Volatility spillovers, hedging and safe-havens under pandemics: All that glitters is not gold!

Abstract

In the context of the COVID-19's outbreak and its implications for the financial sector, this study analyses the aspect of hedging and safe-haven under the pandemic. Drawing on the daily data from 02 August 2019 to 17 April 2020, our key findings suggest that the contagious effects in financial assets' returns significantly increased under COVID-19, indicating exacerbated market risk. The connectedness spiked in the middle of March, consistent with lockdown timings in major economies. The effect became severe with the WHO's declaration of a pandemic, confirming negative news effects. The return connectedness suggests that COVID-19 has been a catalyst of contagious effects on the financial markets. The crude oil and the government bonds are however not as much affected by the spillovers as their endogenous innovation. In terms of spillovers, we do find the safe-haven function of Gold and Bitcoin. Comparatively, the safe-haven effectiveness of Bitcoin is unstable over the pandemic. Whereas, GOLD is the most promising hedge and safe-haven asset, as it remains robust during the current crisis of COVID-19 and thus exhibits superiority over Bitcoin and Tether. Our findings are useful for investors, portfolio managers and policymakers interested in spillovers and safe havens during the current pandemic.

1 INTRODUCTION

The outbreak of COVID-19 a.k.a Coronavirus has been devastatingly affecting the global economy, financial system and societies with its adverse socio-economic as well as political implications. The cost to human life is beyond any monetary value but the financial losses are not negligible either. The earlier estimates by the IMF suggested a contraction of – 3% in the global economy, which is now expected to even get worst, amounting to losses in trillions of US$. The global fiscal stimulus of over US$ 8.7 trillion and liquidity injection by various central banks including Federal Reserves, European Central Bank, Bank of Japan and the Bank of England are not ample enough to revert the downturn in the international economy (Wheatley, 2020). According to the Institute of International Finance, in March 2020, the equity and bond markets in large emerging economies suffered cross-border capital outflows of over $100 billion. Though the outlook improved thereafter, owing to the fact that the epicentre of the Pandemic shifted to first Europe and then the USA, the risks of capital flight remains significantly high (IIF, 2020). As COVID-19 is not contained by the national borders so does its adverse impact on the global financial markets. No previous Pandemic including the Spanish Flu had a comparable adverse impact on the stock market as COVID-19 (Baker et al., 2020). According to estimates by Bloomberg, the global stock losses amounted to around US$ 16.7 trillion from the beginning of the year to 12 March 2020 (Young-won, 2020). Fearing the collapse of the global economy, the oil market fell to an unprecedented and historically all-time low level where the price per barrel became negative. The collapse of oil market can have major implications for the oil-exporting economies (Nasir et al., 2019), but in its essence, such a market fall is just one of the many signs of economic and financial disruption that COVID-19 has brought us.

While the disruption of COVID-19 presents an obnoxious global economic and financial outlook, it also raises various crucial questions on the ability of global financial markets and asset classes to weather this shock. Especially, which asset classes and financial markets can be a better hedge or safe-haven against the Pandemic? Flight to safety in the time of a crisis is a very old instinct common among almost all species and including the one who indulges in financial activities. The COVID-19 is the worst Pandemic since the Spanish Flu in 1917, but the world has changed a lot since then. The 21st Century has brought us many new challenges as well as new opportunities. Due to globalization and technological progression, the spread of COVID-19, as well as financial contagion across the global financial system, is a lot more rapid than in 1917. Nonetheless, the size, significance and structure of the global financial markets have also changed in the last few decades and this includes the availability of a large variety of new asset classes and investment venues. For instance, there are various kinds of financial and commodity derivatives, cryptocurrencies, global stock indexes and green investment opportunities.

Since their inception, cryptocurrencies have gained a lot of controversy and debate around their existence as well as usage. One crucial aspect of this debate has been the ability and the role of Cryptocurrencies in hedging and whether they can be considered as safe-havens. Often their role as a safe-haven is compared and contrasted against Gold, among other traditional assets. Gold has attracted the attention of various scholars who have reported on its hedging effectiveness of and its safe-haven property during periods of stock market turmoil (Baur & Lucey, 2010; Lucey and Li, 2014; Lucey et al., 2014; Beckmann et al., 2015; Dimitriou et al., 2020). However, several studies mostly focusing on Bitcoin have argued that Cryptocurrencies are an alternative to Gold as having many common features and consider cryptocurrencies as a safe-haven in times of stress given their resilience to the financial crisis such as the Cypriot banking crisis of 2012–2013 and the European debt crisis of 2010–2013 (Bekiros et al., 2017; Luther & Salter, 2017; Popper, 2015; Rogojanu & Badea, 2014; Stensås et al., 2019; Urquhart & Zhang, 2019). Nonetheless, some studies have indicated that the hedging ability of Gold has diminished in recent years. For instance, Klein (2017), reveals that Gold used to act as a hedge for the USA and European stock markets, however, this property does not hold after 2013. Similarly, comparing precious metals (gold, silver, platinum and palladium) Lucey and Li (2014) argued that it might be that on some occasions Gold does not act as a safe-haven.1 With the availability of additional investment options, the attention has shifted from Gold to cryptocurrencies, mainly Bitcoin and its potential role as a diversifier, hedge and safe-haven against movements in traditional asset classes (See, for instance, Brière et al., 2015; Dyhrberg, 2016; Bouri, Moln_ar, et al., 2017; Bouri, Jalkh, et al., 2017; Corbet et al., 2018; Baur et al., 2018; Ji et al., 2018; Guesmi et al., 2019; Fang et al., 2019) and in some cases an effective hedge or safe-haven against stocks and commodity indices (Bouri, Moln_ar, et al., 2017; Bouri, Jalkh, et al., 2017; Baur et al., 2018). However, there is also overwhelming evidence suggesting that the hedging ability of Bitcoin is not stable (Corbet et al., 2020; Klein et al., 2018). Furthermore, Bitcoin has a time-varying safe -haven capability against equity losses, (Li & Lucey, 2017; Shahzad et al., 2019, 2019b). Other studies, for instance, Shahzad et al. (2019) found that the diversification benefits of Gold are much higher and stable than Bitcoin, whereas, Baur and Hoang (2020) argued that other cryptos such as Tether, acts as a better safe-haven. Concomitantly, this huge contrast in empirical literature puts the notion Cryptos replacing Gold in doubt.

In addition to Cryptocurrencies, financial innovation and environmental challenges have also brought us green investment opportunities in the form of clean energy stocks (e.g., Wilder Hill Clean Energy Index, ECO and the European Renewable Energy Index, ERIX). The outbreak of the Pandemic also raises the question that whether these green investment opportunities can also be good hedges or safe havens in a time of crisis. Despite the sharp interest of scholars in the implications of COVID-19 for the financial market, quite understandably, the evidence on this subject is very limited. Very few studies, for instance, Conlon and McGee (2020) have reported that Bitcoin has been a weak hedge and does not act as a safe-haven against S&P 500 losses during COVID-19. Similarly, Corbet et al. (2020) focusing on Chinese stock, argued that Bitcoin has not shown to be a hedge or safe haven during COVID-19. On the contrary, Goodell and Goutte (2020) reveal that the pandemic has caused a rise in the value of Bitcoin. Cheema and Szulczyk (2020) reported that Gold has lost its safe-haven property during the global pandemic. This limited and contrasting evidence provides a rationale for the subject study and our endeavour to take an inclusive approach by considering various asset classes to address the question of safe-havens. The ongoing pandemic provides a strong motivation to investigate the connectedness and volatility spillovers among cryptocurrencies, financial markets, clean energy stock markets and commodities. The severity of the COVID-19 crisis allows us to re-evaluate and compare the hedging and safe-haven abilities of Gold, Bitcoin and the stablecoin, Tether, since it becomes difficult to detect a safe-haven asset in the period of COVID-19 distress, though this is the time when safe-havens are needed most. In the context of growing debate that whether Bitcoin is really pegged to Tether or not, this study contributes to the debate by explaining the connectedness between these two coins. To be more precise, Griffin and Shams (2020) indicated that Tether plays a big role in primarily driving the investors' demand in the booming period of Bitcoin by analysing the algorithm of blockchain. In contrast, Kristoufek (2021) found the opposite results. Accordingly, there is no clear evidence that stablecoin could boost cryptocurrency returns by using forecast error variance decompositions. These findings are inconclusive; therefore, we used the two representatives of cryptocurrencies alongside other financial assets to examine whether they exhibit connectedness and dynamic correlation during the COVID-19 pandemic. More importantly, this paper also looks at the different features of cryptocurrency during the pandemic time: monetary value or property (Yuneline, 2019). So far, there is no consensus about the effects of the global pandemic on the extreme connectedness spillovers among different asset classes and its implications on the traditional safe-havens, Gold and Bitcoin. We aim to fill this gap and examine the effectiveness of Bitcoin in this period of great financial turmoil and compare its hedging and safe-haven ability with Gold and Tether against a variety of asset classes including stocks, bonds, energy commodities, non-energy commodities (Platinum, Aluminium, Silver, Corn, Wheat and Soybean) and clean energy stock indexes. Drawing on the daily data from 02 August 2019 to 17 April 2020 and performing the pre and post-COVID-19 period analysis, our key findings suggest that the contagious effects in financial assets' returns significantly increased by almost two folds under COVID-19 indicating exacerbated aggregate market risks. The rolling window of interconnectedness among underlying asset classes showed that the total connectedness spiked to nearly 65% in mid-March, which is consistent with the lockdown in some of the major economies. The effect became more severe as the World Health Organization (WHO) started to express concerns and peaked with the declaration of the Pandemic, confirming negative news effects. The return connectedness suggests that the COVID-19 crisis could be a catalyst of contagious effects on the financial markets. In particular, the crude oil and the government bonds are however not as much affected by the spillovers but their endogenous dynamics. Multi-directional spillovers among financial assets have higher values in the late period of the COVID-19 crisis. In terms of spillovers, we do find the safe-haven function of Gold and Bitcoin. Comparatively, the safe-haven effectiveness of Bitcoin is unstable over the Pandemic. However, GOLD is the most promising hedge and safe-haven asset, as it remains robust during the current crisis of COVID-19 and thus exhibits superiority over Bitcoin and Tether. Our findings are useful for investors, portfolio managers and policymakers searching for the best asset among GOLD, Bitcoin and stablecoins as a hedge against the adverse movements in any of the under analysis assets classes during the current pandemic.

The paper proceeds as follows: Section 2 provides a brief critical review of the debate on the hedging and safe-haven role of different asset classes and the implications of the Pandemic; Section 3 elaborates on the empirical approach. Analysis and Findings are reported and discussed in Section 4 and lastly, the conclusion and policy implications are drawn in Section 5.

