A portfolio diversification measure in the unit interval: A coherent and practical approach

Abstract

In this article, we introduce and examine the efficiency of a portfolio diversification measure. Using the recently developed coherence properties for diversification measures as well as other criteria, we show that the novel measure outperforms the most commonly used diversification measures. Although similar in shape to other measures, our measure is the only one that satisfies all nine coherence properties whilst being easily interpreted. After testing interpretability and coherence for all measures, we perform an empirical analysis divided into two main parts. In the first part, we test some common diversification measures in a Gaussian context and in the second part we consider three empirical portfolios during the COVID-19 pandemic. We establish the efficiency of our measure in capturing the changing level of diversification in empirical portfolios. We believe these results imply a competitive advantage for our measure and make it relevant for econometricians, practitioners and decision-makers in general in a portfolio optimisation context.

1 INTRODUCTION

- find measures that are easily interpreted.

- establish if the measures do indeed measure diversification.

The main objective of this work is to contribute to the adequate measurement of diversification. We do this by introducing a ratio that lives in the unit interval, is straightforward to interpret and has desirable statistical properties. Although our measure is similar in shape to other ratios, as we will see in detail, that does not mean that it shares the same properties or performance. As well as establishing the properties of our measure, we point out its competitive advantages with respect to the most commonly used DMs. Our measure is based on an underlying risk measure and its desirable properties rely upon the choice of such measure. However, we do not restrict its use to any particular measure. We prove theoretically as well as practically that our measure presents several competitive advantages with respect to other measures. It is a risk-measuring tool that can be useful for statisticians and practitioners alike.

In terms of the motivation of our measure, as we have pointed out, there is a need in statistical literature for DMs to be easily interpreted as well as having robust statistical properties. It is remarkable how there is no preferred DM either in statistical literature or in terms of popularity among practitioners. Given the importance of point (1), many of the DMs used in recent times are directly or inversely proportional to the level of diversification. This is desirable because the concept of diversification is closely related to the level of risk aversion of the investors. Among the risk-based DMs found in the literature, the use of ratios and indices based on underlying risk measures stands out. These ratios measure the proportion of the overall risk of the portfolio with respect to the risk of the assets. Some of the most popular ones are the Herfindahl–Hirschman Index (HHI) (see Hirschman (1945)). The portfolio diversification index (PDI) (see Rudin (2006)), the Tasche ratio (see Tasche (2006)) and the diversification ratio (see Choueifaty and Coignard (2008)). More recently, other indices have been developed such as the index of Embrechts et al. (2009), the diversification delta (DD) (Vermorken et al. (2012)) and the revised diversification delta (DD*) (Salazar et al. (2017)). Other works include Curi et al. (2015) and Choueifaty et al. (2013).

The issue of assessing how good a DM is, raised in point (2), is twofold. On the one hand, rather than assessing a DM, in some studies it is the underlying risk measure the one being assessed. However, building a measure from an adequate underlying risk measure does not guarantee that the resulting DM is adequate. This is because, while being related concepts, having a diversified portfolio is not equivalent to having a portfolio with low-risk exposure, see for example, Brighi and Venturelli (2014). On the other hand, other common criteria to assess DMs rely on empirical evidence only, see for example, Cole and Karl (2016). Again, while relying on empirical models is useful, the results are not robust enough. Because of this, recent studies point out the need to establish desirable statistical properties for DMs. Similarly to the analysis done for risk measures, authors like Koumou and Dionne (2022), Torrente and Uberti (2021a) and Han et al. (2022) point out the need and provide the criteria to call a DM coherent. This approach has the advantage of being applicable to any measure, without depending only on the underlying risk measure or their performance with empirical data.

All of the DMs we have discussed so far have been shown to perform well under very particular circumstances and data. It has been well documented that this good behaviour is not always general, see for example, Torrente and Uberti (2021a) and Pola (2016). Among the issues being raised are the fact that the DMs are not restricted to a particular interval and that they are not proportional to the level of diversification. This responds to both the definition of the DM itself as well as the underlying risk measure. In particular, some risk measures do not satisfy all coherence properties or fail to capture stylised facts of financial data, see for example, Fabozzi and Focardi (2010), Dowd (2005) or Giuzio and Paterlini (2019). This is the case of the variance, the correlation coefficient, the Value at Risk (VaR) and Shannon's entropy among others.

