Decision making framework for foreign direct investment: Analytic hierarchy process and weighted aggregated sum product assessment integrated approach

Abstract

Foreign direct investment (FDI) plays a paramount role in economic and social growth of every country. FDI acts as a source of external capital and helps in economic growth of the host country. Making decision for FDI during uncertain business environment is a challenge for all stakeholders. Therefore, in this study, we are proposing a decision making framework for FDI. Through literature review, we have identified the factors, on which FDI depends. A process-based, multi-criterion, integrated hierarchical approach for deciding about FDI, has been illustrated. In this study, five sectors are considered, that is, petroleum and natural resource, retailing and e-commerce, healthcare, information technology, and road and highways for illustrating the proposed framework. It is observed that information technology sector has got top priority for FDI followed by retailing and e-commerce and health care sector. Findings will help in taking appropriate decision by stakeholders for FDI. Ultimately it will also help in creating employment, economic growth, and welfare of society at large in the host country.

1 INTRODUCTION

A country's economic progress depends heavily on foreign direct investment (FDI). Foreign investors' cash enables developing nations to improve their infrastructure, increase their production, and provide new employment possibilities (Crespo & Fontoura, 2007). FDI also serves as a means of acquiring sophisticated technologies and mobilizing foreign exchange resources. The presence of foreign currency reserves in the nation allows the central banking institutions to engage in the foreign exchange market and manage any unfavorable movements in order to stabilize foreign exchange rates. Therefore, it creates a more conducive economic climate for any economy to grow (Menkhoff, 2013). In the era of globalization, most of the developing economies have realized the importance of flows of FDI in different sectors and are making favorable policies concerning the FDI inflows (Paul, 2016). Indian economy, being categorized as a middle income developing market economy, started focuses on attracting FDI inflows in India. To encourage FDI, the Indian government has put in place an investor-friendly policy that allows FDI into the majority of industries on an automatic basis (Jana et al., 2019). With the liberalization in the FDI policy, India has become a preferred destination for FDI. India has been ranked as the ninth largest FDI recipient in the year 2019 as per the World Investment Report, 2020. The FDI inflow in India has been continuously increasing over the number of years. In 2012, it was 24,195.8 million dollars. It was increased to 50,533 million dollars in 2020 (UNCTAD World Investment Report, 2020).

There is a brighter future for the Indian economy due to its large human capital base, rapidly developing service sector, availability of sufficient number of skilled individuals, enormous market for every good or service, growing consumer influence, lack of regulation and licensing, and the presence of 400 million middle-class Indian citizens. Of all countries in the world, India offers the greatest returns on FDI (Sarkodie & Strezov, 2019). In India, FDI inflow has played a crucial role, and it is encouraged for the overall growth of the economy (Sahoo & Mathiyazhagan, 2003). Indian government is making policies to ease out restrictions for creating an investment-friendly environment for the investors. Reforms in industrial policy have resulted in a considerable reduction in the number of licenses required, the removal of business expansion limitations, and the facilitation of simple access to foreign technology and FDI. In India, sector-wise investment pattern is witnessed, and it has been observed that the FDI inflow is highest in the service sector (17.66%), followed by computer science (9.54%) and telecommunication (8.13%) from the year April 2000 to December 2019 (DPIIT, 2020). FDI inflow in any economy depends upon the multiple factors, through which other countries attracts for foreign investment. Piteli et al. (2021) investigated how inward FDI affects migrant remittance in 46 developing economies. In this study, authors established a novel framework that describes the fundamental processes for remittance interactions. Jushi et al. (2021) examined the importance of the impacts of FDI on economic growth for Western Balkan countries. They proposed the use of incoming transfer flows by introducing new policies to ensure a steady attraction of remittances.

FDI inflow to a nation is affected by a variety of factors. However, based on the degree of economic development, the links vary from one country to another. FDI inflows into India are influenced by a variety of factors (Kishor & Singh, 2015). Before investing, investors first, determine the riskiness of the investment atmosphere in the country before making a choice to invest overseas. Some of the factors that may be considered, include the availability of natural resources, a good geographic location, a large and prospective market, a stable cultural and political environment, inexpensive transportation and labor expenses, as well as supportive government and economic policy (Kumari & Sharma, 2017). FDI is also influenced by the number of attributes including sustainability related factors (Langley et al., 2021). Buchanan et al. (2012) investigated the influence of institutional quality on FDI volumes and volatility. They offered new evidence to show that the quality of educational institutions has a favorable and significant impact on FDI. Wang et al. (2013) endorsed that FDI and growth depend upon the changing policy and institutional environment impacts the investors' decision. Gupta and Singh (2016) concluded that there is a positive and significant relationship between FDI and economic growth of the country but all the sectors are not equally benefited with the FDI inflows. The nexus between FDI and economic growth is essential to study the impact of continuous investment flows on economic development (Alfaro & Charlton, 2013). Hitt (2016) determined that formal regulatory elements may be “even more essential” for foreign strategies than cultural and cognitive characteristics in the host nation. Li and Tanna (2019) stated that institutions factors are more essential than human capital factors in deciding productivity benefits from FDI. The detailed literature related to the factors affecting FDI decision in the host country is given in the next section.

Nowadays, experts use multiple analytical and scientific approaches for choosing the best alternative over many alternatives. The decision-making based on several criteria, popularly known as multi-criteria decision making (MCDM), is one of the most reliable methods used in assessing the different criteria. In MCDM, decision-makers choose the best alternative from the different independent alternatives (Ferreira et al., 2019; Gal et al., 2013; Mardani et al., 2015; Zavadskas et al., 2014). In recent years MCDM methods and applications have been used for many financial studies to address field problems such as portfolio analysis, general financial planning, capital budgeting, interest rate and risk analysis, prediction, and classification, working capital and commercial bank management, auditing, accounting, insurance, and pension fund management, government and nonprofit organizations, strategic planning, mergers, and acquisitions (Dymowa, 2011; Hallerbach & Spronk, 2002; Steuer & Na, 2003). In context to developing economies, limited studies have been done to suggest a framework for making decisions on FDI. Therefore our study will try to bridge this research gap by answering following research questions.

RQi.What are the criteria influencing FDI in developing economy.

RQii.How to decide best sector for making FDI in developing countries.

In this study, we employ the integrated approach comprising of analytic hierarchy process (AHP) and weighted aggregated sum product assessment (WASPAS) methods for assessing the preference of FDI in different sectors of. The first phase consisted of the AHP framework to delegate weights to different criteria's and sub-criteria's. The second phase included the use of WASPAS method to set ranks of sectors according to the preference value to various alternatives. WASPAS method differs from other approaches because it is easy to comprehend and use, but very efficient considering the weighted sum model (WSM) and weighted product model (WPM). Because of its mathematical simplicity and capability to provide more accurate results as compared to other methods, it is now being widely accepted as an efficient decision-making tool.

The rest of this article is structured in the following way. Section 2 includes a summary of FDI literature along with the integrated AHP-WASPAS methods. Section 3 deals with the problem description of the proposed work. AHP and WASPAS based procedure for determining the FDI for different sectors is given in Section 4. Section 5 describes the hierarchical problem layout and the findings of the proposed work. Finally, in the last part, conclusions are given.

