Corporate governance mechanisms and carbon disclosure: A multilevel and multitheory literature survey

Abstract

This study provides a comprehensive review and synthesis of 62 empirical studies on corporate governance drivers of carbon disclosure. We reveal that companies are experiencing pressure for carbon disclosure at multiple levels. At the macro-level, pressures from regulatory institutions, normative institutions, financial markets, media, society, and economic cost were the most influential factors driving carbon disclosure. At the meso-level, peer pressure from companies in similar industries as well as owners and investors influenced carbon disclosure. At the micro-level, board diversity, board independence, and internal organizational systems explained the likelihood and commitment to carbon disclosure. In addition, we comprehensively reviewed and synthesized the theoretical lenses that have been used in scholarship on the impact of corporate governance mechanisms on carbon disclosure. Our study is the first multitheory and multilevel literature review on the impact of corporate governance mechanisms on carbon disclosure.

1 INTRODUCTION

Climate change poses serious challenges to humanity and mitigating climate change is critical for the long-term viability of society and economy (Addison and Roe, 2018; IPCC, 2023; King, 2004). Companies are under enormous pressure from stakeholders to reduce GHG emissions and report climate related risks (Doh et al., 2021; Lee, 2012; Wakabayashi, 2013). To address climate change concerns, corporate governance (CG) mechanisms at different levels can contribute to better environmental management practices of companies (Ayuk et al., 2020; Jain & Jamali, 2016; Shrivastava & Addas, 2014), and numerous studies have examined the impact of a variety of CG mechanisms on carbon disclosure (e.g., Prado-Lorenzo and Garcia-Sanchez, 2010; Al-Qahtani & Elgharbawy, 2020; Azar et al., 2021; Mardini and Elleuch, 2022; Luo et al., 2023; Qosasi et al., 2022; Rahman et al., 2023; Raimo et al., 2022).

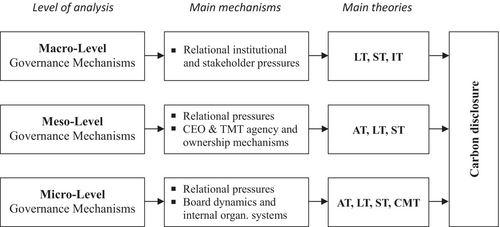

CG is a multifaceted construct (Zaman et al., 2022) and includes factors either internal or external to a firm's boundary (Walsh & Seward, 1990). In line with the extant literature (cf. Ali et al., 2022a; Jain & Jamali, 2016), we classify CG mechanisms into macro-, meso-, and micro-level CG mechanisms. Macro-level factors refer to those mechanisms originating from outside the firm related to both formal and informal institutions, such as the nature of the legal system, market control, stakeholder activism, external auditing, the media, as well as cultural and social norms (Aguilera et al., 2015; Zaman et al., 2022). Meso-level factors include stakeholder interactions at an organizational level (Ali et al., 2022a; Barbour, 2017), which captures the interactions among owners, investors, and stakeholders interacting to influence companies' social and environmental practices and their subsequent disclosures (see reviews by Ali et al., 2017; Fifka, 2013; Jain & Jamali, 2016; Ali et al., 2022b). At a micro-level, board composition and CEOs/executives' attributes have been linked to companies' environmental performance (Jain & Jamali, 2016; Velte et al., 2020). There is a complex web of relationships between these multilevel CG variables that have not been systematically examined before, especially in regard to how they affect particularly carbon disclosure, either separately or in combination (Aguilera et al., 2015).

A multilevel approach is vital, as the success of environmental disclosure depends on different configurations of CG mechanisms in different contexts. It has been shown that the quality of environmental disclosure is context-specific (e.g. Giannarakis et al., 2019; Grauel & Gotthardt, 2016) and that different configurations of CG mechanisms can help to achieve similar levels of environmental disclosure and performance (e.g. García-Sánchez et al., 2023; Walls et al., 2012). However, these studies have tended to study the impact of CG at a single level of analysis, either focusing on the macro-level national context (e.g. Giannarakis et al., 2019), or on organizational-level factors (e.g. García-Sánchez et al., 2023), or on micro-level factors (e.g. Elsayih et al., 2021), but failing to encompass the full spectrum of CG mechanisms. Likewise, prior reviews on governance drivers of carbon disclosure have failed to comprehensively explore governance mechanisms at all three levels. For example, Hahn et al.'s (2015) review looked only at macro-level determinants of carbon disclosure, while Velte et al. (2020) only addressed limited micro-level governance factors, along with macro-level determinants. In order to understand what configurations may work best to advance carbon disclosure, we need to first understand the full spectrum of CG mechanisms at all three levels, a gap that we are trying to fill.

While a multilevel approach is vital, it is also vital to gain a thorough, theoretically informed, understanding of what motivates companies to engage in carbon disclosure. Although reviews have been undertaken on CG drivers of carbon disclosure (Ascui, 2014; Hahn et al., 2015; Velte et al., 2020), no study examined the use of organizational and management theories, which can help to distinguish and explain the different motivations behind companies' engagement in carbon disclosure. The previous review by Velte et al. (2020) concluded that legitimacy theory is “the prevailing lens” and only discussed CG and carbon disclosure with respect to legitimacy theory. However, legitimacy theory fails to explain the internal organizational dynamics behind carbon disclosure, which are the result of economic calculations and distinct managerial decisions that are often influenced by personal characteristics of senior managers. Scholarship has used a myriad of theoretical perspectives—including economic and behavioral theories—that underpin the relationship between CG mechanisms and carbon disclosure. There is a compelling need for research that comprehensively examines the theoretical basis of the governance–carbon disclosure relationship, while considering the full spectrum of governance factors that drive it. Our study aims to address this gap by reviewing the existing literature on CG-related determinants of carbon disclosure using a multitheory analysis.

- What are the theoretical perspectives used to explain the link between CG mechanisms and carbon disclosure?

- What are the macro-, meso-, and micro- CG mechanisms influencing carbon disclosure?

- What are the avenues for future research?

Our study makes two significant contributions to the literature. First, we comprehensively review and synthesize the theoretical lenses that have been used in scholarship on the impact of CG mechanisms on carbon disclosure. A thorough understanding of theory helps to introduce greater scholarly rigor and helps to make sense and simplify the complex empirical world on the basis of sound explanations and predictions (Bacharach, 1989; on CSR/sustainability theorizing: Unerman & Chapman, 2014), while theory also signals the values upon which scholarship is built and can indicate how social change might be triggered or precluded at different levels of analysis (Suddaby, 2014; on CSR/sustainability theorizing: Aguilera et al., 2007). While Velte et al. (2020) only considered legitimacy theory, our review will demonstrate that legitimacy theory only accounts for less than one-quarter of scholarship on this topic. Other prior reviews have not even addressed theory. To the best of our knowledge, our study is the first to synthesize the theories on the impact of CG mechanisms on carbon disclosure.

Second, this study employs a multilevel (macro-, meso-, and micro-) framework to organize the CG-carbon disclosure literature, providing rich insights into the various levels of governance mechanisms that contribute to carbon disclosure in both developed and developing countries. Leading reviews of CSR scholarship have previously emphasized the importance of studying the factors behind social and environmental outcomes at three different levels of analysis (Aguinis & Glavas, 2012; Frynas & Stephens, 2015; Mellahi et al., 2016). However, reviews on the impact of CG failed to distinguish between governance mechanisms at different levels (Jain & Jamali, 2016; Zaman et al., 2022) or have failed to comprehensively explore this impact at all three levels (Hahn et al., 2015; Velte et al., 2020), often assuming that different levels of governance mechanisms will have similar kinds of influence on disclosure. This is the first study using a comprehensive multilevel framework (i.e., micro-, meso-, and macro-level) to group governance-related determinants influencing carbon disclosure.

2 RESEARCH FRAMEWORK

In line with previous leading reviews (Aguinis & Glavas, 2012; Frynas & Stephens, 2015; Mellahi et al., 2016), this study employs a multilevel framework analysis to gain a holistic understanding of the factors that influence carbon disclosure. Economic, social, cultural, political, legal, and environmental contexts are all considered to be at the “macro-level” in this analysis (Barbour, 2017; Frynas & Yamahaki, 2016). Meso-level study emphasizes stakeholder–organizational interaction (Ali et al., 2022a; Barbour, 2017). Customers, workers, shareholders, creditors, governments, media, communities, nonprofits, and the general public are all examples of stakeholders (Clarkson, 1995). Analysis at the micro-level looks at the specifics of an organization such as its departments and employees and their attributes (Frynas & Yamahaki, 2016; Jones et al., 2004).

