Impacts of cross-border equity portfolio flow and central bank transparency on financial development: The role of economic freedom and international bonds

Abstract

We investigate the effects of international equity portfolio diversification and central bank independence on financial development using panel data from 49 countries from 2001 to 2016. We find that international equity portfolio diversification improves financial development. We correspondingly examine potential factors through which international equity portfolio diversification may impact financial development and find that central bank transparency provides an important channel for improving financial development. We further find that the relationship between international equity portfolio diversification and financial development is sensitive to economic freedom. Concerning sequencing, we find that foreign equity and debt flow are complementary to financial system development. Our results are robust to endogeneity using the exogenous shock of the 2008 financial crisis. This study offers new empirical evidence on the relationship between international capital and financial development.

1 INTRODUCTION

Several countries in the last four decades have undertaken financial liberalization with the aim to develop their financial markets. However, empirical evidence indicates that the results have been mixed. This is consistent with the view that financial development is not just an interplay of free-market forces. A more recent work by Laeven (2014) shows that government-led efforts to develop domestic markets to improve risk-sharing and capital allocation efficiency have had mixed success, with several countries failing. The question that then naturally arises is; why have reforms witnessed in the past four decades in the form of financial liberalization leading to global financial integration been unsuccessful in several countries? These reforms were mainly to promote financial development to achieve economic growth.

Understanding of factors that determine financial development is necessary due to the salient role financial markets play in economic growth and development (Beck et al., 2000; La Porta et al., 1998; Levine & Zervos, 1998). Turner (2002) finds the development of the local bond market is an important source of funds for the government in financing substantial fiscal deficits without necessarily resorting to foreign borrowing. Other threads of the finance literature have explored the impact of financial development on corporate investment decisions (see Fazzari et al., 2000; Kaplan and Zingales, 2000; Erickson and Whited, 2000; Houston and James, 2001).

The preponderance of empirical evidence indicates that there is a shift from studies examining the finance-growth nexus, to a growing number of studies investigating factors that influence financial development. Amongst these studies include; trade and financial openness (Rajan & Zingales, 2003), institutions (Law et al., 2013), culture (Stulz and Williamson, 2003), political institutions (Roe & Siegel, 2011), ownership of banks by the state (La Porta et al. 2002; Andrianova et al., 2008), legal systems (La Porta et al., 1998), financial sector policies (Ang, 2008).

Our study is largely in response to the relevant role financial markets play in the economy and the challenges countries face in developing their financial markets. In line with the theoretical argument, we examine the role of international capital flow in domestic financial market development. We further test whether central bank transparency interacts with international equity portfolio diversification to boost financial development. We additionally investigate whether the relationship between international capital and financial development is sensitive to economic freedom.1 Finally, we test if international equity portfolio diversification and international bond flow (IBF) have a complementary role in financial development.

In this study, we argue that cross-country differences in financial development following financial liberalization particularly in developing countries are due to insufficient international capital flow and lower investor participation, which are linked to a high prevalence of poor institutional quality and information asymmetry. For instance, Lau et al. (2010) provide empirical evidence that despite the suggestions by the international capital pricing model (ICAPM) that investors should construct an internationally diversified equity portfolio, investors exhibit equity home bias.2 The financial market will be segmented with the high pervasiveness of equity home bias. Segmented financial markets suffer from illiquidity, information asymmetry, poor-functioning regulatory system, and under-developed financial infrastructure. A critical open question is whether international equity portfolio diversification directly and interactively enhances financial development. This question has previously never been addressed because cross-border equity portfolio data recently became available. We fill the gap in the finance literature by showing that central bank transparency and economic freedom will encourage international investors to participate in the domestic financial market to enhance financial development.

Using panel data from 49 countries from 2001 to 2016, we find that international equity portfolio diversification boosts financial development. For instance, one standard deviation increase in international portfolio diversification will increase market capitalization to GDP by 0.57%. We further provide evidence to support our hypothesis that central bank transparency interacts with international equity portfolio diversification to improve financial development. We find the relation between international equity portfolio flow and financial market development is sensitive to economic freedom which reflects the institutional quality. In a further empirical analysis, we find that international equity and bond flow are complementary to financial system development.

We are motivated to undertake this study mainly to build on existing literature and also due to the policy orientation of the study. Our study extends the international finance literature in several ways. First, we directly examine the effects of international equity portfolio diversification on financial development. More importantly, the analysis allows us to quantify the magnitude of the financial development impact of cross-country variations in attracting international capital. We show that international investors contribute to financial market development. Our research closely relates to Chinn and Ito (2006) who find that financial openness directly and interactively with legal quality to enhance financial development. Particularly, when a certain level of legal development is attained. We also provide an incremental contribution to Kwabi et al. (2020) who show the stock market development effects of variations in equity home and foreign bias, Demirguc-Kunt and Maksimovic (1999) who document that stock market capitalization determines external financing for firms to increase long term credit.

Second, our research advances the plethora of related literature that tests the impact of legal institutions on financial development. Prior studies such as Claessens et al. (2002), Beck and Levine (2004), Caprio et al. (2004), Levine (2000) show the financial development effects of legal development. However, these studies did not consider whether the effects of legal institutions' development on financial development are sensitive to international capital flow. In contrast to existing literature, our study interacts economic freedom with international equity portfolio diversification to determine whether there is a combined effect on financial development. This is consistent with the conventional view that legal institutions influence economic agents' investment decisions.

Third, a significant number of prior studies in the finance literature have investigated the role of central banks via transparent macroeconomic information and in price stability. As far as we are concerned, no study has directly explored the interactive effect of transparent information through the central bank in influencing investor participation. We investigate the financial development effect of the interaction between central bank transparency and international equity portfolio diversification. This study extends existing literature that suggests central bank transparency reduces information asymmetry and enhances accountability and legitimacy to prompt investor participation (Chortareas et al., 2002; Crowe & Meade, 2008). Bekaert et al. (2014) find that information asymmetry impacts portfolio risk and returns.

Fourth, our study builds on the strand of literature that has investigated the benefits of international capital flow (see Grubel, 1968; Lessard, 1976; Devereux & Smith, 1994; Errunza, 2001; Driessen & Laeven, 2007; Bae and Goyal, 2010; Lau et al., 2010) and institutional quality (see Henry, 2000; Errunza, 2001; Grosse and Trevino, 2005; Daude and Stein, 2007).

Fifth, a still unresolved question in the finance literature is the debate on banking system development and equity market development nexus. We add to Chinn and Ito (2006) who showed that banking development is a prerequisite for equity market development. They find that trade openness is essential for capital account liberalization. In contrast, we extend the literature by showing that foreign equity and debt flow are complementary to financial development.

Our study has implications for policymakers, particularly, governments in emerging countries. Our results imply that making the central bank transparent will attract foreign equity and debt flow. This will enhance the domestic financial system development to provide funds to firms with greater investment opportunities for economic growth.

The rest of the paper is organized as follows: Section 2 presents the related literature and hypothesis development, Section 3 lays out data and methods, Section 4 presents empirical results, whilst the final section presents conclusions and policy implications of the study.

2 LITERATURE AND HYPOTHESIS DEVELOPMENT

This section provides brief related literature and an overview of the channel through which international equity portfolio diversification, central bank transparency, and economic freedom impact financial development. We first report the findings of existing related studies and then proceed to develop three sets of testable hypotheses.

Following financial liberalization leading to financial globalization allows investors to construct internationally diversified equity portfolios to explore growth opportunities in other countries and also to reduce portfolio risk. The international capital asset pricing model suggests that investors should construct a globally diversified portfolio, and several studies document that international equity portfolio diversification facilitates risk-sharing (Levine & Zervos, 1998; Bae and Goyal, 2010). Subsequent research focusses on the benefits of a foreign equity portfolio to the host country (Colombo et al., 2018; Hail & Leuz, 2006; Kwabi et al., 2018). Agenor (2001) discusses the benefits of international financial integration on investment, growth, and the role of foreign banks in the local financial system.

A number of early studies have hypothesized the relationship between international finance and financial market development under financial liberalization (Stulz, 1999, 2005), and financial globalization (Stulz, 2000). These studies have shown that, as countries attract foreign investors, the presence of international investors upsurges financial market efficiency by fostering well-organized financial institutions (Chinn & Ito, 2006; Henry, 2000) and the reforms prevailing financial infrastructure (Claessens et al., 2001). Several theoretical researchers emphasize the role of international investors in financial development. For instance, Errunza (2001) provides a theoretical argument that foreign capital flow will prompt stock market development via enhanced timeliness and quality of information, better protection of minority shareholders, and adequate market and trading regulations. However, our understanding of how international equity portfolio flows impact financial development is incomplete.

There remains a substantial body of literature that shows greater participation in the domestic stock market by foreign investors improves competition in the domestic market (Bekaert et al., 2007; Gul et al., 2010). Foreign investors' engagement in the domestic financial market will increase the financial system efficiency by removing inefficient financial institutions and exerting pressure for financial infrastructure reforms. This will reduce information asymmetry and increase investor participation in the financial market to provide credit to firms with productive investment opportunities. Drawing from the above literature, we expect foreign equity investors to contribute to the well-functioning of financial market development of the recipient country through liquidity and demand for better trading technologies.

H1.International equity portfolio diversification prompts financial development.

We provide a conceptual framework through which central bank transparency via macroeconomic policy impacts financial development. This is consistent with the view that central banks through transparent monetary policy actions can ensure a stable macroeconomic framework to reduce interest rate risk and exchange rate volatilities. Existing studies have shown the connection between macroeconomic variables development and financial system development following the pioneering and seminal work of Chen et al. (1986).

Other strands of the literature show how institutional factors reflect macroeconomic variables. For instance, Demirguc-Kunt and Levine (1996b) find that countries with well-developed regulatory better institutions tend to experience high stock market development through liquidity (Demirguc-Kunt & Levine, 1996b). Garcia and Liu (1999) postulate that macroeconomic stability impacts financial market development. This is in line with the view that lower volatility will encourage savers and firms to participate in the financial market. Central banks through monetary policy and exchange rate policy can impact the profitability of firms and the funds available to firms.

Investors expect stable portfolio returns and a reliable supply of fixed-income investments. We conjecture that international capital will flow to countries with transparent central banks. This is consistent with the view that investors will consider those countries to have investment and credit-friendly policies as they are not covertly influenced by the national government. Investors expect prudent macroeconomic policies and prudential regulations of the financial system and greater transparency as they are an important requirement for portfolio risk management. Prior literature documents that central banks that are free from political interference enhance economic stability (Alesina & Summers, 1993), and prevent politically motivated monetary policy manipulation, especially before an election (Nordhaus, 1975).

