Insider trading, gender diversity within the board room, CEO pay gap, and stock price crash risk

The authors would like to thank the anonymous reviewers and editor for constructive criticism of the manuscript. We also sincerely thank Ngoc Vuong at City of London School for Girls for her diligent proof reading of this paper.

Abstract

This paper investigates the impact of insider trading and managerial attributes on future stock price crashes. We conduct a series of regressions addressing the managerial attributes determinants of future stock price crashes including gender diversity, CEO age, and CEO power (measured by CEO pay disparity, CEO tenure and CEO duality). Our empirical results reveal a positive association between insider purchases and price crash risk. This implies that other than compensation and career concerns, insiders hoard bad news to fulfil their trading incentives. Our positive coefficients of insider sales also suggest that insider sellers can assess inside information promptly and anticipate shortly before the crashes. We further document that the presence of female directors on boards can mitigate stock price crash risk. However, firms with powerful or younger Chief Executive Officers are more likely to experience crashes. Overall, we highlight the importance of corporate managerial attributes in dealing with information asymmetry problems.

1 INTRODUCTION

A considerable body of literature on stock price crash risk has emerged over the past 15 years (Jin and Myers, 2006; Hutton et al., 2009; Kothari et al., 2009; Andreou et al., 2017). Prior research has highlighted the crucial role that corporate top management teams play in protecting shareholders' wealth. According to Callen and Fang (2013) and Kim and Zhang (2016) firms with high agency problems are more likely to experience stock price crashes. Insiders have a strong incentive to exploit information asymmetries by hoarding bad news (Ball, 2009; Graham et al., 2005; Kothari et al., 2009). However, once the negative information about firm performance has been withheld and accumulated for a long time period it reaches an overwhelming level, which is called the tipping point. Once this occurs all the bad news is disclosed in its entirety, which leads to significant stock price crashes (Hutton et al., 2009; Jin & Myers, 2006; Kim & Zhang, 2016).

Several works of literature find that corporate managers are willing to give up their firm economic value and reduce influences on stock price by managing corporate financial reporting perception, in order to avoid the negative impacts on their compensation and careers (Dichev et al., 2013 and Graham et al., 2005). Furthermore, a large body of research discovers that with separation of ownership and control, corporate insiders have an advantage over other investors in gaining profits through trading their shares using the privileged information (Elliott et al., 1984; Fernandes & Ferreira, 2009; Jaffe, 1974). Other studies document that firms with different manager characteristics have different levels of agency risk (Karamanou & Vafeas, 2005; Klein, 2002; Masulis et al., 2007).

Prior research documents that insiders are believed to possess superior information about firm performances and future prospects (Ke et al., 2003; Piotroski & Roulstone, 2005). The opportunistic insiders trade on unpublished price-sensitive news, which motivates the share price to be further volatile than when other investors trade (Jaffe, 1974; Lorie & Niederhoffer, 1968). They have incentives to conceal bad news and release good news to opportunistically gain profits from insider purchases. Moreover, insiders are believed to be able to anticipate the likelihood of a future crash. This is because they are inclined to sell stocks on their pre-published information on future negative events, which cause a plunge in the stock prices (Agrawal & Cooper, 2015; Seyhun & Bradley, 1997; Skaife et al., 2013 and Thevenot, 2012). Therefore, it is possible that insider abnormal returns are expected to be positively correlated with future price crash risk.

With respect to gender diversity on the board, previous evidence suggests that female directors contribute to the board's efficiency at both the individual and team levels. At the individual level, Adam and Ferreira (2009) show that female directors are more responsible and relatively have higher meeting attendance rates. Price (2012) finds that female directors are more disinclined to risk than male directors. The study by Cumming et al., (2015) reports that firms with more gender-diverse boards have fewer incidents of corporate fraud and less information asymmetry. At the team level, researchers demonstrate that female directors employ a leadership style characterized by trust and cooperation which encourage directors to exchange information among the board (Agarwal et al., 2016; Croson & Gneezy, 2009). Moreover, boards with gender diversity have enhanced communication between directors which increases board efficiency (Adam and Kirchmaier, 2016). Collectively, gender diversity on boards of directors can contribute to the transparency enhancement of firms Gul et al. (2011). Gender diversity can also significantly influence the potential reputation risk (Kaur & Singh, 2017; Zhang et al., 2013). Therefore, gender diversity is predicted to be negatively related to price crashes.

Regarding the Chief Executive Officer (CEO) attributes, larger pay disparity and CEO, chairman duality represent a higher ability to capture managerial power (Bebchuk et al., 2011; Chen et al., 2013; Fama & Jensen, 1983), to control information disclosure and delay negative news. Therefore, we hypothesize a positive relationship between these variables and price crash risk. Conversely, we expect negative impacts of CEO age and tenure on the crash risk as older and longer tenure CEOs are unlikely to risk their career in order to pursue their immediate benefits (Gibbons & Murphy, 1992; Kasnik and Lev, 1995).

We test our hypotheses using a sample of 354 largest firms listed in 8 markets including the United Kingdom, United States, Canada, Australia, Germany, France, the Netherlands and Belgium during 2008–2016. We use two measures of stock price crash risk, the negative conditional skewness of firm-specific returns and down-to-up volatility. We examine the influence of average insider returns, percentage of female directors, CEO pay slice, CEO duality, CEO age and CEO tenure on future crash risk. In order to construct the empirical model, we estimate insider abnormal returns using data sets of 7377 purchase and 15,933 sale transactions made by insiders during the period from 2008 to 2016.

Overall, our results are consistent with our proposed hypotheses. We report empirical evidence that corporate insider buyers earn significant returns on average for 1 year preceding the firm-specific stock price crashes. Whereas, insider sale returns are positively associated with stock price crash risk. These implications suggest that insiders can earn profits from their purchases by hoarding bad news, and they also can assess and anticipate the crashes to avoid losses by selling stocks shortly before crashes. We also discover that the presence of female directors contributes to mitigating the likelihood of stock price crashes. We further document a positive and significant relationship between CEO power (CEO pay slice and CEO duality) and the risk of price crash. The positive relationship between CEO power and price crash risk is significant after controlling for accounting accruals. Furthermore, we observe a negative relationship between CEO age and crash risk. The results are consistent with prior literature (Gibbons & Murphy, 1992; Jin & Myers, 2006), implying that younger CEOs have more incentives to hoard bad news which leads to potential future crashes. Only the coefficient of CEO tenure does not support our hypothesis. A positive coefficient of CEO tenure suggests that firms with longer tenure CEOs are more likely to experience stock price crashes. Although not consistent with our proposed hypothesis, it supports the opinion on managerial power that the large pay disparity between CEO and other senior executives suggests the entrenchment of incumbent CEO with longer tenure (Bebchuk and Fried, 2004; Bebchuk et al., 2011; Chen et al., 2013).

This research contributes to the literature studying the determinants of firm-specific stock price crash in several ways. Prior studies (Dichev et al., 2013; Graham et al., 2005) argue that managers hoard bad news and manage corporate financial reports to avoid negative impacts on their compensation and careers. Our analysis shows that insiders have incentives to hide bad news not only for their compensation and career concerns but also for their personal trading purposes. Second, our evidence contributes to the literature of Chen et al. (2001) that the corporate managerial attributes, including gender and age diversity in the board and CEO pay disparity and CEO duality, also strongly and economically relates to stock price crash risk. This result makes a strong contribution to the research investigating which corporate managerial attributes affect outside investors' wealth.

The remainder of the paper is constructed as follows: The next section discusses the literature and our hypothesis development. Section 3 describes our research design, variable measurements, and sample selection. Section 4 reports our empirical findings. Finally, Section 5 concludes the study.

2 LITERATURE REVIEW AND HYPOTHESIS DEVELOPMENT

Managers or corporate insiders often have higher levels of access to private information about firm performances, values, and future prospects than outside investors. Managers' decisions on information disclosure are governed by a variety of incentives, like the costs and benefits of disclosure which are not perfectly aligned with those of outsider investors (Healy & Palepu, 2001). As evidenced in the study of Kothari et al., (2009), managers, on average, tend to delay the release of bad news to outside investors. A number of studies suggest this inclination arises from career concerns (as in Baginski et al., 2018), personal wealth (as in Andreou et al., 2017), motivation to maintain self-esteem (as in Ball, 2009) and equity-based compensation (as in Kim et al., 2011b). However, the amount of negative information hoarded by managers is limited (Jin and Myer, 2006). When the withheld bad news accumulates and crosses over a certain threshold level known as a tipping point, corporate insiders are forced to disclose all the withholding bad news at once, which in turn results in a stock price crash (Hutton et al., 2009; Jin & Myers, 2006).

