Macroeconomic and financial implications of multi-dimensional interdependencies between OECD countries

Abstract

This paper uses a complex structure of factors of exposure to international shocks for the analysis of regional and inter-regional effects of a variety of financial shocks across Organization for Economic Co-operation and Development (OECD) economies. Those factors (trade, finance, migration and others) are incorporated in a coherent and comparable scheme which, based on observed data, describes pair-wise, directionally asymmetric exposures to foreign economies in the sample. Through a global vector auto-regressive setting, a systemic approach characterizes our modelling by the means of which several standardized shocks are simulated varying the region of origin to compare their effects and spillovers. In the depicted map of risks, the shocks are of particular relevance to both wholesale and retail credit markets, stock and commodities markets and also for the management of monetary and fiscal policies in open economies. The diversity of responses between OECD regions is useful to understand the asymmetric impacts and degrees of relative vulnerability towards disturbances in international markets. A subset of Eurozone countries, for example, consistently shows significant sensitivity to foreign shocks. Other Eurozone countries experience a lower degree of imported volatility while Asia-Pacific appears to be more resilient to shocks in OECD regions. In turn, the significance of the impacts of shocks in the North American Free Trade Agreement region is large enough for them to be close representations of global shocks.

Video Short

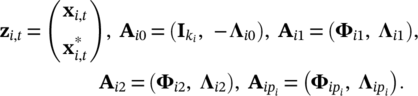

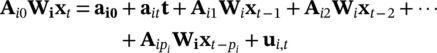

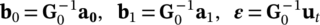

Macroeconomic and financial implications of multi‐dimensional interdependencies between OECD countries

by Sevinc et al.1 INTRODUCTION

After the 2007–2008 financial crisis, which displayed such a large magnitude and widespread impact, the economic and financial linkages between countries have acquired an even greater relevance for the analysis of macroeconomic and financial policies. To develop a suitable classification of their distinctive characteristics, a detailed investigation on the specific nature of those linkages is vital. We contribute to the current literature with a detailed, joint scrutiny of key drivers for a better understanding of the operating mechanisms of international propagation of shocks as well as of the distinctive, sometimes contrasting, features that they display in different regions of the global economy. Despite the vast amount of literature on intra-EU macroeconomic interdependencies (e.g., Nicolini & Resmini, 2010; Ricci-Risquete & Ramajo-Hernández, 2015), spillovers particularly generated from the United States (e.g., Bae & Karolyi, 1994; Colombo, 2013; Bayoumi & Bui, 2010) and from Asian countries (e.g., Khalid & Kawai, 2003; Diebold & Yilmaz, 2009), the characteristics of these channels of transmission have not been sufficiently addressed in depth across a wider geographical scope.

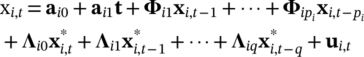

This study makes two main contributions aiming to provide a more holistic understanding of cross-country dynamics. First, we address both the similarities as well as the consequential heterogeneities across a wide geographical area to analyse the impacts of financial and macroeconomic disturbances across countries in five Organization for Economic Co-operation and Development (OECD) sub-regions. As an econometric strategy, we have used the recently developed global vector auto-regressive (GVAR) approach (Pesaran, Schuermann, & Weiner, 2004; Pesaran & Smith, 2006), which allows for a rich and flexible modelling of macroeconomic interdependencies across countries, while keeping the element of dimensionality controllable. The GVAR framework is applied to conduct an empirical examination of the consequences of shocks transmitted between member states. The study includes an empirical identification and measurement of the macroeconomic and financial spillovers between five main OECD regions: (a) Euro-zone advanced economies, (b) Other Euro-zone economies, (c) non-Eurozone European economies, (d) the North American Free Trade Agreement (NAFTA) region and (e) the Asia-Pacific region. The inclusion of these groups of economies is a reflection of our wider approach to international linkages and inter-dependencies which, at the same time, takes into account the specificities of the analysed regions.

Second, the study makes the case for the inclusion of additional components beyond the traditional linkages approach (frequently summarized by the means of trade statistics) to consider, instead, a multidimensional linking matrix helpful for an enhanced depiction of cross-country sensitivities and dynamics. The selection of components used to capture interdependencies between countries constitutes, nonetheless, a harmonious and mutually complementary set of representative factors. The analysis of cross-country effects is frequently based on either trade or financial linkages (see, among others Bussière, Chudik, and Sestieri (2009), Chudik and Fratzscher (2011) and Hiebert and Vansteenkiste (2010) or, less frequently, some combination of the two. Those depictions still leave a significant space for the development of more comprehensive schemes, able to encompass fundamental channels of interaction.

In this sense, our study provides a wide description of sensitivities across country groups relying not only on the use of trade weights, but also through the incorporation of the exposures associated to financial linkages, geographical proximities and migration flows, all of which help to summarize relevant channels influencing cross-country dynamics. The analysis of linkages between economies in the OECD is performed by partitioning a list of selected economies into the mentioned five regional groups with the objective of generating comparative conclusions on those bases.

Our results provide a detailed description of interactions across regions of the world economy taking the form of valuable information on the relative impact and persistence of selected regional and global shocks as well as on their inter-regional spillovers. Particularly, the study focuses on the measurement and comparison of the outcomes and pass-through effects arising after disturbances on key variables representing the conditions of financial markets across the sample of heterogeneous but multi-dimensionally linked economies. This way, the approach adopted by our empirical application widens the perspective of previous studies through the use of an innovative weighting scheme for a set of macroeconomic and financial variables, relevant in the analysis of underlying factors operating in the aftermath of simulated regional and global shocks.

Policy makers interested in assessing the effects of financial shocks on economic performance should be aware of the advantages brought about by the wider perspective taking the form of a multi-dimensional link matrix measuring the relative relevance of key channels of transmission between heterogeneous economies. Such a link matrix, thus, not only aids to sharpen the focus on interactions but also helps to develop a comprehensive analysis of cross-country dynamics.

The remainder of this paper is organized as follows: Section 2 discusses key research experiences in terms of their contributions and limitations in the analysis of international linkages, Section 3 discusses the innovative approach, as proposed in the study, to the construction of weights for multi-country modelling and indicates the data used for estimations, Section 4 describes our empirical application of the GVAR modelling framework and its results and Section 5 presents the conclusions.

2 THE EMPIRICAL ANALYSIS OF INTERNATIONAL LINKAGES IN THE CONTEXT OF ECONOMIC AND FINANCIAL DISTURBANCES

To what extent do financial and macroeconomic spillovers flow across national borders, and by what means are these flows mediated? These questions have been receiving an increasing amount of attention over the last two decades. Consequently, a vast literature exists on the examination of transmission channels of spillovers, that is, the major global conduits through which shocks are propagated. Three main channels for international spillovers between countries are recurrently studied: (a) trade, (b) commodity prices and (c) financial markets. A major portion of the literature concludes that trade channel appears to be the leading transmission mechanism. Using panel and vector auto-regressions (VAR) analysis, Helbling et al. (2007) argued that in the context of U.S.-originated spillovers, the largest estimated contributions to such spillovers can be attributed to trade variables. In the same spirit, Arora and Vamvakidis (2006) provided evidence that trade channel is the key transmission mechanism of the United States shocks the rest of the world.

Authors within a second strand of literature focus on the relative importance of financial and other non-trade channels. In this on-going discussion Bayoumi and Swiston (2009) show that the significant portion of contributions to transmission of U.S. growth shocks come from financial instead of trade variables. They provide estimates for this transmission channel and highlight that the interest rates and financial conditions such as bond yields and equity prices account for around 50% of the international transmission of U.S. growth developments to foreign economic activity. Similarly, Bayoumi and Vitek (2013), Lombardi, Espinoza, and Fornari (2009), and OECD (2012) provide evidence that financial variables play a significant role in terms of their contributions to international transmissions. Sgherri and Galesi (2009), in turn, using a GVAR approach also suggest a relatively more significant role for equity prices as a global transmission mechanism of adverse U.S. financial shocks. Bagliano and Morana (2011), in contrast, conclude that U.S. financial developments do not cause a clear impact on foreign economic activity.

In the general context of the study of transmission mechanisms, a related literature builds on the generalized vector auto-regressions to examine the interdependencies across countries. However, that methodology has been criticized as in it idiosyncratic shocks are correlated across countries and spillovers are not separated in the generalized VAR settings (Pesaran et al., 2004; Dees et al., 2007). VARs also suffer from dimensionality constraints increasing the difficulty in the analysis of international spillovers.