In agreement with Klomp and de Haan (2009), we expect sound and stable macroeconomic policies via a transparent central bank to foster financial development. Particularly, as price stability is associated with better equity portfolio returns. Horváth and Vaško (2016) document that transparent communication has a positive impact on financial stability. As central banks perform a key role in implementing governments' monetary policy in stabilizing the economy (Bernhard, 1998; Fausch & Sigonius, 2018). A transparent central bank will provide a confidence boost to investors to participate in the financial system. This is consistent with the fact that information asymmetry inhibits corporate investment decisions. Nonetheless, a transparent central bank will ensure the pellucidity of monetary policies (see Crowe & Meade, 2008; Gelos & Wei, 2005; Geraats, 2002; Van der Cruijsen et al., 2010). Other studies argue that a transparent central bank provides guidelines for investors about future expectations and financial market participation (Blinder, 1998; Eijffinger et al. 2000). A recent study by Eichler and Littke (2018) shows that enhanced information concerning the central bank's monetary policy objectives lowers exchange rate volatility. Corresponding to the view that central bank transparency impacts interest rate risk, inflation risk, exchange rate risk, and financial stability will have implications for equity portfolio returns.

We hypothesize that central bank transparency interacts with international equity portfolio diversification to increase participation to enhance financial development. This is consistent with the view that greater participation of foreign equity investors in the domestic financial market will bid up stock prices, increase efficiency and trading technologies, and reduce transaction costs. There will also be an increased risk-sharing between domestic and foreign investors which will reduce the cost of capital. Further, a transparent central bank will boost the confidence of investors to participate in the financial market driven by the view that investors will have a fair knowledge of future macroeconomic policies.

H2.Central bank transparency interacts with international equity portfolio diversification to improve financial development.

We offer an underlying channel through which economic freedom, linked to property rights, judicial effectiveness, and government integrity impacts financial development. The element of economic freedom that captures institutional quality is conducive to financial development. La Porta et al. (1998), and Demirguc-Kunt and Maksimovic (1999) show that legal origin and institutions explain cross-countries differences in financial development. A strand of the literature shows the importance of political institutions in influencing financial development (see Keefer, 2008; Roe, 2006; Roe & Siegel, 2008). We postulate that economic freedom will interact with international equity portfolio diversification to impact financial development for a number of reasons. Particularly, economic freedom relate to institutional quality and this may influence rule of law and great investor participation in the financial market.

Previous literature on intellectual property rights and economic history has emphasized that property rights protection prompts entrepreneurial and corporate investment activities at the micro-level and economic development at the macro-level (see Rosenberg & Birdzell, 1986; North et al., 2000; Falvey et al., 2004; Glaeser et al., 2004). This encourages foreign investors to participate in the growth opportunities of those countries, which will in turn improve the development of the financial market. Further, enforcement of income rights sends signals to investors of lower investment risk from expropriation which will stimulate the provision of capital to the financial market.

Most early studies as well as current work focus on government integrity reducing corruption and expropriation by corporate insiders. The absence of government integrity will exacerbate the prevalence of corruption via the use of public power for private benefit (Treisman, 2000). Corruption thrives in an environment where there is poor governance and unaccountability. Several studies suggest that corruption is a cost to businesses and also harmful to financial development (Mauro, 1998; Wei, 2000; Chen et al., 2018). This is consistent with the view that public officials exercise intolerable use of power (Djankov et al., 2003), and corruption reduces the efficient allocation of resources to the most productive sector of the economy, productivity, and competition. There will be lower participation in the financial market as a result of investors' concerns about expropriation risk and lower returns. Pastor and Veronesi (2012), show that investors' lack of confidence in governments' motives and policy results increases stock price crash risk. A recent study by Chen et al. (2018) finds that the rent-seeking behaviour of corrupt public officials increases political risk and uncertainty about the viability of the investment. Pastor and Veronesi (2013) document that firms operating in a corrupt environment have lower transparency, obfuscate financial information and use briberies to gain government protection and other preferential treatment.

In line with the above argument, we conjecture that economic freedom through property rights, government integrity, and judicial effectiveness will prompt greater participation in the financial market. Specifically, empirical evidence shows that foreign investors from well-governed countries can export good governance to the host countries (see Kang and Kim, 2010; Kho et al. 2009). For instance, Aggarwal et al. (2011) document that institutional investors influence good governance around the world. This provides an unequivocal link between foreign portfolio diversification and institutional quality in financial development. Levine et al. (2000) document the effects of legal regulation on financial development.3

Other prior studies show that country-level corruption is influenced by factors including; the extent of market integration, economic agents, business cycle, the legal institutions of corporate governance, and culture (Gokcekus and Suzuki, 2011; Treisman, 2000). Errunza (2001) postulates that international investors can exert pressure on policy-makers to reform corporate governance practices, develop strong institutions and improve transparency. Rajan and Zingales (2003) posit that competition for external funds compels countries to allow foreign investors to actively participate in the governance of the domestic stock market. This was echoed by Huang and Zhu (2015) who find that foreign institutional investors enhance the market-based principle of corporate governance.

We contend that as foreign equity portfolio diversification reduces corruption and improves government integrity, it will boost greater participation in the stock market by both domestic and foreign investors which will successively, lead to financial development. Further, foreign investors will demand property rights protection and restrictive financial and stock markets regulations such as insider trading laws and enforcement. Drawing from the literature, we hypothesize that international equity portfolio diversification will interact with economic freedom linked to institutional quality, and will have a combined effect to improve financial market development.

H3.International portfolio diversification interacts with economic freedom to enhance financial development.

3 DATA AND METHODOLOGY

This section defines the variables we use in our empirical analysis. We first explain the three financial development variables we used as our dependent variables. Next, we explain our key independent variables of interest. We then proceed to explain and justify the variables we control for their effects on financial development. Throughout the analysis, our sample consists of panel data from 49 countries for the years 2001–2016. We sourced data mainly from World Development Indicators (WDI) of the World Bank, the Coordinated Portfolio Investment Survey (CPIS) of the International Monetary Fund (IMF), The Index of Economic Freedom by the Heritage Foundation, International Financial Statistics, and World Governance Indicators (WGI) of the World Bank.

3.1 Dependent variable

This section describes the three variables we employ to proxy for financial development. This is to ensure financial development in the regression capture and recognize different aspects and also to provide robustness. Financial development measures are difficult to construct for many reasons. Financial agents and institutions provide financial services.

First, following Levine and Zervos (1998) we use market capitalization scaled by GDP (MCGDP) to capture the importance of the stock market to the economy. Levine and Zervos (1998) argue that large stock markets may not function well as taxes may reduce the motivation and incentives for firms to list on the stock market. We obtained data from World Development Indicators.

Following existing literature (see Arcand et al., 2012; Beck et al., 2000; Demetriades and Hussein, 1996; Favara, 2003; King & Levine, 1993; Liang & Teng, 2006), we use two bank-based financial development proxies. This is consistent with the view that we aim to further capture the ability of the financial system to channel funds from depositors to investors instead of the transactions offered by the financial system.

Second, we use private sector credit to GDP (PSCGDP) to proxy for financial development. PSCGDP reflects credit to both the private and public sectors including; local, central governments, and public enterprises. This measure of financial market development improves the channelling of financial resources between savers and corporations for investment projects (Levine, 2002; Levine & Zervos, 1998).

Third, we further proxy for financial development using allocated domestic credit to private enterprises by deposit money banks and other financial institutions divided by GDP (DCPGDP). The main idea behind this measure is that financial systems that allocate more credit to private firms are more involved in researching firms, exerting corporate control, providing risk management services, mobilizing savings, and facilitating transactions than financial systems that simply funnel credit to the government or state-owned enterprises. These two bank-based variables reflect credit provided to the private sector which helps the utilization of funds to the most productive sector of the economy. The construction of these variables exempts credit provided by the central bank.

3.2 Independent variables

The three independent variables of interest in our empirical analysis are international equity portfolio diversification (IEPD), central bank transparency (CBT), and economic freedom (EF).

3.2.1 International equity portfolio diversification

3.2.2 Central bank transparency

The central bank transparency (CBT) index we employ in our study was initially developed and maintained by Eijffinger and Geraats (2006) for 120 countries. Subsequently, the CBT was later updated by Dincer and Eichengreen (2014). The CBT index reflects the scope to which the national central bank offers information on monetary policy. The index is constructed using 15 questions which comprise five dimensions, including; political transparency, economic transparency, procedural transparency, policy transparency, and operational transparency (Naszodi et al., 2016). The Eijffinger-Geraats index ranges between 0 (low transparency) and 15 (high transparency).

3.2.3 Economic freedom

There is two economic freedom (EF) data, one provided by the Terry and Holmes (2010) and the other by Economic Freedom of the World Reports provided and maintained by the Fraser Institute. These EF indexes have widely been used in the existing literature. De Haan and Sturm (2000) document that two economic freedom indexes provide a consistent overall ranking. Consistent with Chortareas et al. (2013), we use the economic freedom index provided by Heritage Foundation.4

The economic freedom index is constructed using four main categories; (1). Rule of law which reflects property rights, government integrity, and judicial effectiveness. (2). Government size includes government spending, tax burden, and fiscal health. (3). Regulatory efficiency captures business freedom, labour freedom, and monetary freedom. (4). Open markets include trade freedom, investment freedom, and financial freedom. Because we seek to examine whether institutional quality interacts with international equity portfolio diversification, we used the average index of property rights, government integrity, and judicial effectiveness.

3.3 Control variables

Drawing on extant literature (Aggarwal et al., 2011; Huang, 2011; Huang and Temple, 2005; Boyd et al., 2001; Nouriel & Sala-i-Martin, 1992; Huybens and Smith, 1999; Fielding, 1994; Greenwood and Jovanovic, 1990), we include several variables to control for their potential effects on financial market development. First, in line with the existing literature that shows that an integrated financial market will increase the participation of both domestic and foreign investors in the financial market (Baltagi et al., 2009; Rajan & Zingales, 2003; Svaleryd and Vlachos, 2002). We include financial openness (FINOPEN) and trade openness (TRDOPEN). We expect financial and trade openness to having a positive impact on financial market development. We obtained FINOPEN data from Chinn-Ito index of financial openness. We construct TRDOPEN as the sum of exports and imports of goods and services scaled by GDP.

