Pricing passport option using higher order compact scheme

Abstract

Higher order compact scheme (HOC) is used for pricing both European and American type passport option. We consider the problem for two different cases, namely, the symmetric case (which has a closed form solution) and the non-symmetric case. For the symmetric case HOC schemes result in slightly improved results as compared to the classical Crank–Nicolson implicit method, while still giving approximately second order convergence rate. In order to improve the convergence rate, grid stretching near zero accumulated wealth is introduced in the HOC schemes. The consequent higher order compact scheme with grid stretching gives better results with the rate of convergence being close to third order. For non-symmetric case we also observe similar results for both European and American type passport option. In absence of any analytic formula for the non-symmetric case, convergence rate was calculated using double-mesh differences.

1 INTRODUCTION

2 THE HIGHER ORDER COMPACT SCHEMES

We now construct the fourth-order approximation for the term and .

2.1 The interior points

2.2 The boundary points

Thus the set of schemes, consisting of (7), (10), (11), (14), (15), (18), and (19) has the overall order of .

We developed a HOC scheme in space and used Crank–Nicolson scheme for the time discretization only. For the purpose of subsequent discussion, HOC scheme would mean HOC scheme in space and Crank–Nicolson scheme in time, as detailed in this section.

3 GRID STRETCHING

4 NUMERICAL RESULTS

We now present the numerical results of the HOC and the HOCGS schemes obtained in Sections 2 and 3, respectively. A comparison of results using both the schemes along with the CNIM is presented, to illustrate the advantage of the application of HOC over CNIM with even more improved results that follow from the application of the HOCGS schemes.

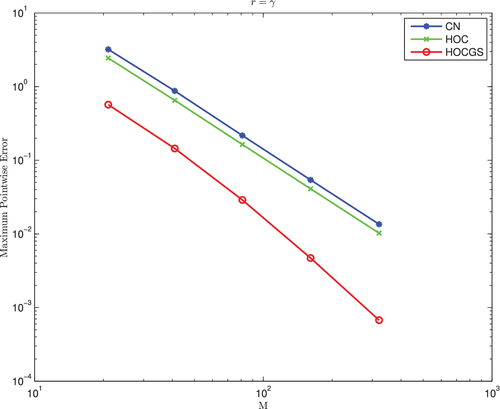

We begin with the symmetric case of where we have the advantage of comparing the results with the analytic solution. The parameters used for the simulations (carried out in MatLabTM) were the same that were used in the CNIM implementation carried out in Reference 3, that is, , , , , and . The simulations were carried out for several values of M and N. However, the tabulated results presented here are only for and . The prices for the symmetric case are tabulated in Table 1. We observe that the HOC scheme gives slightly better results as compared to the CNIM scheme. The inclusion of grid stretching through the HOCGS scheme further improves the results by giving values that closely match the analytic values. To further observe these improvements, the loglog plot of the maximum error against the number of spatial steps (M) for all the schemes are given in Figure 1. Note that this comparison was not restricted to only , but for several values of M, namely M = 21, 41, 81, 161, and 321. It is clear that there is a marginal reduction in maximum error for the HOC scheme, but significant reduction if HOCGS scheme is used. The maximum error, the rate of convergence, and the CPU time for all the three schemes are tabulated in Table 2. We observe that both CNIM and HOC achieve only second order convergence while the HOCGS achieves close to third order convergence. While the convergence achieved through numerical implementation using HOCGS is unable to achieve fourth order accuracy, one does achieve better accuracy as compared to the CNIM scheme.

