Static and dynamic RCA analysis of India and China in world economy

Abstract

This study is an attempt to examine similarities and differences in the patterns of revealed comparative advantage (RCA) of India and China in the global market at different levels of classification. The study analyses whether RCAs of these economies have undergone any structural shift/change or whether the pattern of specialization in these economies is competitive or complementary in the world market. The study reveals that India holds a comparative advantage in 9 out of 16 product groups of Harmonized System (HS) classification, 41 out of 97 HS chapters at HS 2-digit level, and 2377 out of 4163 traded commodities at HS 6-digit level, while China holds a comparative advantage in 6 out of 16 HS product groups, 45 out of 97 HS chapters at HS 2-digit level, and 2075 out of 4381 traded commodities at HS 6-digit level in 2018. Major findings suggest that both the countries have been performing well and broadly maintained their comparative advantage, especially since 2000. A comparative analysis of India and China reveals a small structural change in RCA over time in both economies at disaggregated levels. The study highlights that India and China neither have a competitive nor a complementary relationship in the global market. These findings reflect a scope of independent expansion of the economies of both India and China, without hurting mutual interest in the global market. It may be inferred from the results that mutual cooperation will enhance the competitiveness of both economies and contributes to global economic progress.

1 INTRODUCTION

The economic growth in India and China is one of the most remarkable stories in recent economic global discourse. Both economies have emerged as important economic players, playing an influential role in policy space and economic mass in the contemporary global economy. Economic progress or recession in both or either of these economies arouses global perspectives/concerns. Undoubtedly, there is a substantial gap in the economic size of India and China, but the growth rate and the potential of economic growth show some similarities despite the fundamental differences in their economic and political governance. There are questions regarding India and China whether they are competitive or cooperative with each other in the world economy, and whether there are possibilities to maximize their economic potential in the world economy without hurting mutual interests.

China began to open up its economy through a gradual process of economic liberalization in 1978, while India started the process in 1991. A gradual opening of the economy and withdrawal of trade barriers were the natural offshoots of the policy options hitherto chosen. With the withering away of “protectionist” policies, the trade pattern of India and China is likely to march in the direction of their comparative advantage. It has also been observed that since the economic reforms were undertaken by these two economies, both have recorded high gross domestic product (GDP) growth. The trade between India and China has also gained momentum since India's new economic policy of 1991 and accelerated further after China acceded to the World Trade Organization (WTO). Kowalski (2010) argues that China and India's growth performance and trade received a boost after their integration with the world economy.

In a free and fair market, the comparative advantage that economies offer determines their market share in international trade in the world market. The concept of comparative advantage is widely used in economic literature to evaluate the pattern of trade and specialization of countries in commodities that have a competitive edge. However, it is difficult to capture a theoretical concept of comparative advantage in its true sense as it is difficult to get comprehensive data on factor costs. As an approximation of comparative advantage, the most widely accepted indirect approach is the revealed comparative advantage (RCA) index, which reveals the comparative advantage of a nation from the traded data. While Ricardo laid down the basic tenets of comparative advantage, Balassa (1965) developed the concept of RCA.

Given the significant role of trade in the growth of both India and China, it is important to conduct an RCA analysis of these two countries. A static and dynamic RCA analysis of India–China in the world economy has been undertaken to answer questions whether they are competitive or cooperative with each other in the world economy, and whether there are possibilities to maximize their economic potential in the world economy without hurting mutual interests. The study examines RCAs for India and China at three levels of grouping, namely, Harmonized System (HS) Standard Product Groupings, HS 2-digit level of classification, and HS 6-digit level of classification as a whole for the years 2000, 2010, and 2018. The summary statistics of the RCA analysis indicate that both India and China have a comparative advantage in various product groups/sectors/commodities in the world market; although these products were not fixed, the level of comparative advantage varies in the categories of strong, moderate, and weak comparative advantage. The study also reveals that there are product groups where RCA values have not shown any significant change over the period of time while losing comparative advantage in a few others. A comparative analysis of India and China reveals that there are 726 products (17.44%) at the HS 6-digit level of classification where the RCA of India and China is greater than 1, revealing the scope of market access for both countries. There are 645 products (15.5%) at the HS 6-digit level of classification where India's RCA is greater than 1, while China's RCA is less than 1, implying that India has a comparative advantage over China in the global market in these products. The study also reveals that there are 1251 products (30%) where India's RCA is less than 1, while China's RCA is greater than 1, implying that China has a comparative advantage over India in the global market in these products. The study points out that the diversity of the export basket of China is higher than that of India. At the same time, there are 1541 product (37%) commodities where the RCA of both India and China are less than 1, signifying untapped potential in traded commodities for both countries. Looking at the changing dynamics and global competition, the penetration of India and China in the global market has increased substantially on their individual strength in the direction of their comparative advantage without hurting the interest of each other.

The resurgence and resistance of the economies of India and China are expected to shed light on the global economy. As far as experience is concerned, India has gained in multiple dimensions of the economy after unlocking the new economic policy of 1991. Similarly, external trade is the backbone of the Chinese economy and a crucial contributor to its double-digit growth over a long period of time. In both economies, export growth occupies a place of strategic importance in the context of economic development, which has led to various remarkable changes in their foreign trade policies. Policies should be designed so as to promote exports of items, where the comparative advantage truly lies. The present study is important from a trade policy perspective.

The rest of the paper is arranged as follows: Section 2 provides the review of selected literature. Section 3 provides a brief summary of India and China's trade policies and their evolution. Section 4 reviews bilateral trade relations between India and China. Section 5 presents the research methodology and data sources. Section 6 reports and discusses the RCA results, while Section 7 provides concluding remarks.

2 REVIEW OF THE SELECTED LITERATURE

The theoretical literature on international trade has highlighted the importance of international trade in economic prospects in a global economy. The classical approach of international trade developed by Adam Smith (1776) talks about absolute cost advantage in a laissez-fair economy, while David Ricardo (1817) illustrates the comparative advantage in cost of production as the driver of international trade. Haberler (1936)'s theory of opportunity cost of International trade states that it is the differences in the opportunity cost of production that creates the condition for international trade, while the Heckscher and Ohlin theory of international trade states that the difference in factor prices across countries is the reason for international trade. A country exports the commodity that uses its abundant factor intensively. Products using labor-intensive techniques in their production should normally be produced in poorer, less developed countries where labor cost is relatively low. In contrast, products using capital-intensive techniques in their production should be produced in richer, developed countries where the cost of capital is relatively low (Widodo & Tri, 2009).

Several studies have been undertaken using the concept of comparative advantage. However, due to the absence of observable data on relative prices and/or costs, Balassa (1965) has introduced an alternative approach to calculate the comparative advantage. This is called the RCA index. Balassa (1965) first calculated the RCA index empirically, but it has been changed several times (1977, 1979, and 1986). Balassa used post-trade data to calculate the RCA index. The index does not determine the sources of comparative advantage, rather it tries to identify whether a country has RCA or not. The RCA index has been widely used to analyze changes in trading patterns (Batra & Khan, 2005; Ferto & Hubbard, 2002; Kannan, 2010). However, the pattern of international trade is rapidly changing owing to globalization, trade liberalization policies, and market distortions.

Over a period of time, both India and China have observed a change in the technological characteristics of entire exports. Bensidoun et al. (2009) stated that China's exports of manufactured products contain an increasing proportion of high-technology (HT) goods (31% in 2005), while China has become the world's major exporter of HT products, having overtaken the United States since 2004. In contrast, India's performance has stagnated, with a high-tech content of manufactured exports stable at around 5%. Alessandrini et al. (2007) argued that India exhibits the largest degree of trade specialization in low-technology sectors, while import-dependent for HT sectors. Qureshi Mahvash and Guanghua (2008) and Ahmed and Saba (2020) found that China's exports have been changing with an increasing share of skill-intensive, medium- to-HT products and decreasing share of labor-intensive products, which means competition from China in labor-intensive products may decrease in long run.

Both composition of exports and structure of comparative advantage differs between these two countries, despite both being labor intensive in nature. Shujin et al. (2009) while studying the technology sophistication of exports of India and China found that the technology level of exports of both countries is rising and they are reaching more toward the optimum level. It has also been pointed out that China is much ahead in the improvement of the technical structure of exports compared to India. Devadason (2012) found that the export composition of China and India differ substantially, China's exports mainly comprise finished goods, whereas India's exports mainly comprise intermediate goods. Bagaria and Ismail (2017, 2018, 2019) argued that China's specialization has increased in high technology while there is a sharp decline in the share of low-technology manufactures in China, whereas in India, exports are dominated by resource-based manufactures and low-technology manufactures.

In view of the above, there has thus far been little attempt to analyze the competitiveness that India and Chinese exports may pose for each other in the global economy. Given the similarity in size, factor endowments, and geographical proximity of the two economies, it is imperative that an analysis of the comparative advantage that India and China hold in the world market be undertaken. This paper is an attempt to examine similarities and differences in the patterns of RCA for India and China in the global market at HS Standard Product Group and at HS 2- and 6-digit levels. The paper attempts to examine whether RCAs of these economies have undergone any structural shift/change, and if so, which sectors are the front runners in this change? Finally, the paper attempts to examine whether the pattern of specialization in India and China is competitive or complementary in the world market.

3 OVERVIEW OF EVOLUTION OF TRADE POLICIES IN INDIA AND CHINA

India, after achieving independence from British rule in 1947, pursued socialist-minded development plans that emphasized self-reliance and state-led investment in heavy capital-intensive industries. The “license raj” was created in which most imports required government approval, most investments required government permission, and most foreign investments were barred. The government put into place a stringent quantitative restriction (QR) to restrict imports to the amount of foreign exchange available. Imports of only those goods were allowed that were considered essential and were not produced at home. Under restricted trade, India succeeded in industrializing, but inefficiency and bureaucratic controls were rampant and economic growth was slow (Irwin, 2021).

