Propelling steady growth and high-quality development through deeper reform and more comprehensive opening up: Outlook, policy simulations, and reform implementation—A summary of the Annual SUFE Macroeconomic Report (2021–2022)

Abstract

China's economy underwent a steady recovery in 2021. Investment grew steadily with structural improvement. Exports and imports surged while trade surplus expanded. On the other hand, although labor market conditions improved, income distribution worsened, contributing to sluggish growth in consumption, whereas the gap between consumer price index and producer price index widened, and the profits of enterprises of different sizes diverged, which may go beyond how they are correlated with the locations of the enterprises in the chain of production and trade. While proper liquidity was maintained with prudent monetary policy, risk spillover rose in the financial system, particularly for small and medium-sized banks. Household and local government debts remained at relatively high levels, further dragging down growth in consumption and infrastructure investment. The “dual carbon” goals exerted downward pressure on near-term growth in trading off their long-term benefits. The economy also faced challenges in its external environment in the midst of the prolonged COVID-19 pandemic aboard, trade protectionism, and the readjustment of the global value chain. Moreover, excessive supervision and inadequate implementation disturbed China's economy, resulting in declined market vitality and confidence of market participants. Based on the Institute for Advanced Research-China Macroeconomic Model, the baseline real gross domestic product growth rate is projected to be 5.5% in 2022. Alternative scenario analyses and policy simulations are conducted, in addition to the benchmark forecast, to reflect the influences of various risks and possible favorable situations. The findings suggest that China should deepen reform and open up more comprehensively and initiatively, while special effort should be placed on providing accommodative policy and friendly public opinion environment, to facilitate steady growth and propel high-quality development. A comprehensive macroeconomic governance framework with Chinese characteristics must be developed from systems thinking, to resolve the various issues, internal and external, cyclical and secular, structural and institutional, in an all-inclusive and coherent manner.

1 INTRODUCTION

China's economy continued on a recovery trajectory in 2021, with an expected gross domestic product (GDP) growth rate of 8.0%. Investment grew steadily with structural improvement; in particular, manufacturing investment improved structurally, with a higher growth rate in high-tech industries. Property market cooled down due to strict curbs. Exports and imports surged while trade surplus expanded, as China effectively contained the spread of COVID-19 within the nation. Although labor market recovered roughly back to its prepandemic conditions, consumption growth continued to be stagnant, due in large part to worsened income distribution. The gap between consumer price index (CPI) and producer price index (PPI) widened, and the profits of downstream and upstream enterprises diverged, in the face of risen production costs of the formers. The economy was also faced with challenges in the nation's external environment in the midst of the prolonged COVID-19 pandemic aboard, trade protectionism, and the readjustment of the global value chain.

There also still existed some challenges and structural headwinds that we had already emphasized in our previous reports (Huang et al., 2021, 2020, 2018; Huang & Tian, 2016; Huang et al., 2019, 2017), such as educational mismatch (e.g., over-education) in the labor market, declined purchasing power of middle-income groups, excessive household and local government debts, and systemic risks, especially those associated with the banking system. Moreover, we addressed some emerging issues, including those related to the “dual carbon” goals, “double reduction” policy, income distribution, and digital renminbi (RMB) and digital assets.

We have obtained the above assessments based on the Institute for Advanced Research-China Macroeconomic Model (IAR-CMM) developed by the Institute for Advanced Research at the Shanghai University of Finance and Economics, taking both cyclical and secular factors into consideration, and respecting various internal structural imbalances and external uncertainties. Taken together, our analyses provide a unified framework for addressing China's short-, medium-, and long-term issues in an internally coherent manner. Our baseline forecast indicates that China's economy will likely witness a real GDP growth rate of 5.5% in 2022. Alternative scenario analyses concerning various internal and external risks and uncertainties lend support to the robustness of our main conclusions.

In addition to providing our forecasts with the baseline and alternative scenarios, we have also conducted policy simulations under various scenarios to configure a menu of policy options that may help achieve the implicit targets for ensuring social stability. It should be emphasized that our results from these policy simulations should be evaluated and applied with caution in practice in light of their side effects, especially when examined from a long-run perspective.

This annual report also extends several special-topic analyses released in our previous quarterly and semiannual reports (IAR, SUFE, 2016, 2017, 2018, 2019, 2020, 2021). These extensions reflect our continued effort in updating frontier analyses on both existing and emerging issues of economic significance in China and worldwide.

As stressed in the 2021 Central Economic Work Conference, China's economy is faced with triple pressures, emanating from demand contraction, supply shocks, and weakening expectations. To tackle these problems to facilitate steady growth and propel high-quality development, China should deepen reform and open up more comprehensively and initiatively. We emphasize that particular attention should be paid to promoting a friendly public opinion environment and accommodative policies that should be conducive to market-oriented reforms.

2 MACROECONOMIC OUTLOOK AND MAJOR RISKS

2.1 Sluggish consumption amid the prolonged impacts of COVID-19

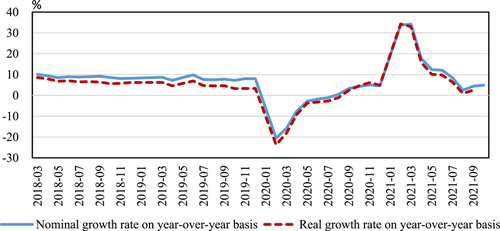

Due to the low-base effect, the year-over-year growth rate of total retail sales of consumer goods increased rapidly in the first half of 2021, and peaked at 34.2% in March (Figure 1). As the base effect subsided and retaliatory factors kicked in, consumption grew only modestly in the second half of the year. The year-over-year cumulative nominal growth rate over the first 10 months of 2021 registered 14.9%, and the annualized growth rate over the 2 years was only 4.0%. The sluggish consumption growth was mainly attributed to differentiation in labor market and growing income inequalities during the pandemic.