The rest of this work is structured as follows. In the next section, we present our DM, based on an arbitrary risk measure. We discuss its interpretability and how it is bound to the unit interval. We then discuss the conditions under which it satisfies the properties of coherence. In the following section, we compare, as underlying risk measures, the standard deviation (σ) and the expected shortfall (ES). For this comparison, we first consider different scenarios for a portfolio in a Gaussian context. We then do the comparison considering a portfolio of returns of gold and the U.S. Dollar during the COVID-19 pandemic. In a second application, using the diversification ratio as a benchmark estimator, we analyse the S&P 500 index. The general conclusions and the references are next. Finally, in the Appendix A, we present the conditions of coherence for risk and DMs, along with the proof that our DM satisfies coherence properties as long as the underlying risk measure does the same.

2 METHODOLOGY

2.1 A diversification measure in the unit interval

As we have mentioned, the concepts of diversification and risk are closely related. Consider a portfolio, which is defined as the weighted average of a number of assets. In general terms, a DM aims to measure how much the risk of the assets decreases when combining them in a portfolio. Because of this, the concept of risk underpins the concept of diversification. Our DM is built on this idea, leaving the choice of the underlying risk measure open. It comes after a thorough analysis of diversification ratios and measures as well as their underlying risk measures. In this analysis, we considered the coherence properties for both risk and diversification. The particular shape of our measure responds to the need to overcome the issues of other DMs, which we will explain in Section 2.2.

Note that, roughly speaking, D risk measures the relative variation between the risk of the portfolio and the risk of the assets. From this definition, we see that this measure is parsimonious in terms of its simplicity of calculation, our measure is not restricted to a particular underlying risk measure. This gives users the flexibility to choose risk according to their particular risk assessment and computational requirements.

2.2 Some setbacks of common diversification measures

Some well-known DMs are somehow related to our measure. The HHI of Hirschman (1945) is similar to 1 − D risk, Liu et al. (2022) define a household portfolio diversification index as 1 − HHI and hence similar to D risk. In both cases risk is taken as the squared exposure to risk (which is not a coherent measure). The diversification factor of a portfolio presented in Tasche (2006) is equal to 1 − D ρ for risk measure ρ. The diversification ratio is , with σ the standard deviation. The family of measures defined in Embrechts et al. (2009) for a portfolio P can be expressed as . On the other hand the diversification delta (DD) (Vermorken et al. (2012)) has similarities with D H , with H the Shannon's entropy. The revised DD* of Salazar et al. (2017) is equal to D exp(H).

Without overlooking the usefulness of the aforementioned measures, they have several setbacks in terms of statistical properties. In Section A.1.2 of the Appendix we explore in detail the desirable properties of DMs. More precisely, we consider nine coherence properties, which are divided into three main parts. The first part corresponds to Stability conditions, which ensure that the DM is homogeneous, in the sense that is proportional under multiplying constants; it is size monotonous, which guarantees that the DM detects higher diversification when an asset is added; and is quasi concave which ensures that the weighted mean of two portfolios has higher diversification than each of its forming portfolios. The second part corresponds to invariance conditions, they ensure that the DM is invariant when a constant is added; when a duplicated asset is added; and when the assets of the portfolio are permuted. Finally, the third part corresponds to degeneracy conditions, they ensure that diversification is constant when a single asset is considered; when the portfolio is formed by replications of the same asset; and when it is formed by comonotonic assets.

We now briefly describe the setbacks of common DMs in terms of the coherent conditions for the DMs we just mentioned and that are presented in the Appendix A.

Given that the underlying RMs of the HHI, the measure introduced in Liu et al. (2022) and the DD do not satisfy any of the coherence properties neither do their corresponding DMs. The exponential entropy used in the revised DD* is not subadditive so DD* is not quasi-concave. Furthermore, regardless of the underlying risk measure, the diversification factor of a portfolio defined in Tasche (2006) does not satisfy invariance conditions as neither it is size monotonous nor it is quasi concave. The diversification ratio does not satisfy any of the three degeneracy conditions. The family measures defined in Embrechts et al. (2009) are rather difficult to interpret as they do not have an upper bound. The fact that our measure not only satisfies all coherent conditions but is easily interpretable gives it a competitive advantage over other DMs. These theoretical and empirical features make D risk an appealing measure for statisticians and portfolio optimisers in general. As we will prove in the Appendix A, for our measure D risk to have desirable statistical properties it is only required that risk is a coherent risk measure. In the following subsection, we prove it is also straightforward to interpret.

