Determinants of the degree of fiscal sustainability

Abstract

We assess the link between fiscal sustainability coefficients, namely the responses of the primary government balance and the global government balance to the debt-to-GDP ratio, and the response of government revenues to government expenditures. For 22 OECD developed countries we use annual data between 1950 and 2019. Other determinants of fiscal responses are also studied in the context of quantile regressions. We find that the output gap contributes to increasing fiscal sustainability by positively influencing the responsiveness of the primary and global government balances; and the responses of the primary and global government balances to the debt ratio and the response of government revenues to government expenditures depend on the level of the debt ratio. In addition, from the quantile analysis, the influence of the response of government revenues to government expenditures is negative and increasing over the deciles, confirming the existence of a negative cross-relationship between the fiscal sustainability coefficients.

1 INTRODUCTION

The solvency of public finances has been the subject of several analysis and debates over the last decades. More specifically, the existing literature has payed attention not only to the relationship between government revenues and expenditures (Hakkio & Rush, 1991) but also to the relevance of fiscal reaction functions, that is, the responses of fiscal authorities to increases in government debt stocks and the effects of primary budget surplus on the public debt (Bohn, 1998; Canzoneri et al., 2001). To some extent, a sustainable growth path of government debt is crucial to ensure a sustainable level of economic growth.

In the more recent decades a large number of economies, mostly advanced economies, have faced some problems regarding fiscal solvency. After the Global and Financial Crisis (GFC) of 2008, peripheral Euro Area countries suffered from a rise in the long-term interest rates, having to resort to international financial assistance programmes to ensure the solvency of the general government. Moreover, the fiscal stress suffered by the countries that faced both rising debt ratios and interest rate expenses put some doubts on the existence of the Euro Area. In fact, the European institutions and the European Union (EU) framework were not prepared for this negative shock and, consequently, it reinforced the notion that the Euro Area was far from an optimum currency area (OCA). A positive aspect of this malfunctioning of Eurozone as an OCA was that once the sovereign debt crisis was over, the political and economic debate was more intense and focused in solving the institutional arrangements to ensure that fiscal solvency is observed not only in the short-run but also in the long-run.

Hence, fiscal discipline and sound public finances are paramount to face adverse economic shocks. Those shocks are not only related to the increase in interest rates or the reduction of fiscal space. Shocks as higher inflation or increasing external imbalances, caused by the deterioration of current account balances but also by the depreciation of the currency, will limit the main role of fiscal policy in conducting policies of stabilisation. In addition, the interest rate-growth rate differential is also crucial for government debt sustainability, that is, if an economy registers positive differentials, government debt will increase, signalling lack of long-term sustainability.

In this article, we provide an analysis of the factors that explain fiscal responsiveness to increase vis-à-vis government debt ratios. To accomplish this objective, we compute time-varying fiscal sustainability coefficients for the primary budget balance. We also add as fiscal reaction coefficients the response of the global budget balance to the public debt-to-GDP ratio variations, since it incorporates the interests on government debt expenditures and may cause some financial stress to public finances (Debrun & Kinda, 2016). We consider that this analysis is crucial to assess fiscal sustainability in a broader sense and to provide a clearer understanding of public debt sustainability. In fact, the existing literature considers a time invariant interest rate, which can be considered a strong assumption, especially during a crisis. Moreover, financial markets' volatility, and the weak adherence to fiscal rules or to fiscal targets is perceived as a medium and long-term risk for government debt sustainability, with creditors demanding higher interest rates due to those risk factors. Finally, we estimate the time-varying responses of the government revenues to government expenditures in order to obtain a more complete picture about fiscal sustainability. In particular, the relationship between government revenues and expenditures is derived from the intertemporal government budget constraint.

In the second step of our empirical assessment, we contribute to the existing literature by assessing the determinants of those abovementioned fiscal sustainability coefficients. This analysis is conducted for 22 OECD developed countries during the second half of the twentieth century and the first two decades of the XXI century, using annual data between 1950 and 2019, allowing for a high number of observations, necessary for the use of the expanding window method. In order to compute such time-varying coefficients, we make use of an expanding-window approach and, secondly, we apply panel data and quantile regressions techniques to empirically assess fiscal sustainability coefficients.

More specifically, in the second step of the empirical analysis, we assess the link between the fiscal sustainability coefficients: responses of the primary and global government balance to the lagged debt-to-GDP ratio; and the response of government revenues to government expenditures. More specifically, we admit as an explanatory factor of the coefficients of the responses of the primary (total) budget balance to the lagged debt-to-GDP ratio the response of government revenues to government expenditures. Likewise, we assume that the response of government revenues to government expenditures is determined by the responses of the primary (total) budget balance to the lagged debt-to-GDP ratio. Consequently, the cross-analysis of fiscal sustainability coefficients is an innovative aspect of this article and is also assumed to be an important contribution to the literature on the issue of fiscal sustainability.

In addition, we use quantile regressions technique to find the heterogeneity in the way fiscal sustainability coefficients respond to variations in a set of explanatory variables. More specifically, we assume that the responses of fiscal sustainability coefficients to dependent variables are asymmetric and therefore heterogenous. Since conventional panel data techniques only deal with the effect of unobserved heterogeneity in the mean, the recourse of a fixed effects model may not be sufficient to capture the existing heterogeneity in the distributions of fiscal sustainability coefficients. Then, quantile regressions offer a complete view of the effect of the covariates on the location, scale and slope of the distributions of fiscal sustainability coefficients.

In brief, our findings allow us to conclude that the output gap contributes to increasing fiscal sustainability by positively influencing the responsiveness of the primary and global government balance; and the responses of the primary and global government balance to the debt ratio and the response of government revenues to government expenditures depend on the level of the debt ratio itself. In addition, from the quantile analysis, the influence of the response of government revenues to government expenditures is negative and increasing over the deciles, confirming the existence of a negative cross-relationship between the fiscal sustainability coefficients.

The article is organised as follows. Section 2 reviews the related literature on fiscal sustainability. Section 3 details our methodological approach and data sources. Section 4 analyses the empirical results. Lastly, Section 5 provides the conclusions and policy implications.

2 LITERATURE REVIEW

We explore the existing literature on the sustainability of public finances, which relies broadly on two strands of studies, one assessing the fiscal sustainability by analysing the cointegration relationship between government revenues and expenditures, and the second one, that assess fiscal reaction functions, that is, the improvement of primary budget balances as a response to an increase of government debt ratios and the effects of primary government balance on the public debt. On the other hand, the literature on the determinants of fiscal responsiveness or fiscal sustainability is scarcer. Therefore, we first disentangle the literature that is focused in the two approaches of public finances literature, and then we provide a revision on the few studies we found on the explanatory factors of fiscal sustainability.