Among all categories, catering consumption was particularly sensitive to the epidemic. COVID-19 recurrences caused fluctuations in catering consumption. It soared to 91.6% in March, then fell rapidly. The lowest value was recorded in August due to an epidemic rebound. Since then, the epidemic situation had been relatively alleviated but outbreaks occurred sporadically, which triggered closures in some cities. Therefore, catering consumption had not improved significantly from September to October, with a year-over-year growth rate of 3.1% and 2.0%, respectively. From August to October, income inequalities put restrictions on daily necessities, with the yearly increases of −0.2%, 0.5%, and 3.5%, respectively. Among them, clothing consumption experienced a greater decline, with a year-over-year growth rate lower than that before the epidemic. Supply chain disruption had also led to a decline in consumption of related categories. For instance, the shortage of chips had led to a shortage of automobile supply, which was reflected in the decline of automobile sales. The decline deepened gradually, and the year-over-year growth rate in October had dropped to −11.5%. As for the housing market, slowing growth rate of housing prices and increasing bond default risks of real estate enterprises created a stagnant housing market, therefore, housing-related consumption, such as construction, decoration and furniture, experienced declines.

2.2 Investment increased steadily with fine performance in manufacturing

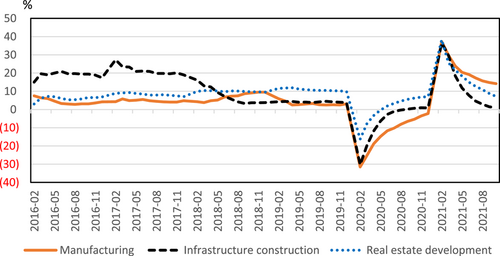

From January to October 2021, the national fixed asset investment was 44582.3 billion yuan, an increase of 6.1% compared to the corresponding period of 2020. The annualized growth rate (cumulative) over the recent 2 years was 3.8%, indicating that the overall investment growth was still weak. Investment in the primary, secondary, and tertiary sectors were 1164.6, 13,517.3, and 29,900.4 billion yuan, with year-over-year increase of 11.1%, 11.3%, and 3.7%, respectively. Investment in the eastern, central, western, and northeastern regions of China increased by 7.1%, 12.0%, 4.5%, and 6.8% year-over-year, respectively.

In the first 10 months of 2021, manufacturing investment increased by 14.2% on a year-over-year basis, 8.1 percentage points higher than that of the overall investment. It contributed 52.2% to the overall growth rate of investment, and was a main driving force. Moreover, the distribution of manufacturing investment was further optimized, with higher growth rates in high-tech industries. Investment in high-tech manufacturing industry increased by 23.5%, including 29.9% in computer and office equipment, 28.2% in medical equipment and instruments, 27.7% in aerospace equipment, and 25.5% in electronic and communication equipment. On the one hand, imported inflation drove up upstream costs in manufacturing, forcing the manufacturing to accelerate technological transformation and upgrading; on the other hand, industrial policies provided strong support for the investment of high-tech manufacturing, to deal with technology restrictions from abroad, enhance supply chain security, and ensure a smooth implementation of the “dual circulation” strategy.

The growth rate of infrastructure construction investment declined to 0.7% cumulatively in October, with an annualized growth rate of 1.9% over the past 2 years. The newly issued government bonds were less than expected, which caused the downward-sloping investment in infrastructure construction directly. The new special bonds of local governments only completed 75.3% of the annual quota through October, which was much slower than that in the past 2 years. Furthermore, the willingness of local government to invest was insufficient, due to the lack of high-quality projects and strict approval. The good news was that the National Development and Reform Commission proposed to include some children's service facilities projects into the support scope of special debt funds, and continued to promote mega projects such as new infrastructure, new urbanization, and low-carbon transportation system. Based on these good news and large subsequent budgets, the infrastructure construction investment is expected to pick up in the fourth quarter.

The real estate investment slowed down through October, due to the persistent gloomy fundamentals of real estate market. The real estate investment nationwide increased 8.8% on a cumulative year-over-year basis, and annualized to 6.8% in recent 2 years. The contraction of credit loans was the main reason. The prudential management of real estate finance had been over-implemented, resulting in a 10% decline in credit loans for real estate investment. In addition, shrinking sales also played a cooling role in real estate investment, with a cumulative increase of 7.3% year-over-year, an annualized growth of 3.6% in the recent 2 years. Although the excessively tight credit for real estate market had been gradually corrected, we expect that the property sector will only improve marginally in the coming months, and still be pessimistic in the long run, under the relative tight policies, the slowdown of urbanization expansion and the marginal decline of potential home buyers.

On the whole, manufacturing investment growth performed better, investment in infrastructure construction was still at a low growth rate, and growth in real estate investment fell continuously (Figure 2). There will still be many unstable and uncertain factors in China's economy in 2022, and the structural headwinds and imbalances will still exert great pressure on economic development. Therefore, counter-cyclical policies should still play a key stabilizing role in 2022, to boost domestic demand.

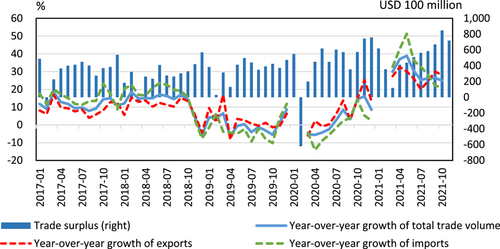

2.3 Strong exports and imports and expanded trade surplus

The effective containment of COVID-19 in China provided comparative advantage for Chinese goods, and both exports and imports experienced surges, while trade surplus expanded greatly. From January to November 2021, the total trade volume was USD 5471.2 billion, a year-over-year increase of 31.3%, and the trade surplus increased by USD 133.5 billion over the same period in 2020 (see Figure 3). Specifically, exports and imports reached to USD 3026.5 billion and USD 2444.7 billion, increased by 31.1% and 31.4%, respectively. Due to the appreciation of RMB against the US dollar, the growth rates of exports and imports denominated in RMB were lower than that denominated in US dollars. The trade volume of services had also maintained an upward trend over the first 10 months in 2021. According to the statistics of the State Administration of Foreign Exchange, the total service trade volume was USD 605.4 billion, a year-over-year increase of 21.0%. The COVID-19 pandemic had dealt a heavier blow to imports of services. Service exports increased by 41.0%, much higher than the 8.9% growth rate of service imports. Service trade deficits kept shrinking, fell by USD 49.1 billion over the same period of 2020.