A large body of literature finds that with separation of ownership and control, corporate insiders have an advantage over other investors to gain profits through trading their shares using the privileged information (Elliott et al., 1984; Fernandes & Ferreira, 2009; Jaffe, 1974). Other studies document that firms with different manager characteristics have dissimilar levels of agency risk (Karamanou & Vafeas, 2005; Klein, 2002; Masulis et al., 2007; Xie et al., 2003). In a recent study, He et al. (2021) examine the cross-sectional variation in the association between insider sales and future stock price crash risk. Their research does not take into account the impact of insider purchases when measuring insider trading. It defines insider trading as insider sales if the net insider sales (insider sales minus insider purchases) are positive and 0, otherwise. This may ignore the important events that associate with the future stock price crash risk. In another study on the relationship between board diversity and stock price crash risk, Jebran et al. (2020) shows that firms with greater board diversity are connected with a lower risk of future stock crash. However, their results may be biased by not including the impacts of insider trading on stock crash risk, when concluding that diverse boards can reduce bad-news hoarding. In order to fill this void, we investigate the impacts of both insider purchases and sales as well as insider attributes on stock price crash risk.

This section discusses the association between insider trading and future stock price crash risk, the connection between stock price crash risk, insider gender diversity, and CEO attributes.

2.1 The association between insider trading and future stock price crash risk

Corporate managers tend to release good news and conceal bad news (as documented in Kothari et al., 2009) because of their job security (as in Baginski et al., 2018) and personal wealth (as in Andreou et al., 2017). As insiders with the privilege of access to private and price-sensitive information of the firm (Elliott et al., 1984; Jaffe, 1974), corporate managers can earn profits by purchasing their stocks before stock price increases and selling their shares prior to stock price crashes. Insider trading purchases (sales) trigger stock prices to rise (fall) after announcements.

Corporate insiders have incentives to extract insider trading returns by purchasing stocks before disclosing positive information and hiding negative news to maintain the value of their purchased stocks. Early researchers document that opportunistic insiders trade on unpublished price-sensitive news, which motivates the share price to move more than when other investors trade (see Jaffe, 1974; Lorie & Niederhoffer, 1968 among others). Outside investors believe that insiders possess superior news about firm performances and future prospects (Ke et al., 2003; Piotroski & Roulstone, 2005 among others). Therefore, corporate insiders have an incentive to conceal negative news and reveal positive news to opportunistically gain profits from their purchases. As a result, their share prices increase and gradually turn out to be overvalued (Hutton et al., 2009; Jin & Myers, 2006; Kim & Zhang, 2016). When this amount reaches a certain tipping point, managers can no longer hide the bad news. The sudden disclosure of accumulated negative news in turn increases the likelihood of extreme negative outliers in the stock return distribution that leads to a price crash in the future (see Hutton et al., 2009; Jin & Myers, 2006).

Similarly, corporate directors have incentives to earn profits or avoid losses by selling their stocks before a plunge in stock prices causes a stock price crash. Fidrmuc et al., 2006 argue that insiders trade more effectively by timing their informative transactions, as they often sell stocks after the price has increased. Even though it is impossible for managers to foresee the tipping point at which a stock price crash occurs, as insiders with the privilege to possess different kinds of inside information about the firm, they are reasonably able to anticipate the likelihood of a future crash. Several studies report that insiders tend to sell stocks on their pre-published information of future negative events, which caused a plunge in stock prices (Agrawal & Cooper, 2015; He et al., 2021; Seyhun & Bradley, 1997; Skaife et al., 2013 and Thevenot, 2012). Seyhun and Bradley (1997) argue that a vast proportion of insiders sell stocks prior to the date of bankruptcy. Skaife et al., (2013) evidence that insiders earn significant profits from their share sales before disclosures of material internal control weakness. Thevenot (2012) and Agrawal and Cooper (2015) find that relatively more shares are sold by insiders before the revelation of accounting irregularities. In the same vein, a recent study, (He et al., 2021), examines the cross-sectional variation in the crash-risk-based insider sales, and documents a positive association between insider sales and future stock price crash risk.

Since the timing of insider trades plays a key role in insider's strategy, timing of insider purchases and sales tends to be different. Marin and Olivier (2008) argue that insider trading occurs preceding large movements in stock prices. They show corporate managers sell their stocks in the far past preceding crashes, and purchase shares in the near past preceding the jumps in prices. Ke et al. (2003) report that insider sales increase three to nine quarters prior to a break in the string of continuous increases in a firm's quarterly earnings. However, as discussed above, insiders are reasonably able to anticipate the stock price crash risk. Thus, they tend to sell stocks prior to large drops in stock prices. Insiders release good news and withhold bad news as long as possible, in order to extract returns from their purchased stocks. Therefore, this purpose accelerates the insiders' inclination to buy stock long before the price crash.

Collectively, the above discussion suggests that insider purchases and insider sales are both signals for future stock price crashes. Insider purchases are predicted to positively affect stock price crash risk. Accordingly, we formulate our first hypothesis as follows:

Hypothesis H1.Insider trading returns are positively associated with stock price crash risk.

2.2 The relationship between insider gender diversity and stock price crash risk

There is widespread literature on stock price crash risk, however, only a few studies show the association between insider diversity and stock price crash risk (Andreous et al., 2016; Yeung & Lento, 2018). Although the determinants of stock price crashes have been extensively studied, the evidence of the relationship between board diversity and crash risk is still rare. Insider diversity or board diversity is defined as the varied combination of characteristics and attributes in a board (Milliken & Martins, 1996; Walt & Ingley, 2003). A study by Carter et al., (2008) document that firms with a more diverse board can strengthen the monitoring of management. These firms tend to have lower levels of information asymmetry, agency costs and higher reputation (Gul et al., 2011; Upadhyay & Zeng, 2014). Thus, diverse insiders provide firms with opportunities to extend their networks helping them to reach their goals and make better decisions (Ayuso & Argandoña, 2009; Williams & O'Reilly III, 1998), therefore, lowering the risk of stock price crash.

There are several academic studies supporting the argument for the association between gender diversity on boards and crash risk. Gul et al. (2011) argue that gender diversity on boards of directors can increase information efficiency and mitigate the information asymmetry levels of firms. They also argue that gender diversity can contribute to the transparency enhancement of firms. In addition, prior studies (Kaur & Singh, 2017; Zhang et al., 2013) show that gender diversity on boards significantly influence the potential reputation risk. The number of female directors in a firm is positively associated with the corporate image and reputation. Chen et al., (2017) also argue that female managers are less likely to risk their firm reputation by avoiding taxes. Other studies suggest that firms with gender-diverse boards have more effective corporate governance and higher corporate valuations (Adams et al., 2009; Kim & Starks, 2016). Adams and Kirchmaier (2016) document a positive impact of female executives on technology-listed firms.

Some researchers state that female directors contribute to the board's efficiency at both individual and team levels. At the individual level, Adam and Ferreira (2009) show that female directors are more responsible and relatively have higher meeting attendance rates. Price (2012) discovers that females are more disinclined to take risks than male directors. The study by Cumming et al., (2015) report that firms with more gender-diverse boards have fewer incidents of corporate fraud and less information asymmetry. At the team level, researchers demonstrate that female directors employ a leadership style characterized by trust and cooperation, which encourage directors to exchange information among the board (Croson & Gneezy, 2009; Agrawal et al., 2015). Moreover, boards with gender diversity have better communication between directors which increases board efficiency (Adam and Kirchmaier, 2016).

Collectively, these studies suggest that gender diversity within boardrooms promotes firm transparency, increases board efficiency, improves corporate reputation and reduces information asymmetry. Therefore, we expect that greater gender diversity on boards can lead to less stock price crash risk. Our second hypothesis is as follows:

Hypothesis H2.The gender diversity on corporate insiders is negatively and significantly associated with stock price crash risk.