In what concerns fiscal sustainability, the literature has looked at the relationship between government expenditures and revenues. For instance, Afonso (2005) and Afonso and Rault (2010) assess the cointegration between the two sides of the budget balance with structural breaks for a set of EU-15 countries since 1970 until 2003 and between 1970 and 2006 (also analysing different subperiods), reaching the conclusion that fiscal authorities of Austria, Finland and the United Kingdom, amongst others, tend to display fiscal discipline. By estimating the cointegration vector for each country, for each monetary unit spent by fiscal authorities, the revenues collected were much lower, hence, exhibiting lack of sustainability of public finances. Likewise, Chen (2016) explores the cointegration relationship between government expenditures and revenues for the United States between 1960Q2 to 2010Q3, but in novel quantile approach. The innovative approach led the author to conclude that the higher the quantile of government expenditures and revenues, the lower is the coefficient of the cointegration relationship. Hence, the convergence between government expenditures and revenues is quantile dependent.

However, the need to verify a cointegration analysis between total government revenues and expenditures (including payment on debt interests) is not fundamental as discussed in Bohn (2007). As this author demonstrates, the intertemporal budget constraint may be verified with no cointegration or without stationarity of variables that explain the debt trajectory. According to this, other approaches are more suitable to assess fiscal sustainability, namely by assessing the fiscal reaction function of governments, that is, debt is found to be sustainable if fiscal authorities increase primary balances when facing growing debt-to-GDP ratios (Bohn, 1998). In opposition to this conclusion, Fincke and Greiner (2012), based in an empirical analysis conducted for some European countries, stated that Bohn's approach is not sufficient to guarantee a bounded government debt ratio in the long run, which is crucial to ensure a sustainable growth path for public debt, but also that global budget balances should be stationary. Beside this, the role of model specification chosen for the fiscal reaction function analysis is considered to fundamental for the conclusion's robustness (Plödt & Reicher, 2015).

In line with Bohn's framework, several studies have tackled this issue mostly for advanced economies. For instance, Greiner et al. (2007) study fiscal reaction functions for developed countries experiencing high debt-to-GDP ratios or that have not accomplished with the 3% of deficit as demanded in the Maastricht Treaty. In spite of not meeting this fiscal criterion, fiscal authorities have evidenced fiscal sustainability.

The sustainability analysis is not exclusive to advanced economies. In fact, also fiscal authorities of emerging economies have shown fiscal responsiveness to growing public debt ratios. Furthermore, not only such behaviour is stronger for lower income economies than for the most developed economies, but also the fiscal reaction functions are found to be more robust for low-debt economies (Mendoza & Ostry, 2008).

For instance, applying a panel data analysis and a panel vector auto-regressive (VAR), Afonso and Jalles (2011) find that fiscal authorities of OECD countries follow a Ricardian regime, since they improve budget balances in response to increases in debt-to-GDP ratios. This conclusion is also reached in Afonso et al. (2021), where the authors assess the fiscal reaction function for 28 EU countries in the period 1995Q1–2021Q2, looking in detail the responsiveness of fiscal authorities when interest rate-growth rate differential is positive or negative. These authors conclude that although fiscal authorities follow a Ricardian behaviour, governments tend to react more when the differential between interests and economic growth is positive.

In addition, Ghosh, Kim, et al. (2013) assessed how public authorities could increase the fulfilment of their debt obligations, and at the same time, ensure fiscal sustainability. Although the study provides a set of debt limits and fiscal space for economies displaying different levels of fiscal fatigue, the authors recognise the fragility of the assumption they assume about the risk-free interest rate, which can be easily criticised. Actually, the assumption of invariant interest rates associated to government debt can be considered a disputable assumption, since the rise of interest rates associated to debt can crowd-out social expenditures. These expenditures are quite rigid and even raising, especially for advanced economies facing demographic ageing phenomena (Debrun & Kinda, 2016).

In turn, Potrafke and Reischmann (2015) concluded that transfers play a major role when assessing fiscal sustainability for the United States and Germany. In detail, if fiscal transfers are not included in the primary budget balances, these economies do not follow a sustainable path for their public finances. Yet, in a complementary approach Saadaoui et al. (2022) resort to time-varying fiscal reaction functions and threshold reaction function for a set of six industrial countries, covering three centuries. They concluded that whilst the results are inconclusive for the Italian, Canadian, and Portuguese public finances sustainability, the results support the sustainability hypothesis for Sweden and the United Kingdom.

Some studies also assess how Euro Area membership impacts on debt sustainability and financial markets awareness of default risk for each member country of Eurozone. Although there are some solidarity mechanisms within the Eurozone when economies are being subject to fiscal stress, given the rules in force to ensure a stability of the euro common currency area, the capacity to reduce the real value of public spending is limited. Briefly, the fiscal bulk to promote macroeconomic stabilization is bounded when compared with other economies that do not belong to currency unions (Ghosh, Ostry, & Qureshi, 2013).

On the other hand, the relationship between fiscal reaction functions and the business cycle are also explored, assessing how fiscal authorities react to changes in government indebtedness during economic expansions and slowdowns, as, for instance, Combes et al. (2017), Legrenzi and Milas (2013), Everaert and Jansen (2018), and Afonso et al. (2021). Particularly, Legrenzi and Milas (2013) introduce a non-linear fiscal reaction function incorporating endogenous thresholds as economic stance, public debt level and financial pressure index. This comprehensive approach applied to peripheral Eurozone economies helps to disentangle fiscal authorities' behaviour, concluding that, for instance, that Greek fiscal authorities have not being responsive to the business cycle. At the same time fiscal adjustment of Greek public finances are found to be quite rigid to meet the Maastricht Treaty reference values. A similar conclusion is reached in Weichenrieder and Zimmer (2014) that found that fiscal responsiveness to increasing debt ratios dropped when the signatories' countries of the Maastricht Treaty adhered to the Eurozone. Being aware of the European sovereign debt crisis that almost led to the failure of Eurozone, fiscal authorities increased their responsiveness to increases in debt ratios afterwards (Baldi and Staehr, 2016; Checherita-Westphal & Ždárek, 2017; Di Iorio & Fachin, 2022).

Another strand of the literature has analysed the impacts of fiscal behaviour on government debt yields. In particular, Laubach (2009) concludes that public debt interest rates are quite sensitive to fiscal indiscipline. In detail, interest rates raise almost 30 basis points or nearly 4 basis points in response to a unit increase in the budget deficit and in government debt ratios, respectively.

