Future Pathways for Net Zero Emission: Analyzing the Nexus of Entrepreneurship and Ecological Sustainability Development in Developed Economies

Abstract

This study aims to investigate the impact of entrepreneurship and green investments on environmental sustainability within the scope of Sustainable Development Goals for developed economies. The study conducts an in-depth analysis from 2001 to 2022 and reveals the possible effects of increases and decreases in entrepreneurship. Based on the results of the empirical analysis, an asymmetric relationship between entrepreneurship and environmental sustainability has been determined in the short and long run. Although decreases in entrepreneurial activities cause a reduction in environmental quality, increases in entrepreneurial activities contribute to environmental sustainability. Increases in green investments provide improvements in environmental quality. These results show that entrepreneurial activities and green investments significantly impact environmental sustainability in developed economies. Based on these results, this study recommends that policymakers in developed countries incentivize green investments, foster the growth of sustainable entrepreneurial ventures, and implement policies that assess and enhance the environmental sustainability of entrepreneurial activities.

1 Introduction

In recent decades, environmental protection and green development have become important goals of developed economies. This is because the development of economies has augmented societies' sensitivity toward environmental protection. In addition, the instances of environment-related catastrophes have substantially increased, and floods, droughts, heatwaves, and cyclones have become common. Economic growth, mainly when driven by fossil fuel-dependent industries, significantly contributes to increased greenhouse gas emissions and, consequently, climate change. Accordingly, global carbon emissions (CEs) have recorded a substantial growth of over 50% from the inception of the Industrial Revolution due to increased energy consumption (IEA 2021). Given the relevance of energy patterns in environmental sustainability, the COP26 agenda to control global warming by restricting it below 2°C and even mounting efforts toward achieving 1.5°C for attaining carbon neutrality (United Nations 2021) will require a massive surge in investments related to green energy.

Economies mostly use fossil energy to achieve economic growth. In this context, the International Renewable Energy Agency (2023) points out that currently, the global capacity to produce renewable energy is insufficient to restrict global warming to the desired levels; thus, the capacity to produce renewables will need to be increased by around threefold by 2030 to reach the objective of 1.5°C. This will require a massive surge in green energy innovation by uplifting investments in renewable energy research and development (R&D). Lee and Min (2015) acknowledge that green investments can stimulate the generation of renewables, boosting their availability and, thereby, augmenting sustainable growth. This makes sense since alternative energy sources, including hydro, geothermal, solar, wind, and bioenergy, are considered to be green with a favorable effect on the sustainability of the environment (Ahmed et al. 2022).

Sustainable Development Goal (SDG) 7, which highlights the concept of “reliable, affordable, and sustainable energy for everyone,” points out the criticality of focusing on three fronts, that is, reliability, affordability, and sustainability. Unless sustainable energy is affordable, it may not be economically viable for the economies to achieve energy transition. Thus, the markets for green energy must be properly developed to support the energy transition. In this regard, Ardito et al. (2019) postulate that green investments in the public sector can even influence the development of green technologies in the private sector, improving the market of cleaner technologies. Likewise, Becker (2015) identifies connections between private and public sector R&D. Thus, public sector green investments in renewable R&D can aid economies in achieving energy transition. According to Koçak and Ulucak (2019), green investments related to renewables are the essential input to the green energy innovation that supports ecological sustainability. Augmenting green innovation can lead to a surge in green growth by stimulating energy conservation and promoting green energy consumption, which in turn can increase environmental sustainability (Wang et al. 2023). The increase in innovation due to a surge in green investments can decrease fuel wastage, production costs, and equipment losses (Sharif et al. 2024).

Entrepreneurship (ENT) is the process of initiating and managing a business and is a vital force that promotes economic development (Stel et al. 2005). In recent literature, scholars have discussed ENT's role in mitigating climate change (Omri 2018). ENT helps attain socio-economic growth (Urbano and Aparicio 2016) and ecological sustainability (York and Venkataraman 2010). Past literature has divided ENT into many different types, such as imitative ENT, innovative ENT, collective ENT, individual ENT, and private ENT, with different impacts on economic progress and sustainability (Omri and Afi 2020). Scholars have presented two views on the environmental impacts of ENT. The first view postulates that ENT brings innovation to the economic initiatives that support economic growth, economic productivity, and environmental sustainability (Galindo-Martín et al. 2021; Khezri et al. 2024; Pradhan et al. 2020). The innovation in economic activities can promote energy savings, reduce waste, and augment resource conservation, promoting environmental sustainability. In this regard, York and Venkataraman (2010) suggest that entrepreneurial initiatives represent a solution to ecological problems. Patzelt and Shepherd (2011) argue that ENT supports agricultural activities, lessens deforestation and pollution, and decreases climate change. Conversely, studies have also suggested that ENT activities degrade the environment by augmenting economic growth and modernization (Dhahri and Omri 2018; Omri and Afi 2020; Riti et al. 2015). This is because the increase in growth on account of ENT and escalation in resource consumption will upsurge nations' ecological footprints (EFs), increasing the environmental burden. Overall, studies have linked ENT with environmental sustainability with different points of view and inconsistent findings.

