China's OFDI and the economic growth: From the perspective of natural resource

Abstract

Using a country-level panel data set of China's outward foreign direct investment (OFDI) during 2003–2015, we find that China increases its direct investment in an economy endowed with natural resources, which increases the exports of the resources to China. Facilitated by the industry-level data between 2003 and 2008, we further show that the increase of China's OFDI in the economies abundant in natural resources would boost the output of Chinese industries which use the resources intensively but shrink the industries that are less intensive in the resources. These findings are consistent with the Rybczynski theorem and suggest that China's OFDI increases its domestic supply of natural resources.

1 INTRODUCTION

China's outward foreign direct investment (OFDI) has grown substantially since the initiative of the “Going out” strategy in 2002. Chinese multinational enterprises (MNEs) participate actively in FDI by setting up foreign subsidiaries or conducting cross-border M&As. According to the Statistical Bulletin of China's Outward Foreign Direct Investment (MOFCOM, 2019), Chinese MNEs have invested in 188 economies through FDI and set up 44,000 foreign subsidiaries by the end of 2019. China's OFDI ranks 2nd and 3rd in terms of its flow and stock positions in the world, respectively. These facts demonstrate that FDI is one of the primary modes that China has integrated into the world economy.

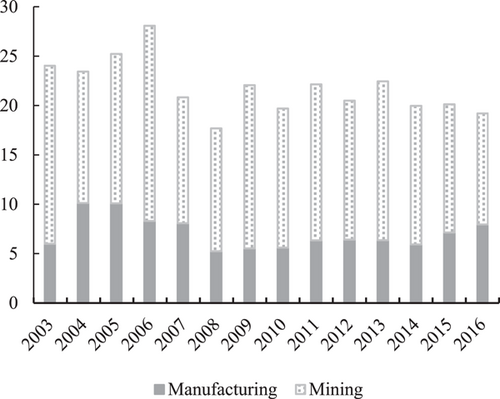

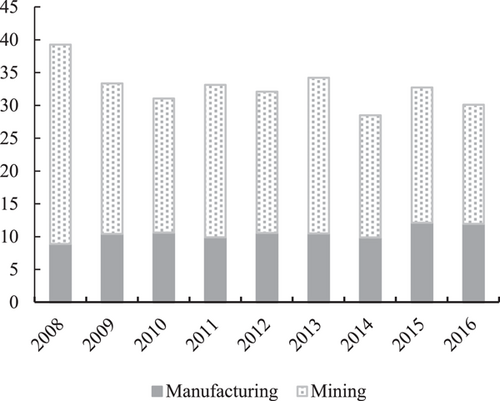

A large proportion of China's OFDI flows to developing economies in Asia, Africa, and Latin America, and to developed economies such as Australia and Canada. Empirical results find that Chinese MNEs tend to invest in resource-abundant economies (Luo & Tung, 2007; Ramasamy et al., 2012), and that China's investment projects in developing economies have a resource- or infrastructure-oriented incentive (Buckley et al., 2007; Kolstad & Wiig, 2012; Yang et al., 2018). The resource-oriented incentive can also be highlighted by the industrial decomposition in Figures 1 and 2, which shows that a large fraction of China's OFDI is in the mining industry, far greater than that of manufacturing, especially in the early years and when excluding China's investment in Hong Kong.1

Although extant literature has recognized that the home economy's resource abundance is closely related to China's OFDI, much less attention is given to the impact of such resource-related investments on the home economy. Does it enhance China's resource supply and boost Chinese economic growth? To provide a better understanding of this question, we refer to the well-known Rybczynski theorem, which states that in a long-run Heckscher–Ohlin Samuelson (HOS) model with two goods and two factors of production, an increase in one factor will expand the output of the industry using that factor intensively, and decrease the output of the other industry using that factor less intensively (Rybczynski, 1955). We expect that China's OFDI would boost the output of Chinese industries that intensively use a natural resource, but shrink the industries that use the resource less intensively if China's OFDI does increase the supply of the resource in China.

We first examine whether China's OFDI would increase its supply of a natural resource by looking at its OFDI to 169 host economies and the corresponding exports of these hosts to China in the period 2003–2015. We look at two natural resources, fuel, and metal. We conclude that China would increase its investment in an economy endowed with a resource when the world price of the corresponding resource is expected to rise, and this increased investment would contribute to the host economy's exports of the resource to China.

We then investigate whether China's OFDI boosts the output of its resource-intensive industries. Based on the Chinese Industrial Enterprise Database (CIED) between 2003 and 2008, we incorporate the interaction terms of the fuel or metal intensity of an industry and the total amount of China's OFDI in the host economies that are abundant in the corresponding resource in the regressions. Our results show that the increase of China's OFDI in the fuel or metal abundant economies would boost the output of Chinese industries which use the fuel or metal intensively. Furthermore, we find that the industries that use metal and fuel less intensively are associated with reductions in output, in response to the increase of China's OFDI in the fuel or metal abundant economies. These findings are consistent with the predictions of the Rybczynski theorem.

Our paper contributes to the vast literature studying the determinants of China's OFDI, in particular, the strand of the literature that emphasizes the role of the natural resource endowment of the host country in attracting China's OFDI (Amighini et al., 2013; Yang et al., 2018), and that studies the impacts of outward FDI on domestic economic growth in general (Agnihotri & Arora, 2019; Amin et al., 2022; Herzer, 2008) and in China (Cozza et al., 2015; Huang & Zhang, 2017; Li et al., 2017).2

Although a wide variety of literature has recognized the impact of OFDI on China's economic growth, few studies investigate this impact from the perspective of natural resources. However, the bulk of China's OFDI goes to the resource sector and natural resource plays an important role in economic growth. As a result, considering the influence of resource-oriented motivation helps to provide a more comprehensive picture of the relationship between China's OFDI and its economic growth. From the perspective of Rybczynski theorem, therefore, we complement the literature by pointing out that, China's OFDI is associated with increases in the supply of natural resources, and the expansion of industries that use these resources intensively but the shrinkage of industries that use these resources less intensively.

The remainder of the paper is structured as follows. Section 2 develops the hypotheses, and describes the econometric model and the data. Section 3 presents the empirical results. Section 4 concludes.

2 HYPOTHESES, METHODOLOGY, AND DATA

2.1 Testing hypotheses

Previous empirical studies have a consensus on the fact that China's OFDI is positively correlated with host economy' resource endowment, while it is not clear whether China's OFDI increases its domestic resource supply.

The positive correlation between China's OFDI and host economy resource endowment can be partly attributed to domestic natural resource shortage. Although China is endowed with a variety of natural resources, its resource availability per capita is far below the international standard and China faces severe resource shortage (Tan, 2013). Recognizing the fact that natural resource is essential in manufacturing production, Chinese MNEs actively participate in cooperation with other countries in exploiting natural resource, including minerals, natural gas, and oil (Wu, 2014). As a result, we consider FDI as a channel of domestic resource supply and attempt to confirm the link between China's OFDI and host economies' exports to China by hypothesizing that:

-

Hypothesis 1: An increase of China's OFDI would lead to a rise of host economies’ resource exports to China.