In contrast, and in a political economy perspective, fiscal consolidation programmes aiming at balanced budgets are found to have no impacts in the short run on default risk premium and, therefore, on sovereign yields. Only credible perceived fiscal programmes in the long run have relevant decreasing effects on interest rates (Bi, 2012). In line with this, Fournier and Fall (2017) provide public debt limits by setting up as endogenous the probability of default evaluated by financial markets. The authors claim that the existing debt limit values registered for a set of OECD countries between 1985 and 2013 are only possible because of low levels of interest rates, highlighting, at the same time, the existing vulnerabilities that fiscal authorities may face in a financial turmoil.

Lastly, and as referred before, few studies have examined the factors that explain the fiscal sustainability coefficients obtained by the cointegration approach or by the Bohn's approach. One of that studies is Afonso and Jalles (2017a), where the authors report that fiscal rules are determinant of fiscal sustainability. In fact, and for Euro Area, expenditure-based fiscal rules are extremely significant to explain the fiscal reaction function coefficients. Meanwhile, Afonso and Jalles (2017b) analysed fiscal sustainability time-varying coefficients for a set of 13 advanced economies for more than 30 years, reaching the conclusion that government debt composition matters for the responsiveness of fiscal authorities. The higher the percentage of debt borrowed in foreign currency and the higher the share of long-term maturity of debt in the total stock of government debt stimulate the fiscal authority to manage the public finances in a higher sustainable way. In turn, Afonso and Coelho (2022) assess the determinants of fiscal sustainability coefficients and primary balance responses to government debt of the previous period for 19 Euro Area countries for 25 years, based in Schlicht (2003)'s approach, as Afonso and Jalles (2017a, 2017b). They report that the sustainability of public finances increases with economic performance, fiscal rules, whilst trade openness is detrimental for fiscal sustainability, amongst others.

3 DATA AND METHODOLOGICAL APPROACH

3.1 Data

The data sample in our study consists of 22 OECD countries, namely: Australia, Austria, Belgium, Canada, Denmark, Finland, France, Germany, Greece, Iceland, Ireland, Italy, Japan, the Netherlands, New Zealand, Norway, Portugal, Spain, Sweden, Switzerland, the United Kingdom and the United States, using annual data between 1950 and 2019.

The dependent variables are the estimated responses: (i) of revenues to government expenditures (); and (ii) of the primary () and global government balance () vis-à-vis the one-period lagged government debt ratio. The variables are expressed as a percentage of GDP. As explanatory factors for these marginal responses, we consider the output gap (output gap), the differential between the real long-term interest rate and the real GDP growth rate (r-g), the inflation rate (inflation) and the degree of trade openness (openness). Furthermore, with the aim of capturing differentiated effects of the debt-to-GDP ratios on fiscal sustainability coefficients, the debt-to-GDP ratio was interacted with three dummy variables, corresponding to intervals of the debt ratio, namely equal to or below 60%, between 60% and 90% and above 90% (debtbelow60, debt6090 and debtabove90, respectively). This analysis is based on Reinhart and Rogoff (2010) who grouped observations according to the debt-to-GDP ratio.

We present the variables, definitions and data sources, the descriptive statistics and the correlations matrix in Tables 1–3, respectively.

| Variable | Definition | Source |

|---|---|---|

| Expanding window coefficient of the response of the government revenues to a unit change in the government expenditures, both variables as a percentage of GDP | Author's estimations based on Maruo et al. (2013)'s Historic Public Finance Dataset and OECD.Stat data | |

| Expanding window coefficient of the response of the primary government balance to a unit change in the government debt lagged by one period, both variables as a percentage of GDP | Author's estimations based on Maruo et al. (2013)'s Historic Public Finance Dataset and OECD.Stat data | |

| Expanding window coefficient of the response of the global government balance to a unit change in the government debt lagged by one period, both variables as a percentage of GDP | Author's estimations based on Maruo et al. (2013)'s Historic Public Finance Dataset and OECD.Stat data | |

| output gap | Gap between effective and potential gross domestic product at constant market prices, as a percentage of potential output | Author's estimations, based on the Hodrick–Prescott (HP) filter and using data from Penn World Table, version 10.0 |

| debt | Government debt as a percentage of GDP | Maruo et al. (2013)'s Historic Public Finance Dataset and OECD.Stat |

| r-g | Differential between the real long term interest rate and the real growth rate of GDP; the real long term interest rate corresponds to the difference between the nominal long term interest rate and the inflation rate | Maruo et al. (2013)'s Historic Public Finance Dataset; Author's calculations based on OECD. Stat, World Bank and Penn World Table, version 10.0 data |

| inflation | Inflation rate | World Bank |

| openness | Trade openness, the sum of exports with imports measured as a share of GDP | Author's calculations based on World Bank data |

| Variable | Obs. | Mean | Std. dev. | Maximum | Minimum |

|---|---|---|---|---|---|

| 1100 | 0.832 | 0.167 | 1.369 | −0.291 | |

| 1100 | 0.021 | 0.080 | 0.436 | −0.311 | |

| 1100 | −0.023 | 0.102 | 0.419 | −0.315 | |

| output gap | 1100 | 0.026 | 0.472 | 2.139 | −1.787 |

| debt | 1100 | 60.850 | 37.601 | 229.610 | 2.974 |

| r-g | 1051 | 0.016 | 4.211 | 25.829 | −38.347 |

| inflation | 1100 | 5.351 | 6.789 | 83.950 | −4.478 |

| openness | 1089 | 66.235 | 33.659 | 252.335 | 10.757 |

| output gap | debt | r-g | inflation | openness | ||||

|---|---|---|---|---|---|---|---|---|

| 1.000 | ||||||||

| 0.075 | 1.000 | |||||||

| 0.110 | 0.812 | 1.000 | ||||||

| output gap | 0.013 | 0.122 | 0.173 | 1.000 | ||||

| debt | −0.189 | 0.007 | −0.126 | −0.260 | 1.000 | |||

| r-g | 0.014 | −0.016 | −0.111 | −0.368 | 0.176 | 1.000 | ||

| inflation | −0.091 | −0.129 | −0.110 | 0.141 | −0.362 | −0.239 | 1.000 | |

| openness | 0.213 | 0.127 | −0.009 | −0.033 | 0.162 | −0.124 | −0.172 | 1.000 |

3.2 Methodology

The Equations (1-3) are estimated using a time-varying parameter model. We use an expanding window that weights historical data equally of 20 years. More specifically, for each country, we estimate series of , and for the periods 1950–1970, 1950–1971, 1950–1972 and, finally, 1950–2019.

According to Hakkio and Rush (1991), when government revenues and expenditures are expressed as a percentage of GDP, as is the case in our analysis, it is necessary in (Afonso, 2005) that β = 1, in order to guarantee that the trajectory of the share of public debt on GDP does not diverge over an infinite horizon. If β < 1, government expenditures grow faster than revenues and the budget deficit may not be sustainable. Bohn (1998), in turn, shows that if in (Afonso et al., 2021) σp > 0 this is a sufficient condition to ensure fiscal sustainability. In this case, the fiscal regime in force is Ricardian. If, on the contrary, σp < 0, a non-Ricardian fiscal regime prevails.