Surged growth in exports and imports could be attributed to the following four factors. First, the sharp decline in 2020 (lower base) led directly to the higher growth in 2021. To remove the base effect, we calculated the annualized growth rates of exports and imports over the past 2 years, which was 15.7% and 13.8%, respectively. Second, the recovery in China's trade benefited from the economy recovery worldwide. According to the World Economic Outlook report released by International Monetary Fund in October 2021 (IMF, 2021), the global economy was projected to grow 5.9% in 2021, and it drove the growth of trade. Third, the rise in the prices of bulk commodities and industrial raw materials boosted nominal trade volume. The Reuters CRB commodity index increased 47.6% on November 30, 2021, compared with the same time in 2020. As a result, the average year-over-year growth rate of import prices reached 11.4% from January to October 2021. Fourth, the development of cross-border e-commerce had effectively alleviated the negative pandemic shock on trade. China's cross-border e-commerce exports reached 1.12 trillion yuan in 2020, a year-over-year growth of 40.1%, much higher than the total export growth rate of 3.63% in the same period. It had become an important engine of trade during the pandemic.

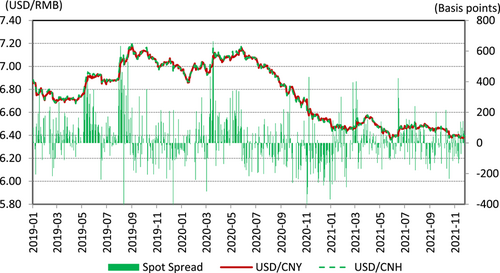

2.4 Steady foreign reserve and appreciated RMB exchange rates

In the first three quarters of 2021, foreign exchange reserves remained relatively steady around the level of USD 3.2 trillion, slightly higher than at the beginning of the year (Figure 4). It increased slightly in July, receded in September, and then rebounded slightly in October. The RMB exchange rate appreciated through fluctuations. At the beginning of 2021, the RMB/USD exchange rate continued an earlier strong appreciation trend, rising to 6.43 on February 10. Then, with the vaccination programs in major economies, such as Europe and the United States, went smoothly, the RMB depreciated to about 6.57 in early April. It reached to 6.37 on May 28 with the weakening of the US dollar in the second quarter. In the third quarter, it fluctuated around 6.50 from July to August, then gradually appreciated, breaking 6.40 in late October. The sustained recovery of the domestic economy, the uncertainty of the pandemic situation, and international military politics were main factors that supported the appreciation of RMB exchange rate. We predict that the RMB/USD exchange rate will fluctuate within a wide range, with an averaged value of 6.4 in 2022. It may appreciate slightly if the pandemic is effectively curbed at home and abroad, and the Sino-U.S. relations find a way out of the stalemate. It may fall to about 6.8 in case of black swan events, such as a worse pandemic situation, an escalation of Sino-US trade war.

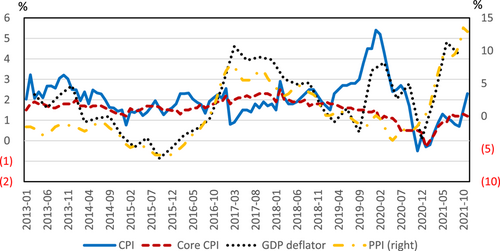

2.5 Widened gap between CPI and PPI

Prices rose in 2021 across the board but by different extents. CPI increased modestly while PPI increased sharply, resulting in a widened gap between the two price indices (see Figure 5). The normalized prevention and effective control of the COVID-19 epidemic created advantages for economic recovery. CPI went up modestly in the first 11 months of 2021, a 0.9% increase and 1.8 percentage points lower compared with the same period in 2020. Food prices decreased by 1.4% on average, driving CPI down by 0.28 percentage points. PPI surged over the first 11 months of 2021, with a cumulative year-over-year growth rate of 7.9%. Surges in prices of production means (caused by the sharp rise of international commodity prices) dominated the PPI, pushing up PPI by 7.7 percentage points. The cumulative year-over-year growth rate of the GDP deflator in the first three quarters of 2021 was about 4.2%, 0.7 percentage points higher than that in the same period in 2020.

The enlarged gap between CPI and PPI brought with it a divergence in profits of enterprises of different sizes, which may go beyond how they are correlated with the locations of the enterprises in the chain of production and trade. Statistics released by NBS indicated that, in the first 10 months, the total profits of industrial enterprises increased by 42.2% cumulatively, of which the total profits of large and medium-sized industrial enterprises increased by 49.8%, while those of other small industrial enterprises increased by only about 27%. Close attention should be paid to the above divergence. Given the base effect, recurrences of the COVID-19 epidemic, and fluctuations of commodity prices, we predict that in 2022, CPI will keep increasing, PPI will peak and then fall back, and GDP deflator will decrease as well.