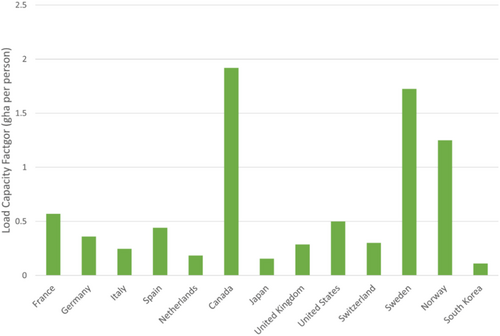

Given this background, this study aims to analyze the effects of green investments and asymmetric effects of ENT on environmental sustainability in selected developed nations. Considering that past literature employs various proxies to represent environmental quality, such as CE, carbon footprint, EF, and others with certain limitations, this study adopted the load capacity factor (LCF) because it accurately assesses environmental sustainability by comparing the demand and supply of resources. As argued before, there is a close connection between ecological unsustainability and development. Therefore, selecting a sample of developed nations for this analysis makes sense. This is because development involves massive consumption of fossil fuels, minerals, and natural resources, which can exacerbate environmental degradation and resource depletion. Apart from this, transportation and industrial activities related to development can produce air, soil, and water contamination, degrading human health and ecosystems. Development can also stimulate habitat destruction due to potential deforestation for urbanization or agricultural activities. The 13 developed nations based on the data availability for ENT and green investments are selected for the study, including the United States, Germany, Spain, Italy, Canada, the Netherlands, the United Kingdom, Japan, Sweden, Switzerland, Norway, France, and South Korea. Figure 1 illustrates that only Sweden, Norway, and Canada exhibited LCF values exceeding 1. Conversely, all other nations displayed LCF values below 1 in 2022 (GFN 2023), indicating a higher resource utilization rate and a lower biocapacity. This suggests that a majority of the sampled nations confront challenges associated with environmental unsustainability, as they currently consume more resources than their respective territories can sustainably provide. Among the sampled nations, the United States, Japan, Germany, South Korea, Canada, the United Kingdom, and Italy are major carbon emitters (STATISTA 2022). Consequently, most of the selected economies grapple with significant ecological challenges alongside high levels of development. Notably, these economies encompass nations with advanced technologies and a burgeoning entrepreneurial landscape. Recognizing the urgency of addressing ecological degradation, these economies actively seek to increase green investments. Therefore, this study analyzes the effects of green investments and ENT on ecological sustainability to facilitate better sustainable development policies. Assessing the nexus between ENT, green investment, and the LCF will contribute to the development of policies that support the achievement of SDGs 13 (Climate Action) and 7 (Affordable and Clean Energy). SDG 13 emphasizes the urgent need to combat climate change, and understanding the interrelationship between ENT, green investment, and LCF will provide valuable insights for policymakers on how to adjust these variables to enhance environmental sustainability and mitigate climate change. Furthermore, green technology investments in energy directly impact the availability of affordable and clean energy, a key objective of SDG 7, which aims to ensure universal access to modern, affordable, and reliable energy services.

Notably, previous research studies assess the symmetric effects of ENT on the environment, assuming that positive and negative shocks in ENT will affect the environment with equal elasticity, significance, and magnitude. Moreover, these studies also assume that both shocks will influence the environment in different directions, that is, if the positive shock increases sustainability, the negative shock decreases it, and vice versa. However, macroeconomic variables often pose asymmetric impacts due to changes in business cycles, fluctuations in supply and demand, changes in fiscal and monetary policies, and others (Ahmed et al. 2021). Thus, the positive and negative shocks to ENT may pose effects of different elasticity, significance, and magnitude. Therefore, the use of a symmetric method may not reveal the correct associations between ENT and ecological sustainability. Given the diverse environmental effects of ENT documented in prior research, it will be interesting to unveil whether ENT increases or decreases the LCF. Second, it will be interesting to understand how positive and negative changes in ENT impact the LCF. In addition, the study will also unfold how green investments affect the LCF.

Considering this background, this research makes the following contribution to the literature. First, this study represents a novel endeavor to investigate the asymmetric impacts of ENT on ecological sustainability. Specifically, it will examine how positive and negative shocks to entrepreneurial activity affect the LCF. This research departs from previous studies, which primarily focused on the symmetric impacts of ENT on various environmental indicators. Second, this study investigates the impacts of green investments on the LCF within the context of developed nations, a facet largely overlooked in previous research. Given the pivotal role of green investments in driving energy transitions, mitigating global warming, and addressing climate change, evaluating their impact on sustainability is crucial for the development of effective environmental policies. Third, this study adopts a novel asymmetric Augmented Autoregressive Distributed Lag (CS-ARDL) test by incorporating positive and negative shocks into the standard CS-ARDL framework. This methodological innovation allows us to accurately assess the asymmetric effects of ENT and the long-run impacts of green investments on the LCF while simultaneously addressing endogeneity, cross-sectional dependence (CSD), and heterogeneity. Notably, the traditional asymmetric ARDL approach, frequently employed in prior research, often fails to account for CSD and heterogeneity, common challenges in panel data analysis. Consequently, this study provides more reliable findings than previous investigations within the ENT–environmental sustainability nexus. Furthermore, the study utilizes the LCF indicator, recognized as one of the most comprehensive measures of environmental sustainability, to analyze the intricate relationship between ENT and ecological sustainability. By providing reliable insights into the effect of green investments and positive and negative shocks in ENT on the LCF, this study will give authorities a deeper understanding of the actual relationship between these variables and environmental sustainability. This knowledge will facilitate the design of more effective policies to incentivize green investments and enhance ecological sustainability. Furthermore, understanding the asymmetric relationship between ENT and the LCF will empower authorities to assess the sustainability of entrepreneurial activities and implement policies that promote environmentally responsible entrepreneurial growth.

