Privatization of SOEs and its innovation performance: A reexamination

Abstract

The empirical literature comparing the innovation performance of state-owned enterprises (SOEs) and private firms in China often yields conflicting results. To shed new light on this debate, we construct an extensive dataset by linking the Annual Survey of Industrial Enterprises (ASIE) dataset with patent quality data. Our analysis focuses on the impact of privatization on the innovation performance of former SOEs. Our findings suggest that the privatization of SOEs generally results in a decrease in innovation performance. This adverse effect is particularly pronounced for firms situated in regions characterized by low levels of market development or those grappling with high financial constraints. This supports the hypothesis that SOEs can serve as a mechanism to address institutional deficiencies in China's context. Our study contributes to a deeper understanding of the relative innovation performance of SOEs and private enterprises and has significant policy implications for ongoing SOE reforms in China and other developing countries.

1 INTRODUCTION

Innovation is a pivotal driver of economic growth, garnering extensive attention from scholars and policymakers, especially with respect to its performance in different institutional environments (Kogan et al., 2017; Mokyr, 2009). One prominent area of research examines innovation disparities between state-owned enterprises (SOEs) and private firms in developing and transition economies. Prior studies generally find that SOEs lag behind private firms in innovation performance (Boeing et al., 2016; Chen et al., 2021; Fang et al., 2017). This disparity is attributed to risk aversion among SOE managers, who fear the potential repercussions of failed innovative projects on their careers and reputations (Hirshleifer & Thakor, 1992). Additionally, SOEs often prioritize broader social objectives such as reducing unemployment and promoting social equality over profit maximization and innovation (Boubakri et al., 2013). Lastly, bureaucracy and soft-budget constraints within SOEs can also hinder resource allocation and decision-making for innovation (Qian & Xu, 1998). In contrast, private firms may be better equipped to incentivize their managers to pursue innovation, either through the establishment of managerial shareholding or through performance-based bonuses tied to innovative outcomes.

However, these discussions are rooted in theoretical foundations within neoclassical economics. These arguments are most applicable in a market economy equipped with well-established institutions, including robust intellectual property rights protection, efficient financial systems, and a well-functioning market. Such institutions are essential to navigate the inherent uncertainties and budget constraints of innovation production, particularly for small private firms. Many developing countries, including China, often lack these crucial institutional elements (Chen et al., 2014).

In the absence of these supportive institutional environments, market risks and financial limitations can become formidable obstacles for private enterprises. These challenges may lead them to shy away from long-term and high-risk innovation projects, as they lack the protective shield of state ownership. Conversely, for SOEs, state ownership may serve as an alternative mechanism to mitigate institutional frictions (Fang et al., 2017). In fact, some empirical studies have even discovered that SOEs can outperform their private counterparts in innovation (Choi et al., 2011). Others suggest that a certain degree of state ownership might represent an optimal structure for enterprises aiming to innovate (Zhou et al., 2016). Therefore, the debate over the relative effectiveness of innovation activities between SOEs and private firms remains far from yielding a definitive conclusion.

The prior empirical literature has often heavily relied on quantitative measures, such as patent counts, to gauge innovation output in their analyses. This approach poses several issues and likely contributes to the mixed findings in the field. Patents serve as heterogeneous carriers of technological knowledge, and their value distribution tends to be highly skewed. Drawing conclusions about innovation performance without factoring in patent quality is imprecise, at best.

Furthermore, China's institutional environment for innovation is not yet fully developed, particularly in terms of marketization and financial systems to support R&D investment. In this less-than-ideal institutional setting, a second-best scenario may arise where SOEs are inclined and capable of undertaking innovation investments with high potential but also high associated risks. This is because SOEs rely less on institutional safeguards and are relatively less constrained by obstacles and limitations compared with other entities (Fang et al., 2017; Snyder, 2012). Indeed, many noteworthy breakthroughs in fields that require substantial long-term investments, such as aviation, aerospace, oil and gas exploration, and electric power transmission, have been accomplished by large SOEs in China (Ye et al., 2019).

Lastly, over the past two decades, governments at all levels in China have been actively promoting innovation through subsidies and policies (e.g., Li, 2012). These policies create heterogeneous incentives for SOEs and private firms. Specifically, private firms are highly motivated to achieve a higher level of innovation output that can be recognized by the government, with patents being a prominent example. This performance can lead to valuable benefits for the firms, such as tax cuts and favorable access to credit, especially when it elevates their status (e.g., as high-tech firms). In contrast, SOEs are less likely to respond to such policy incentives as they often enjoy numerous privileges from the outset. However, these policy measures can be double-edged swords, potentially driving private firms toward a focus on quantity over quality in innovation (Li & Zheng, 2016).

The SOE vs non-SOE debate presents a persistent puzzle: despite the strong performance of private enterprises, as frequently demonstrated in academic studies, practitioners, including patent lawyers, often express skepticism regarding the innovation quality of private firms, particularly small and medium-sized ones. They accuse these firms of pursuing the so-called “policy dividend” without investing significantly in genuine innovation.

This paper advances the literature by delving deeper into the quality of patents and conducting a comprehensive comparison between SOEs and private firms at both the firm and patent levels. Recognizing that a direct comparison between these two ownership types may be influenced by unobservable factors related to innovation performance, we take advantage of the privatization experiences of SOEs. This approach allows us to examine changes in innovation for a given firm before and after the privatization events. To address potential endogeneity concerns, we employ a matching procedure in combination with fixed-effect models. This method helps us identify, for each privatized SOE, a “comparable” nonprivatized SOE with a similar likelihood of undergoing privatization in the year when the privatization event occurred.