2 LITERATURE REVIEW

To fulfill the paper's purpose, the literature review has been divided into two parts, that is, a literature review on FDI and its determinants and an integrated AHP-WASPAS approach used for determining the real-life application.

2.1 FDI and determinants

In their study, Mun et al. (2009) concluded that FDI helps in fostering economic development. It helps in creating employment, developing skilled laborers, and enhancing productivity. Government policy should be framed so that both domestic producers and foreign direct investors have profit. Pegkas (2015) examined the relationship between FDI stock variables and economic growth in the Eurozone economies. The study revealed that in the Eurozone countries, there exists a positive relationship between FDI and economic growth and factors like macroeconomic stability, reduced market distortions, and critical structural reforms will help in achieving a high growth rate for the Eurozone countries not only as individuals but as a Eurozone together. Wang (2009) examined that investment highly influences economic growth in the ASEAN economies in the manufacturing sector, and therefore favorable policies should be made to attract FDI in this sector. Chakraborty and Nunnenkamp (2008), in a study, found that the impact of FDI on the manufacturing sector is favorable, leading to a positive relationship between FDI stocks and output. However, no such causal relationship was noticed in the primary sector. Though FDI can generate employment, enhance tax revenues, and develop markets, the relationship between the FDI and economic growth still remains vexing. Sarkodie and Strezov (2019) found that FDI inflows of clean and modern technology in developing countries help in achieving sustainable development goals.

Ali and Guo (2005), in a study on determinants of FDI in China, examined that market size is an essential factor for FDI in the case of US firms. Anyanwu and Yameogo (2015) examined that there is a positive impact of the macro-economic factors like trade openness, domestic investment, natural resources, the quadratic real per capita gross domestic products (GDP) and so forth, on the FDI inflows to West Africa. However, the study found that variables like sub-regions and the official development assistance (ODA) loan component negatively impact the FDI inflows in South Africa. There is a U shaped relationship between economic development and FDI inflows. FDI inflows and economic growth are interrelated (Iamsiraroj, 2016). The higher economic growth rate factor stimulates higher FDI inflows, which leads to the economic growth of a country. The other related factors that attract FDIs are labor force availability, openness to trade, and economic freedom. Government policy should be framed so that it attracts FDI inflows and leads to per capita income growth.

Blonigen (2005) investigated the best determinants of FDIs in developing countries and found that communication is the most important determinant of FDI in developing countries. Appropriate domestic policies encourage FDI inflows in developing countries and benefit domestic business and society at large. De Gregorio (2005) recommended that greater openness and improved means of transportation and communications will attract foreign investors in small developing economies. Kishor and Singh (2015) studied the determinants of FDI, and its impact on the BRICS economy, and they examined that market capitalization, sound infrastructure, and GDP of the BRICS economy are the major factors attracting FDI. The study further suggested that FDI benefits can be further realized if a country has a conducive political environment, proficient economic policies, and proper corporate governance.

Post liberalization, policymakers in India is carefully examining the factors determining FDI inflows in India. Sury (2008) concluded that trade openness, tax rate, labor cost, and national income are the major determinants of foreign investment in India. Singhania and Gupta (2011) examined several macroeconomic variables and found that the significant variables determining foreign investment include GDP, inflation rate and scientific research, and Kaur and Sharma (2013), in their empirical analysis related to the determinants of FDI in India, examined that GDP, openness to trade, reserves and long term debt plays a significant role in foreign investment in India. The study further revealed that the high inflation rate and fluctuating exchange rate acts as a detrimental factor for FDI in India. Current account balance and FDI in India are positively related, and the inflow of FDI depends on the current account balance percentage of GDP (Iqbal et al., 2018). Saikia (2021) found three commonly used institutional pillars for FDI namely, state judiciary, bureaucracy, and property rights enforcement and explored the significant positive impact on FDI related to choice of location. Islam et al. (2021) shown that the FDI has an important and beneficial effect on Southeast Asian economies' financial environment. The FDI in the area of Southeast Asia helps in financial deepening by providing capital directly or indirectly and the right cash channel for accelerating FDI financial deepening should also be investigated by policy makers. Tsitouras et al. (2020) provided essential implications by examining the factors that can influence FDI decisions, and suggested new insights regarding the diachronically high importance of technological capabilities compared to other FDI determinants. Dorakh (2021) analyzed the patterns and determinants of FDI in Europe, in particular, the roles of trade costs and connectivity in determining the volume of FDI, and compare impacts of “European Union” and “Belt and Road Initiative” membership in shaping FDI patterns across European countries. Mugableh (2021) examined the causal links, long term and short term between inward FDI and its determinants for Jordan over the period from 1980 to 2018. Shahbaz et al. (2021) explored the effect of education and transportation infrastructure on FDI over the period of 1965–2017 and provided appropriate policy implications to maintain economic development to French economy. After reviewing the literature, we have identified multiple determinants on which FDI depends, and these are summarized in Table 1.

| Authors | Country | Determinants |

|---|---|---|

| Saikia (2021) | India |

|

| Shahbaz et al. (2021) | France |

|

| Bohle and Regan (2021) | Ireland and Hungary |

|

| Mugableh (2021) | Jordan |

|

| Dorakh (2021) | China |

|

| Tsitouras et al. (2020) | Greece |

|

| Dellis et al. (2020) | Advanced economies |

|

| Nam et al. (2020) | General study |

|

| Fertő and Sass (2020) | Central and Eastern European countries |

|

| Jana et al. (2019) | India |

|

| Sarkodie and Strezov (2019) | China India Iran Indonesia South Africa |

|

| Iqbal et al. (2018) | India Sri Lanka |

|

| Kumari and Sharma (2017) | General study |

|

| Iamsiraroj (2016) | General study |

|

| Anyanwu and Yameogo (2015) | West-Africa |

|

| Kishor and Singh (2015) | Brazil Russia India China South-Africa |

|

Kaur and Sharma (2013) |

India |

|

| Singhania and Gupta (2011) | India |

|

| Sury (2008) | India |

|

| Ali and Guo (2005) | China |

|

| De Gregorio (2005) | General study |

|

- Abbreviations: FDI, foreign direct investment; GDP, gross domestic product.