In addition, Afonso and Jalles (2017a) study the time-series features of the series, whilst Afonso and Jalles (2017b) do not carry out this analysis. Our argument for not needing to report stationarity and cointegration test results is based on Bohn (2007). More specifically, the author shows that compliance with the intertemporal budget constraint (IBC) is compatible with any order of integration of the public debt and government revenues and expenditures series, that is, the stochastic process of the series does not have to have a finite order. Therefore, the rejection of stationarity and cointegration is consistent with the IBC, and an integrated process is not necessarily synonymous with a violation of the IBC.

In the second step of the expanding window approach, we use the computed expanding window estimates as dependent variables and identify explanatory factors for these marginal responses. We estimate the equations that identify the explanatory factors of the expanding window fiscal sustainability coefficients through ordinary least squares with country and time fixed effects (OLS-FE). In particular, the estimates of marginal responses are weighted by the respective standard deviations as a way of standardising the estimated coefficients.

Furthermore, we estimate these equations resorting to a quantile regression process. The quantile regression method, proposed by Koenker and Bassett (1978), deals with estimation and inference in different quantiles, provides information of different points of a conditional distribution, and constitutes a parsimonious way to describe a distribution as a whole. The analysis is performed for different points of the conditional distribution, not just for the mean location. In turn, the effects of the explanatory variables depend on the different points of the distribution that are looked at, and their changes affect not only the location but also the shape of the conditional distribution of the variables to be explained. As it is a semiparametric method, it assumes a parametric specification for the quantiles of the conditional distribution but leaves the random perturbation term unspecified.

On the one hand, a quantile regression approach allows to analyse the relationships of variables under study outside their average values. On the other hand, this method allows to examine possible non-linear relationships between the explanatory factors and the variables of interest. Therefore, the main advantage of quantile regressions is to show heterogeneous impacts of the independent variables on the estimated marginal responses of fiscal sustainability, providing a richer set of information. In practice, the sample is divided into deciles, from negative to positive marginal responses, and these are a function of the explanatory factors of fiscal sustainability mentioned above.

4 EMPIRICAL ANALYSIS

Table 4 shows that the output gap has a positive impact on the response of the primary government balance to lagged government debt. The effect of the debt-to-GDP ratio is negative, although it is greater for ratios below or equal to 60% and smaller for ratios above 90%. The differential between the long-term interest rate and the growth of GDP and the inflation rate negatively influence the fiscal responsiveness, in two specifications, and the degree of trade openness positively influences it. The greater the response of revenues to government expenditures, the smaller the response of the primary government balance to the lagged public debt ratio. This result means that the more revenues react to government expenditures (columns 4 and 5), the lower the reaction of the primary government balance to the past government debt.

| Regressors/specification | (1) | (2) | (3) | (4) | (5) |

|---|---|---|---|---|---|

| output gap (lagged) | 0.344* | 0.228 | 0.402** | 0.357* | 0.294 |

| (0.195) | (0.193) | (0.198) | (0.193) | (0.195) | |

| debtbelow60 (lagged) | −0.025*** | −0.028*** | −0.027*** | −0.018*** | −0.023*** |

| (0.006) | (0.006) | (0.006) | (0.006) | (0.006) | |

| debt6090 (lagged) | −0.020*** | −0.023*** | −0.022*** | −0.015*** | −0.018*** |

| (0.005) | (0.005) | (0.005) | (0.005) | (0.005) | |

| debtabove90 (lagged) | −0.014*** | −0.017*** | −0.015*** | −0.010*** | −0.013*** |

| (0.003) | (0.003) | (0.003) | (0.003) | (0.003) | |

| r-g (lagged) | −0.028 | −0.070*** | −0.026 | −0.030 | −0.070*** |

| (0.020) | (0.021) | (0.021) | (0.020) | (0.022) | |

| inflation (lagged) | −0.144*** | −0.148*** | |||

| (0.025) | (0.025) | ||||

| openness (lagged) | 0.011* | 0.011* | |||

| (0.006) | (0.006) | ||||

| −0.038*** | −0.040*** | ||||

| (0.008) | (0.008) | ||||

| Observations | 1029 | 1029 | 1018 | 1029 | 1018 |

| R-squared | 0.517 | 0.534 | 0.526 | 0.529 | 0.551 |

- Note: (a) The dependent variable is the response of the primary government balance to a unit change in government debt lagged by one period, both variables as a percentage of GDP; (b) The fiscal sustainability coefficients are weighted by the inverse of the standard errors of the estimated expanding window coefficients; (c) Robust standard errors in brackets; (d) Constant term estimated, but omitted for reasons of parsimony and (e) *, ** and *** denote statistical significance at the 10%, 5% and 1% level, respectively.

According to the results of the estimations in Table 5, the output gap positively influences the response of the global government balance to the lagged public debt ratio. The public debt-to-GDP ratio has a negative impact, greater for public debt ratios above 60% and equal to or below 90% and smaller for ratios above 90%. The differential between the long-term interest rate and the growth of GDP has a positive impact on fiscal responsiveness, and the inflation rate, a negative one. The degree of trade openness, in turn, has a non-significant effect. Again, the more revenues adjust to government expenditures, the less the global government balance reacts to the past government debt.

| Regressors/specification | (1) | (2) | (3) | (4) | (5) |

|---|---|---|---|---|---|

| output gap (lagged) | 0.390** | 0.312 | 0.350* | 0.406** | 0.286 |

| (0.192) | (0.191) | (0.196) | (0.188) | (0.193) | |

| debtbelow60 (lagged) | −0.027*** | −0.029*** | −0.028*** | −0.019*** | −0.021*** |

| (0.006) | (0.006) | (0.006) | (0.006) | (0.006) | |

| debt6090 (lagged) | −0.029*** | −0.030*** | −0.030*** | −0.022*** | −0.023*** |

| (0.005) | (0.005) | (0.005) | (0.005) | (0.005) | |

| debtabove90 (lagged) | −0.025*** | −0.026*** | −0.025*** | −0.019*** | −0.021*** |

| (0.003) | (0.003) | (0.003) | (0.003) | (0.003) | |

| r-g (lagged) | 0.053*** | 0.025 | 0.049** | 0.051*** | 0.015 |

| (0.020) | (0.021) | (0.021) | (0.019) | (0.021) | |

| inflation (lagged) | −0.097*** | −0.117*** | |||

| (0.025) | (0.025) | ||||

| openness (lagged) | −0.006 | −0.005 | |||

| (0.006) | (0.006) | ||||

| −0.046*** | −0.051*** | ||||

| (0.008) | (0.008) | ||||

| Observations | 1029 | 1029 | 1018 | 1029 | 1018 |

| R-squared | 0.749 | 0.753 | 0.749 | 0.758 | 0.764 |

- Note: (a) The dependent variable is the response of the global government balance to a unit change in government debt lagged by one period, both variables as a percentage of GDP; (b) The fiscal sustainability coefficients are weighted by the inverse of the standard errors of the estimated expanding window coefficients; (c) Robust standard errors in brackets; (d) Constant term estimated, but omitted for reasons of parsimony; (e) *, ** and *** denote statistical significance at the 10%, 5% and 1% level, respectively.