2 RELATED STUDIES

The crucial aspect of hedging is the connectedness among the underlying asset classes. In this regard, the relationship between cryptocurrencies, particularly Bitcoin and conventional assets has been given increasing attention by researchers (see, for instance, Zhang & Broadstock, 2018, Wang et al., 2018; Zhang et al., 2019). It has been argued that Bitcoin and commodity markets, specifically Gold and oil are weakly connected and this relationship is unstable over time (Bouri et al., 2018; Ji, Bouri, Roubaud, & Shahzad, 2018; Shahzad, Bouri, Roubaud, Kristoufek, & Lucey, 2019). Kristoufek et al. (2012) were the first to examine the network structure of commodity markets with financial assets and show that the separation between clusters can manifest considerable time variation. Later, Filip et al. (2016) confirmed the results of Kristoufek et al. (2012) on a larger scale, using various stock indices, energy and non-energy commodities, and interest and exchange rates. In this context, prior literature identified different factors and channels to explain the connection between commodity and cryptocurrency markets. The correlations and information channels are based on the price discovery process through which connections occur (Kodres & Pritsker, 2002). The risk premium channel is based on the effect of a potential shock in one market on market participants in other markets (Acharya & Pedersen, 2005). Another channel was advanced by Hayes (2017) to explain the relationship between Bitcoin and energy markets, based on the fact that energy, specifically electricity, is the main cost of mining. Other studies focus on the similarity of some characteristics to explain the connection between Bitcoin and Gold (Selmi et al., 2018, Klein et al., 2018, Shahzad, Bouri, Roubaud, Kristoufek, & Lucey, 2019; Huynh et al., 2020). These studies have often considered Bitcoin as the leading cryptocurrency and disregard other digital currencies. However, Huynh, Burggarf, and Wang (2020) show that other cryptocurrencies also matter.

A financial crisis intensifies the connection and the volatility spillovers implying that a shock in one market can affect the return and the volatility of another market. Using the spillover index of Diebold and Yilmaz (2012, 2014), Mensi et al. (2018) investigated the connectedness and risk spillover between global, regional and GIPSI2 stock markets. They found that volatility spillovers increased considerably during the financial crisis and great recession (global financial crisis “GFC” in 2007–2009 and European debt crisis in 2010–2012). These two global financial crises have stimulated considerable interest to examine the connectedness between markets and asset classes. A strand of literature has emerged to assess the interconnectedness and spillover effects among traditional asset classes and examine the importance of systematic risk (Baur & Lucey, 2010; Beckmann et al., 2015; Botman et al., 2013; Bouoiyour & Selmi, 2017; Lucey et al., 2014; Papadamou et al., 2021; Umar et al., 2020). Yet, other studies have explored the interconnectedness between different types of cryptos and examined the transmission channels in the cryptocurrency market (Antonakakis et al., 2019; Zięba et al., 2019). The findings showed that periods of stress and high market uncertainty are associated with strong connectedness between cryptocurrencies. Applying the generalized variance decomposition approach and frequency domain method, Corbet et al. (2018) examined the connectedness between leading digital currencies and some traditional assets. They argued that Bitcoin is isolated and independent form other assets suggesting potential diversification benefits.

Gold has a historical aspect in human civilization and its price dynamics are the manifestation of macroeconomic outlook and market psychology (Aggarwal & Lucey, 2007; Lucey et al., 2014; Lucey et al., 2017; Tully & Lucey, 2007).3 However, recently attention has been shifted from Gold to cryptocurrencies and the potential role of Bitcoin as a diversifier, hedge and safe-haven against adverse movements in traditional asset classes. This strand of literature focuses on the comparative hedging and safe-haven capabilities of Gold and Bitcoin. Previous studies have provided evidence on the hedging role of Gold in normal times and its safe-haven property during periods of financial markets turmoil (Baur & Lucey, 2010; Ciner et al., 2014; Beckmann et al., 2015; Dimitriou et al., 2020). However, some studies reveal that Bitcoin is an alternative to Gold as having many common features and consider cryptocurrencies as a safe-haven in times of stress given its resilience to banking and the European debt crisis (Bekiros et al., 2017; Luther & Salter, 2017; Popper, 2015; Rogojanu & Badea, 2014; Stensås et al., 2019; Urquhart & Zhang, 2019). On this aspect, using a dynamic correlation model, Klein (2017), reported that Gold is used to be a hedge for the USA and European stock markets, however, this property does not hold anymore. Whereas, some empirical evidence suggests that Bitcoin can act as a valuable diversifier since it is weakly correlated with traditional assets (Brière et al., 2015; Dyhrberg, 2016; Bouri, Moln_ar, et al., 2017; Bouri, Jalkh, et al., 2017; Corbet et al., 2018; Baur et al., 2018; Ji et al., 2018; Guesmi et al., 2019; Fang et al., 2019) and in some cases an effective hedge or safe-haven against stocks and commodity indices (Bouri, Moln_ar, et al., 2017; Bouri, Jalkh, et al., 2017; Baur et al., 2018). There is also some evidence that cryptocurrency prices are insulated from financial and economic variables and do not share the same price determinants with traditional asset classes (Bouoiyour et al., 2016; Ciaian et al., 2016; Corbet et al., 2018; Kristoufek, 2015). Based on this notion, several studies have centred the debate on the ability of Bitcoin to mimic the hedging and safe-haven property of Gold when markets are in a bearish state (Kristoufek, 2015; Bouoiyour & Selmi, 2015; Ciaian et al., 2016, Bouri, Moln_ar, et al., 2017; Ji et al., 2018; Al-Khazali et al., 2018; Corbet et al., 2018). However, it also reported that Bitcoin moves in tandem with stock markets suggesting that it may not have stable hedging abilities (Klein et al. (2018)). Furthermore, Ji et al. (2018) found that the relationship between Bitcoin and equities in unstable and can be influenced by structural breaks. A limited number of studies have pointed to the time-varying safe -haven abilities of Bitcoin compared to Gold and other commodities against equities (Li & Lucey, 2017; Shahzad et al., 2019, 2019b). For instance, Shahzad et al. (2019) found that the diversification benefits of Gold are much higher and stable in comparison to Bitcoin especially when stock markets are in a bearish state. Few studies considered Bitcoin as a risky asset given its extreme volatility and thus cannot be considered as a safe-haven tool (Klein et al., 2018; Smales, 2019). Recently, Baur and Hoang (2020) examined the ability of stablecoins to act as a safe-haven against Bitcoin. They showed that Tether, which is pegged to stable assets, provides the strongest effect and thus acts as a safe-haven for Bitcoin in periods of extreme negative price changes. In a nutshell, the evidence on Bitcoin as the successor of Gold is contrasting.

To reiterate, COVID-19 has plummeted the financial markets to their lowest levels since the GFC. According to Baker et al. (2020), the effect of the global pandemic on equities is more profound than in prior epidemics (SARS, Swin flu, Spanish flu). The severity of the crisis has gathered the attention of various scholars. Schell et al. (2020) have reported that COVID-19 caused the largest shock in United States equity markets as compared to the earlier diseases. Sharif et al. (2020) reported on the adverse impact on the oil market. Similarly, Yarovaya et al. (2020) have reflected contagion effects under COVID-19. A noteworthy study by Onali and Mascia (2020) emphasized the role of diversification in this tough time. Le et al. (2021) have reported that COVID-19 has exacerbated the volatility spillovers among different asset classes. The crisis also reinvigorated the debate on safe-havens, though the evidence is limited. For instance, Conlon and McGee (2020) showed that Bitcoin has been a weak hedge and does not act as a safe-haven against S&P 500 losses during the COVID-19. Cheema and Szulczyk (2020) argued that Gold has lost its safe-haven property during the global pandemic. While, U.S. Dollar index, S&P U.S. Treasury bill index, S&P U.S. Treasury bond index serve as strong safe -havens against stock market losses and a weak safe -haven against Bitcoin losses. Furthermore, the stablecoin, Tether, acts as a weak safe-haven against the stock market and Bitcoin losses. However, Dimitriou et al. (2020) found that Gold acts as a safe haven against crude oil and commodities during the GFC and the Eurozone sovereign debt crisis. Papadamou et al. (2021) examined the effect of the COVID-19 crisis on the time-varying correlation between stock and bond returns and showed that these two asset classes offered diversification advantages to investors during the pandemic. Focusing on the Chinese stock market and Gold and Bitcoin, Corbet et al. (2020) argued that during a series of economic and financial crises such as COVID-19, these assets do not act as hedges or safe havens but instead amplify the contagion. On the contrary, Goodell and Goutte (2020) argued that COVID-19 has caused a rise in the value of Bitcoin. Concomitantly, there is very limited and contrasting evidence on hedging and safe havens during the COVID-19 crisis.

The ongoing pandemic provides a strong motivation to investigate the connectedness and volatility spillovers among various markets including cryptocurrencies, financial markets, clean energy stock markets and commodities. In addition to that the severe COVID-19 crisis allows us to re-evaluate and compare the hedging and safe-haven abilities of Gold, Bitcoin and the stablecoin, Tether, since vital to detect a safe-haven asset in the period of COVID-19 distress where the safe-havens are most needed. To this day, there is no consensus about the effects of the global pandemic on the extreme connectedness spillovers among different asset classes and its implications on the traditional safe-havens, Gold and Bitcoin. We aim to fill this gap and examine the effectiveness of Bitcoin in this period of great turmoil and compare its hedge and safe-haven ability with Gold and Tether against stocks, bonds, energy commodities, non-energy commodities and clean energy stock markets.

3 METHODOLOGY

The empirical analysis entails two aspects. First, to investigate the volatility spillovers and connectedness, we employed the Diebold and Yilmaz (2014) generalized VAR spillover model. Second, to assess and compare the hedging and safe-haven capabilities of Gold, Bitcoin and Tether during the COVID-19 crisis, we used the ADCC-GARCH approach (Cappiello et al., 2006). This study employs DY VAR spillover and ADCC-GARCH to explore the network spillovers. Although the literature has been growing on the dynamic copulas with and without regime-switching, nonparametric approaches, wavelet coherence, DY VAR, and ADCC-GARCH has been built on the traditional variance decompositions, which have been widely recognized by Engle et al. (1988). The concepts of these approaches allow us to split the forecast error variances; therefore, the results could disentangle the attributes from different shocks. However, dynamic Copulas with and without regime-switching are more likely to focus on the tail dependence, while nonparametric methodologies and wavelet coherence rely on the data structure. Each methodology has pros and cons in exploring the network structure. Hence, this study focuses on the parsimony concept of econometrics to choose the best appropriate method to see the spillovers.

3.1 Diebold and Yilmaz (2014) Generalized VAR spillover model

3.2 ADCC model

Where 𝜔 is a constant, is the conditional variance, α is the coefficient that captures the shock of yesterday's news, and 𝛽 is the coefficient indicating the GARCH effect.

To assess and compare the hedging and safe-haven capabilities of God, Bitcoin and Tether, we regress the pairwise DCC extracted from the ADCC model on the dummy variables (D) representing extreme downward movements in the 10%, 5% and 1% quantile of the return distribution.

3.3 Data

Our study employed daily data6 on COVID-19 cases and the daily closing prices of three potential safe-havens (God, Bitcoin and the stablecoin, Tether), the global MSCI World Index, the Barclays Global Aggregate Corporate Index, the US 10-year Treasury constant maturity rates TCM (10 Y TCM), energy commodities (West Texas Intermediate, WTI and Natural gas futures), clean energy stock markets (The equally modified weighted Wilder Hill Clean Energy Index, ECO and the European Renewable Energy Index, ERIX), precious metal markets (Platinum, silver and Aluminium) and food commodities (Corn, Wheat and Soybean). Bitcoin and Tether data are collected from coinmarketcap.com . Data on the rest of the variables are extracted from Bloomberg, except for the clean energy stock markets and food commodities data, which are sourced from Thomson Reuters. COVID-19 cases data are obtained from the daily reports published by the WHO. The main reason for us to choose a wide variety of asset classes is the scope of the pandemic where the investors are searching for potential safe-havens. Thus, it is important to include assets with varying degrees of risk that investors might be willing to invest in. To cover the COVID-19 pandemic, the daily data span from 02 August 2019 to 17 April 2020. Accordingly, the entire period is divided into two sub-periods, before and after COVID-19 pandemic.