This study will proceed as follows: Section 2 indicates a review of the literature, Section 3 develops the model of the research and discusses methods, Section 4 explains and discusses the results, and the final section (Section 5) presents the concluding remarks and policy directions.

2 Literature Review

2.1 Theoretical Literature

Green investments are considered a strong determinant of environmental sustainability (Bakry et al. 2023). Green investments can encourage CE reductions and climate change resiliency (Uche et al. 2024). Green investments transcend all financial initiatives that amplify environmental progress and carbon reductions and support climate change resilience (He et al. 2023). Besides, Bakry et al. (2023) emphasized that green investments include financial support for climate sensitivity and adaptation projects. They highlight four pathways through which green investments influence environmental sustainability. These pathways include technological efficiency, resource allocation, capital support, and green economic perspectives. It is envisaged that these investments are catalysts for green transition, carbon neutrality, and overall environmental progress.

On the other hand, the environmentally relevant market failure theory attributable to Dean and McMullen (2007) could explain the ENT–environmental sustainability nexus. Notably, the environmentally pertinent market failure theorization emphasizes channels of opportunities for entrepreneurs to achieve their profitability targets while simultaneously imbibing environmental quality soothing behaviors (Dean and McMullen 2007). The theory explains that entrepreneurs could seize the opportunities inherent in market failures yet avoid environmentally harmful actions. This conceptualization necessitates the sustainable or environmental ENT ideology. Notwithstanding the theorizations, environmental economics researchers have not extensively explored the contributions of these factors to environmental progress. Meanwhile, the empirical sub-section provides a thematic exposition of extant studies for more insights.

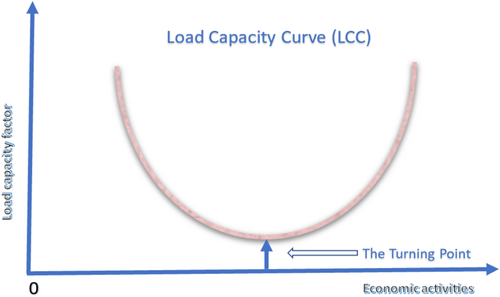

The load capacity curve (LCC) hypothesis extended by Dogan and Pata (2022) is fundamental to understanding the interactions between economic activities and ecological performance. Notably, LCC emphasizes possible short-run detrimental effects of economic activities and their long-term favorable implications on environmental sustainability. According to Narayan and Narayan (2010), it can be determined whether the environmental Kuznets curve (EKC) hypothesis is valid by looking at the short-term and long-term coefficients of income. If the long-term coefficient of income is smaller than the short-term coefficient of income, the EKC hypothesis is valid. In other words, environmental pollution decreases as the country's income increases. When this theory is adapted to the LCC hypothesis, if the decrease in environmental quality is lower in the long run than in the short run, the LCC hypothesis is valid. The hypothesis denotes a possible U-shaped relationship between economic growth and ecological performance (Figure 2). The LCC hypothesis suggests a dynamic trade-off relationship between ecological sustainability and economic progress (Caglar et al. 2024a). It portrays a possible U-shaped relationship permissible when an economy prioritizes ecological sustainability by investing its income in green energies and environmental quality-enhancing ENT. Hinging on the above discussions, the following hypothesis is established accordingly:

Hypothesis 1.The LCC hypothesis is valid in the context of the 13 developed economies.

2.2 Empirical Literature

2.2.1 Green Investments–Environmental Sustainability Nexus

Insights from extant studies suggest the need for more empirical inputs to streamline the understanding of the intricate relationship between green investments and environmental sustainability. This position is premised on the countervailing submissions of prior studies regarding this relationship. For instance, Ren et al. (2020) examined the implications of green investments on carbon intensity in China between 2000 and 2018. The empirical discovery of the study highlights the pivotal role of green investments in carbon intensity reductions. Lee and Lee (2022) proffered a similar narrative, suggesting the appealing effects of green finance on green total factor productivity in China. Likewise, Khan et al. (2022) emphasized that green financing reduced the EF significantly in 26 Asian economies. The CE and environmental pollution inhibitory efficacy of green investments are further extolled in other studies, including Sinha et al. (2021), Hu and Zheng (2022), and Yao et al. (2022). Notably, Al Mamun et al. (2022) emphasized regional heterogeneities per green investments–CE reductions. Likewise, Fang et al. (2022), Madaleno et al. (2022), and Wang and Ma (2022) also reported heterogeneous effects of green investments, particularly in G7, the global sample, and China, respectively. These studies underscore the need to explore the perspective of other leading economies, highlighting current issues to guide policy adjustments. Besides, the prominent emphasis on CE represents a significant drawback of most prior studies since they neglected the LCF with broader implications.