2.3 The impact of CEO attributes on stock price crash risk

Research on the impacts of CEO attributes on firm the risk level of stock price crash is sporadic and fragmented with various researchers examining different aspects, for instance, the study of the impact of CEO age on price crash risk by Andreou et al., (2016), and the study of the impact of CEO overconfidence on price crash risk by Kim et al., (2016). CEO pay disparity can also play a crucial role in corporate performance and shareholder wealth. Under managerial power theory, CEO pay disparity reflects the CEO's ability to capture the pay process. Larger CEO pay disparity represents a higher managerial power (Bebchuk et al., 2011; Chen et al., 2013). Adams et al. (2005) find that firms with more powerful CEOs have lower performance given that the CEO has the power of being a founder of the firm. Daily and Johnson (1997) suggest that CEOs with enhanced power can possess sufficient discretion to pursue their personal objectives which are inconsistent with outsiders' wealth maximization.

Other research states that powerful CEOs can influence board decisions in order to receive significantly higher bonuses, or undertake majority merger and acquisition transactions, which leads to negative reactions on market price. Recent studies report that powerful CEOs tend to use earnings management in order to achieve their purposes (Morse et al., 2011; Friedman, 2014; Feng et al., 2011). Morse et al., (2011) document that powerful CEOs tend to influence boards to produce better performing measures, thereby, promoting their incentives. Friedman (2014) demonstrates that powerful CEOs can potentially pressure their Chief Finance Officers to provide biased measures of firm performance in order to increase compensation. Feng et al., (2011) document that powerful CEOs tend to involve in accounting manipulation. Given the previous literature, we argue that CEOs with higher power can withhold bad news from outside investors to pursue their personal purposes which, can increase the likelihood of stock price crash.

Second, this study argues that CEO duality is positively associated with crash risk because it magnifies managerial incentives, and the ability to manipulate financial reports and hide bad news from outside investors. According to Fama and Jensen (1983), CEO duality based on agency theory emphasizes the agency tension between managers and investors which can lead to agency problems. Davidson et al. (2004) document that a dual CEO usually has greater expectations on firm performance than others and therefore this CEO has extra incentive to veil bad news and release good news. Furthermore, they argue that dual CEO has greater power to control the firm accounting disclosures and hide negative information.

Third, there is mixed evidence of the relationship between CEO tenure and stock price crash risk. Simsek (2007) argues that short tenure can lead to uncertain ability and deficient firm-specific knowledge and experience of CEOs. Therefore, this puts pressure on such CEOs to defend their careers by hoarding bad news. Conversely, Graham et al. (2017) and Kasnik and Lev (1995) report that powerful CEOs are more difficult to be replaced solely due to poor firm performance because they try to mitigate litigation risk by disclosing bad news. Jenter and Kanaan (2015) argue that CEOs with longer tenure should have proven their ability in both good and bad times, hence, the longer tenure decreases the likelihood of a price crash. Therefore, we expect a negative relationship between CEO tenure and stock price crash.

Finally, prior studies show that younger CEOs are more likely to conceal negative information to avoid concerns on their wealth and career (Gibbons & Murphy, 1992; Jensen & Meckling, 1976; Jin & Myers, 2006). Jensen and Meckling (1976) argue that the levels of CEO pay-performance sensitivity are related to CEOs' ages. Gibbons and Murphy (1992) suggest that the personal wealth of younger CEOs can be affected more by the disclosure of bad news about firm performance because their compensation will be set at a corresponding level (lower level), which is costlier for younger CEOs across their career. As such, younger CEOs have higher motivation to veil bad information. The amount of bad information hoarded is limited (Jin & Myers, 2006). In the long run, when all the withheld bad news accumulates and crosses a tipping point, managers are forced to disclose all bad news at once. This leads to a price crash (Hutton et al., 2009; Jin & Myers, 2006). Thus, firms with younger CEOs may experience more stock price crashes. Taking the above discussions together, we propose our third hypothesis as follows:

Hypothesis H3a.The higher the CEO pay gap or/and duality, the higher the future stock price crash.

Hypothesis H3b.The higher the CEO age or/and CEO tenure, the lower the risk level of future stock price crash.

3 DATA SAMPLE AND RESEARCH DESIGN

Our paper aims to examine insider trading in the eight largest stock markets (by capitalization of listed firms), namely the US, UK, Canada, France, Germany, Australia, the Netherlands and Belgium. These are the developed countries where the level of information asymmetry is relatively lower and insider trading regulations are more intensive than the emerging markets. Regarding the country selection, initially, many other countries were considered, however, due to the lack of data for either insider transactions or the fundamental information of the firms, we had to exclude them. Cline et al. (2021) argue that individualistic cultured countries which emphasize personal freedom and achievements, regulate insider trading activities more intensely, while Aussenegg et al. (2018) show that insiders in the countries with lower Insider Trading Enforcement (ITE) index can earn higher abnormal returns. Furthermore, investigating the emerging markets may be biased because more volatile markets could be caused by mixed events. Du and Wei (2004) state that the Chinese and Russian markets, respectively, are 350% and 650% as volatile as the US market. Therefore, investigating the association between insider trading and stock price crash risk in the eight developed markets may be a distinct contribution to the literature.

3.1 Dependent variables

3.2 Independent variables

3.2.1 Measure of insider trading profitability

3.2.2 Measure of insider gender

In this study, we define insiders as executive and non-executive members of the board. The measure of gender diversity is defined as the number of female executives divided by the total number of executives of a firm. We hypothesize that the gender diversity of corporate insiders is negatively and significantly associated with stock price crash risk.

3.2.3 Measures of CEO attributes

Our main variables representing the CEO attributes include CEO power (CEO's pay disparity, tenure and duality) and CEO age. The first measure of CEO power is the CEO pay gap used by Bebchuk et al. (2011), defined as the ratio of the total CEO compensation to the sum of total compensation of top five executives in the top management team. Executive pay usually includes both cash (salary and bonus) and long-term incentives. Our study focuses on cash compensation for several reasons. First, cash compensation is easy to calculate and is the measure selected in previous studies of executive compensation structures (Shen et al., 2010; Bognanno, 2001; Eriksson, 1999). From the managerial power perspective, CEO pay disparity reflects the relative power of the CEO within the top management team (Finkelstein, 1992). From tournament theory, it indicates the relative size between the top and the second prize (Rosen, 1986). Second, we measure CEO tenure using the natural logarithm of the number of years that the CEO has held the position in a firm. We compute CEO duality using a binary variable which equals 1 when the positions of CEO and Chairman are held by the same person, and equals 0 otherwise. Finally, we calculate the CEO age variable by taking natural logarithms of the CEO's age.

3.2.4 Other control variables

A set of control variables are used as potential predictions of stock price crash risk including board characteristics and firm characteristics. Regarding board characteristics, we control for three widely used measures of board features namely board size, CEO turnover and CEO retirement. We control for Board size which is measured as the natural logarithm of the total number of directors plus 0.1. Andreou et al. (2016) find a negative association between board size and stock price crash risk. We also control for CEO turnover using a binary variable that is equal to 1 when there is a change in a firm's CEO in the year t and equals 0 otherwise. Another board characteristic variable is CEO retirement, which is captured using a binary variable that is equal to one when the CEO age is close to retirement (i.e., at age of 64 and 65), and zero otherwise. Ali and Zhang (2015) argue that earnings overstatement increases when CEO retirement is going to occur. The variable CEO age is calculated as the natural logarithm of CEO age.

In terms of firm characteristics following Chen et al. (2001) and Hutton et al. (2009), we control for firm attributes using firm size, firm growth, leverage and accruals. We define firm size as the natural logarithm of total assets, firm growth as the ratio of the market to the book value of equity and firm leverage as the firm's total liabilities divided to total assets. Finally, we follow Murphy and Zimmerman (1993) using accounting accruals defined as the difference between accounting earnings and cash flows. Accounting accruals are used as a proxy for the portion of earnings over which managers can exercise the most discretion. The prediction on managerial discretion suggests that managers may take action by increasing accounting earnings, thereby increasing the likelihood of stock price crash.