Panagariya (2004) discussed the history of India's trade policies since independence in three phases. In the first phase (1950–1975), India followed an inward-looking strategy for a long time after Independence, that is, 1947, with the idea that it will make India economically strong and self-reliant, but on the contrary, it resulted in the balance of payment problem. Keeping in view the persistent balance of payment problem that led to a shortage of foreign exchange and the presence of a powerful domestic industrial lobby that was opposing trade liberalization, India had to pursue inward-looking and anti-trade policies. In this phase, the trend was toward tighter controls, culminating in virtual autarky by the end of the period. In the second phase (1976–1991), trade liberalization began in 1976 with the reintroduction of the Open General Licensing list. At the beginning of the 1980s, it became clear that exports cannot be seen in isolation from production for the domestic market. Hence, the licensing and highly regulated trade policy started becoming liberal from the early 1980s. In the third phase, 1991 onward, deeper and more systematic liberalization was undertaken. New industrial and trade policies became more liberal and transparent with the adoption of liberalization, privatization, and globalization of the policy framework in 1991. Changes in trade policies started taking place and institutions were set up to follow WTO obligations since 1995. These changes in policy were inclined toward export promotion and removing import restrictions. Various reform measures were announced since 1991 to promote the integration of the Indian economy with the world economy.

In China, the Western embargo erected after the communist revolution largely determined Beijing's self-reliance strategy that lasted for nearly three decades since 1949 (Hsiao, 1977). China introduced a centrally planned command economy patterned on that of the Soviet Union. The Chinese economy during the first three decades of rule was organized in a fundamentally different way from that of market economies in much of the rest of the world (Perkins, 2012). During 1950–1978, the Chinese foreign trade system demonstrated three major features: first, in the organization of foreign trade, the system was completely monopolized by the state through the central government. The second feature was the strategy of “import substitution” and trade planning. Before the late 1970s, China's foreign trade pattern could be characterized as an extreme example of import substitution. The third feature, resulting from the second one, was that the exchange rate and relative prices, which usually constitute the essence of the foreign trade system of a market economy, were unimportant in determining the magnitude and commodity composition of China's foreign trade (Wang, 2007). As a result, China's share of world trade dropped significantly, from 1.5% in 1953 to only 0.6% in 1977 (Lardy, 1994).

China's economic reforms were undertaken gradually, with feedback mechanisms from each reform taken into account. The reform process is identified as “crossing the river by feeling the stones.” Since 1949, China has transformed from an inward-looking state into one of the major players in the international market. Moreover, China's approach to trade reform has been consistent with its overall approach to the transformation of the economy: gradual changes, dualistic in nature, with parallel pricing, a focus on administrative decentralization, and retention of ultimate control at the center. China's trade reform and liberalization fall into three distinct episodes: the administrative decentralization of trade planning to lower levels of government, together with increased exports through improvements in economic incentives and comprehensive liberalization and rapid integration with global trade since accession to the WTO in 2001 (Li & Wei, 2018).

During 1978–1991, the focus of reforms was on administrative decentralization of trade planning, foreign exchange retention, the foreign trade contract responsibility system, adoption of a more realistic exchange rate, and other measures that reduced the bias against exports. The fundamental objective of these reforms was to raise the role of exports in China's economic development. In market-oriented reforms, China's paradigm-shifting measures include adopting an “open door policy” in 1978 and joining WTO in 2001. Major reforms took place in 1984, 1988, and again in 1991. All these reforms were intended to decrease the role of state planning and to strengthen the role of market forces in determining the pattern of trade and use of the foreign exchange. In October 1991, China signed a memorandum of understanding with the United States, giving commitments to reduce quantitative import restrictions and tariffs (Li & Wei, 2018). China's accession to the WTO in December 2001 was a milestone in the history of its reform and opening up. It marked recognition by the international community of China's market-oriented reform and the extension of international standards and rules in the Chinese market. Since its joining of WTO, China's trade reform can be looked into three phases, that is, the first phase (2001–2005) where China tried to fulfill its commitments made at the time of accession and continued the process of trade liberalization; the second phase (2006–2008) when an adjustment in trade policies and transformation in growth pattern took place; and the third phase of the period beginning from 2008, which can be seen as a period of addressing and recovering from the global financial crisis (Bin, 2015).

First of all, it should be noted that “gradualism” is a common feature of Chinese and Indian transition (Srinivasan Thirukodikaval, 2004) from inward-looking import substitution policies to export-oriented open economic policies. In the beginning, both countries emphasized the inward-looking import substitution policies by building industries to support growth and employment generation. In the preliberalization period, China's import regime was highly regimented and exports were planned to meet import requirements, while the Indian trade regime was characterized by high tariffs on imports, restrictive licensing, QRs, and imports through state trading. Just like the Chinese case, India's reforms were implemented in a gradual manner. Nevertheless, the reasons for the gradual approach to reforms are different between China and India. The Indian institutional change and the reform policies began later, contributing to a significant delay in the integration of India into the global economy with respect to China. In addition to persisting rigidities and weaknesses, the integration of India into the world economy is much less intense than that of China (Marelli & Marcello, 2011).

4 INDIA–CHINA TRADE: PATTERN, DIRECTION, AND STRUCTURE

The integration of the Indian economy has accelerated in the past two decades, which resulted in India's higher GDP growth of economy, boosting the desire to attain US$5 trillion economy by 2024. The annual GDP growth rate in China averaged 9.32% over the last three decades. Trade policy had played a strategic role in achieving a high growth rate in both economies. In the case of India, five HS chapters, namely, 27, 71, 84, 87, and 29, jointly constitute 45% of India's exports to the world. Approximately 80% of India's exports generate from 20 out of 97 HS chapters. India's exports of mineral fuels, mineral oils, and products of their distillation; bituminous substances; mineral waxes (HS chapter 27) were US$48.56 billion, which was 15.07% of India's gross exports to the world. India's exports of natural or cultured pearls, precious or semiprecious stones, precious metals, metals clad with precious metal and articles thereof; imitation jewelry; coin (HS chapter 71) to the world was US$39.21 billion, which was 12.17% of India's gross exports to the world. In the case of China, five HS chapters 85, 84, 94, 39, and 87 jointly constitute 53% of China's exports to the world. Approximately 82% of China's exports generate from 20 out of 97 HS chapters. China's exports of electrical machinery and equipment and parts thereof; sound recorders and reproducers, television image, and sound recorders and reproducers; and parts and accessories of such articles (HS chapter 85) was US$664.43 billion, which was 26.64% of China's gross exports to the world, while the exports of nuclear reactors, boilers, machinery, and mechanical appliances; parts thereof (HS chapter 84) to the world was US$429.95 billion, which was 17.24% of China's gross exports to the world. Looking at both countries from a global market penetration perspective, trade data show that India's gross exports to the world were US$322.29 billion, while China's gross exports to the world were US$2494.23 billion in 2018, which was eight times higher than India (Table 1).

| India's gross exports to the world | China's gross exports to the world | ||||

|---|---|---|---|---|---|

| Product code | Trade value in USD in billions | % | Product code | Trade value in USD in billions | % |

| 27 | 48.56 | 15.07 | 85 | 664.43 | 26.64 |

| 71 | 39.21 | 12.17 | 84 | 429.95 | 17.24 |

| 84 | 20.41 | 6.33 | 94 | 96.42 | 3.87 |

| 87 | 18.23 | 5.66 | 39 | 80.14 | 3.21 |

| 29 | 17.77 | 5.51 | 87 | 75.09 | 3.01 |

| 30 | 14.29 | 4.43 | 61 | 73.53 | 2.95 |

| 85 | 11.84 | 3.67 | 62 | 71.45 | 2.86 |

| 72 | 9.94 | 3.09 | 90 | 71.44 | 2.86 |

| 52 | 8.09 | 2.51 | 73 | 65.56 | 2.63 |

| 62 | 8.06 | 2.50 | 29 | 59.80 | 2.40 |

| 39 | 7.86 | 2.44 | 95 | 56.73 | 2.27 |

| 10 | 7.72 | 2.39 | 64 | 47.14 | 1.89 |

| 61 | 7.56 | 2.35 | 72 | 46.92 | 1.88 |

| 73 | 7.08 | 2.20 | 27 | 46.63 | 1.87 |

| 3 | 6.38 | 1.98 | 42 | 29.70 | 1.19 |

| 63 | 5.23 | 1.62 | 63 | 27.85 | 1.12 |

| 76 | 5.16 | 1.60 | 76 | 27.08 | 1.09 |

| 38 | 4.42 | 1.37 | 89 | 25.01 | 1.00 |

| 2 | 3.73 | 1.16 | 69 | 22.37 | 0.90 |

| 89 | 3.55 | 1.10 | 40 | 22.28 | 0.89 |

| Gross exports | 322.29 | 100 | Gross exports | 2494.23 | 100 |

- Abbreviations: UN, United Nations; WITS, World Integrated Trade Solution.

- Source: Author's calculation using UN Comtrade database, retrieved from WITS (accessed on 20 January, 2020).