Next, we control the effect of economic growth on financial market development using GDP growth (GDPG). There will be greater participation in the financial market when a country experiences an increase in wealth. We sourced GDPG from the World Development Indicators (WDI) of the World Bank. Following Boyd et al. (2001), we also control for the effects of inflation on financial market development. This is consistent with the fact that inflation (INFL) reduces returns and may inhibit investor participation in the financial market. We obtained INFL from the International Financial Statistics of the IMF.

Although we had wanted to keep our regression analysis as parsimonious as possible, we further control variations in country characteristics by including population growth (POPG). We sourced data from the World Development Indicators of the World Bank.

Next, we control the effects of institutional quality on financial market development using law and order (LAWNO), and legal origin (LEGORI). For instance, prior studies (see La Porta et al., 1997, 1998; Mahoney, 2001) show that LEGORI impacts financial market development. We measure LEGORI as a dummy variable that takes a value of 1 if a common law country and 0 if otherwise. Next, we control the effects of bond market development using outstanding total international debt securities scaled by GDP (OTIDSGDP). We obtained data from World Bank's global financial development database. Following Beck et al. (2010) we control the effects of savings depository using financial system deposits scaled by GDP (FSDSGDP). Niţescu et al. (2020) find that FSDSGDP increases financial system liquidity. We expect FSDGDP to have a positive influence on financial development.

Finally, we control for remittance (REMIT) on stock market development. This is consistent with the view that greater remittances suggest an increase in the wealth of the diaspora. Studies suggest diaspora contributes to the financial development of their mother countries by engaging in diaspora bonds and participating in the stock markets. We sourced data from World Development Indicators.

4 EMPIRICAL ANALYSIS

This section provides an empirical analysis of our study. First, we present a summary of statistics of the variables we used in the analysis. We then produce a cross-country correlation matrix of all the variables. Next, we examine whether international equity portfolio diversification has a varying impact on financial market development. We further investigate if the relationship between international finance and financial market development is sensitive to central bank transparency and economic freedom which are linked to greater information flow and institutional quality.

4.1 Summary statistics

Table 1 presents country-level univariate summary statistics of the dependent and key independent variables employed in our analysis. To ensure a better understanding of the variables, we categorize Table 1 into Panel A for developed countries and Panel B for emerging countries. In Panel A of Table 1, the mean values for the three financial development measures are MCGDP (4.3), PSCGDP (4.7), and DCPGDP (4.7) are relatively higher relative to the mean values of emerging countries in Panel B of Table 1 MCGDP (3.5), PSCGDP (3.8), and DCPGDP (3.7). Interestingly, the mean value of the international equity portfolio diversification in advanced economies (IEPD = −2.9) is higher than the mean of emerging countries of −4.8. This provides an early indication that ceteris paribus, countries that attract higher international capital experience better financial development. Further analysis shows that developed countries on average have the most transparent central banks (with a mean CBT value of 10.2), compared to emerging countries (with a mean CBT value of 6.8). Government integrity is higher in developed countries (EF = 77.7) relative to emerging countries (EF = 38.5). There are significant cross-country variations in the EF ranging from Denmark 94.48 to Ukraine 23.68.

| Panel A: Developed countries | ||||||

|---|---|---|---|---|---|---|

| Country | MCGDP | PSCGDP | DCPGDP | IEPD | CBT | EF |

| Australia | 4.64 | 4.75 | 4.74 | −3.15 | 9.93 | 80.94 |

| Austria | 3.27 | 4.52 | 4.50 | −3.19 | 10.86 | 78.25 |

| Belgium | 4.16 | 4.11 | 4.10 | −2.87 | 10.86 | 75.56 |

| Canada | 4.71 | 5.06 | 5.04 | −2.85 | 10.89 | 81.19 |

| Denmark | 4.09 | 5.13 | 5.14 | −3.25 | 7.18 | 79.26 |

| Finland | 4.45 | 4.35 | 4.32 | −3.34 | 10.86 | 78.92 |

| France | 4.33 | 4.48 | 4.46 | −2.32 | 10.86 | 74.28 |

| Germany | 3.78 | 4.54 | 4.54 | −2.33 | 10.86 | 78.08 |

| Greece | 3.59 | 4.45 | 4.42 | −3.76 | 10.86 | 70.27 |

| Hong Kong | 5.88 | 5.13 | 5.10 | −2.83 | 7.25 | 89.44 |

| Ireland | 3.84 | 4.63 | 4.62 | −2.46 | 10.86 | 80.60 |

| Israel | 4.22 | 4.26 | 4.35 | −4.03 | 10.36 | 72.57 |

| Italy | 3.53 | 4.38 | 4.36 | −2.64 | 10.86 | 74.02 |

| Japan | 4.30 | 5.12 | 5.12 | −2.24 | 9.75 | 78.16 |

| Netherland | 4.46 | 4.74 | 4.74 | −2.54 | 10.86 | 84.49 |

| New Zealand | 3.49 | 4.81 | 4.83 | −4.07 | 13.96 | 67.07 |

| Norway | 3.92 | 4.76 | 4.65 | −2.96 | 9.75 | 77.48 |

| Portugal | 3.54 | 4.90 | 4.89 | −3.52 | 10.86 | 71.12 |

| Singapore | 5.30 | 4.66 | 4.66 | −3.00 | 5.07 | 70.21 |

| Spain | 4.36 | 4.91 | 4.89 | −2.97 | 10.86 | 75.82 |

| Sweden | 4.56 | 4.73 | 4.69 | −3.09 | 9.57 | 76.65 |

| Switzerland | 5.34 | 5.05 | 5.04 | −2.67 | 9.68 | 84.49 |

| United Kingdom | 4.75 | 5.02 | 5.00 | −2.21 | 11.53 | 58.07 |

| United States | 4.81 | 5.22 | 5.18 | −1.90 | 10.64 | 81.91 |

| Mean | 4.3 | 4.7 | 4.7 | −2.9 | 10.2 | 76.6 |

| Panel B: Emerging countries | ||||||

|---|---|---|---|---|---|---|

| Argentina | 2.56 | 2.59 | 2.50 | −4.38 | 4.38 | 57.72 |

| Brazil | 3.80 | 3.80 | 3.81 | −4.49 | 8.46 | 61.82 |

| Bulgaria | 2.34 | 3.82 | 3.75 | −5.30 | 5.47 | 71.57 |

| Chile | 4.59 | 4.52 | 4.45 | −3.92 | 6.96 | 78.04 |

| China | 3.78 | 4.81 | 4.74 | −3.14 | 2.89 | 61.69 |

| Colombia | 3.49 | 3.61 | 3.49 | −4.68 | 6.75 | 66.64 |

| Czech Republic | 2.99 | 3.67 | 3.70 | −4.33 | 12.71 | 74.30 |

| Egypt | 3.52 | 3.66 | 3.58 | −5.28 | 2.75 | 59.63 |

| Hungary | 2.96 | 3.80 | 3.83 | −4.97 | 11.54 | 73.26 |

| India | 4.10 | 3.79 | 3.70 | −5.74 | 2.75 | 65.88 |

| Indonesia | 3.41 | 3.35 | 3.18 | −5.05 | 7.93 | 65.97 |

| Korea | 4.25 | 4.86 | 4.58 | −3.76 | 8.86 | 74.04 |

| Malaysia | 4.88 | 4.73 | 4.66 | −4.46 | 6.00 | 74.71 |

| Mexico | 3.33 | 3.06 | 3.01 | −4.15 | 5.69 | 68.44 |

| Pakistan | 3.06 | 3.06 | 2.99 | −6.33 | 3.79 | 75.60 |

| Peru | 3.58 | 3.21 | 3.24 | −4.28 | 7.79 | 59.15 |

| Philippines | 3.90 | 3.51 | 3.46 | −4.90 | 9.50 | 75.27 |

| Poland | 3.31 | 3.58 | 3.65 | −4.62 | 8.62 | 70.85 |

| Romania | 2.04 | 3.21 | 3.20 | −5.77 | 6.96 | 71.37 |

| Russia | 3.75 | 3.56 | 3.43 | −4.35 | 3.86 | 62.61 |

| Slovenia | 3.02 | 3.72 | 4.04 | −4.44 | 7.08 | 68.41 |

| South Africa | 5.32 | 4.95 | 4.90 | −3.72 | 9.00 | 86.39 |

| Thailand | 4.15 | 4.73 | 4.70 | −4.64 | 8.07 | 66.88 |

| Turkey | 3.19 | 3.50 | 3.38 | −5.50 | 9.25 | 65.92 |

| Ukraine | 2.78 | 3.85 | 3.72 | −6.87 | 3.68 | 81.81 |

| Mean | 3.5 | 3.8 | 3.7 | −4.8 | 6.8 | 69.5 |

| Overall summary | ||||||

|---|---|---|---|---|---|---|

| Observations | 737 | 770 | 769 | 742 | 675 | 784 |

| Mean | 3.9 | 4.2 | 4.2 | −3.8 | 8.5 | 73.0 |

| Median | 3.9 | 4.4 | 4.5 | −3.7 | 9.0 | 74.3 |

| Std. Dev. | 0.8 | 0.7 | 0.7 | 1.2 | 3.0 | 7.9 |

| Minimum | −0.3 | 1.9 | −1.7 | −7.8 | 1.0 | 4.62 |

| Maximum | 6.1 | 5.4 | 5.5 | −1.6 | 14.5 | 91.2 |

- Note: All variables are as defined in Table A1.