To understand how China's OFDI may affect the output of different industries at the home market, we appeal to the Rybczynski Theorem, which, proposed by Rybczynski (1955), predicts that, in a long-run HOS model with two goods and two factors of production, an increase in one factor will expand the output of the industry using that factor intensively, and decrease the output of the other industry using that factor less intensively.

A large body of literature has discussed the Rybczynski theorem,3 while little research applies the Rybczynski theorem to the domestic economic impact of OFDI from the perspective of natural resources. Following the Rybczynski theorem, we would expect that China's OFDI would benefit industries that use the corresponding resources more intensively than other industries. We thus propose the following hypothesis:

-

Hypothesis 2: An increase of China's OFDI in resource abundant economies would benefit firms which depend heavily on natural resources as production inputs more than those less dependent on resources.

2.2 Estimating equation

To test whether China's OFDI benefits home economic growth as predicted by the Rybczynski theorem, we first examine whether China's OFDI contributes to the resource exports of host economies to China and hence increases its domestic resource supply. We then study whether China's OFDI would benefit the industries that use resources more intensively than other industries.

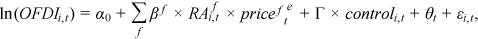

2.2.1 From Chinese investment to the exports to China

()

() is host economy's exports to China, and

is host economy's exports to China, and  is China's OFDI in the host economy. We consider three measures of the host economy's exports to China, the total merchandise export (

is China's OFDI in the host economy. We consider three measures of the host economy's exports to China, the total merchandise export ( ), the fuel exports (

), the fuel exports ( ) and the metal exports (

) and the metal exports ( ). Under Hypothesis 1, we would expect the coefficient on China's OFDI to be positive,

). Under Hypothesis 1, we would expect the coefficient on China's OFDI to be positive,  .

.In addition,  is a vector of country-level controls, including host economy market size, market opportunities, and geometrical distance. Besides these determinants,

is a vector of country-level controls, including host economy market size, market opportunities, and geometrical distance. Besides these determinants,  represents year-fixed effects, capturing country-invariant factors such as government policies and financial crisis shock to all countries. We exclude country fixed effect as the geometrical distance is host specific and time-invariant.

represents year-fixed effects, capturing country-invariant factors such as government policies and financial crisis shock to all countries. We exclude country fixed effect as the geometrical distance is host specific and time-invariant.  is the error term.

is the error term.

Considering the endogeneity of OFDI, we use the expected world price of a natural resource as the instrumental variable in the baseline estimation. Empirical evidence has demonstrated that host economy's resource abundance is closely related to China's OFDI, and that resource price affects the internalization of MNEs in resource sectors (Alfalih & Hadj, 2020; Brown & Huntington, 2018; Kang, 2018). The Granger causality results in Table A4 also shows the lead of resource prices to China's OFDI in the corresponding resource-abundant economies, but not the other way round.

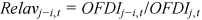

()

() refers to the resource abundance indicator of host economy i in resource f at year t, and

refers to the resource abundance indicator of host economy i in resource f at year t, and  is the expected price of the natural resource f.

is the expected price of the natural resource f.We include two groups of natural resources: the fuel resource, denoted by the subscript of fuel, and the metal resource, denoted by the subscript of metal. The prime interest of our analysis is the coefficients on the interaction terms ( ). We expect

). We expect  .

.

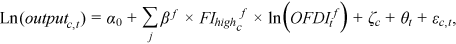

2.2.2 From China's OFDI to its economic growth

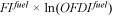

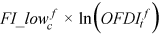

()

() is the average output of industry c in year t, and the

is the average output of industry c in year t, and the  is industry c's factor intensity of resource f. Again, we consider two types of resources, fuel and metal. Thus, f = fuel, metal.

is industry c's factor intensity of resource f. Again, we consider two types of resources, fuel and metal. Thus, f = fuel, metal.Here,  is China's OFDI to the host economies which are abundant in resource-f in year t. We will discuss the detailed construction of

is China's OFDI to the host economies which are abundant in resource-f in year t. We will discuss the detailed construction of  in Section 3.2.

in Section 3.2.  , and

, and  are defined as above.

are defined as above.

The parameter  is the coefficient of interest. It allows the effect of China's OFDI on industrial output to vary by the factor intensity. We expect

is the coefficient of interest. It allows the effect of China's OFDI on industrial output to vary by the factor intensity. We expect  > 0, which indicates that China's OFDI benefits the growth of the domestic industry that intensively uses resource f.

> 0, which indicates that China's OFDI benefits the growth of the domestic industry that intensively uses resource f.

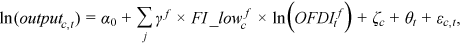

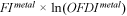

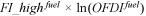

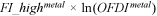

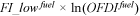

()

() ()

() (j = fuel, metal) takes the value of 1 if the factor intensity of industry c is larger than median factor intensity, and otherwise 0. Similarly,

(j = fuel, metal) takes the value of 1 if the factor intensity of industry c is larger than median factor intensity, and otherwise 0. Similarly,  (j = fuel, metal) takes the value of 1 if the factor intensity of industry c is smaller than median factor intensity, and otherwise 0. The parameters

(j = fuel, metal) takes the value of 1 if the factor intensity of industry c is smaller than median factor intensity, and otherwise 0. The parameters  and

and  are the coefficients of interest. Therefore, we expect

are the coefficients of interest. Therefore, we expect  and

and  .

.2.3 Data

In this section, we use two datasets, including the panel data of China's OFDI to 169 host economies in the period of 2003 to 2015 and Chinese manufacturing industry level data spanning from 2003 to 2008. The former is from the Statistical Bulletin of China's Outward Foreign Direct Investment, and the latter is from “The Chinese Industrial Enterprise Database”. Table A2 provides a detailed definition and sources of the data.

2.3.1 Country-level data

- (1)

China's OFDI (ln(OFDI)): There are two measurements of OFDI scale, the OFDI flows and the OFDI stocks. In this paper, we use net OFDI stocks as the measure of China's OFDI, rather than the OFDI flows. There are three reasons for doing so. First, the OFDI flows indicate the annual net outflow of Chinese MNEs' investment, which will be negative in several years, but the OFDI stocks are non-negative. To address skewness in the FDI variable, we take a logarithmic transformation. Second, Blonigen and Piger (2014) argue that FDI stocks, rather than FDI flows, connect directly to the main general equilibrium theories of multinational firm behavior and FDI. Lastly, as stated in Yang et al. (2018), the profitability depends on marginal return on capital stocks rather than capital flows, and the flows could be too much volatile, in particular for small economies, due to large takeovers.