3 MATERIALS AND METHODS

3.1 Searching articles

For systematic review, we first developed the search string (e.g., CG or board or gender or independence and carbon or GHG or disclosure) by combining notable keywords representing CG and carbon disclosure. We searched the same search string in six databases: Emerald Insight, Wiley Online Library, Science Direct, Taylor & Francis, Springer, and JSTOR. We investigated the articles' titles and their abstracts to locate those articles that looked into the relationship between governance structures and carbon disclosure. This process yielded 124 articles (see Table 1). Second, all downloaded articles were cross-referenced against the Charted Association of Business Schools (CABS) journal ranking 2021. We discovered that 37 of the downloaded publications were published in journals that were not CABS ranked and were excluded from our analysis. Finally, in line with Aguinis et al. (2011), we used the ancestry approach and searched for missing articles from the reference list of already published review papers (see Velte, 2022). The ancestry approach brought two new articles, resulting in a total of 89 articles. After reading full length papers, we found 27 irrelevant articles which were excluded from our database. Thus, the final database includes 62 articles (see Appendix A).

| Description | Total |

|---|---|

| Using of search string in | |

| Emerald | 53 |

| Wiley Online Library | 19 |

| Jstor | 9 |

| Science Direct | 19 |

| Taylor & Francis | 13 |

| Springer | 11 |

| Total articles downloaded | 124 |

| Articles not published in CABS ranked journals | 37 |

| Articles published in CABS ranked journals | |

| 4* | 2 |

| 4 | 1 |

| 3 | 25 |

| 2 | 36 |

| 1 | 23 |

| Total CABS ranked articles | 87 |

| Articles through ancestry approach | 2 |

| Total articles considered for analysis | 89 |

| Irrelevant articles | 27 |

| Total relevant articles | 62 |

- Abbreviation: CABS, Charted Association of Business School.

3.2 Coding reliability

In line with prior review papers (see Ali et al., 2017; Ali et al., 2022a; Jain & Jamali, 2016; Zaman et al., 2022), the authors first developed a list of information to be collected from each review paper for the coding perspective. The authors deliberated on the information to be collected and finalized the list, which was then shared with several notable researchers writing systematic reviews and resulted in additional suggestions for improvements. The resultant list of information to be collected is presented in Appendix B. Two authors independently coded the articles against the predefined parameters and compared the coding results. The coding results reflected significant evidence of inter-coder1 reliability (Krippendorf Alpha value = 0.94). The discrepancies were later resolved through mutual discussion between the coders.

3.3 Analysis

This study first developed frequency tables for all the included variables such as research journals, context, theoretical perspectives, methods, independent and dependent variables, and results. We categorized governance-related determinants into macro-, meso-, and micro-level mechanisms to better understand the level of governance influences that companies face. Based on the findings, we listed future research directions in the field of carbon disclosure.

4 REVIEW RESULTS

4.1 Overview of selected studies

4.1.1 Field of publications

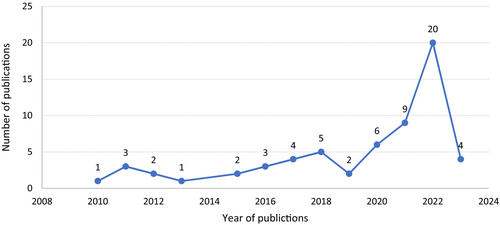

Briefly, 35.48% of the studies included in our research were published in accounting journals, 32.26% in business ethics and CSR journals, and remaining studies were published in management, finance, and economics journals (see Table 2). However, Sustainability Accounting, Management and Policy Journal, Business Strategy and the Environment, Journal of Business Ethics, and Social Responsibility Journal appeared to be the dominant journals in terms of their publications on the focal topic (see Appendix C). Figure 1 shows that all of the studies on the focal topic were published between 2010 and 2023, and 62.90% of them were published during the last 3 years, suggesting an upwards trend of CG and carbon disclosure research in recent times. To our understanding, the steeper increase in CG—carbon disclosure research can be largely attributed to the 2015 Paris Accords for climate change. Finally, most of the studies included in our analysis are empirical in nature.

| Studies on developed vs. developing markets | |

| Developed markets | 38 (61.29%) |

| Developing markets | 13 (20.97%) |

| Both developed and developing markets | 11 (17.74%) |

| Most frequently studied focal countries | |

| US | 14 (22.58%) |

| Australia | 8 (12.90%) |

| UK | 4 (6.45%) |

| China | 4 (6.45%) |

| Europe | 3 (4.84%) |

| India | 2 (3.23%) |

| Malaysia | 2 (3.23%) |

| Publication field | |

| Accounting | 22 (35.48%) |

| Ethics, CSR and Management | 22 (32.48%) |

| Management | 10 (16.13%) |

| Finance | 7 (11.29%) |

| Economics | 3 (4.84%) |

4.1.2 Context of studies

Developed countries were predominately represented in the carbon disclosure literature. Briefly, 61.29% of the studies in our sample addressed exclusively developed countries, 20.97% focused on developing countries, and 17.74% of studies focused on both developed and developing countries (see Table 2). In developed countries, the studies mainly targeted the USA, Australia, the UK, and Canada while, in developing countries, the carbon disclosure literature was largely limited to China, India, and Malaysia.

4.1.3 Measurement of carbon disclosure

Table 3 summarizes the measures of carbon disclosure used in extant literature. These measures fall within the categories of carbon disclosure and carbon performance. Carbon disclosure refers to public provision of information about environmental performance and disclosure whereas carbon performance covers the environmental impacts such as CO2 emissions, CHG emissions, CO2 intensity, and sustainability index scores.

| Carbon disclosure related variables | Total | Percent |

|---|---|---|

| Carbon disclosure project score | 17 | 27.42% |

| Carbon information disclosure | 7 | 11.29% |

| GHG disclosure | 6 | 9.68% |

| Environmental sustainability disclosure | 5 | 8.06% |

| Carbon emission disclosure score | 5 | 8.06% |

| Carbon performance | 5 | 8.06% |

| Climate change disclosure | 3 | 4.84% |

| Carbon management strategy adoption | 2 | 3.23% |

| Carbon emission intensity | 2 | 3.23% |

| Carbon mitigating strategies score | 1 | 1.61% |

| Carbon reduction strategy | 1 | 1.61% |

| Corporate carbon commitment | 1 | 1.61% |

| Corporate sustainability practices | 1 | 1.61% |

| Environmental performance | 1 | 1.61% |

| Environmental pillar (ESG performance) | 1 | 1.61% |

| GHG performance and its components | 1 | 1.61% |

| Participation in GHG protocol program | 1 | 1.61% |

| Quality of carbon reporting and its aspects | 1 | 1.61% |

| Sustainability reporting | 1 | 1.61% |

| Total | 62 | 100.00% |

4.1.4 Theoretical perspectives

Table 4 presents a summary of theoretical perspectives used to explain the link between CG mechanisms and carbon disclosure. Our findings demonstrate that the existing literature uses a wide range of theoretical perspectives, however legitimacy theory, stakeholder theory, agency theory, and institutional theoretical perspectives are the most widely used theoretical viewpoints. To explain the governance-related determinants of carbon disclosure, 93.55% of the studies in our sample utilized at least one theory, 61.29% used at least two theories, and 25.31% used at least three theories. Thus, scholars did not rely on a single theoretical perspective to explain the complex linkage between CG mechanisms and carbon disclosure but rather used multiple theoretical perspectives.

| Theory | Code | Number of studies | Variable level insights | |||

|---|---|---|---|---|---|---|

| Positive | Negative | Insignificant | Total | |||

| Legitimacy theory | LT | 27 | 136 | 25 | 100 | 261 |

| Stakeholder theory | ST | 23 | 73 | 28 | 80 | 181 |

| Agency theory | AT | 19 | 81 | 27 | 76 | 184 |

| Institutional theory | IT | 17 | 73 | 20 | 43 | 136 |

| Critical mass theory | CMT | 11 | 39 | 17 | 35 | 91 |

| Signaling theory | SigT | 6 | 33 | 7 | 26 | 66 |

| Resource dependence theory | RDT | 6 | 37 | 7 | 33 | 77 |

| Resource based view | RBV | 1 | 10 | 2 | 2 | 14 |

| Proprietary cost theory | PCT | 1 | 4 | 0 | 4 | 8 |

| Voluntary disclosure theory | VDT | 1 | 4 | 1 | 2 | 7 |

| Political cost theory | PoCT | 1 | 6 | 1 | 0 | 7 |

| Upper echelons theory | UET | 1 | 0 | 4 | 2 | 6 |

| Social identity theory | SIT | 1 | 0 | 2 | 3 | 5 |

| Group development theory | GDT | 1 | 5 | 2 | 3 | 10 |

| Gender socialization theory | GST | 1 | 7 | 1 | 6 | 14 |

| Managerial discretion theory | MDT | 1 | 2 | 3 | 5 | 10 |

| Stewardship theory | StewT | 1 | 5 | 1 | 5 | 11 |

| Studies used: | ||||||

| At least single theory | 58 | 93.55% | ||||

| At least combination of two theories | 38 | 61.29% | ||||

| At least combination of three theories | 16 | 25.81% | ||||

| At least combination of four theories | 2 | 3.23% | ||||

In line with previous categorizations of theoretical perspectives in CSR research (Frynas & Yamahaki, 2016; Garriga & Melé, 2004; Secchi, 2007), we distinguish between relational and instrumental theories. Relational theories explore the interactions between the organization and society, where environmental practices can be viewed as the outcome of social relationships and societal norms. Instrumental theories provide economic and managerial perspectives, which can help to explain the internal organizational dynamics behind environmental practices, where environmental practices can be viewed as the outcome of managerial decisions and economic calculations.

