Integrating sustainable finance into energy policies: A comprehensive study on the influence of green investments on energy performance in OECD nations

Abstract

This research investigates the interplay between sustainable finance, energy policies, and environmental outcomes in OECD countries from 2005 to 2018. Recognising the pivotal role of OECD countries in global sustainability efforts, this study focuses on Australia, Belgium, Denmark, Germany, Japan, Norway, Portugal, Spain, Sweden, and Switzerland. Within this framework, the key independent variables are climate finance, renewable energy, financial inclusion, energy intensity, and economic growth, and the load capacity factor and CO2 emissions are dependent variables. The current analysis was carried out by employing econometric techniques, such as the panel mean group autoregressive distributed lag (PMG-ARDL) model, the Arellano-Bond test, random effects modelling, and ordinary least squares (OLS) modelling, due to the panel sample format of the data. The empirical results from the initial model focusing on the load capacity factor indicate that economic growth, energy intensity, financial inclusion, and renewable energy consumption positively contribute to the load capacity factor in OECD countries. Notably, climate finance was observed to diminish the load capacity factor within this model. In the subsequent model, examining CO2 emissions as the dependent variable, the findings reveal that all variables, except renewable energy consumption, exhibit a positive and statistically significant influence on CO2 emissions.

1 INTRODUCTION

This study addresses the critical issues and motivations behind sustainable energy consumption, climate finance, and environmental outcomes in OECD countries. High-pollution sectors must shift toward sustainable energy to mitigate negative externalities in global economies. Investments in climate mitigation and environmental laws are critical to this transformation, reducing greenhouse gas emissions in both developed and emerging nations (Jin et al., 2023).

International agreements, such as the Paglia (2021), Quarrie (1992), Betsill (2008), Milan (2003), and Agreement (2015), highlight the global commitment to environmental performance and reducing global warming impacts. The UN's ‘2030 Agenda for Sustainable Development’ further emphasises international cooperation for equitable economic, social, and environmental progress (Elder et al., 2016; Xue et al., 2022). As a crucial component of sustainable development, the 2030 Sustainable Development Goals (SDGs) aim for equitable progress in the economy, society, and environment. This Agenda incorporates incentive programs to address the dual challenges of environmental preservation and socioeconomic prosperity (Elder et al., 2016; Khan et al., 2022).

In setting environmental dilemmas and seeking a climate solution, Siche et al. (2010) introduced the load capacity factor as a more complex tool for environmental evaluation. The load capacity factor indicates the nation's or region's potential to sustain its inhabitants based on widespread living habits. The load capacity factor, computed as the biomass-to-ecological footprint ratio, assesses how durable the present environmental situation is. A value higher than one indicates an environmentally friendly system (Pata, 2021; Siche et al., 2010).

Many studies have examined the impact of CO2 through the lens of many factors (Ayobamiji & Kalmaz, 2020; Yuping et al., 2021). Despite their size, carbon emissions make up only a small percentage of greenhouse gases (GHGs). However, it would be misleading and a shortcoming if the total environmental deterioration is perceived as carbon emissions as the only factor (Akinsola et al., 2022). On the other hand, other researchers, such as Kirikkaleli et al. (2021), argue that the ecological footprint (EF) provides a broader measure of environmental degradation. However, the two most important metrics in ecological footprint evaluation are the ecological footprint and biocapacity. These measurements capture different aspects of the ecosystem: biocapacity deals with the supply side of nature, whereas EFs deal with the demand side; some studies have investigated the influence of various factors on the footprint of the environment (Akinsola et al., 2022; Kihombo et al., 2022; Kirikkaleli et al., 2021). Nevertheless, there is a significant gap because these studies frequently ignore the supply side, particularly biocapacity. As a result, developing a more appropriate and trustworthy assessment technique to gauge environmental quality becomes imperative. Thus, the load capacity factor proposed by Siche et al. (2010), Fareed et al. (2021), and Pata et al. (2024) is an ideal solution to this discrepancy. However, we cannot only focus on the premise of load capacity factors and ignore the carbon emission variable as the authors have done; instead, we adopt a more constructive approach that juxtaposes both factors as representative factors for environmental performance.

To promote the implementation of the UN Framework Climate Change Constitution, climate finance has regularly played an integral part in UN discussions on climate change (Ciplet et al., 2015). The fight against climate change accounts for most public financing for implementing global environmental accords (Pickering et al., 2017), and this played a crucial pillar at the UN climate conference in Copenhagen in 2009, representing an important milestone in climate funding. For the first time, wealthy nations have committed to an agreed-upon amount of climate funds to assist impoverished nations with efforts to mitigate and adjust to climate change. These commitments totaled US$30 billion between 2010 and 2012, with US$100 billion being raised yearly by 2020 (UNFCCC, 2009). The Cancun Agreements of 2010 (UNFCCC, 2010) reaffirmed these figures. They stipulated that US $100 billion is between mitigation and adaptation and that private investors should be included in the climate finance framework. A significant fraction of the necessary funding cannot be met by the current flow of climate finance, especially from public sources. As such, the private sector's mobilisation becomes crucial. This collaborative effort is essential for achieving overall mitigation and adaptation goals, as stated in Article 2, paragraph 1(c) of the Paris Agreement.

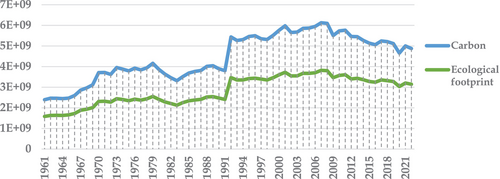

This study explores the impact of financial inclusion on carbon dioxide emissions and load capacity factors. While earlier studies have closely examined the relationship between financial development and CO2 emissions in a variety of settings (e.g., Charfeddine & Kahia, 2019; Farhani & Ozturk, 2015; Shahbaz et al., 2013), relatively few studies have investigated the role of financial inclusion in mitigating climate change, mainly within an ecological footprint and biocapacity factor framework. This study aims to examine the interplay between sustainable finance, energy policies, and environmental outcomes in OECD countries from 2005 to 2018. Recognising the importance of OECD countries in global sustainability efforts, this research focuses on 10 specific nations: Australia, Belgium, Denmark, Germany, Japan, Norway, Portugal, Spain, Sweden, and Switzerland. These countries are selected to represent a diverse range of economic structures and environmental policies within the OECD framework. We chose OECD countries as potential subjects for this study for several reasons. Historically, these nations have been significant contributors to global greenhouse gas emissions, even though European countries, which constitute a significant portion of OECD countries, accounted for only 6 billion in 2000, as shownin Figure 1.

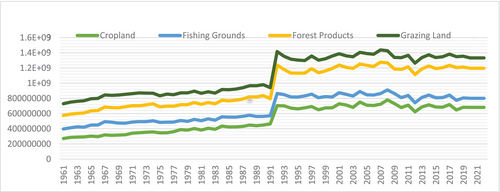

Despite some progress by OECD countries in curbing CO2 emissions in recent years, the total volume remains substantial and somewhat uncertain. Furthermore, as shown in Figure 2, rapid population growth in OECD countries has resulted in heightened energy consumption and a larger human footprint, leading to increased carbon emissions and impacting grazing lands and forest commerce.

The links between financial inclusion, climate finance, and environmental quality are less prevalent in the literature than those between financial inclusion and financial development. The main question is whether offering inclusive financial services to all citizens, including those in vulnerable communities, helps mitigate greenhouse gas emissions or worsens a nation's capacity. In addition, improved access to financial services can contribute to environmental sustainability and the load capacity factor. However, this should be addressed cautiously since financial inclusion stands for overcoming economic inequality and providing citizens access. Overcoming wealth disparity is also known as a cornerstone for assessing financial inclusivity. It can be linked to an increase in carbon emissions as this scenario of CO2 increases through income inequality is more prevalent in developing economies (Çetin et al., 2023; Ozturk et al., 2022).

The roles of energy intensity and renewable energy are also factors of interest in this study. Global energy demand increased twofold between 2011 and 2018. The escalating demand for electricity was identified as a significant driver, contributing to approximately half of the overall energy consumption growth. This heightened energy demand has resulted in a 1.7% increase in carbon emissions and worsening environmental pressures (Abbasi & Adedoyin, 2021). However, according to the IEA (2022), renewable energy sources, particularly solar photovoltaics (PVs) and wind, have recently experienced significant growth, constituting 43% of global electricity generation by 2030, compared to the current 28% leading to an oil demand decline. This decline is attributed to the increasing popularity of electric vehicles (EVs) and improvements in energy efficiency, which collectively diminish the long-term prospects of oil. Hence, renewable energy can preserve the environment. Validating this positive impact of renewable energy, Pata et al. (2024) noted a bidirectional effect between renewable energy and the load capacity factor. This extends the spillover effect of renewable energies to both carbon emissions and LCF.