2.2 Application of MCDM techniques

The literature review indicates that several MCDM techniques exist, including AHP, TOPSIS, MAUT, CRITIC, ELECTRE, ANP, WASPAS, and TODIM (Mardani et al., 2015; Toloie-Eshlaghy & Homayonfar, 2011). MCDM techniques have been extensively used in operations area. Gupta et al. (2021) have used fuzzy AHP-TOPSIS approach for selection of logistic service provider. Gupta and Singh (2020) used graph theory matrix approach for evaluating sustainability index. Kumar et al. (2021) have used MCDM approach for studying application of big data analytics for sustainable manufacturing. Kumar and Singh (2020) have used MCDM approach for selection of sustainable solution for crop burning. MCDM approach has got application in other areas of research also. In the process of evaluating the banks' financial performance, Mandic et al. (2014) used integrated AHP-TOPSIS and conducted the analyses covering the period of 2005–2010, of the entire Serbian banking industry. In three phases (pre-recession (2014–06), recession (2007–2009), and post-recession (2010–2012), (Gokmenoglu & Alaghemand, 2015) assessed the relative priorities for FDIs as the home-country of nine developing countries from the US' perspective using the integrated AHP-TOPSIS. Using the integrated AHP-TOPSIS methodology, Çalık et al. (2019) analyzed the appropriate industry's selection by taking note of the economic factors (ECO), political factors (POL), and country factors (COU) for foreign investors. Based on a survey of 100 young consumers, Sharma and Joshi (2019) identified the leading brand characteristics using AHP-TOPSIS technology to recognize their sustainable brands' attitudes. Chakraborty and Zavadskas (2014) used the WASPAS technique to resolve many production issues with several parameters, such as fluid cutting distribution, electroplating procedure, forging, welding phase, and so forth. By introducing a new fuzzy multi-attribute performance assessment system based on the merits of the fuzzy-WASPAS and fuzzy-AHP, Turskis et al. (2015) developed a strategy to identify a suitable shopping center in Vilnius' strategic demand regions. Deveci et al. (2018) proposed an optimized WASPAS-based TOPSIS with the Type-2-fuzzy MCDM method for analyzing an appropriate car sharing selection problem for Istanbul stations. An uncertain Hybrid MCDM model was developed by Alam et al. (2018) using the fuzzy AHP and WASPAS for cloud service assessment and selection process, consisting of nine primary and 30 secondary variables assessing 6 real-world providers of public cloud services. Ayyildiz and Gumus (2020) developed a novel AHP-integrated spherical WASPAS technique for the positioning of petrol stations, consisting of four main criteria's and 16 sub-criteria's. Sergi and Sari (2021) has used fuzzy AHP and fuzzy WASPAS as a means of prioritizing the digitalization of public health systems at decreased costs, speedy response, ease of access, decreases in delivery hours, expanded data, and improved efficiency.

Recently, a very few studies have utilized MCDM approaches in FDI context, either independently, or hybridization of two MCDM approaches. Subsequently, recent studies, we can find hybridization of AHP-TOPSIS approaches in FDI context. On the other hand, the hybridization of AHP and WASPAS in the context of evaluating the different industries of India on the basis of different factors that affects FDI decision has not been available in the existing literatures. Thus, addressing this research gaps inspired us to propose a hybrid approach based on AHP and WASP approaches to evaluate the FDI decision in the specific Indian industries.

3 FRAMEWORK DEVELOPMENT

However, the literature reviews also found specific gaps in knowledge, whereby very few studies have studied and used MCDM for efficiency measurement and decision making in FDI. There is also a lack of studies using ECO, social factor (SOC), POL, and COUs all-together and their impact on FDI in developing nations. Last, no studies combine five significant sectors, that is, retailing and wholesaling, energy and natural resource, communication technology and information, finance and banking service, and manufacturing and industrial, for evaluating the FDI using MCDM.

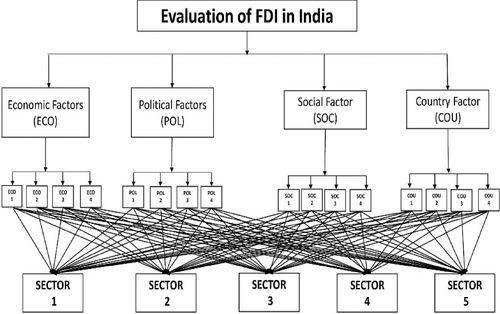

The spectacular rise of FDI in the world economy is one of the most striking trends in the past two decades. The exponential rise in FDI globally in 1990 makes it a significant and central aspect of the growth policy in developed and developing countries, and policies are structured accordingly to enhance internal flows. FDI gives the host and home countries a win–win scenario (Goel et al., 2012). The Indian region is one of the world's most diverse economic regions and interlinked and enticing multi-national investment venues for investors. The following criteria are defined for FDI, based on the literature review. In India, the FDI's origin can be traced back to the British East India Company's existence. During Britain's colonial time in India, the British capital came to India (Teli, 2014). The literature that supports FDI criterion is reviewed and framework is shown in Figure 1.

Some countries are stable in term of the political situation; however, the general economic condition is weak because some external factors such as country and social criteria's play an essential role in choosing FDI. On the other hand, if the targeted country is vital in economic terms, but it is not politically stable, other external factors' role comes into play before finalizing FDI. Most of the studies focus on these two factors, that is, political and economic, but some countries and SOCs are also considered before FDI in any countries. This study focuses on the ECO, POL, COU, and SOCs that can be considered before investing in any counties.

3.1 Economic factors

- Size of economy (ECO1): The size of the economy and FDI can start a “success domino effect” business. Effectively, the more FDI an economy can have drawn, the more it expands, inducing more FDI in turn, helps in establishing overall sustainable growth in the country (Ali & Guo, 2005; Anyanwu & Yameogo, 2015; Sharma & Bandara, 2010; Sury, 2008).

- Exchange rate (ECO2): Any FDI's profitability is dependent on stability in exchange rates. This means the national currency value does not collapse unusually since foreign investors would suffer significantly when repatriating money. At the time of the investment, exchange rates should be more or less equal (Anyanwu & Yameogo, 2015; Kaur & Sharma, 2013; Singhania & Gupta, 2011).

- Tax rate (ECO3): Government should follow uniform policies on taxes in compliance with international standards. FDIs are prohibited from being levied by high excise tax or revenue tax or other taxes. The FDIs ought to proceed with a modest taxation strategy to make it convenient (Asongu et al., 2018; Iqbal et al., 2018; Kishor & Singh, 2015).

- Wage rate (ECO4): The outsource meant to lower-cost countries with labor-intensive manufacturing is an essential opportunity for global firms to invest abroad. But FDIs do not dictate wage prices alone; high-paying countries can also draw more technical investment. A business can oppose investment in Sub-Saharan African countries because of other disadvantages, such as infrastructure problems and transport links, outweigh low wages (Anyanwu & Yameogo, 2015; Asongu et al., 2018; Kaur & Sharma, 2013).

3.2 Political factors

- Political stability (POL1): For any investment, a steady government is a necessary requirement. The investor will always search out a government that encourages investment and does not take anti-investment policies. The investor does not fear the government's takeover, allowing the investor to broaden the project or investment (Anyanwu & Yameogo, 2015; Bohle & Regan, 2021; Jensen et al., 2012; Sury, 2008).

- Foreign trade regulation (POL2): The flexibility of a free-trade environment and have very low non-tariff barriers are significant consideration for businesses that invested in foreign markets (Asongu et al., 2018; Iamsiraroj, 2016; Tuman & Shirali, 2017).

- Laws regulating environment pollution (POL3): International businesses are more vulnerable than domestic companies to emissions regulations. Environmental laws do not mean that multinationals in host countries strive to limit their polluting goods. However, it is a common fact that environmental rigor should not affect the decision about whether an international firm can be located. At the same time, other facilities and consumer access considerations are taken into account (Anyanwu & Yameogo, 2015; Demir et al., 2018; Jensen et al., 2012).