Our findings show that scholarship on the impact of CG on carbon disclosure is dominated by relational theories, in line with CSR and sustainability scholarship in general (cf. Frynas & Yamahaki, 2016). Legitimacy theory (27 studies), stakeholder theory (23 studies), and institutional theory (17 studies) appear 67 times between them (see Table 4). All of these three theories address the societal challenge that firms require legitimacy from society in order to survive and prosper, either by addressing stakeholder needs or by adapting to prevailing institutional norms. Indeed, a number of studies in our review used all three theories in tandem, providing a holistic system-oriented perspective on governance and carbon disclosure (e.g. Comyns, 2016; Houqe & Khan, 2023).

In addition to the three main theories, some scholars also used resource-dependence theory (6 studies), which suggests that firms' success and survival depend on accessing critical resources from internal and external actors, with environmental disclosure helping to maintain this resource flow. A core assumption of this theory, namely that stakeholders or institutional actors provide critical resources to the firm, has cross-fertilized some of the other relational approaches that focus on legitimacy. Relational theories also include less popular perspectives, such as group development theory and social identity theory. All relational perspectives highlight in different ways the organization's dependence on societal approval, whereby specific actors or institutional norms convey accepted ideas to the organization on managerial practices related to environmental management. Accordingly, environmental disclosure thus helps organizations to gain and maintain societal approval (see Table 5).

| Theory | Core assumption | Rationale of disclosure | Examples of studies from the review |

|---|---|---|---|

| Legitimacy theory | Firms operate on the basis of a social contract with society and require societal legitimacy for their survival | Disclosure enhances firms' legitimacy | Li et al., 2018 Rohani et al. 2022 |

| Stakeholder theory | Firms' success is significantly affected by stakeholder actions and thus firms must address stakeholder interests | Disclosure addresses stakeholder demands | Dhanda et al., 2022 Liesen et al., 2015 |

| Agency theory | Managers as agents have distinct incentives and objectives from their principals, giving rise to agency conflicts | Disclosure is the outcome of managerial agency but it can also serve to monitor managerial conduct | Kumar et al., 2022 Shan et al. 2021 |

| Institutional theory | Firms' success depends on adapting to institutional environments within which they operate | Disclosure enhances firms' legitimacy in different institutional environments | Comyns 2016 Dhanda et al., 2022 |

| Critical mass theory | Firms' boards of directors must have a critical mass of individuals who support a given policy | Disclosure is supported by a critical mass of individuals on the board | Ben-Amar et al. 2017 Nuber & Velte 2021 |

Signaling theory |

Firms' success depends on sending signals about their conduct to stakeholders to reduce uncertainty associated with incomplete and asymmetrically distributed information | Disclosure signals good ESG performance to the market and stakeholders | Bui et al. 2020 Karim et al. 2021 |

| Resource dependence theory | Firms' success depends on accessing critical resources from internal and external actors | Disclosure helps to satisfy internal and external actors and maintains resource flow to the firm | Elleuch Lahyani 2022 Xia et al. 2023 |

Instrumental theories are represented, above all, by agency theory (19 studies). Agency theory addresses “the agency problem” that may arise as a result of a conflict of interest between “principals” (such as owners of a publicly owned firm) and “agents” (such as managers of a firm) or the inability of the principal to effectively monitor the conduct of the agent, and how this agency problem can be overcome through different governance mechanisms. This theory has been used to explore both the organizational aspects of environmental disclosure, such as the influence of organizational ownership, as well as the individual behavior of senior managers, which can both explain disclosure choices.

Broadly speaking, other instrumental theories either focus on the organization itself and its resources or on the behavior of individuals within the organization that may produce collective outcomes. Theories that focus on organizations explain managerial and economic calculations behind disclosure, including signaling theory (6 studies) and another popular theory from business and management studies, the resource-based view (one study). As one example, signaling theory addresses the managerial challenge that stakeholders face the uncertainty of incomplete and asymmetrically distributed information about a firm's conduct, environmental disclosure helps to close this informational gap by sending signals about the firm's conduct to stakeholders.

Behavioral theories that focus on individuals explain how individual characteristics of decision-makers within organizations can help produce collective outcomes such as disclosure, including critical mass theory (11 studies) and another popular theory from business and management, the upper echelons theory (one study). Critical mass theory addresses the behavioral challenge that a firm's board of directors must have a critical mass of individuals who support a given corporate policy such as environmental disclosure, hence the individual characteristics of board members become the key focus of analysis.

All of these instrumental perspectives help to explain meso- and micro-level drivers of carbon disclosure in different ways.

5 DETERMINANTS OF CARBON DISCLOSURE

The following subsections discuss macro-, meso- and micro-level governance determinants of carbon disclosure.

5.1 Macro-level CG determinants of carbon disclosure

Studies on the macro-level determinants of carbon disclosure are dominated by relational theories that emphasize external pressures on the organization to adopt carbon disclosure. They explore external governance mechanisms related to the pressures from regulatory institutions, normative institutions, financial markets, media, and society, which all influence corporate carbon disclosure (see Table 6). Economic pressure refers to the imposition of carbon fees, charges, and taxes (Luo et al., 2012), which incentivizes management to reduce emissions and then disclose them to its stakeholders. Emission trading scheme is considered a proxy of economic pressure (Luo et al., 2012) and all the studies examining the role of emission trading schemes in promoting carbon disclosure showed a positive relationship suggesting that economic pressure positively drives carbon disclosure (see Table 6). Financial market pressure emanating from creditors, shareholders, and debtholders has been reported to have mixed influence on carbon disclosure. Table 6 shows that 31.11% of the studies examining the relationship between proxies of financial market pressures and carbon disclosure showed a positive relationship, 13.13% found a negative relationship, and 55.55% showed an insignificant relationship. This evidence provides empirical support for stakeholder theory suggesting that firms disclose carbon-related information to manage their key stakeholders.

| Categories | Main theory used | Variables | Positive | Negative | Insig | Total |

|---|---|---|---|---|---|---|

| Economic pressure | LT (7), ST (5), IT (5) | Emission trading scheme | 7 | 0 | 0 | 7 |

| Regulatory guideline on carbon | 1 | 0 | 0 | 1 | ||

| Economic pressure (ETS) | 1 | 0 | 0 | 1 | ||

| Financial market pressure | LT (25), ST (15), IT (12), AT (10), CMT (6) | Leverage | 11 | 5 | 21 | 37 |

| Liquidity | 1 | 0 | 2 | 3 | ||

| Creditors' concerns | 1 | 0 | 0 | 1 | ||

| Pressure from creditors | 1 | 0 | 0 | 1 | ||

| Finance | 0 | 0 | 1 | 1 | ||

| Financial market pressure | 0 | 0 | 1 | 1 | ||

| Debt to Equity | 0 | 1 | 0 | 1 | ||

| Regulatory/institutional pressure | LT (21), IT (14), ST (11), SigT (6), AT (6) | Government ownership | 2 | 0 | 4 | 6 |

| Regulatory pressure | 4 | 0 | 1 | 5 | ||

| Stringency of environmental regulation | 3 | 0 | 1 | 4 | ||

| Legislation for greenhouse and energy reporting | 2 | 0 | 0 | 2 | ||

| Civil and common-law countries | 2 | 0 | 0 | 2 | ||

| Democratic government | 1 | 0 | 0 | 1 | ||

| Country legal system | 1 | 0 | 0 | 1 | ||

| Promoter ownership | 1 | 0 | 0 | 1 | ||

| Institutional and stakeholder pressures | 1 | 0 | 0 | 1 | ||

| Investor protection | 0 | 1 | 0 | 1 | ||

| Countries that have ratified the Kyoto Protocol | 0 | 0 | 1 | 1 | ||

| Quality of legal enforcement | 0 | 1 | 1 | 1 | ||

| External monitoring | ST (5), LT (2) | External assurance (by accounting firms) | 1 | 0 | 0 | 1 |

| External assurance | 1 | 0 | 0 | 1 | ||

| Carbon assurance | 1 | 0 | 0 | 1 | ||

| Corporate carbon assurance | 3 | 0 | 0 | 3 | ||

| Environmental reputation | LT (6), IT (4), ST (3) | Systematic risk | 2 | 0 | 3 | 5 |