3.3 Model

| Variables | Definitions | |

|---|---|---|

| Stock price crash risk: | ||

| NCSKEW | Negative skewness | The negative of the third moment scaled by the standard deviation of firm-specific weekly returns during the financial year. |

| DUVOL | Down-to-up volatility | The natural-logarithm of the ratio of the standard-deviations of the down-week of firm-specific weekly returns. Divided by the standard-deviations of the up-week weekly returns. |

| Insider trading | ||

| ARET | Average abnormal return | Measured by weighted mean of total insider returns made in a year. |

| ARET_n | Average abnormal return with window n-day | The average insider returns for different windows of n-day representing 60, 120 and 180-day. |

| INSVOL | The insider trading volume | The natural logarithms of insider trading volumes plus one |

| Managerial attributes: | ||

| FDIR | Percentage of female directors | The number of female executives divided by total number of executives of a firm. |

| CPS | CEO pay slice | The ratio of the total CEO compensation to sum of total compensation of top five executives in the top management team. |

| TENURE | CEO tenure | The natural logarithm of the number of years that the CEO has held the position in a firm. |

| DUAL | CEO duality | Equals 1 when the positions of CEO and Chairman are held by the same person, and zero otherwise. |

| CEOAGE | CEO age | The natural logarithms of CEO's age |

| Control variables: | ||

| BOARDSIZE | Board size | Measured as the natural logarithm of total number of directors plus 0.1. |

| TURNOVER | CEO turnover | Equal to 1 when there is a change in a firm's CEO in the year t and zero otherwise. |

| RETIRE | CEO retirement | Equal to 1 when the CEO age is close to retirement (i.e., at age of 64 and 65). |

| FSIZE | Firm size | The natural logarithm of total assets. |

| ACCRUALS | Accounting accruals | The difference between accounting earnings and cash flows. |

| LEV | Firm leverage | The firm's total liabilities scaled to total assets. |

| MB | Market to book value | The ratio of the market value to the book value of equity. |

3.4 Sample selection and descriptive statistics

3.4.1 Sample selection

We collected insider transactions and managerial attributes, including executive gender, CEO age, tenure, CEO duality, etc. from the Bloomberg database (2020). Stock prices, value weighted indices, firm characteristics and other accounting data are drawn from Refinitiv DataStream Advance (2020). Our sample covers the nine-year period from 2008 to 2016, the period for which insider trading data is most available. We start with 23,310 insider transactions of 360 non-financial firms listed in the major indices that represent the largest publicly owned companies based in eight developed markets namely the United Kingdom (FTSE100), United States (DJIA), Canada (TSX60), Australia (ASX50), Germany (DAX), France (CAC40), the Netherlands (AEX), and Belgium (BEL20).

We then apply the following criteria. First, we exclude the non-financial firms and the firms that have no insider transactions. Second, the measure of CEO pay disparity requires annual compensation information for the top five executives. If the information of one executive is missing, the calculation of the managerial pay disparity may be misleading. When this occurs, the compensation information of the whole executive team for that year is eliminated. Third, if the stocks are cross-listed on more than one market, we only keep the data of the firms in their primary markets. For example, Royal Dutch Shell is dual listed in both London and Amsterdam, data in LSE is kept and the other is deleted. Finally, we include not only current listed stocks but also stocks of firms that were de-listed at some point during the sample period. The final criteria is to ensure that our dataset is free of any potential survivorship bias. As a result of the screening process, our sample includes 19,745 insider transactions from 295 firms. After calculating average abnormal returns using equation (5), our final sample contains a total of 2655 firm-year observations constructed from 19,745 insider transactions, in 295 firms over a nine-year period (2008 to 2016).

Table 2 summarizes the sample and the insider transactions collected for each country and the sample after filtering. The table shows that the market capitalisations of these firms represent largely the total market capitalisation of all firms listed in these countries.

| After filtering data | ||||||

|---|---|---|---|---|---|---|

| Country | Index | Number of constituents | % Total market cap | Initial insider transactions from databases | Number of firms | Insider transactions |

| U.K | FTSE 100 | 100 | 62.24% | 5621 | 90 | 4961 |

| U.S | DJIA | 30 | 28.35% | 3619 | 26 | 3120 |

| Australia | ASX50 | 50 | 51.50% | 3232 | 42 | 2810 |

| Canada | TSX60 | 60 | 72.26% | 4120 | 48 | 3525 |

| Germany | DAX | 30 | 58.53% | 1923 | 23 | 1529 |

| France | CAC40 | 40 | 67.28% | 2308 | 28 | 1665 |

| Belgium | BEL20 | 20 | 66.31% | 970 | 16 | 880 |

| Netherlands | AEX | 30 | 79.53% | 1517 | 22 | 1255 |

| Total | 360 | 23.310 | 295 | 19.745 | ||

- Source: Bloomberg, 2020.

3.4.2 Descriptive statistics

Table 3 presents the descriptive statistics of crash risk measures, insider trading, managerial attributes and the control variables. The Table reports each variable's statistics including the number of observations, mean value, standard deviation, minimum and maximum values, 25th quartiles and 75th quartiles. The mean values of the future crash risk variables in year t are 0.005 and 0.90 for NCSKEW and DUVOL, respectively, which are comparable with prior studies (e.g. Kim et al., 2011a). The mean values of insider purchase returns for three windows (60, 120 and 180-day) at t−1 are recorded as positive values of 0.59, 1.50 and 1.55 respectively, while the average insider sale returns for the three windows are negative with values of −1.14, −2.13 and − 3.02 respectively. The figures suggest that insider buyers earn significantly higher profits than insider sellers.

| Variables | N | Mean | St. dev. | Min | Pctl (25) | Pctl (75) | Max |

|---|---|---|---|---|---|---|---|

| Stock price crash risk at t | |||||||

| NCSKEW | 2416 | 0.005 | 0.015 | −0.065 | −0.004 | 0.011 | 0.137 |

| DUVOL | 2416 | 0.090 | 0.226 | −0.840 | −0.045 | 0.204 | 1.918 |

| Insider returns for purchase sample ARET_n at t−1 | |||||||

| ARET_60t−1 | 2448 | 0.590 | 8.731 | −54.835 | −1.807 | 2.528 | 72.646 |

| ARET_120t−1 | 2448 | 1.505 | 14.984 | −82.873 | −2.106 | 4.293 | 168.195 |

| ARET_180t−1 | 2448 | 1.546 | 19.860 | −97.782 | −3.692 | 5.507 | 220.018 |

| Insider returns for sale sample ARET_n at t−1 | |||||||

| ARET_60t−1 | 2439 | −1.138 | 7.603 | −51.630 | −3.796 | 0.868 | 82.229 |

| ARET_120t−1 | 2439 | −2.125 | 12.727 | −121.966 | −6.821 | 1.461 | 111.913 |

| ARET_180t−1 | 2439 | −3.016 | 17.149 | −158.437 | −9.855 | 2.133 | 128.840 |

| Managerial attributes at t−1 | |||||||

| FDIRt−1 | 1925 | 0.108 | 0.119 | 0.000 | 0.000 | 0.182 | 0.909 |

| CPSt−1 | 1946 | 0.520 | 0.211 | 0.014 | 0.375 | 0.631 | 1.000 |

| CEOAGEt−1 | 1980 | 54.183 | 5.901 | 32.00 | 50.00 | 58.00 | 81.00 |

| TENUREt−1 | 2132 | 5.714 | 5.338 | 0.080 | 2.000 | 7.580 | 42.000 |

| DUALt−1 | 2269 | 0.188 | 0.391 | 0.000 | 0.000 | 0.000 | 1.000 |

| Control variables | |||||||

| BOARDSIZEt−1 | 2335 | 11.457 | 3.443 | 3.000 | 9.000 | 13.000 | 25.000 |

| TURNOVERt | 2070 | 0.132 | 0.339 | 0.000 | 0.000 | 0.000 | 1.000 |

| RETIREt−1 | 1980 | 0.032 | 0.176 | 0.000 | 0.000 | 0.000 | 1.000 |

| FSIZEt−1 | 2356 | 9.508 | 1.346 | 4.440 | 8.601 | 10.448 | 13.381 |

| ACCRUALSt−1 | 2424 | 0.003 | 0.077 | −0.930 | −0.021 | 0.032 | 0.576 |

| LEVt−1 | 2383 | 25.265 | 15.351 | 0.000 | 14.684 | 35.388 | 93.779 |

| MBt−1 | 2323 | 3.492 | 9.077 | 0.053 | 1.302 | 3.600 | 315.567 |

| Alternative variables used for additional analyses | |||||||

| INSVOLBuy,t | 2448 | 9.706 | 2.236 | 1.099 | 8.292 | 11.078 | 17.456 |

| INSVOLSell,t | 2439 | 11,934 | 1.984 | 3.932 | 10.871 | 13.260 | 16.760 |

- Note: This Table reports descriptive statistics (i.e., Number of observations, mean, standard deviation, minimum, 25th percentile, 75th percentile and maximum) for the sample. The variable definitions are summarized in Table 1.