- (2)

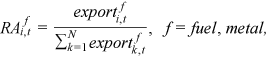

Resource abundance (RA): There are several ways to measure host economy resource abundance. Auty (2007) uses the total natural resource rents as the indicator of the host economy's natural resource endowment. Natural resource rents refer to the difference between the revenues and the extracting costs. Higher resource rents suggest a higher resource supply. Another widely adopted indicator of natural resource endowment in literature is calculated by resource exports. For example, Cheung and Qian (2009) use the sum of fuel, ores, and metals exports as a share of total merchandise exports as the proxy for the host economy's resource abundance.

In this paper, we examine whether China's OFDI benefits the home economy resource supply through bilateral trade. Therefore, we define resource abundance indicator

as the share of host economy i's total export of resource f to the worldwide total export of resource f, which is given as follows:

where

as the share of host economy i's total export of resource f to the worldwide total export of resource f, which is given as follows:

where ()

() is the fuel/metal export of economy i at year t.

is the fuel/metal export of economy i at year t.

- (3)

Resource price expectation (pricee): We expect the fluctuations in natural resource international price will affect China's OFDI. There are two ways to construct price expectations. Bec and Kanda (2020) denote expectations with the lagged one-period resource price. Another way to construct myopic expectation is adopted by Fuster et al. (2010). They proxy the rational expectations using the predicted component of AR(1) estimation. In the baseline estimation, we use the one-period lagged price as the measurement of resource price expectation.4

- (4)

Other controls: We further employ host country market size (LGDP), market opportunities (LGDPP), and geometrical distance between the host economy and China (LDIST) to account for other factors that may determine the location of China's OFDI.

Literature has demonstrated the market-seeking motivation of China's OFDI (Buckley et al., 2007). China's OFDI tends to flow into economies with large market volumes and high market growth. Hence, we include market size and market opportunities as controls. Following Filippini and Molini (2003), we use GDP and GDP per capita of the host economy as the indicators of market size and market opportunities, respectively. However, according to Helpman (1987), GDP per capita can be used as the measurement for labor cost, and cross-border investment is supposed to be negatively related to host economy labor cost. Thus, LLGDP may have an ambiguous effect on China's OFDI.

Furthermore, the transportation cost and investment risk may rise as the geometrical distance between the host economy and China increases. Therefore, firms tend to choose nearby countries as FDI destinations. We include distance to control such factors.

We take natural logarithms of market size, opportunities, and geometrical distance to reduce heteroscedasticity. Also, to reduce potential endogeneity issues, the lagged control variables are used.

- (5)

Data sources: China's OFDI data is collected from the Statistical Bulletin of China's Outward Foreign Direct Investment, which is published by the Chinese Ministry of Commerce. The data on fuel exports and metal exports, GDP, and GDP per capita come from the World Bank World Development Indicators (WDI) database.5 The price indices of fuel and metal come from IMF Primary Commodity Price System (PCPS).6 Host economy's total merchandise exports to China come from the IMF Direction of Trade Statistics (DOTS) database. The host economy's fuel and metal exports to China come from UN Comtrade database.7

2.3.2 Industry-level data

- (1)

Industrial output (ln(output)): We define industry c according to the four-digit national economy classification code (GB/T4754-2002) and compute

as the average output of total firms in industry c in year t. Our sample spans the period from 2003 to 2008.

as the average output of total firms in industry c in year t. Our sample spans the period from 2003 to 2008. - (2)

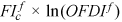

Factor intensity (FI): Literature provides the definition of energy intensity. For instance, Luan et al. (2020) refer the energy intensity as the proportion of factor input to total industrial added value. Accordingly, we define

as the share of factor j inputs in total intermediate inputs of industry c, which is given by

where

as the share of factor j inputs in total intermediate inputs of industry c, which is given by

where ()

() is industry c's intermediate inputs related with factor f, and

is industry c's intermediate inputs related with factor f, and  is the total intermediate inputs of industry c. In particular, when defining the industry c, we concord the five-digit code used by IO table with the four-digit national economy classification code used by CIED by sector classification definition.

is the total intermediate inputs of industry c. In particular, when defining the industry c, we concord the five-digit code used by IO table with the four-digit national economy classification code used by CIED by sector classification definition.

- (3)

Data source: The industry-level output comes from the Chinese Industrial Enterprise Database (CIED). This database covers manufacturing firms with annual sales above 5 million RMB and is widely used by studies, such as Brandt et al. (2012), and Hsieh and Song (2015). Factor intensity

is computed based on China's 2002 Input-Output (IO) table, which is compiled by the Chinese National Bureau of Statistics. The IO table reports key information on factor inputs, total intermediate inputs, total output, and value added of 87 industries in China.

is computed based on China's 2002 Input-Output (IO) table, which is compiled by the Chinese National Bureau of Statistics. The IO table reports key information on factor inputs, total intermediate inputs, total output, and value added of 87 industries in China.

2.4 Descriptive statistics

Table 1 Panel A lists the descriptive statistics for the national data of the total 169 host economies in the period 2003–2015.8 We use ln(OFDI+1) instead of ln(OFDI) to deal with zero values. In the sample period, China's OFDI grew substantially, and the average growth rate reached 33.8%. We notice that the variations in the host economy's exports are larger than that in China's OFDI, indicating larger fluctuations in international trade than cross-border investment. The fuel abundance indicator (RAfuel) and the metal abundance indicator (RAmetal) of the host economies differ substantially across countries. In terms of fuel abundance, the maximum value is 1.451, while in terms of metal abundance the maximum value is 1.394. Their minimum values are both zero.

| Panel A | Country-level data | ||||

|---|---|---|---|---|---|

| Variable | N | Mean | Std. dev. | Min | Max |

| ln(OFDI) | 2197 | 0.890 | 1.227 | 0 | 8.790 |

| ln(export) | 2197 | 5.103 | 3.216 | 0 | 12.56 |

| ln(exportfuel) | 2197 | 3.339 | 4.105 | 0 | 12.92 |

| ln(exportmetal) | 2197 | 4.747 | 3.435 | 0 | 13.29 |

| RAfuel | 2197 | 0.0641 | 0.168 | 0 | 1.451 |

| RAmetal | 2197 | 0.0643 | 0.160 | 0 | 1.394 |

| pricefuel | 13 | 5.087 | 0.355 | 4.359 | 5.459 |

| pricemetal | 13 | 4.822 | 0.428 | 3.879 | 5.344 |

| LGDP | 2157 | 5.724 | 2.228 | 0.598 | 12.07 |

| LGDPP | 2157 | 8.341 | 1.634 | 4.682 | 11.67 |

| LDIST | 2158 | 9.008 | 0.520 | 7.063 | 9.858 |

| Panel B | Industry-level data | ||||

|---|---|---|---|---|---|

| Variable | N | Mean | Std. dev. | Min | Max |

| ln(Output) | 2525 | 11.111 | 0.852 | 9.315 | 15.764 |

| FImetal | 2525 | 0.188 | 0.171 | 0.003 | 0.736 |

| FIfuel | 2525 | 0.039 | 0.086 | 0.001 | 0.797 |

- Note: (1) We use ln(x + 1), x = OFDI and export instead of ln(x) to deal with zero values. (2) We take logs of fuel and metal price indices.