The share of the top five markets of Indian exports, namely, United States, United Arab Emirates, China, Hong Kong-China, and Singapore are 16.02%, 8.85%, 5.08%, 4.07%, and 3.24%, respectively, while the share of the top five exporter countries, namely, China, United States, Saudi Arabia, United Arab Emirates, and Iraq are 14.62%, 6.30%, 5.56%, 5.20%, and 4.60%, respectively. China is in third place as a market and first place as exporters for India. This is an indication of the high significance of China both as a destination and sourcing in the Indian external sector. The share of the top five markets of Chinese exports, namely, United States, Hong Kong-China, Japan, Korea, Rep., and Vietnam is 19.23%, 12.15%, 5.90%, 4.37%, and 3.37%, respectively, while the share of the top five exporter countries, namely, Korea, Rep., Japan, Other Asia, nes (not elsewhere specified), United States, and Germany is 9.58%, 8.45%, 8.31%, 7.31%, and 4.98%, respectively (Table 2). India falls neither in the top five markets nor in the top 5 exporters. This indicates the low significance of the Indian market both as a destination and sourcing in China's external sector.

| India | China | ||||||

|---|---|---|---|---|---|---|---|

| Markets | % | Exporters | % | Markets | % | Exporters | % |

| United States | 16.02 | China | 14.62 | United States | 19.23 | Korea, Rep. | 9.58 |

| United Arab Emirates | 8.85 | United States | 6.3 | Hong Kong, China | 12.15 | Japan | 8.45 |

| China | 5.08 | United Arab Emirates | 5.56 | Japan | 5.9 | Other Asia, nes | 8.31 |

| Hong Kong, China | 4.07 | Saudi Arabia | 5.2 | Korea, Rep. | 4.37 | United States | 7.31 |

| Singapore | 3.24 | Switzerland | 4.6 | Vietnam | 3.37 | Germany | 4.98 |

- Abbreviations: nes, not elsewhere specified; UN, United Nations; WITS, World Integrated Trade Solution.

- Source: UN Comtrade, retrieved from WITS (accessed on January 20, 2020).

Table 3 presents gross exports in terms of HS Standard Product Groups for the year 2018. In terms of the United Nations Conference on Trade and Development (UNCTAD) classification by stages of processing (SoP), all HS 6-digit goods are classified into four product groups.1 India's exports of raw materials (SoP1) to the world were US$24 billion, which was 7.48% of India's gross exports to the world. India's exports of intermediate goods (SoP2) to the world were US$104.06 billion, which was 32.45% of India's gross exports to the world. India's exports of consumer goods (SoP3) to the world were US$144.87 billion, which was 45.45% of India's gross exports to the world. India's exports of capital goods (SoP4) to the world were US$47.80 billion, which was 14.90% of India's gross exports. The descending order of India's export items is consumer goods; intermediate goods; capital goods; and raw materials. On the basis of economic activities, WTO classified all HS 6-digit goods into three product groups.2 India's exports of agricultural goods to the world were US$31.94 billion, which was 8.65% of India's gross exports to the world. India's exports of industrial goods to the world were US$290.17 billion, which was 78.60% of India's gross exports. India's exports of petroleum products to the world were US$47.05 billion, which was 12.75% of India's gross exports. In terms of economic activities, India's exports mainly fall in the category of industrial goods.

| Product code | Reporter name | Partner name | Trade value (billion USD) | % of World exports |

|---|---|---|---|---|

| UNCTAD-SoP1 | India | World | 24.00 | 7.48 |

| UNCTAD-SoP2 | India | World | 104.06 | 32.45 |

| UNCTAD-SoP3 | India | World | 144.87 | 45.17 |

| UNCTAD-SoP4 | India | World | 47.80 | 14.90 |

| WTO_H3_Aggri | India | World | 31.94 | 8.65 |

| WTO_H3_Indus | India | World | 290.17 | 78.60 |

| WTO_H3_Petro | India | World | 47.05 | 12.75 |

| UNCTAD-SoP1 | China | World | 41.06 | 1.66 |

| UNCTAD-SoP2 | China | World | 401.11 | 16.22 |

| UNCTAD-SoP3 | China | World | 887.92 | 35.91 |

| UNCTAD-SoP4 | China | World | 1142.50 | 46.21 |

| WTO_H3_Aggri | China | World | 57.67 | 2.28 |

| WTO_H3_Indus | China | World | 2431.09 | 96.25 |

| WTO_H3_Petro | China | World | 37.02 | 1.47 |

- Abbreviations: UNCTAD, United Nations Conference on Trade and Development; WTO, World Trade Organization.

In terms of UNCTAD classification, China's exports of raw materials (SoP1) to the world were US$41.06 billion, which was 1.66% of China's gross exports to the world. China's exports of intermediate goods (SoP2) to the world were US$401.11 billion, which was 16.22% of China's gross exports to the world. China's exports of consumer goods (SoP3) to the world were US$887.92 billion, which was 35.91% of China's gross exports. China's exports of capital goods (SoP4) to the world were US$1142.50 billion, which was 46.21% of China's gross exports. The descending order of China's export items is capital goods; intermediate goods; consumer goods; and raw materials. On the basis of economic activities, China's exports of agricultural good to the world was US$57.67 billion, which was 2.28% of China's gross exports to the world. China's exports of industrial good to the world was US$2431.09 billion, which was 96.25% of China's gross exports. China's exports of petroleum products to the world were US$37.02 billion, which was 1.47% of China's gross exports. In terms of economic activities, China's exports mainly fall in the category of industrial goods.

5 DATA SOURCES AND METHODOLOGY

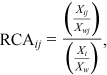

The study is based on export data of United Nations Commodity Trade (UN Comtrade) extracted from the World Integrated Trade Solution (WITS) platform. The empirical analysis is carried out using the RCA index of Balassa (1965). As per the RCA measure, comparative advantage is “revealed” by the relative export performance of individual product categories. RCA index has been used as an indicator of a country's export potential in the published literature. It is assumed to “reveal” the comparative advantage of a country provided that the commodity pattern of trade reflects the intercountry differences in relative cost and nonprice factors.

5.1 RCA index

denotes export of product j from country i,

denotes export of product j from country i,  denotes export of product j from the world w,

denotes export of product j from the world w,  denotes the total exports of country i, and

denotes the total exports of country i, and  denotes the total world exports. This index compares the share of a sector in a country's total exports with the share of the same sector in the world's total exports. A value of the RCA index greater than unity indicates that the country specializes in a product j, whereas a value of less than unity implies that the country has a revealed comparative disadvantage in product j. Following Hinloopen and Van Marrewijk (2001), Deb and Sengupta (2017), and Wosiek Roman (2021) to evaluate the magnitude of the RCA index, this study considers that the values of the RCA index lower than 1 indicate that an economy has no comparative advantages; values within the interval (1, 2) indicate a weak comparative advantage; and those in the interval (2, 4) show a moderate advantage, while values over 4 signify a strong comparative advantage.

denotes the total world exports. This index compares the share of a sector in a country's total exports with the share of the same sector in the world's total exports. A value of the RCA index greater than unity indicates that the country specializes in a product j, whereas a value of less than unity implies that the country has a revealed comparative disadvantage in product j. Following Hinloopen and Van Marrewijk (2001), Deb and Sengupta (2017), and Wosiek Roman (2021) to evaluate the magnitude of the RCA index, this study considers that the values of the RCA index lower than 1 indicate that an economy has no comparative advantages; values within the interval (1, 2) indicate a weak comparative advantage; and those in the interval (2, 4) show a moderate advantage, while values over 4 signify a strong comparative advantage.While trading, the country exports those goods in which they have a comparative advantage. Similarly, they import products in which they have a comparative disadvantage. Theoretically, the structure of trade should reflect a country's pattern of comparative advantage. However, it may happen that the actual trade patterns are not in sync due to trade distortionary activities/policies. As the actual trade data are used to calculate the RCA index, the outcome reflects the scenarios of market distortions besides the natural determinants in comparative advantage. Market distortion may happen due to export incentives, tariffs, quotas, embargoes, labor market distortions, extraordinarily high transport costs, and so forth (Alam & Shahid, 2015).

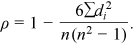

5.2 Spearman rank correlation (SRC)

For the purpose of our analysis, a high-rank correlation will be interpreted to mean the ranking of a country's industries by comparative advantage has changed little over time. A low coefficient will indicate the ranking has changed considerably, suggesting thereby rapid change. The SRC coefficient analysis has been undertaken for India and China at three levels of grouping, namely, HS Standard Product Groupings, HS 2-digit level of classification, and HS 6-digit level of classification as a whole.

The degree and nature of competition between India and China in the world market are evaluated by calculating the SRC coefficients for RCA indices for India and China in the world market at three levels of disaggregation. The aim is to identify the sectors where India and China compete/complement in the world market. A higher and positive value of the coefficient reflects the fact that both the countries are contesting for a share in the world market. This indicates a competitive relationship between the two countries in the export market. A high negative coefficient in a similar manner indicates complementarity in export specialization between the two economies. A value of zero for Spearman's correlation coefficient implies no relationship.

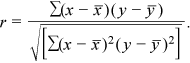

5.3 Pearson's correlation coefficient

6 EMPIRICAL ANALYSIS

In this paper, RCA analysis has been undertaken for India and China at three levels of grouping, namely, HS Standard Product Groupings, HS 2-digit level of classification, and HS 6-digit level of classification as a whole for the years 2000, 2010, and 2018. As it is possible that the pattern of comparative advantage may differ across different levels of disaggregation and sectors in which a country's exports may be typically strong may often include disaggregated subproducts in which they are not, and conversely, the paper also analyses RCA analysis at the more disaggregated level, that is, the HS 6-digit level of classification. The index of RCA is calculated using data on exports for both India and China from UN COMTRADE. Broad trends that emerge from this analysis for the two countries are discussed below.