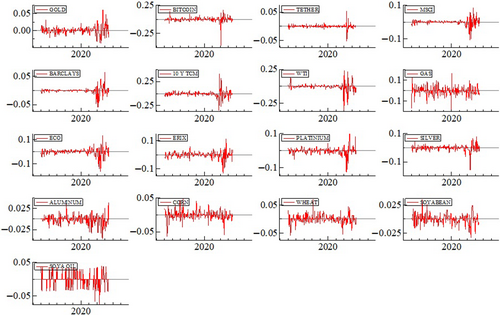

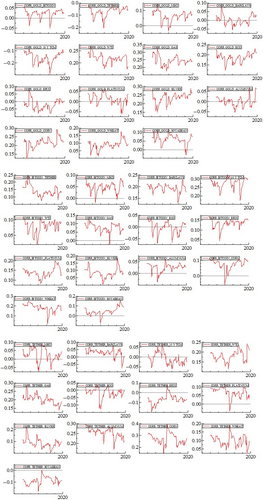

The return on each asset is calculated as the difference in the logarithm of two successive period prices. Figure 1 displays the dynamics of the returns for the selected assets and as shown, all the series exhibit growing risks and high volatility after the global spread of the COVID-19 disease, particularly since February 2020 when all the markets have experienced a sharp and precipitous downfall and disastrous losses, except Gold and Tether for which the volatility is relatively low, as its price levels are relatively stable while all the assets fell in value. The descriptive statistics are presented in Table 1. No surprise, the average returns series is negative for all the assets except for Gold, the clean energy stock market ERIX, Wheat and Tether which exhibit positive average returns during the entire period. Bitcoin, crude oil WTI and 10 Y TCM are the most volatile, as presented by the standard deviations and the minimum and maximum of the return series. The stablecoin Tether is the least volatile asset. Skewness coefficients are negative for all variables except for 10 Y TCM, Gold, Wheat, soybean and Tether, however, kurtosis coefficients are high for all the assets showing that all the return series are asymmetric and leptokurtic, justifying the results of the Jarque-Bera test, which strongly rejects a normal distribution. The results of the ADF unit root test show that apart from lnCOVID, all return series are stationary at the 1% significance level.

| Variable | Mean | Std. dev. | Min | Max | Skewness | Kurtosis | Jarque-Bera (p-value) | ADF |

|---|---|---|---|---|---|---|---|---|

| MSCI | −0.00039 | 0.01935 | −0.10441 | 0.08406 | −1.2182 | 10.407 | 128.79 (0.000) |

−5.784*** |

| BARCLAYS | −0.00055 | 0.01194 | −0.05929 | 0.06493 | −0.1688 | 10.590 | 244.54 (0.000) |

−5.704*** |

| 10 Y TCM | −0.00625 | 0.07222 | −0.34701 | 0.40480 | 0.3815 | 11.020 | 246.42 (0.000) |

−9.489*** |

| WTI | −0.00611 | 0.05759 | −0.34400 | 0.23791 | −1.3550 | 13.491 | 175.45 (0.000) |

−6.817*** |

| GAS | −0.00207 | 0.04486 | −0.17755 | 0.16309 | −0.25992 | 5.3631 | 30.987 (0.000) |

−10.02*** |

| ECO | −0.00014 | 0.03180 | −0.16239 | 0.13399 | −1.5058 | 8.6759 | 64.059 (0.000) |

−5.972*** |

| ERIX | 0.00025 | 0.02445 | −0.13248 | 0.11309 | −0.70924 | 7.1422 | 115.82 (0.000) |

−7.205*** |

| PLATINIUM | −0.00079 | 0.02277 | −0.12800 | 0.099238 | −0.94733 | 12.423 | 219.98 (0.000) |

−5.217*** |

| SILVER | −0.00099 | 0.021576 | −0.15796 | 0.076834 | −1.7479 | 15.215 | 139.12 (0.000) |

−6.27*** |

| GOLD | 0.00067 | 0.012387 | −0.038434 | 0.061409 | 0.74107 | 4.6387 | 57.093 (0.000) |

−7.43*** |

| ALUMINIUM | −0.00088 | 0.011281 | −0.046403 | 0.038675 | −0.46515 | 5.5909 | 30.524 (0.000) |

−7.681*** |

| CORN | −0.00131 | 0.014528 | −0.063393 | 0.047754 | −0.45282 | 3.9650 | 58.905 (0.000) |

−7.986*** |

| WHEAT | 0.00072 | 0.015193 | −0.057748 | 0.068993 | 0.15484 | 3.5788 | 59.273 (0.000) |

−7.693*** |

| SOYABEAN | −0.00003 | 0.00910 | −0.032830 | 0.034672 | 0.054974 | 5.0427 | 26.822 (0.000) |

−7.627*** |

| BITCOIN | −0.00121 | 0.048538 | −0.46473 | 0.16710 | −4.1742 | 43.682 | 131.69 (0.000) |

−8.431*** |

| TETHER | 0.0000 | 0.0072 | −0.0525 | 0.0533 | 0.3879 | 30.782 | 789.57 (0.000) |

−11.19*** |

| lnCOVID | 4.2964 | 5.4950 | 0.00000 | 14.564 | 0.69477 | −1.2801 | 148.87 (0.000) |

1.274 |

- Note: This table reports summary statistics of daily returns related to several asset classes. The results of the unit root test ADF (Augmented Dickey-Fuller) are reported. The p-value for the Jarque-Bera test denotes the rejection of the null hypothesis for normality at the 1% significance level. *; **; *** denote the significance at 10%, 5% and 1% levels, respectively.

4 EMPIRICAL RESULTS

4.1 Connectedness and volatility spillovers

At the first glance, we observed the total spillover effects for three estimates with 26.061%, 44.611% and 25.336% for the full sample, sub-sample in post-pandemic, and the pre-pandemic sub-sample, respectively. The contagious effects on financial assets' returns significantly increase by approximately two folds during COVID-19. Therefore, the COVID-19 pandemic can be considered as the factor that induces the connectedness among financial assets' returns. Indeed, our findings are consistent with the current literature about the linkage between the pandemic and market reactions (Onali & Mascia, 2020; Schell et al., 2020; Yarovaya et al., 2020). Our finding also confirms the contagious effects on the financial markets. The contagion's spillover effects at financial markets and underlying macroeconomic fundamentals have affected precious metals, stocks, alternative investments, commodity products and energy indices. There are two main possible explanations. First, this pandemic causes the largest economic lockdown in many countries, with a substantial negative impact on economic performance. Foreseeing the decline in economic activity and consumption, investors are likely to flee their capital investment to a safer investment. Furthermore, the commodity markets have witnessed extreme shocks. Sharif et al. (2020) argued that the oil-price volatility this year contributes to severe negative effects on the variety of financial markets. Second, apart from the economic fundamentals, COVID-19 also changed investors' expectations. Investors tend to be pessimistic to spend or invest in this tough time. They might choose to shelter their money in assets, which have stored-values functions such as Gold and platinum. Therefore, the markets are likely to be distorted by the structural changes in their behaviours.

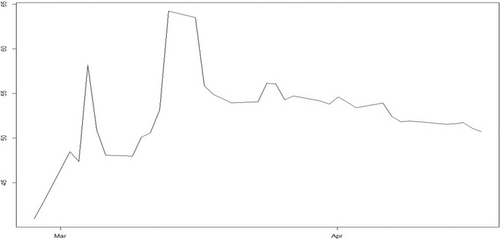

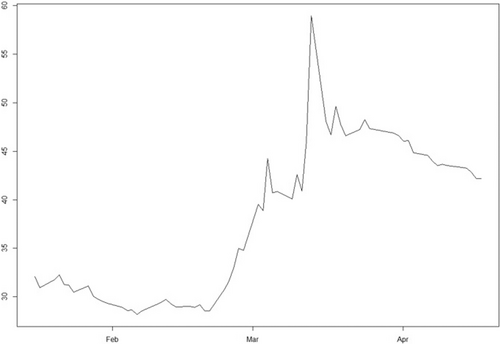

Figure 2 represents the rolling window of interconnectedness among our financial markets estimations. Since we employed the rolling windows to estimate the day-by-day connectedness values of 3 months before- and after- the pandemic, the horizontal window would be 30 trading days. As observed, the total connectedness spiked to nearly 65% in the middle of March, which is consistent with the timing of lockdown in several major economies. The increasing pattern is the clear picture that we could see in the spillover level among these markets. Although the total connectedness increased at the beginning of March, this effect became more severe when the WHO started to express deep concerns about the severity of COVID-19. On 11 March 2020, the WHO declared COVID-19 as a Pandemic. Therefore, the peaked point of financial markets regarding the spillover effect could be explainable by the official confirmation of negative news.

Tables 2, 3 and 4 represents details on the values of directional spillover from one asset to another. While the values which lie on the diagonal represent the spillover effect of an asset on itself, the other describes the percentage of connectedness values from asset i to asset j.

| Variables | MSCI | BARCLAYS | X10.Y.TCM | WTI | GAS | ECO | ERIX | PLAT | SILVER | GOLD | ALUM | CORN | WHEAT | SOYA | SOYAOIL | BIT | TETHER | COVID-19 | Total | From |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| MSCI | 57.56% | 5.00% | 1.54% | 0.53% | 0.50% | 5.93% | 1.05% | 3.37% | 2.24% | 3.22% | 1.05% | 0.78% | 1.09% | 1.06% | 1.35% | 0.21% | 13.30% | 0.21% | 100.00% | 2.36% |

| BARCLAYS | 9.04% | 77.48% | 2.82% | 0.40% | 0.04% | 0.74% | 0.32% | 0.33% | 2.02% | 1.31% | 0.73% | 0.70% | 0.36% | 0.25% | 0.34% | 0.50% | 2.45% | 0.18% | 100.00% | 1.25% |

| X10.Y.TCM | 6.38% | 0.77% | 76.97% | 3.98% | 0.78% | 2.60% | 0.62% | 2.14% | 0.95% | 0.07% | 0.25% | 0.18% | 0.09% | 0.07% | 0.15% | 2.25% | 1.23% | 0.50% | 100.00% | 1.28% |

| WTI | 4.25% | 13.85% | 1.95% | 61.88% | 0.06% | 0.84% | 0.42% | 0.48% | 0.63% | 1.29% | 0.21% | 0.40% | 2.45% | 0.04% | 0.34% | 0.34% | 9.65% | 0.90% | 100.00% | 2.12% |

| GAS | 2.55% | 0.71% | 0.37% | 1.04% | 84.11% | 2.10% | 0.98% | 0.59% | 0.59% | 0.29% | 1.00% | 3.46% | 0.03% | 0.16% | 1.22% | 0.16% | 0.55% | 0.07% | 100.00% | 0.88% |