2.3 Interpretability

First, it must be noted that D risk is 1 when the weighted average of the risk of the assets is not 0 and yet the risk of the portfolio is 0. That is when the risk is completely diversified by combining the assets, meaning maximum diversification. However, it must be highlighted that this would mean that the portfolio is constant, something that cannot be observed in empirical data, simply because of the existence of systematic risk. One example in which this can occur is a two-asset equally weighted portfolio in which . Because this is rather unrealistic, D risk = 1, can be considered as an asymptotic case. On the other hand, D risk is 0 when the risk of the portfolio is equal to the weighted average of the risk of the assets. This is equivalent to saying that the risk of the portfolio was not at all diversified by combining the assets in the portfolio, meaning minimum diversification. This implies that our measure is directly proportional to the level of diversification.

The properties of D risk are mainly determined by the properties of risk. Two of the basic properties of a coherent risk measure are that they satisfy risk ≥ 0 (positive) and that for assets A and B, risk(A + B) ≤ risk(A) + risk(B) (subadditivity). i It is straightforward to prove that as long these two properties hold then 0 ≤ D risk ≤ 1, which further supports its interpretability.

2.4 Properties

For D risk defined in Equation (1) to have good properties, it is necessary that the measure risk has good properties. Artzner et al. (1999) and other authors have established desirable properties for risk measures from a financial point of view. Among these so-called coherence properties the translation invariance, homogeneity and subadditivity aforementioned stand out.

More recently and in a similar fashion Koumou and Dionne (2022) established nine coherence properties for a DM, also in a financial context. These properties can be divided into conditions of stability, invariance and degeneration. In Section A.1 of the Appendix, we present and briefly discuss these conditions of coherence for risk and DMs. It is not difficult to verify that if risk satisfies conditions of coherence then D risk, introduced in Equation (1) satisfies the conditions of coherence for diversification measures. We present the corresponding theoretical proof in Section A.2 of the Appendix.

3 EMPIRICAL RESULTS

In this section, we assess the performance of several DMs, including the one we introduced, first in a Gaussian context and then on three examples of empirical portfolios. The period of study covers the toughest part of the COVID-19 pandemic (January, 2020–August, 2021). It must be noted that during crisis periods, such as this pandemic, the validity of portfolio diversification techniques is questioned. This responds to the fact that the very correlation between assets is affected. Hence, it is crucial to have DMs that are effective in capturing such changes in the diversification structure of the portfolio. The use of a DM in a financial portfolio like this portrays several advantages over a mean-variance approach, see for example, Ortobelli et al. (2018).

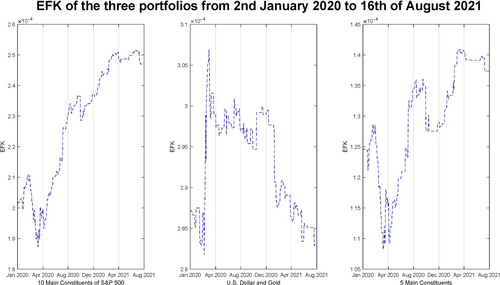

Out of the DMs we discussed in the previous section, in this exercise we assess the performance of the following common DMs: Our measure (with two underlying RMs), the Embrechts distance (EFK), the diversification ratio (DR) and the revised version of the diversification delta (DD*). Although, as mentioned in Section 2.2, the DR does not satisfy any of the three degeneracy conditions, is perhaps the most popular DM found in the literature, see for example, Mehta and Yang (2018). We do not include for this exercise the Hirschman index HHI, which was introduced in 1945 and neither its variation 1 − HHI introduced by Liu et al. (2022). They are based on a non-coherent measure, which is used to measure market competitiveness and not diversification. Neither do we include in our analysis the DF (defined as 1 − D risk) of Tasche (2006), as it is graphically equivalent to our measure (D risk). However, despite being graphically equivalent, the DF is not proportional to diversification, is not size monotonous and is not quasi-concave, as we stated in Section 2.2. A comparative study of the original diversification delta (DD) was already carried out in Salazar et al. (2017) so we exclude this measure from our analysis as well.

