learning orientation, decentralization and formal routines in enabling a firm to become flexible. Thus, engaging in these firm-wide orientations demands the ability to engage in ambidextrous and polydextrous behaviours that allow these different plates to be consistently and simultaneously spun. However, managers also need to be aware that slack resources can have unintended consequences with regard to SF and that past success further inhibits SF, while firm size and firm age do not have opposing effects. Finally, the positive effect of competitive intensity on SF (but not of environmental dynamism and demand uncertainty) highlights that competitive pressure will motivate firms to become more flexible. These different findings indicate a repertoire of nuanced managerial interventions and not a ‘one-size-fits-all’ approach. Clearly, managers need to be aware of the complacency effect that is often characterized by exemplary past performance. The appetite firms have to engage in success needs to remain once they become successful. Ensuring that structural, leadership and cultural transformation remains aligned with the evolving marketplace is critical, and maintaining a focus on the competitive pressures will keep this intensity to perform high.

Moreover, our meta-analytical findings demonstrate that SF has an overall positive impact on firm performance. However, not all firms can extract the highest gains from SF. As such, the findings on the contingencies provide useful managerial insights pertaining to which firms should invest more or less in SF. While SF appears to be especially valuable for firms that face high levels of environmental dynamism, firms facing lower levels of dynamism should be more cautious about whether their investment will pay off. However, demand uncertainty and competitive intensity did not affect the SF–performance relationship and are thus not helpful to managers in terms of determining what level of SF may be appropriate. We also found that firms should invest in SF regardless of their size and age, as these characteristics did not affect the SF–performance relationship.

Our findings further reveal that managers should be cognisant of the total impact that SF can have on firm performance, rather than focusing on its impact on financial outcomes alone. We examine a more comprehensive model of the mechanisms that mediate the SF–financial outcomes relationship than those tested in the extant literature. We thus suggest that measures of the mediating variables – innovation and market outcomes – may be useful for managers in terms of tracking the impact of SF on overall performance. Only if managers undertake such tracking can the full potential of SF be captured. A myopic focus on financial outcomes may underestimate the importance of SF.

Limitations and directions for future research

Despite its contributions, this study has some important limitations that should be considered when interpreting our findings. First, any meta-analysis is constrained by the nature and scope of the original studies. Thus, our study is de facto limited to examining the effects of variables that were available in existing studies. Moreover, because the primary-level studies were not experimental in nature, the reported results do not provide direct and unequivocal evidence regarding causality. Indeed, the vast majority of the studies have used cross-sectional methods to examine SF. However, most research questions concerning SF – even if not framed as such – address issues of change. Consequently, we recommend that future studies use longitudinal or experimental designs in order to overcome these methodological weaknesses and capture the causal effects of SF. Another important concern is that the relationships reported in the original studies may be positively biased because of an oversampling of successful firms; firms that failed to be flexible may well have exited the market and would, therefore, not have been captured by the studies in our sample.

In terms of measurement, many studies have employed a unidimensional measure of SF, thus ignoring the multidimensional composition of the construct. Their empirical findings may have underestimated the extent of SF because they did not consider that SF can be a combination of various factors: the ability to be both reactive and proactive and to have internal and external options, which enable a firm to take a variety of actions and to do so rapidly. Thus, multidimensional measures of SF should be employed in order to better capture the relationships under scrutiny. Moreover, most studies investigating the SF–performance relationship under different environmental conditions have employed a unidimensional measure of the environment. A shortcoming of the argument that more flexibility is needed in more dynamic markets is that this fails to consider the multidimensionality of the environment and the conflicting empirical findings. Therefore, further research should detail the effects of SF under varying environmental conditions.

Despite significant progress in understanding SF and its nomological network, several knowledge gaps remain, and future research directions arise from these gaps. Longitudinal studies that differentiate clearly between short-term and long-term outcomes would also be valuable – this would yield a greater understanding of SF's effects on firm performance. In addition, while the current focus in the strategy literature is on the external consequences of SF, it is important to note that SF may affect several internal organizational factors that, in turn, may affect innovation, market and financial outcomes. Further research should therefore investigate the mediating role of the costs of experimentation, inefficiency, stress among employees and a potential lack of focus in the SF–performance relationship. Due to data limitations, we could not examine individual- or team-level aspects of SF. Thus, we only focused on the firm level while neglecting the micro and meso level of SF such as leadership and motivation, commitment and focus among employees. Future studies should take a more multi-level approach, in which both the micro and meso level of SF are involved.

In summary, this meta-analysis develops an integrative framework of the antecedents, consequences and contingencies of SF by resolving several tensions and conflicting findings in the literature. By highlighting which enablers, inhibitors and triggers have the strongest impact on building SF, and by clarifying when and how SF influences the performance of firms, we provide managerial guidance to benefit from SF and conceptual clarity for future research on SF.

Acknowledgements

We are grateful for comments provided by Don Bergh, Mike Hitt, Dave Ketchen, Michael Leiblein, Neil Morgan, Sucheta Nadkarni, Hans van Oosterhout and Charles Snow on previous drafts of this paper. We also appreciate the cooperation of authors from whom we requested additional data.

Biographies

Dennis Herhausen is Associate Professor of Marketing at KEDGE Business School. His research focuses on marketing strategy implementation, customer relationships, digital marketing and channel management. His work has been published in the British Journal of Management, Journal of Marketing, Journal of Retailing, Journal of Service Research, Journal of Business Research and Academy of Management Best Paper Proceedings, among others.

Robert E. Morgan holds the Sir Julian Hodge Chair and is a Professor of Marketing and Strategy at Cardiff University. He is a Strategy Research Foundation Scholar and hold visiting professorships including VU Universiteit Amsterdam and Copenhagen Business School. His research focuses on firm capabilities, new product development and technology management from a strategy perspective. His work has appeared in the British Journal of Management, Strategic Management Journal, Journal of Management Studies, Journal of the Academy of Marketing Science, Journal of Service Research, Strategic Entrepreneurship Journal and Journal of Product Innovation Management, among others.

Danilo Brozović is Senior Lecturer in Business Administration at the University of Skövde, Sweden. His research interests include strategic flexibility, service marketing and the intersection between these topics. His research has been published in the International Journal of Management Reviews, Journal of Service Theory and Practice, Journal of Services Marketing and Marketing Theory, among others.

Henk W. Volberda is Professor of Strategic Management and Innovation at Amsterdam Business School, University of Amsterdam. His research has been published extensively in several international peer-reviewed journals, including Academy of Management Journal, Global Strategy Journal, Journal of International Business, Journal of Management, Journal of Management Studies, Management Science, Organization Science, Strategic Entrepreneurship Journal and Strategic Management Journal.

References

- 1 We acknowledge that, recently, SF has sometimes been subsumed with related concepts operating under different aliases with similar definitions, ranging from synonyms – such as strategic adaptability, to antonyms – such as strategic adherence and strategic rigidity (see Appendix 1 in the online Supporting Information).

- 2 Please note that we are dependent on the operationalization of SF in the existing studies in our analysis. Given that a large majority of the studies operationalize SF as a single construct, we are unfortunately not able to disaggregate SF into its components and test those in our meta-analytic analyses.

- 3 We focus our discussion on antecedents that have frequently been empirically investigated. See Brozovic (2018) for a more exhaustive conceptual review of enablers, inhibitors and triggers.

- 4 We contacted the authors of nine studies with requests to provide correlation tables of their studies. These efforts yielded four additional studies that were included in the meta-analysis.