| Reputational purpose | 1 | 0 | 0 | 1 | ||

| Organizational image/reputation | 0 | 0 | 1 | 1 | ||

| Environmental legitimacy (an external informal mechanism) | 0 | 1 | 0 | 1 | ||

| Industry's environmental sensitivity | LT (5), ST (5), IT (5), AT (3) | Highly level of carbon emission | 1 | 0 | 0 | 1 |

| Industry membership | 1 | 0 | 0 | 1 | ||

| Extractive industries | 1 | 0 | 0 | 1 | ||

| Litigation | 1 | 0 | 0 | 1 | ||

| Companies in GHG intensive sectors | 1 | 0 | 0 | 1 | ||

| Litigation industry | 0 | 0 | 1 | 1 | ||

| Intensity of carbon emissions | 0 | 0 | 1 | 1 | ||

| Firm pollution | 0 | 0 | 1 | 1 | ||

| Pollution intensive industry | 0 | 1 | 0 | 1 | ||

| Environmental litigation risk | 0 | 0 | 1 | 1 | ||

| Industry's litigation sensitivity | 0 | 0 | 1 | 1 | ||

| Media visibility | AT (3), ST (2), LT (2), VDT (2) | Media visibility | 1 | 0 | 1 | 2 |

| Pressure from media | 1 | 0 | 0 | 1 | ||

| Analyst following | 1 | 0 | 0 | 1 | ||

| News publications | 0 | 0 | 1 | 1 | ||

| Media coverage | 0 | 0 | 1 | 1 | ||

| Normative pressures | LT (4), ST (4), IT (4) | Use of GRI guidelines | 3 | 0 | 0 | 3 |

| Guidance by CDP | 1 | 0 | 0 | 1 | ||

| Membership of UNGC | 1 | 0 | 0 | 1 | ||

| NGOs pressure | 0 | 0 | 1 | 1 | ||

| Public visibility | LT (6), ST (3), IT (3) | Concentrated ownership | 1 | 1 | 1 | 3 |

| Dispersed ownership | 2 | 0 | 0 | 2 | ||

| National listing status | 1 | 0 | 0 | 1 | ||

| Foreign listing | 1 | 0 | 0 | 1 | ||

| Multiple listing | 0 | 0 | 1 | 1 | ||

| Dual listing | 0 | 0 | 1 | 1 | ||

| Social pressure | LT (66), ST (50), AT (40), IT (29), CMT (16), SigT (15), RDT (13) | Firm size | 46 | 3 | 5 | 54 |

| Profitability | 11 | 8 | 29 | 48 | ||

| Industry sensitivity | 10 | 3 | 7 | 20 | ||

| Social pressure | 2 | 0 | 0 | 2 | ||

| Public pressure | 1 | 1 | 0 | 2 | ||

| Environmental sensitivity | 1 | 0 | 0 | 1 | ||

| Firm age | 6 | 0 | 7 | 13 |

- Abbreviations: AT, agency theory; CMT, critical mass theory; Insig, insignificant; IT, institutional theory; LT, legitimacy theory; RDT, resource dependence theory; SigT, signaling theory; ST, stakeholder theory; VDT, voluntary disclosure theory.

Turning toward regulatory and institutional pressures, consistent with Luo et al. (2012), we considered state ownership, civil and common-law countries, quality and stringency of laws, and their enforcement as proxies of regulatory and institutional pressures. Briefly, 62.95% (17) of the studies on the relationship between regulatory and institutional pressures and carbon disclosure showed a positive relationship, 7.40% (2) showed negative influence, and 29.62% (8) showed no relationship (see Table 6). Consistent with institutional and regulatory pressures, external monitoring by accounting and nonaccounting firms contributes to corporate carbon disclosure (see Table 6). Companies' interactions with normative institutions such as Carbon Disclosure Project (CDP), Global Reporting Initiative (GRI), and United Nations Global Compact (UNGC) by following their guidelines on environmental sustainability reporting have been positively linked with carbon disclosure (see Table 6). These results provide empirical support for the institutional theory argument that organizational practices, including carbon disclosure, are influenced by either coercive, normative, or mimetic institutional pressures emerging from the environment in which the firm operates (Dhanda et al., 2022; Gold and Taib (2023); Safiullah et al., 2022).

Social pressures emerging from public visibility, NGOs, and media coverage have been reported to influence corporate carbon disclosure. In line with prior studies (see Luo et al., 2012; Ali et al., 2018), large, highly profitable, and environmentally sensitive firms are considered proxies of social pressure in this research. The results identified that 53.89% of the studies investigating proxies of social pressure showed the positive relationship between social pressure and carbon disclosure, 10.17% showed a negative relationship, and 37.12% showed an insignificant relationship. These findings provide empirical support for the legitimacy theory argument that companies adapt, adopt, or change a particular practice, that is, carbon disclosure in response to the pressures emerging from the general public, NGOs, and media regarding climate change. Three instances from our review results have reported a positive link between the intention to build environmental reputation and carbon disclosure (see Table 6), providing additional support for legitimacy theory explanations.

5.2 Meso-level CG determinants of carbon disclosure

Studies on the link between meso-level governance mechanisms and corporate carbon disclosure employ a combination of relational and instrumental theories (see Table 7). Studies from the agency theory perspective explored different aspects of ownership, which lies at the heart of agency conflicts. Ownership is a critical component of CG (Aguilera et al., 2021), but the extant literature provides conflicting findings on the usefulness of different types of ownership in terms of encouraging carbon disclosure. Two research studies on insider ownership revealed a significant positive relationship, one study found a negative relationship, and three studies found an insignificant relationship (see Table 7). In terms of institutional ownership, three studies found a significant positive relationship, two discovered a negative relationship, and seven studies discovered no relationship. The results on family ownership were also inconclusive. Interestingly, foreign ownership was found to be negatively associated with carbon disclosure. Because a firm's foreign owner may not be actively promoting the climate change agenda, the corporation may not be focusing on carbon reduction and subsequent disclosure. Studies using relational theory perspectives explored external pressures from investors and peers. Peer pressure for mitigating carbon emissions and subsequent disclosure was positively linked with carbon disclosure. This result provides empirical support for institutional theory suggesting that a firm adopts a particular practice i.e., carbon disclosure here due to mimetic isomorphic pressures (Ali & Frynas, 2018). However, most studies on the impact of institutional investor pressure and investor activism on carbon disclosure provide inconclusive findings. This underlines that meso-level governance mechanisms remain underexplored in the extant literature.

| Categories | Main theory used | Variables | Positive | Negative | Insignificant | Total |

|---|---|---|---|---|---|---|

| Family ownership | AT (1), RDT (1), StewT (1) | Family ownership | 1 | 1 | 0 | 2 |

| Foreign Ownership | LT (3), AT (2) | Foreign ownership | 0 | 4 | 0 | 4 |

| Insiders' ownership | AT (3), ST (2) | Managerial ownership | 2 | 0 | 0 | 2 |

| CEO ownership | 0 | 0 | 1 | 1 | ||

| Shares held by directors | 0 | 1 | 0 | 1 | ||

| Insiders' (directors and large shareholders) shareholding | 0 | 0 | 1 | 1 | ||

| Directors' ownership | 0 | 0 | 1 | 1 | ||

| Institutional investors' pressure | AT (6), LT (4), ST (3), RDT (3) | Institutional ownership | 1 | 0 | 5 | 6 |

| Institutional investors | 2 | 1 | 0 | 3 | ||

| Pressure from institutional investors | 0 | 0 | 1 | 1 | ||

| Outside block (domestic and foreign institutional investors) | 0 | 0 | 1 | 1 | ||

| Big 3 investors | 0 | 1 | 0 | 1 | ||

| Investors activism | LT (4), ST (3) | Capital providers | 0 | 0 | 2 | 2 |

| Investor activism | 1 | 0 | 0 | 1 | ||

| Shareholder rights index | 0 | 1 | 0 | 1 | ||

| Shareholders' interest in ecological information | 0 | 0 | 1 | 1 | ||

| Peers pressure | LT (3), ST (3), IT (3) | Industrial peers disclosing carbon information | 1 | 0 | 0 | 1 |

| Competition within industry | 1 | 0 | 0 | 1 | ||

| Relative status within industry | 1 | 0 | 0 | 1 |

- Abbreviations: AT, agency theory; IT, institutional theory; LT, legitimacy theory; RDT, resource dependence theory; ST, stakeholder theory; StewT, stewardship theory.

