Why do Emerging Market Firms Engage in Voluntary Environmental Management Practices? A Strategic Choice Perspective

The authors are grateful to Professor Douglas Cumming and three anonymous reviewers for their helpful comments on earlier drafts of this paper.

Abstract

In this paper, we investigate firms’ decisions to engage in voluntary environmental management (VEM) practices within an emerging market context. Drawing on the strategic choice and the resource-based view perspectives, we report results from a survey of VEM practices – a specific form of self-governance – drawing on a sample of 519 Turkish firms from various industries to identify important strategic antecedents of firms’ decisions to engage in such practices. We find that as firms become more customer focused, more inclined to pursue a differentiation strategy and subject to a higher level of strategy-oriented stakeholder focus, they tend to implement higher levels of VEM practices, with important implications for research, policy and practice for both emerging and developed markets.

Introduction

Voluntary environmental management (VEM) goes beyond the normal scope of governmental regulations and can be defined as management efforts to proactively identify the non-regulated environmental aspects of organizational practices; to determine which environmental aspects are important for the organization; and to decide how these environmental aspects should be addressed by the organization (Morelli, 1999, p. 39). VEM practices may include global certification schemes such as the ISO 14000 series, industry codes such as Responsible Care in the chemical sector and a plethora of individual corporate environmental practices. VEM practices have substantially increased in emerging markets (EMs); as one indicator, ISO 14001 certifications in Latin America increased from 556 to 10,301 from 2000 to 2017, while in East Asia and the Pacific (excluding Japan) they increased from 3,437 to 190,720 in the same period (ISO, 2018). Despite the phenomenal growth of new standards and voluntary initiatives, there is a paucity of research focusing on the underlying motives and determinants of VEM practices, particularly in EMs (Aravind and Christmann, 2011; Arda, Bayraktar and Tatoglu, 2018; Montiel and Husted, 2009; Peng, Luan and Chou, 2009; Tatoglu et al., 2014; Vazquez-Brust et al., 2010).

Since VEM efforts normally demand significant organizational resources and widespread cooperation across the organization, they typically require top-level management support; therefore, VEM tends to be a strategic and cross-functional process by which the organization achieves its environmental goals (Morelli, 1999). However, most of the literature on VEM adoption has drawn from institutional and/or stakeholder perspectives and focuses on the external drivers (Delmas and Toffel, 2004; Montiel and Husted, 2009; Rueda-Manzanares, Aragon-Correa and Sharma, 2007) rather than the firm's strategic motivations to adopt VEM practices. As Testa, Boiral and Iraldo (2018) argue, looking at the external variables to understand adoption of environmental management practices is like looking at one side of a coin. Internal capabilities and the choice of strategy also have a significant impact, as suggested by key conceptual papers from the resource-based perspective (Hart and Dowell, 2011; McWilliams and Siegel, 2011) and as demonstrated by empirical examples from developed countries (Escobar and Vredenburg, 2011; Frynas, 2015; Torugsa, O'Donohue and Hecker, 2013).

In stark contrast to the dominant institutional and stakeholder perspectives, a strategic choice perspective can explain the specific process through which decision makers develop specific VEM practices (Clark, Varadarajan and Pride, 1994; Ransom and Lober, 1999; Wagner, 2005). Complementing this perspective, scholarship from the resource-based view (RBV) on VEM practices in developed countries has provided evidence that firm-specific factors can explain VEM adoption (Aragon-Correa and Sharma, 2003; Christmann, 2000; Escobar and Vredenburg, 2011). However, the bulk of this scholarship investigated performance outcomes of the adoption of VEM practices (Chen, Lai and Wen, 2006; Lourenço et al., 2014) rather than their antecedents. More seriously, the bulk of VEM scholarship has considered the adoption of environmental practices in developed countries (Parsons, 2017).

The extant literature on the social and environmental responsibilities of firms in EMs has paid little attention to the strategic choices of firms (Jamali and Karam, 2018). From an exhaustive meta-analysis of the extant studies in the VEM domain, Earnhart, Khanna and Lyon (2014) observe that studies on the adoption of environmental management practices by EM firms are narrowly focused. These studies limit their scope to the impact of external environmental forces – primarily foreign stakeholder pressures inter alia from multinational buyers and pressure groups – rather than a firm's strategic choices (Tong et al., 2018; Zhu, Feng and Choi, 2017). However, scholarship on VEM practices in EMs has failed to investigate the internal strategic motives for VEM adoption. In this study, we attempt to fill this gap by investigating the influence of three aspects of firms’ strategic choices – customer focus, differentiation strategy and stakeholder orientation – on the adoption of VEM practices in EMs. We draw on the strategic choice perspective and the RBV to illuminate the strategic rationale for the adoption of VEM practices.

While research on the antecedents of environmental practices of firms in EMs suffers from the lack of a strategic choice perspective, the need for advancing knowledge in this domain is evident. Firms in EMs often lack incentives to comply with environmental rules due to weak governmental capacity for regulation (Russell and Vaughan, 2003) or strong lobbying and a lack of political will to enforce environmental regulations (Earnhart, Khanna and Lyon, 2014; Lopez and Mitra, 2000). For instance, in a study conducted in India (Singh, Jain and Sharma, 2014), governmental pressure did not have any impact on proactive environmental behaviour of firms. Similarly, in a study conducted in China, Wang, Wijen and Heugens (2018) found that the lack of enforcing mechanisms in local government and the general tendency by government officials to prioritize economic development over environmental protection significantly relaxed the burden on firms to comply with environmental protection issues. In a context where many EMs suffer from institutional voids – the underdevelopment or absence of certain institutions (Khanna and Palepu, 1997, 2010) – the impact of conventional institutional pressures on VEM adoption is highly questionable. In an interesting qualitative study conducted in Greece, where economic crises have significantly eroded the institutional regulatory mechanisms, Latridis and Kesidou (2018) found that the lack of institutional pressures could lead to symbolic implementation of ISO 14001 unless there is a strong motive to differentiate from their competitors. Given that firms in many EMs engage in VEM practices despite relatively weak pressures from external environmental forces, a focus on internal strategic pressures may provide an alternative explanation of VEM adoption.

Insights about the strategic determinants of VEM practices in EMs are also critical, as these countries are slated to grow at a much higher rate than developed countries in the coming decades. A 2015 study by PricewaterhouseCoopers (PWC, 2015) shows that by 2050 the combined gross domestic product of seven prominent EMs (Brazil, China, India, Russia, Mexico, Indonesia and Turkey) will have become 75% larger than that of the present G7 economies (USA, UK, Germany, France, Canada, Italy and Japan). Since industrial pollution is directly related to economic development, adoption of VEM practices by EM firms could prove to be a significant contributor to reducing environmental degradation globally; hence, our research may contribute towards a better understanding of effective environmental mitigation strategies in EMs.