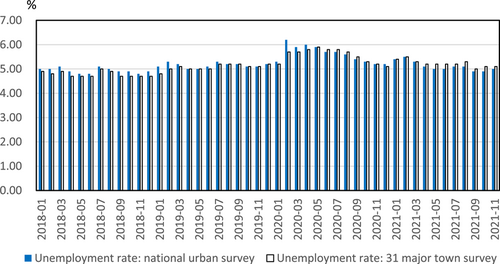

2.6 Labor market recovered well but still faced structural problems

Labor market recovered roughly to its prepandemic conditions. The unemployment rate decreased gradually, from 5.5% in February to 4.9% in October (Figure 6). The number of newly created jobs increased significantly to 11.33 million, which was only slightly lower than that in 2019 and beat the annual target of 11 million in 2021. Demand and job seekers changed similarly in the first three quarters, leading to the jobs-to-applicants ratio kept at a high level steadily. The jobs-to-applicants ratio reached 1.53 in the third quarter, but needed structural adjustments. For instance, there existed a large demand gap for technicians. In the third quarter, the jobs-to-applicants ratio of senior technicians, technicians, and senior skilled workers were 3.05, 2.7, and 2.51, respectively. Furthermore, the annualized growth rate in the income of rural migrant workers and the per capita disposable income of residents over the 2 years had also returned to the prepandemic range.

According to the seventh census carried out in 2020, China's population with university education was 218.36 million, and the average years of education for people over age 15 increased from 7.11 in 2000 to 9.91 in 2020, yet still lower than those in developed countries.1 In addition, with the expansion of higher education and the saturation of the employment market, over-education had become an increasingly important issue in China's labor market. We calculated that the over-education rate had remained above 30% in China's labor market for most of the time since 2005, with the education–occupation match rate below 50%. Over-education created a punitive effect on their income, and the efficiency of labor allocation needs to be improved urgently. Furthermore, the enlarged income inequality caused by education had greatly raised the education demand in China, which strengthened the “anxiety” of parents about their children's education and aggravated the burden of students in the stage of compulsory education. In this regard, China issued guidelines (“double reduction” policy) in July 2021 to ease burdens on young students. However, we think the government can go further in solving problems related to education anxiety, such as prolonging the period of compulsory education, promoting the reform of the education system and the college entrance exam, integrating and reallocating on- and off-campus resources to help achieve education equity.

2.7 Income inequality continued to be a major challenge

The degree of China's income inequality is severe, with inequality in labor income being a most important contributing factor. The Gini coefficient has been higher than 0.45 for a long time, ranked 72nd and 78th in 2000 and 2015, respectively, and far behind those in most European, American and Asian countries. The proportion of labor remuneration is relatively low, and its improvement may effectively reduce income inequality. Besides, redistribution is also conducive to reduction in income inequality. China has not formulated the tax regulations on inheritance gift and property holding, and property tax coverage is also far from enough. Overall, both primary distribution and redistribution can play large roles in shaping income inequality; hence tax reform can be improved from two perspectives: improving the share of labor remuneration and perfecting the tax redistribution system. From world experiences, the effect of the third distribution on income inequality may be limited, thus needs to be treated with caution.

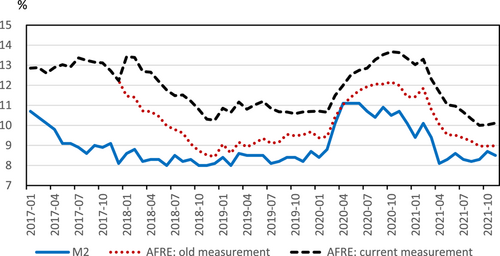

2.8 Monetary policy returned to normal and maintained proper liquidity

Monetary policy was gradually normalized in 2021 to the prepandemic level. Specifically, the M2 measure of money supply increased by 8.5% in the first 11 months, 2.2 percentage points lower than that in 2020 (Figure 7). Accordingly, M1 and M0 increased by 3% and 7%, with a decline of 7 and 3.1 percentage points, respectively. Compared with M2 and M0, the deeper decline in M1 came from the downward slide of current deposit, which reflected the decline in business vitality. The growth rate of the stock of AFRE2 registered 10.11%,3 decreased by 3.49 percentage points compared to year 2020. As of the first three quarters, the weighted average interest rate of all loans was 5.0%, decreased by 0.12 percentage points on a year-over-year basis. Among them, the weighted average interest rates of ordinary loans, mortgage loans, and negotiable instruments were 5.3%, 5.54%, and 2.65%, respectively. Financing costs of real economic activities declined slightly except for mortgage loans.

In the first 11 months of 2021, the balance of standing lending facility decreased by 8.067 billion yuan, while the balance of medium-term lending facility increased by 200 billion yuan, compared with the same period of 2020. In total, the open market operations pumped out about 600 billion yuan from the market. In terms of liquidity injection, the People' Bank of China (PBC) lowered the deposit reserve ratio by 0.5 percentage points on July 15, releasing about 1 trillion yuan of long-term liquidity, followed by another 0.5 percentage point reduction on December 15. Overall, the liquidity remained generally stable in 2021. Given the potential business risks and the “dual carbon” goals, we predict that in year 2022 PBC is likely to lower the reserve requirement ratio again with a possibility of lowering interest rate as well.

2.9 Vigilance needed on household and local government debts

Household debt has always been an important issue in our reports, of which the mortgage loan is the focus. Although the property market in the first quarter of 2021 continued the boom started in the previous year, it cooled down dramatically under the restrictive policies and supervisions. Mortgage loans went on a slightly downward trajectory in 2021. With credit policy loosening marginally in October, it was expected that there would be a slight rebound of the household debt in 2022. In the first three quarters, households' new short-term loans increased by only 4.4% compared with that during the same period of 2019, reflecting the fact that consumption demand was still weak. It can be also inferred that labor market may be sluggish though seemed to have recovered.

In spite of the slowdown in total household debt, its growth rate was still higher than 10%, hence we predict that the leverage of household sector would continue to rise in the coming months. We further evaluated the effect of property tax based on a dynamic structural model. Results showed that the property tax would indeed curb the speculation in housing market, at the expense of inducing short-term fluctuations.