However, the dynamic effect of environmental degradation is not consistent and sporadic, given the region of interest. Let us take the upper middle-income countries as an example. Financial development and renewable energy consumption reduce CO2 emissions (Çetin et al., 2022). However, a slightly different outcome can be recorded in developed economies where their economy is directed toward green transition rather than environmental degradation. This is rather explanatory, as relatively new emerging countries seek economic expansion; in other words, the posterior effect of financial development is unlikely or scarce to contribute positively to the environment.

Therefore, this study examines the impact of climate finance, renewable energy, economic growth, energy intensity, and financial inclusion on load capacity factors across selected OECD countries. The investigation utilises a panel ARDL method applied to a dataset from 1980 to 2017. The noteworthy contributions of this study to the existing body of literature on energy and the environment include (i) an exploration of the role of climate finance in terms of load capacity, a dimension less explored than the predominant focus on carbon emissions; (ii) the incorporation of both financial inclusion and climate finance in a model assessing load capacity factors; (iii) a departure from a singular rudimentary focus on carbon emissions by examining how carbon emission mitigation and a country's capacity factor can be concurrently addressed; and (iv) the use of a combination of econometric methods such as panel ARDL and causality tests to uncover the relationships and causal associations between the selected variables, load capacity factors, and CO2 emissions while providing robust results with a random effect, OLS regression and Arellano estimating model. The sections of this study are grouped as follows: The next section summarises the relevant works, whereas Section 3 provides the data, methodologies, and theoretical foundations. Section 4 covers the findings and discussion, while Section 5 concludes the study.

2 LITERATURE REVIEW

The literature on climate finance underscores its critical role in environmental sustainability and policy formulation across diverse contexts. Lee et al. (2022) highlight its potential to significantly reduce carbon emissions, especially in developed and small island states, thus facilitating green growth. Bracking (2019) provides a historical perspective on climate finance, emphasising challenges in methodology and the need for robust accounting frameworks. Aglietta et al. (2015) advocate aligning infrastructure investments with long-term climate goals, stressing the importance of integrating climate finance into broader financial systems.

Quynh et al. (2022) explore climate funding's impact on environmental quality, noting its complex interactions with renewable energy and CO2 emissions relevant to global climate goals like COP26. Pindiriri and Kwaramba (2024) examine how ecological budget labelling correlates with increased climate-related funding but stress the need for more effective carbon reduction strategies. Leal et al. (2023) and Hsu (2023) respectively highlight the positive effects of climate finance on environmental decline in emerging nations and its role in mitigating carbon emissions through sustainable bonds and green technologies.

Studies by Zhang and Wang (2021), Sadiq et al. (2022), and Li et al. (2022) emphasise the beneficial impact of green finance on energy efficiency and sustainable economic growth, particularly in regions like China and South Asia. Rasoulinezhad and Taghizadeh-Hesary (2022) and Liu et al. (2023) further investigate the causal relationships between green financing and renewable energy development, stressing the importance of stable investment environments.

Wang et al. (2023) discuss the uneven impacts of green financing on energy efficiency across different economies, suggesting regulatory reforms to maximise its potential. Kawabata (2019) and Pollitt and Mercure (2018) critique current climate and energy policy evaluation methods, advocating for more precise modelling techniques. Cetin et al. (2018) confirm the Environmental Kuznets Curve, linking economic growth and urbanisation with CO2 emissions.

Additionally, studies by Sun et al. (2022), Chang et al. (2023), and In et al. (2022) explore the interplay between renewable energy usage, climate risk financing, and CO2 emissions across various global contexts, highlighting the complexities in leveraging climate finance for sustainable development. Steckel et al. (2017) argue for a shift from climate funding to sustainable development investment, emphasising the integration of global objectives with local development priorities.

Michaelowa et al. (2021) examined the application of venture capital for energy-focused mitigation measures in sub-Saharan Africa. The report underlines the need to deploy private financing for broad access to energy and environmental mitigation objectives. This paper presents case studies demonstrating the interplay between climate finance and domestic policy instruments.

Mungai et al. (2022) analyse the possibilities for renewable energy and energy efficiency investment in Sub-Saharan Africa, emphasising the need to overcome financial barriers to sustainable development. This report underlines the urgent need to address institutional knowledge deficits and legislative constraints to realise the funding potential of renewable energy and energy efficiency.

Corrocher and Cappa (2020) examine the variables that influence private investment in solar energy, emphasising the impact of public funding and policy. Their findings highlight the favourable relationship between public money and venture capital, with clean energy mandates having a more significant effect than feed-in taxes.

Anantharajah and Setyowati (2022) study climate finance conditions in Asia and the Pacific, illustrating how current organisations and power dynamics influence funding transformations to low-carbon energy. This paper emphasises the need for climate finance administration that reduces inequality and encourages vital co-benefit implementation.

Çetin et al. (2023) found that globalisation and renewable energy consumption mitigate environmental pollution, while economic growth and financial development contribute to it. Furthermore, two recent studies shed light on the factors influencing environmental sustainability. Pata and Destek (2023) focused on India's environmental quality and discovered that structural changes have no impact, whereas renewable energy and information and communication technologies (ICT) positively affect it. Sun et al. (2024) analysed the ecological importance of 17 APEC countries and found that while economic growth diminishes environmental quality, natural resources, technological development, urbanisation, and renewable energy enhance it. Both studies emphasise the importance of prioritising technological development and renewable energy to foster environmentally friendly economic models and align growth strategies with sustainable development goals (SDGs).

These papers analyse different perspectives on climate finance, including its ability to reduce greenhouse gas emissions and the difficulties associated with its financial practices and accounting. These papers emphasise the need for comprehensive and coordinated efforts to utilize climate finance to achieve environmental sustainability effectively.

Some of the studies in the literature explore the relationships between green finance, green economic growth, and the advancement of renewable energy, providing insight into their impact on sustainable development and energy efficiency. These studies cover various topics, such as green finance, financial development, climate finance, climate risk, renewable energy, and sustainable development. They offer valuable insights into the intricate connections between financial stability, climate risks, renewable energy consumption, and the mobilisation of private and public resources for sustainable energy goals.

Within the literature reviewed, there appears to be a shortage of studies specifically investigating the relationship between the load capacity factor and the integration of sustainable finance into energy policies. While the literature extensively covers topics such as climate finance, renewable energy consumption, and CO2 emissions, there is a limited exploration into how sustainable finance initiatives impact the load capacity factor within OECD countries. By addressing this gap, this study aims to understand how these factors influence the load capacity factor in OECD countries.

Including the load capacity factor as a measure of environmental degradation sets this study apart from existing research in the field. While previous studies have primarily focused on traditional measures such as CO2 emissions, this study pioneers exploring the relationships among climate finance, energy policies, and environmental outcomes using a more up-to-date metric such as the load capacity factor.

Additionally, by examining the relationship between climate finance and the load capacity factor for the first time, this study breaks new ground in the literature, shedding light on how financial mechanisms can impact energy performance.

Previous research has explored the relationship between renewable energy usage and CO2 emissions, primarily in emerging economies. However, there is a lack of comprehensive analyses focusing specifically on OECD countries. This study seeks to bridge this gap by examining how renewable energy consumption influences CO2 emissions within the context of OECD countries' energy policies.

Based on the literature review and the variables outlined in the study, the following hypotheses are proposed:

H1.Higher levels of climate finance will lead to a decrease in CO2 emissions in OECD countries.

H2.Increased investment in renewable energy will positively influence the load capacity factor in OECD countries.

H3.Higher levels of financial inclusion will lead to a significant load capacity factor.

H4.Lower energy intensity will be associated with a higher load capacity factor in OECD countries.

H5.Economic growth will positively influence the load capacity factor in OECD countries.

H6.Higher levels of renewable energy consumption will be associated with lower CO2 emissions in OECD countries.