5.3 Micro-level CG determinants of carbon disclosure

Micro-level CG determinants include individual attributes and firm level governance factors contributing toward carbon disclosure. Similar to meso-level scholarship, studies on the link between micro-level governance mechanisms and corporate carbon disclosure employ a combination of relational and instrumental theories (see Table 8). When compared with macro-level and meso-level scholarship, the variety of theoretical perspectives is greater.

| Categories | Main theory used | Variables | Positive | Negative | Insignificant | Total |

|---|---|---|---|---|---|---|

| Board composition | AT (20), LT (16), ST (16), CMT (9), RDT (8), IT (6) | Board size | 11 | 5 | 11 | 27 |

| Board meetings | 4 | 1 | 8 | 13 | ||

| Foreign directors on the board | 1 | 0 | 0 | 1 | ||

| Board tenure | 0 | 0 | 1 | 1 | ||

| Board skills (Financial) | 0 | 1 | 0 | 1 | ||

| Board Diversity | CMT (18), LT (9), AT (8), ST (8), RDT (5) | Gender diversity | 13 | 4 | 6 | 23 |

| At least on female on board | 1 | 1 | 0 | 2 | ||

| Critical mass | 2 | 0 | 0 | 2 | ||

| Number of committees having women | 1 | 0 | 0 | 1 | ||

| Number of years women were on board | 1 | 0 | 0 | 1 | ||

| Blau index for gender heterogeneity | 1 | 0 | 0 | 1 | ||

| At least two females on board | 1 | 0 | 0 | 1 | ||

| Board ethnic diversity | 0 | 0 | 1 | 1 | ||

| Number of females on board | 0 | 1 | 0 | 1 | ||

| Board Independence | LT (13), AT (10, ST (8), CMT (6) | Board independence | 10 | 2 | 12 | 24 |

| Independent members in audit committee | 1 | 0 | 0 | 1 | ||

| Nomination committee independence | 0 | 0 | 1 | 1 | ||

| CEO attributes | ST (11), AT (8), LT (6), UET (5) | CEO duality | 2 | 1 | 7 | 10 |

| NOT CEO duality | 0 | 1 | 3 | 4 | ||

| CEO tenure | 0 | 1 | 1 | 2 | ||

| CEO executive experience | 1 | 0 | 0 | 1 | ||

| Managerial awareness of carbon risks | 1 | 0 | 0 | 1 | ||

| CEO functional background experience | 0 | 1 | 0 | 1 | ||

| CEO industry experience | 0 | 1 | 0 | 1 | ||

| CEO age | 0 | 0 | 1 | 1 | ||

| Corporate governance quality | LT (4), ST (3), AT (2), SigT (2) | Corporate governance quality | 3 | 1 | 0 | 4 |

| Internal corporate governance | 1 | 0 | 0 | 1 | ||

| Corporate governance | 1 | 0 | 0 | 1 | ||

| Good governance score | 1 | 0 | 0 | 1 | ||

| Executive compensation | LT (4), ST (2), CMT (2) | Incentive target | 1 | 0 | 0 | 1 |

| Financial incentives | 1 | 0 | 0 | 1 | ||

| Compensation committee independence | 0 | 1 | 0 | 1 | ||

| Carbon-related targets in CEO compensation | 0 | 0 | 1 | 1 | ||

| ESG compensation | 0 | 0 | 1 | 1 | ||

| Executive compensation | 0 | 0 | 2 | 2 | ||

| Firm audit | AT (4), LT (2), ST (2) | Big 4 auditors | 0 | 0 | 2 | 2 |

| Audit committee independence | 1 | 0 | 0 | 1 | ||

| Big4 financial auditors | 0 | 0 | 1 | 1 | ||

| External auditing by big4 | 0 | 0 | 1 | 1 | ||

| Audit committee size | 0 | 1 | 0 | 1 | ||

| Innovation capability | LT (16), ST (15), AT (15), IT (10), CMT (10), RDT (8), SigT (5) | Tobin's Q | 4 | 4 | 14 | 22 |

| Market to book value | 1 | 2 | 4 | 7 | ||

| Research and development expenditure | 0 | 2 | 3 | 5 | ||

| Price to book value | 0 | 0 | 2 | 2 | ||

| Financial performance | 0 | 0 | 2 | 2 | ||

| Firm efficiency | 0 | 2 | 0 | 2 | ||

| Productivity | 1 | 0 | 0 | 1 | ||

| Asset tangibility | 2 | 0 | 1 | 3 | ||

| Low carbon innovation | 0 | 1 | 0 | 1 | ||

| Internal organization system | LT (17), AT (10), ST (8), IT (7), CMT (5), SigT (5), RDT (3) | Environmental management committee | 6 | 0 | 3 | 9 |

| CSR/sustainability committee | 2 | 0 | 3 | 5 | ||

| Environmental management systems | 2 | 0 | 0 | 2 | ||

| Energy consumption | 1 | 0 | 0 | 1 | ||

| Corporate carbon emission target | 1 | 0 | 0 | 1 | ||

| Carbon-reduction strategy | 2 | 0 | 1 | 3 | ||

| Firm's identification of climate change risk and opportunities | 2 | 0 | 0 | 2 | ||

| Firm's engagement in public policy | 1 | 0 | 0 | 1 | ||

| Climate governance | 1 | 0 | 0 | 1 | ||

| Employees environmental training | 1 | 0 | 0 | 1 | ||

| CSR report | 1 | 0 | 0 | 1 | ||

| Green process innovation | 2 | 0 | 0 | 2 | ||

| Board responsibility | 0 | 0 | 1 | 1 | ||

| Frequency of carbon reporting | 0 | 0 | 1 | 1 | ||

| Green product innovation | 0 | 0 | 1 | 1 | ||

| Environmental performance | LT (2), ST (2) | Environmental performance | 0 | 2 | 0 | 2 |

| Environmental and social performance | 1 | 0 | 0 | 1 | ||

| Carbon performance | 0 | 1 | 0 | 1 | ||

| Investment in clean technologies | LT (8), IT (4), AT (2), CMT (2), SigT (2) | Capital expenditure | 3 | 1 | 1 | 5 |

| Capital spending on innovation and renewable energy | 0 | 1 | 2 | 3 | ||

| Asset newness | 1 | 1 | 0 | 2 | ||

| Capital intensity | 1 | 0 | 1 | 2 |

- Abbreviations: AT, agency theory; CMT, critical mass theory; IT, institutional theory; LT, legitimacy theory; RDT, resource dependence theory; ST, stakeholder theory; SigT, signaling theory.

Micro-level governance mechanisms include board attributes, compensation mechanisms, firm's innovative capability, and internal organizational systems. As corporate boards take crucial micro-level decisions related to carbon disclosure, the extant literature has focused on board attributes, including board composition (43 times), board diversity (33 times), board independence (26 times), CEO attributes (21 times), elements of executive compensation (7 times), and firm audit (6 times). Proxies of board composition such as board size (11 times positive, 5 times negative) and board meetings (4 times positive, 1 time negative) showed mixed results. Yet, the presence of foreign directors on a board has a significant positive relationship with carbon disclosure, although the board's financial skills have a significant negative relationship (see Table 8). Studies from the critical mass theory perspective highlight that boards must have a critical mass of individuals who support carbon disclosure, in order to implement effective disclosure, for example, Ben-Amar et al. (2017) suggested that three women on the board can provide such a critical mass. The review results also provide partial support for the resource-based view and agency theory argument that large boards comprised of knowledgeable, skilled and experienced individuals are better able to perform oversight functions and make strategic decisions, that is, reduction of carbon emissions and their subsequent disclosure (Gold and Taib (2023)).

The majority of the studies examining the link between board diversity and carbon disclosure showed a positive relationship, while only six studies showed a negative relationship (see Table 8). The participation of women on the board and in its functional committees was found to positively influence carbon disclosure. Further, the presence of independent members on a corporate board (11 times) and audit committees (1 time) positively influences carbon disclosure. However, some studies found that board independence has a negative relationship with carbon disclosure. These results provide empirical support for the agency theoretical perspective that board diversity and independent directors on the board and in audit committees can effectively contribute to monitoring management behavior due to their substantial control over management decisions (see Gold and Taib (2023); Kumar et al., 2022).

Turning toward CEO attributes, the review results showed mixed results (see Table 8). The influence of board leadership (CEO duality) is mixed. Two studies found a positive relationship and two studies found a negative relationship. Executive experience and carbon risk knowledge of CEOs were positively linked with carbon disclosure. However, CEO tenure, functional background, and relevant industry experience were inversely linked with carbon emission reduction. These findings provide credence to the upper echelons' theory, which posits that executives' subjective understandings of the strategic circumstances in which their organizations find themselves give rise to distinctive decisions regarding carbon disclosure (Elsayih et al., 2021; Hambrick, 2007).

Review results of executive compensation and firm audit mechanisms of CG were mixed as well. Two studies found a positive relationship between executive compensation and carbon disclosure, whereas one study found a negative relationship and three studies found an insignificant relationship. Like executive compensation, firm audit committee independence was positively related with carbon disclosure, whereas audit by the major four firms was deemed insignificant. Executive compensation and audit committee governance mechanisms appeared to be less effective in promoting carbon disclosure challenging agency theoretical perspectives.