In our study, we use a sample of Turkish firms from various industries. Turkey, like other EMs, features relatively underdeveloped institutions – as documented by Khanna and Palepu (1997, 2006, 2010) – and management practices in which traditional and modern values coexist (Wasti, 1998). Although the sociocultural and business environment has evolved over the past few decades (Fikret-Pasa, Kabasakal and Bodur, 2001; Goregenli, 1997; Tatoglu, Glaister and Demirbag, 2016), management and organization culture in Turkey – as in most other EMs – is substantially different from that of Western countries (Ciftci et al., 2019; Demirbag et al., 2010; Wasti, 1998). While the institutional, industrial and corporate structures in Turkey bear a resemblance to those of other big emerging markets, Turkish firms inherit a rich, diverse and conflicting sociocultural and political macro-environment that gives rise to complex organizational dynamics and tensions (Demirbag, Tatoglu and Glaister, 2009; Glaister et al., 2008; Gölgeci et al., 2019). At the same time, Turkish firms have been switching their attention towards adopting VEM practices. The number of ISO 14001 certifications in Turkey increased from 91 to 2,001 from 2000 to 2017 (ISO, 2018), suggesting Turkish firms’ increasing awareness of maintaining higher standards of environmental protection to exploit better business opportunities (Tatoglu, Bayraktar and Arda, 2015; Turk, 2009). Further, the transition from traditional industries to more Western sectoral environments in EMs such as Turkey provides an ideal laboratory to test and extend findings from developed markets to EMs. In particular, exploration of the influence of different industry environments and their interaction with firm-level strategic orientation in an EM environment has the potential to uncover insights that may be further extended to other EMs.

Our findings support our hypothesized direct links between the three strategic choice specific factors and VEM adoption among Turkish firms. In other words, as firms become more customer focused, more inclined to pursue a differentiation strategy and subject to greater strategy-oriented stakeholder focus, they tend to implement higher levels of VEM practices. We demonstrate that – despite the many differences between developed and emerging markets – some of the strategic influences behind VEM adoption that have been tentatively observed in developed markets can also be observed in EMs.

VEM practices in an emerging market: A strategic choice perspective

Increasing environmental awareness worldwide encourages scholars to engage in research on the underlying motives and determinants of VEM practices within firms. Studies that explore the determinants of proactive environmental management practices predominantly adopt an institutional or stakeholder perspective (Cespedes-Lorente, de Burgos-Jimenez and Alvarez-Gil, 2003; Delmas and Toffel, 2004; Montiel and Husted, 2009; Özen and Küskü, 2009; Rueda-Manzanares, Aragon-Correa and Sharma, 2007; Tatoglu et al., 2014; Tighe, 2016). The institutional perspective focuses primarily on the influence of exogenous factors on firm performance. In addition, studies following a stakeholder perspective have identified a variety of stakeholders who influence environmental policies and described the pressures those stakeholders exert on firms. However, neither the institutional nor the stakeholder perspective satisfactorily explains the internally driven motivations of firms to voluntarily implement VEM practices (Aragon-Correa and Sharma, 2003; Orts and Strudler, 2002), since this scholarship focused exclusively on powerful external pressures.

Nonetheless, extant studies show that factors like managerial cognition (Hamann et al., 2017; Yang et al., 2018), firms’ past decisions (Peiro-Signes and Segarra-Oña, 2017) and firm-specific resources and capabilities (Christmann, 2000; Escobar and Vredenburg, 2011) could also drive proactive environmental strategy. Most notably, the RBV of the firm has been applied to firm decisions to adopt VEM practices. Starting with the influential paper by Hart (1995), the RBV lens on VEM adoption suggested that firms may develop valuable capabilities such as organizational learning, continuous innovation and stakeholder integration as a result of a proactive environmental strategy (Aragon-Correa and Sharma, 2003; Christmann, 2000; Majumdar and Marcus, 2001; Menguc, Auh and Ozanne, 2010). However, the RBV scholarship largely focuses on the organizational performance outcomes of the adoption of VEM practices (Chen, Lai and Wen, 2006; Lourenço et al., 2014) rather than the adoption's antecedents.

Furthermore, RBV scholarship on VEM practices has taken for granted that the presence of resources and capabilities equates to their use in VEM practices, whereas more recent general RBV studies suggest that the use of resources is contingent upon resource orchestration (Helfat and Peteraf, 2015; Sirmon and Hitt, 2009; Sirmon et al., 2011). These studies assert that, while controlling valuable and rare resources and capabilities is a prerequisite for successful organizations, managers must proactively exploit and develop such resources, for example by structuring their resource portfolios and by leveraging capabilities to create value for customers (Hitt et al., 2011). By extension, the successful adoption of VEM practices is contingent upon the strategic approaches that organizations follow, which could be manifest, for example, in the degree of customer orientation adopted by the firm. It is this neglected strategic perspective on VEM that this paper addresses.

Strategic perspectives on VEM

VEM practices vary across a continuum (Hart, 1995) and a firm has the choice to adopt a particular level in this continuum. Thus, a firm's adoption of VEM practices is part of a consciously chosen strategy. The strategic choice perspective introduced by Child (1972) offers a compelling approach to explain the antecedents that motivate firms to adopt a proactive environmental strategy. This perspective rests on the general view that the exercise of strategic choice by organizational decision makers is a process that starts with an evaluation of the existing position of the organization. This evaluation involves the expectations of an organization's external stakeholders, the firm's relationship to key stakeholders and the organization's present level of performance. Based on this evaluation, decision makers choose the most appropriate strategy.

Based on the strategic choice lens, the firm's choice of a particular level of VEM practices can be viewed as the outcome of the decision makers’ conscious assessment of options and ranges (Clark, Varadarajan and Pride, 1994; Ransom and Lober, 1999; Wagner, 2005). In EMs where the institutional mechanisms to implement mandated requirements are weak (Singh, Jain and Sharma, 2014) and as VEM practices go much beyond them, their adoption is entirely based on the incentives that they provide to the firm as perceived by the decision makers. As Luo and Tan (1998, p. 21) submit, ‘the complex and uncertain environments in EMs have a strong and sustainable influence on the strategic choice of the local business there’.