3 METHODOLOGY

3.1 Variables and data

This research explores the complex dynamics between sustainable finance, energy policies, and environmental outcomes within the context of OECD countries from 2005 to 2018. The period selection was primarily guided by the availability of comprehensive and reliable data spanning those years, facilitating a robust analysis of the interplay between sustainable finance, energy policies, and environmental outcomes in OECD countries. To delve into the specifics, the 2005–2018 timeframe was selected to encapsulate a period marked by significant shifts in global energy policies, financial landscapes, and sustainability initiatives within the OECD context. During this span, various landmark agreements and initiatives, such as the Paris Agreement 2015, propelled considerable attention toward green investments and sustainable finance mechanisms across OECD countries. Additionally, advancements in renewable energy technologies, and evolving regulatory frameworks, have shaped the energy landscape during these years. Focusing on this timeframe, we aimed to capture a comprehensive snapshot of the changing dynamics between sustainable finance and energy policies while ensuring a sufficiently robust dataset for econometric analysis. Notably, our study's scope intentionally excludes events post-2018, such as the COVID-19 pandemic, and geopolitical conflicts, such as the Russia-Ukraine war and the Israel-Gaza conflict, to maintain the analytical focus on the predefined period and mitigate potential confounding factors.

The importance of OECD countries in the broader sustainability discourse is underscored, given their significant contributions to global pollution and their potential role as influential players in harmonising economic progress with environmental stewardship. By selecting countries such as Australia, Belgium, Denmark, Germany, Japan, Norway, Portugal, Spain, Sweden, and Switzerland as case studies, this study aims to capture diverse economic perspectives and critical points within the broader OECD landscape. We used Kao (1999), Pedroni (1999), Pedroni (2004), and Westerlund (2007) tests of cointegration on a panel dataset. All tests have a common null hypothesis of no cointegration. The alternative hypothesis of the Kao and Pedroni tests is that the variables are cointegrated in all panels. In one version of the Westerlund test, the alternative hypothesis is that the variables are cointegrated in some of the panels. These tests get good coverage and power properties by combining panel-level statistics computed from a time-series regression using only the observations in that panel. Kao (1999) finds that his tests have nearly nominal size when T = 100 and N = 300. Pedroni (2004) finds that his tests have nearly nominal size when T = 250 and N = 60. Westerlund (2005) limited his simulations to datasets with T = 150, and he did not find a combination of T and N in which his tests had nearly nominal size. He said that T > 150 should produce better coverage. The panel data structure in this study is (T > N). The independent variables under scrutiny include climate finance, renewable energy, financial inclusion, energy intensity, and economic growth. These variables, in turn, serve as the basis for constructing two distinct econometric models in which the load capacity factor and CO2 emissions act as dependent variables. All the variables were used as their natural log values in the analyses. More detailed information is provided in Table 1.

| Notation | Variables | Metric | Definition |

|---|---|---|---|

| LCF | Load capacity factor | The load capacity factor is computed as the proportion of biocapacity divided by the ecological footprint. | (Siche et al., 2010) presented a measure for environmental evaluation. It assesses an area or country's capacity to support its people based on its lifestyle. |

| CO2 | CO2 emissions | CO2 emissions from energy (millions of tons) | A greenhouse gas generated by the combustion of energy sources such as coal, oil, and natural gas |

| CF | Climate finance | Development finance for climate and environment (US $) | This applies to monetary assistance granted to assist programs and activities that aid in reducing the effects of climate change in low-income nations |

| GDP | Economic growth | GDP per capita (constant 2020 US$) | Describes the gradual rise in an economy's manufacturing and consumption of products and services |

| EI | Energy intensity | Energy intensity is assessed as a function of the primary energy source and GDP. | Measures the energy used per unit of economic output (e.g., GDP). It reflects the efficiency of energy use in an economy. |

| FI | Financial inclusion | Financial institution access index | Provides a variety of monetary services, such as banking, credit, and insurance, to people and companies who are generally omitted from the official financial system |

| RE | Renewable energy | Renewable energy consumption (% of total final energy consumption) | It describes energy obtained from renewable sources recharged on a human timeframe, such as sunshine, wind, rain, tides, waves, and geothermal heat |

To rigorously analyse the relationships among these variables, this study employs a combination of econometric techniques, including the panel mean group autoregressive distributed lag (PMG-ARDL) model, the Arellano-Bond test to address potential endogeneity concerns, random effects modelling to account for unobserved heterogeneity, and ordinary least squares (OLS) modelling to assess linear relationships. A comprehensive statistical analysis was adopted due to the panel sample format of the data. Authors such as Mensah et al. (2019), Hongxing et al. (2021), Boufateh and Saadaoui (2020), and Attiaoui and Boufateh (2019) performed similar models in Africa and 81 selected countries. Furthermore, the reliability of the study's findings is fortified by the careful curation of data from reputable sources, including OECD databases, World Development Indicators, International Energy intensity, and the Global Ecological Footprint Index.

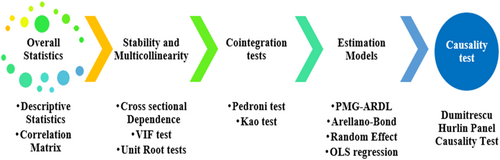

Figure 3 provides a comprehensive overview of the methodological structure employed in the current study. The methodological structure depicted in Figure 3 unfolds in several distinct stages, each contributing crucial insights to the research endeavour. The initial stage involves the examination of descriptive statistics, offering a foundational understanding of the dataset under scrutiny. Building upon the descriptive statistics, the correlation matrix explores the relationships between variables, shedding light on potential associations and dependencies. Addressing multicollinearity and cross-sectional dependence is paramount in panel data analysis. The assessment of stationarity through unit root tests is fundamental in time series analysis. Cointegration analysis offers insights into the existence of stable equilibrium relationships among the variables. PMG-ARDL, Arellano–Bond estimation, the random effect model, and simple OLS models enable the exploration of complex relationships and provide empirical evidence to address the research objectives. The Dumitrescu Hurlin panel causality test is crucial in exploring causal relationships among variables in panel data analysis. This test examines the direction of causality between pairs of variables, providing insights into the dynamic interactions within the dataset.

3.2 Model specification

The error element in this formula is indicated by , while the fixed element is indicated by . The factors through are used as indexes to calculate the LCF and CO2. It is also possible to compute both the long-run and short-run components simultaneously. The prior model was built to define the bounds of the PMG ARDL model.

3.2.1 Cross-section dependence

3.2.2 Unit root tests

3.2.3 Panel unit root test

3.2.4 Panel cointegration tests

The null hypothesis asserts no interaction between variables and is assumed to be pi = 1.

3.2.5 PMG-ARDL (pooled mean group autoregressive distributive lag model)

3.2.6 Arellano–Bond linear estimator and Arellano-Bover/Blundell-Bond estimator

In equations (15) and (16) we can see that i = 1…, Nt = 1…, Ti and j = 1, 2. Then, the factors to be evaluated are j and p. The impacts on the panel are represented by vi. μ it denotes incorrect phrases. The factors that need to be estimated are numbered β 1 to β 5 and are related to the independent variables.

3.2.7 Panel causality test

As illustrated by the model, x and y are two stationary variables for the country in year and are the individual fixed effects. are slope parameters, and are lag metrics. The framework enables fluctuations between parts but should remain constant over time. The approach also estimates the unique Wald values for each cross-section, which are then averaged to calculate the Wald test statistic for the panel. The design additionally shows its limited range and generates a distinct test statistic.

We believe that the individual Wald averages are considering the test scores because of the experimental data. This yields the typical N(0, 1) distribution. The approach recommends using when the time aspect is less than the cross-sectional scale and when the cross-sectional aspect is less than the time scale.

We suppose that the single Wald estimates are considering the test scores regarding the test outcome. This results in the N(0, 1) normal distribution. The framework indicates that should be utilised when the time component is less than the cross-sectional aspect, and should be utilised when the cross-sectional aspect is less than the time dimension.