Twenty-three instances revealed a positive association between aspects of internal organizational systems and carbon disclosure, indicating that internal organizational systems were highly effective in promoting carbon disclosure (see Table 8). Internal organizational systems include numerous elements such as the establishment of an environmental/CSR/sustainability committee, environmental management systems, climate change/environmental strategy, and the implementation of internal systems aiming to control carbon emissions. In fact, our results provide empirical evidence in favor of internal organizational systems needed to manage, measure, control, and report carbon emissions. These results provide empirical support for the institutional governance theory, which seeks to explain the incentives behind proactive corporate reactions to the issues posed by climate change and is well-grounded in the context of international competitive advantage. Additionally, corporate environmental performance and proxies of investment in clean technologies provide mixed results (see Table 8).

6 DISCUSSION

This research reviewed the existing literature on CG-related determinants of carbon disclosure using a multitheory and multilevel framework analysis. This study reviewed 62 studies published in CABS ranked journals. We found that the literature on the link between CG mechanisms and carbon disclosure is dominated by relational theories, specifically legitimacy theory, institutional theory, and stakeholder theory. To a lesser extent, scholars have utilized instrumental perspectives, above all, agency theory to explain those relationships. The prevalence of relational theories is not surprising, as the macro-level pressures on firms and organizations to engage in environmental practices seem to be relatively well understood (cf. Frynas & Yamahaki, 2016). What is notable is the current under-representation of instrumental—economic and managerial—theories in the research on the link between governance mechanisms and carbon disclosure, such as planned behavior theory and transaction cost economics, which are prevalent in climate change studies more generally (cf. Daddi et al., 2018). This is linked to the under-representation of meso-level studies on the CG–carbon disclosure relationship. We know from prior CSR and sustainability scholarship that the active engagement of firms in environmental practices is often driven by strategic and economic considerations (e.g. McWilliams & Siegel, 2011; Tatoglu et al., 2020; Verbeke & Hutzschenreuter, 2021); however, scholarship on the impact of CG mechanisms on disclosure has yet to explore these drivers in full.

As a consequence of the theoretical and topical choices made in current scholarship, we know a great deal about macro-level drivers of carbon disclosure compared with meso-level and micro-level drivers. Pressure from regulatory institutions, normative institutions, financial markets, media, society, and economic cost appear to be most influential macro-level factors driving carbon disclosure. The single most influential variable is firm size, identified as a positive driver of carbon disclosure in as many as 46 out of 62 studies (or nearly three-quarters of studies). Firm size captures a firm's societal visibility, on the assumption that greater firm size exposes firms to greater environmental risks and societal scrutiny, which can explain why larger firms make greater efforts to strengthen their societal legitimacy and consequently tend to exhibit better environmental practices (cf. Aguilar-Fernández & Otegi-Olaso, 2018; Drempetic et al., 2020). In comparison with macro-level drivers, meso-level governance mechanisms such as owners and investors appeared to be less effective. Nonetheless, peer pressure appeared to drive carbon disclosure. Many studies provide evidence that board diversity, board independence, and internal organizational systems can be very effective micro-level mechanisms in promoting carbon disclosure.

Our findings, encapsulated in a comprehensive multilevel framework, highlight the complex interplay of governance mechanisms at varying levels in shaping carbon disclosure practices. We acknowledge that these mechanisms do not work in isolation and the success of carbon disclosure depends on configurations of CG mechanisms at different levels. Consequently, managing carbon disclosure effectively demands an integrated approach, leveraging drivers from multiple levels. Figure 2 provides a multilevel framework on governance mechanisms and carbon disclosure that summarizes our findings.

7 CONCLUSION

This research aimed to summarize and synthesize the literature on CG-related determinants of carbon disclosure and classify them into macro-, meso-, and micro- level factors. This study used 62 studies published in CABS ranked journals. The research revealed that companies are experiencing pressures at multiple levels emanating from numerous stakeholders to disclose carbon emissions. At a macro-level, pressures from regulatory institutions, normative institutions, financial markets, media, society, and economic cost appear to be the most influential factors driving carbon disclosure. Meso-level governance mechanisms such as owners and investors appeared to be less effective. Nonetheless, peer pressure appeared to drive carbon disclosure. Factors of board diversity, board independence, and internal organizational systems appeared to be very effective micro-level mechanisms in promoting carbon disclosure. A variety of relational and instrumental theory perspectives complement each other in explaining different CG mechanisms driving carbon disclosure at different levels of analysis. However, instrumental theory explanations at meso-level remain significantly under-utilized.

7.1 Research implications

The findings of this research have implications for businesses and policymakers. At the macro-level, firms are confronted with facing mounting pressures from a broad spectrum of stakeholders—including regulators, the media, NGOs, the public, institutional investors, and industry counterparts—all advocating for the transparent reporting of carbon emissions. To effectively navigate this complex landscape, firms must incorporate these stakeholder interests and concerns into their carbon management strategies, showcasing accountability and fostering an environmental reputation. At the micro-level, governance mechanisms—specifically, the diversity of boards concerning gender and education, board and audit committee independence, and internal governance systems such as environmental management systems—have emerged as key influencers of carbon disclosure. Consequently, companies aspiring to enhance their carbon disclosure practices must prioritize the implementation of these micro-level governance mechanisms. Finally, a profound understanding of governance-related determinants significantly contributes to a firm's development of an efficient carbon management system. Such a system not only facilitates the communication of the firm's commitment to carbon compliance, leadership, and accountability to shareholders and the public but also allows stakeholders to access crucial carbon data for making well-informed decisions.

Turning toward implications for policymakers, the review results reveal that board diversity contributes to carbon disclosure. We believe that policymakers should develop policy guidelines promoting gender diversity on corporate boards. In line with the positive link between board and audit committee independence and carbon disclosure, policymakers need to devise policy guidelines to ensure board independence and audit committee independence to enhance the quality of carbon disclosure. Third, policymakers are advised to devise guidelines to strengthen internal organizational mechanisms such as CG quality, environmental management systems, establishment of sustainability committee, and climate change/environmental strategy, as these mechanisms have been found to positively influence carbon disclosure. Fourth, policymakers must ensure external monitoring and assurance of carbon disclosures, as external monitoring and assurance positively influence carbon disclosure. Fifth, policymakers must strengthen the quality and enforcement of environmental regulations, as companies have been found to report carbon information due to regulatory pressures. Sixth, policymakers must implement schemes, similar to the emission trading scheme, in order to control carbon emissions given that review results indicate the influence of economic pressures on carbon emission reduction and their subsequent disclosures. In addition to promoting and strengthening regulatory institutions, policymakers must also strengthen normative institutions such as GRI in their respective countries as companies that interact with these institutions and follow their guidelines tend to provide better carbon disclosure.

7.2 Future research directions

- Our review findings show that meso-level studies are under-represented in current research on the impact of CG mechanisms on carbon disclosure. Therefore, future studies should utilize economic and managerial theories to properly consider the CG-carbon disclosure link at organizational level.

- Our review findings also show that there are under-researched factors at the micro-level. Future studies could apply behavioral theories to address currently neglected personal characteristics of CEOs and board members such as the educational background, including environmental/ethical/CSR training, cultural and linguistic background, age, tenure and board interlocking.

- Our review has helped to synthesize CG factors at different levels. What we still do not know is exactly how factors at different levels interact to advance carbon disclosure. Future multilevel and multitheory studies should explore how different configurations of CG mechanisms can help to achieve environmental disclosure and performance.

- Our review findings show that the extant CG-carbon disclosure research is mainly limited to a small number of developed countries, USA, Australia, UK, and Canada, and developing countries, China, India and Malaysia. Future research examining the CG-carbon disclosure link needs to focus on other countries, especially emerging markets, to ascertain the usefulness of CG mechanisms in promoting carbon disclosure.

- Since most of the studies included in the review analysis employed large companies as their sample, it is recommended, in line with Yunus et al. (2020) and Al-Qahtani and Elgharbawy (2020), that future research should include small and medium-sized enterprises. According to Yunus et al. (2020), stakeholder demands prompting actions in smaller organizations may vary from those of larger firms.

- Since most of the studies reviewed in this research are quantitative and empirical in nature, new insights may emerge by employing qualitative methods such as interviews and focus groups to explore the underlying motivations driving firms to mitigate climate change and carbon disclosure. Qualitative methods can also help to explore the interactions between governance factors at different levels, which we have mentioned above.

7.3 Research limitations

This research has some limitations. First, this research relied on the count method (i.e., number of studies with significant positive, negative, and insignificant) to synthesize results from numerous evaluations without considering the sample size and effect size of the relationship. Therefore, future research should conduct quantitative meta-analysis to overcome this limitation. We must acknowledge here that due to the heterogeneity of determinants and the low number of studies focusing on relationships such as CEO tenure, CEO background, executive compensation, board tenure, and board skills, it would be difficult to conduct a meta-analysis. However, a meta-analysis can be performed where sufficient studies are available on focal relationships such as board size, board meetings, board independence, and gender diversity. Further, meta-analysis can allow for consideration of various moderators influencing the relationship. Second, this research considers carbon performance and carbon disclosure as interdependent concepts. Various other authors consider them distinct, therefore, future researchers are advised to group studies according to carbon performance and carbon disclosure and then interpret the results of governance related determinants to better understand the results. Third, this study focused solely on English-language studies and omitted papers published in other languages. Finally, the insights of this research are based on extant scholarships, which are not free from limitations, therefore, probable limitations and biases part of extant research should be carefully considered while interpreting and devising the research implications.