6.1 RCA analysis for India

The RCA values of India at HS Standard Product Group for the years 2000, 2010, and 2018 are presented in Table A1. The summary statistics of the RCA analysis indicate that India has a comparative advantage in 9, 10, and 9 product groups out of 16 product groups in the world market in 2000, 2010, and 2018, respectively (Table 4). In the year 2000, Table A1 shows the RCA values of the product group of HS chapters 68–71 (stone and glass), HS chapters 50–63 (textiles and clothing), and HS chapters 41–43 (hides and skin), signifying a strong comparative advantage. While the RCA values of the product group of HS chapters 6–15 (vegetables), HS chapters 1–5 (animals), and HS chapters 25–26 (minerals) show a moderate advantage, the RCA values for the product group of HS chapters 28–38 (chemicals), HS chapters 72–83 (metals), and HS chapters 64–67 (footwear) indicate a weak comparative advantage. In the year 2010, the RCA values have declined for the product group of HS chapters 50–63 (textiles and clothing) in the world market, signifying a change from a strong comparative advantage to a moderate comparative advantage, whereas there is a significant decrease in RCA values of HS chapters 41–43 (hides and skin), signifying a change from a strong comparative advantage to a weak comparative advantage. The RCA values of HS chapters 6–15 (vegetables), HS chapters 1–5 (animals), and HS chapters 25–26 (minerals) have declined, signifying a change from a moderate comparative advantage to a weak comparative advantage. In the case of HS chapter 27 (mineral fuels), the RCA values have increased to greater than 1, indicating the gaining of a weak comparative advantage. In the year 2018, the RCA analysis indicates that India holds a comparative advantage in 9 out of 16 product groups in the world market. Further, a decline in RCA values of HS chapters 68–71 (stone and glass) is observed, signifying a change from a strong comparative advantage to a moderate comparative advantage. In the case of HS chapters 25–26 (minerals), the RCA values have fallen below 1, indicating losing of comparative advantage. The RCA values of the remaining sector have not shown any significant change over a period of time.

| RCA2000 > 1 | RCA2010 > 1 | RCA2018 > 1 |

| 9 | 10 | 9 |

| RCA2000 < 1 | RCA2010 < 1 | RCA2018 < 1 |

| 7 | 6 | 7 |

- Abbreviations: HS, Harmonized System; RCA, revealed comparative advantage.

Table 5 presents the number of HS Standard Product Groups with RCA gains/losses for India. However, changes in absolute values of RCA over time may not always reflect gains and losses in terms of competitiveness in the usual standard definition of RCA values, but reflect changing dynamics and competition in trading sectors. In absolute terms, the number of HS Standard Product Groups with RCA gains in 2010 over 2000 was 7, which remains invariant in 2018 over 2000. However, the number of HS Standard Product Groups with RCA gains was 6 in 2018 over 2010.

| RCA gain in 2010 in 2000 | RCA gain in 2018 over 2000 | RCA gain in 2018 over 2010 |

| RCA2010 > RCA2000 | RCA2018 > RCA2000 | RCA2018 > RCA2010 |

| 7 | 7 | 6 |

| RCA loss over 2000 in 2010 | RCA loss over 2000 in 2018 | RCA loss over 2010 in 2018 |

| RCA2010 < RCA2000 | RCA2018 < RCA2000 | RCA2018 < RCA2010 |

| 9 | 9 | 10 |

- Abbreviations: HS, Harmonized System; RCA, revealed comparative advantage.

The RCA values of India at the HS 2-digit level of classification for the years 2000, 2010, and 2018 are presented in Table A2. The summary statistics of the RCA analysis indicate that India has comparative advantage in 41, 40, and 41 sectors out of 97 sectors in the world market in 2000, 2010, and 2018, respectively (Table 6). In the year 2000, Table A2 shows the RCA values of HS chapters 13 (lac, gums, resins, etc.), 50 (silk), 57 (carpets and other textile floor coverings), 52 (cotton), 71 (natural or cultured pearls, etc.), 63 (other made up textile articles, etc.), 9 (coffee, tea, mate, and spices), 42 (articles of leather, travel goods, etc.), 14 (vegetable plaiting materials), 62 (articles of apparel and clothing accessories, not knitted or crocheted), 3 (fish and crustaceans, etc.), and 53 (other vegetable textile fibers), signifying a strong comparative advantage. The RCA values of HS chapters 25 (salt, sulfur, etc.), 23 (residues and waste from the food industries), 58 (special woven fabrics, etc.), 61 (articles of apparel and clothing accessories knitted or crocheted), 10 (cereals), 68 (articles of stone, plaster, etc.), 55 (man-made staple fibers), 41 (raw hides and skins [other than furskins] and leather), 54 (man-made filaments), 67 (prepared feathers down articles made products), and 32 (tanning or dyeing extracts) show a moderate advantage, while the RCA values of HS chapters 64 (footwear, gaiters and the like), 7 (edible vegetables and certain roots and tubers), 29 (organic chemicals), 73 (articles of iron or steel), 72 (iron and steel), 30 (pharmaceutical products), 24 (tobacco and manufactured tobacco substitutes), 38 (miscellaneous chemical products), and 2 (meat and edible meat) indicate a weak comparative advantage.

| RCA2000 > 1 | RCA2010 > 1 | RCA2018 > 1 |

| 41 | 40 | 41 |

| RCA2000 < 1 | RCA2010 < 1 | RCA2018 < 1 |

| 56 | 57 | 56 |

- Abbreviations: HS, Harmonized System; RCA, revealed comparative advantage.

In the year 2010, despite a decrease in RCA values, the level of competitiveness remains a strong comparative advantage for the sectors, namely, HS chapters 13, 50, 57, 52, 71, 63, 14, and 53; however, the RCA values have declined for HS chapters 9, 42, 62, and 3 in the world market, signifying a change from a strong comparative advantage to a moderate comparative advantage. The present study indicates that the level of competitiveness for HS chapters 25, 23, 10, 55, 54, and 67 remain moderate, although the RCA values of HS chapters 58, 61, 68, 41, and 32 have declined, signifying a change from a moderate comparative advantage to weak comparative advantage. The level of competitiveness remains invariant for HS chapters 64, 7, 29, 73, 72, 24, and 2; however, India has lost its comparative advantage in HS chapters 30 and 38. In the case of HS chapters 36, 17, and 28, the RCA values have increased to greater than 1, indicating the gaining of a weak comparative advantage in these sectors.

In the year 2018, despite changes in RCA values, the level of competitiveness remains a strong comparative advantage for the sectors, namely, HS chapters 13, 57, 52, 63, and 53. The RCA values of HS chapters 9 and10 increased over time, indicating a change from a moderate comparative advantage to a strong comparative advantage, while the RCA values of HS chapters 50, 71, and 14 have declined over time, revealing a change from a strong comparative advantage to a moderate comparative advantage. The present study indicates that the level of competitiveness for HS chapters 3, 78, 55, 25, 54, 29, 62, 32, 79, and 61 remains moderate. The study reveals that India has improved its level of competitiveness to a moderate level in HS chapters 29, 78, and 79 in this period, while the RCA values of HS chapters 23 and 67 have declined, signifying a change from a moderate comparative advantage to a weak comparative advantage. In the case of HS chapters 76, 69, 27, and 89, the RCA values have increased to more than 1, indicating the gaining of a weak comparative advantage in these sectors, while the RCA values of HS chapters 79 and 78 have increased from less than 1 to greater than 2, signifying a gain toward a moderate comparative advantage. The RCA values of the remaining sectors have not shown any significant change over a period of time.

Table 7 shows the changing dynamics by comparing absolute RCA values at the HS 2-digit level of classification. Table 7 reflects that there is an absolute increase in RCA values of 42 HS chapters in 2010 over 2000, 56 in 2018 over 2000, and 61 in 2018 over 2010.

| RCA gain in 2010 over 2000 | RCA gain in 2018 over 2000 | RCA gain in 2018 over 2010 |

| RCA2010 > RCA2000 | RCA2018 > RCA2000 | RCA2018 > RCA2010 |

| 42 | 56 | 61 |

| RCA loss in 2010 over 2000 | RCA loss in 2018 over 2000 | RCA loss in 2018 over 2020 |

| RCA2010 < RCA2000 | RCA2018 < RCA2000 | RCA2018 < RCA2010 |

| 55 | 41 | 36 |

- Abbreviations: HS, Harmonized System; RCA, revealed comparative advantage.

The RCA values at the HS 6-digit level of classification for the years 2000, 2010, and 2018 for all 4163 commodities exported by India to the world in 2018 are calculated. The summary statistics of RCA analysis indicate that India has a comparative advantage in 1162, 1223, and 1371 out of 4163 commodities in the world market in 2000, 2010, and 2018, respectively (Table 8). Looking at the changing dynamics and global competition, the number of HS products at a 6-digit level with a positive change in RCA values in 2010 over 2000, 2018 over 2000, and 2018 over 2010 was 2110, 2509, and 2377, respectively (Table 9). This may be the result of national trade policies and economic policies of partner and competitor countries.

| RCA2000 > 1 | RCA2010 > 1 | RCA2018 > 1 |

| 1162 | 1223 | 1371 |

| RCA2000 < 1 | RCA2010 < 1 | RCA2018 < 1 |

| 3001 | 2940 | 2792 |

- Abbreviations: HS, Harmonized System; RCA, revealed comparative advantage.

| RCA gain over 2000 in 2010 | RCA gain over 2000 in 2018 | RCA gain over 2010 in 2018 |

| RCA2000 > RCA2010 | RCA2000 > RCA2018 | RCA2010 > RCA2018 |

| 2110 | 2509 | 2377 |

| RCA loss over 2000 in 2010 | RCA loss over 2000 in 2018 | RCA gain loss 2010 in 2018 |

| RCA2000 < RCA2010 | RCA2000 < RCA2018 | RCA2010 < RCA2018 |

| 2053 | 1654 | 1786 |

- Abbreviations: HS, Harmonized System; RCA, revealed comparative advantage.