Based on Table 6, we find that the output gap and the (r-g) differential do not influence the response of revenues to government expenditures. The higher the debt-to GDP ratio, the lower the response of revenues to government expenditures, although it remains positive. The inflation rate has a negative effect and the effect of the trade openness is positive. The responses of the primary government balance and the global government balance to lagged public debt have a highly significant negative impact on the response of revenues to government expenditures. These results indicate that the greater the reaction of the primary and global government balance to the debt ratios, the smaller the adjustment of revenues to government expenditures.

| Regressors/specification | (1) | (2) | (3) | (4) | (5) | (6) | (7) |

|---|---|---|---|---|---|---|---|

| output gap (lagged) | 0.359 | 0.132 | 1.115 | 0.570 | 0.659 | 1.007 | 1.039 |

| (0.787) | (0.788) | (0.766) | (0.779) | (0.775) | (0.762) | (0.756) | |

| debtbelow60 (lagged) | 0.169*** | 0.162*** | 0.188*** | 0.154*** | 0.149*** | 0.164*** | 0.158*** |

| (0.025) | (0.025) | (0.024) | (0.025) | (0.025) | (0.024) | (0.024) | |

| debt6090 (lagged) | 0.157*** | 0.153*** | 0.170*** | 0.144*** | 0.135*** | 0.152*** | 0.142*** |

| (0.019) | (0.019) | (0.018) | (0.019) | (0.019) | (0.018) | (0.018) | |

| debtabove90 (lagged) | 0.113*** | 0.108*** | 0.128*** | 0.105*** | 0.095*** | 0.112*** | 0.102*** |

| (0.013) | (0.013) | (0.012) | (0.013) | (0.013) | (0.012) | (0.013) | |

| r-g (lagged) | −0.053 | −0.136 | 0.026 | −0.071 | −0.012 | −0.093 | −0.038 |

| (0.081) | (0.086) | (0.080) | (0.080) | (0.080) | (0.085) | (0.084) | |

| inflation (lagged) | −0.282*** | −0.342*** | −0.340*** | ||||

| (0.102) | (0.099) | (0.098) | |||||

| openness (lagged) | 0.068*** | 0.067*** | 0.056** | ||||

| (0.024) | (0.023) | (0.023) | |||||

| −0.615*** | −0.608*** | ||||||

| (0.129) | (0.126) | ||||||

| −0.770*** | −0.782*** | ||||||

| (0.130) | (0.125) | ||||||

| Observations | 1029 | 1029 | 1018 | 1029 | 1029 | 1018 | 1018 |

| R-squared | 0.761 | 0.763 | 0.782 | 0.767 | 0.770 | 0.788 | 0.792 |

- Note: (a) The dependent variable is the response of the government revenues to a unit change in government expenditures, both variables as a percentage of GDP; (b) The fiscal sustainability coefficients are weighted by the inverse of the standard errors of the estimated expanding window coefficients; (c) Robust standard errors in brackets; (d) Constant term estimated, but omitted for reasons of parsimony and (e) *, ** and *** denote statistical significance at the 10%, 5% and 1% level, respectively.

Combining the results reported in Tables 4–6, we can conclude that: (i) the output gap contributes to increasing fiscal sustainability by positively influencing the responsiveness of the primary and global government balance; (ii) the responses of the primary and global government balance to the debt ratio and the response of revenues to government expenditures depend on the public debt ratio itself; (iii) the (r-g) differential decreases the response of the primary government balance, whereas increasing the response of the global government balance; (v) the output gap and the (r-g) differential are not statistically significant for the response of revenues to government expenditures; (vi) the inflation rate has a negative impact on fiscal sustainability; (vii) the trade openness positively affects the responses of the primary government balance to the public debt ratio and of the revenues to government expenditures, albeit it does not influence the response of the global government balance to the public debt ratio and (viii) fiscal sustainability coefficients have a negative cross-impact. The empirical literature on the determinants of time-varying fiscal sustainability coefficients is scarce. Therefore, it is difficult to make a counterpoint with results reported in previous articles. Nevertheless, the obtained results can be further explained as follows. The output gap improves fiscal sustainability, since in periods when the output gap is positive, government revenues increase and government expenditures decrease due notably to the action of automatic stabilisers. In these periods, in general, there is less use of discretionary fiscal policies, and public savings increase. Alternatively, in periods when the output gap is negative, government revenues decrease, government expenditures increase and there is greater recourse to discretionary fiscal policies in order to stabilise economic activity, diminishing public savings.

The debt-to-GDP ratio has a negative effect on fiscal sustainability, however, for higher ratios, the negative effect is attenuated. This result can be explained because the most indebted countries have a greater need to carry out fiscal adjustments in order to guarantee the sustainability of public accounts. The higher the debt-to-GDP ratio, the smaller the adjustment of revenues to government expenditures. This result may be explained by the fact that in a scenario where the debt-to-GDP ratio is higher, interest expenditure is higher and governments are less able to accommodate a higher level of public expenditure, considering that there is a fiscal limit that taxpayers are willing to bear.

The (r-g) differential reduces fiscal sustainability, that is, an increase of the differential, attenuates the responsiveness of the primary government balance to changes in the public debt-to-GDP ratio, constraining the capacity of fiscal authorities to carry out fiscal adjustments. Conversely, the positive impact of the (r-g) differential means that when the real interest rate is higher than the GDP growth rate, public interest expenditure is higher, which may put pressure on fiscal authorities to obtain budget surpluses in order to reduce the public debt-to-GDP ratio. Furthermore, as interest expenditure is excluded from the primary government balance but included in the global government balance, budgetary authorities put a greater effort into reacting the global government balance to changes in the public debt-to-GDP ratio. Also due to higher sovereign public debt yields, fiscal authorities carry out a higher global fiscal effort.