ACKNOWLEDGMENTS

All the sources cited in the text have been duly referenced.

APPENDIX A: Final list of sample studies

| Author | Reference |

|---|---|

| Al-Qahtani and Elgharbawy (2020) | Al-Qahtani, M., & Elgharbawy, A. (2020). The effect of board diversity on disclosure and management of greenhouse gas information: evidence from the United Kingdom. Journal of Enterprise Information Management, 33(6), 1557–1579. |

| Azar et al. (2021) | Azar, J., Duro, M., Kadach, I., & Ormazabal, G. (2021). The big three and corporate carbon emissions around the world. Journal of Financial Economics, 142(2), 674–696. |

| Beauchamp and Cormier (2022) | Beauchamp, C., & Cormier, D. (2022). Corporate disclosure of CO2 embedded in oil and gas reserves: stock market assessment in a context of global warming. Managerial Finance, (ahead-of-print). |

| Ben-Amar et al. (2017) | Ben-Amar, W., Chang, M., & McIlkenny, P. (2017). Board gender diversity and corporate response to sustainability initiatives: Evidence from the carbon disclosure project. Journal of Business Ethics, 142(2), 369–383. |

| Bui et al. (2020) | Bui, B., Houqe, M. N., & Zaman, M. (2020). Climate governance effects on carbon disclosure and performance. British Accounting Review, 52(2), 100,880. |

| Choi et al. (2013) | Choi, B. B., Lee, D., & Psaros, J. (2013). An analysis of Australian company carbon emission disclosures. Pacific Accounting Review. |

| Comyns (2016) | Comyns, B. (2016). Determinants of GHG reporting: An analysis of global oil and gas companies. Journal of Business Ethics, 136, 349–369. |

| Cong and Freedman (2011) | Cong, Y., & Freedman, M. (2011). Corporate governance and environmental performance and disclosures. Advances in Accounting, 27(2), 223–232. |

| Dawkins and Fraas (2011) | Dawkins, C., & Fraas, J. W. (2011). Coming clean: The impact of environmental performance and visibility on corporate climate change disclosure. Journal of Business Ethics, 100, 303–322. |

| Dhanda et al. (2022) | Dhanda, K. K., Sarkis, J., & Dhavale, D. G. (2022). Institutional and stakeholder effects on carbon mitigation strategies. Business Strategy and the Environment, 31(3), 782–795. |

| Dutta and Dutta (2021) | Dutta, P., & Dutta, A. (2021). Impact of external assurance on corporate climate change disclosures: new evidence from Finland. Journal of Applied Accounting Research, 22(2), 252–285. |

| Elaigwu et al. (2022) | Elaigwu, M., Abdulmalik, S. O., & Talab, H. R. (2022). Corporate integrity, external assurance and sustainability reporting quality: evidence from the Malaysian public listed companies. Asia-Pacific Journal of Business Administration, (ahead-of-print). |

| Elleuch Lahyani (2022) | Elleuch Lahyani, F. (2022). Corporate board diversity and carbon disclosure: evidence from France. Accounting Research Journal, 35(6), 721–736. |

| Elsayih et al. (2018) | Elsayih, J., Tang, Q., & Lan, Y. C. (2018). Corporate governance and carbon transparency: Australian experience. Accounting Research Journal, 31(3), 405–422. |

| Elsayih et al. (2021) | Elsayih, J., Datt, R., & Hamid, A. (2021). CEO characteristics: do they matter for carbon performance? An empirical investigation of Australian firms. Social Responsibility Journal, 17(8), 1279–1298. |

| Fabricio et al. (2022) | Fabricio, S. A., Ferreira, D. D. M., & Rover, S. (2022). Female representation on boards of directors and environmental disclosure: evidence of the Brazilian GHG protocol program. Gender in Management: An International Journal. |

| Fan et al. (2023) | Fan, P., Qian, X., & Wang, J. (2023). Does gender diversity matter? Female directors and firm carbon emissions in Japan. Pacific-Basin Finance Journal, 77, 101931. |

| Gold and Taib (2023) | Gold, N. O., & Taib, F. M. (2023). Corporate governance and extent of corporate sustainability practice: the role of investor activism. Social Responsibility Journal, 19(1), 184–210. |

| Goud (2022) | Goud, N. N. (2022). Corporate governance: Does it matter management of carbon emission performance? An empirical analyses of Indian companies. Journal of Cleaner Production, 379, 134485. |

| Grauel and Gotthardt (2017) | Grauel, J., & Gotthardt, D. (2017). Carbon disclosure, freedom and democracy. Social Responsibility Journal, 13(3), 428–456. |

| Hossain and Farooque (2019) | Hossain, M., & Farooque, O. (2019). The emission trading system, risk management committee and voluntary corporate response to climate change–a CDP study. International Journal of Accounting & Information Management, 27(2), 262–283. |

| Hossain et al. (2017) | Hossain, M., Farooque, O. A., Momin, M. A., & Almotairy, O. (2017). Women in the boardroom and their impact on climate change related disclosure. Social Responsibility Journal, 13(4), 828–855. |

| Houqe and Khan (2023) | Houqe, M. N., & Khan, H. Z. (2023). What determines the quality of carbon reporting? A system-oriented theories and corporate governance perspective. Business Strategy and the Environment, 32(6), 3197–3216. |

| Jaggi et al. (2018) | Jaggi, B., Allini, A., Macchioni, R., & Zagaria, C. (2018). The factors motivating voluntary disclosure of carbon information: Evidence based on Italian listed companies. Organization & Environment, 31(2), 178–202. |

| Jiang et al. (2022) | Jiang, Y., Fan, H., Zhu, Y., & Xu, J. F. (2022). Carbon disclosure: A legitimizing tool or a governance tool? Evidence from listed US companies. Journal of International Financial Management & Accounting. |

| Karim et al. (2021) | Karim, A. E., Albitar, K., & Elmarzouky, M. (2021). A novel measure of corporate carbon emission disclosure, the effect of capital expenditures and corporate governance. Journal of Environmental Management, 290, 112581. |

| Kılıc and Kuzey (2019) | Kılıç, M., & Kuzey, C. (2019). Determinants of climate change disclosures in the Turkish banking industry. International Journal of Bank Marketing. |

| Konadu et al. (2022) | Konadu, R., Ahinful, G. S., Boakye, D. J., & Elbardan, H. (2022). Board gender diversity, environmental innovation and corporate carbon emissions. Technological Forecasting and Social Change, 174, 121279. |

| Krishnamurti and Velayutham (2018) | Krishnamurti, C., & Velayutham, E. (2018). The influence of board committee structures on voluntary disclosure of greenhouse gas emissions: Australian evidence. Pacific-Basin Finance Journal, 50, 65–81. |

| Kumar et al. (2022) | Kumar, K., Kumari, R., Nandy, M., Sarim, M., & Kumar, R. (2022). Do ownership structures and governance attributes matter for corporate sustainability reporting? An examination in the Indian context. Management of Environmental Quality: An International Journal. |

| Kuo and Yu (2017) | Kuo, L., & Yu, H. C. (2017). Corporate political activity and environmental sustainability disclosure: the case of Chinese companies. Baltic Journal of Management, 12(3), 348–367. |

| Lemma et al. (2022) | Lemma, T. T., Tavakolifar, M., Mihret, D., & Samkin, G. (2022). Board gender diversity and corporate carbon commitment: Does industry matter? Business Strategy and the Environment, 32(6), 3550–3568. |

| Li et al. (2018) | Li, D., Huang, M., Ren, S., Chen, X., & Ning, L. (2018). Environmental legitimacy, green innovation, and corporate carbon disclosure: Evidence from CDP China 100. Journal of Business Ethics, 150, 1089–1104. |

| Liesen et al. (2015) | Liesen, A., Hoepner, A. G., Patten, D. M., & Figge, F. (2015). Does stakeholder pressure influence corporate GHG emissions reporting? Empirical evidence from Europe. Accounting, Auditing & Accountability Journal, 28(7), 1047–1074. |

| Luo and Tang (2021) | Luo, L., & Tang, Q. (2021). Corporate governance and carbon performance: Role of carbon strategy and awareness of climate risk. Accounting & Finance, 61(2), 2891–2934. |

| Luo et al. (2012) | Luo, L., Lan, Y. C., & Tang, Q. (2012). Corporate incentives to disclose carbon information: Evidence from the CDP Global 500 report. Journal of International Financial Management & Accounting, 23(2), 93–120. |

| Luo et al. (2023) | Luo, L., Tang, Q., Fan, H., & Ayers, J. (2023). Corporate carbon assurance and the quality of carbon disclosure. Accounting & Finance. |