Table A3 presents RCA values at the HS 6-digit disaggregated level for the top 50 commodities on the RCA values for the year 2018. In the years 2000, 2010, and 2018, Table A3 shows that the RCA values of the HS product for the top 50 commodities retain the comparative advantage. In the top 50 commodities, most of the commodities are from HS chapters 25, 29, 52, 53, 57, and 63, namely, HS chapter 13—lac, and so forth (130211, 130232), HS chapter 25—salt, sulfur, and so forth (251611, 251622, 252510, 252530), HS chapter 29—organic chemicals (290362, 290611, 291431, 293311, 293332, 293929, 293949, 293950, 294200), HS chapter 52—cotton (520521, 520523, 520524, 520526, 520527, 520533, 520535, 520547), HS 53—other vegetable textile fibers, and so forth (530599, 530720, 530810, 531010), HS chapter 57—carpets and other textile floor coverings (570220, 570231, 570232, 570390), HS chapter 63—other made-up textile articles, and so forth (630240, 630419, 630492, 630510), HS chapter 68—articles of stone, plaster, and so forth (680223, 681270), and HS chapter 84—nuclear reactors, boilers, machinery and mechanical appliances, and so forth (840610, 844629). In addition to the above, India has performed consistently well in international trade in HS products 50100, 71140, 90930, 91030, 151530, 230690, 283190, 320416, 330125, 610729, and 670300 during this period. Due to the US subprime and Euro-zone crisis, the RCA values in 2010 are not consistent with the RCA values in 2000 and 2018.

6.2 RCA analysis for China

The RCA values of China at HS Standard Product Group for the years 2000, 2010, and 2018 are presented in Table A4. The summary statistics of the RCA analysis indicate that China has a comparative advantage in 5, 4, and 6 product groups out of 16 product groups in the world market in 2000, 2010, and 2018, respectively (Table 10). Table A4 shows that the RCA values of the product group of HS chapters 64–67 (Footwear) signify a strong comparative advantage, while the RCA values of the product group of HS chapters 50–63 (textile and clothing) and HS chapters 41–43 (hides and skin) show a moderate advantage. The RCA values for the product group of HS chapters 90–99 (miscellaneous) and HS chapters 72–83 (metals) indicate a weak comparative advantage. In the year 2010, the RCA values have declined for the product group of HS chapters 64–67 (footwear) in the world market, signifying a change from a strong to a moderate comparative advantage, whereas there is a decline in RCA values of HS chapters 50–63 (textile and clothing) and HS chapters 41–43 (hides and skin), but the level of comparative advantage remains unchanged. In the case of HS chapters 84–85 (Mach Elec), the RCA values have increased to greater than 1, indicating the gaining of a weak comparative advantage. In the year 2018, the RCA analysis at HS Standard Product Group in 2018 indicates that China holds a comparative advantage in 6 out of 16 product groups in the world market. These product groups consist of HS chapters 64–67 (footwear), chapters 50–63 (textiles and clothing), chapters 41–43 (hides and skin), chapters 72–83 (metals), chapters 84–85 (machinery and electricals), and chapters 90–99 (miscellaneous). Out of six product groups, only in three product groups, namely, HS chapters 50–63, chapters 41–43, and chapters 72–83, both India and China have a comparative advantage. In the case of HS chapters 72–83 (metals), the RCA values have increased to greater than 1, indicating the gaining of a comparative advantage. The RCA values of the remaining sectors have not shown any significant change over a period of time. The summary statistics of above changes in numbers of RCA Gains and Losses for China over a period of time are presented in Table 11.

| RCA2000 > 1 | RCA2010 > 1 | RCA2018 > 1 |

| 5 | 4 | 6 |

| RCA2000 < 1 | RCA2010 < 1 | RCA2018 < 1 |

| 11 | 11 | 10 |

- Abbreviations: HS, Harmonized System; RCA, revealed comparative advantage.

| RCA gain over 2000 in 2010 | RCA gain over 2000 in 2018 | RCA gain over 2010 in 2018 |

| RCA2010 > RCA2000 | RCA2018 > RCA2000 | RCA2018 > RCA2010 |

| 3 | 5 | 6 |

| RCA loss over 2000 in 2010 | RCA loss over 2000 in 2018 | RCA loss over 2010 in 2018 |

| RCA2010 < RCA2000 | RCA2018 < RCA2000 | RCA2018 < RCA2010 |

| 13 | 11 | 10 |

- Abbreviations: HS, Harmonized System; RCA, revealed comparative advantage.

The RCA values of China at the HS 2-digit level of classification for the years 2000, 2010, and 2018 are presented in Table A5. The summary statistics of RCA analysis indicate that China has a comparative advantage (RCA > 1) in 48, 45, and 45 HS chapters out of 97 in the world market in 2000, 2010, and 2018, respectively (Table 12). In absolute terms, the number of HS products at the HS 2-digit level with RCA gains was 31 in 2010 over 2000, 35 in 2018 over 2000, and 44 in 2018 over 2010 (Table 13). At the HS 2-digit level of classification, China's RCA statistics shows an improvement in world markets.

| RCA2000 > 1 | RCA2010 > 1 | RCA2018 > 1 |

| 48 | 45 | 45 |

| RCA2000 < 1 | RCA2010 < 1 | RCA2018 < 1 |

| 49 | 52 | 52 |

- Abbreviations: HS, Harmonized System; RCA, revealed comparative advantage.

| RCA gain over 2000 in 2010 | RCA gain over 2000 in 2018 | RCA gain over 2010 in 2018 |

| RCA2010 > RCA2000 | RCA2018 > RCA2000 | RCA2018 > RCA2010 |

| 31 | 35 | 44 |

| RCA loss over 2000 in 2010 | RCA loss over 2000 in 2018 | RCA gain loss 2010 in 2018 |

| RCA2010 < RCA2000 | RCA2018 < RCA2000 | RCA2018 < RCA2010 |

| 66 | 62 | 53 |

- Abbreviations: HS, Harmonized System; RCA, revealed comparative advantage.

In the year 2000, Table A5 shows that the RCA values of HS chapters 46 (manufactures of straw, of esparto, or of other plaiting materials; basket-ware and wickerwork), 66 (umbrellas, sun umbrellas, walking sticks, etc.), 50 (silk), 67 (prepared feathers and down and articles made of), 42 (articles of leather, travel goods, etc.), 5 (products of animal origin, nes, or included), 86 (railway or tramway locomotives, etc.), 64 (footwear, gaiters, etc.), 65 (headgear and parts thereof), 63 (other made-up textile articles), 95 (toys, games and sports, etc.), 62 (articles of apparel and clothing accessories, not knitted or crocheted), 53 (other vegetable textile fibers), 36 (explosives, pyrotechnic products, matches, pyrophoric products), and 61 (articles of apparel and clothing accessories knitted or crocheted) are greater than 4, signifying a strong comparative advantage. The RCA values of HS chapters 16 (preparation of meat, of fish or invertebrate, etc.), 52 (cotton), 55 (man-made staple fibers), 96 (miscellaneous manufactured articles), 43 (furskins and artificial fur, manufactures thereof), 92 (musical instruments), 14 (vegetable plaiting materials), 51 (wool), 81 (other base metals; articles thereof), 69 (ceramic products), 94 (furniture), 58 (special woven fabrics), 60 (knitted or crocheted fabrics), and 82 (tools, implements, cutlery, spoons, and forks, etc.) varies in the range 2–4, showing a moderate comparative advantage, while the RCA values of HS chapters 7 (edible vegetables and certain roots and tubers), 28 (inorganic chemicals), 83 (miscellaneous articles of base metal), 73 (articles of iron or steel), 68 (articles of stone, plaster, etc.), 57 (carpets and other textile floor coverings), 85 (electrical machinery and equipment and parts thereof), 89 (ships, boats, and floating structures), and 54 (man-made filaments) varies in the range 1–2, indicating a weak comparative advantage.

In the year 2010, despite a decrease in RCA values, there exists a strong comparative advantage for the sectors, namely, HS chapters 46, 66, 50, 65, and 67; however, the RCA values have declined for HS chapters 42, 86, 64, 63, 95, 62, 53, and 61 in the world market, signifying a change from a strong comparative advantage to a moderate comparative advantage. The study also indicates a significant decline in the level of competitiveness in HS chapters 5 and 36 from RCA greater than 4 to RCA less than 2, showing a change from a strong comparative advantage to a weak comparative advantage. The present study indicates that the level of competitiveness for HS chapters 52, 55, 96, 43, 92, 81, 69, 94, 58, and 60 remain invariant at a moderate level, although the RCA values of HS chapters 16, 51, and 82 have declined, signifying a change from a moderate comparative advantage to a weak comparative advantage. The RCA values of HS chapter 14 indicate that China has lost its comparative advantage. The level of competitiveness remains invariant for HS chapters 7, 28, 83, 73, 68, 57, and 85, while China has improved its comparative advantage in HS chapters 89, 54, and 59. In the case of HS chapters 70, 56, 84, and 13, the RCA values have increased to greater than 1, indicating the gaining of a weak comparative advantage in these sectors.

In the year 2018, despite changes in RCA values, there exists a strong comparative advantage for the sectors, namely, HS chapters 46, 66, 50, 65, and 67; however, there are no change in competitiveness since 2010. The RCA values of HS chapters 92, 81, and 89 have declined over time, revealing a change from a moderate comparative advantage to a weak comparative advantage. The RCA values of HS chapters 42, 5, 86, 64, 65, 63, 95, 62, 53, 36, and 61 declined, signifying a change from a strong comparative advantage to a moderate or a weak comparative advantage. In the case of HS chapters 70, 56, 59, 84, 29, 13, and 76, the RCA values have increased to greater than 1, indicating the gaining of a weak comparative advantage in these sectors. The RCA values of the remaining sector have not shown any significant change over the period of time.