| ECO | 14.99% | 5.09% | 0.77% | 2.05% | 0.38% | 50.43% | 1.30% | 2.79% | 3.60% | 2.33% | 1.11% | 1.39% | 0.48% | 0.61% | 1.25% | 0.06% | 11.18% | 0.18% | 100.00% | 2.75% |

| ERIX | 4.36% | 1.90% | 1.45% | 3.14% | 0.42% | 14.28% | 60.73% | 3.57% | 0.99% | 0.74% | 1.40% | 0.71% | 0.71% | 0.32% | 0.72% | 0.85% | 3.48% | 0.23% | 100.00% | 2.18% |

| PLATINIUM | 0.70% | 2.06% | 0.18% | 0.22% | 1.24% | 2.72% | 0.80% | 73.41% | 6.32% | 0.34% | 3.19% | 0.49% | 0.47% | 2.58% | 0.18% | 0.07% | 4.85% | 0.17% | 100.00% | 1.48% |

| SILVER | 1.96% | 5.61% | 1.04% | 5.20% | 0.12% | 2.64% | 0.57% | 3.35% | 64.63% | 1.70% | 0.25% | 0.20% | 0.14% | 1.74% | 0.12% | 0.11% | 10.56% | 0.06% | 100.00% | 1.97% |

| GOLD | 0.65% | 2.99% | 0.30% | 5.96% | 0.26% | 1.33% | 2.07% | 4.96% | 1.58% | 74.48% | 0.76% | 1.00% | 1.01% | 0.31% | 0.28% | 0.08% | 1.91% | 0.08% | 100.00% | 1.42% |

| ALUMINIUM | 3.26% | 1.40% | 0.33% | 2.59% | 0.01% | 2.54% | 0.52% | 2.64% | 2.15% | 0.80% | 79.87% | 0.15% | 0.36% | 1.62% | 0.50% | 0.12% | 0.39% | 0.76% | 100.00% | 1.12% |

| CORN | 0.15% | 0.73% | 0.35% | 0.06% | 1.19% | 1.94% | 0.80% | 0.32% | 3.28% | 0.06% | 0.53% | 88.95% | 0.05% | 0.07% | 0.17% | 0.27% | 0.43% | 0.64% | 100.00% | 0.61% |

| WHEAT | 1.28% | 0.24% | 0.07% | 0.75% | 2.01% | 1.81% | 0.92% | 1.74% | 1.53% | 0.02% | 0.15% | 2.10% | 83.97% | 0.19% | 0.92% | 1.01% | 0.38% | 0.93% | 100.00% | 0.89% |

| SOYABEAN | 2.04% | 1.78% | 1.91% | 0.21% | 1.20% | 2.88% | 0.13% | 1.06% | 5.27% | 0.55% | 0.12% | 0.15% | 0.14% | 79.54% | 0.15% | 0.11% | 2.01% | 0.75% | 100.00% | 1.14% |

| BITCOIN | 0.50% | 3.74% | 0.52% | 11.63% | 0.30% | 1.86% | 5.69% | 0.78% | 2.41% | 1.22% | 0.52% | 1.23% | 0.69% | 0.04% | 0.45% | 64.54% | 3.74% | 0.13% | 100.00% | 1.97% |

| TETHER | 5.83% | 0.32% | 1.97% | 0.65% | 0.47% | 1.95% | 3.86% | 0.78% | 1.23% | 0.16% | 0.55% | 2.13% | 1.91% | 0.16% | 0.39% | 0.15% | 77.50% | 0.00% | 100.00% | 1.25% |

| COVID-19 | 2.86% | 0.01% | 0.10% | 0.00% | 0.07% | 2.18% | 0.00% | 0.27% | 0.07% | 0.00% | 0.18% | 0.22% | 0.15% | 0.24% | 0.00% | 0.02% | 0.03% | 93.59% | 100.00% | 0.36% |

| Total | 118.62% | 125.82% | 93.12% | 100.47% | 95.06% | 101.36% | 81.39% | 103.21% | 100.41% | 88.64% | 92.11% | 105.11% | 94.27% | 90.77% | 89.82% | 70.86% | 148.90% | 100.05% | 1800.00% | |

| To | 3.39% | 2.69% | 0.90% | 2.14% | 0.61% | 2.83% | 1.15% | 1.66% | 1.99% | 0.79% | 0.68% | 0.90% | 0.57% | 0.62% | 0.48% | 0.35% | 3.97% | 0.36% | 26.06% |

- Note: We used the Selection-order criteria to choose the optimal lag for our estimation based on AIC and SBIC. Own contributions to variance shares make up the diagonal of the main section of the table and are emphasized.

| Variables | MSCI | BARCLAYS | X10.Y.TCM | WTI | GAS | ECO | ERIX | PLAT | SILVER | GOLD | ALUM | CORN | WHEAT | SOYA | SOYAOIL | BIT | TETHER | COVID-19 | Total | From |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| MSCI | 39.39% | 4.20% | 1.16% | 0.62% | 0.97% | 2.60% | 4.00% | 5.00% | 3.85% | 1.38% | 1.71% | 2.66% | 5.22% | 3.69% | 4.14% | 0.57% | 18.81% | 0.00% | 100.00% | 3.37% |

| BARCLAYS | 6.74% | 68.34% | 2.51% | 0.50% | 0.60% | 0.59% | 2.98% | 1.25% | 2.39% | 1.01% | 0.86% | 2.57% | 2.39% | 2.25% | 0.78% | 0.63% | 3.62% | 0.00% | 100.00% | 1.76% |

| X10.Y.TCM | 14.23% | 0.75% | 57.12% | 3.56% | 2.57% | 7.56% | 0.95% | 1.99% | 2.22% | 1.26% | 0.85% | 0.53% | 1.22% | 0.61% | 1.04% | 1.82% | 1.70% | 0.00% | 100.00% | 2.38% |

| WTI | 2.13% | 13.07% | 2.64% | 47.23% | 0.23% | 0.50% | 3.68% | 2.79% | 2.67% | 2.01% | 0.41% | 0.98% | 6.09% | 0.54% | 0.66% | 0.55% | 13.79% | 0.03% | 100.00% | 2.93% |

| GAS | 0.96% | 0.77% | 1.15% | 2.22% | 77.44% | 1.82% | 1.56% | 0.47% | 1.81% | 0.67% | 0.69% | 2.90% | 0.40% | 0.84% | 0.03% | 0.74% | 5.54% | 0.00% | 100.00% | 1.25% |

| ECO | 9.37% | 5.78% | 0.47% | 2.10% | 0.65% | 34.91% | 3.29% | 4.93% | 3.67% | 1.48% | 2.09% | 4.05% | 2.69% | 3.85% | 3.68% | 0.27% | 16.71% | 0.01% | 100.00% | 3.62% |

| ERIX | 5.48% | 2.30% | 1.33% | 3.12% | 0.22% | 16.97% | 39.70% | 4.31% | 3.15% | 0.48% | 2.93% | 4.26% | 3.29% | 3.89% | 3.15% | 0.20% | 5.23% | 0.01% | 100.00% | 3.35% |

| PLATINIUM | 1.63% | 3.89% | 0.97% | 0.48% | 2.35% | 2.64% | 1.15% | 48.81% | 8.34% | 2.94% | 5.80% | 4.13% | 1.55% | 7.07% | 1.20% | 0.39% | 6.64% | 0.02% | 100.00% | 2.84% |

| SILVER | 2.12% | 8.17% | 0.33% | 6.40% | 0.21% | 3.23% | 3.55% | 5.66% | 40.93% | 1.49% | 0.20% | 1.52% | 0.31% | 5.97% | 0.99% | 1.00% | 17.91% | 0.01% | 100.00% | 3.28% |

| GOLD | 1.42% | 4.34% | 0.25% | 7.72% | 0.10% | 1.75% | 4.36% | 9.00% | 5.38% | 55.97% | 0.52% | 1.53% | 0.32% | 1.33% | 0.72% | 0.45% | 4.84% | 0.01% | 100.00% | 2.45% |

| ALUMINIUM | 6.72% | 2.94% | 0.77% | 1.85% | 0.22% | 11.84% | 3.27% | 4.40% | 3.31% | 1.34% | 54.01% | 2.11% | 0.45% | 3.69% | 0.01% | 1.75% | 1.29% | 0.02% | 100.00% | 2.56% |

| CORN | 4.44% | 4.00% | 0.68% | 1.03% | 1.02% | 1.94% | 5.84% | 0.99% | 4.55% | 0.46% | 0.60% | 64.06% | 2.19% | 5.67% | 0.81% | 0.93% | 0.62% | 0.18% | 100.00% | 2.00% |

| WHEAT | 1.86% | 0.60% | 0.07% | 1.73% | 1.51% | 1.58% | 1.26% | 2.49% | 3.82% | 0.24% | 0.25% | 3.75% | 75.01% | 2.89% | 0.49% | 0.97% | 1.40% | 0.07% | 100.00% | 1.39% |

| SOYABEAN | 4.32% | 3.54% | 1.77% | 0.17% | 0.92% | 3.96% | 0.92% | 0.97% | 6.38% | 3.00% | 0.67% | 2.22% | 2.89% | 61.04% | 2.02% | 0.15% | 5.02% | 0.04% | 100.00% | 2.16% |

| BITCOIN | 0.76% | 4.44% | 1.17% | 12.24% | 0.94% | 7.39% | 10.54% | 1.93% | 3.62% | 1.35% | 1.81% | 1.47% | 1.19% | 0.65% | 1.66% | 43.06% | 5.72% | 0.05% | 100.00% | 3.16% |

| TETHER | 5.57% | 2.02% | 2.55% | 1.50% | 0.70% | 3.74% | 6.29% | 3.21% | 0.68% | 0.15% | 2.56% | 7.60% | 2.65% | 1.60% | 0.78% | 0.25% | 58.16% | 0.00% | 100.00% | 2.32% |

| COVID-19 | 12.76% | 0.49% | 1.37% | 0.72% | 0.39% | 11.40% | 0.63% | 0.04% | 1.78% | 0.04% | 0.12% | 0.77% | 0.04% | 0.01% | 0.02% | 0.07% | 0.45% | 68.91% | 100.00% | 1.73% |

| Total | 122.26% | 133.02% | 76.46% | 94.96% | 94.24% | 115.73% | 98.12% | 100.29% | 100.93% | 75.90% | 76.97% | 108.12% | 112.66% | 106.60% | 85.12% | 54.00% | 175.24% | 69.38% | 1800.00% | |

| To | 4.60% | 3.59% | 1.07% | 2.65% | 0.93% | 4.49% | 3.25% | 2.86% | 3.33% | 1.11% | 1.28% | 2.45% | 2.09% | 2.53% | 1.23% | 0.61% | 6.50% | 0.03% |

- Note: We used the Selection-order criteria to choose the optimal lag for our estimation based on AIC and SBIC. Own contributions to variance shares make up the diagonal of the main section of the table and are emphasized.