Table 1, Panel B reports the descriptive statistics of the industrial data. Due to data availability, annual data for 425 Chinese manufacturing industries are collected in the period 2003–2007, while only 400 industries are collected in 2008. Note that the maximum values of metal intensity and fuel intensity are up to 0.736 and 0.797, respectively, and the minimum values of metal intensity and fuel intensity are only 0.003 and 0.001, respectively. This indicates that the industries in our sample differ largely in terms of their factor intensity. In addition, the mean of fuel intensity (FIfuel) and metal intensity (FImetal) are 0.188 and 0.039, respectively, suggesting that, on average, Chinese manufacturing firms use more fuel than metals as factor inputs in production.

Table 2 lists the top 10 industries that use fuel or metal most intensively. We find that fuel-intensive industries include petroleum and nuclear fuel processing, coking, production, and supply of electricity and heat, while metal-intensive industries include nonferrous metal processing, metal products manufacturing, steel processing, and other sectors closely related to the metal resource. The industry with maximum fuel intensity is petroleum and nuclear fuel processing, with a fuel intensity value of 79.73%. The industry with maximum metal intensity is nonferrous metal processing, with the metal intensity up to 73.57%.

| Industry name | Industry code | Fuel intensity (%) |

|---|---|---|

| Panel A: Top 10 fuel-intensive industries | ||

| Petroleum and nuclear fuel processing | 25,036 | 79.73 |

| Coking | 25,037 | 50.00 |

| Production and supply of electricity and heat | 44,086 | 42.88 |

| Synthetic materials manufacturing | 26,042 | 39.80 |

| Iron-making | 32,054 | 21.26 |

| Fertilizer manufacturing | 26,039 | 16.038 |

| Chemical Fiber Manufacturing | 28,046 | 12.65 |

| Glass and glass products manufacturing | 31,050 | 11.59 |

| Non-metallic mineral products manufacturing | 31,053 | 11.45 |

| Steel manufacturing | 32,055 | 10.65 |

| Panel B: Top 10 metal-intensive industries | ||

| Nonferrous metal processing | 33,059 | 73.57 |

| Metal products manufacturing | 34,060 | 63.37 |

| Steel processing | 32,056 | 59.40 |

| Ferroalloy smelting | 32,057 | 57.96 |

| Non-ferrous metal smelting | 33,058 | 51.74 |

| Steel manufacturing | 32,055 | 44.96 |

| Communication Equipment Manufacturing | 39,074 | 41.97 |

| Non-metallic mineral products manufacturing | 31,053 | 38.94 |

| Special equipment manufacturing | 36,065 | 36.14 |

| Iron-making | 32,054 | 35.34 |

- Source: China's IO table, 2002.

3 EMPIRICAL RESULTS

Below, we first present evidence that Chinese multinationals seek natural resources, which helps increase their domestic supply of resources. We then investigate whether the benefit of doing OFDI in resource-abundant economies relies on an industry's dependence on natural resources.

3.1 The effects of China's OFDI on home resource supply

3.1.1 Baseline IV estimation results

In this part, we explore the nexus between China's OFDI and home natural resource supply through an instrumental variable approach. The second and first stage estimations are respectively given by Equations (1) and (2). Under the premise that the expected higher world price of a natural resource may increase Chinese investment in a host economy abundant in the corresponding resource, we use the interactions of expected natural resource prices and the host economy's resource abundances ( ) as the instrumental variable.

) as the instrumental variable.

As we use a short but large cross-sectional panel (T = 13, N = 169) for the analysis, there wouldn't be a big concern for the unit roots. However, to relieve this concern, we apply the Fisher-ADF panel unit root tests to our relevant variables. The results are reported in Table 3, where all tests strongly reject the null hypothesis that the panel contains unit roots.

| Fisher-ADF unit-root test | ||||

|---|---|---|---|---|

| Variables | Inverse χ2 | Inverse normal | Inverse logit t | Modified inv. χ2 |

| ln(OFDI) | 660.62 (0.00)*** | −11.72 (0.00)*** | −11.56 (0.00)*** | 12.41 (0.00)*** |

| ln(export) | 775.01 (0.00)*** | −14.62 (0.00)*** | 14.80 (0.00)*** | 17.06 (0.00)*** |

| ln(exportfuel) | 856.35 (0.00)*** | −16.52 (0.00)*** | −16.87 (0.00)*** | 20.21 (0.00)*** |

| ln(exportmetal) | 843.11 (0.00)*** | −16.16 (0.00)*** | −14.68 (0.00)*** | 17.60 (0.00)*** |

| LGDP | 788.82 (0.00)*** | −14.28 (0.00)*** | −16.42 (0.00)*** | 19.70 (0.00)*** |

| LGDPP | 798.76 (0.00)*** | −14.87 (0.00)*** | −15.10 (0.00)*** | 18.11 (0.00)*** |

- Note: *, **, *** show a level of significance of 10%, 5%, and 1%, respectively, and p value is listed in the parentheses. We do not report the unit-root test results of LDIST as the geometrical distance is time-invariant.

The IV estimation results are reported in Table 4. Column (1) reports the first-stage result based on Equation (2), where we adopt a fixed-effect model and control both year and host economy fixed effects. Consistent with our expectation, the estimated coefficients associated with the two interaction terms are significant at 1% and positive, 0.183 for the fuel interaction term  and 0.595 for the metal interaction term

and 0.595 for the metal interaction term  .

.

| (1) | (2) | (3) | (4) | |

|---|---|---|---|---|

| IV: First stage | IV: Second stage | |||

| ln(OFDI) | ln(export) | ln(exportfuel) | ln(exportmetal) | |

| ln(OFDI) | 0.712*** | 1.397*** | 1.408*** | |

| (0.231) | (0.483) | (0.409) | ||

|

0.183*** | |||

| (0.063) | ||||

|

0.595*** | |||

| (0.146) | ||||

| LGDP | 0.091** | 1.003*** | 0.658*** | 0.885*** |

| (0.037) | (0.075) | (0.156) | (0.112) | |

| LGDPP | −0.077* | 0.009 | 0.068 | −0.157 |

| (0.046) | (0.081) | (0.186) | (0.111) | |

| LDIST | −0.699*** | −0.557** | −0.493 | 0.439 |

| (0.176) | (0.273) | (0.531) | (0.440) | |

| Year FE | Yes | Yes | Yes | Yes |

| Constant | −2.017 | −0.544 | −3.837*** | −3.500*** |

| (1.979) | (1.347) | (0.966) | (1.319) | |

| Observations | 2145 | 2145 | 2145 | 2145 |

| KP stat | 28.41 | 28.41 | 28.41 | |

| KP p value | 0.00 | 0.00 | 0.00 | |

| Hansen-J p value | 0.386 | 0.123 | 0.183 | |

| R2 | 0.845 | 0.946 | 0.901 | 0.916 |

- Note: Cluster-robust standard errors are given in parentheses.