4 FINDINGS AND DISCUSSION

The dataset in Table 2 comprises seven variables, each providing distinct insights into aspects such as environmental impact, financial implications, and resource efficiency. Notably, the load capacity factor (LCF) exhibits a positively skewed distribution with a mean of 0.645, indicating an asymmetrical pattern with a heavier tail on the right side. Carbon dioxide (CO2) displays a wide range of values, from 14.04 to 11.24, suggesting considerable variability. Its positive skewness (1.270) implies concentration toward lower values, with a few higher values pulling the distribution to the right. LCF shows moderate variability (standard deviation: 2.345) and a slightly left-skewed distribution (skewness: −0.260). Gross domestic product (GDP) and energy intensity (EI) have lower standard deviations, indicating less variability around their means. Financial Inclusion (FI) and Renewable Energy (RE) exhibit distributions resembling normality, as their skewness and kurtosis values suggest.

| LCF | CO2 | CF | GDP | EI | FI | RE | |

|---|---|---|---|---|---|---|---|

| Mean | 0.645186 | 11.78232 | 11.14512 | 4.637673 | 1.239102 | 0.814341 | 2.799646 |

| Maximum | 1.896739 | 11.24923 | 15.54858 | 4.938303 | 1.719189 | 1.000000 | 4.112348 |

| Minimum | 0.110973 | 14.04883 | 4.499810 | 4.269152 | 0.506818 | 0.541754 | 0.900161 |

| SD | 0.582120 | 10.40819 | 2.345812 | 0.184284 | 0.286942 | 0.115132 | 0.814052 |

| Skewness | 0.878301 | 1.270035 | −0.260635 | −0.303805 | −0.501420 | −0.590501 | −0.104505 |

| Kurtosis | 2.131179 | 0.529874 | 2.997271 | 2.315447 | 2.581767 | 2.879018 | 2.107929 |

| Jarque-Bera | 22.40292 | 1.685742 | 1.585095 | 4.887180 | 6.886885 | 8.221501 | 4.896943 |

| Observations | 140 | 140 | 140 | 140 | 140 | 140 | 140 |

The correlation matrix presented in Table 3 offers insightful relationships involving both models of the study. The negative correlation between LCF and CO2 emissions (−0.215) suggests that as the load capacity factor increases, CO2 emissions tend to decrease. This negative correlation aligns with sustainability goals, indicating that higher load capacity factors may contribute to a reduction in environmental impact. Additionally, the positive correlations of LCF with GDP, EI, and RE (0.417764, 0.520750, and 0.423112, respectively) imply that increased load capacity factors are associated with greater economic growth, energy efficiency and renewable energy source utilisation. On the other hand, the negative correlation between LCF and FI (−0.156) suggests a potential trade-off between load capacity factors and financial inclusion.

| LCF | CO2 | CF | GDP | EI | FI | RE | |

|---|---|---|---|---|---|---|---|

| LCF | 1.000000 | −0.215474 | −0.029049 | 0.417764 | 0.520750 | −0.156517 | 0.423112 |

| CO2 | −0.215474 | 1.000000 | 0.487793 | −0.347884 | 0.333317 | 0.202258 | −0.753689 |

| CF | −0.029049 | 0.487793 | 1.000000 | 0.268727 | 0.055078 | −0.208450 | −0.122759 |

| GDP | 0.417764 | −0.347884 | 0.268727 | 1.000000 | −0.070130 | −0.029070 | 0.312750 |

| EI | 0.520750 | 0.333317 | 0.055078 | −0.070130 | 1.000000 | −0.205355 | −0.284983 |

| FI | −0.156517 | 0.202258 | −0.208450 | −0.029070 | −0.205355 | 1.000000 | −0.505227 |

| RE | 0.423112 | −0.753689 | −0.122759 | 0.312750 | −0.284983 | −0.505227 | 1.000000 |

Furthermore, the positive correlation between CO2 and climate finance (CF), which is 0.487, underscores the positive relationship between increased carbon dioxide emissions and augmented financial allocations for climate-related endeavours. The negative correlation between CO2 and GDP highlights the ecological repercussions of diminished economic growth, necessitating a reconciliatory approach to sustainable development. The positive correlation between CO2 and EI accentuates the nexus between heightened carbon emissions and augmented energy intensity, emphasising the imperative role of energy efficiency in decreasing carbon emissions. The modest positive correlation with financial inclusion (FI) becomes a more specific exploration of the interplay between carbon emissions and financial inclusivity. Finally, the robust negative correlation with renewable energy (RE) accentuated the pronounced role of renewable energy sources in reducing carbon emissions.

It is important to emphasise that further statistical verification of the correlations is necessary because the given correlation matrix cannot infer how the predictor factors influence the dependent variables. As a result, the variance inflation factor (VIF) indicates whether multicollinearity emerges (Miles, 2014). This study assessed the degree of variance between the variables specified. As a result, if the VIF is near to or greater than 10, there will be an exponential association among the endogenous variables and the explanatory factors (Myers & Myers, 1990). According to Table 4, the mean VIF is estimated to be 1.79, which is less than 10. As a result, we find no indication of multicollinearity among the variables used for prediction. The cross-sectional dependency test was also used in the study. According to Table 4, the test determines the existence of cross-sectional dependence, revealing an overall dependency between the metrics analysed in this study, given that the p-value (in parentheses) implies a 1% degree of significance in the two models.

| Variables | Multicollinearity test | Cross-sectional dependence (CSD) tests | |||

|---|---|---|---|---|---|

| VIF | 1/VIF | Test | Model 1: LCF | Model 2: CO2 | |

| RE | 2.39 | 0.41 | Breusch–Pagan LM | 169.07*** | 92.75*** |

| FI | 2.07 | 0.48 | |||

| GDP | 1.39 | 0.71 | Pesaran scaled LM | 13.079*** | 5.03*** |

| CF | 1.39 | 0.71 | |||

| EI | 1.39 | 0.72 | Pesaran CD | 7.299*** | 4.68*** |

| Mean VIF | 1.79 | ||||

- ***, **, and * denote 1%, 5%, and 10%, respectively.

Based on the three particular tests for cross-sectional dependency utilised in Table 5, the invalidation of the null assumption suggests that the remaining coefficients are cross-sectionally dependent (Akın, 2019). The findings reveal that the autonomous cross-sectional null hypothesis is firmly rejected for all variables, demonstrating the existence of cross-sectional dependency. This means that an upsurge in one of the OECD countries might have a commercial and environmental impact on the other nations. This finding, derived from a deductive process, allows us to conduct more appropriate tests and computations in the following phases of the empirical inquiry (Henningsen & Henningsen, 2019).

| Variables | LM | LMadj | Pesaran CD |

|---|---|---|---|

| LCF | 96.65*** | 5.44*** | 7.20*** |

| CO2 | 229.85*** | 19.48*** | 7.93*** |

| CF | 201.48*** | 16.49*** | 11.45*** |

| GDP | 320.07*** | 28.99*** | 16.63*** |

| EI | 495.26*** | 47.47*** | 22.11*** |

| FI | 139.26*** | 9.94*** | 4.967*** |

| RE | 428.22*** | 40.18*** | 19.78*** |

- ***, **, and * denote 1%, 5%, and 10%, respectively.

We must resolve two modelling difficulties before delving into our empirical findings. The initial problem to be answered is the necessity of testing for the occurrence of unit roots in panellists. Kim et al. (2010) showed that while three alternative estimation tools may be used even when certain variables are I(1) and others are I(0), they are not appropriate for I(2) or higher sequences. To verify the unit roots in the datasets, the LLC, Breitung, Fisher ADF, and Fisher PP tests are used to confirm that not all the components have I(2) characteristics. The outcomes typically suggest that all variables in the complete sample and subgroups emerge as I(1) or I(0) functions. For example, performing the four tests on the whole sample yields the findings in Table 6, indicating that all the selected variables are I(1).

| Variables | Common unit root | Individual unit root | ||||||

|---|---|---|---|---|---|---|---|---|

| LLC | Breitung | ADF | PP | |||||

| Level | 1st difference | Level | 1st difference | Level | 1st difference | Level | 1st difference | |

| LCF | −2.293 | −5.514*** | −0.603 | −3.614*** | 20.85 | 52.96*** | 42.47*** | 129.98*** |

| CO2 | −0.449 | −4.568*** | −0.065 | −4.761*** | 14.74 | 48.14*** | 38.15*** | 131.84*** |

| CF | −3.748*** | −3.392*** | −0.461 | −3.614*** | 23.00 | 37.46** | 17.96 | 84.80*** |

| GDP | −2.152** | −8.863*** | −2.129** | −3.138*** | 27.41 | 52.72*** | 24.00 | 84.49*** |

| EI | −3.806*** | −5.341*** | −0.745 | −3.155*** | 30.31* | 41.51*** | 57.76*** | 123.75*** |

| FI | −2.126** | −7.922*** | −0.492 | −2.891*** | 29.02* | 59.39*** | 87.86*** | 139.43*** |

| RE | −0.799 | −6.482*** | −0.277 | −2.649*** | 11.47 | 47.31*** | 32.37** | 115.15*** |

- ***, **, and * denote 1%, 5%, and 10%, respectively.