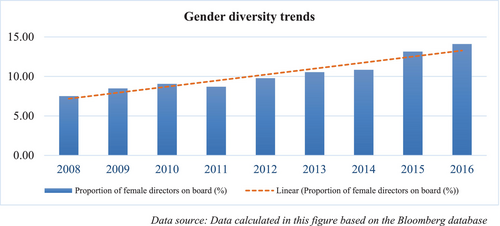

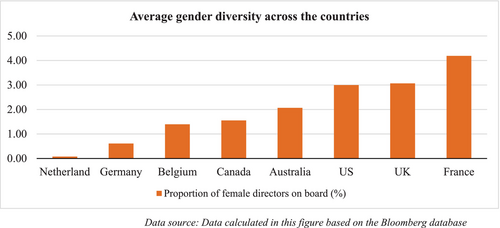

Regarding the gender diversity on boards, the statistics show that on average, there are only 10.8% of directors that are female. This is evidence that the proportion of female directors serving in these firms is significantly low. Figure 1 shows the yearly average proportion of female directors on boards over the period from 2008 to 2016. Figure 2 presents the national average percentage of female directors on board by country. Overall, Figure 1 shows the trend of the number of female executives increasing from 2008 to 2016, across the countries indicating that companies around these nations are beginning to realize the importance of female presence on boards (Alesina et al., 2013; Fernandez, 2009). Among the eight countries, the average percentage of female directors is highest for France and lowest for the Netherlands. This may reflect different social climates across the countries.

Concerning the CEO power variables, Table 3 reports that CEOs, on average, receive 52% of the total compensation paid to the top five executives in the top management team. The average years that CEOs have held the position is 5.7. The Table also shows that approximately 19% of the CEOs hold the positions of CEO and Chairman in a firm.

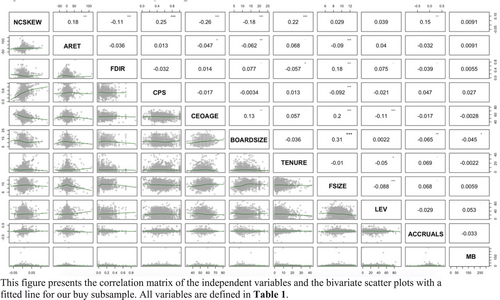

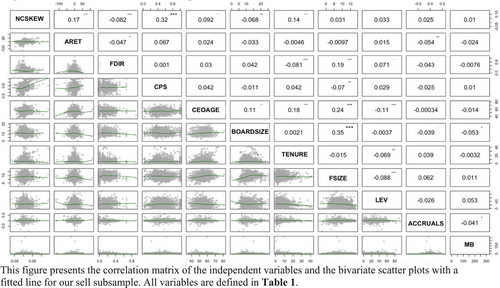

3.4.3 Correlation matrix and univariate test

We present the correlation matrices (scatter plots) above (below) the diagonal for purchase and sale subsamples in Figures 3 and Figure 4 respectively. The Figures report correlation coefficients between stock price crash risk, key variables and control variables. As expected, we find that insider purchases and sale returns for the 120-day window (ARET) representing average insider returns are positively correlated with stock price crash risk (NCSKEW). The other two key variables (FDIR and CEOAGE) are negatively and significantly related to our crash risk measure. However, the positive correlation between TENURE and stock price crash risk is inconsistent with our hypothesis H3b. The results show an early sign of potential links between some of our key variables and crash risk. Overall, our results in Figures 3 and 4 provide initial support of the key variables and crash risk.

4 EMPIRICAL RESULTS

4.1 Main results

Table 4 and Table 5 provide coefficient estimates of various specifications of managerial attribute factors on stock price crash risk measures over three different event windows (60, 120, 180-day) of average insider returns earned by insider buyers and sellers, respectively, in the previous fiscal year (t−1). In Table 4, Columns (1), (2) and (3) report the coefficients of the factors impacting NCSKEW with 60, 120 and 180-day event windows of average insider purchase returns, respectively. Similarly, columns (4), (5) and (6) of Table 4 report the coefficients for the model using DUVOL as an alternative dependent variable. The results show that insider returns of the short and medium windows (i.e., 60 and 120-day windows) are positively and significantly associated with either of the future price crash risk variables (NCSKEW and DUVOL). This suggests that insiders may exploit information asymmetry to earn profits in short and medium terms from their stock purchases by releasing positive news instead of negative information which, thereby, causes price crashes in the upcoming year. In particular, columns (1) and (2) demonstrate that a 1% increase in the previous year's insider buying returns for 60 and 120-day windows leads to the increases of 0.4% and 0.2% of one standard deviation of crash risk (NCSKEW). A similar picture emerges when we explain the impacts of insider purchases on DUVOL. However, the results in Table 5 show no evidence of the relationship between insider sale returns and stock price crash risk, regardless of the measure used. These results suggest that insider sellers are unable to predict the future price crash.

| Dependent variable: | NCSKEW | DUVOL | ||||

|---|---|---|---|---|---|---|

| Window (days) | [0–60] | [0–120] | [0–180] | [0–60] | [0–120] | [0–180] |

| (1) | (2) | (3) | (4) | (5) | (6) | |

| ARET_60i,t−1 | 0.004c | 0.005c | ||||

| (0.000) | (0.000) | |||||

| ARET_120i,t−1 | 0.002c | 0.002c | ||||

| (0.000) | (0.000) | |||||

| ARET_180i,t−1 | −0.002 | −0.001 | ||||

| (0.292) | (0.699) | |||||

| FDIRi,t−1 | −0.019c | −0.020c | −0.017c | −0.241c | −0.262c | −0.202c |

| (0.000) | (0.000) | (0.000) | (0.001) | (0.000) | (0.012) | |

| CPSi,t−1 | 0.026c | 0.025c | 0.028c | 0.323c | 0.318c | 0.345c |

| (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | |

| CEOAGEi,t−1 | −0.046c | −0.045c | −0.044c | −0.569c | −0.564c | −0.551c |

| (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | |

| TENUREi,t−1 | 0.001c | 0.001c | 0.001c | 0.007c | 0.008c | 0.009c |

| (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | |

| DUALi,t−1 | −0.006c | −0.006c | −0.007c | −0.056b | −0.056b | −0.067b |

| (0.000) | (0.000) | (0.000) | (0.036) | (0.039) | (0.021) | |

| BOARDSIZEi,t−1 | −0.011c | −0.011c | −0.012c | −0.099c | −0.106c | −0.113c |

| (0.000) | (0.000) | (0.000) | (0.001) | (0.000) | (0.000) | |

| TURNOVERi,t | 0.002 | 0.002a | 0.001 | 0.021 | 0.024 | 0.020 |

| (0.106) | (0.066) | (0.232) | (0.268) | (0.201) | (0.325) | |

| RETIREi,t−1 | −0.004 | −0.001 | −0.002 | 0.012 | 0.004 | 0.003 |

| (0.865) | (0.664) | (0.501) | (0.786) | (0.937) | (0.952) | |

| FSIZEi,t−1 | 0.003c | 0.004c | 0.003c | 0.034a | 0.047b | 0.029 |

| (0.003) | (0.000) | (0.008) | (0.057) | (0.011) | (0.132) | |

| ACCRUALSi,t−1 | 0.023c | 0.022c | 0.022c | 0.166 | 0.161 | 0.185 |

| (0.002) | (0.003) | (0.004) | (0.175) | (0.192) | (0.150) | |

| LEVi,t−1 | −0.000 | −0.001 | 0.00002 | 0.0002 | 0.0004 | 0.001 |

| (0.799) | (0.984) | (0.750) | (0.893) | (0.774) | (0.507) | |

| MBi,t−1 | 0.0001 | 0.00005 | 0.0001 | −0.004 | −0.0001 | 0.00004 |

| (0.320) | (0.372) | (0.309) | (0.963) | (0.913) | (0.966) | |

| Firm-Year fixed effects | (Y) | (Y) | (Y) | (Y) | (Y) | (Y) |

| Observations | 1300 | 1300 | 1183 | 1300 | 1300 | 1183 |

| Adjusted R2 | 0.236 | 0.206 | 0.162 | 0.045 | 0.027 | 0.005 |

- Note: This Table presents the results of regression of stock price crash risk on the previous fiscal year insider trading returns (ARETi,t−1), gender diversity in the boardroom, (FDIRi,t−1), CEO age (CEOAGEi,t−1), and CEO power measured by CEO pay disparity CPSi,t−1, CEO tenure TENUREi,t−1, and CEO duality DUALi,t−1 with different event windows (e.g. 60, 120 and 180-day) using the insider Purchase subsample. The columns (1), (2) and (3) show the results of the regression models using Negative skewness (NCSKEW) as the dependent variable. The columns (4), (5) and (6) show the results of the regression models using Down-to-up volatility (DUVOL) as the dependent variable. The variable definitions and measures are presented in Table 1. p values are in parentheses.