| Variables | MSCI | BARCLAYS | X10.Y.TCM | WTI | GAS | ECO | ERIX | PLAT | SILVER | GOLD | ALUM | CORN | WHEAT | SOYA | SOYAOIL | BIT | TETHER | Total | From |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| MSCI | 64.75% | 4.36% | 0.39% | 1.97% | 6.59% | 7.90% | 0.08% | 0.20% | 0.37% | 3.63% | 0.74% | 2.43% | 3.29% | 2.49% | 0.43% | 0.15% | 0.24% | 100.00% | 2.07% |

| BARCLAYS | 3.88% | 77.16% | 2.83% | 1.13% | 7.07% | 0.52% | 2.82% | 0.49% | 0.93% | 0.56% | 0.30% | 0.36% | 0.22% | 0.47% | 0.42% | 0.59% | 0.25% | 100.00% | 1.34% |

| X10.Y.TCM | 2.42% | 1.89% | 71.76% | 4.75% | 2.01% | 1.30% | 0.69% | 1.24% | 1.95% | 2.25% | 0.55% | 1.76% | 2.42% | 2.53% | 1.77% | 0.36% | 0.36% | 100.00% | 1.66% |

| WTI | 0.30% | 0.60% | 0.18% | 90.16% | 1.28% | 0.46% | 0.09% | 0.62% | 0.09% | 2.21% | 0.61% | 1.70% | 0.17% | 0.29% | 0.08% | 0.39% | 0.77% | 100.00% | 0.58% |

| GAS | 2.38% | 0.37% | 1.18% | 2.34% | 76.34% | 0.55% | 1.97% | 0.29% | 0.27% | 0.40% | 3.12% | 3.87% | 0.06% | 0.55% | 3.91% | 0.44% | 1.95% | 100.00% | 1.39% |

| ECO | 12.22% | 6.57% | 0.45% | 0.91% | 4.33% | 56.70% | 2.47% | 0.66% | 1.63% | 1.98% | 0.49% | 3.24% | 3.86% | 2.29% | 0.89% | 0.65% | 0.65% | 100.00% | 2.55% |

| ERIX | 2.03% | 1.03% | 3.22% | 0.36% | 3.67% | 1.32% | 76.63% | 0.89% | 1.53% | 2.19% | 0.13% | 0.24% | 1.20% | 1.38% | 1.28% | 1.82% | 1.07% | 100.00% | 1.37% |

| PLATINIUM | 0.75% | 1.41% | 2.47% | 0.79% | 1.10% | 0.74% | 1.56% | 86.44% | 0.10% | 0.78% | 0.44% | 0.04% | 0.46% | 0.61% | 1.76% | 0.28% | 0.26% | 100.00% | 0.80% |

| SILVER | 0.31% | 0.94% | 9.39% | 1.87% | 0.36% | 1.72% | 0.36% | 0.30% | 73.69% | 4.93% | 0.18% | 2.16% | 0.55% | 0.31% | 1.40% | 1.24% | 0.29% | 100.00% | 1.55% |

| GOLD | 4.53% | 4.02% | 0.72% | 1.50% | 0.80% | 4.17% | 0.07% | 5.76% | 0.06% | 63.72% | 1.61% | 1.83% | 6.25% | 1.09% | 2.52% | 0.73% | 0.63% | 100.00% | 2.13% |

| ALUMINIUM | 1.44% | 0.05% | 11.96% | 0.81% | 0.19% | 0.67% | 0.70% | 0.41% | 0.52% | 2.14% | 68.19% | 1.88% | 3.40% | 0.82% | 2.57% | 3.45% | 0.80% | 100.00% | 1.87% |

| CORN | 0.56% | 0.18% | 1.25% | 3.91% | 0.72% | 1.31% | 0.21% | 1.19% | 0.33% | 0.24% | 0.42% | 85.98% | 0.18% | 2.40% | 0.28% | 0.22% | 0.62% | 100.00% | 0.82% |

| WHEAT | 0.63% | 0.68% | 0.13% | 0.30% | 1.76% | 2.11% | 1.92% | 1.34% | 0.01% | 0.78% | 0.63% | 0.52% | 83.11% | 0.85% | 3.63% | 1.04% | 0.55% | 100.00% | 0.99% |

| SOYABEAN | 0.59% | 0.62% | 0.12% | 1.27% | 0.56% | 1.46% | 0.19% | 3.34% | 3.52% | 0.90% | 0.44% | 1.61% | 1.15% | 79.82% | 3.54% | 0.49% | 0.37% | 100.00% | 1.19% |

| BITCOIN | 1.19% | 0.13% | 0.96% | 1.36% | 0.46% | 1.06% | 0.53% | 1.60% | 0.17% | 10.89% | 0.45% | 2.76% | 6.25% | 1.07% | 0.67% | 69.71% | 0.74% | 100.00% | 1.78% |

| TETHER | 5.94% | 0.40% | 0.16% | 0.29% | 0.34% | 0.48% | 4.59% | 0.48% | 1.04% | 1.16% | 0.98% | 1.21% | 2.84% | 1.55% | 0.04% | 4.60% | 73.89% | 100.00% | 1.54% |

| Total | 105.44% | 101.15% | 108.55% | 117.47% | 108.79% | 86.10% | 95.13% | 105.40% | 86.54% | 99.35% | 79.64% | 113.77% | 118.14% | 101.89% | 96.38% | 87.31% | 88.94% | 1700.00% | |

| To | 2.39% | 1.41% | 2.16% | 1.61% | 1.91% | 1.73% | 1.09% | 1.12% | 0.76% | 2.10% | 0.67% | 1.63% | 2.06% | 1.30% | 1.48% | 1.04% | 0.89% |

- Note: We used the Selection-order criteria to choose the optimal lag for our estimation based on AIC and SBIC. Own contributions to variance shares make up the diagonal of the main section of the table and are emphasized.

We can observe two main patterns from these tables. First, the number of COVID-19 cases is not the prime reason, which causes the return connectedness to the other financial markets. It means that the proxy of COVID-19 crisis does not directly transmit return shocks but it plays an indirect role to shake the whole spillover effects among the other financial classes. As seen in Table 2 (after the pandemic period), the spillover effects of the COVID-19 column is quite marginal values (around 0.00% and 0.18%). Therefore, COVID-19 could not be seen as the prominent factor inducing the return connectedness. It is the catalyst to raise the return connectedness effects, which is suggested in the study of Yarovaya et al. (2020) and Onali and Mascia (2020). Second, among the financial assets, crude oil exhibits the highest return connectedness to itself in the period before- and after- the pandemic with 47.23% and 90.16%, respectively. This can be associated with the internal factors of the oil markets and specifically collapse in the oil demand, rather the spillovers from other assets. To our expectation, the government yield bond returns (Barclays and 10 Y TCM) share the same pattern with WTI crude oil. In contrast, the other financial assets reduce their connectedness themselves after the COVID-19 crisis. When we look at the total return that these financial assets transmitted to the others, obviously, the aggregate spillover effects significantly increase in the post period.

Taking a closer look at the supposedly safe-havens such as Gold and Bitcoin, the total spillover effects of these assets seemed to be marginal under the COVID-19 crisis with around 75.9% and 54%, respectively. On the contrary, in full-sample estimates, these spillover effects are significantly higher. In a recent study, Huynh et al. (2020) emphasized the role of Gold and platinum in pricing Bitcoin under economic shocks. However, we do not find strong evidence to support our hypothesis that the Tether could be the safe-haven asset although there exists a decrease in the total spillover effect. In the following part, we would further investigate; how these potential safe-haven assets play their role in the COVID-19 pandemic. But to sum up, using the return connectedness, we can see that a crisis such as this could be a catalyst of contagious effects on the financial markets. In particular, crude oil and government bonds are mostly caused by endogenous factors rather than other financial assets. Moreover, multi-directional spillovers among financial assets have higher values under COVID-19. Finally, we do find evidence of the role of Gold and Bitcoin in terms of safe-haven for various asset classes.

4.2 Hedging and safe-haven analyses

To further examine the joint dynamics of returns and transmission channels between the different financial assets, we use the VARMA (1,1)-ADCC-GARCH, the best fit model for the conditional correlation7. The ADCC (1,1) model is identified based on minimum values of Schwarz Bayesian Criterion (SBC), Hannan-Quinn (HQ) and Akaike Information Criterion (AIC)8. The time series pairwise conditional correlations are generated to investigate the hedging and safe-haven abilities of Gold, Bitcoin and Tether against risk in stocks, bonds, energy and non-energy commodity markets. The analysis is conducted for the entire period and two sub-sample, before and after the COVID-19 pandemic. The descriptive statistics of the estimated pairwise dynamic conditional correlations are presented in Table 5.

| Entire period | Before COVID-19 | After COVID-19 | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Mean | Std. dev | Min | Max | Mean | Std. dev | Min | Max | Mean | Std. dev | Min | Max | |

| GOLD/Bitcoin | 0.050 | 0.010 | −0.004 | 0.081 | 0.033 | 0.004 | 0.028 | 0.058 | 0.211 | 0.028 | 0.158 | 0.273 |

| GOLD/Tether | −0.132 | 0.008 | −0.149 | −0.095 | −0.069 | 0.038 | −0.208 | −0.012 | −0.081 | 0.026 | −0.141 | 0.145 |

| GOLD/MSCI | −0.088 | 0.010 | −0.124 | −0.045 | −0.085 | 0.008 | −0.095 | −0.044 | −0.193 | 0.081 | −0.361 | −0.104 |

| GOLD/Barclays | −0.157 | 0.005 | −0.167 | −0.135 | −0.156 | 0.004 | −0.162 | −0.141 | −0.173 | 0.064 | −0.268 | −0.096 |

| GOLD/10 Y TCM | −0.219 | 0.009 | −0.238 | −0.192 | −0.233 | 0.004 | −0.227 | −0.207 | 0.147 | 0.037 | 0.07 | 0.192 |

| GOLD/ WTI | 0.046 | 0.022 | 0.027 | 0.211 | 0.022 | 0.003 | 0.016 | 0.033 | 0.061 | 0.076 | −0.050 | 0.134 |

| GOLD/ GAS | 0.063 | 0.06 | 0045 | 0.087 | 0.065 | 0.005 | 0.056 | 0.083 | 0.172 | 0.025 | 0.119 | 0.200 |

| GOLD/ ECO | −0.021 | 0.011 | −0.057 | 0.028 | −0.018 | 0.011 | −0.028 | 0.034 | −0.262 | 0.063 | −0.358 | −0.197 |

| GOLD/ ERIX | −0.027 | 0.007 | −0.097 | −0.046 | −0.066 | 0.005 | −0.071 | −0.045 | −0.137 | 0.042 | −0.216 | −0.087 |

| GOLD/Platinium | −0.073 | 0.011 | −0.055 | 0.039 | −0.029 | 0.004 | 0.047 | 0.068 | 0.098 | 0.024 | 0.056 | 0.130 |

| GOLD/Silver | 0.066 | 0.014 | 0.019 | 0.134 | −0.072 | 0.002 | 0.076 | −0.062 | 0.211 | 0.067 | 0.073 | 0.292 |

| GOLD/Aluminium | −0.081 | 0.005 | −0.097 | −0.054 | 0.154 | 0.005 | 0.129 | 0.166 | −0.136 | 0.042 | −0.222 | −0.088 |

| GOLD/Corn | 0.149 | 0.011 | 0.113 | 0.211 | 0.015 | 0.005 | 0.129 | 0.166 | −0.066 | 0.061 | −0.179 | −0.005 |