Out of the measures we consider, only D σ and D ES are restricted to the [0,1] interval. Also, , it is typically very low and hard to interpret. On the other hand, the DR is always greater than one with no upper bound. Because the DR lives in a different interval for comparison purposes, in all of the plots we consider, we use a different scale for the DR. This scale is presented on the right-hand side of all plots in red; we also use red for the corresponding plot of the DR.

For our measure, we consider the standard deviation (D σ ) and the expected shortfall (D ES) as underlying risk measures (RMs). For comparison purposes, we use the ES as the underlying RM for the EFK. The DR and the DD* consider the standard deviation and the exponential entropy as RMs respectively.

3.1 The standard deviation (σ) and the ES as underlying risk measures

The standard deviation and the ES are two measures commonly used to quantify the risk of an asset in a financial context. These two measures satisfy conditions of coherence for risk measures, see for example, Artzner et al. (1999) and Koumou and Dionne (2022) Proposition 4, Corollary 2 respectively.

σ is defined as the positive square root of the variance, it has the advantage of being of direct estimation and easy interpretation. In Gaussian contexts or contexts of linear dependence, it displays an acceptable performance.

It can be interpreted as the expected value of the loss given that it surpassed the VaR. Unlike σ, the ES is not as straightforward to calculate as it involves an expected value and the quantile function F ←, from its definition we can see that, unlike other measures, it is affected by the mean of the variable and its extreme behaviour. Because of this, it penalizes extreme risks, for a detailed analysis of ES see Tasche (2002).

Our estimation of the underlying risk measures, ES and σ, is based on an empirical approach. This allows us to have a bigger sensitivity to the daily changes in the dynamics of the portfolio in our empirical applications.

3.2 Comparison of several diversification measures in a Gaussian context

In this part, we review representative scenarios of conditions for a portfolio in a Gaussian framework. The Gaussian context provides an excellent baseline of stressed financial scenarios by changing its relevant variables: mean, variance and correlation. This is similar to other studies such as those presented in Vermorken et al. (2012) and Salazar et al. (2017). Consider a portfolio of assets X and Y with joint normal distribution.

As baseline, we consider an equally weighted portfolio with , , , and .

Note that, because of the Gaussian assumption, the aforementioned parameters define completely the behaviour of the portfolio. For this Gaussian framework, we only consider four DMs. This is because, in a Gaussian context, the exponential entropy is equal to the standard deviation multiplied by a constant. This implies that DD* = D σ , so DD* is not included explicitly. In Figure 1 we modify the mean μ X (−0.3 ≤ μ X ≤ 0.3), to assess the effect on the DMs. We find that D ES is the only one responsive to the changing mean of the first asset. This follows from the fact that the ES is directly proportional to the mean of the assets. Although the EFK is also dependent on the ES, it is constant with respect to the mean of the first asset. This is because the EFK is defined as a difference that cancels out the mean of the first asset. The other DMs are only dependent on σ, which is constant in this case.

The EFK has a very low value of 0.0697, which is hard to interpret since the EFK does not have an upper bound. D σ = 0.1832 and the DR = 1.2243. The fact that D ES is able to detect a higher mean as positive is a competitive advantage with respect to the other DMs.

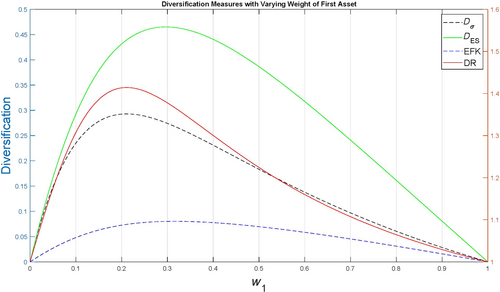

In Figure 2 we vary the weight of the first asset . All four measures have a parabolic behaviour. D σ and DR at maximized at around 0.2, D ES is maximized at around 0.3, while EFK exhibits a plateau from 0.25 and 0.45. This preference of D ES for X responds to its higher mean with respect to the mean of Y. As mentioned earlier, considering a portfolio with a higher weight on X to be more diversified is a competitive advantage for portfolio optimisation purposes. This is particularly true against EFK since EFK has no clear maximum.