- a p < 0.1.

- b p < 0.05.

- c p < 0.01.

| Dependent variable: | NCSKEW | DUVOL | ||||

|---|---|---|---|---|---|---|

| Window (days) | [0–60] | [0–120] | [0–180] | [0–60] | [0–120] | [0–180] |

| (1) | (2) | (3) | (4) | (5) | (6) | |

| ARET_60i,t−1 | −0.001 | −0.004 | ||||

| (0.306) | (0.697) | |||||

| ARET_120i,t−1 | −0.004 | −0.004 | ||||

| (0.290) | (0.496) | |||||

| ARET_180i,t−1 | 0.001 | 0.001 | ||||

| (0.852) | (0.975) | |||||

| FDIRi,t−1 | −0.022c | −0.022c | −0.022c | −0.256c | −0.257c | −0.256c |

| (0.000) | (0.000) | (0.000) | (0.001) | (0.001) | (0.001) | |

| CPSi,t−1 | 0.029c | 0.029c | 0.029c | 0.355c | 0.355c | 0.354c |

| (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | |

| CEOAGEi,t−1 | 0.020c | 0.020c | 0.020c | 0.347c | 0.346c | 0.349c |

| (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | |

| TENUREi,t−1 | 0.001c | 0.001c | 0.001c | 0.006c | 0.006c | 0.006c |

| (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.002) | |

| DUALi,t−1 | −0.012c | −0.012c | −0.012c | −0.149c | −0.148c | −0.150c |

| (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | |

| BOARDSIZEi,t−1 | −0.012c | −0.012c | −0.012c | −0.129c | −0.129c | −0.129c |

| (0.000) | (0.000) | (0.000) | (0.007) | (0.008) | (0.007) | |

| TURNOVERi,t | −0.004 | −0.004 | −0.001 | −0.011 | −0.011 | −0.011 |

| (0.742) | (0.741) | (0.715) | (0.568) | (0.573) | (0.561) | |

| RETIREi,t−1 | 0.001 | 0.0005 | 0.001 | −0.031 | −0.032 | −0.031 |

| (0.878) | (0.887) | (0.877) | (0.573) | (0.568) | (0.573) | |

| FSIZEi,t−1 | 0.002a | 0.002a | 0.002a | 0.021 | 0.021 | 0.021 |

| (0.061) | (0.055) | (0.062) | (0.273) | (0.261) | (0.273) | |

| ACCRUALSi,t−1 | 0.015a | 0.015a | 0.015a | 0.037 | 0.036 | 0.038 |

| (0.076) | (0.075) | (0.071) | (0.787) | (0.789) | (0.779) | |

| LEVi,t−1 | −0.001 | −0.001 | −0.001 | −0.003 | −0.0004 | −0.0003 |

| (0.427) | (0.428) | (0.474) | (0.787) | (0.775) | (0.807) | |

| MBi,t−1 | 0.0001 | 0.0001 | 0.0001 | 0.0004 | 0.0004 | 0.0004 |

| (0.152) | (0.145) | (0.131) | (0.672) | (0.675) | (0.652) | |

| Firm-Year fixed effects | (Y) | (Y) | (Y) | (Y) | (Y) | (Y) |

| Observations | 1311 | 1311 | 1311 | 1311 | 1311 | 1311 |

| Adjusted R2 | 0.122 | 0.120 | 0.119 | 0.102 | 0.112 | 0.106 |

- Note: This Table presents the results of regression of stock price crash risk on the previous fiscal year insider trading returns (ARETi,t−1), gender diversity in the boardroom (FDIRi,t−1) CEO age (CEOAGEi,t−1), and CEO power (measured by CEO pay disparity CPSi,t−1, CEO tenure TENUREi,t−1, and CEO duality DUALi,t−1) with different event windows (e.g. 60, 120 and 180-day) using the insider Sale subsample. The columns (1), (2) and (3) show the results of the regression models using Negative skewness (NCSKEW) as the dependent variable. The columns (4), (5) and (6) show the results of the regression models using Down-to-up volatility (DUVOL) as the dependent variable. The variable definitions and measures are presented in Table 1. p values are in parentheses.

- a p < 0.1.

- b p < 0.05.

- c p < 0.01.

The results also show a negative association at a level of significance of 1% between the proportion of female executives on boards and stock price crash risk, in both of our subsamples indicating that the presence of female directors on boards decreases the likelihood of future stock price crash. This indication is consistent with the argument of Gul et al. (2011), that gender-diverse boards can increase information efficiency and mitigate the information asymmetry levels of firms. This finding supports our second hypothesis on the relationship between gender diversity and stock price crash risk.

Concerning the managerial attribute factors (CEO pay disparity, duality, tenure and age), the results in Tables 4 and 5 provide further evidence for supporting our hypotheses 3a and 3b, except the result on the CEO tenure factor. In particular, consistent with hypothesis H3a, we document that CEO pay disparity and CEO duality representing CEO power factors positively influence the future crash risk. This indicates that CEOs with higher managerial power tend to contribute to the likelihood of future crash risk. For the results on CEO age and CEO tenure, we find that the coefficients of CEO age (CEOAGE) are significantly negative, which partly supports our hypothesis H3b. The results are consistent with prior literature (Gibbons & Murphy, 1992; Jin & Myers, 2006) suggesting that younger CEOs have more incentives to hoard bad news, which lead to a potential future crash. However, the results show that the coefficients of CEO tenure (TENURE) are significantly positive, which is inconsistent with our proposition.

Turning next to the control variables, Tables 4 and 5 report a slight difference in the coefficients of the control variables. Specifically, concerning the board size (BOARDSIZE), the results report a significant and negative association between the size of board and future price crash, in line with the view of Andreou et al. (2016). However, the results display weak evidence of the relationship between CEO turnover and stock price crash risk in the same years. We only find a positive coefficient of CEO turnover at the 10% level of significance in model (2) of our purchase sample. The results suggest more CEOs are dismissed in the year that stock price crashes occur. Furthermore, the results show that firm size is positively and significantly related to future price crash, in all the models indicating that larger firms face more risk of price crash than smaller ones. In addition, we observe positive coefficients of accounting accruals (ACCRUALS), suggesting that managers may take action by increasing accounting earnings, thereby leading to future price crashes. Finally, inconsistent with prior studies, we find no evidence of the relationship between the factors CEO retirement (RETIRE), leverage (LEV) and Market to book value (MB) and stock price crash.