Table 2 reports the summary statistics of the control variables at the country-level in Panel A (developed countries) and Panel B (emerging countries) used in the study. There are significant cross-country variations in the control variables across developed countries and emerging countries. GDPG, INFL, and REMITT are generally higher in emerging countries compared to developed countries. For instance, INFL varies significantly between developed countries 1.7 and emerging countries 5.8.

| Panel A: Developed economies | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Country | FSDGDP | FINOPEN | LAWNO | POPG | GDPG | INFL | TRDOPEN | REMITT | OTIDSGDP | LEGORI |

| Australia | 84.32 | 1.25 | 0.94 | 1.46 | 2.94 | 2.68 | 41.71 | 0.15 | 41.01 | 1 |

| Austria | 71.54 | 2.37 | 1.00 | 0.54 | 1.41 | 1.91 | 97.11 | 0.79 | 69.83 | 3 |

| Belgium | 94.2 | 2.32 | 0.83 | 0.63 | 1.42 | 1.95 | 150.56 | 1.98 | 60.17 | 2 |

| Canada | 132.57 | 2.37 | 0.96 | 1.03 | 1.96 | 1.88 | 66.5 | 0.08 | 35.09 | 1 |

| Denmark | 53.41 | 2.37 | 1.00 | 0.44 | 0.98 | 1.73 | 95.12 | 0.36 | 36.63 | 4 |

| Finland | 56.88 | 2.37 | 1.00 | 0.37 | 1.23 | 1.52 | 75.84 | 0.34 | 38.72 | 4 |

| France | 70.44 | 2.37 | 0.82 | 0.58 | 1.14 | 1.42 | 56.35 | 0.76 | 53.07 | 2 |

| Germany | 69.97 | 2.37 | 0.83 | 0.01 | 1.23 | 1.42 | 76.12 | 0.33 | 54.35 | 3 |

| Greece | 85.48 | 2.23 | 0.72 | −0.02 | −0.07 | 2.07 | 56.32 | 0.58 | 56.6 | 2 |

| Hong Kong | 281.21 | 2.37 | 0.81 | 0.60 | 3.64 | 1.75 | 362.01 | 0.13 | 34.23 | 1 |

| Ireland | 84.39 | 2.37 | 1.00 | 1.39 | 4.72 | 1.86 | 176.8 | 0.25 | 121.76 | 1 |

| Israel | 77.85 | 2.15 | 0.83 | 1.92 | 3.22 | 1.73 | 70.38 | 0.25 | 11.00 | 1 |

| Italy | 66.19 | 2.37 | 0.65 | 0.39 | 0.08 | 1.8 | 52.44 | 0.32 | 43.84 | 2 |

| Japan | 198.53 | 2.37 | 0.83 | 0.01 | 0.8 | 0.05 | 28.94 | 0.04 | 7.03 | 3 |

| Netherland | 91.51 | 2.37 | 1.00 | 0.42 | 1.22 | 1.84 | 135.06 | 0.18 | 126.78 | 2 |

| New Zealand | 83.27 | 2.37 | 0.94 | 1.23 | 2.89 | 2.17 | 58.33 | 0.29 | 10.38 | 1 |

| Norway | 52.61 | 2.37 | 1.00 | 0.96 | 1.6 | 2 | 69.62 | 0.16 | 38.89 | 4 |

| Portugal | 81.83 | 2.37 | 0.83 | 0.02 | 0.3 | 2.01 | 69.83 | 0.22 | 68.05 | 2 |

| Singapore | 113.46 | 2.37 | 0.84 | 2.07 | 5.2 | 1.78 | 377.42 | NA | 26.8 | 1 |

| Spain | 87.58 | 2.37 | 0.82 | 0.85 | 1.56 | 2.14 | 56.94 | 0.14 | 62.24 | 2 |

| Sweden | 51.24 | 2.37 | 1.00 | 0.70 | 2.22 | 1.22 | 84.75 | 0.62 | 66.07 | 4 |

| Switzerland | 134.93 | 2.37 | 0.83 | 0.96 | 1.75 | 0.4 | 109.62 | 0.4 | 57.32 | 3 |

| United Kingdom | NA | 2.37 | 0.89 | 0.67 | 1.75 | 2.06 | 55.62 | 0.22 | 80.68 | 1 |

| United States | 74.04 | 2.37 | 0.83 | 0.85 | 1.81 | 2.1 | 26.96 | 0.04 | 19.3 | 1 |

| Mean | 95.5 | 2.3 | 0.9 | 0.8 | 1.9 | 1.7 | 102.1 | 0.4 | 50.8 | 2.1 |

| Panel B: Emerging countries | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Argentina | 18.34 | −1.03 | 0.38 | 1.05 | 2.66 | 9.83 | 34.27 | 0.16 | 25.84 | 2 |

| Brazil | 49.2 | −0.1 | 0.34 | 1.06 | 2.47 | 6.83 | 25.81 | 0.23 | 11.97 | 2 |

| Bulgaria | 48.94 | 1.27 | 0.5 | −0.85 | 3.63 | 4.1 | 108.8 | 4.3 | 12.12 | 3 |

| Chile | 46.1 | 1.69 | 0.79 | 1 | 3.96 | 3.23 | 67.82 | 0.02 | 11.13 | 2 |

| China | 43.57 | −1.19 | 0.68 | 0.55 | 9.48 | 2.35 | 49.93 | 0.22 | 2.03 | 3 |

| Colombia | 18.21 | −0.26 | 0.28 | 1.16 | 4.12 | 4.98 | 36.41 | 1.91 | 11.1 | 2 |

| Czech Republic | 59.5 | 2.27 | 0.83 | 0.19 | 2.71 | 2.1 | 127.95 | 0.83 | 8.14 | 3 |

| Egypt | 66.21 | 1.34 | 0.58 | 1.96 | 4.15 | 9.05 | 48.67 | 5.12 | 2.67 | 2 |

| Hungary | 43.92 | 2.2 | 0.67 | −0.25 | 2.05 | 4.24 | 149.27 | 1.95 | 22.93 | 3 |

| India | 56.76 | −1.19 | 0.68 | 1.43 | 7.28 | 6.83 | 44.18 | 3.3 | NA | 1 |

| Indonesia | 33.32 | 0.68 | 0.47 | 1.32 | 5.31 | 7.39 | 52.77 | 1.03 | 5.33 | 2 |

| Korea | 76.32 | 0.39 | 0.82 | 0.54 | 3.89 | 2.64 | 84.22 | 0.61 | 11.12 | 3 |

| Malaysia | 113.05 | −0.33 | 0.65 | 1.85 | 4.82 | 2.27 | 171.84 | 0.55 | 17.48 | 1 |

| Mexico | 23.42 | 0.94 | 0.36 | 1.41 | 2.04 | 4.23 | 59.85 | 2.18 | 11.53 | 2 |

| Pakistan | 30.07 | −1.19 | 0.52 | 2.08 | 4.24 | 8.25 | 31.97 | 5.11 | 1.13 | 2 |

| Peru | 28.32 | 2.37 | 0.51 | 1.27 | 5.25 | 2.75 | 47.41 | 1.64 | 12.63 | 2 |

| Philippines | 52.82 | −0.31 | 0.4 | 1.76 | 5.27 | 4.03 | 80.03 | 11.2 | 21.76 | 3 |

| Poland | 43.45 | 0.01 | 0.73 | −0.05 | 3.59 | 2.23 | 80.23 | 1.59 | 11.59 | 3 |

| Romania | 26.28 | 1.74 | 0.64 | −0.81 | 3.87 | 8.51 | 75.87 | 0.83 | 5.35 | 2 |

| Russia | 29.52 | 0.18 | 0.61 | −0.1 | 3.61 | 11.03 | 52.26 | 0.36 | 10.49 | 5 |

| Slovenia | 49.93 | 1.51 | 0.75 | 0.23 | 2.03 | 2.98 | 127.57 | 0.76 | 15.78 | 3 |

| South Africa | 55.38 | −1.19 | 0.38 | 1.27 | 2.91 | 5.85 | 59.41 | 0.26 | 13.05 | 1 |

| Thailand | 98.29 | −0.7 | 0.45 | 0.56 | 4.02 | 2.27 | 128.69 | 1.14 | 4.76 | 1 |

| Turkey | 38.94 | −0.55 | 0.65 | 1.43 | 5.02 | 14.76 | 48.5 | 0.34 | 8.5 | 2 |

| Ukraine | 29.64 | −1.53 | 0.67 | −0.55 | 2.32 | 12.25 | 102.28 | 4.61 | 9.84 | 5 |

| Mean | 47.2 | 0.3 | 0.6 | 0.8 | 4.0 | 5.8 | 75.8 | 2.0 | 11.2 | 2.4 |

| Overall summary | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Observations | 754 | 735 | 735 | 784 | 784 | 781 | 784 | 768 | 765 | 784 |

| Mean | 69.6 | 1.3 | 0.7 | 0.8 | 3 | 3.8 | 88.7 | 1.2 | 31 | 2.3 |

| Median | 59.9 | 2.4 | 0.8 | 0.8 | 2.9 | 2.7 | 66.8 | 0.4 | 17.9 | 2.0 |

| Std. Dev. | 47.0 | 1.4 | 0.2 | 0.8 | 3.4 | 4.8 | 70.4 | 2.1 | 32.3 | 1.1 |

| Minimum | 10.5 | −1.9 | 0.2 | −2.2 | −14.8 | −4.5 | 19.8 | 0.0 | 0.3 | 1.0 |

| Maximum | 347.4 | 2.4 | 1.0 | 5.3 | 25.6 | 54.4 | 442.6 | 13.3 | 223.2 | 5.0 |

- Note: All variables are as defined in Table A1.

Previous studies have documented that remittance by citizens in the diaspora is next to the highest form of investment flow after foreign direct investment and contributes to economic growth and poverty decline in developing countries (Aggarwal et al., 2011; Sobiech, 2019). Consistent with these studies, we find a relative degree of variability between the mean value of remittance (REMITT) for a developed country and emerging economies as 0.4 and 2.0 respectively. Overall, the descriptive statistics for the control variables signify a high degree of heterogeneity across our sample countries.