By November 2021, the total amount of local government bonds issued was 7.18 trillion yuan, an increase of 14.7% on a year-over-year basis. There existed great differences in debt structure and scale among provinces, with the highest debt ratio (more than 80%) in Qinghai, Guizhou, and Tianjin, and the lowest (below 30%) in Henan, Shanghai, and Guangdong. From 2021 to 2026, the amount of maturing debt will exceed 2.5 trillion yuan every year, which means high repayment pressure for the local government as well as high default risk. Considering that about 80% of the local government debt was held by commercial banks, we examined how the debt expansion of local government can affect the maturity mismatch of bank assets and liabilities. Results indicated that debt expansion of local government aggravated the maturity mismatch of commercial banks, with non-state-owned commercial banks suffered more. Furthermore, there also existed a close relationship between the expansion of local government debt and income inequality. The larger the scale of local government debt, the higher the degree of income inequality between urban and rural areas.

2.10 Systemic risks

By the end of the third quarter of 2021, the macroleverage ratio4 of China was 264.8%, most of which was concentrated in the nonfinancial sector with a relatively high leverage ratio of 157.2%. Furthermore, the risen default risk of private- and state-owned enterprises injected undeniable shock into the bond market and the banking system, due to the downward pressure on the economy in 2021. Hence, it is critical to identify the potential risk. We tested the potential default risk of enterprises and the related financial stability based on a conditional value at risk model. The results indicated that the stability of China's banking system got weaker in the second half of 2021 than that in the first half. It was worth noting that the risk spillover of urban and rural commercial banks of relatively small scale had shown a continued upward trend since the middle of 2020. More importantly, the systemic importance of urban and rural commercial banks has been at its highest level in the past 4 years. This calls for vigilance, because: difficulties faced by private enterprises in 2021 had led to the rise of default risk again, increasing the risk of the financial system. In addition, banks' risk exposure had further expanded due to the intensified supportive policies for small- and medium-sized enterprises in 2021. Hence, the financial sector will be confronted with sharp increase in systemic risk when commercial banks encounter severe risks.

2.11 Challenges and opportunities in achieving the “dual carbon” goals

To meet the challenges posed by climate change and environmental pollution, China announced the “dual carbon” goals in September 2020, which committed that China's carbon dioxide (CO2) emissions will reach a peak by 2030 and carbon neutrality will be achieved by 2060. As a developing country, China is still in the process of industrialization, and its demand for primary energy consumption and carbon emissions is still on the rise. In contrast, developed countries are already in the postindustrialization era, with economic growth decoupled from energy consumption. It takes 71 and 43 years for EU and United States to go from carbon peak to carbon neutralization, respectively, while the transition period as outlined for China is only 30 years. Compared with developed countries, China has both a tighter time frame and a heavier task in achieving the “dual carbon” goals. Moreover, it is difficult to change the energy consumption structure that is dominated by coal in such a short period, hence the striving for “dual carbon” goals will inevitably pose a threat on economy growth in the near term. Specifically, it will drive up production cost by costly energy consumption and huge investment in environmental protection facilities. The industrial sector will suffer more due to its high energy intensity. From a regional perspective, provinces with an abundance of fossil fuel will also bear more pains due to their abundance of fossil fuel. We examined the effect of the air pollution prevention and control action implemented from 2014 to 2017. Results showed that, on average, a 1% decrease in emissions per unit GDP caused about a 0.02% decrease in GDP growth.

In spite of the above challenges, the dual carbon goals will bring opportunities in the long run. First, they are conducive to promoting the transformation and upgrading of industrial structure and accelerating the development of green and clean energy. We estimated that the carbon emission pilot policy started in 2013 caused an increase of about 5% in the investment of new energy in the pilot area. Second, strict regulation on carbon emission will cause asset shrinkage of banks whose positions are dominated by carbon-intensive industries. Carattini et al. (2021) indicated that it was necessary to combine climate change policy with macroprudential policy, to confront related transition risks. In practice, the PBC lowed the interest rate of carbon reduction loans to 1.75% in November 2021, and the issuance scale of green bonds had also reached a high growth rate in the first three quarters of 2021.

2.12 Digital RMB and digital assets

The digital currency/electronic payment (DC/EP) system had been put into test, with a joint effort by PBC and commercial banks. The digital fiat currency (e-CNY) had been piloted in several regions. On July 16, 2021, PBC released a white paper entitled “Progress of Research & Development of E-CNY in China,” which detailed the background, objectives and visions, design framework, and policy considerations of the e-CNY system (Working Group on E-CNY Research and Development of the People's Bank of China, 2021). It was the first time that China disclosed the research and development of e-CNY, and clarified some basic properties of e-CNY, such as noninterest accrual, and managed anonymity. DC had been deemed as a new track of currency competition, and major economies around the world had accelerated the research, development, and discussion of DC. In February 2021, the Hong Kong Monetary Authority, the Bank of Thailand, the Central Bank of the United Arab Emirates and the Digital Currency Institute of the PBC jointly launched an “mBridge” project. It aimed to build a real-time cross-border payment system that can span over different systems of DC.

In terms of digital assets, the first bitcoin futures ETF (with the ticker name of BITO) in the United States had been approved by the SEC. The compliance of cryptocurrency as a kind of financial instruments was recognized, and it was an important milestone in the history of bitcoin. BITO made bitcoin accessible to a wider range of investors, and would gradually become an important investment choice available to ordinary investors. In contrast, the development of digital assets in China is restrained. Domestic investors are not encouraged to participate in activities related to DC and digital assets. Research on block chain technology and cryptocurrency is mostly concentrated in public sectors.