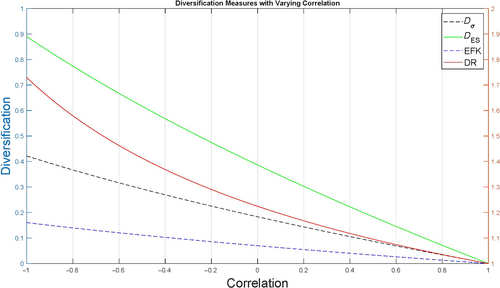

In Figure 3 we obtain the different DMs of the portfolio varying ρ (−1 ≤ ρ ≤ 1).

Although they are all decreasing, D ES has a more linear behaviour with respect to ρ than the other measures. D ES also starts at a much higher value close to 0.9 and is always higher than the other measures. Once more, this shows that D ES perceives the portfolios as more diversified. This responds to the fact that both means are non-negative and μ X is relatively high.

In these three exercises, we observe that all measures can generally capture the change in the dynamics of the portfolio. However, the D ES is the only one that penalizes a portfolio with a low mean. This is a desirable feature since, out of two portfolios with the same level of risk, the one with the higher mean is preferable.

3.3 Empirical data applications

In this subsection, we will consider three portfolios, the first one consists of the 10 main constituents of the S&P 500 Index, the second one of the U.S. Dollar index and the Gold index and the third one of the 5 main constituents of the S&P 500 Index. With these examples, we have a robust idea of the behaviour of the DMs under different conditions. The S&P 500 index is widely regarded as the best single gauge of large-cap U.S. equities. The index includes 500 leading companies and covers approximately 80% of available market capitalization. This guarantees that we consider real life constituents of representing portfolios. On the other, the U.S. Dollar and Gold have been historically seen as reserve assets. Furthermore, they are also seen, given their negative dependence, as protection against each other's fluctuations. Because of this, they are often used together in financial portfolios to be protected against market fluctuations.

3.3.1 Analysis of a portfolio of the 10 main constituents of the S&P 500 index

We begin by comparing the five DMs in a portfolio of 10 assets. This will allow us to assess if the measures can capture the changing dynamics of diversification while considering a large number of assets. Our approach aligns with the work of Balcilar et al. (2021), Chen et al. (2016) and Oyenubi (2020); they all present innovative applications of diversification for risk measurement. The period of study is between the 2nd of January 2020 and the 16th of August 2021. We consider the 10 main constituents of the S&P 500 index and the other constituents as the 11th index. This will allow us to determine how much diversification is acquired by considering a large portfolio of 10 assets. The weights are those used for the S&P 500 index, this means that the resulting portfolio is equal to this index. The choice of the S&P 500 as a broad market index is also in line with the analysis carried out in Pfaff (2016), chap. 11. The 10 constituents we consider are Apple Inc., Microsoft Corporation, Amazon.com, NVIDIA, Google (Alphabet Inc. Class A), Tesla, Meta Platforms, Eli Lilly, Unitedhealth group and JP Morgan.

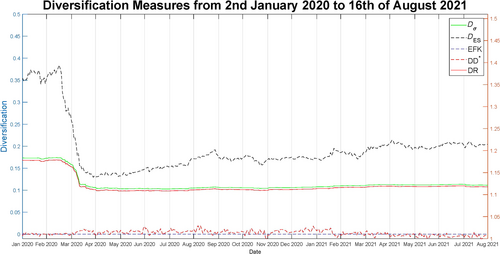

In Figure 4 we consider a rolling window of the five DMs for the portfolio of the S&P 500 index for the period of study. We consider the 750 previous data (roughly 3 years). We find that the EFK has very low values that range between 0.0001874 and 0.00025154, which makes it hard to interpret it graphically against the other measures. In Section A.3 of the Appendix we plot the EFK by itself in the three empirical portfolios studied in this subsection. The revised DD* is even harder to interpret in this example, since not only does it have very low values, it also has negative values. These values come from the non-subadditivity of the exponential entropy used as the underlying risk measure. In the other three DMs, we see that the level of diversification is relatively low during the whole period with a decline during the beginning of the pandemic and a moderate but steady recovery afterwards. We can see that D ES clearly anticipates the decline at the beginning of the pandemic. It does it in a much quicker way with respect to D σ and DR, which exhibit almost identical behaviour. D ES also detects a quicker and higher increase in diversification after that.