The RCA values at the HS 6-digit level of classification for the years 2000, 2010, and 2018 for all 4381 commodities exported by China to the world in 2018 are calculated. The summary statistics of RCA analysis indicate that India has a comparative advantage in 1748, 1993, and 2075 out of 4381 commodities in the world market in 2000, 2010, and 2018, respectively (Table 14). Looking at the changing dynamics and global competition, the number of HS products at the 6-digit level with positive change in RCA values in 2010 over 2000, 2018 over 2000, and 2018 over 2010 was 2300, 2362, and 2147, respectively (Table 15). This may be the result of national trade policies and the entry of China into the WTO multilateral trading system or economic policies of other countries.

| RCA2000 > 1 | RCA2010 > 1 | RCA2018 > 1 |

| 1748 | 1993 | 2075 |

| RCA2000 < 1 | RCA2010 < 1 | RCA2018 < 1 |

| 2633 | 2388 | 2306 |

- Abbreviations: HS, Harmonized System; RCA, revealed comparative advantage.

| RCA gain over 2000 in 2010 | RCA gain over 2000 in 2018 | RCA gain over 2010 in 2018 |

| RCA2000 > RCA2010 | RCA2000 > RCA2018 | RCA2010 > RCA2018 |

| 2300 | 2362 | 2147 |

| RCA loss over 2000 in 2010 | RCA loss over 2000 in 2018 | RCA gain loss 2010 in 2018 |

| RCA2000 < RCA2010 | RCA2000 < RCA2018 | RCA2010 < RCA2018 |

| 1863 | 1801 | 2016 |

- Abbreviations: HS, Harmonized System; RCA, revealed comparative advantage.

Table A6 presents the RCA values of China at the HS 6-digit disaggregated level for the top 50 commodities on the basis of RCA values for the year 2018. In the years 2000, 2010, and 2018, Table A6 shows that the RCA values of the HS product for the top 50 commodities indicate that China consistently retains a comparative advantage in these commodities. In the top 50 commodities, most of the commodities are from 11 HS chapters, namely, HS chapter 05—products of animal origin (50210, 50290), HS chapter 28—inorganic chemicals, and so forth (280511, 282710, 282919), HS chapter 29—organic chemicals (291461, 294140), HS chapter 54—man-made filaments (540331, 540754), HS chapter 55—man-made staple fibers (551341, 551441), HS chapter 58—special woven fabrics (580131, 580132, 580133), HS chapter 61—articles of apparel and clothing accessories knitted or crocheted (610322, 610332, 610432, 610722, 611692), HS chapters 63—other made-up textile articles, and so forth (630110, 630140, 630222, 630232, 630411), HS chapter 66—umbrellas, sun umbrellas, walking sticks, and so forth (660191, 660199, 660320), HS chapter 67—prepared feathers and down and articles made of feathers or of down, and so forth (670210, 670290, 670490), and HS chapter 85—electrical machinery and equipment and parts thereof (850740, 851672, 854011). In addition to above, China has performed consistently well in international trade in HS products 71230, 360410, 392640, 430310, 460120, 521111, 531100, 600192, 621520, 691310, 701890, 810411, 810430, 860900, 940530, 950510, and 961511 during 2000–2018. In the case of China as well, the RCA values in 2010 are not consistent with the RCA values in 2000 and 2018 due to the US subprime and Euro-zone crisis.

6.3 Analysis of dynamic structural changes

Dynamic structural changes over time are analyzed using the SRC coefficient for India and China. The results of SRC for India are reported in Table 16. At HS Standard Product Group level, the SRC for India is 0.92 and 0.83 between RCA_2000 and RCA_2010 and RCA_2000 and RCA_2018, respectively, indicating a marginal structural change in 2010 and 2018 over 2000. The SRC for India is 0.83 between RCA_2010 and RCA_2018, indicating a marginal structural change in 2018 over 2010. For all traded sectors/commodities at the HS 2-digit level as a whole, the SRC for India is 0.83 and 0.77 between RCA_2000 and RCA_2010 and RCA_2000 and RCA_2018, respectively, indicating a marginal structural change in 2010 and 2018 over 2000. The SRC for India is 0.88 between RCA_2010 and RCA_2018, indicating a marginal structural change in 2018 over 2010. At the HS 6-digit level of classification for all traded sectors/commodities, the SRC for India is 0.53 and 0.74 between RCA_2000 and RCA_2010 and RCA_2000 and RCA_2018, indicating a small structural change in 2010 and 2018 over 2000. The SRC for India is 0.63 between RCA_2010 and RCA_2018, indicating small structural change in 2018 over 2010. For robustness of our results, Carl Pearson correlation results confirm the SRC results, that is, India has a small or marginal structural change in 2018 over 2000 or 2010 (Table 19). However, these results also indicate that there were more dynamic changes in the patterns (rank orders) of comparative advantages at the HS 6-digit level of classification for all traded sectors/commodities compared to the HS Standard Product Group level or the HS 2-digit level of classification.

| RCA | RCA2000_INDIA | RCA2010_INDIA | RCA2018_INDIA |

|---|---|---|---|

| HS Standard Product Group | |||

| RCA2000_INDIA | 1 | 0.92 | 0.83 |

| RCA2010_INDIA | 0.92 | 1 | 0.83 |

| RCA2018_INDIA | 0.83 | 0.83 | 1 |

| HS 2-digit level | |||

| RCA2000_INDIA | 1 | 0.83 | 0.77 |

| RCA2010_INDIA | 0.83 | 1 | 0.88 |

| RCA2018_INDIA | 0.77 | 0.88 | 1 |

| HS 6-digit level | |||

| RCA2000_INDIA | 1 | 0.53 | 0.74 |

| RCA2010_INDIA | 0.53 | 1 | 0.63 |

| RCA2018_INDIA | 0.74 | 0.63 | 1 |

- Abbreviations: HS, Harmonized System; RCA, revealed comparative advantage.

The results of SRC for China are reported in Table 17. At HS Standard Product Group level as a whole, the SRC for China is 0.74 and 0.70 between RCA_2000 and RCA_2010 and RCA_2000 and RCA_2018, indicating a marginal structural change in 2010 and 2018 over 2000. The SRC for China is 0.99 between RCA_2010 and RCA_2018, indicating no structural change in 2018 over 2010. At the HS 2-digit level for all traded sectors/commodities as a whole, the SRC for China is 0.80 and 0.77 between RCA_2000 and RCA_2010 and RCA_2000 and RCA_2018, indicating a marginal structural change in 2010 and 2018 over 2000. The SRC for China is 0.98 between RCA_2010 and RCA_2018, indicating no structural change in 2018 over 2010. At the HS 6-digit level for all traded sectors/commodities as a whole, the SRC for India is 0.72 and 0.63 between RCA_2000 and RCA_2010 and RCA_2000 and RCA_2018, indicating a small structural change at the HS 6-digit level of classification in 2010 and 2018 over 2000. The SRC for China is 0.88 between RCA_2010 and RCA_2018, indicating no or a marginal structural change in 2018 over 2010. For robustness of our results, Carl Pearson correlation results confirm the SRC results, that is, China has little/small structural change in 2018 over 2000 or 2010 (Table 19). Though, these results indicate that there were more dynamic changes in the patterns (rank orders) of comparative advantages at the HS 6-digit level of classification for all traded sectors/commodities compared to the HS Standard Product Group level or the HS 2-digit level of classification.

| RCA | RCA2000_CHINA | RCA2010_CHINA | RCA2018_CHINA |

|---|---|---|---|

| HS Standard Product Group | |||

| RCA2000_CHINA | 1 | 0.74 | 0.70 |

| RCA2010_CHINA | 0.74 | 1 | 0.99 |

| RCA2018_CHINA | 0.70 | 0.99 | 1 |

| HS 2-digit level | |||

| RCA2000_CHINA | 1 | 0.80 | 0.77 |

| RCA2010_CHINA | 0.80 | 1 | 0.98 |

| RCA2018_CHINA | 0.77 | 0.98 | 1 |

| HS 6-digit level | |||

| RCA2000_CHINA | 1 | 0.72 | 0.63 |

| RCA2010_CHINA | 0.72 | 1 | 0.88 |

| RCA2018_CHINA | 0.63 | 0.88 | 1 |

- Abbreviations: HS, Harmonized System; RCA, revealed comparative advantage.

6.4 India–China: A comparative analysis

A comparative analysis of India and China reveals that there are 726 products (17.44%) at the HS 6-digit level where India's and China's RCA is greater than >1. Most of these are constituents of HS chapters 30 (8 products), 25 (7 products), 28 (41 products), 29 (108 products), 32 (7 products), 40(14 products), 52 (66 products), 54 (25 products), 55 (10 products), 56 (8 products), 58 (14 products), 61 (25 products), 62 (43 products), 63 (20 products), 68 (9 products), 70 (8 products), 72 (9 products), 73 (30 products), 82 (12 products), 84 (64 products), 86 (26 products), among others. Table A7 presents India's top 50 products at the HS 6-digit level of classification where India's and China's RCA is greater than 1. These 50 products belong to 18 HS chapters. Most of the products are part of HS chapters 29 (organic chemicals), 52 (cotton), 55 (man-made staple fibers), and 63 (other made-up textile articles, sets, worn clothing and worn textile articles, rags). In these 50 items, India's RCA is significantly higher than China's RCA. However, China has also RCA in these products.