We move beyond the analysis of the firm-level aggregate patent output to conduct a patent-level quality comparison of patents filed by firms before and after they become privatized. The firm-level and patent-level comparisons provide information on firm innovation at the “extensive margin” and “intensive margin,” respectively. Previous studies generally focus on the “extensive margin,” which could obscure the quality heterogeneity in patents filed by the firms. The distortion due to bureaucracy and soft-budget constraints, and the advantageous position to invest in innovative activities that are risky and long-term in nature, could coexist in SOEs. For example, it is conceivable that firms may respond to policy incentives by generating “narrower” patents (e.g., Dang & Motohashi, 2015; Sun et al., 2020), which could result in an apparent improvement in firm-level performance. However, a patent-level study offers a more comprehensive perspective. Another difficulty with patent-related study lies in the sparsity nature of patent data at the firm level—a large chunk of the observations in firm-year units take values of 0—which could contribute to the inconsistent findings across different ways of data aggregation and model specifications. The patent-level analysis is an important supplement, as it relies on patent-level data and does not have the data difficulty as the firm-level analysis does. Therefore, patent-level analysis helps consider the heterogeneity in patent value and the statistical specialty of patent data and provides a comprehensive view of the comparison.

In this study, we have compiled a unique and comprehensive data set focusing on patent filings by Chinese industrial enterprises. Our data set is a result of merging four extensive sources: the Annual Survey of Industrial Enterprises (ASIE) in China, Chinese patent data from the China National Intellectual Property Administration (CNIPA), the Google Patent Database, and a database linking Chinese patents to China's industrial firms available in the Harvard Dataverse repository (He et al., 2018).

Our matching effort has led to a substantially larger sample size of patents linked to Chinese industrial enterprises compared with previous studies (e.g., Dang & Motohashi, 2015; Wei et al., 2017). Additionally, we have successfully incorporated patent quality measures, including forward citations and the number of granted patents, sourced from the Google Patent Database, overcoming a critical data limitation in previous research.

Our study reveals an overall negative impact of privatization on firms' innovation output, contrary to some earlier research findings (e.g., Fang et al., 2017). Following privatization, firms tend to experience a decline in both the quantity and quality-weighted quantity of patent output compared with “comparable” SOEs that did not undergo privatization. These adverse effects of privatization are particularly pronounced among firms located in regions with lower levels of market development or those facing high financial constraints, indicating the role of state ownership in mitigating institutional deficiencies.

We hope that our findings, based on a more comprehensive data set, improved patent quality measures, and careful identification strategies, contribute significantly to the ongoing debate regarding the relative innovation performance of SOEs and private enterprises in China.

The rest of our paper is structured as follows: Section 2 provides an overview of the data construction and matching procedure. Section 3 details the variables utilized in our analysis and presents summary statistics for both firm and patent data. In Section 4, we present the empirical findings from our estimation of the impact of privatization on innovation. Finally, Section 5 concludes.

2 DATA

We construct a unique and comprehensive data set on patent data of Chinese industrial enterprises constructed from ASIE, CNIPA and Google Patent database and construct a panel data of the industrial enterprises with invention patent information from 1998 to 2009. In this section, we briefly introduce each of the data sources and discuss its limitations and our construction and matching procedure.

2.1 ASIE

The firm data used in our analysis is derived from the ASIE, which is conducted by the National Bureau of Statistics of China. This data set covers all state-owned industrial enterprises and non-state-owned industrial enterprises that meet specific size criteria. The ASIE data set is a comprehensive and widely recognized source of information, and it has been extensively employed in numerous empirical studies focusing on various aspects of China's industrial landscape (Aghion et al., 2015; Chen et al., 2021; Fang et al., 2017; Harrison et al., 2019; Song et al., 2011; Yu et al., 2019; Yu, 2014). We use ASIE data from 1998 to 2009 as the base data set to construct the firm-patent matching.1 There are substantial missing values for corporate code values in the years 2008 and 2009, with 161,643 and 115,750 observations with missing corporate codes, respectively. To address this issue, we leveraged the available enterprise data from the remaining years to impute the corporate codes for 2008–2009 by matching enterprise names across different years.

The survival time of enterprises was determined based on their initial appearance and final appearance within the 1998–2009 period. We also employed linear interpolation to estimate missing values for several critical firm-related variables, including total assets, total debt, interest expenditure, and fixed assets. In instances where ownership information was missing, we imputed it using the ownership data from the previous year. Additionally, in our empirical analysis, we conducted robustness tests by excluding observations with missing data to ensure the robustness of our findings.

2.2 Chinese patent data

In China, the patents granted by CNIPA include invention patents, utility model patents, and design patents. Among them, the invention patent requires substantive examination from the patent office and is comparable to patents in other jurisdictions in terms of technological criteria. Therefore, this study focuses on the invention patents of enterprises.

To compile our patent data set, we gathered invention patents filed up to 2011 from the CNIPA. Subsequently, we updated the legal information and tracked forward citations for these patents up to 2016 using data from Google Patents. Our data set was further enriched with patent citation information obtained from Google Patents. Citation information is a widely recognized and utilized indicator of patent quality.

2.3 Merging industrial enterprise data with Chinese patent data

To address the challenge of matching industrial enterprise data with the Chinese patent database, we adopted a multistep process facilitated by the linkage established by He et al. (2018). Here's a breakdown of our methodology:

We initiated the process by matching the SIPO patent data with the linkage using patent application numbers for the period spanning 1998–2009. We retained the patent data that successfully matched with the corporate code through this linkage.

Subsequently, we utilized the corporate code and the corresponding year to perform a matching process with the ASIE data. However, we encountered some mismatches due to discrepancies in the recording of ASIE data. Specifically, there were instances where a firm was not included in the ASIE data set for the year in which it filed a patent, leading to these mismatches.

To mitigate these mismatches, we implemented an auxiliary matching approach. This involved assigning the remaining unmatched patents to the nearest neighboring year in which the firm was recorded in the ASIE data set.

Finally, we further extended our matching process to incorporate data from the Google patent database, allowing us to extract patent-level quality measures.