There are more overwhelming inferences supporting the environmental quality-enabling effects of green investment. In this perspective, recent studies include Bakry et al. (2023) in the case of developing countries and He et al. (2023) in the context of BRICS economies. Likewise, Lee et al. (2023) exposed that green investments elevated environmental performance in China. However, Xu et al. (2023) reported heterogeneous implications of green investment in the environmental performance of Chinese Provinces. Irrespective of these overwhelming supportive submissions, Singh et al. (2023) explained that green investment remained ineffective for CE reductions in the context of G7 and G20 countries. This submission and the analogous inputs of Wang et al. (2023) in the context of China puts policy adjustment in a state of quagmire since they conflict with previous or popular understanding. Hence, more inputs within the broader perspective of other prominent global economies are expedient for policy harmonization. A streamlined empirical re-assessment is fundamental for a clearer understanding of the implications of green investments on environmental quality, mainly in advanced economies, given their position in the global economic landscape. Given the highlighted polarized inferences of extant literature, the following hypothesis is provided herewith:

Hypothesis 2.Green investments are sufficient to increase environmental quality in the 13 advanced economies.

2.2.2 Entrepreneurship–Environmental Sustainability Nexus

Scartozzi et al. (2024) explored 172 journal articles via bibliometric and systematic literature procedures to provide empirical clarification for the ENT–environmental sustainability nexus. Accordingly, they explained that extant studies focused more on ENT's social and economic implications while neglecting the environmental repercussions. In summary, they emphasized the need for more empirical investigation of the environmental concerns of entrepreneurial activities. Furthermore, Cohen and Winn (2007) explained the environmental sustainability–ENT relationship as a zero-sum game that rewards only the entrepreneur. On their part, York and Venkataraman (2010) explained that ENT contributes positively to environmental sustainability through their participation and investments in corporate social responsibilities. Shepherd and Patzelt (2011) extended supportive inferences by highlighting that ENT contributes to biodiversity conservation, counteracts climate change, and enhances ecological sustainability. Likewise, Sun et al. (2020) and Udemba et al. (2022) highlighted the environmental quality-enhancing effects of ENT in 35 sub-Saharan African (SSA) countries and Malaysia, respectively.

However, several studies, including Dhahri and Omri (2018) and Youssef et al. (2018), provided countervailing inferences by highlighting the environmental quality-dampening implications of entrepreneurial activities in 12 developing economies and 17 African countries, respectively. Similarly, Alvarado et al. (2022) and Philip et al. (2021) remarked that ENT contributed to environmental pollution in 95 countries and Turkey in both the long and short terms. Likewise, Omri and Afi (2020) provided similar inferences in the case of 32 developing countries. Similar inferences were al extended by Omri (2018) in 69 countries. The study noted that ENT contributed substantially to environmental challenges in developing countries, with lower effects in developed economies. The above inferences underscore the need for harmonized empirical articulation about the relationship between ENT and environmental performance. The prominent conflicting narratives could mar policy adjustments toward pushing the frontiers of SDG 13. Hence, the perspectives of 13 advanced economies that highlight the implications of the partial effects of ENT suffice herein.

Most recent studies have also provided countervailing narratives regarding the relationship between ENT and environmental sustainability. Accordingly, Chen et al. (2024) suggest that ENT contributes significantly to CE reductions in the East Asian economies, particularly in the long term. Analogous inferences were extended by Elmonshid and Sayed (2024) for Saudi Arabia, Hussain et al. (2024), and He and Zhou (2024) for China. These studies support that countries can rely on entrepreneurial activities to eliminate environmental pollution and ecological damage. However, they selected greenhouse gas emissions as a standalone proxy of environmental sustainability. Their inferences may be biased given that CE does not consider both sides (demand and supply) of environmental performance. Other studies, including Jha and Pande (2024), Raimi (2024), and Udemba et al. (2024), confirmed the environmental quality-enhancing effects of ENT in China and the BRICS economies. Conversely, Khezri et al. (2024) explained that various forms of ENT contributed profoundly to CEs in 14 selected economies.

Beyond the fact that prior studies did not test the implications of ENT within the LCF framework, this study also introduced the novel asymmetric CS-ARDL estimator. Accordingly, the asymmetric effects of the partial changes of increasing and decreasing ENT on environmental quality were ascertained. Such peculiar information is nonexistent in existing studies, thereby enhancing the novel contributions of the present study. Prior evaluations have not identified the possible asymmetric implications of positive and negative ENT on environmental quality in the 13 advanced economies. Given this empirical lacuna, the current study remains fundamental to identifying how these opposing changes influence environmental health in these leading global economies. These novel insights are expected to shape policy formulations and implementations regarding ecological sustainability in advanced economies, with possible spillover effects to other global economies.