2.13 Global economy recovered slowly with significant uncertainties

The global economy recovered slowly in 2021 after experiencing a deep recession in 2020. According to IMF (2021), the global economy was expected to grow by 5.9% in 2021. Among which, the Asia-Pacific region still occupied a leading position with an increase of 7.2%, the emerging markets followed with 6.4%, then were the developed countries with an increase of 5.4%. The ongoing COVID-19 pandemic was still the biggest threat. We predicted that vaccination is not enough to resist the spread of the latest virus variants in densely populated regions. The Delta variant had become the predominant strain of the virus in many countries, and the recent outbreak of Omicron variant in South Africa had also attracted much attention. At the moment, many economies around the world are planning to open their doors and promote the normalization of international exchanges and trade, to help speed up their economic recoveries. However, premature opening may also nurture continual variations of the virus and increase the probability of bypassing the immune barrier of the virus.

To alleviate heavy reliance on outside suppliers, western countries have a strong motivation to seek self-construction or expansion of their own production capacity. But reshoring still faces some obstacles and will make tardy progress. The His Markit purchasing manager index showed that the production situation of various countries was not optimistic. The expectation of high inflation brought by the loose monetary policy in Western economies was unfavorable for attracting the return of manufacturing, and the Fed's attitude towards raising interest rates remained unchanged in the near term. Therefore, it may be too early for the current pattern of the global supply chain to change dramatically, and China is still a driving force behind the global trade.

3 NEAR TO MEDIUM TERM FORECASTS AND POLICY SIMULATIONS

- (1)

Global recovery assumptions for major developed economies are taken from IMF (2021). Economic growth in 2022 are projected to be 5.2% for United States, 4.3% for Eurozone, 3.2% for Japan, and 5.8% for the five countries of Association of Southeast Asian Nations5;

- (2)

Based on the directives released from the US FOMC meeting in September 2021, the market expects the Fed to complete the reduction of its bond purchase by mid-2022, and to hike interest rate before year end;

- (3)

The RMB exchange rate against USD is expected to fluctuate around 6.4 within a reasonable band in 2022;

- (4)

Trade tensions between United States and China will continue to exist in 2022.

| 2021 | 2021 | 2021 | 2021 | 2021 | 2022 | 2022 | 2022 | 2022 | 2022 | |

|---|---|---|---|---|---|---|---|---|---|---|

| Q1 | Q2 | Q3 | Q4 | Q1 | Q2 | Q3 | Q4 | |||

| GDP | 18.3 | 7.9 | 4.9 | 4.4 | 8.0 | 5.0 | 5.4 | 5.6 | 5.3 | 5.5 |

| Investment | 25.6 | 12.6 | 7.3 | 5.5 | 5.5 | 6.0 | 5.5 | 5.1 | 5.1 | 5.1 |

| Consumption | 33.9 | 13.9 | 5.0 | 4.7 | 12.5 | 5.9 | 6.4 | 6.9 | 6.7 | 6.5 |

| Exportb | 48.8 | 30.7 | 24.4 | 25.7 | 29.3 | 9.7 | 12.5 | 14.8 | 8.3 | 11.3 |

| Import | 29.3 | 44.0 | 25.9 | 24.5 | 29.8 | 10.8 | 15.7 | 15.7 | 4.9 | 11.8 |

| CPI | −0.03 | 1.1 | 0.8 | 1.9 | 0.9 | 1.0 | 1.5 | 2.0 | 2.5 | 1.8 |

| PPI | 2.1 | 8.2 | 9.7 | 13.1 | 8.3 | 7.7 | 3.2 | 3.6 | 1.0 | 3.9 |

| GDP deflator | 2.1 | 4.8 | 4.2 | 9.4 | 5.1 | 4.2 | 2.9 | 3.4 | 2.3 | 3.2 |

- Abbreviations: CPI, consumer price index; GDP, gross domestic product; PPI, producer price index.

- a The statistics reported in the table are based on real measure for GDP but nominal measures for the other variables. Yearly growth rate is cumulative for investment but noncumulative for the other variables.

- b The import and export statistics here are all measured in USD and are comparable to those reported by the customs.

- Source: IAR, SUFE (2021).

- (1)

COVID-19 epidemic will unfold following the trajectory since 2021:Q3, with only sporadic infections.

- (2)

Household leverage ratio increases continually, and exerts a negative impact on consumption growth. It is expected to rise by 3 percentage points, returning to the pre-pandemic level, under the influence of slowdown in GDP growth and loosening of property curbs.

- (3)

Investment in infrastructure construction and manufacturing picks up, and investment in real estate bears downward pressure.

- (4)

According to the data released by the China Banking and Insurance Regulatory Commission, as of the end of 2021:Q3, the nonperforming loan ratio of commercial banks is 1.75%. We assume that by the end of 2021, this ratio will rise to 1.81%.

- (5)

Fiscal policy is expected to remain stimulative, with the deficit rate contracted to 3%.

- (6)

Monetary policy is expected to remain prudent, flexible, and appropriate in 2022. We postulate the most likely monetary policy stance in 2022 to be a combination of two 25-basis point reductions in the required reserve ratio (RRR) and a 10-basis point reduction in the benchmark interest rate.

- (7)

During the 14th Five Year Plan period, the carbon emission intensity (carbon emission per unit of GDP) decreases by 18%, an annual decrease of 4%.

The take-home from our baseline forecast, as can be seen from Table 1, is that the economic growth rate shows the trend of continual recovery. The annual real GDP growth rate of 2021 is expected to be 8.0%, and that of 2022 is expected to be 5.5% due to a low-base effect.

In light of the uncertainty surrounding the economic outlook, we have considered alternative scenarios to explore the implications for the outlook of alternative forecast assumptions. Specifically, we have studied alternative scenarios to accommodate for the various internal and external economic factors. Dividing them into six groups, with each highlighting a particular risk or beneficial factor, we report below the major assumptions and results for each of the alternative scenarios.