Through this comprehensive construction procedure, we successfully matched a total of 243,800 invention patents filed by 644,970 ASIE firms during the period from 1998 to 2009. This data set is notably larger than those used in previous literature, such as being nearly twice the size of the patent data set employed in the study by Dang and Motohashi (2015). We leveraged this data to create two distinct datasets for our analysis: firm-level panel data and patent-level quality data.

3 VARIABLES AND DESCRIPTIVE STATISTICS

3.1 Characterizing SOEs and non-SOEs: Key distinctions

The key variable of interest is the ownership type of the firm. Nie et al. (2012) emphasized that shareholder information is a more immediate and accurate reflection of the ownership type of an enterprise. However, a notable limitation when using shareholder information to define SOEs is the presence of missing shareholder information. Therefore, following the literature (Fang et al., 2017; Harrison et al., 2019; Hsieh & Song, 2015), we adopt a two-step procedure for delineating SOEs. In cases where shareholder information is available, firms are classified as SOEs if their state-owned equity ownership exceeds 50%. For firms missing this information, their ownership is determined based on their recorded registration type. If their registration types indicate that they are SOEs, state-owned joint ventures, or state-owned and collective joint ventures, they are designated as SOEs.

In Table 1, we present the summary statistics of key variables, along with the number of firms in each category. Firm size is represented by the logarithm of total assets, the debt ratio is calculated as total debt divided by total assets, and the fixed asset ratio is determined by dividing fixed assets by total assets.

| Variables | SOEs | Non-SOEs | ||

|---|---|---|---|---|

| Mean | SD | Mean | SD | |

| Firm size | 10.088 | 2.081 | 9.669 | 1.382 |

| Debt ratio | 0.605 | 0.254 | 0.544 | 0.257 |

| Fixed asset ratio | 0.465 | 0.247 | 0.361 | 0.222 |

| Year | 2001.632 | 2.987 | 2004.722 | 3.119 |

| Number of firms | 94,258 | 546,729 | ||

Patents are used to measure enterprise innovation with unique advantages (Griliches, 1990). First of all, patents as innovation output are publicly available, reliable, and rich in information, compared with other innovation measures such as R&D input (Kou & Liu, 2020). Moreover, patent is a direct measurement of innovation output and unlike other measures (e.g., new product sales), does not rely on the firm's business strategy or marketing ability.

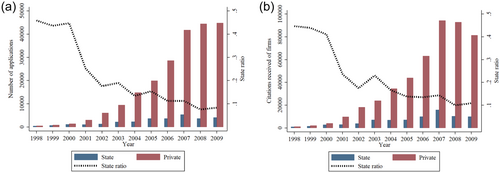

We use whether the patent is granted to measure its technical quality and the number of citations received post its application to measure its value. At the firm level, we aggregate the number of patent applications, number of granted patents, total citations received at the firm level to measure firm-level innovation output. We report a few patterns from the comparison of SOEs and private enterprises. The first stylized fact is that, while both types of firms filed an increasing number of patents, private firms dominate the total number of invention patent applications in China, with their advantage more and more evident over the years, as is shown in Figure 1a. The share of patents filed by SOEs drops from 45% around the onset of the new century to a level of less than 10%, likely reflecting both a relative diminish in innovation output of SOEs and reform in firm ownership from SOEs to private firms. Considering the heterogeneity of patents in quality, we also plot the total citations received by SOEs and private enterprises to provide a rough comparison of the total quality-weighted innovation output by the two types of firms. Unsurprisingly, we find a similar trend for the dominant position of private firms (Figure 1b).

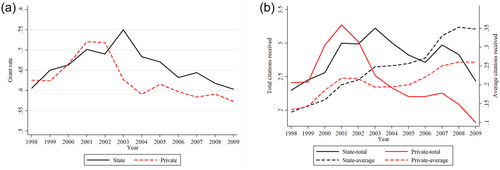

However, when we look at the average patent quality, the comparisons are strikingly different. Figure 2 suggests that an average patent filed by an SOE, in general, has a higher grant rate and attains a higher number of citations, compared with an average patent from a private firm. The advantage becomes more evident after 2002. Since earlier patents tend to have more citations, we divide the total number of citations received by the period from its application year to the year 2016 to construct the average yearly number of citations received by each patent. The average number of citations received by patents from SOEs still overtook that from private firms after 2002 (the lower pair of lines in Figure 2b). While private firms in total filed a much larger share of invention patents, the average quality of patent filings from private firms is lower than that from SOEs.

3.2 SOE privatizations

To draw a causal inference about the relationship between state ownership and innovation, we focus on SOEs and compare firms that experienced a change in ownership from SOE to private firm to those that stay as SOEs throughout the study period. In China's transformation from planned economy to market economy, between 1996 and 2005, the Chinese government embarked on a concerted campaign to privatize and restructure SOEs. This initiative, aimed at improving the efficiency of the sprawling state sector, set off a significant wave of privatizations. Notably, the policy emphasis on innovation emerged much later. Our study underscores that within our study timeframe, privatization was predominantly driven by a quest for increased efficiency rather than a direct incentive for corporate innovation. Therefore, SOEs' privatization provides a reasonably exogenous change to the ownership structure in evaluating innovation performance. The privatization event arguably allows us to better draw a causal inference about the relationship between state ownership and innovation performance (Fang et al., 2017).

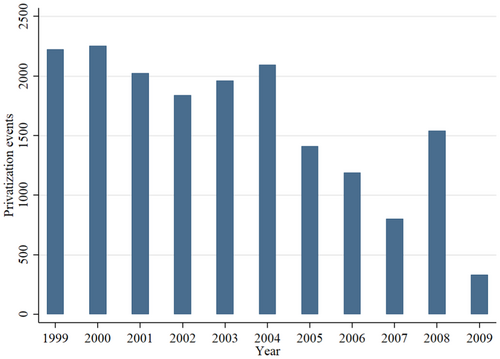

Our approach to identifying privatization events involves selecting firms that are initially designated as SOEs in their first year of appearance. We then track the year in which these firms transition from SOEs to non-SOEs based on changes in equity ownership or registration type. Figure 3 provides an overview of the number of privatization events that occurred between 1999 and 2009. The majority of privatizations took place before 2005, with more than 2000 SOEs privatized each year during this period. In total, 17,668 SOEs underwent privatization between 1999 and 2009, while 68,680 SOEs remained nonprivatized within the ASIE sample.