A relevant question has to do with the negative effect of the (r-g) differential on the time-varying responses of the primary government balance to variations in the public debt-to-GDP ratio. Considering the public debt dynamics equation, and in order to ensure the relative stabilization of public debt, we would expect the reaction of the primary budget balance to changes in public debt to be positive, when the (r-g) differential is unfavourable, that is, positive.

Although inflation reduces the real value of the stock of government debt and translates into increased tax revenues, it worsens the level of public expenditure, which deteriorates public accounts and limits fiscal space. The higher degree of trade openness reflects the greater openness of the economy to the outside world, which is beneficial for foreign trade, increases the level of exports and GDP, and boosts economic growth. Consequently, greater economic strength benefits the health of public finances and increases the responsiveness of budgetary authorities. Conversely, Afonso and Jalles (2017b) find a positive effect of the inflation rate and a negative effect of the degree of trade openness on the time-varying responses of the primary government balance to variations in the public debt-to-GDP ratio.

If revenues are more in line with expenditures, the government is less pressed to make fiscal adjustments, as fiscal sustainability problems are not as paramount. Likewise, if the primary and global government balance respond more to the debt-to-GDP ratio, fiscal sustainability is improved, and there is less urgency for revenues to adjust more immediately to government expenditures.

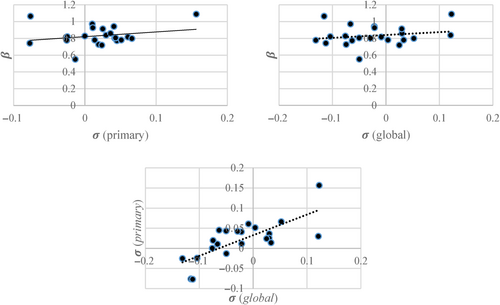

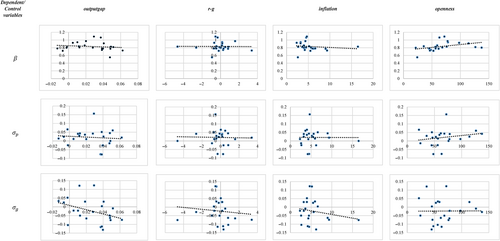

In order to illustrate the discussed rationale regarding the results that we obtain, in Figure 1 we show the cross-relation between the fiscal sustainability coefficients, estimated via Equations (1-3), whilst in Figure 2 we highlight the relationship between those fiscal sustainability coefficients and the control variables.

Turning now to the quantile regression analysis, in Table 7, we can see that the effect of the degree of trade openness on the response of the primary government balance to the public debt-to-GDP ratio, although positive, is decreasing as we move from lower to higher deciles. This means that, for higher levels of trade openness to the outside world, the impact on fiscal sustainability fades away, being stronger for negative fiscal sustainability coefficients. Conversely, the influence of the response of revenues to government expenditures is negative and increasing over the deciles, confirming the existence of a negative cross-relationship between the fiscal sustainability coefficients. The output gap has higher positive effects for the lower and upper deciles, and the inflation rate has greater negative impacts on lower deciles than on higher deciles. Lastly, the government debt-to-GDP ratio has a positive effect for fiscal responsiveness for higher deciles.

| Decil | q10 | q20 | q30 | q40 | q50 | q60 | q70 | q80 | q90 |

|---|---|---|---|---|---|---|---|---|---|

| Regressors/specification | (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | (9) |

| output gap (lagged) | 0.904*** | 0.574** | 0.497** | 0.531 | 0.455 | 0.477* | 0.547*** | 0.790*** | 0.677** |

| (0.287) | (0.265) | (0.221) | (0.337) | (0.301) | (0.245) | (0.204) | (0.185) | (0.344) | |

| debtbelow60 (lagged) | −0.010 | −0.001 | −0.001 | 0.011 | 0.029** | 0.035*** | 0.035*** | 0.024*** | 0.014 |

| (0.009) | (0.012) | (0.014) | (0.012) | (0.013) | (0.010) | (0.005) | (0.005) | (0.013) | |

| debt6090 (lagged) | −0.010* | −0.009 | −0.008 | 0.001 | 0.005 | 0.011*** | 0.026*** | 0.024*** | 0.009 |

| (0.006) | (0.008) | (0.009) | (0.008) | (0.005) | (0.004) | (0.005) | (0.004) | (0.010) | |

| debtabove90 (lagged) | −0.021*** | −0.017* | −0.007 | −0.000 | 0.007 | 0.013*** | 0.022*** | 0.024*** | 0.013** |

| (0.005) | (0.009) | (0.008) | (0.008) | (0.005) | (0.005) | (0.004) | (0.002) | (0.006) | |

| r-g (lagged) | 0.053 | 0.027 | 0.018 | 0.051* | 0.022 | 0.003 | 0.013 | 0.025** | 0.033 |

| (0.039) | (0.053) | (0.027) | (0.026) | (0.021) | (0.019) | (0.027) | (0.013) | (0.034) | |

| inflation (lagged) | −0.185*** | −0.094* | −0.029 | −0.038 | −0.068*** | −0.101*** | −0.081*** | −0.070*** | −0.079** |

| (0.034) | (0.054) | (0.027) | (0.027) | (0.020) | (0.015) | (0.021) | (0.015) | (0.037) | |

| openness (lagged) | 0.038*** | 0.031*** | 0.028*** | 0.020*** | 0.014*** | 0.008* | 0.004 | 0.002 | 0.005* |

| (0.002) | (0.004) | (0.003) | (0.004) | (0.005) | (0.005) | (0.004) | (0.003) | (0.003) | |

| −0.011** | −0.015* | −0.018*** | −0.022*** | −0.026*** | −0.028*** | −0.033*** | −0.043*** | −0.071*** | |

| (0.005) | (0.008) | (0.005) | (0.008) | (0.007) | (0.004) | (0.004) | (0.004) | (0.012) |

- Note: (a) The dependent variable is the response of the primary government balance to a unit change in government debt lagged by one period, both variables as a percentage of GDP; (b) The fiscal sustainability coefficients are weighted by the inverse of the standard errors of the estimated expanding window coefficients; (c) Constant term estimated, but omitted for reasons of parsimony and (d) *, ** and *** denote statistical significance at the 10%, 5% and 1% level, respectively.