In turn, the GVAR analysis, relying on a set of linked country-specific models, is one of the most widely used, clearly defined, and well-validated modelling tools, appropriate for the study of spillover dynamics. It allows for a rich and flexible modelling of macroeconomic interdependencies across countries, while keeping dimensionality controllable by reducing the country-specific spillovers to a weighted average of country-specific variables (Bussière et al., 2009; Dees et al., 2007; Pesaran et al., 2004; Pesaran & Smith, 2006; Sgherri & Galesi, 2009). Dovern, Feldkircher, and Huber (2016) found that the GVAR methodology is appropriate indeed for the analysis of heterogeneous economies and their inter-linkages with a system-based approach.

Notably, financial linkages constitute factors of exposure to the intrinsic variations of foreign markets. The role and pro-cyclical nature of financial variables in driving real outcomes have been widely discussed in earlier literature (e.g., Giacomini & White, 2006; Espinoza, Fornari, & Lombardi, 2012). The so-called channels of transmission are defined as the mechanisms through which national economies are interconnected regarding a certain variable or set of variables and the phenomenon of international contagion has been subject of scrutiny on such lines especially after the most recent crisis.1 In this context, key variables have arisen as crucial components of a policy-maker's check-list for a succinct, yet robust, assessment of the overall macroeconomic conditions when considering the impact of financial interactions.

Specifically, for the selection of variables in the study's model, we use as reference the main components put forward by Reinhart and Rogoff (2009) (henceforth RR) as prices of financial assets, output and employment levels, and government debt, since this set of indicators are able to reflect common grounds of measurement, even between diverse economies, particularly during periods before and after significant events such as financial crises. The selection of variables used in our modelling aims to provide a concise representation of the main factors reflecting the prevailing conditions in each economy, its financial system and external sector after the occurrence of financial shocks.

The financial indicators commonly used in empirical studies are the ones, which are generally regarded as primary variables explaining intra and inter-country economic activity, such as equity prices, monetary aggregates, interest rates, interest rate spreads, stock market capitalization, credit markets indicators and the real effective exchange rates. Several studies have also emphasized the positive linkage between equity prices and future economic activity. Correspondingly, equity prices are associated with future developments of the economy, since they capture the firms' expected profitability (see, among others, Estrella & Mishkin, 1998; Fama & French, 1993; Hassapis, 2003; Lombardi et al., 2009; Panopoulou, 2009).

It is also well recognized that the magnitude of financial spreads can be associated to the level of economic growth (Panopoulou, 2009). Moneta (2005), for example, concludes that the yield spread conveys the most useful information to the aim of predicting recessions in the euro area. Similarly, Ang, Piazzesi, and Wei (2006), Duarte, Venetis, and Paya (2005) and Gilchrist, Yankov, and Zakrajˇsek (2009) confirmed the predictive ability of yield spreads for forecasting growth and recessions.

Our specific choice of variables in this respect aims to incorporate data on key variations with domestic implications for private agents and policy-makers, on the one hand, and on the status of each economy in an internationally competitive market, on the other. The first part is represented by lending rates, as well as by borrowing rates, both with macroeconomic implications that result from their impact on consumption and investment trends. These variables are intended to provide a clear indication of the overall conditions in the domestic credit markets (Jermann & Quadrini, 2012). The second component, which focuses on the international side of credit markets, is depicted by the spread between lending rates and a proxy for an international risk-free rate embodied by the U.S. 3-month Treasury Bill.2 In addition, the health of the financial sector, embedded in lending and borrowing activities, is considered a powerful predictor of economic performance (see among others for empirical applications to the United States: Goodhart, 2006; Swiston, 2008). The health of the financial sector is indeed an important driver of growth as it may increase the cost of intermediation and hinder firms' ability to invest (Lombardi et al., 2009).

As far as prices in the financial markets are concerned, they have been found to be significantly sensitive to the deterioration of overall macroeconomic conditions. The so-called fundamental analysis in finance relies on discerning likely trends in prices from the observation of a combination of factors among which macroeconomic variables play an important role.3 In turn, large macroeconomic variations have repeatedly been preceded by price bubbles in the financial markets,4 which dramatically deflate in the aftermath of a crisis. This documented relationship is vital for understanding the macroeconomic impacts of common variations in financial markets. The representative variable for this component, in our study, takes the form of a share price index for the countries of interest. Share prices display common trends principally when the overall macroeconomic conditions show deterioration or improvement. Furthermore, regional trends have been observed between strongly related markets. But, relevant variations in the financial markets are not limited to the shares valuation. They also include significant consequences from abrupt changes in exchanges rates, mainly for economies with higher levels of trade openness. For these reasons, our study also includes series for the real effective exchange rate.

Another common feature among economies facing large shocks is the occurrence of simultaneous variations in interest rates (not necessarily in the same direction). In the presence of generalized shocks, capital which was previously distributed among mid-income economies – due to their generally higher returns – tends to turn back towards higher-income economies. This flight to safety and the resulting differentiated flows generate equally distinctive pressures on interest rates with lower-income economies suffering larger impacts in the form of severely increased interest rates. Alternatively, a contrasting phenomenon has appeared for advanced economies in the aftermath of the 2008–2010 financial crisis with interest rates reaching their lowest levels during prolonged periods. What makes this particularly relevant in our context is the widespread generalization of trends within the study sample.

Our study of heterogeneous responses to external shocks is developed with the support of evidence provided by the GVAR modelling framework proposed by Pesaran et al. (2004), suitable to analyse propagation of macroeconomic and financial shocks. In line with the principles set in the OECD (2011), modelling with a system-based approach is crucial for enhancing the opportunities to build resilient regions and stronger economies. In this sense, GVAR is a useful tool for analysing the consequences of shock spillovers between OECD countries. With an innovative approach to international weights (in the following section), this study addresses the relevance of trade, financial and migration linkages in addition to geographical neighbourhood between economies in the OECD by partitioning a list of selected economies into five regional groups with the objective of generating comparative findings and conclusions. Aiming to derive valuable insights on the relative impact and persistence of selected shocks as well as on their inter-regional spillovers, our results provide a detailed description of interactions across main regions of the world economy. The information on these regional contrasts is relevant for policy analysts and practitioners alike since accounting for the direct and indirect effects of economic and financial disturbances allows for an improved assessment of the role that each region holds and of the heterogeneous policy adjustments necessary to be performed after such events.

3 CONNECTEDNESS AND RATIONALE FOR MULTI-DIMENSIONAL OECD WEIGHTS: A NOVEL MULTIDIMENSIONAL SCHEME

International weights play a central role in a GVAR model's formulation since they are intended to describe the intensity of the linkages between economies and, therefore, they intervene in the measurement of the potential impacts arising from international spillovers. Previous empirical applications assessing international economic interactions within the GVAR framework have repeatedly resorted to the use of trade weights as a standard practice. Examples of this are as early as Pesaran, Shin, and Smith (2000) and Dees et al. (2007), but are concurrently found in recent papers of Caporale and Girardi (2013), Ericsson and Reisman (2012) and Greenwood-Nimmo, Nguyen, and Shin (2012).

Given that, in practice, OECD economies are connected to each other in a diversity of ways, such an approach remains incomplete, as it does not consider other channels of interactions with significant economic consequences as financial and migration exchanges between OECD countries. Therefore, it is necessary to overcome the restrictions of previous studies and gather a broader set of measurements reflecting the strength of cross-country interactions in terms of trade, finance, and migration for the purpose of integrating them into the model's international weights. So how can these channels be incorporated in a robust manner? As explained in detail below, this paper makes an innovative proposal to do so taking into account: (a) relevant data availability and (b) empirical evidence – namely, by building upon structured evidence-based literature – regarding the multi-faceted and inter-linked nature of OECD economies.

Acknowledging that specific channels of interaction operate in the map of exchanges between OECD economies with various strengths, different weights have been assigned to the indexes that contribute to generate a summarizing composite weight matrix. The resulting composite weight matrix is aimed to reflect the relative importance that each individual economy represents towards each other in the sample (and the asymmetries that these relationships display).