One major endogeneity concern with the causal inference about the relationship between privatization and innovation is the privatized SOEs are likely from a very selected group of SOEs. To mitigate this concern, we employ the propensity score matching (PSM) combined with the difference-in-differences (DID) technique to find a group of never privatized SOEs (control firms) that display similar characteristics to the group of privatized SOEs (treatment firms). Since SOEs were privatized in different years, the matching of control firms is implemented year-by-year. Specifically, for SOEs that were privatized in year t (t = 1999, 2000, …, 2009), we drop SOEs that were privatized in all other years and then keep the observations in year t. On this cohort, we use a logit model to calculate the propensity of an SOE being privatized in year t, conditional on the observable characteristics (e.g., firm size, debt ratio, fixed asset ratio, province, and industry). Each privatized SOE is then matched with a comparable but not privatized SOE according to the closeness of their propensity scores, provided that the scores of the privatized SOE fall on the support of that of the control firms.

Since the number of control firms is of a similar magnitude as the number of treated firms and the matching proceeds year by year, to create better balance, we adopt the matching with replacement procedure. After matching was conducted on the final cohort, we add up the number of times each control firm was matched overall cohorts, which are included as weights for control firms in regression analysis.

We report in Table 2 the summary statistics of key variables used in pscore matching, as well as the number of firms on the last row. It's clear from the comparison in Table 2 that privatized SOEs are not a random selection of SOEs. They are, on average, larger and younger, and have lower fixed asset ratio, compared with the population of SOEs. On the other hand, after the pscore matching, the variable balance between the privatized SOEs and the control SOEs is significantly improved, which attests to the effectiveness of the matching strategy.

| Variables | Privatized SOEs | Nonprivatized SOEs | Diff/SD | Matched nonprivatized SOEs | Matched nonprivatized SOEs | Diff/SD | ||||

|---|---|---|---|---|---|---|---|---|---|---|

| Mean | SD | Mean | SD | Mean | SD | Mean | SD | |||

| Firm size | 10.711 | 1.753 | 9.903 | 2.141 | 0.413 | 10.730 | 1.765 | 10.556 | 2.103 | 0.075 |

| Debt ratio | 0.609 | 0.230 | 0.604 | 0.262 | 0.020 | 0.609 | 0.227 | 0.615 | 0.238 | 0.026 |

| Fixed asset ratio | 0.408 | 0.225 | 0.478 | 0.252 | 0.293 | 0.411 | 0.225 | 0.439 | 0.232 | 0.123 |

| Year | 2003.1 | 3.279 | 2001.6 | 3.002 | 0.521 | 2003.2 | 3.262 | 2002.3 | 3.099 | 0.267 |

| Number of firms | 17,668 | 68,680 | 15,674 | 10,568 | ||||||

- Note: Firm size is the logarithm of total assets. Debt ratio is total debt divided by total assets. Fixed asset ratio is fixed assets divided by total assets. We use propensity score matching with replacement to match privatized SOEs to nonprivatized SOEs. Additionally, we limit matches to those within the common support of their propensity scores.

We conduct a balance check for our control variables using the normalized difference, calculated as the mean difference divided by the pooled estimate of the standard deviation The advantage of normalized difference over the t-statistic is that normalized difference is not affected by sample size, which makes it more appropriate to evaluate sample balance in large data (Rosenbaum & Rubin, 1985). The rule of thumb is that any difference in normalized differences above 0.25 is considered large (Imbens & Wooldridge, 2007). The results are reported in the “Diff/SD” column. After matching, the variable balance between privatized and nonprivatized SOEs is greatly improved.

4 EMPIRICAL FINDINGS

4.1 The model

- 1.

The number of patent applications by firm in year .

- 2.

The number of granted invention patents by firm in year .

- 3.

Total citations received by firm from its patent filed in year .

- 4.

Yearly average citations, which represent the total citations a patent received divided by the period between its application and 2016, summed over all patents filed by firm in year .

- 5.

The number of valid patents held by firm in year .

- 6.

The total number of patent classifications associated with patents by firm in year .

In all models, we control firm-level variables including firm size, debt ratio, and fixed asset ratio, as these variables change on a yearly basis. Additionally, we include two market-related variables, namely, the industry Herfindahl-Hirschman Index (HHI) and the Fan Gang Marketization Index (Fan et al., 2003), consistent with existing literature (Yu et al., 2019). The industry HHI index is computed for each industry to gauge the competitiveness of different sectors. A higher HHI index signifies a more concentrated industrial structure with less competition, whereas a lower HHI index indicates a more competitive industry landscape. Fan Gang's Marketization Index, developed by economist Fan Gang, a former member of the Monetary Policy Committee of the People's Bank of China, is a widely recognized tool in China for evaluating and quantifying the level of marketization across various regions within the country.

Furthermore, we report the comparison at the patent-level, which looks directly at the quality of individual patent. In our patent-level analysis, the dependent variables include whether a patent is granted, the total number of citations received by the patent, the yearly average citations received by the patent (total citation divided by the exposure window of the patent: the number of years between patent application and 2016, the end year of data collection), whether the patent is still in force, and the number of patent classification. At the patent level, the inclusion of firm fixed effects is equivalent to comparing the quality of patents within the same firm, before and after the change in ownership of the firm.

Through the two dimensions of comparison, the relative advantage of the innovation performance of SOEs and private enterprises can be explored more comprehensively to expand the existing literature.