- Bureaucracy (POL4): Bureaucracy plays an imperative role in FDI decisions. Foreign direct investors consider the bureaucratic system of the host country before making any decision. Bureaucratic factors like complicated official rules, lack of transparency in the system, corruption, incongruous public servants' behavior, and long problem-solving time increase the cost of multinational enterprises. The presence of bureaucracy in the host country has a negative impact on foreign investors. Most of the economies try to attract FDI by removing the bureaucratic barriers (Not revealed in depth literature).

3.3 Social factors

- Population density (SOC1): The host countries' population is one of the main possible influences of the FDI. Countries with big populations have a large demand for MNEs goods and services, have a large workforce, and a large base of expertise (De Gregorio, 2005; Demir et al., 2018).

- Human capital development (SOC2): Human capital is an important in evaluating the host countries' capacity to absorb technological diffusion due to foreign inflows. The MNCs can also induce less cost incurred in employee training if a country's workforce is qualified and educated (Demir et al., 2018; Iamsiraroj, 2016).

- Level of education (SOC3): Educational adequacy remains a critical indicator in developing countries for FDI flows. Healthy education provides citizens the necessary skills to fulfill the country's needs, which may be a way to make developed countries more attractive to international investments (De Gregorio, 2005; Demir et al., 2018).

- Religious diversity (SOC4): Many authors claimed that investors would be more likely to invest in places that are culturally and religious, far from their country of origin (De Gregorio, 2005).

3.4 Country factor

- Country size (COU1): The countries demographics makes it an enticing nation for investors to invest in advanced sectors such as hospitals, IT, manufacturing, and luxury commodities factor (Ali & Guo, 2005; Kishor & Singh, 2015; Sury, 2008; Tahir & Larimo, 2004).

- Competitiveness (COU2): FDI aims to build a dynamic atmosphere that breaks domestic monopolies by promoting international organizations' entrance. A stable business climate encourages businesses to continually change their operations and goods and promote creativity. In addition, customers have access to a greater variety of goods which are competitively priced (Ali & Guo, 2005; Kaur & Sharma, 2013; Singhania & Gupta, 2011; Sury, 2008).

- Infrastructure (COU3): Transportation costs and infrastructure levels are the crucial consideration in the desirability of investments. A country that have low labor rates, but if the costs of shipping for the goods to reach the global market are still high, this is inconvenient. Countries with sea access benefit landlocked countries which have higher shipment costs (Anyanwu & Yameogo, 2015; Iamsiraroj, 2016; Iqbal et al., 2018; Kishor & Singh, 2015).

- Labor skills (COU4): Some sectors need higher expertise, such as pharmaceuticals and electronics. Thus, in countries with low incomes but have high labor productivity and expertise, multinationals firms always try to invest (Anyanwu & Yameogo, 2015; Iamsiraroj, 2016; Kishor & Singh, 2015; Tahir & Larimo, 2004).

Last, the impact of these criteria and sub-criteria for making FDI has been evaluated on five major sectors, that is, petroleum and natural resource (S1), retailing and e-commerce (S2), healthcare (S3), information technology (S4), and road and highways (S5) by using the integrated AHP-WASPAS method.

4 SOLUTION PROCEDURE

This section outlines the various steps taken to accomplish the aims of this research. Figure 2 demonstrates different phases in carrying out this analysis. According to Figure 1, as given in Section 3, multiple economic, social, political, and country criteria have been considered the main decision criteria to choose the best sector for FDI in India.

In 2018–2019, India remained the world's fastest expanding largest economy (Ministry of Statistics and Program Implementation, Government of India). India's GDP is expected to raise much more in 2019 by 7.3%, according to the April 2019 World Economic Outlook of the International Monetary Fund. Based on the literature, this paper aims to analyze which India sectors is most suitable for FDI in India. To achieve this document, 100 academics and industrial experts using purposive sampling were chosen from online databases, and questionnaires sent to them. During the period from September to October, 2020 data was collected using mailing, telephonic interviews and two follow-ups fetched up 82 responses. The illustrated figure of political, economic, social, and country criteria and their sub-criteria used to evaluate FDI in different sectors of India are given in Figure 1.

- Description of FDI

- Introduction to the criteria and sub-criteria

- Guidelines for filling the questionnaire

- Pairwise comparison matrix of the criteria

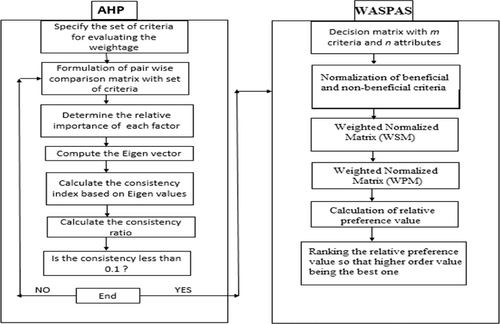

The data analysis part was divided into two sections. The first section comprises the application of AHP to assign weights to various attributes (Section 3.1). The second section involved the application of WASPAS to assign ranks to different attributes as per the closeness index value (Section 3.2). In the current study, AHP calculates the weights, which will serve as a primary input to WASPAS method. The comprehensive research framework used for solving the proposed work is discussed below:

4.1 Determination of weights

AHP (Saaty, 1989; Wu et al., 2009) is an efficient and fast decision-making tool. It is widely used in the priority and selection of criteria's. AHP selects the strategic priorities as a compilation of weighted parameters which can be used to assess the criteria. It structures the decision to reduce decision bias and ensure each criterion has an equal chance of being prioritized and can also consensus between the decision-making is effectively identified. The steps by step procedure for obtaining the weights are described below:

Step (i) Construct pairwise comparisons; the next step after determining the weight of each attribute is to figure out the relative significance of one alternative over another.

Step (ii) Sum up the values of each column obtained from the pairwise comparison.

Step (iii) In order to get the matrix normalized, divide each element of the column of a pairwise matrix with its corresponding sum.

Step (iv) The next step is to sum up all the elements of each row obtained by using step (iii) and dividing it by the number of elements in each row. The outcome indicates each alternative the total priority rating.

Step (v) The last step is to calculate the priority vectors of the alternatives obtained by multiplying the pairwise comparisons of the alternatives matrix and the criteria weight.

(1)

(1) is the maximum eigenvalue of the matrix for a pair comparison However, the CR is determined by dividing the CI value by the “random consistency index (RCI)”, as shown in Equation (2) (Table 2)

is the maximum eigenvalue of the matrix for a pair comparison However, the CR is determined by dividing the CI value by the “random consistency index (RCI)”, as shown in Equation (2) (Table 2)

(2)

(2)| N | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 |

|---|---|---|---|---|---|---|---|---|---|---|

| RCI | 0 | 0 | 0.52 | 0.89 | 1.11 | 1.25 | 1.35 | 1.4 | 1.45 | 1.49 |

- Abbreviation: RCI, random consistency index.

When the CR value is smaller than or equivalent to 10%, data is considered to be accurate; however, if it is greater than 10%, it is not reliable.