3.1 Trade

One mechanism through which a country-specific shock can have wider consequences in the international economy is trade. Being at the core of the OECD's interests since its inception, the exchange of goods and services between national economies is an uncontroversial element of exposure to the variability of a foreign economy both in terms of volumes (which are in turn, associated with productive trends) and prices (where additional factors such as financial or even fiscal variables have a considerable impact).

Recent studies such as Beetsma and Giuliodori (2011), and Inklaar, Jong-A-Pin, and De Haan (2008) focus on analysing the importance of the trade channels and assessing their role in the transmission of spillovers from national policies. They were able to confirm the decisive influence of trade exchanges in the transmission of shocks between the OECD economies, suggesting that trade integration strengthens business cycle synchronization. Besides trade dependency, the international trade literature also emphasizes the importance of commodity and geographical trade clusters in relation to the escalation of spillover effects (Cheewatrakoolpong & Manprasert, 2014). Kali and Reyes (2010) also conclude that countries that become centres of trade are highly prone to suffer from serious detrimental effects during crises. In turn, a number of recent works on international spillovers have discussed in depth how crucial trade linkages are in terms of a country's vulnerability to a crisis as well as the effect of increased trade linkages that originates from a process of integrated activity in core areas that are deeply connected to the economic cycle.

OECD countries are strongly interconnected by trade linkages. The intra-industry trade in goods between OECD member states was 60–70% larger than the flow of exports leaving the OECD to non-member countries (OECD, 2010). Cross-border intermediate and final goods interrelations can have substantial implications for propagation mechanisms and the linkages among demand, trade, and production across OECD countries. Indeed, the literature demonstrates that a large fall in demand of goods and services played an important role in driving the trade collapse during the global recession of 2008–2009 (Alessandria, Joseph, & Virgiliu, 2010; Eaton, Kortum, Neiman, & Romalis, 2016). Similarly, Bems, Johnson, and Yi (2010) show that demand forces can account for roughly 70% of the trade collapse and that trade linkages are substantially important in terms of each country's vulnerability to recent crises.

Bems et al. (2010), an authoritative study of its kind, suggest that trade could transmit crises internationally through a combined integration of three channels: (a) a competitiveness effect, (b) an income effect and (c) a cheap-import effect. A competitiveness effect occurs when devaluation of one country's currency drives up the relative competitiveness of its exports and diminishes the competitiveness of exports from other countries. An income effect occurs when a crisis affects income and growth within the crisis country, by reducing purchases of imports from abroad. A cheap-import effect occurs when devaluation of one country's currency down the relative price of its exports and thereby reducing prices in countries that import these goods.

Within the OECD context, Eichengreen and Rose (1999), utilizing a trade-weighted matrix of macroeconomic variables, show that trade linkages instead of macroeconomic similarities have acted as a crucial channel for the contagion mechanisms of transmission between economies. Similarly, using a global input–output framework, Bems et al. (2010) show that the large magnitude of trade spillovers originating from and within many OECD countries played a crucial role in explaining both the collapse of trade and transmission of the global recession. Several studies such as Alessandria et al. (2010) and Eaton et al. (2016) conclude that trade linkages were large and significant in the context of international transmission of a crisis. Therefore, the first part of the multi-dimensional interdependency matrix must focus on the role of OECD's deeply connected trade linkages and quantify the role of trade in the exposure to shocks across OECD economies.

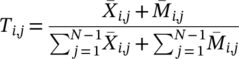

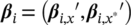

(3.1)

(3.1) i,j and

i,j and  i,j represent, respectively, the mean of exports and imports between country i and country j during the studied time horizon.

i,j represent, respectively, the mean of exports and imports between country i and country j during the studied time horizon.3.2 Finance

Another important thread in the links between economies is found in the exchange of financial resources. The financial channel of transmission has been studied in the context of macroeconomic policies by Faini (2006) with special attention to interest rates and fiscal spillovers as well as by Corsetti and Müller (2011) who conclude on the dominant effect of financial factors in an international transmission mechanism that operates on domestic and foreign private spending through expectations, interest rates and international asset markets, in that sequence, extending the study on the role and impact on private spending of the sovereign risk channel as analysed in Corsetti, Pericoli, and Sbracia (2011) in an international, interdependent context.

As far as financial interdependencies are concerned, OECD (2018) suggests that the degree of financial interlinkages between OECD economies has increased significantly over the last two decades. The importance of direct investment, in particular, has grown notably over time. The escalation of direct investment flows is partly explained by increased global cross-border mergers and acquisitions to a certain extent, following a decreasing pattern after the global financial crisis. Global mergers and acquisitions have not only resumed again recently, but also its regional composition changed (OECD, 2018). The EU countries position has changed from being net outward investors to becoming the world's largest net recipient of cross border merger and acquisitions. In addition to foreign direct investment exchanges, the outstanding stock of gross financial derivatives has also increased as financial products became more complex as a result of financial innovation over the last decade (OECD, 2018). OECD statistics suggest that in 2005–2007, the total volume of international mergers and acquisitions formed up to 80% of global foreign direct investment flows which then followed a decreasing pattern to under 60% during 2008 and 2014 (OECD, 2014). Since then it has been following an increasing pattern with substantial individual cross-border deals taking place (UNCTAD, 2017).

In most OECD economies, the total volume of capital investments by foreign-owned firms is around 2% of domestic GDP, and this ratio is significantly higher in smaller sized economies (OECD, 2015; OECD, 2018). Recent OECD figures suggest that, in the majority of advanced and emerging OECD economies, the stock of foreign direct investment (FDI) assets and investment income from FDI as a percentage of GDP have doubled or tripled over the past two decades, although the share is smaller in emerging than in advanced economies (OECD, 2018). This is noted particularly in the United Kingdom with 4.5% of its GDP is formed by FDI investment income, then in Canada with 3.5% of its domestic GDP followed by France, Germany and the United States (in a descending order). As far as the stock of FDI assets are concerned, this ratio is significantly higher in the United Kingdom with 80% of its domestic GDP, followed by France (75%), Germany (65%) and Italy (45%).

Increased gross asset and liability positions as well as growing bilateral direct investment exchanges translate into international exposures, turning financial centres as increasingly vulnerable to shocks which makes the exact identification of exposures a complex task. Other consequences, resulting from increased financial interconnectedness, are mainly base erosion, profit shifting, exposure to the risk of illicit financial flows – such as money-laundering, tax evasion and international bribery – all at the forefront of the OECD agenda (OECD, 2018). The degree of financial interlinkages among Western European countries and those in Central, Eastern, and South-eastern Europe (CESE) has grown notably as well, with a consequential increase in foreign ownership of the CESE banking systems. Arvai, Driessen, and Otker (2009) show that the financial interlinkages in Europe are economically significant. Also, it should be noted that intra-EU FDI flows rose by 40% in 2015 and reached 365 billion (data from Eurostat).

A recent OECD study (OECD, 2018) underlines the importance of financial interdependencies for the propagation of economic shocks across borders. They demonstrate that geographical diversification of increased cross border flows enables financial markets to grow and diversify risks, assisting companies to expand and diversify the risks by investing where the rate of return is highest while mitigating negative domestic shocks. On the other hand, such connectedness increases the risks of exposure to negative spillovers across borders. In turn, changes in economic conditions abroad become more influential than national economic policies, particularly on domestic investment and employment decisions as well as corporate earnings. Such connectedness and increased geo-diversification explain the significant role played by global factors in equity prices (OECD, 2018). There is a great deal of literature on the effects of financial interconnectedness on the growth in volatility that supports OECD's view (see, e.g., Kose, Prasad, Rogoff, & Wei, 2009; Prasad, Rogoff, Wei, & Kose, 2007). Moreover, increased financial flows, particularly FDI and portfolio flows, have also been shown to raise income inequality in both advanced and emerging market economies (Basu & Guariglia, 2007). In addition to these papers, other studies of scholars like Kazi, Mehanaoui, and Akbar (2014) and Guesmi, Kaabia, and Irfan (2013) have documented the substantial importance of financial exposures across OECD countries.

The complexity and variety of the interactions discussed above, in turn, highlight the necessity to concentrate on specific aspects as FDI positions given the role they play for the transmission of economic shocks across borders6 which, as explained above, is intended to reflect a more structural element of financial exposure as opposed to short-term (and possibly speculative) financial flows on the basis of the former having a stronger relationship with the real sector of recipient countries and, therefore, with macroeconomic aggregates such as consumption, investment, and output.