3.3.2 Analysis of a portfolio of the U.S. Dollar and the gold indices

In this second empirical application, we analyse the changing dynamics of diversification in an equally weighted portfolio formed by daily log-returns of the U.S. Dollar index and the Gold index. The relationship between the U.S. Dollar and Gold has caused great interest in the financial world for a long time, for recent surveys see Arfaoui and Rejeb (2017) and Zhou et al. (2018). Gold is often seen as a safe haven against fluctuations in the U.S. Dollar. Furthermore, it has been found that there is a negative correlation and a negative tail dependence between the indices, see Salazar and Ng (2015). Unlike the previous example, this portfolio has only two assets and is an example of a portfolio that is perceived with a very high level of diversification. In Table A1 of the Appendix we present the descriptive statistics of the log-returns of the assets of our portfolio for the whole period from the 9th of January of 2017 to the 16th of August of 2021.

It is interesting to note that, although close to zero, the mean of the U.S. Dollar is negative and it has lower risk measures. Because of the negative mean, having a low standard deviation is not necessarily desirable. This index also has a positive skewness and a kurtosis slightly higher than 3, the baseline of the Gaussian distribution. The Gold has a slightly positive mean, much higher risk measures and negative skewness. It is remarkable how big its kurtosis is, suggesting the presence of fat tails.

In this second application, again we use a rolling window of diversification to assess the changing dynamics of the portfolio from the 2nd of January 2020 to the 16th of August of 2021. iii We consider the five DMs of the previous example. In Figure 5 we present such rolling window. In this figure, we find that, again, the EFK has very low values that are not easy to interpret (they range from 0.00028178 to 0.00030685). In Section A.3 of the Appendix, we present a detailed account of the performance of this DM. The revised DD* does not detect the changing dynamics of the portfolio during the pandemic. Again D σ and DR show a similar behaviour throughout the whole period (although on different scales). They detect a decreasing level of diversification even after April 2020. The D ES also detects a fall in diversification at the beginning of the pandemic. However, unlike the other two measures, it detects a slow recovery soon after. Unlike the previous example the D σ detects a higher diversification level than the D ES. This suggests that the low mean and high kurtosis of the portfolio is being penalized by the ES. We also find that the change in diversification of this portfolio is lower during the pandemic. This suggests higher resistance to external shocks.

3.3.3 Analysis of a portfolio formed by the five most important constituents of the S&P 500

To complement the analysis carried out in 3.2.1 we now analyse a portfolio consisting of only the five main constituents of the S&P 500 index and the other constituents as the sixth index. The five constituents which we consider are Apple Inc., Microsoft Corporation, Amazon.com, Google (Alphabet Inc. Class A) and Tesla. This will help us determine how much diversification is gained or lost by taking away five assets. We consider the weights to be those used for the S&P 500, yielding a portfolio equal to this index.

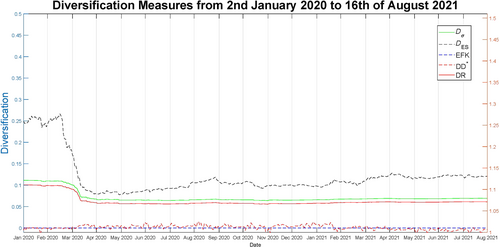

In Figure 6 we consider the rolling window of the five DMs for the portfolio.

We find a similar behaviour to Figure 4. Both the revised DD* and EFK display poor behaviour (the case of EFK is analysed in Section A.3 of the Appendix). The other three measures detect a loss in diversification with respect to Figure 4. In particular, D ES has the sharpest drop in diversification of around 30%. This is the effect of subtracting five assets from the portfolio.

Considering the two S&P portfolios, we find that D ES is not only more easily interpreted but also able to capture the changes in diversification over time faster. This further underpins the assertion that D risk can be a useful tool compared to other alternatives for statisticians and practitioners in their decision-making process.

4 CONCLUSION

We present a diversification measure based on an underlying risk measure. This measure is expressed as a ratio that lives in the unit interval and is directly proportional to the level of diversification, which makes it easily interpreted. We also verify in the appendix that it satisfies the desirable properties of coherence if the underlying risk measure does. Our article is novel in the sense of introducing a DM which, although similar in shape to other ratios, outperforms other measures in terms of interpretability, statistical properties and performance with empirical data. It must also be highlighted that this is the first study to comprehensively assess the coherence and interpretability of a wide range of DMs.