Scenario 1 pertains to the stricter implementation of the “dual carbon” goals. Compared with the baseline assumption that the carbon emission will decrease by 4% in 2022, this scenario assumes a greater emission reduction of 6%. The greater reduction in carbon emission will cause both the growth rates of consumption and investment decline by 0.1%, the exports and imports decline by 0.1% and 0.3%, respectively. At the same time, CPI and PPI fall by 0.1% and 0.2% on a year-over-year basis. All these together drag down GDP by 0.1% compared with that in the baseline scenario.

Scenario 2 takes on a pessimistic outlook on the default risk of private-owned enterprises. It is estimated that a 1% increase in the default risk of private-owned enterprises causes an increase in the credit spread, as well as liquidity crisis for large enterprises, leading to a 0.48% decline in the private investment. It is expected that the investment, consumption, exports and imports decline by 0.5%, 0.1%, 0.2%, and 0.3%, respectively. The CPI and PPI also decreased by 0.1% and 0.3% on a year-over-year basis. Overall, the annual real GDP growth rate will be 0.3% lower than that in the baseline scenario.

Scenario 3 considers an acceleration in implementing property tax. In this scenario, it is estimated that the property tax will lower the consumption by 2% in the near run, although benefit it in the long run. It will also cause the investment and imports to decline by 0.5% and 0.7%, respectively, and exports to rise by 0.5%. The CPI and PPI are also to decrease by 0.5% and 0.2% on a year-over-year basis. Overall, the annual real GDP growth rate will be 1% lower than that in the baseline scenario.

Scenario 4 considers a more optimistic outlook on the epidemic prevention and control policies. In this scenario, the prevention and control of the domestic epidemic is more targeted, thus avoiding large-scale shutdown and closures and minimizing the impact of sporadic infections on economic activities. This would lead investment, consumption, exports, and imports to increase by 0.2%, 0.5%, 0.3%, and 0.1%, respectively, relative to the baseline. The CPI and PPI are to increase by 0.3% and 0.2% on a year-over-year basis, respectively. Overall, the annual real GDP growth rate will be 0.3% higher than that in the baseline scenario.

Scenario 5 considers a more optimistic outlook on market-based competitiveness in the economy. In this scenario, an optimal capital supervision policy is implemented and effective competition is achieved. This would lead income gap to decrease by 0.02 units and consumption growth to increase by 0.8%. Investment, exports, and imports will also see a rise in their growth rates, each by 0.1%, and CPI will rise by 0.2%, on a year-over-year basis. Overall, the annual real GDP growth rate will be 0.4% higher than that in the baseline scenario.

Scenario 6 takes a more optimistic outlook on policy adjustments and reform. In December 2021, the Central Economic Work Conference highlighted the timing, extent, and efficiency of policy adjustments and reform to ensure their steady advancement. This scenario assumes a stable and predictable market environment for market players, especially for micro, small, and medium-sized enterprises, and self-employed workers. The improved market environment will boost investment confidence, employment, household income, and consumption, so as to promote economic growth. The result is that investment, consumption, exports and imports will increase by 0.7%, 0.5%, 0.1%, and 0.3%, respectively. CPI and PPI will increase by 0.3% and 0.4% on a year-over-year basis. Overall, the annual real GDP growth rate will be 0.6% higher than that in the baseline scenario.

- (1)

Baseline: Fiscal deficit needs to be increased by 421.71 billion yuan, exceeding the budget deficit by 12.3%. The annual deficit rate is about 3.4%, and the proportion of deficit in fiscal space is 10.5%. In addition, the PBC needs to deliver another 50 basis point cut in the RRR.

- (2)

Scenario I: Government spending needs to be increased by 506.05 billion yuan, amounting to a 14.7% increase in budget deficit relative to the baseline. The annual deficit rate is about 3.4%, and the proportion of deficit in fiscal space is 10.8%. In addition, the PBC needs to lower the RRR by 50 basis points compared with the baseline.

- (3)

Scenario II: Fiscal deficit needs to be increased by 674.73 billion yuan, exceeding the baseline deficit by 19.6%. The annual deficit rate is about 3.6%, and the proportion of deficit in fiscal space is 11.2%. Moreover, the PBC needs to cut the RRR twice, 50 basis points each, compared with the baseline.

- (4)

Scenario III: Fiscal deficit needs to be increased by 1265.13 billion yuan, 36.8% higher than the baseline deficit. The annual deficit rate is about 4.1%, and the proportion of deficit in fiscal space is 12.8%. Furthermore, the PBC needs to cut the RRR four times, 50 basis points each, compared with the baseline. However, we do not recommend such a radical step due to its great distortion and side effects on the long-term development of economy.

- (5)

Scenario IV: Fiscal deficit needs to be increased by 168.68 billion yuan, 4.9% higher than the baseline deficit. The annual deficit rate is about 3.2%, and the proportion of deficit in fiscal space is 9.8%.

- (6)

Scenario V: Fiscal deficit needs to be increased by 84.34 billion yuan, 2.5% higher than the baseline deficit. The annual deficit rate is about 3.1%, and the proportion of deficit in fiscal space is 9.6%.

| Baseline | Scenarios | ||||||

|---|---|---|---|---|---|---|---|

| I | II | III | IV | V | VI | ||

| Yearly growth rate | 5.5 | 5.4 | 5.2 | 4.5 | 5.8 | 5.9 | 6.1 |

| Monetary policy easing | 50 BP reduction in RRR | 50 BP reduction in RRR | 50 BP reduction in RRR, twice | 50 BP reduction in RRR, four times | – | – | – |

| Fiscal deficit expansion (billion yuan) | 421.71 | 506.05 | 674.73 | 1265.13 | 168.68 | 843.4 | – |

| Fiscal deficit expansion rate | 12.3 | 14.7 | 19.6 | 36.8 | 4.9 | 2.5 | – |

| Deficit ratio | 3.4% | 3.4% | 3.6% | 4.1% | 3.2% | 3.1% | 3% |

| Proportion of deficit in fiscal space | 10.5 | 10.8 | 11.2 | 12.8 | 9.8 | 9.6 | 9.4 |

We want to stress that our alternative scenario analyses and policy simulations should not be viewed as suggesting or recommending certain monetary and fiscal stimuli for the government to implement to meet the implicit targets. Rather, we urge that these kinds of stimulus packages should be used with caution in light of their side effects, especially from a long-run perspective.