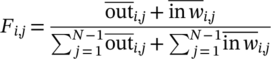

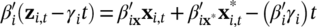

(3.2)

(3.2) and

and  stand, respectively, for the means of total outflows and inflows of direct investments between country i and country j.

stand, respectively, for the means of total outflows and inflows of direct investments between country i and country j.3.3 Bilateral migration flows

An under-explored element in previous literature is migration, which is typically associated with allocative, distributive and external effects.7 Migration of various kinds within OECD countries has become increasingly common as a way for individuals to diversify household income and reduce the divide they perceive between their own circumstances and those in more advanced countries. A recent OECD study (OECD, 2017a) shows how increasingly important migration exchanges have become in member economies. Overall, the migrant stock made up for 13% of the population in OECD countries in 2015, which was around 10% in 2000 (OECD, 2017a). In addition, around 5 million people migrated permanently to OECD countries in 2016, well above the pre-crisis previous peak in 2007. There was also a surge in asylum applications in 2015–2016. Global international tourist arrivals rose by over 4% per annum on average in the two decades of 2016 (OECD, 2018).

Migration linkages between economies are associated to economic and financial impacts which have not been captured by conventional measurements of international interaction. Trade or financial statistics, for example, fail to properly reflect the economic exposure to the effects of migration on productivity, public finance (both on income and expenditure, see Lisenkova et al., 2014), wages (Damette & Fromentin, 2013) and aggregate demand.8 Current migration links, between not necessarily neighbouring countries, form intricate networks displaying distinctive, typically asymmetric, intensities and therefore cannot be represented by geographical distances either.

Indirect improving effects of migration exchanges operate through three main channels: (a) labour markets, (b) remittances and (c) international students and tourist traffic. Within each bi-lateral relationship, the composition of migration exchanges, similarly, brings about consequential effects at both ends of these links. The movement of skilled migrants, for example, whether temporary (cyclical) or in the longer term, constitutes a significant factor for the performance of increasingly international business models with accentuated use in advanced OECD economies.9 Similarly, at the lower end of the skills range, shortages of human resources in source countries for example, have implications on productivity and household income. In this paper, we do not differentiate by skills in migration exchanges which means all the described relationships are equally contained in our weighting scheme.

In 2015, total remittance flow from migrants in OECD countries to their home countries was around 500 billion USD. In the 21st century, migrants are seen not only as a source of foreign currency, but also as bearers of skills, knowledge and social remittances (Faist & Fauser, 2011; Levitt, 1998). This view often contains the underlying assumption that migration has significant potential for tackling inequality, either through the cash remittances that migrant workers are able to send back, or through the skills, technology transfer and knowledge they acquire abroad and then take back to their country of origin. Social remittance flows are often larger than either bilateral aid or foreign direct investment (Ratha & Shaw, 2007). Kapur and McHale (2009) argue that emigration from poorer to richer countries increases the income of the migrants, and also that of their relatives who remain in the country of origin. In fact, migration holds greater potential for reducing inequality when the migrants are from poorer households. In addition to long term migration's potential impacts on labour market and remittances, increasing flow of short-term migration such as international students (OECD, 2017a) and growing international tourist traffic facilitate new digital technologies usage. Thus, increased flow of short-term migration has a knock-on effect on creating economic opportunities, enabling firms to access new markets, and offering consumers a wider choice of goods and services (OECD, 2017b).

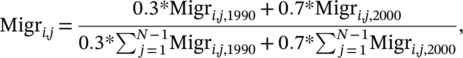

As discussed above, migration exchanges in the OECD can have significant impacts on economic performance, primarily through the pressure they put on labour markets. Our inclusion of migration weights is ultimately aimed at reflecting the intensity and asymmetric nature of these bi-lateral relationships between economies in the studied sample (not to be confused by the reader with any attempt to simulate shocks from variations in migration). Heterogeneities between countries can be marked as they assume distinct roles such as origin or destinations with different intensities in the exchanges for which a differentiating factor is often the stance of the immigration policies they apply (see Pedersen, Pytlikova, & Smith, 2008). Although deeply constrained by data limitations, analysing the bi-directional linkages is a crucial task for a more complete understanding of international exposures. However, no attempt has been made in the GVAR literature to measure these cross-border factors. Thus, to account for the role played by migration as transmission mechanisms, total bilateral stocks of migration are used for formulating an index of the relative position between countries. Data from the World Bank has been used for these purposes (see the Data section below). Two pre-2008 financial crisis periods, 1990 and 2000, were selected in an attempt to depict more structural, long-term relationships in terms of migration. Then, given the availability of data, a higher weight (70% in each bi-lateral set) was assigned to the most recent series, 2000, which sits approximately in the middle of the typical timespan of other macroeconomic series in the study. That weight is a choice largely made to emphasize the higher relevance of the most recent available series in the context of the overall time-coverage of our analysis.

(3.3)

(3.3)3.4 Geographical proximities

Tobler's (1979) first law of geography, ‘everything is related to everything else, but near things are more related than distant things’ is appropriate here as an indicator of geographical proximities between economies can absorb other channels of interaction not captured by the other three channels outlined above. On the other hand, while geographic closeness does not strictly precondition the intensity-based ordering of the first three considered relationships, it is still a factor of interaction in other aspects with final expression in economic and financial performance. Among those, we can mention institutional and legal similarities which benefit contractual arrangements, technology transfers, educational and scientific cooperation, common development projects and their funding, regional (including inter-city) agreements, etc. This theme surfaces in Krugman's (1991) work emphasizing the importance of locational decisions by various centripetal forces and linkages that are caused by large local markets. They have demonstrated that economic integration in geographic regions has been central in terms of concentration of economic activities.

Studies analysing the effect of economic geography generally fall into two categories, with one strand consisting of the studies of Brakman, Garretsen, and Schramm (2004) for Germany, Hanson (2005) for the United States and Mion (2004) for Italy, who all assume labour to be perfectly mobile and real wages to be equalized. The second strand meanwhile concentrates on the same effect at international level, and is represented by the work of Redding and Venables (2004), in which real wage levels are influenced by intermediate factors of production. Studies at both national and international level have shown geography to have a significant impact on access to markets, which then shapes income levels. Krugman (1991) and Venables (1994) also document the economic relevance of such proximities in examining regional integration. More recent studies such as Redding and Venables (2003) produced an authoritative study of its kind, showing that the geography of access to markets and sources of supply is statistically significant and is essential in explaining cross-country variation in income per capita. Around 29% of cross regional variation in wage levels can be explained by a region's proximity to customer markets (Lopez Rodriguez & Faina, 2007).

Taking into account the context discussed above, we propose to add a proxy to measure those additional linkages based on the country's location within the OECD space. The inclusion of geographic proximity (1/disti,j, where disti,j is the geographic distance between countries i and j) in the weighting scheme, thus, serves the purpose of representing other channels of interaction between economies not captured by the previous three measurements. An index of inverse distances that assigns greater weight to closer neighbourhoods is calculated using data from the World Bank's API10 (geo-localization of capital cities). Inverse-distance weights are commonly used in configurations of spatial econometrics involving units that are geographically dispersed (LeSage & Pace, 2009).

(3.4)

(3.4)3.5 Composite weights based on key linkages

While proposing an innovative scheme of weights in GVAR models, we are well aware that such a complex picture of cross-country interdependencies will require a great deal of acceptance from scholars who have predominantly concentrated on trade linkages.

Further justification for the weighting scheme draws from the suggestions in three well-known papers. First, Eickmeier and Ng (2015) consider a range of different connectivity matrices and assess differences through a forecasting exercise. Second, Crespo Cuaresma, Feldkircher and Huber (2016) analyse weight schemes that allow for a variety of weights for different foreign variables in the system, specifically evaluating alternative weight schemes to suit the likelihoods of the GVAR model. Third, Gross (2013) proposes estimating weights rather than choosing them exogenously for the model.