| w | Analytic | CNIM | HOC | HOCGS |

|---|---|---|---|---|

| 20 | 5.887568 | 5.886553 | 5.886658 | 5.887572 |

| 10 | 8.880836 | 8.879288 | 8.879603 | 8.880844 |

| 5 | 10.830686 | 10.828835 | 10.829259 | 10.830680 |

| 2 | 12.169565 | 12.168752 | 12.169237 | 12.169553 |

| 1 | 12.646019 | 12.644768 | 12.645272 | 12.646016 |

| 0 | 13.138099 | 13.135937 | 13.136459 | 13.138079 |

| 1 | 13.646019 | 13.644768 | 13.645272 | 13.646016 |

| 2 | 14.169565 | 14.168752 | 14.169237 | 14.169553 |

| 5 | 15.830686 | 15.828835 | 15.829259 | 15.830680 |

| 10 | 18.880836 | 18.879288 | 18.879603 | 18.880844 |

| 20 | 25.887568 | 25.886553 | 25.886658 | 25.887572 |

| Spatial nodes | 21 | 41 | 81 | 161 | 321 |

|---|---|---|---|---|---|

| CNIM error | 3.203367 | 0.873704 | 0.216691 | 0.054095 | 0.013519 |

| CNIM order | - | 1.874372 | 2.011507 | 2.002059 | 2.000502 |

| CPU time (s) | 0.050000 | 0.050000 | 0.150000 | 0.360000 | 1.370000 |

| HOC error | 2.442399 | 0.651655 | 0.163756 | 0.040994 | 0.010252 |

| HOC order | - | 1.906119 | 1.992564 | 1.998047 | 1.999559 |

| CPU time (s) | 0.080000 | 0.360000 | 0.860000 | 4.020000 | 171.6900 |

| HOCGS error | 0.568289 | 0.144473 | 0.028900 | 0.004692 | 0.000673 |

| HOCGS order | - | 1.975826 | 2.321656 | 2.622644 | 2.800841 |

| CPU time (s) | 0.100000 | 0.510000 | 1.200000 | 6.770000 | 51.68000 |

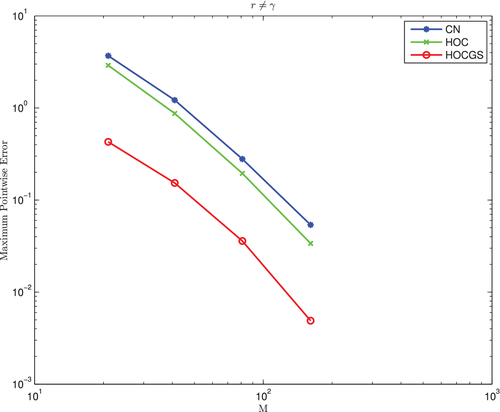

The numerical values of the European and American passport option for the nonsymmetric case, using all the three schemes are tabulated (for various accumulated gains) in Tables 3 and 4, respectively, with the parameters being taken to be , , , , and .3 The loglog plot of the maximum error against various spatial steps, as given by (56) are presented in Figure 2. Finally, the maximum error, the rate of convergence and the CPU time for the nonsymmetric case using the CNIM, HOC and HOCGS are given in Tables 5 and 6, respectively.