When random shocks (positive ways: improvement in investment environment, increase in productivity, increase in economic growth, decrease in inflation; negative ways: financial crisis, pandemic, war) occur in the economy, the assumption that all entrepreneurs will behave similarly may not always be valid (Krishnan et al. 2022; Castellanza and Woywode 2024). In other words, when a random shock occurs in the economy, some entrepreneurs continue their activities and can resist the shocks. Entrepreneurs with solid infrastructure are significantly unaffected by random shocks and want to continue in the economy (Provasnek et al. 2017; Santos et al. 2017). On the other hand, entrepreneurs may suspend their activities for a certain period and decrease their outputs in the face of a random shock. As a result, evaluating ENT in a single way may lead to the production of biased policies. This study investigates this situation by dividing ENT into positive and negative shocks. In this context, the following hypothesis will be examined:

Hypothesis 3.There is an asymmetric relationship between ENT and environmental quality.

Before entering the economic cycle, some entrepreneurs build their entrepreneurial activities on environmental sensitivity. They put environmental regulations in the workflow's first stage and focus on environmental sensitivities carried out together with profit (Muñoz and Cohen 2018). Since these entrepreneurs integrate the environment into the first stage of the business, they do not engage in activities that destroy nature (He et al. 2020). Environmental quality may also increase for enterprises in this situation if entrepreneurial activities increase. In this context, the following hypothesis will be investigated:

Hypothesis 4.Positive shocks from entrepreneurship increase environmental quality.

On the other hand, random shocks can disrupt entrepreneurial activities. In other words, entrepreneurial activities may decrease because of a shock (economic crisis, pandemic, war) (Krishnan et al. 2022; Santos et al. 2017). Entrepreneurs who are financially problematic, do not have a solid infrastructure, and do not follow innovations may suspend their activities or choose to reduce them in the face of a crisis. Environmental awareness may also decrease because of the decrease in entrepreneurial activities. In this case, environmental quality may decline. In this context, this study will investigate the following hypothesis:

Hypothesis 5.Negative shocks from entrepreneurship decrease environmental quality.

3 Data, Model, and Econometric Strategy

3.1 Model

3.2 Data

Table 1 shows the variables' definition, measurement, and data sources in Equation (1). Five different data sources were used in the analysis. Before proceeding to the empirical analysis, the natural logarithm of all variables was taken. The study collected yearly data from 2001 to 2022 for developed countries for which green investments and ENT data were available. The ENT variable determines the start year of the data set, whereas the LCF variable defines the end year. Hence, countries selected for the analysis include the United States, Germany, Spain, Italy, Canada, the Netherlands, the United Kingdom, Japan, Sweden, Switzerland, Norway, France, and South Korea.

| Variable | Sign | Measurement | Source |

|---|---|---|---|

| Load capacity factor | LCF | Biocapacity/ecological footprint, per capita | GFN (2024) |

| Entrepreneurship | ENT | Established business ownership rate | GEM (2024) |

| Economic growth | EGP | GDP per capita (constant 2015 US$) | WDI (2024) |

| Green Investments | GIN | Renewable energy research and development investment, USD (Constant, 2023) | IEA (2024) |

| Globalization | GLO | Index | Dreher (2006) |

3.3 Econometric Strategy

4 Data Analysis and Discussions

The novel asymmetric CS-ARDL panel econometric procedure answered three critical research questions based on in-depth empirical analysis. These identified research questions (earlier stated) had eluded policymakers, given that prior studies failed to provide any empirical answers to these burning issues. Consistent with standard econometric protocols, several pre-estimation procedures were incorporated, including the CSD test, slope homogeneity, panel unit-root test, and panel cointegration test (Table 2).

| Panel A: Cross-section dependence | |||||

|---|---|---|---|---|---|

| LCF | EGP | GIN | ENT | GLO | |

| CD |

15.590 [0.000] |

28.653 [0.000] |

26.676 [0.000] |

8.668 [0.000] |

38.534 [0.000] |

| BP-LM |

650.994 [0.000] |

1154.496 [0.000] |

760.237 [0.000] |

228.752 [0.000] |

1486.838 [0.000] |

| Panel B: Slope homogeneity | ||

|---|---|---|

| Tests | Stats. | p-value |

| Delta | 7.118 | 0.000 |

| Adj. | 8.718 | 0.000 |

| Panel C: Unit root | ||||

|---|---|---|---|---|

| Variables | CADF | |||

| At level | First differences | |||

| Stat. | p-value | Stat. | p-value | |

| LCF | −1.936 | 0.268 | −3.807* | 0.000 |

| EGP | −1.689 | 0.618 | −2.379** | 0.012 |

| GIN | −2.689* | 0.000 | — | — |

| ENT | −2.482* | 0.004 | — | — |

| GLO | −2.098 | 0.111 | −3.470* | 0.000 |

- Note: [] denotes p-values.

- * and ** refer to 1% and 5% at significance levels.

The outcome of the CD and the slope homogeneity tests eminently informs the rejection of the null hypothesis of cross-sectional independence and nonheterogeneous slopes. These highlight the chances of cross-sectional error overlap among the selected countries. Likewise, the outcome of the panel unit-root test underscores the mutual integration of the panel series between order-zero [I(0)] and order-one [I(1)]. Notably, the series of green investments and ENT are naturally stationary, whereas others became stationary after differencing once. It is also pertinent to highlight the capacity of the selected econometric technique to harmonize both the long- and short-term interactions of mix-integrated series.