- *** p < 0.01

- ** p < 0.05

- * p < 0.1.

Our finding suggests that Chinese multinationals may increase their investment in a host economy endowed with a rich resource if the price of the resource is expected to rise. In particular, given the average fuel and metal abundance of 0.0641 and 0.0643, respectively, a 10% increase in the expected price will lead to a 0.64% increase in China's investment in the host economy rich in the resource. In terms of control variables, the estimations of the market size (LGDP) are significantly positive, implying the market-seeking motivation in China's OFDI.

Table 4, Columns (2)–(4) report the second-stage result for the total export, the fuel export, and the metal export, respectivel. We use the two interaction terms as the instrumental variables for China's OFDI and perform IV regressions based on Equation (1). The value of Kleinberg–Paap Wald tests rejects the null of weak instruments in Table 4. Further, the validity of our instrument choice is confirmed by the fact that the Hansen tests do not reject the overidentification restrictions.

It can be seen that, first, the coefficients on China's OFDI are all positive and statistically significant at the 1% level. This suggests that, on average, the increased OFDI of China to a host country induced by the expected rising price of a natural resource may lead to increased exports from the host economy to China. Second, when taking individual resource exports as the dependent variables, we find that the impact is larger for the metal exports than for the fuel exports. When taking fuel exports as the dependent variable, the estimated coefficient for China's OFDI is 1.397, while when taking metal exports as the dependent variable, the estimated coefficient is 1.408.

3.1.2 Robustness

GMM estimation

For robustness check, we use 1-year lag of China's OFDI as the instrumental variable and report the GMM regression results in Table 5. It can be seen that the coefficients of China's OFDI are all statistically significant and positive, supporting the view that China's OFDI may increase its domestic resource supply.

| (1) | (2) | (3) | |

|---|---|---|---|

| GMM | |||

| ln(export) | ln(exportfuel) | ln(exportmetal) | |

| ln(OFDI) | 0.420*** | 0.965*** | 0.571*** |

| (0.101) | (0.245) | (0.132) | |

| LGDP | 1.075*** | 0.767*** | 1.092*** |

| (0.0628) | (0.128) | (0.0740) | |

| LGDPP | −0.0104 | 0.0511 | −0.213** |

| (0.0794) | (0.182) | (0.103) | |

| LDIST | −0.717*** | −0.713 | −0.0544 |

| (0.230) | (0.469) | (0.370) | |

| Year FE | Yes | Yes | Yes |

| Constant | 4.858** | 3.373 | −0.220 |

| (2.310) | (4.393) | (3.642) | |

| Observations | 1980 | 1980 | 1980 |

| R2 | 0.768 | 0.413 | 0.611 |

- Note: Cluster-robust standard errors in parentheses.

- ***p< 0.01

- ** p < 0.5.

Additional IV

We also construct an alternative instrumental variable, which is the relevance of China's OFDI to a region where a host economy resides, excluding the investment in the host economy. The investment allocation to a region but the host economy is defined as  , where

, where  is China's OFDI to economy i in year t, and

is China's OFDI to economy i in year t, and  is China's OFDI in region j that economy i belongs to. The corresponding relevance of the remaining region is hence given by

is China's OFDI in region j that economy i belongs to. The corresponding relevance of the remaining region is hence given by  . Economies in the sample belong to 6 regions, including Africa, North America, Latin America, Asia, Europe, and Oceania. The detailed economy and associated region list are reported in Table A3.

. Economies in the sample belong to 6 regions, including Africa, North America, Latin America, Asia, Europe, and Oceania. The detailed economy and associated region list are reported in Table A3.

Table 6 reports the corresponding results. Column (1) reports the first stage regression results. The instrumental variable is significant at 1%, suggesting the relevancy of the instrumental variable. The value of Kleinberg-Paap Wald tests rejects the null of weak instruments. Columns (2)–(4) report the second stage results. China's OFDI is significant and positive, indicating that an increase in China's OFDI may contribute to the increased fuel/metal export from the host economy to China.

| (1) | (2) | (3) | (4) | |

|---|---|---|---|---|

| IV: First stage | IV: Second stage | |||

| ln(OFDI) | ln(export) | ln(exportfuel) | ln(exportmetal) | |

| ln(OFDI) | 0.335* | 0.699** | 0.763*** | |

| (0.187) | (0.345) | (0.286) | ||

|

−1.484*** | |||

| (0.408) | ||||

| LGDP | 0.199*** | 1.093*** | 0.823*** | 1.038*** |

| (0.026) | (0.076) | (0.136) | (0.095) | |

| LGDPP | −0.091** | −0.012 | 0.029 | −0.193* |

| (0.038) | (0.079) | (0.175) | (0.103) | |

| LDIST | −0.616*** | −0.796*** | −0.936* | 0.030 |

| (0.127) | (0.239) | (0.504) | (0.396) | |

| Year FE | Yes | Yes | Yes | Yes |

| Constant | 12.171*** | 5.719** | 6.393 | −0.745 |

| (2.437) | (2.292) | (4.515) | (3.726) | |

| Observations | 2145 | 2145 | 2145 | 2145 |

| KP stat | 13.25 | 13.25 | 13.25 | |

| KP p value | 0.03 | 0.03 | 0.03 | |

| R2 | 0.749 | 0.767 | 0.412 | 0.614 |

- Note: Cluster-robust standard errors are given in parentheses.

- *** p < 0.01

- ** p < 0.05

- * p < 0.1.

LIML estimation

We also report the limited information maximum likelihood (LIML) estimation results for the robustness check. The LIML estimation performs better than 2SLS at specifying weak IV in a small sample. The LIML estimation results reported in Table 7 show a similar pattern to the results in Table 4.

| (1) | (2) | (3) | |

|---|---|---|---|

| LIML | |||

| ln(export) | ln(exportfuel) | ln(exportmetal) | |

| ln(OFDI) | 0.717*** | 1.893* | 1.453*** |

| (0.234) | (1.112) | (0.435) | |

| LGDP | 1.002*** | 0.540* | 0.875*** |

| (0.076) | (0.282) | (0.118) | |

| LGDPP | 0.010 | 0.095 | −0.154 |

| (0.081) | (0.208) | (0.113) | |

| LDIST | −0.554** | −0.178 | 0.468 |

| (0.275) | (0.753) | (0.448) | |

| Year FE | Yes | Yes | Yes |

| Constant | 3.763 | 0.264 | −4.284 |

| (2.534) | (6.404) | (4.106) | |

| Observations | 2145 | 2145 | 2145 |

| R2 | 0.762 | 0.370 | 0.561 |

- Note: Cluster-robust standard errors are given in parentheses.