To avoid a potential problem of endogeneity in the formulation of our composite weights, the study utilizes averages, formulated in a way that their outcomes are as disengaged from quarterly policy variations as possible. By using either temporarily long or very punctual averages in time according to data availability with the prime objective of measuring how important country i has been for country j in terms of the considered exchanges and features. As described above, trade and financial weights, for example, calculate averages over the entire timespan of the series so that quarterly policies are completely diluted in these calculations (macroeconomic policies would require a large, multi-annual persistent stance to generate a significant endogenous association with these metrics, such a scenario is implausible). At the other extreme, migration weights rely on only two dates 1990 and 2000. The short-term dynamics of variations in immigration policies, for example, would have little impact on the snapshots of the flows taken in those dates.12

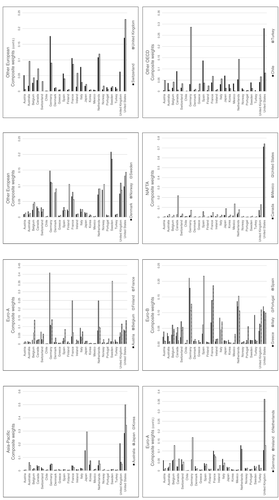

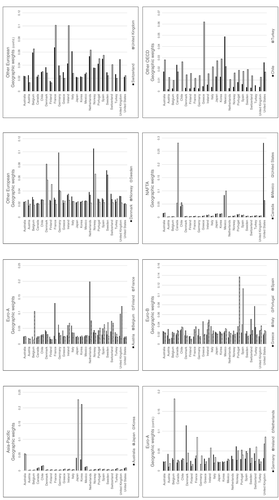

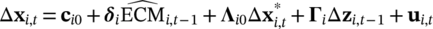

(3.5)

(3.5)Based on historical trend as well as volume of trade and financial exchanges (see Appendix C, Figures C3 and C4) between OECD economies, trade and financial channels are given preponderant roles in the depiction of exposures to foreign variables (adding up to 70% of the total weights).

In turn, as discussed above, bilateral migration exchanges are also considered consequential factors of exposure. Given the relative importance of such linkages in the OECD context (see Appendix C, Figure C5), migration holds the role of a secondary factor of exposure (25% of the total weights, which is lower that the weights assigned to trade and finance). Lastly, geographical proximities are also taken into consideration in order to include other aspects of spatial interdependencies among OECD economies (see Appendix C and Figure C2). Their residual, although complementary, role is reflected in a lower participation in the final composite weights (5% of the weights).

| Country | Domestic variables | Foreign variables |

|---|---|---|

| Austria | 2 | 2 |

| Australia | 2 | 2 |

| Belgium | 2 | 2 |

| Canada | 2 | 2 |

| Switzerland | 2 | 2 |

| Chile | 2 | 2 |

| Germany | 2 | 2 |

| Denmark | 2 | 1 |

| Greece | 2 | 2 |

| Spain | 2 | 2 |

| Finland | 2 | 2 |

| France | 2 | 2 |

| Ireland | 2 | 1 |

| Italy | 2 | 2 |

| Japan | 2 | 2 |

| Korea | 2 | 2 |

| Mexico | 2 | 2 |

| Netherlands | 2 | 2 |

| Norway | 2 | 1 |

| Portugal | 2 | 1 |

| Sweden | 2 | 2 |

| Turkey | 1 | 1 |

| United Kingdom | 2 | 2 |

| United States | 2 | 2 |

| Macroeconomic variables | Macro-relevant financial indicators | Open economy variables |

|---|---|---|

| Real output | Lending rate | Current account |

| Inflation | Int. rate spread | Oil price |

| Unemployment rate | Real exchange rate | |

| General government balance | Corporate borrowing rate | |

| Government debt (first diff.) | Share price index |

| Eurozone A | Eurozone B | Other European |

|---|---|---|

| Austria | Greece | Denmark |

| Belgium | Italy | Norway |

| Finland | Portugal | Sweden |

| France | Spain | Switzerland |

| Germany | United Kingdom | |

| Ireland | ||

| Netherlands | ||

| NAFTA | Asia-Pacific | |

| United States | Australia | |

| Canada | Japan | |

| Mexico | Korea |

- Note: Chile and Turkey were not assigned to a region.

It is worth noting that, although the weights assigned to each contributing factor of exposure are the product of the authors' choice, this is not arbitrary or random as it takes into account observed features of international interaction. Most importantly, while showing consistency with the prevailing descriptions of foreign exposure found in previous literature (where trade and finance are the key, predominant drivers), they allow for the inclusion of secondary and residual factors of interaction acknowledging, at the same time, their complementary roles in a scheme that ensures comparability across the sample (as opposed to an alternative where the weightings are the product of estimations).

In addition, the reader should recall that, in the context of our study, weights are intended to provide a measurement of the intensity of relevant relationships between country pairings. The variables representing those weights are, therefore, not used as direct factors of shock-simulation. Their participation in the modelled system is restricted to the measurement of multi-dimensional exposures to foreign shocks. Key qualities of the final weights, Z, are (a) their reflection of multiple factors intervening in economic and financial interactions/exposures with intensities specific to each country pair in a standardized, coherent scheme, (b) their depiction of asymmetries in relation to the included exposures (except only for the case of geographic distances) and (c) their flexibility to materialize only in the values strictly supported by the underlying data (if two countries have very low migration exchanges, then Migri,j → 0, for example, without affecting any of the depicted exposures to other channels which would still vary within their own respective ranges).

Additionally, regional aggregation weights wi, ℓ required by the GVAR framework are defined following.

:

:

(3.6)

(3.6)3.6 Data

This study's sample consists of 24 selected OECD countries'14 quarterly data between 1989Q4 and 2013Q3 (N = 24, T = 96) comprising of geographic data, macroeconomic aggregates, financial indicators as well as migration and key open-economy variables.

3.6.1 Weights

-

Geo-localization data, coordinates of capital cities from the World Bank's online database's API.15

Geographic distances were calculated using James P. LeSage's econometric toolbox.16

- Total imports and Total exports, bi-lateral trade data, millions U.S. dollars (IMF DTS).

- Foreign direct investment positions (inward plus outward) bi-lateral totals, normalized with respect to each country's total in relation to the other economies in the sample. Calculated with data from IMF's Coordinated Direct Investment Survey.

- Bi-lateral migration, total stocks 1990 and 2000, weighted average calculated with data from the World Bank's Global Bilateral Migration Database.

- GDP, (yearly) U.S. dollars, current prices, current PPPs, millions (OECD Stat).

3.6.2 Main panel

- Real output (lgdp), logarithm of GDP volume index series (2005 = 100), seasonally adjusted, (OECD QNA, OxEc).

- Inflation (infl), quarterly percent difference of the Consumer Price Index (OECD MEI).

- Current account balance (curracc), percent of GDP (OECD EO /for Ireland 1989Q4-1991Q1 OECD EO78).

- General government balance (govbal), as percent of GDP (OxEc).

- Gross government debt (dgdebt), as percent of GDP (OxEc).

- Real effective exchange rate index (rfx) (OxEc). Homologated to a 2010-base year for Germany and Turkey.

- Interest rate spread (spread), calculated as the difference between each country's lending rate (IMF IFS/OECD MEI/OxEc/BCL/BANXICO) and the United States' 3-month Treasury Bill (FRED).

- Lending rate (lrate), quarterly percent (IMF IFS/OECD MEI/OxEc/BCL/BANXICO).

- Corporate borrowing rate (corprate), quarterly average (OxEc).

- Share price index (shprind), quarterly average (OxEc).

- Unemployment rate (unempr), percentage (OxEc).

- Oil prices, nominal price (poil), U.S. dollars, (GVARdb, updated with own calculations on Bloomberg data between 2012Q2 and 2013Q3).

4 EMPIRICAL GVAR APPLICATION

- macroeconomic variables (including public finance),

- macroeconomic-relevant financial indicators and

- open economy variables. By these means the study aims to gather a well-targeted and parsimonious portrayal of the overall state of key macroeconomic, financial and external factors in each economy.

In consistency with GVAR modelling requirements and, due to its position as a global reference, the exchange rate and interest rate spread variables are removed from the United States' individual model as domestic variables while, in turn, their foreign representations are treated as weakly exogenous only in its specific model. The oil price has been included as an endogenous variable in the U.S. model. As a result of the considerations stated in Section 3, a composite weight matrix Z (included in Appendix C) is used in the construction of country-specific foreign variables.

For comparative purposes, five regions are defined between the countries in the sample.19 These regions, shown in Appendix Table 2, constitute the main basis of our empirical analysis and are intended to reflect the heterogeneities between OECD economies in relation to their responses to the simulated financial shocks. European countries are classified in three groups (a) Eurozone A, with the most stable, high-income Eurozone economies, (b) Eurozone B, with the Euro-economies characterized by greater instability and (c) other, non-Euro economies. American economies are predominantly represented by the members of the NAFTA bloc and Asia-Pacific is composed by Australia, Japan and Korea.