4.2 Baseline findings

At the firm level, we report results with different measures of innovation output: the number of applications by firm i in year t, the number of granted patents by firm i in year t, total citations received by firm i's patent applications filed in year t, yearly average citations firm i received from its patents filed in year t, the number of valid patent by firm i in year t and the number of patent classification by firm i in year t. The results are reported in Table 3. We find privatization leads to significant reductions of innovation output across all these measures of innovation output.2

| Variables | Number of applications | Number of patents granted | Total citations firms received | Yearly citations firms received | Number of valid patents | Number of patent classifications |

|---|---|---|---|---|---|---|

| Privatization | −0.101** | −0.061* | −0.333** | −0.042** | −0.042** | −0.228** |

| (0.045) | (0.033) | (0.153) | (0.020) | (0.019) | (0.107) | |

| Firm size | 0.179*** | 0.117*** | 0.509*** | 0.059*** | 0.090** | 0.440*** |

| (0.060) | (0.045) | (0.177) | (0.020) | (0.041) | (0.167) | |

| Debt ratio | 0.088 | 0.055 | 0.246 | 0.037* | 0.042 | 0.132 |

| (0.057) | (0.040) | (0.155) | (0.020) | (0.036) | (0.149) | |

| Fixed asset ratio | −0.074 | −0.085 | −0.273 | −0.037 | −0.028 | −0.160 |

| (0.104) | (0.077) | (0.343) | (0.045) | (0.043) | (0.262) | |

| HHI index | −4.174*** | −2.994*** | −13.610** | −1.586** | −2.032*** | −11.170*** |

| (1.533) | (1.126) | (5.471) | (0.643) | (0.674) | (3.799) | |

| Marketization index | 0.087*** | 0.049*** | 0.223*** | 0.026** | 0.046*** | 0.215*** |

| (0.025) | (0.016) | (0.079) | (0.010) | (0.012) | (0.056) | |

| Year effect | Y | Y | Y | Y | Y | Y |

| Firm fixed effect | Y | Y | Y | Y | Y | Y |

| N | 215,952 | 215,952 | 215,952 | 215,952 | 215,952 | 215,952 |

- Note: Clustered standard errors at firm level are in parentheses. *, **, and *** indicate statistical significance at the 10%, 5%, and 1% level, respectively.

We further investigate the change in patent quality using the patent level analysis, controlling firm fixed effects. The results are reported in Table 4. At the patent level, we find the effects of privatization to be insignificant on patent quality. Therefore, overall, we find the effect of privatization on firm's innovation to be negative. The total output of innovation decreases, and the average quality per patent also did not improve.

| Variables | Whether the patent is granted | Total citations patents received | Yearly citations patents received | Whether the patent is valid | Number of patent classification |

|---|---|---|---|---|---|

| Privatization | 0.013 | −0.077 | −0.010 | 0.004 | −0.047 |

| (0.019) | (0.114) | (0.014) | (0.017) | (0.071) | |

| N | 29,747 | 29,747 | 29,747 | 29,747 | 29,747 |

- Note: Control variables in all models include the firm size (ln(asset)), debt ratio (debt/asset), fixed asset ratio (fixed asset/asset), HHI index, marketization index. We also control firm and year fixed effect. Clustered standard errors at firm level are in parentheses. *, **, and *** indicate statistical significance at the 10%, 5%, and 1% level, respectively.

These findings contrast with some of the previous literature (e.g., Fang et al., 2017). One possible explanation is that without properly constructing a cohort-level control group for the privatized SOEs, some of the observed effects of privatization could be attributed to the overall improvement in innovation performance in China over the years. Privatization takes place over time and thus puts larger weight on the more recent years, compared with a loosely constructed control group of firms.

4.3 Parallel trend and dynamic effect

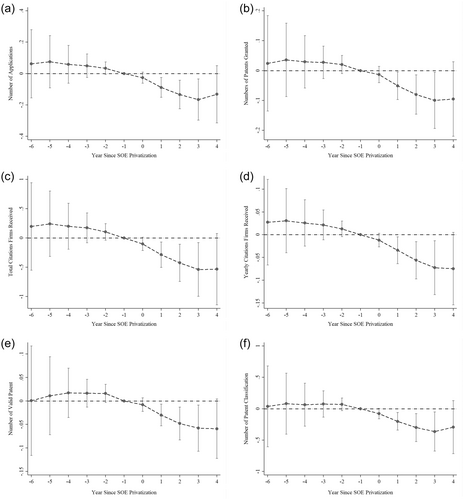

Figure 4 plots our dynamic effect estimates from Equation (2). We cluster standard errors by firm i and plot the 95% confidence intervals together with the point estimates. In all figures, the preprivatization estimates are relatively small and not statistically different from 0, suggesting that all measures of innovation performance between the privatized and control SOEs follow similar trends before the privatization event. The estimates following privatization reveal a consistent pattern: the privatization of SOEs results in a decrease in innovation outcomes across all six measured indicators. Furthermore, this negative effect persists for the subsequent 4–5 years following privatization. It's worth noting that there appears to be a slight diminishment in the effect after the fourth year, which could imply that the long-term implications of privatization remain somewhat uncertain and warrant further investigation.

4.4 Robustness checks

The negative impacts of SOE privatization on firm innovation remain consistent and persistent in our estimation results. To explore the robustness of these estimates, we look at different model specifications.