Taking these conceptual foundations into consideration, and consistent with the strategic choice perspective, we suggest three important antecedents to the decision to adopt VEM practices in EM firms: the generic overarching strategy followed by the firm in terms of differentiation or cost leadership; the degree to which the firm follows a customer-focused culture; and the pressure exerted on the firm by its stakeholders for better environmental management. From a consistency of strategic choice perspective (Nath and Sudharshan, 1994), these three antecedents have an internal coherence with the adoption of VEM practices. Further, case studies reported in the popular press show how a combination of these three factors is compelling firms to choose VEM practices at a global scale. Recently, the Financial Times (FT, 2018) reported initiatives by Coke to collect and recycle plastic bottles and by McDonald's, P&G, Nestlé and other firms to voluntarily set goals for making all of their packaging recyclable. These voluntary initiatives show a clear pattern, as three important motives are discernible: a clear need to show empathy with customer concerns (especially millennials), the desire to differentiate the corporate brand and the pressure exerted by influential stakeholders.

Strategic choice influences

Customer focus

Vandermerwe and Oliff (1990) described what has become an increasingly widespread view that ‘going green’ may assist in attracting and retaining customers. They also note that customer pressure for greater environmental performance affects corporations’ strategic plans and operational procedures. Numerous studies have linked customer pressure to a firm's intention to implement environmental management practices (Foster, Sampson and Dunn, 2000; Henriques and Sadorsky, 1996; Huang et al., 2016; Kim, 2015; Martínez García de Leaniz, Herrero Crespo and Gómez López, 2017; Quazi et al., 2001).

Customer focus includes deep connection with customer-oriented values and beliefs and a commitment to understanding customer needs (Strong, 2006; Vandermerwe, 2004), and is hence related to strategic choices that an organization has previously taken. From the RBV lens, customer focus can be a crucial factor in developing valuable resources and capabilities, and increasing organizational value. RBV scholarship has demonstrated that strong customer focus can inter alia improve organizational performance (Auh and Menguc, 2006), enhance the effectiveness of external marketing (Saad, Hassan and Shya, 2015), lead to greater innovativeness (Wang, Zhao and Voss, 2016) and improve alliance partner relationships (O'Dwyer and Gilmore, 2018). Likewise, with increasing environmental consciousness of customers (Cho, 2015; Lin et al., 2015; Misra and Panda, 2017), firms with greater customer focus can be expected to place more emphasis on developing VEM practices that customers consider valuable. In support of this contention, Schmitz et al. (2017) noted a direct link between customer orientation of German firms and their pro-environmental strategy, while Pekovic, Rolland and Gatignon (2018) found a similar relationship among French firms. At another level, as King, Lenox and Barnett (2002) suggest, firms building on their superior environmental performance could send a signal to their customers about their environmental consciousness. However, to our knowledge, studies on VEM in EMs have failed to investigate the role of customer focus.

It was previously widely assumed that consumers in EMs may be less sensitive to the environmental performance of firms because of lower awareness and greater concern with value and quality over environmental considerations (Khanna and Palepu, 1997, 2006, 2010). However, on the one hand, various studies on EMs – most notably China – demonstrate that the adoption of VEM practices by firms may be related to customer pressures from multinational buyers (Sandhu et al., 2012; Tong et al., 2018). On the other hand, the adoption of VEM practices yields other kinds of consumer value and spills over into the aggregate perception of the quality and reliability of a given product. Khanna, Palepu and Sinha (2005) note that institutional underdevelopment can include a lack of consumer product safety organizations or non-profit entities that test, validate and verify product quality and safety. Hence, the adoption of VEM practices may serve as an indirect signal of these product features in the absence of independent arbiters (Castka and Prajogo, 2013). Some examples from practice also provide evidence that EM consumers are sensitive to environmental concerns. Based on a survey of 30,000 consumers from 60 countries on how sustainability impacts purchasing decisions, market research company Nielsen (2015) found that 66% of consumers are willing to spend more for sustainable goods; indeed, consumers from Asia, the Middle East, Latin America and Africa are willing to pay more for products that come from firms committed to positive social and environmental impact. This can help to explain the success of EM firms such as Brazil's Natura or Korea's Cconma.com that focus on sustainability strategies in order to attract a customer base.

Hence, we believe that the connection between customer focus and adoption of VEM will be strong in EMs as it is in developed country markets:

-

- H1:

-

- EM firms with a higher customer focus are more likely to adopt higher levels of VEM practices than those with a lower customer focus.

Differentiation strategy

Porter (1985) describes two distinct types of generic strategies: ‘differentiation’ and ‘cost leadership’. The latter strategy involves using the firm's resources efficiently to attain the lowest cost in the industry. This strategy requires the firm to discover cost efficiencies in all of its value chain activities and reduce costs to the minimum. Differentiation, on the other hand, aims to offer goods and services that are unique and coveted by segments of customers. Differentiation strategy therefore does not consider cost reduction as a priority and instead focuses on developing unique and specialized features for customers.

Differentiation lies at the heart of the RBV, which suggests that firm-specific, rare and difficult-to-imitate capabilities lead to sustainable competitive advantages for the organization (Mosakowski, 1993). RBV scholarship suggests that cost leadership and differentiation strategies require different types and levels of resources and capabilities for effective implementation (Sirmon and Hitt, 2009). This is relevant for explaining VEM adoption, given that previous studies have shown that the strategic orientation pursued by a firm influences the level of VEM strategy the firm pursues (Delmas, Hoffman and Kuss, 2011; Schmitz et al., 2017; Walls, Phan and Berrone, 2011). Consequently, Buysse and Verbeke (2003), for example, build on the RBV to argue that firms following a cost leadership strategy typically pursue a pollution prevention approach (for reasons of cost minimization) rather than a proactive VEM strategy. Conversely, several studies in developed countries have associated a differentiation strategy pursued by the firm and the likelihood of a consequent choice of VEM practices (Orsato, 2006; Yuksel, 2008).

We contend that the absence or limited scope of third parties in EMs that can credibly evaluate the cost–benefit of products or services, and the desire of some firms to set themselves apart from their competitors (especially to distinguish themselves from those competitors who engage in predatory pricing, questionable sales tactics and otherwise unsavoury business practices) may include signalling to convey that they are distinct, more trustworthy and otherwise unique in their business model and practice. Adoption of VEM practices can thus serve as one element of an overall differentiation strategy within an EM where information asymmetries and cost pressures coexist. Furthermore, as outlined earlier, given the significant demand for sustainability products in EMs (cf. Nielsen, 2015), a differentiation strategy based on VEM practices increasingly makes good business sense.

-

- H2:

-

- EM firms that follow a differentiation strategy are more likely to adopt VEM practices than those that follow a cost leadership strategy.