4.2 Correlation matrix

Table 3 presents the cross-country correlation matrix of all the variables employed in our empirical analysis. Consistent with existing studies, the three financial development measures positively and highly correlated with each other. The strongest correlation is between MCGDP and DCPGDP (0.96). This suggests that as the domestic stock market develops, it prompts also the development of the local financial sector. Further, in line with theoretical predictions, IEPD, CBT, and EF positively correlate with all three measures of financial development.

| Variable | (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | (9) | (10) | (11) | (12) | (13) | (14) | (15) | (16) |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| MCGDP (1) | 1 | |||||||||||||||

| PSCGDP (2) | 0.65 | 1 | ||||||||||||||

| DCPGDP (3) | 0.64 | 0.96 | 1 | |||||||||||||

| CBT (4) | 0.22 | 0.46 | 0.41 | 1 | ||||||||||||

| EF (5) | 0.46 | 0.52 | 0.50 | 0.34 | 1 | |||||||||||

| IEPD (6) | 0.57 | 0.73 | 0.71 | 0.59 | 0.74 | 1 | ||||||||||

| FSDGDP (7) | 0.55 | 0.62 | 0.59 | 0.24 | 0.47 | 0.5 | 1 | |||||||||

| FINOPEN (8) | 0.25 | 0.47 | 0.42 | 0.60 | 0.69 | 0.68 | 0.37 | 1 | ||||||||

| LAWNO (9) | 0.31 | 0.42 | 0.40 | 0.40 | 0.60 | 0.5 | 0.25 | 0.44 | 1 | |||||||

| POPG (10) | 0.32 | −0.05 | −0.03 | −0.11 | 0.02 | 0.01 | 0.02 | −0.14 | −0.07 | 1 | ||||||

| GDPG (11) | 0.05 | −0.28 | −0.24 | −0.35 | −0.25 | −0.29 | −0.14 | −0.3 | −0.17 | 0.18 | 1 | |||||

| INFL (12) | −0.35 | −0.50 | −0.46 | −0.39 | −0.45 | −0.54 | −0.32 | −0.46 | −0.25 | 0.04 | 0.06 | 1 | ||||

| TRDOPEN (13) | 0.25 | 0.25 | 0.23 | −0.03 | 0.31 | 0.15 | 0.56 | 0.23 | 0.1 | 0.03 | 0.07 | −0.16 | 1 | |||

| REMITT (14) | −0.25 | −0.43 | −0.41 | −0.29 | −0.46 | −0.5 | −0.22 | −0.36 | −0.19 | 0.16 | 0.14 | 0.23 | −0.04 | 1 | ||

| OTIDSGDP (15) | 0.18 | 0.42 | 0.39 | 0.44 | 0.51 | 0.58 | 0.24 | 0.45 | 0.41 | −0.09 | −0.3 | −0.28 | 0.19 | −0.21 | 1 | |

| LEGORI (16) | −0.29 | −0.15 | −0.14 | −0.13 | −0.08 | −0.17 | −0.3 | −0.03 | 0.05 | −0.47 | −0.1 | 0.11 | −0.15 | 0.16 | −0.08 | 1 |

- Note: All variables are as defined in Table A1. For brevity and space, statistical significance of at least the 5% level is reported in bold.

Concerning the control variables, we find that they all possess the expected signs and effects. However, to ensure that there is no potential multicollinearity problem in our study, we compute and found the maximum variance inflation factor (VIF) of 5.3, which is well below the VIF threshold of 10 (Gujarati, 2003; Hair et al., 2010; Neter et al., 1990). Generally, the bivariate correlation analysis results and the VIF estimations confirm that our study does not suffer multicollinearity issues.

4.3 Multivariate regression analysis

Following the univariate analysis of the three financial development measures and our key independent variables of interest have positive correlations. This empirical test whether cross-country financial development is impacted by international equity portfolio diversification, central bank transparency, and economic freedom.

4.3.1 International equity portfolio diversification and financial development

Table 3 presents the results of Equation (2) using a panel OLS. In model 1 where the financial development measure is stock market capitalization scaled by GDP, The coefficient on IEPD is positive and statistically significant at the 1% level. In model 2, we report a repeated analysis where the financial development measure is private sector credit scaled by GDP. The estimated coefficient on IEPD is again positive and statistically significant at the 1% level. Adding to the existing literature on the salient role of foreign investors via financial liberalization in enhancing financial system development (Claessens et al., 2001; Stiglitz, 2000; Stulz, 1999). Finally, turning to model 3 where we use domestic credit to the private sector scaled by GDP, the estimated coefficient on IEPD is lower but positive and statistically significant at the 1% level. The results suggest that foreign investors contribute to not only the development of the domestic stock market but also the development of banking institutions by providing credit to the private sector. The estimated coefficients on financial development range from 0.047 in model 3 to 0.477 in model 1. These indicate that one standard increase in international equity portfolio diversification will increase financial development ranging from 0.06% in model 3 to 0.57% in model 1. These are economically significant since the mean (median) levels of MCGDP and DCPGDP in our sample are 3.9 (3.9) and 4.2 (4.4) respectively. These results add to Chinn and Ito's (2006) finding that financial openness enhances financial development. FINOPEN and POPG have a positive effect on financial development. Other control variables have the expected signs as reported in previous studies (see Arcand et al., 2012; Greenwood, & Jovanovic 1990). GDPG and INFL have inconsistent signs on the stock market and banking sector development. The negative coefficient of inflation on banking sector development suggests that inflation has an adverse effect on savings. This is consistent with the view that inflation makes investors reluctant to increase their savings (Table 4).

| Variable | Model (1) | Model (2) | Model (3) |

|---|---|---|---|

| MCGDP | PSCGDP | DCPGDP | |

| IEPD | 0.477*** | 0.313*** | 0.047*** |

| (9.44) | (11.25) | (5.76) | |

| FSDGDP | 0.000 | 0.005*** | −0.000 |

| (0.01) | (5.28) | (−1.16) | |

| FINOPEN | 0.159*** | 0.097*** | 0.010* |

| (3.93) | (5.04) | (1.76) | |

| LAWNO | 0.101* | −0.002 | −0.006 |

| (1.89) | (−0.06) | (−0.78) | |

| POPG | 0.094* | 0.081*** | 0.025*** |

| (1.94) | (3.29) | (3.56) | |

| GDPG | 0.033*** | −0.027*** | −0.003*** |

| (4.87) | (−8.24) | (−3.20) | |

| INFL | 0.013** | −0.010** | −0.002** |

| (2.26) | (−2.38) | (−2.39) | |

| TRDOPEN | 0.001 | −0.001 | −0.000 |

| (0.73) | (−1.55) | (−0.49) | |

| REMITT | −0.108*** | −0.040* | −0.004 |

| (−2.93) | (−1.67) | (−0.61) | |

| OTIDSGDP | −0.004*** | 0.001 | −0.000 |

| (−3.83) | (1.59) | (−1.14) | |

| LEGORI | −0.315 | −1.188*** | −0.027 |

| (−1.33) | (−9.75) | (−0.59) | |

| Constant | 5.017*** | 6.365*** | 4.587*** |

| (9.86) | (26.99) | (49.53) | |

| No of observations | 603 | 637 | 599 |

| Adj. R-square | 0.87 | 0.94 | 0.77 |

| Country fixed effects | Yes | Yes | Yes |

| Year fixed effects | Yes | Yes | Yes |

- Note: All variables are as defined in Table A1. The t-statistics are robust to heteroscedasticity reported in parentheses, are based on double clustered standard errors (clustering done at the country and year levels). For tractable interpretation, all the coefficients are reported as elasticity and the statistical significance is reported against 10% (*), 5% (**) and 1% (***) significance levels respectively.

4.3.2 The role of central bank transparency

In this section, we examine whether central bank transparency interacts with international equity portfolio flow to enhance the financial market development. We expect central bank transparency to boost international equity portfolio flow. This is consistent with the view that investors will consider a transparent central bank to be an institutional quality. Further investors will be aware of the monetary policies of the central bank. The greater participation of foreign investors in the domestic financial market will spur up stock prices and better trading technologies.

Table 5 presents estimation results for Equation (3). The coefficients of interest are IEPD, CBT, and IEPD × CBT. In line with Hypothesis 2, the coefficient on the interaction term IEPD × CBT in models 1–3 is positive and statistically significant at the 1% level. The coefficients on IEPD × CBT are 0.074 (t-statistics = 5.12) in model 1, 0.040 (t-statistics = 5.00) in model 2, 0.038 (t-statistics = 4.54) in model 3.

| Variable | Model (1) | Model(2) | Model (3) |

|---|---|---|---|

| MCGDP | PSCGDP | DCPGDP | |

| IEPD | 0.993*** | 0.548*** | 0.518*** |

| (8.49) | (8.34) | (7.27) | |

| CBT | 0.333*** | 0.159*** | 0.150*** |

| (5.45) | (4.91) | (4.44) | |

| IEPD × CBT | 0.074*** | 0.040*** | 0.038*** |

| (5.12) | (5.00) | (4.54) | |

| FSDGDP | 0.004 | 0.007*** | 0.006*** |

| (1.65) | (5.99) | (4.43) | |

| FINOPEN | 0.087** | 0.085*** | 0.067*** |

| (1.98) | (3.98) | (2.93) | |

| LAWNO | 0.109** | 0.010 | 0.025 |

| (2.00) | (0.42) | (1.00) | |

| POPG | 0.109** | 0.103*** | 0.097*** |

| (2.14) | (4.06) | (3.71) | |

| GDPG | 0.039*** | −0.022*** | −0.016*** |

| (6.46) | (−6.19) | (−4.71) | |

| INFL | 0.020*** | −0.010** | −0.008* |

| (2.84) | (−2.46) | (−1.78) | |

| TRDOPEN | 0.004*** | −0.001* | −0.000 |

| (2.84) | (−1.80) | (−0.22) | |

| REMITT | −0.127*** | −0.047** | −0.052*** |

| (−3.27) | (−2.48) | (−2.67) | |

| OTIDSGDP | −0.003** | 0.002*** | 0.002*** |

| (−2.52) | (3.87) | (2.84) | |

| LEGORI | −1.152*** | −1.500*** | −1.594*** |

| (−4.56) | (−11.08) | (−10.92) | |

| Constant | 8.594*** | 7.816*** | 7.866*** |

| (11.73) | (21.63) | (20.04) | |

| No of observations | 531 | 556 | 556 |

| Adj. R-square | 0.88 | 0.95 | 0.94 |

| Country fixed effects | Yes | Yes | Yes |

| Year fixed effects | Yes | Yes | Yes |

- Note: All variables are as defined in Table A1. The t-statistics are robust to heteroscedasticity reported in parentheses, are based on double clustered standard errors (clustering done at the country and year levels). For tractable interpretation, all the coefficients are reported as elasticity and the statistical significance is reported against 10% (*), 5% (**) and 1% (***) significance levels respectively.

In terms of the economic significance of our results in Table 5, we find that a 1% increase in central bank transparency is estimated to increase the various measures of financial development by 0.99% (0.333 × 3), 0.48% (0.159 × 3), and 0.45% (0.150 × 3) for MCGDP, PSCGDP and DCPGDP respectively. Consequently, 1% increase of the interaction term (IEPDxCBT) improves a country's financial development by 0.22% (0.074 × 3), 0.12% (0.040 × 3) and 0.11% (0.038 × 3) respectively, with the country's market capitalisation per GDP benefitting most. In line with the previous study (Tayssir & Feryel, 2018), our results show that central bank transparency will promote a country's financial development.