In addition, Table 8 shows that the impact of the degree of trade openness is positive in the first five deciles and negative in ninth decile, decreasing as we move from the lower to the higher deciles, on the response of the global government balance to a unit change in lagged government debt. The response of revenues to government expenditures has a negative and increasing influence up to the seventh decile. These results are partially reported by Table 7. Moreover, the inflation rate has a strong negative effect on the first deciles, and the public debt-to-GDP ratio has a negative effect on most deciles, higher in the lower deciles.

| Decil | q10 | q20 | q30 | q40 | q50 | q60 | q70 | q80 | q90 |

|---|---|---|---|---|---|---|---|---|---|

| Regressors/specification | (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | (9) |

| output gap (lagged) | −0.144 | 0.309 | 0.483* | 0.202 | −0.117 | −0.604 | −0.596 | −1.049* | −0.847 |

| (0.192) | (0.212) | (0.250) | (0.229) | (0.399) | (0.399) | (0.411) | (0.583) | (0.591) | |

| debtbelow60 (lagged) | −0.063*** | −0.059*** | −0.056*** | −0.059*** | −0.031** | −0.009 | 0.015 | 0.013 | −0.025** |

| (0.010) | (0.009) | (0.008) | (0.013) | (0.013) | (0.018) | (0.016) | (0.013) | (0.012) | |

| debt6090 (lagged) | −0.073*** | −0.058*** | −0.051*** | −0.053*** | −0.038*** | −0.029** | −0.013 | −0.005 | −0.037*** |

| (0.012) | (0.006) | (0.006) | (0.007) | (0.009) | (0.013) | (0.010) | (0.010) | (0.010) | |

| debtabove90 (lagged) | −0.040*** | −0.038*** | −0.038*** | −0.043*** | −0.036*** | −0.034*** | −0.029*** | −0.031*** | −0.044*** |

| (0.005) | (0.003) | (0.003) | (0.004) | (0.007) | (0.007) | (0.006) | (0.006) | (0.006) | |

| r-g (lagged) | −0.048* | −0.015 | −0.048 | −0.063** | −0.073** | −0.044 | −0.096* | −0.047 | −0.014 |

| (0.026) | (0.033) | (0.031) | (0.025) | (0.036) | (0.047) | (0.051) | (0.053) | (0.039) | |

| inflation (lagged) | −0.162*** | −0.132*** | −0.052 | −0.065*** | −0.041 | −0.015 | −0.051 | 0.000 | −0.030 |

| (0.056) | (0.046) | (0.038) | (0.017) | (0.038) | (0.040) | (0.048) | (0.037) | (0.044) | |

| openness (lagged | 0.024*** | 0.023*** | 0.023*** | 0.017*** | 0.011*** | −0.000 | −0.003 | −0.004 | −0.014*** |

| (0.003) | (0.004) | (0.004) | (0.003) | (0.004) | (0.006) | (0.007) | (0.005) | (0.003) | |

| −0.018* | −0.020** | −0.027*** | −0.036*** | −0.043*** | −0.052*** | −0.057*** | −0.038** | −0.010 | |

| (0.011) | (0.009) | (0.007) | (0.007) | (0.005) | (0.011) | (0.013) | (0.016) | (0.012) |

- Note: (a) The dependent variable is the response of the global government balance to a unit change in government debt lagged by one period, both variables as a percentage of GDP; (b) The fiscal sustainability coefficients are weighted by the inverse of the standard errors of the estimated expanding window coefficients; (c) Constant term estimated, but omitted for reasons of parsimony and (d) *, ** and *** denote statistical significance at the 10%, 5% and 1% level, respectively.

Looking now at the response of the government revenues to a unit change in government expenditures, in Table 9, we can conclude that the inflation rate has a negative impact, smaller for lower deciles and higher for higher deciles. Thus, the inflation rate has a more accentuated negative impact on higher fiscal sustainability coefficients. This evidence can be explained by the fact that the more adverse the effects of inflation on the sustainability of public accounts, the greater the adjustment of revenues to government expenditures. The degree of trade openness has a positive and increasing effect over the various deciles, which suggests that the greater the degree of trade openness, the higher the adjustment of revenues to government expenditures. The response of the primary government balance to the public debt ratio is strongly negative for the upper deciles and positive for the first decile. In turn, the output gap has strong negative effects for the first and fifth deciles and also for higher deciles, and the public debt ratio has mixed impacts.

| Decil | q10 | q20 | q30 | q40 | q50 | q60 | q70 | q80 | q90 |

|---|---|---|---|---|---|---|---|---|---|

| Regressors/specification | (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | (9) |

| output gap (lagged) | −2.385** | −1.197 | −2.136 | −3.708 | −3.555** | −1.149 | −3.118** | −2.589*** | −4.192* |

| (0.939) | (1.114) | (2.358) | (2.324) | (1.794) | (1.592) | (1.339) | (0.845) | (2.295) | |

| debtbelow60 (lagged) | 0.105* | 0.055 | −0.044 | −0.048 | 0.007 | 0.067** | 0.047 | 0.046 | 0.027 |

| (0.060) | (0.037) | (0.068) | (0.052) | (0.047) | (0.033) | (0.049) | (0.043) | (0.068) | |

| debt6090 (lagged) | 0.061 | 0.040 | 0.033 | −0.007 | 0.002 | −0.024 | −0.020 | 0.005 | 0.004 |

| (0.042) | (0.033) | (0.036) | (0.023) | (0.021) | (0.030) | (0.041) | (0.020) | (0.044) | |

| debtabove90 (lagged) | 0.042** | 0.010 | −0.038* | −0.073*** | −0.074*** | −0.078*** | −0.069** | −0.057*** | −0.068*** |

| (0.018) | (0.009) | (0.021) | (0.011) | (0.012) | (0.017) | (0.027) | (0.018) | (0.026) | |

| r-g (lagged) | 0.201* | 0.289** | 0.299 | 0.342 | 0.305 | 0.436*** | 0.313** | 0.107 | −0.214 |

| (0.107) | (0.132) | (0.206) | (0.230) | (0.207) | (0.129) | (0.155) | (0.120) | (0.190) | |

| inflation (lagged) | −0.388*** | −0.449*** | −0.627*** | −0.689*** | −0.771*** | −0.661*** | −0.671*** | −0.850*** | −1.170*** |

| (0.089) | (0.051) | (0.132) | (0.106) | (0.149) | (0.147) | (0.081) | (0.103) | (0.172) | |

| openness (lagged) | 0.027 | 0.069** | 0.088*** | 0.105*** | 0.113*** | 0.185*** | 0.187*** | 0.230*** | 0.267*** |

| (0.023) | (0.032) | (0.024) | (0.014) | (0.024) | (0.017) | (0.021) | (0.026) | (0.028) | |

| 0.456* | 0.239 | −0.190 | −0.533*** | −0.419** | −0.399** | −0.604*** | −1.078*** | −2.173*** | |

| (0.275) | (0.166) | (0.246) | (0.140) | (0.163) | (0.198) | (0.202) | (0.156) | (0.415) |

- Note: (a) The dependent variable is the response of the government revenues to a unit change in government expenditures, both variables as a percentage of GDP; (b) The fiscal sustainability coefficients are weighted by the inverse of the standard errors of the estimated expanding window coefficients; (c) Constant term estimated, but omitted for reasons of parsimony and (d) *, ** and *** denote statistical significance at the 10%, 5% and 1% level, respectively.