The criteria for these groupings eminently correspond, this way, to economic and spatial factors. From this perspective, a comparative analysis of the inter-regional effects of the modelled shocks is performed.

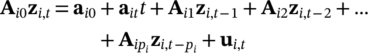

4.1 Contemporaneous effects of foreign variables on their domestic counterparts

The cross-country impact elasticities from changes in foreign variables provide a crucial source of information in relation to the interactions and potential spillovers between economies. The setting chosen in the study allows us to examine the elasticities with respect to variations in the global environment as seen from the perspective of each economy. Those elasticities, computed from the cointegrating VECMX models20 can be understood as the contemporaneous change of a domestic variable as a result of a 1% variation in its foreign equivalent.

The complete table of elasticities is included in Appendix E jointly with their corresponding Newey-West t-ratios (based on heteroskedasticity and autocorrelation corrected standard errors). From them, the following substantial findings should be highlighted: Sweden, Portugal, Germany, Norway, Japan, and Italy (in that order) present the largest elasticities to foreign variations in GDP. Although this may not be surprising for the smaller economies in this list, it is particularly relevant in the case of Germany and Japan, given the relative size of their economies, since it reflects a high degree of exposure to global levels of activity. Contrastingly, the elasticity in the case of the U.S. economy is among the lowest. This indicates that even with the considerable size of the international exchanges it has with the world, the U.S. domestic economy displays a high degree of resilience against external variations in economic activity.

Large elasticities (most of them larger than one) to global variations in lending rates are shown by Austria, Canada, Netherlands and Finland revealing their high exposure to the patterns followed by foreign financial variables. The relative depth of their involvement in foreign financial exchanges as compared to the size of their own economies (notably in the case of the Netherlands) appears to be an important factor of this sensitivity, particularly when compared to cases like Germany with a larger domestic economy and, then, a much lower elasticity to global variations in this respect.

Similarly important in this evaluation of the global circumstances surrounding credit markets are the results showing that national corporate borrowing rates are markedly susceptible to global disturbances. Sweden, Spain, France, Italy, Canada, Germany, the United Kingdom, Ireland and Netherlands all show statistically significant elasticities ranging from 0.78 to 1.38, which indicates that the foreign component of this variable has consequential implications for the operation of credit markets including cases of large financial hubs like the United Kingdom and Germany. A consequential finding in terms of elasticities to global variations is the one that shows a high degree of responsiveness of share prices. Ten of the economies in the study sample display elasticities close to one or even considerably larger, no other variable displays the same levels of sensitivity to foreign developments. This feature is shared indistinctively among the economies with diverse sizes and global roles as Greece, Ireland, Finland, Italy, Germany, Japan, France, Portugal, Spain, and Sweden; all at the top of this scale. This exhibits not only the considerable degree of their financial markets integration, but also the fact that some economies would be in better positions to face large variations while others, in this list, for example, would find such events highly detrimental.

4.2 Dynamic analysis

This section addresses the analysis of the model's dynamics through a number of shocks intended to reveal two main features: (a) the heterogeneous response to comparable disturbances across regions and (b) the impact and persistence of spillovers between regions. The study uses generalized impulse-response functions (GIRFs),21 taking advantage of their independence of the ordering of the variables and, crucially, of their ability to express the features of dissimilar responses to the modelled disturbances22in a comparable way.23 The graphs in this section display two main components: (a) the own-region effect of the modelled shock and (b) its inter-regional spillovers. For comparative purposes, each panel corresponds to an independent scenario as described in its caption.

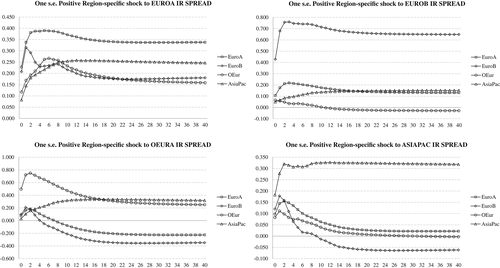

4.2.1 Shocks to the interest rate spread

In Figure 1, the effects of a shock to the interest rate spread against the U.S. Treasury Bonds rate are summarized by region of origin.24 The shock to this spread in the Euro-A region has an immediate effect of nearly 23 basis points from where it continues to display a persistent upward trend during the following two quarters until it reaches a maximum level (of 39 basis points) by the fourth quarter when it starts to decline until it stabilizes in a rate which is 33.7 basis points higher than its pre-shock level. The spillovers to the Euro-B and Other European regions follow similar patterns although the former differs by displaying a response which is synchronous and of similar size to the ones in the Euro-A region until the second quarter when that spillover starts to rapidly decline till it dissipates almost simultaneously with those in other regions (around 19 quarters after the impact). It is, therefore, notorious that the Euro-B region has a significant exposure to the shock and, although the spillover shows a degree of persistence similar to all the European regions, it displays an accentuated degree of responsiveness during the first two quarters after the shock.

The spillover to the Other European region presents a mimicking effect to the original shock, but with a smaller magnitude (11.6 basis points on impact and a maximum of 26.6 basis points in quarter 6) and in a lagged fashion (around two to three quarters after the original shock). This shows that the dynamics of the links between these two regions are characterized by lower intensity and less immediacy.

Important asymmetries are also clear when, in turn, the shock is applied to the Euro-B region since the own-region effect is considerably larger (both initial and maximum impacts) but, conversely, its inter-regional spillovers are smaller than the ones from the previous shock. Stronger links between these two Eurozone regions help to explain that Euro-A receives the largest spillover although its intensity is significantly smaller than the one generated in the opposite direction. By contrast, the Other European region shows little exposure to the Euro-B shock.

When the shock is originated in the Other European region, it generates a more complex set of outcomes. First, the own-region effect is of a similar scale as the one in the Euro-B shock but with a lower degree of persistence in general. The spillovers to Euro-A and Euro-B regions mimic that same pattern almost synchronously although with lower intensity (maxima around 20 basis points) and, interestingly, they eventually lead to negative spreads for these two regions which imply the transition to lower risk levels when compared to the United States.

A brief interpretation of these responses is that, if economies like Norway, Sweden or Switzerland, with their financial and macroeconomic record and positioning, suffered a shock of such scale, other economies would take over their role as safe markets and, in this competition, the Euro area members seem to be the first candidates. In particular economies, the interest rates appear to be more responsive to regional shocks, which is consistent with the empirical findings of Chudik and Fratzscher (2011).

The Asia-Pacific region also experiences a considerable effect from the shock generated in Euro-A, resulting in a spillover with stronger persistence than those registered in the other two European regions, increasing the spread by 25 basis points. In turn, the shock to the Euro-B countries creates a spillover on Asia-Pacific which displaces the spread by almost half that magnitude although with similar persistence. Greater exposure is revealed to a shock in Other European countries which generates a significant and permanent increase of the spread (even larger than the own-effect of an equivalent shock).

Turning to a shock originated in the Asia-Pacific region, the study reveals that it leads to a lower disturbance in the series (less than half the magnitude of the impacts of comparable shocks in the other regions) and moves towards a fast adjustment, which reaches most of its impact in quarter 2 and, after a very minor oscillation, stabilizes around that level (32 basis points up). Its spillovers are also smaller and comparatively quicker in their reversion to lower spreads. On these spillovers, Euro-A countries find themselves with a slightly higher spread, Other European countries with the same spread as before the shock and Euro-B countries even experience a final reduction in their spread.

This information helps to gain better understanding of the mechanics involved in the asymmetric and dissimilar interactions between regions and of the short and long-term effects and re-alignments of relative risk positions (as represented by the spread) resulting from the shocks.

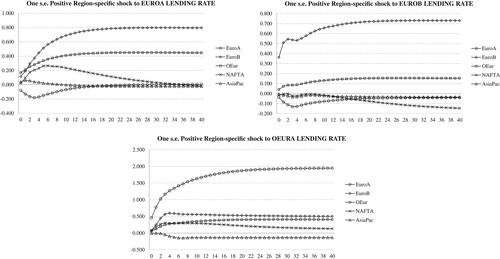

4.2.2 Shocks to the lending rate

As discussed above, interest rate spreads have the function of defining internationally-relevant positions in terms of competitive financial exchanges. The series for lending rates and corporate borrowing rates tend to have, by contrast, a more domestic-oriented content, which reflects the prevailing conditions in domestic credit markets. But this does not rule out the presence of international (and inter-regional) spillovers that result from financial interconnections as explored below.