The results imply central bank transparency interacts with international equity portfolio flow to have a combined effect to promote financial market development. This is consistent with the theoretical argument that higher transparency about monetary policies increases information flow which is linked to lower portfolio investment risk and higher corporate investment. Correspondingly, it will encourage investors to participate in the financial market and provide credit to banking institutions. These results extend Laeven (2014) who theoretically documented that sound macroeconomic policies from a transparent central bank will enhance financial development.

4.3.3 The effects of economic freedom

Table 6 presents the regression results of the effects of the interaction between economic freedom and international equity portfolio diversification. In models 1–3, the coefficients of interest are IEPD, EF, and interaction term IEPD × EF. The coefficients on IEPD and EF are positive and statistically significant at the 1% level and 5% level respectively. Further, in line with theoretical predictions, the coefficients on the interaction term IEPD × EF are positive and statistically significant at the 1% level in models 1 and 2.

| Model (1) | Model (2) | Model (3) | |

|---|---|---|---|

| Variable | MCGDP | PSCGDP | DCPGDP |

| IEPD | 0.984*** | 0.084*** | 0.091*** |

| (3.80) | (4.33) | (4.37) | |

| EF | 1.058** | 0.099** | 0.111** |

| (2.05) | (2.38) | (2.55) | |

| IEPD × EF | 0.185 | 0.032*** | 0.035*** |

| (1.18) | (2.71) | (2.73) | |

| FSDGDP | 0.016 | 0.007*** | 0.005*** |

| (1.39) | (7.84) | (5.05) | |

| FINOPEN | −0.334 | −0.006 | −0.018 |

| (−1.44) | (−0.45) | (−1.27) | |

| LAWNO | 0.602** | 0.007 | 0.010 |

| (2.15) | (0.48) | (0.61) | |

| POPG | −0.301 | 0.044* | 0.062** |

| (−1.41) | (1.93) | (2.38) | |

| GDPG | 0.098*** | −0.014*** | −0.014*** |

| (2.67) | (−7.01) | (−6.18) | |

| INFL | 0.042** | −0.003** | −0.003** |

| (2.54) | (−2.28) | (−2.13) | |

| TRDOPEN | 0.014 | −0.002*** | −0.001 |

| (1.22) | (−3.01) | (−0.86) | |

| REMITT | −0.330** | −0.017** | −0.026*** |

| (−2.08) | (−2.15) | (−3.07) | |

| OTIDSGDP | −0.024*** | 0.003*** | 0.002*** |

| (−3.81) | (5.69) | (4.35) | |

| LEGORI | −6.161*** | −1.036*** | −1.178*** |

| (−4.76) | (−11.88) | (−10.99) | |

Constant |

14.344*** | 2.252*** | 2.533*** |

| (4.83) | (13.49) | (12.11) | |

| No of observations | 603 | 637 | 637 |

| F-statistics | 495 | 4965 | 6751 |

| Country fixed effects | Yes | Yes | Yes |

| Year fixed effects | Yes | Yes | Yes |

- Note: All variables are as defined in Table A1. The t-statistics are robust to heteroscedasticity reported in parentheses, are based on double clustered standard errors (clustering done at the country and year levels). For tractable interpretation, all the coefficients are reported as elasticity and the statistical significance is reported against 10% (*), 5% (**) and 1% (***) significance levels respectively.

With regards to the economic significance of the results obtained in Table 6, we find that a 1% increase in economic freedom is estimated to increase the various measures of financial development by 8.36% (1.058 × 7.9), 0.78% (0.099 × 7.9), and 0.88% (0.111 × 7.9) for MCGDP, PSCGDP and DCPGDP respectively. Consequently, 1% increase of the interaction term (IEPDxEF) improves a country's financial development by 1.46% (0.185 × 7.9), 0.25% (0.032 × 7.9) and 0.28% (0.035 × 7.9) respectively, with the country's market capitalisation per GDP profiting more than others. This implies that, if foreign investors demand higher economic freedom would enhance a nation's financial development.

The results suggest that economic freedom increases the effects of international equity portfolio diversification on financial development. This is consistent with existing studies that show that countries' institutions have a salient impact on finance and economic development (North, 1990). The results provide further support for finance literature that finds that legal institutions explain cross-country variations in financial development (see Demirguc-Kunt & Maksimovic, 1998, 1999; La Porta et al., 1997, 1998). This confirms the view that financial systems need to have a robust legal and institutional infrastructure for development.

4.4 Robustness tests

We performed several robustness checks to ensure our results consistent with different specifications. First, we performed a dynamic generalized method of moments (GMM) to address the concern of endogeneity. Second, we run the fixed effects model as an alternative specification. Third, we performed a quasi-natural experiment using a difference-in-differences approach. Finally, examine whether the relationship between international equity portfolio diversification and financial market development is sensitive to international bond flow.

4.4.1 Dynamic generalized method of moments estimation

In this section, we address endogeneity concerns arising from reverse causality. Countries that have developed financial markets may attract international investors and not the other way around. Another possibility is that domestic investors may support policies that enhance the financial market development. However, existing finance studies provide both theoretical arguments and empirical evidence that foreign investors influence governance and institutional quality in the host country (see Chinn & Ito, 2006; Laeven, 2014).

Table 7 presents the results of the GMM estimation technique. The coefficients on IEPD in models 1–3 are positive and statistically significant at the 1% level. Further, in models 4–6, the variable of interest is the interaction between international equity portfolio diversification and economic freedom. The coefficient on the interaction term IEPD × EF is positive and statistically significant at the 1% level.

| Variable | Model (1) | Model (2) | Model (3) | Model (4) | Model (5) | Model (6) | Model (7) | Model (8) | Model (9) |

|---|---|---|---|---|---|---|---|---|---|

| MCGDP | PSCGDP | DCPGDP | MCGDP | PSCGDP | DCPGDP | MCGDP | PSCGDP | DCPGDP | |

| IEPD | 0.411*** | 0.210*** | 0.224*** | 2.033*** | 0.991*** | 0.876** | 1.969*** | 0.678** | 0.674** |

| (4.10) | (2.64) | (2.93) | (2.90) | (3.46) | (2.28) | (3.46) | (2.62) | (2.47) | |

| EF | 0.136** | 0.057** | 0.044 | ||||||

| (2.17) | (2.30) | (1.48) | |||||||

| IEPD × EF | 0.027* | 0.018*** | 0.013** | ||||||

| (2.00) | (3.09) | (2.13) | |||||||

| CBT | 0.853*** | 0.259** | 0.234 | ||||||

| (3.13) | (2.06) | (1.59) | |||||||

| IEPD × CBT | 0.177*** | 0.059* | 0.057* | ||||||

| (2.83) | (1.89) | (1.97) | |||||||

| FSDGDP | 0.004* | 0.005** | 0.004* | 0.013* | 0.008*** | 0.008*** | 0.009* | 0.006 | 0.006* |

| (1.77) | (2.38) | (2.00) | (2.00) | (3.19) | (2.70) | (1.76) | (1.31) | (1.75) | |

| FINOPEN | −0.126 | 0.023 | 0.003 | −0.055 | −0.052 | −0.031 | −0.101 | 0.039 | 0.017 |

| (−0.97) | (0.33) | (0.03) | (−0.45) | (−0.57) | (−0.37) | (−0.71) | (0.24) | (0.20) | |

| LAWNO | 0.023 | 0.026 | 0.045 | 0.208 | 0.007 | −0.015 | 0.097 | 0.022 | 0.006 |

| (0.28) | (0.40) | (0.56) | (1.54) | (0.07) | (−0.18) | (1.26) | (0.27) | (0.09) | |

| POPG | 0.315*** | −0.002 | 0.001 | 0.482** | −0.019 | 0.014 | 0.242* | 0.065 | −0.015 |

| (3.30) | (−0.02) | (0.02) | (2.43) | (−0.20) | (0.13) | (1.84) | (0.94) | (−0.20) | |

| GDPG | 0.011 | −0.028** | −0.025* | −0.005 | −0.003 | −0.005 | 0.006 | −0.028** | −0.028** |

| (0.73) | (−2.44) | (−2.00) | (−0.41) | (−0.42) | (−0.79) | (0.30) | (−2.10) | (−2.68) | |

| INFL | −0.002 | −0.014 | −0.015 | 0.024 | 0.004 | 0.001 | 0.020 | −0.028 | −0.028 |

| (−0.13) | (−1.04) | (−1.06) | (1.03) | (0.46) | (0.15) | (0.65) | (−1.02) | (−1.13) | |

| TRDOPEN | 0.002** | −0.000 | −0.000 | 0.000 | −0.002 | −0.001 | −0.002 | −0.001 | −0.001 |

| (2.05) | (−0.02) | (−0.13) | (0.11) | (−1.34) | (−0.96) | (−0.59) | (−0.51) | (−0.57) | |

| REMITT | −0.048 | −0.051** | −0.050* | −0.068 | 0.014 | −0.002 | −0.025 | −0.044 | −0.025 |

| (−1.35) | (−2.50) | (−2.01) | (−1.51) | (0.36) | (−0.05) | (−0.53) | (−0.88) | (−0.53) | |

| OTIDSGDP | −0.003 | 0.001 | 0.000 | 0.003 | 0.004* | 0.003 | 0.002 | 0.002 | 0.002 |

| (−1.17) | (0.36) | (0.20) | (0.51) | (1.96) | (1.43) | (0.34) | (1.01) | (1.00) | |

| LEGORI | 0.023 | −0.045 | −0.027 | 0.271 | 0.055 | 0.087 | −0.001 | −0.036 | −0.069 |

| (0.24) | (−0.58) | (−0.32) | (1.07) | (0.36) | (0.68) | (−0.01) | (−0.22) | (−0.56) | |

| Lagged FD | 0.193** | 0.222*** | 0.273*** | 2.832*** | 0.673*** | 0.370** | 0.673*** | 0.666** | 0.811** |

| (2.32) | (2.57) | (2.71) | (2.52) | (3.03) | (2.14) | (3.03) | (2.25) | (2.10) | |

| Constant | 0.002* | 0.001 | 4.850*** | −0.028 | 0.015** | 0.012* | 12.230*** | 6.744*** | 0.000 |

| (2.02) | (1.27) | (8.98) | (−1.58) | (2.17) | (1.76) | (5.21) | (3.65) | (0.84) | |

| No of observation | 537 | 554 | 554 | 537 | 554 | 554 | 492 | 501 | 501 |

| AR1 (p-value) | 0.01 | 0.04 | 0.03 | 0.09 | 0.01 | 0.03 | 0.03 | 0.07 | 0.08 |

| AR2 (p-value) | 0.52 | 0.61 | 0.28 | 0.14 | 0.34 | 0.34 | 0.84 | 0.30 | 0.61 |

| Hansen J (p-value) | 0.34 | 0.24 | 0.12 | 0.15 | 0.11 | 0.38 | 0.35 | 0.71 | 0.87 |

| Hansen J statistics | 19 | 12 | 14 | 33 | 35 | 28 | 23 | 17 | 14 |

- Note: All variables are as defined in Table A1. Lagged FD is the lagged values of the three financial development measures (MCGDP, PSCGDP, and DCPGDP). The t-statistics are robust to heteroscedasticity reported in parentheses, are based on double clustered standard errors (clustering done at the country and year levels). For tractable interpretation, all the coefficients are reported as elasticity, and the statistical significance is reported against 10% (*), 5% (**), and 1% (***) significance levels respectively.