There are 645 products (15.5%) at the HS 6-digit level of classification where India's RCA > 1 and China's RCA < 1, implying that India has a comparative advantage over China in the global market in these products. Table A8 provides India's top 50 products where India's RCA > 1 and China's RCA < 1. These 50 products belong to 17 HS chapters, signifying a diverse range of products. Most of these products belong to HS chapters 09, 25, 29, 52, 53, 57, and 61. Out of 4163 products at the HS 6-digit concordance in 2018 for India and China, there are 1251 products (30%) where India's RCA < 1 and China's RCA > 1, implying that China has a comparative advantage over India in the global market in these products. Table A9 provides China's top 50 products where India's RCA < 1 and China's RCA > 1. These 50 products belong to 29 HS chapters, signifying a diverse range of products. In these 50 products, HS chapters 55, 61, 63, 67, 69, and 81 show significant presence. However, the diversity of export competitiveness of China is higher than in India. It has also been found that there are 1541 product (37%) commodities where RCA for both India and China are less than 1, that is, India's RCA < 1 and China's RCA < 1, signifying untapped potential in traded commodities for both countries.

6.5 India–China: Degree of export competition

The degree and nature of competition between India and China in the world market are evaluated by calculating the SRC coefficients for RCA indices for India and China in the world market. A higher and positive value of the coefficient reflects the fact that both the countries are contesting for a share in the world market, which indicates a competitive relationship between the two countries in the export market. A high negative coefficient in a similar manner indicates complementarity in export specialization between two economies. A value of zero for the Spearman correlation coefficient implies no relationship.

The results of SRC between RCAs of India and China are reported in Table 18. At HS Standard Product Group for all traded sectors/commodities as a whole, the value of the SRC coefficient between RCAs of India and China is 0.48, 0.00, and −0.9 for the years 2000, 2010, and 2018, respectively. The SRC indicates no competitive relationship between India and China in 2010 and 2018. For all traded sectors/commodities at the HS 2-digit level of classification as a whole, the value of the SRC coefficient between RCAs of India and China is 0.21, 0.10, and 0.22 for the years 2000, 2010, and 2018, respectively, indicating diminutive competitive relations between India and China. For all traded sectors/commodities at the HS 6-digit level of classification as a whole, the value of the SRC coefficient between RCAs of India and China is 0.16, 0.14, and 0.10 for the years 2000, 2010, and 2018, respectively, indicating no or diminutive competitive relations between India and China in the global market. For robustness of our results, Carl Pearson correlation results confirm the SRC results, that is, India and China have no competitive relationship in the global market in a macro context. However, there may be competitive relations in some sectors or some individual products (Table 19).

| RCA | RCA2000_INDIA | RCA2010_INDIA | RCA2018_INDIA |

|---|---|---|---|

| HS Standard Product Group | |||

| RCA2000_CHINA | 0.48 | ||

| RCA2010_CHINA | 0.00 | ||

| RCA2018_CHINA | −0.09 | ||

| HS 2-digit level | |||

| RCA2000_CHINA | 0.21 | ||

| RCA2010_CHINA | 0.10 | ||

| RCA2018_CHINA | 0.22 | ||

| HS 6-digit level | |||

| RCA2000_CHINA | 0.16 | ||

| RCA2010_CHINA | 0.14 | ||

| RCA2018_CHINA | 0.10 | ||

- Abbreviations: HS, Harmonized System; RCA, revealed comparative advantage.

| RCA2000 _INDIA | RCA2010 _INDIA | RCA2018 _INDIA | RCA2000 _CHINA | RCA2010 _CHINA | RCA2018 _CHINA | |

|---|---|---|---|---|---|---|

| HS Standard Product Group | ||||||

| RCA2000_INDIA | 1.00 | 0.93 | 0.88 | 0.35 | 0.24 | 0.23 |

| RCA2010_INDIA | 0.93 | 1.00 | 0.87 | 0.20 | 0.11 | 0.09 |

| RCA2018_INDIA | 0.88 | 0.87 | 1.00 | 0.26 | 0.19 | 0.17 |

| RCA2000_CHINA | 0.35 | 0.20 | 0.26 | 1.00 | 0.94 | 0.89 |

| RCA2010_CHINA | 0.24 | 0.11 | 0.19 | 0.94 | 1.00 | 0.98 |

| RCA2018_CHINA | 0.23 | 0.09 | 0.17 | 0.89 | 0.98 | 1.00 |

| HS 2-digit level | ||||||

| RCA2000_INDIA | 1.00 | 0.88 | 0.80 | 0.19 | 0.17 | 0.16 |

| RCA2010_INDIA | 0.88 | 1.00 | 0.90 | 0.16 | 0.12 | 0.15 |

| RCA2018_INDIA | 0.80 | 0.90 | 1.00 | 0.09 | 0.08 | 0.11 |

| RCA2000_CHINA | 0.19 | 0.16 | 0.09 | 1.00 | 0.85 | 0.78 |

| RCA2010_CHINA | 0.17 | 0.12 | 0.08 | 0.85 | 1.00 | 0.97 |

| RCA2018_CHINA | 0.16 | 0.15 | 0.11 | 0.78 | 0.97 | 1.00 |

| HS 6-digit level | ||||||

| RCA2000_INDIA | 1.00 | 0.62 | 0.78 | 0.02 | −0.04 | −0.05 |

| RCA2010_INDIA | 0.62 | 1.00 | 0.53 | 0.027 | 0.01 | −0.014 |

| RCA2018_INDIA | 0.78 | 0.53 | 1.00 | 0.07 | 0.002 | -0.04 |

| RCA2000_CHINA | 0.02 | 0.027 | 0.07 | 1.00 | 0.70 | 0.58 |

| RCA2010_CHINA | −0.044 | 0.01 | 0.002 | 0.70 | 1.00 | 0.87 |

| RCA2018_CHINA | −0.052 | −0.014 | −0.04 | 0.58 | 0.87 | 1.00 |

- Abbreviations: HS, Harmonized System; RCA, revealed comparative advantage.

7 CONCLUDING REMARKS

The present study is important from a trade policy perspective. Policies should be designed so as to promote exports of items, where the comparative advantage truly lies. The present study examines RCAs for India and China at three levels of grouping, namely, HS Standard Product Groupings, HS 2-digit level of classification, and HS 6-digit level of classification as a whole for the years 2000, 2010, and 2018. This study argues that there is massive untapped potential for broader economic cooperation between China and India. The study shows that India's comparative advantage is focused on sectors like salt; sulfur; earths and stone; plastering materials, lime and cement; organic chemicals; cotton, inc. yarns woven fabrics thereof; other vegetable textile fibers; paper yarn and woven fabrics of paper yarn; carpets and other textile floor coverings; and other made-up textile articles; sets; worn clothing and worn textile articles; rags. The study indicates that China's comparative advantage is focused on sectors like inorganic chemicals; organic or inorganic compounds of precious metals, rare-earth metals, radioactive elements, or isotopes; special woven fabrics; tufted textile fabrics; lace; tapestries; trimmings; embroidery; articles of apparel and clothing accessories knitted or crocheted; other made up textile articles; sets; worn clothing and worn textile articles; rags; umbrellas, sun umbrellas, walking sticks, seat sticks, whips, riding crops and parts thereof; prepared feathers and down and articles made of feathers or of down; artificial flowers; articles of human hair; and electrical machinery and equipment and parts thereof; sound recorders and reproducers, television image, and sound recorders and reproducers.

The study evaluates dynamic structural changes over time using the SRC coefficient for India and China. For all traded sectors/commodities at different levels of classifications, a comparative analysis of India and China reveals a small structural change in RCA over time in both economies at a disaggregated level. However, there were more dynamic changes in the patterns of comparative advantages at the HS 6-digit level of classification for all traded sectors/commodities compared to the HS Standard Product Group level or the HS 2-digit level of classification. The present study indicates limited evidence of a competitive relationship between India and China in the global market, hence the scope of independent expansion. These findings reflect a scope of expansion of the economy for both India and China, without compromising mutual interest in the global market. It may be inferred from the results that mutual cooperation will enhance the competitiveness of both economies.

Finally, it is important to recognize that the comparative advantage revealed by RCA indices should be interpreted in light of existing policy restrictions or distortions to trade. In the comparative discussion on the RCAs, it is pertinent to understand that RCAs are calculated using a country's gross exports by products/sectors or other categorizations. As such, when supply chains and production networks become increasingly important, especially in certain sectors, RCA values become less reliable to reflect a country's comparative advantage, since they tend to overestimate a country's RCA in sectors that are more heavily engaged in supply chain activities.

AUTHOR CONTRIBUTIONS

Saba Ismail: Conceptualization; formal analysis; investigation; resources; writing— original draft. Shahid Ahmed: Data curation; methodology; software; visualization.

ACKNOWLEDGMENTS

The authors gratefully acknowledge the constructive comments and suggestions of an anonymous referee and the editor of this journal.

CONFLICT OF INTEREST

The authors declare no conflict of interest.

ETHICS STATEMENT

None declared.