The reality that an intersecting relationship across datasets has been demonstrated means that standard ways of verifying the unit root are incorrect. Consequently, we performed a second unit root test (CIPS and CADF) to validate the data series integration pattern. Table 7 shows that all the components remain unaltered and static at the initial difference between the CIPS and CADF supports. As a result, because the combined order of all the variables is identical (first difference), we may use the cointegration technique to evaluate the long-term relationships between components.

| Variables | CIPS stats (constant) | CADF stats (constant) | ||

|---|---|---|---|---|

| Levels | First difference | Levels | First difference | |

| LCF | −2.327** | −4.182*** | −2.327** | −4.182*** |

| CO2 | −2.320** | −3.276*** | −2.320** | −3.276*** |

| CF | −2.613*** | −3.827*** | −2.613** | −3.827*** |

| GDP | −1.486 | −2.441** | −1.486 | −2.441**** |

| EI | −2.723*** | −3.744*** | −2.723*** | −3.744**** |

| FI | −2.183** | −3.918*** | −2.483** | −3.918*** |

| RE | −2.619*** | −4.439*** | −2.619*** | −4.439*** |

- ***, **, and * denote 1%, 5%, and 10%, respectively.

The second modelling problem to be resolved is determining whether there are signs of interdependence among factors. We fix this problem by running numerous panel cointegration assessments. Cross-sectional dependence occurs when observations across different panels (countries, in this case) are not independent, which violates the assumptions of traditional panel cointegration tests like those by Pedroni and Kao. Westerlund (2007) developed cointegration tests that explicitly address cross-sectional dependence by allowing for correlation among panel units. These tests are robust when there might be common shocks or other forms of interdependence among the countries studied. By employing Westerlund's panel cointegration tests, we can better capture the true relationships among variables across the OECD countries while accounting for potential cross-sectional dependencies. Therefore, alongside the Pedroni and Kao test, including the Westerlund panel cointegration test enriches our methodological toolkit. As displayed in Table 8, the conclusions of Pedroni and Kao tests suggest significant cointegration among the variables at traditional significance levels. Pedroni's test, accounting for both within and between group autoregressive parameters, rejects the null hypothesis of no cointegration at the 1% and 5% significance levels, indicating a robust long-term relationship among the variables. Similarly, Kao test supports a long-term association, with p-values below 1% and 10% thresholds for its models.

| Approach | Panel cointegration tests | Model 1. LCF | Model 2. CO2 | ||

|---|---|---|---|---|---|

| Statistics | p values | Statistics | p values | ||

| Pedroni: Common AR coefficients (within dimension) | Panel-v | −1.30316 | 0.9037 | −0.55847 | 0.7117 |

| Panel-rho | 1.15824 | 0.8766 | 2.60745 | 0.9954 | |

| Panel-PP | −8.76972*** | 0.0000 | −7.77314 | 0.0000 | |

| Panel-ADF | −2.42533*** | 0.0076 | −2.35246*** | 0.0093 | |

| Pedroni: Individual AR coefficients (between dimensions) | Group-rho | 4.2806 | 1.0000 | 4.034665*** | 1.0000 |

| Group-PP | −4.0409*** | 0.0000 | −16.0416*** | 0.0000 | |

| Group-ADF | −2.07363** | 0.0191 | −4.01591*** | 0.0000 | |

| Kao | −1.338842* | 0.0903 | −2.43959*** | 0.0074 | |

| Westerlund | −1.3269* | 0.0923 | 2.0452** | 0.0204 | |

- ***, **, and * denote 1%, 5%, and 10%, respectively.

In addition to these findings, we have incorporated Westerlund's (2007) panel cointegration test to address potential cross-sectional dependence among panel units. The Westerlund test provides further insights by allowing for correlation among panel units, which is crucial in environments where variables may be affected by common economic or environmental shocks. Our results from the Westerlund test show a variance ratio statistic of −1.3269 with a p-value of 0.0923 and 2.0452 with a p-value of 0.0204 for models 1 and 2, respectively. These results suggest a borderline case regarding cointegration, indicating weak evidence against the null hypothesis of no cointegration for model 1, and provide strong evidence against the null hypothesis of no cointegration for model 2, indicating a stable long-term relationship among the variables. These methodological approaches—Pedroni, Kao, and Westerlund tests—comprehensively assess the long-term relationships among climate finance, energy policies, economic growth, and environmental outcomes across OECD countries from 2005 to 2018.

Determining appropriate models is crucial in examining the potential long-term relationship between the selected variables and the load capacity factor. Accordingly, Table 9 presents the results of the four different models, namely, PMG-ARDL, Arellano–Bond estimation, the random effect model, and simple OLS, focusing on the five distinct indicators of sustainable finance and energy policies, which are climate finance (CF), economic growth (GDP), energy intensity (EI), financial inclusion (FI), and renewable energy (RE). In this study, utilising four different models is essential for ensuring the robustness and credibility of the findings. Each model has its own set of assumptions and strengths, and employing a variety of assumptions and strengths allows for a comprehensive assessment of the data. This approach facilitates robustness checking, model comparison, and addressing specific econometric challenges such as endogeneity or heterogeneity. Notably, all four models revealed outcomes and relationships among the variables, which supports the robustness of the study's findings.

| Model 1. Load capacity factor | |||||

|---|---|---|---|---|---|

| Dependent variable: LCF | |||||

| Variables | PMG-ARDL (1, 1, 1, 1, 1, 1) | Arellano–Bond estimation | Random Effect | OLS | |

| Short Run | Long Run | ||||

| CF | 0.0020 | −0.0032*** | −0.001 | −0.002 | 0.0180* |

| (0.8860) | (0.0000) | (0.913) | (0.818) | (0.088) | |

| GDP | −2.5838*** | 0.2498*** | 0.426** | 0.978*** | 0.6474*** |

| (0.0073) | (0.0000) | (0.045) | (0.000) | (0.000) | |

| EI | −0.4678** | 0.1847*** | 0.252** | 0.733*** | 1.7726*** |

| (0.0266) | (0.0000) | (0.031) | (0.000) | (0.000) | |

| FI | 0.4109 | 1.2288*** | 0.623* | 0.453*** | 2.4150*** |

| (0.3343) | (0.0000) | (0.057) | (0.000) | (0.000) | |

| RE | −0.0395 | 0.2667*** | 0.142** | 0.291*** | 0.6137*** |

| (0.7116) | (0.0000) | (0.017) | (0.000) | (0.000) | |

| Constant | −0.9429** | −2.995** | −5.964*** | −8.4400*** | |

| (0.0251) | (0.014) | (0.000) | (0.000) | ||

| COINTEQ01 | −0.4292*** | ||||

| (0.0140) | |||||

- ***, **, and * denote 1%, 5%, and 10%, respectively.

First, a study examining the impact of climate finance on the load capacity factor (LCF) across 10 OECD countries, including Australia, Belgium, Denmark, Germany, Japan, Norway, Portugal, Spain, Sweden, and Switzerland, revealed a surprising negative correlation. We observe that an increase of 1% in climate finance (CF) results in a 0.003 decrease in the load capacity factor. One plausible explanation could be the sectoral allocation of climate finance within these nations. Suppose a significant portion of the funds is directed toward industries with inherently high resource consumption or ecological footprints, such as heavy manufacturing or certain agricultural practices. In that case, it counteracts the intended positive environmental effects. For instance, it is well known that countries such as Australia, Spain, and Japan rely heavily on energy-intensive industries, so directing climate finance toward renewable energy projects alone will not be sufficient to offset the overall negative impact.

Moreover, these nations' economic structure and dependency can be considered among the factors influencing the observed negative relationships. Countries that rely strongly on industries that contribute substantially to environmental degradation often face challenges in improving their LCFs. For example, suppose a nation's economy is driven by fossil fuel extraction or processing. In that case, the positive impact of climate finance on overall sustainability may be hindered by the inherent environmental costs associated with these industries. This is the case for Norway, which is among the top fossil fuel-producing countries in the world.