4 PROPELLING HIGH-QUALITY ECONOMIC DEVELOPMENT

The Central Economic Work Conference held on December 8–10, 2021, summarized the economic work in 2021, analyzed the current economic situation and deployed the economic tasks in 2022. The conference stressed that China's economy was faced with triple pressures, emanating from demand contraction, supply shocks, and weakening expectations. It emphasized again the central position of economic construction, stressed the timing, extent and efficiency of policy adjustments and reform, and highlighted the importance of coordination and systems thinking. It laid down the general strategy of seeking progress while maintaining stability in 2022, emphasized “six stabilities,”6 “six guarantees,”7 and an innovation-driven approach. It concluded that China will pursue steady growth and high-quality development by deepening reform and opening-up more comprehensively and initiatively.

The triple pressures on China's economy and the complexity of the external environment lead to complexity and uncertainty in China's economy. At the same time, the economy has seen both excessive supervision and inadequate implementation, which lead to a decline in market vitality and expectations, and even more seriously, doubt on market-oriented reform. To overcome these problems, China should deepen reform and open up more comprehensively, promote accommodative policies and create a more friendly public opinion environment that are conducive to market-oriented reform and private enterprises. It also needs to develop a comprehensive macroeconomic governance framework with Chinese characteristics based on systems thinking, to help resolve various issues, cyclical and secular, structural and institutional, internal and external, in a comprehensively coherent manner.

- (1)

Innovation-driven development. China is in the transition from factor driven to efficiency driven and innovation driven, and there are still too many government administrative interventions, which impose restrictions on the allocation of innovation resources.

- (2)

Coordinated development. There remains much room for improvement in economic structures, urban and rural, regional and industrial, income and wealth, to help achieve a high-quality, balanced development.

- (3)

Green development. China's energy consumption per unit of GDP is almost 1.5 times that of the world average. Strict measures should be taken to deal with environmental pollution in some regions and industries.

- (4)

Opening up initiatively. China needs to open up initiatively, through participating in free trade agreements with higher standards and higher-level. It is also conducive to deepening reform.

- (5)

Common prosperity. To ensure a thriving and vibrant middle class, China should ensure fair starting point and fair opportunity, so as to avoid social class solidification.

It is still needed to clarify the dialectical relationship between reform and development, stability and innovation, as well as the relationship between government and market, and between government and society. To cope with the downward pressure in the near term, China should maintain a relatively accommodative policy environment. To pursue high-quality development in the medium and long term, China should rely on deepening structural and institutional reforms, which are the most effective countermeasures for dealing with the weakening expectations.

5 CONCLUSION

After experiencing the recession caused by the COVID-19 pandemic in 2020, China's economy began to recover slowly in 2021. The economic structure had been improved further, with the transformation and upgrading in manufacturing investment, as well as the cooling down of the excessively prosperous property market. In the meantime, year 2021 saw continued challenges, including worsened income inequality, sluggish consumption growth, risen default risk of small and medium-sized enterprises. As emphasized in the Central Economic Work Conference, China should prioritize economic stability while pursuing progress. To help achieve this goal, China should deepen market-oriented reform and open up more comprehensively and initiatively, and develop a comprehensive and coherent macroeconomic governance framework with Chinese characteristics based on systems thinking. This annual report highlights major features and risks in the near term and structural headwinds in the medium and long term, and discusses various measures that compromise short-, medium-, and long-term matters for accomplishing these tasks.

AUTHOR CONTRIBUTIONS

Kevin X. D. Huang: Conceptualization, project administration, writing – original draft, writing – review and editing. Guoqiang Tian: Conceptualization, project administration, writing – original draft, writing – review and editing. Lin Zhao: Data curation, writing – original draft.

CONFLICTS OF INTEREST

Lin Zhao declares that there is no conflicts of interest. Guoqiang Tian and Kevin X. D. Huang are editors and coeditor of the International Studies of Economics. To minimize bias, they were excluded from all editorial decision-making related to the acceptance of this article for publication.

ETHICS STATEMENT

There is no ethics statement for this study.

REFERENCES

- 1 Take Organisation for Economic Cooperation and Development (OECD) countries for example, the per capita education in some OECD countries had been more than 12 years since 2010.

- 2 Aggregate Financing to the Real Economy (AFRE) is the outstanding of financing provided by the financial system to the real economy at the end of a period. Before July 2018, AFRE included RMB loans, foreign currency-denominated loans (RMB equivalent), entrusted loans, trust loans, undiscounted bankers' acceptances, net financing of corporate bonds, and equity financing on the domestic stock market by nonfinancial enterprises. Since July 2018, The People's Bank of China (PBC) has improved the statistical method for AFRE, and incorporated in it “Asset-backed Securities of Depository Financial Institutions” and “Loans Written off,” which are summarized into a subitem of “Other Financing.” Since September 2018, the PBC has incorporated “Local government special bonds” into AFRE, which is recorded when claims and obligations are registered at depositories.

- 3 The year-over-year growth rate of AFRE is 13.6% by the current measurement in 2020, while it is only 12% in the old measurement.

- 4 We calculated the macroleverage ratio using data from the Center for National Balance Sheet.

- 5 The five countries are Malaysia, Indonesia, Thailand, Philippines, and Vietnam.

- 6 It refers to stability in employment, the financial sector, foreign trade, foreign investment, domestic investment, and expectations.

- 7 The six areas refer to job security, basic living needs, operations of market entities, food and energy security, stable industrial and supply chains, and the normal functioning of primary-level governments.