| GOLD/Wheat | 0.011 | 0.007 | −0.012 | 0.037 | 0.016 | 0.004 | 0.005 | 0.027 | −0.133 | 0.046 | −0.226 | −0.079 |

| GOLD/Soyabean | 0.088 | 0.008 | 0.058 | 0.113 | 0.086 | 0.004 | 0.076 | 0.096 | −0.209 | 0.060 | −0.337 | −0.143 |

| Bitcoin/GOLD | 0.050 | 0.010 | −0.004 | 0.081 | 0.033 | 0.004 | 0.028 | 0.058 | 0.211 | 0.028 | 0.158 | 0.273 |

| Bitcoin/Tether | −0.013 | 0.010 | −0.027 | 0.039 | 0.140 | 0.034 | 0.073 | 0.247 | 0.117 | 0.016 | 0.064 | 0.145 |

| Bitcoin/MSCI | −0.121 | 0.009 | −0.137 | −0.075 | −0.113 | 0.009 | −0.121 | −0.062 | 0.046 | 0.158 | −0.219 | 0.197 |

| Bitcoin/Barclays | 0.023 | 0.013 | 0.005 | 0.101 | 0.030 | 0.009 | 0.022 | 0.077 | 0.120 | 0.165 | −0.149 | 0.275 |

| Bitcoin/10YTCM | 0.029 | 0.012 | 0.010 | 0.097 | 0.029 | 0.006 | 0.020 | 0.052 | 0.108 | 0.186 | −0.209 | 0.298 |

| Bitcoin/WTI | −0.034 | 0.009 | −0.046 | 0.025 | 0.002 | 0.002 | −0.001 | 0.08 | 0.119 | 0.108 | −0.105 | 0.206 |

| Bitcoin/GAS | 0.017 | 0.007 | −0.003 | 0.059 | 0.050 | 0.007 | 0.041 | 0.086 | 0.210 | 0.048 | 0.130 | 0.280 |

| Bitcoin/ECO | −0.148 | 0.010 | −0.166 | −0.085 | −0.133 | 0.006 | −0.140 | −0.102 | 0.047 | 0.131 | −0.197 | 0.158 |

| Bitcoin/ERIX | −0.004 | 0.007 | −0.022 | 0.034 | 0.004 | 0.008 | −0.007 | 0.041 | −0.155 | 0.179 | −0.493 | 0.014 |

| Bitcoin/Platinium | 0.057 | 0.007 | 0.038 | 0.102 | 0.035 | 0.006 | 0.027 | 0.077 | 0.045 | 0.087 | −0.107 | 0.123 |

| Bitcoin/Silver | 0.025 | 0.010 | 0.006 | 0.082 | 0.016 | 0.008 | 0.007 | 0.066 | 0.232 | 0.062 | 0.113 | 0.289 |

| Bitcoin/Aluminium | −0.012 | 0.006 | −0.026 | 0.012 | 0.000 | 0.005 | −0.008 | 0.025 | 0.098 | 0.078 | −0.055 | 0.184 |

| Bitcoin/Corn | 0.042 | 0.009 | 0.017 | 0.100 | 0.025 | 0.09 | 0.010 | 0.079 | 0.104 | 0.079 | −0.063 | 0.199 |

| Bitcoin/Wheat | 0.080 | 0.011 | 0.054 | 0.142 | 0.072 | 0.004 | 0.062 | 0.090 | 0.076 | 0.109 | −0.070 | 0.192 |

| Bitcoin/Soyabean | −0.014 | 0.006 | −0.030 | 0.017 | −0.022 | 0.005 | −0.030 | 0.006 | −0.021 | 0.101 | −0.202 | 0.074 |

| Tether/GOLD | −0.132 | 0.008 | −0.149 | −0.095 | 0.069 | 0.038 | −0.208 | −0.012 | −0.081 | 0.026 | −0.141 | −0.013 |

| Tether/Bitcoin | −0.013 | 0.010 | −0.027 | 0.039 | 0.140 | 0.034 | 0.073 | 0.247 | 0.117 | 0.016 | 0.064 | 0.145 |

| Tether/MSCI | 0.005 | 0.053 | −0.256 | 0.085 | 0.025 | 0.037 | −0.074 | 0.085 | −0.021 | 0.059 | −0.256 | 0.056 |

| Tether/ Barclays | 0.020 | 0.031 | −0.088 | 0.079 | 0.027 | 0.024 | −0.076 | 0.079 | 0.012 | 0.036 | −0.088 | 0.058 |

| Tether/10 YTCM | −0.022 | 0.039 | −0.178 | 0.062 | −0.009 | 0.027 | −0.062 | 0.062 | −0.038 | 0.046 | −0.178 | 0.009 |

| Tether/WTI | 0.171 | 0.026 | 0.105 | 0.242 | 0.179 | 0.027 | 0.113 | 0.242 | 0.159 | 0.021 | 0.105 | 0.205 |

| Tether/Gas | 0.176 | 0.053 | −0.041 | 0.285 | 0.201 | 0.026 | 0.138 | 0.285 | 0.141 | 0.060 | −0.041 | 0.218 |

| Tether/ECO | −0.027 | 0.05 | −0.304 | 0.058 | −0.017 | 0.033 | −0.127 | 0.034 | −0.041 | 0.073 | −0.304 | 0.058 |

| Tether/ERIX | −0.086 | 0.067 | −0.432 | 0.078 | −0.068 | 0.046 | −0.194 | 0.078 | −0.111 | 0.082 | −0.432 | −0.010 |

| Tether/Platinium | 0.070 | 0.027 | −0.042 | 0.134 | 0.067 | 0.030 | −0.042 | 0.118 | 0.073 | 0.023 | 0.023 | 0.134 |

| Tether/Silver | 0.077 | 0.038 | −0.044 | 0.224 | 0.085 | 0.037 | 0.000 | 0.224 | 0.066 | 0.037 | −0.044 | 0.157 |

| Tether/Aluminium | 0.251 | 0.025 | 0.145 | 0.294 | 0.254 | 0.024 | 0.168 | 0.294 | 0.246 | 0.026 | 0.145 | 0.291 |

| Tether/Corn | 0.266 | 0.051 | 0.028 | 0.393 | 0.296 | 0.046 | 0.151 | 0.393 | 0.261 | 0.056 | 0.028 | 0.329 |

| Tether/Wheat | 0.099 | 0.029 | 0.002 | 0.192 | 0.096 | 0.030 | 0.027 | 0.192 | 0.103 | 0.027 | 0.002 | 0.149 |

| Tether/Soyabean | −0.103 | 0.040 | −0.277 | 0.001 | −0.089 | 0.031 | −0.178 | 0.001 | −0.122 | 0.042 | −0.277 | −0.036 |

- Note: This table presents the descriptive statistics of the Asymmetric dynamic correlation coefficients (ADCC) for GOLD/…, Bitcoin/…and Tether/….pairs for the full sample, 02 August 2019 to 17 April 2020. Number of observations: 186.

4.2.1 Dynamic conditional correlations and ADCC characteristics

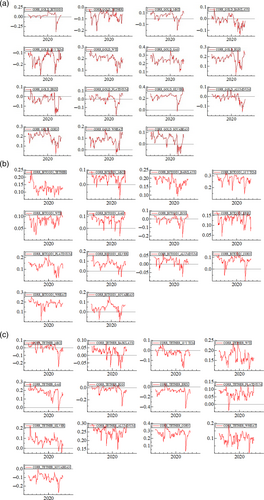

The results of the dynamic conditional correlation coefficients of Gold, Bitcoin and Tether with each of the selected assets for the entire period are reported in Table 5. Starting with Gold, Panel A indicates that on average; the correlation coefficients are negative, indicating that Gold serves as a potential hedge against these financial assets, except Bitcoin, fuel energy and food commodities. However, the extent of negativity varies from one asset to another. The most negative correlation coefficients occur in government yield bonds (10 Y TCM), while the least negative ADCC coefficients are observed in the clean energy stock markets, ECO and ERIX. Nevertheless, positive conditional correlations are apparent in Bitcoin, crude oil WTI, natural gas and food commodities suggesting that Gold moves in tandem with these markets and does not hedge against risk for these assets (see Figure 3).

Panel B shows that Bitcoin is negatively correlated with Tether, MSCI world index, crude oil, clean energy stock markets and non-energy commodities, Aluminium and Soyabean. Furthermore, the average of the time-varying correlation coefficients for each pair is low, ranging only from −0.148 to −0.004, suggesting that Bitcoin is a potential hedge for these indices. However, the conditional correlations are positive for bonds, natural gas, platinum, silver and food commodities such as corn and wheat implying that Bitcoin acts as an effective diversifier for these assets. Unlike, Panel A and B, the average correlation coefficients reported in Panel C, are positive which indicates that Tether moves along with stocks, bonds, crude oil, natural gas, non-energy and food commodities implying that Tether does not serve as a hedge for these markets, except for the government yield bonds (10 Y TCM) and clean energy stock markets for which the conditional correlations are negative.

To examine the effect of the COVID-19 pandemic on the dynamic conditional correlations, we focus on the two sub-periods. As shown in Table 5, the results on the hedging abilities of Gold, Bitcoin and Tether for each pair before the pandemic, are similar to that for the entire period. In other words, Gold can act as a hedge for stablecoin Tether, Stocks, bonds, clean energy and non-energy commodities as Platinum and Aluminium, whereas it is just a diversifier for Bitcoin, crude oil, natural gas and food commodities. However, Bitcoin serves as a diversification tool before the pandemic except for MSCI Stock Index, Eco and Soyabean (see Figure 4). As reported in Figure 5, the results on the hedging abilities of Gold, Bitcoin and Tether differ after the global pandemic. Table 5 shows that the average ADCC coefficients for Gold, Bitcoin and Tether pairs are lower than those during the entire period and before the pandemic. Most importantly, the conditional correlations are almost negative, suggesting that Gold can act as a hedge, not only for Tether, stocks, bonds and clean energy commodities, as for the entire period and before the pandemic, but also for non-energy commodities. Yet, the results after the pandemic reveal that Bitcoin can serve just as a diversifier for all the selected assets, except for the clean energy stock Index ERIX. This finding indicates that during the COVID-19 global pandemic, Bitcoin could lose its hedging ability against risk in stock markets, crude oil and clean energy. However, the results show that the estimated coefficients for Tether remain negative after the pandemic as for the entire period and before COVID-19. Interestingly, we find that the stablecoin Tether can act as a hedge against the bearish state of the MSCI Stock Index during the Coronavirus crisis.