4.1 Panel Cointegration Analysis

The panel series were subjected to long-term coevolution tests via the Westerlund panel cointegration technique (Table 3, Panel A). The outcome of the summarized cointegration test prominently underscores the rejection of the null hypothesis of no long-run cointegration among the panel variables. Therefore, it is concluded that the enlisted panel series trend along in the long term and are cointegrated.

| Panel A: Cointegration findings | ||||

|---|---|---|---|---|

| Gt | Ga | Pt | Pa | |

| Value | −3.694 | −3.912 | −12.442 | −4.119 |

| z-value | 2.660 | 6.007 | 2.407 | 4.621 |

| p-value | 0.004 | 0.999 | 0.008 | 0.999 |

| Panel B: Long- and short-run asymmetry findings | ||

|---|---|---|

| Short-run asymmetry | ||

| Wald F-test | p-value | Is there asymmetry? |

| 76.61 | 0.000 | + |

| Long-run asymmetry | ||

| Wald F-test | p-value | Is there asymmetry? |

| 143.72 | 0.000 | + |

- Note: Bold values indicate cointegration.

4.2 Marginal Effects Analysis

The outcomes of the marginal effects test are summarized in Table 4. The empirical analysis exposes that economic growth consistently and substantially dampened environmental quality in the short and long term. Since the decrease in environmental quality is higher in the long run than in the short run, the LCC hypothesis (first hypothesis) is invalid. In other words, the improvement in EGP does not support the development of environmental sustainability in the 13 advanced economies. This discovery which is at variance with the submissions of Dogan and Pata (2022) in the context of G7 countries, connotes a tradeoff between economic/income expansion and environmental progress. Conversely, this discovery is consistent with that of Caglar et al. (2024b), who disproved the validity of the LCC in European countries. The outcome typifies consistent negligence to environmental sustainability in preference to economic growth, negating a critical component of SDGs that canvasses growth processes that prioritize sustainability. As highlighted in several investigations (Lin et al. 2023; Sharif et al. 2024), most economies neglect environmental progress for economic gains, which remains inimical to sustainable development. However, this trend is reversible, and environmental sustainability is achievable despite economic growth. The critical step is to reinvest substantial portions of growth proceeds into projects with environmental quality-improving potentials. It could be most profitable to channel more growth proceeds to green investments since they possess environmental quality-improving attributes. Likewise, these countries are encouraged to invest more significant national income in green energy sources rather than traditional ones, facilitating environmental pollution. Investments into and the consumption of these nontraditional energies will enhance the quality of their environments and ensure the speedy realization of SDGs 7 and 13.

| Panel A: Asymmetric CS-ARDL estimator | |||||

|---|---|---|---|---|---|

| Variables | Long-run | Short-run | |||

| Coeff. | p-value | Variables | Coeff. | p-value | |

| GIN | 0.031 | 0.180 | GIN | 0.030 | 0.120 |

| EGP | −1.095* | 0.000 | EGP | −0.888* | 0.000 |

| ENT− | −0.128** | 0.016 | ENT− | −0.137* | 0.002 |

| ENT+ | 0.106*** | 0.066 | ENT+ | 0.060 | 0.115 |

| GLO | −1.132*** | 0.068 | GLO | −0.831** | 0.045 |

| ECT | −0.868* | 0.000 | |||

| Panel B: Robustness check | ||||

|---|---|---|---|---|

| Variables | Asymmetric FMOLS | Asymmetric CCR | ||

| Coeff. | t-stat | Coeff. | t-stat | |

| GIN | 0.020 | 1.500 | 0.020 | −0.280 |

| EGP | −0.970* | −41.300 | −0.980* | −26.260 |

| ENT− | −0.170* | −43.520 | −0.180* | −25.510 |

| ENT+ | 0.060* | 25.450 | 0.050* | 14.110 |

| GLO | −0.410* | −7.200 | −0.340* | −4.180 |

- *, **, and *** refer to 1%, 5%, and 10% at significance levels, respectively.

The empirical estimates underscored that green investments possess environmental quality-enhancing attributes in the short and long run. However, it is pertinent to highlight that the contributions of green investment to environmental progress remained unsubstantial in both time frames. This outcome answered the third research question by highlighting green investments' insufficient environmental quality-enhancing effects in these selected economies. Furthermore, this revelation invalidates the second hypothesis that green investments are sufficient to increase environmental quality in the 13 advanced economies. However, the outcome underscores the potential of these green investments to enhance environmental quality if more investments are made in its favor. Unarguably, green investments are critical to green development and environmental progress. This inference hinges on the submissions of some extant studies (Lin et al. 2023; Sharif et al. 2024; Uche et al. 2024) that underscored the pivotal role of green investments in environmental progress in several countries. Not discountenancing possible dissenting inferences (Singh et al. 2023; Wang 2023); however, adequate and consistent public and private financial support remains critical to environmental vitality in any economy. Among others, such investments should transcend several areas of green investments, including energy efficiency R&D and environmental quality-enhancing innovations. Hence, policymakers in these developed economies should prioritize green investments among other vital components of sustainable development. Likewise, they should ensure public and private sector participation, given that isolated practices may not yield optimal results.