| w | CNIM | HOC | HOCGS |

|---|---|---|---|

| 20 | 10.428911 | 10.430595 | 10.430803 |

| 10 | 13.509960 | 13.512246 | 13.512163 |

| 5 | 15.357743 | 15.360405 | 15.360103 |

| 2 | 16.577444 | 16.580551 | 16.579883 |

| 1 | 17.003622 | 17.006314 | 17.006092 |

| 0 | 17.439919 | 17.440792 | 17.442332 |

| 1 | 17.886523 | 17.889334 | 17.889046 |

| 2 | 18.343627 | 18.347030 | 18.346170 |

| 5 | 19.778782 | 19.781776 | 19.781271 |

| 10 | 22.372380 | 22.374982 | 22.374694 |

| 20 | 28.226310 | 28.228299 | 28.228294 |

| w | CNIM | HOC | HOCGS |

|---|---|---|---|

| 20 | 10.612413 | 10.614219 | 10.613976 |

| 10 | 13.787373 | 13.789847 | 13.789170 |

| 5 | 15.700414 | 15.703318 | 15.702323 |

| 2 | 16.967035 | 16.970438 | 16.968990 |

| 1 | 17.410351 | 17.413314 | 17.412324 |

| 0 | 17.864595 | 17.865597 | 17.866500 |

| 1 | 18.330000 | 18.333108 | 18.332004 |

| 2 | 18.806809 | 18.810562 | 18.808815 |

| 5 | 20.306628 | 20.309958 | 20.308561 |

| 10 | 23.027069 | 23.030020 | 23.028786 |

| 20 | 28.551988 | 29.213696 | 29.212595 |

| Spatial nodes | 21 | 41 | 81 | 161 |

|---|---|---|---|---|

| CNIM error | 3.692374 | 1.218312 | 0.279163 | 0.053758 |

| CNIM order | - | 1.599666 | 2.125705 | 2.376550 |

| CPU time (s) | 0.090000 | 0.090000 | 0.310000 | 0.450000 |

| HOC error | 2.904958 | 0.871569 | 0.194817 | 0.033796 |

| HOC order | - | 1.736830 | 2.161497 | 2.527194 |

| CPU time (s) | 0.290000 | 1.830000 | 4.480000 | 28.59000 |

| HOCGS error | 0.429031 | 0.153247 | 0.035894 | 0.004895 |

| HOCGS order | - | 1.485222 | 2.094036 | 2.874414 |

| CPU time (s) | 0.320000 | 2.210000 | 5.850000 | 38.76000 |

| Spatial nodes | 21 | 41 | 81 | 161 |

|---|---|---|---|---|

| CNIM error | 3.692747 | 1.238479 | 0.284755 | 0.054978 |

| CNIM order | - | 1.576126 | 2.120778 | 2.372786 |

| CPU time (s) | 0.090000 | 0.090000 | 0.460000 | 0.540000 |

| HOC error | 2.864784 | 0.859610 | 0.186518 | 0.029594 |

| HOC order | - | 1.736673 | 2.204366 | 2.655934 |

| CPU time (s) | 0.270000 | 1.760000 | 4.500000 | 27.99000 |

| HOCGS error | 0.003617 | 0.004003 | 0.000790 | 0.000110 |

| HOCGS ORDER | - | −0.146441 | 2.341362 | 2.841505 |

| CPU time (s) | 0.330000 | 2.050000 | 5.820000 | 36.82000 |

In order to observe the maximum error and rate of convergence with respect to grid stretching parameter , we present the numerical results for both the symmetric and nonsymmetric case, for several grid stretching parameters , in Tables 7 and 8, respectively, for various number of spatial steps.