In Section 2, we find that the novel measure D risk is the only one that satisfies all coherence properties as well as being easily interpreted. After examining the theoretical properties, in Section 3 we test the performance of D risk along with three commonly used DMs. First, we conclude that when used jointly with ES, our measure outperforms the other DMs in terms of capturing the changing levels of diversification in a Gaussian environment.

Further to this, we test its performance in the real data world. In our first empirical application, we test the DMs with a portfolio consisting of the 10 main constituents of the S&P 500 index. In the second application, we consider a portfolio of only two assets: The U.S. Dollar and the Gold indices. Finally, in the third application, we analyse a portfolio consisting of the five main constituents of the S&P 500 index. The choice of these portfolios gives us a more robust idea of the performance of the different DMs under different scenarios. We can conclude that the revised DD* and the EFK are not suitable for these examples since they do not detect the changes in diversification. In particular, the revised DD* has negative values and the EFK has extremely low values that are not easy to interpret since it does not have an upper bound. In Section A.3 of the Appendix, we analyse the performance of the EFK in detail in the empirical data applications. Although the EFK has good statistical properties we see why the use of ratios is preferred by practitioners. Finally, we conclude that the D σ and the DR are sufficient to establish how much volatility has been diversified in the portfolio. However, for a decision-making process in which higher moments are relevant D ES is more convenient. The use of the ES has the advantage of penalizing low mean portfolios with high kurtosis, which is advantageous in a portfolio optimisation framework. From this study we are able to establish the usefulness as well as the competitive advantages of the proposed DM, particularly when it is used jointly with the ES. An example where this is relevant is the optimal choice of weights. We believe that the results we have presented shed light on the correct estimation of the diversification of a portfolio. Our measure aims to be a helpful tool for portfolio managers as well as other actors in the financial market.

ACKNOWLEDGEMENTS

We are grateful to two anonymous referees for their insightful comments. The contribution of Dr. Yuri Salazar Flores was supported by UNAM PASPA-DGAPA.

FUNDING INFORMATION

Yuri Salazar Flores work was supported by UNAM PASPA-DGAPA.

CONFLICT OF INTEREST STATEMENT

The authors declare no conflict of interest.

Endnotes

APPENDIX A

A.1 Conditions of coherence for risk and diversification measures

A.1.1. Risk measures

There is a wide range of desirable conditions for risk measures, see for example, Artzner et al. (1999), McNeil et al. (2005) and Rockafellar et al. (2006). In particular, the following three conditions of coherence stand out.

- (Translation Invariance) risk(X + C) = risk(X) − ηC, for η ≥ 0.

- (Positive Normalized) risk(0) = 0, risk(X) > 0 and (Positive Homogeneity) risk(λX) = λrisk(X), λ > 0.

- (Subadditivity) risk(X + Y) ≤ risk(X) + risk(Y). And the equality holds only if X and Y have a lower comonotonic behaviour.

A.1.2. Diversification measures

Only recently coherence properties for diversification measures have been established, see for example, Koumou and Dionne (2022) and Torrente and Uberti (2021a). In their Definition 3 Torrente and Uberti (2021a) state the following conditions:

-

It is said that a DM δ(W, X) is coherent if the following three conditions hold.

-

(Stability Conditions)

- (Homogeneity) For α ≥ 0, there exists r ∈ R such that δ(W, αX) = α r δ(W, X).

- (Size Monotonicity) Consider the vector where an additional asset is added, with not directly proportional to X · W′. Then there exists with and with the same proportion as W such that δ ≥ δ (W, X).

- (Quasi-Concavity) For another vector of weights V and λ ∈ [0, 1], δ(λW + (1 − λ)V, X) ≥ min{δ(W, X), δ(V, X)}, with the strict inequality holding for some λ.

-

(Invariance Conditions)

- (Translation Invariance) For α ∈ R, δ(W, X + α) = δ(W, X). (When risk is defined as a capital requirement or loss probability, translation invariance can be counterintuitive, see the counterexample in Koumou and Dionne (2022) Axiom 6-Definition 3 pp. 7. Because of this if risk satisfies T.I. with η ≠ 0, ≥ is desirable in this definition.)