The empirical analysis also highlights the critical role of ENT in environmental survival in the selected 13 developed nations. The study differentiates the effects of increasing and decreasing ENT on environmental quality in these selected developed countries. This step underlines a critical novelty of this study, given that prior studies ignored such dimensions. Besides, such information will guide policymaking regarding supporting ENT or otherwise. The empirical analysis uncovers that while increasing entrepreneurial activities facilitates environmental progress, decreasing entrepreneurial activities dampens environmental progress in these developed countries. Notably, the opposing implications of ENT on environmental quality are consistent in both time dimensions. As seen in Table 3 Panel B, ENT has an asymmetric effect on environmental quality in both the short and long term. Hence, the third hypothesis is accepted, given the differential effects of opposing changes in ENT on environmental quality. Furthermore, the verified asymmetric relationship underlines the essence of cautious policy implementations since a one-size-fits-all policy option may bias policy targets.

In the long run, increased ENT elevated environmental progress by approximately 0.11%, whereas decreased ENT reduced the quality of the environment by approximately 0.13%. The short-run effects of increasing and decreasing ENT mirror their long-run attributes with considerable policy imports. The opposing implications of positive and negative changes in ENT are fundamental to verifying the fourth and fifth hypotheses. Accordingly, the differentiated effects validate the fourth and fifth hypotheses, given that positive/negative shocks from ENT increase/decrease environmental quality in the 13 advanced economies. Notably, increasing ENT produced an insufficient positive impact in the short run; however, its long-run significant positive contributions highlight the essence of functional entrepreneurial activities for environmental sustainability. Although the results demonstrate a positive relationship between ENT and environmental sustainability in developed nations, a decline in entrepreneurial activity exerts a more pronounced negative impact on environmental quality further confirming that this connection is asymmetric. This finding underscores the importance of fostering a supportive environment for entrepreneurial endeavors. This observation aligns with existing literature that emphasizes the pivotal role of ENT in driving economic growth and fostering innovation (Galindo-Martín et al. 2021; Khezri et al. 2024; Pradhan et al. 2020). Increased entrepreneurial activity can stimulate innovation, leading to resource efficiency, reduced waste generation, and enhanced energy conservation, all of which contribute to improved environmental sustainability. Furthermore, Patzelt and Shepherd (2011) argue that entrepreneurial ventures can contribute to environmental protection by mitigating pollution, supporting sustainable agricultural practices, and curbing deforestation. York and Venkataraman (2010) further emphasize the potential of ENT as a key driver of solutions to pressing environmental challenges.

In conclusion, governments of developed countries should actively foster and encourage entrepreneurial activities, given their demonstrated potential to contribute to environmental sustainability goals. Policy efforts should be directed toward mitigating any factors that may lead to a decline in entrepreneurial activity, thereby preventing potential negative impacts on environmental quality. As highlighted by Hussain et al. (2024), Omri and Afi (2020), and Udemba et al. (2024), in the cases of China, 32 developing countries, and BRICS, ENT activities spur environmental progress. However, they should be encouraged to opt for low-carbon energies instead of their high-carbon version for environmental vitality.

As a policy roadmap, it is of the essence that 13 developed countries align all ENT activities to existing environmental sustainability policies and regulations. It is also cogent to ensure maximum compliance and adherence to SDGs that emphasize ecological stability. Furthermore, Raimi (2024) underscores the need to forestall the overriding influence of harmful ideologies, social structures, and power dynamics hindering the contributions of ENT to environmental progress in most countries. This submission is noteworthy, given that ENT is profit-oriented. Likewise, Pacheco et al. (2010) explain that the environmental quality-deteriorating effects of ENT are contingent on the divergences between individual goals and collective gains. Hence, in pursuit of profits and business expansions, most entrepreneurs neglect the environmental consequences of their actions. Therefore, some stringent policies are required to keep them in check.

The contributions of globalization to environmental performance in these 13 developed countries are also articulated herein. The empirical analysis uncovers the negative implications of globalization on environmental performance both in the short and long term. The outcomes of this investigation underscore the fundamental role of globalization in the escalating environmental sprawl witnessed in these countries over time. The explanations for these unpleasant contributions of globalization may not be far-fetched. First, prior studies, including Sadiq et al. (2023), reported similar outcomes in the case of Southeast Asian countries. Second, these countries constantly pursue economic gains through several engagements, including globalization. Hence, it is only logical to expect negative repercussions from activities prioritizing economic prosperity over environmental gains. Based on this discovery, these countries should align all their economic and noneconomic relationships with other countries for sustainable development requirements. They should ensure that globalization engagements do not override environmental survival. Instead, all activities that negate the established environmental sustainability protocols should be avoided.

4.3 Robustness Analysis

Further insights pertaining to the relationship between environmental quality and the enlisted control variables were derived from two robustness analyses. In this regard, two novel analytical techniques were extended for updated perspectives, including the asymmetric FMOLS and CCR. Remarkably, the evidence from the robustness tests (Table 4, Panel B) remained consistent with the results of the baseline estimator. On this premise, the adaptation and implementation of the underlying policy inferences is expected to ensure environmental sustainability in the 13 advanced economies. Remarkably, the outcomes highlight that enhancing ENT and green investments remains fundamental to the enthronement of ecological progress in these economies.