4.2.2 Gold, bitcoin and tether as hedges and safe-havens

In order to re-evaluate and compare the hedging and safe-haven abilities of Gold, Bitcoin and Tether during periods of extreme volatility and assess whether those characteristics hold during the COVID-19 pandemic, we build on the ADCC results and we used the regression model specified in Equation (4). The coefficient estimates from the regression model (4) are reported in Table 6. The hedge column shows that the constant term for Gold, during the entire period, is almost significantly negative at the 1% level, implying that Gold provides a strong hedge for the daily returns of stocks, bonds, clean energy and metal, specifically, Platinum and Aluminium. However, Gold is no more than a diversifier against cryptocurrencies, fuel energy and food commodities. When considering the two sub-periods (see Tables 7 and 8), the results on the hedging role of Gold, before and after the pandemic, are similar to that during the full sample period, except Tether for which the coefficient of the constant term becomes negative and statistically significant. This finding suggests the strong ability of Gold to reduce the overall risk associated to uncertainty and adverse movements in stablecoins, stocks, bonds, clean energy and metals during the COVID-19 pandemic.

| 10% Q (c1) | 5% Q (c2) | 1% Q (c3) | Constant (c0) | |

|---|---|---|---|---|

| Bitcoin | −0.0202 | −0.0178 | −0.0081 | 0.0514*** |

| Tether | 0.0399*** | −0.0699 | 0.0579*** | 0.0744*** |

| MSCI | 0.0026 | −0.0068 | −0.0082*** | −0.0885*** |

| Barclays | −0.0045** | 0.0026 | −0.0048*** | −0.1571*** |

| 10 Y TCM | −0.0069*** | 0.0050*** | 0.0163*** | −0.2196*** |

| WTI | 0.0044 | 0.0078** | −0.0045 | 0.0461*** |

| GAS | 0.0010 | −0.0003 | −0.0001 | 0.0635*** |

| ECO | 0.0019 | 0.0083*** | −0.0101*** | −0.0276*** |

| ERIX | −0.0126*** | −0.0074*** | 0.0032** | −0.0733*** |

| Platinium | −0.0009 | 0.0028 | 0.0510*** | −0.0218*** |

| Silver | −0.0022 | −0.0068 | −0.0003 | 0.0668*** |

| Aluminium | −0.0013** | 0.0071** | −0.0008 | −0.0814*** |

| Corn | −0.0065 | −0.0026 | −0.0269*** | 0.1493*** |

| Wheat | 0.0183*** | 0.0180*** | 0.0089*** | 0.0106*** |

| Soyabean | 0.0029 | −0.0063 | −0.0164*** | 0.0882*** |

| Tether | 0.0342*** | 0.0137 | 0.0326*** | 0.1304*** |

| MSCI | 0.0308** | −0.0015 | 0.0211*** | −0.1224*** |

| Barclays | −0.0041 | 0.0104 | 0.0440*** | 0.0228*** |

| 10 Y TCM | −0.0083*** | −0.0124*** | −0.0083*** | 0.0295*** |

| WTI | −0.0063*** | −0.0007 | −0.0049*** | −0.0341*** |

| GAS | −0.0011 | 0.0038 | 0.0051*** | 0.0175*** |

| ECO | −0.0031 | 0.0041*** | −0.0014 | −0.1482*** |

| ERIX | 0.0008 | −0.0072*** | −0.0029** | −0.0040*** |

| Platinium | −0.0071*** | −0.0039 | −0.0087*** | 0.0576*** |

| Silver | −0.0041 | −0.0042 | 0.0160*** | 0.0260*** |

| Aluminium | −0.0092*** | 0.0014 | −0.0048** | −0.0129*** |

| Corn | −0.0196*** | −0.0033** | −0.0032** | 0.0425*** |

| Wheat | −0.0011 | −0.0063*** | −0.0043** | 0.0800*** |

| Soyabean | −0.0017** | −0.0086*** | −0.0077*** | −0.0148*** |

| MSCI | −0.0344 | −0.0677** | −0.0509*** | 0.0090 |

| Barclays | 0.0159 | −0.0403** | −0.0299*** | 0.0216*** |

| 10 Y TCM | 0.0014 | 0.0043 | −0.0601*** | −0.0220*** |

| WTI | −0.0050 | 0.0095** | 0.0285*** | 0.1711*** |

| GAS | 0.0224 | 0.0196 | 0.0443*** | 0.1754*** |

| ECO | 0.0087 | 0.0141 | 0.0218** | −0.0268*** |

| ERIX | 0.0279 | −0.0233** | 0.0433*** | −0.0867*** |

| Platinium | 0.0058 | −0.0013 | −0.0158 | 0.0707*** |

| Silver | 0.0181 | −0.0048 | −0.1007*** | 0.0786*** |

| Aluminium | 0.0230*** | −0.0226 | −0.0096 | 0.2515*** |

| Corn | 0.0643 | 0.0365*** | 0.0403*** | 0.2652*** |

| Wheat | 0.0013 | −0.0088** | 0.0045 | 0.0996*** |

| Soyabean | 0.0120 | −0.0271 | −0.0323*** | −0.1021*** |

- Note: This table presents the estimation results from the ADCC Equation for the full sample 02 August 2019 to 17 April 2020. Values in bold indicate statistical significance at the 1% and 5% levels. Gold/ Bitcoin is a diversifier against movements in the other index if c0 is weakly positive. Gold/Bitcoin is a weak hedge against movements in the other index if c0 is zero or a strong hedge if c0 is negative. Gold /Bitcoin is a weak safe-haven against movements in the other index if the c1, c2, or c3 coefficients are not significantly different from zero, or a strong safe- haven if these coefficients are negative.

| 10% Q (c1) | 5% Q (c2) | 1% Q (c3) | Constant (c0) | |

|---|---|---|---|---|

| Bitcoin | 0.0004 | 0.0000 | 0.0000 | 0.0509*** |

| Tether | 0.0344*** | −0.0753 | 0.0524*** | −0.0690*** |

| MSCI | 0.0130*** | 0.0000 | 0.0000 | −0.0880*** |

| Barclays | −0.0023 | 0.0000 | 0.0000 | −0.1568*** |

| 10 Y TCM | −0.0019 | 0.0000 | 0.0000 | −0.2246*** |

| WTI | 0.0083*** | 0.0117*** | −0.0006 | 0.0422*** |

| GAS | 0.0011 | −0.0005 | −0.0005 | 0.0631*** |

| ECO | 0.0000 | 0.0062** | −0.0121*** | −0.0256*** |

| ERIX | −0.0082*** | 0.0000 | 0.0029** | −0.0730*** |

| Platinium | 0.0007 | 0.0046 | 0.0000 | −0.0236*** |

| Silver | −0.0126*** | −0.0089*** | 0.0000 | 0.0646*** |

| Aluminium | −0.0016** | 0.0000 | 0.0000 | −0.0811*** |

| Corn | 0.0065*** | 0.0000 | −0.0277*** | 0.1501*** |

| Wheat | 0.0000 | −0.0034 | 0.0000 | 0.0771*** |

| Soyabean | 0.0000 | −0.0013 | 0.0000 | 0.0906*** |

| Tether | 0.0244*** | 0.0039 | 0.0228*** | 0.1401*** |

| MSCI | 0.0241 | 0.0000 | 0.0000 | −0.1240*** |

| Barclays | −0.0052** | 0.0000 | 0.0000 | 0.0224*** |

| 10 Y TCM | −0.0060*** | 0.0000 | 0.0000 | 0.0271*** |

| WTI | −0.0027*** | 0.0027*** | −0.0013 | −0.0376*** |

| GAS | −0.0009 | 0.0099*** | 0.0054*** | 0.0172*** |

| ECO | −0.0010 | 0.0062*** | 0.0006 | −0.1503*** |

| ERIX | −0.0052** | 0.0000 | −0.0039** | −0.0030*** |

| Platinium | −0.0085*** | −0.0053 | 0.0000 | 0.0591*** |

| Silver | −0.0001 | −0.0016 | 0.0000 | 0.0269*** |

| Aluminium | −0.0092*** | 0.0000 | 0.0000 | −0.0129*** |

| Corn | −0.0156*** | 0.0000 | −0.0048 | 0.0441*** |

| Wheat | 0.0000 | −0.0034 | 0.0000 | 0.0771*** |

| Soyabean | 0.0000 | −0.0121*** | 0.0000 | −0.0139*** |

| MSCI | −0.0544 | 0.0000 | 0.0000 | 0.0260*** |

| Barclays | −0.0088** | 0.0000 | 0.0000 | 0.0271*** |

| 10 Y TCM | −0.0108* | 0.0000 | 0.0000 | −0.0097 |

| WTI | −0.0135** | 0.0010 | 0.0200*** | 0.1796**** |

| GAS | −0.0031 | 0.0734*** | 0.0187*** | 0.2010*** |

| ECO | −0.0002 | 0.0051 | 0.0128 | −0.0178** |

| ERIX | −0.0399*** | 0.0000 | 0.0235** | −0.0669*** |

| Platinium | 0.0082 | 0.0011 | 0.0000 | 0.0682*** |

| Silver | 0.0757 | 0.0009 | 0.0000 | 0.0850*** |

| Aluminium | 0.0200*** | 0.0000 | 0.0000 | 0.2544*** |

| Corn | 0.1170*** | 0.0000 | 0.0367*** | 0.2688*** |

| Wheat | 0.0000 | −0.0057 | 0.0000 | 0.0965*** |

| Soyabean | 0.0000 | −0.0054 | 0.0000 | −0.0885*** |

- Note: This table presents the estimation results from the ADCC Equation for the sub-sample before the Pandemic. Values in bold indicate statistical significance at the 1% and 5% levels.