First, if a firm did not file a patent each year, the corresponding outcome variables take a value of 0, resulting in a data structure with a large chunk of 0 s. Considering the skewed distribution of the outcome variable, we use log(Y + 1) transformation and Poisson regression to look at the effect of privatization. The results are reported in Panel A and Panel B of Table 5. Privatization of SOEs leads to a consistently decrease in innovation output each year after privatization across all measures of innovation output.

| Variables | Number of applications | Number of patents granted | Total citations firms received | Yearly citations firms received | Number of valid patents | Number of patent classifications |

|---|---|---|---|---|---|---|

| Panel A: log(Y + 1) transformation | ||||||

| Privatization | −0.010*** | −0.007*** | −0.011** | −0.006*** | −0.007*** | −0.013*** |

| (0.003) | (0.003) | (0.005) | (0.002) | (0.002) | (0.005) | |

| N | 215,952 | 215,952 | 215,952 | 215,952 | 215,952 | 215,952 |

| Panel B: Poisson regression | ||||||

| Privatization | −0.055 | −0.074 | −0.124 | −0.031 | −0.089 | −0.092 |

| (0.117) | (0.137) | (0.136) | (0.117) | (0.120) | (0.108) | |

| N | 215,952 | 215,952 | 215,952 | 215,952 | 215,952 | 215,952 |

| Panel C: refined PSM-DID | ||||||

| Privatization | −0.103** | −0.061* | −0.339** | −0.042** | −0.041** | −0.231** |

| (0.045) | (0.033) | (0.153) | (0.020) | (0.019) | (0.106) | |

| N | 205,724 | 205,724 | 205,724 | 205,724 | 205,724 | 205,724 |

| Panel D: innovating firms | ||||||

| Privatization | −0.527** | −0.315* | −1.772** | −0.203** | −0.264* | −1.186* |

| (0.254) | (0.184) | (0.746) | (0.090) | (0.154) | (0.674) | |

| N | 29,179 | 29,179 | 29,179 | 29,179 | 29,179 | 29,179 |

| Panel E: stacked DID | ||||||

| Privatization | −0.047** | −0.022* | −0.147* | −0.017* | −0.017* | −0.106** |

| (0.020) | (0.013) | (0.076) | (0.010) | (0.010) | (0.050) | |

| Firm × cohort fixed effect | Y | Y | Y | Y | Y | Y |

| Year × cohort fixed effect | Y | Y | Y | Y | Y | Y |

| N | 149,355 | 149,355 | 149,355 | 149,355 | 149,355 | 149,355 |

- Note: Control variables in all models include the firm size (ln(asset)), debt ratio (debt/asset), fixed asset ratio (fixed asset/asset), HHI index, marketization index. We also control firm and year fixed effect. Clustered standard errors at firm level are in parentheses. *, **, and *** indicate statistical significance at the 10%, 5%, and 1% level, respectively.

Second, since we designate firms as SOEs mainly through the ratio of state-owned equity, a few SOEs may experience a reversal to SOE after privatization. To rule out their impact on the estimates, we drop all observations where the privatized SOEs switch back to SOEs, based on the values of state-owned equity. We re-estimate the model adopting this adjustment and report the findings in Panel C.

Third, we consider a very restricted subsample of “innovating” SOEs, SOEs that have filed at least one invention patent during our study period in Panel D. This represents a rather selected sample of firms as only around 4000 SOEs have ever filed an invention patent which account for less than 5% of the total number of SOEs. Estimation on the “innovating firms” still find the negative impacts of SOE privatization and the estimates are much larger, almost five times that of baseline results. In other words, to the extent that these innovating firms are of relevance for evaluation of innovation performance, we underestimate the negative effects of privatization on innovation by analyzing the full sample.

4.5 Mechanism analysis

The findings of our study support the hypothesis that SOEs can serve as a substitute for addressing institutional deficiencies in a developing country like China. To further substantiate this hypothesis, we delve into the impact of different institutional environments on the relationship between privatization and innovation.

We examine two specific types of institutional environments: first, the level of market development, which is quantified using Fan Gang's marketization index, and second, the degree of financial development, measured by the financial constraints faced by firms. For the assessment of financial constraints, we employ the interest-to-debt ratio as a metric, a method adopted from prior research (Jiang, 2014; Yu et al., 2019). A higher interest-to-debt ratio signifies increased interest costs, effectively reflecting the expense associated with various capital resources, such as bank credit and private loans.

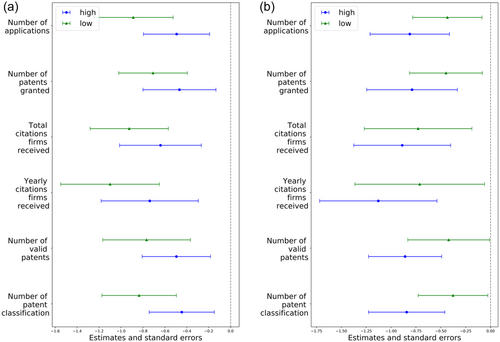

If our hypothesis is true, we would observe that following privatization, firms tend to exhibit weaker innovation performance when they face institutional deficiencies, particularly in regions with low levels of market development or high financial constraints. To account for these institutional measures at the regional and annual levels, we divide the samples into two subgroups based on the median values of the marketization index or financial constraints calculated at the region-year level.

We have re-run the model on two distinct subsamples. To enhance the comparability of estimates across these subsamples, we have divided the estimated coefficients by the mean of the outcome variables within each respective subsample. This normalization approach facilitates a more equitable comparison since, for instance, a subsample with high marketization may inherently exhibit a higher level of innovation output on average. Therefore, our analysis focuses on assessing the proportional impact of privatization, rather than considering the absolute impact. The results, presented in a side-by-side comparison for the two subsamples, illustrating the effect of privatization on innovation, are presented in Figure 5. The detailed regression results are reported in Appendix B.

The comparative analysis aligns with our initial hypothesis. While the differences between the two subsamples do not reach statistical significance, the overall comparison reveals that the adverse impacts of SOE privatization are more substantial and statistically more significant for firms that have undergone privatization in regions characterized by low marketization indices or for firms facing high financial constraints. In contrast, for firms that have undergone privatization in regions with high marketization indices or for those with lower financial constraints, we do not observe a significant difference in innovation outcomes postprivatization.

These findings strongly support the theory that in regions with low levels of market or financial development, SOEs can serve as a mechanism to help firms overcome these deficiencies, leading to improved innovation. Consequently, in such regions, privatization appears to be associated with reduced levels of innovation.