5 Conclusion, Policy Perspective, and Limits

This study uses novel econometric methods to determine how ENT impacts environmental sustainability. The existing literature is insufficient to explain the impacts of ENT on the environment. This study focuses on developed economies, in particular, targeting a sample where entrepreneurs can integrate into the economy more easily. Furthermore, this study presents an in-depth ENT–environment nexus by modifying the CS-ARDL method and separating ENT into positive and negative shocks. Empirical analyses confirmed the existence of an asymmetric relationship between LCF and ENT. In other words, negative movements in ENT lead to environmental quality moving toward a negative path. On the other hand, positive fluctuations in ENT contribute to ecological sustainability. These results stem from the superiority of our modified Asymmetric CS-ARDL estimator. In addition, green investments also support ecological quality. Economic growth and globalization activities are detrimental to environmental sustainability. Based on these results, our study offers a policy perspective within the framework of SDGs.

The primary sources of ENT are motivation and the enrichment of profit perspectives. The findings of our study confirm that the decrease in ENT is unsuitable for environmental sustainability. Therefore, entrepreneurial activities should be increased in a controlled manner in 13 developed economies. For this, governments need to activate policies that encourage ENT. This can be achieved through two channels. First, successful entrepreneurs should be brought together and asked what difficulties they face in entering the markets. According to their answers, ENT courses should be organized by expert teams in 13 developed economies. The aim here is to prepare individuals for ENT both scientifically and sociologically. These courses can be organized through municipalities, and individuals who do not dare to be entrepreneurs can contribute to the economy through these courses. Moreover, in these courses, where environmental awareness will also be explained, individuals will prioritize environmental concerns before starting entrepreneurial activities. Otherwise, an uncontrolled increase in entrepreneurial activities will direct entrepreneurs to fossil energy sources and support the aim of making a quick profit. Environmental concerns will be kept in the background because of a lack of financing. Second, positive financing privileges can be provided to educated entrepreneurs. Low interest rates can be applied to entrepreneurs who prioritize environmental awareness, and tax advantages can be provided. Thus, individuals will increase their environmental awareness before becoming entrepreneurs and prioritize the environment in their entrepreneurial activities. Therefore, these policies will encourage clean and accessible energy sources (SDG 7) and contribute to the climate action (SDG 13) movement.

The positive environmental contribution of green investments should continue to be utilized. Since the 13 economies in question are developed, they are in a comfortable financial position. Because of this advantage, these economies can accelerate the climate action movement by making more green investments. Since renewable energy sources require serious infrastructure and substantial financing, the results obtained from the analysis are essential for the 13 economies. In these economies, green investments are mainly carried out through the state. In this case, rapid policies should be implemented so that at least 50% of the state and 50% of the private sector. The state should activate policies encouraging the private sector to increase green investments. Green investments, especially those made by large companies, are essential. Statements should be made to the representatives of the largest companies in 13 countries, and financing packages should be announced to attract them to this area. In this way, most large companies using fossil resources can accelerate the transition to green energy sources. Countries can give these companies unused lands and thus accelerate renewable energy R&D studies. Then, 13 developed economies can take an essential step toward SDG 7.

Economic growth must create environmental pollution. Here, countries should move to accelerate the transition from fossil to green resources without compromising growth. In other words, countries should continue to grow and move away from fossil fuels and toward green resources. This cannot be achieved with short-term policies. However, it can be achieved with long-term and determined policies. Especially in the transition from fossil to green resources, serious infrastructure moves are required, and since this is a long process, energy efficiency policies should be pioneered. With the maturation of green resources, energy efficiency policies should be terminated, and fossil fuels should be moved away. In this way, economies can continue to grow and minimize environmental damage by polluting the environment to a minimum. Globalization activities provide harmful environmental conditions for 13 developed economies. Therefore, ecological damage caused by globalization should be minimized and, if possible, eliminated. For this purpose, the environmental activities of multinational companies operating globally should be examined in detail. Policies that reduce these companies' intensive use of fossil resources should be implemented. In this context, tax advantages that encourage green energy can be provided. Moreover, strict environmental policies should be implemented in trade activities, and fossil-based products should be limited.

Because of the nature of science, this study has some limitations. In addition, this study provides critical future directions. First, because of the limited data on ENT, this study covers the data from 2001 to 2022. If future studies can extend the data range, they can investigate the validity of the LCC by adding income and the income square. Second, this study uses the established business ownership rate as a proxy for ENT. Future studies can deeply examine the relationships between ENT and the environment using different subheadings for ENT. Third, this study analyzes panel data because of insufficient data length. Future studies can investigate the environmental quality of individual countries with recent time series techniques (Fourier Augmented ARDL, Fourier asymmetric ARDL, quantile on quantile, time-varying causality). Fourth, our study uses LCF as the dependent variable. Future studies can test the EKC hypothesis with environmental pollution indicators for the same sample. Thus, it can be seen whether the results change according to environmental indicators. Lastly, this study allows only ENT to be asymmetric. Future studies can investigate by allowing financial deepening, foreign direct investment, and trade openness variables to be asymmetric in addition to ENT.