Stakeholder pressure

Following stakeholder theory, corporate actions are conceived as a direct consequence of pressures from various constituent groups (stakeholders) (cf. Laplume, Sonpar and Litz, 2008), and many studies have examined the impact of stakeholder pressures on environmental practices (Christmann, 2004; Darnall, Henriques and Sadorsky, 2010). Indeed, the role of stakeholder pressures has been integrated into RBV scholarship on environmental management practices, suggesting that stakeholder management is an important factor in developing strategic environmental practices. Hart and Dowell (2011, p. 1469) argued that ‘considering diverse stakeholder views is valuable not only for product stewardship but for pollution efforts as well’. Various studies from the RBV lens have empirically demonstrated that stakeholder engagement can encourage firms to develop environmental capabilities, but managerial attitudes influence stakeholder engagement (Torugsa, O'Donohue and Hecker, 2013; Walls, Phan and Berrone, 2011). Hence, from the RBV perspective, the decision maker's assessment of stakeholder pressure (as distinct from the actual level of stakeholder pressure) is another important motivation for adopting a particular level of VEM practices.

Stakeholder theory suggests that decision makers in an organization have to ‘actively manage’ stakeholder interests (Frooman, 1999). Most of the existing VEM literature emphasizes the importance of stakeholders in the VEM strategies of firms (Banerjee, Iyer and Kashyap, 2003; Buysse and Verbeke, 2003; Cordano, Marshall and Silverman, 2010; Delmas and Toffel, 2004; Gonzalez-Benito and Gonzalez-Benito, 2006; Gonzalez-Torre et al., 2010; Tang and Tang, 2017). Going beyond conventional stakeholder theory predictions, the strategic choice and the RBV perspectives predict that organizations’ strategic choices and heterogenous resource endowments influence the extent to which stakeholder demands are accommodated (Julian, Ofori-Dankwa and Justis, 2008). According to Hart (1995), the level of proactive environmental strategy pursued by a firm depends on the orientation towards its stakeholders. Indeed, various recent studies have shown that the strategic orientation of a firm influences the level to which different stakeholder interests are accommodated with regard to adopting socially and environmentally responsible practices (Abebe and Cha, 2018; Brower and Rowe, 2017; Nybakk and Panwar, 2015).

In EMs, stakeholder interest in social/environmental matters and the exercise of those interests is growing; stakeholders have greater power and influence on corporate environmental practices than has previously been assumed (Ali and Frynas, 2018; Perez-Batres et al., 2012). Indeed, various studies have investigated the effect of stakeholders on VEM practices in these markets; however, they tended to focus on the external, foreign stakeholder pressures from multinational buyers as well as environmental non-governmental organizations (NGOs) and other foreign stakeholders (Sandhu et al., 2012; Tong et al., 2018; Zhu, Feng and Choi, 2017). In effect, EM scholarship failed to comprehensively investigate stakeholder groups that are likely to exert a more intimate influence on the cognitive aspects of strategic decision making. In contrast, our study adopts a more comprehensive strategy-oriented stakeholder focus by investigating the impact of four stakeholder groups: senior management, competitors, customers and government. It is the influence of actors – such as senior management and competitors – that can better account for the business-driven strategic choices and orchestration decisions that organizations take. Based on the above, we believe that in EMs, as in developed markets, stakeholder interest and pressure will result in strategic decisions that lead to higher VEM adoption rates.

-

- H3:

-

- The higher the level of stakeholder interests in environmental issues as perceived by management, the higher the level of VEM practices adopted by the EM firm.

Research methods

Sample and data collection

We collected survey data by means of a single-respondent mail survey using a questionnaire. While several researchers have been opposed to the use of single-respondent or key-informant surveys due to their inherent limitations and suggested the use of multiple respondents, they are not a silver bullet (Flynn, Pagell and Fugate, 2018; Krause, Luzzini and Lawson, 2018; Montabon, Daugherty and Chen, 2018). In our survey, our key informants’ knowledge and expertise are well aligned with the constructs of our research model. All respondents are from senior management levels in charge of environmental management issues and have some serious decision-making authority, building the case for our choice of a single key respondent (Montabon, Daugherty and Chen, 2018).

The questionnaire was devised to measure the underlying determinants of the implementation level of VEM practices based on five-point scales (1 = ‘strongly disagree’ to 5 = ‘strongly agree’). The items of the questionnaire were derived from previous studies (Chen and Paulraj, 2004; Gonzales-Benito and Gonzalez-Benito, 2008; Sarkis, 1998; Zhu, Sarkis and Geng, 2005; Zhu, Sarkis and Lai, 2007) and a series of semi-structured interviews with senior executives from three firms operating in different industry sectors to establish content validity of the measures used in this study.

The sample firms were drawn from the industrial database of TOBB (The Union of Chambers of Commerce, Industry, Maritime Trade and Commodity Exchanges of Turkey; http://www.tobb.org.tr), which contains information on over 40,000 firms in Turkey. Within this sample frame, several very small firms of less than 10 employees were omitted. A total of 2,000 firms from various industry sectors was identified as the sampling frame for the survey through a random sampling selection procedure.

The survey questionnaire was sent to the managing director/chairman of each company with a cover letter soliciting he/she or his/her senior manager in charge of environmental management practices complete it. Following one reminder, a total of 570 questionnaires were received, of which 519 were usable, representing an effective return rate of 25.9%, which was adequate, given the nature of the questionnaire. Non-response bias for the mail survey was checked through t-tests by comparing the first wave of survey responses to the last wave of survey responses (Armstrong and Overton, 1977). Nearly 50% of the surveys were randomly selected for each of the first and last waves of the questionnaires received. The test results revealed no significant differences in the responses between early and late respondents (p > 0.1) for the following measures used in the study: VEM practices (t-value = 0.21, p = 0.79), customer focus (t-value = 0.15, p = 0.88), differentiation strategy (t-value = 1.17, p = 0.24) and stakeholder pressure (t-value = 1.39, p = 0.15). Chi-square and t-tests were also used to compare the respondent firms with non-respondent firms with respect to the key features of the sample, such as firm size (t-value = 0.17, p = 0.85), industry sector (χ2 = 7.19, p = 0.18) and geographical location (χ2 = 2.37, p = 0.34). Again this showed no systematic differences (p > 0.1), hence no response bias was evident. Table 1 summarizes the characteristics of the sample.

| Sample characteristics | No. | % |

|---|---|---|

| Firm size (number of employees) | ||

| Small (<50) | 81 | 15.6 |

| Medium (50–249) | 280 | 53.9 |

| Large (>250) | 158 | 30.5 |

| Firm age (years) | ||

| Young (<10) | 84 | 16.2 |

| Middle-aged (10–19) | 181 | 34.9 |

| Mature (>20) | 254 | 48.9 |

| Industry sector | ||

| Industrial, automotive and electrical equipment | 58 | 11.2 |

| Food, textile and paper | 149 | 28.7 |

| Metal, wood, leather and glass | 91 | 17.5 |

| Chemical and pharmaceuticals | 28 | 5.4 |

| Other manufacturing | 45 | 8.7 |

| Wholesale and retail trade | 42 | 8.1 |

| Computer engineering services | 24 | 4.6 |

| Financial services and consultancy | 11 | 2.1 |

| Hospital and leisure services | 32 | 6.2 |

| Other services | 39 | 7.5 |

| Geographic location | ||

| Marmara | 435 | 83.8 |

| Aegean | 34 | 6.6 |

| Black Sea | 16 | 3.1 |

| Other | 34 | 6.5 |

| Total | 519 | 100 |

Variable measurement

Brief descriptions of the measures used in this study are provided in the ensuing subsections.