Additionally, the time lag in realising the impact of climate projects should be considered. Climate initiatives often have longer time horizons, and if the study period is relatively short, the positive effects of climate finance on the LCF may not have had sufficient time to manifest. This could lead to a misleading perception of a negative correlation when, in fact, the long-term benefits are yet to be fully realised. Our findings oppose those of Jin et al. (2023), who explored the drivers of LCF in Germany, employing information collected from 1974 to 2018. The authors discovered that investments in research and development in green energy increase LCFs and enable Germany to strengthen its overall environmental conditions. In greater detail, they proposed that increasing the RER by 1% can increase the LCF by 0.331%. This is obvious given that the RER is a realistic and feasible way to boost green energy research while reducing environmental deterioration (Altıntaş & Kassouri, 2020). The authors stress that Germany increased its spending on sustainable energy research and development over the study period. Germany has increased the RER by approximately 70% in the previous 30 years. Improved RER initiatives increase LCF while also having a positive environmental impact. As Germany plans to reduce pollution by approximately 65% by 2030, policymakers can concentrate on improving the RER to meet this goal. The literature has adequate research on the relationships between climate and LCFs. Another study, conducted in the context of G7 nations by Ahmed et al. (2022), demonstrated that increasing climate funding promotes energy transformation by increasing the supply of green energy, which reduces emissions and improves environmental quality.

The positive correlation found in the study indicates that a 0.24 unit increase in the load capacity factor (LCF) is associated with an increase in gross domestic product (GDP) in OECD countries. This implies a complex relationship between economic growth and environmental sustainability. One concrete example supporting this relationship is the case of Germany. The country has experienced substantial GDP growth while investing heavily in renewable energy and energy efficiency measures. Expanding its renewable energy sector, such as wind and solar power, has contributed to a more sustainable energy mix and reduced environmental impact.

Conversely, contrasting examples can be found in countries where economic growth is closely tied to industries with high environmental costs. For instance, Australia's economy has historically relied heavily on mining and extracting natural resources, including coal and minerals. This economic model has contributed to a greater ecological footprint, potentially counteracting the positive impact one might expect from increased GDP on the load capacity factor. The country's dependence on coal, one of the world's largest coal exporters, has led to environmental concerns, including greenhouse gas emissions, land degradation, and pollution. Resource extraction, deforestation, and habitat disruption have contributed to biodiversity loss. Water consumption and potential contamination from mining activities further impact aquatic ecosystems. Australia's limited economic diversification and reliance on resource-intensive industries make it susceptible to global market fluctuations.

Moreover, the study's findings underscore the importance of the quality and nature of economic growth. If GDP growth is driven by technology, innovation, and sustainable industries, it is more likely to influence LCFs positively. Countries such as Sweden exemplify this approach, where economic growth is coupled with a strong emphasis on sustainable practices, leading to a lower ecological footprint. The country has prioritised investments in renewable energy sources, such as hydroelectric power and wind, leading to a cleaner energy mix emphasising green technology and innovation. Additionally, Sweden actively supports research and development initiatives to create environmentally friendly solutions across various sectors. The implementation of comprehensive policies and regulations fosters sustainability by addressing carbon emissions, energy efficiency, and industry practices. Sweden's commitment to a circular economy, focusing on recycling and waste reduction, further minimises resource consumption. Notably, the population's environmental consciousness and support for sustainable practices contribute to shaping a positive and harmonious relationship between economic growth and a lower ecological footprint in Sweden. Our findings agree with Pata et al. (2023). The authors pointed out that economic expansion decreases the LCF more quickly in the early phases of economic expansion than in the later phases, implying that the ecological Kuznets curve theory is correct in Germany. According to Raihan et al. (2023) the prominence of the Mexican economy is expected to diminish the nation's load capacity factor. Temporary and long-term statistics show that economic success interacts adversely with the load capacity factor. A 1% increase in GDP reduces the load capacity by 0.63% over time and 0.23% in a short period. As a result, economic development undermines the ecological character over time. Additional research has revealed a negative correlation between economic progress and the load capacity factor. These include Xu et al. (2022) for Brazil; Pata and Balsalobre-Lorente (2022) for Turkiye; Khan et al. (2023) for the G7 and E7 countries; Awosusi et al. (2022) for South Africa; Shang et al. (2022) for the Association of Southeast Asian nations; Akadiri et al. (2022) for India; Pata (2021) in Japan and the United States; Pata and Isik (2021) for China; Fareed et al. (2021) for Indonesia; and Majeed et al. (2021) for Pakistan.

The study's findings indicate that a 1% increase in energy intensity increases the load capacity factor (LCF) by 0.18 in OECD countries, suggesting an exciting relationship between energy efficiency and environmental sustainability. Energy intensity refers to the energy used per unit of economic output. A positive correlation implies that more efficient energy use is associated with greater LCF. Denmark is a concrete example illustrating the positive relationship between improved energy intensity and a higher load capacity factor (LCF). The country has made substantial investments in renewable energy and energy efficiency measures. Denmark's commitment to wind energy, in particular, has resulted in a significant portion of its electricity being generated from wind power. This shift to cleaner and more energy-efficient technologies has contributed to reducing carbon emissions and enhancing energy efficiency, positively impacting LCFs. The Danish case highlights the potential of aligning economic growth with sustainable practices, where advancements in energy efficiency become instrumental in improving the country's overall environmental sustainability.

In contrast, some OECD countries with higher energy intensity, such as the United States, which has historically been dependent on fossil fuels, face challenges in achieving comparable energy efficiency gains. However, there are ongoing efforts within the U.S. to transition toward cleaner energy and enhance energy efficiency, particularly in sectors such as transportation and manufacturing. The positive correlation observed in the study emphasises the potential benefits for OECD countries as they progressively adopt and prioritise energy-efficient technologies and practices to enhance their LCF. Arguments supporting the positive correlation between increased energy intensity and a higher LCF include that energy efficiency measures contribute to resource conservation. By adopting cleaner technologies and optimising energy use, countries can achieve economic growth without a proportional increase in resource consumption.

Moreover, policies promoting energy efficiency reduce environmental impact and position countries better to handle the challenges of resource scarcity and climate change. The positive relationship between energy intensity and LCF thus reinforces the importance of integrating sustainability principles into economic development strategies, showcasing how efficient energy use can catalyse environmental resilience and long-term ecological balance. Adebayo (2022) reported contradictory results with our approach. The author discovered a negative link between fossil fuel and load capacity parameters in the medium and long-term. This means that fossil fuels contribute to ecological damage in the long and short term.

Nonetheless, there is no long-term consistency between the load capacity factor and fossil fuel. As a result, fossil fuels have no long-term environmental impact. Following the findings, the Spanish administration should direct its economy toward shifting away from traditional fossil fuels that play a role in growing emissions and toward less expensive and reliable alternative power options that support environmentally friendly and sustainable growth. Furthermore, additional government finances should be allocated toward studying and developing more innovative methods to address the country's environmental concerns. Increased government R&D expenditure will improve energy resource capacity utilisation and promote FDI influxes into the economy. Spain can meet the SDGs by cutting emissions by substituting petroleum and coal with renewable energy sources. Comparable results were observed by Shan et al. (2021) for highly decentralised countries, Yuping et al. (2021) for Argentina, and Adebayo et al. (2021) for Thailand.

According to the specifications outlined in Model 1, an increase in financial inclusion is associated with a 1.22% increase in the load capacity factor within OECD countries. One concrete example illustrating the positive correlation between financial inclusion and a higher load capacity factor (LCF) is Sweden's green finance initiatives. As an OECD member, Sweden has actively pursued financial inclusion policies with a focus on sustainability. The country has implemented programs that provide financial services to a broad range of individuals and businesses, emphasising green investments and environmentally friendly practices. Individuals in Sweden who are financially included have access to loans and investment opportunities that support renewable energy projects, energy-efficient technologies, and sustainable agriculture. This collective effort contributes to a higher LCF by aligning economic activities with ecological sustainability. Sweden's commitment to inclusive green finance policies shows how financial inclusion can directly support environmentally sustainable practices and positively impact the load capacity factor.