Further, in models 7–9, the coefficient of interest is the interaction between international equity portfolio diversification and central bank transparency. The coefficient on the interaction term IEPD × CBT is positive and mainly statistically at the 5% level. The results are not substantially different from the baseline regression results. This implies that our results are robust and do not suffer from reverse causality.

4.4.2 Fixed effects

We use fixed effects estimation to address time-invariant country-level characteristics determinants of financial market development. As in Bell and Jones (2015), the fixed effects estimation model provides robustness to our baseline regression by exploring the impact of the within-country variations in international equity portfolio diversification, central bank transparency, and economic freedom enhancing financial market development.

Table 8 presents the results of the fixed effects estimations. The coefficients on IEPD in models 1–9 are mainly significant. In models 4–6, we interact economic freedom with international equity portfolio diversification to determine whether they have a combined effect on financial development. This is in line with the view that countries that have economic freedom will attract foreign equity investors. In models 4–6, the coefficient on the interaction term IEPD × EF is positive and statistically significant at the 1% level. Whilst in models 7–9 the coefficient on IEPD × CBT is positive and statistically significant at the 1% level. The results are similar to our baseline regression results which suggest that our empirical analysis is robust.

| Model (1) | Model (2) | Model (3) | Model (4) | Model (5) | Model (6) | Model (7) | Model (8) | Model (9) | |

|---|---|---|---|---|---|---|---|---|---|

| Variable | MCGDP | PSCGDP | DCPGDP | MCGDP | PSCGDP | DCPGDP | MCGDP | PSCGDP | DCPGDP |

| IEPD | 0.364*** | 0.205*** | 0.150** | 0.335*** | 0.198*** | 0.205*** | 0.790*** | 0.401*** | 0.353*** |

| (3.76) | (3.32) | (2.28) | (4.95) | (4.71) | (4.24) | (4.33) | (3.81) | (3.24) | |

| EF | 0.182*** | 0.155*** | 0.134*** | ||||||

| (2.98) | (3.80) | (3.40) | |||||||

| IEPD × EF | 0.061** | 0.044*** | 0.032** | ||||||

| (2.58) | (2.99) | (2.23) | |||||||

| CBT | 0.365*** | 0.191** | 0.186** | ||||||

| (3.20) | (2.50) | (2.38) | |||||||

| IEPD × CBT | 0.085*** | 0.044** | 0.044** | ||||||

| (3.40) | (2.52) | (2.38) | |||||||

| FSDGDP | 0.003 | 0.005*** | 0.004** | 0.005** | 0.006*** | 0.005*** | 0.005 | 0.006*** | 0.005** |

| (1.46) | (3.75) | (2.54) | (2.19) | (4.39) | (3.24) | (1.57) | (2.75) | (2.25) | |

| FINOPEN | 0.120** | 0.108*** | 0.087*** | 0.060 | 0.065*** | 0.043* | 0.049 | 0.105*** | 0.083** |

| (2.53) | (4.35) | (3.34) | (1.43) | (2.59) | (1.73) | (0.70) | (2.98) | (2.28) | |

| LAWNO | 0.060 | −0.007 | −0.004 | 0.113** | 0.026 | 0.023 | 0.083 | 0.009 | 0.020 |

| (1.00) | (−0.27) | (−0.14) | (2.11) | (0.92) | (0.86) | (1.13) | (0.23) | (0.49) | |

| POPG | 0.053 | 0.086*** | 0.084*** | 0.052 | 0.091*** | 0.089*** | 0.074 | 0.119*** | 0.110** |

| (0.99) | (3.06) | (2.76) | (1.18) | (3.59) | (3.39) | (0.94) | (2.90) | (2.49) | |

| GDPG | 0.022** | −0.035*** | −0.030*** | 0.027*** | −0.031*** | −0.027*** | 0.029*** | −0.031*** | −0.025*** |

| (2.58) | (−8.17) | (−7.17) | (3.45) | (−8.33) | (−7.56) | (3.34) | (−6.99) | (−5.27) | |

| INFL | 0.008 | −0.013*** | −0.012*** | 0.008 | −0.013*** | −0.012*** | 0.021*** | −0.012** | −0.010* |

| (1.58) | (−2.92) | (−2.86) | (1.56) | (−3.31) | (−3.25) | (3.06) | (−2.51) | (−1.70) | |

| TRDOPEN | 0.001 | −0.002** | −0.001 | −0.001 | −0.003*** | −0.002* | 0.003 | −0.002 | −0.001 |

| (0.55) | (−2.14) | (−0.88) | (−0.53) | (−3.19) | (−1.78) | (1.42) | (−1.59) | (−0.79) | |

| REMITT | −0.113*** | −0.035 | −0.047* | −0.057 | −0.005 | −0.022 | −0.158*** | −0.038 | −0.047 |

| (−2.66) | (−1.27) | (−1.67) | (−1.25) | (−0.22) | (−0.91) | (−2.82) | (−1.07) | (−1.45) | |

| OTIDSGDP | −0.005*** | 0.000 | −0.000 | −0.003** | 0.002*** | 0.001*** | −0.003 | 0.001* | 0.001 |

| (−3.45) | (0.48) | (−0.22) | (−2.33) | (3.86) | (2.96) | (−1.68) | (1.91) | (1.31) | |

| Constant | 4.684*** | 4.776*** | 4.714*** | 4.769*** | 6.305*** | 6.536*** | 6.255*** | 5.564*** | 5.350*** |

| (6.58) | (9.75) | (34.48) | (8.75) | (19.77) | (19.30) | (7.68) | (10.55) | (10.17) | |

| No of Observations | 603 | 637 | 599 | 603 | 637 | 637 | 531 | 556 | 556 |

| Adj. R-square | 0.38 | 0.62 | 0.08 | 0.33 | 0.62 | 0.57 | 0.31 | 0.55 | 0.46 |

| Country effects | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Year fixed effects | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

- Note: All variables are as defined in Table A1. The t-statistics are robust to heteroscedasticity reported in parentheses, are based on double clustered standard errors (clustering done at the country and year levels). For tractable interpretation, all the coefficients are reported as elasticity, and the statistical significance is reported against 10% (*), 5% (**), and 1% (***) significance levels respectively.

4.4.3 Quasi-natural experiment

In this section, perform a quasi-natural experiment using difference-in-differences to provide robustness to the results by addressing endogeneity (Bertrand and Mullainathan, 2003; Yang and Zhao, 2014). Following Kwabi et al. (2020) and Gropp et al. (2018), we use the 2010 Eurozone sovereign debt crises which severely affected five countries as an event year. Countries that were severely affected by the 2010 Eurozone debt crisis are used as the treatment group and the rest of the Eurozone countries as the controlled group. As in Kwabi et al. (2020), the treatment group is Greece, Ireland, Italy, Portugal, and Spain (GIIPS). According to Acharya et al. (2018), the GIIPS countries suffered severe sovereign debt crises and banking sector distress as they were later supported financially with the help of the European Union (EU) and the international monetary fund (IMF), except for the Italian government who succeeded in borrowing at commercial terms. Evidence from the Eurozone sovereign debt crisis shows that the GIIPS countries experienced sporadic economic growth which led to a rapid increase in domestic credit and enhanced foreign capital investments. Table 9 presents the results of the quasi-natural experiment model using DiD. The coefficients on the interactive term are positive and statistically significant. These suggest that the 2010 Eurozone debt crisis affected financial market development and our results are robust.

| Model (1) | Model (2) | Model (3) | |

|---|---|---|---|

| Variable | MCGDP | PSCGDP | DCPGDP |

| PORTFOLIO × GIIPS × Post-crisis | 0.225** | 0.138*** | 0.082** |

| (2.25) | (3.19) | (2.09) | |

| Controls | Yes | Yes | Yes |

| Number of observations | 519 | 551 | 551 |

| Adj. R-square | 0.65 | 0.67 | 0.64 |

| Country effects | Yes | Yes | Yes |

| Year fixed effects | Yes | Yes | Yes |

- Note: GIIPS and Post-crisis are dummy variables, respectively. Where GIIPS is the treated group.