5 CONCLUSION

The relative effectiveness of innovation activities between SOEs and private firms has been debated intensely. However, the conclusion is far from clear-cut and empirical evidence has been mixed due to limitations in the measurement of innovation and the absence of data on patent quality. In this paper, we embark on a more in-depth exploration by conducting a within-firm comparison, with a specific focus on SOEs that have undergone privatization, using a carefully constructed sample of nonprivatized SOEs as counterfactuals. Our approach leverages the temporal dimension to investigate the impact of privatization on innovation, thereby enabling more robust causal inferences. Our findings indicate that the privatization of SOEs is associated with a substantial reduction in the quantity of innovative output and does not yield any discernible positive effect on patent quality. In essence, contrary to many previous studies, we do not find compelling evidence to suggest that privatization spurs greater innovation.

Furthermore, our analysis of heterogeneity suggests that the adverse effects of privatization on innovation are more pronounced for firms located in regions characterized by low levels of market development or for those grappling with high financial constraints. This confirms our hypothesis that SOEs function as a substitute for institutional deficiencies.

Our findings reveal a multifaceted landscape of innovation outcomes between SOEs and private firms, urging caution when considering state-ownership reforms with a goal to promote innovation. In a developing economy like China, it appears that SOEs can effectively navigate certain institutional inefficiencies and guide firms toward more substantial innovation.

It's important to note that these findings do not suggest that innovation capabilities are inherently linked to the ownership structure of firms, per se; rather, the disparities in innovation capabilities between SOEs and private firms are likely induced by the external environment. Therefore, a key policy implication is that government interventions aimed at enhancing the institutional infrastructure could play a pivotal role in fostering a more conducive innovation landscape for all enterprises, regardless of ownership structure.

AUTHOR CONTRIBUTIONS

Peizhen Wu: Conceptualization; formal analysis; investigation; project administration; validation; visualization; writing—original draft; writing—review and editing. Zhen Sun: Conceptualization; formal analysis; investigation; project administration; validation; visualization; writing—original draft; writing—review and editing.

ACKNOWLEDGMENTS

The authors acknowledge funding support from the Institute of China Modern State-Owned Enterprises of Tsinghua University [Grant No. 19iSOEZD002].

CONFLICT OF INTEREST STATEMENT

The authors declare no conflict of interest.

ETHICS STATEMENT

Informed consent was not required for this study because this work does not contain any studies with human participants performed by any of the authors and are based on publicly available data.

APPENDIX A

See Table A1.

| Variables | Number of applications | Number of patents granted | Total citations firms received | Yearly citations firms received | Number of valid patents | Number of patent classifications |

|---|---|---|---|---|---|---|

| privatizationyear_10 | 0.118 | 0.028 | 0.395 | 0.051 | −0.022 | 0.086 |

| (0.170) | (0.123) | (0.549) | (0.068) | (0.078) | (0.439) | |

| privatizationyear_9 | 0.139 | 0.052 | 0.405 | 0.057 | 0.007 | 0.204 |

| (0.139) | (0.102) | (0.468) | (0.059) | (0.064) | (0.370) | |

| privatizationyear_8 | 0.029 | −0.034 | 0.051 | 0.008 | −0.064 | −0.162 |

| (0.212) | (0.168) | (0.735) | (0.091) | (0.136) | (0.666) | |

| privatizationyear_7 | 0.070 | 0.007 | 0.231 | 0.029 | −0.027 | 0.008 |

| (0.157) | (0.121) | (0.524) | (0.066) | (0.094) | (0.481) | |

| privatizationyear_6 | 0.063 | 0.025 | 0.198 | 0.028 | 0.001 | 0.038 |

| (0.111) | (0.082) | (0.381) | (0.048) | (0.059) | (0.329) | |

| privatizationyear_5 | 0.076 | 0.036 | 0.244 | 0.031 | 0.011 | 0.081 |

| (0.085) | (0.063) | (0.285) | (0.036) | (0.042) | (0.248) | |

| privatizationyear_4 | 0.059 | 0.030 | 0.201 | 0.026 | 0.017 | 0.065 |

| (0.061) | (0.045) | (0.200) | (0.026) | (0.027) | (0.175) | |

| privatizationyear_3 | 0.050 | 0.028 | 0.174 | 0.022 | 0.016 | 0.075 |

| (0.038) | (0.028) | (0.130) | (0.017) | (0.015) | (0.107) | |

| privatizationyear_2 | 0.034 | 0.020 | 0.105 | 0.013 | 0.016 | 0.069 |

| (0.021) | (0.016) | (0.072) | (0.009) | (0.010) | (0.051) | |

| privatizationyear1 | −0.026 | −0.013 | −0.101* | −0.012 | −0.008 | −0.078* |

| (0.018) | (0.014) | (0.059) | (0.008) | (0.007) | (0.042) | |

| privatizationyear2 | −0.089*** | −0.051** | −0.287*** | −0.034** | −0.030** | −0.201*** |

| (0.032) | (0.024) | (0.111) | (0.015) | (0.012) | (0.072) | |

| privatizationyear3 | −0.135*** | −0.080** | −0.426*** | −0.056*** | −0.049*** | −0.300*** |

| (0.046) | (0.034) | (0.162) | (0.021) | (0.018) | (0.114) | |

| privatizationyear4 | −0.167** | −0.100** | −0.541** | −0.073** | −0.058** | −0.364** |