In contrast, countries with lower levels of financial inclusion often face challenges in achieving a higher LCF. For example, Greece, an OECD member with a history of economic challenges, has struggled with financial inclusivity. Limited access to financial services can hinder the ability of individuals and businesses to invest in sustainable practices and technologies, potentially limiting the country's progress toward a higher LCF. This example underscores the importance of addressing barriers to financial inclusion to unleash the full potential of individuals and businesses in contributing to environmental sustainability. Arguments supporting the positive correlation between financial inclusion and LCF emphasise that access to financial services empowers communities to participate actively in sustainable initiatives. Financially included individuals are more likely to adopt eco-friendly technologies, invest in renewable energy, and engage in community-led conservation projects.

Moreover, inclusive green finance policies specifically target environmentally sustainable projects and can direct funds toward initiatives that enhance ecological balance. Financially resilient communities are better equipped to adapt to environmental challenges and contribute to the overall environmental sustainability of a region. The study's findings, exemplified by the cases of Sweden and Greece, emphasise the integral role of financial inclusion in shaping a more sustainable and resilient approach to environmental stewardship within the context of OECD countries. Several scholars have regarded the financial development sector or financial globalisation as proxies for financial indicators. Beginning with Latif and Faridi (2023), the authors obtained results equivalent to those of the current study. For example, the authors' model anticipated that a 1% rise in financial development would culminate in a 0.02% improvement in LCF (at a 1% significance level). The authors substantially confirmed the EKC based on financial markets. These results revealed that as financial development advances, the quality of the environment increases (Fakher, 2019; Nasir et al., 2019; Ntow-Gyamfi et al., 2020). Additionally, the authors created a nonlinear connection between FDIN2 (the squared term of financial expansion) and LCF to find the threshold at which the causal connection between the factors shifts from positive to negative. In conclusion, initiatives to speed up financial growth should be taken as soon as possible to achieve the breaking point in financial development.

Our subsequent documentation reveals that an increase in the deployment of renewable energy sources corresponds to a 0.26% increase in the load capacity factor within OECD countries. This positive correlation suggests that as these countries incorporate a greater share of renewable energy into their energy portfolios, there is a concurrent improvement in their ability to manage resources and the environment sustainably, as reflected by the LCF. Renewable energy sources such as wind, solar, and hydropower are inherently associated with lower EFs than traditional fossil fuel-based sources. Therefore, the observed increase in the LCF underscores the potential of transitioning toward cleaner and more sustainable energy options to impact overall environmental sustainability within the OECD context positively. Concrete examples illustrating this positive correlation within OECD countries can be observed in the experiences of Germany and Denmark. As a prominent member of the OECD, Germany has been at the forefront of embracing renewable energy. The country's ‘Energiewende’ initiative involves a comprehensive shift toward renewable sources such as wind, solar, and biomass. Germany's commitment to renewable energy has reduced carbon emissions and positively impacted its LCFs. Integrating a substantial share of renewable energy into its power grid aligns with environmental sustainability goals and enhances the country's capacity to manage resources more sustainably. Denmark provides another compelling example. With a strong emphasis on wind energy, Denmark has consistently increased its renewable energy capacity. Wind power alone contributes significantly to Denmark's energy mix. The country's dedication to clean and sustainable energy has led to a lower carbon footprint and positively influenced its LCF. Denmark's experience demonstrates the potential benefits of prioritising renewable energy deployment to enhance environmental sustainability within the OECD framework. Notably, in the aftermath of the Fukushima nuclear disaster, Japan underwent a significant shift in its energy strategy, emphasising renewable energy sources, notably solar and wind power. This catastrophic event prompted a re-evaluation of the risks associated with nuclear energy, leading to a concerted effort to reduce the country's reliance on this form of power generation. Japan's commitment to transitioning toward renewables, characterised by increased investments in solar and wind technologies, has diversified its energy mix and positively impacted the load capacity factor (LCF). By embracing cleaner and more sustainable energy options, Japan has aligned itself with global efforts to mitigate environmental impact and enhance resource management, underscoring the potential for positive outcomes in environmental sustainability within the OECD context. Moreover, Canada, endowed with abundant renewable resources, has capitalised on its natural advantages by investing in various renewable energy sources, including hydroelectric power, wind, and solar energy. Notably, provinces such as Quebec and British Columbia have emerged as key contributors to Canada's commitment to sustainable energy practices. Hydroelectric power, harnessed from the country's numerous rivers, is a prominent feature of Canada's energy landscape. The provinces' substantial reliance on hydroelectricity has positively influenced Canada's Load Capacity Factor (LCF) Top of Form. Arguments supporting the observed correlation emphasise the inherent environmental advantages of renewable energy sources. Unlike fossil fuels, renewable energy technologies generate electricity with lower greenhouse gas emissions and reduced environmental impact. The transition to renewable energy aligns with global efforts to mitigate climate change and foster a more sustainable energy future. Moreover, the decentralised nature of many renewable energy sources allows for community-level engagement and ownership, fostering a sense of environmental stewardship. As countries within the OECD increasingly invest in renewable energy deployment, they contribute to a cleaner and more sustainable energy landscape and enhance their overall capacity to manage resources in an environmentally responsible manner, as reflected by the positive impact on the load capacity factor. Research from industrialised countries suggests a positive association between the percentage of renewable resources in total energy consumption and the load capacity factor, as established in Pata and Samour (2023) and Guloglu et al. (2023) for OECD countries. Moreover, equivalent impacts are evident within developing economies, notably in Asia, as underlined by Alola et al. (2023) for India and Zhao et al. (2023) for BRICS-T states. Generally, there is a relationship between the share of green energy use and the load capacity factor, so our outcomes are consistent with theirs. However, our findings contradict those of Akadiri et al. (2022), who discovered that employing renewable energy sources momentarily affects the load capacity factor in India. Relevant studies, such as Xu et al. (2022), found that energy from renewable sources has a detrimental effect on the load capacity factor in Brazil, suggesting that green energy degrades environmental sustainability and raising the possibility that renewable energy use in Brazil is still in its early stages.

Table 10 reports the findings for CO2 emissions. At the 1% significance level, climate financing (CF) significantly and favourably affects CO2 emissions. The long-term increase in CO2 emissions from a 1% increase in climate funding is estimated at 0.019%, while the OLS model predicts an increase of 28%. This analysis implies that climate funding streams have not been ‘innovative and supplementary’ as promised since the 1992 UNFCCC (Nakhooda et al., 2013; Roberts et al., 2021).

| Model 2. CO2 emission | |||||

|---|---|---|---|---|---|

| Dependent variable: CO2 | |||||

| Variables | PMG-ARDL (1, 1, 1, 1, 1, 1) | Arellano–Bond estimation | Random Effect | OLS | |

| Short Run | Long Run | ||||

| CF | −0.0021 | 0.0192*** | 0.002 | 0.001 | 0.2894*** |

| (0.798) | (0.000) | (0.490) | (0.732) | (0.000) | |

| GDP | 1.6994*** | 1.1736*** | 1.617*** | 1.883*** | 1.1772*** |

| (0.004) | (0.000) | (0.000) | (0.000) | (0.000) | |

| EI | 0.4250** | 0.4077*** | 0.301*** | 0.591*** | 1.5588*** |

| (0.043) | (0.000) | (0.000) | (0.000) | (0.000) | |

| FI | −0.0752 | 0.2923* | 0.565*** | 0.896*** | 3.5895*** |

| (0.663) | (0.053) | (0.000) | (0.000) | (0.000) | |

| RE | 0.0685 | −0.1348*** | −0.178*** | −0.145*** | −0.6370*** |

| (0.715) | (0.000) | (0.000) | (0.000) | (0.000) | |

| Constant | 2.5278** | 0.335 | 1.98 | 19.43*** | |

| (0.031) | (0.845) | (0.293) | (0.000) | ||

| COINTEQ01 | −0.4841** | ||||

| (0.043) | |||||

- ***, **, and * denote 1%, 5%, and 10%, respectively.

There are worries that essential assistance may be diverted from crucial development objectives such as public health and education or that aid budgets may decrease. Oxfam (2020) posits that wealthy nations need to pledge to guarantee that any forthcoming augmentations in climate finance that qualify as official development assistance (ODA) be integrated into an overall aid budget that is growing, at minimum, in tandem with the pace of climate finance. The idea of ‘new and additional’ money is becoming less relevant, even if climate finance and ODA may be recorded separately since the benchmark they are judged will alter. According to Cochran and Pauthier (2019) and Jachnik et al. (2019), Article 2.1(c) establishes a worldwide direction for all financial flows, including development financing, to at least stop investing in activities that undermine mitigation and/or adaptation objectives. As a result, various definitions of ‘climate finance’ persist among nations. This increases the possibility that funds intended for development cooperation would be misdirected to climate financing in conjunction with nations' attempts to integrate climate change into development cooperation. For example, when financing formerly provided for education and health flows to sectors classified as climate financing, this would reallocate rather than boost the budget (Roberts et al., 2021). In adhering to the most stringent interpretation of ‘new and additional’, only Norway and Sweden explicitly delineated their climate funding figures as exceeding the target of 0.7% of gross national income (GNI) allocated for general development finance (Standing Committee on Funding, 2021).