4.2 Determination of rank

The WASPAS method (Chakraborty & Zavadskas, 2014; Pathapalli et al., 2019) is commonly used to overcome real-world ranking issues, and it is used often to tackle multi-criteria decision-making complexities in comparing the criteria and attributes. It is a method of offsetting sum and product contrasted by defining each criterion's weight for a set of alternatives, normalizing values for each criterion, and evaluating the relative preference value using the WSM and WPM for every alternatives. The steps by step procedure for ranking the sectors are described below:

Step (i) Construct the decision matrix of m number of alternatives, and n number of evaluation criteria, and  is the performance of ith alternative with respect to jth criterion

is the performance of ith alternative with respect to jth criterion

Step (ii) Construct the normalized decision matrix that requires linear normalization of the decision matrix elements using the following two equations:

(3)

(3) (4)

(4) is the normalized value of

is the normalized value of  .

. (5)

(5) is the relative weightage of the jth criterion.

is the relative weightage of the jth criterion. (6)

(6) (7)

(7)Note that, higher the value of  , higher the rating order of alternatives. All the above discussed steps involved in the process of evaluating the best sector for FDI is summarized below in the flowchart.

, higher the rating order of alternatives. All the above discussed steps involved in the process of evaluating the best sector for FDI is summarized below in the flowchart.

In this study, two-stage integrated MCDM methods were used to evaluate the FDI factors and to determine the most ideal industrial sector for FDI in India. The integrated AHP-WASPAS approach applied is shown schematically in Figure 2. The AHP method is used to calculate the weights of the main-criteria's and sub-criteria's, however, WASPAS method is used for evaluating the priority of different sectors. The main advantage of using WASPAS is that it is the joint generalized criterion of weighted aggregation of additive and multiplicative methods, for ranking of the alternatives. As part of its own process, this approach may be used to control the consistency of alternative ranks by doing sensitivity analyses.

5 RESULTS AND DISCUSSION

To use the AHP and WASPAS methods for figuring out the best sector for the FDI in India, some data are necessary. To collect the data, a questionnaire is distributed to the selected individuals (academicians and industry professionals) and asked them to compare each criteria with the others criteria, particularly by assigning a pairwise comparison in scale of 1–9 according to their preferences. The average value of all the criteria have been recorded for creating the hierarchy matrix of the model.

The pairwise comparison matrix of four criteria with respect to the ultimate goal was formed to estimate their relative weights. Table 3 shows the pairwise comparison of the criteria as well as their priority weights with a CR 0.0052. As can be seen, in the evaluation of the FDI, the most significant weight is given to the economic criterion followed by the country criterion.

| ECO | POL | SOC | COU | Weight | |

|---|---|---|---|---|---|

| ECO | 1 | 1.322004 | 1.440546 | 1.215461 | 0.305498 |

| POL | 0.756428 | 1 | 1.089669 | 0.919408 | 0.231087 |

| SOC | 0.694181 | 0.91771 | 1 | 0.84375 | 0.212071 |

| COU | 0.822733 | 1.087657 | 1.185185 | 1 | 0.251344 |

- Abbreviations: COU, country factor; ECO, economic factor; POL, political factor; SOC, social factor.

After obtaining the main criteria's weight, the next target is to obtain the weightage of the sub-criteria's of the considered main criteria. AHP technique is applied on sub-criteria of main criteria, economics, political, social, and country criteria. It can be seen that among the sub-criteria of the economic criteria for FDI, the greatest weight is obtained by the size of the economy followed by the wage rate. For political sub-criteria, the most significant weight is obtained by the political stability followed by the bureaucracy. And also, for the social and country sub-criteria, the most significant weight is obtained by the population density followed by the level of the education, and competitiveness followed by the country size, respectively.

While reviewing the pairwise comparison matrix of all sub-criteria's of main criteria, it has been observed that all expert team decisions are compatible as CR value is lower than 0.1 for all the cases (economic sub-criteria CR value is 0.046; political sub-criteria CR value is 0.041; social sub-criteria CR is 0.087; and country sub-criteria CR value is 0.026). It means that the decisions of the expert panel can be satisfactorily analyzed for further stage. After obtaining the local weights of the criteria and sub-criteria used for evaluating the FDI in different sectors of India by using the AHP method, the next step is to obtain the global weights of criteria's and sub-criteria's, and the obtained global weight is given below (Table 4).

| Criteria's/sub-criteria's | Local weightage | Global weightage |

|---|---|---|

| 1. ECO | 0.305498 | 0.305498 |

| 1.1 ECO1 | 0.286058 | 0.08739 |

| 1.2 ECO2 | 0.223558 | 0.06829 |

| 1.3 ECO3 | 0.226442 | 0.06918 |

| 1.4 EC04 | 0.263942 | 0.08063 |

| 2. POL | 0.231087 | 0.231087 |

| 2.1 POL1 | 0.226481 | 0.05234 |

| 2.2 POL2 | 0.28671 | 0.06625 |

| 2.3 POL3 | 0.238427 | 0.05509 |

| 2.4 POL4 | 0.248382 | 0.05740 |

| 3. SOC | 0.212071 | 0.212071 |

| 3.1 SOC1 | 0.271144 | 0.05750 |

| 3.2 SOC2 | 0.231841 | 0.04917 |

| 3.3 SOC3 | 0.252736 | 0.05360 |

| 3.4 SOC4 | 0.244279 | 0.05180 |

| 4. COU | 0.251344 | 0.251344 |

| 4.1 COU1 | 0.25666 | 0.06451 |

| 4.2 COU2 | 0.259734 | 0.06528 |

| 4.3 COU3 | 0.238217 | 0.05987 |

| 4.4 COU4 | 0.245389 | 0.06168 |

- Abbreviations: COU, country factor; ECO, economic factor; POL, political factor; SOC, social factor.

Table 4 shows the global weightage of the criteria's and sub-criteria's for FDI evaluation in India. Economic criteria (0.305498) is perceived to be the most important criteria for FDI in India, followed by the country criteria (0.251344), political criteria (0.231087), and social criteria (0.212071). Among the sub-criteria of economic criteria for FDI, size of the economy (0.08063) occupies the most important sub-criteria followed by wage rate (0.08063), tax rate (0.06918), and exchange rate (0.06829). Second important criteria for FDI is country criteria, among which competitiveness (0.06528) occupies the most important sub-criteria followed by country size (0.06451), labor skills (0.06168), and infrastructure (0.05987). Third important criteria for FDI is political criteria, among which foreign trade regulation (0.06625) occupies the most important sub-criteria followed by bureaucracy (0.05740), laws regulating environment pollution (0.05509), and political stability (0.05740). The last important criteria for FDI evaluation is social criteria, among which population density (0.05750) occupies the most important sub-criteria followed by level of education (0.05360), religious diversity (0.05180), and human capital development (0.04917).