APPENDIX

Table A1-A9

| Product code | RCA2000 | RCA2010 | RCA2018 |

|---|---|---|---|

| 68–71_StoneGlas | 6.52 | 4.12 | 3.09 |

| 50–63_TextCloth | 4.62 | 2.9 | 2.79 |

| 6–15_Vegetable | 3.1 | 1.51 | 1.78 |

| 1–5_Animal | 2.15 | 1.07 | 1.71 |

| 41–43_HidesSkin | 4.02 | 1.7 | 1.67 |

| 28–38_Chemicals | 1.26 | 1.14 | 1.5 |

| 27–27_Fuels | 0.36 | 1.14 | 1.3 |

| 72–83_Metals | 1.1 | 1.38 | 1.2 |

| 64–67_Footwear | 1.85 | 1.15 | 1.1 |

| 25–26_Minerals | 3.23 | 2.47 | 0.93 |

| 39–40_PlastiRub | 0.55 | 0.56 | 0.77 |

| 86–89_Transport | 0.2 | 0.72 | 0.7 |

| 16–24_FoodProd | 0.87 | 0.83 | 0.65 |

| 84–85_MachElec | 0.18 | 0.31 | 0.38 |

| 44–49_Wood | 0.17 | 0.22 | 0.36 |

| 90–99_Miscellan | 0.36 | 0.35 | 0.22 |

- Abbreviations: HS, Harmonized System; RCA, revealed comparative advantage.

| Product code | RCA2000 | RCA2010 | RCA2018 | Product code | RCA2000 | RCA2010 | RCA2018 |

|---|---|---|---|---|---|---|---|

| 52 | 10.49 | 8.41 | 8.2 | 42 | 6.04 | 1.91 | 1.77 |

| 13 | 18.8 | 8.61 | 7.61 | 2 | 1.02 | 1.25 | 1.71 |

| 57 | 11.59 | 6.5 | 6.51 | 17 | 0.83 | 1.64 | 1.7 |

| 53 | 4.32 | 6.26 | 6.14 | 58 | 3.46 | 1.41 | 1.7 |

| 63 | 9.43 | 4.1 | 4.71 | 89 | 0.17 | 1.69 | 1.64 |

| 9 | 7.86 | 3.79 | 4.1 | 68 | 2.76 | 1.81 | 1.59 |

| 10 | 2.87 | 2.38 | 4.03 | 76 | 0.68 | 0.64 | 1.58 |

| 71 | 9.6 | 5.19 | 3.67 | 36 | 0.98 | 1.43 | 1.55 |

| 3 | 5.13 | 1.84 | 3.24 | 69 | 0.37 | 0.53 | 1.53 |

| 14 | 5.76 | 5.23 | 3.07 | 30 | 1.41 | 0.99 | 1.45 |

| 78 | 0.07 | 1.3 | 3.03 | 72 | 1.44 | 1.26 | 1.4 |

| 55 | 2.75 | 3.43 | 2.95 | 67 | 2.16 | 2.97 | 1.38 |

| 25 | 3.87 | 2.09 | 2.9 | 73 | 1.54 | 1.79 | 1.32 |

| 54 | 2.19 | 3.63 | 2.63 | 24 | 1.22 | 1.7 | 1.31 |

| 29 | 1.58 | 1.65 | 2.38 | 27 | 0.36 | 1.14 | 1.3 |

| 50 | 15.45 | 7.02 | 2.23 | 23 | 3.68 | 2.53 | 1.25 |

| 62 | 5.6 | 2.45 | 2.23 | 38 | 1.12 | 0.94 | 1.22 |

| 32 | 2.06 | 1.6 | 2.22 | 64 | 1.99 | 1.16 | 1.16 |

| 79 | 0.14 | 3.4 | 2.19 | 7 | 1.92 | 1.18 | 1.03 |

| 61 | 3.24 | 1.75 | 2.08 | 28 | 0.83 | 1.54 | 1.01 |

| 41 | 2.38 | 1.8 | 1.94 |

- Abbreviations: HS, Harmonized System; RCA, revealed comparative advantage.

| Product code | RCA2000 | RCA2010 | RCA2018 | Product code | RCA2000 | RCA2010 | RCA2018 |

|---|---|---|---|---|---|---|---|

| 50100 | 32.12 | 3.99 | 27.69 | 520523 | 34.6 | 5.79 | 30.89 |

| 71140 | 26.79 | 29.92 | 37.27 | 520524 | 19.74 | 3.57 | 27.92 |

| 90930 | 30.94 | 54.21 | 48.64 | 520526 | 23.87 | 1.9 | 23.64 |

| 91030 | 50.15 | 113.52 | 40.72 | 520527 | 18.82 | 4.15 | 24.26 |

| 130211 | 62.73 | 21.45 | 33.21 | 520533 | 12.08 | 1.97 | 35.06 |

| 130232 | 38.64 | 72.46 | 33.31 | 520535 | 4.74 | 128.55 | 37.98 |

| 151530 | 56.22 | 121.18 | 50.16 | 520547 | 24.02 | 0.99 | 28.12 |

| 230690 | 14.19 | 19.23 | 27.99 | 530599 | 15.84 | 1.29 | 30.4 |

| 251611 | 31.89 | 52.42 | 35.55 | 530720 | 53.79 | 78.04 | 34.29 |

| 251622 | 46.49 | 39.83 | 46.51 | 530810 | 35.11 | 64.13 | 42.02 |

| 252510 | 19.72 | 46.41 | 27.46 | 531010 | 44.85 | 77.06 | 49.52 |

| 252530 | 60.58 | 60.07 | 47 | 570220 | 53.55 | 68.78 | 40.91 |

| 283190 | 12.93 | 10.96 | 33.9 | 570231 | 18.16 | 68.58 | 24.67 |

| 290362 | 66.25 | 26.8 | 55.41 | 570232 | 7.14 | 1.04 | 25.08 |

| 290611 | 26.91 | 47.81 | 24.9 | 570390 | 12.55 | 6.5 | 30.76 |

| 291431 | 9.19 | 3.24 | 36.93 | 610729 | 1.95 | 4.76 | 24.62 |

| 293311 | 9.61 | 1.96 | 25.07 | 630240 | 6.51 | 1.72 | 29.08 |

| 293332 | 4.53 | 16.3 | 26.96 | 630419 | 33.51 | 47.55 | 40.58 |

| 293929 | 24.72 | 1.44 | 24.98 | 630492 | 42.54 | 113.9 | 39.38 |

| 293949 | 12.25 | 0.14 | 26.51 | 630510 | 18.4 | 47.34 | 35.6 |

| 293950 | 2.59 | 0.25 | 28.66 | 670300 | 33.85 | 59.94 | 26.01 |

| 294200 | 53.58 | 89.55 | 35.98 | 680223 | 43.97 | 27.41 | 35.75 |

| 320416 | 12.79 | 21.47 | 24.49 | 681270 | 15.21 | 3.19 | 23.9 |

| 330125 | 23.66 | 17.98 | 40.05 | 840610 | 16.07 | 0.42 | 23.76 |

| 520521 | 53.18 | 119.71 | 23.67 | 844629 | 1.44 | 1.47 | 33.49 |

- Abbreviations: HS, Harmonized System; RCA, revealed comparative advantage.

| Product code | RCA2000 | RCA2010 | RCA2018 |

|---|---|---|---|

| 64–67_Footwear | 5.64 | 3.79 | 2.81 |

| 50–63_TextCloth | 3.48 | 2.98 | 2.6 |

| 41–43_HidesSkin | 3.85 | 2.46 | 2.27 |

| 84–85_MachElec | 0.95 | 1.78 | 1.66 |

| 90–99_Miscellan | 1.2 | 1 | 1.14 |

| 72–83_Metals | 1.08 | 0.97 | 1.09 |

| 39–40_PlastiRub | 0.8 | 0.74 | 0.92 |

| 44–49_Wood | 0.51 | 0.62 | 0.73 |

| 68–71_StoneGlas | 0.88 | 0.67 | 0.66 |

| 28–38_Chemicals | 0.62 | 0.54 | 0.59 |

| 86–89_Transport | 0.32 | 0.6 | 0.44 |

| 16–24_FoodProd | 0.78 | 0.42 | 0.42 |

| 1–5_Animal | 0.93 | 0.42 | 0.35 |

| 6-15_Vegetable | 0.9 | 0.35 | 0.34 |

| 27-27_Fuels | 0.33 | 0.11 | 0.16 |

| 25-26_Minerals | 0.85 | 0.16 | 0.15 |

- Abbreviations: HS, Harmonized System; RCA, revealed comparative advantage.

| Product code | RCA2000 | RCA2010 | RCA2018 | Product code | RCA2000 | RCA2010 | RCA2018 |

|---|---|---|---|---|---|---|---|

| 67 | 9.03 | 6.24 | 5.77 | 83 | 1.6 | 1.81 | 1.96 |

| 66 | 10.66 | 7.23 | 5.74 | 85 | 1.16 | 1.88 | 1.83 |

| 46 | 12.39 | 6.64 | 4.92 | 92 | 2.56 | 2.41 | 1.81 |

| 50 | 9.41 | 4.8 | 3.97 | 82 | 2.02 | 1.66 | 1.8 |

| 60 | 2.05 | 3.14 | 3.73 | 5 | 5.57 | 1.83 | 1.7 |

| 65 | 5.26 | 4.37 | 3.63 | 68 | 1.43 | 1.48 | 1.68 |

| 95 | 5.03 | 3.33 | 3.6 | 36 | 4.46 | 1.72 | 1.66 |

| 43 | 2.61 | 2.26 | 3.49 | 70 | 0.95 | 1.58 | 1.65 |

| 63 | 5.09 | 3.89 | 3.24 | 56 | 0.81 | 1.28 | 1.6 |

| 54 | 1.01 | 2.34 | 3.08 | 73 | 1.58 | 1.54 | 1.58 |

| 96 | 2.7 | 3.08 | 3.02 | 89 | 1.03 | 2.26 | 1.5 |

| 58 | 2.24 | 3.12 | 3.01 | 81 | 2.5 | 2.02 | 1.46 |

| 69 | 2.39 | 2.71 | 2.92 | 84 | 0.72 | 1.67 | 1.46 |

| 94 | 2.26 | 2.9 | 2.83 | 57 | 1.42 | 1.34 | 1.43 |

| 42 | 6.78 | 3.84 | 2.72 | 13 | 0.61 | 1.18 | 1.42 |