| Mardini and Elleuch (2022) | Mardini, G. H., & Elleuch Lahyani, F. (2022). Impact of foreign directors on carbon emissions performance and disclosure: empirical evidence from France. Sustainability Accounting, Management and Policy Journal, 13(1), 221–246. |

| Mateo-Márquez et al. (2020) | Mateo-Márquez, A. J., González-González, J. M., & Zamora-Ramírez, C. (2020). Countries' regulatory context and voluntary carbon disclosures. Sustainability Accounting, Management and Policy Journal, 11(2), 383–408. |

| Mooneeapen et al. (2022) | Mooneeapen, O., Abhayawansa, S., & Mamode Khan, N. (2022). The influence of the country governance environment on corporate environmental, social and governance (ESG) performance. Sustainability Accounting, Management and Policy Journal, 13(4), 953–985. |

| Nuber and Velte (2021) | Nuber, C., & Velte, P. (2021). Board gender diversity and carbon emissions: European evidence on curvilinear relationships and critical mass. Business Strategy and the Environment, 30(4), 1958–1992. |

| Nuskiya et al. (2021) | Nuskiya, M. N. F., Ekanayake, A., Beddewela, E., & Meftah Gerged, A. (2021). Determinants of corporate environmental disclosures in Sri Lanka: the role of corporate governance. Journal of Accounting in Emerging Economies, 11(3), 367–394. |

| Peng et al. (2015) | Peng, J., Sun, J., & Luo, R. (2015). Corporate voluntary carbon information disclosure: Evidence from China's listed companies. The World Economy, 38(1), 91–109. |

| Prado-Lorenzo and Garcia-Sanchez (2010) | Prado-Lorenzo, J. M., & Garcia-Sanchez, I. M. (2010). The role of the board of directors in disseminating relevant information on greenhouse gases. Journal of Business Ethics, 97, 391–424. |

| Qosasi et al. (2022) | Qosasi, A., Susanto, H., Rusmin, R., Astami, E. W., & Brown, A. (2022). An alignment effect of concentrated and family ownership on carbon emission performance: The case of Indonesia. Cogent Economics & Finance, 10(1), 2140906. |

| Rahman et al. (2023) | Rahman, S., Kabir, M. N., Talukdar, K. H., & Anwar, M. (2023). National culture and firm-level carbon emissions: a global perspective. Sustainability Accounting, Management and Policy Journal, (ahead-of-print). |

| Raimo et al. (2022) | Raimo, N., de Nuccio, E., & Vitolla, F. (2022). Corporate governance and environmental disclosure through integrated reporting. Measuring Business Excellence, 26(4), 451–470. |

| Rankin et al. (2011) | Rankin, M., Windsor, C., & Wahyuni, D. (2011). An investigation of voluntary corporate greenhouse gas emissions reporting in a market governance system: Australian evidence. Accounting, Auditing & Accountability Journal. |

| Rjiba and Thavaharan (2022) | Rjiba, H., & Thavaharan, T. (2022). Female representation on boards and carbon emissions: International evidence. Finance Research Letters, 49, 103079. |

| Rohani et al. (2022) | Rohani, A., Jabbour, M., & Aliyu, S. (2022). Corporate incentives for obtaining higher level of carbon assurance: seeking legitimacy or improving performance? Journal of Applied Accounting Research, (ahead-of-print). |

| Safiullah et al. (2022) | Safiullah, M., Alam, M. S., & Islam, M. S. (2022). Do all institutional investors care about corporate carbon emissions? Energy Economics, 115, 106376. |

| Shan et al. (2021) | Shan, Y. G., Tang, Q., & Zhang, J. (2021). The impact of managerial ownership on carbon transparency: Australian evidence. Journal of Cleaner Production, 317, 128480. |

| Shu and Chiang (2020) | Shu, P. G., & Chiang, S. J. (2020). The impact of corporate governance on corporate social performance: Cases from listed firms in Taiwan. Pacific-Basin Finance Journal, 61, 101332. |

| Tang and Demeritt (2018) | Tang, S., & Demeritt, D. (2018). Climate change and mandatory carbon reporting: Impacts on business process and performance. Business Strategy and the Environment, 27(4), 437–455. |

| Tang and Luo (2016) | Tang, Q., & Luo, L. (2016). Corporate ecological transparency: Theories and empirical evidence. Asian Review of Accounting, 24(4), 498–524. |

| Tang et al. (2020) | Tang, Y., Sun, M., Ma, W., & Bai, S. (2020). The external pressure, internal drive and voluntary carbon disclosure in China. Emerging Markets Finance and Trade, 56(14), 3367–3382. |

| Toukabri and Jilani (2022) | Toukabri, M., & Jilani, F. (2022). The power of critical mass to make a difference: how gender diversity in board affect US corporate carbon performance. Society and Business Review, (ahead-of-print). |

| Winschel (2021) | Winschel, J. (2021). Climate change policies and carbon-related CEO compensation systems: an exploratory study of European companies. Journal of Global Responsibility, 12(2), 158–188. |

| Xia et al. (2023) | Xia, M., Zhu, B., & Cai, H. H. (2023). Does duration of team governance decrease corporate carbon emission intensity. Corporate Social Responsibility and Environmental Management, 30(3), 1363–1388. |

| Yu and Ting (2012) | Yu, V. F., & Ting, H. I. (2012). Financial development, investor protection, and corporate commitment to sustainability: Evidence from the FTSE Global 500. Management Decision, 50(1), 130–146. |

| Yunus et al. (2016) | Yunus, S., Elijido-Ten, E., & Abhayawansa, S. (2016). Determinants of carbon management strategy adoption: Evidence from Australia's top 200 publicly listed firms. Managerial Auditing Journal, 31(2), 156–179. |

| Yunus et al. (2020) | Yunus, S., Elijido-Ten, E. O., & Abhayawansa, S. (2020). Impact of stakeholder pressure on the adoption of carbon management strategies: Evidence from Australia. Sustainability Accounting, Management and Policy Journal, 11(7), 1189–1212. |

APPENDIX B: Coding instrument

| Article details |

| Author name |

| Journal title |

| Context |

| Theoretical perspectives used |

| Variables and their measurement |

| Independent variables (corporate governance mechanisms) and their measurement |

| Dependent variables (carbon/GHG disclosure) and their measurement |

| Material and methods |

| Methods (Content analysis or survey or interviews) |

| Sources of data |

| Unit of analysis (individuals or firms) |

| Sample size and time frame |

| Types and techniques of analysis (qualitative or quantitative and their techniques) |

| Results |

| Link between independent and dependent variables (+ve, −ve, insignificant) |

| Relevant research suggestions if any |

APPENDIX C: List of Journals

| Field | Journal | Frequency | %age |

|---|---|---|---|

| Accounting | Sustainability Accounting, Management and Policy Journal | 5 | 22 (35.48%) |

| Accounting & Finance | 2 | ||

| Accounting Research Journal | 2 | ||

| Accounting, Auditing & Accountability Journal | 2 | ||

| Journal of Applied Accounting Research | 2 | ||

| Journal of International Financial Management & Accounting | 2 | ||

| Advances in Accounting | 1 | ||

| Asian Review of Accounting | 1 | ||

| Journal of Accounting & Information Management | 1 | ||

| Journal of Accounting in Emerging Economies | 1 | ||

| Managerial Auditing Journal | 1 | ||

| Pacific Accounting Review | 1 | ||

| The British Accounting Review | 1 | ||

| Ethics, CSR and Management | Business Strategy and the Environment | 5 | 22 (32.26%) |

| Journal of Business Ethics | 5 | ||

| Social Responsibility Journal | 4 | ||

| Corporate Social Responsibility and Environmental Management | 1 | ||

| Gender in Management: An International Journal | 1 | ||

| Journal of Global Responsibility | 1 | ||

| Management Decision | 1 | ||

| Measuring Business Excellence | 1 | ||

| Society and Business Review | 1 | ||

| Management | Asia-Pacific Journal of Business Administration | 1 | 10 (16.13%) |

| Baltic Journal of Management | 1 | ||

| Journal of Enterprise Information Management | 1 | ||

| Journal of Environmental Management | 1 | ||

| Management of Environmental Quality: An International Journal | 1 | ||

| Organization & Environment | 1 | ||

| Technological Forecasting and Social Change | 1 | ||

| International Journal of Bank Marketing | 1 | ||

| Journal of Cleaner Production | 2 | ||

| Finance | Pacific-Basin Finance Journal | 3 | 7 (11.29%) |

| Emerging Markets Finance and Trade | 1 | ||

| Finance Research Letters | 1 | ||

| Journal of Financial Economics | 1 | ||

| Managerial Finance | 1 | ||

| Economics | Cogent Economics & Finance | 1 | 3 (4.84%) |

| Energy Economics | 1 | ||

| The World Economy | 1 | ||

| Total | 62 | ||