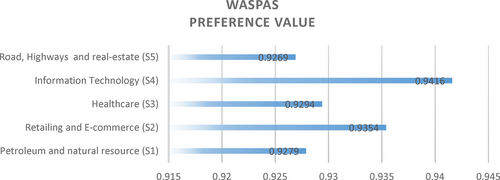

Table 5 gives the alternatives value for each criteria used for the evaluation of FDI in India. Before applying the WASPAS method, the decision maker has to identify the beneficial and non-beneficial criteria for FDI. Among all the considered criteria, that is, economic, social, political, and country criteria's, decision maker decided to considered economic and country criteria's as the beneficial criteria while social and political criteria's as the non-beneficial criteria for FDI. After normalizing the Table 5 by using the Equations (3) and (4), and the decision maker next step is to get the weighted normalized matrix. WASPAS method is the combination of both WSM and WPM method. Table 6 shows the weighted sum normalized decision matrix derived by multiplying the criteria's weight with normalized value, while Table 7 shows the weighted product normalized decision matrix derived by using the normalized value to the power of weightage value of each criterion. Further, Equations (5) and (6) are used for determining the preference value of each alternatives. The obtained preference value of WSM and WPM is given in Table 8. Finally Equation (7) is used to determine the WASPAS preference value of each of the alternatives, which is given in Table 9 and graphically presented in Figure 3. The higher value of preferences, represents a higher ranking. Based on the obtained result of WASPAS, the considered sectors are ranked in the order of preference. It is observed that information technology (S4) has got the highest priority followed by retailing and e-commerce (S2), and healthcare (S3) sector. Appropriate decision for making FDI will give better return and will help not only to stakeholders but to society overall.

| Sectors | ECO1 | ECO2 | ECO3 | ECO4 | POL1 | POL2 | POL3 | POL4 | SOC1 | SOC2 | SOC3 | SOC4 | COU1 | COU2 | COU3 | COU4 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| S1 | 0.877 | 1.110 | 0.923 | 0.961 | 1.050 | 0.898 | 0.979 | 0.946 | 0.877 | 1.110 | 0.923 | 0.961 | 0.965 | 0.977 | 0.896 | 0.923 |

| S2 | 0.946 | 1.198 | 0.996 | 1.037 | 1.133 | 0.969 | 1.056 | 1.021 | 0.946 | 1.198 | 0.996 | 1.037 | 1.042 | 1.054 | 0.967 | 0.996 |

| S3 | 0.892 | 1.129 | 0.939 | 0.978 | 1.069 | 0.914 | 0.996 | 0.963 | 0.892 | 1.129 | 0.939 | 0.978 | 0.982 | 0.994 | 0.912 | 0.939 |

| S4 | 0.993 | 1.258 | 1.046 | 1.090 | 1.190 | 1.017 | 1.109 | 1.072 | 0.993 | 1.258 | 1.046 | 1.090 | 1.094 | 1.107 | 1.015 | 1.046 |

| S5 | 0.865 | 1.095 | 0.911 | 0.949 | 1.036 | 0.886 | 0.966 | 0.933 | 0.865 | 1.095 | 0.911 | 0.949 | 0.952 | 0.964 | 0.884 | 0.911 |

| Global weight | 0.087 | 0.068 | 0.069 | 0.081 | 0.052 | 0.066 | 0.055 | 0.057 | 0.058 | 0.049 | 0.054 | 0.052 | 0.065 | 0.065 | 0.060 | 0.062 |

- Abbreviations: COU, country factor; ECO, economic factor; FDI, foreign direct investment; POL, political factor; SOC, social factor.

| Sectors | ECO1 | ECO2 | ECO3 | ECO4 | POL1 | POL2 | POL3 | POL4 |

|---|---|---|---|---|---|---|---|---|

| S1 | 0.0771 | 0.0603 | 0.0610 | 0.0712 | 0.0516 | 0.0654 | 0.0544 | 0.0566 |

| S2 | 0.0832 | 0.0650 | 0.0659 | 0.0768 | 0.0479 | 0.0606 | 0.0504 | 0.0525 |

| S3 | 0.0785 | 0.0613 | 0.0621 | 0.0724 | 0.0507 | 0.0642 | 0.0534 | 0.0557 |

| S4 | 0.0874 | 0.0683 | 0.0692 | 0.0806 | 0.0456 | 0.0577 | 0.0480 | 0.0500 |

| S5 | 0.0761 | 0.0595 | 0.0602 | 0.0702 | 0.0523 | 0.0663 | 0.0551 | 0.0574 |

| Sectors | SOC1 | SOC2 | SOC3 | SOC4 | COU1 | COU2 | COU3 | COU4 |

|---|---|---|---|---|---|---|---|---|

| S1 | 0.0567 | 0.0485 | 0.0529 | 0.0511 | 0.0569 | 0.0576 | 0.0528 | 0.0544 |

| S2 | 0.0526 | 0.0450 | 0.0490 | 0.0474 | 0.0614 | 0.0622 | 0.0570 | 0.0587 |

| S3 | 0.0558 | 0.0477 | 0.0520 | 0.0502 | 0.0579 | 0.0586 | 0.0538 | 0.0554 |

| S4 | 0.0501 | 0.0428 | 0.0467 | 0.0451 | 0.0645 | 0.0653 | 0.0599 | 0.0617 |

| S5 | 0.0575 | 0.0492 | 0.0536 | 0.0518 | 0.0562 | 0.0568 | 0.0521 | 0.0537 |

- Abbreviations: COU, country factor; ECO, economic factor; FDI, foreign direct investment; POL, political factor; SOC, social factor.

| Sectors | ECO1 | ECO2 | ECO3 | ECO4 | POL1 | POL2 | POL3 | POL4 |

|---|---|---|---|---|---|---|---|---|

| S1 | 0.9891 | 0.9915 | 0.9914 | 0.9900 | 0.9993 | 0.9991 | 0.9993 | 0.9992 |

| S2 | 0.9957 | 0.9967 | 0.9966 | 0.9961 | 0.9953 | 0.9941 | 0.9951 | 0.9949 |

| S3 | 0.9906 | 0.9927 | 0.9926 | 0.9914 | 0.9984 | 0.9980 | 0.9983 | 0.9982 |

| S4 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 0.9928 | 0.9909 | 0.9924 | 0.9921 |

| S5 | 0.9880 | 0.9906 | 0.9905 | 0.9889 | 1.0000 | 1.0000 | 1.0000 | 1.0000 |

| Sectors | SOC1 | SOC2 | SOC3 | SOC4 | COU1 | COU2 | COU3 | COU4 |

|---|---|---|---|---|---|---|---|---|

| S1 | 0.9992 | 0.9993 | 0.9993 | 0.9993 | 0.9920 | 0.9919 | 0.9925 | 0.9923 |

| S2 | 0.9949 | 0.9956 | 0.9952 | 0.9954 | 0.9968 | 0.9968 | 0.9971 | 0.9970 |

| S3 | 0.9982 | 0.9985 | 0.9983 | 0.9984 | 0.9931 | 0.9930 | 0.9936 | 0.9934 |

| S4 | 0.9921 | 0.9932 | 0.9926 | 0.9929 | 1.0000 | 1.0000 | 1.0000 | 1.0000 |

| S5 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 0.9911 | 0.9910 | 0.9917 | 0.9915 |

- Abbreviations: COU, country factor; ECO, economic factor; FDI, foreign direct investment; POL, political factor; SOC, social factor.

| Sectors | WSM | WPM |

|---|---|---|

| S1 | 0.9287 | 0.9272 |

| S2 | 0.9355 | 0.9353 |

| S3 | 0.9297 | 0.9291 |

| S4 | 0.9427 | 0.9405 |

| S5 | 0.9280 | 0.9258 |

- Abbreviations: WPM, weighted product model; WSM, weighted sum model.

| Sectors | WASPAS preference value | Rank |

|---|---|---|

| Petroleum and natural resource (S1) | 0.9279 | 4 |

| Retailing and E-commerce (S2) | 0.9354 | 2 |

| Healthcare (S3) | 0.9294 | 3 |

| Information technology (S4) | 0.9416 | 1 |

| Road, highways, and real-estate (S5) | 0.9269 | 5 |

- Abbreviation: WASPAS, weighted aggregated sum product assessment.