- *** p < 0.01

- ** p < 0.05

- * p < 0.1.

3.2 The effects of China's OFDI on home production

3.2.1 Baseline results

Now we turn to investigate whether China's OFDI has a positive impact on its economic growth. We include the interaction terms of factor intensity and China's total OFDI to the economies which are abundant in the corresponding resource ( , f = fuel, metal) in Equation (3).

, f = fuel, metal) in Equation (3).

We construct  in two steps. First, we define a host economy as being resource-f (f = fuel/metal) abundant if its exports of resource-f account for the top kth quantile of the world's total exports of resource-f in year t. Second, we compute

in two steps. First, we define a host economy as being resource-f (f = fuel/metal) abundant if its exports of resource-f account for the top kth quantile of the world's total exports of resource-f in year t. Second, we compute  as the total value of China's OFDI to these economies which are defined as resource-f abundant.

as the total value of China's OFDI to these economies which are defined as resource-f abundant.

Table 8 presents the estimation results based on Equation (3). In Column (1), a host economy is resource-f abundant if its resource-f exports are in the top 1/2 quantile (k = 1/2). A similar definition applies to Column (2) (k = 1/3) and Column (3) (k = 1/4), respectively. It turns out that the estimated coefficients on the two interaction terms ( , f = fuel, metal) are positive and statistically significant at the 1% level in all cases, which is consistent with Hypothesis 2.

, f = fuel, metal) are positive and statistically significant at the 1% level in all cases, which is consistent with Hypothesis 2.

| (1) | (2) | (3) | |

|---|---|---|---|

| Top 1/2 quantile | Top 1/3 quantile | Top 1/4 quantile | |

|

0.507*** | 0.509*** | 0.363*** |

| (0.142) | (0.142) | (0.102) | |

|

0.143*** | 0.145*** | 0.144*** |

| (0.0508) | (0.0517) | (0.0518) | |

| Year FE | Yes | Yes | Yes |

| Industry FE | Yes | Yes | Yes |

| Constant | −26.10*** | −24.40*** | −38.24*** |

| (8.237) | (7.090) | (7.813) | |

| Observations | 2519 | 2519 | 2519 |

| R2 | 0.968 | 0.968 | 0.968 |

- Note: Cluster-robust standard errors are given in parentheses.

- ***p < 0.01.

Specifically, the coefficients on the interaction term of fuel intensity and China's OFDI range between 0.363 and 0.509, and the coefficients on the interaction term of metal intensity and China's OFDI range between 0.143 and 0.145, suggesting a positive impact on China's OFDI in resource-abundant economies on the growth of Chinese industries that intensively use these natural resources. In addition, the coefficients on the interaction term related to fuel intensity are larger than the coefficients on the interaction term related to metal intensity. This may suggest that fuel-intensive industries benefit more from China's OFDI than metal-intensive industries.

To provide further evidence to the Rybczynski theorem, Table 9 reports the estimation results based on Equations (4) and (5). In accord with our expectation, the interaction terms of China's OFDI and the high factor-intensity indicator ( j =fuel, metal) are positive and statistically significant at the 10% level in all cases, and the interaction terms of OFDI and the low factor-intensity indicator (

j =fuel, metal) are positive and statistically significant at the 10% level in all cases, and the interaction terms of OFDI and the low factor-intensity indicator ( j = fuel, metal) are negative and statistically significant at the 10% level. It demonstrates that only industries whose resource factor intensities are above the median level would benefit from the OFDI, while the industries that rely less on resource factors may even be hurt by the OFDI. These findings are in line with the Rybczynski theorem.

j = fuel, metal) are negative and statistically significant at the 10% level. It demonstrates that only industries whose resource factor intensities are above the median level would benefit from the OFDI, while the industries that rely less on resource factors may even be hurt by the OFDI. These findings are in line with the Rybczynski theorem.

| (1) | (2) | (3) | (4) | (5) | (6) | |

|---|---|---|---|---|---|---|

| Top 1/2 quantile (k = 1/2) | Top 1/3 quantile (k = 1/3) | Top 1/4 quantile (k=1/4) | ||||

|

0.0867*** | 0.0872*** | 0.0628*** | |||

| (0.0183) | (0.0184) | (0.0132) | ||||

|

0.0354* | 0.0355* | 0.0274** | |||

| (0.0184) | (0.0185) | (0.0133) | ||||

|

−0.0870*** | −0.0875*** | −0.0634*** | |||

| (0.0183) | (0.0184) | (0.0133) | ||||

|

−0.0328* | −0.0328* | −0.0255* | |||

| (0.0184) | (0.0185) | (0.0133) | ||||

| Year FE | Yes | Yes | Yes | Yes | Yes | Yes |

| Industry FE | Yes | Yes | Yes | Yes | Yes | Yes |

| Constant | 9.953*** | 11.73*** | 9.950*** | 11.73*** | 10.30*** | 11.39*** |

| (0.189) | (0.190) | (0.190) | (0.191) | (0.112) | (0.114) | |

| Observations | 2525 | 2525 | 2525 | 2525 | 2525 | 2525 |

| R2 | 0.684 | 0.684 | 0.684 | 0.684 | 0.684 | 0.684 |

- Note: Cluster-robust standard errors in parentheses.

- *** p < 0.01

- ** p < 0.05

- * p < 0.1.

3.2.2 Robustness

Additional evidence from individual components of the fuel

Anticipating that Chinese manufacturing firms may require different types of fuel resources, we spilt the fuel into individual components. Due to data availability, we can only collect price data of two components of the fuel resource, crude oil, and coal, and construct the coal intensity and oil intensity indicators following Equation (7). Similarly, we define  and

and  as the sum of China's total OFDI to the host economies which are abundant in coal and oil resources. We replace the fuel interaction term with the coal interaction term and the oil interaction term.

as the sum of China's total OFDI to the host economies which are abundant in coal and oil resources. We replace the fuel interaction term with the coal interaction term and the oil interaction term.

Table 10 reports the estimation results. It can be seen that all interaction terms are significantly positive, but the one associated with the coal resource in Column (1), is insignificant but still positive. These results are consistent with our baseline findings, indicating that the increase of China's OFDI in resource-abundant economies will benefit the industries that use the corresponding resources intensively.

| (1) | (2) | (3) | |

|---|---|---|---|

| Top 1/2 quantile (k = 1/2) | Top 1/3 quantile (k = 1/3) | Top 1/4 quantile (k = 1/4) | |

|

0.139 | 0.233** | 0.928*** |

| (0.133) | (0.114) | (0.190) | |

|

0.379** | 0.281** | 0.222** |

| (0.155) | (0.114) | (0.113) | |

|

0.135*** | 0.137*** | 0.139*** |

| (0.0516) | (0.0523) | (0.0512) | |

| Year FE | Yes | Yes | Yes |

| Industry FE | Yes | Yes | Yes |

| Constant | 10.30*** | 10.33*** | 10.25*** |

| (0.161) | (0.153) | (0.152) | |

| Observations | 2,525 | 2,525 | 2,525 |

| R2 | 0.679 | 0.679 | 0.687 |

- Note: Cluster-robust standard errors are given in parentheses.