Dependent variable

VEM practices (VEMP) is treated as the dependent variable and is measured by a multi-item scale composed of four five-point items. These items, which measure the adoption level of VEM practices, include: requesting suppliers to conform to certain environmental regulations (Koh, Gunasekaran and Tseng, 2012); increasing emphasis on improving eco-efficiency in production (Côté, Booth and Louis, 2006); reusing/recycling waste materials (Sarkis, 1998); and building a culture for green/environmental operations (Seuring, 2004).

Independent variables

Customer focus (CFOC) is a scale composed of seven items and adapted from Chen and Paulraj (2004). The items measure the firms’ responsiveness to considering customers’ concerns and complaints about their goods and services. The participant firms specify the extent of their emphasis on the following items: evaluating the formal and informal complaints of their customers; interacting with customers to set reliability, responsiveness and other standards; customer follow-up for quality/service feedback; measuring and evaluating customer satisfaction; determining future customer expectations; facilitating customers’ ability to seek assistance from the firm; and evaluating the importance of relationships with customers.

Differentiation strategy (DIFFER)

Drawing on the indicators formulated by previous researchers – Chen and Paulraj (2004), Miller and Roth (1994) and Santos (2000) – this four-item scale captures the firm's willingness to pursue a differentiation strategy and is closely related to the notion of generic strategies developed by Porter (1985). The first item asks the respondents to indicate whether the firm's strategy is based on high-quality performance rather than price. The second and third items measure the extent to which the firm pays greater attention to innovation and customer service, respectively, as opposed to price. The last item asks the respondents to identify whether the firm places emphasis on delivering products with high performance.

Stakeholder pressure (SPRS)

Relying on Delmas and Toffel (2004), this multi-item scale captures the extent to which internal and external stakeholders drive firms to adopt VEM practices, and is measured by an index including four items. The items identify four sets of stakeholders that are likely to exert pressures on firms to adopt VEMs: customers, competitors, government and senior management.

Control variables

To control for the impact of the industry sector (SECT), two industrial groupings were generated – high-pollution and low-pollution industries based on the approach adapted from earlier studies (Berrone and Gomez-Mejia, 2009; Gölgeci et al., 2019). High-pollution industries include metal, mining, leather, textile, transport and related equipment, petroleum, auto, electrical, electronics, durables and chemicals. Low-pollution industries comprise logistics, construction, food, banking and financial services, export–import trading, tourism and other services. In terms of the number of firms in these two groups, the high-pollution group consists of 311 firms while the low-pollution group includes 208 firms.

Industry sectors that employ a higher proportion of the workforce are also likely to attract greater attention from a country's policy makers and economic planners. The employment intensity of an industry (E_INT) therefore controls for the visibility of the firms – both in the media as well as in the eyes of the policy makers and regulators. E_INT is calculated from the Annual Industry and Service Statistics 2016 database of the Turkish Statistics Institute (Turkstat, 2016). The index value for a particular industry is computed by dividing the number of people employed in that industry in a particular year by the total number of people employed across all the 92 industry sectors in the database for that year.

Industry sector profitability (P_IND) controls for the surplus resources of the firms in an industry, which in turn may affect strategic choices that firms make in that industry. P_IND for an industry sector is computed as the ratio of the value added at factor cost by all the firms in that sector to the total turnover of all the firms in the sector. Value added at factor cost is roughly the gross profit and therefore the industry profitability of a sector is an indirect measure of the profitability of firms in that sector. The figures for calculating the profitability index were also drawn from the Annual Industry and Service Statistics of 2016 (Turkstat, 2016).

Firm size (LN_SIZE) is controlled for as large firms may assign more resources to the business and may tend to have more developed environmental management systems and processes. In contrast, small firms are understood to be less knowledgeable about environmental issues (Spence, Jeurissen and Rutherfoord, 2000; Tilley, 1999) and to be concerned with other matters more central to their very survival (Hunt and Auster, 1990). Large firms – as compared to small and medium-sized enterprises – have ample resources to cope with environmental issues, which may explain the differing practices between them (Pimenova and van der Vorst, 2004). Thus, we suggest a positive association between firm size and the firm's proclivity to engage in VEM practices. Firm size is measured through the logarithm of the total number of employees in the firm.

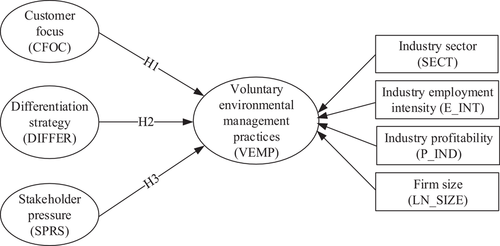

The measurement of the study's constructs/variables used in our survey questionnaire (with the exact wording of the questions) and their sources is reproduced in the Appendix. Our conceptual model, along with hypothesized relationships, is delineated in Figure 1.

Validity and reliability of measures

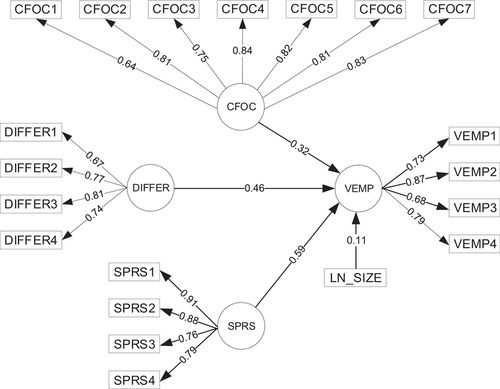

The reliability and validity of constructs is assessed by confirmatory factor analysis (CFA) using AMOS. The CFA technique is based on the comparison of the variance–covariance matrix obtained from the sample to the one obtained from the model. The technique is quite sensitive to sample size, and it is recommended to have several cases per free parameter (Bollen, 1989). The initial measurement model, comprising five latent constructs and their respective observed variables, does not provide an acceptable fit. Therefore, the items which are loading poorly to their underlying latent variables are eliminated. A total of seven items are dropped from the constructs of VEMP, CFOC and DIFFER (please see Appendix for the dropped items).