| 10% Q (c1) | 5% Q (c2) | 1% Q (c3) | Constant (c0) | |

|---|---|---|---|---|

| Panel A: GOLD | ||||

| Bitcoin | −0.0411*** | −0.0185 | −0.0089 | 0.0521*** |

| Tether | 0.0000 | 0.0000 | 0.0000 | −0.0817*** |

| MSCI | −0.0184*** | −0.0061 | −0.0075** | −0.0892*** |

| Barclays | −0.0064*** | 0.0030 | −0.0043*** | −0.1575*** |

| 10 Y TCM | 0.0000 | −0.0018 | 0.0094*** | −0.2128*** |

| WTI | 0.0000 | 0.0000 | 0.0000 | 0.0514*** |

| GAS | 0.0000 | −0.0014 | 0.0000 | 0.0641*** |

| ECO | 0.0000 | 0.0000 | 0.0000 | −0.0304*** |

| ERIX | −0.0168*** | −0.0070*** | 0.0000 | −0.0738*** |

| Platinium | 0.0000 | 0.0000 | 0.0487*** | −0.0195*** |

| Silver | 0.0071 | −0.0056 | −0.0035 | 0.0700*** |

| Aluminium | 0.0000 | 0.0014 | −0.0048** | −0.0129*** |

| Corn | −0.0193*** | −0.0015 | 0.0000 | 0.1483*** |

| Wheat | 0.0185** | 0.0000 | 0.0092*** | 0.0104*** |

| Soyabean | 0.0064 | −0.0103*** | −0.0128*** | 0.0847*** |

| Panel B: Bitcoin | ||||

| Tether | 0.0000 | 0.0000 | 0.0000 | 0.1172*** |

| MSCI | 0.0450*** | −0.0039 | 0.0187*** | −0.1200*** |

| Barclays | −0.0032 | 0.0098 | 0.0434*** | 0.0234*** |

| 10 Y TCM | 0.0000 | −0.0157*** | −0.0116*** | 0.0327*** |

| WTI | 0.0000 | 0.0000 | 0.0000 | 0.0291*** |

| GAS | 0.0000 | −0.0024 | 0.0000 | 0.0179*** |

| ECO | 0.0000 | 0.0000 | 0.0000 | −0.1453*** |

| ERIX | 0.0072*** | −0.0059*** | 0.0000 | −0.0053*** |

| Platinium | 0.0000 | 0.0000 | −0.0067*** | 0.0557*** |

| Silver | −0.0076** | −0.0063** | 0.0174*** | 0.0246*** |

| Aluminium | 0.0000 | 0.0014 | −0.0048** | 0.0129*** |

| Corn | −0.0231*** | −0.0012 | 0.0000 | 0.0404*** |

| Wheat | −0.0052 | 0.0000 | −0.0084** | 0.0841*** |

| Soyabean | −0.0004 | −0.0047*** | −0.0064*** | −0.0161*** |

| Panel C: Tether | ||||

| Bitcoin | 0.0000 | 0.0000 | 0.0000 | 0.1177*** |

| MSCI | −0.0033 | −0.0425 | −0.0258** | −0.0161 |

| Barclays | 0.0435*** | −0.0321 | −0.0216** | 0.0133 |

| 10 Y TCM | 0.0000 | 0.0213* | −0.0431*** | −0.0390*** |

| WTI | 0.0000 | 0.0000 | 0.0000 | 0.1595*** |

| GAS | 0.0000 | −0.0256 | 0.0000 | 0.1414*** |

| ECO | 0.0000 | 0.0000 | 0.0000 | −0.0393** |

| ERIX | 0.1022*** | 0.0028 | 0.0000 | −0.1129*** |

| Platinium | 0.0000 | 0.0000 | −0.0191*** | 0.0740*** |

| Silver | −0.0365*** | −0.0077 | −0.0914*** | 0.0694*** |

| Aluminium | 0.0000 | −0.0179 | −0.0049 | 0.2467*** |

| Corn | 0.0127 | 0.0413** | 0.0000 | 0.2605*** |

| Wheat | −0.0030 | 0.000 | 0.0000 | 0.1040*** |

| Soyabean | 0.0317** | −0.0429*** | −0.0126 | −0.1218*** |

- Note: This table presents the estimation results from the ADCC equation for the sub-sample after the Pandemic. Values in bold indicate statistical significance at the 1% and 5% levels.

Compared to Gold, the results on the hedging ability of Bitcoin against each asset under study during the entire period show that Bitcoin serves as a strong hedge against stocks, crude oil, clean energy and Platinum. Whereas, it is just a diversifier for the stablecoin Tether, bonds, natural gas, and non-energy commodities. The results of the two sup-periods provide evidence that the hedging properties of Bitcoin differ before and after the global crisis. Table 7 shows that before COVID-19, the constant terms are similar to those for the full period. However, the results on the hedging ability of Bitcoin after the pandemic are different from those before COVID-19. More precisely, Table 8 indicates that after the coronavirus, Bitcoin can act just as a hedge for stocks and clean energy indices. This finding argues that, after the pandemic, Bitcoin has no hedging ability against extreme down movements in the crude oil market WTI.

Regarding the stablecoin, the results for the full period and before the COVID-19 pandemic show that Tether acts as a hedge just for treasury bonds and clean energy stock markets. Nevertheless, Table 8 shows that after the pandemic, the constant term for MSCI becomes negative but not statistically significant, suggesting that Tether is a weak hedge against stock markets during the global pandemic. Overall, our findings are in line with the descriptive statistics of the dynamic conditional correlations discussed in the previous section. After analysing the hedging ability of Gold, Bitcoin and Tether, we focus on their safe-haven characteristics. During the entire period, the negative and significant quantile regression coefficients show that Gold can act as a strong safe-haven for stocks, bonds, clean energy index (ECO), and food commodities in the 1% quantile. However, the results differ between pre-and post-pandemic. For the period before the pandemic, Gold is just a strong safe-haven for Eco (−0.0121) and Corn (−0.0277). Interestingly, after the pandemic, Gold can serve as a safe-haven against stocks (− 0.0075) and bonds (− 0.0043) in the 1% and 10% quantile and against Aluminium (−0.0048) and Soyabean (−0.0128) at the 1% quantile.

Our findings also show that over the entire period, Bitcoin acts as a strong safe-haven against treasury bonds and WTI crude oil, ERIX, and non-energy commodities in the 1% and 5% quantiles of the return distribution. Whereas, in the normal period before the pandemic, Bitcoin serves as a strong safe-haven for the same assets in the 10% quantile. But most importantly, under the pandemic, Bitcoin has no safe-haven ability against stocks and crude oil and remains as a safe-haven just for treasury bonds, ERIX and non-energy commodities like platinum, Aluminium, Wheat and Soybean. The positive association between Bitcoin and energy commodities are more likely to be observed during the global pandemic. In fact, after COVID-19, energy commodities declined sharply and are in freefall, especially from the end of February 2020, thus, Bitcoin plunged and went hand-in-hand with the Coronavirus spread rate. Consequently, the safe-haven characteristics of Bitcoin towards adverse movements vanished in the period after the pandemic and Bitcoin is no more than a valuable diversifier for stocks. Our finding is consistent with the study of Conlon and McGee (2020).

Finally, the results show that during the full period, the stablecoin Tether serves as a strong safe-haven against stocks, bonds, Silver and Soyabean in the 1% quantile. However, before the virus, the safe-haven potential is quite limited and Tether acts as a strong safe-haven just for bonds, crude oil and the clean energy stock market, ERIX in the 10% quantile. Most importantly, after COVID-19, we find significant negative coefficients suggesting that Tether can act as a strong safe-Haven for stocks, bonds and metals in the 1% quantile and provides a weak safe-haven against Bitcoin losses in the 1%, 5% and 10% quantiles. A safe-haven in stablecoin during the pandemic may provide an additional benefit to investors beyond Gold to reduce the risk of extreme volatility in Bitcoin and stock markets. Thus, after COVID-19, the response of Gold, Bitcoin and Tether is not expected to be exactly the same against all the assets under study. In other words, the results during the global pandemic indicate that Bitcoin does not contribute to reducing risk and provides either weak or no safe-haven, even though it is resilient to crisis periods (Luther & Salter, 2017). The failure of Bitcoin to act as a strong safe-haven is due to the systematic risk of the coronavirus reflected in most financial markets.

Our overarching results reveal that the safe-haven effectiveness of Bitcoin is unstable over time which is consistent with the findings of Shahzad et al. (2019) and Smales (2019). However, Gold is the most promising hedge and safe-haven asset, as it remains robust during the current crisis of COVID-19 and thus exhibits superiority over Bitcoin and Tether. Our findings are useful for investors, portfolio managers and policymakers searching for the best asset among Gold, Bitcoin and stablecoins as an investment shelter to hedge against uncertainty and adverse movements in any of the under-analysis assets during the current pandemic.

4.3 Robustness check

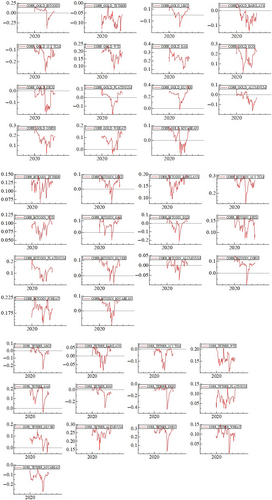

Regarding our limitations, we admitted that rolling window analysis is sensitive to the window size (Diebold & Yilmaz, 2012, 2014); therefore, a one-month window size was employed for the first wave of COVID-19. We also employed the window-rolling approach for a different size to see whether the previous results still hold or not. Figure 6 acknowledges the longer horizon to see the dynamic connectedness for all assets.

As seen in Figure 6, we also obtained the peak of the total spillover effect in the mid-March, when the official announcement of WHO was released that COVID-19 was Public Health Risk Emergency of International Concern (PHEIC) (Schell et al., 2020). Concomitantly, the level of connectedness increased significantly in March, while February exhibits a persistent and low level. We also confirmed that COVID-19 persistently provokes the connectedness return among these markets; therefore, Schell et al. (2020) indicate that COVID-19 is negatively associated with the stock returns at least for the last 30 days.

5 CONCLUSION & POLICY IMPLICATIONS

The ongoing COVID-19 pandemic has been devastatingly affecting the global financial markets and economy. So far, there is no consensus about the connectedness and volatility spillovers among various asset classes during the global pandemic and its effects on hedging and safe-havens. In response to this, this paper investigates the effects of the global COVID-19 crisis on the extreme connectedness spillovers among various asset classes and its implications on the traditional safe-havens, Gold and Bitcoin. In particular, we examine the effectiveness of Bitcoin and compare its hedging and safe-haven ability with Gold and Tether against stocks, bonds, energy commodities, non-energy commodities and clean energy stock markets. Our key findings lead us to conclude that the contagious effects in financial assets' returns significantly increased by almost two folds under COVID-19, indicating exacerbated market risk. The rolling window of interconnectedness among underlying asset classes showed that the total connectedness spiked in the middle of March, which is consistent with the time to perform the lockdown in the majority of countries and economies. The effect became more severe as WHO started to express concerns and peaked with the declaration of the Pandemic, confirming negative news effects.

Among the financial assets, crude oil exhibits the highest return connectedness to itself in the period before- and during the pandemic, the government yield bond returns share the same pattern with crude oil, leading to conclude that these assets are mostly affected by their endogenous factors than spillovers from other asset classes. In contrast, the other financial assets reduce their connectedness themselves after the COVID-19 crisis. When we look at the total return that these financial assets transmitted to the others, obviously, the aggregate spillover effects significantly increase in the post period. In terms of the safe-haven role of Gold and Bitcoin, the total spillover effects of these assets are marginal under the COVID-19 crisis. In contrast, in full-sample estimates, these spillover effects are significantly higher than in the COVID-19 pandemic. The Tether did not seem to be a safe-haven asset although there exists evidence of a decrease in the total spillover effect. On the whole, we conclude that the COVID-19 crisis could be a catalyst of contagious effects on the financial markets.

Finally, the results show that during the full period, the stablecoin Tether serves as a strong safe-haven against stocks, bonds, Silver and Soyabean. However, before the virus, the safe-haven potential is quite limited and Tether acts as a strong safe-haven just for bonds, crude oil and the clean energy stock market, ERIX. Most importantly, after COVID-19, our results lead us to conclude that Tether can act as a strong safe-Haven for stocks, bonds and metals and provides a weak safe-haven against Bitcoin losses. A safe-haven in stablecoin during the pandemic may provide an additional benefit to investors beyond Gold to reduce the risk of extreme volatility in Bitcoin and stock markets. Thus, after COVID-19, the response of Gold, Bitcoin and Tether are not expected to be the same against all the assets under study. In other words, the results during the global pandemic indicate that Bitcoin does not contribute to reducing risk and provides either a weak or no safe-haven, even though it is resilient to crisis periods. The failure of Bitcoin to act as a strong safe-haven is due to the systematic risk of the coronavirus reflected in most financial markets.

Regarding limitations, our study only looked at the first wave of COVID-19 when new information was released that brought a lot of uncertainty and fear to the investors. Therefore, we observed unprecedented shocks in the markets. The second and third waves can be considered to see the differences and similarities when the outbreaks happened. Furthermore, the extended sample set with novel assets such as companies with advanced technologies (Artificial Intelligence) might be a good anchor for extreme volatility (Huynh et al., 2020). Nevertheless, the supplementary features of media and news coverage with these financial assets could offer different insights into the in-depth analysis of connectedness (Ambros et al., 2021).