- *** p < 0.01

- ** p < 0.5.

Resource prices, China's OFDI and industrial output

In Section 3.1.1, we show that the higher expected world price of a natural resource will increase Chinese investment in a host economy abundant in the corresponding resource. Consequently, we expect the positive relationship between China's OFDI and domestic production would be stronger when the expected resource prices are about to rise.

in Equation (3) with the expected resource price

in Equation (3) with the expected resource price  . The estimating equation is given by Equation (8). Table 11 reports the estimation results which are consistent with our expectation.

. The estimating equation is given by Equation (8). Table 11 reports the estimation results which are consistent with our expectation.

()

()| (1) | (2) | (3) | |

|---|---|---|---|

| Top 1/2 quantile (k = 1/2) | Top 1/3 quantile (k = 1/3) | Top 1/4 quantile (k = 1/4) | |

|

0.0356*** | 0.0357*** | 0.0340*** |

| (0.0102) | (0.0102) | (0.00975) | |

|

0.0105*** | 0.0106*** | 0.0106*** |

| (0.00315) | (0.00317) | (0.00318) | |

| Year FE | Yes | Yes | Yes |

| Industry FE | Yes | Yes | Yes |

| Constant | −11.23*** | −11.27*** | −9.854*** |

| (3.298) | (3.306) | (2.908) | |

| Observations | 2519 | 2519 | 2519 |

| R2 | 0.968 | 0.968 | 0.968 |

- Note: We take log of fuel and metal price indices. Cluster-robust standard errors are given in parentheses.

- *** p < 0.01.

We further split the fuel intensity into the coal intensity and the oil intensity and report the estimation results in Table 12. Again, we find a stronger positive relation between China's OFDI and domestic production when the expected resource prices are about to rise.

| (1) | (2) | (3) | |

|---|---|---|---|

| Top 1/2 quantile (k = 1/2) | Top 1/3 quantile (k = 1/3) | Top 1/4 quantile (k = 1/4) | |

|

0.0988*** | 0.104*** | 0.0872*** |

| (0.0211) | (0.0214) | (0.0178) | |

|

0.0233** | 0.0221** | 0.0211** |

| (0.0108) | (0.0105) | (0.0105) | |

|

0.0101*** | 0.0102*** | 0.0102*** |

| (0.00313) | (0.00315) | (0.00315) | |

| Year FE | Yes | Yes | Yes |

| Industry FE | Yes | Yes | Yes |

| Constant | 10.63*** | 10.63*** | 10.66*** |

| (0.0421) | (0.0408) | (0.0394) | |

| Observations | 2525 | 2525 | 2525 |

| R2 | 0.687 | 0.688 | 0.688 |

- Note: We take log of fuel and metal price indices. Cluster-robust standard errors are given in parentheses.

- ***p < 0.01

- ** p < 0.5.

4 CONCLUSION

In this paper, we investigate whether China's OFDI enhances its domestic resource supply and boosts its economic growth. Guided by the Rybczynski theorem, we expect that China's OFDI would boost the output of Chinese industries that intensively use a natural resource, but shrinks the industries that use the resource less intensively if China's OFDI does increase the supply of the resource in China.

We first examine whether China's OFDI would increase its supply of a natural resource. By looking at China's OFDI to 169 host economies and the corresponding exports of these hosts to China in the period 2003–2015, we conclude that China would increase its investment in an economy endowed with a resource when the world price of the corresponding resource is expected to rise, and this increased investment would contribute to the host economy' exports of the resource to China.

We then investigate whether China's OFDI boosts the output of its industries that use natural resources intensively. Based on the Chinese Industrial Enterprise Database (CIED) between 2003 and 2008, we show that the increase of China's OFDI in the resource-abundant economies would boost the output of Chinese industries which use the resource intensively but reduce the output of the industries that use the resource less intensively. These findings are consistent with the predictions of the Rybczynski theorem.

AUTHOR CONTRIBUTIONS

Ling Feng: Conceptualization; funding acquisition; methodology; project administration; supervision; writing–review & editing. Lulan Ge: Data curation; formal analysis; investigation; software; visualization; writing–original draft.

ACKNOWLEDGMENTS

Ling Feng thanks the financial support by the National Natural Science Foundation of China, Grant No. 72173078, the Major Program of the National Social Science Foundation of China, Grant No. 21ZDA094, and the Humanities and Social Science Research Grant, No. 19YJA790011, Ministry of Education of China.

CONFLICT OF INTEREST

The authors declare no conflict of interest.

ETHICS STATEMENT

None declared.

APPENDIX A

| Panel A | Total | |||||||

|---|---|---|---|---|---|---|---|---|

| Industry number | 2013 | 2014 | 2015 | 2016 | ||||

| Position | Share | Position | Share | Position | Share | Position | Share | |

| 1 | 139.82 | 31.3 | 240.82 | 40.1 | 331.31 | 43.1 | 385.50 | 42.5 |

| 2 | 83.81 | 18.7 | 80.96 | 13.5 | 103.09 | 13.4 | 118.95 | 13.1 |

| 3 | 70.98 | 15.9 | 81.29 | 13.5 | 100.43 | 13.1 | 117.00 | 12.9 |

| 4 | 57.17 | 12.8 | 74.27 | 12.4 | 71.46 | 9.3 | 71.72 | 7.9 |

| 5 | 40.71 | 5.3 | 62.40 | 6.9 | ||||

| Subtotal | 379.50 | 84.9 | 505.69 | 84.2 | 647.00 | 84.1 | 755.57 | 83.2 |

| Panel B | Excluding Hong Kong | |||||||

|---|---|---|---|---|---|---|---|---|

| Industry number | 2013 | 2014 | 2015 | 2016 | ||||

| Position | Share | Position | Share | Position | Share | Position | Share | |

| 1 | 4.64 | 6.6 | 7.70 | 8.5 | 17.81 | 15.9 | 13.01 | 10.2 |

| 2 | 7.40 | 10.5 | 13.48 | 14.8 | 13.23 | 11.8 | 13.91 | 10.9 |

| 3 | 8.45 | 12.0 | 8.16 | 9.0 | 10.27 | 9.2 | 13.07 | 10.3 |

| 4 | 18.20 | 25.9 | 19.92 | 21.9 | 19.92 | 17.8 | 23.92 | 18.8 |

| 5 | 15.68 | 14.0 | 23.31 | 18.3 | ||||

| Subtotal | 41.04 | 58.4 | 52.00 | 57.1 | 76.91 | 68.6 | 87.22 | 68.5 |

- Note: Industry Number: 1. Leasing and Business Services; 2. Financial Services; 3. Wholesale and Retail Trade; 4. Mining; 5. Manufacturing; 6. Transportation, Storage and Postal Services. FDI Position: Billion USD; Share: %.