In Figure 2, starting with the shock to lending rates in the Euro-A region, a moderate immediate own-region response is followed by a gradual, twofold persistent effect which continues until quarter 14 leading to an increased rate for this region. In turn, the notorious presence of a much larger spillover to the Euro-B region almost doubles the own-region final effect. An accelerating effect is shown to operate between these two regions (although this effect is mainly uni-directional). This shock is also followed by a moderate increase in NAFTA's lending rates but, contrastingly, this effect does disseminate in time leaving the NAFTA rate at the same level registered before the shock. The initial impact of the spillover in the Other European economies is negative, pushing the rates towards temporary lower levels and reaching a minimum at 20 basis points below the pre-shock rate in the third quarter before starting to dissipate. The impact on Asia-Pacific is minor and comparatively short-lived (lasting nearly six quarters).

When the shock is originated in the Euro-B region, the own-region effect is stronger both in immediate terms and as a source of persistent pressure on the rate. This region's lending rate displays a high degree of sensitivity to domestic and foreign disturbances responding in a significant manner to all the regional shocks but, alternatively, it does not exhibit the power to generate major spillovers on other regions revealing, this way, significant directional asymmetry.

One of the largest after-shock responses reviewed so far is the one resulting from a shock to the lending rate in Other European economies gradually pushing the lending rate two points above its initial level. It can be observed that even the associated spillovers have considerable magnitude, especially in the case of Euro-B economies, followed by Euro-A and to a more transitory extent by the NAFTA region. A minor lagged spillover occurs in the Asia-Pacific region after three quarters of the shock just to displace the corresponding rate 13.6 basis points below its initial level.

By contrast, the shock on the Asia-Pacific lending rate lasts for only six quarters with a final moderate displacement (for an own-region effect) of 43.8 basis points, showing spillovers which are only significant for the Euro-B region.

These results show the mixture of effects that diverse regional linkages can have on credit market conditions when exposed to common shocks. These, rather unexplored, effects are final expressions of linkages operating through variables like inflation and aggregate demand which alter the credit markets conditions in both the regions impacted by the shock and those receiving their spillovers.

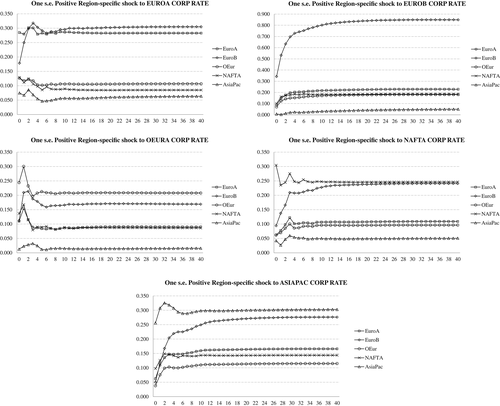

4.2.3 Shocks to the corporate rate

In general terms, we observe, in Figure 3, that corporate rates show a faster speed of recovery after disturbances, which is clearly related to the competitive pressures associated with these markets. Another remarkable, perhaps unexpected feature, is the similarity in the behaviour of the responses across regions.25

Euro-A and Euro-B regions display remarkably similar impacts from a shock to the former where the spillover gets to equalize and even exceed the own-region effect. Once again, this is evidence of the significant sensitivity shown by the Euro-B region to external disturbances. The correspondence between these commercial rates is shown to be stronger across the two Eurozone regions than in the case of retail rates (although in both scenarios the correlations between regions are high). Spillovers to non-Euro regions, by contrast, are moderate. However, they generate small permanent displacements among which the largest corresponds to the region with greater closeness: Other European economies.

The shock to the Euro-B region reveals greater sensitivity both in own-region terms (causing a large displacement) as in relation to spillovers, all of which, except for Asia-Pacific, are larger than those from the shock to Euro-A. This way, Euro-B countries seem to be able to spread the effects of financial shocks to other regions.

It is notorious that the shock to the NAFTA region also appears to transmit significant effects to the Euro-B region while its spillovers to other regions are moderate. The same applies in the case of the shocks to Asia-Pacific and Other European economies' corporate rates as their major spillover drag Euro-B's corporate rate up almost to the same extent of the own-region effects.

At the other extreme, the Asia-Pacific region consistently shows little sensitivity to external shocks. Only the own-region effect causes a significant displacement of the corporate rate.

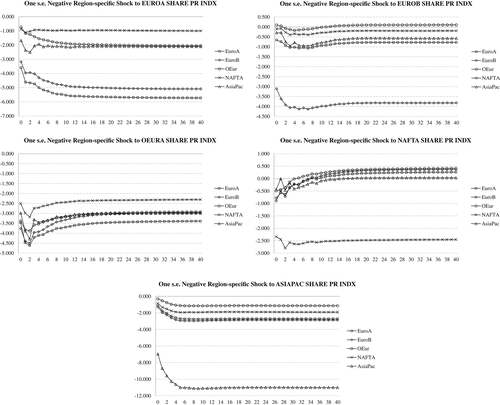

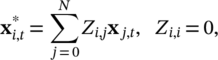

4.2.4 Shocks to the share price index

This shock, shown in Figure 4, represents a generalized deterioration of the risk-conditions in the stock markets of the involved regions. Our analysis reveals the international dimensions of its impact. The response to a negative shock to this index in the Euro-A region, for example, creates a spillover in the Euro-B region with very similar magnitude and behaviour as the own-region response, both of them lead to a permanent decrease in share prices across the Eurozone. The spillover, this way accentuates the own-region effect by almost doubling the aggregate impact. Asia-Pacific and Other European markets also display spillovers of a more moderate nature while NAFTA markets are only slightly affected reflecting greater resilience to the European shock.

When the equivalent shock is applied to the Euro-B region, even the own-region effect is smaller than the spillover it received from the shock described above and its own spillovers show small impacts on other regions so, in contrast to that shock it generates very modest external effects.

The presence of a large financial hub in the Other European region as London helps to explain that a shock to its share price index creates a significant response in all regions. It is especially notorious the spillover to the Euro-A area evidencing the significance of financial linkages between these regions. Again NAFTA markets, although not immune to the spreading of the shock, exhibit the smallest spillover.

The comparative strength of financial linkages in European regions contrasts to inter-regional linkages with the NAFTA region as the shock to its share price index displays only small spillovers to the other four regions. It can be noted, however, the relative uniformity of those external effects as in this case even the Asia-Pacific region receives a similar spillover.26

Larger spillovers result from a shock to the Asia-Pacific region, causing also more permanent displacements in all regions where Eurozone countries are the most affected. The size of the own-region effect is significantly larger than the ones in other groups revealing high sensitivity of this region to internal (as opposed to externally-generated) shocks.

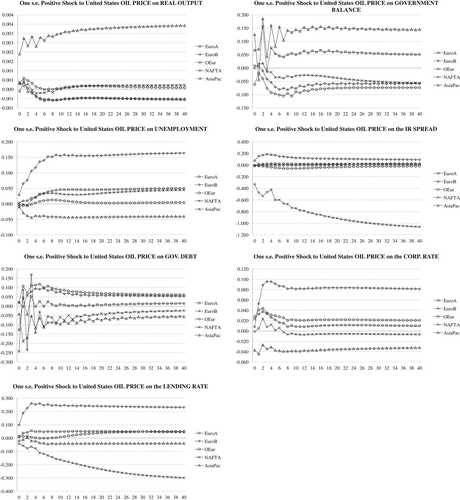

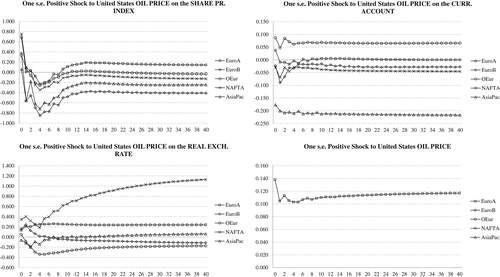

4.2.5 Shock to the oil price

By analysing the effects of a positive one standard error shock to oil prices in Figures 5 and 6, it is also possible to observe key differences and similarities between the responses in the studied regions. It is notorious, for example, the presence of counter-cyclical responses in Asia-Pacific to the oil price shock on output, unemployment and government accounts, which contrast to the relative deterioration experienced by other regions under such conditions. Euro-B's unemployment, for example, shows a marked increase as a result to the oil price shock and the subsequent fall in the region's real output. Euro-B's suffers a increase in the lending rate, the corporate rate and the interest rate spread signifying an overall deterioration of its relative risk stance.27

Both Eurozone regions display effectively the same lagged decline in real output and a permanent displacement below pre-shock levels. Non-Euro economies, in turn, escape those effects and remain relatively unaffected except for a minor productive increase in the immediate aftermath of the shock which is quickly reversed. The strongest impact for this region, by contrast, is shown as a deterioration of the government's balance with considerable persistence closely followed by the response in Euro-B.