4.2 Robustness test and additional analysis

4.2.1 Alternative measure of stock price crash risk

We re-estimate our model using another measure of stock price crash risk, (DUVOL) for robustness. The results are summarized in Table 6 and Table 7. As expected, the coefficients of the variables are similar to the models with NCSKKEW as a dependent variable. Our findings are consistent with an alternative measure of crash risk.

| Dependent variable: | NCSKEW | DUVOL | ||||

|---|---|---|---|---|---|---|

| Window (days) | [0–60] | [0–120] | [0–180] | [0–60] | [0–120] | [0–180] |

| (1) | (2) | (3) | (4) | (5) | (6) | |

| ARET_60i,t | −0.004 | −0.004 | ||||

| (0.463) | (0.672) | |||||

| ARET_120i,t | −0.002 | −0.001 | ||||

| (0.570) | (0.822) | |||||

| ARET_180i,t | 0.002c | 0.003c | ||||

| (0.000) | (0.000) | |||||

| FDIRi,t−1 | −0.019c | −0.019c | −0.016c | −0.245c | −0.246c | −0.216c |

| (0.000) | (0.000) | (0.000) | (0.001) | (0.001) | (0.003) | |

| CPSi,t−1 | 0.027c | 0.027c | 0.025c | 0.324c | 0.325c | 0.295c |

| (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | |

| CEOAGEi,t−1 | −0.046c | −0.046c | −0.040c | −0.561c | −0.562c | −0.492c |

| (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | |

| TENUREi,t−1 | 0.001c | 0.001c | 0.001c | 0.009c | 0.009c | 0.008c |

| (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | |

| DUALi,t−1 | −0.006c | −0.006c | −0.005c | −0.057b | −0.056b | −0.041 |

| (0.000) | (0.000) | (0.001) | (0.037) | (0.037) | (0.121) | |

| CONTROLS | (Y) | (Y) | (Y) | (Y) | (Y) | (Y) |

| Firm-Year fixed effects | (Y) | (Y) | (Y) | (Y) | (Y) | (Y) |

| Observations | 1318 | 1318 | 1318 | 1318 | 1318 | 1318 |

| Adjusted R2 | 0.188 | 0.188 | 0.249 | 0.115 | 0.116 | 0.128 |

- Note: This Table presents the results of regression of stock price crash risk on the insider trading returns in the same year (ARETit), gender diversity in the boardroom (FDIRi,t−1), CEO age (CEOAGEi,t−1), and CEO power (measured by CEO pay disparity CPSi,t−1, CEO tenure TENUREi,t−1, and CEO duality DUALi,t−1) with different event windows (60, 120 and 180-day) using insider Purchase subsample. The columns (1), (2) and (3) show the results of the regression models using Negative skewness (NCSKEW) as the dependent variable. The columns (4), (5) and (6) show the results of the regression models using Down-to-up volatility (DUVOL) as the dependent variable. The variable definitions and measures are presented in Table 1. p values are in parentheses.

- a p < 0.1.

- b p < 0.05.

- c p < 0.01.

| Dependent variable: | NCSKEW | DUVOL | ||||

|---|---|---|---|---|---|---|

| Window (days) | [0–60] | [0–120] | [0–180] | [0–60] | [0–120] | [0–180] |

| (1) | (2) | (3) | (4) | (5) | (6) | |

| ARET_60i,t | 0.003c | 0.004c | ||||

| (0.000) | (0.001) | |||||

| ARET_120i,t | 0.001c | 0.002c | ||||

| (0.000) | (0.001) | |||||

| ARET_180i,t | −0.001c | −0.001c | ||||

| (0.005) | (0.005) | |||||

| FDIRi,t−1 | −0.019c | −0.020c | −0.021c | −0.223c | −0.239c | −0.247c |

| (0.000) | (0.000) | (0.000) | (0.003) | (0.002) | (0.001) | |

| CPSi,t−1 | 0.030c | 0.030c | 0.030c | 0.353c | 0.353c | 0.357c |

| (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | |

| CEOAGEi,t−1 | 0.018c | 0.019c | 0.019c | 0.328c | 0.342c | 0.336c |

| (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | |

| TENUREi,t−1 | 0.001c | 0.001c | 0.001c | 0.006c | 0.006c | 0.006c |

| (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | |

| DUALi,t−1 | −0.012c | −0.012c | −0.011c | −0.152c | −0.153c | −0.141c |

| (0.000) | (0.000) | (0.000) | (0.000) | (0.003) | (0.000) | |

| CONTROLS | (Y) | (Y) | (Y) | (Y) | (Y) | (Y) |

| Firm-Year fixed effects | (Y) | (Y) | (Y) | (Y) | (Y) | (Y) |

| Observations | 1329 | 1329 | 1329 | 1329 | 1329 | 1329 |

| Adjusted R2 | 0.140 | 0.136 | 0.133 | 0.109 | 0.102 | 0.096 |

- Note: This Table presents the results of regression of stock price crash risk on the insider trading returns in the same year (ARETit), gender diversity in the boardroom (FDIRi,t−1), CEO age (CEOAGEi,t−1), and CEO power (measured by CEO pay disparity CPSi,t−1, CEO tenure TENUREi,t−1, and CEO duality DUALi,t−1) with different event windows (60, 120 and 180-day) using insider Sale subsample. The columns (1), (2) and (3) show the results of the regression models using Negative skewness (NCSKEW) as the dependent variable. The columns (4), (5) and (6) show the results of the regression models using Down-to-up volatility (DUVOL) as the dependent variable. The variable definitions and measures are presented in Table 1. p values are in parentheses.

- a p < 0.1.

- b p < 0.05.

- c p < 0.01.

4.2.2 Additional analysis on insider trading

The main results in the previous tables 4 and 5 suggest that insider trading returns for the buy sample are positively and significantly associated with crash risk, while there is no evidence of the lagged insider returns for the sell sample and stock price crash risk. However, some previous research argues that the timing of insider trades plays a key role in insiders' strategy. Marin and Olivier (2008) argue that insider trading occurs preceding large movements in stock prices. They report that corporate managers sell their stocks intensively in the far past preceding crashes, and purchase stocks in the near past preceding the jumps in prices. Ke et al. (2003) discover that insider sales increase three to nine quarters before a break in the string of continuous increases in a firm's quarterly earnings. Therefore, we believe that insiders can anticipate and foresee the crash. To examine whether insiders take actions preceding the large movements in prices, we investigate insider returns in different timelines at t−2 and t. As a result, we find that the only abnormal returns of inside sellers increase in the year that the crash risk increases (year t), indicating that insiders sell their stock shortly before crashes.

After replacing insider returns in year t−1 with the returns in year t, we find the inverse results to our main findings from Tables 4 and 5. The additional analysis results are reported in Table 6 and Table 7 for buy and sell samples, respectively. Table 6 reports no evidence of the relationship between insider buying returns for the 60 and 120-day windows and crash risk. However, it shows a positive coefficient of the insider buying returns for the 180-day window. The results imply that in the long run stock prices in the year of the crash may bounce back, thereby, the returns for insider buyers are recorded to increase. More importantly, the results in Table 7 show that abnormal returns of inside sales for the 60 and 120-day windows are positively and significantly associated with stock price crash risk at the 5% and 1% level of significance, respectively. These results suggest that inside sellers can access the inside information promptly and anticipate shortly before the crashes. A similar image in Table 6 emerges when we explain the inverse coefficients of insider selling returns for the 180-day window. The results show that in the long run stock prices may bounce back after a crash, which leads inside selling returns to decrease.

The significant coefficients of insider trading seen in Table 4 and Table 7 lead to our conclusion that inside buyers can earn significant profits 1 year ahead of the crashes, while inside sellers can foresee and anticipate the stock price crashes shortly before they occur. The results indicate that insiders can hide bad news to exploit information asymmetry by earning profits from their purchases, and they can also anticipate the crash risk to sell their stocks shortly preceding the crashes. This evidence supports our first hypothesis on the relation between insider trading and stock price crash risk. Our empirical estimates are consistent with prior research, including Lorie & Niederhoffer, 1968; Jaffe, 1974, Jin & Myers, 2006; Hutton et al., 2009; Kim & Zhang, 2016, Seyhun & Bradley, 1997; Skaife et al., 2013; Thevenot, 2012; Agrawal & Cooper, 2015; He et al., 2021. Our results are the opposite to the findings of Marin and Olivier (2008) and Ke et al. (2003) who document that managers sell their stocks in the far past preceding crashes and buy shares in the near past preceding the rises in prices. We report that managers buy the stocks in the far past preceding crashes and sell shares in the near past preceding the rises in prices. A possible interpretation would be that insider sales are mostly based on liquidity purposes and not on information. This is consistent with many papers on insider trading, where authors state that purchases are more informative than sales (see He & Marginson, 2020; Qiang & Kin, 2006; Lakonishok & Lee, 2001; Tavakoli.et al., 2000 among others). Uninformed investors may react more strongly to the absence of insider purchases than their presence, whereas they react inversely to insider sales.