| M=21 | M=41 | M=81 | M=161 | M=321 | |

|---|---|---|---|---|---|

| 1 | 0.858980 | 0.217465 | 0.054529 | 0.013642 | 0.003411 |

| 1.981842 | 1.995687 | 1.998968 | 1.999916 | ||

| 2 | 0.393637 | 0.099603 | 0.024972 | 0.006247 | 0.001562 |

| 1.982607 | 1.995885 | 1.999085 | 2.000152 | ||

| 3 | 0.262586 | 0.059071 | 0.014811 | 0.003705 | 0.000926 |

| 2.152258 | 1.995776 | 1.999125 | 2.000421 | ||

| 4 | 0.316357 | 0.072677 | 0.013157 | 0.002502 | 0.000625 |

| 2.121981 | 2.465625 | 2.394758 | 2.000752 | ||

| 5 | 0.360326 | 0.084606 | 0.015630 | 0.002408 | 0.000456 |

| 2.090476 | 2.436402 | 2.698680 | 2.400214 | ||

| 6 | 0.397625 | 0.094951 | 0.017826 | 0.002774 | 0.000391 |

| 2.066148 | 2.413170 | 2.684078 | 2.827118 | ||

| 7 | 0.430080 | 0.104107 | 0.019807 | 0.003108 | 0.000439 |

| 2.046534 | 2.394007 | 2.671740 | 2.822355 | ||

| 8 | 0.458848 | 0.112334 | 0.021614 | 0.003417 | 0.000485 |

| 2.030222 | 2.377773 | 2.661075 | 2.817996 | ||

| 9 | 0.484714 | 0.119814 | 0.023278 | 0.003704 | 0.000527 |

| 2.016338 | 2.363740 | 2.651695 | 2.814002 | ||

| 10 | 0.508230 | 0.126679 | 0.024823 | 0.003973 | 0.000566 |

| 2.004303 | 2.351414 | 2.643332 | 2.810328 | ||

| 11 | 0.529804 | 0.133029 | 0.026266 | 0.004226 | 0.000604 |

| 1.993717 | 2.340450 | 2.635792 | 2.806933 | ||

| 12 | 0.549744 | 0.138940 | 0.027622 | 0.004465 | 0.000639 |

| 1.984296 | 2.330594 | 2.628933 | 2.803781 | ||

| 13 | 0.568289 | 0.144473 | 0.028900 | 0.004692 | 0.000673 |

| 1.975826 | 2.321656 | 2.622644 | 2.800841 | ||

| 14 | 0.585628 | 0.149675 | 0.030111 | 0.004909 | 0.000706 |

| 1.968147 | 2.313491 | 2.616842 | 2.798089 | ||

| 15 | 0.601915 | 0.154587 | 0.031261 | 0.005115 | 0.000737 |

| 1.961136 | 2.305983 | 2.611457 | 2.795503 |

| M=21 | M=41 | M=81 | M=161 | |

|---|---|---|---|---|

| 1 | 0.658137 | 0.143690 | 0.026107 | 0.006971 |

| 2.195429 | 2.460436 | 1.905090 | ||

| 2 | 0.252002 | 0.059186 | 0.014014 | 0.003056 |

| 2.090101 | 2.078355 | 2.197110 | ||

| 3 | 0.269837 | 0.077166 | 0.013052 | 0.002396 |

| 1.806046 | 2.563666 | 2.445724 | ||

| 4 | 0.303693 | 0.090864 | 0.016459 | 0.002862 |

| 1.740837 | 2.464800 | 2.523634 | ||

| 5 | 0.329496 | 0.101962 | 0.019449 | 0.003191 |

| 1.692228 | 2.390271 | 2.607718 | ||

| 6 | 0.349808 | 0.111354 | 0.022124 | 0.003498 |

| 1.651409 | 2.331468 | 2.661031 | ||

| 7 | 0.366531 | 0.119434 | 0.024553 | 0.003767 |

| 1.617722 | 2.282261 | 2.704571 | ||

| 8 | 0.380658 | 0.126579 | 0.026782 | 0.003973 |

| 1.588455 | 2.240695 | 2.753014 | ||

| 9 | 0.393092 | 0.132907 | 0.028847 | 0.004180 |

| 1.564453 | 2.203930 | 2.786737 | ||

| 10 | 0.403794 | 0.138755 | 0.030772 | 0.004379 |

| 1.541075 | 2.172835 | 2.812973 | ||

| 11 | 0.413034 | 0.143960 | 0.032579 | 0.004546 |

| 1.520596 | 2.143658 | 2.841175 | ||

| 12 | 0.421538 | 0.148877 | 0.034282 | 0.004724 |

| 1.501543 | 2.118600 | 2.859329 | ||

| 13 | 0.429031 | 0.153247 | 0.035894 | 0.004895 |

| 1.485222 | 2.094036 | 2.874414 | ||

| 14 | 0.436074 | 0.157517 | 0.037426 | 0.004989 |

| 1.469064 | 2.073388 | 2.907113 | ||

| 15 | 0.442243 | 0.161376 | 0.038886 | 0.005182 |

| 1.454413 | 2.053086 | 2.907717 |

5 CONCLUSION

We consider the problem of pricing the passport option for both the symmetric case as well as the nonsymmetric case through HOC schemes in order to obtain better results on a compact stencil. The HOC scheme applied on the nonlinear pricing PDE with non-smooth coefficients resulted in improved results as compared to the CNIM, for the symmetric case with known pricing formula. However, the advantage of the HOC schemes turned out to be much more significant with close to third order accuracy being achieved with the introduction of grid stretching near the zero accumulated wealth level. In fact, the results obtained through grid stretching show a very close match for the analytic solution for the symmetric case. Further, it was observed that the maximum error was also significantly reduced with the introduction of grid stretching. Similar results with regards to accuracy and maximum error was observed for the nonsymmetric case also, using the double-mesh differences for the error.

ACKNOWLEDGMENTS

The first author is grateful to Indian Institute of Technology Guwahati for the Assistantship provided to pursue his Ph.D. The authors express their gratitude to both the Referees for their comments and suggestions.

CONFLICT OF INTEREST

This work does not have any conflicts of interest.

Biographies

Ankur Kanaujiya has been a faculty at the National Institute of Technology Rourkela, since 2020. He earned a doctorate degree in Mathematics from the Indian Institute of Technology Guwahati. His area of interest is Computational Finance. He has worked as assistant professor under Technical Education Quality Improvement Programme (TEQIP-III), a World Bank assisted project implemented by the National Project Implementation Unit (NPIU), at Birla Institute of Technology Mesra, Ranchi.

Siddhartha P. Chakrabarty is a professor in Mathematics and Data Science & Artificial Intelligence at the Indian Institute of Technology Guwahati. His research areas include Mathematical Finance and Mathematical Biology. He has supervised more than 40 students, including 4 Ph.D. students and is a recipient of several grants and awards, he is actively involved in service and outreach activities, including organizing professional events. His diverse teaching experience includes MOOC courses.