- (Duplication Invariance) Consider a vector of N + 1 assets (where the N + 1-th asset is the repeated k-th asset of X), , k ∈ {1, …, N}. With W + with (the original weight is shared by the two duplications) and for i ∈ {1, …, N}, i = k. Then, δ(W +, X +) = δ(W, X).

- (Symmetry) For Π a matrix that permutates values, δ(W Π, XΠ) = δ(W, X).

-

(Degeneracy Conditions) (Although Koumou and Dionne (2022) only consider size and reverse risk degeneracy, we include risk degeneracy as it guarantees that there is no benefit in diversifying across perfectly similar assets)

- (Size Degeneracy) For the vector of weights e i = (0, …, 1, …, 0) (that gives all weight to i-th asset and zero to all other assets) δ(e i , X) is constant for i ∈ {1, …, N}.

- (Risk Degeneracy) Consider a vector of assets Y such that Y i = Y j for i, j ∈ {1, …, N}. Then δ(V, Y) = K, with K constant for any vector of weights V.

- (Reverse Risk Degeneracy) Consider a vector of weights V that satisfies v i > 0 for i ∈ {1, …, N}. If Y* is a solution of δ(V, Y) = K (with K from point b), then the assets of Y* are lower comonotonic.

-

A.2 Coherence of the diversification measure D risk

-

(Stability Conditions)

-

(Homogeneity) For α ≥ 0, given the homogeneity of risk, we have:

-

-

directly proportional P = X···W t . W + such that . keeps the same proportion as W, that is , i ∈ {1, …, N}. When ⇒ , but ⇒ and . However, given the non-comonotonicity, there exists such that ≤ . That is, by adding to , it does not increase its risk. Hence,

-

(Quasi-Concavity) Let us call A = , B = , C = and D = . For the subadditivity and homogeneity of we have,

-

(Invariance Conditions)

- (Translation Invariance) For α ∈ R, if the constant of invariance is η = 0, the proof is direct. If this does not hold then the numerators of D risk(W, X + α) and D risk(W, X) are equal while the denominator of D risk(W, X + α) is smaller, so D risk(W, X + α) > D risk(W, X).

- (Duplication Invariance) Consider X + = (X 1, X N , X k ) and k ∈ {1, …, N}.

-

(Symmetry) For a matrix Π that permutates values,

-

(Degeneracy Conditions)

-

(Size Degeneracy) For that gives all weight to asset i

-

- (Risk Degeneracy) Taking Y such that Y i for i, j ∈ {1, …, N} and a vector of weights V,

-

(Reverse Risk Degeneracy) For V with v i >0 for i ∈ {1, …, N}. If Y* satisfies , then,

A.3 Performance of the EFK in the three portfolios of Section 3.3

In this subsection, we analyse the performance of the EFK DM. Since it has extremely low values it cannot be compared on the same scale as the other DMs.

In Figure A1 we present the rolling window of the EFK against the three empirical portfolios studied in this work. It must be pointed out that the only difference between the EFK and the D ES is that the D ES is divided by the weighted average risk of the assets (). However, the EFK behaves quite differently. The two S&P 500 portfolios exhibit a sharp increase in diversification starting in April of 2020, while the U.S. Dollar-Gold portfolio does it from mid-March of 2020. According to the EFK, starting from those dates, the pandemic had a positive effect on the portfolios (in some cases throughout the whole period). This is not only contradictory to what the other measures detect, it is also counterintuitive. In general, the EFK has a rather erratic behaviour that is not easily interpreted. This index is seldom found in financial literature, where the use of ratios prevails.

| Series | Mean | Median | SD | ES | Min. | Max. | Skew. | Kurtosis |

|---|---|---|---|---|---|---|---|---|

| U.S. Dollar | 0.00002 | 0.00005 | 0.00380 | 0.00796 | 0.01626 | 0.01579 | 0.15567 | 4.06873 |

| Gold | 0.00007 | 0.00000 | 0.02137 | 0.04995 | 0.15535 | 0.14232 | 0.02999 | 10.45623 |

Open Research

DATA AVAILABILITY STATEMENT

The data that support the findings of this study are available in OSF Home at https://osf.io/jb4ys/. These data were derived from the following resources available in the public domain: Yahoo! Finance, https://osf.io/jb4ys/.