| (0.067) | (0.048) | (0.234) | (0.030) | (0.025) | (0.159) | |

| privatizationyear5 | −0.132 | −0.096 | −0.534* | −0.075* | −0.059* | −0.294 |

| (0.093) | (0.064) | (0.311) | (0.041) | (0.032) | (0.216) | |

| privatizationyear6 | −0.164 | −0.106 | −0.640 | −0.089* | −0.054 | −0.317 |

| (0.122) | (0.082) | (0.398) | (0.053) | (0.044) | (0.266) | |

| privatizationyear7 | −0.161 | −0.077 | −0.643 | −0.098 | −0.001 | −0.334 |

| (0.161) | (0.118) | (0.500) | (0.063) | (0.082) | (0.379) | |

| privatizationyear8 | −0.162 | −0.053 | −0.544 | −0.091 | 0.039 | −0.202 |

| (0.255) | (0.184) | (0.831) | (0.096) | (0.144) | (0.688) | |

| privatizationyear9 | 0.022 | 0.103 | −0.225 | −0.058 | 0.226 | 0.200 |

| (0.452) | (0.351) | (1.353) | (0.160) | (0.316) | (1.228) | |

| privatizationyear10 | −0.048 | 0.061 | −0.442 | −0.074 | 0.216 | 0.386 |

| (0.609) | (0.443) | (1.676) | (0.221) | (0.412) | (1.736) | |

| N | 215,952 | 215,952 | 215,952 | 215,952 | 215,952 | 215,952 |

- Note: Control variables in all models include the firm size (ln(asset)), debt ratio (debt/asset), fixed asset ratio (fixed asset/asset), HHI index, marketization index. We also control firm and year fixed effect. Clustered standard errors at firm level are in parentheses. *, **, and *** indicate statistical significance at the 10%, 5%, and 1% level, respectively.

APPENDIX B: MECHANISM ANALYSIS

| Variables | Number of applications | Numbers of patents granted | Total citations firms received | Yearly citations firms received | Number of valid patents | Number of patent classifications | ||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Marketization | low | high | low | high | low | high | low | high | low | high | low | high |

| Privatization | −0.071** | −0.101 | −0.034** | −0.063 | −0.184*** | −0.357* | −0.022** | −0.045 | −0.023* | −0.046 | −0.157** | −0.225 |

| (0.029) | (0.062) | (0.015) | (0.045) | (0.071) | (0.208) | (0.009) | (0.027) | (0.012) | (0.029) | (0.064) | (0.150) | |

| Mean | 0.080 | 0.205 | 0.048 | 0.135 | 0.199 | 0.558 | 0.020 | 0.061 | 0.030 | 0.093 | 0.188 | 0.505 |

| Standardized privatization | −0.888 | −0.493 | −0.708 | −0.467 | −0.925 | −0.640 | −1.100 | −0.738 | −0.767 | −0.495 | −0.835 | −0.446 |

| (0.363) | (0.302) | 0.313 | (0.333) | (0.357) | (0.373) | (0.450) | (0.443) | (0.400) | (0.312) | (0.340) | (0.297) | |

| SDiff t test | 0.395 (0.4029) | 0.241 (0.598) | 0.285 (0.581) | 0.362 (0.567) | 0.272 (0.592) | 0.389 (0.389) | ||||||

| N | 74,808 | 141,144 | 74,808 | 141,144 | 74,808 | 141,144 | 74,808 | 141,144 | 74,808 | 141,144 | 74,808 | 141,144 |

- Note: Control variables in all models include the firm size (ln(asset)), debt ratio (debt/asset), fixed asset ratio (fixed asset/asset), HHI index, marketization index. We also control firm and year fixed effect. Coefficient t test and the p-values are reported for every two subsample regressions. Clustered standard errors at firm level are in parentheses. *, **, and *** indicate statistical significance at the 10%, 5%, and 1% level, respectively.

| Variables | Number of applications | Numbers of patents granted | Total citations firms received | Yearly citations firms received | Number of valid patents | Number of patent classifications | ||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Ratio of interest to debt | low | high | low | high | low | high | low | high | low | high | low | high |

| Privatization | −0.0963 | −0.112** | −0.065 | −0.071* | −0.428 | −0.332* | −0.047 | −0.044* | −0.045 | −0.051** | −0.212 | −0.279** |

| (0.0773) | (0.055) | (0.053) | (0.041) | (0.318) | (0.182) | (0.043) | (0.023) | (0.044) | (0.021) | (0.197) | (0.127) | |

| Mean | 0.222 | 0.138 | 0.145 | 0.090 | 0.588 | 0.374 | 0.066 | 0.039 | 0.107 | 0.057 | 0.563 | 0.331 |

| Standardized privatization | −0.434 | −0.812** | −0.448 | −0.789* | −0.728 | −0.888* | −0.712 | −1.128* | −0.421 | −0.895** | −0.377 | −0.843** |

| 0.348 | 0.399 | 0.366 | 0.456 | 0.541 | 0.487 | 0.652 | 0.590 | 0.411 | 0.368 | 0.350 | 0.384 | |

| SDiff t test | 0.378 (0.476) | 0.341 (0.560) | 0.160 (0.826) | 0.416 (0.636) | 0.474 (0.390) | 0.466 (0.369) | ||||||

| N | 54,865 | 161,087 | 54,865 | 161,087 | 54,865 | 161,087 | 54,865 | 161,087 | 54,865 | 161,087 | 54,865 | 161,087 |

- Note: Control variables in all models include the firm size (ln(asset)), debt ratio (debt/asset), fixed asset ratio (fixed asset/asset), HHI index, marketization index. We also control firm and year fixed effect. Coefficient t test and the p values are reported for every two subsample regressions. Clustered standard errors at firm level are in parentheses. *, **, and *** indicate statistical significance at the 10%, 5%, and 1% level, respectively.

Open Research

DATA AVAILABILITY STATEMENT

Data associated with our study have not been deposited into a publicly available repository but will be made available on request.

REFERENCES

- 1 The ASIE data was most recently updated in the year 2013. However, for our analysis, we primarily rely on the data from 1998 to 2009, as these years are widely used in the literature and are considered to be more reliable.

- 2 We also conduct additional investigations to confirm that the privatization event of former SOEs do not show any impact on innovation of SOEs in control groups, thereby demonstrating that the spillover effect is not a concern. The results are available upon request.