4.2.3 Alternative measures of insider trading, CEO pay disparity

In this section, we perform additional analysis to evaluate the robustness of the findings. We examine the impacts of insider trading and CEO pay disparity on stock price crash risk using alternative measures of insider trading and CEO pay disparity. In particular, we use insider trading volume as an alternative proxy for insider trading. First, we measure the insider trading volume (INSVOL) as the natural logarithms of insider trading volumes plus one [i.e., log(INSVOL+1)]. Outside investors believe that insiders possess superior information about firm performances and future prospects (Ke et al., 2003; Piotroski & Roulstone, 2005). Thereby, insiders trade more preceding the information disclosures. Following Bebchuk et al. (2011) we use CEO pay gap (CEOGAP) defined as the difference between the total CEO pay and the mean of other four executive pays, divided by the sum of the total pay of the top five executives.

| Dependent variable: | NCSKEW | DUVOL | ||

|---|---|---|---|---|

| (1) | (2) | (3) | (4) | |

| INSVOLi,t | 0.001 | 0.002 | ||

| (0.186) | (0.102) | |||

| INSVOLi,t−1 | 0.001c | 0.006c | ||

| (0.000) | (0.000) | |||

| FDIRi,t−1 | −0.020c | −0.018c | −0.265c | −0.212b |

| (0.000) | (0.000) | (0.000) | (0.010) | |

| CEOGAPi,t−1 | 0.012c | 0.014c | 0.136b | 0.155c |

| (0.000) | (0.000) | (0.010) | (0.006) | |

| CEOAGEi,t−1 | −0.050c | −0.045c | −0.609c | −0.562c |

| (0.000) | (0.000) | (0.000) | (0.000) | |

| TENUREi,t−1 | 0.001c | 0.001c | 0.009c | 0.009c |

| (0.000) | (0.000) | (0.000) | (0.000) | |

| DUALi,t−1 | −0.006c | −0.007c | −0.053a | −0.065b |

| (0.000) | (0.000) | (0.056) | (0.028) | |

| CONTROLS | (Y) | (Y) | (Y) | (Y) |

| Firm-Year fixed effects | (Y) | (Y) | (Y) | (Y) |

| Observations | 1318 | 1318 | 1318 | 1318 |

| Adjusted R2 | 0.115 | 0.119 | 0.068 | 0.072 |

- Note: This Table presents the results of regression of stock price crash risk on the alternative measure of insider trading. Natural logarithm of insider trading volume (INSVOLi,t and INSVOLi,t−1), gender diversity in the boardroom (FDIRi,t−1) CEO age (CEOAGEi,t−1), and CEO power (measured by CEO pay gap CEOGAPi,t−1, CEO tenure TENUREi,t−1, and CEO duality DUALi,t−1) for different event windows (60, 120 and 180-day) using insider Purchase subsample. The columns (1), (2) and (3) show the results of the regression models using Negative skewness (NCSKEW) as the dependent variable. The columns (4), (5) and (6) show the results of the regression models using Down-to-up volatility (DUVOL) as the dependent variable. The variable definitions and measures are presented in Table 1. p values are in parentheses.

- a p < 0.1.

- b p < 0.05.

- c p < 0.01.

| Dependent variable: | NCSKEW | DUVOL | ||

|---|---|---|---|---|

| (1) | (2) | (3) | (4) | |

| INSVOLi,t | 0.004c | 0.006b | ||

| (0.001)a | (0.038) | |||

| INSVOLi,t−1 | −0.002 | −0.003 | ||

| (0.144) | (0.156) | |||

| FDIRi,t−1 | −0.020c | −0.020c | −0.233c | −0.232c |

| (0.000) | (0.000) | (0.003) | (0.003) | |

| CEOGAPi,t−1 | 0.01c | 0.017c | 0.176c | 0.178c |

| (0.000) | (0.000) | (0.001) | (0.001) | |

| CEOAGEi,t−1 | 0.021c | 0.023c | 0.361c | 0.382c |

| (0.000) | (0.000) | (0.000) | (0.000) | |

| TENUREi,t−1 | 0.001c | 0.001c | 0.007c | 0.007c |

| (0.000) | (0.000) | (0.000) | (0.000) | |

| DUALi,t−1 | −0.012c | −0.012c | −0.151c | −0.154c |

| (0.000) | (0.000) | (0.000) | (0.000) | |

| CONTROLS | (Y) | (Y) | (Y) | (Y) |

| Firm-Year fixed effects | (Y) | (Y) | (Y) | (Y) |

| Observations | 1332 | 1313 | 1332 | 1313 |

| Adjusted R2 | 0.110 | 0.113 | 0.056 | 0.068 |

- Note: This Table presents the results of regression of stock price crash risk on the alternative measure of insider trading natural logarithm of insider trading volume (INSVOLi,t and INSVOLi,t−1), gender diversity in the boardroom (FDIRi,t−1), CEO age (CEOAGEi,t−1), and CEO power (measured by CEO pay gap CEOGAPi,t−1, CEO tenure TENUREi,t−1, and CEO duality DUALi,t−1) for different event windows (60, 120 and 180-day) using insider Sale subsample. The columns (1), (2) and (3) show the results of the regression models using Negative skewness (NCSKEW) as the dependent variable. The columns (4), (5) and (6) show the results of the regression models using Down-to-up volatility (DUVOL) as the dependent variable. The variable definitions and measures are presented in Table 1. p values are in parentheses.

- a p < 0.1.

- b p < 0.05.

- c p < 0.01.

Tables 8 and 9 report the outcome of our regression using alternative measures of insider trading and CEO pay disparity using insider the Buy and Sell sample, respectively. In general, the results are consistent with our main findings. Specifically, using insider trading volume, we find that the magnitude of insider purchases increases is significantly and positively related to future price crash risk, while the trading volume of insider sales rises as price crash increases in the same year. The findings are more pronounced in supporting our hypothesis H1.

We also discover a similar impact of CEO power on the price crash when using CEOGAP as an alternative measure for CPS. The results indicate that CEOs with more power tend to hide bad news to pursue their agendas, thereby increasing the potential future price crash risk. Taken together, the results of Table 8 and Table 9 show that our primary findings are robust to alternative empirical specifications.

5 CONCLUSION

Using a sample of 19,745 insider trading transactions in the largest publicly owned companies based in eight developed markets (United Kingdom, United States, Canada, Australia, Germany, France, the Netherlands and Belgium) from 2008 to 2016, we investigate the impacts of different managerial attributes, including insider trading, gender diversity and CEO power (measured by CEO pay disparity, CEO tenure and CEO duality) on stock price crash risk. Our findings show a positive association between one-year-lagged insider purchase returns and price crash risk. This finding is robust with different measures of stock price crash risk, insider trading and CEO pay disparity. Our additional analysis also documents that the only abnormal returns of inside sellers increase in the year that the crash risk increases (year t). We conclude that inside buyers can earn significant profits 1 year ahead of the crashes, while inside sellers can foresee and anticipate the stock price crashes and sell shortly before they occur. In other words, managers buy the stocks in the far past preceding crashes and sell shares in the near past preceding the rises in prices. These results indicate that insiders exploit information asymmetry from their purchases and that they are in a position to assess and anticipate the crashes, hence they can sell stocks shortly and promptly before stock price crashes.

Furthermore, we discover that the proportion of female directors has a negative relationship to future stock price crash. These findings suggest that the presence of women on boards reduces the likelihood of stock price crashes. Moreover, we document that CEO pay disparity, CEO duality and tenure are positively associated with future price crash. On the other hand, CEO age is negatively related to future crash. Our discoveries are robust to alternative measures of stock price crash risk. Our evidence provides insights into the selection, monitoring and incentivizing of managers in large co-operations.

Our findings highlight the importance of corporate managerial attributes including board characteristics such as gender and age diversity, and CEO power (measured by CEO pay disparity, CEO tenure and CEO duality) for firm policies in dealing with information asymmetry problems. Several questions are raised for the future. First of all, even though corporate governance has been well documented to play a significant role in the literature on stock crash risk (Andreou et al., 2016; Andreou et al., 2017, among others), corporate governance characteristics have multiple dimensions that have not been examined carefully. Future research could examine the role of board composition, CEO tenure and code of corporate governance practices on the association between insider trading and stock price crash risk. Further, managers often delay the disclosure of negative news for an extended period for corporate strategic or nonstrategic reasons and when bad news is accumulated, it causes a significant drop in stock price. We find that gender diversity within the boardroom can mitigate stock price crash risk. Due to risk preference, there is high probability that corporate disclosures made by female CEO will have different impacts on stock price crash risk as compare to their male counterparts. This is another avenue for further research.

Open Research

DATA AVAILABILITY STATEMENT

The data that support the findings of this study are available from the corresponding author upon reasonable request.