- Source: Statistical Bulletin of China's Outward Foreign Direct Investment (2013–2016).

| Indicator | Definition | Source |

|---|---|---|

| ln(OFDI) | Annual net position of China's OFDI in host economy i in year t, log | Statistical Bulletin of China's Outward Foreign Direct Investment |

| ln(export) | Host economy i's total merchandise export to China in year t, log | IMF, DOTS |

| ln(fuel export) | Host economy i's fuel exports to china in year t, log | UN Comtrade |

| ln(metal export) | Host economy i's metal exports to china in year t, log | |

| RAfuel | Host economy i's total fuel exports as share of world total fuel exports in year t, % | World Bank, WDI |

| RAmetal | Host economy i's total ore and metal exports as share of world total ore and metal exports in year t, % | |

| RAcoal | Host economy i's total coal exports as share of world total coal exports in year t, % | UN Comtrade |

| RAoil | Host economy i's total crued oil exports as share of world total oil exports in year t, % | |

| pricefuel | Fuel price index, 2016 = 100, log | IMF, PCPS |

| pricemetal | Metal price index, 2016 = 100, log | |

| pricecoal | Coal price index, 2016 = 100, log | |

| priceoil | Crude oil price index, 2016 = 100, log | |

| LGDP | Host economy GDP in current U.S., log | World Bank, WDI |

| LGDPP | Host economy GDP per capita in current U.S., log | |

| ln(Output) | Average output of industry c in year t, log | CIED |

| FIfuel | Fuel input as share of total intermediate inputs of industry c | Input-Output table of China, 2002 |

| FImetal | Metal input as share of total intermediate inputs of industry c | |

| FIcoal | Coal input as share of total intermediate inputs of industry c | |

| FIoil | Crude oil input as share of total intermediate inputs of industry c |

| Region | Economy |

|---|---|

| Africa | Algeria; Angola; Benin; Botswana; Burkina Faso; Burundi; Cabo Verde; Cameroon; Central African Republic; Chad; Comoros; Congo; Côte d'Ivoire; Djibouti; Egypt; Equatorial Guinea; Eritrea; Ethiopia; Gabon; Gambia; Ghana; Guinea; Guinea-Bissau; Japan; Kenya; Lesotho; Liberia; Libya; Madagascar; Malawi; Mali; Mauritania; Mauritius; Morocco; Mozambique; Niger; Nigeria; Rwanda; Senegal; Seychelles; Sierra Leone; South Africa; Sudan; Togo; Tunisia; Uganda; Tanzania; Zambia; Zimbabwe |

| North America | Canada; U. S.; Bermuda; |

| Latin America | Antigua and Barbuda; Argentina; Bahamas; Barbados; Belize; Bolivia; Brazil; Chile; Colombia; Costa Rica; Cuba; Dominica; Dominican Republic; Ecuador; El Salvador; Grenada; Guatemala; Honduras; Jamaica; Mexico; Nicaragua; Panama; Paraguay; Peru; Saint Lucia; Suriname; Trinidad and Tobago; Uruguay; Venezuela |

| Asia | Afghanistan; Armenia; Azerbaijan; Bahrain; Bangladesh; Brunei Darussalam; Cambodia |

| Hong Kong (SAR), China; Macao (SAR), China; Georgia; India; Indonesia; Iran; Iraq; Israel; Jordan; Kazakhstan; Kuwait; Kyrgyzstan; Laos; Lebanon; Malaysia; Maldives; Mongolia; Myanmar; Nepal; Oman; Pakistan; Philippines; Qatar; Republic of Korea; Saudi Arabia; Singapore; Sri Lanka; Syrian Arab Republic; Tajikistan; Thailand; Turkey; Turkmenistan; United Arab Emirates; Uzbekistan; Vietnam; Yemen | |

| Europe | Albania; Bosnia and Herzegovina; Belarus; Montenegro; Republic of Moldova; Russian Federation; Serbia; Ukraine; Austria; Belgium; Bulgaria; Croatia; Czechia; Cyprus; Denmark; Estonia; Finland; France; Germany; Greece; Hungary; Iceland; Ireland; Italy; Latvia; Lithuania; Luxembourg; Malta; Netherlands; Norway; Poland; Portugal; Slovakia; Slovenia; Spain; Sweden; Switzerland; U. K. |

| Oceania | Fiji; Papua New Guinea; Solomon Islands; Tonga; Vanuatu; Australia; New Zealand |

| Variable | H0 | Conclusion | p value |

|---|---|---|---|

| ln(OFDI) | Expected fuel price does not Granger cause China's OFDI | Reject | 0.005 |

| Fuel price | China's OFDI does not Granger cause expected fuel price | Cannot reject | 0.824 |

| ln(OFDI) | Expected metal price does not Granger cause China's OFDI | Reject | 0.001 |

| Metal price | China's OFDI does not Granger cause expected metal price | Cannot reject | 0.545 |

REFERENCES

- 1 For instance, in 2003, the share of mining sector was 18% (30.34% when excluding Hong Kong in 2008). When we restrict our focus to Asia, which is the largest recipient of China's OFDI, mining again is the sector with a substantial fraction of China's OFDI (see Table A1).

- 2 For detailed literature, please see the online Appendix to this paper.

- 3 For example, Jones (1965) generalizes this theorem by pointing out that endowment factor expanding rate determines the growth rate of the commodity that use the factor intensively. Ethier (1972) introduces nontraded final goods into the traditional 2 × 2 HOS setting. Suzuki (1985) works with a three-factor, two-good model and derives a supportive result for Rybczynski theorem. Recent studies have extended the Rybczynski framework by accommodating the assumption of different technology endowment (Fisher, 2011), vertical production chain (Ma, 2009) and mobile labor endowment (Dogan & Akay, 2016).

- 4 We do all regressions for the two measures, that is, the myopic measure with lagged price and the rational measure with AR(1) predicted component. The results are consistent. However, to save space we report the results based on the lagged measure only.

- 5 Fuels comprise the commodities in SITC Section 3 (mineral fuels, lubricants, and related materials). Ores and metals comprise the commodities in SITC sections 27 (crude fertilizer, minerals nes), 28 (metalliferous ores, scrap), and 68 (non-ferrous metals).

- 6 Fuel price index includes crude oil (petroleum), natural gas, coal price and propane indices. Metal price index includes iron ore, copper, lead, tin, zinc, aluminum, cobalt, molybdenum, nickel and uranium price indices. 2016 = 100.

- 7 According to UN Comtrade, fuel exports comprise commodities in SITC Section 3, metal exports comprise commodities in SITC 3 section 27, 28, and 68.

- 8 The detailed economy list can be found in Table A3.