All the European regions exhibit an accumulation of government debt with greater persistence in Euro-B and Other European economies while the opposite occurs in Asia-Pacific and NAFTA. The responses of the share price indexes display a significantly more homogeneous pattern after the oil shock, varying only in terms of size. Euro-B and Asia-Pacific are the markets most affected by the shock.

The deterioration of overall macroeconomic conditions arising from this shock (lower output, higher interest rates, share prices in decline and European debt accumulating), helps to understand it as a critical component of the global economic performance.

Nevertheless, regional specificities arise from our analysis as the relative resilience to this shock shown in Other European economies, particularly in relation to the responses they have in output, unemployment and share prices. Government debt accumulates and the current account shows a permanent displacement towards surplus. This last effect is contrasting to the responses in Euro-B, NAFTA and, especially, Asia-Pacific where the shock moves the current account into negative figures.

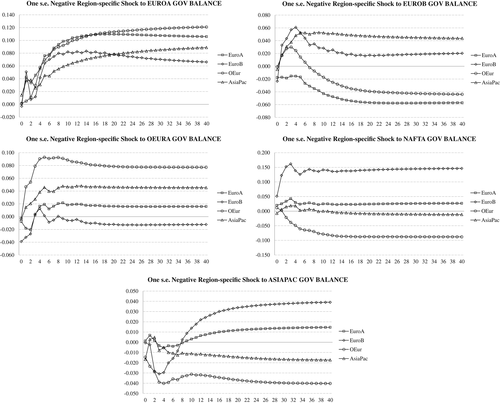

4.2.6 Effects of shocks to government balance on spreads

The government's financial accounts can have important impacts on the aggregate risk-conditions of each economy. Similarly, fiscal crises are recurrently amongst the most worrying scenarios for the global economy. A particularly exemplifying event in this sense is found in the 2009 European debt crisis. Figure 7 presents the responses of the interest rate spreads (our key measure of comparative risk) to a one standard error negative shock to each region's government balance.

In general terms, these shocks result in increases of the spreads, confirming the presence of an expected relationship between government accounts and the markets' assessment of relative risks. But, far from being homogeneous, the responses reveal a range of diverse profiles between the regions. In this case, given that (a) the U.S. constitutes the common global reference against which all relative risk spreads are calculated and (b) it is the dominating economy within the NAFTA region, the study concentrates on analysing the effects of the shocks on Europe and Asia-Pacific.28

The disturbance to Euro-A's government balance sparks a relatively lagged increasing trend in all European and Asia-Pacific regions. The shock effectively results in the deterioration of the risk profiles of all these regions (showing greater spreads) generating the largest spillovers by origin. Those are mainly transmitted to Other European and Euro-B economies although Asia-Pacific eventually displays a greater long-term upward displacement of the spread.

Applying the same shock to the Euro-B region, the study reveals more transitory effects except for the Asia-Pacific region which can be due to important exposure to European debt. The spillover to the Other European economies is eventually reversed, even inducing a change towards negative spreads (that is, the region displaying a lower interest rate than the global reference). The response in the Euro-A region also indicates that the risk-deterioration in Euro-B eventually reflects into the improvement of relative risk profiles in the rest of Europe.

The equivalent shock to Other European economies also reveals the exposure to European fiscal accounts by Asia-Pacific29 and a lagged deterioration of the risk-profile in Euro-A. A competitive stance between European economies in terms of prevailing risk assessments means that this shock eventually leads to negative spreads (while the other regions experienced increases in their spreads).

The spillovers from a shock to the government balance in the NAFTA region splits the European economies in two with the Euro-zone experiencing increases in the spreads (that is, showing higher relative risks) mainly in the case of Euro-B countries, while non-Euro economies follow a lagged pattern of gradual decrease of the spread. Asia-Pacific is comparatively unresponsive to this shock.

When the shock occurs in Asia-Pacific, a small increase of the spread is reversed relatively quickly and with enough intensity to lead it to negative figures in the long term. Spillovers seem to also reveal a competitive relationship with the Euro-B region as their variations mostly oppose each other. The Other European region seems to benefit from the results of the shock as it transitions to a negative throughout the timespan of the response profiles. The Euro-A region displays a transitory, minor increase of the spread which is fully reversed afterwards although its long-term trajectory leads again to an increase in its spread which can be associated to the responsiveness towards variations in the Euro-B region.

5 CONCLUSIONS

This paper has described both similarities and consequential heterogeneities between OECD regions in relation to the impacts of financial disturbances on their economies. Making use of an innovative international weighting scheme in a GVAR framework, the study takes into account key dimensions of exposure to such international disturbances. By applying relevant shocks to specific regions, we observed not only the impacts as expressed in their own variables but also the spillovers generated on other regions. The results, therefore, provide an opportunity to assess the dynamic effects of shocks from a broader, systemic point of view.

Complex exposures between OECD economies are considered in our empirical application in a setting mediated by multi-dimensional, composite weights which reflect the relative relevance between economies. Those weights helped to simulate a system where diversity between linked participants and asymmetries in the modelled relationships are the norm. The scheme is flexible enough to account for the directional strength of the considered factors of exposure (trade, finance, migration and other secondary channels, as revealed by historical data) and to exclude linkages which might not have support by the observed data (meaning standardization without over-generalization of any weight-related findings).

Any effective set of policy measures should take into account these dimensions emanating from significantly distinct relationships and occurring within each of the dominant welfare clusters in the OECD.

A number of salient regional features revealed by this study are summarized as follows: (a) The Euro-B region (integrated by Greece, Italy, Portugal and Spain) displays a high degree of vulnerability in relation to shocks to its financial variables as well as to the spillovers generated by shocks in other regions. This is particularly accentuated in the case of the interest rates included in the model. Its own capacity to influence other regions' dynamics is contrastingly limited. (b) At the other extreme of this spectrum, the region which appears as less exposed to regional spillovers is Asia-Pacific (Australia, Korea, and Japan), based on this information it can be argued that its structural linkages with the other regions are at the lower end within the scope of this study. (c) The NAFTA region (Canada, Mexico and the United States) is capable of generating synchronous and generalized responses in all the other regions in such a way that these could be seen as proxies for global disturbances. (d) The Euro-A region (Austria, Belgium, Finland, France, Germany, Ireland, and Netherlands) appears to be less sensitive to own and inter-regional shocks when compared to the Euro-B region, however, it consistently displays a contagion effect from variations in the latter, which implies that it is subject to the effects of imported variability.

The interconnections between regions, as depicted in a concrete and comparable way, reveal not only specific features of the defined clusters, but also of the international component of the variables in the model ranging from those having relatively low external sensitivities to others displaying a high degree of synchronicity in the responses to common shocks, particularly in the context of financial markets. The study confirmed and measured the international components of crucial variables such as interest rates and shares prices and compared them by region of origin of the corresponding disturbances. This information, in conjunction to the exploration of shocks to the oil price, is relevant for researchers and monetary authorities alike as it points out the potential direct impacts and spillovers pressing for distinctive adjustment of national and/or regional policies. Concrete measurements of international risk contagion and global rebalancing are provided by our study and, within the same context, the impacts of shocks to government balances on comparative risks helped to describe consequential nominal effects of fiscal policies which might, subsequently, generate pressures on interest rates. This way, the handling of domestic and foreign fiscal policies will impinge not only on the manoeuvring space for monetary policies, attempting to influence the trends of interest rates, but also on the domestic and foreign patterns of financial costs.