The resulting measurement model comprising four latent constructs and their respective observed variables indicate an acceptable fit [χ2/d.f. = 2.44; CFI = 0.93; IFI = 0.93; NFI = 0.90; RMSEA = 0.05]. All the observed variables have a standardized loading of more than 0.5, attesting to the convergent validity of the measures. The internal consistency of the scales is measured using Cronbach's alpha. Table 2 shows the Cronbach alpha coefficient for each construct. The four constructs have reliability coefficients of more than 0.70, well above the acceptable level suggested by Nunnally (1978). The composite reliability (CR) values are all above the threshold value of 0.7, thereby establishing the reliability of the measurement model.

| Latent variable | Number of items | CFOC | EMP | SPRS | AVE1 | CR2 | Cronbach's alpha |

|---|---|---|---|---|---|---|---|

| DIFFER | 4 | 0.27 | 0.36 | 0.14 | 0.70 | 0.73 | 0.80 |

| CFOC | 7 | 0.30 | 0.17 | 0.74 | 0.76 | 0.89 | |

| VEMP | 4 | 0.43 | 0.69 | 0.72 | 0.77 | ||

| SPRS | 4 | 0.76 | 0.78 | 0.84 |

- 1AVE = √[∑λ2/(∑λ2 + ∑(1 − λ2))].

- 2CR = [∑2λ/(∑2λ + ∑(1 − λ2))].

We assessed discriminant validity using the method suggested by Fornell and Larcker (1981), where the average communality measure is compared with the variance shared between the construct and other constructs in the model. If the average communality for all the constructs is found to be greater than the variance shared between all the other constructs, then discriminant validity is established. Table 2 shows the average communality and the variance shared between the constructs. It can be seen that all the constructs have an average communality value higher than the variance shared between the four constructs. Hence, discriminant validity is also established for the constructs in the measurement model. Descriptive statistics and correlations among the variables used in the study are shown in Table 3.

| Variable name | Definition | Mean | S.D. | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 1. VEMP | Voluntary environmental management practices | 3.96 | 0.74 | 1.00 | |||||||

| 2. CFOC | Customer focus | 4.26 | 0.61 | 0.44* | 1.00 | ||||||

| 3. DIFFER | Differentiation strategy | 4.14 | 0.66 | 0.44* | 0.40* | 1.00 | |||||

| 4. SPRS | Stakeholder pressure | 3.71 | 0.86 | 0.51* | 0.36* | 0.28* | 1.00 | ||||

| 5. SECT | Industry sector (high pollution vs low pollution) | 0.60 | 0.49 | −0.03 | 0.06 | −0.04 | −0.01 | 1.00 | |||

| 6. E_INT | Industry employment intensity | 2.11 | 2.54 | −0.02 | −0.03 | −0.03 | −0.03 | −0.28* | 1.00 | ||

| 7. P_IND | Industry profitability | 0.21 | 0.08 | 0.04 | 0.09 | 0.09 | −0.01 | −0.27* | −0.41* | 1.00 | |

| 8. LN_SIZE | Firm size | 5.08 | 1.24 | 0.18* | −0.02 | −0.06 | 0.09 | 0.01 | −0.02 | −0.03 | 1.00 |

- *p < 0.01.

- S.D. = standard deviation.

Common method bias

As the independent and dependent constructs are measured from the same source, there is a potential for common method bias (CMB). In general, there are two main ways to control for CMB: design-related procedures and statistical controls (Podsakoff et al., 2003).

Of the design-related procedural remedies, we followed these steps. First, we pre-screened the potential respondents to ensure that they have relevant knowledge and expertise of the research theme. Second, we assured all respondents that their identity and answers would be kept secret and refrained from asking about sensitive data. Finally, we placed dependent and independent variables/constructs distant from each other and also randomized items within each construct.

Two statistical control methods recommended by Podsakoff et al. (2003) are conducted in order to measure the extent to which CMB is likely to have affected the results. First, drawing on Harman's single factor test, all the fit indices for a single factor measurement model are compared to the actual measurement model. The single factor model is found to be poor compared to the actual measurement model in terms of the fit indices, indicating a lack of CMB. In the second test, all the observed variables in the measurement model are loaded to their assigned latent factors as well as to a single unmeasured latent method factor (Carlson and Kacmar, 2000; Carlson and Perrewe, 1999). The fit indices obtained from this model are then compared to the fit indices for the actual measurement model. The model with the unmeasured latent method factor is found to have better fit indices than the actual measurement model. However, the total variance explained by the single unmeasured factor is noted to be not significant (less than 5%) and well below 25%, in line with the standard set of Williams, Cote and Buckley (1989).

Results and discussion

Test of hypotheses

To test our hypotheses, we used path analyses with AMOS software. Figure 2 presents the results of path analysis for the entire sample. Apart from the three independent variables that are used as reflective constructs, the four control variables (industry sector, industry employment intensity, industry profitability and firm size) are also included in the base model. The fit indices for this model indicate an acceptable level of fit [χ2/d.f. = 2.84; CFI = 0.93; TLI = 0.92; IFI = 0.93; RMSEA = 0.06]. The model coefficients are all positive and significant (p < 0.01) for the main effect variables. These findings, then, provide support for H1, H2 and H3. It should also be noted that of these main effect variables, SPRS is found to be the most important factor on the adoption level of VEM practices in terms of the magnitude of its coefficient being the highest (β = 0.59), followed by DIFFER (β = 0.46) and CFOC (β = 0.32), respectively. As for the control variables, only firm size (LN_SIZE) has a positive and significant coefficient (p < 0.01).

Discussion

Interpretation of the path analysis results leads to several important points of discussion. First, all three independent variables are found to be positively and significantly related to the adoption level of VEM practices. In an EM setting, and despite the common perception that various pressures for adoption of VEM practices may be absent or less intense than in developed country markets, our antecedent variables are strong predictors of the adoption of VEM practices.

The results show that there is a strong and positive link between CFOC and VEM practices. That is, the more a firm chooses to be focused towards its customers, the more it tends to adopt VEM practices. Extant studies suggest that customer pressure is one of the main motives for adopting VEM practices, but – in the EM context – this has typically been explained as a firm's reaction to external pressure from multinational buyers (Sandhu et al., 2012; Tong et al., 2018). Our results, in contrast, show that a firm's strategic choice of a customer-focused culture prods them to adopt VEM practices. This is a significant contribution to the extant literature considering the context of an EM where external customer pressure may not be as strong as in a developed economy. The implication is therefore that even when customer pressure to adopt VEM practices is not very strong – as in the case of EMs – a strong customer-focused culture could propel firms towards VEM practices. This is an important result that can be extended to other EMs.