According to Table 10, the impact of the trade openness on the response of government revenues to a unit change in government expenditures is increasing as we move from lower to higher deciles. The inflation rate has a negative effect that gets worse as we move to higher deciles. These results were also found in Table 9. The response of the global government balance to the public debt-to-GDP ratio has a negative influence, with the exception of the first two deciles, and it is strongest in the ninth decile. The output gap has strong negative responses from the fourth decile onwards. Finally, the public debt-to-GDP ratio exhibits mixed responses. However, for ratios above 90% of GDP, the responses become negatively increasing from the third decile onwards.

| Decil | q10 | q20 | q30 | q40 | q50 | q60 | q70 | q80 | q90 |

|---|---|---|---|---|---|---|---|---|---|

| Regressors/specification | (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | (9) |

| output gap (lagged) | −2.243 | −0.478 | −1.657 | −4.442*** | −3.709*** | −3.089** | −3.324** | −3.411** | −8.041*** |

| (1.515) | (1.433) | (1.717) | (1.692) | (0.964) | (1.293) | (1.412) | (1.357) | (2.872) | |

| debtbelow60 (lagged) | 0.106** | 0.080** | −0.027 | −0.040 | 0.012 | 0.001 | −0.008 | −0.034 | −0.126* |

| (0.052) | (0.037) | (0.036) | (0.035) | (0.036) | (0.041) | (0.038) | (0.036) | (0.071) | |

| debtd6090 (lagged) | 0.060 | 0.029 | 0.033 | −0.018 | −0.013 | −0.048* | −0.067*** | −0.082*** | −0.126** |

| (0.045) | (0.040) | (0.036) | (0.022) | (0.027) | (0.025) | (0.019) | (0.027) | (0.055) | |

| debtabove90 (lagged) | 0.029* | −0.003 | −0.048*** | −0.084*** | −0.086*** | −0.103*** | −0.114*** | −0.127*** | −0.187*** |

| (0.016) | (0.012) | (0.015) | (0.009) | (0.010) | (0.013) | (0.012) | (0.014) | (0.024) | |

| r-g (lagged) | 0.296** | 0.292* | 0.245 | 0.232 | 0.250 | 0.361*** | 0.257*** | 0.030 | −0.278* |

| (0.126) | (0.165) | (0.174) | (0.145) | (0.166) | (0.118) | (0.084) | (0.087) | (0.161) | |

| inflation (lagged) | −0.458*** | −0.452*** | −0.666*** | −0.670*** | −0.745*** | −0.717*** | −0.733*** | −0.807*** | −0.977*** |

| (0.099) | (0.083) | (0.155) | (0.160) | (0.176) | (0.168) | (0.112) | (0.089) | (0.185) | |

| openness (lagged) | 0.046** | 0.091** | 0.090** | 0.086*** | 0.097*** | 0.170*** | 0.180*** | 0.232*** | 0.280*** |

| (0.021) | (0.038) | (0.037) | (0.018) | (0.025) | (0.027) | (0.014) | (0.033) | (0.024) | |

| −0.047 | −0.304 | −0.488*** | −0.788*** | −0.651*** | −0.678*** | −0.613*** | −0.709*** | −1.569*** | |

| (0.123) | (0.209) | (0.186) | (0.215) | (0.200) | (0.189) | (0.132) | (0.129) | (0.282) |

- Note: (a) The dependent variable is the response of the government revenues to a unit change in government expenditures, both variables as a percentage of GDP; (b) The fiscal sustainability coefficients are weighted by the inverse of the standard errors of the estimated expanding window coefficients; (c) Constant term estimated, but omitted for reasons of parsimony and (d) *, ** and *** denote statistical significance at the 10%, 5% and 1% level, respectively.

5 CONCLUSION

We have assessed the link between fiscal sustainability coefficients, namely the responses of the primary government balance and the global government balance to the debt-to-GDP ratio, and the response of government revenues to government expenditures. For 22 OECD developed countries, we used annual data between 1950 and 2019. The determinants of fiscal responses are also studied in the context of quantile regressions.

Our results allow to conclude that: (i) the output gap contributes to increasing fiscal sustainability by positively influencing the responsiveness of the primary and global government balance; (ii) the responses of the primary and global government balance to the debt ratio and the response of government revenues to government expenditures depend on the level of the debt ratio itself; (iii) the (r-g) differential decreases the response of the primary government balance; (v) the inflation rate has a negative impact on fiscal sustainability; (vi) the trade openness positively affects the responses of the primary government balance to the public debt ratio and of the revenues to government expenditures and (viii) fiscal sustainability coefficients have a negative cross-impact.

From the quantile analysis, we find that: (i) the influence of the response of government revenues to government expenditures is negative and increasing over the deciles, confirming the existence of a negative cross-relationship between the fiscal sustainability coefficients; (ii) debt-to-GDP ratios have a positive effect for fiscal responsiveness for higher deciles; (iii) the response of the primary government balance to the debt ratio is strongly negative for the upper deciles and positive for the first decile and (iv) the output gap has strong negative effects for the first and fifth deciles and also for higher deciles.

Our results have relevant policy implications. For instance, the debt-to-GDP ratio has a negative effect on fiscal sustainability, however, for higher ratios, the negative effect is attenuated. This result can be explained because the most indebted countries have a greater need to carry out fiscal adjustments in order to guarantee the sustainability of public accounts. On the other hand, the positive impact of the (r-g) differential implies that when the real interest rates are higher than the GDP growth rate, public interest expenditure is higher, which may put pressure on fiscal authorities to obtain budget surpluses in order to reduce the public debt-to-GDP ratio.

In line with Greiner et al. (2007) who states that “This is of particular relevance for European countries with its in part fast ageing population which may make it more difficult for governments to follow sustainable debt paths in the next decades.”, we suggest as a future investigation the study of effects of population ageing on fiscal solvency and the fiscal sustainability coefficients themselves.

ACKNOWLEDGEMENT

We thank two anonymous referees for very useful comments and suggestions, and also participants at the European Economics and Finance Society (EEFS) 2023 conference, 15–18 June, in Berlin. This work was supported by the FCT (Fundação para a Ciência e a Tecnologia) [grant number UIDB/05069/2020]. The opinions expressed herein are those of the authors and do not necessarily reflect those of the authors' employers. Any remaining errors are the authors' sole responsibility.

CONFLICT OF INTEREST STATEMENT

The authors declare no conflicts of interest.

Open Research

DATA AVAILABILITY STATEMENT

The data that support the findings of this study are available from the corresponding author upon reasonable request.