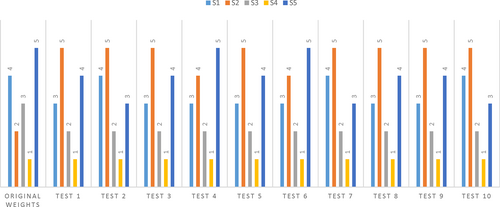

In Table 11, sensitivity analysis is also carried out for all the considered sectors. The purpose of the sensitivity analysis is to verify the findings and clarify the precision and deviations of in the determination of results. When ambiguity occurs in one or more characteristics, it is important to do so. It helps in the estimation of the minimal difference of existing characteristics weights which may influence the current attributes rank. Ten trials are administered by using various weight to assess the robustness of attributes. The final ranking is determined with the help of relative preference value of WASPAS method. Table 10 shows new sets of weights to analyze the sensitivity, and the ranks of sectors based on new sets of weights are shown in Table 11 and presented in Figure 4.

| Test | W11 | W12 | W13 | W14 | W21 | W22 | W23 | W24 | W31 | W32 | W33 | W34 | W41 | W42 | W43 | W45 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Original weight | 0.087 | 0.068 | 0.069 | 0.081 | 0.052 | 0.066 | 0.055 | 0.057 | 0.058 | 0.049 | 0.054 | 0.052 | 0.065 | 0.065 | 0.060 | 0.062 |

| Test 1 | 0.089 | 0.070 | 0.071 | 0.083 | 0.054 | 0.066 | 0.060 | 0.052 | 0.053 | 0.044 | 0.059 | 0.047 | 0.070 | 0.060 | 0.065 | 0.057 |

| Test 2 | 0.090 | 0.071 | 0.072 | 0.084 | 0.055 | 0.067 | 0.061 | 0.053 | 0.048 | 0.039 | 0.064 | 0.044 | 0.075 | 0.055 | 0.070 | 0.052 |

| Test 3 | 0.091 | 0.053 | 0.084 | 0.066 | 0.067 | 0.051 | 0.070 | 0.042 | 0.043 | 0.034 | 0.069 | 0.078 | 0.080 | 0.050 | 0.075 | 0.047 |

| Test 4 | 0.092 | 0.048 | 0.089 | 0.061 | 0.072 | 0.046 | 0.075 | 0.037 | 0.038 | 0.029 | 0.074 | 0.087 | 0.085 | 0.045 | 0.080 | 0.042 |

| Test 5 | 0.093 | 0.043 | 0.094 | 0.056 | 0.077 | 0.041 | 0.080 | 0.032 | 0.032 | 0.092 | 0.079 | 0.027 | 0.090 | 0.040 | 0.085 | 0.037 |

| Test 6 | 0.094 | 0.038 | 0.099 | 0.051 | 0.082 | 0.036 | 0.085 | 0.103 | 0.028 | 0.019 | 0.084 | 0.029 | 0.095 | 0.035 | 0.090 | 0.032 |

| Test 7 | 0.095 | 0.033 | 0.012 | 0.046 | 0.087 | 0.057 | 0.090 | 0.042 | 0.023 | 0.054 | 0.089 | 0.057 | 0.100 | 0.050 | 0.095 | 0.070 |

| Test 8 | 0.096 | 0.088 | 0.051 | 0.091 | 0.062 | 0.026 | 0.089 | 0.017 | 0.058 | 0.069 | 0.093 | 0.012 | 0.060 | 0.025 | 0.100 | 0.062 |

| Test 9 | 0.097 | 0.063 | 0.041 | 0.036 | 0.097 | 0.091 | 0.080 | 0.092 | 0.053 | 0.034 | 0.059 | 0.009 | 0.011 | 0.070 | 0.099 | 0.067 |

| Test 10 | 0.098 | 0.058 | 0.042 | 0.031 | 0.097 | 0.056 | 0.031 | 0.067 | 0.018 | 0.044 | 0.080 | 0.081 | 0.091 | 0.095 | 0.098 | 0.012 |

| Sectors | Original rank | Test 1 | Test 2 | Test 3 | Test 4 | Test 5 | Test 6 | Test 7 | Test 8 | Test 9 | Test 10 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| S1 | 4 | 3 | 4 | 3 | 3 | 3 | 3 | 4 | 3 | 3 | 4 |

| S2 | 2 | 5 | 5 | 5 | 4 | 5 | 4 | 5 | 5 | 5 | 5 |

| S3 | 3 | 2 | 2 | 2 | 2 | 2 | 2 | 2 | 2 | 2 | 2 |

| S4 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 |

| S5 | 5 | 4 | 3 | 4 | 5 | 4 | 5 | 3 | 4 | 4 | 3 |

6 DISCUSSION

This work offers a systematic and structural approach to distinguishing the goals of FDI assessment in India. The work underlined 4 main-criteria's and 16 sub-criteria's, which impact decision for FDI in any country. FDI is crucial for economic growth. Probably that is why economic criteria is ranked first when analyzing FDI. Also, the critical factor of FDI inflows is primarily based on macroeconomic principles; among them, the economy's size is the important one for investment. Second, for FDIs, the countries with the most readily available natural resources are considered as the most favorable destination for investment. As a result, investors pursued investment options in emerging and developed economies that have good competitiveness in the market, rated as the most prominent sub-criteria on the analysis. Third, political considerations are essential to investment decision by foreign investors. Foreign investors invest only when they know that the country has a stable political environment which is rated as the most prominent sub-criteria on the analysis. Fourth criteria on the rated list is SOC for which population density, language, religious practices, and culture plays a significant role in investment decisions. They influence investment decisions dramatically. In some cases, language and culture differences will have unforeseen implications for the business.

The findings can be concluded with the following observations, there is a continuing need to extend and improve the road and highways network around the country on the importance to both economic growth and movement for goods and services. For this sector growth, government is trying to draw more private sector investment because the strong road network will be an essential pillar of a rapid economic recoversal in India and one would expect the government's budgetary contribution to building road networks to be supplemented by lucrative private sector investment options. Furthermore, India's government most important decision in economic policy is to liberalize FDI regulations in the real estate industry. External companies, outside of NRI's, were authorized to participate, via a wholly-owned corporation or through an Indian joint venture with a local association, in establishing the integrated townships and settlements. With the consideration of “Housing for all” in India, real-estate will witnessed a whooping FDI in the coming years.