The positive and significant sign on DIFFER provides a strong empirical foundation to the relationship between a strategic orientation that places emphasis on differentiation (versus cost leadership) strategy and the implementation level of VEM practices. Given an EM context like Turkey, this finding is particularly important as an increasing number of Turkish firms have pursued differentiation-based competitive advantages in recent years (Ulusoy and Yegenoglu, 2007). These firms are more likely to adopt a proactive approach to VEM as they consider environmentally friendly measures as part of their broad differentiation strategy (Yuksel, 2008). This finding broadly supports the framework developed by Orsato (2006) as well as the propositions put forward by Buysse and Verbeke (2003) in developed country contexts, but not previously explored in the EM context.

Finally, the results show that there is a strong and positive relationship between SPRS and VEM practices. That is, the more a firm chooses to be focused towards stakeholder interests, the more it tends to adopt VEM practices. In contrast to previous studies that have investigated the effects of external, foreign stakeholder pressures from multinational buyers or environmental NGOs and other foreign stakeholders on VEM practices in EMs (Tong et al., 2018; Zhu, Feng and Choi, 2017), our results demonstrate that the influence of stakeholders – such as senior management and competitors – can better account for the business-driven strategic choices and orchestration decisions that organizations take. The implication is that stakeholder pressures related to the firm's internal strategic considerations – as opposed to externally imposed norms of behaviour – have more potential to explain the intrinsic motives of firms for VEM adoption as well as the heterogeneity of corporate VEM practices.

Of our four control variables, only firm size was significant, a finding consistent with prior studies showing that larger firms with more slack resources have greater discretion in pursuing environmental initiatives (Darnall, Henriques and Sadorsky, 2010).

Conclusions and implications

Drawing on the strategic choice perspective and the RBV, this study has examined the antecedents of VEM practices based on a dataset of Turkish firms from various industries. Going beyond the institutional, stakeholder and ethical perspectives that have dominated the VEM literature (e.g. Montiel and Husted, 2009; Rueda-Manzanares, Aragon-Correa and Sharma, 2007; Zhu, Feng and Choi, 2017), the strategic choice perspective focuses on the process through which decision makers develop specific strategies. The emphasis is on the process of analysing the internal and external environment of the firm and the outcomes of this process, a system that can provide a more accurate, nuanced and contingent understanding of how and why firms elect to conform to pressures to adopt social or environmental practices. The underlying belief is the centrality of the decision maker's perspective about the firm's internal and external environment and its present and past strategies. The RBV operationalizes the strategic choice lens by zooming in on the role of internal resources/capabilities and, more recently, also the specific strategic mindsets and actions, which can in turn explain the heterogeneity of organizations with regard to their managerial practices.

Scholarship on the internal strategic motives for VEM adoption previously suggest, inter alia, that strategic decisions already taken by the firm in the past (Peiro-Signes and Segarra-Oña, 2017), or the presence of firm-specific resources and capabilities (Christmann, 2000; Escobar and Vredenburg, 2011), could drive the proactive environmental strategy of firms, but this scholarship notably failed to investigate strategic motives for VEM adoption in EMs. This study attempts to fill this gap by providing a number of interesting findings. At the outset, the results support all of the hypothesized direct links between the three strategic choice specific factors and the adoption level of VEM practices. That is, as firms become more customer focused, more inclined to pursue a differentiation strategy and also subject to a higher level of strategy-oriented stakeholder focus, they tend to implement higher levels of VEM practices. While these findings have been suggested by some studies in developed countries, ours is the first to apply and confirm them in an EM setting where the general conditions would call into question whether and how these choices would lead to VEM practice adoption. Furthermore, while some prior research on VEM practices has tackled discrete elements of our strategic choice perspective (e.g. Pekovic, Rolland and Gatignon, 2018 on customer orientation and VEM adoption; Brower and Rowe, 2017 on strategic orientation and stakeholder responses), ours is also the first scholarship to address these elements in an integrated and systematic fashion.

By integrating and extending these isolated contributions in the EM setting, we demonstrate that some of the forces behind – and mechanisms of – VEM adoption that have been tentatively demonstrated in the developed country setting extend to EMs, a finding that is somewhat surprising and even counterintuitive. One possible reason is the undeniable fact that degradation of the physical environment impacts economies across the globe regardless of their status as developed markets or EMs. Hence, the motives for adopting VEM practices are expected to have comparable impacts on firms regardless of the strength of their regulatory environment. This finding also implies that conceptual relationships established through empirical studies carried out in developed countries need not be discarded merely on the pretext of their unsuitability for EMs. This result should therefore remind researchers that contextual effects, as important as they are for the development of VEM practices, must be complemented by internal strategic factors that influence decision making at the organizational level. Instead, the theory formulated in the context of developed economies should serve as a guide for broadening and enriching the theoretical knowledge base about EMs. Similar conclusions have been drawn in a number of extant studies (Jugend et al., 2017; Qu and Ennew, 2008). In order to explain our findings, we invoke distinct theoretical insights from the strategic choice lens and the RBV that conceptualize VEM practices as an outcome of strategic choices and firm-specific considerations, as opposed to broader external institutional and other relational influences taken for granted in the extant literature. In so doing, we open up a potentially novel research stream that leverages and integrates insights from strategic choice and the RBV with the existing institutional and stakeholder perspectives, and the unique product and factor market conditions in EMs. These results can be extended to other EMs, as the study points out the potential antecedents of VEM adoption within the context of institutional voids. Future studies in other EMs could establish the relevance and validity of these antecedents.

Managerial and policy implications

The study also provides several important insights for decision makers, especially for strategy formulation and policy development. Policy makers in EMs have always been interested in formulating policies that encourage VEM practices among firms, but do not require significant application of the regulatory infrastructure. The results from the study provide pointers to generate policy prescriptions for such soft-touch implementation. Primarily, the study finds that customer-focused and differentiation-oriented firms are more committed to implementing VEMs. While policy makers cannot foist these strategies on firms, it is possible to devise ways to prod firms towards these two strategies. For instance, devising policies to encourage firms to listen to their customers – like valuing customer satisfaction scores in dispute settlements or developing a strict customer complaint resolution mechanism – could slowly make it difficult for firms to ignore the customer's voice. This could, over time, create an internal culture that focuses on customers and in turn leads to greater adoption of VEMs. While these mechanisms may already exist in several EMs, it is important for governments in EMs to prioritize them within industry sectors so that firms are compelled to hear the voice of the customers. Policy makers could also indirectly encourage firms to adopt differentiation strategies by reducing the scope for monopolies and the subsequent adoption of cost leadership strategies.