The second interpretation may be seen primarily from an economic perspective. Next, we address the normative question of how the present costs of reducing climate risks should be balanced against their perhaps ambiguous future benefits. This raises the question of whether climate change mitigation projects would typically ‘pay off’ in good, bad or self-sufficients fiscal times. According to Stroebel and Wurgler's (2021) exploratory study, it is likely that mitigation payoffs are more prone to manifest during periods of economic prosperity than during economic downturns. Nordhaus (2014), Barro (2015), and Giglio et al. (2021) construct a model encompassing both perspectives. This model emphasises the implications of discount rates. Suppose the impact of climate change is more severe during periods of economic prosperity. In that case, investments in climate mitigation yield disproportionately higher returns during those times, warranting a positive risk premium. Conversely, if the benefits of climate change mitigation investments are more pronounced during economic downturns, they should be regarded as hedges, commanding a negative risk premium.

While there is room for hope about the private sector's significant contribution to CO2 mitigation efforts, the Standing Committee on Funding (2021) noted that evaluating and reporting mobilised private funding remains complex and challenging. According to OECD projections from 2021, between 2013 and 2019, the amount of private financing mobilised yearly varied from 18% – 27% of the overall climate finance under the UNFCCC. It is possible that more private funding was raised but not officially documented, as Cui et al. (2020) mentioned, either because of indirect methods such as regulatory changes or data secrecy. Ironically, even the UN Climate Change Conference (COP28) in 2023 concluded with a highly motivated quote, ‘beginning of the end’, which was interpreted as marking the conclusion of the fossil fuels era by committing to reducing greenhouse gas emissions by 43% by 2023. However, despite this ambitious declaration, most countries and parties are currently off track in meeting the goals of the Paris Agreement. Given their failure to adhere to previously defined thresholds, there is growing scepticism about the feasibility of achieving the same pledge.

The estimation findings demonstrate that CO2 emissions are positively and significantly impacted by the energy intensity (EI) coefficient. As a result, a 1% increase in EI raises CO2 emissions by approximately 0.40% over the long term, 0.42% over the near term, and 0.30% over the bond estimate. This is further supported by the random effect and OLS regression results, which show that in the chosen OECD countries, increases in energy intensity contribute to CO2 by 0.59% and 1.5%, respectively. This conclusion fits with other studies that view energy intensity as a fundamental element leading to environmental pollution (Baloch et al., 2019; Işık et al., 2019). This implies that there might be economic consequences for lowering the dependency on high-energy processes produced by nonrenewable sources. Reducing one might jeopardise the other, as microeconomic entities' production decisions are closely related to CO2 emissions.

The lagged coefficient of financial inclusion (FI), which affects the CO2 emissions variable, is statistically significant and positive at the 10% level in the long run (0.292) and negative in the short run (−0.07). Accordingly, financial inclusion benefits the environment over time even though it does not affect it immediately because of increased carbon emissions. In other words, FI negatively impacts greenhouse gases in a short time. Therefore, a 10% increase in the financial sector's development in the long run that prioritises financial inclusion results in a 0.292% increase in CO2 emissions. This implies that the magnitude of the FI effect on CO2 emissions is negligible due to the dominance of purchasing environmentally degrading energy in the region. This result is also robust to the OLS model (3.589), random effects (0.896), and Arellano estimation (0.565).

In contrast to the prevailing notion that financial inclusion contributes to economic growth by providing easier access to affordable financial services and facilitating investments in green technology, this study challenges this conventional theory. This is because the basic premise of this theory holds when green practices align with financial development and primarily benefit national economies rather than extending to broader ecological improvement initiatives. For example, increased access to financial services may support manufacturing and industrial activities, potentially leading to increased CO2 emissions and contributing to global warming (Jensen, 1996). Additionally, greater financial inclusion allows consumers to afford energy-intensive goods such as automobiles, refrigerators, and air conditioners, which poses environmental threats through increased greenhouse gas (GHG) emissions. Inclusive financial systems also stimulate economic activities, leading to heightened demand for polluting energy sources and further amplifying GHG emissions (Boutabba, 2014; Farhani & Ozturk, 2015).

Furthermore, in the long term and across several models, renewable energy is found to have a negative and statistically significant effect on carbon dioxide emissions. To be more precise, the OECD's carbon emissions are reduced by 0.134% in the long term and by 0.145%, 0.637%, and 0.178%, respectively, in the random effect, OLS and Arellano estimation models for every 1% increase in renewable energy consumption. In other words, the use of renewable energy leads to environmental enhancements. The findings of this study are consistent with those of (Ali et al., 2017; Bélaïd & Youssef, 2017; Dogan & Seker, 2016). Therefore, increasing the share of renewable energy in the energy mix is essential for advancing the environmental cleanup process. This is essential for mitigating the negative effects of fossil fuel sources on carbon emissions, especially when increased energy needs result from societal economic growth. Our research confirms that the amount of renewable energy and CO2 emissions are inversely related.

Economic development appears to mitigate the benefits of renewable energy for environmental quality, as indicated by the increase in GDP. It follows that developing nations reduce their reliance on renewable energy sources by still continuously using nonrenewable energies to fulfil their rising energy demands. This lowers the quality of the environment by increasing greenhouse gas emissions. One potential regulatory measure involves increasing the proportion of renewable energy in overall energy consumption (Balsalobre-Lorente et al., 2018). Building on the work of Vaona (2012) and Balsalobre-Lorente et al. (2018), we posit that greater reliance on nonrenewable energy sources fosters economic growth and escalates carbon emissions. Conversely, incrising renewable energy consumption is anticipated to facilitate sustainable economic development by enhancing energy efficiency.

Despite forecasting long-term elastic properties, the panel ARDL technique cannot establish a causal link between two variables. As a result, as part of the present inquiry, the Dumitrescu-Hurlin panel causality test was applied to assess the causal relationships between the variables. Furthermore, given the existence of cross-sectional dependency in the panel, Dumitrescu-Hurlin is the most suitable for causality analysis (Mitra, 2019). Table 11 summarises the findings. We noticed distinct unidirectional causation among the factors after examining the outcomes. For example, in Model 1, which depicts the interaction between the chosen variables and the load capacity factor (LCF), we find a one-way causation between energy intensity and renewable energy and the LCF. The other factors revealed no apparent associations with the load capacity factor.

| Model 1. LCF | Model 2. CO2 | ||||||

|---|---|---|---|---|---|---|---|

| Null hypothesis | W-stat. | Zbar-stat. | Prob. | Null hypothesis | W-stat. | Zbar-stat. | Prob. |

| CF → LCF | 2.8150 | 0.011 | 0.9911 | CF → CO2 | 4.198*** | 4.306 | 0.000 |

| LCF → CF | 2.521 | −0.206 | 0.8368 | CO2 → CF | 1.631 | 0.556 | 0.577 |

| Remark | No causality | Remark | One-way causality | ||||

| GDP → LCF | 3.2969 | 0.367 | 0.713 | GDP → CO2 | 3.771*** | 3.683 | 0.0002 |

| LCF → GDP | 4.437 | 1.210 | 0.226 | CO2 → GDP | 1.584 | 0.488 | 0.6254 |

| Remark | No causality | Remark | One-way causality | ||||

| EI → LCF | 3.076 | 0.204 | 0.8380 | EI → CO2 | 1.968 | 1.0491 | 0.294 |

| LCF → EI | 6.530*** | 2.757 | 0.0058 | CO2 → EI | 1.180 | −0.1016 | 0.919 |

| Remark | One-way causality | Remark | No causality | ||||

| FI → LCF | 4.036 | 0.914 | 0.360 | FI → CO2 | 3.466*** | 3.237 | 0.0012 |

| LCF → FI | 1.735 | −0.787 | 0.431 | CO2 → FI | 2.450* | 1.753 | 0.0796 |

| Remark | No causality | Remark | Two-way causality | ||||