The information technology sector is currently undergoing a change from a global business environment perspective. India is the most favorable place for investment because the availability of highly educated, lower-wage labor tends to minimize costs for source countries by ~60%–70%. FDI in the retailing and e-commerce sector is supposed to be the most benefited one for the investors because of India's high population and diversity, and also the government's “Make in India” program, too, aimed at raising this sector share to 25% by 2022, while also generating 100 million new jobs in this sector. It is expected that the Indian e-commerce industry has been on an upward growth trajectory and is expected to surpass the United States to become the second largest e-commerce market in the world by 2034. As most of the Indians have started shopping online rather than stepping outside their houses due to COVID outbreak, the Indian e-commerce sector witnessed an increase and proved to be the good place for FDI. India has a low per capita energy usage for a nation that is home to one-sixth of the world's population. As India sees fast economic growth and becomes a manufacturing hub, energy demand is increasing.

The growing urbanization, higher incomes and demographic growth would also stimulate energy use. To accommodate this considerable demand surge, India will need to double its electricity production by 2030, while still upholding its pledge to a 35% reduction of its carbon footprint from 2005 levels. The government has already taken several steps to promote foreign investment in this sector and will be an investor's eye-catcher. Healthcare sector is one of the major industries in India—both in terms of income and employment. Hospitals, medical supplies, medical trials, outsourcing, telemedicine, medical tourism, medical insurance, and facilities are covered under the healthcare sector. The Indian healthcare market is expanding rapidly because of its rising penetration, facilities, and spending from both public and private stakeholders. And, also 100% FDI is permitted for healthcare sector under the greenfield projects in India under the automated path. Therefore, international investors are increasingly interested in entering India's healthcare sector through investment in capital, technological interconnections, and collaborative initiatives across different segments.

7 CONCLUSION, LIMITATIONS, AND FUTURE SCOPE

The drivers to FDI across different sectors in developing countries are affected by the globalization, government policies, competitive consumer market, and market condition. In this study, authors have used a decision making framework for making investment in context to India. In the current study, to prioritize sectors for FDI, 4 main criteria, that is, ECO, SOC, POL, and COUs are considered along with 16 sub-criteria. It includes size of economy, exchange rate, tax rate, wage rate, political stability, foreign trade regulation, laws regulating environment pollution, bureaucracy, population density, human capital development, level of education, religious diversity, country size, competitiveness, infrastructure, and labor skills. For illustrating the proposed framework, five prominent sectors for the investment purpose are considered. These are petroleum and natural resource, retailing, and e-commerce, healthcare, information technology, and road and highways. Results are obtained by using the integrated approach of AHP and WASPAS techniques. Based on the results obtained, ECOs have been found to be the most important criteria for FDI in India, followed by COUs, POLs, and SOCs. Among the sub-criteria's of ECOs, POLs, SOCs, and COUs for FDI, size of the economy, foreign trade regulation, population density, and competitiveness are the most important sub factors that can affect FDI decision. Based on importance rating of these factors, we find most preferred sector for FDI. Information technology sector is found to be the most appropriate sectors for FDI, followed by the retailing and e-commerce, and healthcare sector. This study has contributed mainly in terms of developing decision making framework for FDI and use of MCDM for solving such complex problem.

7.1 Managerial implications, limitations, and future scope

The present study is mainly focused on ECOs, POLs, SOCs, and COUs for FDI. This study has got some limitations. First, because of data restrictions, various forms of FDI cannot be distinguished. Second, there can be an added advantage of adding the regression model, which can offer new insights for future studies. Finally, both FDI and remittances are affected substantially by the recently occurring COVID-19 pandemic. The convergence of wellbeing with recessional conditions and the resurgence of trade ties and global tensions, along with the rise of protectionism, is expected to have a very significant effect on FDI, due to unlike condition of economic recession. Langley et al. (2021) have also advocated for facilitating investment in low-carbon projects and enterprises. Therefore, future research should also consider inclusion of more factors related to sustainability, human capital, infrastructure factors, technological factors, institutional factors, legal integration factors, and entrepreneurial matters factors while analyzing investment decisions. During the last few decades, policymakers of developing and emerging economies are focusing their attention toward identifying factors impacting FDI in their country. As a host to FDI, it becomes essential for the government of a country to have an accurate view of the factors determining FDI in its country. The implications drawn from this study will help policy makers in devising policies that would create favorable environment to attract FDIs.

This proposed framework can also be used for different countries over varying time periods. It could also be regarded as an effective method for decision-making to achieve optimal results. Apart from it, this framework will also help policy makers to address the various facets of FDI. Under different scenario for other countries, the ranking of criteria derived by an integrated AHP-WASPAS approach may change. Therefore findings cannot be generalized for all countries. As a future scope, findings can also be compared with other approaches such as fuzzy AHP, ANP, and VIKOR for validation.

Biographies

Dr. Srikant Gupta is an Assistant Professor at the Jaipuria Institute of Management, which is India's amongst best B schools in Jaipur, Rajasthan. He received his B.Sc. (Statistics) in 2010, M.Sc. (Operations Research) in 2012, and completed a Ph.D. (Operations Research) in 2019 from Aligarh Muslim University, Aligarh, India. He has more than four years of experience in research and his current areas of research interest include applied statistics and operations research and its application areas like supply chain networks, system reliability, industrial production planning modeling, sustainable development, and many others.

Dr. Babita Jha is an Associate Professor at Christ (Deemed to be University), Ghaziabad, NCR, India. She has an experience of 15+ years. She has been awarded doctorate from Rajasthan University in the area of Finance and is NET(UGC) Qualified. She has done her MBA in the area of Finance from University Institute of Management, RDVV, Jabalpur. Previously she has worked with groups like Jaipuria Institute of Management, Manipal University, Centurion Institute of Professional Studies etc. She has written research paper in National and International Journals. Her core area of competencies includes Accounting, Financial Management, Financial Inclusion and Corporate Valuation..

Dr. Rajesh Kr. Singh is a Professor at the Management Development Institute, Gurgaon, India. His areas of interest include supply chain management, Industry 4.0, quality management and circular economy. He has about 170 research papers published in reputed international/national journals and conferences. He has published papers in journals such as Resources, Conservation and Recycling, Journal of Cleaner Production, Industrial Management and Data Systems, Production planning and Control, Singapore Management Review, International Journal of Productivity and Performance Management, Benchmarking: An International Journal, Journal of Modelling in Management, Competitiveness Review: An International Business Journal, Global Journal of Flexible Systems and Management, International Journal of Productivity and Quality Management, International Journal of Services and Operations Management, International Journal of Automotive Industry and Management, International Journal of Logistic Systems Management, IIMB Management Review and Productivity Promotion.

Open Research

DATA AVAILABILITY STATEMENT

The data that support the findings of this study are available on request from the corresponding author. The data are not publicly available due to privacy or ethical restrictions.