4.4.4 Interaction between international equity portfolio flow and international bond flow

Table 10 presents the results of the interaction between international equity portfolio flow and international bond flow. In models 1–3, the coefficients on IEPD are positive and statistically significant at the 1% level. The coefficients on the interaction term IEPD × IBF are −1.384 (t-statistics = −1.31) in model 1, −0.206 (t-statistics = −3.46) in model 2, and − 0.151 (t-statistics = −2.32) in model 3. The results suggest that international bond flow inhibits financial development. This is consistent with the view that high government borrowing via bonds, particularly in emerging markets reduces funds available to the private sector. This finding adds to existing literature that suggests that banking system development is the precondition for equity market development.

| Model (1) | Model (2) | Model (3) | |

|---|---|---|---|

| Variable | MCGDP | PSCGDP | DCPGDP |

| IEPD | 0.549** | 0.057*** | 0.076*** |

| (2.02) | (2.82) | (3.31) | |

| IBF | −1.197 | −0.955*** | −0.755*** |

| (−0.30) | (−3.74) | (−2.81) | |

| IEPD × IBF | −1.384 | −0.206*** | −0.151** |

| (−1.31) | (−3.46) | (−2.32) | |

| FSDGDP | 0.010 | 0.007*** | 0.005*** |

| (0.86) | (8.53) | (4.14) | |

| FINOPEN | 0.008 | −0.018 | −0.021 |

| (0.04) | (−1.46) | (−1.45) | |

| LAWNO | 0.552* | 0.013 | 0.018 |

| (1.69) | (0.89) | (1.05) | |

| POPG | −0.495** | 0.029 | 0.059** |

| (−2.28) | (1.29) | (2.27) | |

| GDPG | 0.076** | −0.012*** | −0.011*** |

| (2.26) | (−5.75) | (−4.99) | |

| INFL | 0.042** | −0.002 | −0.002 |

| (2.56) | (−1.46) | (−1.19) | |

| TRDOPEN | −0.000 | −0.001*** | −0.001* |

| (−0.02) | (−2.75) | (−1.77) | |

| REMITT | −0.407*** | −0.009 | −0.017** |

| (−2.79) | (−1.28) | (−2.05) | |

| OTIDSGDP | −0.023*** | 0.003*** | 0.003*** |

| (−2.85) | (4.40) | (3.98) | |

| LEGORI | −7.414*** | −1.511*** | −1.596*** |

| (−3.53) | (−11.25) | (−10.66) | |

| Constant | 16.868*** | 3.037*** | 3.270*** |

| (3.86) | (13.26) | (12.42) | |

| No of Observations | 562 | 584 | 584 |

| F-Statistics | 117 | 448 | 598 |

| Country fixed effects | Yes | Yes | Yes |

| Year fixed effects | Yes | Yes | Yes |

- Note: All variables are as defined in Table A1. The t-statistics are robust to heteroscedasticity reported in parentheses, are based on double clustered standard errors (clustering done at the country and year levels). For tractable interpretation, all the coefficients are reported as elasticity, and the statistical significance is reported against 10% (*), 5% (**), and 1% (***) significance levels respectively.

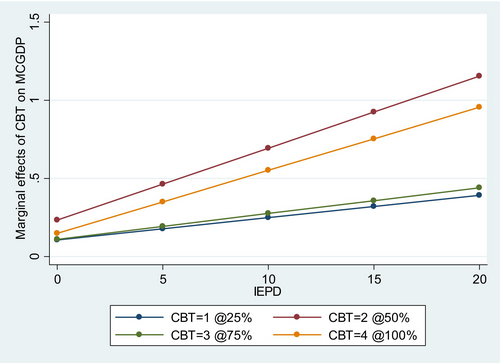

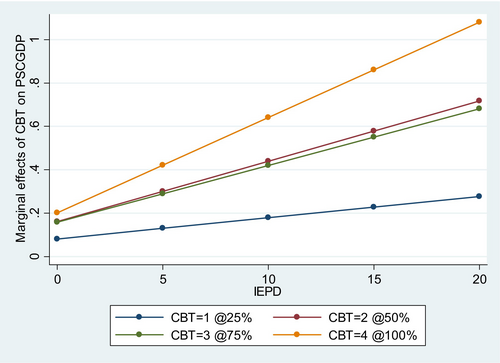

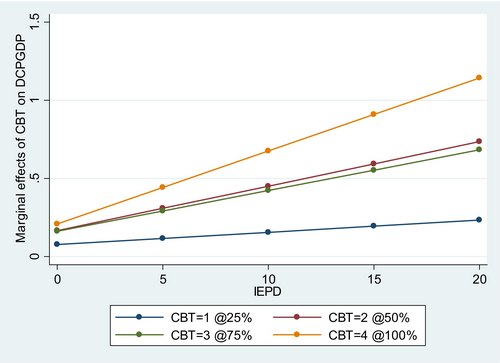

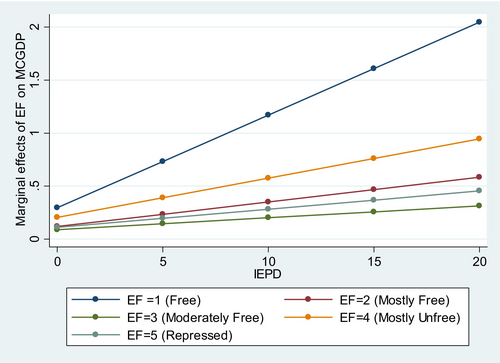

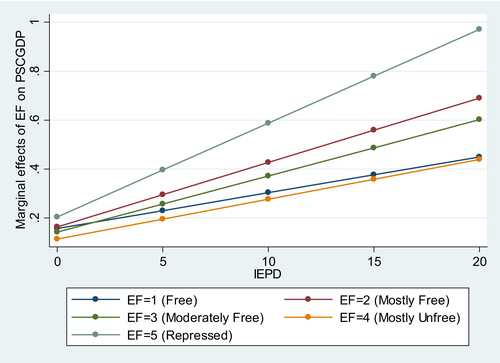

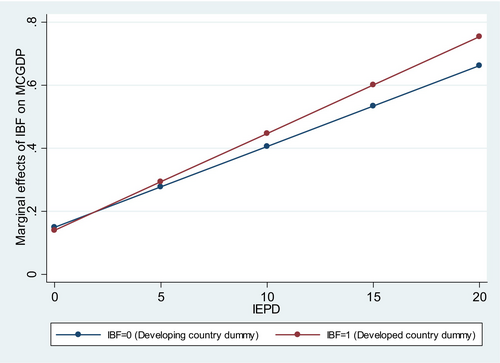

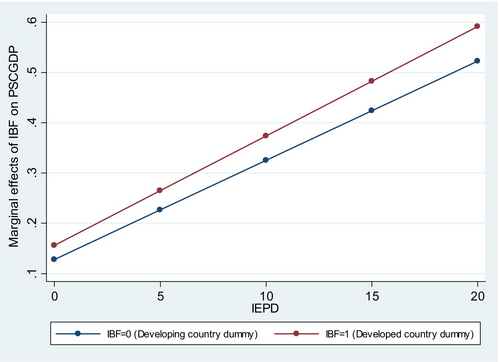

4.4.5 Computation and analysis of the marginal effects of the interaction terms

This section presents the marginal effects of the interaction terms only, which include central bank transparency (CBT), economic freedom (EF), and international bond flow (IBF), respectively. First, to compute the marginal effects of central bank transparency on financial market development, we rescale the CBT data where code 1 represents data ranges 1–4; code 2 denotes data ranges 4.5–7.5; code 3 signifies data ranges 8–11, and code 4 depicts data ranges 11.5–14.5. This approach was adopted as a systematic way of grouping the CBT data for marginal effect evaluation purposes only, to our knowledge, there is currently no methodology in the extant literature on the partitioning or ranking of the CBT data. Second, following the Heritage Foundation country ranking criteria (Heritage, 2022), we partition the economic freedom data into five main groups, namely: free, mostly free; moderately free; mostly unfree, and repressed. Third, for the purpose of estimating the marginal effects of the international bond flow, we categorized the data into developed and underdeveloped economies.

Table 11 presents the results of the marginal effects for the three interaction terms as follows: (i) the marginal effects of CBT on FD; (ii) the marginal effects of EF on FD; and finally (iii) the marginal effects of IBF on FD. In all three aspects, the results are statistically significant at the 1% level of significance. Furthermore, the results reveal that countries with greater levels of central bank transparency are likely to attract more foreign investors than those that are less transparent, thus fostering the financial market development. Additionally, in terms of MCGDP, the results also show that foreign investors are likely to invest in countries that have a high-level of freedom, which enhances their financial development. This finding is consistent with existing studies which document that economic freedom improves economic growth (Brkić et al., 2020; Ciftci & Durusu-Ciftci, 2022; De Haan & Sturm, 2000; Haydaroglu, 2016; Heckelman, 2000). Finally, the marginal effects of IBF show that countries with higher bond flows are able to develop the financial market when compared with countries with less borrowing, and this would assist foreign investors in where to invest. It is worth noting that most of the results support our baseline regression outcomes; however, caution should be exercised on the interpretation of these results. Appendix B reports the plots for the marginal effects of the interactions.

| Model (1) | Model (2) | Model (3) | |

|---|---|---|---|

| Variable | MCGDP | PSCGDP | DCPGDP |

| (i) Marginal effects of CBT on FD | |||

| CBT = 1 (For data ranges 1–4) | 0.067*** | 0.055*** | 0.056*** |

| (5.80) | (7.06) | (7.02) | |

| CBT = 2 (For data ranges 4.5–7.5) | 0.107*** | 0.085*** | 0.088*** |

| (23.10) | (27.47) | (27.85) | |

| CBT = 3 (For data ranges 8–11) | 0.065*** | 0.087*** | 0.091*** |

| (25.84) | (46.51) | (47.32) | |

| CBT = 4 (For data ranges 11.5–14.5) | 0.038*** | 0.081*** | 0.079*** |

| (5.58) | (16.31) | (15.66) |

|

| (ii) Marginal effects of EF on FD | |||

| EF = 1 (Free) | 0.055*** | 0.117*** | 0.114*** |

| (4.78) | (11.39) | (10.73) | |

| EF = 2 (Mostly Free) | 0.055*** | 0.091*** | 0.093*** |

| (15.45) | (36.95) | (36.64) | |

| EF = 3 (Moderately Free) | 0.058*** | 0.078*** | 0.082*** |

| (21.04) | (38.92) | (39.13) | |

| EF = 4 (Mostly Unfree) | 0.102*** | 0.069*** | 0.072*** |

| (17.09) | (15.85) | (16.04) | |

| EF = 5 (Repressed) | 0.063*** | 0.099*** | 0.106*** |

| (3.31) | (7.07) | (7.37) |

|

| (iii) Marginal effects of IBF on FD | |||

| IBF = 0 (Developing country dummy) | 0.078*** | 0.074*** | 0.079*** |

| (20.42) | (29.18) | (30.24) | |

| IBF = 1 (Developed country dummy) | 0.055*** | 0.096*** | 0.095*** |

| (11.27) | (28.89) | (27.62) | |

- Note: All variables are as defined in Table A1. The t-statistics are robust to heteroscedasticity reported in parentheses, are based on double clustered standard errors (clustering done at the country and year levels). For tractable interpretation, all the coefficients are reported as elasticity, and the statistical significance is reported against 10% (*), 5% (**), and 1% (***) significance levels respectively.

5 CONCLUSIONS