The results are also useful for corporate decision makers engaged in competitor analysis and scenario planning. The study results are useful to anticipate the adoption of VEM strategies by competitor firms and thus may guide strategy formulation, especially for industry sectors characterized by differentiation strategy. Firms may learn from these insights as to the ideal level of VEM adoption, depending on the strategy and industry in which they operate. Governments and NGOs may derive which ‘levers’ are the most effective in terms of influencing VEM adoption. Finally, scholars and practitioners concerned with VEM adoption may use our findings as a window into the mechanisms and sequence of VEM adoption in both EM and developed markets.

Limitations and future research

While this study presents some important findings to enhance our understanding of this field, more research is called for to develop a complete picture. First, this study is based on a single country setting, and therefore future studies could test the validity of the model relying on comparative perspectives across various countries. Second, while unavailability of quantitative and objective firm-level performance data within the Turkish context constitutes a serious limitation, examining the effect of VEM practices on improving organizational and competitive performance of firms in EMs relying on at least perceptual measures would serve as an additional area of research. More research is certainly called for to explore the impact of relevant contingency variables (e.g. environmental uncertainty and competitive intensity) or additional control variables (e.g. firm profitability and degree of internationalization). Third, while the use of single-respondent or key-informant surveys is still acknowledged as a useful research tool, some caution should be exercised in designing and using such surveys due to their potential limitations. For example, designing the survey to include multiple respondents could be recommended to alleviate the CMB problem arising mainly from the use of single-respondent surveys. The use of mixed methods or triangulation could improve the quality and outcomes of single-respondent surveys. Through this approach, a combination of two or more different types of data collection (e.g. as secondary or archival data, personal interviews, surveys and case studies) can be utilized. Further, as this study is based on self-reported measurements provided by firm managers, future research may involve more objective measurements of the constructs, which could enhance the quality of the findings. Finally, future research should track the evolution of these relationships as EMs evolve in their social, economic and institutional development, to see if these same relationships persist as these markets grow and develop.

Nonetheless, our study is a first step in uncovering some of the managerial mechanisms and processes through which EM firms take affirmative steps to become more environmentally responsible through voluntary action.

Appendix: Measurement of constructs/variables

| Variables1 | Measurement2 | Source(s) |

|---|---|---|

| VEM practices (VEMP) |

|

Côté, Booth and Louis (2006), Koh, Gunasekaran and Tseng (2012), Sarkis (1998), Seuring (2004) |

| Customer focus (CFOC) |

|

Chen and Paulraj (2004) |

| Differentiation strategy (DIFFER) |

|

Chen and Paulraj (2004), Miller and Roth (1994), Santos (2000) |

| Stakeholder pressure (SPRS) |

|

Delmas and Toffel (2004) |

| Industry sector (SECT) | Measured by a dichotomous variable: high-pollution vs low-pollution industries. High-pollution industries include metal, mining, leather, textile, transport and related equipment, petroleum, auto, electrical, electronics, durables and chemicals. Low-pollution industries include logistics, construction, food, banking and financial services, export–import trading, tourism and other services. | Berrone and Gomez-Mejia (2009), Gölgeci et al. (2019) |

| Industry employment intensity (E_INT) | Measured by the index value for a particular industry that is computed by dividing the number of people employed in that industry in a particular year by the total number of people employed across all 92 industry sectors in the Annual Industry and Service Statistics 2016 database of the Turkish Statistics Institute. | Turkstat (2016) |

| Industry profitability (P_IND) | Computed as the ratio of the value added at factor cost by all the firms in that sector to the total turnover of all the firms in the sector. | Turkstat (2016) |

| Firm size (LN_SIZE) | Measured through the logarithm of the total number of employees in the firm. | Tatoglu et al. (2014) |

- 1All four multi-item constructs are measured through five-point Likert-type scales ranging from 1 (‘strongly disagree’) to 5 (‘strongly agree’).

- 2The items marked * are deleted and removed from further analysis.

Biographies

Ekrem Tatoglu is Professor of International Business at Ibn Haldun University, Istanbul, Turkey. His research interests include global management strategies and strategy in emerging countries. He has authored/co-authored over 80 academic articles in various internationally refereed journals, such as Journal of World Business, Human Resource Management, Omega, Management International Review and Journal of Business Research. He is also an associate member of the Turkish Academy of Sciences.

Jedrzej George Frynas is Professor of Strategic Management at the Open University Business School, Milton Keynes, UK. He has published extensively on topics in corporate social responsibility, strategic management and international business, and has a passion for research on developing/emerging economies. He has authored/co-authored four books and over 40 academic papers in journals such as Strategic Management Journal, Journal of Management, British Journal of Management, International Journal of Management Reviews and African Affairs, among others.

Erkan Bayraktar is Professor of Industrial Engineering at the American University of the Middle East, Kuwait. He holds a PhD in Industrial Engineering from the University of Iowa. His publications have appeared in leading international academic journals, including the Journal of the Operational Research Society, International Journal of Production Research, International Journal of Production Economics, Expert Systems with Applications, Journal of Cleaner Production, Business Strategy and Environment and Journal of World Business, among others. He is a member of the Academy of Management.

Mehmet Demirbag is Professor of International Business and Deputy Dean of Essex Business School, Southend-on-Sea, UK. His current research interest focuses on multinational enterprises (MNEs) from emerging markets and the impact of institutional factors on MNEs’ operations. He has authored/co-authored four books, 10 book chapters and more than 75 refereed articles in journals such as the Journal of Management Studies, British Journal of Management, Human Resource Management, Journal of World Business and Management International Review, among others.

Sunil Sahadev is Professor of Marketing at Salford Business School, Manchester, UK. He specializes in the areas of sustainability, boundary spanning elements and digital economy. He has published widely in these areas. His work has appeared in journals such as the Journal of World Business, Journal of Business Research, International Marketing Review and European Journal of Marketing, among others.

Jonathan Doh is Associate Dean of Research, Rammrath Chair, Co-Faculty Director of the Moran Center for Global Leadership and Professor of Management at Villanova School of Business, Pennsylvania, USA. His research on international business and corporate responsibility has been published in more than 85 refereed articles, 35 chapters and eight books. Previously Editor-in-Chief of Journal of World Business, he currently serves as Senior Associate Editor of the Journal of Management Studies. Doh received his PhD from George Washington University.

Lenny Koh is Director of the Advanced Resource Efficiency Centre (AREC) at the University of Sheffield, Sheffield, UK. H index 57; more than 343 publications; own IPs of three Cloud-based software tools (SCEnAT suites) for supply chain transformation towards resource sustainability across sectors, technologies and systems, working in partnership with Microsoft; winner of Atlas Award (‘Research for a Better World’) for distinction in research that makes a significant impact on people's lives around the world.